A reminder for new readers. That Was The Week collects the best writing on critical issues in tech, startups, and venture capital. I selected the articles because they are of interest. The selections often include things I entirely disagree with. But they express common opinions, or they provoke me to think. The articles are only snippets. Click on the headline to go to the original. I express my point of view in the editorial and the weekly video below.

This Week’s Video and Podcast:

Thanks To This Week’s Contributors: @kteare, @ajkeen,

Contents

Editorial: New, new media

Scenes from a dying web - Casey Newton

State of Private Markets: Q4 and 2023 in review - Peter Walker and Kevin Dowd

Venture Markets Will Not Recover Quickly - Scott Shane

The creator economy can't rely on Patreon. - Joan Westenberg

Finding the product in your platform - Sangeet Paul Choudary

How AI Will Usher in an Era of Abundance - Anish Acharya

Google launches Gemini Ultra, its most powerful LLM yet - Frederic Lardinois

Some OpenAI Investors Sit Out Share Sale, Reflecting AI Divide - Natascha Mascarenhas and Kate Clark

a16z’s Chris Dixon thinks it’s time to focus on blockchains’ use cases, not speculation - Jacquelyn Melinek

Highlights of the OpenAI’s New GPT Store - ODSC Team

X, formerly Twitter, becomes No. 1 app on US App Store after news of Tucker Carlson-Putin interview emerges - Sarah Perez

Arm’s gains are SoftBank’s gains - Kyle Wiggers

Uber ends the year in the black for the first time ever - Andrew J. Hawkins

Adam Neumann got kicked out of WeWork — now he wants to buy it - Emma Roth

EU countries strike deal on landmark AI rulebook - Gian Volpicelli

Zuckerberg Calls Apple's DMA Compliance Changes 'Onerous' and 'Difficult to Seriously Entertain' - Tim Hardwick

Spotify CEO Daniel Ek tells investors Apple’s DMA rules are a ‘farce,’ but says there are ‘future upsides’ too - Sarah Perez

Apple says EU represents 7% of global App Store revenue - Ivan Mehta

Tucker Carlson and Vladimir Putin

Editorial: New, new media

Tucker Carlson has intuition. His break with his former employer, Fox, seemed challenging at the time. He showed up on a battered X and was mocked for the seeming irrelevance he was going to have to endure.

Fast forward a little while and Carlson is in Russia doing a one to one interview with Vladimir Putin.

More US users installed X in a few days than any other app

The interview could originally only be seen if you subscribe to the ‘The Tucker Carlson Network’. I’m going to guess a lot of people did.

But, breaking news

Tucker Carlson released his two-hour interview with Vladimir Putin, the Russian president whose military is deep into its second year of the Ukraine invasion, marking an unprecedented sitdown between an American journalist and adversarial head of state during wartime.

From The Wrap

If there was ever a moment to shine a light on the power of the internet (web, apps, messages, email and more) to deliver compelling content outside of the old media franchises, this was it.

A camera, a computer, a streaming service and - depending on the content - you can take over attention.

Most commentators will focus on their distaste for the interview, or the fact that Carlson is a Trump supporter. But the main point is none of those. It is the very fact it could happen.

Substack should be very happy and be thinking about live events and audiences as additional features.

X will be more happy. This brings to life the ideas Musk has been working towards - a global multi-modal platform with content you cannot miss.

Issac Saul has an interview with Bill O’Reilly discussing this, and the role of Tangle.

Thanks to Andrew Keen for the reference. O’Reilly seems prescient and logical. And not on big media.

Enough said.

Ironically this coincides with this week’s first Essay of the Week by Casey Newton speaking about “the dying web”. He focuses on the Arc browser and Perplexity AI and the experience of getting answers to questions without search and without visiting web pages.

Joan Westenberg’s essay about how to monetize this new internet is a timely delve into the challenges facing the new, new media.

The web is not dying, it is changing. X is part of the web, as are the tools Newton discusses. But they are not web pages. Or even web apps. They are audience networks delivering experiences people want. More properly they are the result of the internet developing scale, speed and computing power. The web is dead, long live the web.

Peter Walker and colleagues have an excellent review of the venture market - we are still deep in correction territory. Smart investors will find a lot less competition investing in the next generation of big companies.

Enjoy…

Essays of the Week

Scenes from a dying web

Casey Newton

Feb 5, 2024

From Arc Search to Quora, the future is coming into focus — and there’s reason to worry

I.

If the web is going to die, it won’t die all at once.

Instead, it will die a little bit at a time: with a venerable old publication being folded into another; with a well funded upstart sputtering into nothing in under a year; with a subscription business abandoned after it struggled to find enough good writers to keep it going.

The death of digital media has many causes, including the ineptitude of its funders and managers. But today I want to talk about another potential rifle on the firing squad: generative artificial intelligence, which in its capacity to strip-mine the web and repurpose it as an input for search engines threatens to remove one of the few pillars of revenue remaining for publishers.

This is a story that is less about how the web is used today and more about how it is viewed by the tech platforms now searching it for fresh opportunities. It’s a reminder that the future of the web depends on what products get built for it. On what labor is funded, and what labor is not.

Last week, a startup called the Browser Company released a new app called Arc Search. For a few years now, the company has been working to devise a more useful web browser. And while none of the tools it has developed so far have given me cause to abandon Chrome, by default I root for anyone who spends their time and energy working to improve the open web.

Opening the Arc Search app for the first time last week, though, I experienced a rare emotion: a kind of revulsion at the app’s mere existence, and at what it portends. When you enter a query in the app, Arc Search uses APIs from OpenAI and others to “read the web” for you and build a page that attempts to answer your question in full. When I asked about King Charles’ cancer diagnosis today, Arc Search sourced information from six websites, synthesized it, and gave me an accurate, bullet-pointed rundown of the little that is known so far.

Arc is not alone in exploring this new, more extractive form of web search. Perplexity, which was profiled last week by my podcast co-host Kevin Roose, offers a similar generative AI summary based on news articles. So does ChatGPT.

This is clearly a better user experience for those seeking information about the king. Rather than click on one or more stories, navigate various ads and pop-up windows, and scan for information, Arc Search and its peers grab the most valuable bits and serve them to you without interruption.

To deliver that user experience, though, Arc Search relied on stories from NBC, CNN, USA Today, and others. Those stories were written by journalists who are paid largely through the advertising revenue on the web pages that readers might have otherwise visited. A huge number of the journalism jobs that still remain depend on the pipeline that delivers search queries to web pages.

To its credit, Arc Search links to its sources somewhat prominently. (Much more prominently, for example, than OpenAI, which puts a tiny linked quotation mark in brackets at the end of queries that offers no indication of what the source is and would require surgical precision to click on even if you wanted to.)

Still, the point of apps like Arc Search is that you should never have to visit the links at all. In Arc’s vision of the internet, all the labor that makes up the web is abstracted away into an input. And, best of all for a small startup, it’s a free input. You have to pay OpenAI for the APIs, sure. But it’s a small price to pay to harness the collective labor of thousands of people whom you will never have to compensate, even as you eventually figure out your own way to monetize it through ads and subscriptions.

To be fair, Arc Search didn’t invent this kind of scraping and remixing. Google itself has long offered excerpts and snippets of web pages as part of search results, and its own Search Generative Experience product moves even further toward the place where Arc and its peers have already arrived.

On Monday afternoon I spoke with Josh Miller, co-founder and CEO of the Browser Company, to ask how he thought about these issues. Miller previously founded the conversation platform Branch, which he sold to Facebook, and later served as the director of product at the White House. In addition to running the Browser Company, he is also a board member of Patreon.

Miller told me that Arc Search had arisen from his frustration with traditional web search. While traveling to Finland, he said, a flight attendant had told him that tea cost $6 but he could have water or blueberry juice for free. Why was the airline giving away free blueberry juice, he wondered? Miller said he struggled to get the right answer with a traditional search, and hoped to get a better one with generative AI. (When I ran the queries in both Arc Search and Google today, the correct answer came up at the top of both apps. Blueberry juice is the signature drink of Finnair, and is meant to invoke Finnish cuisine.)

Miller told me that generative AI represents a chance to shake up the stagnant oligopoly that runs much of the web today — but acknowledged that it was not clear how writers would be paid in the future. “It completely upends the economics of publishing on the internet,” he said.

Arc Search was conceived as a kind of side project for the Browser Company, Miller told me, and as such he had not put much thought into the second-order implications of a world where search queries no longer result in outbound clicks.

“The reason we didn't talk about our ideas related to web pages and creator monetization of the future (in the video) is because we don't have all the answers yet!” Miller wrote on X, in response to a developer who asked him about Arc Search’s economics. “Nobody does. It's all too new. And it felt important to be honest.”

He added: “But promise I'm thinking deeply about this conundrum. It's so important for everything from our web to our democracy.”

Like Miller, I wish Google had less power over the web. At the same time, Google at least has a theory of how the web can be funded: it will deliver clicks to publishers, and publishers will monetize those clicks via ads. (Ads which Google also sells, of course.)

This is far from an ideal system. The number of working journalists continues to shrink, while Google continues to print money. And it seems clear that Google will gradually replace as much of its current search product with generative AI as it can. How can it not? Its competitors all already have.

But as unsatisfying as the status quo may be, it still represents a marked improvement on the world predicted by Arc Search. The Google of today is organized around the principle that it is necessary and even enjoyable to visit websites. The search engines of tomorrow are premised on the idea that it would be far better and more enjoyable not to.

II.

As less of the web is created by professional journalists, what will replace it?

State of Private Markets: Q4 and 2023 in review

February 5, 2024

Peter Walker and Kevin Dowd

Executive summary

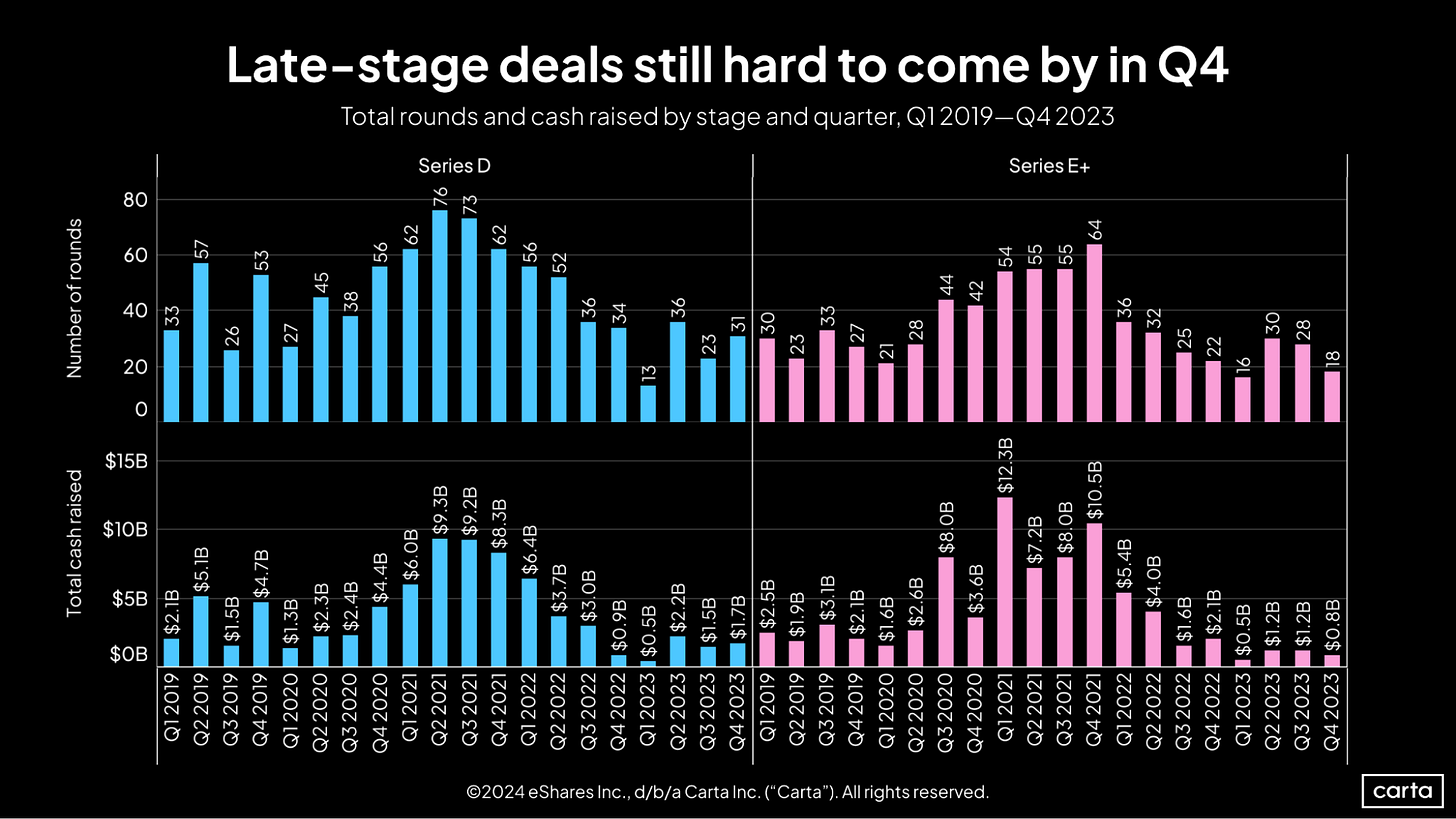

During the rise and fall of an unprecedented bull market across 2021 and 2022, founders and investors had to navigate a wild ride of ups and downs. That volatility diminished in 2023. The startup ecosystem trundled along at a slow but steady pace, with activity near recent lows.

This new equilibrium involves fewer deals and fewer dollars. Total venture deal count on Carta was down 24% year over year in 2023, while cash raised by startups fell by 50%. But the fundraising that took place in 2023 proceeded at a steady pace. In each quarter, startups closed somewhere between 1,209 and 1,574 rounds and brought in between $12.8 billion and $20.3 billion in total capital.

Several facets of the fundraising scene shifted in 2023 in ways that will continue to impact founders and investors in 2024. Startups were forced to extend their runways longer than ever. Bridge rounds boomed in popularity. Series A valuations experienced a second-half surge. But the sort of seismic movements that shaped the venture landscape in recent years were fewer and farther between.

Q4 highlights

Down rounds remained elevated: The rate of down rounds across all venture stages landed somewhere between 19% and 20% every quarter last year, including 19.6% of all investments in Q4. These were the four highest quarterly down-round rates since the start of 2018.

Seed activity slumped: Startups closed just 462 seed investments in Q4, the smallest total since Q1 2018. Year over year, seed deal count is down 27%.

Late-stage valuations took a leap: In Q4 2023, the median pre-money valuation increased by 71% at Series D and by 46% at Series E+ over Q3 medians. These late stages had felt the brunt of the venture slowdown, with valuations plummeting in prior quarters.

Note: If you’re looking for more industry-specific data, download the addendum to this report for an extended dataset.

Key trends

For now, Q4 was the slowest quarter of the year for venture dealmaking, with 1,209 new investments. That would be the lowest quarterly total since Q1 2019. However, the total number of Q4 rounds will likely increase in the months to come as companies report additional transactions.

Still, the comparison to 2019 may be a useful one: That year, there were 5,799 transactions logged on Carta, compared to 2023’s current count of 5,409. In terms of both the number of deals and the amount of capital raised, the data from 2023 looks much more similar to the pre-pandemic years of 2018 and 2019 than any year from the 2020s.

It was the year of the down round. In all four quarters of 2023, more than 19% of new funding rounds came at a lower valuation than the company’s previous round. Those are far and away the four highest quarterly rates the market has seen since the start of 2018.

This new normal has been an adjustment for founders and investors alike. Many had grown used to a funding environment where valuations could generally be expected to proceed in an orderly fashion up and to the right. Instead of a relative rarity, down rounds were a common feature on the startup landscape in 2023.

While California retained its usual place at the top of the fundraising heap in 2023, the past year brought a new runner-up. Startups based in Massachusetts raised 13.75% of all capital over the course of 2023, as the Bay State sailed past New York into second place on the national leaderboard.

Two of the year’s other biggest gainers were Texas and Florida. In 2022, each state accounted for 3.2% of all funding. In 2023, Texas’s share climbed to 6.05%, and Florida’s rose to 4.43%. Ohio, New Jersey, and Nevada were other states that saw their share of startup fundraising climb significantly in 2023.

Startups in the South raised 16.2% of all capital in the U.S. over the course of 2023, up from 15.5% the year prior. But despite that annual uptick, the South’s market share has now decreased for three straight quarters, dipping to 15% in Q4 2023, its lowest quarterly mark in two years.

Conversely, the Midwest’s market share grew to 7% in Q4, tied for its highest point in more than two years. The Northeast also brought in a slightly larger portion of all capital in Q4, but that region’s market share has largely held steady over the past year and a half.

The earliest stages of startup life are typically more insulated from macroeconomic upheaval than later stages. But no stage has been immune from the recent market slowdown.

The number of priced seed rounds on Carta fell to 462 during Q4, its lowest point since Q1 2019. And while the number of Series A rounds increased slightly compared to Q3, there were fewer than 400 deals in the quarter for the second consecutive quarter—a return to a slower pace of Series A dealmaking not seen since Q1 2019. Capital raised in Series A deals also fell to its lowest point in five years.

At both Series B and Series C, deal counts and capital raised remain low relative to the previous five years. In Q4, Series B startups combined to raise about $3.4 billion, while Series C startups brought in $1.6 billion. That’s the second-lowest quarterly total at Series B since the start of 2019, and at Series C, it’s the lowest.

On a year-over-year basis, Series B deal count was down 25% in Q4 and capital raised fell 33%. At Series C, deal count declined by 33% and cash raised by 52%.

It appears the market for Series D fundings may have turned a corner after bottoming out in Q1 2023. The number of rounds and the value of capital raised have now both increased at Series D in two of the past three quarters.

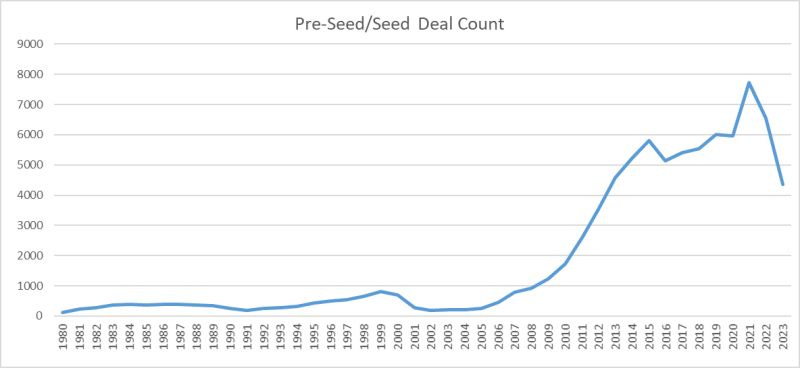

Venture Markets Will Not Recover Quickly

Many observers are predicting a fairly quick recovery from the current venture capital downturn because venture capital markets recovered fairly quickly from previous downturns.

I disagree.

The early stage venture capital bull market of 2010 to 2021 was fundamentally different from earlier venture capital markets. So history isn't a useful predictor.

I plotted the National Venture Capital Association pre-seed/seed deal count by year since 1980. A simple glance at the chart shows how different the 1980-2009 period was from the post-2009 period.

The recent VC bull market was not the result of growth in entrepreneurial activity. Between 2009 and 2021, the number of pre-seed and seed stage venture capital-backed companies increased MANY times more than business creation statistics suggest they should have grown. According to Internal Revenue Service statistics, US C-Corps - the legal form that external investors put money into - DECREASED by 8.7 percent from 2009 to 2021. Yet, from 2009 to 2021, the number of early stage venture capital deals INCREASED 631%.

The most likely explanation for the growth is the cost of capital. The post 2009 growth in early stage deal activity lines up well with the Zero Interest Rate Policy (ZIRP) in the United States. The US experienced ZIRP from 2009 to 2015 and again from (March) 2022 to (March) 2022. We saw a dramatic rise in early stage deals from 2009 to 2015 and again in 2020 and 2021.

It looks like early stage venture capital has come off the 2020-2022 ZIRP effects, but we have a ways to go to unwind the 2008-2015 effects.

I don't think we will go all the way back to 2009 deal count levels because of non-ZIRP changes in venture capital. Prior to 2009, most VC money came from institutional LPs (pension funds, foundations, university endowments). Starting in the mid 2000s, individuals became a more important source of capital for three reasons.

First, Y Combinator launched the first startup accelerator in 2005. By 2021, US accelerators were launching more than 6000 companies per year. Individuals make up a large part of the capital for accelerators and the people who fund these companies.

Second, the JOBS ACT of 2012 made it much easier to invest in early stage companies through online platforms and syndicates like AngelList.

Third, technological changes have lowered the cost of bringing new products to market. It once took a venture capital firm making a several million dollar investment in a pre-revenue company to create a product. That is no longer the case.

I believe we will decline to 3000 early stage deals per year before we level out - but that's another 1/3 decline from 2023 levels.

Tagging a few people and organizations that might have thoughts on this: Carta Peter Walker Angel Capital Association AngelList

The creator economy can't rely on Patreon.

5 Feb

Written By Joan Westenberg

I've been thinking about a friend who used to run a cooking channel on YouTube. When she first started, it was just her goofing around in her tiny apartment kitchen, sharing recipes and little cooking hacks. And people loved it. She was able to quit her office job and do her channel full-time.

Eventually, her viewers were asking for more recipes, more elaborate productions, and fancier kitchen gadgets to review. Suddenly, she needed some serious cash to keep it all going. She started taking on sponsors, then product placements, then brand deals. I watched her churn-out videos, just ads for knives, mixers, or meal kits. And I could see the light going out of her eyes a little.

She felt like she had no creative freedom or joy in her creations. And the only answer had been a pivot to direct financial support. But despite racking up tens of thousands of views per video, she struggled to convert more than a tiny fraction into paid subscribers.

Finally, we were grabbing coffee, and she just broke down. She asked me, "At what point am I selling out? And is it even worth it?"

I didn't have an answer. I don't think anyone does.

Creators who are burned out by renting space on someone else’s platform and playing the Shopping Channel game, squeezing dollars out of sponsored promotions, eventually shift toward a direct funding patronage model.

The promise of it is certainly attractive.

But it's just not realistic.

From Ghost to Patreon memberships and everything in between, there are more options than ever for artists, musicians, writers, and video producers to get paid directly by their audience. It's the 1,000 true fans theory that we've all been sold for the past 15 years - that all you need is a strong mailing list of people who give a shit, and a healthy living will follow.

Unfortunately, a theory is all it is.

Put simply, the numbers don't add up. Data from Patreon and Substack suggests the average conversion rate from follower to paying fan is about 5%. This means a creator would need a total fanbase of 20,000 followers to yield 1,000 paying supporters. And building a core fanbase of 20,000 engaged followers is extremely difficult in today's crowded creative landscape.

Relying solely on organic user payments rarely provides reliable and adequate income. Creators soon discover building a subscriber base is far easier said than done. Though some succeed due to viral content or niche popularity, creators are more often stranded in the discouraging and disappointing gap between audience reach and monetisable support.

In a crowded market, the supply of content creators hoping to profit from their work directly outstrips demand. The number of YouTube channels, podcasts, Substack newsletters, and other independently produced media has exploded. The signal-to-noise ratio is utterly unhinged. Talented creators struggle to stand out and attract an audience, let alone convince fans to pay up regularly. It is statistically unlikely that any random podcast or YouTube channel will blow up in popularity to the point of replacing the creator's working salary through direct payments.

And even when virality strikes, all forms of content rely on easily substitutable free alternatives. YouTube and Apple Podcasts offer a nearly endless feed of free, on-demand videos on every topic imaginable. Convincing music and video fans to pay even a few dollars monthly for exclusive content requires immense effort when similar artists offer work for free. The same dynamic applies to written content. With so many high-quality blogs and news sites available at no cost, it's a hard sell to entice swathes of readers to pay for niche reporting or commentary.

The challenges of direct audience monetisation go beyond marketplace saturation and free rider problems.

The transactional ask inherent in requesting money damages community trust and goodwill. Turning fans into individual revenue streams backfires, breaking the genuine parasocial relationships creators build with their audiences. The shift from viewing fans as community members to income sources changes social dynamics in ways many find unpalatable.

..More

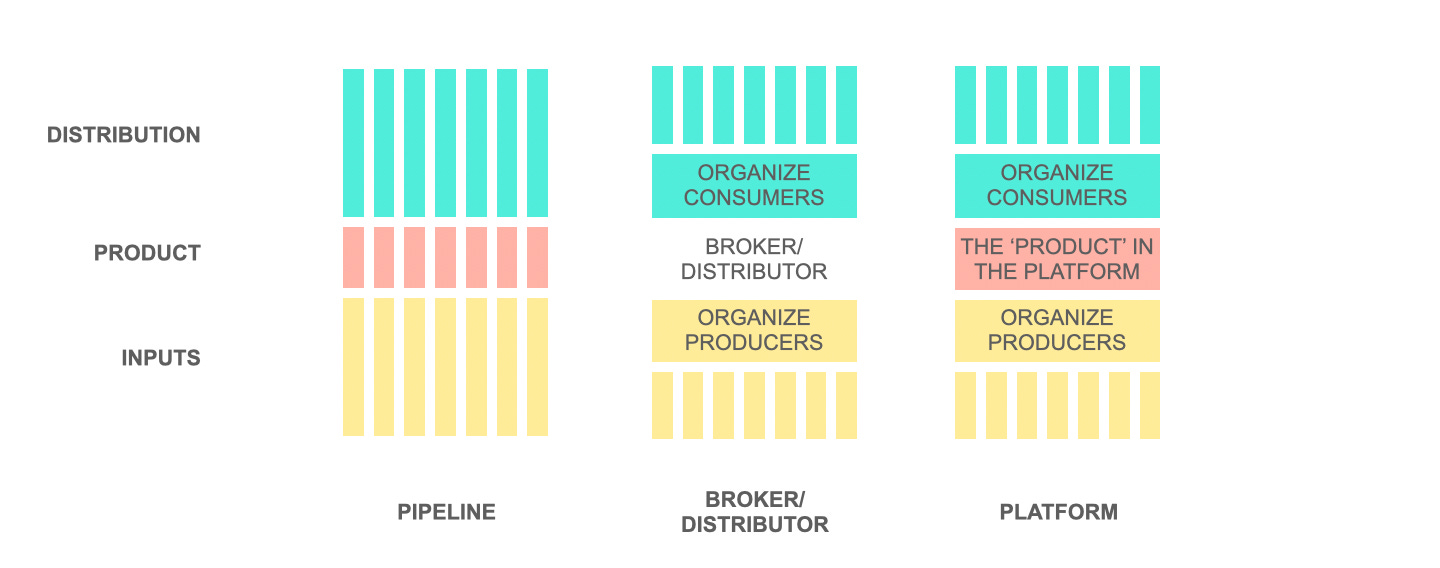

Finding the product in your platform

On the risks of over-emphasizing platform thinking

FEB 4, 2024

In an age of platform hype, everyone scrambles to find the platform in their product.

If you’re a product business, chances are you’ve been told that platforms beat products and hence you should look to become a platform.

There is a problem with over-emphasising platform thinking and the ‘platforms beat products’ narrative:

By positioning ‘platforms’ as superior to ‘products’, we risk throwing away the simple first principles of product thinking which have served us well for centuries.

We need to embrace ‘product thinking’ and find the product in our platform.

Understanding the ‘product’ in our platform helps us clarify where it really creates value, and more importantly, where it can effectively capture value.

Through the examples used below, it will also help understand:

How Spotify gains control back from labels

Why most Banking-as-a-service API platforms fail

Where reputation systems work and where they don’t

Why food delivery models work better in Asia/LatAm than in Europe/US

Amazon’s right to play in the Kindle publishing ecosystem

Let’s dig in!

If this is the first time you’re here, subscribe to get the latest analysis straight to your inbox!

Pledge your support

What is a product, really?

Traditional product value chains operate across inputs, product, and distribution.

This simple arrangement creates a linear flow of value to create -what I first called back in 2013 - a ‘pipe’ or a ‘pipeline’.

A product is the offering the firm creates through the transformation of inputs, which it then distributes downstream.

This is fairly straightforward in product value chains.

It gets a lot more vague with platforms.

Platforms combine:

a mechanism to attract and organize inputs (on the producer side) and

a mechanism to distribute (on the consumer side).

But what is the ‘product’ in the middle in case of platforms.

Essentially, apart from aggregating and organizing producers and consumers - which is largely a mechanism to organize value chain actors - what is the unique product that the platform is creating which gives it the right to sit at the centre of the ecosystem?

If you think of it, distributors and brokers also aggregate producers and consumers. Yet they don’t command the right to sit at the centre of the ecosystem (except through the control of asymmetric information or relationships).

The ‘product’ creates the difference between a distributor and a platform.

What is a platform uniquely creating in the middle which gives it the right to sit at the center of the ecosystem?

Let’s unpack this with a few examples.

Video of the Week

AI of the Week

How AI Will Usher in an Era of Abundance

Posted February 7, 2024

It’s impossible to talk about new technology without talking about human flourishing — every new technology from the plow to the microchip has typically been followed by a period of newfound wealth for consumers in the form of cheaper goods, improved productivity, and longer, healthier lives. In many ways, the most financially average person in our modern society experiences daily luxuries that history’s Pharaohs and Caesars could not imagine: instant communication, broadcast television, global travel, antibiotics.

As we enter the AI era, we predict the benefits to consumers will be as profound as the technology is magical; what indeed are the implications for software that can write poetry, listen emphatically, compose music, or provide dating advice?

In a word, we predict an Era of Abundance — consumers’ lives will be enriched through new channels for creativity and self expression, new paths to self discovery and belonging, and new ways to do the most meaningful work of their lives.

Specifically:

Consumers will rediscover the latent creativity that lives within all of us. Lacking creative skills will no longer be a barrier to creating art; indeed, AI will close the gap between taste and art, and new creative workflows like Real Time will emerge from the technology.

Consumers will have an opportunity to craft their most impactful and efficient work, as their productivity multiplies and their administrative overhead goes to zero. New skill sets, new techniques, and new ways to gain expertise will clear a path toward wider, more meaningful careers.

Consumers will find new opportunities for connection and belonging, as the fundamental human need for compassion and fellowship is increasingly facilitated by AIs that are infinitely empathic to everyone’s unique forms of weird.

And consumers will have access to richer opportunities for personal development and self care. Teams of smart and dedicated specialists focused solely on the needs of one person will exist for all, as AI plays the role of a patient tutor, savvy wealth manager, and expert therapist.

Consumer software companies are amongst the most valuable in the world (FAANG is all consumer) and were built during a major platform shift or product cycle. We expect this time to be no different.

Below you’ll find our thoughts and observations regarding the state of consumer AI. As we say, “Consumer cannot be predicted, only observed” — so we put forward these thoughts with the humility of knowledge that founders will be the ones to invent and define the future, and we can’t wait to invest in them. Click below to learn more.

Google launches Gemini Ultra, its most powerful LLM yet

Frederic Lardinois @fredericl / 5:00 AM PST•February 8, 2024

Image Credits: Google

Google Bard is no more. Almost exactly a year after first introducing its (rushed) efforts to challenge OpenAI’s ChatGPT, the company is retiring the name and rebranding Bard as Gemini, the name of its family of foundation models. More importantly, though, it is also now launching Gemini Ultra, its most capable large language model yet.

Gemini Ultra will be a paid experience, though. Google is making it available through a new $20 Google One tier (with a two-month free trial) that also includes 2TB of storage and the rest of Google One’s feature set, as well as access to Gemini in Google Workspace apps like Docs, Slides, Sheets and Meet. With that, Google will also sunset the Duet AI brand, which was mostly restricted to its AI features in Workspace, and move that to Gemini as well.

The company is also launching a new Gemini app for Android and bringing it to the Google app on iOS — and on Android, you can now replace your Google Assistant with Gemini, too. As for developers who want API access to the Ultra model, Google said it’ll have more to share in the coming weeks.

Gemini Advanced will be available in more than 150 countries and territories, but only in English for the time being. Japanese and Korean are next on the roadmap for additional languages.

Image Credits: Google

Gemini Ultra 1.0

Image Credits: Google

When Google announced Gemini, it only made the Gemini Pro model widely available through Bard. Gemini Pro, Google said at the time, performed at roughly the level of GPT-3.5, but with GPT-4 widely available, that announcement felt a bit underwhelming. Back then, Google said Gemini Ultra, the flagship model, would launch to consumers in early 2024 after a round of private tests. While the company didn’t say so explicitly, the understanding at the time was already that the Ultra model would be part of a paid plan, dubbed Bard Advanced at the time and now renamed to Gemini Advanced.

“Gemini Ultra 1.0 is a model that sets the state of the art across a wide range of benchmarks across text, image, audio and video,” Google’s Sissie Hsiao said in a press conference ahead of today’s announcement. “For Google, Gemini is more than just the models. It’s really a shift in how we think about the state-of-the-art technology and the entire ecosystem that we’re building on it, from products that affect billions of users, to the APIs and platforms that developers and businesses use to innovate.”

Some OpenAI Investors Sit Out Share Sale, Reflecting AI Divide

After a yearlong frenzy to invest in AI startups, some VC firms are largely avoiding the buzzy sector, chilled by the high valuations of OpenAI and worried about the threat of Google and Amazon.

By Natasha Mascarenhas and Kate Clark

Feb 6, 2024, 6:00am PST

Sam Altman. Photo via Getty Images

For the past year, owning a stake in OpenAI was akin to possessing Silicon Valley gold, signaling that the investor had a ticket to the next great tech transformation. But as the valuation of the startup has tripled, some investors have refrained from buying more. And a number of marquee venture capital firms have shied from investing in dozens of artificial intelligence startups out of fears that the sector is too competitive and prices are too high.

Founders Fund has been in the more cautious camp. In January 2023, it agreed to buy shares in the ChatGPT maker from existing holders at a price that implied a $29 billion valuation. But when OpenAI late last year embarked on a new sale of employee and investor shares at an $86 billion valuation, Founders Fund didn’t purchase more. It’s largely been avoiding the generative AI sector.

The Takeaway

• Founders Fund has avoided most generative AI investments

• Approach contrasts with Thrive, Kleiner and Menlo

• Some firms have balked at OpenAI’s rising valuation

“Even if you have another startup that is twice as efficient as OpenAI…it’s not enough,” said John Luttig, a Founders Fund investor who led the OpenAI investment with partner Trae Stephens. The startup “captured lightning in a bottle,” making it hard for others to catch up, he said.

AI Divide

This position reflects a growing schism between venture capitalists over the investment opportunities in conversational AI that helps automate coding, writing, graphic design and other tasks. Some, such as Andreessen Horowitz, have overhauled their firms to focus investments on AI, backing startups trying to catch up to OpenAI or piggybacking on AI successes. But others are leery, worried that large companies like Microsoft, Amazon and Google will ultimately win out because they have the immense capital needed to develop the technology.

At the same time, OpenAI’s valuation has continued to surge, turning off some investors.

Sequoia Capital, which backed OpenAI in 2021 during an employee share sale that year, did not invest in the $86 billion–valuation tender offer because of some partners’ belief that the valuation was too high, The Information previously reported.

Khosla Ventures, which in 2019 made the first outside VC investment in the startup after it launched a for-profit arm, did not participate in the latest tender offer because the firm targets early-stage investments, a person familiar with the matter said. Those typically come at much lower prices.

As OpenAI has discussed a new round of capital raising at a $100 billion valuation, according to Bloomberg, some existing OpenAI investors and prospective ones have said privately that such a price would be too high.

That said, plenty of other VC firms have been more than happy to jump into OpenAI, especially as the company has increased its annualized revenue pace to $1.6 billion as of December from $1.3 billion in October.

Thrive Capital, which also invested in the 2023 secondary offer, led the most recent secondary sale, which attracted Ashton Kutcher’s Sound Ventures and others. For the startup’s future fundraising, sovereign wealth funds, private equity firms and other large institutional investors, which aren’t under the same pressure to produce home-run venture returns of 100 times the invested capital, could invest.

a16z’s Chris Dixon thinks it’s time to focus on blockchains’ use cases, not speculation

'The focus should be on digital ownership'

Jacquelyn Melinek @jacqmelinek / 9:30 AM PST•February 2, 2024

Comment

Image Credits: Darrell Etherington / TechCrunch

The crypto world is riddled with noise. Memecoins, speculation, rug pulls, scams, hype and doomers distract us from all the innovative stuff people are building with blockchains. And sometimes the noise pollutes the stream of information so much, it can get really difficult to continue to believe in the technology.

Still, one venture capital veteran feels the only way to cut a clear path is to focus on blockchain technology and startups building in the industry.

“Crypto and blockchains are in the news a lot, but a lot of it is around speculation and prices. I feel that there’s another side of the story,” Chris Dixon, partner at Andreessen Horowitz (a16z), told me on TechCrunch’s Chain Reaction podcast. “It’s the side of the story that I live in, that the entrepreneurs we work with live in, which is what I would call the productive side of blockchains.”

Dixon has been at a16z since 2012 and he even helped found the firm’s crypto division, which he currently leads. In the past year or so, he has been heads-down writing his new book, “Read Write Own,” which came out earlier this week.

In the book, Dixon compares blockchains to steel and the Web 2.0 internet to wood — when steel first came about, most people thought it was unnecessary because wood worked fine, but then things changed drastically once steel was adopted at scale.

“Blockchains are a new building material that lets you build internet services,” Dixon said, explaining the analogy. “My core argument is that [you] have all of the wonderful advantages of these corporate networks like Facebook and Twitter, and you can build modern interfaces. You can do all sorts of other interesting stuff. But you don’t have to sacrifice the control and give it over to a small group of people; you can maintain community control.”

He argues that blockchains are the best of both worlds, and “allow entrepreneurs to build new internet services that return the internet through an open and democratic network.”

..More

Highlights of the OpenAI’s New GPT Store

GENERATIVE AIMODELINGCHATGPTOPENAIposted by ODSC Team February 1, 2024

With OpenAI’s ChatGPT Store coming online this year, thousands of AI enthusiasts are flocking to the platform to create original chatbots based on the Generative Pre-trained Transformers (GPT) architecture. As you can imagine, a wealth of creativity has created chatbots for about any task. From graphic design to academic research, the capabilities of GPT tools are expanding horizons and simplifying complex tasks. So let’s dive in, and check out some of the trending GPTs in the ChatGPT store.

Canva: The Ultimate Design Tool

Canva has emerged as a go-to tool for anyone looking to design anything from presentations to logos and social media posts in the GPT Store. Its user-friendly interface combined with a vast library of templates and design elements makes it a favorite among both professionals and hobbyists. This section explores how Canva stands out in the market and the experiences of users who have incorporated it into their design workflow.

Image Generator: Bringing Visuals to Life

In the realm of visual content creation, Image Generator has carved out a niche for itself. This GPT specializes in generating and refining images, striking a balance between professional quality and a friendly user interface. This part of the article looks at how Image Generator differentiates itself in the market and its practical applications in various fields.

Logo Creator: Professional Designs Made Simple

Creating a professional-looking logo is no longer the exclusive domain of graphic designers, thanks to tools like Logo Creator. This section focuses on the advantages of using Logo Creator for both businesses and individuals, supplemented by case studies of successful logo designs created with this tool.

Diagrams: Show Me – Visualization Simplified

For those who need to create diagrams, flow charts, or mind maps, “Diagrams: Show Me” offers a simplified yet powerful solution. This segment explores the unique selling points of this tool, how it simplifies the visualization process, and its real-world applications.

Consensus: Your AI Research Assistant

Consensus is changing the game in academic research by providing access to a vast database of academic papers and science-based answers. This section looks at the capabilities of Consensus and its impact on the research community, including testimonials from users.

Video GPT by VEEDAI: Revolutionizing Video Creation

Video GPT by VEEDAI is a groundbreaking tool for creating videos for social media platforms like YouTube, Instagram, and TikTok. This part of the article breaks down the features and innovations of Video GPT, alongside success stories and creative uses by its users.

Hot Mods: Customizing Images Like Never Before

Hot Mods offers a unique service for image modification, allowing users to transform their images into something extraordinary. This section delves into the features of Hot Mods and showcases creative outcomes from its users.

Super Describe: Enhanced Image Descriptions

Super Describe uses DALL·E 3 to provide similar images along with detailed prompts. This segment discusses the technology behind Super Describe and shares stories from users who have benefited from its services.

…More

News Of the Week

X, formerly Twitter, becomes No. 1 app on US App Store after news of Tucker Carlson-Putin interview emerges

Sarah Perez@sarahpereztc / 9:28 AM PST•February 7, 2024

Comment

Image Credits: TechCrunch

After former Fox News TV host Tucker Carlson announced on X he would be interviewing Russian president Vladimir Putin, downloads of the app formerly known as Twitter jumped, sending X to the top of the U.S. App Store overnight. Multiple outlets on Wednesday, including Reuters, the AP, and The New York Times, have confirmed that Carlson’s interview has already taken place, and The Wall Street Journal said the interview is expected to air on Thursday, citing unnamed sources.

Interest in the Carlson-Putin interview likely drove a spike in new installs for the X app, which began climbing up the App Store charts around 7 PM EST and then became the No. 1 app by midnight, according to data from app intelligence firm Appfigures. Its move unseated rival Instagram Threads, which was previously the top app and has now moved down to No. 2.

Image Credits: Appfigures

Appfigures’ early estimates indicate X gained 117,000 new downloads on Tuesday, up from 93,000 the day before. Because the app started gaining steam later in the evening, the firm believes X could still gain more installs today.

In his video, Carlson touted on the Elon Musk–owned platform that he would soon air Putin’s first interview with a Western media outlet since Russia’s invasion of Ukraine. A Kremlin spokesperson told Reuters that Putin agreed to the interview because Carlson’s approach would differ from the “one-sided” reporting on Ukraine by many Western media outlets. In other words, Putin believes he will not only get a sympathetic ear but also the ability to reach a broader, potentially sympathetic audience.

…More

Arm’s gains are SoftBank’s gains

Kyle Wiggers @kyle_l_wiggers / 4:23 PM PST•February 8, 2024

Image Credits: Kiyoshi Ota / Bloomberg / Getty Images

Not so long ago, things were looking bleak for SoftBank, the investment holding company headed by eclectic — and controversial — tech mogul Masayoshi Son. The Vision Fund, SoftBank’s venture arm, posted a $6.2 billion loss in Q2 2023, tied to WeWork and other unfortunate bets.

But — thanks in no small part to chip design house Arm — SoftBank’s fortunes appear to be turning around. While consensus remains mixed on the Vision Fund’s long-term prospects, it’s on the upswing for now — and what an upswing it is.

SoftBank took Arm public in September and still owns about 930 million shares, or 90%, of the chip company’s stock. Arm had a blockbuster quarter, blowing past analysts’ expectations for both revenue and earnings. The company reported adjusted earnings per share of 29 cents, topping the average analyst estimate of 25 cents, according to LSEG (via CNBC), while the company’s revenue rose 14% to $824 million, beating the $761 million average estimate.

Arm projects revenue growth into the next quarter will be even stronger: 38%.

Investors rewarded Arm’s performance, driving the company’s stock price up as high as 57.4% on Wednesday. The chip company added about $38 billion to its market cap, more than $34 billion of which accrued to SoftBank. As CNBC pointed out, SoftBank made more in Arm’s trading than the total amount it lost on now-bankrupt WeWork ($14 billion).

The AI boom drove much of Arm’s recent business.

Arm, based in Cambridge, makes most of its money licensing the chips it designs to customers and charging royalties for each chip sold that uses its technologies. Arm’s bread-and-butter work remains mobile chips for devices like smartphones, tablets and smartwatches; 35% of overall units shipped this quarter were smartphone-bound, according to Arm finance chief Jason Child. But an increasing share of the billions of chips Arm’s customers produce each quarter is hardware designed to accelerate AI workloads.

Both Microsoft and Amazon, among others, are deploying custom-designed Arm chips to run AI models. So are countless startups in the expanding market for tailored AI chips.

While the bulk of Arm’s AI chip sales are indirect at present, often paired with GPUs in data centers, the company expects direct sales to increase as consumers buy new laptops and other devices with chip-accelerated AI features. In another boon for Arm, AI-supporting chips will command higher royalty revenues. Arm charges roughly double the royalty rate for its latest processor architecture (v9) versus the previous generation.

All this is music to SoftBank’s ears, I’d guess — particularly at a time when tempestuous U.S.-China relations have put a damper on the holding company’s investments in key Asian economies.

…More

Uber ends the year in the black for the first time ever

The once perennially unprofitable company has finally found its financial footing.

By Andrew J. Hawkins, transportation editor with 10+ years of experience who covers EVs, public transportation, and aviation. His work has appeared in The New York Daily News and City & State.

Feb 8, 2024, 7:50 AM PST

Well, it only took 15 years, but better late than never.

For the first time in its history, Uber ended the year having made more money than it spent on its ridehailing and delivery operations. As noted by Business Insider, the company reported an operating profit of $1.1 billion in 2023, compared to a $1.8 billion loss in 2022. Moreover, Uber said it made a net income of $1.9 billion after losing a whopping $9.1 billion in 2022.

“Looking back, 2023 was an inflection point for Uber,” CEO Dara Khosrowshahi said in an earnings call this week, “proving that we can continue to generate strong profitable growth at scale.”

“Looking back, 2023 was an inflection point for Uber”

Under Khosrowshahi, Uber has made steady progress in the years following the pandemic. Even as far back as February 2020, Uber was sounding like profitability was well within reach. But covid led to a major crash, as the company’s rides business collapsed. Demand for delivery spiked, but it was barely enough to keep the company afloat.

As the pandemic subsided, driver supply became a major issue, so Uber started spending huge piles of cash luring them back to the platform. That led to more big quarterly losses, spurring Khosrowshahi to order a “hardcore” cost-cutting effort. In August 2022, Uber reported its first positive cash flow, which indicated that the company was generating more money from its business operations than it was losing. Still, profitability remained elusive.

Less than two years later, Khosrowshahi finally found the right balance and will have a lot to brag about heading into the company’s investor day event next week. Analysts are predicting some sort of share repurchase program and updated financial targets.

But all that belies the importance of getting Uber onto stronger financial ground. For years, the company was derided for using its bundles of venture capital cash to subsidize the price of a car trip in a city, artificially lowering the cost of a ride to lure in millennial customers who were turned off by clunky, digitally hostile taxis. And critics predicted that Uber would never be profitable because its business model was fundamentally flawed.

Now, Uber trips are more expensive, and taxi fleets are slowly rebuilding their operations. In fact, Uber is adding taxis to its app in a bid to offer a helping hand to its former rival. And instead of subverting the law and thumbing its nose at regulators, the company is attempting to play nice — or at least that’s what it says.

…More

Adam Neumann got kicked out of WeWork — now he wants to buy it

It doesn’t seem like WeWork is interested in entertaining the ousted CEO’s offer.

By Emma Roth, a news writer who covers the streaming wars, consumer tech, crypto, social media, and much more. Previously, she was a writer and editor at MUO.

Feb 6, 2024, 6:58 AM PST

Five years after driving WeWork into the ground, co-founder and ousted CEO Adam Neumann has now hatched a plan to buy it out of bankruptcy. In a letter to WeWork’s advisers obtained by The New York Times, Neumann and his new real estate business, Flow Global, express interest in buying the co-working space solution — but claim WeWork has been ignoring attempts to get more information so they can come up with a bid.

Neumann and Flow Global have been exploring a purchase of WeWork since December 2023, with the help of funding from Dan Loeb’s hedge fund, Third Point. However, as noted in the letter written by Neumann’s attorney Alex Spiro — the same person who represents Elon Musk — WeWork doesn’t seem interested in entertaining Neumann’s potential offer.

“We write to express our dismay with WeWork’s lack of engagement even to provide information to my clients in what is intended to be a value-maximizing transaction for all stakeholders,” Spiro writes. I wonder why. With Neumann at the helm, the once-$47 billion company threw out plans for an initial public offering in 2019. That’s around the same time Neumann stepped down (but not before taking an enormous payout, of course).

..More

EU countries strike deal on landmark AI rulebook

The bloc’s law to regulate AI overcomes threats of late opposition.

FEBRUARY 2, 2024 3:42 PM CET

BRUSSELS — European Union member countries on Friday unanimously reached a deal on the bloc’s Artificial Intelligence Act, overcoming last-minute fears that the rulebook would stifle European innovation.

EU deputy ambassadors green-lighted the final compromise text, hashed out following lengthy negotiations between representatives of the Council, members of the European Parliament and European Commission officials.

The law would ban some applications of AI technology, impose strict limits on use cases considered high-risk, and hem in the most advanced software models with obligations of transparency and stress-testing.

The EU is the first out of the blocks in laying down binding rules for fast-moving AI technology. Even if many countries and international clubs — from the OECD to the G7 — have spent the past few years pondering how to regulate AI, most have stuck to voluntary guidelines or codes of practice.

When EU policymakers announced they had found a final compromise on the AI Act’s content in December, the breakthrough was hailed as a pioneering step Europe should celebrate amid the rise of ubiquitous AI tools such as OpenAI’s ChatGPT and Google’s Bard.

But the achievement rubbed some EU countries the wrong way. Over the past few weeks, the bloc’s top economies Germany and France, alongside Austria, hinted that they might oppose the text in Friday’s vote.

While Vienna’s beef was with data protection provisions, Paris and Berlin warned that rules for advanced AI models would hamstring Europe’s budding AI champions, such as France’s Mistral and Germany’s Aleph Alpha. With Italy — sometimes an AI Act critic — keeping mum on its intentions, the AI Act’s fate was suddenly in question, as four opposing countries would be enough to derail the law for good.

.. More

Zuckerberg Calls Apple's DMA Compliance Changes 'Onerous' and 'Difficult to Seriously Entertain'

Friday February 2, 2024 3:02 am PST by Tim Hardwick

Meta CEO Mark Zuckerberg has criticized Apple's compliance with the EU's Digital Markets Act (DMA) regulation, which forces Apple to let third-party developers create alternative App Stores and use their own payment systems, amongst other things.

Speaking to investors on Thursday during Meta's Q4 earnings call, Zuckerberg called Apple's new rules "so onerous" that he would not be surprised if any developer adopted them.

"I don't think that the Apple thing is going to have any difference for us. Because I think that the way they have implemented it, I would be very surprised if any developer chose to go into the alternative app stores that they have. They've made it so onerous, and I think so at odds with the intent of what the EU regulation was, that I think it's just going to be very difficult for anyone, including ourselves, to really seriously entertain what they're doing there."

The introduction of the EU's DMA regulations were designed to increase competition in the bloc's app economy by allowing other companies to host their own app stores and collect payments, without them being subjected to Apple's commission rates. However, Apple has introduced a new fee structure as part of the change, including a €0.50 "Core Technology Fee" or CTF for every app install over one million installs, a model that could be prohibitively expensive for free apps like Meta's if they are distributed outside of the App Store.

Meta's comments broadly align with several other big companies critical of Apple's proposed DMA changes, including Spotify, Epic Games, Mozilla, and Microsoft.

Spotify CEO Daniel EK called Apple's plan "a complete and total farce" under "the false pretense of compliance and concessions." Epic Games CEO Tim Sweeney, another outspoken Apple critic, said that the App Store changes are a "devious new instance of malicious compliance" aimed at thwarting EU regulations. Microsoft said they are a "step in the wrong direction," while Mozilla said it was "extremely disappointed" and called the plans "another example of Apple creating barriers to prevent true browser competition on iOS."

EU regulators say they intend to study Apple's proposed plans after March 7, when the DMA goes into effect.

..More

Spotify CEO Daniel Ek tells investors Apple’s DMA rules are a ‘farce,’ but says there are ‘future upsides’ too

Sarah Perez @sarahpereztc / 9:36 AM PST•February 6, 2024

Image Credits: TOBIAS SCHWARZ/AFP / Getty Images

Spotify, a notable Apple critic, unsurprisingly came out swinging after Apple announced how it was complying with the EU’s new regulation, the Digital Markets Act, or DMA, calling Apple’s plan “extortion” and a “complete and total farce.” But on its Q4 2023 earnings call with investors, Spotify CEO Daniel Ek took a more muted tone concerning the new law, saying that there’s no real downside to its business, from an investor standpoint, as companies can remain on their current terms with Apple, and in fact, there are potential “future upsides, that could be quite significant.”

The streamer is one of many vocal critics of the new law, joining others like Epic Games, Mozilla and Microsoft which have raised concerns about Apple’s implementation.

Though Apple is complying with the letter of the law — which forces Apple to open up its app ecosystem to new app stores and other payment mechanisms — it’s definitely not complying with the spirit of the law, meant to foster greater competition. Instead, Apple’s complicated new terms involve a new Core Technology Fee, which requires developers to pay €0.50 for each first annual install per year over a 1 million threshold, regardless of their distribution channel. It will also take a commission on digital goods and services that take place on a developer’s website within seven days of a user tapping through an in-app link for external purchases.

Ek immediately blasted Apple on social media after its terms were announced, calling Apple’s solution a “masterclass in distortion” and warning that Spotify could “not afford these fees” if it wanted “to be a profitable company.”

To investors on the quarterly earnings call, he reiterated this stance, saying that Apple’s solution was a “farce” that “no sane developer” would want to choose. However, he downplayed any negative impact Apple’s rules would have on Spotify’s business or revenues.

“I know that there initially was some questions about whether or not this would be a downside for Spotify. I don’t think that’s the case. So, you know, we still have the ability to be on the old terms, and keep going as we’re currently going,” Ek said. In other words, nothing is changing for Spotify in the near term as the new law goes into effect.

In addition, the CEO suggested some pluses could emerge from the new competitive landscape, adding that there are “future upsides” to the new rules that could be “quite significant.” The company had hinted before about its plans in a blog post, saying that the DMA would allow for things like superfan clubs and alternative app stores, and would give creators the ability to download the Spotify for Artists app and Spotify for Podcasters app directly from its website. (This was the first time Spotify mentioned superfan clubs, in fact.)

In addition, the company had earlier said that the loosened rules would mean it could communicate to customers in its app about “new products for sale, promotional campaigns, superfan clubs, and upcoming events, including when items like audiobooks are going on sale,” the blog post read.

… More

Apple says EU represents 7% of global App Store revenue

Ivan Mehta @indianidle / 9:37 PM PST•February 1, 2024

Image Credits: Bryce Durbin / TechCrunch

Nearly a week after Apple announced big changes to the App Store because of the European Union’s Digital Markets Act (DMA) rules, the company said that the market represents 7% of its global App Store revenues.

The company’s chief financial officer Luca Maestri said that the monetary impact of these changes will depend on choices made by developers to adopt different systems.

“A lot will depend on the choices that will be made. Just to keep it in context, the changes applied to the EU market, which represents roughly 7% of our global app store revenue,” he said in reply to an analyst’s question.

Because of DMA, Apple has to allow alternative app stores and let developers use third-party payment processors. The company plans to charge a core tech fee if an app crosses a million annual downloads across different app stores.

..More

Startup of the Week

Bluesky is now open for anyone to join

Amanda Silberling @asilbwrites / 6:00 AM PST•February 6, 2024

Image Credits: Bryce Durbin / TechCrunch

After almost a year as an invite-only app, Bluesky is now open to the public. Funded by Twitter co-founder Jack Dorsey, Bluesky is one of the more promising micro-blogging platforms that could provide an alternative to Elon Musk’s X.

Before opening to the public, the platform had about 3 million sign-ups. Now that anyone can join, the young platform faces a challenge: How can it meaningfully stand up to Threads’ 130 million monthly active users, or even Mastodon’s 1.8 million?

Bluesky looks and functions like Twitter at the outset, but the platform stands out because of what lies under the hood. The company began as a project inside of Twitter that sought to build a decentralized infrastructure called the AT Protocol for social networking. As a decentralized platform, Bluesky’s code is completely open source, which gives people outside of the company transparency into what is being built and how. Developers can even write their own code on top of the AT Protocol, so they can create anything from a custom algorithm to an entirely new social platform.

“What decentralization gets you is the ability to try multiple things in parallel, and so you’re not bottlenecking change on one organization,” Bluesky CEO Jay Graber told TechCrunch. “The way we built Bluesky actually lets anyone insert a change into the product.”

This setup gives users more agency to control and curate their social media experience. On a centralized platform like Instagram, for example, users have revolted against algorithm changes that they dislike, but there’s not much they can do to revert or improve upon an undesired app update.

The literal elephant in the room is Mastodon, the open source, decentralized social network that’s been around since 2016, years before Bluesky existed. While the platforms share similar goals, they use different protocols, making it difficult for the platforms to work together. While some communities have found a home on Mastodon, others have been deterred by the network’s confusing onboarding process and technical terminology. That’s where Bluesky’s strategy diverges.

“The whole philosophy has been that this needs to have a good UX and be a good experience,” Graber said on a panel last month. “People aren’t just in it for the decentralization and abstract ideas. They’re in it for having fun and having a good time here.”

..More