Contents

Editorial: A Year Just Happened in a Week: The Great Leap Forward

Essays

Venture Capital

AI

Claude 4

Google IO

AI Overviews are now available in over 200 countries and territories, and more than 40 languages.

Google finally launches NotebookLM mobile app at I/O: hands-on, first impressions

DeepMind CEO Demis Hassabis + Google Co-Founder Sergey Brin: AGI by 2030?

Inside Google’s AI leap: Gemini 2.5 thinks deeper, speaks smarter and codes faster

Google I/O 2025: Everything announced at this year’s developer conference

Demis Hassabis and Sergey Brin on AI Scaling, AGI Timeline, Robotics, Simulation Theory

OpenAI

Space

From SignalRank

Government Overreach

Startup of the Week

Post of the Week

Editorial: A Year Happened in a Week

This editorial was written by Google’s Notebook LM after reading this week’s collection and being prompted by myself. It is in the spirit of my views as a result. I am traveling and so grabbed the chance to try it out. And as Andrew and I are both traveling the Podcast is also done by Google Notebook LM.

Welcome to "That Was The Week". While each week brings significant developments in the tech and startup world, the past seven days have felt less like a single week and more like an entire year of technological advancement compressed into an intense period. What we've witnessed is nothing short of a Great Leap Forward in artificial intelligence, reshaping industries, devices, and even the fundamental nature of work and competition.

The focus is squarely on AI, demonstrating an extraordinary acceleration not just in capability, but in its practical integration across applications and devices. We are seeing a shift from AI as a conceptual tool to AI as a usable, deeply embedded assistant. This isn't about simple chat interfaces anymore; it's about sustained, autonomous collaboration with users, capable of complex reasoning, coding, multi-modal inputs, and integrating various tools. Examples from the week highlight this, with developments from players like Anthropic demonstrating sustained coding sessions and achieving new benchmarks, and Google introducing enhanced reasoning modes for complex problem-solving. These developments lay the foundation for redefining productivity and user experience.

Alongside the leap in AI models, a crucial new battleground is emerging beyond software: hardware. A major strategic pivot into "physical AI embodiments" is signaled by large acquisitions aimed at building new AI companion devices. These devices are designed potentially to transcend conventional screens, reduce screen dependence, and even challenge entrenched players in the device market. While another major player continues to embed AI heavily within its existing software and services like Search, NotebookLM mobile, and AI Overviews, moves into physical design leadership signify that the competition is increasingly moving into the physical realm, creating new dynamics around device innovation and consumer ownership.

The ripple effects of this AI acceleration are evident across the landscape. Venture capital funding continues to flow heavily into AI, capturing roughly one-third of global VC investment, exceeding $100 billion in 2024. While Series B rounds are showing some volatility, there's a broader pivot towards efficiency and profitability. Simultaneously, seed-stage investing is adapting with new playbooks supporting founders early without necessarily dominating ownership.

Perhaps most immediately impactful for many is the transformation already underway in the workplace. Leading companies are not just recommending AI adoption; they are mandating widespread proficiency. Executives are issuing stark warnings that mastering AI tools is becoming essential, linking job security to demonstrating how tasks can be done more efficiently with AI, and cautioning against professional irrelevance for those who don't adapt. This trend underscores the profound sociological and managerial upheaval AI is causing, influencing workflows, morale, and corporate culture fundamentally.

Beneath these rapid shifts lies a critical, perhaps defining, debate over AI's ultimate architecture. There's a powerful advocacy for an open, protocol-based AI ecosystem fostering interoperability and innovation—what's been called "an architecture of participation". Proponents argue that participatory markets allow solutions to emerge from anywhere, preventing monopolistic control. Yet, the aggressive maneuvers of dominant players building controlling ecosystems and platforms suggest a strong pursuit of winner-takes-most opportunities. This sets the stage for an ideological and practical contest with huge technological, economic, and ethical implications.

This week crystallized a pivotal inflection point—AI is maturing rapidly, its reach is expanding dramatically, and strategic battles are being drawn across software, hardware, and ecosystem control. As we reflect on this "Great Leap Forward", crucial questions remain: Are we witnessing the dawn of truly universal AI assistants integrated seamlessly into our lives, or are we seeing the birth of new digital gatekeepers controlling access and innovation? Navigating this rapid transition to stay ahead will be the defining challenge for individuals and organizations alike in this AI-powered future. What’s clear is this: the year truly just happened, compressed within a single week, and AI stands at the stage center, shaping what comes next.

Essays

24 Years After ‘Sorry, Steve: Here’s Why the Apple Stores Won’t Work’

Ritholtz • John Gruber • May 22, 2025

Technology•Retail•AppleStores•Innovation•MarketingStrategy•Essays

Barry Ritholtz, in an excerpt from his brand-new book, How Not to Invest, marking the occasion of the 24th anniversary of Cliff Edwards’s claim chowder hall of famer, predicting doom for Apple’s then-new foray into its own chain of retail stores:

There are many genuinely revolutionary products and services that, when they come along, change everything. Pick your favorite: the iPod and iPhone, Tesla Model S, Netflix streaming, Amazon Prime, AI, perhaps even Bitcoin. Radical products break the mold; their difference and unfamiliarity challenge us. We (mostly) cannot foretell the impact of true innovation. Then, once it’s a wild success, we have a hard time recalling how life was before that product existed.

The Apple Store was clearly one of those game-changers: By 2020, Apple had opened over 500 stores in 25 countries. They are among the top-tier retailers and the fastest to reach a billion dollars in annual sales. They achieved the highest sales per square foot in 2012 among all retailers. By 2017, they were generating $5,546 per square foot in revenues, twice the dollar amount of Tiffany’s, their closest competitor. Apple no longer breaks out the specifics of its stores in its quarterly reports, but estimates of store revenue are about $2.4 billion per month.

May 2001 is so long ago, Daring Fireball hadn’t yet launched. So I can’t say I predicted the success of Apple’s retail stores. But what I recall thinking, at the time, was that it might work, and was definitely worth trying. Here’s the nut of Edwards’s 2001 piece:

Since PC retailing gross margins are normally 10% or less, Apple would have to sell $12 million a year per store to pay for the space. Gateway does about $8 million annually at each of its Country Stores. Then there’s the cost of construction, hiring experienced staff. “I give them two years before they’re turning out the lights on a very painful and expensive mistake,” says Goldstein. [...]

What’s more, Apple’s retail thrust could be one step forward, two steps back in terms of getting Macs in front of customers. Since most Mac fans already know where to buy, much of the sales from Apple’s stores could come out of the hides of existing Mac dealers. That would bring its already damaged relations with partners to new lows. In early 1999, Best Buy Co. dropped the iMac line after refusing a Jobs edict that it stock all eight colors. Sears, Roebuck & Co. late last year dumped Apple, sources say, after concluding that sales were too hit or miss. And in recent weeks, Mac-only chains such as The Computer Store and ComputerWare have closed down, citing weak margins. Now, faced with competition from Apple, others may cut back. “When you choose to compete with your retailers, clearly that’s not a comfortable situation,” says CompUSA Chief Operating Officer Lawrence N. Mondry.

Two decades later, talking about the importance of Sears as a retail partner looks pretty dumb. But to me, the obvious problem with this argument in 2001 is that if Apple’s existing retail partners in 2001 were going an even vaguely good job, why was the Mac’s market share so low? At the time they were only a handful of years past the crisis where the company almost went bankrupt. Apple, in the old days, had some fantastic small mom-and-pop official retailers, but they were small. And the big partners, like CompUSA, absolutely sucked at showcasing the Mac. Their demo machines frequently broken. If you understood and believed that the Mac was a superior product, it was easy to conclude that its relatively low market share must have been a function of problem with its marketing and retail strategy.

(I’m a longtime fan of Ritholtz’s writing; I’ve got a copy of How Not to Invest and it’s next on my reading list after I finish Patrick McGee’s Apple in China.)

The Great Product Reset: Will AI Leave Designers Behind?

Newinternet • Jeff Morris Jr. • May 22, 2025

Technology•AI•ProductDesign•CareerDevelopment•Innovation•Essays

I spoke yesterday with one of the most talented product designers I've ever collaborated with, and something he said stuck with me: "I feel old."

He's around 37, an age when professionals in most fields are entering the prime of their careers.

But today he's witnessing the AI-driven product design landscape reinvent itself in a language he hasn't yet learned.

He had a few job interviews recently where he didn't get the role, and I could see the experience woke him up.

So he asked me for advice.

Should he target Series A startups? Update his resume? What could he do this summer?

My answer was pretty simple: Start designing again. But use all the new tools.

Pick a model on Hugging Face. Experiment with GPT-4, Claude, or Gemini.

Or take an app from 2015 and reimagine them with an AI-native products lens.

Evernote. Yelp. Early Instagram. Whatever you want, but start experimenting again.

If you feel the world accelerating past you, you can start doing things.

That's why like Jony Ive joined OpenAI, and why Sergey Brin jumped back in, saying:

"This is the most fun I've had in my life, honestly, and this is the greatest transformative moment in computer science ever. Being a computer scientist, it is the most exciting thing of my life technologically."

Because they love the game. They know the game just reset. And they're endlessly curious, eager to discover what they can build.

One great product idea is all it takes to change everything, to make you relevant again.

That's the unique part of this moment, when building a powerful app is nearly as easy as writing this essay.

Start building today. Not tomorrow, not next week. Today.

That's your way back to relevance and the only path to rediscover your creative confidence.

Now is your moment to fall in love with technology again.

An Architecture of Participation for AI?

Oreilly • Tim O’Reilly • May 19, 2025

Technology•AI•Innovation•ArchitectureOfParticipation•AIprotocols•Essays

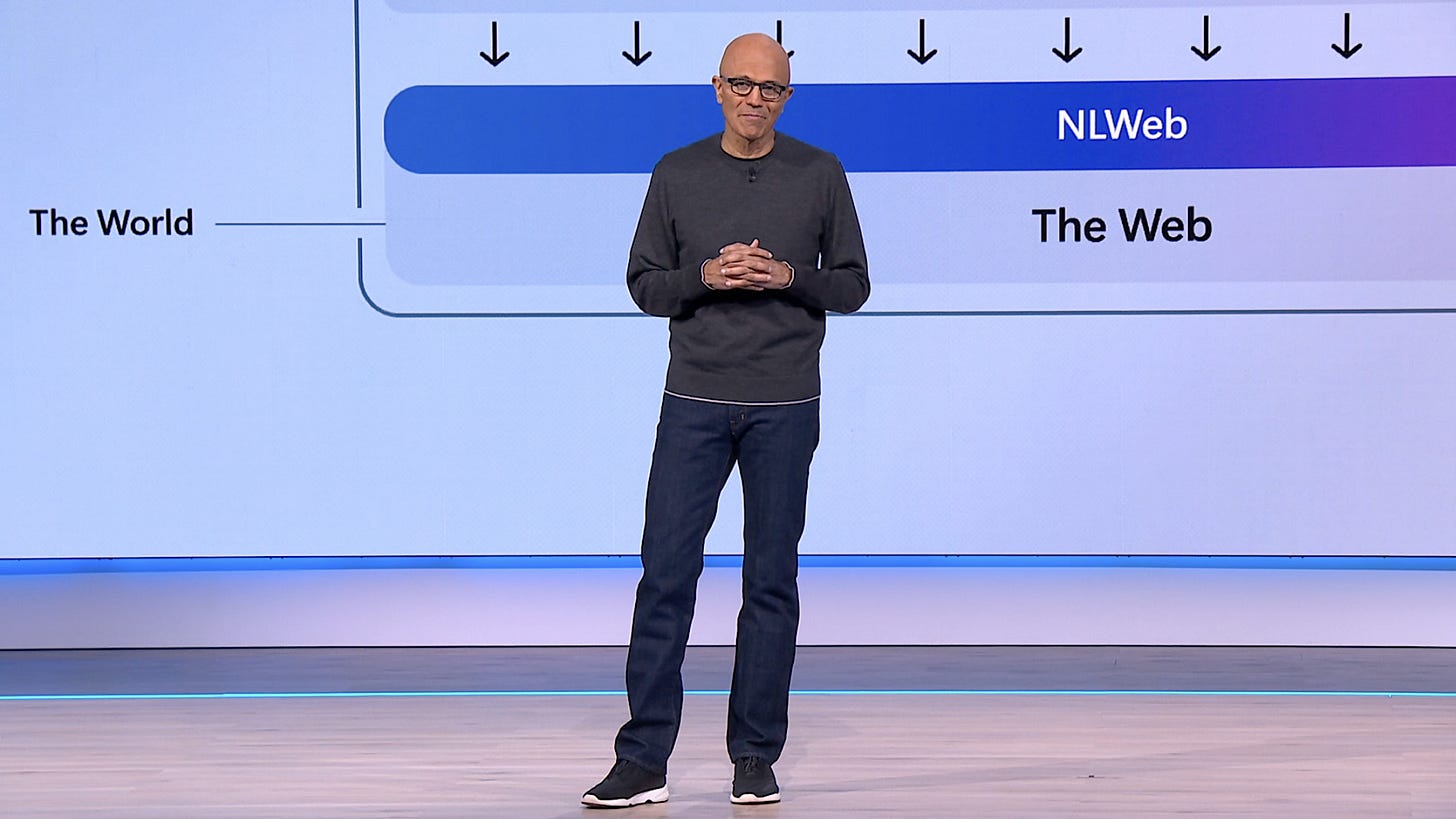

About six weeks ago, I sent an email to Satya Nadella complaining about the monolithic winner-takes-all architecture that Silicon Valley seems to envision for AI, contrasting it with “the architecture of participation” that had driven previous technology revolutions, most notably the internet and open source software. I suspected that Satya might be sympathetic because of past conversations we’d had when his book Hit Refresh was published in 2017.

I made the case that we need an architecture for the AI industry that enables cooperating AIs, that isn’t a winner-takes-all market, and that doesn’t make existing companies in every industry simply the colonial domains of extractive AI conquerors, which seems to be the Silicon Valley vision.

Little did I know that Microsoft already had something in the works that is a demonstration of what I am hoping for. It’s called NLWeb (Natural Language Web), and it’s being announced today. Satya offered O’Reilly the chance to be part of the rollout, and we jumped at it.

My ideas are rooted in a notion about how technology markets evolve. We have lived through three eras in computing. Each began with distributed innovation, went through a period of fierce competition, and ended with monopolistic gatekeepers. In the first age (mainframes), it was IBM, in the second (PCs) Microsoft, and in the third (internet and mobile) the oligopoly of Google, Amazon, Meta, and Apple.

The mistake that everyone makes is a rush to crown the new monopolist at the start of what is essentially a wide-open field at the beginning of a new disruptive market. And they envision that monopoly largely as a replacement for what went before, rather than realizing that the paradigm has changed. When the personal computer challenged IBM’s hardware-based monopoly, companies raced to become the dominant personal computer hardware company. Microsoft won because it realized that software, not hardware, was the new source of competitive advantage.

The story repeated itself at the beginning of the internet era. Marc Andreessen’s Netscape sought to replace Microsoft as a dominant software platform, except for the internet rather than the PC. AOL realized that content and community, not software, was going to be a source of competitive advantage on the internet, but they made the same mistake of assuming the end game of consolidated monopoly rather than embracing the early stage of distributed innovation.

So here we are at the beginning of the fourth age, the age of AI, and once again, everyone is rushing to crown the new king. So much of the chatter is whether OpenAI or one of its rivals will be the next Google, when it looks to me that they are more likely the next Netscape or the next AOL. DeepSeek has thrown a bomb into the coronation parade, but we haven’t yet fully realized the depth of the reset, or conceptualized what comes next. That is typically figured out through a period of distributed innovation.

The term “the architecture of participation” originally came to me as an explanation of why Unix had succeeded as a collaborative project despite its proprietary license while other projects failed despite having open source licenses. Unix was designed as a small operating system kernel supporting layers of utilities and applications that could come from anyone, as long as they followed the same rules. Complex behaviors could be assembled by passing information between small programs using standard data formats. It was a protocol-centric view of how complex software systems should be built, and how they could evolve collaboratively. Linux, of course, began as a re-implementation of Unix, and it was the architecture of participation that it inherited, as much as the license and the community, that was the foundation of its success. The internet was also developed as a distributed, protocol-based system.

That concept ran through my web advocacy in the early ’90s, open source advocacy in the late ’90s, and Web 2.0 in the aughts. Participatory markets are innovative markets; prematurely consolidated markets, not so much. The barriers to entry in the early PC market were very low, entrepreneurship high. Ditto for the Web, ditto for open source software and for Web 2.0. For late Silicon Valley, fixated on premature monopolization via “blitzscaling” (think Uber, Lyft, and WeWork as examples, and now OpenAI and Anthropic), not so much. It’s become a kind of central planning. A small cadre of deep-pocketed investors pick the winners early on and try to drown out competition with massive amounts of capital rather than allowing the experimentation and competition that allows for the discovery of true product-market fit.

And I don’t think we have that product-market fit for AI yet. Product-market fit isn’t just getting lots of users. It’s also finding business models that pay the costs of those services, and that create value for more than the centralized platform. The problem with premature consolidation is that it narrows the focus to the business model of the platform, often at the expense of its ecosystem of developers.

As Bill Gates famously told Chamath Palihapitiya when he was running the nascent (and ultimately failed) Facebook developer platform, “This isn’t a platform. A platform is when the economic value of everybody that uses it exceeds the value of the company that creates it. Then it’s a platform.” To be clear, that is not just value to end users. It’s value to developers and entrepreneurs. And that means the opportunity to profit from their innovations, not to have that value immediately harvested by a dominant gatekeeper.

Now of course, Sam Altman talks about creating value for developers. In a recent appearance at Sequoia Capital’s AI Ascent event, he said his hope is to create “like just an unbelievable amount of wealth creation in the world and other people to build on that.” But he uses the language of “an operating system” that others build on top of (and pay OpenAI for the use of) rather than a shared infrastructure co-created by an ecosystem of developers.

That’s why I’ve been rooting for something different. A world where specialized content providers can build AI interfaces to their own content rather than having it sucked up by AI model builders who offer up services based on it to their own users. A world where application developers can offer new kinds of services that enable others in a cooperative cascade.

Anthropic’s Model Context Protocol, an open standard for connecting AI agents and assistants to data sources, is the first step toward a protocol-centric vision of cooperating AIs. It has generated a lot of well-deserved enthusiasm. Google’s A2A takes that further with a vision of how AI agents might cooperate. NLWeb adds to that an easy way for internet content sites to join the party, offering both a conversational front end to their content and an MCP server so that it is accessible to agents.

This is all going to take years to get right. But because it’s a protocol-centric rather than a platform-centric vision, solutions can come from everywhere, not just from a dominant monopolist.

Every new wave of computing has also had a new user interface paradigm. In the mainframe era, it was the teletype terminal; for the PC, the Graphical User Interface; for the internet, the web’s document-centric interface; for mobile, touch screens. For AI (for now at least), it appears to be conversational interfaces.

Companies such as Salesforce and Bret Taylor’s Sierra are betting on conversational agents that are front ends to companies, their services, and their business processes, in the same way that their website or mobile app is today. Others are betting on client-side agents that will access remote sites, but often by calling APIs or even performing the equivalent of screen scraping. MCP, A2A, and other agent protocols point to a richer interaction layer made up of cooperating AIs, able to connect to any site offering AI services, not just via API calls to a dominant AI platform.

All companies need at least a start on an AI frontend today. There’s a fabulous line from C. S. Lewis’s novel Till We Have Faces: “We cannot see the gods face to face until we have faces.” Right now, some companies are able to offer an AI face to their users, but most do not. NLWeb is a chance for every company to have an AI interface (or simply “face”) for not just their human users but any bot that chooses to visit.

NLWeb is fully compatible with MCP and offers existing websites a simple mechanism to add AI search and other services to an existing web frontend. We put together our demo AI search frontend for O’Reilly in a few days. We’ll be rolling it out to the public soon.

Give it a try

We need a new…database?

Benn • Benn Stancil • May 16, 2025

Technology•Software•Databases•DataAnalytics•AI•Essays

On one hand, maybe calling Databricks a $36 billion mistake was a bit hyperbolic. Since I said that three years ago, the Nasdaq has crashed twice, and Snowflake, Databricks’ chief competitor, has gone from being a $70 billion company to a $60 billion company. Meanwhile, Databricks raised another funding round in January that valued the business at $62 billion. Uh, lol, whoops.

On the other hand, maybe it wasn't hyperbolic enough, and maybe the entire cloud database market was a mistake?

Like, if this blog is anything, it’s a stylized history of the last few years of data (and other concerns)—and here are some parts of that history:

Concern 1: Databases are really good now.

Companies collect tons of information about how their businesses work. They keep a ledger of customers’ purchases; they track clicks on their websites; they record your call for quality and training purposes. In the strange new world of the internet, we all emit billions of bits of structured digital exhaust—a like on a TikTok, an ad impression, a credit card swipe—and companies log it all.

Historically, this stuff was scattered across dozens of disparate systems. Today, it’s more centralized. Data is collected from a variety of sources, tidied up and cleaned, and carefully placed into a library of tables. If you were an analyst working for, say, the Charlotte Hornets, you could log into a single database and type, “Show me all the people we sent a marketing email to, and tell me if they bought a ticket to a game, and if they did, did we win the game, and did they buy any concessions?” Despite all of that data coming from different places, the magic of the entire modern data apparatus was that you could pretend that they didn’t.

Sure, this all a dramatic oversimplification, and nothing ever quite works this way in practice. Tables are rarely that well organized, there are often thousands of them, and they often overlap in confusing and contradictory ways. They’re frequently broken and out of date. And the questions people ask usually return messy answers: “Eh, wait, are these actually the people we sent marketing emails to? This doesn’t look right. Are we sure we’re logging this correctly? Oh, I think we used different campaigns for people who hadn’t been to a game before. No, that’s not it. Oh, no, that is it, we just did it wrong, and some people got both emails. But why does it say that this person who didn’t get an email clicked on one? Why does it say that this person who didn’t get an email clicked on 4,000? What is happening? Ah well, at least I don’t have to worry about whether or not we won the game.”

Nevertheless. That was the idea—a single pane of glass, for viewing all of your data—and over the last ten years, databases got a lot better at supporting it. They can hold, for all intents and purposes, unlimited amounts of information. They can run calculations over that data at nearly unfathomable speeds. They can be queried with many different languages. People can build custom apps on top of them. Or as I said a few years ago, comparing 2022 data stuff to 2012 data stuff:

The tools we have today—built and supported by thousands of people across dozens of companies—represent a profound leap forward from what we had then. And their effect extends beyond easing the daily frustrations of existing data scientists; they also made the work we did in 2012 accessible to a far greater range of companies and aspiring analysts and analytics engineers. Nearly every part of the industry is breathtakingly easier, faster, more powerful, and more reliable than it was a few short years ago.

….

Shared Memory, Knowledge Arbitrage, Why the Future of Creativity is Bright & AI Education FTW!

Implications • May 20, 2025

Technology•AI•Education•Innovation•Creativity•Essays

In this edition, we explore the evolving landscape of collective memory, the concept of knowledge arbitrage during platform shifts, the transformative impact of AI on education, the future of creativity, and share some off-the-record insights.

Me Becomes We: The Implications of Collective Memory

As AI-native companies develop new workflows, individual contributions are increasingly enriching the organization's collective memory. Tools like Glean, Notion, and Atlassian's Rovo facilitate enterprise-wide search across various documents and data, while platforms like Granola capture meeting notes. These tools are designed to integrate individual work into the organization's knowledge base, making it accessible to all members.

Consumer technologies such as ChatGPT and Claude are extending their memory capabilities, and it's anticipated that users will soon have the option to share their AI's memory with family and friends, similar to sharing a photo album or playlist. Looking ahead, as large language models (LLMs) remember our schedules, conversations, preferences, and purchases, sharing selective access to this memory with others could lead to a profound interconnectedness. This would enable loved ones to leverage—and even inherit—our accumulated knowledge, enriching their interactions and decisions.

In professional settings, colleagues could mine each other's interactions and insights, fostering unprecedented networking opportunities to advance business objectives. This evolution begins with shared memory through syncing data or selecting context windows (memories organized by theme) across families or teams. Ultimately, it could lead to literal brain melds when technologies like Neuralink enable direct brain-to-brain communication.

The Moment of Knowledge Arbitrage

We are at a pivotal moment of knowledge arbitrage during platform shifts. As new platforms emerge, early adopters can leverage their unique insights to gain a competitive edge. This period offers opportunities for those who can quickly adapt and harness the potential of these platforms to access and disseminate knowledge more effectively.

The Vastly Underestimated Impact of AI on Education

AI is transforming education in ways that are often underestimated. Beyond automating administrative tasks, AI is becoming a tool for personalized learning, adapting to individual student needs and learning styles. This personalization can lead to more effective teaching and learning experiences, fostering deeper engagement and understanding.

Why the Future of Creativity is Bright, Yet Different

The future of creativity is bright, albeit different from traditional notions. AI is not replacing human creativity but augmenting it, providing new tools and mediums for expression. This collaboration between human ingenuity and AI opens up new possibilities for innovation and artistic expression, leading to a renaissance of creativity.

Off-the-Record Insights

In addition to the above, we share some off-the-record insights that provide a glimpse into the future of technology and its implications for society. These insights offer a forward-looking perspective on the evolving relationship between humans and technology, highlighting the potential for growth, adaptation, and innovation in the face of rapid technological advancements.

Kara Swisher Hosts Fierce Debate On Future Of AI With Google VP, AI Ethicist

Youtube • Noema Magazine • May 15, 2025

Technology•AI•Ethics•Innovation•Regulation•Essays

In a recent discussion, Kara Swisher, a prominent tech journalist, engaged in a comprehensive conversation about the future of artificial intelligence (AI) with a Google Vice President and an AI ethicist. The dialogue delved into the rapid advancements in AI, its potential applications, and the ethical considerations that accompany its integration into various sectors.

The conversation began with an exploration of AI's transformative impact on industries such as healthcare, finance, and education. The Google VP highlighted AI's capacity to analyze vast datasets, leading to more accurate diagnoses in medicine, optimized financial strategies, and personalized learning experiences in education. However, Swisher raised concerns about the potential for job displacement due to automation, emphasizing the need for reskilling programs to prepare the workforce for new roles in an AI-driven economy.

Ethical considerations were a central theme in the discussion. The AI ethicist underscored the importance of transparency in AI algorithms to prevent biases that could perpetuate existing societal inequalities. They advocated for the establishment of ethical guidelines and regulatory frameworks to ensure responsible AI development and deployment. Swisher echoed these sentiments, stressing the necessity for global cooperation in creating standards that promote fairness and accountability in AI systems.

The conversation also touched upon the role of AI in content creation and media. Swisher expressed apprehension about AI-generated content potentially flooding information channels, making it challenging for consumers to discern credible sources. The Google VP acknowledged these challenges but highlighted ongoing efforts to develop AI tools that can assist in verifying information and combating misinformation.

In conclusion, the dialogue between Swisher, the Google VP, and the AI ethicist provided a nuanced perspective on AI's evolving role in society. While acknowledging the immense potential of AI to drive innovation and efficiency, they collectively emphasized the imperative to address ethical challenges and implement safeguards that ensure AI technologies are developed and utilized in ways that benefit humanity as a whole.

Sergey Brin, Google Co-Founder | All-In Live from Miami

Youtube • All-In Podcast • May 20, 2025

Technology•AI•Innovation•Leadership•Ethics•Essays

This interview with Sergey Brin, co-founder of Google, delves into the genesis, growth, and vision behind one of the world’s most influential technology companies. Brin shares insights on Google’s early days, emphasizing the foundational goal of organizing the world's information and making it universally accessible and useful. He reflects on the technological innovations that drove Google’s rapid expansion and how they have continuously sought to address complex information challenges through machine learning and AI advancements.

Brin discusses the evolution of Google's search engine and the importance of maintaining an extremely user-focused approach. He stresses that the company's success has hinged on relentless experimentation and learning from failures, fostering a culture that encourages innovation without fear. Notably, Brin highlights the impact of Google’s algorithms not only in search but in transforming broader digital landscapes like advertising, cloud computing, and hardware.

The conversation also explores Google's role in the broader tech ecosystem, including the ethical considerations involved in AI development and data privacy. Brin articulates a cautious optimism about AI's potential, emphasizing the need for responsible innovation frameworks to mitigate risks and ensure equitable benefits. He acknowledges societal challenges but is hopeful that technology, guided ethically, can contribute positively to solving global problems.

Brin touches on his current interests post-Google executive leadership, including projects at the intersection of technology and health, environmental sustainability, and longevity research. He envisions a future where tech continues to augment human capabilities and address critical challenges like climate change, healthcare, and education, leveraging AI and data science.

Key takeaways include:

The core mission of Google as an information organizer and the consistent user-centric innovation approach.

The pivotal role of AI and machine learning in evolving search and other digital services.

The culture of experimentation and learning from failure as central to Google's enduring creativity and growth.

Ethical vigilance in AI and data privacy as imperative for sustainable technological progress.

Brin’s contemporary focus on tech applications in health, environment, and longevity, reflecting a broader impact vision.

This conversation provides a nuanced understanding of Sergey Brin’s vision and leadership philosophy, illuminating how deep technical expertise combined with a pioneering mindset enabled Google’s transformational impact. It also underscores ongoing challenges and responsibilities the tech industry faces as it shapes the future.

How Kara Swisher Scaled Even Higher

Nytimes • Jessica Testa • May 20, 2025

Business•Management•MediaEntrepreneurship•Podcasting•MediaIndustry•Essays

Kara Swisher’s interviews made her famous among technology obsessives decades ago. She persuaded the rivals Bill Gates of Microsoft and Steve Jobs of Apple to play nice onstage. She reduced Meta’s founder Mark Zuckerberg, then just 26, to a puddle of sweat. She shoved her camera in the face of her future boss Jim Bankoff, Vox Media’s chief executive, among others.

But it wasn’t until she began podcasting that she reached an audience far beyond the tech world.

In 2018, she started “Pivot,” a news-chat podcast, with Scott Galloway, a serial entrepreneur and marketing professor who now has his own slate of brash business podcasts under the name “Prof G.”

They were an odd couple — she was grouchy, he was raunchy — but their banter was tender and intellectual when they weren’t torturing each other. Fans began stopping Ms. Swisher in public, recognizing the aviator sunglasses that had become a swaggering signature.

“I’d never made a product or a news thing that people thanked me for,” Ms. Swisher, 62, said in a recent interview at a cafe in the shadow of the National Cathedral in Washington, where she lives with her wife and children. “At the end of this long career, it’s like: ‘Oh, wow. I make something people really like.’”

So she and Mr. Galloway decided to assess its worth, shopping their portfolio of five podcasts around to other companies before their contract with Vox Media, their publisher, neared its end.

Competitive offers came in with guaranteed payments of about $40 million on four-year contracts, Ms. Swisher said. But in the end, they agreed to re-sign with Vox Media, with an unusual twist.

The deal does not carry any guarantees or upfront cash. The payday for Ms. Swisher and Mr. Galloway is instead based entirely on how much money their podcasts generate. Vox Media will pocket about 30 percent, while the co-hosts split the rest.

At the high end of back-of-the-envelope calculations — Mr. Galloway said the podcasts could generate $100 million in revenue over the four years — the pair would stand to make about $70 million excluding some costs. (A portion of the costs for their slate of shows is split among the hosts and Vox Media.)

The novel structure of the deal cements Ms. Swisher’s reputation for betting on herself. But it is also the kind of deal that could have wider implications, as more journalists follow Ms. Swisher’s example in fashioning themselves as new media entrepreneurs.

Ms. Swisher’s path to celebrity — a power broker who name-drops other power brokers — has taken her from The Washington Post to The Wall Street Journal to The New York Times, where she was an opinion columnist and host of a podcast called “Sway.”

Along the way, she co-founded two media businesses, AllThingsD and Recode; published three books; survived a mini-stroke; raised a family; and harbored few regrets. (Here’s one: “I was too nice to Elon for too long,” Ms. Swisher said of Elon Musk, the Tesla chief executive.)

She also learned a fundamental truth about herself: She does not want to be an employee, nor does she want to employ anyone. She wore a sweater to a White House Correspondents’ Association dinner party that warned people, or perhaps boasted, “I’m not for everyone.”

“Every day I get to decide what I do,” she said, “and it’s not dependent on anybody.”

….

The Agentic Web and Original Sin

Stratechery • Ben Thompson • May 20, 2025

Technology•AI•AgenticWeb•DigitalPayments•InternetEvolution•Essays

The concept of the "Agentic Web" represents a transformative shift in how artificial intelligence (AI) interacts with the internet. Unlike traditional AI applications that require human intervention, the Agentic Web envisions AI systems operating autonomously, making decisions, negotiating deals, and innovating without constant human oversight. This evolution is poised to reshape the digital landscape, enabling businesses to function more dynamically and efficiently. (forbes.com.au)

A critical component in realizing the Agentic Web is the integration of digital payments. The current reliance on advertising as the primary revenue model for online content has led to privacy concerns and a fragmented user experience. By incorporating seamless digital payment systems, a new content marketplace can emerge, allowing creators to monetize their work directly and users to access content without intrusive ads. This shift could address longstanding issues associated with the advertising-driven internet model. (theatlantic.com)

However, the transition to an Agentic Web is not without challenges. The current internet infrastructure is deeply intertwined with advertising, making a shift to digital payments complex. Additionally, concerns about data privacy and security must be addressed to build trust among users and content creators. Despite these hurdles, the potential benefits of an Agentic Web—such as enhanced efficiency, autonomy, and user experience—make it a compelling vision for the future of the internet.

The Anti iPhone

Spyglass • M.G. Siegler • May 22, 2025

Technology•Hardware•AI•VoiceComputing•ProductDesign•Essays

Yesterday, upon reading all the coverage about OpenAI buying io – which I'm going to continue to style as 'IO' for my own typing sanity – and especially watching the um, unique, video that Jony Ive and Sam Altman released to both formally announce IO and to talk a bit about what they're working on, it became pretty clear, pretty quickly that despite all the rumors to the contrary, the device wouldn't be a wearable.

Ive himself gave an interview just a couple weeks ago, hinting at what such a collaboration could be working towards – notably, a potential anecdote to smartphone addiction that Ive feels some level of remorse for having helped to usher into existence via his iPhone designs. Beyond that, all we get are whispers of "headphones" and "cameras" from WSJ sources. NYT talks vaguely about "ambient computing". What might this be? It's almost impossible to say, but I'm not sure it's exactly wearable, which is interesting. One thing it's not: a pair of smart glasses.

The key tell was the part of the video where Altman starts talking about how we're using the current "legacy" products, to use Ive's wording, to access future technology in the form of AI. It starts around 3:50 in:

"We have like magic intelligence in the cloud. If I wanted to ask ChatGPT something right now about something we talked about earlier, think about what would happen. I would like reach down, I would get out my laptop, I would open it up, I'd launch a web browser, I'd start typing and I'd have to like explain that thing and I'd hit 'enter' and I would wait and I would get a response. And that is at the limit of what the current tool of a laptop can do. But I think this technology deserves something much better."

Now, all of that could imply a wearable of some sort. But the key thing Altman seems focused on there is input, not necessarily the need to use it on-the-go. To me, this implies voice is the key of this device. Perhaps I'm biasing myself as I've been writing about this notion for years and years at this point. While the initial wave of devices leveraging Siri and Alexa got us closer to this type of computing, the truth is that the underlying tech wasn't good enough. Not nearly. We got sort of tricked because the voice recognition had finally gotten to the point where it worked well most of the time. But that actually wasn't the hard part, as it turns out. The hard part was the AI. OpenAI built the hard part first.

As I wrote almost exactly a year ago, right after the launch of GPT-4o and alongside it, the new voice mode for ChatGPT:

There were several points during OpenAI's demonstration of their new 'GPT-4o' model yesterday where I had to laugh. Not necessarily a "that's funny" laugh but more a "that's amazing" laugh. A profound laugh. A laugh to myself. A "this is it" laugh.

….

Venture Capital

The 10-Year Trend At Series B

Crunchbase • May 20, 2025

Business•VentureCapital•SeriesBFunding•ArtificialIntelligence•SiliconValley•Venture Capital

Over the past decade, Series B funding has experienced significant fluctuations, reflecting broader trends in the venture capital landscape. In 2014, the median Series B round was $11.7 million, with an average of $16.3 million. This figure saw a substantial increase, peaking in 2021 at a median of $32 million and an average of $46 million. However, by 2023, these numbers had declined to a median of $28 million and an average of $40 million, indicating a contraction in funding sizes. (xlera8.com)

The concentration of venture capital has also shifted notably. In 2024, the artificial intelligence (AI) sector dominated global venture funding, attracting approximately one-third of the total, amounting to over $100 billion—a significant increase from $55.6 billion in 2023. This surge underscores AI's growing prominence in the investment landscape. (vccafe.com)

Geographically, Silicon Valley maintained its dominance, securing $90 billion in venture capital in 2024, which accounted for 57% of global funding. This concentration is attributed to the region's strong AI presence, proximity to major tech companies, and a well-established startup ecosystem. (vccafe.com)

In terms of investment activity, the first half of 2024 saw an uptick in the number of companies raising funds and the number of deals done across Series A and B rounds. This trend suggests a renewed investor confidence and a more favorable environment for startups seeking growth capital. (ainad.net)

Overall, the past decade has been marked by significant volatility in Series B funding, influenced by sector-specific booms, regional dynamics, and broader economic factors. While the peak funding years have passed, the landscape continues to evolve, with AI and established tech hubs like Silicon Valley playing pivotal roles in shaping the future of venture capital investments.

The Production Capital Mosaic

Venturedesktop • Brett.Bivens • May 21, 2025

Business•Strategy•ProductionCapital•IndustrialInnovation•InvestmentModels•Venture Capital

A few weeks ago, Will Godfrey (CEO, Tangible) and I co-wrote a piece titled The Rise of Production Capital. For several years, I’ve used “Production Capital” to refer to a wide and growing range of approaches for financing the emerging physical technologies aimed at transforming critical industries like energy, aerospace and defense, manufacturing, materials, and transportation.

The term is a nod to Carlota Perez’s seminal framework for understanding technological revolutions, particularly the constructive deployment “golden ages” that follow from periods of i) technological “installation” and ii) intense socio-political tension and conflict, wherein:

Constellations of convergent innovations create the building blocks that enable a new class of innovators to transform key industries.

Technology is rapidly adopted across industries, extending its reach beyond geographically limited innovation hubs to benefit a wider segment of society.

Capital flows into real businesses contributing fundamental value to the economy.

This magnitude of the deployment age is captured by BlackRock’s estimate of the impending $68 trillion global infrastructure investment boom, unfolding in an era increasingly defined by what Russell Napier calls “National Capitalism”, where state priorities reshape capital allocation toward energy security, industrial capacity, and technological sovereignty.

With that (still broad) framing in place, I thought it would be helpful to sketch out a mosaic of the types of firms and companies I’ve seen focused on this. The use of the term “mosaic” is intentional. This isn’t a comprehensive market map or a clean framing of the so-called “capital stack”.

The boundaries between these models are often blurry. Most are still a work in progress, not yet fully legible to the institutional capital allocation world that cements the clean lines between asset classes and financial products over the long term. These organizations are also, to lean on the scientific definition of mosaic, typically “composed of cells of two genetically different types” – founder x financier; venture x infra; physical x digital.

This entrepreneurial nature of Production Capitalists is captured well by Perez:

"Financial capital can successfully invest in a firm without much knowledge of what it does or how it does it. Its main question is potential profitability, sometimes even just the perception others may have about it. For production capital, knowledge about product, process, and markets is the very foundation of potential success."

Carlota Perez, Technological Revolutions and Financial Capital

That these organizations transcend straightforward categorization is what creates their opportunity.

This is also an exercise to understand what I am missing. So if I have omitted categories or interesting approaches, please let me know!

Things Shaped Like an Investment Firm

Venture + Capital Markets Connectivity → "Unlock downstream financing" has always been a core VC job to be done. Diverse downstream capital needs arrive early in the physical technology company life cycle, creating an opportunity for specialist firms to earn a spot on the cap tables of the best emerging industrial companies by building a capital markets function on behalf of their portfolio. Some venture firms do this well informally, but few (none?) have developed this as a systematic platform capability. By helping founders optimize around structure, strategy, and capital markets connectivity, firms can have a substantial impact on the metrics that matter to them, like dilution over time (equity efficiency) and set companies up for more efficient subsequent financings.

“GAP” (Growth and Project) Capital → The "Compound Startup" of the Production Capital universe. Vertical integrators, building a system of capabilities that spans venture, project development, financial engineering, and industrial business development to power companies through the proverbial valley of death. The problem is abundantly obvious, but the ability to commandeer and coordinate the capital and cultural resources (i.e. world world-class talent across several disciplines from day one) to make this model a reality – as The New Industrial Corporation has done – is hyper-scarce. (h/t Will Dufton from Giant Ventures for the term GAP capital)

Modern Merchant Banks → A more flexible, “fundless” variation of the first two models, leaning into the diverse nature of capital problems to be solved inside new industrial businesses. Bespoke capital support via advisory and strategic positioning, systematic capital markets connectivity, and investment (via balance sheet or SPVs) – mirroring the way entrepreneurial financiers of previous eras built centrality during industrial shifts.

SPACs and PIPEs → Will value distribution in the new industrial ecosystem more closely resemble Silicon Valley (power law) or the German Mittelstand? If it is the latter, and if the barriers to going public remain for mid-sized companies (roughly $100m - $10b in value) we might see a revival of SPACs – ideally wielded more responsibly – to raise large amounts of capital needed for industrial scale-up, align with strategic investors, simplify access to government programs, and use public equity as M&A currency. Nuscale is a rare success story here, while blank check companies like Perimeter are emerging with this angle in mind.

Venture Turnarounds → Industrial technology scale-up and venture equity are not always perfectly compatible (as this list conveys). As more venture capital has flowed into the physical economy, more companies are finding themselves in a position with strong IP, physical assets, and commercial traction but misaligned cap tables, organizational structure, and operating models. This creates an opportunity to restructure and reaccelerate these businesses more sustainably. Jeremy Giffon discussed this on TBPN, and I am aware of a few efforts behind the scenes, but haven’t seen any public announcements.

New SaaStr on 20VC! “The VC Playbook: What’s Working in 2025”

Saastr • Jason Lemkin • May 16, 2025

Technology•AI•VentureCapital•Fundraising•Leadership•Venture Capital

We’ve back this week on 20VC with Harry and Rory from Scale for another great deep dive on the latest in VC funding and more. We kick off with a quick deep dive on Vertical SaaS leader for restaurants Owner raising at $1 Billion — a deal SaaStr Fund led at seed. Why was it so hot?

5 Key Takeaways

Capital is plentiful for the right metrics: Companies growing 10%+ MoM with $40M+ ARR can still close $100M+ rounds in days, while Series A rounds overall are down 81%. The divergence between haves and have-nots has never been greater.

AI is creating urgency but also fear: CMOs and other executives are buying AI tools out of fear of becoming obsolete, creating a gold rush for companies like Clay that position themselves as job-saving solutions.

The trillion-dollar investment thesis: VCs are now evaluating deals based on “odds of trillion-dollar outcome” rather than traditional metrics, justifying seemingly irrational valuations (like Perplexity at $14B) for companies with even a small chance at massive outcomes.

Non-technical CEOs can win in AI: Despite conventional wisdom, OpenAI is dominating with non-technical leadership because they excel at recruitment, empowerment, and strategic partnerships.

Winning today requires aggressive capitalization: The playbook for category winners is to raise more than needed and “scorched earth” the competition, as the pace of innovation and competition in AI-enabled categories is unprecedented.

Why Series A Is Hard (But Great Companies Still Get Funded)

Reports show Series A rounds are down 81% – but this is actually normal. The seed round is the “believe in the team” round, while Series A is the “show me the traction” round. And traction is hard to manufacture.

The key insight: Don’t go fundraising for a Series A unless you’re certain you have what it takes. Smart companies sometimes choose to delay raising until they have undeniable metrics.

For founders: If you’ve built a B-tier startup that could get funded in 2021 but can’t today, that’s just market reality. The bar has gone up. The best startups with stellar metrics still get 5+ term sheets.

The New Fundraising Timeline: Preempts Getting More Aggressive

The competition for quality deals has become so intense that Series A investors are asking “how quickly after the seed can we preempt?” Often this happens just 2-3 months after a company’s seed round.

Why this works: If a company has grown 50% in just two months since you first met them and you’ve already done your diligence, why wouldn’t you move? The best companies in high-growth markets have the highest velocity of fundraising.

Hard truth: If you’re not tracking your top 10-20 companies you want to invest in over the next 12 months, you’re doing it wrong. The days of “wandering around hoping stuff will turn up on Monday that will make you money by Wednesday” are over.

….

Why VC and software have PE envy

Mtb • Matt Brown • May 13, 2025

Business•Startups•VentureCapital•PrivateEquity•VerticalSoftware•Venture Capital

Imagine you’re the world’s most entrepreneurial dentist, the Mark Zuckerberg of molars. You’re great at cleaning teeth, but you’re also great at running a practice. You have your own playbook for the dental business.

Thanks to your playbook, your practice is larger and more profitable than the market average. You’ve surveyed your dentist friends. You’ve learned that you’re the best at acquiring patients, running your back office, configuring your CRM to minimize cancellations, and getting paid quickly. But you aren’t satisfied with cleaning teeth all day. You want to build a dental empire. The gap between the average business and what’s possible with your playbook is your opportunity.

How do you start your empire? Until recently, there were two broad and distinct paths: private equity (PE) and venture capital (VC).

In the PE model, you’d raise money to acquire a controlling stake in one or more practices. Then you would have full control to implement your playbook and manage those practices day-to-day.

In the VC model for B2B software, you’d raise money to start a company that builds software that codifies your playbook for any practice to implement. Maybe it’s a suite of CRM, scheduling, and billing tools, with opinionated workflows and design choices specifically for dental practices. You wouldn’t own or manage any practices directly, but your software would help them run better.

Both models start with the same principles: (1) the average company in a given vertical isn’t run as effectively as it could be, and (2) you have the insights and playbooks to run the average company more effectively. You believe you can close the gap between the blue and green dots, and get paid handsomely for it.

However, the PE and VC models take very different approaches to point 2. The tradeoffs of each model are most obvious in their approaches to control, concentration, and value capture.

The PE model is high control, high concentration, and high value capture. It says, “This specific business can be run better, and so it’s likely undervalued. I’m going to buy and run it, applying my playbook. As the business grows and becomes more efficient, it will become more valuable. I’ll benefit from the increased equity value.”

The VC model (at least within B2B software) is low control, low concentration, low value capture relative to an individual business. It says “There are lots of businesses in this market, and most of them could be run better. I’m going to build software that helps them do that. I’ll charge a small fee, but will sell it to many businesses.”

The PE and VC models are extreme ends of a spectrum, rather than distinct models. PE and VC firms are both in the business of generating returns for their investors. They take capital, combine it with their belief in the superiority of their playbook, and then implement their strategies and playbooks in a given vertical. This may involve buying businesses or building tools to enhance their performance, generating profits, and returning the profits to their investors.

Until recently, you’d be forgiven for thinking PE and VC are effectively distinct entities. However, headlines are making it more apparent that they’re just a spectrum of strategies and that there’s a lot of white space in between them.

Why are VCs (and the companies they fund) adopting PE-like strategies? Let’s explore.

In seeking outsized returns, VCs and venture-funded startups are venturing beyond their previously narrowly defined model. They’re getting more creative and aggressive in exploring the messy middle, the whitespace between the previously distinct PE and VC ends of the spectrum.

Several factors are behind this move towards the messy middle. Some are pushes from the traditional VC model: the classic, almost boutique approach of minority investments in asset-light, high-growth, all-or-nothing, power-law-seeking, software-first-and-only startups. As this model gets more competitive, smart founders and investors realize they must try something different. At the same time, several powerful factors are pulling toward these new models: new technologies and business models seem to enable venture-like returns from traditionally non-venture-type businesses.

The push side is well-documented: the traditional VC asset class has become saturated, especially in B2B SaaS. Nearly a trillion dollars have flowed into the venture industry in the last decade. This has led to a proliferation of companies serving every vertical and every niche.

At the same time, AI promises to further reduce the cost of software development. That isn’t to say that the B2B SaaS market is going to zero, or that there won’t be another generational B2B SaaS business. But the noise and saturation make it harder for these companies to grow quickly while retaining customers and high margins. There aren’t many land grab opportunities in pure SaaS like there were in the 2010s.

Even for companies with great products, it’s getting harder to sell to businesses with SaaS fatigue. To return to the original dental example: suppose you (the entrepreneurial dentist) build the best vertical software for dental practices. Your target customers are already inundated with such pitches. The same is true if you’re pitching the most well-oiled acquisition strategy for underperforming practices. It’s hard to sell them a genuinely better product, and it’s also hard to convince them to sell their businesses.

If 198 Pieces of Unsolicited, (Possibly) Ungoogleable Advice for Founders Were Not Enough

Cupofzhou • David • May 17, 2025

Business•Startups•Fundraising•Governance•Hiring•ProductManagement•Venture Capital

This is my third iteration of the 99 series for founders. You can find the first two here and here. The premise for this series was simple. The best, most insightful, unsuspecting lessons are hidden in the deepest, darkest corners of the internet. Hell, many more are hidden in rooms behind closed doors. The goal of this 99 series is to unveil those. Advice you’ve likely never thought about, and most likely have never heard of.

While you don’t need to read all the below at once, it’s helpful to keep the below at your fingertips for when you do need them. As always, unless the advice is not cited, all advice has been backlinked to its source, in case you want the longer, sometimes more nuanced version.

To make it easier for you, I’ve also pooled the advice in categories, depending on your needs:

Fundraising

Governance

Hiring/Team/Culture

Product/Customers

Competition

Legal

Expenses

Secondaries

P.S. Have I started the next one in the 99 series for founders? Yes, I have. Stay tuned!

Fundraising

1/ “Once you take venture capital, the venture capitalist’s business model is your business model. You’ve got to get liquid at a number that makes sense for them. High valuations are good because you take less dilution. Et Cetera. But the reality is that when you have a high valuation, that starts to eliminate your options.” — Chris Douvos

2/ The employee option pool is easier to negotiate than asking an investor to take less ownership. The pool at the time of term sheet comes out of founder/team’s equity. If the pool becomes completely allocated post-investment, you need to go back to the board and ask for a larger pool, and everyone (you and VCs) gets diluted then.

3/ Beware of the “senior pari-passu,” which means that that investor gets paid back before everyone else on the preference stack AND they get equal footing with all the other investors. If one investor has this, subsequent rounds may demand the same.

4/ Repeat founders often ask for co-sale right immunity (usually 15%) when putting together term sheets. Co-sale rights give investors first dibs on buying your equity if you sell before a liquidity event, and they can sell alongside you. This can send negative market signals.

5/ If any corporates own more than 19.5% of a company, they must treat your company as a subsidiary for accounting, making them less valuation sensitive.

6/ You’re likely not the only one in market with your solution. A competitor raising a massive round signals market validation, not necessarily a reason to change your pitch. Only change your pitch if customers prefer the competitor.

7/ “Once you have $500k+ raised, spend 2/3 of your time on funds, 1/3 on small checks.” — Ash Rust

8/ Beware of SAFE overhangs. Avoid raising more than 25% on SAFEs compared to the next priced round. — Martin Tobias

9/ Don’t say “The market is so large, there are room for many winners.” To a VC, that sounds like you’re being beaten by competition. — Harry Stebbings

10/ If many employees lack startup experience, carefully decide how and when to be transparent about company realities; startup experience level will influence whether transparency helps or hurts. — Javier Soltero

11/ To fundraise, even if your recent months were tough, show three months of strong growth before fundraising. — Jason Lemkin

12/ Revenue growth benchmarks for VCs: before $1M ARR, grow 10-15% monthly; around $1M ARR, 8-10%; around $10M ARR, ideally doubling.

13/ “An investor is an employee you can’t fire.” — Vinod Khosla

14/ “Things that break the rules have a bigger threshold to overcome to grab attention but tend to have stronger, more dedicated followings. Blandness gets fewer dedicated followers.” — Brandon Sanderson

15/ Great worldbuilding with poor characters/plot is just an encyclopedia; great characters and plot with weak worldbuilding can still be excellent. This applies to markets and teams as well.

16/ In all great stories, the protagonist (pitch) is proactive, capable, and relatable. Your pitch should show at least two of these. — Brandon Sanderson

17/ “Data rooms are where fundraising processes go to die.” Prioritize live conversations, ask for 15 minutes on investor calendars to prepare info. If they refuse, you’ve lost the deal. — Mark Suster

18/ “Second conversation with a serious investor explores what you’re trying to prove and to whom.” — Fund III GP

19/ “Set your own agenda or someone else will.” — Melinda Gates

20/ “The ‘raise very little’ strategy only works if the market is believed tiny or unimportant. If others pay attention, you must beat the next guy.” — Parker Conrad

21/ Beware of stacking SAFEs, model founder ownership to stay above 50% pre-Series A. — Itamar Novick

….

The Bar Today for a Series B

Saastr • Jason Lemkin • May 17, 2025

Business•Startups•Funding•SaaS•SeriesB•Venture Capital

In the world of SaaS startups, securing Series A funding is an achievement worth celebrating. At least for a day :). It’s a sign you’ve hit Initial Traction.

But each round usually gets harder. Successfully graduating to Series B takes a lot of strong growth and metrics.

The latest data from Carta analyzing 10,755 US Series A startups offers a revealing look at these graduation rates – and there are important lessons for B2B founders to absorb.

The comprehensive Carta data reveals several critical insights about Series A to B progression:

Time Horizon Matters Tremendously: The probability of securing Series B funding increases substantially over time. For cohorts with sufficient maturity (2018-2020), we see progression rates reaching 40-50%+ by Year 4, compared to just 1-4% in the first quarter after Series A.

Vintage Effect Is Real: Startups that raised Series A between 2018-2020 show higher Series B graduation rates than those raising in 2021 or later. The 2020 Q1 cohort shows particularly strong performance, with over 55% reaching Series B by Year 4.

The Recent Funding Winter: There’s a visible cooling in graduation rates for startups that raised Series A from 2021 onwards, with significantly lower progression percentages across all time horizons.

Signs of Recovery: As the chart annotation indicates, there are “signs of life” with graduation rates “inching back up in more recent cohorts” – a cautiously optimistic indicator for the current fundraising environment.

What This Means for SaaS Founders

Plan for the Long Haul

The data makes it clear: the path to Series B is a marathon, not a sprint. For SaaS companies specifically:

Most successful Series A companies take 2-3 years to secure Series B funding

The median time between rounds is approximately 24 months

Only a small minority (typically under 10%) secure follow-on funding within the first 6 months

Action item: Structure your Series A round to provide at least 24-30 months of runway, with contingency plans for extending it if needed.

Understand the New Metrics Bar for SaaS Series B. The funding environment since 2021 has reset expectations. Today’s Series B SaaS companies typically need to demonstrate:

$4-8M in ARR (up from $2-4M pre-2021)

2-3x YoY growth (with some flexibility for higher efficiency)

Clear path to profitability with improving unit economics

CAC payback periods under 18 months

Net revenue retention above 110%

Action item: Build your post-Series A strategy around achieving these specific benchmarks rather than vanity metrics.

Capital Efficiency Is the New Growth

The data shows that 2021 was a turning point, with graduation rates dropping significantly. This coincides with the shift from “growth at all costs” to “efficient growth”:

Companies that raised Series A in 2020 or earlier could often secure Series B primarily on growth metrics

Post-2021 companies face stricter scrutiny on burn rate and capital efficiency….

FOUNDERS: stop reimbursing your VC’s legal fees

Auren • Auren Hoffman • May 22, 2025

Business•Startups•VentureCapital•LegalFees•FounderFriendly•Venture Capital

I remember the terrible feeling after wiring $38,432 to a law firm that did not represent me ... it represented the venture capitalists negotiating against me. Everything about it felt wrong.

Ramen-eating founders should not be footing legal bills for billionaire venture capitalists. Yet that’s still the industry default.

The most outrageous term-sheet item is also the most common. Almost every VC asks their founders to reimburse their legal fees. I’ve raised more than 15 priced rounds in my career and paid my VC’s legal fees every time.

Any VC that does this is the opposite of founder-friendly. VCs should pay their own legal fees.

And these legal fees aren’t cheap – it is not uncommon for a venture capitalist to ask for a $50k to $100k reimbursement on a $5 million round. That’s like hiring a good software engineer for six months—gone to lawyers in a single wire. It’s a charge to the companies of 1-2% of the round right off the bat.

These fees are very dilutive to the company and they actively incentivize lawyers on both sides to rack up billable hours. Most of these deals have a legal fee cap but guess what happens when you set a cap? The lawyers work hard to meet it.

VCs: “We back scrappy underdogs.”

Also VCs: “Pay our legal fees which costs more than your salary.”

Parkinson’s Law says that work expands so as to fill the time available for its completion. You will never, ever get a bill from the opposing counsel’s lawyers that is less than 90% of the legal fee cap. The VC’s lawyers have no one watching their costs. And every $2,000 they bill is usually at least a day delay in closing.

Founders should not be funding VC legal fees.

It's like inviting a poor friend over for dinner and charging them for the ingredients.

Double-Taxing Shareholders and LPs

This practice is not just unfriendly to founders … it is also unfriendly to LPs.

“Our endowment shelled out over $3 million last year for ‘deal expenses’ we never approved,” confessed one large university LP.

By having portfolio companies pay for a VC’s legal expense, the VC is essentially backdooring another expense that LPs will never see or audit.

This is because VCs are billing the legal fees to the fund without explicitly telling their LPs about these billing practices. That is just wrong.

Most people don’t realize that venture firms split their expenses between the management company, which collects the ~2% annual fee, and direct charges to LPs in their funds. Costs like deal diligence, fund administration, banking, annual meetings, and even travel are sometimes passed through to LPs. Meanwhile, the 2% management fee is carefully protected to fund large GP salaries.

So why not just pass the legal fees to the LP? Well, VCs are required to report fees passed through to LPs, and these fees face scrutiny (because they are additional fees that come directly out of the LP’s pockets) and must go through a deep audit.

So the VCs elect to backdoor the fees.

It is kind of unseemly.

And it might not even be legal.

Most VCs already over-bill their fund for things they shouldn’t and overly hurt their LPs. But at least most of these expenses are explicit and categorized and the LPs can see them. Hidden fees to the fund are against the spirit of being a limited partner.

Expensing a VC’s legal fees takes advantage of BOTH the company’s shareholders and the VC’s shareholders. It is doubly bad.

It is both founder unfriendly and LP unfriendly.

Why This Bad Practice Persists

The only logical answer is because they can. Because no one fights back.

While 98%+ of VCs do this, not EVERY VC does this. When I did my first VC deals, I reflexively asked founders to reimburse my legal fees … but quickly ended the practice because it is extremely unfriendly to both founders and LPs. Plural (a highly regarded European VC), Flex Capital (where I work), Relentless, and Y Combinator all have an explicit policy of not asking their portfolio companies to cover their legal fees. If you know of other VCs that are truly founder-friendly, please comment or email me and I will add them here. We can celebrate them.

Founders—everything is negotiable. Start with these asks:

“Line-item ‘Legal Fees: $0’—the VC pays their own.”

Go further: add a “delay-penalty clause": for every extra week caused by the VC’s counsel, the VC reimburses the company $5k.

Who Else Can Fix It?

YC already popularized the SAFE which usually does not need legal fees because of its simplicity. YC should go one step further and specifically tell VCs that it will discourage its founders from working with investors that push founder-unfriendly terms in priced rounds.

Big LPs also can put pressure on VCs to change the practice. LPs should require VCs to report any backdoor fees to the funds.

Let’s change this bad practice.

Founders should not be funding VC legal fees.

It's like inviting a poor friend over for dinner and charging them for the ingredients.

Every VC’s slogan:

📝 “We’re founder friendly.”

Yet every VC term sheet:

📝 “Please reimburse our $100K legal bill.”

Cool cool cool.

any VC that tries to force companies to pay their legal fees, by definition, founder unfriendly. next time you get a term sheet like that, ask the VC if they are having money problems.

forcing little companies to pay legal fees is an insult.

VCs: “We back scrappy underdogs.”

Also VCs: “Pay our legal fees which costs more than your salary.”

HT: Lily Petherick, Rajal Patel, Sush Bhardwaj of Flex Capital.

Seed Investing At Scale | David Tisch, Managing Partner at BoxGroup

Youtube • Uncapped with Jack Altman • May 22, 2025

Business•VentureCapital•SeedInvesting•StartupFunding•Entrepreneurship•Venture Capital

David Tisch, Managing Partner at BoxGroup, discusses the evolution of seed investing and the strategies that have contributed to his firm's success. BoxGroup, established in 2007, has invested in over 500 seed-stage startups, including notable companies like Plaid, Ro, Ramp, and Stripe. (thetwentyminutevc.com)

Tisch emphasizes the importance of being an early believer in a startup's potential. He notes that securing the first investment is often the most challenging, yet it provides founders with the confidence and momentum to move forward. BoxGroup prides itself on being that initial supporter, aiming to be the second or third largest check in a round, with investments typically ranging from $250,000 to $1 million. (greenbayhotelstoday.com)

The firm's investment approach is collaborative, focusing on supporting founders without overemphasizing ownership stakes or board seats. Tisch highlights that BoxGroup makes about 40 investments annually, seeking to be part of founders' journeys without dominating them. (deciphr.ai)

In terms of portfolio construction, Tisch acknowledges the challenges of increasing ownership stakes in later funding rounds due to competition from larger firms. He suggests that maintaining ownership is more about building strong relationships with both founders and other investors rather than aggressively seeking higher stakes. (deciphr.ai)

Tisch also discusses the impact of multi-stage funds on seed rounds, noting that while larger funds can lead to increased competition, they also validate the market and attract more attention to the sector. He believes that the key to success in seed investing lies in identifying exceptional founders and supporting them through the various stages of their company's growth. (thetwentyminutevc.com)

Overall, David Tisch's insights provide a comprehensive understanding of the dynamics of seed investing, emphasizing the importance of early support, collaborative partnerships, and strategic portfolio management.

AI

AI Adoption Among Private SaaS Companies and Its Impacts on Spending and Profitability

Saas Capital • Nick Perry • May 16, 2025

Technology•AI•SaaS•Adoption•Profitability

Since the launch of ChatGPT in late 2022, AI has dominated both discourse and funding dollars in the SaaS industry. With opinions ranging from existential threat to limitless opportunity, we were keen to extend our annual survey to cover several questions on AI in order to glean just how it is being incorporated by private SaaS companies and what the impact has been to date on spend. Below are our key takeaways:

AI utilization is not limited to several large companies or young start-ups. Roughly three-quarters of our respondents are using AI in their day-to-day operations or product.

The majority of respondents are using limited AI functionality to complement their core software offering, but the role of AI is expected to expand going forward.

At the margin, AI utilization strategies to date appear to be supporting companies’ drive to profitability rather than a renewed emphasis on growth at all costs.

Teasing out the impact of AI on particular spending categories is not possible without an understanding of how each company is approaching its AI strategy and accounting for its AI spend.

Nevertheless, we do note the following broad conclusions when comparing companies with $1–20 million ARR that are using AI in operations and product vs. similarly sized companies using no AI. The former group of companies reported higher COGS as well as selling and marketing costs, and lower R&D and G&A expenses relative to companies not using AI.

AI Adoption has been Broad-Based and is Likely to Accelerate

As part of our annual survey, we asked respondents several questions about their use of AI both in their operations and in their product. Their answers reflect the breadth of AI adoption among our universe of private SaaS companies.

Over 76% of respondents indicated they were using at least some amount of AI in their existing products, and 69% are deploying AI solutions in their day-to-day operations.

Now, it bears stating that what is termed AI can mean vastly different things to different operators; nevertheless, the conclusion is unmistakable: AI (broadly defined) has been widely incorporated by SaaS companies.

This conclusion holds regardless of funding type (i.e., if the company is bootstrapped or equity-backed). There is a slight preference for bootstrapped companies to deploy AI in operations (70% of respondents) compared to equity-backed companies (66%), whereas equity-backed companies were somewhat more likely to have built AI functionality in their product: 79% vs. 71% for bootstrapped companies.

Interestingly, AI adoption in product appears to be the typical first step for companies. While we did not ask respondents to specify the timeline of their AI adoption in operations vs. product, we can derive an informed guess by comparing the number of companies using AI in their product that are also using it in operations and vice versa. Of the companies that deployed AI in their product, 50% were also using AI in their daily operations.

Conversely, 88% of companies that had AI in their operations were also using it in their product. This supports the conclusion that, in general, companies are first deploying AI in their product before implementing it in their daily operations.

If the breadth of AI adoption is not in doubt, its depth is a more nuanced matter. We asked companies to specify whether AI was a limited, significant, or predominant piece of their product. The majority of companies reported having limited AI functionality around their core software product. Interestingly, the same percentage of companies reported using no AI in their product as the combined percentage of companies that reported their product was either significantly or predominantly/entirely AI.