Contents

Essays

Venture Capital

SignalRank News

AI

Who's Coding Now? - AI and the Future of Software Development

Sequoia on AI's trillion-dollar opportunity: https://t.co/N7OoYA6msf

How AI is Reinventing Software Business Models ft. Bret Taylor of Sierra

The Physical Turing Test: Jim Fan on Nvidia's Roadmap for Embodied AI

OpenAI Restructuring, Microsoft's Rights, Simo and Windsurf

Deepwater's Gene Munster talks if Alphabet shares may fail to rebound

How Ramp solved the Fatal Flaw in AI Agent Strategy ft. Rahul Sengottuvelu

Government Overreach

Interview of the Week

Peter Voss on Why Generative AI is a dead end, with Andrew Keen

Startup of the Week

Post of the Week

Editorial: What is Truth?

The word “Truth” has become a highly talked about concept over recent years. It is a contested space where one person’s truth is another persons lie.

“Fake News” is not true. And if you disagree with it, it clearly must be fake, so false.

But when you think about it the very concept of truth only makes sense when discussing provable facts. It makes no sense in other contexts because there is no certainty.

Most discourse is not about facts but about opinions. And there is no place more subject to opinions that discussion about the implications of current events to the future. In this area of human thought there is no truth, only opinion.

And opinion is essential to determining a course of action. Opinion and action are necessary to change.

So most of the meaningful human discourse is in this space. And the discourse is hot air unless attached to action. That doesn’t mean pure intellectual output is useless, but somebody needs to be moved to action for it to be able to drive historical outcomes. Action is meaningless unless it produces outcomes, and therefore change.

This is why the famous quote about being “in the arena” is so pertinent. You can’t change anything without being an agent of outcomes or change.

Almost every week this newsletter focuses on people seeking to do just that. This week is no exception. For example, Packy McCormick in his essay - everything is technology:

Welcome to the idea that technology companies will displace incumbents with products that are so much better than what existed before that the shift is inevitable. The modern shift in business is that technology companies are replacing sclerotic incumbents, creating tens of trillions of dollars of value as we speak.

Packy McCormick, Not Boring (see below)

This core idea, that what exists, what “is”, is in the process of being displaced by “what will be”. The GeoPolitics essays on the rise of Chinese technology speak to the same inevitability. Those doing things in the present can replace the past, by leveraging better tools, more cheaply at scale.

For that to be true somebody has to take on the task of building the new. That is one reason venture capital is so fundamental to change. It is the fuel for the upstart to improve on the incumbent.

The bottom line is that history (and so truth) are contested. Outcomes are not pre-ordained. Human conscious action translated to successful outcomes is a precondition for change. The AI revolution shows this in real time. Some believe AI is the most significant addition to human productivity and future ever. A16Z is on the record this week saying just that. Others believe that it is a limited technology that is also dangerous. Neither are right in the sense of speaking the truth. Both are contesting a real time set of decisions that point to very different futures.

The China debate is similar. Some see China only through the lens of American supremacy and want to slow its progress. Others see it as an important market for US products and services and want to open up trade. Both are taking actions in support of their goals. Neither is right or wrong. But we all need to have educated opinions about what we think and join actions supporting those views. History will be made by the winning strategy that is put into action and succeeds.

So this newsletter is intended to feed thought, educate opinion, and catalyze action so that we can all be in the arena. And when we disagree we are not disputing truth, but arguing for opinions we believe in, or disagree with.

The fact that truth is not an appropriate word to describe the contested present, or the future we want, does not mean there is no right and wrong. It is crucial to hold opinions and seek to convert them into the future you want. That is the essence of human progress and democratic change. Not only by voting, indeed especially not only by voting, but by engaging with others and seeking change through words and then by actions.

I hope it works.

Essays

The Great Divergence

Yaschamounk • Yascha Mounk • May 15, 2025

Business•Strategy•EconomicDivergence•Europe•UnitedStates•Essays

I have at this point been taking part in public life for long enough that I usually have a sense of when I am about to say something controversial. If I make a strong criticism of Donald Trump or attack the excesses of wokeness, I know that I’m about to get some angry emails in my inbox. I no longer mind, really; it’s one of the less pleasant aspects of doing a job I truly love, one that is well worth the bad which comes with the good.

But from time to time, I still get a nasty surprise. For sometimes I blithely express a fact that I take to be far removed from the most emotive issues of the day and well-established in the relevant literature—only to learn from the state of my inbox that I had vastly underestimated the strength of popular sentiment about it.

When I recently spoke to Paul Krugman on his interview show, for example, I casually mentioned the astonishing economic divergence between Europe and the United States. Whereas both continents were similarly affluent a few decades ago, America is now nearly twice as rich as Europe.

Cue a flood of outraged emails. Lots of people wrote to me to say that I must have the facts wrong, or at least must have failed to understand what really is important. Nominally, some correspondents conceded, the GDP of the United States might now be much higher than that of France or Germany. But that’s only because America lacks a welfare state and is so vastly unequal. In reality, the average European is doing just as well.

The strength of this reaction may have had something to do with Krugman’s audience, which skews progressive. But oddly, mentioning this fact has elicited a similar reaction from very different audiences in the past. When I off-handedly cited the same stat to a center-right Member of the European Parliament a few months ago, he too had an allergic reaction. Raising his voice, he insisted that such stats just weren’t meaningful; in all of the metrics of life quality that truly mattered, such as disposable income and access to good housing, Europeans were surely doing at least as well as Americans.

But that just isn’t true. Largely unnoticed by the general public on both sides of the Atlantic, America has pulled away from Europe. The average American is now vastly more affluent than the average European. And this difference in life quality is not only reflected in the overall size of the economy; it is also evident in much more practical metrics such as the disposable income, the living space, or the services accessible to the average person.

When I was a teenager, the United States and the richest large countries in Europe, such as Germany and the United Kingdom, were similarly affluent. In 1995, Germany’s nominal GDP per capita was a little higher ($32,000) than that of the United States ($29,000), with the United Kingdom lagging behind at a noticeable distance ($23,000).

When I was in graduate school, the United States and the richest countries in Europe remained similarly affluent. In 2007, on the cusp of the financial crisis, for example, Britain was in the lead ($50,000), with the United States ($48,000) and Germany ($42,000) following closely behind.

Since then, the two continents have markedly diverged. To an extent that few people have fully internalized, an economic gulf has opened up between America and Europe. On average, Americans are now nearly twice as rich as Europeans. According to the latest available data for GDP per capita, the United States stands at $83,000, with Germany at $54,000 and the United Kingdom at $50,000.

The contrast to less affluent European countries is even more striking. The GDPs per capita of France ($45,000) and Italy ($39,000) have fallen to about half of America’s level. Those of Portugal ($27,000), Greece ($23,000) and Poland ($22,000) are less than a third that of the United States.

GDP per capita is of course vulnerable to many of the critiques made by those who deny the existence of the great economic divergence. If America is vastly more unequal than Germany or the United Kingdom, then it is indeed possible that the lion’s share of that economic pie is captured by a very small number of people; in that case, America’s greater GDP simply wouldn’t translate into notably more affluence for the average person.

The problem with this seemingly plausible explanation is that it doesn’t hold up to empirical scrutiny. America is indeed somewhat more unequal than Europe. But the difference is not nearly as stark as some people on both sides of the Atlantic seem to assume. Indeed, America’s GINI coefficient, at 0.39, is only modestly higher than that of Britain, at 0.36, and only moderately higher than that of Germany, at 0.29. As a result, metrics that aren’t skewed by outsized wealth at the top, like household income at the median, still show a vast divergence between the two continents…

Netflix Is Turning Into an Advertising Company

Nymag • John Herrman • May 16, 2025

Business•Marketing•Advertising•Streaming•AI•Media•Essays

I wish I remembered half as much about more important milestones than “my first time streaming Netflix,” but we don’t get to choose our brains. It must have been late 2007, and the company had just started experimenting beyond DVD by mail. I was watching on a creaky Dell laptop, probably in bed. I remember there weren’t many options (at launch, Netflix’s “Watch Now” feature had only around a thousand movies, many of which seemed to be mockbusters). I think I ended up choosing The Matrix. I think I didn’t finish it, because there was no way to watch on a real TV. I sort of remember thinking it was cool that it worked at all, but that my roommate’s compulsive piracy habit still provided a better service. One thing I definitely remember, though, is that it didn’t have ads. TV did, network websites did, and soon, so would other baby streamers like Hulu. But not Netflix. Which was nice.

Skip ahead to this week. Depending on what you call YouTube, Netflix is now the leading streamer, with hundreds of millions of customers and billions of dollars of original programming in its catalogue. This week, it shared some news:

Amy Reinhard, Netflix’s President of Advertising, took the stage at our third Upfront to highlight the growth of the ad-supported plan, which now reaches more than 94M global monthly active users and more 18-34-year-olds than any other US broadcast or cable network. Ads members in the US are highly engaged, spending an average of 41 hours per month on Netflix.

Netflix, onetime avatar of post-advertising TV, now does upfronts; on top of that, its ad-supported subscription tier (which is cheaper, but not free) is by far the fastest-growing part of its business, more than doubling in a year. While a lot of these ad-tier subscriptions will be downgrades from more expensive plans, rather than new subscribers, that’s fine for Netflix: The $10 price gap between its ad-supported tier, which was just raised in January, and its premium tier is proving relatively easy to close with sponsorship. The company once opposed to “chopping up” its content, whose founder insisted should be a “safe respite” and not “tied up with all that controversy around advertising,” and which used to argue that ad-free TV development led to better programming, is doing everything it can to become an advertising heavyweight.

It’s on its way. Netflix no longer discloses total subscriber numbers, but 94 million ad-tier subscribers, based on the most recent available data, probably account for a bit less than a third of its total subscribers. Earlier this year, the company opened its long-awaited ad platform, which it hopes will streamline ad sales but which will notably put it in more direct competition with YouTube, which it has lately described as its biggest competitor. This comparison, along with recent tests of a “TikTok-style” discovery feed, makes it clear that Netflix is trying to stake a claim in the broader digital advertising market, competing directly with companies like Google, Meta, and Amazon, which, to be fair, are some of the only bigger internet firms left to take on. To do so, the company says, it’s not just permitting ads. It’s ready to extrude brands through its interfaces in whole new ways:

Netflix debuted a new modular framework for ad formats that leverages generative AI to instantly marry advertisers’ ads with the worlds of our shows. This will create a better, more relevant experience for our members and drive the best results. [Netflix’s head of advertising] unveiled the first capability with interactive midroll and pause formats that build custom advertising creative with added overlays, call to action, second screen buttons, and more to serve the right ad to the right member at the right time.

To translate this a bit, with the help of the Verge, this means that viewers “might see an ad that blends in with the show [they’re] watching,” like an “image of a product over a background inspired by one of its shows, like Stranger Things.” (Amazon announced something similar this week, telling brands about AI-powered contextual “pause ads” that could “dynamically align the ad message with the content viewers are watching — creating a natural and relevant connection.”) Looking past the thin AI angle here, the future of television sounds a lot like the rest of the internet’s recent past: targeted ads, automated product placement, the constant invention of new sponsorship formats, and the gradual disappearance of unmonetized attention.

The sensation of being constantly surveilled and contextually marketed to will of course be familiar to anyone who has opened a website, watched an online video, or used a social-media app in the last two decades, but it’s a fairly big pivot for Netflix. Users can still pay to avoid ads, but the last two years of numbers suggest the possibility that, soon, a majority won’t bother. At that point, Netflix won’t just have ads; it’ll be an advertising company. It’s already starting to program like one.

Everything is Technology

Notboring • May 13, 2025

Technology•Strategy•Innovation•VentureCapital•MarketDisruption•Essays

Welcome to the idea that technology companies will displace incumbents with products that are so much better than what existed before that the shift is inevitable. The modern shift in business is that technology companies are replacing sclerotic incumbents, creating tens of trillions of dollars of value as we speak.

The world changes faster than expected, and the resulting outcomes are larger than anticipated. Technology “eats the world” in two ways: direct displacement, like Tesla versus legacy autos, and market aggregation or creation, like Uber versus taxis. Today, $1 billion exits are around the 85th percentile of outcomes, not the 99th, and VC megafunds are positioned to capture this expanding opportunity.

History shows technology's transformative power. The shift from horse-drawn carriages to motor cars in New York City between 1900 and 1913 exemplifies rapid displacement. Ford’s Model T, introduced in 1908, quickly dominated, generating revenue far beyond the entire carriage industry it replaced.

Similarly, Tesla has overtaken the traditional automotive industry, valued near $1 trillion, exceeding the combined worth of the large automakers when it entered. This transformation indicates technology’s power and the growing venture capital addressable value (VCAV).

Technology companies grow by either directly displacing existing industries with better products, like Tesla, or by creating new, addressable markets from fragmented ones, like Ford and Uber. Uber expanded the market far beyond traditional taxi revenue, tapping into a much larger car ownership cost market, and is now worth $175 billion, surpassing initial market size estimates.

VC megafunds are not simply excessive fee-grabs but a response to the scale of opportunity created by technology-driven market shifts. The scale of successful exits and the size of funds have grown alongside the expanding tech market. Large venture funds reflect the belief that the VC addressable market will grow substantially as technology displaces and aggregates markets in industries beyond traditional tech.

Asset managers, like Vanguard, Blackstone, BlackRock, and Brookfield, have historically capitalized on major shifts by building scale and expertise early. Today’s megafunds are similarly positioning around “everything is technology,” betting that future industries—from energy to healthcare to education—will be dominated by technology companies, often vertical integrators.

VC-backed companies are staying private longer and compounding value with new financing products, presenting further reasons for the growth and size of megafunds. Historical and modern evidence point to a future where technology permeates every sector, with venture capital driving large-scale value creation and transformation.

Everything is technology, and the future belongs to those who understand and invest accordingly.

Sway: a plan to reimagine democracy

Neo • Ali Partovi • May 13, 2025

Politics•Democracy•CivicTech•LiquidDemocracy•PoliticalInnovation•Essays

Dear Neo family, we’re incubating something new.

I’m starting the most ambitious project of my life: a tech platform to reimagine democracy.

I know you've probably got opinions on this – please give feedback and maybe join us.

This is personal for me. Throughout my life, I’ve spoken out on political topics — both in my work launching Code.org, and on various issues from local to national and international. Whether I was right or wrong, winning or losing, I felt a deeper frustration: the system sucks.

If you think politics is hopeless, you're not alone. As a child from Tehran who saw the 1979 Islamic revolution, I know how much worse it can get. It’s time to make democracy better, and there is hope.

What would representative democracy look like if it were invented today?

I’m starting Sway, a powerful new network for people to organize around shared views. Led by my long-time colleague Claire and cofounders Kayla and Prachi, Sway will start with a humble focus: a new way for local organizers to advance local causes by uniting voters. These groups will connect in an organic network that informs how people vote and impacts election outcomes. If this network grows large enough, Sway has the potential to shift the balance of power to the people and restructure the fabric of democracy.

To succeed, this plan needs: 1) a compelling value proposition at the small scale; 2) a distribution mechanism to make it spread; and 3) the power to cause systemic change at scale.

A new way for voters to unite

If you've ever tried to change anything related to government, you know how frustrating it is. Elected officials don't really listen to you and me; they listen to special interest groups whose support they need to stay in power (labor unions, lobbyists, etc). What if you and I could wield similar influence by joining voices with other citizens in a new way?

This is where Sway comes in. The atomic transaction of Sway is Vote with [Person] on Topic. For example, you might click to Vote with Melissa on Education or Vote with Bob on Housing. This simple concept has the potential to give citizens unprecedented power.

When you click to Vote with Melissa on Education:

We’ll verify your identity as a registered voter. Melissa can see a tally of how many registered voters are voting with her (“Sway Score”).

We’ll alert you at election time with Melissa’s Education voter guide, including ballot recommendations and tweet-length explanations.

You can be a leader too: if you want, recruit your own followers and rebroadcast Melissa’s voter guide to them. Every follower can also be a leader, resulting in a network.

Both sides benefit from this transaction. Leaders gain influence, and followers gain a way to align their votes with individuals they trust and causes that matter to them.

Voting is hard! Beyond major offices like President, who has time to study all the local options like county sheriff and school board? Most of us are passionate about specific causes, yet don’t know how to connect the dots to those causes when we vote.

We want a shortcut. For example, just choose Democrats or Republicans, then vote D or R down the ballot. Political parties, labor unions, and lobbies like the NRA all serve this need. They unify people around shared issues, and they send out voter guides.

Sway is the modern alternative to these legacy orgs. We’ll enable the same thing on a much more personal, granular level. You might not align with a party on everything. Wouldn’t you prefer to vote with someone you trust on the specific issues you care about? Vote with multiple leaders and get a personalized Sway voter guide that combines their recommendations. Like investing in a portfolio, spread your vote among the causes and people that matter to you.

Voting with a leader will make you feel empowered too. You're uniting with others to give someone you trust a bit of power to make change on your behalf.

Stage 1: A platform for local influence

Even on a small scale, Sway empowers citizens. With enough followers, an ordinary citizen can wield extraordinary influence when advocating for their cause.

For illustration, consider my wife Melissa Partovi, a passionate parent in Piedmont, California, whose organization, Piedmont Unplugged, wants the local public schools to be phone-free. She might speak to the Piedmont Board of Education only to be ignored.

Using Sway, she can change the game by recruiting others to Vote with Melissa on Education. If she amasses 100 Piedmont voters, she’ll get the board’s attention, because she’s no longer just a lone citizen. Her Education voting guide will reach 100 subscribers, potentially enough to swing the next election.

If voting alerts and ballot recommendations can decide election outcomes, Sway’s impact will extend far beyond. All year round, Sway will empower organizers like Melissa to demand meaningful change from policymakers, and Sway Score will become a new currency for power.

Our focus on local organizers like Melissa is also a key distribution strategy. Leaders like her will promote Sway just as they promote online petitions. They’ll have extra motivation to use Sway, because unlike a petition, the verified voter constituency will endow them with outsized, lasting influence.

As more and more people form organic connections on Sway, we'll build a network uniting millions of citizens in interconnected coalitions.

Stage 2: Expanding to regional levels and beyond

The granular example above is the building block for a larger network. As Sway groups interconnect and leaders join forces, they’ll pave new paths to advance popular causes.

Any leader can themself become a follower. If a local leader decides to Vote With a regional leader, the regional leader’s voting recommendations will pass through to the local followers.

In the last example, Melissa may want to align with a national figure such as Jonathan Haidt of The Anxious Generation. Assuming Haidt has a Sway profile, Melissa would click Vote With Jonathan on Education. Now Haidt’s voter guide will go to Melissa’s followers, and all her Piedmont voters will add to Haidt’s Sway Score.

This empowers Haidt to advocate for phone-free schools not only in his local state of New York, but also in California and even nationally. As Haidt accumulates enough voters in California, he can contact a California lawmaker and ask them to support a statewide bill for phone-free schools, and so on.

Have you ever felt that a cause you cared about was excluded from the prevailing political dialogue? Sway gives you a platform to join forces with others and advance your ideas at every level, ultimately empowering anybody to become a national leader.

Stage 3: Power to the people

Sway will hit an inflection point at critical mass. It will start helping a few groups amplify their influence. This will attract other groups, including opposing causes competing for voters (the platform itself must remain neutral). Eventually, if Sway reaches a representative cross-section of all voters in any jurisdiction, it will resemble liquid democracy and unlock systemic change.

At critical mass, elected officials will see Sway as a valuable and necessary resource to listen to you and me (their constituents) instead of inaccurate polls.

What if we could directly predict election outcomes based on Sway followers? The more people use Sway, the better these predictions. One day, Sway could tell a candidate running for office whether they’re going to lose, and precisely which causes and citizen leaders they must embrace to win. This would be an indispensable service to any elected official….

Airbnb’s New App, Experiences and Services, Chesky’s Founder Mode

Stratechery • Ben Thompson • May 14, 2025

Business•Strategy•MarketplaceDynamics•ExperienceEconomy•SharingEconomy•Essays

Airbnb has a new app with new offerings for experiences and services; I'm not sure the economics make sense for either.

From Bloomberg:

After more than a year of teasing expansion plans beyond home rentals, Airbnb Inc. launched an overhauled app that’s not just for homeowners and travelers, but also for personal chefs, hair stylists, trainers and tour operators to offer their services widely. The company, whose name has become synonymous with vacation stays, revealed its new Services offering and relaunched its Experiences tour-booking product at an event Tuesday in Los Angeles. It’s vetted providers to offer 10 categories of in-home services, including personally cooked meals, prepared food items, full-service catering, photography, spa treatments, massages, personal training, hair, makeup and nail appointments. The services can be reserved anytime even without a vacation booked, and many of them include “an entry offering below $50,” Airbnb said.

The new Experiences business touts a trimmed-down list of nearly 20,000 tours and cooking classes, curated for quality and uniqueness with an average cost of $66. Think: a tour of the restored Notre-Dame cathedral with an architect from its restoration team, or a ramen-making class in Japan led by an award-winning chef. And similar to the branded stays it promoted last year, Airbnb will offer limited-time celebrity-led experiences, like playing football and having Kansas City barbecue with Chiefs quarterback Patrick Mahomes…

“What if people monetize their biggest asset in their life, which is not their house probably, but their time? That’s exactly what we’re doing with the launch of Services and Experiences,” said Chief Executive Officer Brian Chesky in an interview ahead of the event. “What it means is Airbnb is not just a marketplace for vacation rentals. It’s a global community in the real world where you can travel and live anywhere and you can certainly use Airbnb every week now in your own city. It’s just going to be a bigger part of your life.”

Chesky framed the announcement at the end of The Airbnb 2025 Summer Release presentation:

When I came to Silicon Valley, the world was excited about tech. The promise of the Internet was that we’d all be more connected, and these amazing tools were supposed to bring us closer and make us happier. And for a while it really felt like they were. But somewhere along the way, something drifted, and we started spending more time looking at screens, and less time in the real world, and instead of growing closer and feeling happier, people drifted further apart and became more lonely. But despite all of this, I am still optimistic, because I’ve seen how technology can bring us together and truly connect us.

I’ve been asked this question, with two billion guests, what have you learned? My answer is simple: people are fundamentally good, we are 99% the same, and if this wasn’t true, we would have been out of business a long time ago. Travel reminds us of this truth, because it’s when we are most open and curious about other people, it allows us to see and understand the world and each other. But Airbnb is not limited to travel. What we experienced with our guests that first weekend was about so much more. It was about real connection with real people in the real world. What we’re building is much more than a travel app. It’s a global community in the real world, where you can travel anywhere, live anywhere, and belong anywhere. This is what we’re building, and to think it all started with the air bed.

It’s a beautiful vision that, unsurprisingly, is a lot like Airbnb itself; the problem is that I’m not sure that is a compliment. While Chesky romanticizes Airbnb’s founding story and the idea of making friends with strangers anywhere in the world, the reality of Airbnb is often much different: professionalized hosts you never see giving you codes to non-descript condos or houses with endless rules and fees, all governed by fake courtesy and the fear of a bad review.

More broadly, setting up Airbnb as a counter to everything that has allegedly gone wrong with tech is an interesting choice, when Airbnb is arguably more emblematic of tech’s recent impact than any other company: on one hand, Airbnb has created new markets that didn’t exist previously, transforming real estate from static assets to much more dynamic ones, and providing a dizzying array of new choices to travelers; on the other hand, the cost of the former has been the transformation of residential neighborhoods to awkward hotel districts, and the latter has entailed creating a massive market and making everything into a transaction.

Those marketplace dynamics govern everything: Airbnb hosts have a fixed asset that needs to maximize utilization to earn money; that means they are beholden to a service that brings huge amounts of demand consistently, minimizing the number of vacant nights. Travelers, for their part, want something other than a hotel for whatever reason (families with kids, for example), but still want a mechanism to establish trust; Airbnb succeeds by bringing these parties together at scale. Or, to put it another way, the route to connecting real people with real assets necessarily first entails atomizing both sides of the market such that only Airbnb can bring them together. Sure, real people in real houses is different than looking at a screen, but it’s arguably less enduring and meaningful precisely because of just how impersonal and fleeting the transaction is.

Venture Capital

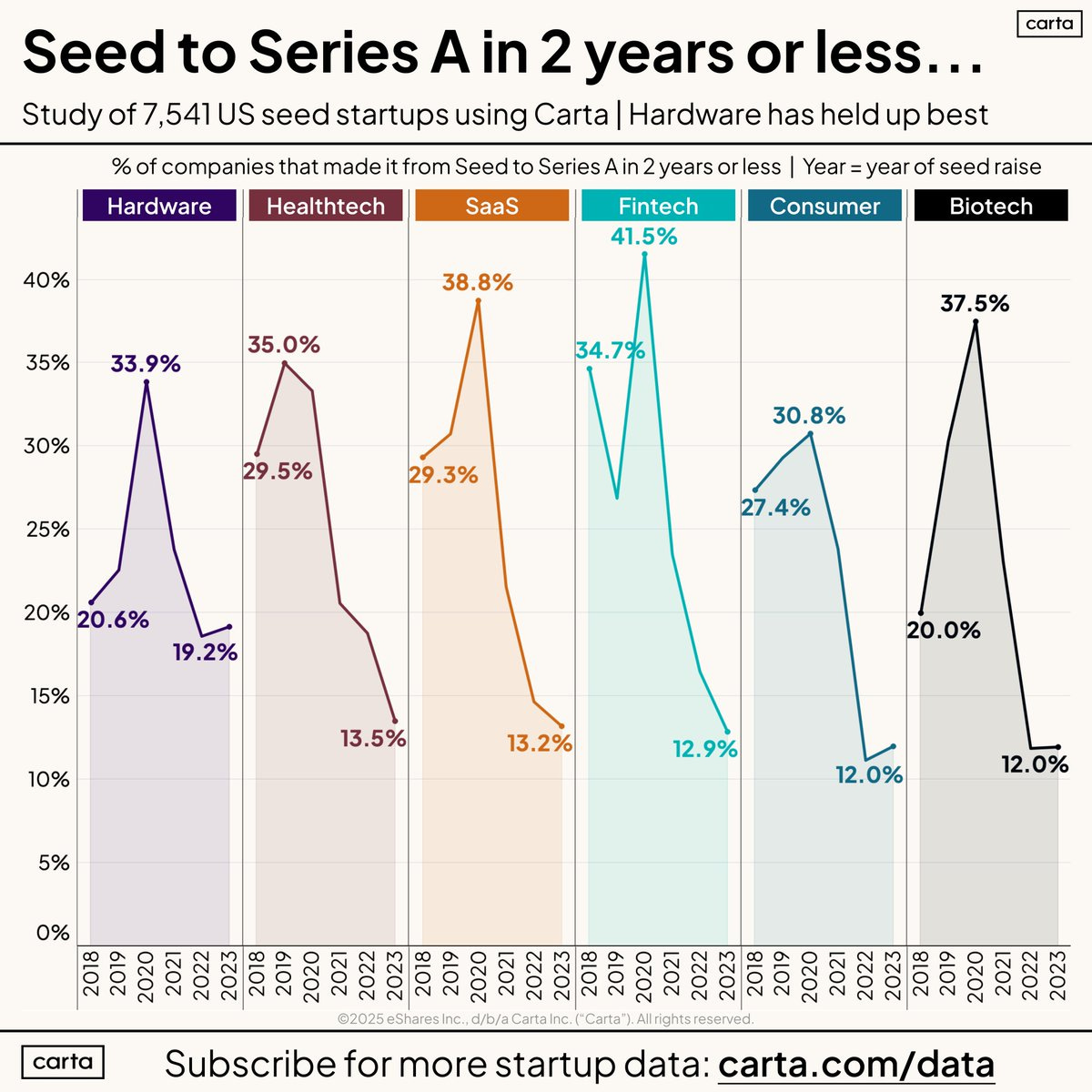

Seed to Series A Graduation Rates by Sector: A Sector-by-Sector Analysis

X • PeterJ_Walker • May 16, 2025

X•Post of the Week

Key takeaway: Graduation rates from Seed to Series A funding remain challenging across sectors, with no standout outperformers. Hardware startups have shown the most resilience, avoiding extreme market bubbles, while 2024 seed cohorts hint at a modest improvement.

In this insightful Twitter thread, industry analyst @PeterJ_Walker breaks down the dynamics of startup funding progression from Seed to Series A rounds, segmented by sector. The data reveals a tough funding environment where most sectors struggle to maintain high graduation rates.

Highlights from the analysis:

Hardware Sector: Has demonstrated the strongest performance in Seed to Series A graduation rates. Notably, hardware startups avoided the excesses of bubbly market conditions seen elsewhere. The thread credits @lpolovets for highlighting this sector’s relative stability.

Other Sectors: Across the board, no sector is excelling, indicating a widespread difficulty for startups progressing beyond the Seed round.

Year of Seed Raise: Graduation rates are calculated relative to the year in which a company raised its Seed round, providing a nuanced view of temporal trends.

2024 Seed Cohort: Early indicators suggest this group of startups could experience slightly better graduation rates compared to previous years, signaling a potential shift or recovery in the funding landscape.

Below is the key visual shared by @PeterJ_Walker, illustrating sector-specific graduation trends with historical context:

This graphic provides a clear year-by-year comparison, emphasizing how graduation rates have fluctuated and positioning hardware startups as comparatively more resilient during challenging funding cycles.

For producers and hosts, potential discussion points include:

What structural factors might explain why hardware startups weather funding downturns better than others?

How could market conditions in 2024 be enabling improved graduation rates

What do these trends imply for founders and investors strategizing in different sectors?

Are there emerging sectors or technologies outside this analysis that could disrupt these patterns?

This thread offers crucial insight for anyone tracking venture capital trends, startup survival rates, and sector-specific funding dynamics in today’s evolving innovation ecosystem.

Crypto and stock trading app eToro shares soar in Nasdaq debut: CNBC Crypto World

Youtube • CNBC Television • May 14, 2025

Finance•Trading•Cryptocurrency•StockMarket•Fintech•Venture Capital

Shares of eToro, the crypto and stock trading app, soared in their Nasdaq debut, highlighting strong investor interest in platforms that combine both markets. The company’s public listing marks a significant milestone as it aims to capitalize on growing retail demand for accessible trading and investment solutions.

eToro has positioned itself at the intersection of traditional stock trading and cryptocurrency markets. Its platform allows users to invest in a variety of assets, including stocks, cryptocurrencies, and other financial instruments, making it a one-stop solution for diverse investor needs.

The company’s listing reflects broader trends in the finance and technology sectors, where fintech firms are increasingly integrating multiple asset classes to attract a younger, tech-savvy demographic investing globally.

As eToro moves forward, its Nasdaq debut is seen as a test of how hybrid trading platforms will perform in public markets amid evolving regulatory landscapes and competitive pressures from both legacy financial institutions and new market entrants.

The 30-Year Unicorn Backlog

Crunchbase • May 12, 2025

Business•Startups•Unicorns•Exits•VentureCapital•Venture Capital

If the current pace of exits persists, it would take 30 years for every U.S. company on The Crunchbase Unicorn Board to go public or be acquired. While it may sound disheartening, it’s actually an improvement from the measure we took nearly a year ago.

In the past 12 months, 15 private, venture-backed companies valued at $1 billion or more have gone public or been acquired. This is a slight increase from the previous period, indicating a modest acceleration in exit activity. However, with 741 U.S.-based private, venture-backed companies still on the Unicorn Board, the backlog remains substantial.

Historically, the annual number of unicorn exits has varied. In 2021, a peak year, 86 known unicorns achieved exits. Over the past five years, the average has been 38 per year. At this average rate, it would take nearly 20 years to clear the current backlog.

It's important to note that not all unicorns will eventually exit. Some may fail, leading to shutdowns or bankruptcy reorganizations. Others might remain private indefinitely, as demonstrated by companies like SpaceX. Additionally, a booming secondary market for shares in private companies has opened up a path to liquidity that doesn’t require a formal exit event.

Looking ahead, while not all unicorns will achieve exits worthy of their valuations, there is hope for an increase in IPO activity. Public markets have shown receptiveness in recent months, and unicorn shareholders are eager for liquidity.

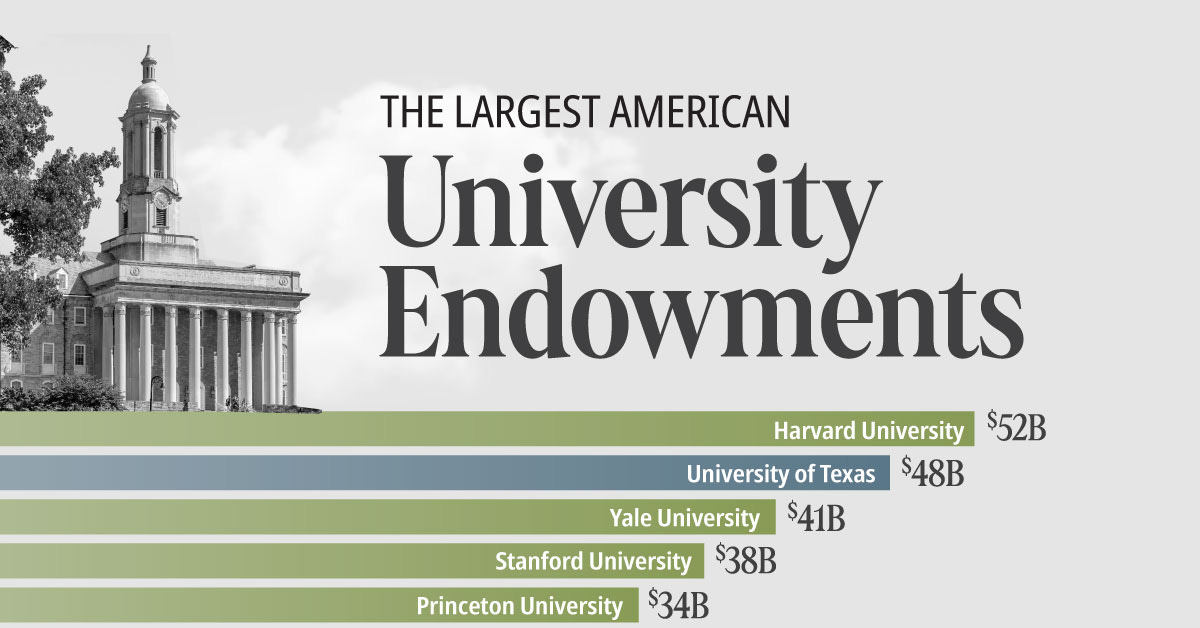

Ranked: The Largest American University Endowments

Visualcapitalist • Dorothy Neufeld • May 14, 2025

Education•Finance•UniversityEndowments•Investment•HigherEducation•Venture Capital

At $52 billion, Harvard University has the largest endowment nationally, with Mark Zuckerberg, Bill Gates, and Ken Griffin among its megadonors. In second is the University of Texas System, worth $47.5 billion as of fiscal year 2024. Yale follows next, at $41.4 billion, seeing among the strongest investment returns over the last decade.

University endowments held more than $870 billion in assets last year, largely dominated by America’s elite institutions. While Harvard, Yale, and Stanford have amassed tens of billions in assets, the median endowment stands at $243 million across 658 institutions. Overall, endowment assets increased by 4% in 2024 driven by donations and investment returns.

As the largest university endowment worldwide, Harvard boasts a number of wealthy donors including Michael Bloomberg and hedge fund billionaire John Paulson. After the Trump administration froze billions in grants and funding, it raised $1.1 million across more than 4,000 online donations in the first two days after stating it would push back against their demands. Overall, the fund holds $52 billion in assets.

The University of Texas System is the only public university endowment ranking in the top five. UT Austin is among the few universities that has invested in Bitcoin, along with Stanford and Brown. While endowments typically avoid riskier investments, they are increasingly allocating funds into cryptocurrency thanks to regulatory factors. A number of elite institutions have the largest endowments nationally, including Stanford and Princeton.

While universities hold significant endowment funds, much of the assets are designated for a specific purpose, such as scholarships. These assets are often invested in illiquid assets such as real estate and hedge funds. Selling these at a loss can be damaging if universities face a funding shortfall.

In fiscal year 2024, $30 billion in endowment funds were spent as follows: 48% on student financial aid, 18% on academic programs and research, 11% on endowed faculty positions, 7% on facilities operation and management, and 17% on other purposes. Nearly half of spending went toward student financial aid, with some of the largest endowments such as Stanford and Harvard covering 100% of students' financial aid requests. Academic research was the second-highest category, followed by endowed faculty positions funded by endowment donations over many years. Facilities operation and management covered renovations and building repairs, accounting for the smallest share overall.

Venture Capital’s Second(ary) Chance

Crunchbase • May 15, 2025

Finance•VentureCapital•SecondaryMarket•Liquidity•CorporateInvestors•Venture Capital

The venture capital (VC) industry has long embraced the notion that "illiquidity is a feature, not a bug," operating under the premise that investments are held until exit, with returns primarily realized through initial public offerings (IPOs) or strategic acquisitions. However, this traditional approach is increasingly being challenged by the evolving dynamics of the secondary market.

The secondary market allows investors to sell their stakes in private companies before an IPO or acquisition, providing a mechanism for liquidity that was previously unavailable. This shift is particularly significant given the extended timelines often associated with VC investments, which can span over a decade. The emergence of this market offers a lifeline for investors seeking to realize returns without waiting for a traditional exit event.

Recent trends indicate a surge in secondary market activity. In the first half of 2024, the volume of secondary transactions reached a record $68 billion, marking a 58% increase from the same period in 2023. This growth is driven by several factors, including the maturation of VC funds, the need for liquidity among limited partners (LPs), and the increasing acceptance of secondary transactions as a legitimate exit strategy. (commonfund.org)

Corporate venture capital (CVC) investors are particularly active in this space. Facing a dearth of IPOs and mergers and acquisitions (M&A) opportunities, CVCs are turning to the secondary market to divest their holdings. In 2024, secondary market funds had close to $30 billion in unspent cash reserves, highlighting the liquidity available for such transactions. (globalventuring.com)

The growth of the secondary market is also evident in the increasing capital raised for secondary funds. Industry Ventures, a leading firm in this sector, raised $1.45 billion in September 2024 for its 10th secondary fund, underscoring the growing investor appetite for such assets. (pitchbook.com)

Despite these positive developments, challenges remain. Valuation discrepancies between buyers and sellers can complicate transactions, and the market's complexity requires specialized knowledge to navigate effectively. Nevertheless, the secondary market's expansion represents a significant evolution in the VC landscape, offering new avenues for liquidity and reshaping traditional investment timelines.

SignalRank News

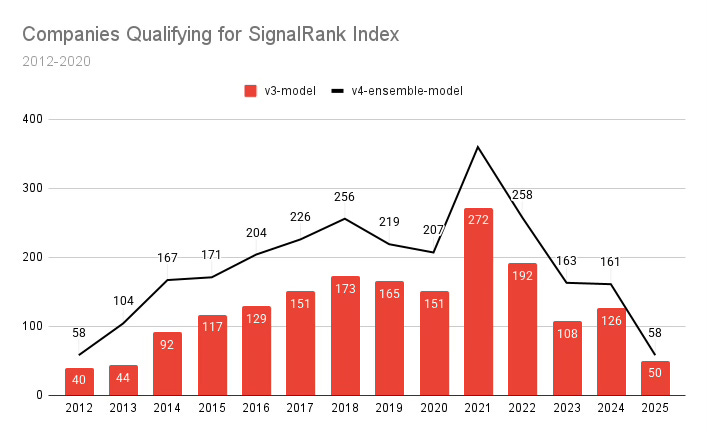

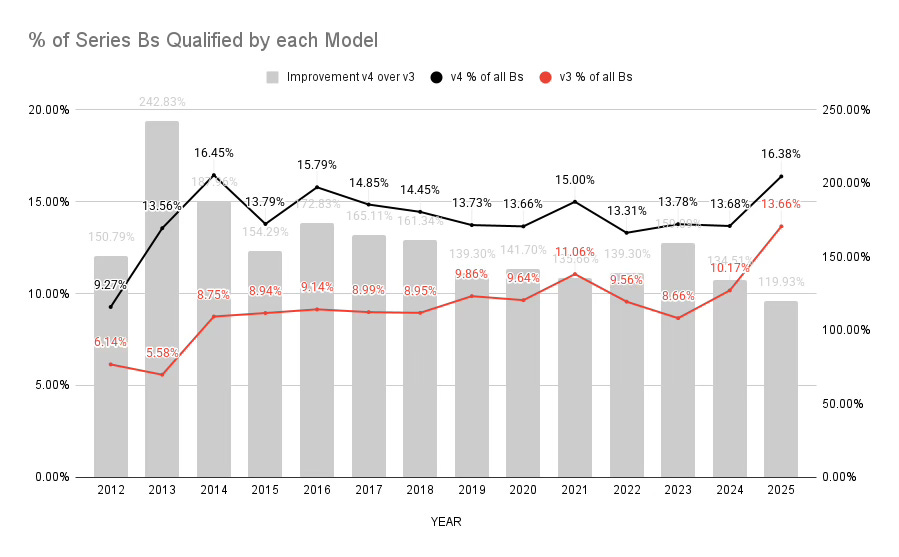

SignalRank Marks Two-Year Milestone with Strong Performance, Announces v4 of Investment Selection Model

Signalrankupdate • May 15, 2025

Business•Finance•Investment•Performance•DataDriven•SignalRank News

PALO ALTO, CA – May 15, 2025 – SignalRank, the Palo Alto-based technology-driven venture investment platform, today announced several key milestones, including:

Two years of performance data for The SignalRank Index

Launch of Version 4 (v4) of its investment selection model

Availability of the SignalRank Index to accredited U.S. investors and overseas equivalents

35 Series B investments completed in 24 months

Since making its first Series B investment in May 2023, SignalRank has emerged as the world’s second most active Series B investor—trailing only Andreessen Horowitz in completed deals. SignalRank has participated in 35 financings alongside leading firms such as Sequoia Capital, General Catalyst, Lightspeed, Khosla Ventures, Accel, Founders Fund, and Kleiner Perkins.

The SignalRank Index—a first-of-its-kind venture capital index—offers qualified investors access to a diversified portfolio of high-growth AI and technology companies. Notable Index constituents include Mercor, Saronic, Chainguard, and Together AI. Shares of the Index are priced daily and are available for purchase by accredited investors and equivalent entities outside the United States. The company ultimately aims to list the Index, expanding access to retail investors and wealth managers.

Early Performance

While venture investing requires a long-term view, preliminary results are promising. As of May 2025, the SignalRank Index reports:

2023 cohort: 1.26x multiple on invested capital (MOIC)

2024 cohort: 1.2x MOIC

These early returns place the Index in the top decile of performance among comparable venture investments.

“We’re encouraged by the growth of our partner network—now nearing 300 early-stage firms,” said Rob Hodgkinson, Head of Investments at SignalRank. “The quality of both deal selection and access continues to improve, helping us deliver a compelling investment product while supporting our partners at a critical stage of company growth”

Details are available in the SignalRank Index Two-Year Briefing Report.

Launch of v4: Ensemble-Based Investment Selection Model

SignalRank also announced the release of v4, its most advanced company selection model to date. The v4 model combines heuristic and machine learning techniques in an ensemble architecture to identify high-potential Series B investments. Backtesting indicates that v4 can:

Reject up to 87% of Series B opportunities as unlikely to perform

Generate a projected average 6x return over five years for annual investment cohorts

Keith Teare, CEO and CTO said:

“This is the first time we’ve blended heuristics with machine learning into a true ensemble model. The backtest shows performance that exceeds that of any known Series B investor over a five-year horizon. For our partners, it’s a decision support engine; for Index investors, it signals potential returns far ahead of public market benchmarks.”

The full v4 Technical Report is available here: v4 detailed report.

The SignalRank Index: two years in

Signalrankupdate • May 15, 2025

Finance•Investment•VentureCapital•PrivateEquity•AIInvestment•SignalRank News

The SignalRank Index (the “Index”) is two years old this month.

The Index now consists of 35 companies, all selected by SignalRank’s proprietary algorithm and accessed via the pro rata of our seed partners.

We started investing two years ago in May. Here are some of the key milestones achieved in those two years:

Top decile performance of US VC funds for the 2023 vintage (per Carta data)

35 investments completed to date, making us the 2nd most active Series B investor in the world. Every investment is alongside the highest quality VCs.

Our growing seed network now gives us visibility of over 50% of all live B rounds globally

The full (announced) Index can be found on our website here.

In this post, we analyze the Index to date, summarize our progress and consider our forward-looking goals.

Index analysis

1. Index performance

The Index is still young as our first investment was in May 2023. We have nevertheless already seen strong momentum in the Index, including:

Chainguard raised $356m Series D

Saronic raised $600m Series C

Three other Index companies are slated to announce Series Cs shortly

Our 2023 cohort ranks comfortably in the top decile of 2,079 US funds based on Carta’s data (where top decile is 1.2x TVPI for 2023 vintages), our 2024 cohort is also performing above that threshold.

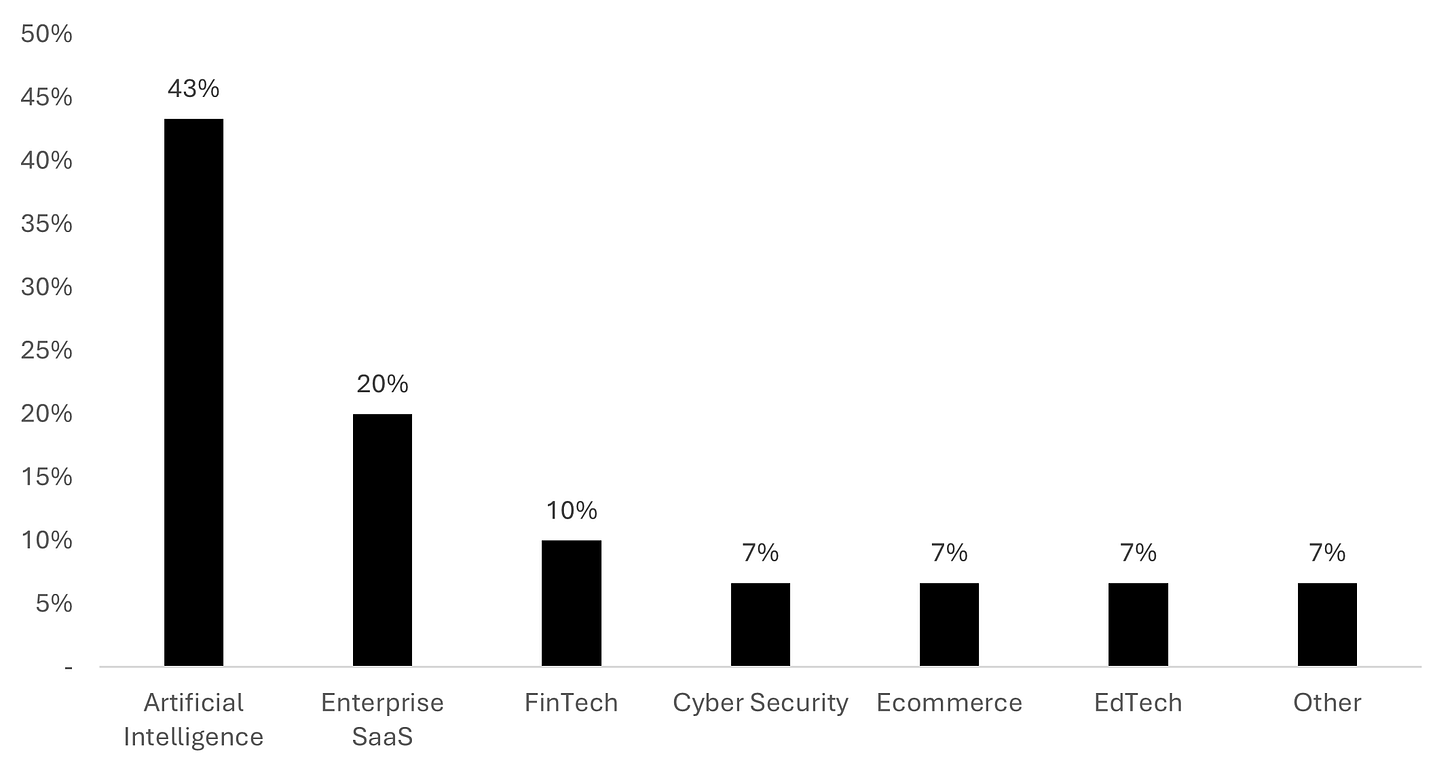

2. Index composition

This chart (Figure 1) demonstrates our index construction in terms of investment sizing per opportunity. Our goal is for the Index to be equal weighted at scale. Current variance in check size reflects variability in fundraising. With new capital inflows, we expect improved consistency.

Figure 1. SignalRank Index by check size

Source: SignalRank

SignalRank’s investment strategy is agnostic to geography, sector and manager. Our Index is majority (67% by number of investments; Figure 2) in the US and the largest sector is artificial intelligence (43%; Figure 3).

Figure 2. SignalRank Index by geography of investment (% of investments)

Source: SignalRank

Figure 3. SignalRank Index by sector (% of investments)

Source: SignalRank; Crunchbase sector designation

Within AI, SignalRank is spotting and funding the next breakout companies (Figure 4).

Figure 4. Select AI companies in the SignalRank Index

3. Sourcing

We have reviewed over 900 pro rata opportunities from 200+ seed managers in the last two years. The 35 Series B investments to date are in support of 27 unique seed managers.

SignalRank releases v4-ensemble-model to production.

Signalrankupdate • May 15, 2025

Technology•AI•MachineLearning•VentureCapital•InvestmentModel•SignalRank News

SignalRank is an index of private venture backed companies at Series B, currently 35 of them. Access is available via SignalRank share purchase to accredited and qualified investors.

In the 24 months since our initial investment, SignalRank has deployed capital across three annual cohorts, 2023, 2024 and the in-progress 2025 cohort. The 2023 and 2024 cohorts have already achieved a 1.2x multiple on invested capital (MOIC) placing them in the top decile of venture performance (per Carta data).

The value of SignalRank’s preferred shares has risen to a price of $27.09 a share, having seen four price increases over 24 months due to multiple company up-rounds.

SignalRank selects Series B investments through a scoring system that identifies the top 5% of opportunities. The newest version, v4-ensemble-model, enhances the previous heuristic-only method by incorporating machine learning into an ensemble framework.

The model scores every Series B round as it happens and is designed to predict likely outcomes. It targets a five year MOIC of 5x as its definition of “success”.

v4 is based on a new three year scoring paradigm, a change from the five year horizon used in v3. This means we have fine tuned the heuristic part of the model to score investors on three years of investments and outcomes for every round type. This refinement focuses on more recent investor performance trends.

Selection

v4 selected more and rejected fewer companies than the prior model while improving performance.

The new model rejected 9,732 of 11,344 Series B rounds between 2012-2020 (the backtest). It was 86% accurate in predicting those 9,732 companies would not achieve a 5x in five years MOIC performance. The prior model rejected 10,282 and was 83.5% accurate.

This means that v4 accepted 1,612 selections as qualifiers as compared to 1,062 for v3. That is 52% more investable companies without the cost of reduced performance.

v4 is 28.9% accurate in selecting companies that deliver 5x or more in five years, compared to 27.9% for the prior version. v4 generated 466 companies over 5x in five years as compared to 296 from v3 in 2012-2020.

Take Away: v4 selects more companies and they perform better…..

Reference: v4 backtest

AI

No, really, everything becomes BI

Benn • May 9, 2025

Technology•AI•BusinessIntelligence•DecisionMaking•ContextualAI

Here's a question I sometimes think about: If you wrote down every memory and fact and thought inside of the head of a CEO and gave it to an AI, which one would make better decisions?

You could have two theories:

Being a CEO requires some impossible-to-quantify human judgement that can never be replicated by a computer, so the best way to run a business is by giving the CEO more information. Show her a useful chart; recommend to her the right management book; give her a timely snippet of a few customer calls, or a summary of all of them. It is much better to give her the right presentation of facts, and let her combine them with her inscrutable sense of judgement, than it is to leave important decisions up to an AI.

Being a CEO requires context. The average CEO isn’t smarter than ChatGPT, but the average CEO has a lot more information—decades of personal experiences; memories from thousands of unrecorded conversations; proprietary knowledge about her business that wasn’t in the millions of ChatGPT’s training documents. Though the world’s most powerful tech companies are now great vampire squids wrapped around the face of humanity, relentlessly jamming their blood funnels into anything that smells like text, they can’t yet reach all the text. And perhaps the difference between us and them—and, in particular, the reason why we might make better decisions than they do—is not our divine sense of taste, but simply because we have some text that they do not. Perhaps human intuition is just a large context window and a creative RAG process. So rather than using AI to make the CEO more informed, maybe the best way to run a business is by reversing the roles: The AI should ask her questions to make itself smarter, so that it can make better decisions.

On one hand, this is obviously a dumb hypothetical. Our heads are not folders full of Word documents that can be exported onto a USB drive.1 We make decisions based on an uncountable number of beliefs and emotions that nudge our thinking in mysterious ways. We have preferences, and opinions, and inexplicable gut feelings whose origins we can't even explain ourselves. "Write down everything you know" is a ridiculous thing to ask someone to do.2 So any advocate of the second option can always say that an AI that makes worse decisions than the CEO is no true Scotsman: Not only would a fully informed AI make better decisions than she would, but the fact that it didn’t is itself proof that it wasn't fully informed.

On the other hand, the question doesn’t have to be so metaphysical. There are degrees. Does a CEO make better decisions than an LLM when she asks, “Sales are down, what do I do?” I mean, I hope so. But what if she tells it her business type or shows it a few metrics (like traffic, conversion, CAC)? What if she spends five minutes explaining why she thinks sales are down? What if she spends an hour? What if she gives it the deck that her vice president of sales presented to the board about why he thinks sales are down? What if she gives it a transcript of that board meeting, in which everyone talked about the vice president of sales’ presentation? What if she gives it the emails that she sent back and forth between the board and the vice president of sales? What if she gives her Slack messages and Google docs? What if she gives it every Slack message, and every email, and every Google doc? What if she gives it everything that’s ever been typed, recorded, or transcribed inside of her company? What if, when it needs to make a decision, the AI can ask her questions, about her preferences and opinions and inexplicable gut feelings, and weigh those in its decisions as it sees fit? What if it straps itself to her head and records her entire life?

What if the question isn’t about the CEO—who’s making enigmatic strategic decisions and engaging in the dark art of the deal—but the vice president of sales? A sales rep? A content marketer writing corporate blog posts? An analyst? An intern?

I don’t know. But historically, we’ve built organizations and products around the first theory.3 Companies hired consultants to produce giant reports full of research; they employed data teams to meticulously log every sale and click, and aggregate them up into giant binders full of numbers; they convene weekly business reviews in which departments present giant decks full of charts; they recruit spies at rival companieswho can send them giant texts full of gossi–um, no, I mean, giant boxes of watches to London.

In the first couple years of this whole AI thing, it seemed like that was how we’d use it too: As another source of information. Transcription tools like Gong and Granola log all of your sales calls and make them searchable; “enterprise search” products like Glean tentacle through your Gmail and Google Drive, and summarize them for you; PwC and Walmart and McKinsey built chatbots that answer “common tax questions” and “summarize large documents” and “synthesize vast stores of knowledge.“ OpenAI’s deep research reads industry blogs and checks Twitter, and turns what it finds into a tidy book report. A gazillion SQL chatbots look for insights in your corporate databases. And on the other end of all these tools, someone reads the transcripts and the reports and the reports about the transcripts, blends what they learn with their inscrutable sense of judgement, and makes a decision.

But without the history that came before it, would we design our use of AI this way? Between the two of us—an AI that, in some approximate sense, knows everything that has ever been known, and me, who has a smattering of specialized experiences and meaty hands—who should be the agent and who should be the executive? Who would be the labor and who would be the management?

Takeaways from Coding with AI

Oreilly • Tim O’Reilly • May 14, 2025

Technology•AI•SoftwareDevelopment•GenerativeAI•AIProgramming

I thought I’d offer a few takeaways and reflections based on last week’s first AI Codecon virtual conference, Coding with AI: The End of Software Development as We Know It. I’m also going to include a few short video excerpts from the event. If you registered for Coding with AI or if you’re an existing O’Reilly subscriber, you can watch or rewatch the whole thing on the O’Reilly learning platform. If you aren’t a subscriber yet, it’s easy to start a free trial. We’ll also be posting additional excerpts on the O’Reilly YouTube channel in the next few weeks.

But on to the promised takeaways.

First off, Harper Reed is a mad genius who made everyone’s head explode. (Camille Fournier apparently has joked that Harper has rotted his brain with AI, and Harper actually agreed.) Harper discussed his design process in a talk that you might want to run at half speed. His greenfield workflow is to start with an idea. Give your idea to a chat model and have it ask you questions with yes/no answers. Have it extract all the ideas. That becomes your spec or PRD. Use the spec as input to a reasoning model and have it generate a plan; then feed that plan into a different reasoning model and have it generate prompts for code generation for both the application and tests. He’s having a wild time.

Agile Manifesto coauthor Kent Beck was also on Team Enthusiasm. He told us that augmented coding with AI was “the most fun I’ve ever had,” and said that it “reawakened the joy of programming.” Nikola Balic agreed: “As Kent said, it just brought the joy of writing code, the joy of programming, it brought it back. So I’m now generating more code than ever. I have, like, a million lines of code in the last month. I’m playing with stuff that I never played with before. And I’m just spending an obscene amount of tokens.” But in the future, “I think that we won’t write code anymore. We will nurture it. This is a vision. I’m sure that many of you will disagree but let’s look years in the future and how everything will change. I think that we are more going toward intention-driven programming.”

Others, like Chelsea Troy, Chip Huyen, swyx, Birgitta Böckeler, and Gergely Orosz weren’t so sure. Don’t get me wrong. They think that there’s a ton of amazing stuff to do and learn. But there’s also a lot of hype and loose thinking. And while there will be a lot of change, a lot of existing skills will remain important.

Here’s Chelsea’s critique of the recent paper that claimed a 26% productivity increase for developers using generative AI.

If Chelsea will do a sermon every week in the Church of Don’t Believe Everything You Read that consists of her showing off various papers and giving her dry and insightful perspective on how to think about them more clearly, I am so there.

I was a bit surprised by how skeptical Chip Huyen and swyx were about A2A. They really schooled me on the notion that the future of agents is in direct AI-to-AI interactions. I’ve been of the opinion that having an AI agent work the user-facing interface of a remote website is a throwback to screen scraping—surely a transitional stage—and while calling an API will be the best way to handle a deterministic process like payment, there will be a whole lot of other activities, like taste matching, that are ideal for LLM to LLM. When I think about AI shopping for example, I imagine an agent that has learned and remembered my tastes and preferences and specific goals communicating with an agent that knows and understands the inventory of a merchant. But swyx and Chip weren’t buying it, at least not now. They think that’s a long way off, given the current state of AI engineering. I was glad to have them bring me back to earth….

OpenAI just fixed ChatGPT’s most annoying business problem: meet the PDF export that changes everything

Venturebeat • Michael Nuñez • May 12, 2025

Technology•AI•EnterpriseAI•Productivity•DocumentManagement

OpenAI has added a powerful PDF export feature to its Deep Research tool, signaling a major push into enterprise AI and transforming how businesses generate and share insights.

This new capability addresses one of the most frustrating business problems faced by users of AI tools like ChatGPT—efficiently exporting generated content into a professional, shareable format. The PDF export allows users to produce polished documents that retain the formatting and context of conversations or research outputs, making it easier to distribute and present findings.

With this feature, users no longer need to rely on cumbersome copy-and-paste methods or third-party software to compile reports and insights derived from AI interactions. Instead, the export function simplifies the workflow for business professionals, researchers, and teams leveraging AI for data-driven decision making.

The introduction of PDF export is part of OpenAI’s broader strategy to enhance its enterprise offerings, aiming to embed AI more deeply into workplace processes and improve productivity.

Databricks' buying spree: CEO on the catalysts changing AI

Youtube • CNBC Television • May 14, 2025

Technology•AI•Software•Databricks•ArtificialIntelligence

Watch this video on YouTube

Databricks Is On An M&A Roll With $1B Neon Acquisition

Crunchbase • Joanna Glasner • May 14, 2025

Technology•AI•Cloud•MergersAndAcquisitions•DatabaseManagement

Databricks announced Wednesday that it will acquire database management platform Neon in a deal reportedly valued at around $1 billion.

The planned purchase is one of 13 known acquisitions to date for San Francisco-based Databricks, which looks well-capitalized for more deals going forward. The AI data unicorn raised $10 billion in a late-stage venture funding five months ago at a $62 billion valuation, alongside $5.3 billion in debt financing.

With its Neon purchase, Databricks CEO Ali Ghodsi said the company is looking to sharpen its edge in an “era of AI-native, agent-driven applications.” Per Ghodsi, a good part of Neon’s appeal was that 80% of the databases provisioned on its platform were created automatically by AI agents rather than by humans.

Databricks is willing to pay handsomely for that use case. Per Crunchbase data, the Neon purchase appears to be the second-most-expensive to date for Databricks, after its $1.3 billion purchase of generative AI startup MosaicML two years ago.

As a startup, Neon also attracted attention and good-sized checks from venture and strategic investors. Founded in 2021, the Silicon Valley company raised about $130 million in known venture funding to date, with lead investors including Microsoft’s M12 and Menlo Ventures.

For Databricks, the Neon acquisition comes amid a period of sharp growth. Per a CNBC report posted on the company’s website, annualized revenue is expected to reach $2.4 billion by the midpoint of this year. The company also projects that annualized sales for the first half of this year will be up 60% from a year earlier.

Databricks’ purchase of Neon isn’t a done deal yet, as it will require regulatory approval.

Who's Coding Now? - AI and the Future of Software Development

Youtube • a16z • May 16, 2025

Technology•AI•Software•Coding•FutureOfWork

The landscape of software development is undergoing a significant transformation driven by advances in artificial intelligence. The future of coding is being reshaped by AI tools that enhance productivity, reduce routine work, and open new possibilities for developers and businesses alike.

AI-assisted coding environments leverage machine learning models to generate, complete, and even debug code based on natural language prompts or partial input. This technology is already changing how programmers work, shifting the focus from writing boilerplate code to supervising and directing AI-generated solutions. The integration of AI in software development promises to democratize programming, allowing people with less traditional coding experience to create complex applications and automate tasks efficiently.

The shift raises important questions about the nature of programming jobs and the skills developers will need to thrive. Rather than replacing human coders, AI is expected to augment their capabilities, handling repetitive or highly technical tasks while enabling humans to focus on creativity, design, and problem-solving. This partnership can drive innovation at unprecedented speeds and reduce time-to-market for new software products.

Companies are investing heavily in AI tools to stay competitive, recognizing that the synergy between human developers and intelligent machines will define the next era of technology. As AI continues to evolve, the role of the software developer will evolve too, emphasizing adaptability, strategic thinking, and collaboration with AI systems.

When Will We Pay a Premium for AI Labor?

Tomtunguz • 82 to 92 percent • May 15, 2025

Technology•AI•Pricing•EnterpriseSoftware•HealthcareAI

AI agents are increasingly outperforming humans in various tasks, yet they typically cost 70% to 80% less.

Will they ever be able to charge a premium?

Waymo has reduced accidents by 82 to 92 percent in San Francisco. Waymos monitor more sensors, don’t fatigue, and react more quickly than humans. But, Waymo is often 13-33% cheaper than alternatives.

Within medicine, recent studies suggest AI can be at least as accurate as human doctors, in the evaluation of rashes from smartphone photos, estimating longevity, and diagnosing medical case histories, scoring 90% accuracy compared to human doctors who averaged in the mid-70s.

But who today is paying a premium for an AI doctor?

This is equally true within the world of enterprise software where many agentic startups are priced at a quarter to a third of a human worker.

One rationale for pricing at a discount in the short term is the technology is still evolving. While AI might be strong in some particular cases, quality needs work. An executive sponsor of an AI technology needs to be paid in some sense for assuming the risk the project may not succeed.

Most recently, Klarna reverted to human customer support because AI output is lower quality.

For a startup, pricing at a discount offers a trade-off: the ability to capture market share, secure recognizable clients (logos), build credibility, and gather data to improve systems is considered worth the initial revenue sacrifice.

Another reason lies within Jeff Bezos’ maxim, “your margin is my opportunity.” If an AI can complete the same task as a human for a third of the cost and maintain similar margin, there’s a competitive advantage to gathering share. Plus, economies of scale, data network effects, and brand building associated with rapid growth also justify a lower price in the market.

Last, customers may prefer speaking to another person and are willing to pay a premium for it.

The current discount model for AI, driven by market penetration strategies and evolving technology, might not last forever.

We haven’t yet seen an AI product command a premium to the human alternative. But for applications where AI’s unique advantages - constant vigilance, instant processing, and comprehensive knowledge are paramount, we may see it.

In such cases, AI would transform from a cost-saving tool to a premium service.

Sequoia on AI's Trillion-Dollar Opportunity

X • Benln • May 14, 2025

X•AI

Key Takeaway: Sequoia highlights artificial intelligence as a monumental economic force, poised to create a trillion-dollar market by transforming industries globally through unprecedented innovation and productivity gains.

In this insightful thread, @benln shares a powerful infographic from Sequoia Capital illustrating the vast financial opportunity artificial intelligence presents. The visual breaks down the scale and scope of AI’s impact across different sectors, emphasizing its role as a revolutionary technology with the potential to unlock massive new markets and efficiencies.

The image underlines how AI will be a driving force behind the next wave of economic growth by enabling companies to:

Automate complex workflows and reduce operational costs.

Enhance decision-making through advanced data analytics.

Create entirely new product categories and business models.

Accelerate innovation cycles and scale impact rapidly.

Sequoia’s analysis forecasts that AI will not just improve existing sectors but will unlock latent value within emerging markets—leading to the creation of trillion-dollar businesses unlike anything seen before.

This thread is a must-read for investors, entrepreneurs, and technologists eager to understand where the future economic power lies and how AI will shape our world in the coming decade.

```

OpenAI launches research preview of Codex AI software engineering agent for developers — with parallel tasking

Venturebeat • Carl Franzen • May 16, 2025

Technology•AI•SoftwareDevelopment•OpenAI•Codex

OpenAI has introduced a research preview of Codex, an AI software engineering agent designed to autonomously perform various development tasks. This advanced agent is built upon a fine-tuned version of OpenAI's o3 reasoning model, enabling it to execute multiple development tasks simultaneously. Initially, the service is available to ChatGPT Pro, Enterprise, and Team users, with plans to extend support to Plus and Edu users in the near future.

The evolution of Codex marks a significant advancement from its original iteration, which debuted in 2021 as a model for translating natural language into code. The initial version powered GitHub Copilot, offering code generation and completion capabilities. However, it faced challenges such as syntactic errors, insecure code suggestions, and biases in its training data. The new Codex addresses these issues by acting autonomously over extended periods, capable of writing features, fixing bugs, and answering codebase-specific questions. This enhancement positions Codex as a comprehensive tool for developers, streamlining the software development process.

The introduction of Codex aligns with OpenAI's broader strategy to integrate AI into various aspects of software engineering. In January 2025, OpenAI launched Operator, an AI agent capable of autonomously performing tasks through web browser interactions, including filling forms, placing online orders, and scheduling appointments. This initiative reflects OpenAI's commitment to expanding the practical applications of AI in daily activities. (en.wikipedia.org)

The release of Codex also highlights the competitive landscape in AI-driven coding tools. Companies like Anthropic, Google, and Meta are actively developing similar technologies, aiming to revolutionize the software industry by enhancing coding efficiency and accessibility. OpenAI's Codex, with its advanced reasoning capabilities and autonomous task execution, is poised to play a pivotal role in this transformation. (ft.com)

As AI continues to evolve, tools like Codex are expected to significantly impact software development, offering developers powerful resources to enhance productivity and innovation. While challenges such as code quality, security, and ethical considerations remain, the potential benefits of integrating AI into software engineering are substantial.

Google’s Jeff Dean on the Coming Era of Virtual Engineers

Youtube • Sequoia Capital • May 12, 2025

Technology•AI•Software•MachineLearning•Innovation

In this discussion, Jeff Dean, a leading figure at Google, explores the transformative potential of AI in the field of software engineering. He envisions a future where "virtual engineers" powered by advanced AI capabilities significantly augment human developers' productivity, creativity, and problem-solving abilities.

Dean highlights how recent advances in large language models and machine learning are already changing the way software is written and maintained. These models can understand natural language specifications, generate code snippets, and even identify bugs, enabling a new generation of tools that collaborate with engineers rather than simply serving as utilities.

The conversation touches on the progress Google and others have made in creating AI systems that can perform complex coding tasks, reduce repetitive work, and provide contextual recommendations. Jeff points out that while these AI systems will not fully replace human engineers, they will augment teams by handling routine or tedious aspects of development, freeing human talent to focus on higher-level design and innovation.

He also discusses the challenges ahead, such as ensuring reliability, mitigating bias, and addressing security concerns as the AI tools become more deeply embedded in the software development lifecycle. The promise, however, is a radical shift in engineering workflows, leading to faster iteration cycles and the democratization of software creation, lowering barriers for non-experts to build and deploy applications.

Ultimately, Jeff Dean’s vision paints a future where virtual engineers powered by AI are essential collaborators, transforming not just how software is built but also enabling new possibilities across industries.

When Software Buys Software

Newinternet • Jeff Morris Jr. • May 8, 2025

Technology•AI•Software•Automation•EnterpriseSoftware

It’s now obvious to most builders and investors that AI Agents are the new platform shift.

We’re in the early innings and seeing major breakthroughs in reasoning and chain- of- thought (CoT) everyday.

Frameworks like LangChain are driving rapid agent development, while software giants like Anthropic and Google are explicitly exploring agent-to-agent (A2A) communication paradigms.

From my vantage point as an investor, what’s most fascinating is how agents are beginning to operate with real autonomy. They aren’t just copilots anymore—they’re becoming decision-makers, even in enterprise software procurement.

Agents selling software to other agents sounds dystopian, but it’s not far off.

The traditional B2B sales cycle—built around human relationships, months-long funnels, and enterprise steak dinners—will give way to A2A transactions, where procurement is algorithmic, fast, and deeply rational.

We’re already seeing glimpses of this future.

Companies like Replit, Lovable, Bolt, and V0 have strong opinions about the infrastructure best suited for AI-driven applications. But the next step is agents deciding on that infrastructure without any human involvement. They’ll pick the tools that solve the problem fastest, cheapest, and most securely—no procurement team required.

Chapter One portfolio company Supabase is a perfect case study.

Just yesterday at Figma Config—now arguably the design conference of the year—Figma announced Figma Sites, with Supabase as the default backend.

In just over three years, Supabase has gone from open-source Firebase alternative to the database of choice for over 2 million developers. But more importantly, it’s begun winning embedded integrations inside app-building platforms. That’s a new level of distribution.

The Impact of AI on Education & What It Means for Work

Tomtunguz • half (still an effect of 0.332). • May 10, 2025

Technology•AI•Education•WorkplaceLearning•HigherOrderThinking

The blocky charts. The ability to solve a hard test problem. The hidden game of Snake. My graphing calculator was a 7th grade miracle.

AI is this generation’s graphing calculator. With about 2 years’ of studies, we can draw some conclusions on its impact. A meta-analysis published in Nature showed a medium to large impact on students.

The higher the Effect Size, the greater the Effect. 0.3-0.5 is considered a medium sized effect. Above 0.5 is considered a large effect.

As a tutor creating lessons & a personalized teacher answering questions to meet a student, AI improves higher-order thinking materially. This analysis supports the intuition behind AI as a personal Socrates.

Not every effect is strong in the study: longer use of AI reduces the Effect Size by half (still an effect of 0.332).

If this is true within education, the need for AI at work is more acute.

Elevating colleagues’ time & focus on higher-order thinking should provide a strong business competitive advantage. This effect might be short-lived - a jump start provides an early advantage - that is mitigated as more of the industry adopts AI.

The study suggests at work AI can function as a coach helping us improve how we sell, how we market, how we run companies. AI can help us learn about our industry, amalgamating insights across media & internal documents, & learn new skills.

And more familiarity with tools should enable compounded learning.

1See more about Hedges’ G

How AI is Reinventing Software Business Models ft. Bret Taylor of Sierra

Youtube • Sequoia Capital • May 8, 2025

Technology•AI•Software•BusinessModels•Innovation

Artificial intelligence (AI) is fundamentally reshaping the software industry, transforming how companies build, deliver, and monetize their products. Bret Taylor of Sierra shares insights into this transformation, emphasizing how AI integration enables businesses to create more adaptive and value-driven models.

One of the key shifts driven by AI is the move from traditional static software licensing to more dynamic, usage-based pricing models. This change allows companies to better align pricing with customer outcomes, fostering deeper engagement and creating more sustainable revenue streams. AI enables software to become more personalized and continuously improving, which in turn drives increased customer satisfaction and loyalty.