Contents

We Are Accelerating to Abundance: Is it a Good Thing?

Essays

Venture Capital

Airwallex CEO & Co-Founder, Jack Zhang: The Angel That Turned $1M into $1BN

The Great ARR Acceleration: Q1’25 Numbers Tell the Comeback Story

The Growing Secondary Market In Venture: A Conversation On The Emergence Of VC Continuation Funds

DPI in a Tough Market — What Early Belief in an Immigrant Entrepreneur Can Create

AI

Geopolitics

Interview of the Week

Post of the Week

Editorial

We Are Accelerating to Abundance: Is it a Good Thing?

Ed Kilgore’s article in New York Magazine surfaces the divisive potential of the idea of Abundance in the context of the Democratic Party. Albert Wenger’s hope for a Start Trek like future highlights its liberating potential.

We hear a lot about "abundance" – is it real, can we handle it, are our institutions ready? I think most of that kind of talk misses the point entirely. Abundance isn't a possibility; it's an inevitability being driven by forces so powerful they're already overwhelming the obstacles we keep putting in their way.

This isn't just about having more stuff. It's about unlocking human potential on a scale we've barely begun to imagine, fueled by the potent combination of technology, energy, and capital. And the evidence isn't just promising; it's overwhelming. Abundance as a word in modern use describes the end result of automation delivering all human needs and wants while reducing labor time to a tiny fraction of what it is today.

Look at the numbers, the real numbers. Saastr and Clouded Judgement both point to top-decile AI based B2B startups aren't just growing; they're achieving escape velocity with 236% ARR growth . That's not incremental improvement; that's operating in an entirely new paradigm where AI acts as a fundamental multiplier of human capability. These companies aren't waiting for permission or perfectly untied government knots; they're building with AI agents, automating workflows, and scaling expertise right now. The power law dynamics in venture capital? They haven't changed, they've intensified. Top 1% exits are growing exponentially, reaching over $10 billion already and projected to hit $40-60 billion within a decade. When a $1 million seed investment can turn into a billion-dollar company like Airwallex, that's not just a good return; that's abundance creation in action. Capital is flowing massively into AI, particularly late-stage deals over $100 million, confirming investor confidence in scalability and profitability. Unicorns aren't rare anymore; they're becoming common, and AI companies dominate the list of new ones. The size of the prize is growing, and fast. And AI promises to be far larger than SaaS.

But none of this is possible without energy. And here too, the trend is undeniable. Energy abundance is the absolute prerequisite, and we are rapidly approaching it. Solar costs have plummeted, at least on the sunny side of the street, and AI demand is exploding, creating a perfect storm driving us towards "energy too cheap to meter".

Oracle's massive $40 billion commitment to Nvidia chips for OpenAI's new data center isn't just buying hardware; it's a colossal bet on a future where energy is cheap enough to fuel trillion-parameter models for pennies. The path is clear: solar, nuclear fusion research, small modular reactors – the solutions are emerging and entrepreneurial activity is driving costs down dramatically. We desperately need this energy, for AI, and for the health of complex societies, and the means to produce it are already here or on the horizon.

So, you hear about the "obstacles." Institutional sclerosis, government inefficiency, the friction of legacy systems. Yes, the Biden administration's infrastructure efforts show how painfully slow things can be, and Elon Musk finding only $175 billion in wasteful spending falls short of a $1 trillion goal. But the very existence of the "Abundance Agenda" is a recognition that the need for speed and efficiency is forcing change.

The companies achieving 236% growth aren't bogged down by "progressive coalition politics" or interest group "quilts"; they've chosen speed over safety and execution over inertia. While governments debate, the market is building the future. The ability to build, ship, and adapt faster is the only sustainable edge, and the best companies are proving it daily.

The "Information Abundance Paradox" with Google summarizing content? That's not a barrier; it's a recognition that AI has to be positioned to gather, summarize and act on content. Publishers with verified facts and editorial authority are more valuable than ever to AI, and the market will find ways to reward them. This is a necessary evolution, not an ecosystem collapse.

Even the "memeification" of capital, with things like Fartcoin hitting a $2 billion market cap, simply highlights that attention and narrative velocity are powerful in the age of AI and social media. But it doesn't fundamentally change the power law where lasting value creation wins in the end.

And the shift in media, like sports moving to streaming? It's messy, it introduces friction, and it changes the consumer experience. But it also trades the old cable bundle's "inevitability" for the consumer's "intentionality" – the choice of what to subscribe to. This unbundling is a restructuring, forcing media companies to acquire customers and manage churn, yes, but also opening doors for new, potentially better ways to consume content in the long run. It's a transition, not a permanent state of scarcity for the viewer.

Apple seems to be in victim mode in light of all this change. Reacting with "thin skin" to criticism? Declining interviews because they can't handle critiques? That's simply a sign that the unprecedented market pressures and the dizzying pace of AI innovation demand more honesty and external feedback, not less. Companies that don't listen will be left behind. The market forces driving abundance require agility and a willingness to adapt, punishing the kind of insular complacency that leads to "something rotten."

Even the challenges to free speech, accelerated by technology, are forcing a necessary and urgent defense. The crisis highlights that free speech requires constant protection, and technology isn't just a tool for polarization; it's also a tool for organizing, disseminating diverse voices, and fighting back against censorship from any side. It's a battle for abundance of expression, not a sign that it's lost.

The potential for abundance is not some distant utopian dream; it is the logical outcome of the exponential trends in technology, energy, and capital that are already reshaping the world. The speed of change is so great that the perceived obstacles – institutional inertia, outdated business models, resistance to change – are simply temporary points of friction that will be overcome by the sheer momentum of progress.

The path forward isn't complicated: speed over safety, energy first, institutional reform driven by necessity, and value creation that benefits participants, not just extractors. The companies leading the charge already understand this. We have the technology, the capital is ready, and the energy solutions are emerging. The question isn't whether abundance is possible or even good; it's whether we fully embrace the inevitable future that is already unfolding around us. And frankly, given the forces at play, there's really only one choice. Abundance isn't just coming; it's here, and it's only accelerating.

Facing the consequences of less labor time and increased leisure time is a key part of this. “What are your hobbies?” will replace “What do you do?” as the first question we ask each other.

Essays

Google Is Burying the Web Alive

Nymag • John Herrman • May 26, 2025

Technology•AI•SearchEngines•GenerativeAI•WebEcosystem•Essays

By now, there’s a good chance you’ve encountered Google’s AI Overviews, possibly thousands of times. Appearing as blurbs at the top of search results, they attempt to settle your queries before you scroll — to offer answers, or relevant information, gleaned from websites that you no longer need to click on. The feature was officially rolled out at Google’s developer conference last year and had been in testing for quite some time before that; on the occasion of this year’s conference, the company characterized it as “one of the most successful launches in Search in the past decade,” a strangely narrow claim that is almost certainly true: Google put AI summaries on top of everything else, for everyone, as if to say, “Before you use our main product, see if this works instead.”

This year’s conference included another change to search, this one more profound but less aggressively deployed. “AI Mode,” which has similarly been in beta testing for a while, will appear as an option for all users. It’s not like AI Overviews; that is, it’s not an extra module taking up space on a familiar search-results page but rather a complete replacement for conventional search. It’s Google’s “most powerful AI search, with more advanced reasoning and multimodality, and the ability to go deeper through follow-up questions and helpful links to the web,” the company says, “breaking down your question into subtopics and issuing a multitude of queries simultaneously on your behalf.” It’s available to everyone. It’s a lot like using AI-first chatbots that have search functions, like those from OpenAI, Anthropic, and Perplexity, and Google says it’s destined for greater things than a small tab. “As we get feedback, we’ll graduate many features and capabilities from AI Mode right into the core Search experience,” the company says.

I’ve been testing AI Mode for a few months now, and in some ways it’s less radical than it sounds and (at first) feels. It resembles the initial demos of AI search tools, including those by Google, meaning it responds to many questions with clean, ad-free answers. Sometimes it answers in extended plain language, but it also makes a lot of lists and pulls in familiar little gridded modules — especially when you ask about things you can buy — resulting in a product that, despite its chatty interface, feels an awful lot like … search.

Again, now you can try it yourself, and your mileage may vary; it hasn’t drawn me away from Google proper for a lot of thoughtless rote tasks, but it’s competitive with ChatGPT for the expanding range of searchish tasks you might attempt with a chatbot.

From the very first use, however, AI Mode crystallized something about Google’s priorities and in particular its relationship to the web from which the company has drawn, and returned, many hundreds of billions of dollars of value. AI Overviews demoted links, quite literally pushing content from the web down on the page, and summarizing its contents for digestion without clicking:

Meanwhile, AI Mode all but buries them, not just summarizing their content for reading within Google’s product but inviting you to explore and expand on those summaries by asking more questions, rather than clicking out. In many cases, links are retained merely to provide backup and sourcing, included as footnotes and appendices rather than destinations:

This is typical with AI search tools and all but inevitable now that such things are possible. In terms of automation, this means companies like OpenAI and Google are mechanizing some of the “work” that goes into using tools like Google search, removing, when possible, the step where users leave their platforms and reducing, in theory, the time and effort it takes to navigate to somewhere else when necessary. In even broader terms — contra Google’s effort to brand this as “going beyond information to intelligence” — this is an example of how LLMs offer different ways to interact with much of the same information: summarization rather than retrieval, regeneration rather than fact-finding, and vibe-y reconstruction over deterministic reproduction.

This is interesting to think about and often compelling to use but leaves unresolved one of the first questions posed by chatbots-as-search: Where will they get all the data they need to continue to work well? When Microsoft and Google showed off their first neo-search mockups in 2023, which are pretty close to today’s AI mode, it revealed a dilemma:

Search engines still provide the de facto gateway to the broader web, and have a deeply codependent relationship with the people and companies whose content they crawl, index, and rank; a Google that instantly but sometimes unreliably summarizes the websites to which it used to send people would destroy that relationship, and probably a lot of websites, including the ones on which its models were trained.

And, well, yep! Now, both AI Overviews and AI Mode, when they aren’t occasionally hallucinating, produce relatively clean answers that benefit in contrast to increasingly degraded regular search results on Google, which are full of hyperoptimized and duplicative spamlike content designed first and foremost with the demands of Google’s ranking algorithms and advertising in mind. AI Mode feels one step further removed from that ecosystem and once again looks good in contrast, a placid textual escape from Google’s own mountain of links that look like ads and ads that look like links (of course, Google is already working on ads for both Overviews and AI Mode). In its drive to embrace AI, Google is further concealing the raw material that fuels it, demoting links as it continues to ingest them for abstraction.

….

OpenAI risks being undercut by cheaper rivals, says star investor

Ft • May 30, 2025

Technology•AI•OpenAI•DeepSeek•Investment•Essays

Mary Meeker, a prominent tech investor, warns that U.S. AI leaders like OpenAI may be undercut by cheaper alternatives such as China’s DeepSeek. In her latest industry analysis, Meeker highlights a shift in the AI market where soaring model training costs and rising competition from cost-effective, custom-trained models challenge the dominance of large U.S.-based language model developers. OpenAI, xAI, and Anthropic—together valued at around $400 billion—have generated a combined $12 billion in annualized revenue but have required massive funding of $95 billion, raising concerns about sustainability and profitability.

Meeker notes that advancements in hardware and algorithms have significantly reduced model operating costs, enabling new contenders to launch efficient models more affordably. Despite explosive growth since ChatGPT’s 2022 debut and a surge in AI-related infrastructure investments, Meeker emphasizes that the general-purpose LLM business resembles a commodity structure with substantial financial burn. She advises investors to diversify and manage risk carefully, drawing comparisons to past tech giants like Uber and Tesla who also navigated long periods of unprofitability. The proliferation of affordable models may benefit consumers but presents a tough landscape for AI start-ups hoping to monetize their innovations effectively.

The Abundance Agenda Revives an Old Democratic Rivalry

Nymag • Ed Kilgore • May 29, 2025

Politics•Strategy•DemocraticParty•ProgressivePolitics•AbundanceAgenda•Essays

If you are an aficionado of wonky policy debates, or perhaps if you are a civically active Californian, you may have heard there’s a debate going on in left-of-center circles over a so-called “Abundance Agenda.” That term was coined in 2022 by Derek Thompson, whose recent book with Ezra Klein, entitled Abundance, has helped raise interest (and some hackles) over its tenets. Put briefly, “abundance” advocates believe progressive politics needs to be refocused around producing public and private goods that broadly raise living standards, instead of insisting on narrow and legalistic group agendas that often frustrate the operations of government, particularly with respect to prosperity-enhancing public projects.

The leading edge of this debate has been the issue that is in danger of consuming California politics: the massive regulatory and legal obstacles to creating an adequate supply of affordable housing for sale or rent. But as my former colleague Jonathan Chait points out at The Atlantic, the recent experience of the Biden administration has really intensified concerns that progressives are sabotaging themselves by embracing interest-group-driven roadblocks to getting things done:

Biden had anticipated, after quickly signing his infrastructure bill and then two more big laws pumping hundreds of billions of dollars into manufacturing and energy, that he would spend the rest of his presidency cutting ribbons at gleaming new bridges and plants. But only a fraction of the funds Biden had authorized were spent before he began his reelection campaign, and of those, hardly any yielded concrete results.

More than two years after signing the infrastructure law, Biden was “expressing deep frustration that he can’t show off physical construction of many projects that his signature legislative accomplishments will fund,” CNN reported. The nationwide network of electric-vehicle-charging stations amounted to just 58new stations by the time Biden left office. The average completion date for road projects, according to the nonprofit news site NOTUS, was mid-2027. The effort to bring broadband access to rural America, a centerpiece of Biden’s plan to show that he would work to help the entire country and not just the parts that had voted for him, had connected zero customers.

The fateful failure of Biden’s Build Back Better agenda contributed, of course, to the opportunity Donald Trump had to become president again and launch his own very different BBB. And as Chait observed, that realization led to a lot of reconsiderations of prior assumptions:

Policy wonks, mostly liberal ones, began to ask why public tasks that used to be doable no longer were. How could a government that once constructed miracles of engineering—the Hoover Dam, the Golden Gate Bridge—ahead of schedule and under budget now find itself incapable of executing routine functions? Why was Medicare available less than a year after the enabling legislation passed, when the Affordable Care Act’s individual-insurance exchange took nearly four years to come online (and had to survive a failed website)? And, more disturbing, why was everything slower, more expensive, and more dysfunctional in states and cities controlled by Democrats?

The obvious conclusion is that if “the government has tied itself in knots … enormous amounts of prosperity could be unleashed by simply untying them.” But “untying them” would offend the progressive interest and identity groups who had built up an edifice of safeguards against potentially abusive government power, and whose entire approach to politics involved defending each other’s regulatory and legal turf. So any effort to ride roughshod over these safeguards, even in the most unimpeachably progressive causes like battling homelessness, has drawn a lot of fire from the left and “the groups” (as various interest and identity advocates are often called).

The rivalry between “common purpose” liberals seeking to do good things quickly through government, and progressives affiliated with various “groups,” is a lot older than the arguments over “abundance.” Reading Chait’s description of a progressivism that “seeks to maintain solidarity among its component groups, expecting each to endorse the positions taken by the others” reminded me instantly of one of the best political speeches I ever heard, at the 1988 Democratic National Convention, by the Reverend Jesse Jackson, who said his piece before delivering his endorsement to party presidential nominee Michael Dukakis:

When I was a child growing up in Greenville, South Carolina, my grandmama could not afford a blanket, she didn’t complain and we did not freeze. Instead she took pieces of old cloth — patches, wool, silk, gabardine, crockersack — only patches, barely good enough to wipe off your shoes with. But they didn’t stay that way very long. With sturdy hands and a strong cord, she sewed them together into a quilt, a thing of beauty and power and culture. Now, Democrats, we must build such a quilt.

Farmers, you seek fair prices and you are right — but you cannot stand alone. Your patch is not big enough. Workers, you fight for fair wages, you are right — but your patch of labor is not big enough. Women, you seek comparable worth and pay equity, you are right — but your patch is not big enough.

And on through the litany of groups he went … students … Blacks and Hispanics … gays and lesbians, in every case their “patch” was not big enough alone. Jesse Jackson’s very clear vision was a Democratic Party that was a coalition of groups linking arms to protect their stuff, their solidarity more important than any particular thing that they might do together. And that’s the entrenched and emotionally compelling point of view the abundance advocates are trying to overcome. It’s a struggle that is also evident in separate discussions over the morality of policy positions that leave any vulnerable group less than fully empowered, such as restricting athletic opportunities for transgender women, a wildly popular but deeply offensive position from the point of view of progressive solidarity.

….

Profiles in Courage: Apple Edition

Spyglass • M.G. Siegler • May 30, 2025

Technology•Management•CorporateCulture•Apple•Criticism•Essays

We're about a week and a half out from WWDC – which will be an interesting one this year for a number of reasons that potentially have little to do with what is actually announced on stage. And, in fact, what is not announced, or talked about, may end up being the bigger story. And if that's the case, it will be Apple's own fault. Not only for the lack of execution on their end, internally, but also some of the curious choices they're making externally.

Case in point, here's John Gruber with an update about this year's version of The Talk Show Live, a taping of his podcast which has become a staple of WWDC, to the point where for the past decade, Apple themselves have unofficially sanctioned the event, by sending executives on stage to talk to Gruber. But this year:

Ever since I started doing these live shows from WWDC, I've kept the guest(s) secret, until showtime. I'm still doing that this year. But in recent years the guests have seemed a bit predictable: senior executives from Apple. This year I again extended my usual invitation to Apple, but, for the first time since 2015, they declined.

This is wild. Both because they declined – again, for the first time in a decade – but more so because they have to know the signal it sends in declining.[1] At best, it looks like they're trying to avoid answering any non-staged questions about how things are going. At worst, it looks like they're freezing Gruber out for a few recently critical posts about the company – notably, his "Something Is Rotten in the State of Cupertino" post about the Apple Intelligence shitshow back in March.

Even if that's not explicitly what Apple is doing here,[2] they simply must know that's what it looks like. And it's just about the worst look imaginable. It's something the Trump administration would do, not Apple.

But the truth is that this is what Apple does and has long done. Gizmodo was famously frozen out after the whole iPhone-in-a-bar situation. Later, Mark Gurman was persona-non-grata for all of his various Apple scoops (though Apple later started "playing ball" with Gurman again once he shifted to Bloomberg). Though both of those cases were around scoops that "spoiled" Apple announcements. This would be something slightly different. A freezing over an opinion. Albeit a strongly critical one, but still. Just words.

Can Apple really be that thin-skinned? Again, yes. While similar "bans" were never as explicit as the one around the Gizmodo one (which was undoubtedly dictated from Steve Jobs himself),[3] anyone who has covered Apple knows there have always been less explicit bans – never really talked about, and more simply chalked up to the "sin of omission", that is, simply choosing not to play ball with anyone too critical of the company.

….

The ESPN Streaming Service, The Status of U.S. Sports Rights, The Danger of Intentionality

Stratechery • Ben Thompson • May 28, 2025

Business•Strategy•StreamingServices•SportsRights•MediaRights•Essays

The ESPN streaming service is official, completing the transition of sports watching from inevitability to intentionality.

From the Wall Street Journal earlier this month:

ESPN’s highly anticipated streaming service will cost $29.99 a month and be named “ESPN.” The new service, set to launch this fall, will give sports fans all the content shown on ESPN’s television channels, including professional and college football and basketball games. Disney is ESPN’s parent.

Such live sports programming is among the most valuable assets in media. ESPN is counting on its new streaming service to attract cord-cutters and those who have never paid for cable. Disney is betting that viewers will pay for a package of its marquee streaming offerings. The company will include the ESPN service in its streaming bundle with Disney+ and Hulu for $35.99 a month. The bundle will be available at launch for a price of $29.99 a month for the first 12 months.

The current Disney bundle, which includes Disney+, Hulu and ESPN+, starts at $16.99 a month, according to the Disney+ website. Sports-centric streaming service Fubo’s elite plan costs $94.99 a month. YouTube TV is $82.99 a month. A package with Hulu + Live TV, ESPN+ and Disney+ costs $82.99 a month, according to Hulu’s website.

This is the sort of news that deserves a finally: Disney CEO Bob Iger officially announced that an ESPN streaming service was coming in February 2024, although he hinted as much in July 2023; at the time I called it The End of Linear TV:

It’s worth remembering what that value once was: Disney’s status as a fully-integrated entertainment and sports giant meant they benefited more than anyone else from the cable bundle. ESPN was the most essential cable channel, and bundling it with Disney’s general entertainment channels gave pricing power to the latter. Those channels benefited ESPN too, though, by giving Disney’s bundle pricing power that was broader than just sports fans, which both gave it leverage with distributors and kept leagues at bay in terms of extracting their share of ESPN’s fees.

The mad dash to streaming, though, decimated the value of those channels directly, and by extension destroyed the value of the integration Disney had built: the more that bundle subscribers became sports subscribers, the less Disney could leverage ESPN to drive up the value of its other channels, and the greedier sports leagues could become in extracting the full value of their rights. That move to devalue linear general entertainment channels is probably one Iger wishes he could undo, but it is also one that can’t be undone: consumers who aren’t sports fans aren’t signing back up for cable and enduring commercials just to get access to a TV show.

To that end this is a move that makes sense — and it also raises big questions about what is next for ESPN.

At that time Iger said that Disney was looking for a partner for ESPN, which is to say the biggest news from this announcement is what wasn’t announced: there isn’t a partner in sight. Disney is just going to go ahead and rip off the band-aid (and, funnily enough, keep the ESPN+ streaming service, which is the only ‘+’ that actually means less).

In truth, however, it’s not clear that this is really going to make that much of a difference at this point. Disney currently makes around $18/month from MVPDs, including ABC retransmission fees; $30/month for ESPN streaming, minus a 30% commission, is $21/month, but keep in mind that Disney is getting paid by MVPD subscribers who don’t watch sports. Still, how many of those consumers are there? It’s hard to see why you would be subscribed to an MVPD if you’re not interested in sports, or old (and thus not going to cancel your cable bill until you die), so it’s hard to see this service moving the needle in any meaningful way for anyone.

Here is the status of U.S. sports rights as of this fall, once ESPN streaming launches, the Fox One streaming service launches, and the NBA starts its new TV deals:

Before this announcement, a sports fan who wanted access to almost all major sports (excluding some very small deals, like the Apple TV+ and Roku weekly baseball games) would have needed to subscribe to the following (using YouTube TV as a stand-in for MVPDs, FanDuel Sports Network as a stand-in for RSNs, and the cheapest ad-supported tier for all streaming services with exclusive content):

YouTube TV - $84.99/month

RSN - $19.99/month

Netflix - $7.99/month (NFL)

Peacock - $7.99/month (NFL, NBA)

Prime - $8.99/month (NFL, NBA)

Total: $129.95/month

After this announcement, you can dump the MVPD, but the number of necessary subscriptions will increase:

ESPN - $29.99/month

Fox One - $29.99/month (Estimated)

RSN - $19.99/month

Max - $16.99/month (Sports not on basic-with-ads)

Netflix - $7.99/month

Paramount+ - $7.99/month

Peacock - $7.99/month

Prime - $8.99/month

Total: $129.92/month

….

Ads Are Coming to AI and None of Us Are Ready

Bigtechnology • Joe Marchese • May 30, 2025

Technology•AI•Advertising•PerformanceMarketing•GenerativeAI•Essays

Today we’re featuring an article from Joe Marchese, co-founder of Human Ventures and a longtime advertising executive, about what advertising in generative AI might look like, and why it’s important to get it right. Joe’s also joined our private discord server, and you can participate the discussion about this story via the link at the bottom of the article. - Alex

You’re halfway home from work when you decide to have a spontaneous early dinner at the new fast-food place in your neighborhood. You were going to hit the gym, but you thought “why not treat myself?” so you tell your AI assistant to reschedule gym time for tomorrow.

What you don’t know is that you are one of the 100,000 people the company that owns the assistant has promised would try Acme Burger that week. You are the product, and the money you spend on the burger is the ROI of a performance marketing campaign.

If you think this is far-fetched, stop reading now. You haven’t been paying enough attention to the shift from “advertising” to “performance marketing.” Advertising promises to deliver a message in return for human attention. Performance marketing promises outcomes. And promising outcomes has an entirely different meaning when it comes to generative AI and the large language models behind it.

Advertising will shape generative AI platforms as it has shaped every medium of communication prior. And that could have a hugely disruptive effect on search, and the trillions of dollars of business built on top of it. Not to mention the entire content ecosystem which has fed search for the past 20+ years and is feeding generative AI today.

I’m an advocate for the advertising industry, but only to a very specific point. Brands subsidizing our stories and experiences in exchange for the ability to deliver their message is a trade-off people instinctively understand and can freely accept. We allow brands to borrow our most precious resource, our time and attention, in return for promises of a quality product or experience. But brands also need to deliver on those promises or the bargain falls apart.

The entire online economy is built on top of systems trying to capture and optimize our time and attention. The generative AI explosion kicked off with a seminal paper at Google, and used by ChatGPT, that’s based on something called the “attention mechanism” which reflects the way that humans process language. The paper this idea was founded on was called “Attention Is All You Need.”

The most effective advertising gives people transparency and agency over how their attention is being monetized. But when we abdicate the optimization for our attention to algorithms and AI, it can lead to massive problems.

What Google did brilliantly with search, better than any before, was ensure that advertising was additive to the search experience. There was, and still is, utility in search ad results. And paid search results are well marked as advertisements, in order to maintain trust, lest people start using alternative search engines.

Poor advertising experiences can kill entire mediums. Just look at cable TV. It’s not the content, or the bundle that bothers most people (I’ll happily debate this with anyone), it is the viewer's experience. And cable isn’t the only medium where the consumer experience was entirely broken by the advertising business model.

With the trillions of dollars at stake in the generative AI wars, platforms will not, or perhaps I should say should not, risk losing people’s trust or degrading the experience for advertising revenue. But if history is any indication, the platform that wins in generative AI will figure out how to make advertising additive to user the experience, transparent, and, perhaps most importantly, support the quality content ecosystem that generative AI platforms need to maintain relevance, namely publishers of quality content.

This means that publishers of original content should be more valuable than ever. The publishers in particular should benefit from this dynamic because what is generative AI without taste, and how relevant is generative AI if it’s not up to speed on the news?

A truly sustainable business model for LLMs should value platforms like Reddit, LinkedIn, YouTube or X, and publishers like Conde Nast, Dotdash Meredith, The New York Times, Reuters and Forbes, which deliver verified facts and foster human conversation. It’s ironic that the editorial authority that defines traditional publisher brands is exactly what generative AI needs for fresh, relevant content, yet many of those same outlets are the most under pressure from the collapse of traffic.

Creating value through fair advertising has always been the trick and could be the key to a generative AI advertising system that benefits platform and publisher partners. But it suggests a positive path forward for generating AI advertising: one that’s transparent, values human attention, and is actually useful, and isn’t just making promises to marketers that we’ll eat more burgers without realizing why we’re doing it.

Here’s some good news: ChatGPT actually agrees with me on this, or at least it says it does. I asked about the risk to consumers of hidden advertising in LLMs. Its response? “If a generative AI system like ChatGPT is also an ad platform, its primary job becomes not helping you, but monetizing you.”

Star Trek Vision: Energy Too Cheap To Meter

Paragraph • continuations@newsletter.paragraph.com (Albert Wenger) • May 29, 2025

Technology•Energy•SolarEnergy•NuclearFusion•EnergyPolicy•Essays

A few weeks ago I wrote a post outlining a Star Trek Vision for the US. More broadly speaking, I believe that an agenda like this should be the vision for the world. One of the many inspiring aspects of Star Trek, the original series, was humans collaborating across backgrounds including race, gender and nationality. I am now turning my initial outline into a series of posts that explores each of the bullet points in more detail, starting with "energy too cheap to meter" (to illustrate that above is a picture of the engine room from the Enterprise).

Progress has in the past been driven by great breakthroughs in energy. At DLD earlier this year, I gave a talk on this precise topic.

Humanity's first big energy unlock came from figuring out how to make fire. Fire let us cook our food, which made meat more digestible, resulting in larger net calory uptake. This made bigger brains possible. The second big breakthrough was agriculture, which increased the food density of land by an order of magnitude or more. This made large societies possible. The third big break through were fossil fuels. This made larger economies possible.

We are now living through the fourth big breakthrough in the form of solar energy. Already today it is by far the cheapest form of energy when there is sun. Battery (and other storage) costs are declining rapidly. We still need to dramatically improve energy transport from solar. Some of this will come via high voltage DC transmission lines, some of it via making synthetic fuels and shipping those in existing infrastructure. In addition to this "remote fusion" we also have the ability to dramatically drive down the cost of nuclear and possibly unlock "local fusion." Further out there is the potential to generate heat through catalytic reactions, where AI might help us unlock the right catalysts.

When we put all of this together we can absolutely achieve a place where energy is so cheap that at the margin we will not need to meter its consumption. While this may strike some people as crazy because energy had always been comparatively expensive, it is worth keeping in mind that we all make use of sunlight everyday and nobody meters that.

As it turns we are desperately in need of this new energy breakthrough. There are at least three areas in which we need a lot more energy and need it fast.

Climate Crisis: Concentrations of greenhouse gases in the Earth's atmosphere are way too high resulting in rapid warming. We need to drastically reduce our emissions by switching away from fossil fuels and adding carbon capture. We must rapidly draw down some of the existing carbon. And we need to deal with the near term overheating through more air conditioning for humans and for agriculture. All of these require dramatically more energy. Important aside: we are so far behind that we may need to pull a temporary emergency break in the form of solar radiation management.

Artificial Intelligence: We are in the age of rapid breakthroughs in AI. These are making all sorts of fantastic things possible, such as autonomous vehicles. AI and robots/smart machines as its physical embodiment are far less energy efficient than humans and will remain so for some time being (it will take us a while to catch up on evolution). Using AI broadly thus requires massive additional amounts of energy.

Modern Society: This may come as a surprise to some, but markets, democracy, the rule of law, and effective bureaucracy also all require energy. These systems are expensive to operate and over time show diminishing returns. The terrific book "The Collapse of Complex Civilizations" by Joseph Tainter examines how these diminishing returns can result in collapse. He points out that the way to avoid this is to unlock a new energy "subsidy." Historically this was a euphemism for conquest and slavery. Today it is a rallying cry for producing nearly abundant energy.

So what does it take to get there?

….

On YC startup exits (2025 update)

Medium • Jared Heyman • May 29, 2025

Business•Startups•VentureCapital•InvestmentReturns•StartupExits•Venture Capital•Essays

One of the questions I’m asked most often by Rebel Fund LPs is “How long will it take to get my money back?”

I get it — venture is an illiquid asset class with long holding periods, and especially with the recent slowdown in IPO and acquisition activity, DPI is top-of-mind for many venture investors.

A couple of years ago, I wrote a blog post On YC startup exits that attempted to answer that question statistically. Rebel has improved our data infrastructure dramatically since then, allowing us to answer this with even more nuance, so I figured now is a good time for an update.

As my long-time readers know, Rebel maintains the most comprehensive dataset that exists of YC startups outside of YC itself, now with millions of datapoints across every YC founder and company in history, including the outcomes of every exited company (exit type, exit year, estimated valuation, etc). We use this data primarily to train our proprietary Rebel Theorem 3.0 machine learning algorithm, but it’s also useful for tracking interesting trends in the YC startup ecosystem.

So, I queried our database for every exited YC startup to date, excluding those with very small outcomes for early investors (<10% IRR) to remove the acqui-hires, leaving me with ~250 companies to analyze. As I mentioned in my popular post On the life and death of Y Combinator startups, about ~40% of YC startups ultimately achieve an exit, so these ~250 companies are a small fraction of the thousands of YC startups that will eventually be acquired or go public.

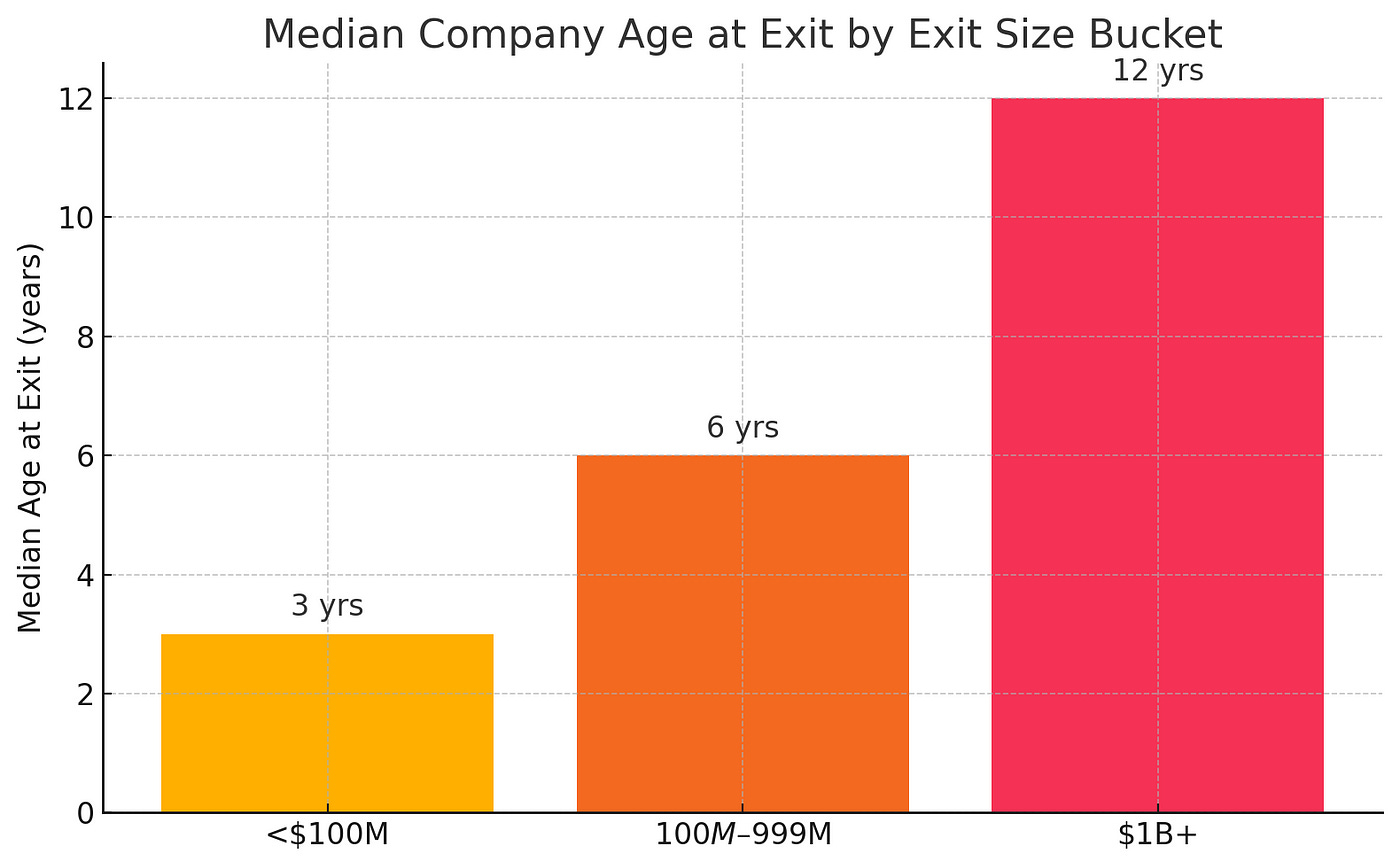

The first thing I found is the median time it takes for a YC startup to achieve an exit is about 5 years, but not all exits are created equal. As you’ll see in the chart below, the <$100M exits take only about 3 years, the $100M-$999M exits take closer to 6 years, and the $1B+ exits take over a decade!

The reason the overall median time to exit is just 5 years is the smaller exits are much more common:

In my post On the power law of Y Combinator startups, I spoke about how incredibly skewed startup investor returns are towards the big winners, and we see this when looking at exited startups as well. Even though the unicorns are just ~8% of all exits, they represent a whopping ~93% of the cash returned to YC startup seed investors:

Predictably, the IRR enjoyed by seed investors in companies achieving these larger exits is much higher, hitting 75% IRR for the unicorns, which is of course insanely good:

Many investors have felt the pace of startup exits has slowed recently, and we see this reflected in our data as well. After the craziness of the 2021 ZIRP-era peak, YC exits have been slower in recent years than as far back as 2017, despite steadily growing batch sizes:

We also found that median exit times vary quite a bit by technology sector, with Industrials, Consumer, and B2B companies achieving quicker exits, and Healthcare companies taking the longest:

So what does all this mean for early-stage startup investors? Here’s my take:

Power-law is real — Investors looking for DPI should follow the same strategies as those seeking IRR, which I speak to in my power law post

Be patient, my friends — The best exits take the longest and drive the vast majority of cash returns, so ride your winners all the way

Keep a balanced diet — Invest in a wide variety of sectors to cover all your bases. B2B companies exit more quickly and often, Fintech companies post the highest IRR, Consumer companies drive the most exit dollars but are riskier, etc.

Don’t try to time the market — Nobody knows what the IPO market will look like a decade from now when today’s best seed investments are exiting, nor when the next 2021-style liquidity bonanza will hit, so just keep making startup investments year after year

Don’t discount unrealized IRR — I know you can’t buy beer or yachts with unrealized returns, but they definitely still ‘count’ in an asset class like venture with very long liquidity timelines, and are useful for tracking portfolio performance along the way

As always, I hope you guys found this helpful. Best of luck investing in tomorrow’s 10+ year overnight successes!

The memeification of venture capital

Signalrankupdate • Rob Hodgkinson • May 29, 2025

Business•Startups•VentureCapital•SocialMedia•AI•Essays

We need to talk about Fartcoin. This is the AI-generated memecoin that reached a $2bn+ market cap in early 2025. This coin has zero practical use. It is nevertheless Exhibit A in demonstrating that hype is all you need in the attention economy.

The more interesting element behind Fartcoin is that it was generated by Truth Terminal, an AI chatbot funded by Marc Andreessen. Truth Terminal interacts with crypto communities, hypes coins and creates compelling narratives. It also owns a lot of Fartcoins, making it the first AI centimillionaire.

In essence, Truth Terminal is a window into the future of finance, where AI drives trades, builds reinforcement loops and manufactures increased volatility. Update your priors accordingly.

Narrative has always been key to fundraising. But there has been a fundamental change in the speed at which information can spread across social media, weaponized further by AI bots.

Kyla Scanlon wrote this compelling piece about how 2024 was the year when narrative ate reality in financial markets: “The relationship between narrative and reality truly inverted in 2024. Events used to create narratives. Now, narratives create events.” She goes on to argue that “narrative velocity can become a force for creation rather than just speculation.”

What does this mean (if anything) for venture capital? Are VCs just becoming financial influencers? How should allocators adjust?

Changing media landscape

The world will belong to those who natively combine social media and AI.

The algorithmic approach to attention steepens the power law of media consumption. Hits are bigger. The middle gets hollowed out. The tail in aggregate attracts a higher percentage of attention. This is happening across social media, TV, music and gaming.

It feels like the rise of TikTok was the inflection point, with a focus on short-form video and making the algorithm front and center of the entire strategy. No more feeds based on timelines. Inject that dopamine into my veins as quick as possible.

Individuals are now more likely to get news direct from social media than from reading a news article. The FT shows here how video has now taken over text in terms of consumption. While text-based social media favored the pithy writing of mainstream journalism, the pivot to video places the currency on charisma, energy and delivery: “being first is less important than being hyper-engaging.”

Venture capital is not immune to these changes. VC thought leadership mirrors the platform du jour. Fred Wilson mastered blogs (Web 1.0), while Tom Tunguz inherited this mantle in the halcyon days of early Web 2.0 social media (LinkedIn), and Turner Novak is now king of the memes (TikTok / X). Meme mastery is already a brand development tool for VCs.

Slow’s Sam Lessin went even further here by arguing that VCs should “invest in memes… messages and positioning need to be ready to be transmitted through memes / in short repeatable clips.”

And this is all before VC court retail investors in earnest (with established firms like General Catalyst rumored to be considering an IPO). While the seasoned CIO of an endowment with a strong VC track record may plough through the minutiae of data rooms, a retail investor will probably not. The messaging needs to hit a retail investor over the head. Shock and awe beats thoughtful nuance all day long. Witness the public spat between meme-using DXYZ and long-form Cathie Wood’s Ark. Who made the most compelling argument here?

Venture Capital

AI Grows the Size of the Prize

Clouded judgement • Jamin Ball • May 23, 2025

Finance•Investment•VentureCapital•InterestRates•DebtMarkets•Venture Capital

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

The Size of the Prize is Growing

There’s been a great discussion on X over the last couple weeks. It started when Packy McCormick published a piece called Everything is Technology, with a section titled “In Defense of Megafunds.” Dave Clark from VenCap (him and his team publish great data related to VC / LP markets) then followed up with data of his own. Everyone who’s been following Clouded Judgement knows I’m a bit of an analytical nerd - I love a good data driven discussion. And both Packy and Dave brought lots of good data to a broader discussion around the scalability of venture. Or said another way, will the return profile of venture funds hold up as fund sizes scale. There’s of course no definitive answer to the question. BUT - there’s a good argument that it’s possible (many people say it isn’t). And the data behind this viewpoint all starts with looking at the size of the exit market. A core argument individuals make that venture returns can scale as fund sizes scale is that the size of venture backed exits is growing. Dave brought great data to this (below).

This data is great. What does it show? A top 1% VC backed exit from 2005 - 2009 was $1.4b (and there were 13 exits of this size). From 2020-2024 a top 1% VC backed exit was $10.2b (and there were 22 exits of that size). Said another way, the size of a top 1% exit nearly doubles every 5 years. And as Dave pointed out, if you expect this trend to continue, a top 1% VC backed exit in 10 years will be ~$40b (and maybe there will be ~40 outcomes of this size in a 5 year window). This is what matters most. You can’t look at a venture fund today and make a judgement on its scalability using a lens of today’s exit environment. You have to look through a 10 year out lens (because this is when investments made today will exit). And I personally think there’s a very credible argument that the rate at which the top 1% exits will grow will exceed the prior rate (of roughly doubling every 5 years). Tech platforms compound (mobile > cloud > and now AI). And I think this current AI wave will lead to much faster growing companies with larger exits (I am a VC at the end of the day, I’m an optimist at heart!). Maybe the top 1% outcome in 10 years looks more like $50b - $60b.

At the end of the day, venture has always been a power law game. You’re either in the big winners and have a great fund, or you’re not in them and you don’t. If the power law outcomes start looking like $50-$60b, and if you have a ~$4b fund, then ~8% ownership in one of these power law outcomes returns your fund. And bingo - generally having a fund returner in a fund leads to outsized returns.

There are a lot of other plusses and minuses of a large fund (some I’ve discussed in the past), but if you believe the trend of exit value growth will continue, there is a credible argument to be made that venture returns can hold up as fund sizes scale. Venture will always be about the power law.

Why Are Rates Rising (Again)?

The 10Y Treasury yield quietly spiked last week, from ~4.45% to over 4.6%, and mortgage rates followed suit. The move wasn’t driven by a single event, but a cluster of factors all pointing in the same direction: higher long-term risk, and more inflation uncertainty.

Here’s a breakdown of what’s happening:

Moody’s downgrade adds fuel. On Friday, Moody’s downgraded the U.S. credit outlook. It didn’t get as much airtime as it should’ve, but it matters. Combine that with the “big, beautiful” spending bill passed in the House, and you’ve got a bond market that’s starting to price in real sovereign risk. Investors want a higher yield to hold U.S. debt when there’s more concern about long-term fiscal stability.

Government spending is back in focus. That same bill (which includes an extension of the 2017 tax cuts) is projected to add $4 trillion to the national debt over the next decade. Even if you believe the U.S. won’t default, you still have to ask: who’s going to buy all this debt? The Treasury is already issuing aggressively. When supply goes up, and demand is soft, yields rise. That’s exactly what we’re seeing.

Treasury auctions weren’t great. This past week’s 10Y and 30Y auctions were lukewarm. Not catastrophic, but not strong. Foreign buyers are more cautious. Japan was on holiday. China may be quietly reducing U.S. exposure. And the Fed isn’t buying. That means the marginal buyer needs a bigger incentive (read: higher yield) to step in.

Inflation expectations are creeping back. Core CPI remains sticky, and shelter costs are still elevated. Add in the potential for new tariffs and you get a market starting to rethink its “disinflation is here” narrative. Lenders raise rates to protect against future inflation. It’s bond market 101.

Rate cuts are off the table (for now). The market’s gone from expecting 3 to 4 cuts this year to maybe just one. A strong labor market, resilient consumer spending, and sticky inflation are pushing the Fed’s hand. If short rates stay higher for longer, and long rates rise too, you get a full re-tightening of financial conditions. That’s what’s happening.

So what? The 10Y yield drives mortgage rates, shapes equity valuations, and sets the tone for the entire market. Even if the Fed holds still, the bond market is moving. And right now, it’s saying: “we need more yield to hold your debt.”

It’s not a panic move. But it’s a warning shot. And if the fiscal outlook gets worse, or inflation proves even stickier, there’s still room for yields to climb. Keep watching the 10Y. It’s doing more tightening than Powell right now.

Taste Is Everywhere

Youtube • Uncapped with Jack Altman • May 23, 2025

Culture•SocialMedia•DigitalCulture•Creativity•Marketing•Venture Capital

The video "Taste Is Everywhere," presented by Uncapped with Jack Altman, explores the concept of "taste" as a powerful and ubiquitous force shaping modern culture, creativity, and consumer behavior. The discussion centers on how taste is no longer confined to traditional notions of aesthetics or style but has become a dynamic, accessible, and inclusive way for individuals and communities to express identity and influence trends.

Expanding Definition of Taste

Taste is described as a form of personal expression that extends beyond luxury or high-culture references to include various subcultures and digital communities.

The video emphasizes how online platforms have democratized taste, allowing diverse voices to emerge and reshape what is considered appealing or valuable.

Taste becomes a signal of authenticity and belonging, with communities rallying around shared preferences in art, music, fashion, and technology.

Role of Digital and Cultural Shifts

The proliferation of social media has accelerated taste cycles, making trends more transient but also more widely accessible.

Algorithms and recommendation systems on platforms like Instagram, TikTok, and YouTube play a pivotal role in curating and amplifying tastes, impacting what gains popularity.

The video highlights how this digital curation influences cultural norms and business strategies, with brands increasingly aligning themselves with niche communities to build loyalty.

Implications for Creativity and Commerce

Taste serves as a currency in creative industries, where originality and personal authenticity can translate into tangible success.

The video underscores the importance of recognizing taste as a strategic asset for startups and entrepreneurs aiming to connect with modern consumers.

There's a noted shift from top-down trend setting to bottom-up, grass-roots movement of tastes, which demands that businesses adapt to hyper-personalized and rapidly evolving consumer demands.

Quotes and Key Insights

"Taste is the new cultural currency—everyone has access, and it reflects who they are."

The conversation highlights examples of creators turning niche tastes into successful ventures, illustrating the commercial potential of cultivating unique and genuine taste identities.

Conclusion

The video ultimately frames taste as a fundamental, evolving force shaping culture and commerce in the digital age. It reflects the convergence of identity, technology, and creativity, suggesting that understanding and harnessing taste is essential for anyone looking to thrive in modern cultural landscapes. By appreciating taste as pervasive and participatory, the discussion points to a future where cultural influence is broadly distributed and continuously redefined by global communities.

Airwallex CEO & Co-Founder, Jack Zhang: The Angel That Turned $1M into $1BN

Youtube • 20VC with Harry Stebbings • May 26, 2025

Technology•FinTech•Startups•Payments•Leadership•Venture Capital

This interview with Jack Zhang, CEO and Co-Founder of Airwallex, dives into the fascinating journey of transforming a $1 million initial investment into a billion-dollar fintech powerhouse. Zhang shares insights into the strategic decisions, growth challenges, and leadership philosophy that propelled Airwallex to become a global player in the cross-border payments landscape.

Early Beginnings and Vision

Jack Zhang narrates how Airwallex was conceived to solve a significant pain point in international finance—high costs and inefficiencies in cross-border transactions for startups and small businesses. The vision was clear: build a seamless, technology-driven payments platform that could simplify global financial operations. From the outset, Zhang and his team focused on leveraging technology to automate and streamline processes that were traditionally cumbersome and expensive.

Growth Strategy and Funding

The company’s early growth hinged on a strategic focus on customer-centric product development, enabling Airwallex to tap into the underserved market of fintech-savvy businesses. Initial traction was fueled by raising a $1 million angel round, which Zhang describes as critical in validating the product-market fit and attracting subsequent institutional investors. Over time, Airwallex successfully scaled operations, growing its valuations to over $1 billion, transforming from a startup to a unicorn with a robust presence across Asia, Europe, and the United States.

Zhang emphasizes the importance of an adaptable mindset during fundraising and expansion phases, noting, “Being flexible and understanding different investor motivations helped us secure the right partners to expand globally.” The company’s impressive growth trajectory is attributed to its relentless focus on innovation, customer trust, and strong execution.

Leadership and Company Culture

Jack Zhang delves into the leadership lessons learned throughout Airwallex’s evolution. He advocates for transparent, mission-driven leadership where every team member is aligned on the vision and encouraged to take ownership. Zhang highlights fostering a culture of resilience—embracing failures as learning opportunities and continuously iterating to improve products and service delivery.

The CEO also stresses the value of diversity in building global teams, stating that varied perspectives fuel creativity and help tackle complex regulatory environments across different countries. This cultural approach, combined with a strong focus on technology development, positioned Airwallex as not just a payments provider but a fintech innovator.

Technology Innovation and Market Impact

Airwallex’s proprietary technology stack, built on cloud infrastructure, enables real-time currency conversion and multi-currency accounts, significantly reducing transaction costs for customers. Zhang notes how integrating advanced APIs and compliance frameworks drove operational efficiency and scalability. The company’s ability to adapt quickly to regulatory changes has been a competitive moat, ensuring trust and reliability.

The impact of Airwallex in democratizing access to global business markets is notable. By lowering barriers in cross-border payments, it empowers businesses to expand internationally with ease. Zhang envisions Airwallex continuing to leverage AI and blockchain technologies to further enhance payment speed, transparency, and security.

Conclusion

Jack Zhang’s story exemplifies how vision, strategic agility, and customer-centric innovation can turn a modest seed investment into a fintech giant valued at over a billion dollars. Airwallex’s journey underscores the transformative potential of technology in global finance and offers valuable leadership insights for entrepreneurs navigating high-growth environments. Zhang’s emphasis on culture, flexibility, and relentless execution has cemented Airwallex’s position as a prominent innovator in the competitive fintech landscape.

Clouded Judgement 5.30.25 - Moats in the Age of AI

Cloudedjudgement • Jamin Ball • May 30, 2025

Technology•Cloud•Software•SaaS•AI•Venture Capital

Every week I’ll provide updates on the latest trends in cloud software companies. Follow along to stay up to date!

Moats in the Age of AI

A lot has been written about moats in software. Network effects. Switching costs. Proprietary data. Everyone wants to believe they’re building one. But I’ve come to believe the idea of a “long term moat” is mostly a myth, especially in this market. Moats aren’t permanent. They’re time-bound. At best, they function as a bridge. And companies either use that bridge to reach the next defensible position, or watch their moat get breached.

The real “long-term moat” is just a sequence of smaller moats stacked together. Each one buys time. And what you do with that time, how fast you execute, how quickly you evolve, determines whether you stay ahead. In the Age of AI, this is more true than ever. If the moat time window used to be 6–12 months, today it’s 2–3 weeks. Models change. Infrastructure shifts. Customer needs rewrite themselves in real time. What was a 12-month product head start in 2022 is now 3 prompts and a wrapper in 2024. It’s easier than ever to both build and distribute software.

And it’s happening all around us! The first LLM-based CRMs? Swarmed. The first AI note-taking tools? Cloned endlessly. Even infra plays like vector DBs or agent frameworks are seeing differentiation collapse overnight.

Speed isn’t just important, it is the moat. The ability to build, ship, learn, and adapt faster than everyone else is the only sustainable edge right now. In a world where everything is open source, everything is demo-able, and everything is one blog post away from being copied, speed is the only thing that compounds.

Execution speed. Hiring speed. Firing speed. Distribution speed. Even decision-making speed. You don’t win because you’re defensible, you win because you’re faster. Killing bad ideas is just as important as the speed of executing against good ones. The opportunity cost of time has never been greater. So if you’re trying to build a moat today, maybe don’t think of it as a castle wall. Think of it as a race. Whoever stacks the most advantages the fastest: products, distribution, talent, infra, wins.

Update on Multiples

SaaS businesses are generally valued on a multiple of their revenue - in most cases the projected revenue for the next 12 months. Revenue multiples are a shorthand valuation framework. Given most software companies are not profitable, or not generating meaningful FCF, it’s the only metric to compare the entire industry against. Even a DCF is riddled with long term assumptions. The promise of SaaS is that growth in the early years leads to profits in the mature years. Multiples shown below are calculated by taking the Enterprise Value (market cap + debt - cash) / NTM revenue.

Overall Stats:

Overall Median: 5.6x

Top 5 Median: 23.2x

10Y: 4.4%

Bucketed by Growth. In the buckets below I consider high growth >25% projected NTM growth, mid growth 15%-25% and low growth <15%

High Growth Median: 20.6x

Mid Growth Median: 9.2x

Low Growth Median: 4.1x

Sources used in this post include Bloomberg, Pitchbook and company filings

The information presented in this newsletter is the opinion of the author and does not necessarily reflect the view of any other person or entity, including Altimeter Capital Management, LP ("Altimeter"). The information provided is believed to be from reliable sources but no liability is accepted for any inaccuracies. This is for information purposes and should not be construed as an investment recommendation. Past performance is no guarantee of future performance. Altimeter is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. Altimeter and its clients trade in public securities and have made and/or may make investments in or investment decisions relating to the companies referenced herein. The views expressed herein are those of the author and not of Altimeter or its clients, which reserve the right to make investment decisions or engage in trading activity that would be (or could be construed as) consistent and/or inconsistent with the views expressed herein.

This post and the information presented are intended for informational purposes only. The views expressed herein are the author’s alone and do not constitute an offer to sell, or a recommendation to purchase, or a solicitation of an offer to buy, any security, nor a recommendation for any investment product or service. While certain information contained herein has been obtained from sources believed to be reliable, neither the author nor any of his employers or their affiliates have independently verified this information, and its accuracy and completeness cannot be guaranteed. Accordingly, no representation or warranty, express or implied, is made as to, and no reliance should be placed on, the fairness, accuracy, timeliness or completeness of this information. The author and all employers and their affiliated persons assume no liability for this information and no obligation to update the information or analysis contained herein in the future.

The Great ARR Acceleration: Q1’25 Numbers Tell the Comeback Story

Saastr • Jason Lemkin • May 30, 2025

Business•Startups•SaaS•Growth•VentureCapital•Venture Capital

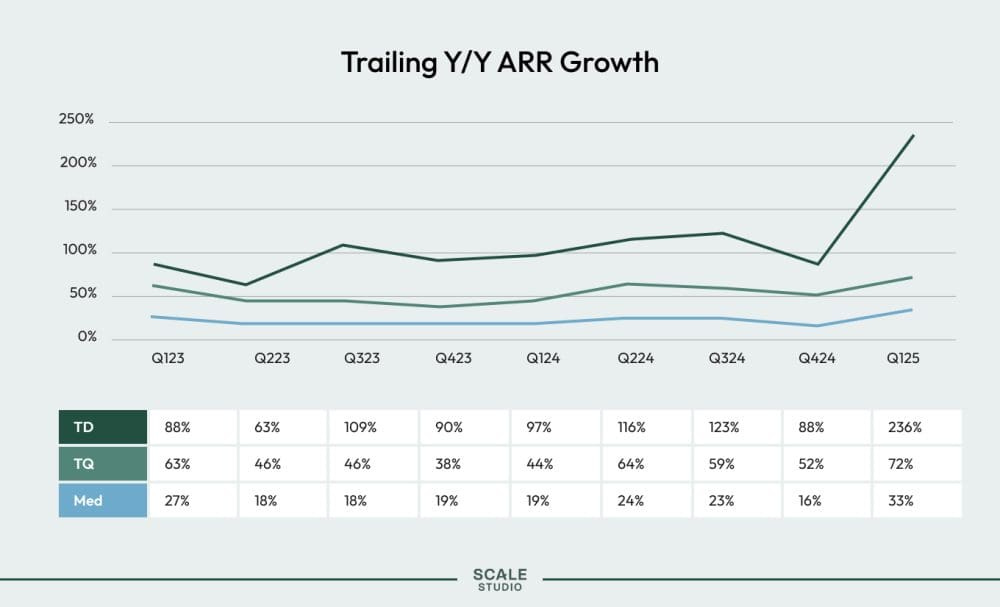

Scale Venture Partners has its latest report out on B2B start-up and it quantifies what a lot of us are seeing:

In the Age of AI, the very very best B2B start-ups, the top decile of venture-backed ones … are growing faster than ever. Or at least faster than in many years:

The top quartile is growing materially faster than 12 months ago — 72% vs. 44%.

The median in this group of VC-backed B2B start-ups is still growing much faster than 12 months ago — 33% vs. 19%.

And the top, AI fueled decile? The Top 10%? They are growing at a stunning 236% — vs. 97% a year ago.

The top decile (TD) line of B2B start-ups has rocketed to 236% ARR growth in Q1’25. That’s not a typo—the best companies just hit escape velocity while everyone else is still figuring out the launch sequence. We haven’t seen numbers like this since 2021.

Here’s what should terrify every SaaS founder: the gap between winners and losers is becoming a chasm. While top decile companies are hitting 236% growth, the median is sitting at a respectable but unremarkable 33%. The third quartile (TQ) managed 72%—solid, but not spectacular.

Translation: If you’re not in the top quartile, you’re getting left in the dust. The middle of the pack is becoming the kiss of death.

Look at Q4’24—that dip to 88% for top decile was the final exhale of the efficiency-first era. Companies were still playing it safe, still squeezing every last drop of optimization. But Q1’25? That’s the sound of the growth engine roaring back to life.

Even the median jumped from 16% to 33%—that’s a doubling of growth rates quarter-over-quarter. When median companies are doubling their growth, you know something fundamental has shifted.

The most telling story is 2023-2024: top decile ARR growth was stuck in the 80-130% band for nearly two years. Companies were treading water, optimizing, cutting, surviving. The third quartile was trapped in the 40-65% range—alive but not thriving.

The pattern is crystal clear: Survival mode from Q1’23 through Q4’24, then explosive reacceleration in Q1’25.

What This Means for Your SaaS Business

The efficiency ceiling is real: After two years of optimization, there’s simply nothing left to cut. Growth is the only path forward.

Capital is flowing to growth again: That top decile spike isn’t happening in a vacuum—investors are clearly rewarding revenue acceleration over burn multiple optimization.

The middle is getting squeezed: Third quartile at 72% vs top decile at 236% means moderate growth isn’t enough anymore. You’re either hypergrowth or you’re slowly dying.

Market timing matters: Companies that stayed disciplined through 2023-2024 and maintained product-market fit are now positioned to capture disproportionate share as demand returns.

This isn’t just a quarterly blip—it’s the starting gun for the next SaaS gold rush. The companies that survived the efficiency winter with their growth engines intact are now pulling away from the pack at an unprecedented rate.

If you’re not seeing some acceleration — you may be falling behind. Because while you’re optimizing for the last war, your competitors are already fighting the next one.

The message is clear: Grow faster or get left behind. The middle ground is a tougher spot than 12 months ago.

The Best Angel Investment In History?

Youtube • 20VC with Harry Stebbings • May 26, 2025

Business•Startups•Investment•AngelInvesting•Entrepreneurship•Venture Capital

This discussion centers on one of the most remarkable angel investments in history, unpacking the factors that contributed to its extraordinary success. The episode examines the unique insights, timing, and strategic decisions behind the initial investment, providing a detailed look into how early vision and risk tolerance paid off exponentially for the investor involved.

Key Elements of the Investment

The investor recognized an opportunity in a startup with transformative potential at a time when the market was uncertain about the sector's viability.

Early engagement allowed the investor to not only provide capital but also strategically influence company growth and direction.

The investment was made when valuations were relatively low, giving the stakeholder a significant equity share that appreciated massively over time.

Insights into Decision-Making and Risk

The investor’s successful bet hinged on an understanding of market trends and consumer behavior that others undervalued.

There was an emphasis on patience and a long-term outlook, resisting the pressure to exit early despite many doubts from the industry.

The investor also highlighted the importance of backing passionate founders and scalable technology, crucial drivers for sustained growth.

Broader Implications and Lessons

This case serves as a benchmark in angel investing, showing the power of early-stage involvement beyond capital injection, including mentorship and network access.

It underscores the importance of vision in investment, where foresight into disruptive technologies or business models can lead to outsized returns.

The narrative also illustrates the volatile nature of early investments, where high risk is balanced by the possibility of groundbreaking success.

Conclusion

This story of one of the best angel investments illustrates the intersection of insight, timing, and commitment. It not only celebrates a remarkable financial outcome but also offers a playbook on how investors can identify and nurture future game-changing companies. The example highlights angel investing as both an art and science, demanding courage, knowledge, and strategic patience.

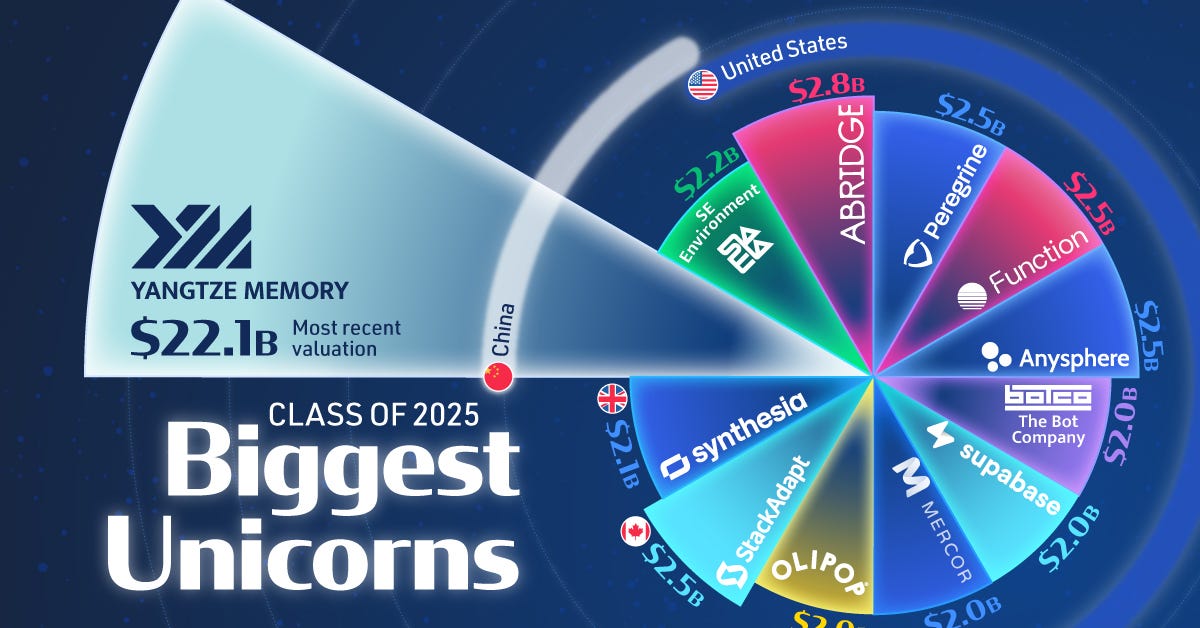

Ranked: Most Valuable Unicorns Created in 2025

Visualcapitalist • Kayla Zhu • May 30, 2025

Technology•Startups•Unicorns•AI•Investment•Venture Capital

Billion-dollar startups were once rare, but they’ve become increasingly common as venture capital funding has surged and tech innovation accelerates across industries.

This graphic visualizes unicorns valued at $2 billion or more that became unicorns ($1 billion+ in valuation) in 2025. Data comes from PitchBook, as of May 1, 2025.

PitchBook defines unicorns as venture-backed companies valued at $1 billion or more after a funding round, until it goes public, gets acquired, or drops below that valuation.

Yangtze Memory, a Chinese flash memory chip developer, is 2025’s biggest unicorn so far with a $22.1 billion valuation.

The company became a unicorn, by PitchBook’s definition, in April 2025 after it secured a $222 million investment from Quanhong Investment. Even if a company’s internal or market valuation exceeds $1 billion, PitchBook’s definition requires a qualifying funding event for official unicorn status.

Abridge, an American healthcare AI startup that summarizes clinician-patient conversations into documentation, is the second-most valuable unicorn in the class of 2025.

AI-driven companies dominate the list of the biggest unicorns of 2025—such as Synthesia (AI video generation), AnySphere (AI programming assistants), and The Bot Company (AI agents)—and have attracted significant investment in recent years.

There have been 43 new unicorns created in 2025, as of May. The largest share (65%) of new unicorns in 2025 are from North America, followed by Europe (23%).

Currently, the most valuable unicorns in the world are ByteDance, the creator of TikTok, and Elon Musk’s SpaceX.

The Growing Secondary Market In Venture: A Conversation On The Emergence Of VC Continuation Funds

Crunchbase • May 30, 2025

Business•VentureCapital•SecondaryMarket•ContinuationFunds•LiquidityStrategies•Venture Capital

In a slow exit market, venture capital firms are turning to liquidity strategies typically used in private equity, one of which is the creation of continuation funds. These funds allow firms to extend the life of investments in high-performing portfolio companies, providing liquidity to existing investors while maintaining exposure to promising assets.

The secondary market for venture capital has experienced significant growth, with transaction volumes increasing by more than 50% in recent years. This surge is driven by the need for liquidity solutions as traditional exit routes, such as IPOs and acquisitions, become less frequent. Firms like Lightspeed Venture Partners have been active in this space, spending $580 million over three years to purchase secondary shares in companies like Anduril, Rippling, and Stripe. (ft.com)

The emergence of continuation funds represents a shift in venture capital strategies, allowing firms to hold onto their best-performing investments for longer periods. This approach not only provides liquidity to existing investors but also enables firms to attract new investors interested in discounted assets with significant upside potential. For instance, HV Capital launched a €430 million continuation fund to acquire existing portfolio investments from legacy vehicles, marking the first of its kind in the German tech sector. (pitchbook.com)

The rise of continuation funds and the expanding secondary market reflect the venture capital industry's adaptability in navigating changing market conditions. By leveraging these strategies, firms can offer liquidity solutions to investors and continue to support the growth of their portfolio companies.

Startups, This Is Why Japan Can’t Be Ignored

Crunchbase • May 30, 2025

Business•Startups•Innovation•Japan•Venture Capital

After spending a week in Tokyo recently, I think it’s worth sharing some key takeaways and data on the Japanese startup ecosystem, which is substantial, growing and seeing increased government investment and international interest.

The occasion for my visit was Mind the Bridge’s Scaleup Summit Japan, which took place in Tokyo on May 15-16, 2025. The event was organized in collaboration with the Japan External Trade Organization (JETRO) and the Japan Association of New Economy (JANE). It brought together over 100 participants, including 30 international scaleups, 20 Japanese corporates, and 10 investors.

The Japanese startup ecosystem is substantial, growing, and seeing increased government investment and international interest. The country has a population of 125 million people, a GDP of $4.9 trillion, and is the third-largest economy in the world. Japan is also the third-largest venture capital market globally, with over $3 billion invested in startups in 2024.

The government has been actively supporting startups through various initiatives, including the establishment of innovation hubs, tax incentives, and funding programs. For example, the Japan Innovation Network (JIN) was created to support the commercialization of innovative technologies. Additionally, the government has set a goal to increase the number of startups in Japan to 10,000 by 2025.

International interest in Japanese startups is also growing. In 2024, foreign direct investment in Japan reached $10 billion, with a significant portion directed towards the startup sector. This trend is expected to continue, as Japan offers a large consumer market, advanced infrastructure, and a highly educated workforce.

However, challenges remain. The startup ecosystem in Japan is still developing compared to other countries, and there is a need for more risk-taking and a stronger culture of entrepreneurship. Additionally, the aging population poses a challenge to the labor market and consumer demand.

In conclusion, Japan presents a promising landscape for startups, with substantial government support and growing international interest. While challenges exist, the opportunities for innovation and growth are significant.

DPI in a Tough Market — What Early Belief in an Immigrant Entrepreneur Can Create

Unshackledvc • Unshackled Ventures • May 29, 2025

Business•Startups•VentureCapital•ImmigrantFounders•EarlyStageInvesting•Venture Capital

In a market where exits are rare and liquidity even more so, we’re proud to share that last week we delivered meaningful DPI to our LPs through a partial secondary sale at no discount to the latest round.

We use a disciplined internal framework to make these decisions. A company must cross at least a 50x markup, and we must still hold a meaningful stake to preserve potential fund-returning upside. This one checked both boxes.

We first met the founder as a teenager who had just arrived in the U.S. on a one-way ticket, determined to change the trajectory of his life. Days before the pandemic shut the world down in 2020, we wrote him his first check despite his visa dependency and pre-traction.

Today, he’s the founder of a category-defining company backed by some of the best investors in the industry. This is what we mean when we back immigrant founders from Day Zero - before the visa, the traction, or the world sees their potential.