Contents

Editorial

Whiplash: The World Isn't Ending. But the 'West' is.

Essays

Mapped: How China Overtook the U.S. in Global Trade (2000–2024)

If Trump is trying to suppress China, he’s going about it all wrong

How AI Will Enhance Human Potential, Not Replace It: Reid Hoffman

Geopolitics

How Trump’s TikTok Negotiations Were Upended by China and Tariffs

The self-inflicted death of American science has already begun

Trump Cuts Most Tariffs to 10% but Increases Tariffs on China to 125%

Trump, Supposedly, Thinks the U.S. Has the ‘Resources’ Needed to Make iPhones

Regulation

AI

The Power of Context: How Graph Technology is Reshaping AI and Decision-Making

China gains dexterous upper hand in humanoid robot tussle with US

The AI magic behind Sphere’s upcoming 'The Wizard of Oz' experience

Shopify CEO Requires Proof Jobs Can’t Be Done by AI Before Adding Headcount

Google says it’ll embrace Anthropic’s standard for connecting AI models to data

Venture Capital

Rethinking Unit Economics: How AI Agents Are Rewriting The SaaS Playbook

Express Trains and Warp Zones – The Bifurcation of the VC Market

North America Startup Investment Spiked In Q1 Due To OpenAI, But Seed And Early Stage Fell

Why Senior VC Partners Are Leaving Big Firms for Smaller Funds

Media Innovation

How NFL’s New 8k “Hawk Eye” Cameras Offer an Interesting Model for Truth and Verification

Established Writers Are Making More Money After Leaving Substack

Private Indexes in Public Markets

Startup of the Week

Interview of the Week

Keach Hagey on Sam Altman's Superpower

Post of the Week

Whiplash

Editorial: Whiplash: The World Isn't Ending. But the 'West' is.

The concept of the ‘West’ has been in existence since shortly after the end of World War II. It describes the post-war order of the USA and its allies against the ‘East’. It consisted of an economic, political, and military arrangement and had nothing to do with geography. It included the dominance of the Dollar as the reserve currency of the world, initially backed by Gold and then not.

It symbolized an American-led world order that included Japan, Korea, and in the period since the collapse of the Soviet Union, many Eastern European nations.

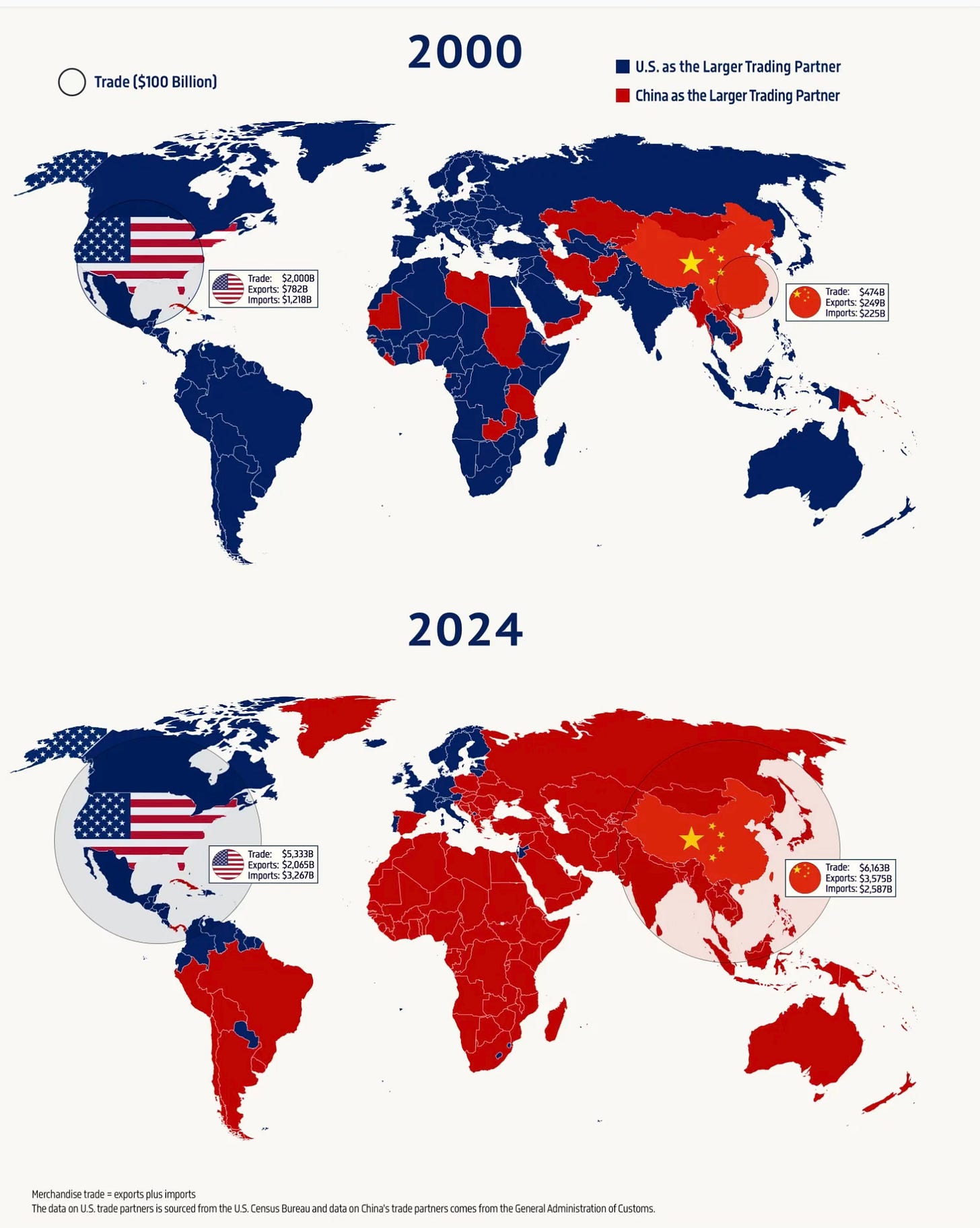

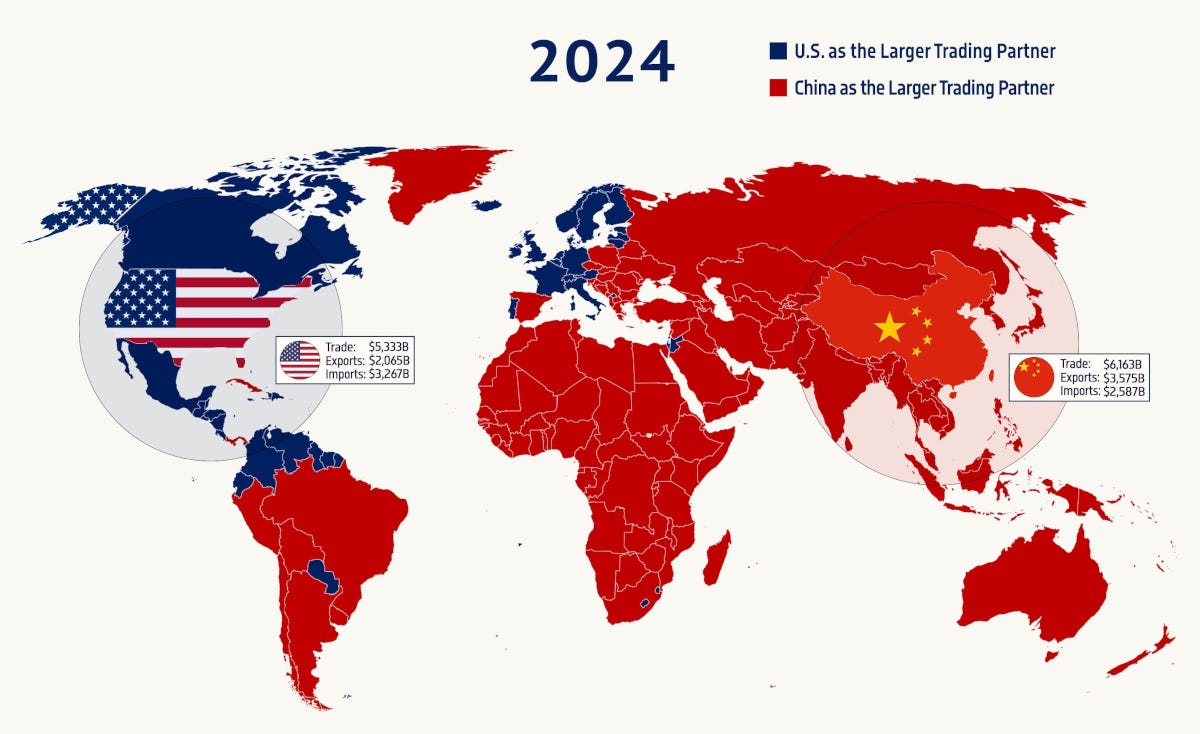

The nature of US world leadership has been impacted by the changing balance within the global order, led by economic changes. See this graphic from Visual Capitalist (article below).

The share of world GDP accounted for by the USA has shrunk and so to its share of world trade.

Weakening nations have historically favored protectionism. Strengthening nations, especially economic global leaders, have historically favored free trade. The US began moves towards protectionism well before the current Government, but now the tipping point has arrived.

2025 represents the end of the ‘West’. USA first replaces the ‘West’ as an organizing principle. The on-again, off-again whiplash of tariffs and markets is noise. The signal is in the breakup of former relationships and an attempt to reorganize the US’s position in a new fragmented world order.

Attempts to characterize these changes as deglobalization are superficially correct. But only because the USA was the world leader for the past 8 decades. Unchallenged US leadership was the form taken by globalization. Free trade represented its strength in the context of economic growth. The end of US world leadership is the end of globalization in that definition. But actually, we are about to experience a new global order.

The next phase of the global order will be made up of the same players, but playing different roles. China is already a global giant and growing. Asia as a whole is bigger still and a center of manufacturing as well as technology. Consumption inside Asia will be larger than the rest of the world as a whole.

Global (and US) GDP is not going to shrink. Indeed it may grow faster under the rise of AI than ever before. But a shrinking percentage of it will be made in or revert to the USA.

Looked at from this point of view Trump’s tariffs, and the direction they represent, is rational. The USA has to do what the UK learned to do over the past century, play defense and accept not being the sole world leader. This may slow down the change to a new global order, but not stop it.

In this context, ideological memes can be confusing. It is worth remembering some truths.

Global trade is a human good.

GDP grows more if trade grows.

The local share of global GDP is a measure of success in making and selling things

Policies to protect local economies from global competition are a symptom of weakness, not strength

As individuals, we want good products at the best price. This requires a global market.

My point of view is that humanity wants to be global. That is an economic truth and can live alongside social and political preferences that are intensely local. In the same way, technology wants to be global. The Internet and the smartphone were not local but instantly global. The same is true of AI. Economic and technical globalization is a bottom-up globalization.

It contrasts with top-down political, economic, and military structures like the World Bank, the United Nations, The EU, NATO, the G7, the G20 and so on that are symbolic of US leadership since World War Two and so only global due to the strength of the US in that time.

So what to think? Trump isn’t wrong to react to these changes to attempt to slow down a long-term trend of US relative decline. However, the future of the world is about bottom-up globalization driven by technology innovation and related markets. World GDP will grow, despite tariffs. US GDP will also grow but more slowly. The US-based AI leaders can play a big role in US performance if they can figure out global growth and monetization. But so too will China’s AI leaders.

This week’s articles are a smorgasbord of content all relevant to these discussions.

Essays

Long Live RSS

Windley | Cory to try one more time | April 7, 2025

#Technology • #Web • #RSS • #SocialMedia • #Newsblur • #Essays

I've stopped using social media apps as much and have started using RSS again. I'm wasting less time scrolling past stuff I don't care about and more time reading things I enjoy. Try it. Like many, I've grown increasingly disinterested in social media over the last year. I still have accounts on X, Substack, Facebook, and others. But I find that there's less and less there that I actually care about. I find myself wading through lots of crap to find the things I want to see. Still, I do like to browse through ideas while waiting in line, at the doctor's office, and so on. This post from Cory Doctorow entitled "You should be using an RSS reader" caught my eye a while ago. I used to use an RSS reader all the time. I've tried to get back into it a time or two, but it didn't stick. Inspired by Cory to try one more time, I downloaded the RSS reader he uses (Newsblur) and gave it another shot. This time I coupled it with moving the RSS reader app on my phone to a more prominent position so when I'm looking for something to browse, I see it first. First I found RSS feeds for some of my friends and publications I like to read. I also discovered that Substack publications have RSS feeds. Many publications don't make finding RSS easy, but it's almost always there. There are a few authors I like on The New Stack and I found that if you enter /rss after the URL for an author or category page, you get RSS for that author or category. For example, here's the RSS page for Jon Udell. Cool. After adding RSS feeds for things I like (most online publications have one), I started reading things on Newsblur instead of opening up a social media app. Most newsreaders don't have an algorithm. If they do, it is not usually the default setting and can be turned off. If you subscribe to too many feeds, turn it on and let it prioritize your reading. But regardless, you control the experience. Just like you should. Cory's right, using an RSS reader will make your digital life better. I'm wasting less time scrolling past stuff I don't care about and more time reading things I enjoy. That's a win.

Globalization Is Collapsing. Brace Yourselves.

Nytimes | April 5, 2025

#Politics • #Globalization • #EconomicPolicy • #InternationalRelations • #Nationalism • #Geopolitics • #Essays

The article discusses the potential collapse of globalization, drawing parallels with historical events where global interconnectedness unraveled.

This collapse is not unprecedented; the world was similarly intertwined 100 years ago, and its unraveling led to disastrous consequences. The question posed is whether we can avoid a similar outcome today.

Historical Context and Current Trends Historically, globalization has been a recurring phenomenon, with periods of increased global integration followed by periods of fragmentation. The early 20th century saw a significant decline in globalization due to political tensions and economic protectionism, culminating in the Great Depression and World War II. Today, similar forces are at play, with rising nationalism, trade barriers, and geopolitical tensions threatening the current era of globalization. Key factors contributing to this trend include:

Rise of Nationalism: Many countries are adopting more nationalist policies, which often lead to protectionism and reduced international cooperation.

Trade Tensions: Increased tariffs and trade disputes between major economies have disrupted global supply chains and reduced economic interdependence.

Geopolitical Conflicts: Escalating tensions between major powers are creating an environment where international collaboration is increasingly difficult.

Implications and Potential Outcomes The collapse of globalization could have profound implications for economies, societies, and international relations. Economically, reduced trade and investment could lead to slower growth, higher prices, and reduced economic opportunities. Socially, it could exacerbate inequalities and reduce cultural exchange. Politically, it could lead to increased conflict and instability. The article suggests that understanding the historical context and learning from past mistakes could help mitigate these outcomes. However, the complexity of current global challenges means that finding solutions will be difficult.

Conclusion In conclusion, the potential collapse of globalization is a pressing concern, with historical precedents suggesting severe consequences. Understanding these dynamics and working towards international cooperation could help prevent or mitigate the negative impacts of such a collapse.

The future of globalization depends on the ability of nations to navigate these challenges and find a path towards sustainable and equitable global integration.

How to Think When the World Doesn’t Make Sense

Beehiiv | the old rules. | April 10, 2025

#Business • #Strategy • #Globalization • #Investment • #Inflation • #Geopolitics • #Essays

The Shift to Protectionism On April 2, 2025, President Donald Trump announced a significant shift in U.S. trade policy, dubbing the day "Liberation Day." This involved sweeping tariffs, including a universal 10% tariff on all imports and a significant 54% cumulative tariff on Chinese goods. These measures marked a break from decades of globalization, signaling a turn towards protectionism. The global market reaction was swift, with the Dow Jones Industrial Average falling by 1,500 points, highlighting fears of a potential global trade war. Despite the panic, Howard Marks, co-founder of Oaktree Capital, provided a calm analysis of these events, emphasizing the importance of "clear thinking in complex times." He argued that this policy shift represents a structural change rather than a cyclical fluctuation in trade economics.

Globalization and Inflation Dynamics For decades, globalization contributed to suppressed inflation by optimizing supply chains and enabling cheaper imports. Marks notes that from 1980 to 2005, prices of durable goods in the U.S. fell significantly due to outsourced manufacturing and global labor arbitrage. The new tariffs counter this trend by increasing production costs and reducing trade efficiencies, leading to a more persistent inflationary environment. This shift poses challenges for investors who relied on the steady, predictable economic landscape created by globalization.

Rethinking Investment Strategies Marks emphasizes the need to adapt investment strategies to the changing economic climate. As the rules of the game alter, relying on past predictions becomes less effective. He advises adopting judgment and context over strict data-driven forecasts. With assumptions about free trade, stable alliances, and cheap capital in flux, investors need to reassess their strategies. Marks highlights the importance of evaluating whether price changes represent genuine changes in risk or mere fluctuations in market sentiment.

Volatility as an Opportunity Rather than fearing market volatility, Marks suggests viewing it as an opportunity for thoughtful analysis and value-driven investments. He advises investors to ask whether price declines reflect changes in underlying value or merely present discounted buying opportunities. This mindset is crucial in navigating today’s erratic market environment.

Positioning Over Predictions In an era where old assumptions like "the U.S. will always outperform" are challenged, Marks advises focusing on positioning rather than predictions. Investors should build resilient portfolios accommodating diverse outcomes, emphasizing fundamentals and durability over speculative gains. He stresses evaluating the price of uncertainty and whether current valuations reflect realistic scenarios or overlook potential risks.

The U.S. as an Investment Destination While Marks acknowledges the U.S. remains a strong investment destination, he notes it is less so than before. The foundations that made the U.S. attractive—predictable legal systems, fiscal discipline, and investor trust—are increasingly under strain. Investors are urged to be selective, not complacent, with their U.S. investments, considering the broader shifts in global economic dynamics.

Mindset as an Investment Tool Marks underscores that in times of global uncertainty, mindset becomes a critical asset. Investors should focus on understanding the evolving landscape rather than clinging to outdated paradigms. He encourages asking better questions and observing market dynamics rather than reacting impulsively to changes.

Key Takeaways Marks' insights serve as a guide for investors facing a world no longer constrained by the old rules of globalization. This shift to protectionism, the structural change towards persistent inflation, and the volatility that comes with it require a rethinking of investment approaches. Marks’ emphasis on context, judgment, and adaptability provides a valuable framework for navigating these challenging times.

Read full article

Oaktree's Howard Marks on Credit Yields, Trump's Tariffs

Youtube | Bloomberg Television | April 10, 2025

#Finance • #Investment • #CreditYields • #Tariffs • #EconomicPolicy • #Geopolitics • #Essays

Oaktree Capital co-Chair Howard Marks recently discussed the health of credit yields and their comparison to equity investments. Speaking on "Bloomberg Open Interest,"

Marks emphasized that credit yields remain very healthy, even in a volatile market environment. He noted that high-yield bonds, for instance, were yielding around 7.2% a few weeks ago but have since increased to nearly 8%, reflecting a higher prospective return due to price declines.

Marks also addressed the impact of the Trump administration's tariffs on the economy and financial markets. He highlighted that despite market turmoil and significant tariff implementations, credit yields have become more attractive compared to equities.

Marks argued that while stocks have historically delivered higher returns, their current valuations are elevated, suggesting lower future returns. In contrast, credit offers a more predictable return, as it is based on contractual obligations and yields that are sufficient to offset potential credit losses.

The discussion also touched on the historical performance of credit instruments. Marks pointed out that even with narrow spreads, credit has historically outperformed risk-free assets like Treasurys. He emphasized that the key consideration should be whether current spreads are adequate to cover expected credit losses, rather than comparing them to historical norms.

In his recent memo, Marks reiterated that credit presents a better deal than equities at current spreads. He believes that the elevated yields offered by credit make it an attractive option for investors seeking predictable returns in uncertain market conditions. Despite the challenges posed by tariffs and market volatility, Marks remains optimistic about the health of credit yields and their potential for providing strong returns relative to other asset classes.

Mapped: How China Overtook the U.S. in Global Trade (2000–2024)

Visualcapitalist | Bruno Venditti | April 9, 2025

#Business • #InternationalTrade • #GlobalEconomy • #China • #US • #Geopolitics • #Essays

The imposition of tariffs by the Trump administration has sparked global discussions about a potential reshaping of the world economy, with countries considering diversifying trade ties beyond the United States.

The measures announced by the White House target several countries, with China being one of the main ones. President Trump pledged to increase tariffs on China by an additional 50% if the country did not withdraw its 34% retaliatory tariffs, which were introduced in response to U.S. tariffs.

In this visualization, creator Ehsan Soltani explores the shift in global trade dominance between the United States and China over the past two decades. The data is sourced from the United States Census Bureau and the General Administration of Customs of the People's Republic of China.

In 2000, U.S. trade totaled $2 trillion—more than four times China’s $474 billion. At the time, China was the primary trade partner for only a handful of countries, including Cuba, Iran, Libya, Myanmar, Mongolia, North Korea, Oman, Sudan, Tanzania, and Vietnam.

From 2000 to 2024, U.S. trade grew by 167% (a 4.2% compound annual growth rate), while China’s trade surged by 1,200% (an 11.3% CAGR), overtaking the U.S. in 2012.

By 2024, total trade reached $5.3 trillion for the U.S. and $6.2 trillion for China. China is now the dominant trade partner for most of Asia, Eastern Europe, the Middle East, Oceania, South America, and Africa. Looking forward, China is expected to continue to deepen its relationships with emerging markets—importing fuels, minerals, and agricultural goods, and exporting manufactured products.

If Trump is trying to suppress China, he’s going about it all wrong

Ft | April 10, 2025

#Politics • #InternationalRelations • #TradePolicy • #EconomicStrategy • #Globalization • #Geopolitics

The article discusses the economic strategies employed by the U.S. government, particularly under former President Donald Trump, in relation to China. It suggests that if the goal is to suppress China economically, the approach being used is ineffective. The article highlights how tariffs and other economic measures have prompted Beijing to refocus on its economic fundamentals.

Economic Impact of Tariffs Tariffs imposed by the U.S. have had a significant impact on China, but not necessarily in the way intended. Instead of weakening China's economy, these measures have encouraged Beijing to strengthen its economic foundations. This includes focusing on domestic consumption and reducing reliance on exports. The tariffs have also led to increased investment in technology and innovation within China, as the country seeks to become more self-sufficient.

Strategic Shifts in China's Economy China's strategic shift towards economic self-sufficiency is a key takeaway from the article.

This involves:

Domestic Consumption: China is focusing on boosting domestic consumption to reduce its reliance on exports. This strategy aims to stabilize the economy and make it less vulnerable to external pressures.

Technological Advancements: There is a significant push towards technological innovation and development. This includes investments in sectors like renewable energy, advanced manufacturing, and digital technologies.

Economic Diversification: China is diversifying its economy by promoting service sectors and reducing dependence on manufacturing exports.

Implications and Analysis The implications of these economic strategies are multifaceted. On one hand, they demonstrate China's resilience and ability to adapt to external pressures. On the other hand, they pose challenges for countries like the U.S. that have traditionally relied on trade with China. The article suggests that if the goal is to suppress China's economic growth, current strategies may need reevaluation.

Conclusion In conclusion, the article highlights the unintended consequences of economic measures aimed at China. Instead of weakening China, these measures have prompted the country to strengthen its economic foundations. This strategic shift towards self-sufficiency and technological advancement poses new challenges for global economic dynamics and highlights the need for a reevaluation of international economic strategies.

How AI Will Enhance Human Potential, Not Replace It: Reid Hoffman

Thegeneralist | Mario Gabriele | April 8, 2025

#Technology • #AI • #Innovation • #Ethics • #HumanAmplification • #Essays

Reid Hoffman thinks AI won’t take our jobs — it’ll give us superpowers.

Here’s why he’s betting on a future of human amplification, not obsolescence. For decades, science fiction has painted AI as humanity's downfall, depicting scenarios like killer robots, surveillance states, and the end of human agency.

However, Reid Hoffman, co-founder of LinkedIn and a prominent figure in the tech industry, presents a different vision for AI's future. He believes that AI will enhance human potential rather than replace it. Reid isn't just theorizing about AI; he's actively involved in shaping its future.

As a co-founder of LinkedIn, a former OpenAI board member, and founder of multiple AI startups, he has played a significant role in the technological landscape over the past two decades. His latest book, *Superagency: What Could Possibly Go Right with Our AI Future*, offers a compelling case for AI optimism grounded in deep thinking and practical experience. In discussions, Reid shares why he’s optimistic about AI’s potential, how it can foster human creativity, and what steps are needed to ensure technology works for humanity's benefit.

The conversation with Reid explores several key themes, including why he wrote *Superagency* and his belief that AI leads to more human agency, not less. He also delves into philosophical questions about AI's reasoning capabilities and how generative AI can promote collaboration and creativity over passive consumption.

Additionally, Reid discusses preserving humanity's essence as transformative technologies like gene editing and neural interfaces become mainstream. He offers an optimistic view of synthetic biological intelligence as a symbiotic relationship and suggests that AI agents can deepen human friendships rather than replace them. Reid’s perspective on AI is not just theoretical; he actively uses AI in his daily life. He emphasizes the importance of thoughtful regulation and the need for more optimistic science fiction to inspire positive visions of AI's future.

His work challenges conventional fears about AI, inviting readers to view the future through a lens of opportunity rather than fear. This approach is a call to action, encouraging people to embrace AI with excitement and actively shape a world where human ingenuity and AI combine to create something extraordinary.

Reid Hoffman's vision for AI is encapsulated in his concept of "homo techne," where technology enhances human capabilities, making us more human. He advocates for preserving genetic diversity to safeguard humanity and believes that AI can help address some of the world's most pressing challenges. His optimism about AI's potential to unlock new levels of creativity, productivity, and problem-solving is shared by other tech visionaries, who see Superagency as an essential guide for navigating the future of AI. Overall, Reid Hoffman's perspective on AI emphasizes its potential to enhance human potential rather than replace it. By focusing on the opportunities AI presents, he encourages a future where technology and humanity collaborate to achieve extraordinary outcomes.

The one person $1bn company

Signalrank update | Rob Hodgkinson | April 8, 2025

#Business • #Startups • #Entrepreneurship • #AI • #Innovation • #Essays

There needs to be a vibe shift away from the phrase ‘vibe shift’. It already sounds tired.

And it’s only a phrase that has had currency in the last four years (a lifetime in the memetic era) after pop culture commentator Sean Monohan created the phrase in 2021 by identifying three distinct cultural zeitgeists from hipsters onwards. Each epoch had a distinct aesthetic, and the shift between eras was swift (nicely broken down in this article).

This framing clicked in the post pandemic world and has subsequently been applied to various domains from geopolitics, media, and beyond.

This is a long way of saying that there has been a vibe shift in tech. The advent of a new platform technology (AI) at a time of higher interest rates (leading to tighter capital markets) and greater geopolitical instability will do such a thing.

This table is our attempt to capture some of these rapid changes seen within tech & VC in recent years. Individually each change is notable, collectively they form a vibe shift.

Figure 1. SignalRank’s summary of the vibe shift

The idea of the one person $1bn company (if we’re coining epithets, the “unocorn” or “unacorn” perhaps) is the most emblematic of these changes. It is becoming the north star for the latest generation of ambitious founders, a radical aspirational idea that could only be realized with the power of AI tools.

The first notable public discussion of the one person $1bn company was in this interview last year between Reddit co-founder Alexis Ohanian and OpenAI’s Sam Altman. Here’s Altman:

“In my little group chat with my tech CEO friends, there’s this betting pool for the first year that there is a one-person billion-dollar company, which would have been unimaginable without AI — and now [it] will happen.”

How will the creation of a one person $1bn company happen?

We see three key changes to startups that could enable the vision: 1) AI tools that enable scale, 2) a shift in working culture and 3) an aversion to normcore VC.

Data Infrastructure in 2025: Platforms vs. Specialization

Datagravity | Chris Zeoli | April 7, 2025

#Technology • #Cloud • #DataInfrastructure • #Specialization • #CostEfficiency • #Essays

Platforms serve as the backbone of data infrastructure, but there is a growing shift towards specialization, orchestration, and cost-efficiency in the development of next-generation frameworks. This evolution is driven by a need to address specific challenges and enhance performance in increasingly complex environments.

Platforms vs. Specialization While platforms provide broad capabilities and serve as essential foundations, specialization is seen as critical to optimize performance and meet unique requirements of different industries. Specialized systems can handle specific tasks more efficiently than general platforms, which may lack the granularity needed for certain applications. For example, industries like finance and healthcare often require highly tailored solutions that platforms, in their traditional form, cannot adequately address.

Orchestration and Integration The orchestration of diverse systems is becoming increasingly important. As organizations deploy specialized tools, the ability to integrate and manage these components seamlessly is crucial. Effective orchestration ensures that different systems work together cohesively, maximizing performance and minimizing disruptions. This is particularly important in environments where real-time data processing is essential, such as in automated trading systems or IoT networks.

Cost-Aware Execution Cost efficiency remains a major concern for businesses, pushing the need for infrastructure that is both effective and economical. With the rise of cloud computing and other scalable solutions, organizations can allocate resources more dynamically, optimizing for both performance and cost. This flexibility allows for smarter budgeting and resource management, which is critical in today’s competitive landscape.

Implications for Future Development The shift towards specialization and cost-aware execution has significant implications for the future of data infrastructure. Companies are likely to invest more heavily in developing solutions that align with their specific needs while ensuring that these are seamlessly orchestrated with existing platforms. This approach promises not only improved performance but also strategic advantages in cost management and resource allocation.

Key Takeaways - The move from traditional platforms to specialized systems addresses unique industry needs with greater efficiency. - Orchestration of disparate tools and systems allows for cohesive operation, essential for environments requiring real-time data handling. - A focus on cost-aware execution empowers organizations to manage resources and expenses effectively, aligning with dynamic market demands. - Future infrastructure development will likely prioritize tailored solutions that enhance integration and cost efficiency.

A Look Back at Q4 '24 Public Cloud Software Earnings

Cloudedjudgement | Jamin Ball | April 9, 2025

#Technology • #Cloud • #Software • #SaaS • #Finance • #Essays

Q4 earnings season for cloud businesses is now behind us. The 60 companies that I’ll discuss here all reported quarterly earnings sometime between January 29th – April 1st. In this post, I’ll take a data-driven approach in evaluating the overall group’s performance, and highlight individual standouts along the way. As a venture capitalist, I naturally cater my analysis through the lens of a private investor. Over my years as a VC, I’ve had the opportunity to meet with hundreds of entrepreneurs who are all building special companies. Through these interactions, I’ve built up mental benchmarks for metrics on which I place extra emphasis. My hope is that this analysis can provide startup entrepreneurs with a framework for how to manage their businesses around SaaS metrics (e.g., net retention and CAC payback). When looking at the aggregate net new ARR added in Q4, it paints a mixed picture. The quarterly sequential build was great throughout the year, but Q4 ’24 net new added was less than Q4 ’23. The percentage of companies beating Q4 consensus estimates ticked down to ~92%. The median beat was ~2.1%. Of course, the above chart shows historical (i.e., lagging) data. What’s more interesting is the outlook—are companies giving us any hints that things are improving (or degrading)? When we look at guidance for Q1 relative to consensus, we’ll see things ticked down. 50% of companies guided above consensus (down from 71% last Q), and the median guidance was 0.0% below consensus (very slightly negative). Let’s get into some high-level data. If we look at the percentage of companies beating Q4 consensus estimates, it ticked down to ~92%. The median beat was ~2.1%. Historically, the median guidance "raise" was in the 2-3% range. The last few quarters have all been quite low. Demonstrating high growth is the third aspect of a successful quarter. This metric is more self-explanatory, so I won’t go into detail. The growth shown below is a year-over-year growth for reported quarters. High net revenue retention is the fourth aspect of a successful quarter, and one of my favorite metrics to evaluate in private SaaS companies. It is calculated by taking the annual recurring revenue of a cohort of customers from 1 year ago, and comparing it to the current annual recurring revenue of that same set of customers (even if you experienced churn). In simpler terms—if you had 10 customers 1 year ago that were paying you $1M in aggregate annual recurring revenue, and today they are paying you $1.1M, your net revenue retention would be 110%. The reason I love this metric is because it really demonstrates how much customers love your product. Demonstrating the ability to efficiently acquire customers is the fifth aspect of a successful quarter. The metric used to measure this is my second-favorite SaaS metric (behind net revenue retention): Gross Margin Adjusted CAC Payback. It’s a mouthful, but this metric is so important because it demonstrates how sustainable a company’s growth is. In theory, any growth rate is possible with an unlimited budget to hire AEs. However, if these AEs aren’t hitting quota and the OTE (base + commission) you’re paying them doesn’t justify the revenue they bring in, your business will burn through money. Tying all of these metrics together is another one of my favorites: the change in revenue consensus estimates for the 2025 calendar year. Heading into Q4 earnings, analysts had expectations for how each business would perform in 2025. After earnings, that perception either changed positively or negatively. It’s important to look at the magnitude of that change to see which companies appear to be on better paths. Analysts take in quite a bit of information into their future predictions—exec commentary on earnings calls, current quarter results, macro tailwinds/headwinds, etc., and how they adjust their 2025 estimates says a lot about whether the outlook for any given business improved or declined. At the end of the day, what investors care about is what happened to the stock after earnings were reported. The stock reaction alone doesn’t represent the strength of a company’s quarter, so the below data has to be viewed in tandem with everything discussed above. Oftentimes the buy-side expects a company to perform well (or poorly), and the company’s stock going into earnings already has these expectations baked in. In these situations, the stock’s earnings reaction could be flat. However, it’s still a fun data point to track.

Market Ending Moves

Eladgil | Elad Gil | April 8, 2025

#Business • #Strategy • #MergersAndAcquisitions • #Competition • #Innovation • #Essays

Every once and a while, there is a move that ends questions and competition for startups in a market. A single move can effectively win the market, or “end the market.” Market-ending moves may include: Merging with your main competitor to remove pricing pressure and options from buyers. The merger between X.com and Paypal in the 1990s consolidated the main payment providers on the internet at the time. Uber and Lyft are rumored to have almost merged at the height of their competition in the 2010s. The rumor is Uber walked from this deal, but then went on to merge its subsidiaries with the major player in multiple international markets to increase leverage of the combined player in the market (China, Russia, etc). Private to private mergers, when companies are still young, are much easier to get past regulators than public/private buys. There are other dynamics to contend with however around ownership, leadership, and ego. Buying a key supplier (of unique data, a bespoke sensor or component, etc.) to starve others of a key input to products, prioritize yourself for volume, or get a cost advantage. Key distribution deal. IBM distributing Microsoft’s early O/S, or Yahoo! distributing Google were two “king making” moves in an industry. Destroy a competitor's cash cow. Sometimes your incumbent competitor will have a legacy cash cow business that funds everything else. Offering a free or cheap version of this, or changing business models to destroy their cash flow can be quite effective. This is part of the concern for Google in search/ads relative to some genAI products. Capital. Sometimes you can raise an enormous sum to buy distribution or saturate a network effect market. TikTok notoriously bought traffic early on at large scale, and Google invested billions in early search distribution. One could argue the current SOTA LLM models are reasonably locked into an oligopoly market due to the ability to raise billions or tens of billions of dollars for the next giant model. Other moves. Lots of other things can be done as well. When you are thinking about market-ending moves, be creative! You can brainstorm literally any scenario. Can you convince a large public company to spin out a key subsidiary to merge with you? Can you put aside ego with your main competitor to combine forces and stop competing for everything? Think broadly. Even if it doesn’t happen, this often sparks key thinking on M&A, partnerships, and key hires that you may not have considered otherwise.

Don't Die With Your Music Still in You

Investing101 | April 5, 2025

#Business • #Strategy • #PersonalDevelopment • #Innovation • #Motivation • #Essays

The article "Don't Die With Your Music Still in You" explores the concept of transforming personal potential into tangible value, often through the lens of corporate success. This idea is encapsulated in the quote by Augustus Doricko, "Literal life force transmuted into shareholder value," which highlights the conversion of personal energy and creativity into financial returns. The concept of "music still in you" metaphorically represents the untapped potential within individuals. It suggests that people often leave their most valuable contributions unexpressed, whether in personal or professional contexts. This theme is particularly relevant in today's fast-paced business environment, where the pressure to perform and deliver results can overshadow personal fulfillment. The article likely delves into the tension between pursuing personal dreams and conforming to societal expectations, particularly those tied to financial success. The implications of this concept are profound, as they touch on the balance between personal fulfillment and external validation. In a world where shareholder value often takes precedence, individuals are encouraged to channel their energy into creating value that is recognized and rewarded by the market. However, this approach can lead to a sense of disconnection from one's true passions and talents, resulting in unfulfilled potential. In conclusion, the article invites readers to reflect on how they allocate their life force—whether it is toward personal fulfillment or external validation. It underscores the importance of aligning personal goals with societal expectations while ensuring that one's true potential is realized.

Geopolitics

How Trump’s Tariffs Play Right Into China’s Hands

Nytimes | April 7, 2025

#Politics • #InternationalRelations • #TradePolicy • #EconomicStrategy • #Globalization • #Geopolitics

The article discusses the implications of former President Trump's tariffs on international trade, particularly in relation to China. It suggests that instead of adopting a unilateral approach, the U.S. should have formed alliances with other industrial democracies to counter China's economic strategies.

Tariff Strategy and Global Implications The article critiques Trump's tariff policies, arguing that they inadvertently benefited China by not leveraging the collective economic power of industrial democracies. This approach, it suggests, would have been more effective in challenging China's advanced manufacturing capabilities and economic influence. By aligning with other industrial nations, the U.S. could have created a stronger front against China's economic practices, potentially leading to more favorable trade agreements and outcomes.

Economic and Political Implications

Global Trade Dynamics: The unilateral approach to tariffs may have isolated the U.S. in global trade discussions, reducing its negotiating power. In contrast, a coalition of industrial democracies could exert more influence on global trade policies.

China's Economic Advantages: China's ability to adapt and innovate in advanced manufacturing sectors has been a key factor in its economic growth. The article suggests that a collective effort by industrial democracies could better address these advancements and mitigate China's economic advantages.

Political Considerations: The article implies that political unity among industrial democracies is crucial for effectively countering China's economic strategies. This unity would not only enhance economic leverage but also provide a stronger political stance against China's expanding influence.

Conclusion and Future Directions In conclusion, the article emphasizes the importance of strategic alliances in international trade, particularly when dealing with major economic powers like China. It suggests that future U.S. trade policies should focus on building coalitions with other industrial democracies to create a more balanced and effective approach to global trade challenges.

How Trump’s TikTok Negotiations Were Upended by China and Tariffs

Nytimes | Lauren Hirsch, David McCabe and Sapna Maheshwari | April 7, 2025

#Technology • #Mobile • #InternationalRelations • #DataPrivacy • #DigitalSovereignty • #Geopolitics

The ongoing situation with TikTok has escalated into a significant geopolitical conflict between the United States and China. The video-sharing platform, which has gained immense popularity globally, particularly among younger users, now finds itself at the center of complex negotiations involving national security concerns, international trade, and technological sovereignty.

Background and Escalation The tensions surrounding TikTok began during the previous administration when concerns about data security and the app's Chinese ownership through ByteDance prompted initial threats of a ban. These concerns centered on the potential for user data to be accessed by the Chinese government, a claim TikTok has consistently denied. The current administration has continued to scrutinize the platform, with various regulatory bodies examining its operations and data handling practices.

Key Players and Positions The negotiations involve multiple stakeholders with competing interests. On the U.S. side, concerns focus primarily on national security and protecting American users' data. Lawmakers from both parties have expressed concern about TikTok's ownership structure and have pushed for either divestiture or stringent restrictions on its operations. China, meanwhile, views the situation through the lens of technological sovereignty and has implemented export control laws that would prevent ByteDance from selling TikTok's algorithm without government approval. This effectively complicates any potential sale or restructuring of the company to satisfy U.S. concerns.

Tariff Complications Adding to the complexity is the broader trade relationship between the U.S. and China. Recent tariff announcements have further strained relations, with technology companies becoming pawns in the larger economic chess match. These tariffs affect the negotiating positions of both countries and have reportedly derailed progress that had previously been made in finding a resolution for TikTok's future in the American market.

Potential Outcomes Several possible scenarios remain on the table:

A forced sale of TikTok's U.S. operations to an American company, though this faces challenges from China's algorithm export restrictions

A technical partnership arrangement with a U.S. firm to handle data security concerns

Continued operation under enhanced monitoring and security protocols

A complete ban of the app in the United States

Broader Implications This conflict illustrates the growing tensions around digital sovereignty, data governance, and the increasingly complex relationship between technology platforms and national interests. The outcome will likely set precedents for how similar cross-border technology platforms are regulated in the future and may accelerate the fragmentation of the global internet along geopolitical lines. For users and content creators who rely on TikTok for entertainment, communication, and increasingly, their livelihoods, the uncertainty creates significant concern. Many businesses have integrated TikTok into their marketing strategies, and disruption to the platform could have widespread economic impacts beyond just the technology sector.

The self-inflicted death of American science has already begun

Vox | Bryan Walsh | April 9, 2025

#Science • #Research • #ImmigrationPolicy • #Innovation • #STEMEducation • #Geopolitics

In Ezra Klein and Derek Thompson's new book, *Abundance*, they share the story of Katalin Karikó, a Hungarian American scientist whose work led to the mRNA Covid vaccines. Karikó's journey to the U.S. highlights the importance of immigration in American scientific advancements. She left Hungary after her research center lost state funding and found opportunities in the U.S., where she could further her research. This narrative illustrates how America's ability to attract global scientific talent has been crucial to its scientific dominance. Karikó faced numerous rejections from grantmakers at the National Institutes of Health (NIH) but persisted, and her work was eventually recognized during the Covid pandemic. The mRNA vaccines developed from her research saved millions of lives, and she won the Nobel Prize for Medicine in 2023. The U.S. has historically been a leader in scientific innovation, partly due to its strong university system and government support for research. However, this leadership is now under threat due to significant funding cuts and restrictive immigration policies. The Trump administration's recent actions, including drastic funding cuts and a crackdown on foreign students, are jeopardizing America's position in the global scientific community. The NIH has announced substantial cuts, including slashing indirect costs for academic research, which will severely impact universities' ability to conduct research. Additionally, the administration's immigration policies are targeting foreign students involved in protests, leading to visa revocations and deportations. This environment of fear is causing many international students and scientists to reconsider their presence in the U.S., with some already planning to leave. The impact of these policies extends beyond immediate funding cuts. International students play a crucial role in STEM fields, accounting for a significant portion of master's and doctoral degrees. The loss of these students could lead to a decline in innovation and research output, as native-born Americans are not filling the gap in STEM enrollments. Other countries, such as China and Canada, are actively recruiting these students, potentially shifting the global balance of scientific talent and innovation. The long-term effects of these policies will be profound. While the immediate consequences might not be fully apparent, the future of American science and innovation is at risk. The recruitment of immigrant scientists has been a key factor in U.S. dynamism, contributing significantly to innovation and economic growth. As other nations capitalize on the U.S.'s loss, America's position as a leader in science and technology could be irreversibly damaged. In a recent poll, three-quarters of scientists in the U.S. expressed concerns about leaving the country due to the current political climate. This exodus of talent could mean that future breakthroughs and innovations occur elsewhere, diminishing America's influence in global science and technology. The combination of funding cuts and immigration restrictions is not just a challenge but a potential turning point for American scientific leadership.

A ‘U.S.-Made iPhone’ is Pure Fantasy

Pxlnv | Nick Heer | April 8, 2025

#Technology • #Mobile • #Manufacturing • #GlobalTrade • #LaborEthics • #Geopolitics

These articles are good exercises but they are also total fantasy. There is no universe in which Apple snaps its fingers and begins making the iPhone in the United States overnight. It could theoretically begin assembling them here, but even that is a years-long process made infinitely harder by the fact that, in Trump’s ideal world, every company would be reshoring American manufacturing at the same time, leading to supply chain issues, factory building issues, and exacerbating the already lacking American talent pool for high-tech manufacturing. In the long term, we could and probably will see more tech manufacturing get reshored to the United States for strategic and national security reasons, but in the interim with massive tariffs, there will likely be unfathomable pain that is likely to last years, not weeks or months. Apple itself is already attempting to make its manufacturing less dependent on factories in China, specifically, but it is a slow transformation over years, and not necessarily in a single direction. Notably, it is not moving production to the United States, instead working with Foxconn to build factories in India, Malaysia, Thailand, and Vietnam. Not only do these countries have lower labour costs and proximity to parts sourcing countries, they also have higher population densities permitting a greater workforce near a factory. Foxconn’s ridiculous con of a U.S. factory for “AI 8K+5G” was built on farmland outside a village outside Wisconsin’s fifth biggest city. Total population of the entire county: 197,727. That is less than the workforce of just one of Foxconn’s factories making iPhones. Anyone who has spent time digging into the supply chains of just about any industry is probably similar parts amazed and disgusted by what they find, and rightfully so. It strains my ability to understand anything to know a device as precise as a smartphone can be made at scale, about as much as I am also baffled when I see Walmart selling a pair of jeans for less than $20. The only way this is possible is at a huge human cost. This happens far away and — in a way beneficial to the name brands involved — at third-party factories, subcontractors, or a component business deep in the supply chain. But this human exploitation is not relegated to over there; it happens closer to home too. I think it is fair and correct to support greater diversification of manufacturing, including to rich countries. What bothers me is how much of the discussion I have seen concerns the dollar value of a hypothetical made-in-the-U.S. iPhone, and how little focuses on higher labour standards no matter where a product is made. Workers’ rights are not what U.S. tariffs are ultimately about. But the exploitation is ours. We, the richest countries in the world, go into developing nations and extract from their people and environment the products we want for the incredibly generous lifestyle we have. Some factory owners have become very rich in being able to meet our demands; many people have not. And then we just move on. Now the U.S. is punishing everyone around the world for partaking, necessarily, in an entrenched global system of trade. Maybe iPhones get more expensive later this year, and maybe that means we buy fewer. The human and environmental cost will be similar. But we will still buy them.

Trump Throws Apple Under the Tariff Bus

Spyglass | M.G. Siegler | April 8, 2025

#Technology • #Business • #Apple • #Tariffs • #TrumpAdministration • #Geopolitics

Apple has reportedly lost its status as the most valuable company globally, dropping behind Microsoft due to a sharp decline in its stock value, a situation attributed to current tariff issues. Apple's fall was significantly more pronounced than Microsoft's, which suggests that the tariffs are having a unique impact on Apple. The broader stock market also experienced a decline, but Apple’s situation seems more severe. There are concerns about the feasibility of manufacturing iPhones in the U.S., given the existing tariff tensions. The U.S. Secretary of Commerce seemed unaware of the complexities of modern iPhone manufacturing, suggesting a simplistic view of the workforce required. Apple's operations are far more advanced than perceived and relocating them to the U.S. could be detrimental to the company. During a recent press briefing, the White House Press Secretary, Karoline Leavitt, claimed that the U.S. has the resources to manufacture iPhones, noting Apple's $500 billion investment. However, it appears her statement might be misleading as the investment focused on R&D, chip production, and media ventures, not on iPhone assembly in the U.S. The dynamic between Apple and the Trump administration seems tense, as Apple is seen as a pivotal player due to its embeddedness in Chinese manufacturing. This situation places CEO Tim Cook in a difficult position, navigating relations with both the U.S. administration and Chinese manufacturing partners. Cook is expected to address these issues leading up to Apple’s upcoming earnings report, and the outcome could significantly impact Apple's strategy and its standing with investors. There's speculation on how Apple will respond to the administration’s demands while safeguarding its business interests.

🔮 How to win as the world changes

Exponentialview | Azeem Azhar | April 9, 2025

#Technology • #AI • #Globalization • #Innovation • #Geopolitics

Last week, I wrote to my portfolio companies with a simple message: the game is changing fast. The global order is being renegotiated in real time, driven by the inversion of globalization and the rise of AI. These forces are creating confusion, hesitation and for the sharpest operators – opportunity. If you’re a founder, executive or investor, this message is for you. We are living through an incredibly weird time. Two massive waves are crashing down upon us: the accelerating force of artificial intelligence and the dramatic inversion of geoeconomics. Each of these forces is disruptive on its own – but together, they are increasing the stakes for everyone. In this message, I will address:

the geoeconomics wave, the AI wave, and my advice to founders and business leaders.

Let’s start with geoeconomics and the shifting posture of the global order. Globalization, as we’ve known it for the past three decades, is being renegotiated, restructured from the ground up.

This isn’t just a US phenomenon. Governments around the world are adapting to this new paradigm, where industrial policy, national resilience and sovereign control take precedence over global efficiency. As political winds shift and global instability intensifies, so too does the appetite for risk and experimentation. Uncertainty is now the defining condition.

The rise of AI is another significant force reshaping our world. AI is not just a tool; it's a transformative technology that can fundamentally alter how businesses operate and how societies function. It offers immense opportunities for innovation and growth but also poses challenges related to job displacement and ethical considerations. For business leaders, understanding and leveraging AI effectively will be crucial in navigating this changing landscape.

My advice to founders and business leaders is to be proactive in embracing these changes. They need to understand how AI and geoeconomic shifts can create new opportunities and challenges. By focusing on innovation, resilience, and adaptability, businesses can thrive in this rapidly evolving environment.

Trump Cuts Most Tariffs to 10% but Increases Tariffs on China to 125%

Truthsocial | John Gruber | April 9, 2025

#Politics • #TradePolicy • #Tariffs • #USChinaRelations • #EconomicPolicy • #Geopolitics

President Trump recently announced significant changes to U.S. tariffs, particularly focusing on China and other global trading partners. In a post on Truth Social, Trump declared that he is raising tariffs on China to 125%, effective immediately. This move is part of a broader strategy aimed at addressing what Trump perceives as unfair trade practices by China and other countries. Trump also announced a 90-day pause and a reduction in reciprocal tariffs to 10% for many countries, excluding China. This decision was reportedly welcomed by financial markets, with significant increases in major stock indices like the S&P 500 and notable gains in shares of companies such as Apple, Meta, Nvidia, and Tesla. However, critics argue that these actions are more symbolic than substantive, shifting the focus of the trade war from a global scale to a more targeted approach against China. The economic implications of these tariff changes are complex and multifaceted. While the reduction in tariffs for most countries may ease trade tensions and boost economic activity, the drastic increase in tariffs on China could lead to further retaliation and economic instability. The move also highlights the unpredictable nature of U.S. trade policy under Trump, which has been characterized by sudden and significant changes in tariffs and trade agreements. In the broader context, Trump's actions reflect ongoing efforts to address large and persistent U.S. trade deficits, which he attributes to non-reciprocal trade practices and economic policies of key trading partners. These policies have been controversial, with some arguing they are necessary to protect U.S. industries and others seeing them as harmful to global trade and economic stability.

Trump, Supposedly, Thinks the U.S. Has the ‘Resources’ Needed to Make iPhones

9to5mac | John Gruber | April 9, 2025

#Technology • #Mobile • #Manufacturing • #TradePolicy • #GlobalSupplyChain • #Geopolitics

White House Press Secretary Karoline Leavitt recently stated that President Donald Trump firmly believes Apple can move iPhone manufacturing to the United States. In response to questions about the types of jobs Trump hopes to create with tariffs, Leavitt emphasized the president's interest in increasing both traditional manufacturing jobs and those in advanced technologies like AI. When asked specifically about iPhone manufacturing, Leavitt said Trump believes the U.S. has the necessary labor, workforce, and resources to support such production. She referenced Apple's $500 billion investment in the U.S., suggesting that if Apple didn't think the U.S. could handle manufacturing, they wouldn't have made such a significant investment. However, Apple's investment announcement did not mention iPhone assembly in the U.S. Instead, it focused on R&D, chip production in Arizona, AI server manufacturing in Houston, and other initiatives. The idea of manufacturing iPhones in the U.S. is seen as challenging due to the complexity of the global supply chain and the scale of production required. Currently, the majority of iPhones are produced in China, with estimates suggesting that 85-90% of annual production occurs there. The Chinese supply chain offers advantages in scale and skill that are difficult to replicate in the U.S. The notion of making iPhones in the U.S. is further complicated by the potential cost implications. Analysts have suggested that if iPhones were manufactured in the U.S., their prices could significantly increase, possibly to as much as $3,500 for a model currently priced at $1,000. This would likely lead to decreased demand and the emergence of a gray market for cheaper, imported iPhones. The U.S. lacks the infrastructure and workforce to produce tens of millions of iPhones annually, making it impractical to rely solely on domestic manufacturing for such a high-volume product. The issue is not just about labor costs; it's also about the advanced tooling and precision required in iPhone manufacturing. Apple CEO Tim Cook has highlighted the skill and scale available in China, which is unmatched in the U.S. While Apple has explored diversifying its manufacturing, including ramping up production in India, challenges such as infrastructure issues and labor shortages have hindered progress. The U.S. would need significant investments in both infrastructure and workforce development to become a viable alternative for large-scale iPhone production.

Regulation

Judge Says U.K Hearing Over Compromising iCloud Encryption Must Be Public

Pxlnv | Nick Heer | April 7, 2025

#Technology • #Cybersecurity • #Privacy • #Encryption • #LegalPrecedent • #Regulation

A recent ruling in the U.K. has mandated that a hearing concerning the potential compromise of iCloud encryption must be held in public. The government had argued that making the details of the case public would jeopardize national security. However, the tribunal rejected this request, emphasizing the importance of transparency in legal proceedings.

Key Points of the Ruling: -

Transparency Over National Security Concerns: The tribunal's decision prioritizes public access to information over concerns about national security. This reflects a broader trend towards greater transparency in legal proceedings, especially when they involve significant public interest.

Implications for Privacy and Security: The case highlights ongoing debates about the balance between privacy, security, and government oversight. iCloud encryption is a critical component of user privacy, and any potential vulnerabilities could have far-reaching implications for data protection.

Legal Precedent: The ruling sets a precedent for future cases involving sensitive information. It suggests that courts are increasingly willing to prioritize public transparency, even when national security is invoked as a concern.

The implications of this ruling are significant, as they touch on issues of privacy, security, and the role of government in digital surveillance. The decision underscores the tension between protecting national security and ensuring transparency in legal processes. As technology continues to evolve, such rulings will play a crucial role in shaping the legal landscape surrounding digital privacy and security.

In conclusion, the tribunal's decision to hold the hearing in public reflects a commitment to transparency and accountability in legal proceedings. This approach is likely to influence future cases involving sensitive information and digital privacy, emphasizing the need for a balanced approach that considers both national security concerns and the public's right to know.

AI

The Power of Context: How Graph Technology is Reshaping AI and Decision-Making

Medium | ODSC - Open Data Science | April 9, 2025

#Technology • #AI • #MachineLearning • #GraphTechnology • #Explainability

In a world overwhelmed with data, the ability to derive meaning from connections is becoming increasingly crucial. Traditional data systems focus on entities—people, products, or events—as isolated points. However, the most important insights often lie in the lines connecting these points, which is where graph technology comes into play. Graph technology transforms how we build AI, understand systems, and make decisions by modeling the relationships between entities. This approach is a natural fit for how humans think and operate—contextually. Graphs are particularly compelling because they capture both the "nouns" (entities) and the "verbs" (how those entities relate). This contextual modeling is what makes graph technology so powerful. Traditional analytics can tell you what happened, but graphs can reveal why it happened and even predict what might happen next. As AI systems become integral to business and society, there's a growing recognition that they must operate with more contextual awareness, which is why graphs are becoming the backbone of many AI workflows. Graphs are essential for grounding large language models (LLMs), helping to mitigate hallucinations, enhance explainability, and make decisions more appropriate to real-world conditions. In use cases like autonomous agents, graph-based orchestration offers structure and memory that pure neural networks lack. There's also a shift happening: where once we asked "How can graphs help AI?" the more pressing question now is "How can AI improve our graphs?" With advances in natural language processing and vision models, AI is now helping to populate and refine graph structures, especially in unstructured domains like legal documentation or scientific literature. Graphs are useful across various domains, but their importance is rapidly increasing in industries such as cybersecurity, documentation and legal review, and systems engineering. In cybersecurity, graphs help map complex attack surfaces and dependencies. In documentation and legal review, AI can extract entities and relationships from text, which graphs then organize into navigable structures. This is transforming how legal teams and compliance officers work. In systems engineering, graphs are used to model dependencies and ensure regulatory compliance. One of the most exciting intersections of AI and graph technology is GraphRAG—Graph-augmented Retrieval-Augmented Generation. This approach uses the structure of graphs to guide context retrieval more intelligently, especially in domains where relationships matter more than keywords. Best practices for GraphRAG start with building high-quality graphs, which require entity resolution, relationship extraction, and contextual modeling. Without this foundational work, performance will suffer. Despite its power, graph technology hasn't always been easy to adopt. However, platforms are emerging that let teams add graph capabilities to existing data warehouses or Spark pipelines without rebuilding infrastructure. There's also a growing emphasis on frameworks, standards, and best practices, paving the way for more scalable adoption. For those considering a career move, graph skills are increasingly a must-have for data scientists and ML engineers. As AI continues to evolve, so too will graphs. One of the most exciting areas is multimodal GraphRAG, which incorporates not just text but also images, audio, and video into graph-based systems. This kind of associative intelligence brings AI closer to human-like reasoning—where understanding a situation requires synthesizing multiple forms of information. Meanwhile, graphs are proving vital in explainable AI and fairness by mapping data lineage, provenance, and usage, which is crucial for regulatory compliance and ethical AI. Graph and GraphRAG technology aren't just niche tools; they're an evolving foundation for the next wave of intelligent systems. As businesses seek deeper insights, greater transparency, and more adaptable AI, graphs will play a central role in shaping that future. Whether you're building smarter models, navigating complex domains, or trying to make sense of messy systems, the message is clear: Context matters. And graphs just might be the best way to capture it.

China gains dexterous upper hand in humanoid robot tussle with US

Ft | April 8, 2025

#Technology • #AI • #HumanoidRobots • #Innovation • #GlobalEconomics

China's Advancements in Humanoid Robotics

China is emerging as a formidable player in the field of humanoid robotics, taking significant strides to surpass the United States. This momentum is fueled by a combination of cost-effective components, rapid technological innovation, and strong governmental support through financing. The country’s approach mirrors the swift ascent seen in its electric vehicle (EV) industry, showcasing its ability to leverage scale and state-led initiatives to outmaneuver global competitors.

Key Factors Driving Growth

Cheaper Components: The availability of inexpensive parts has been crucial in reducing production costs. This economic advantage allows Chinese companies to produce sophisticated robotic systems at competitive prices.

Rapid Innovation: Chinese tech firms are at the forefront of developing cutting-edge robotics technology. The pace of innovation is rapid, with significant investments in research and development driving both hardware and software advancements.

Government Support: Beijing’s strategic investment in AI and robotics aligns with its broader economic goals. By providing funding and resources, the government is creating a supportive environment for homegrown companies to thrive.

Comparison to the EV Industry

The strategy employs lessons learned from the EV sector, where China quickly dominated global markets through aggressive pricing and government backing. Similar dynamics are present in the robotics industry, suggesting potential for dominant market share. - The focus is not only on production but also on creating a comprehensive ecosystem that includes talent development, research institutions, and supportive policy frameworks.

Implications of China's Robotics Boom

Global Market Impact: As China increases production of humanoid robots, global markets could see shifts in leadership and technological standards. This raises the potential for new international collaborations or competitive tensions with other leading nations, particularly the US.

Technological Leadership: China’s advancements highlight its ambition to establish leadership in key future technologies. Achieving dominance in robotics would not only bolster its tech industry but also influence global innovation trends.

Economic Ripple Effects: The robotics industry stands to impact various sectors, from manufacturing to services, potentially reshaping job markets. It could lead to increased automation and efficiencies, driving economic growth and productivity.

Challenges and Opportunities - While the current trajectory appears promising, challenges remain, such as navigating intellectual property rights and ensuring quality standards amid rapid scaling. - Conversely, opportunities lie in expanding China's technology export agenda, as well as creating synergies between robotics and other high-tech sectors like artificial intelligence and Internet of Things (IoT).

Conclusion China’s strategic focus on humanoid robotics, backed by affordable components and state support, positions it to potentially transform the industry much like it did with electric vehicles. While the global implications are vast, involving shifts in economic and technological paradigms, China's relentless push for innovation could redefine how humanoid robots are integrated into everyday life.

The AI magic behind Sphere’s upcoming 'The Wizard of Oz' experience

Blog | Matt A.V. Chaban | April 8, 2025

#Technology • #AI • #Innovation • #Cinema • #Entertainment

The AI Behind ‘The Wizard of Oz’ Experience

In a groundbreaking integration of technology and entertainment, Google DeepMind and Google Cloud are collaborating to create a unique, immersive experience for the classic film "The Wizard of Oz" at the Sphere in Las Vegas. This innovative project aims to transform how audiences engage with cinema by leveraging the power of artificial intelligence to deliver an entirely new level of interactivity and immersion.

Innovative Use of AI and Technology

The project employs cutting-edge AI algorithms developed by Google DeepMind to enhance visual and auditory elements of the film. These algorithms analyze scenes to refine image quality, improve color grading, and dynamically adjust audio to maximize the immersive experience. This transformation allows audiences to feel as though they are part of the iconic journey through the land of Oz, experiencing the narrative in contrast and clarity that were not possible with the original production techniques. Key technological features include:

Enhanced Visuals: AI-powered upscaling tools improve picture clarity and detail, resulting in incredibly vibrant colors and clear visuals.

Dynamic Audio: Sound effects and music are processed to adapt to the venue's acoustics, creating an enveloping sound environment.

Interactive Elements: Audience members can engage with the experience through their mobile devices, accessing additional content synchronously with the film.

Collaborative Effort and Impact This endeavor represents a significant collaboration between entertainment and technology sectors, highlighting the potential of AI to revolutionize traditional media. According to Matt A.V. Chaban’s article, the venture could set a precedent for future cinematic presentations, making classic films more accessible and exciting for modern audiences. Leading experts from Google DeepMind emphasize that this project illustrates AI’s capability not only to innovate but to preserve cultural heritages in dynamic ways.

Implications and Future Prospects

The success of this project could usher in a new era of interactive cinema, encouraging producers to rethink the possibilities of movie exhibitions.

As AI continues to evolve, we might see its applications expand beyond remastering classics, influencing how new films are produced and experienced. Moreover, the technology developed for this project could have broader applications in other areas of entertainment and beyond. For instance, similar AI tools could be used in virtual reality experiences, enhancing user engagement by crafting more lifelike and responsive virtual worlds.

In conclusion, the union of AI and cinematic arts in “The Wizard of Oz” project at the Sphere marks a significant milestone for both the technology and entertainment industries. It exemplifies how innovative applications of AI can breathe new life into existing works, potentially changing the future landscape of media consumption.

OpenAI updates ChatGPT to reference your past chats

Techcrunch | Maxwell Zeff | April 10, 2025

#Technology • #AI • #MachineLearning • #Personalization • #Innovation

OpenAI announced on Thursday that it's starting to roll out a new memory feature in ChatGPT that allows the chatbot to tailor its answers to users based on the contents of their previous conversations. OpenAI says the feature, which appears in ChatGPT's settings as "reference saved memories," aims to make conversations with ChatGPT more relevant. This update is part of OpenAI's broader effort to enhance the personalization and utility of AI systems. By allowing ChatGPT to reference past interactions, users can expect more personalized and contextually relevant responses. This feature is particularly significant as it aligns with OpenAI's vision of creating AI systems that learn and adapt over time, becoming increasingly useful as they get to know users better. The new memory feature is currently available to Pro subscribers, with plans to expand it to Plus subscribers soon. Users have the option to opt out of this feature or use temporary chats if they prefer not to have their conversations saved or referenced. This development highlights OpenAI's commitment to improving user experience through enhanced personalization and memory capabilities. As AI technology continues to evolve, features like these are expected to play a crucial role in shaping how humans interact with AI systems.

Shopify CEO Requires Proof Jobs Can’t Be Done by AI Before Adding Headcount

Medium | ODSC - Open Data Science | April 10, 2025

#Technology • #AI • #ECommerce • #WorkforceManagement • #Automation

Shopify is signaling a firm shift in how it views human resources in the age of AI. CEO Tobi Lutke informed staff in a company memo that they must demonstrate why tasks can’t be automated with AI before requesting additional hires or resources. “There’s a fundamental expectation that employees are using AI in their day-to-day work,” Lutke said in the message, which he later shared on X. “What would this area look like if autonomous AI agents were already part of the team?” The memo reflects the Canadian e-commerce platform’s evolving stance on workforce strategy. Lutke described AI as a powerful productivity enhancer, citing instances where employees used the technology to accomplish tasks that were previously considered unrealistic. “I’ve seen many of these people approach implausible tasks… with reflexive and brilliant usage of AI to get 100X the work done,” he said. The company is now factoring AI usage into performance evaluations. According to Lutke, those who integrate AI tools effectively are outperforming their peers, highlighting a growing divide in productivity based on AI adoption. Shopify has been actively developing and deploying AI tools for its merchant base. Offerings include Sidekick, a customer-facing chatbot, and a suite of automation tools marketed under the brand “Shopify Magic.” These tools aim to streamline online retail operations and enhance customer service experiences. Shopify’s approach mirrors a broader trend in the tech industry: massive AI investment paired with workforce cuts. In 2024 alone, over 152,000 roles have been cut across nearly 550 tech companies, according to Layoffs.fyi. Shopify’s own workforce has steadily declined. The company’s headcount dropped to 8,100 at the end of 2023, down from 8,300 the previous year. Major layoffs occurred in both 2022 and 2023, where the company reduced its workforce by 14% and 20%, respectively. Despite a flat headcount projection, Shopify CFO Jeff Hoffmeister recently told investors at a Morgan Stanley event that employee-related costs may fluctuate. “A higher comp, high-end AI engineer” could drive costs even if overall staffing levels remain steady, he noted.

Elon Musk’s AI company, xAI, launches an API for Grok 3

Techcrunch | April 9, 2025

#Technology • #AI • #MachineLearning • #Innovation • #ArtificialIntelligenceAPIs