Contents

Editorial: The AI Gold Rush, No “Differentiated” Developer Left Behind

Essays

Venture Capital

Figma’s IPO: The Full Breakdown & Why Melio’s $2.5BN Acquisition is “Discouraging”

KKR's Head of European PE, Philipp Freise: Do Andreessen & General Catalyst Scare KKR?

SoftBank Gets Over $17 Billion of Demand for Dollar, Euro Bonds

Sequoia Was Busiest Startup Investor In June, While Meta Spent The Most

AI

Everything Now is Just So Much Faster in The AI Age. Have You Adjusted?

Cloudflare launches a marketplace that lets websites charge AI bots for scraping

What 300 of The Highest Growth B2B Startups Are Actually Doing With AI: The Latest from ICONIQ

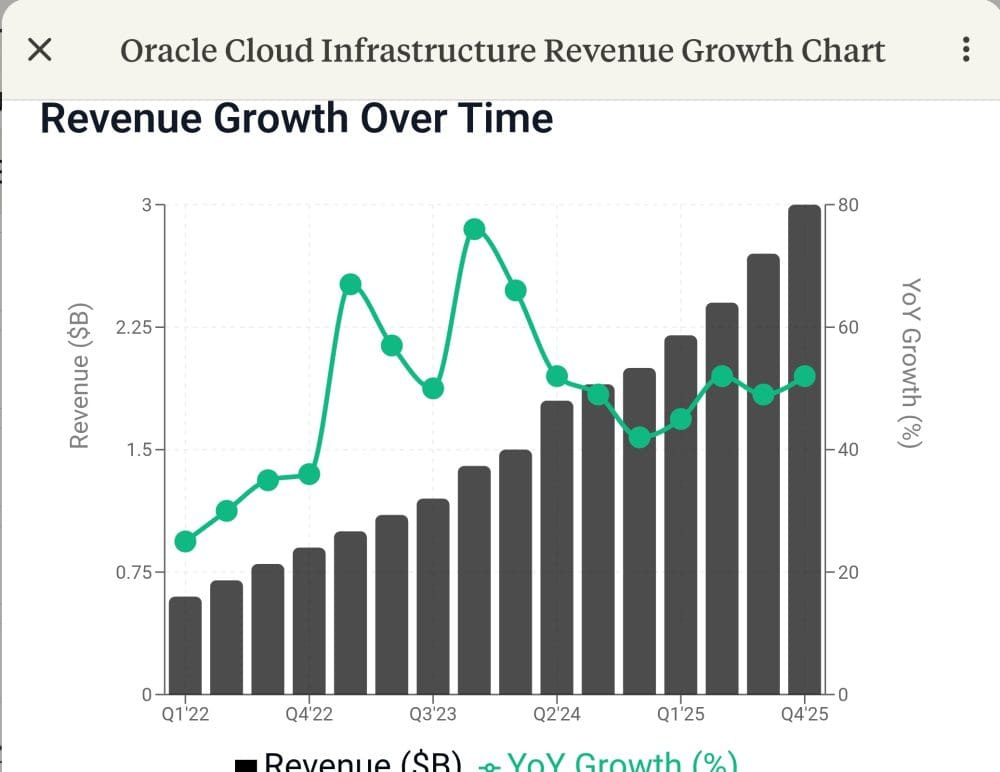

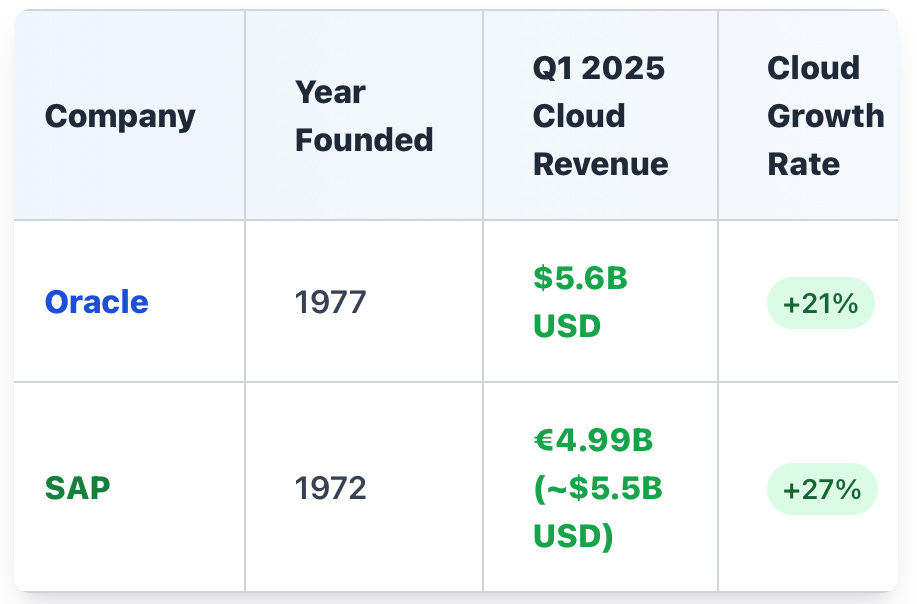

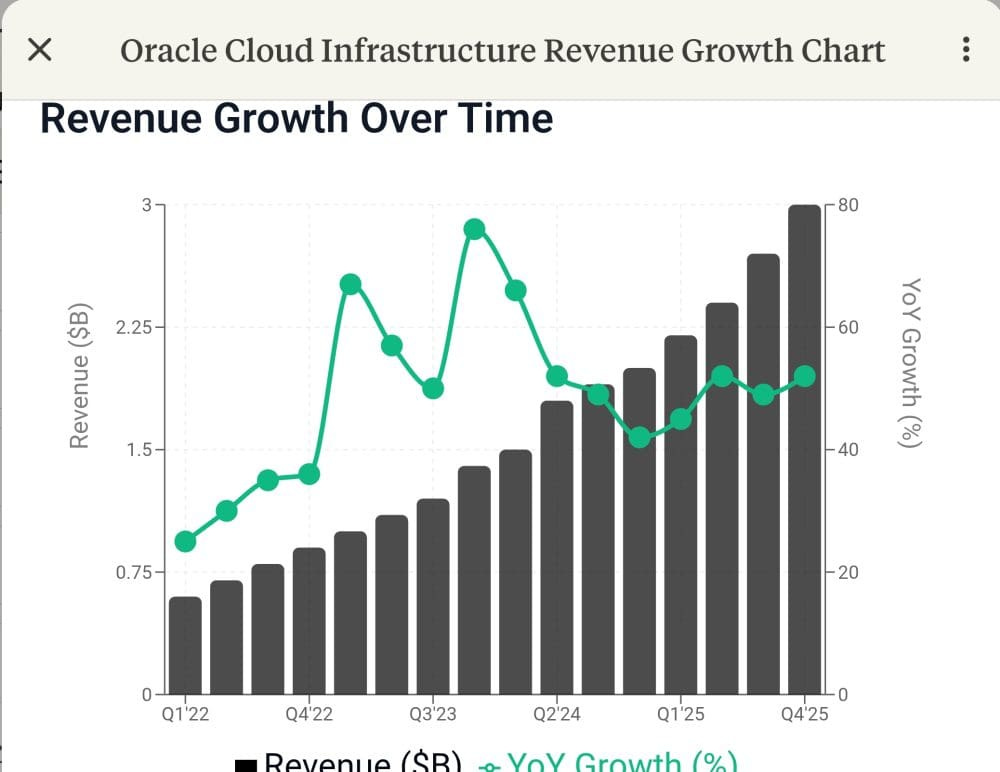

The Surprising Enterprise AI Giants: Oracle and SAP (Really!)

‘Europe is not the US’: Tech insiders call for smarter AI rules

The Future of Data Labeling: From Stop Signs to AI Specialists

Meta seeks $29bn from private credit giants to fund AI data centres

Robinhood shares pop after trading app’s tokenized stock launch announcement: CNBC Crypto World

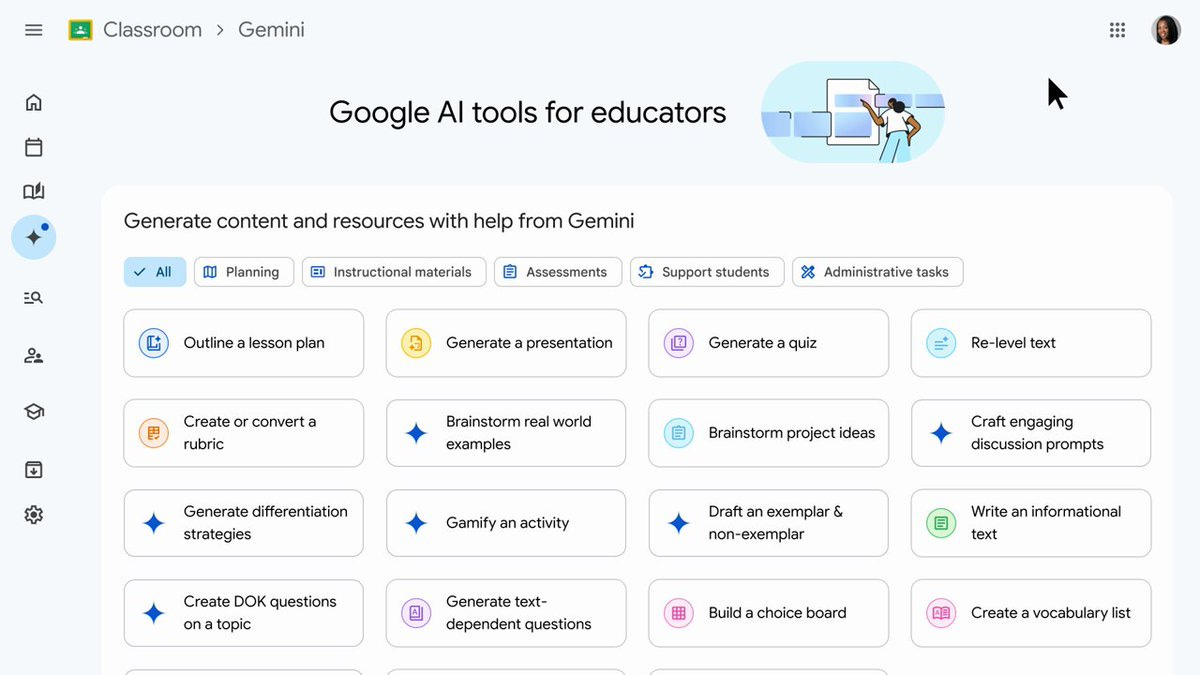

Education

Substack

Startup of the Week

Post of the Week

Editorial: The AI Gold Rush, No “Differentiated” Developer Left Behind

This week, the collection of articles reflect on a moment that’s both exhilarating and for many, disorienting—a point where the exponential curve of AI-driven innovation smashes into the linear realities of venture capital, institutional inertia, and the very fabric of how we build and differentiate in tech.

Let’s start with the obvious: AI isn’t just another wave. It’s a phase shift. Jason Lemkin nailed it in his SaaStr piece: “Everything Now is Just So Much Faster in The AI Age.” Companies like Cursor and Anthropic are leaping from zero to hundreds of millions in ARR in what feels like a blink. Cursor has gone from idea to revenue engine in months, not years. Anthropic’s $4 billion run rate shows what happens when product-market fit meets the accelerant of generative AI. This isn’t your father’s SaaS cycle; it’s hypergrowth on a new operating system.

Venture capital is being forced to play a new game. The “parallel scaling” model—funding and revenue ramping together—is the new normal. OpenAI’s $58 billion raise to support a $13 billion run rate is the archetype. As Lemkin points out, “burn rate is a feature, not a bug.” In a winner-take-all market, you have to spend ahead of the curve, building infrastructure and hiring talent before your competitors even know what hit them.

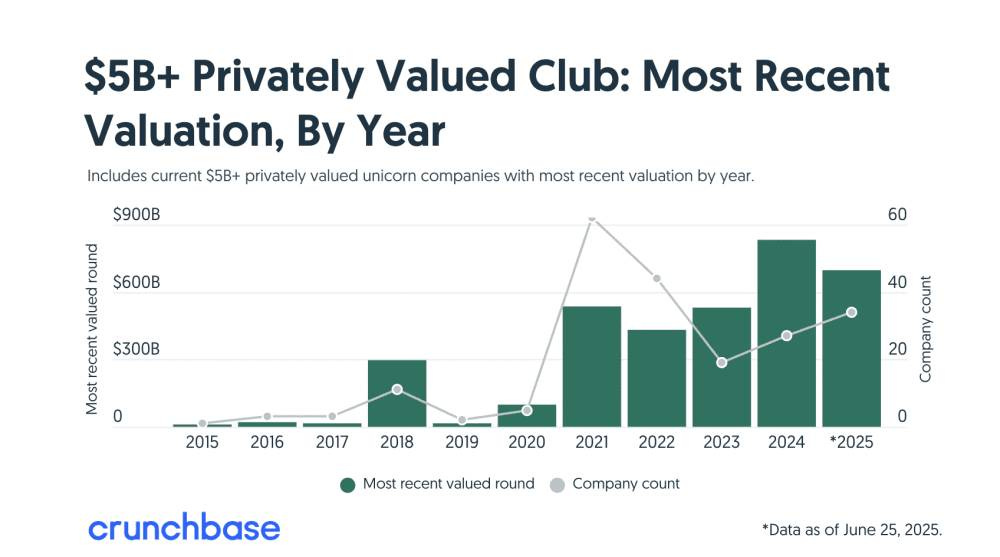

If you want a snapshot of just how much the ground has shifted, look at the rise of the ultra-unicorns. Startups valued at $5 billion or more now make up just 13% of the world’s unicorn herd, but they hold a staggering $3.5 trillion of the $6 trillion total private-market valuation. Seventeen new companies joined this elite club in the first half of 2025 alone. The AI-driven acceleration isn’t just creating more unicorns—it’s creating giants at a historic pace. These ultra-unicorns are concentrating capital, talent, and market power in a handful of breakout winners. In this environment, scale isn’t just an advantage—it’s a necessity for survival and dominance.

And as Rob Hodgkinson lays out in his SignalRank essay, these shifts are also forcing a rethink of the VC model itself. The old “Goldilocks” approach—capital-efficient, staged investing—has been upended by the capital intensity and unpredictability of AI. Hodgkinson argues that algorithmic selection and index-style investing, focused on the rare top-performing Series B rounds, can offer a way forward: de-risking outcomes, building in liquidity, and opening the door to a broader set of investors. In his words, the future of venture capital as an asset class is now in play, with new structures and strategies rising to meet the scale and speed of the AI era. Scale isn’t just an advantage—it’s a necessity for survival and dominance.

And speaking of talent, John Herrman’s reporting for Intelligencer on Meta’s $300 million pay packages to lure OpenAI researchers is a window into the new arms race. Zuckerberg’s strategy is clear: if you can’t out-innovate, out-hire. But it’s not just about warm bodies—it’s about building moats with human capital, data pipelines, and infrastructure. Chris Zeoli’s analysis for DataGravity underscores that the real edge is now in proprietary data and reinforcement learning loops, not just algorithms.

But the disruption doesn’t stop at how we build. It’s also about how we buy and sell. Tanay Jaipuria’s deep dive into the “agentic workforce” is essential reading. AI agents—digital colleagues—are now being slotted into roles from SDR to support rep to test engineer. These aren’t just tools; they’re teammates, and they’re targeting labor budgets, not software budgets. That’s a seismic shift for venture capitalists: the TAM just got an order of magnitude bigger, but the playbook for value creation and pricing is being rewritten in real time. Usage- and outcome-based pricing is replacing the old seat-license model, and leverage is moving from software features to actual work done by autonomous systems.

On the financial frontier, tokenization is getting its moment in the sun. Vlad Tenev at Robinhood is pushing for fractionalized, tokenized access to private company shares—think OpenAI or SpaceX—using blockchain rails. But as TechCrunch reported, OpenAI’s public disavowal of these “OpenAI tokens” is a stark reminder that legitimacy and regulatory clarity still matter. The democratization of access is a seductive narrative, but it’s running headlong into the brick wall of securities law and partnership approvals.

Meanwhile, the content economy is fighting back. Cloudflare’s “Pay Per Crawl” initiative is a shot across the bow of the AI giants. By blocking AI crawlers by default and creating a marketplace for data access, Cloudflare is giving publishers and creators a new way to monetize their content and force AI companies to pay for the data that powers their models. The Atlantic, BuzzFeed, and Condé Nast are all lining up behind this new model, signaling a major shift in the economics of the open web.

This is where Hamish McKenzie’s vision of a creator-led, subscriber-powered media economy and Cloudflare’s latest moves start to converge in a fascinating—and potentially transformative—way. McKenzie is right: breaking free from the constraints of advertising opens the door to new economics for creators, but that freedom also demands new models for value and compensation. Enter Cloudflare’s “Pay Per Crawl”—a direct response to the AI-driven reality where bots scrape content at scale, often without permission or payment.

With “Pay Per Crawl,” publishers and creators can set their own terms, charging AI companies for access to their content or blocking them outright. It’s a shift from the old, ad-funded web toward a marketplace where original work has a price, and access is negotiated, not assumed. For those building communities and differentiated brands outside the traditional ad model, this is a crucial new lever: monetize your content not just from your audience, but from the very AI systems that increasingly power the digital economy. As more publishers and creators embrace this kind of control, we’re seeing the early architecture of a new digital supply chain—one that values originality, transparency, and direct compensation, and could finally align the economics of the web with the interests of those who actually create its value.

In a world where everything digital is infinitely replicable, how do you build something that lasts? Packy McCormick’s “Great Differentiation” thesis (Not Boring) is more relevant than ever. As AI makes copying trivial, the only real moat is what’s hard to copy: costly signals, authentic experiences, and unique cultural or technological assets. Stripe’s Irish pub podcast studio isn’t just a gimmick—it’s a signal. Anduril’s defense tech, Earth AI’s fieldwork—these are companies building moats that are expensive, unique, and deeply human.

Yet, for all the talk of automation, the human in the loop remains indispensable. As Teodora Danilovic at Autogena and the team at ODSC remind us, prompt engineering is evolving into a creative discipline, and the real value is in defining objectives, overseeing ethics, and shaping the societal impact of AI. The symbiosis between human and machine is the new frontier, and the winners will be those who can harness both.

On the global stage, the AI race is as much about geopolitics as it is about technology. ODSC’s coverage of the Paris AI Summit and Macron’s warning that Europe is falling behind the US and China is a wake-up call. The refusal of the UK and US to sign the Paris AI agreement signals a pivot toward growth-first, innovation-driven policies, even as the rest of the world debates how to balance safety and speed.

So where does this leave us? 2025 isn’t just another year. It’s the inflection point. The abundance economy is coming, but it’s unevenly distributed. The winners will be those who can build fast, build defensible, build different—and get paid. For founders, the imperative is clear: speed, scale, and trust are the new currencies. For investors, it’s time to back the new, not the familiar. For all of us, it’s a moment to embrace the complexity, uncertainty, and possibility of this new era.

That was the week. The future is being built—at the speed of AI, with human judgment as the ultimate differentiator.

Essays

Mark Zuckerberg Is Convinced He Can Buy the Future

Nymag • John Herrman • July 2, 2025

Technology•AI•Investment•Talent Poaching•Corporate Strategy•Essays

After ChatGPT drew millions of users to the first mature, widely available LLM-based chatbot, the race was on to build better, bigger, and more versatile AI models for a range of stated and implied purposes: to automate labor; to entertain people; to replace old software; to come up with entirely new types of software; to perhaps accumulate power in less obvious and more ambitious ways; to build some sort of god and hope it doesn’t immediately murder everyone; and, perhaps, to assure markets that your company is on top of things, wherever they’re going.

Building and deploying state-of-the-art generative-AI models is extremely capital intensive, which has resulted in the unsettling spectacle of some of the richest companies on earth broadcasting their intention to buy dominance in a future they’re all saying is inevitable: $75 billion in data-center investment from Google in 2025; $100 billion from Amazon; $80 billion from Microsoft. Each firm has a different connection to the moment and reason to believe it might prevail. Microsoft was an early OpenAI partner. Google produced some of the core research that set things in motion. Amazon is a massive provider of cloud-computing resources.

In contrast, Meta’s AI investment rationale — the company is planning to spend up to $72 billion on AI in 2025 — has been a little more nakedly about not missing out. As a result, the company’s big pivot to AI has been a bit of a mess: half-baked features crammed into every interface possible; models that can’t catch up to the frontier; fudged benchmarks; confused users; and just downstream, slopified Facebook and Instagram. And while there are good arguments in favor of the company’s emphasis on building open-source AI, the company’s leadership clearly isn’t happy with where it stands in 2025. Which is how you end up with a situation like this, as reported in Wired:

As Mark Zuckerberg staffs up Meta’s new superintelligence lab, he’s offering top research talent pay packages of up to $300 million over four years, with more than $100 million in total compensation for the first year, WIRED has learned. Meta has made at least 10 of these staggeringly high offers to OpenAI staffers.

Zuckerberg’s approach has already worked in the narrow sense that a bunch of OpenAI researchers have taken (reportedly smaller) offers, leading the company’s chief scientist to tell employees that it felt like “someone has broken into our home and stolen something.” OpenAI CEO Sam Altman tried to play it cooler, telling staff, “Missionaries will beat mercenaries,” and downplaying the importance of the employees Meta managed to poach. OpenAI’s chief scientist and Altman both suggested that they’d be looking at compensation, however, which makes sense given that their core employees are being lured away with some of the highest job offers in the history of the capitalist system.

This is a different approach to buying the future, which is, for Meta, both novel and familiar. It’s familiar in that Meta, a massive firm, is mostly made up of properties it acquired for amounts that sounded high at the time — $1 billion for Instagram, $19 billion for WhatsApp — but which were, in hindsight, pretty good deals. It’s novel in that the investment here is in a few people rather than in a rapidly growing user base or a foundational technology. The basic plan for scaling current AI is known and shared among the big firms: large training runs with lots of data but also a greater focus on “reasoning” models and “reinforcement learning,” which have helped models improve performance as older methods produce diminishing returns but which still leave these firms basically trying to outspend one another for GPUs and data-center square-footage.

Perhaps Zuckerberg is betting that these researchers will come up with new paths for scaling, which could, for a time, belong to Meta alone. (Note the branded downward revision of “superintelligence” from a fearsome entity that must be carefully aligned to a Meta assistant available to “everyone.”) Or maybe Zuck’s bet — which is relatively small in the context of his company’s overall investment in AI — is just that he can kneecap his competitors, slowing them down enough that Meta can finally just catch up.

Yes, Open AI Has Raised an Insane Amount of Money. But It Tracks Insane Growth Almost 1:1

Saastr • Jason Lemkin • June 30, 2025

Technology•AI•StartupFunding•GrowthStrategy•MarketCapture•Essays

B2B Application: If you’re in a rapidly expanding category (AI tooling, security, vertical SaaS), consider raising larger rounds earlier to capture market share before competitors catch up.

2. Revenue Growth Must Match Funding Velocity

Here’s the pattern most miss:

Every 10x increase in funding preceded a 10x increase in revenue

The timing wasn’t immediate, but the correlation was perfect

Funding enabled infrastructure that enabled revenue scale

SaaS Application: Your Series B should fund your path to 10x revenue, not just 2-3x. Think bigger.

3. Burn Rate Is a Feature, Not a Bug

OpenAI burned $5B+ in 2024 while generating $3.7B in revenue. Net burn rate of 135%. Insane? Maybe. Necessary? Absolutely.

Why it works: In frontier markets, the cost of losing is infinite. The cost of winning is finite.

B2B Application: If you’re in a winner-take-all market, optimize for speed and market capture, not efficiency metrics. Efficiency can come later when you own the category.

4. Valuation Follows Market Creation

OpenAI’s $300B valuation isn’t based on traditional multiples. It’s based on market creation potential:

AI market projected to hit $1T+ by 2030

OpenAI commands 17% market share in generative AI

Winner-take-all dynamics in infrastructure

B2B Application: If you’re creating a new category, price your rounds based on market potential, not current metrics.

…

Beyond Cannes

Post • Hamish McKenzie • July 1, 2025

Business•Marketing•Advertising•Media Economy•Creators•Essays

I. The Revenue Riviera

It’s 95 degrees with 95% humidity and I’m in a green-walled holding pen called Amazon Port, surrounded by soaked-through T-shirts, discussing the intricacies of affiliate links with a business development guy who is roasting like a chestnut. La Croisette—a famous beachfront promenade in this sultry stretch of southern France—has been transformed into a maze of wooden pavilions, where barmen in straw hats sling margaritas and mocktails for a heavily perspiring blob of ad execs and acolytes who have gathered for the industry’s biggest and booziest networking event of the year.

The Cannes Lions.

On a large stage to my left—just past stalls that tout Prime, Influencers, and Storefront—a mic’d-up MC in a green dress hypes an upcoming presentation to an audience of 12 people on laptops. Just across the street, grand hotels are topped with logos the size of Cessnas declaring that they’re the temporary property of Snapchat and LinkedIn. Tonight, 50 Cent will perform at a beachfront party for precisely 30 minutes.

For more than a decade, the Cannes Lions has held near-mythical status in my imagination. It celebrates the world’s best creative ad work, bringing together the brightest minds in advertising and the media platforms that carry their messages to the masses. It’s a platinum-plated excuse for anyone within spitting distance of an ad exchange to briefly escape their everyday lives and behave like mini Richard Bransons and souped-up Anna Wintours on rented yachts in the pink-skinned party town.

What am I doing here?

Well, I’m doing a few meetings and hosting a dinner for creators and their agents, but mostly I’ve come to bear witness to how far the media world bends towards advertising. And, just quietly, I’m seeing if it’s possible to imagine an alternate universe in which the Cannes Lions might have less of a say in how our media is made.

II. The Great Interruption

I first heard of Cannes about 15 years ago, when I was a freelance journalist living in Baltimore. While I was most interested in writing stories about culture and politics, the meager sums that freelancing commanded weren’t enough to cover rent. So I took on a side gig, writing up the awards entries for advertising agencies. The job was tedious—helping agencies win Cannes Lions for campaigns that sold shampoo—but the market value was, unfortunately, greater than getting stories about life and art published in magazines.

My view of advertising was neutral at best. I appreciated that ad revenue funded the publications that printed my stories, but I also knew that its influence could distort journalistic incentives. When I was a magazine reporter in Hong Kong, for instance, the Chinese tech company Tencent paid to fly me to Beijing for a story heralding its nascent ad business that got it on the cover of the magazine. At a different magazine, the publisher killed our planned cover photo of a rising indie band because the young punks didn’t look glam enough to please the luxury brand that had paid for the back cover. My colleagues wrote glowingly of five-star resorts in the Maldives that neither they nor any other ordinary human could possibly afford, all covered by the hotel chains whose ads appeared alongside the reviews.

Those were the days when magazines could command a steady income from advertising. The rise of social media put an end to that.

In the 2010s, the rivers of ad dollars that once flowed to print media were redirected to a couple of internet giants that would reshape the media landscape. They offered a better deal to the shampoo salesmen. The currents of the ad rivers didn’t slow for a second as they cut a new course.

Today, ad agencies don’t need to seek the favor of editors and publishers. The agencies can just go directly to influencers who know how to play the algorithms.

At Cannes this year, creators were second only to AI as the subject du jour. Social media companies flew them in and put them up at fancy hotels. Endless panels featured them. Media platforms threw parties for them—and they’re smart to do so.

There are many creators who produce great work without sacrificing their integrity for ad revenue, and amazing businesses built. But they still must play the game, even if they do so subconsciously. A podcast episode tends to be an hour long, with spots for ads woven into the narrative. A news story is frequently interrupted by a display unit or a screen takeover. A Reel often directs a viewer to an online store that pays the influencer a kickback from resulting sales. Advertising doesn’t just interrupt the content—it shapes it.

But I sometimes wonder if the greater tragedy is one we can’t see.

Since the advent of the internet, advertising has been the dominant funding mechanism for media. We’ve seen what it can produce—the Mr Beasts, Joe Rogans, Addison Raes, and Charli D’Amelios. We know the bright-lights names, the big numbers, and the flashy showcases. We’ve witnessed an entire industry, with its own supply chain, factories, and sub-economies, sprout from its soil. But we haven’t seen what it obscures. We don’t know what it has prevented from emerging in the first place. We don’t quite know what—and who—it has locked out.

III. Benefactors and Benediction

In the early 1700s, the writer Alexander Pope pioneered direct subscriptions as a way to fund his work, promising to deliver his translation of the Iliad in installments over six years. The new model would give Pope total control over his work, freeing him from subservience to a rich benefactor—the standard model at the time. He ended up attracting about 750 subscribers—dukes, earls, and bishops among them—and made the equivalent of millions of dollars.

Pope’s model was later adopted by newspapers and magazines, which paired subscriptions with advertising to fund generations of great journalism. Now we’re beginning to see how powerful that model can be when paired with the internet—and placed in the hands of individuals. Each year, billions of dollars flow directly to artists and creators. On Substack alone, there are more than 5 million paid subscriptions. More than 50 Substack creators make over $1 million a year.

We’re still in the early days of this new economy, however. For more than 20 years, most online media was free and monetized with advertising. It wasn’t until the 2010s, with the arrival of Netflix, Spotify, and Patreon, that we started to pay for online content at scale.

When audiences directly support the creators they most love and trust, new kinds of media businesses can thrive, and new works that don’t fit comfortably with the ad model can flourish.

Dan Carlin’s Hardcore History, a dramatically narrated show with six-hour episodes on obscure historical topics, wouldn’t have gotten off the ground had he relied only on advertisers. His main source of revenue comes from paywalled episodes.

Science education channel Kurzgesagt spends hundreds of hours on each of its animated educational videos. Ad revenue alone can’t sustain that kind of work, so the channel relies on tens of thousands of Patreon supporters.

The British lifestyle writer Emma Gannon had a career in traditional media before she discovered she can support herself through audience subscriptions on Substack. She’s now free to write what she wants, on her own schedule. (Gannon has said of her editorial freedom, quoting Bill Cunningham, “If you don’t take their money, they can’t tell you what to do, kid.”)

Even those who have been successful with the ad model are discovering new riches. Violet Witchel, a young chef who creates recipes that have a tendency to go viral, turned her large social media following into lucrative brand deals, but she has since found that Substack subscriptions bring in much more—and more consistent—revenue.

Then there’s the longer tail: a creator middle class succeeding in ways the ad model never allowed. There are the local news operations, sports team specialists, niche experts, and passion projects that may never reach ad-friendly scale but cover their subjects with real depth. There are those who spend hours crafting the perfect sentences, and take literature so seriously that they devote days to well-informed reviews, publish their own fiction serially, and dissect the state of pop culture with the careful attention otherwise reserved only for the academy. And then there are the wild romantics, spiritual nonconformists, dogged reporters, and edgy anthropologists who will always be many things, but only very seldomly “brand safe.”

How many more great minds have been missed by the constraints of the ad model? How many life-changing creations were never conceived?

The Great Differentiation

Notboring • Packy McCormick • July 1, 2025

Business•Strategy•Differentiation•Branding•Marketing•Essays

A driving-gloved Vlad Tenev pilots a 1961 Jaguar E-Type through the curves and streets of Cannes, France to the gravel allée of Château de la Croix des Gardes. The Robinhood co-founder and CEO steps out of the Jag, resplendent in “playboy-in-Portofino” chic: crisp ivory blazer cut from lightweight suiting cloth, striped with thin navy pinstripes. Lapels: peaked. Shoulders: roped. Neck: ascotted. On his left wrist, Tenev sports a gold watch. In his right hand, a structured, hard-shell attaché case in British racing green.

The resurrected founder bounds through the Château and into its Italianate parterre, where he is to present the future of finance.

Flanked by colleagues and underscored by James Bond instrumentals, Tenev announces Robinhood’s newest product: Stock Tokens. On Robinhood, in Europe, investors can purchase tokens in public American companies like Apple.

How? Tenev, now bespectacled in golden aviators, will explain, on the very same chalkboard on which Cary Grant purportedly scribbled in To Catch a Thief, when he filmed the movie at the Château in 1955. He slips a stick of chalk from his jacket’s besom pocket, doodles a stick figure French investor wearing a beret, and proceeds to chalk it out.

But wait… there’s more. Tenev pops open the attaché, whips out a small metallic cylinder whose cold-storage thumb-drive, he tells us, contains “the keys to the first ever Stock Tokens for OpenAI,” and SpaceX.

Two of the most desirable, hardest-to-access, private company shares in the world, available on Robinhood. Better: on The Robinhood Chain.

Much has been and will be breathlessly written about Robinhood’s tokenization of stocks, and about its tokenization of private shares. “Did Robinhood Just Solve the Liquidity Crunch?” You should read those analyses. This is an important story.

But that’s not today’s story.

Today’s story is about the presentation. How fresh it felt. How different.

Robinhood’s is the latest salvo in The Great Differentiation.

The Great Differentiation is the race to be different. It is the salvation from slop.

For every action, there is an equal and opposite reaction. This is Newton’s Third Law of Motion. It is also an emergent Law of the Market.

Sameness has never been cheaper.

Websites look the same. Writing reads the same. Hype videos hype the same.

Copying is free and frictionless. And because it is cheap, it is low status. What might have been 2019’s most beautiful landing page is 2025’s slop.

When sameness is cheap, differentiation is valuable. But how do you remain differentiated when copying is free and frictionless? Make copying expensive.

Neil Strauss wrote about the world’s greatest pickup artist, Mystery, in his 2005 best-seller, The Game. Mystery recommended to his undersexed mentees a technique called “peacocking”: wear a feather boa, a bright shiny shirt, a top hat, light-up jewelry; wear whatever it takes to be different from every other guy at the bar. It is socially expensive to wear silly outfits; other men will make fun of you. But Mystery and his acolytes weren’t signaling to men.

Male peacocks are famous for their feathers. “If a male peacock has a giant array of feathers and still manages to drag it around everywhere and survive,” Nathan Baschez wrote in his April 2022 essay, DALL•E 2 and The Origin of Vibe Shifts, “it’s a pretty good bet that they are physically fit and have good genes.”

This, Baschez says, borrowing from evolutionary psychology, is a costly signal, costly “because it costs something tangible to send them, which is proof of fitness (in the broadest sense of the word “fit”: well adapted to survive in the environment).”

Beautiful images on websites used to be costly, so all of the cool websites looked like this:

Then Unsplash came out, making beautiful images free, and all the websites started looking like this:

“What will happen when DALL•E 2, or something like it, gets released to the public,” Baschez asked. “The first order consequence is there will be a lot of websites and blog posts that now come with illustrations, or other cool visuals these algorithms are capable of generating, like 3D models, faux photos, clay models, etc.,” he rightly predicted.

Where would companies turn to stand out? Nathan thought “At the high end, in the short run I think the most likely path is to run towards interactivity. There are currently no AIs that can make interactive visualizations.” Even then, though, when DALL•E 2 was a private beta toy, he knew that the models would get good enough to do that, too?

“So what is the end game? What happens if we reach a ‘vibe singularity’ in all forms of art, where anyone can create anything by typing a few phrases? How does status get signaled through aesthetic vibes when all the vibes are free?”

….

Robinhood's CEO on the Plan to Tokenize Everything

Bloomberg • Joe Weisenthal, Tracy Alloway • July 1, 2025

Business•FinTech•Tokenization•Blockchain•Regulation•Essays

Robinhood CEO Vlad Tenev has been a prominent advocate for the tokenization of real-world assets (RWAs), aiming to democratize access to investments traditionally reserved for the wealthy. In a recent proposal to the U.S. Securities and Exchange Commission (SEC), Robinhood outlined plans to establish a national framework for tokenized RWAs, including the creation of the Real World Asset Exchange (RRE). This platform would facilitate the trading of tokenized assets such as bonds, funds, real estate, and commodities, utilizing a dual-chain architecture based on Solana and Base to ensure efficiency and transparency. (cointelegraph.com)

Tenev envisions tokenization as a means to "unleash the true power of the crypto revolution," enabling real-world assets like equities and private investments to be integrated onto blockchain technology. He believes this approach can bridge the gap between traditional finance and decentralized finance (DeFi), offering additional liquidity and other advantages inherent in blockchain systems. (theblock.co)

However, Tenev has expressed concerns over the lack of clear regulatory guidelines in the U.S. regarding tokenized securities. He argues that without updated SEC rules, the potential of tokenization to unlock private market investments for everyday investors remains untapped. Tenev advocates for a security token registration framework and updates to accredited investor regulations to facilitate broader access to these investment opportunities. (staging.coindesk.com)

In line with these initiatives, Robinhood has expanded its crypto offerings by developing its own blockchain network based on Arbitrum and launching tokenized stock trading for European users. The company aims to create an all-in-one investment app with 24/7 trading, self-custody, and cross-chain bridging of tokenized assets underpinned by blockchain technology. (coindesk.com)

Tenev's vision includes making private companies like SpaceX and OpenAI accessible to a broader range of investors through tokenization. He highlights the disparity where only a small cohort of wealthy entities have access to early-stage investments in such firms, advocating for a more inclusive approach that leverages blockchain technology to democratize investment opportunities. (benzinga.com)

Despite the potential benefits, Tenev acknowledges the challenges posed by existing U.S. regulations and calls for a shift in the conversation about cryptocurrencies to focus on the broader possibilities enabled by blockchain technology, moving beyond discussions centered on Bitcoin and meme coins. (investing.com)

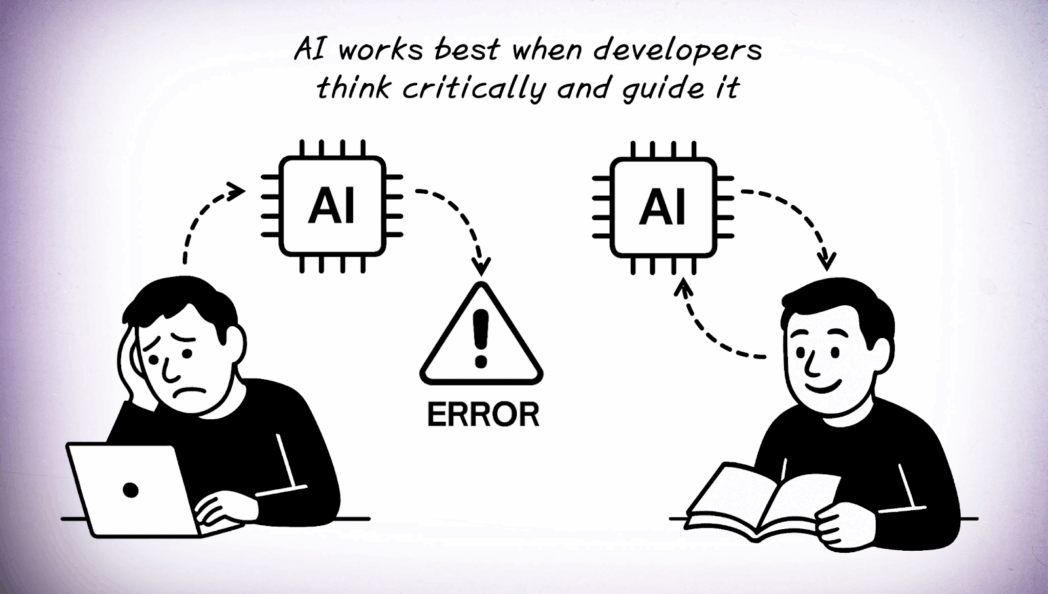

The Sens-AI Framework: Teaching Developers to Think with AI

O’Reilly • Andrew Stellman • July 3, 2025

Technology•AI•Software Development•Prompt Engineering•Learning Framework•Essays

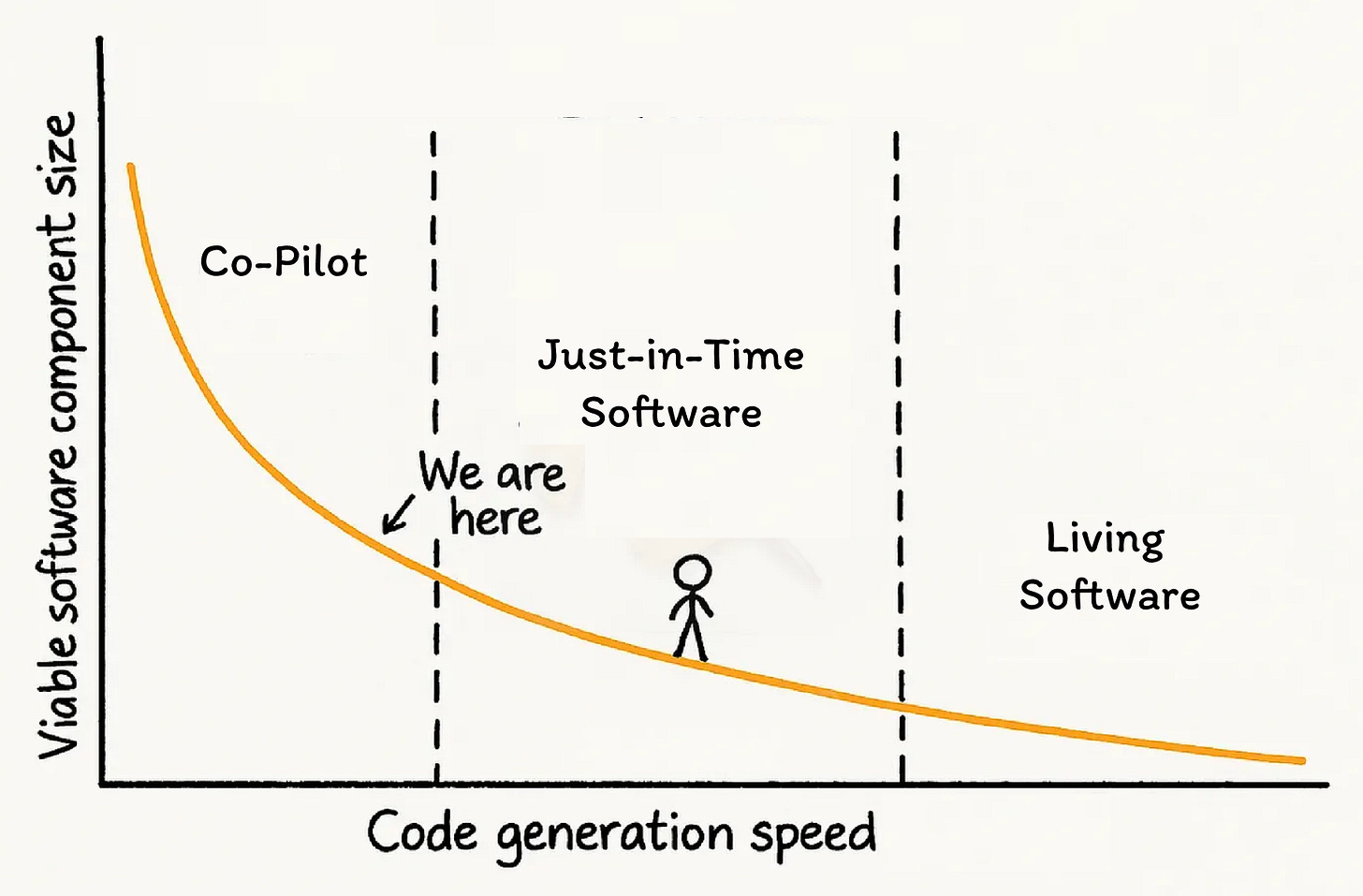

Developers are doing incredible things with AI. Tools like Copilot, ChatGPT, and Claude have rapidly become indispensable for developers, offering unprecedented speed and efficiency in tasks like writing code, debugging tricky behavior, generating tests, and exploring unfamiliar libraries and frameworks. When it works, it’s effective, and it feels incredibly satisfying.

But if you’ve spent any real time coding with AI, you’ve probably hit a point where things stall. You keep refining your prompt and adjusting your approach, but the model keeps generating the same kind of answer, just phrased a little differently each time, and returning slight variations on the same incomplete solution. It feels close, but it’s not getting there. And worse, it’s not clear how to get back on track.

That moment is familiar to a lot of people trying to apply AI in real work. It’s what my recent talk at O’Reilly’s AI Codecon event was all about.

Over the last two years, while working on the latest edition of Head First C#, I’ve been developing a new kind of learning path, one that helps developers get better at both coding and using AI. I call it Sens-AI, and it came out of something I kept seeing:

There’s a learning gap with AI that’s creating real challenges for people who are still building their development skills.

My recent O’Reilly Radar article “Bridging the AI Learning Gap” looked at what happens when developers try to learn AI and coding at the same time. It’s not just a tooling problem—it’s a thinking problem. A lot of developers are figuring things out by trial and error, and it became clear to me that they needed a better way to move from improvising to actually solving problems.

Ask developers how they use AI, and many will describe a kind of improvisational prompting strategy: Give the model a task, see what it returns, and nudge it toward something better. It can be an effective approach because it’s fast, fluid, and almost effortless when it works.

That pattern is common enough to have a name: vibe coding. It’s a great starting point, and it works because it draws on real prompt engineering fundamentals—iterating, reacting to output, and refining based on feedback. But when something breaks, the code doesn’t behave as expected, or the AI keeps rehashing the same unhelpful answers, it’s not always clear what to try next. That’s when vibe coding starts to fall apart.

Senior developers tend to pick up AI more quickly than junior ones, but that’s not a hard-and-fast rule. I’ve seen brand-new developers pick it up quickly, and I’ve seen experienced ones get stuck. The difference is in what they do next. The people who succeed with AI tend to stop and rethink: They figure out what’s going wrong, step back to look at the problem, and reframe their prompt to give the model something better to work with.

When developers think critically, AI works better. (slide from my May 8, 2025, talk at O’Reilly AI Codecon)

As I started working more closely with developers who were using AI tools to try to find ways to help them ramp up more easily, I paid attention to where they were getting stuck, and I started noticing that the pattern of an AI rehashing the same “almost there” suggestions kept coming up in training sessions and real projects. I saw it happen in my own work too. At first it felt like a weird quirk in the model’s behavior, but over time I realized it was a signal: The AI had used up the context I’d given it. The signal tells us that we need a better understanding of the problem, so we can give the model the information it’s missing. That realization was a turning point. Once I started paying attention to those breakdown moments, I began to see the same root cause across many developers’ experiences: not a flaw in the tools but a lack of framing, context, or understanding that the AI couldn’t supply on its own.

The Sens-AI framework steps (slide from my May 8, 2025, talk at O’Reilly AI Codecon)

Over time—and after a lot of testing, iteration, and feedback from developers—I distilled the core of the Sens-AI learning path into five specific habits. They came directly from watching where learners got stuck, what kinds of questions they asked, and what helped them move forward. These habits form a framework that’s the intellectual foundation behind how Head First C# teaches developers to work with AI:

Context: Paying attention to what information you supply to the model, trying to figure out what else it needs to know, and supplying it clearly. This includes code, comments, structure, intent, and anything else that helps the model understand what you’re trying to do.

Research: Actively using AI and external sources to deepen your own understanding of the problem. This means running examples, consulting documentation, and checking references to verify what’s really going on.

Problem framing: Using the information you’ve gathered to define the problem more clearly so the model can respond more usefully. This involves digging deeper into the problem you’re trying to solve, recognizing what the AI still needs to know about it, and shaping your prompt to steer it in a more productive direction—and going back to do more research when you realize that it needs more context.

Refining: Iterating your prompts deliberately. This isn’t about random tweaks; it’s about making targeted changes based on what the model got right and what it missed, and using those results to guide the next step.

Critical thinking: Judging the quality of AI output rather than just simply accepting it. Does the suggestion make sense? Is it correct, relevant, plausible? This habit is especially important because it helps developers avoid the trap of trusting confident-sounding answers that don’t actually work.

These habits let developers get more out of AI while keeping control over the direction of their work.

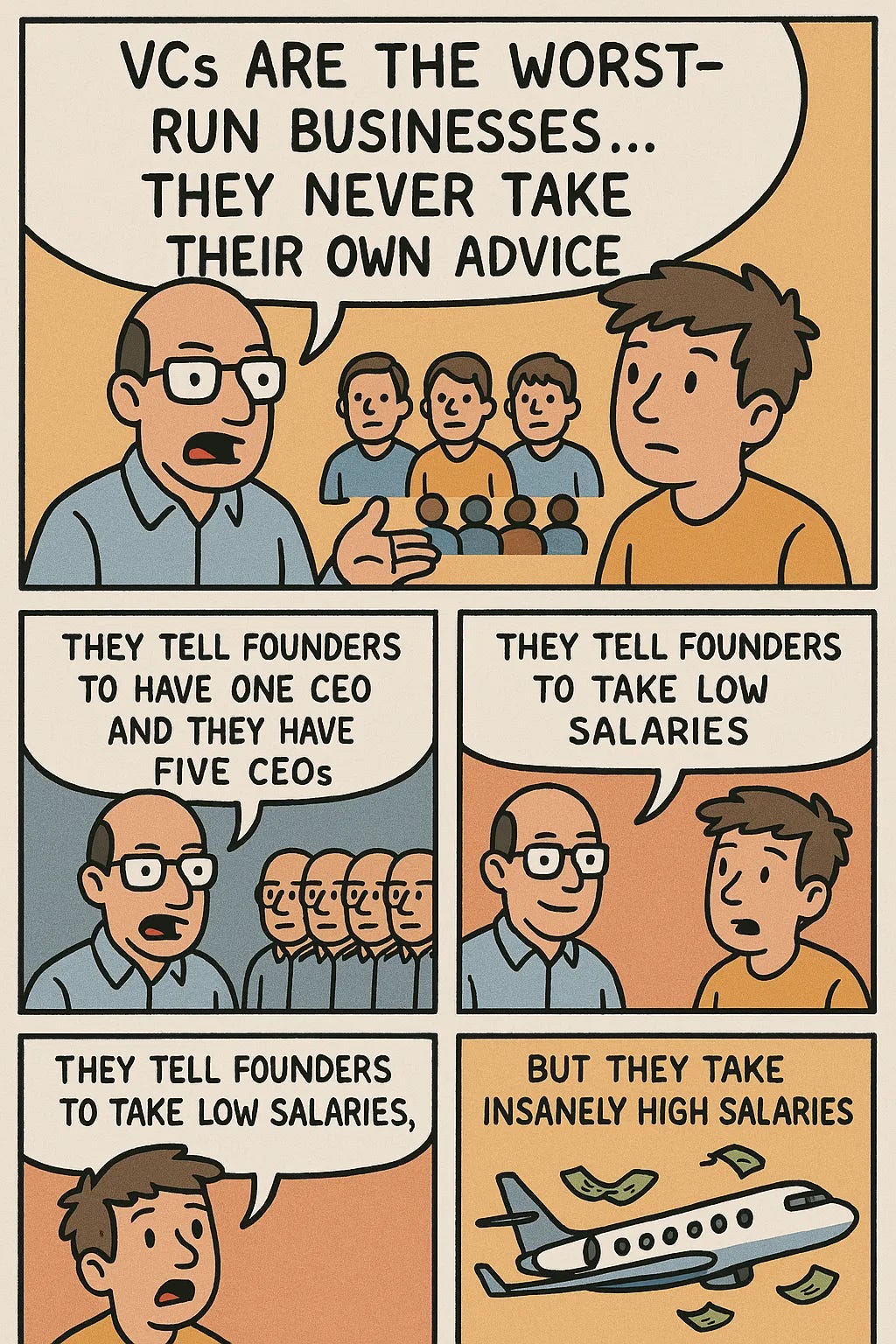

VCs are the worst run businesses … they never take their own advice

Auren • June 29, 2025

Business•Management•VentureCapital•StartupAdvice•IndustryCritique•Essays

Venture capital (VC) firms often advise startups to establish clear leadership structures, yet many operate with complex hierarchies themselves. For instance, while they recommend a single CEO per startup, some VC firms have multiple managing partners, co-managing partners, vice managing partners, and partner emeritus positions. This discrepancy raises questions about the consistency between the guidance VCs offer and their internal organizational practices.

The venture capital industry is highly competitive, with numerous firms vying for similar investment opportunities. Despite this, many VC firms tend to focus narrowly on specific sectors or geographies, often doubling down on areas they believe they know better than their competitors. This approach contrasts with the advice they frequently give to startups to find a niche and exploit it, avoiding overly competitive spaces. The reluctance of VC firms to scale and diversify their own operations suggests a potential misalignment between their strategic guidance to startups and their internal business strategies.

Additionally, the venture capital model itself has been critiqued for its inherent contradictions. VCs often make money by raising funds from limited partners (LPs) and investing in startups, many of which fail. This structure can lead to a focus on maintaining appearances and managing risks, rather than genuinely supporting the long-term success of portfolio companies. The emphasis on short-term returns and the pressure to exit investments within a typical 10-year fund cycle can sometimes overshadow the goal of building sustainable, long-term value.

In summary, while VC firms provide strategic advice to startups, there is a notable gap between this guidance and their own operational practices. The industry's competitive nature, combined with structural incentives, often leads to a focus on short-term gains and risk management, which may not always align with the best interests of the startups they invest in.

The Rise Of The Ultra-Unicorns: $5B+ Startups Are Leading The Private-Market Herd In 2025

Gené Teare • Crunchbase • June 30, 2025

Business•Startups•VentureCapital•Unicorns•PrivateMarket•Essays

Of the nearly 1,600 companies on The Crunchbase Unicorn Board, a small but ultra-elite club of private companies valued at $5 billion or more is growing across multiple metrics, an analysis of the data shows. The trends suggest that the top tier of unicorns is emerging as the dominant force in private markets, even as venture funding for earlier-stage startups remains challenging.

The small cohort of $5 billion-plus unicorns also commands outsized influence — accounting for more than half the board’s total value and funding. With 17 companies newly joining the club in just the first half of 2025 — including high-profile players such as Thinking Machines Lab, Glean and Abridge — this tier is also expanding faster, an analysis of Crunchbase data shows. This year, companies in the club have grown in number, by funding raised and in terms of valuation compared to previous years.

While the $5 billion-plus unicorns make up only around 13% of the board by count, they hold more than half of the board’s value: $3.5 trillion of the $6 trillion cumulative valuation. They also raised half of the $1 trillion total funding to the board’s members.

$5B+ unicorns growing in 2025

Among the most prominent new entrants to the board this year are Thinking Machines, the AI foundation model startup founded by former OpenAI CTO Mira Murati that last week raised a seed round of $2 billion at a $10 billion value — by far the largest seed round on record.

They also include AI note-taking company Abridge, genetic engineering company Colossal Biosciences, coding company Anysphere, AI enterprise search company Glean, legal AI startup Harvey, defense tech startup Shield AI, data security company Cyera, and India-based stock trading company Groww, among many others.

The 2025 count is on track to far surpass the 19 companies that joined the $5 billion club in 2024.

Funding over time to this cohort peaked in 2021 at $102 billion. In 2022, funding dropped to $41 billion, but has grown year over year to close to $79 billion so far in 2025.

However, 73% of funding this year went to just two companies, and they were the two largest fundings ever raised by private venture-back companies: $40 billion to OpenAI in a funding led by SoftBank, and $14.3 billion to Scale AI from Meta.

Founded years

The peak years when the current club of $5 billion-plus unicorns were founded were from 2011 to 2018, meaning the majority of these companies are between 7 and 14 years old.

Venture Capital

Vinod Khosla | Predicting the Future

Youtube • Uncapped with Jack Altman • July 1, 2025

Technology•AI•Innovation•Future Predictions•Venture Capital

LPs want their liquidity and they want it now

The random walk • July 1, 2025

Finance•Investment•PrivateEquity•Liquidity•Fundraising•Essays•Venture Capital

II was talking to a friend of mine who does cap-intro and fundraising at a large commercial bank, on behalf of PE clients.

He confirmed that it’s a tough market out there for raising capital, but the most interesting thing is that PE managers do not appear to have gotten the memo (or at least, cannot allow themselves to get the memo).

The nature of his fundraising mandates follow a pretty typical pattern: the PE manager is either raising a new fund, or upsizing a preexisting position, and turns to existing LPs and says “who wants in?” (just like they’ve done in the past). Except this time around, the LPs are responding along the lines of “definitely not us,” or more politely, “we’d love to, but we still haven’t seen any money back from funds I-IV, so we’re going to have to pass on Fund V.”

And then the PE managers turn to my friend for help.

And the striking thing is that every time they do this, the managers appear surprised that their existing LPs are giving them the heave-ho. Difficult fundraises are supposed to be other managers’ problems, not mine.

GPs are raising $3 for every $1 there is to allocate

Anyways, I take no joy in it, but it sure seems like the other shoe has not fully dropped.

In this case, the other shoe being the “extinction event” or, at least, the full realization of industry contraction for the Finance Bros.

To wit, I found this chart on fundraising rather striking:

PE funds are attempting to raise more than 3x the amount of capital that allocators are intending to allocate.

That 3.1:1 ratio of target capital to actual capital is higher than its ever been, and even higher than the post-GFC lean years of 2011-12.

In other words, there are going to be a lot of disappointed managers—they’re raising money because that’s their business (and it’s unclear what other options they have), but there simply isn’t money to be raised. They haven’t gotten the memo, yet.1

Fake it til you make it, I guess.

Just sell already

Or generate more liquidity, if they can.

Random Walk has written at-length and variously about the lack of exit liquidity in private capital markets. The problem is almost certainly not a lack of willing buyers, but rather a lack of willing sellers, i.e. funds have sold what they can, but what they continue to hold, just isn’t worth their entry price . . . so they continue to hold, presumably because that beats selling at a loss.

The IPO market is wide open, but the private marks are too damn high.

On that front, this too was interesting from the Bain report.

LPs were asked what their preferred paths to liquidity would entail, and the answers will amaze you:

An overwhelmingly large share of LPs said their preferred path to liquidity was a traditional exit, even at a discount.

As for the other liquidity tricks in the bag, LPs generally viewed them as “not preferred.” Only a third selected dividend recaps, a fifth said secondaries, and perhaps most strikingly, only 17% said “nah, let the winners run.”

Why Investors Don’t Care About Your Business

Steve blank • steve blank • July 1, 2025

Business•Startups•Investment•Fundraising•Venture Capital

I’ve been having coffee with lots of frustrated founders (my students and others) bemoaning most VCs won’t even meet with them unless they have AI in their fundraising pitch. And the AI startups they see are getting valuations that appear nonsensical. These conversations brought back a sense of Déjà vu from the Dot Com bubble (at the turn of this century), when if you didn’t have internet as part of your pitch you weren’t getting funded.

I realized that most of these founders were simply confused, thinking that a good business was of interest to VCs. When in fact VCs are looking for extraordinary businesses that can generate extraordinary returns.

In the U.S., startups raising money from venture capitalists are one of the engines that has driven multiple waves of innovation – from silicon, to life sciences, to the internet, and now to AI. However, one of the most frustrating things for founders who have companies with paying customers to see is other companies with no revenue or questionable technology raise enormous sums of cash from VCs.

Why is that? The short answer is that the business model for most venture capital firms is not to build profitable companies, nor is it to build companies in the national interest. VCs’ business model and financial incentives are to invest in companies and markets that will make the most money for their investors. (If they happen to do the former that’s a byproduct, not the goal.) At times that has them investing in companies and sectors that won’t produce useful products or may cause harm but will generate awesome returns (e.g. Juul, and some can argue social media.)

Founders looking to approach VCs for investment need to understand the four forces that influence how and where VCs invest:

1) how VCs make money, 2) the Lemming Effect, 3) the current economic climate and 4) Secondaries.

How VCs Make Money

Just a reminder of some of the basics of venture capital. Venture is a just another financial asset class – with riskier investments that potentially offer much greater returns. A small number of a VC investments will generate 10x to 100x return to make up for the losses or smaller returns from other companies. The key idea is that most VCs are looking for potential homeruns, not small (successful?) businesses.

Venture capital firms are run by general partners who raise money from limited partners (pension funds, endowments, sovereign wealth funds, high-net-worth individuals.) These limited partners expect a 3x net multiple on invested capital (MOIC) over 10 years, which translates to a 20–30% net internal rate of return (IRR). After 75 years of venture investing VC firms still can’t pick which individual company will succeed so they invest in a portfolio of startups.

VCs seesaw between believing that a winning investment strategy is access to the hottest deals (think social media a decade ago, AI today), versus others believing in the skill of finding and investing in non-obvious winners (Amazon, Airbnb, SpaceX, Palantir.)The ultimate goal of a VC investment is to achieve a successful “exit,” such as an Initial Public Offering (IPO) or acquisition, or today on a secondary, where they can sell their shares at a significant profit. Therefore, the metrics for their startups was to create the highest possible market cap(italization). A goal was to have a startup become a “unicorn” having a market cap of $1billion or more.

The Lemming Effect

VCs most often invest as a pack. Once a “brand-name” VC invests in a sector others tend to follow. Do they somehow all see a disruptive opportunity at the same time, or is it Fear Of Missing Out (FOMO)? (It was years after my company Rocket Science Games folded that my two investors admitted that they invested because they needed a multi-media game company in their portfolio.) Earlier in this century the VC play was fuel cells, climate, food delivery, scooters, social media, crypto, et al. Today, it’s defense and AI startups. Capital floods in when the sector is hot and dries up when the hype fades or a big failure occurs.

The current economic climate

In the 20th century the primary path for liquidity for a VC investment in a startup (the way they turned their stock ownership in a startup into dollars) meant having the company “go public” via an initial public offering (IPO) on a U.S. stock exchange. Back then underwriters required that the company had a track record of increasing revenue and profit, and a foreseeable path to do so in the next year. Having your company bought just before the IPO was a tactic for a quick exit but was most often the last resort at a fire sale price if an IPO wasn’t possible.

Beginning with the Netscape IPO in 1995 and through 2000, the public markets began to have an appetite for Internet startups with no revenue or profits. These promised the next wave of disruption. The focus in this area became eyeballs and clicks versus revenue. Most of these companies crashed and burned in the dotcom crash and nuclear winter of 2001-2003, but VC who sold at the IPO or shortly after made money.

For the last two decades IPO windows have briefly opened (although intermittently) for startups with no hope for meaningful revenue, profit or even deliverable products (fusion, quantum, etc. heavy, infrastructure-scale moonshots that require decades to fruition). Yet with company and investor PR, hype and the public’s naivete about deep technology these companies raised money, their investors sold out and the public was left hanging with stock of decreasing value.

Today, the public markets are mostly closed for startup IPOs. That means that venture capital firms have money tied up in startups that are illiquid. They have to think about other ways to get their money from their startup investments.

Secondaries

Today with the Initial Public Offering path for liquidity for VCs mostly closed, secondaries have emerged as a new way for venture firms and their limited partners to make money.

Secondaries allow existing investors (and employees) to sell stock they already own – almost always at a higher price than their purchase price. These are not new shares and don’t dilute the existing investors. (Some VC funds can sell a stake in their entire fund if they want an early exit.) Secondaries offer VC funds a way to take money off the table and reduce their exposure.

The game here is that startups and their investors need to continually hype/promote their startup to increase the company’s perceived value. The new investors – later stage funds, growth equity firms, hedge funds or dedicated secondary funds, now have to do the same to make money on the secondary shares they’ve purchased.

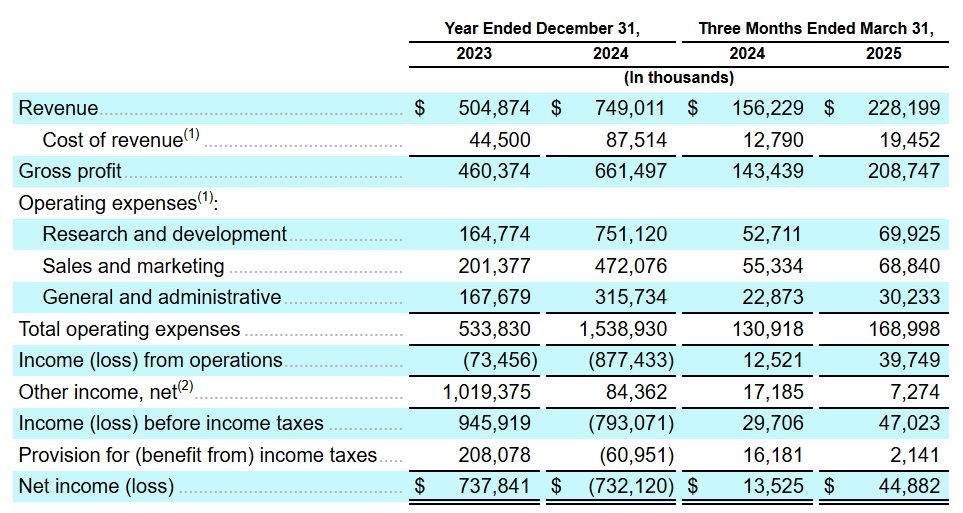

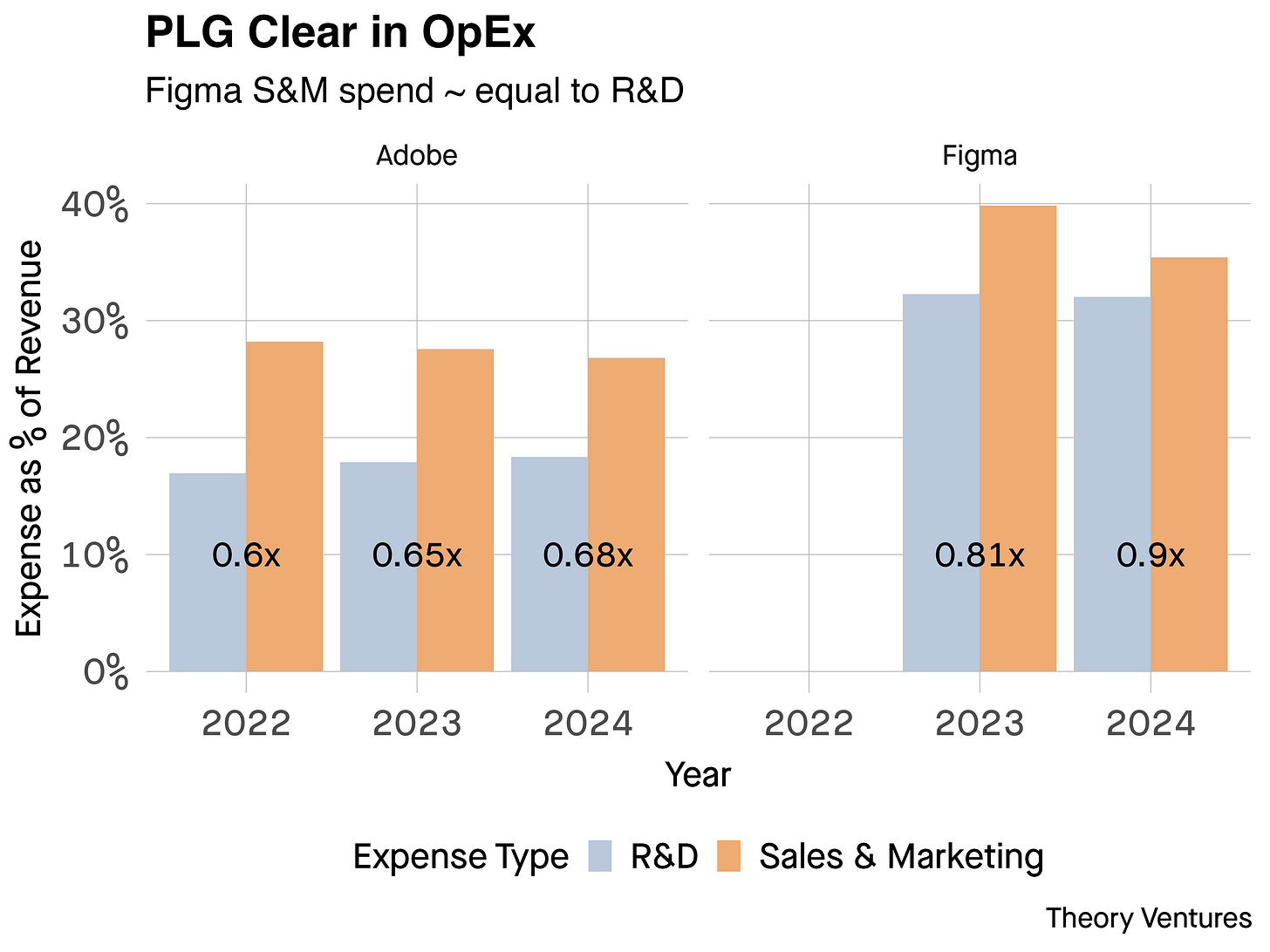

Figma’s IPO: The Full Breakdown & Why Melio’s $2.5BN Acquisition is “Discouraging”

Youtube • 20VC with Harry Stebbings • July 3, 2025

Business•Startups•IPO•Acquisitions•Figma•Melio•Venture Capital

KKR's Head of European PE, Philipp Freise: Do Andreessen & General Catalyst Scare KKR?

Youtube • 20VC with Harry Stebbings • June 30, 2025

Business•Private Equity•Investment Strategies•Technology•Market Trends•Venture Capital

In a recent interview on "The Twenty Minute VC" podcast, Philipp Freise, Co-Head of European Private Equity at KKR, delved into several pivotal topics shaping the private equity landscape. Freise, who has been with KKR since 2001, manages the firm's largest private fund in Europe, valued at $8 billion. His extensive experience includes leading investments in companies such as FGS Global, Axel Springer SE, and GetYourGuide. (kkr.com)

One of the key discussions centered around KKR's $500 million investment in Turkey, which faced significant challenges. Freise candidly shared insights into the missteps and the lessons learned from this venture, emphasizing the importance of thorough due diligence and market understanding.

The conversation also touched upon the evolving dynamics of private equity, particularly in the context of technological advancements. Freise addressed the impact of artificial intelligence on the private equity model, discussing how AI is reshaping investment strategies and operational efficiencies. He highlighted the necessity for private equity firms to adapt to these technological shifts to maintain a competitive edge.

Another significant topic was the changing landscape of liquidity events, especially in the absence of traditional IPOs. Freise explored alternative exit strategies, such as secondary buyouts and strategic sales, and how these methods are becoming more prevalent in the current market environment.

The interview also delved into KKR's disciplined approach to portfolio management. Freise discussed the firm's commitment to maintaining a diversified portfolio and the strategic importance of focusing on sectors with strong growth potential. He emphasized that KKR's investment decisions are driven by long-term value creation rather than short-term market trends.

Regarding the competitive landscape, Freise addressed the emergence of firms like Andreessen Horowitz and General Catalyst. He provided insights into how these venture capital firms are influencing the private equity space and whether they pose a competitive threat to established players like KKR.

The discussion also covered KKR's investment philosophy, highlighting the firm's focus on sectors such as technology, media, and telecommunications. Freise shared examples of successful investments in these areas and discussed the strategic rationale behind targeting these industries.

In conclusion, Freise's insights offered a comprehensive view of the current state and future prospects of private equity, emphasizing the importance of adaptability, strategic focus, and a long-term investment horizon.

How to value a listed VC index

Signalrank update • Rob Hodgkinson • June 30, 2025

Finance•Investment•VentureCapital•Valuation•PrivateMarkets•Venture Capital

Investors will pay for quality. This is as true in public markets as in the private markets.

In this post, we first consider how the public markets share a similar dispersion of returns as seen in the private market. We see how quality assets command premia to the rest of the market. We then consider how a similar dynamic occurs in the private market, and how scarcity of access can even drive valuations beyond Net Asset Value.

It goes without saying that listed entities without quality assets trade at a discount to NAV.

Power laws in public markets

The P/E premium of the Magnificent 7 (Meta, Amazon, Apple, Microsoft, Alphabet, Tesla & NVIDIA) over the remaining S&P 493 has been consistently above 40% since 2018, and at times as high as 100% (Figure 1).

Figure 1. Goldman Sachs analysis on Magnificent 7 vs S&P 493 (May 2025)

This is not surprising given that Morgan Stanley calculates in Figure 2 that the top 10 stocks by market cap delivered 69% of economic profit in 2023 (with economic profit defined as return on invested capital minus the weighted average cost of capital times invested capital).

Figure 2. Economic profit of Top 10 companies by market cap vs rest of US market

Fundamentals ultimately drive valuations; value concentration has led to market cap concentration. The top 10 stocks now account for more than 25% of the market cap weight of the US stock market (Figure 3).

Yet, as the chart below demonstrates, this concentration is not historically unique. Going even further back in history, the top 10 stocks in 1900 represented 38% of the market per this analysis.

Figure 3. Stock market concentration in the US, 1950-2023

This is all another way of saying that the dispersion of returns (aka the power law) is as skewed in the public markets as in the private markets.

By buying the S&P 500, you are wittingly or unwittingly buying into a set of power law distributed assets.

Figure 4 from Goldman Sachs shows how the returns are a reflection of powerful fundamental growth (in the form of EPS), and not irrational exuberance.

Figure 4. 12 month trailing earnings per share, Magnificent 7 versus S&P 493

Again, a longitudinal study by Bessimbinder found that just 86 stocks accounted for half of all wealth creation (above Treasury bills) in the U.S. stock market going back to 1926. All of the wealth creation in that time came from just 4% of stocks (1,092 companies). 58% of stocks failed to beat T-bill returns over their lives.

Bessimbinder’s study also helps explain the success of passive index strategies, as active strategies, which tend to be less diversified, mostly underperform. If indices outperform active managers in power law distributed public markets, surely the same logic should apply to private markets?

Valuing private assets in the public markets

This brings us to the central question of how investors might value private assets in a public markets wrapper.

The combination of quality and scarcity can lead funds to trade at a premium to NAV.

Quality

As with high quality public assets, we would anticipate that high quality private assets with compelling growth stories command premium valuations.

Investors are paying for the growth rates of private companies with the potential to deliver power law outcomes. SaaStr’s Jason Lemkin recently shared this chart on the declining growth of public SaaS companies. Compare this to the AI apps growing from zero to $100m “ARR” in <2 years.

Part of the premium also derives from the fact that high quality VC-backed assets tend to be category defining businesses, meaning they are valued (on a stand alone basis), not priced (on a relative basis). SpaceX, for example, is sui generis. 🚀

And these highly valued assets drive returns. StepStone just showed a positive correlation specifically in secondaries between premium valuations and returns.

Scarcity

The sense of scarcity of access to these assets drives valuation higher still.

If we look at the top 10 private companies by reported valuation, all would be within the top 300 companies in the S&P 500 by market cap (Figure 5, excludes Chinese companies). Altimeter calls this category “quasi-public” companies.

Based on today’s market caps, SpaceX & OpenAI would be within the top 30 companies (above Coca-Cola, GE, Cisco, Salesforce, Chevron, Disney, McDonalds, Morgan Stanley, American Express, AT&T, Goldman Sachs, etc).

Figure 5. Ranking of top 10 private companies in the S&P 500 by market cap

The distinction in investors’ minds between public and private is becoming more blurred. Coatue just published the list in Figure 6 of future “Coatue Fantastic 40” companies by market cap that combines both public and private companies.

Figure 6. The Coatue Fantastic 40 based on projected 2030 market cap

Yet there are very few places that a public investor can access these private companies, which is surprising given the size of these private assets. Hence the premium paid by investors to access these quality assets.

Examples of listed VC vehicles with high quality & scarce assets

We point to two listed vehicles with private market strategies which trade at a premium to NAV, namely Destiny XYZ (~7x NAV) & Flat Capital (~2x NAV). The commonality is exposure to high profile quality US assets (as well as both being founded by CEOs of notable FinTechs).

DXYZ, set up by the founder of Forge, is aiming to build a portfolio of 100 pre-IPO companies. Of the 23 companies in their portfolio today, the SpaceX SPV represents 52% of NAV. The market clamor for SpaceX is such that DXYZ has a market cap of ~$500m, or roughly a 600%+ premium to the $70m NAV.

Flat Capital, set up by the founder of Klarna, has a portfolio of private companies including Klarna (22% of NAV) and OpenAI (7%). Flat, which trades on Nasdaq First North Growth Market in Europe, has a market cap of ~$130m which is a 88% premium to the $68m NAV.

Both entities have the added benefit to investors of immediate 100% liquidity (subject to market conditions); their structures ensure that investors can simply sell their shares without requiring any unwinding of underlying illiquid positions. DXYZ in particular has healthy trading volumes. Greater liquidity itself should support valuation.

SignalRank, which is not currently listed, believes that our Series B investments (all in preferred stock direct on cap table) today are in the brand names of tomorrow; we expect some of our portfolio to be better known by the time any future listing of SignalRank were to take place. We also anticipate higher diversification than existing private market indices, with a target portfolio of 150 companies after five years.

….

What’s Accelerating in 2025: $5B+ Unicorns

Saastr • Jason Lemkin • July 2, 2025

Business•Startups•Unicorns•VentureCapital•MarketTrends•Venture Capital

Crunchbase had a great report out on how unicorns aren’t just back in the Age of AI … $5B+ valuation unicorns are the real growth vector:

Crunchbase calls them “Ultra Unicorns” which I haven’t heard before, but if it sticks as a term, I’m in 🙂

What The Data Shows:

#1: The 13% Rule — Ultra-Unicorns Control Half of Everything

Ultra-unicorns make up only 13% of all unicorn companies by count, but they hold more than half of their value: $3.5 trillion of the $6 trillion cumulative valuation. For B2B founders, this screams one thing: winner-take-most markets are getting more extreme. The companies that break through to ultra-unicorn status aren’t just winning — they’re consuming entire market categories.

#2: 2025 Is Shaping Up to Be an Ultra-Unicorn Vintage Year

With 17 companies newly joining the $5B+ club in just the first half of 2025, this tier is expanding faster than previous years and is on track to far surpass the 19 companies that joined in 2024. The standout? Thinking Machines Lab raised a $2 billion seed round at a $10 billion valuation — by far the largest seed round on record. The takeaway: If you’re building in AI or other frontier categories, the ceiling for initial valuations has been completely blown off.

#3: The Maturity Sweet Spot Is 7-14 Years

The peak founding years for current $5B+ unicorns were 2011-2018, meaning most are between 7 and 14 years old. This isn’t overnight success — it’s sustained execution through multiple market cycles. For SaaS CEOs, this reinforces the long game mentality. Ultra-unicorn status requires building through at least one major market correction and proving resilience across economic cycles.

#4: Exit Velocity Is Accelerating Despite Market Conditions

In 2024, nine companies valued at $5B+ exited, and five have already exited in 2025 including Chime, CoreWeave, and Wiz. Even with a challenging exit environment, ultra-unicorns are finding paths to liquidity. This suggests that when you reach truly massive scale, you create your own market dynamics. The lesson: Scale creates optionality — whether through strategic acquisitions, public offerings, or alternative liquidity events.

VC Has Split Into Mega Venture & All The Rest

The ultra-unicorn phenomenon isn’t just about bragging rights. It reveals that private markets are bifurcating into two distinct games: the traditional venture path and the “build a category-defining platform” path. For SaaS founders aiming high, the question isn’t just “How do we get to unicorn status?” but “How do we build something so foundational that we become infrastructure for an entire ecosystem?”

The companies reaching ultra-unicorn status aren’t just growing faster — they’re playing a fundamentally different game where network effects, platform dynamics, and market consolidation create winner-take-most outcomes that were previously unimaginable in private markets.

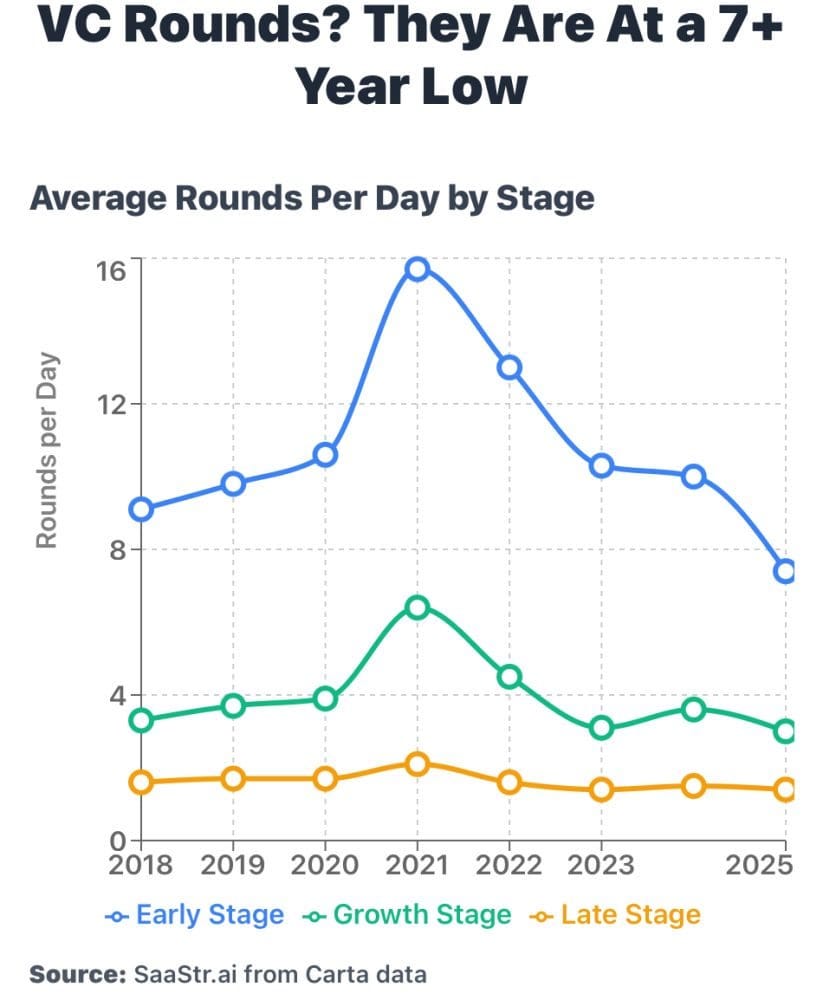

And finally, while all the “action” in VC is in mega rounds at $5B+ valuations, note overall the number of deals is falling per the latest Carta data:

A tale of two worlds. Fewer rounds, more dollars, going in to winners and perceived winners at $5B+ valuations.

SoftBank Gets Over $17 Billion of Demand for Dollar, Euro Bonds

Bloomberg • Takahiko Hyuga, Ronan Martin • July 2, 2025

Business•Finance•Investment•ArtificialIntelligence•DebtMarkets•Venture Capital

SoftBank Group Corp. has attracted over $17.3 billion in investor bids for its dollar and euro bonds, as the technology investment firm turns to global debt markets to accelerate its global push into artificial intelligence. (news.bloomberglaw.com)

The Tokyo-based company set final price guidance across the four dollar and three euro benchmark-sized offerings, tightening guidance by 25 basis points or more, according to a person familiar with the matter who asked not to be identified. (news.bloomberglaw.com)

As part of SoftBank’s large-scale investment plans in AI, its billionaire founder Masayoshi Son has pledged up to $500 billion for a project known as “Stargate,” and announced a planned $30 billion stake in OpenAI Inc earlier this year. (theedgemalaysia.com)

However, in a reminder of antitrust scrutiny Son has faced in his rapid global expansion, the U.S. Federal Trade Commission opened an in-depth investigation of SoftBank’s $6.5 billion takeover of semiconductor designer Ampere Computing LLC, Bloomberg reported this week. (theedgemalaysia.com)

At SoftBank’s annual general meeting in June, Son pledged to make SoftBank the top platform for artificial superintelligence within a decade. (theedgemalaysia.com)

His company has raised more than ¥600 billion ($4.2 billion) via yen bonds this year, the most for an issuer in Japan’s corporate debt market, Bloomberg-compiled data show. (theedgemalaysia.com)

“Japanese investors’ exposure to SoftBank has grown substantially,” said Taketoshi Tsuchiya, chief executive officer at Tsuchiya Asset Management Co. “Tapping overseas demand makes sense under the current environment.” (theedgemalaysia.com)

Dollar-denominated issuance has surged across Asia, supported by improving investor sentiment and lower funding costs. (theedgemalaysia.com)

Sequoia Was Busiest Startup Investor In June, While Meta Spent The Most

Crunchbase • July 3, 2025

Business•VentureCapital•StartupInvesting•ArtificialIntelligence•SequoiaCapital•Venture Capital

In June 2025, Sequoia Capital emerged as the most active startup investor in the United States, leading the deal count among U.S.-based companies. The firm participated in numerous funding rounds across various sectors, including artificial intelligence (AI), healthcare, and financial services. Notably, Sequoia led a $75 million Series B financing for Nominal, a Los Angeles-based startup specializing in real-time testing and monitoring platforms for hardware systems. This investment underscores Sequoia's commitment to supporting innovative technologies in critical industries. (techstartups.com)

While Sequoia led in deal volume, Meta Platforms Inc. (Meta) distinguished itself by leading the highest-value investments during the same period. Meta's strategic focus on artificial intelligence was evident through its significant financial commitments. The company finalized a $14.3 billion investment to acquire a 49% stake in Scale AI, a data-labeling startup valued at $29 billion. This acquisition aims to bolster Meta's AI capabilities by integrating Scale AI's expertise and resources. (reuters.com)

These developments highlight a dynamic landscape in the venture capital sector, with leading firms like Sequoia Capital and Meta Platforms Inc. actively shaping the future of technology through substantial investments in emerging startups.

AI

Everything Now is Just So Much Faster in The AI Age. Have You Adjusted?

Saastr • Jason Lemkin • July 1, 2025

Technology•AI•Innovation•SaaS•BusinessGrowth

“I just get so much more done today with the AI on the team instead of the humans on the team.” — leading CMO to me, last week.

Fast as Frack. That’s the new speed of business in the AI era.

I’ve been in B2B software now for 20+ years (!). Goodness. I’ve seen cycles. Boom, bust, recovery, boom again. But what’s happening right now? This isn’t just another cycle. This is a fundamental rewiring of how fast things move in tech.

Everything — and I mean everything — is Fast as F*ck compared to even 12 months ago.

It’s exciting. It’s tiring. And it’s very, very different than ever before. Not just the software (with AI). The pace.

This Isn’t 2021 “Fast” (That Was Just Demand)

Remember 2021? Everyone thought SaaS was moving at light speed. Companies going from $10M to $100M ARR in 18 months. IPOs every single day — literally an IPO-a-day pace we’d never seen before. Valuations hitting the moon.

But here’s the thing: 2021 wasn’t actually fast innovation. It was the same old SaaS products riding a massive demand wave.

Zoom was still the same video conferencing tool it was in 2019. Slack was still the same chat app. Shopify was still the same e-commerce platform. The products themselves weren’t fundamentally different or faster to build.

What was fast in 2021 was:

Customer adoption (pandemic forced digital transformation)

Sales cycles (everyone needed SaaS immediately)

Revenue growth (unlimited demand for existing solutions)

Fundraising (investors throwing money at anything with growth)

IPO creation (an IPO-a-day because public markets couldn’t get enough SaaS)

The underlying technology stack? Same APIs, same databases, same development cycles. Companies were scaling existing playbooks, not inventing new ones.

Even with that IPO-a-day pace, most 2021 IPOs were just riding the demand wave. Toast and Robinhood still traded flat or down from their IPO prices despite being “iconic properties.”

2025 is different. This is innovation speed, not just demand speed.

The Great Separation is Real (And The Data is Brutal)

The latest Coatue research just dropped some nuclear truth bombs about what’s happening in tech. The Great Separation isn’t coming — it’s here. And the numbers are absolutely wild.

Growth companies are trading at 13x revenue multiples. Slow growers? 4-5x.

But here’s the kicker: Only 5% of public software companies are growing >25% today, down from 26% in 2021. We’ve gone from 17% median revenue growth in 2021 to just 9% today.

Translation: If you’re growing fast, you’re literally in the top 5% of all software companies. Public markets are treating you like the rare unicorn you are.

And if you haven’t shipped meaningful AI into production by June 30, 2025? You don’t have a strategy problem. You have a talent problem.

The AI Explosion Shows What FAF Really Looks Like

Want to see FAF speed in action? The AI coding market exploded from $300M ARR to $1.6B ARR in just 12 months. That’s $1.3B in net-new revenue generated in a single year.

But that’s just coding. Look at the broader AI hypergrowth companies redefining what’s possible:

The Speed Leaders:

Cursor: Hit $100M ARR in 12 months, now at $200M ARR — 10x faster than traditional SaaS

Loveable: $1M ARR in 8 days, $10M in 2 months, $60M ARR in 6 months — Europe’s fastest-growing AI startup ever

Anthropic: $0→$1B ARR in 21 months, then $1B→$2B→$3B in 7 months total

Sierra: $50M ARR and $4.5B valuation with 300%+ growth rate

Harvey AI: Surpassed $50M ARR, targeting $100M in 8 months at $3B valuation

Mercor: $75M ARR in 2 years with 51% month-over-month growth

Artisan: $6m in ARR from AI SDRs in less than 6 months

These aren’t just riding demand waves like 2021 Zoom or Shopify. These companies are creating entirely new product categories and capabilities that didn’t exist 18 months ago.

100% YoY growth? Super impressive, and this will still compound at an epic rate if it’s durable. But AI B2B companies are hitting 500%+ growth rates and creating billion-dollar categories in months, not years.

The 18-Month “Let’s Learn” Window Has Closed

ChatGPT launched November 2022. GPT-4 and foundation models exploded through 2023. By early 2024, every serious B2B company had access to the same AI capabilities for pennies on the dollar.

That gave everyone 18 months to figure it out. The companies that used those 18 months wisely aren’t just winning — they’re lapping the competition.

This is the difference between 2021 and 2025:

2021: Same products, massive demand wave, everyone wins temporarily

2025: New capabilities, fundamental product reimagining, winners take everything

In 2021, you could ride the wave with incremental improvements. Add a mobile app, improve your UI, increase seat count. The rising tide lifted all boats.

In 2025, if you’re not rebuilding your product around AI capabilities, you’re not just behind — you’re building yesterday’s solution to tomorrow’s problems.

The New Rules Are Brutal (But Crystal Clear)

Coatue’s 2025 decision matrix is beautifully simple:

🚀 Growing >25% + Profitable? → File your S-1 immediately

🥶 Growing <25% + Profitable? → Play offense aggressively

🏰 Growing >25% + Unprofitable? → Build fortress balance sheet

💀 Growing <25% + Unprofitable? → Reinvent your business

No middle ground. No participation trophies. You’re either in the top tier or you’re fighting for scraps.

CloudFlare To The AI Industry: Pay Up!

Battellemedia • John Battelle • July 1, 2025

Technology•AI•Web•Data Privacy•Internet Economics

There are precious few companies in the tech world that are willing to stick their necks out and “do the right thing,” and even fewer who both operate at Internet scale and enjoy Wall Street’s unabashed fandom.

In fact, I can only think of one: Cloudflare. And today, the $65 billion public company* announced a new policy that has the potential to tilt the balance of the Internet back toward the little guys. Starting this morning, Cloudflare will automatically block AI crawlers from copying the content of every website the company protects. And it’s doing it for free.

“We’re changing the rules of the internet across all of Cloudflare,” Matthew Prince, Cloudflare CEO, told The New York Times. “If you’re a robot, now you have to go on the toll road in order to get the content of all of these publishers.”

Cloudflare’s scale – it powers more than 20 percent of the Internet – and its financial profile has consistently allowed it to reimagine how the Web can and should work. Without fear or favor, the company has rolled out services that reset the economics and data practices governing our day to day interactions with the Internet. Most of these services fall into the “dull but important” category, things like domain registration, the Domain Name System, or peering and streaming networks. Each move has been marked by a unmistakable philosophy of what might best be called “De-shittification” – a counter narrative to Cory Doctorow’s now famous observation that the Internet is getting worse and worse, mainly due to large tech companies’ extractive, rent-seeking practices.

Seven years ago, in Cloudflare and the Art of Breaching Moats, I wrote: “With every one of these steps, Cloudflare is doing two things: First, it’s refusing to view the Internet as property to be cornered, as real estate where infrastructure owners can camp out and collect rent. And secondly, Cloudflare is actively exercising a core philosophy which can be honestly described as embracing the best (and most earnest) values of Internet 1.0: The web should be open, freely accessible, and an equal playing field upon which anyone can frolic.”