A reminder for new readers. That Was The Week includes a collection of my selected readings on critical issues in tech, startups, and venture capital. I selected the articles because they are of interest to me. The selections often include things I entirely disagree with. But they express common opinions, or they provoke me to think. The articles are sometimes long snippets to convey why they are of interest. Click on the headline, contents link or the ‘More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below.

Congratulations to this week’s chosen creators: @ShapiroDoug, @freddiesubstack, @nmasc_, @loganbartlett, @armon, @HashiCorp, @willknight, @DebateThoughts, @Kantrowitz, @DanMilmo, @thewendylee, @mariella_moon, @virtualnomad, @TaraCopp, @psawers, @ingridlunden, @adcock_brett, @elonmusk, @beehiiv, @Figure_robot

Contents

Editorial: Where is the Money?

$6.4B Deal: HashiCorp Co-Founder Reflects 48-Hours After Selling to IBM

Nick Bostrom Made the World Fear AI. Now He Asks: What if It Fixes Everything?

OpenAI to use FT journalism to train artificial intelligence systems

Eight US newspapers sue OpenAI and Microsoft for copyright infringement

Washed Out’s new music video was created with AI. Is it a watershed moment for Sora?

AI Faces Its ‘Oppenheimer Moment’ During Killer Robot Arms Race

An AI-controlled fighter jet took the Air Force leader for a historic ride. What that means for war

beehiiv

Figure Robot on 60 Minutes

Editorial: Where is the Money?

Doug Shapiro has a very impressive Substack - The Mediator. He is my go-to source for anything related to Media (big M). This week he published -

This lengthy essay asks where the money is in the video industry and goes to great lengths to show that there is no new money and has not been for years. He documents the decline of broadcast networks and the rise of streaming and social media, and his big conclusion ( my interpretation) is that there is no more money; it is just changing hands.

Doug states that his work assumes

the inclusion of YouTube and exclusion of other short form (although the inclusion of TikTok and Reels wouldn’t change the story much). With that squared away, looking at both the waterfall build for last year and the time series of these data yields a couple of conclusions.

His work disabuses many myths, including one I believed, that live sports would move online and grow revenues from video:

Going forward, an important and largely unanalyzable factor will be the competitive bidding dynamic for sports rights. Obviously, if there is significant consolidation among traditional media companies or if Amazon, Apple and/or Google decide to pull in their horns, that might reduce the demand for sports rights and, consequently, rights fees.

His chart demonstrates that sports is an attractive category. He believes there will be a lot of competition to acquire rights, but he does not believe that the total wallet to spend on video will grow.

I agree with him, but only because the sports franchises are challenged to consider their asset's value. I’m most familiar with the premier league in the UK. Here, each week for 38 weeks, there are 19 games. The total audience is well over 2 billion. If each person paid an average of $1 a game, that equals 38x2 billion at a minimum, or $76 billion. The league sells the rights globally for four years. The most recent deal for UK rights was 2024:

The latest domestic EPL media rights deal is worth a total of £6.7 billion over a 4 year cycle, beginning with the 2025/26 season. (National Law Review)

The rest of world rights will be higher when the conclusion is reached. From the same article:

Since this latest EPL deal covers the UK domestic rights only, the next round of overseas broadcast EPL deals will be eagerly anticipated. In February 2022, it emerged for the first time that the value of the EPL’s UK broadcast rights (£5 billion for the period 2022-25) would exceed the value of its overseas rights (£5.05 billion for the same period). Several analysts have forecast that the value of these overseas rights deals look set to increase further.

Suppose the total is £15 billion ($18.5 billion). That translates to $4.65 billion a season. Less than 6.5% of valuing the sport at $1 per viewer.

The league cannot unlock that value without directly selling the games to fans. I guess $1 a game is well below the achievable average. With the rise of Apple Vision Pro and Oculus now open source, the audience for streamed games with in-stadium-like viewing experiences will multiply this greatly.

The obvious course is to build a direct technology stack and provide a global stream that is wholly owned. In that case, the revenues would dwarf current forecasts. But the chances of a conservative, technology-challenged leadership going down that path are low. So, in the end, Doug will probably be right.

The same question about “Where is the Money?” runs through Freddie Deboer’s essay about writing. “Publishing is Designed to Make Most Authors Feel Like Losers Even While the Industry Makes Money”.

Freddie is a writer of books. He focuses on the power law of publishing. Most of the rewards go to a small number of writers. He does not believe that Substack, or this week’s startup of the week beehiiv, will be able to bring money to more creators materially.

Substack has championed writing and writers, for which I’m very grateful, but of course it’s a financial necessity for them to oversell the amount of opportunity out there on their platform. Here’s the reality: there’s always been far more entrants into creative fields than those industries can bear in terms of providing people with a living, and the digital tools that have torn down barriers to entry have simply increased the competition and made the overall Pareto distribution even more brutal. That’s not gonna change, no matter how many of the gatekeeping industries go down. You can’t have a society where no one feels fulfilled unless they’re an actor or a musician or a novelist, but that appears to be the exact culture we’re building, and it’s tough.

Freddie is right, of course. Thank goodness I don’t write this editorial or work on the curated pieces for payment. Writing it helps me think and be relevant, and I get attention from about 60,000 of you each week. In some manner, that translates into my earning ability - but not directly. Some of you do subscribe, but most do not.

The money is in having a skill that connects with a large enough or wealthy enough audience willing to pay.

Many venture capitalists are betting on the likelihood that individuals will be able to build $ billion businesses using AI rather than hitting people, and some will, of that I am sure. Marc Andreessen and Ben Horowitz discuss it here:

The future of earning does involve having something worth buying. Individuals will also be able to scale their earnings using new tools. Let’s see how it goes.

Essays of the Week

Video: Follow the Money

A Holistic View of the U.S. Video Value Chain and Some Surprising Insights

DOUG SHAPIRO, APR 28, 2024

You might think that sizing the market for an industry is relatively straightforward. But that’s often not true, for reasons that include: 1) lack of data; 2) no authoritative source of data; and 3) no consensus definition of what constitutes the industry.

Let’s take music. The IFPI (International Federation of the Phonographic Industry) is the authoritative source for recorded music revenue globally (Figure 1), so that’s good. Even so, this is an incomplete picture of the music industry, because it excludes music publishing, live events and merchandise. For that matter, depending on the goals for the market sizing, “music” may be the wrong definition. Perhaps it should be “audio,” and include terrestrial radio, satellite radio, podcasting and audiobooks?

In this post, I provide a holistic view of the video value chain in the U.S. This includes both the buildup of total video revenue (where it comes from)—including traditional TV, streaming, selected short form (YouTube), box office and home entertainment—and the breakdown to determine how those revenues are then disbursed between distributors, packagers/producers and IP rights holders (where it goes to).

I’ve been in and around the TV business for a long time, but this analysis produced some conclusions that I think are non-obvious (at least they weren’t obvious to me):

The consensus narrative in TV is that streaming is the future and pay TV is the past. While that may be true, the relative numbers may surprise. For every $1 that consumers and advertisers spent on video in the U.S. last year, $0.66 went to traditional TV (pay TV and broadcast). For comparison, all streaming (SVOD, AVOD, FAST and CTV) only represented $0.21. Box office arguably gets too much mindshare; it was only $0.04 of every $1.

For the last several years, aggregate video revenue hasn’t grown on a nominal basis. The growth of streaming is coming entirely at the expense of traditional TV, theatrical and home entertainment. The open question is whether video revenue is currently in a transitionary period and will eventually resume growing, much like the trough that music exhibited from 2005-2015 (Figure 1).

Not only has overall video revenue been flat, but in recent years both consumers and advertisers have implicitly kept their expenditures on video pretty constant too, despite a lot of moving pieces (cord cutting, linear ratings declines, growth in streaming subs, new ad tiers, growth in CTV and FAST, etc.).

This stability means that consumer video spend has declined as a proportion of PCE and video ad spend has declined as a percentage of total U.S. ad spend. Had both kept pace over the last four years, the total video business would be 35% larger than it is today.

Video distribution isn’t a great business (for pay TV distributors, movie theaters, retailers, etc.). For every $1 of revenue, last year distributors took $0.23 off the top, but only kept $0.01 as operating profit.

Media companies spend a lot of money on content. For every $1 of revenue last year, $0.77 was remitted to them by distributors and, of that, almost 2/3 went to programming—$0.40 to entertainment programming and $0.10 to sports rights.

This 4X disparity between entertainment and sports spend shows why we probably aren’t in a sports “bubble,” particularly for premium sports, despite the pressure on traditional TV. Entertainment spend will likely continue to be reallocated towards sports for several reasons: sports programming is dramatically outperforming entertainment in viewership; it commands a disproportionate and rising share of both advertising and affiliate fees; the relative risk of producing entertainment content is rising; and, longer-term, GenAI may both reduce entertainment production costs and increase the relative scarcity of sports.

The TV ecosystem has undergone a significant transition over the last decade—and may possibly be on the precipice of another one, propelled by advances in GenAI. But the resilience of traditional TV and the overall stability in the consumer and advertiser video “wallet” both strike a somewhat hopeful note. Sometimes things aren’t changing as radically as we perceive.

Thanks for reading The Mediator by Doug Shapiro! Subscribe for free to receive new posts and support my work.

Figure 1. The Authoritative Source for Recorded Music Revenue

Source: IFPI.

Where Does the Money Come From?

I set out to build up aggregate video revenue in the U.S., but let’s start with some definitions and nomenclature. As shown in Figure 2, “video” comprises traditional TV (pay TV and broadcast delivered by facilities-based providers, virtual MVPDs and over-the-air), streaming (SVOD, AVOD, FAST and CTV), short form (which here is only YouTube domestic advertising, more on that in a moment), box office and home entertainment (physical and digital rentals and purchases). To be clear, video revenue includes both what I’m calling “direct consumer spend” (subscriptions and transactions) and advertising, as can be seen in the table.

Figure 2. The Total U.S. Video Market is About $230 Billion

Source: Kagan/S&P Capital IQ, MAGNA, MoffettNathanson, OMDIA, Box Office Mojo, DEG and Author estimates.

The rationale for including YouTube is that it is increasingly viewed as a substitute for traditional video, both by consumers and advertisers. It is generating significant watch time on televisions and attracting both brand and performance advertising. By contrast, other short form video, such as Facebook/Instagram Reels and TikTok, doesn’t generate much or any watch time on TVs and predominantly attracts performance advertisers. So, in my view it’s (more) debatable whether they should be included as part of the “video ecosystem.”

Publishing is Designed to Make Most Authors Feel Like Losers Even While the Industry Makes Money

everything in modern culture is about status resentment

FREDDIE DEBOER, APR 26, 2024

This week Kathleen Schmidt of Publishing Confidential, a newsletter to which I subscribe, took some swings at this piece by Elle Griffin, a post skewering the state of book publishing that was remarkably well-read by the standards of contemporary independent media. Schmidt is an insider with 25+ years in the industry, while Griffin is an outsider who has done well for herself by serializing two novels on her Substack. Neither makes one right or wrong, and both have important thoughts to share. But Griffin’s piece has achieved exit velocity and been shared by several people in big-deal media; for example, the piece was linked to in Ross Douthat’s NYT newsletter today. Here’s her summation:

The Big Five publishing houses spend most of their money on book advances for big celebrities like Britney Spears and franchise authors like James Patterson and this is the bulk of their business. They also sell a lot of Bibles, repeat best sellers like Lord of the Rings, and children’s books like The Very Hungry Caterpillar. These two market categories (celebrity books and repeat bestsellers from the backlist) make up the entirety of the publishing industry and even fund their vanity project: publishing all the rest of the books we think about when we think about book publishing (which make no money at all and typically sell less than 1,000 copies).

I’ll tell you upfront that I think that Schmidt has a better grasp of the facts, and I think Griffin’s stance, while emotionally understandable, is really an expression of a particular culture war rather than an honest survey of the industry. You may note that Griffin’s last sentence here self-contradicts; if there exists a “vanity project” of literary novels then celebrity books and the backlist cannot make up “the entirety of the publishing industry.” If you want to say that it’s just exaggeration for effect’s sake, I’m afraid you can’t do that, here, in this piece - if you’re throwing out numbers based on court testimony and professing to share the hidden secrets of an industry’s economics, you can’t allow yourself that kind of imprecision. And is it in fact true that all of the sales go to celebrities and the backlist? Of course not. Hanya Yanigahara’s A Little Life sold a million and a half copies, and it’s a relentlessly bleak literary novel by a woman who was plugged in but not famous. Yanigahara’s first novel The People in the Trees would probably slide comfortably into Griffin’s definition of the vanity project side of publishing, but her more ambitious - and not at first glance any more commercial - second novel sold insanely well. Of course, now that it’s been a few years, Griffin might be tempted to relegate A Little Life to the backlist, but that wouldn’t be very sensible. Every book on the backlist was once a new book, after all. If Griffin will concede that the backlist grows over time, that there are always new old books helping a publishing company’s bottom line, her claims don’t add quite add up. Somebody who isn’t a celebrity is selling books. Not many people, but enough.

The very fact that Griffin’s piece went so viral is a good reason you should be skeptical of it. A fairly dry discussion of publishing’s sales numbers seems unlikely to attract that kind of attention. But Griffin is no dummy, and I think she was very deliberately courting an audience that the online newsletter industry is absolutely stuffed with: people who carry around bitterness and resentment towards the traditional routes through which people achieve success in writing. Which might sound dismissive, but I don’t mean it to be. There are very many reasons to hold resentment towards the people who hold the cards in publishing, and I myself carry around a degree of that bitterness and resentment myself. As I’m still fairly new to publishing books, I don’t have a lot of angst about that world yet. But I’m 15 years into a career in media, and a lot of the frustrations, tensions, and bullshit are the same. There’s every chance for me to grow disenchanted by publishing the way others have. I know that I’ve enjoyed good fortune with books so far, despite tepid sales, and I know that I may not in the future. I understand the resentment.

Still. The trouble with writing towards that kind of resentment is that, while it’s a good way to juice subscriptions, it carries with it this inherent tendency to sacrifice what’s accurate in favor of what’s inflammatory. While Griffin never directly suggests that writing for big publishing houses has no advantages, many on social media have taken exactly that point. One of the top comments on Griffin’s piece, which reflects the overall reaction, reads

Your report confirms all that I have long suspected as agents and the big houses go. A very knowledgeable person told me recently that Hemingway and McCarthy would not get published today were they just starting out. IMO you waste valuable talent, time, and energy pursuing an agent and a big house. Worthless now.

Well, maybe Hemingway and McCarthy wouldn’t get published today, no. You can never be confident of that sort of thing, which is an indictment that applies to any of the creative industries. But I can only tell you that, personally, the advantages of having an agent and a publishing house are considerable.

More VC Firms Are Investing in AI Rivals

By Natasha Mascarenhas, Apr 30, 2024, 3:22pm PDT

Does it make sense to back rival language model companies Anthropic and OpenAI (and Cohere and Mistral)? Some investors seem to think so, taking an approach to startup investing that looks a little like buying an index fund with an array of tech stocks.

Last week my colleagues and I broke the news that Sequoia Capital was among the investors in a new $6 billion fundraising for xAI, Elon Musk’s artificial intelligence startup. Sequoia’s involvement wasn’t that surprising. Since the start of last year, Sequoia has led deals for generative AI startups such as developer assistant LangChain and legal startup Harvey and has participated in dozens of others. The firm also backed Musk’s $44 billion Twitter buyout. What’s notable is that Sequoia already holds shares in an xAI rival, Sam Altman’s OpenAI, after buying shares from other holders when the startup was valued at $20 billion.

Investing in rivals is still rare in venture capital, as Sequoia itself knows. In 2020, the firm gave up its stake in payments company Finix after realizing it was too directly competitive with another portfolio company, Stripe. (It declined to comment when asked about its decision to back both xAI and OpenAI). Rival investments can hurt a VC firm’s chance at winning deals, since many founders don’t love the idea of sharing sensitive information such as finances and product plans with investors in a competitor. But this cross-pollination has been happening during the recent AI investing wave.

Some investors tell me that because the technology is changing so fast, they are investing in multiple, similar startups as a hedge because it remains unclear what it will take to stand out. Others say the startups’ businesses are differentiated enough so all have a chance of success.

“I do not think that one of these generative AI companies will take all of the market share,” said Warren Hui, co-founder and managing partner of Soul Ventures, a venture firm that has used special purpose vehicles to invest in Anthropic and OpenAI, and that also made an investment in Cohere, a Toronto-based large language model developer.

“Each of them have their own focus: Anthropic is more on safety, Cohere is enterprise,” or business clients, he said, while OpenAI is going to get to artificial general intelligence first. “So you have everyone tackling their own piece of the market first,” he said.

Soul Ventures has company when it comes to investing in multiple LLMs. Sound Ventures, an early-stage venture firm co-founded by Ashton Kutcher, has disclosed that it has made investments in OpenAI Anthropic and Stability AI, using a large chunk of its recently closed nearly $240 million AI fund.

Khosla Ventures, an early OpenAI investor, is also backing similar LLM developers—including some located in different countries, such as Japan’s Sakana AI and India’s Sarvam. The early-stage firm expects LLM developers that are native to a country or geography to succeed because they’ll adapt better to language and cultural differences than overseas rivals, as well as receive more local government support, said Khosla partner Jon Chu. That’s different, he said, than investing in similar companies in the expectation that only one will win.

I expect more investors to invest in multiple LLMs given how frequently investors are using SPVs to invest in AI startups. SPVs, which pool cash from multiple investors to buy stakes in one company, allow investors to write smaller checks and still participate in late-stage funding rounds.

Many of these SPV investments will go unnoticed. The managers of these vehicles don’t typically reveal the limited partners who put money into the vehicle, and the company that raises money from an SPV may never disclose that certain investors are part of a round that includes such an investment, as was the case before we broke the news that Intuit and Qualcomm joined an SPV that was investing in Anthropic.

Video of the Week

AI of the Week

Nick Bostrom Made the World Fear AI. Now He Asks: What if It Fixes Everything?

Philosopher Nick Bostrom popularized the idea superintelligent AI could erase humanity. His new book imagines a world in which algorithms have solved every problem.

Philosopher Nick Bostrom is surprisingly cheerful for someone who has spent so much time worrying about ways that humanity might destroy itself. In photographs he often looks deadly serious, perhaps appropriately haunted by the existential dangers roaming around his brain. When we talk over Zoom, he looks relaxed and is smiling.

Bostrom has made it his life’s work to ponder far-off technological advancement and existential risks to humanity. With the publication of his last book, Superintelligence: Paths, Dangers, Strategies, in 2014, Bostrom drew public attention to what was then a fringe idea—that AI would advance to a point where it might turn against and delete humanity.

To many in and outside of AI research the idea seemed fanciful, but influential figures including Elon Musk cited Bostrom’s writing. The book set a strand of apocalyptic worry about AI smoldering that recently flared up following the arrival of ChatGPT. Concern about AI risk is not just mainstream but also a theme within government AI policy circles.

Bostrom’s new book takes a very different tack. Rather than play the doomy hits, Deep Utopia: Life and Meaning in a Solved World, considers a future in which humanity has successfully developed superintelligent machines but averted disaster. All disease has been ended and humans can live indefinitely in infinite abundance. Bostrom’s book examines what meaning there would be in life inside a techno-utopia, and asks if it might be rather hollow. He spoke with WIRED over Zoom, in a conversation that has been lightly edited for length and clarity.

Will Knight: Why switch from writing about superintelligent AI threatening humanity to considering a future in which it’s used to do good?

Nick Bostrom: The various things that could go wrong with the development of AI are now receiving a lot more attention. It's a big shift in the last 10 years. Now all the leading frontier AI labs have research groups trying to develop scalable alignment methods. And in the last couple of years also, we see political leaders starting to pay attention to AI.

There hasn't yet been a commensurate increase in depth and sophistication in terms of thinking of where things go if we don't fall into one of these pits. Thinking has been quite superficial on the topic.

When you wrote Superintelligence, few would have expected existential AI risks to become a mainstream debate so quickly. Will we need to worry about the problems in your new book sooner than people might think?

As we start to see automation roll out, assuming progress continues, then I think these conversations will start to happen and eventually deepen.

Elon Musk’s Plan For AI News

Musk emails with details on AI-powered news inside X. An AI bot will summarize news and commentary, sometimes looking through tens of thousands of posts per story.

MAY 03, 2024

Elon Musk emailed me this week with some surprising details about his plan to distill and present news on X using AI. I’d written him after trying Grok — X’s AI chatbot — and noticing it didn’t link to a Time story it summarized. I wanted to click into the article and read more, so I reached out.

Musk said better citations are coming, but shared a deeper vision for the product, which he wants to build into a real-time synthesizer of news and social media reaction. Effectively, his plan is to use AI to combine breaking news and social commentary around big stories, present the compilation live, and allow you to go deeper via chat.

“As more information becomes available, the news summary will update to include that information,” Musk told me. “The goal is simple: to provide maximally accurate and timely information, citing the most significant sources.”

That goal won’t be easy to achieve, but the bot might become a novel news product given its access to the X firehose. “Grok is analyzing sometimes tens of thousands of X posts to render a news summary,” Musk said.

Subscribe

Already, Grok is displaying a running list of headlines and incorporating social reaction into its summaries, including the chatter around the Time story I sought about Trump’s potential second term. Grok has plenty of room to improve — and will have to figure out issues like citation and hallucination — but it could be valuable if X gets the execution is right.

“That's actually what I used to come to Twitter for — news and commentary,” Ben Smith, editor-in-chief of Semafor and author of Traffic, told me.

Conversation on X will make up the core of Grok’s summaries — or, really almost all of it. Musk said Grok will not look directly at article text, and will instead rely solely on social posts. “It’s summarizing what people say on X,” he said. “Definitely needs to do a better job of displaying relevant posts, including, for example, the TIME post that links to the article.”

Musk’s approach will make Grok distinct from all AI news summarizers, and likely more controversial, but there is an opportunity to satisfy users, publishers, and the platform together. It starts with solid citation, giving users a way to go deeper into the source material once their curiosity is piqued.

Josh Miller, CEO of The Browser Company, whose Arc browser is doing AI summarization, told me that platforms, users, and publishers could all win with aggressive citation. “People want trust in the data,” he said. “They want to understand where it's coming from. And more importantly, if we do a good job giving them what they want, they want more of it. They get more curious. They want to read deeper.”

Grok could similarly be an entry point to news stories that people might otherwise not see, giving them more reason to come back and engage. “I definitely don't go to Time.com,” Miller said. “So if that was pushed to me, I would probably go read that Time article. And I wouldn't have seen it otherwise.”

OpenAI to use FT journalism to train artificial intelligence systems

Under deal, ChatGPT users will receive summaries and quotes from Financial Times content and links to articles

Dan Milmo Global technology editor

Mon 29 Apr 2024 17.36 BST

The Financial Times has struck a deal with the ChatGPT developer OpenAI that allows its content to be used in training artificial intelligence systems.

The FT will receive an undisclosed payment as part of the deal, which is the latest to be agreed between OpenAI and news publishers.

Under the arrangement, ChatGPT users will receive summaries and quotes from FT journalism, as well as links to articles, in responses to prompts, where appropriate.

John Ridding, the chief executive of the FT Group, said it was “right” that AI companies paid publishers for their material.

The New York Times is suing OpenAI and its largest investor, Microsoft, over use of its content to train large language models, the technology that underpins chatbots such as ChatGPT.

“OpenAI understands the importance of transparency, attribution, and compensation – all essential for us,” said Ridding. “At the same time, it’s clearly in the interests of users that these products contain reliable sources.”

OpenAI has already signed content licensing deals with the US news agency the Associated Press, the French title Le Monde, the El País owner Prisa Media and Germany’s Axel Springer, which publishes the Bild tabloid.

Brad Lightcap, the OpenAI chief operating officer, said it was important for the company to “represent quality journalism as these products take shape”.

“As with any transformative technology, there is potential for significant advancements and major challenges, but what’s never possible is turning back time,” he said.

Chatbots such as ChatGPT are at the forefront of advances in generative AI, the term for technology that can produce convincing text, image or audio from simple hand-typed prompts.

However, the models that underpin these tools are trained on vast amounts of data taken from the internet, including copyright-protected text and images.

Eight US newspapers sue OpenAI and Microsoft for copyright infringement

The Chicago Tribune, Denver Post and others file suit saying the tech companies ‘purloin millions’ of articles without permission

Associated Press

Tue 30 Apr 2024 19.29 BST

A group of eight US newspapers is suing ChatGPT-maker OpenAI and Microsoft, alleging that the technology companies have been “purloining millions” of copyrighted news articles without permission or payment to train their artificial intelligence chatbots.

The New York Daily News, Chicago Tribune, Denver Post and other papers filed the lawsuit on Tuesday in a New York federal court.

“We’ve spent billions of dollars gathering information and reporting news at our publications, and we can’t allow OpenAI and Microsoft to expand the Big Tech playbook of stealing our work to build their own businesses at our expense,” said a written statement from Frank Pine, executive editor for the MediaNews Group and Tribune Publishing.

The other newspapers that are part of the lawsuit are MediaNews Group’s Mercury News, Denver Post, Orange County Register and St Paul Pioneer-Press, and Tribune Publishing’s Orlando Sentinel and South Florida Sun Sentinel. All of the newspapers are owned by Alden Global Capital.

Washed Out’s new music video was created with AI. Is it a watershed moment for Sora?

(Paul Trillo)

By Wendy Lee

May 2, 2024 3 AM PT

“The Hardest Part,” a new song from indie pop artist Washed Out, is all about love lost, among the most human of themes.

But ironically, to illustrate the tune’s sense of longing, the musician turned to something far less flesh-and-blood: artificial intelligence.

With Thursday’s release of “The Hardest Part,” Macon, Ga.-based Washed Out, whose real name is Ernest Greene, has the first collaboration between a major music artist and filmmaker on a music video using OpenAI’s Sora text-to-video technology, according to the singer-songwriter’s record label Sub Pop.

..More

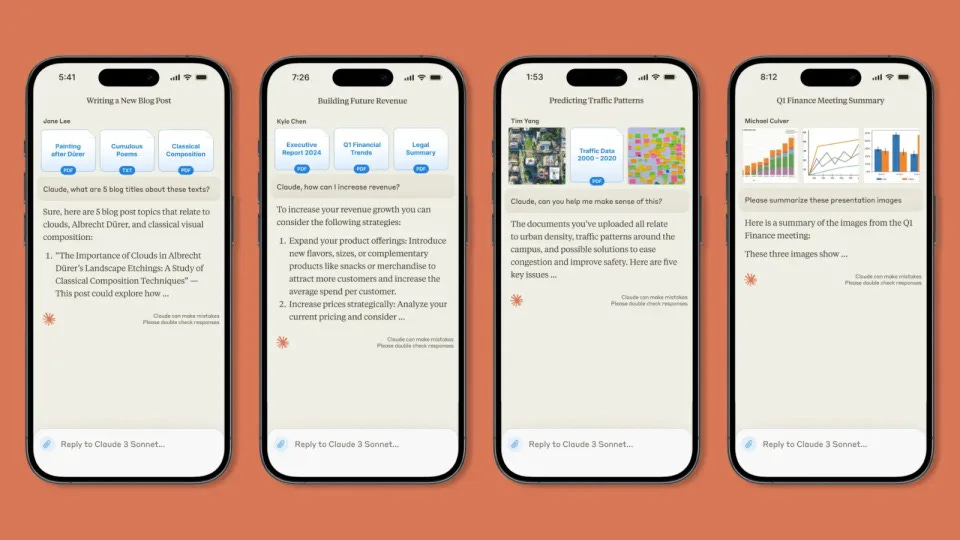

Anthropic now has a Claude chatbot app for iOS

The company has also launched a new paid tier.

Anthropic is making its Claude AI easier to access on mobile. The company has released a Claude mobile app for iOS that any user can download for free. Similar to the mobile web version of the chatbot, the app syncs users' conversations with Claude across devices, allowing them to jump from a computer to the app (or vice versa) without losing their chat history. Users will also be able to upload files and images straight from their iPhone's gallery — or take a photo on the spot — if they need Claude to process or analyze them in real time. They'll be able to download and access the Claude app whatever plan they're using, even if they're not paying for the service.

If they do decide to pay for Claude, they now have a new option other than Pro. The new Team plan provides greater usage than the Pro tier so that members can have more conversations with the chatbot. It also enables users to process longer documents, such as research papers and contracts, thanks to its 200,000 context window. The Team plan gives users access to the Claude 3 model family, as well, which includes Opus, Sonnet and Haiku. It will cost subscribers $30 per user per month, with a minimum head count of five users per team.

..More

AI Faces Its ‘Oppenheimer Moment’ During Killer Robot Arms Race

Civilian, military and technology leaders convene Vienna talks

Artificial intelligence weapons defy traditional arms control

How Drones Are Revolutionizing the Economics of War

By Jonathan Tirone April 29, 2024 at 5:26 AM PDT

Regulators who want to get a grip on an emerging generation of artificially intelligent killing machines may not have much time left to do so, governments were warned on Monday.

As autonomous weapons systems rapidly proliferate, including across battlefields in Ukraine and Gaza, algorithms and unmanned aerial vehicles are already helping military planners decide whether or not to hit targets. Soon, that decision could be outsourced entirely to the machines.

“This is the Oppenheimer Moment of our generation,” said Austrian Foreign Minister Alexander Schallenberg, referencing J. Robert Oppenheimer, who helped invent the atomic bomb in 1945 before going on to advocate for controls over the spread of nuclear arms.

Civilian, military and technology officials from more than 100 countries convened Monday in Vienna to discuss how their economies can control the merger of AI with military technologies — two sectors that have recently animated investors, helping pushing stock valuations to historic highs.

Spreading global conflict combined with financial incentives for companies to promote AI adds to the challenge of controlling killer robots, according to Jaan Tallinn, an early investor in Alphabet Inc.’s AI platform DeepMind Technologies.

An AI-controlled fighter jet took the Air Force leader for a historic ride. What that means for war

An experimental F-16 fighter jet has taken Air Force Secretary Frank Kendall on a history-making flight controlled by artificial intelligence and not a human pilot. (AP Video by Eugene Garcia and Mike Pesoli)

BY TARA COPP

Updated 5:40 PM PDT, May 3, 2024

EDWARDS AIR FORCE BASE, Calif. (AP) — With the midday sun blazing, an experimental orange and white F-16 fighter jet launched with a familiar roar that is a hallmark of U.S. airpower. But the aerial combat that followed was unlike any other: This F-16 was controlled by artificial intelligence, not a human pilot. And riding in the front seat was Air Force Secretary Frank Kendall.

AI marks one of the biggest advances in military aviation since the introduction of stealth in the early 1990s, and the Air Force has aggressively leaned in. Even though the technology is not fully developed, the service is planning for an AI-enabled fleet of more than 1,000 unmanned warplanes, the first of them operating by 2028.

It was fitting that the dogfight took place at Edwards Air Force Base, a vast desert facility where Chuck Yeager broke the speed of sound and the military has incubated its most secret aerospace advances. Inside classified simulators and buildings with layers of shielding against surveillance, a new test-pilot generation is training AI agents to fly in war. Kendall traveled here to see AI fly in real time and make a public statement of confidence in its future role in air combat.

“It’s a security risk not to have it. At this point, we have to have it,” Kendall said in an interview with The Associated Press after he landed. The AP, along with NBC, was granted permission to witness the secret flight on the condition that it would not be reported until it was complete because of operational security concerns.

The AI-controlled F-16, called Vista, flew Kendall in lightning-fast maneuvers at more than 550 miles an hour that put pressure on his body at five times the force of gravity. It went nearly nose to nose with a second human-piloted F-16 as both aircraft raced within 1,000 feet of each other, twisting and looping to try force their opponent into vulnerable positions.

News Of the Week

Peloton to lay off 400 employees as CEO Barry McCarthy departs

The 15% staff cuts come as part of a wider cost-cutting effort

Paul Sawers @psawers / 4:27 AM PDT•May 2, 2024

Image Credits: Michael Nagle/Bloomberg / Getty Images

Peloton, the exercise equipment maker and online fitness course provider, said it is laying off 15% of its workforce (about 400 people) as part of cost-cutting measures. The company also said its CEO, president, and board director, Barry McCarthy, would step down after two years in the role.

McCarthy, who was previously CFO at Spotify and Netflix, was coerced out of retirement in early 2022 when Peloton’s co-founder and then-CEO, John Foley, left the role alongside a major cost-cutting effort that saw 2,800 employees laid off. Foley remained as executive chair, but he left the company seven months later along with co-founder and chief legal officer, Hisao Kushi.

Peloton says it’s in the process of finding a successor to McCarthy. Current Peloton chairperson, Karen Boone, and director, Chris Bruzzo, would serve as interim co-CEOs through the transition.

..More

Startup of the Week

beehiiv attracts $33M to make its newsletter publishing platform more sticky

Ingrid Lunden @ingridlunden / 5:36 AM PDT•April 30, 2024

Image Credits: beehiiv

With the number of people using e-mail globally approaching 5 billion, newsletters delivered regularly into people’s inboxes continue to look like a sticky way of getting attention for whatever it is that you’re writing. Now, in a signal of the popularity of the medium, one of the startups building a platform for creating and distributing newsletters is announcing some funding. New York-based beehiiv has raised $33 million, funding that it will be using to expand its business as well as the technical capabilities of its platform.

NEA is leading this Series B with Sapphire Sport and previous backer Lightspeed Venture Partners also participating. The startup is not disclosing its valuation with this round but it has now raised $46.5 million.

The money is coming on the heels of some significant growth. When we covered beehiiv’s $12.5 million Series A in June 2023 (a round led by Lightspeed), the company had 7,500 active newsletters with 35 million unique readers and 350 million monthly impressions. Now, the company is sending out 1 billion emails per month from around 20,000 active newsletters (it didn’t disclose the number of unique readers, although that figure will have undoubtedly also risen). Newsletter users include both individual writers (plus individual “brands”: Arnold Schwarzenegger is among its customers) as well as bigger organizations like Boston Globe Media and Brex.