Contents

Editorial: The Speed of Now: AI is Fast, Humans are Slow

Essays

Venture Capital

The Great Unicorn Backlog: Visualizing A Decade Of Private-Market Buildup

High-profile venture capital firm to double down on Adam Neumann's Flow

Cluely, a startup that helps ‘cheat on everything,’ raises $15M from a16z

The new math: why seed investors are selling their winners earlier

The (Uncertain) Payoff from Alternative Investments: Many a slip between the cup and the lip?

Unicorns

Apple

Social Media

Abundance

Web 3

Energy

Geopolitics

AI

The ChatGPT Moment: When 8 Years of Growth Happens in 8 Months

After trying to buy Ilya Sutskever’s $32B AI startup, Meta looks to hire its CEO

Microsoft-OpenAI Drama Continues, WhatsApp Ads, Channel Subscriptions and the Creator Perspective

ChatGPT Is Becoming the Ultimate Mega-App: And It’s Already Starting To Eat B2B Software

Sequoia-backed Crosby launches a new kind of AI-powered law firm

Interview of the Week

Startup of the Week

Post of the Week

Editorial: The Speed of Now: AI is Fast, Humans are Slow

Andrew is traveling so we have an AI generated podcast this week

This week's newsletter captures something extraordinary happening in real time: the collision between exponential technological progress and linear human adaptation. We're witnessing what I call the Great Convergence—where AI-driven abundance meets institutional inertia, where billion-dollar startups emerge in months while venture funds take years to return capital, where everything is accelerating except our ability to keep up.

The Speed of Now

The numbers this week are staggering in their implications. ChatGPT compressed a decade of Google's growth into 300 days. Cursor went from zero to 360,000 paying customers with virtually no marketing spend. Databricks caught Snowflake at $3.7 billion ARR through pure AI-driven momentum. These aren't just business metrics—they're signals of a fundamental phase change in how value gets created.

But here's what's really happening: we're not just seeing faster growth; we're seeing the emergence of an entirely new economic operating system. When Andrej Karpathy talks about "Software 3.0," he's describing a world where English becomes the hottest programming language, where AI platforms absorb entire categories of B2B software, where the very concept of traditional SaaS becomes as quaint as punch cards.

This is abundance acceleration in its purest form. The productive capacity of civilization is expanding at rates that would have been inconceivable just two years ago. AI isn't just making existing processes more efficient—it's making entirely new forms of productivity possible.

The Friction of the Old

Yet everywhere this exponential progress touches existing systems, we see friction, delay, and dysfunction. Only 37% of 2019 venture funds have returned capital. The unicorn exit backlog would take 49 years to clear at current rates. Apple, one of the world's most valuable companies, is scrambling to diversify supply chains that took decades to build, spending billions to move production from China to India while navigating the messy reality that infrastructure and capability don't materialize overnight.

These aren't temporary glitches—they're the inevitable collision points between exponential and linear systems. Venture capital was built for a world where companies took 7-10 years to mature. Supply chains were optimized for stability, not agility. Corporate structures were designed for predictable, incremental change.

The Critical Choice

This convergence forces a critical choice that every individual, company, and institution must make: embrace the speed of the new or be relegated to managing the decline of the old.

The companies winning today—Cursor, Databricks, the AI-powered law firm Crosby—have chosen speed over safety, execution over deliberation. They're building in the new paradigm while their competitors are still optimizing for the old one. They understand that in an exponential world, the greatest risk isn't moving too fast; it's moving too slowly.

But this choice isn't just for companies. It's for all of us. The abundance economy isn't something that happens to us—it's something we actively create through our decisions, investments, and actions today.

Beyond the Tech Triumphalism

This isn't naive tech triumphalism. The challenges are real and significant. The venture capital liquidity crisis is creating genuine hardship for funds and LPs. Supply chain realignment is costly and disruptive. The concentration of AI capability in a few mega-platforms raises legitimate concerns about competition and control.

More importantly, as Kyle Harrison’s essay on critical thinking reminds us, we must resist the temptation to accept compelling narratives without rigorous scrutiny. The same intellectual humility that leads us to question claims about telepathy should lead us to question our own assumptions about technological progress and economic transformation. Paul Kedrosky sums this up in his “Who’s Weird - Maybe we’re Weird” essay where he suggests questioning our assumptions.

The Path Forward

But skepticism without action is just intellectual tourism. The trends shaping our world—AI acceleration, capital concentration, supply chain fragmentation, the emergence of new economic models—these are not abstract forces. They're the result of millions of human decisions, investments, and innovations happening right now.

The abundance economy emerging from this convergence offers extraordinary potential: universal access to intelligence, dramatic reductions in the cost of production, new forms of human flourishing. But realizing this potential requires more than just building better technology. It requires building better institutions, better policies, and better ways of thinking about the relationship between progress and equity. Above all it requires humans to embrace change.

In the Arena

The future isn't predetermined. The fact that AI can compress decades of progress into months doesn't guarantee that progress will benefit everyone. The fact that capital is flowing toward abundance-creating technologies doesn't ensure that abundance will be broadly shared. The fact that we can build space-based solar power and AI-powered legal services doesn't mean we will build them in ways that serve human flourishing.

These outcomes depend on the choices we make and the actions we take. They depend on entrepreneurs who choose to build solutions rather than just capture value. They depend on investors who fund long-term capability rather than short-term arbitrage. They depend on citizens who engage with the complexity of technological change rather than retreating into simplistic narratives of either utopian or dystopian inevitability.

The Great Convergence is happening whether we're ready or not. The question isn't whether we can handle the speed of change—it's whether we can match the speed of technological progress with the speed of human adaptation, institutional reform, and collective wisdom.

Everything is accelerating. Nothing is guaranteed. The future belongs to those who choose to build it.

Essays

Weekend Reading: Who's Weird? Maybe We're Weird

Paul Kedrosky • June 20, 2025

Business•Strategy•Economic Theory•Finance•Cultural Analysis•Essays

Like many of you, I think, I feel increasingly unmoored, and it is often unclear what, for want of a better word, still works. As physicist Stephen Hawking famously wrote, "Science will win because it works". That was always my implicit demarcation line between facts and nonsense, the idea that good ideas based on facts work, and thus win out, eventually (and eventually can be very long), whether in science, capital markets, or elsewhere (mostly).

But, but ... we are increasingly finding out, across a host of domains, that maybe we over-extrapolated from limited evidence. Just because something works, that it fits the facts, however briefly, or makes a lot of people a lot of money, doesn't make it a law of nature, economic or otherwise.

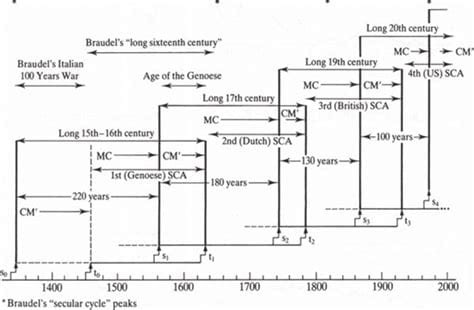

It is easy to fall into wave theory traps here, becoming a naive theoretician throwing around Fernand Braudel's ideas about cycles of capital accumulation, or Giovanni Arrighi's compelling expansion thereof. Those, too, are laws, albeit meta-laws, and we are therefore right to be suspicious of their claims, however appealing.

We are left with ... questions.

What works? And why? Who is the weird one?

Here is Financial Times columnist Gillian Tett on the topic in a recent Odd Lots episode on complexity and risk in finance. She makes many terrific points (with my emphasis added):

[The current economic] mindset arose from a combination of three factors. One was the growth of neoliberal free market ideas after the 1970s and 80s. The second was the explosion in computing power. And the third was the explosion in the financial industry.

And those three things came together to create a voracious demand to use the new digital tools in computing to model finance and free markets, supposedly free markets, to create a set of instruments that the fast-expanding ranks of financial professionals could use to price securities, predict the future, place trading bets, et cetera, around the world, backed by groups like the CFA, which were a bit like the American financial equivalent of the Catholic Church, in that they went around the world evangelizing and spreading the creed right around the world.

Now that was the mindset which we all grew up with—and an anthropologist would say we're all creatures of our own cultural environment—it seems to us to be normal natural and inevitable. It doesn't just use computing power to predict the future; it's also marked by a certain amount of tunnel vision because it assumes that if you put the right inputs into an economic model or put the information that matters onto a balance sheet of a compass you've basically got the key to model and forecast what's going to happen next.

And in some ways, that worked really well. But the problem is that there are always things that you leave out of your economic model. There are always things that you leave out of your balance sheet or just footnotes. And those things tend to be things like politics, social conflict, tech change, environmental risk, medical risk, or what groups like the World Economic Forum. interstate conflict, better known as war.

And the story of the last two decades is that everything that wasn't on the balance sheet or in the model is what's really blown up everyone's forecasts and become increasingly important.

So what we're seeing now, in my view, is the fifth big swing in the intellectual zeitgeist since 1900. And by that, I mean that up until 1914, you had imperialism. imperialist free market capitalism in the world. Then, between the wars, you had protectionist, populist, and nationalist visions of the economy. Then, after World War II, you essentially had Keynesianism, the idea that the state could jump in and direct things for the good of all. And that was sort of international Keynesianism. Then you had the neoliberal age, starting in the 1980s.

And now you've got a swing of the pendulum back towards effectively geoeconomics: the world's woken up and discovered what they always knew back in the 1920s. And they also sort of knew back in the Keynesian period, which is that power matters; politics matters.

[T]he period of time that we all grew up with when free market ideals were taken for granted is actually a historical aberration—if you look across societies and most points of history, it's not the case that the world we're moving into now is weird. We were the weird ones for the last 40 years.

This is me, Paul, back again. Tett's powerful and important points are worth heeding. I am reminded of author Douglas Adams writing about a sentient puddle:

…

On Rebel Theorem 4.0

Medium • Jared Heyman • June 19, 2025

Technology•AI•Machine Learning•Startup Success•Investment Returns•Essays

Last year I shared a post On Rebel Theorem 3.0, which was the world’s most advanced machine-learning (ML) algorithm at the time for predicting Y Combinator startup success. Now a year later, Rebel Fund has released our latest Rebel Theorem 4.0 model, and I’m excited to share how the model works and performs, and what we learned developing it.

In case you’re new here, Rebel is one of the largest investors in the Y Combinator startup ecosystem, now with 250+ YC portfolio companies valued collectively in the tens of billions of dollars. As an extremely data-driven fund, we’ve built the world’s most comprehensive dataset on YC startups and founders outside of YC itself, now encompassing millions of data points across every YC company in history.

We’ve invested millions of dollars into collecting this data and training our internal ML (and now AI) algorithms, which give us a major edge in identifying which YC startups in each batch are most likely to become tomorrow’s unicorns. It’s also helped inspire the dozens of blog posts I’ve published on YC startup trends, outcomes, and optimal investor strategies.

Outcomes

I’ll start by explaining the outcomes our new Rebel Theorem 4.0 model is designed to predict.

As I explained in my popular post On the power law of Y Combinator startups, the top ~6% of YC startups that become $1B+ companies drive the overwhelming majority of early investor returns. So, the obvious thing would be to predict startup valuation growth directly, but because the power law driving YC startup outcomes is so steep, the algorithm would only try to predict the extreme outliers (e.g. DoorDash, Airbnb, Stripe, Coinbase) which would add too much ‘noise’ to be useful.

So instead, as with Rebel Theorem 3.0, we bucketed YC startups into three broad categories for model training purposes, which we can predict accurately and reliably:

“Success” — $60M+ valuation and operating or exited

“Zombie” — Under $60M valuation and still operating

“Dead” — No longer operating nor exited

For batches before 2019, we’ve observed that 1 in 4 companies that achieved $60M+ valuations eventually became unicorns. So, if we can enrich our portfolio with more of these ‘Success’ companies, we’ll end up with a disproportionate share of unicorns in the end, the true driver of portfolio returns.

Performance

Now let’s get to the exciting part — how well our algorithm performs at predicting YC startup success.

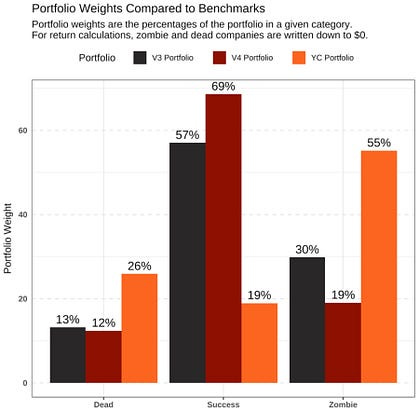

The chart below shows the actual outcomes of startups with top-decile Rebel Theorem 4.0 scores in backtesting. As you’ll see, nearly 70% of startups predicted to be a Success actually were one — about 2.5x better than YC averages. These startups were only half as likely to end up Dead as their peers, and only one-third as likely to end up Zombies.

This performance is astonishing if you know how difficult it is to predict startup success at the seed stage. You’ll also see that our v4 algorithm performed much better than our year-old v3 algorithm, thanks to more and higher quality training data.

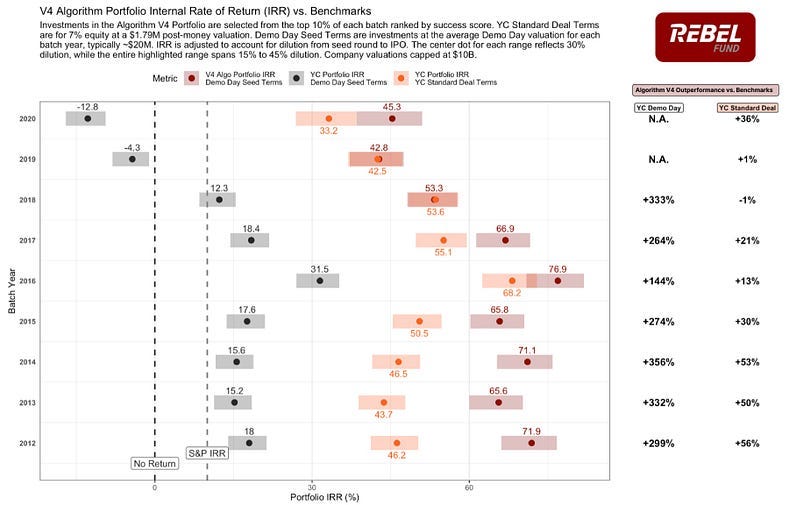

If you’re an investor, you’re probably wondering how this outperformance vs YC averages might translate into financial returns. We backtested that as well:

It’s a busy chart, here are the key findings:

Average YC Demo Day investor returns are estimated around a 15–18% gross IRR for mature vintages — already better than an S&P 500 index

Y Combinator itself kills it — due to its super-low entry valuation, we estimate YC achieved around a 45–55% gross IRR¹ for mature vintages, placing it amongst the highest performing venture funds of all time

Rebel Theorem 4.0 really kills it — had we invested in the top 10% of YC startups per the algorithm, our portfolio would have achieved an estimated 65%+ gross IRR for these mature vintages, even better than YC itself

I know some of these IRR numbers sound fanciful, but in an asset class where a single big winner can return 1,000x or more, they’re entirely possible with great deal selection, access and portfolio strategy.

The Burden of Proof

Investing101 • June 14, 2025

Finance•Investment•CriticalThinking•Telepathy•Autism•Essays

Every once in a while I have a conversation that causes my ears to perk up. I hear something that I either strongly disagree with or strongly agree with and I have a visceral reaction. I feel obligated to respond. To come to blows with the voices I disagree with or go to bat for the ideas I agree with.

I've written over and over again about the idea of storytelling and how its leveraged to reinforce in-group thinking. When I wrote about Intellectual Seat Belts I made the point that "people use establishment or in-group thinking as their 'intellectual seat-belt,' which makes them feel safe enough to just believe something without evaluating it themselves, leaving them to think less carefully."

Then, when I wrote about the Groucho Marx Mandate, I went a step further, making the argument that people don't just stop at believing the things that follow the path of least resistance, but that they'll start to put it into action within their worldview: "The stronger a group of people believe something, and the bigger that group of people is, the more likely that thing is going to start getting reflected in reality."

More and more, I've noticed that people tend to just default to beliefs that align with their in-group and then make that their reality. Leveraging a short-hand like in-group-think means that the burden of proof is on the group for holding the belief in the first place rather than on the person who is deciding whether or not to hold that view themselves.

Don't get me wrong. I'm not impervious to it, either. That verbal trigger of in-group thinking got set off for me this week when I heard an opinion that I immediately and viscerally disagreed with. The topic of conversation? Telepathy.

The Telepathy Tapes

I'm currently on a trip with a group of friends and I overheard a conversation between my wife and a friend of ours. Our friend mentioned a podcast she had recently stumbled upon and it had left her convinced that many non-verbal autistic kids are communicating with their caregivers and each other telepathically.

Again, going back to this idea of ideological heuristics; I am an immediate skeptic of anything that strikes me as lacking a healthy dose of critical thinking. Might seem surprising coming from someone who believes God talks to prophets and revealed a new book of scripture to a farm boy in upstate New York in the early 1800s, but here we are.

The podcast in question? The Telepathy Tapes. In it, documentary filmmaker Ky Dickens explores the stories of non-verbal autistics who are, reportedly, communicating telepathically.

Talking to my friend, she felt wholeheartedly convinced. The story was too compelling to not be believed, regardless of how fantastic it seemed.

But my response? "Absolutely that cannot be true."

She pushed me to, at least, listen to the podcast before I passed judgement. So I did. At least the first four episodes.

And I admit, at first I was very quickly caught up.

Emotional Resonance, Like Any Good Cause

First, its obviously a discussion topic riddled with emotional resonance. These are parents who are dealing with incredibly difficult situations with their children. These are children that are subject to a disease that we know very little about. It makes perfect sense that these parents would be desperate to communicate with their kids.

The stories are also incredibly compelling. The podcast shares stories of an autistic child sitting with an iPad that can communicate numbers and letters, and showing their parent a randomly generated number, only for the child to then tap out the number having seemingly never seen the number itself. The conclusion of the podcast was that this was clear evidence that the autistic children were receiving the information telepathically from their caregiver.

The Study of The Non-Physical

Second, towards the end of episode two, she hooked me with a framework that I've felt partial too myself. Magic is just science that we don't understand yet.

She shared the story of the poet John Keats saying that Isaac Newton was destroying the poetry and wonder of the rainbow by reducing it to just being a prism of colors.

She shared other examples of scientific breakthroughs that are first met with skepticism. Galileo and the sun as the center of the solar system. Gregor Mendel and the theory of genetics.

As the host of the podcast declared, "Many scientific breakthroughs that are rejected or ignored by academics and the public when introduced eventually become accepted as empirical truths about our world."

She reinforced the potential viability of the seemingly mystical element of telepathy amongst autistics with a Nikola Tesla quote that played right into my biased inclination towards the pursuit of the non-physical as it relates to my own spirituality. According to Dickens, Tesla reportedly said:

"The day science begins to study non-physical phenomena It will make more progress in one decade than in all the previous centuries of its existence."

I got excited. I took some notes and made plans to explore further. But that's where things broke down. I started to investigate more about the podcast, trying to apply my own logical lens of question asking, critical thinking, and truth-seeking.

The Case Against Telepathy

What I found that turned my perspective away from the podcast was a few things:

The Body of Contra-Evidence

Right from the jump when I started reading about telepathy in autistic kids, I came across a rich history of scientific studies discrediting the practices I was hearing about called Facilitated Communication (FC) and Rapid Prompting Method (RPM). Not only did I not hear about the work that has been done to cast doubt on these methods, I didn't even get a good description in the early episodes of exactly what these methods actually looked like.

Facilitated Communication, for example, is a parent holding up a letter board and having the kids point at the letters to spell out the answer.

Studies into these phenomenon with non-verbal autistics dates back to the 1990s. Researchers have described an effect that is similar to how Ouija boards work. The ideomotor effect can cause small, unconscious motor movements based on what the adult is thinking. The child, especially if they’ve been trained to respond to subtle prompts, may then type or point at the "correct" answer. The parent may swear up and down that they're not influencing the placement of the board, but a number of studies have shown that, even if unconsciously, they are.

Another story that struck me was a boy who could type his supposedly telepathically received information on an iPad without any assistance from the parent. But when you see the video of those interactions, you see what seem like clear micro-influence from the parent. One critic pointed out that if you watch the Mom's hand, its almost like there is a string attached from her hand to the boys. That could easily be the boys learned ability to pay hyper-attention to the Mom's movements.

The Lack of Skeptical Perspectives

One piece that I read made the point that the most skeptical perspective presented in the podcast is the camera man who self-identifies as a "huge skeptic" and a "materialist," but by the end of episode one he calls himself a "believer." The show doesn't address any perspective from noted critics of these practices, or mention things like the $500K reward offered by the Center For Inquiry "for anyone who can demonstrate paranormal abilities under scientific test conditions."

So, if The Telepathy Tapes are filled with demonstrations of these skills, what is the "scientific test conditions" that are missing? Put the parent in another room. As far as I can tell, the only way these telepathic abilities are demonstrable are if the child and the parent are in separate rooms while the child is offering up communication.

The Credibility of the Creators

The final nail in the coffin was the behavior and reputation of many of the key voices in the podcast. The creators of the show were actively pursuing take-down actions on small YouTube channels with ~500 subscribers, attempting to demonstrate some of the well-worn arguments against FC that are present in the Telepathy Tapes videos, despite those channels being well with their fair-use rights.

….

Are You a $300,000 Writer?

Nymag • Charlotte Klein • June 19, 2025

Business•Management•Journalism•MediaHiring•EditorialStrategy•Essays

Every Tuesday afternoon, many of The Atlantic’s newest, biggest stars gather for a meeting of what is called “the A-Team.” The Google Calendar invite goes out to 18 staffers, more than half of whom joined the magazine in the past six months and almost all of whom have been poached from the Washington Post, including Ashley Parker, Isaac Stanley Becker, Nick Miroff, Shane Harris, Missy Ryan, Jenna Johnson, and Michael Scherer. More veteran Atlantic heavyweights like Mark Leibovich, Tim Alberta, McKay Coppins, and Elaina Plott also are invited, as are the top brass, including editor-in-chief Jeffrey Goldberg and his deputy, Adrienne LaFrance. The organizer of the meeting is Griff Witte, who joined The Atlantic from the Post in January as a managing editor to lead the politics and accountability team.

That’s what the A in A-Team technically stands for: accountability. But it’s not hard to see another connotation, as it also refers to a group of bigwig journalists who have been hired at enormous cost. Nor is it difficult to understand why others at the magazine, the B-teamers by implication, have been rolling their eyes at it.

The Atlantic has been on a hiring spree this year, announcing the addition of roughly 30 editorial staffers since January. Nine of them came from the Post, whose implosion under Jeff Bezos coincided swimmingly with The Atlantic’s drive to double down on political reporting during the second Trump administration. Posties were looking to jump ship, and The Atlantic, which last year became profitable and crossed the threshold of 1 million subscribers, had the money to get them. The magazine, which is owned by Laurene Powell Jobs, has been offering salaries in the $200,000–to–$300,000 range, according to multiple people familiar with the hiring process. A conservative estimate suggests the magazine has added nearly $4 million in salaries to its annual budget, not to mention the expensive investment in new games it announced earlier this month.

“It’s always nice to see people throwing money at journalism, but Jesus Christ, they’re throwing a lot of money, and I’m not sure how it’s sustainable,” said an editor at a competing publication. “The salaries they’re offering are head and shoulders above what the market is for here, and they’ve hired some very good people, but I think it’s going to get crowded there very quickly.” And there are more A-Team additions to come: The Atlantic has just hired Toluse Olorunnipa, currently the Post’s White House bureau chief, and Nancy Youssef, who covers national security for The Wall Street Journal.

The creation of a new echelon of writers at The Atlantic is naturally a source of tension. A quirk of the magazine is that all writers have the same title — staff writer — which means there are huge pay disparities among colleagues of the same rank. “There are very clear hierarchies within that title within the publication, but they’re not delineated in any formal way, which makes it really frustrating to look around and be like, ‘I have the same title as this person but my job is totally different and there’s no clear path to progress toward having those circumstances,” said one former Atlantic staffer. “It’s part of why I think a lot of relatively young people have left in the past couple of years.” Nine women, many of them on the younger side, have left since the end of April 2024. Meanwhile, plenty of longtime staffers continue to labor away for far less money than their newer peers; the salary floor for edit staff was $69,000, according to the contract the union reached last year.

There is also a sense that Goldberg, a gregarious man-about-Washington who is known for his sharp elbows, can’t resist the allure of one-upping his rivals. “Jeff loves sexy hires. He loves to make another publication look foolish, to look like they got got,” a former Atlantic staffer said. “This happened a few times when I was there: Jeff would see a shiny object and suddenly there’d be someone new on your desk.” Or, in this case, a whole new team.

Still, it’s rare to see a media company not only turning a profit but putting that money back into its journalism. The Atlantic is betting on big-ticket reporting at a time when Google’s new AI tools are eating away at what’s left of search traffic and social-media platforms have pivoted away from news. As one Atlantic writer put it, “Who’s got it better? Only a handful of places exist and only a handful of places are literally saying, ‘Quality is all that matters.’ If anybody is unhappy, I’d think even they know well enough to be like, I’m just going to keep that to myself.”

Whatever The Atlantic is doing, it’s working. In March, the scoop of a lifetime landed in Goldberg’s lap when he was inadvertently added to a Signal chat group in which Trump’s national-security team was planning a military attack on Yemen. (“I feel lucky but not as lucky as Jeffrey Goldberg,” Graydon Carter said at a party this spring for his book launch. “Easiest scoop ever. Fuck!”) In the week after breaking the story, the magazine added about 100,000 new subscribers, and today it has more than 1.3 million subscribers at $80 a pop. The question for its newly expanded team is whether it’s going to mess with The Atlantic’s successful formula or enhance it, now and beyond the Trump era.

Venture Capital

The Great Unicorn Backlog: Visualizing A Decade Of Private-Market Buildup

Crunchbase • June 18, 2025

Business•Startups•Unicorns•VentureCapital•Technology•Venture Capital

Editor’s note: This article is part of a series looking at how the venture and startup landscape has evolved over the past 10 years. Read more articles about seed funding, Series B trends and the rise of megafunds over the decade.

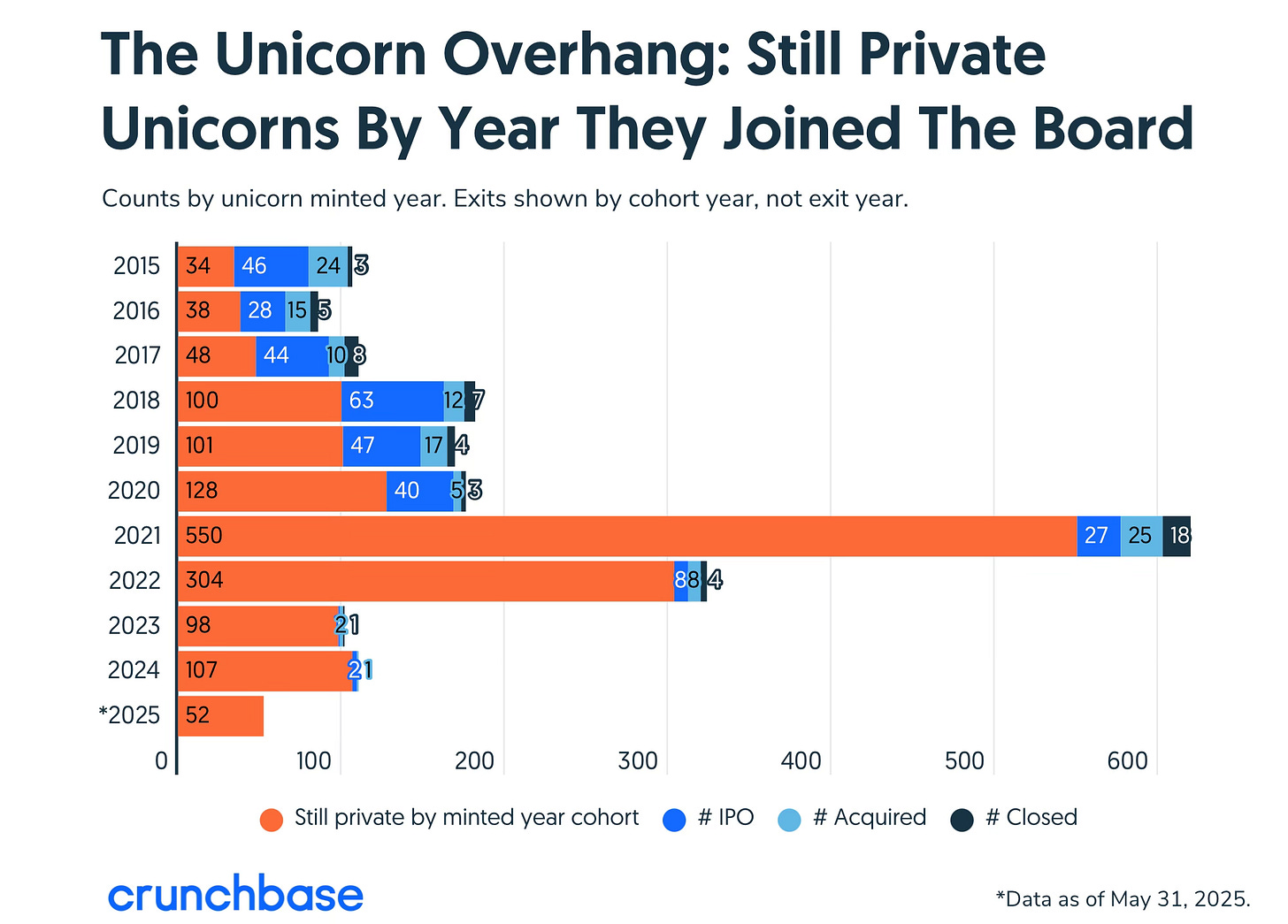

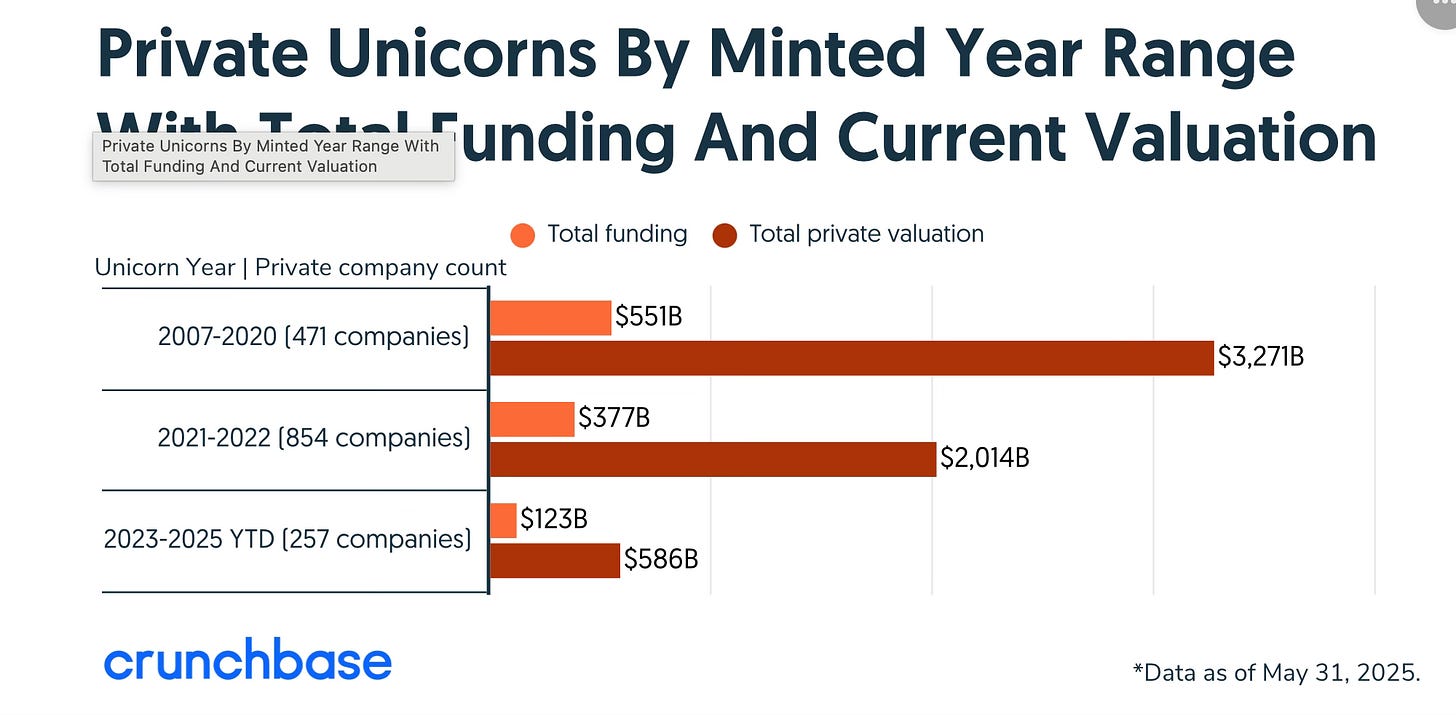

Over the past decade, Crunchbase has chronicled the rise of unicorn companies — private startups valued at $1 billion or more — as a signal of where venture capital dollars and market enthusiasm flow.

What began as a trickle in the early 2010s surged into a flood in 2021, as valuations skyrocketed and new unicorns joined The Crunchbase Unicorn Board at a record pace, with new unicorn creation growing threefold year over year.

But while the number of unicorns has continued to climb, exits have not kept pace. Today, the board hosts more than 1,500 companies, collectively valued at $6 trillion — most of which have not raised at a disclosed valuation in over three years. The board has continued to grow across all metrics, albeit at a slower pace.

Below, we visualize the vast backlog of still-private giant startups, highlighting how the private market boom has evolved into an overhang of capital, value and expectation. To gain some insight on the massive expansion of the board in 2021, we separated out cohorts from 2020 and earlier, the COVID growth years of 2021 which bled into 2022, and the slowdown of the past 2.5 years, even as AI has gained.

2020 and earlier cohorts

The 2020 and earlier cohorts have the highest exit proportion and currently also represent the majority of the board’s value, an analysis shows.

This is not surprising as these companies have had more time to grow their business and make exits. They also benefited from the boom year of 2021, when a record stream of companies went public. Of the 953 companies that joined the unicorn board before 2021, 46% have since exited, with the majority — by a factor of three —as public debuts vs. M&A exits.

Remaining on the board are some 470-plus still-private companies from this era, which account for more than half of the board’s current value at $3.2 trillion. These companies, which have had a longer time to grow, make up many of the most highly valued companies on the board and include SpaceX, OpenAI, ByteDance, Shein, Stripeand Databricks. The youngest of these valued above $60 billion is GenAI giant OpenAI, which will be a decade old by the end of this year, while the oldest is 25-year-old space exploration company SpaceX.

Rapid rise in 2021

The 2021 and 2022 cohort of new unicorns account for 54% of the companies currently on the board, and showed a massive increase in companies that joined in a short period of time. These 854 still-private companies are collectively valued at $2 trillion — a third of the current board’s value with nine of the top 50 valued companies. The most highly valued is Anthropic, part of the 2022 cohort of new unicorns and currently valued at $61.5 billion.

Slowed since 2023

In 2023 and through May 2025, 257 unicorn companies have joined the board, adding a half-trillion in value. The most valuable of this cohort are AI labs xAI, valued at $50 billion, and Safe Superintelligence at $32 billion. Many of the 2023 through May 2025 cohort of companies experienced an increase in value due to the AI wave.

Companies that have joined the board since 2023 match annual counts of earlier years, 2015 through 2017 — with around 100-plus companies per annum.

Unicorn overhang

The Crunchbase Unicorn Board is close to reaching 1,600 companies, approaching $6 trillion in value, with $1 trillion in funding raised. Only a small count of companies have dropped off the board through a lowered valuation or closure — around 40 since 2022.

And as of June 2025, over 60% of companies on the board have not raised funding with a disclosed value in more than three years.

While funds have downgraded valuations internally, they are still looking for returns. And in a more uncertain global market and with a slow pace of exits, the board is poised to keep growing.

….

Venture Fund Liquidity

Peter Walker • Linkedin • June 13, 2025

Finance•Investment•Liquidity•Emerging Managers•Venture Capital

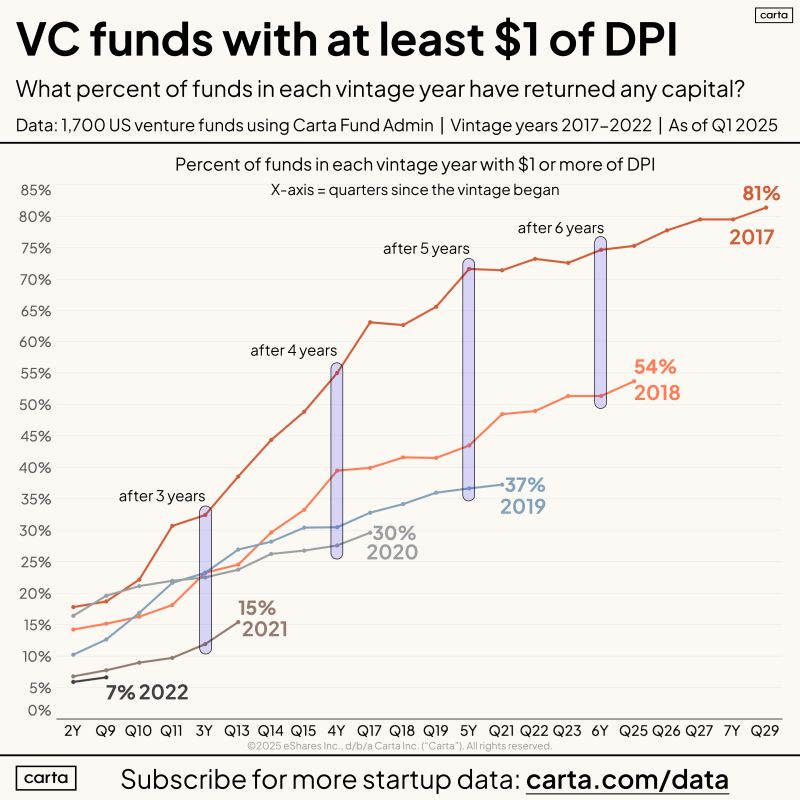

The article explores why venture capital (VC) investing remains exceptionally challenging by highlighting two primary reasons: the extended time frame required for returns and the high level of uncertainty involved. It draws on data from over 1,700 U.S. venture funds administered by Carta, focusing primarily on emerging manager funds with less than $100 million in committed capital. The article uses a chart displaying the percentage of funds from vintage years 2017 to 2022 that have produced any Distributions to Paid-In capital (DPI), which indicates actual capital returned to limited partners (LPs). This visual and data-driven approach illustrates the pace at which funds start generating returns.

A key finding is that more recent vintages are slower to return capital; for instance, after five years, only 36% of 2019 funds had any DPI compared to 72% of 2017 funds. This suggests that investors should expect longer timelines for liquidity in newer VC funds. The article also tackles the role of secondary markets, which have been growing but still represent only a small portion of potential liquidity events for startups and investors. The limited availability of secondaries means they don't substantially accelerate the overall liquidity profile for most funds.

The extended lack of liquidity creates a challenging environment for emerging managers trying to raise new funds. LPs with capital tied up in older vintage funds may be more cautious or even unable to invest in new vehicles. This is compounded by the fast fundraising pace during the recent boom, where managers were raising new funds quickly—often an average of 2.5 years after the prior fund—leading LPs to feel “tapped out” on capital allocation. The article questions the common venture wisdom that managers should recycle capital from early exits into their winners rather than returning it to LPs, suggesting that emerging managers might benefit from taking distributions off the table periodically.

The author argues that many emerging managers who had opportunities to return capital to LPs during the recent boom did not do so, and are now regretting that decision in the current market climate. The uncertainty and prolonged return timeline in venture capital mean that even seemingly upward trajectories can abruptly stall, stressing the importance of strategic liquidity decisions along the fund’s lifecycle.

Overall, the data underscores the inherent difficulty of venture capital investing due to slow return timelines and uncertain outcomes. Emerging managers and investors need to be aware of these realities to navigate fundraising, capital allocation, and distribution strategies effectively.

Only 37% of 2019 VC Funds Have Returned Capital: Inside the Numbers That Show Why VC Fundraising Has Gotten So Hard

Saastr • June 18, 2025

Finance•Investment•VentureCapital•FundPerformance•LPInvestments•Venture Capital

Per the latest Carta performance data, only 37% of 2019 venture funds have returned ANY capital to their LPs after 5 years. Let that sink in. Nearly two-thirds of funds from what we thought was still the “good times” haven’t given investors a single dollar back.

And for recent vintages? Just 7% of 2022 funds have distributed capital. We’re not talking about profits here—we’re talking about getting back even $0.01 on the dollar.

This isn’t just a bad couple of years. This is the industry’s toughest stretch in decades—but there are signs the reset is working.

The Numbers Don’t Lie: A Tale of Two Eras

The Golden Age (2017-2018): When VCs Were Heroes

Looking at 2017 funds—the darlings of the previous cycle:

81% returned capital after 5+ years

Median IRR of 11.5% (that’s actually good!)

Top quartile delivering 28%+ returns

Even the 25th percentile was generating 5% IRRs

2018 was still solid:

54% returned capital

8% median IRR

Distribution activity across all quartiles

These were the funds that made LPs feel smart. The funds that got GPs invited to the best conferences. The funds that made venture capital look like a real asset class.

The Warning Shots (2019-2020): Cracks in the Foundation

By 2019, the warning signs were flashing red:

Only 37% of funds returned capital

Median IRR dropped to 5.4%

Distribution activity slowing dramatically

2020 got worse:

Just 30% returned capital

Median IRR of 2.6% (you could beat this with Treasury bills)

Even 90th percentile funds showing compressed returns at 20%

But here’s the thing—everyone was too busy celebrating unicorns and mega-rounds to notice.

The Reckoning (2021-2024): Welcome to Fund Manager Hell

Then came the tsunami:

2021 Funds:

15% returned capital (and these are 3+ years old!)

Median IRR: -0.4% (negative!)

25th percentile: -6.2% IRR

2022 Funds:

7% returned capital

Median IRR: -1.9%

25th percentile: -8.5% IRR

2023 Funds:

Median IRR: -5.8% (these are still early, but not promising)

25th percentile: -16.8% IRR

Even 75th percentile: just 2.2%

2023 Funds:

Median IRR: -5.8%

25th percentile: -16.8% IRR

Even 75th percentile: just 2.2%

We’re not just talking about poor performance. We’re talking about negative returns across entire vintage years.

What the Hell Happened?

1. The Valuation Bubble Finally Popped for B2B. But It’s Back for AI

100x revenue multiples are now long gone for B2B companies. But for the fastest growing AI start-ups? They are back.

2. The Exit Market Froze — But Strong Signs of Life in 2025

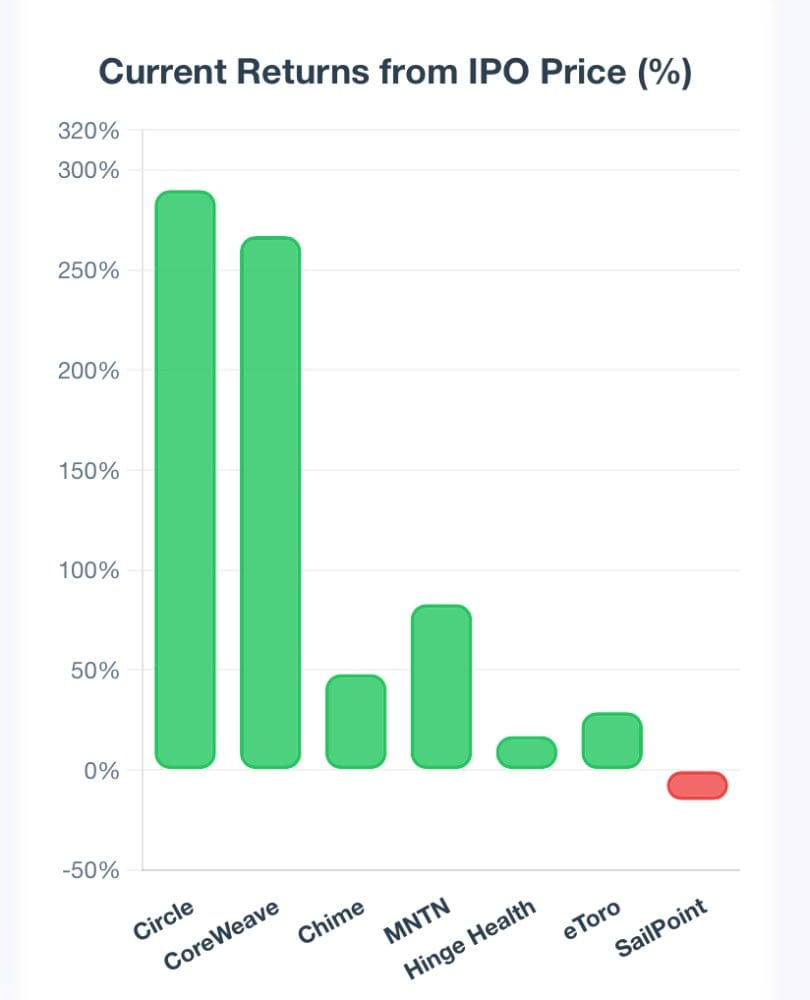

IPO activity in 2022-2024 fell off a cliff:

2021: 1,035 IPOs globally

2022: 181 IPOs

2023: 154 IPOs

2024: ~180 IPOs

But here’s the thing—2025 is showing real signs of life.

We’ve seen successful IPOs from companies like CoreWeave (+250% from IPO price), Rubrik (+206%), ServiceTitan (+50%), and MNTN (+56%). The average first-day pop for recent tech IPOs is 31% with current returns averaging 77% above IPO price. The IPO window isn’t just cracking—it’s actually wide open for the right companies.

M&A is also stirring back to life. We’ve seen some massive deals in 2024-2025:

Scale AI’s $14.3B investment by Meta (49% stake at $29B valuation, with CEO Alexandr Wang joining Meta’s new “Superintelligence” unit)

Wiz’s $32B all-cash acquisition by Google (closed March 2025, up from the rejected $23B offer last year – showing how hot the market got)

Multiple mid-market SaaS exits in the $1-5B range

Strategic buyers are getting antsy. They’ve been sitting on cash for 2+ years, and the pressure to deploy capital is building.

3. The Duration Extension Crisis

VCs used to return capital in years 3-7 of a fund’s life. Now? They’re holding positions for 15+ years, praying for a market recovery.

The problem: LPs committed to 2019-2022 vintages expecting cash back by now. Instead, they’re getting capital calls and no distributions.

4. The AI Winners vs. Everyone Else Divide

Here’s the plot twist: while most VCs are drowning, the outliers with AI exposure are absolutely crushing it.

Look at those 90th percentile numbers again:

2021: 13.0% IRR (decent)

2022: 17.6% IRR (very good)

2023: 21.8% IRR (exceptional)

These aren’t just surviving the downturn—they’re thriving. Why? They got into AI companies before the boom:

Anthropic (valued at $60B+ in latest round)

OpenAI (reportedly worth $157B)

Scale AI (exploring $10B+ strategic options)

Character.AI (sold to Google for hundreds of millions)

Perplexity (valued at $8B+)

The markup velocity on these deals is unlike anything we’ve seen since the early Facebook/Google days. A $10M investment in Anthropic’s Series A is now worth $500M+ on paper.

Meanwhile, if you missed the AI wave? You’re stuck with a portfolio of overvalued SaaS companies from 2021-2022 that can’t find exits.

The LP Perspective: “Where’s My Money?”

Imagine you’re a pension fund or endowment. You committed $100M to venture funds in 2019-2022, expecting distributions to start flowing by 2024-2025.

Instead:

You’ve gotten almost nothing back

You’re still getting capital calls for follow-on investments

Your VC allocation is way overweight because other asset classes have grown

Your beneficiaries are asking tough questions

No wonder LP appetite for new commitments has dried up. They literally don’t have the cash—it’s all tied up in zombie funds.

…..

Chime IPO: Are IPOs Hotter Than Ever?

Youtube • 20VC with Harry Stebbings • June 19, 2025

Business•Startups•IPO•Chime•Financial Technology•Venture Capital

High-profile venture capital firm to double down on Adam Neumann's Flow

Costar • Joshua S. Andino • June 16, 2025

Business•Real Estate•Adam Neumann•Flow•Venture Capital

Flow, the residential real estate company founded by former WeWork CEO Adam Neumann, has secured significant backing from venture capital firm Andreessen Horowitz (a16z). In 2022, a16z invested $350 million in Flow, valuing the company at over $1 billion. (theverge.com) This substantial investment marked a notable endorsement of Neumann's vision for transforming the apartment industry.

In April 2025, Flow raised an additional $100 million, bringing its valuation to approximately $2.5 billion. This funding round was also led by a16z, indicating the firm's continued confidence in Flow's growth potential. (techcrunch.com) Marc Andreessen, co-founder of a16z, expressed strong support for Flow's mission, emphasizing the importance of physical spaces that unlock human potential in an increasingly digital world.

Flow's expansion includes properties in South Florida, such as Flow Miami and Flow Fort Lauderdale, as well as international ventures in Saudi Arabia. The company is also developing its first condominium project, Flow House, adjacent to Flow Miami. Neumann has expressed optimism about Flow's future, stating he is "sure" the company could go public "one day." (techcrunch.com)

Cluely, a startup that helps ‘cheat on everything,’ raises $15M from a16z

Techcrunch • Marina Temkin • June 20, 2025

Technology•Startups•AI•Funding•Ethics•Venture Capital

Cluely, a startup that claims to help users "cheat" on job interviews, exams, and sales calls, has raised a $15 million Series A led by Andreessen Horowitz, the company announced on Friday with a video posted on X.

Two investors who were not part of the deal tell TechCrunch they believe Cluely’s post-money valuation is around $120 million. Andreessen Horowitz declined to comment on that figure. Lee didn’t respond to a request for comment.

Cluely’s new funding comes roughly two months after it raised $5.3 million in seed funding co-led by Abstract Ventures and Susa Ventures.

The startup was co-founded earlier this year by 21-year-old "Roy" Lee and Neel Shanmugam, who were suspended from Columbia University for developing an undetectable AI-powered tool called "Interview Coder" to help engineers cheat on technical interviews.

Cluely is profitable, according to Lee’s multiple posts on X and podcast appearances.

Lee’s provocative social media presence and highly produced controversial videos have helped to draw attention and create brand awareness for Cluely.

In April, for example, as TechCrunch previously reported, Cluely published a slick but polarizing launch video of Lee using a hidden AI assistant to lie to a woman about his age, and even his knowledge of art, on a date at a fancy restaurant.

Earlier this week, Cluely was hoping to throw a large party following Y Combinator’s AI Startup School, a two-day event. But the police shut down the festivities after around 2,000 people tried to enter the venue, Lee told TechCrunch. After they arrived, he told TC, “We did some cleanup, but the drinks are all there waiting for the next party.”

The new math: why seed investors are selling their winners earlier

Techcrunch • Connie Loizos • June 20, 2025

Business•Seed Investing•Liquidity•Startup Funding•Venture Capital

Audio Here

Charles Hudson had just closed his fifth fund several months ago — $66 million for Precursor Ventures — when one of his limited partners asked him to run an exercise. What would have happened, the LP wondered, if Hudson had sold all his portfolio companies at Series A? What about Series B? Or Series C?

The question wasn’t academic. After two decades in venture capital, Hudson has been watching the math of seed investing change, maybe permanently. LPs who’ve previously been patient with seven-to-eight-year hold periods are suddenly asking questions about interim liquidity.

“Seven or eight years feels like a really long time” to LPs right now, says Hudson, even though “it’s always been seven or eight years.”

The reason: A steady stream of venture returns in recent years — returns that made long hold periods acceptable — has largely dried up. Coupled with the availability of other, more liquid investment options, many backers of very early-stage VC are demanding a new approach.

The analysis his LP requested revealed an uncomfortable truth, says Hudson. Selling everything at the Series A stage didn’t work; the compounding effect of staying in the best companies outweighed any benefits from cutting losses early. But Series B was different.

“You could have a north of 3x fund if you sold everything at the B,” Hudson discovered. “And I’m like, ‘Well, that’s pretty good.’”

Beyond pretty good, that realization is reshaping how Hudson thinks about portfolio management in 2025. Though now a veteran investor– Hudson has spent 22 years in VC between Precursor, an eight-year run at Uncork Capital, and another four years at In-Q-Tel earlier in his career — he says investors in very young companies are being forced to think like private equity managers, optimizing for cash returns alongside the home runs that, if they’re lucky, define their careers.

It’s not an easy mental change to make. “The companies where there’s the most secondary interest are also the set of companies where I have the greatest expectations for the future,” says Hudson.

It’s not just Hudson; his thinking about secondary sales reflects broader pressures reshaping the venture ecosystem. Hans Swildens is the founder of Industry Ventures, a San Francisco-based fund of funds and direct investment firm with stakes in 700 venture firms, and he told TechCrunch in April that venture funds are “starting to get savvier about what they need to do to generate liquidity.”

The (Uncertain) Payoff from Alternative Investments: Many a slip between the cup and the lip?

Blogspot • Aswath Damodaran • June 17, 2025

Finance•Investment•AlternativeInvestments•PortfolioManagement•HedgeFunds•Venture Capital

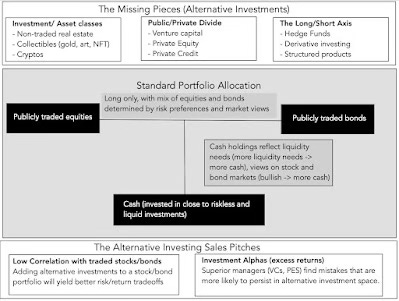

It is true that most investing lessons are directed at those who invest only in stocks and bonds, and mostly with long-only strategies. It is also true that in the process, we are ignoring vast swaths of the investment universe, from other asset classes (real estate, collectibles, cryptos) to private holdings (VC, PE) to strategies that short stocks or use derivatives (hedge funds). These ignored investment classes are what fall under the rubric of alternative investments, and while many of these choices have been with us for as long as we have had financial markets, they were accessible to only a small subset of investors for much of that period. In the last two decades, alternative investments have entered the mainstream, first with choices directed at institutional investors, but more recently, in offerings for individual investors. Without giving too much away, the sales pitch for adding alternative investments to a portfolio composed primarily of stocks and bonds is that the melding will create a better risk-return tradeoff, with higher returns for any given risk level, albeit with two different rationales. The first is that they have low correlations with financial assets (stocks and bonds), allowing for diversification benefits and the second is investments in some of these alternative asset groupings have the potential to earn excess returns or alphas. While the sales pitch has worked, at least at the institutional level, in getting buy-in on adding alternative investments, the net benefits from doing so have been modest at best and negative at worst, raising questions about whether there need to be more guardrails on getting individual investors into the alternative asset universe.

The Alternative Investment Universe

The use of the word "alternative" in the alternative investing pitch is premised on the belief that much of investing advice is aimed at long-only investors allocating their portfolios between traded stocks, bonds and cash (close to riskless and liquid investments). In that standard investment model, investors choose a stock-bond mix, for investing, and use cash as a buffer to bring in not only liquidity needs and risk preferences, but also views on stock and bond markets (being over or under priced):

The mix of stocks and bonds is determined both by risk preferences, with more risk taking associated with a higher allocation to stocks, and market timing playing into more invested in stocks (if stocks are viewed as under priced) or more into bonds (if stocks are over priced and bond are viewed as neutral investments).

This framework accommodates a range of choices, from the purely mechanical (like the much touted 60% stocks/40% bonds mix) to more flexible, where allocations can vary across time and be a function of market conditions. This general framework allows for variants, including different view on markets (from those who believe that markets are efficient to stock pickers and market timers) as well as investors with very different time horizons and risk levels. However, there are clearly large segments of investing that are left out of this mix from private businesses (since they are not listed and traded) to short selling (where you can have negative portfolio weights not just on individual investments but on entire markets) to asset classes that are not traded. In fact, the best way to structure the alternative investing universe if by looking at alternatives through the lens of these missing pieces.

1. Long-Short

In principle, there is little difference between being long on an investment and holding a short position, with the only real difference being in the sequencing of cash flows, with the former requiring a negative cash flow at the time of the action (buying the stock or an asset) and a positive cash flow in a subsequent period (when it is sold), and the latter reversing the process, with the positive cash flow occurring initially (when you sell a stock or an asset that you do not own yet) and the negative cash flow later. That said, they represent actions that you would take with diametrically opposite views of the same stock (asset), with being long (going short) making sense on assets where you expect prices to go up (down). In practice, though, regulators and a subset of investors seem to view short selling more negatively, often not just attaching loaded terms like "speculation" to describe it, but also adding restrictions of how and when it can be done.

Many institutional investors, including most mutual, pension and endowment funds, are restricted from taking short positions on investments, with exceptions sometimes carved out for hedging. For close to a century, at least in the United States, hedge funds have been given the freedom to short assets, and while they do not always use that power to benefit, it is undeniable that having that power allows them to create return distributions (in terms of expected returns, volatility and other distributional parameters) that are different from those faced by long-only investors. Within the hedge fund universe, there are diverse strategies that not only augment long-only strategies (value, growth) but also invest across multiple markets (stocks, bonds and convertibles) and geographies.

The opening up of derivatives markets has allowed some investors to create investment positions and or structured products that use options, futures, swaps and forwards to create cash flow and return profiles that diverge from stock and bond market returns.

2. Public-Private

While much of our attention is spent on publicly traded stocks and bonds, there is a large segment of the economy that is composed of private businesses that are not listed or traded. In fact, there are economies, especially in emerging markets, where the bulk of economic activity occurs in the private business space, with only a small subset of businesses meeting the public listing/trading threshold. Many of these private businesses are owned and funded by their owners, but a significant proportion do need outside equity capital, and historically, there have been two providers:

For young private businesses, and especially those that aspire to become bigger and eventually go public, it is venture capital that fills the void, covering the spectrum from angel financing for idea businesses to growth capital for firms further along in their evolution. From its beginnings in the 1950s, venture capital has grown bigger and carries more heft, especially as technology companies have come to dominate the market in the twenty first century.

For more established private businesses, some of which need capital to grow and some of which have owners who want to cash out, the capital has come from private equity investors. Again, while private equity has been part of markets for a century or more, it has become more formalized and spread its reach in the last four decades, with the capacity to raise tens of billions of dollars to back up deal making.

….

The Coming Wave of Acquihires

Tomtunguz • June 12, 2025

Business•Startups•Acquihires•SeedFunding•AIInnovation•Venture Capital

The Seed Surge of 2021 will lead to a raft of acquihires

.

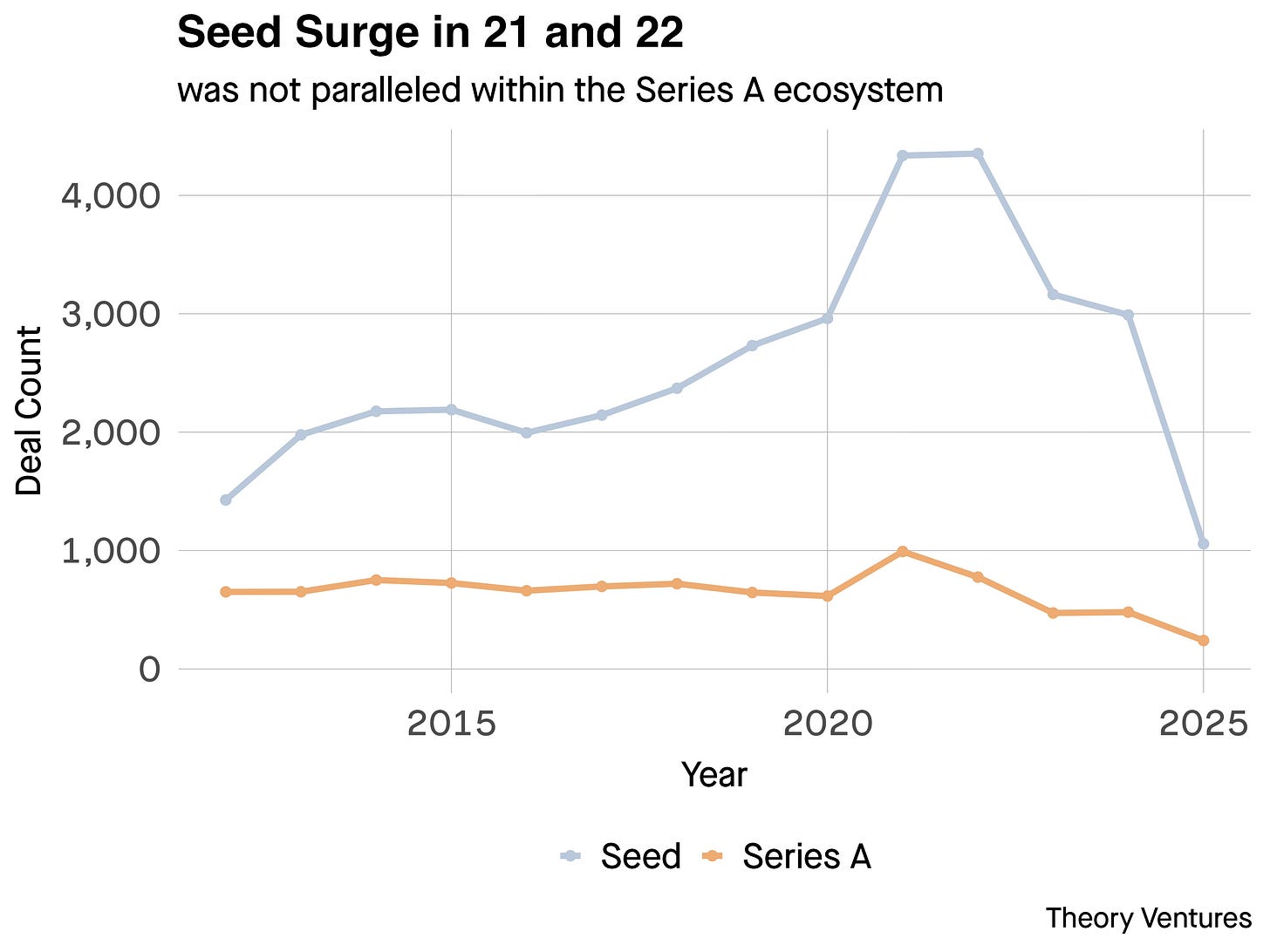

In 2021 the total number of US software & AI seeds jumped from 2900 to 4300 - a 49% jump. Seeds fell to about 3000 creating a seed tabletop.

Series As moved in lockstep both on the way up and the way down - creating a squeeze

.

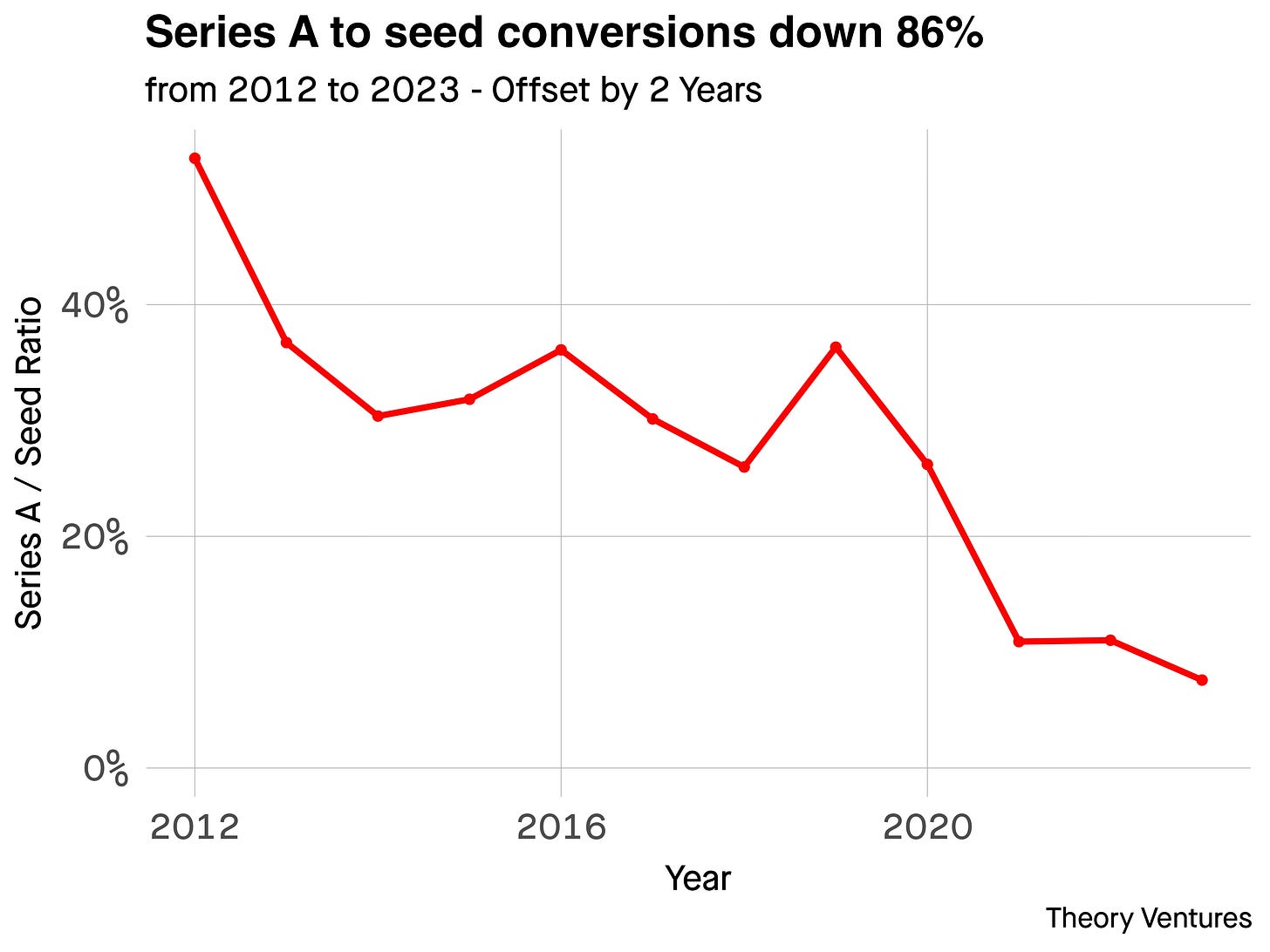

These data form part of a longer term trend of a greater number of seeds but a relatively fixed number of Series As.

The result?

An 86% reduction in the seed to Series A conversion rate. Part of this may be seeds are seed-strapping: raising a seed and continuing on profits, catalyzed by the efficiencies of A.

AI is another component: pre-AI and post-AI companies, which are roughly demarcated by the launch of GPT 3.5 in late 2022. Retooling products with AI takes time.

Even with those factors, the amount of “excess” seeds (quantity more than the Series A market can handle), continues to grow, resulting in the decreasing conversion rate.

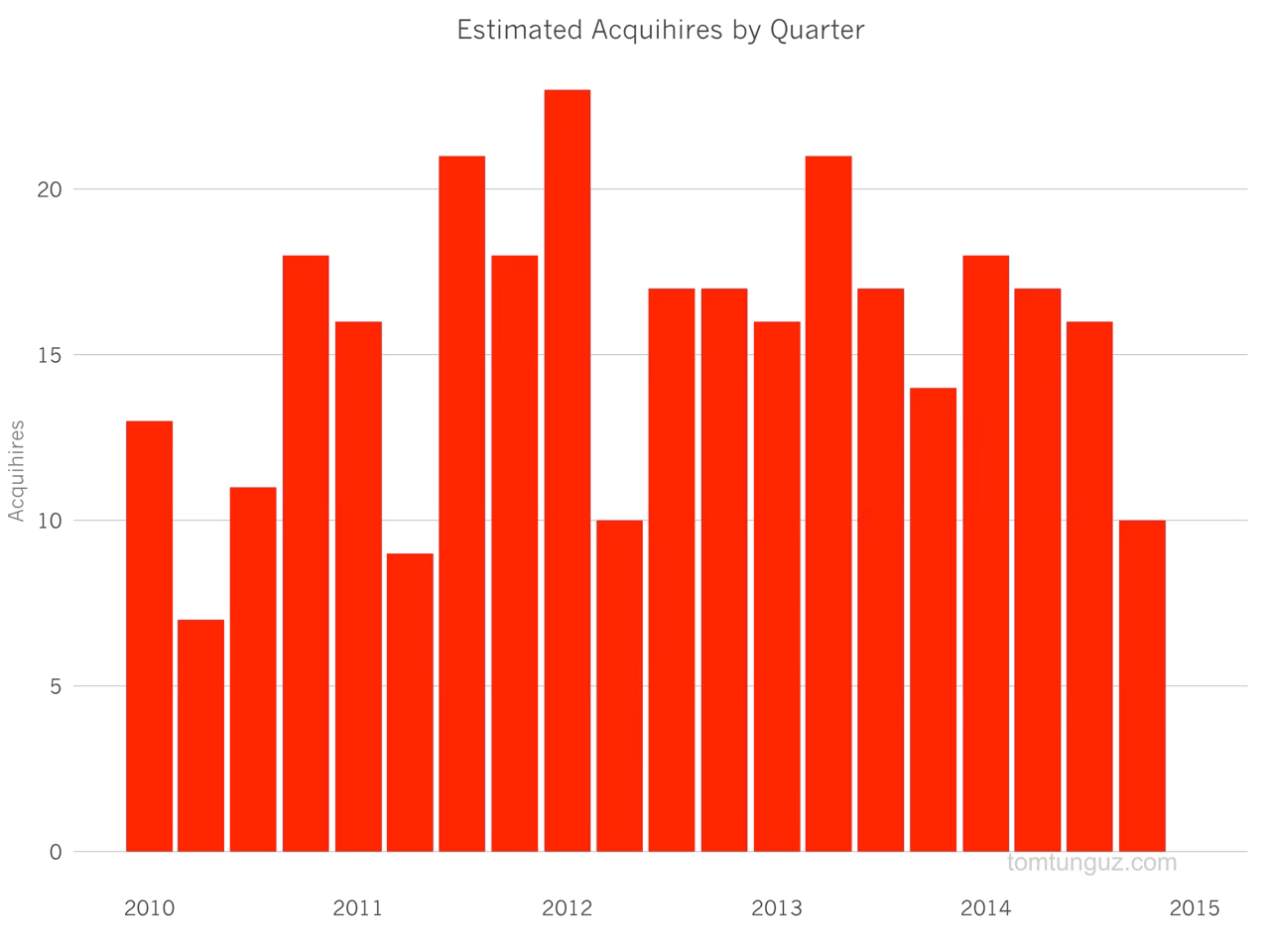

This dynamic mirrors 2015 when a surfeit of seeds drove a steady increase in the number of acquihires

.

Acquihires, acquisitions typically under $20m for talent, may become de rigeur as incumbents seek to bolster their teams with AI talent & update existing products with new capabilities.

Unicorns

Databricks Just Caught Snowflake at $3.7B ARR. Here’s How They Did It (And What’s Next)

Saastr • June 16, 2025

Business•Startups•Databricks•Artificial Intelligence•Growth•Unicorns

Databricks has achieved a remarkable milestone, reaching a $3.7 billion annual recurring revenue (ARR) with a 50% year-over-year growth, positioning itself as the fastest-growing infrastructure company in the public software sector.

This rapid expansion is largely driven by the surge in artificial intelligence (AI) adoption across industries. Enterprises are increasingly seeking robust platforms to manage and analyze vast datasets, and Databricks' lakehouse architecture is tailored to meet these needs. The company's platform seamlessly integrates data lakes and data warehouses, enabling efficient processing and analysis of both structured and unstructured data. (en.wikipedia.org)

In addition to its core offerings, Databricks has diversified its product suite to cater to a broader range of customer needs. Databricks SQL, for instance, has achieved a $600 million revenue run rate, marking a 150% year-over-year increase. The Unity Catalog has attracted over 9,000 customers, contributing significantly to the company's ARR. Furthermore, the AI/ML platform is approaching a $300 million ARR, underscoring the company's commitment to AI-driven solutions.

Databricks' customer base is both extensive and diverse, with over 3,000 customers generating more than $100,000 in ARR and approximately 600 customers exceeding $1 million in ARR. Notably, the top 50 customers each contribute over $15 million in ARR, highlighting the company's strong foothold in the enterprise sector.

The company's financial health is robust, with subscription gross margins exceeding 80%, a net revenue retention rate of 140%, and positive free cash flow for the first time. These metrics reflect Databricks' efficient operations and its ability to deliver value to its customers.

Looking ahead, Databricks is poised to continue its growth trajectory by leveraging its comprehensive product suite and capitalizing on the expanding AI market. The company's strategic focus on multi-product expansion and deepening enterprise relationships positions it well to maintain its leadership in the data and AI infrastructure space.

Apple

★ The Talk Show Live From WWDC 2025

Daringfireball • John Gruber • June 14, 2025

Technology•Software•Apple•VisionPro

Apple

★ The Talk Show Live From WWDC 2025

Daringfireball • John Gruber • June 14, 2025

Technology•Software•Apple•VisionPro

Recorded in front of a live audience at The California Theatre in San Jose Tuesday evening, special guests Joanna Stern and Nilay Patel join me to discuss Apple’s announcements at WWDC 2025.

3D video with spatial audio: Coming soon, exclusively in Sandwich Vision’s Theater on Vision Pro, available on the App Store. This year’s on-demand version of the show in Theater isn’t ready yet, but it looks really good. Better than last year’s by a long shot, and also significantly better than the bandwidth-constrained livestream Tuesday night. The livestream Tuesday night looked good; the on-demand version coming in a few days looks pretty amazing.

As ever, I implore you to watch on the biggest screen you can (real, or virtual). We once again shot and mastered the video in 4K, and it looks and sounds terrific. All credit and thanks for that go to my friends at Sandwich, who are nothing short of a joy to work with.

Social Media

Helping You Find More Channels and Businesses on WhatsApp

Fb • June 16, 2025

Technology•Mobile•WhatsApp•ChannelSubscriptions•AdsInStatus•Social Media

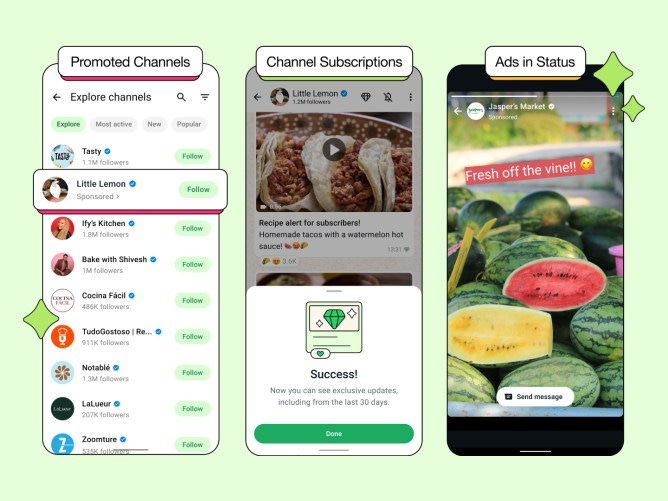

We're introducing channel subscriptions, promoted channels and ads in Status to WhatsApp's Updates tab.

Meta is expanding the ways users can discover channels and businesses on WhatsApp by adding new features to the Updates tab. These enhancements include the launch of channel subscriptions, which will allow users to subscribe to their favorite content channels directly within WhatsApp.

Alongside subscriptions, promoted channels will help surface more content and businesses relevant to users in the Updates tab. This addition is aimed at providing easier access to content and services from creators and businesses they care about, right within the app.

Furthermore, ads will begin appearing in the WhatsApp Status section, integrated in a way that respects user experience while helping businesses reach audiences effectively.

These updates mark a step forward in WhatsApp’s efforts to blend social content and commerce in a seamless, user-friendly environment.

Abundance

Progressives take their best shot at Abundance (but it falls short)

Noahpinion • June 17, 2025

Politics•Policy•Regulation•Government Intervention•Abundance

In his review of "Abundance," Sandeep Vaheesan critiques the book's central thesis that excessive regulation hampers the government's ability to provide essential services like housing, energy, and healthcare. He argues that the authors, Ezra Klein and Derek Thompson, misidentify the root causes of these issues, attributing them to regulatory constraints rather than inherent flaws within the profit-driven system.

Vaheesan contends that the book's focus on increasing state capacity overlooks the complexities of implementing such expansive government interventions. He suggests that the authors fail to provide concrete strategies for empowering the government to deliver on their vision of abundance. This omission, according to Vaheesan, weakens the book's argument and leaves it vulnerable to misinterpretation.

Despite these criticisms, Vaheesan acknowledges the book's potential to stimulate important discussions about the role of government in addressing societal challenges. He emphasizes the need for a more nuanced understanding of the interplay between regulation, market forces, and government intervention to effectively achieve the goals outlined in "Abundance."

Web 3

Senate Passes Cryptocurrency and Stablecoin Rules Bill

Nytimes • June 17, 2025

Politics•Legislation•Cryptocurrency•Stablecoins•Regulation•Web 3

On June 17, 2025, the U.S. Senate passed the GENIUS Act, a bipartisan bill aimed at regulating stablecoins—cryptocurrencies pegged to the U.S. dollar. The legislation passed with a 68-30 vote, with 18 Democrats joining the Republican majority. This marks a significant milestone for the digital asset industry, as it establishes a federal regulatory framework for stablecoins. (apnews.com)

The GENIUS Act requires stablecoins to be backed by liquid assets like U.S. dollars and Treasury bills, and mandates monthly disclosure of reserve composition. This move aims to provide regulatory clarity and consumer protections for stablecoin users. (reuters.com)

Despite broad bipartisan support, the bill faced resistance from some Democrats concerned about potential conflicts of interest involving President Donald Trump. Trump and his family have financial investments in the crypto industry, including a significant stake in World Liberty Financial and its stablecoin USD1. Reports indicate that Trump earned $57.35 million from token sales in 2024. Although the bill bans members of Congress and their families from profiting off stablecoins, it exempts the President and his family. (apnews.com)

Treasury Secretary Scott Bessent and crypto leaders like Coinbase’s Brian Armstrong have endorsed the bill, highlighting its role in mainstream financial integration. President Trump has urged that the legislation reach his desk before Congress's August recess. (apnews.com)

The GENIUS Act now moves to the Republican-controlled House of Representatives, where revisions may include broader crypto market regulations. If passed, the legislation will be sent to President Trump for approval. (reuters.com)

Energy

The Robinhood founder who might just revolutionize energy, if he succeeds

Techcrunch • June 19, 2025

Technology•Space•Solar Power•Innovation•Renewable Energy•Energy

When Baiju Bhatt stepped away from his role as chief creative officer at Robinhood last year, only those close to him could have predicted his next move: launching a space company built around tech that the aerospace industry has largely dismissed, and which might be more groundbreaking than anyone realizes.

If people aren’t paying much attention, that’s just fine with Bhatt, who co-founded the trading app in 2013, five years after earning his master’s degree in mathematics at Stanford. It means less competition for his new company, Aetherflux, which has so far raised $60 million on its quest to prove that beaming solar power from space isn’t science fiction but a new chapter for both renewable energy and national defense.

“Until you do stuff in space, if you happen to be an aerospace company, you’re actually an aspiring space company,” Bhatt said on Wednesday night at a TechCrunch StrictlyVC event held in a glass-lined structure on Sand Hill Road in Menlo Park. “I would like to transition from ‘aspiring space company’ to ‘space company’ sooner.”

Bhatt’s space ambitions date back to his childhood. He says that his dad, who worked as an optometrist in India, spent a decade applying to graduate physics programs in the United States, eventually taking a hard left turn and landing at NASA as a research scientist.

He then proceeded to use the powers of reverse psychology on his son, says Bhatt. “My dad worked at NASA through my whole childhood” and “he was very adamant: ‘When you grow up, I’m not going to tell you you should study physics.’ Which is a very effective way of convincing somebody to do exactly that.”

Now, at roughly the same age his father was when he joined NASA, Bhatt is making his own move into space, seemingly with an eye toward creating even more impact than at Robinhood.

He’s certainly taking a big swing with the effort.

Geopolitics

How Apple Became So Reliant on China & What it Means For Their Future

Youtube • a16z • June 18, 2025

Business•Strategy•SupplyChain•Manufacturing•Geopolitics

Apple's deep integration with China's manufacturing sector has been pivotal to its success, particularly in the production of the iPhone. This collaboration has transformed Apple into one of the world's most valuable companies. However, this reliance has also exposed Apple to the complexities of Chinese politics and policies. (foreignpolicy.com)

In response to escalating trade tensions and tariffs imposed by the U.S. government, Apple has been actively diversifying its supply chain. The company plans to shift the assembly of all iPhones sold in the U.S. to India by the end of 2026. This strategy aims to mitigate the impact of tariffs and reduce dependence on Chinese manufacturing. (ft.com)

Apple's suppliers have also been investing significantly to move production away from China. Since 2018, these suppliers have spent approximately $16 billion on diversifying their manufacturing assets to countries like India, Mexico, the U.S., and Vietnam. This shift is part of a broader strategy to reduce reliance on China and mitigate risks associated with geopolitical tensions. (appleinsider.com)

Despite these efforts, challenges remain. The infrastructure and supply chain capabilities in countries like India and Vietnam are still developing, making it difficult to fully replicate the scale and efficiency of Chinese manufacturing. Additionally, the Chinese market continues to be a significant source of revenue for Apple, contributing nearly 20% to its total sales. (theinformation.com)

In conclusion, while Apple is actively working to reduce its dependence on China, the transition is complex and fraught with challenges. The company's future success will depend on its ability to navigate these complexities and adapt its supply chain strategies accordingly.

AI

The ChatGPT Moment: When 8 Years of Growth Happens in 8 Months

Saastr • Jason Lemkin • June 14, 2025

Technology•AI•SoftwareGrowth•SaaS•Innovation

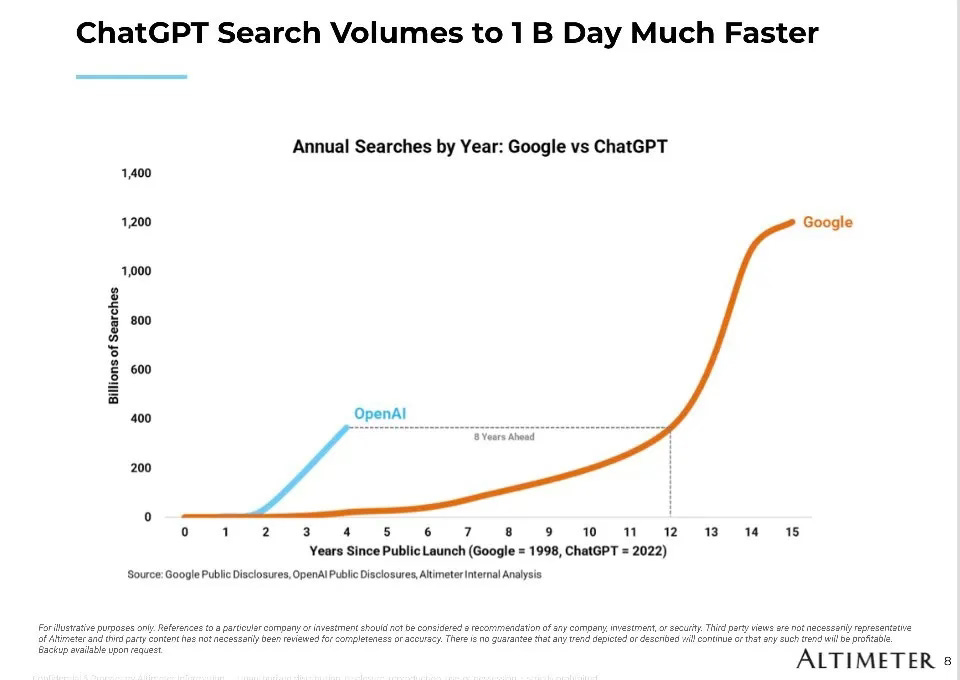

This chart from Altimeter Capital tells one of the most dramatic stories in software history.

Google took 15 years to reach 1.2 trillion annual searches. That catapulted it into the $2 Trillion leader it is today.

ChatGPT? It hit 1 billion searches per day in under a year:

Let’s put this in perspective: ChatGPT compressed what took Google over a decade into roughly 300 days. That’s not just viral growth – that’s a fundamental shift in how humans interact with information.

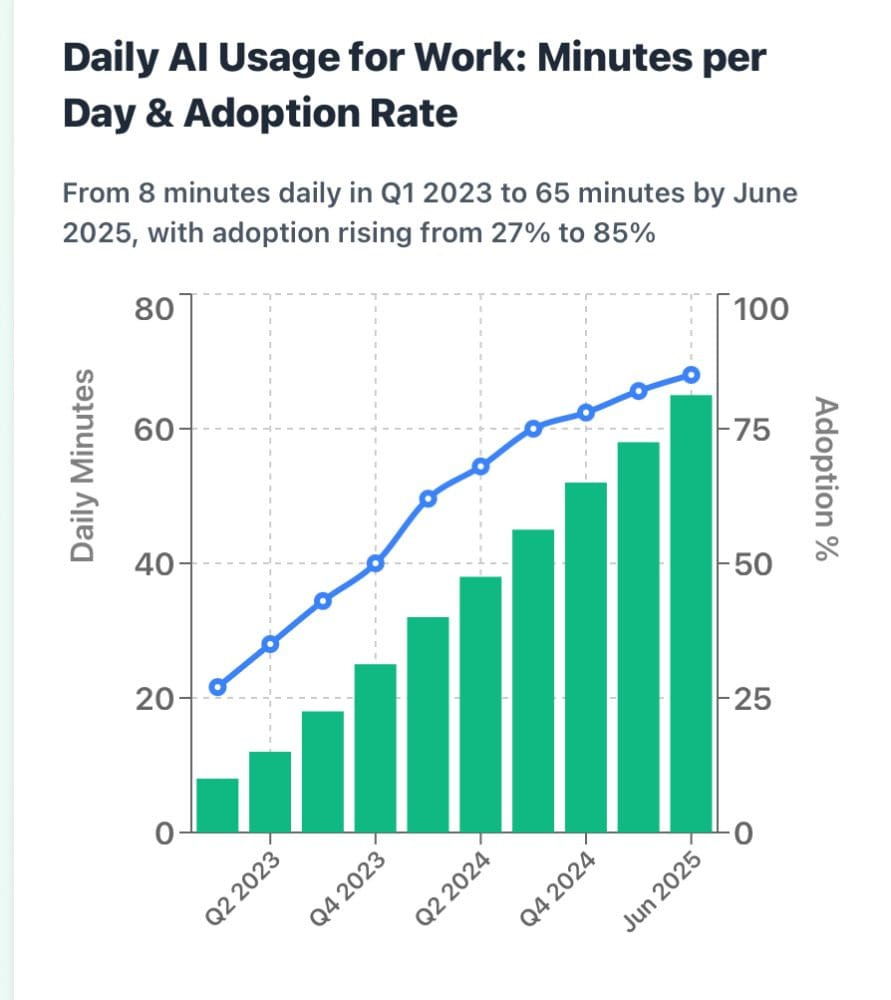

The AI Adoption Explosion Across the Board

But ChatGPT isn’t alone. The entire AI ecosystem is experiencing this vertical growth pattern:

Cursor’s Developer Revolution: The ultimate growth story. Cursor is the fastest-growing SaaS company of all time, going from $1M to $100M ARR in just 12 months—apparently faster than Wiz (18 months), Deel (20 months), and Ramp (24 months). But here’s the kicker: Anysphere’s ARR has been doubling approximately every two months, surpassing $500 million in ARR by June 2025. Despite having spent almost no direct dollars on marketing, they reached 360,000 paying customers at an average ACV of $276—compared to enterprise darlings like Wiz who hit $100M with 260 customers at $384K each.

Claude’s Enterprise Rocket Ship: Anthropic’s Claude hit $3 billion in annualized revenue by May 2025, jumping from nearly $1 billion in December 2024 – that’s 200% growth in 5 months. Claude now has 18.9 million monthly active users, with the majority of revenue coming from selling AI models as a service to other companies.

Midjourney’s Creative Empire: From zero to 19.26 million registered Discord users by March 2024, generating $300 million in revenue in 2024, up from $200 million in 2023. The kicker? They achieved this with $0 invested in marketing and just 131 employees.

Enterprise AI Goes Mainstream: 78% of organizations now use AI in at least one business function.

The “8 Years Ahead” Reality

Notice that dotted line? OpenAI projects ChatGPT is running about 8 years ahead of Google’s original trajectory. But – they might be underselling it.

Google’s growth curve was constrained by:

Dial-up internet in the early days

Limited mobile adoption

Slower global internet penetration

ChatGPT launched into a world with:

5+ billion internet users

Universal smartphone adoption

AI-native expectations from consumers

The Numbers That Matter

Global AI adoption is expected to surge 20% in 2025, reaching 378.8 million users worldwide, with Americans accounting for one-third of all new AI users.

But adoption isn’t just about consumers:

Almost all organizations report measurable ROI with GenAI in their most advanced initiatives, with 20% reporting ROI in excess of 30%

Manufacturing, information services, and healthcare companies report AI adoption rates of about 12%

Why Apple Must Buy Perplexity

Bigtechnology • June 20, 2025

Technology•AI•Acquisition•SearchEngine•Apple

A bonafide AI partner in a moment of need. It's time for Tim Cook to make Apple's biggest acquisition in history.

Tim Cook ought to call Perplexity CEO Aravind Srinivas and offer him $30 billion for his AI search engine. And he should do it right away.

Apple buying Perplexity is such an obviously good deal for both companies that I feel silly even writing it down. Apple would get a bonafide AI service it could plug right into Safari and Siri that would revamp its disappointing AI offering. Perplexity would get access to the 2 billion+ Apple devices in circulation and become an AI force on par with ChatGPT.

“Not likely!” Perplexity chief business officer Dmitry Shevelenko told me of a potential tie-up with Apple. “But Meta-Scale is so unlikely that I feel we aren’t living in a world of likelies.”

Apple and Perplexity have had no M&A discussions to date, Shevelenko added, not even a wink.

But that should change. As an AI search engine, Perplexity could slot in neatly across Apple’s product portfolio. It could integrate into Siri with a seamlessness that only comes via ownership. Apple values control of its product experience, and having its designers work alongside Perplexity’s engineers could help it shape exactly how its AI answers show up in the assistant. Perplexity also has an AI voice mode that could surprise and delight users, and perhaps supplant Siri one day. And many Apple customers who haven’t used AI yet could experience its power for the first time through Perplexity’s search, image generator, and Deep Research.

There’s urgency to get a deal done right away. Apple’s search partner, Google, is at risk of losing its ability to pay Apple for the default search position on Safari, a deal worth billions of dollars per year. If Apple acts now, it could start integrating Perplexity into its products and figure out how to make money from the service before it’s too late. Waiting and scrambling only if the ruling goes through could lead to years of setbacks. And Perplexity’s price will likely go up if a court ruling prevents Google from paying Apple.

Perplexity is also wrapping up a $500 fundraising round at a very manageable $14 billion valuation. If Apple doubled that amount in a purchase offer, Perplexity would have to take it. And Apple has the money. The company did a $110 billion share buyback last year and announced a $100 billion buyback this year.

Apple’s slow AI start is a strategic crisis. There will never be a better time to use its cash. Spending $30 billion on a legitimate AI player is vastly better than standing still. The market would likely celebrate it, even if it means a smaller buyback. Growth stocks get growth multiples.

….

After trying to buy Ilya Sutskever’s $32B AI startup, Meta looks to hire its CEO

Techcrunch • June 20, 2025

Technology•AI•Acquisitions•Meta•ArtificialIntelligence

Meta has intensified its efforts to enhance its artificial intelligence (AI) capabilities by pursuing strategic acquisitions and talent acquisitions. In recent months, Meta attempted to acquire Safe Superintelligence, a $32 billion AI startup co-founded by Ilya Sutskever, OpenAI's former chief scientist. However, Sutskever declined the offer. Subsequently, Meta engaged in discussions to hire Safe Superintelligence's co-founder and CEO, Daniel Gross. Reports indicate that Meta is also in talks to hire former GitHub CEO Nat Friedman and is considering taking a stake in their joint venture firm, NFDG, which has invested in prominent AI startups such as Perplexity and Character.AI.

These initiatives are part of Meta's broader strategy to bolster its position in the AI sector. Earlier this month, Meta announced a $14.3 billion investment in Scale AI, acquiring a 49% stake while keeping Scale independent. As part of the agreement, Scale CEO Alexandr Wang joined Meta's superintelligence team, though he remains on Scale's board. (apnews.com)

Additionally, Meta is reportedly forming a new expert team to develop artificial general intelligence (AGI), technology aimed at equaling or exceeding human cognitive capabilities. This initiative comes alongside Meta's anticipated investment of over $10 billion in Scale AI, a data-labeling company founded by Alexandr Wang, who is expected to join the new AGI group once the deal is finalized. (reuters.com)

These strategic moves reflect Meta's aggressive push to strengthen its AI capabilities and remain competitive in the rapidly evolving AI landscape.

Which jobs AI Will Take

AI • X • RubenHssd • June 17, 2025

Stanford Survey Reveals AI Is Automating Jobs We Didn't Expect – The "AI Takeover" is Happening Backwards

Key takeaway: Contrary to common fears about AI, a Stanford survey of 1,500 workers and AI experts shows that AI is automating less obvious tasks, not primarily jobs perceived as high-risk. This challenges assumptions about which roles are vulnerable and suggests a shift in how AI integration will reshape the workforce.

On June 17, 2025, @RubenHssd shared eye-opening results from a comprehensive Stanford University survey examining which jobs AI is most likely to replace or automate. The survey captures perspectives from both the general workforce and AI professionals, revealing surprising trends that counter popular narratives about AI’s impact on employment.

Key Insights from the Stanford Survey

Misaligned focus: AI development and automation efforts have been concentrated on jobs that experts now believe are less likely to be fully replaced by AI. This means much of the focus is on the "wrong" jobs.