A reminder for new readers. Each week, That Was The Week includes a collection of selected readings on critical issues in tech, startups, and venture capital. I chose the articles based on their interest to me. The selections often include viewpoints I can't entirely agree with. I include them if they provoke me to think. The articles are snippets or varying sizes depending on the length of the original. Click on the headline, contents link, or the ‘More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below.

Hat Tip to this week’s creators: @BrankoMilan, @europressos, @AfPalasciano, @adam_tooze, @MCC_Brussels, @Norm_Lewis, @KateClarkTweets, @Alex_Lazarow, @AABerwick, @BenFoldy, @peternixey, @rhodgkinson, @andyjayhawk, @_odsc, @Kantrowitz, @amir, @steph_palazzolo, @Kyle_L_Wiggers, @girlstothefront, @mcbridesg, @geneteare, @elonmusk

Contents

Elon Musk Live at All In Summit

Waymo and Uber expand their robotaxi partnership to Austin and Atlanta

New AI Chip Surpasses Nvidia, AMD, and Intel with 20x Faster Speeds and Over 4 Trillion Transistors

Is OpenAI’s New “o1” Model The Big Step Forward We’ve Been Waiting For?

OpenAI COO Says ChatGPT Passed 11 Million Paying Subscribers

OpenAI In Talks To Raise $6.5 Billion at $150 Billion Valuation

Keen On: Gary Marcus on How to Tame Silicon Valley’s AI Barons

Australian Government is “Fascist” - Elon Musk

Editorial

I often write about being an optimist here. But this week, Peter Thiel was asked if he is an optimist. I didn’t make it Video of the Week; Elon Musk gets that privilege. Both are from the All In Summit, which appears to have been a great success.

Here is what he had to say:

The key takeaway is that both pessimism and optimism are passive. They are about opinion, unlike doing things and impacting the outcome. Optimism is only an opinion unless it derives from the feeling you get when you try to do something and succeed. He is right, and my support for optimism is unmasked as a passive reaction, needing action to bring about the changes I want. Pessimism is the same. Fearing a future is only helpful if used as fuel to create your desired future. Both Optimism and Pessimism are false gods. And both require action to affect future outcomes. Both need their believers to become activists. And activists almost always become shapers of human experience.

This week, there are a lot of pessimistic pieces in this newsletter. This week's leading piece is the report from former president of the European Central Bank, Mario Draghi. It is a devastating critique of the EU's failure to generate innovation and GDP growth.

He focuses on many failings, but two of the themes highlighted in this newsletter are central—failure to invest sufficiently and an overly restrictive regulatory attitude to technology.

He calls for €800b annually to be spent on innovation, which is 5% of the EU's GDP.

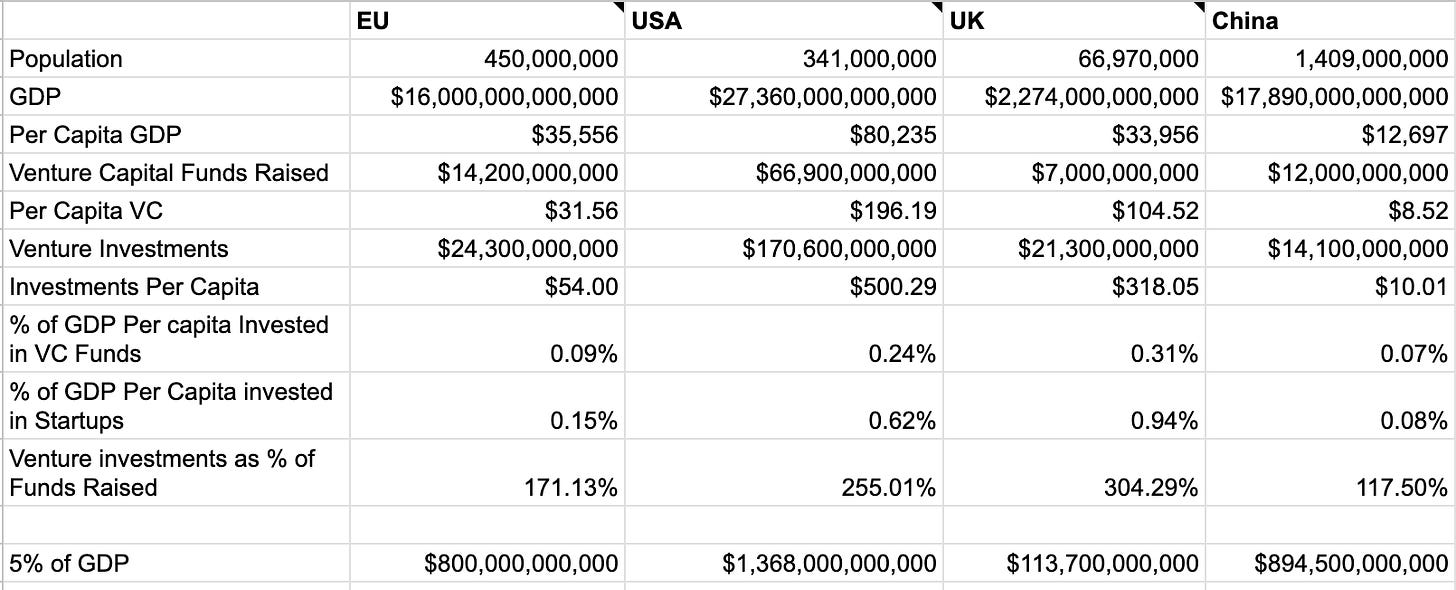

The facts are strikingly in his favor. Here are the GDP, Population, and venture investment numbers to compare the EU to the USA, China, and the UK.

The GDP per capita in the EU and UK are similar. However, the UK spends $318 per capita on venture investments annually, compared to only $54 in the EU. The USA is well ahead, with a GDP per capita almost three times the other two and a spend on venture per capita of $500.

The EU would need to spend $225 billion a year more to equal the USA. He suggested almost four times that he catch up on lost ground.

It isn’t only the EU that is falling into decline. Blanko Milanovic writes about the breakdown of the post-WW2 international monetary and trading system and the challenges an “international economic system” faces with rising “nationalisms.”

If the international neoliberal rules are no longer considered the appropriate rules for the United States and Europe, should they be considered as the right rules for the rest of the world?

There is simply no current answer to this question. The new rules have to be invented and introduced or the entire system will become incoherent and internally contradictory so much that eventually no “system” at all will exist. The world will be back to individual country optimization under the rules of the jungle.

The article from the Wall Street Journal chronicling the rise of the crypto-stable coin Tether perhaps shines a light on how much technology is routing around these failed systems:

A giant unregulated currency is undermining America’s fight against arms dealers, sanctions busters and scammers. Almost as much money flowed through its network last year as through Visa cards. And it has recently minted more profit than BlackRock, with a tiny fraction of the workforce.

Its name: tether. The cryptocurrency has grown into an important cog in the global financial system, with as much as $190 billion changing hands daily.

Earlier in the video embedded above, Peter Thiel speaks about this impact on World War Three pessimists.

Ray Dalio has been speaking about the same thing for a long time.

So, what is an optimist to do? Not sit at home, feeling smug and spouting optimism. A famous politician once said, ‘What is to be Done?’

The answer is to make the future happen. And to help stop the future you least prefer. Draghi’s calls to invest in innovation are right. This week, SpaceX succeeded in the first civilian spacewalk, more than 500 miles above the Earth, and tested equipment designed to go to Mars. Uber and Waymo announced that they would join the robo-taxi initiative in more cities. OpenAi released a “reasoning” version of ChatGPT. Cerebras Systems released a twenty times more efficient AI chip than Nvidia’s GPU chips.

People are doing things and succeeding all around us. I’m neither optimistic nor pessimistic. I’m writing this newsletter and also building SignalRank. See you next week.

Essays of the Week

The third framing

Can an international economic system exist in the world of nationalisms?

Branko Milanovic, Sep 09, 2024

The post World War II international economic organizations were conceived and founded at the Bretton Woods conference held in July 1944, almost exactly eighty years ago. They sought to avoid the disastrous economic effects of protectionism that deepened and lengthened the Great Depression and perhaps led to the War. The rules were based on the ideas of fixed exchange rates, moderate tariff protection, ability to borrow in order to solve temporary balance of payments problems, depolitization of economic decision-making, and in the guise of the International Bank for Reconstruction and Development (the World Bank) to raise funds in rich countries to fund individual economic projects in poorer countries. Hundreds, or perhaps thousands, books were written on the topic. From my recent readings (which were often motivated by different concerns), let me provide just three references: Mark Mazower’s “Governing the World”, Samuel Moyn’s “Not Enough “ (my review here) and Zach Carter’s, “The Price of Peace” (my review here). In addition, the framers planned to create International Trade Organization, which did not materialize then but was “substituted” by the General Agreement on Tariffs and Trade (GATT) that laid down the rules on tariffs, dumping, subsidies etc. that regulated world trade.

The system changed when the US decided to abandon dollar’s parity to gold (under Nixon), flexible exchange rates replaced the fixed rates, and trade became much more liberalized, including, in many cases, the opening of the capital account (i.e. ability to transfer capital from one country to another). By the 1980s, under the influence of the Thatcher/Reagan revolutions in the two most economic-policy-influential countries in the world, the fall of communism, and China’s reinclusion in the global economic system, there was a further liberalization of exchanges while the depoliticization of project lending was replaced by the World Bank Structural Adjustment Loans (SAL) that were direct cash loans to governments in exchange for neoliberal policy reforms.

This represented a signal departure from the earlier rules of depolitization. When lending for projects, the World Bank really, or ostensibly, tried to avoid political conditions and insisted on simple economic viability. For sure, it could be argued that economic viability implied strict market rules but that was not an explicit condition. With the demise of communism, neoliberal rules embraced the world and as far as international development was concerned they became summarized under the ten principles known as the Washington Consensus (originally defined by John Williamson in response to Latin American debt crisis). The rules, among others, included: lower tariffs and no discrimination among trading partners (Rule No 5), reduced government spending and elimination of subsidies (Rule No 1), depoliticization of the economy and absence of industrial policies (Rule No 2), deregulation of all economic activities (Rule No 9), and privatization (Rule No 10).

These rules, even if defined with respect to a development crisis in Latin America, applied in principle to all countries equally. These were, in the minds of their originators, the sound economic principles, “espoused by all right-minded economists” as valid for the United Kingdom as for Bangladesh, for the United States as for Gabon.

That’s where the things stood until recently. Whatever you think of the rules, they were relatively simple, clear and universal. They were supported by the countries of the political West which enjoyed absolute voting majority in the IMF and the World Bank, with the United States alone able to veto the decisions that it did not like.

With the current geopolitical tensions, international economic policies of the West are in the process of dramatic change. Instead of an open worldwide trading system, the current approach calls for the creation of trade blocs among the political allies. This is in contravention both of the first and the second framing of the international economic system that sought to differentiate trade from political relations, having learned from the disastrous creation of politically-segregated trade blocs between the two World Wars.

The current policies openly accept or call for the politization of economic decisions by accepting economic coercion as a normal toolkit. The US currently has 38 sanction regimes that affect about 50 countries, hundreds of entities and probably thousands of individuals. The European Union is not far behind. China is using similar coercion with respect to several Asia-Pacific countries.

The calls for, and increasingly the practice of, industrial policies, of “decoupling”, technological sovereignty, politically-motivated bans on trade or investment are segmenting international economic relations in function of purely geopolitical and so-called security concerns.

The point is that in practice the neoliberal international regime that debuted in the 1980s is dead. The major countries that defined its rules have ceased to abide by them. We are thus facing a strange situation where the main architects and the founders of the neoliberal international order no longer believe in it and do not apply it, but somehow the system should be still apparently adhered to by the rest of the world. This is an untenable situation. There is no way in which a World Bank mission to an African, Latin American or Asian country can seriously complain about government subsidies, trade discrimination, seizure of assets of political opponents, trade bloc trading, or industrial policy while the very same policies are prosecuted by the framers of the international economic system. The contradiction can be papered over for a while, but cannot be ignored forever. If the international neoliberal rules are no longer considered the appropriate rules for the United States and Europe, should they be considered as the right rules for the rest of the world?

..More

Draghi Says EU Itself at Risk Without More Funds, Joint Debt

Former ECB chief releases his report on EU competitiveness

He calls for as much as €800 billion of new spending a year

By Jorge Valero and Andrea Palasciano

September 9, 2024 at 5:34 AM PDT

Former European Central Bank President Mario Draghi called on the EU to invest as much as €800 billion ($884 billion) extra a year and commit to the regular issuance of common bonds to make the bloc more competitive with China and the US.

In his long-awaited report on European Union competitiveness, Draghi urged the bloc to develop its advanced technologies, create a plan to meet its climate targets and boost defense and security of critical raw materials, labeling the task “an existential challenge.”

Draghi said that Europe will need to boost investment by about 5 percentage points of the bloc’s GDP — a level not seen in more than 50 years — in order to transform its economy so that it can remain competitive. He warned that EU economic growth was “persistently slower” than in the US, calling into question the bloc’s ability to digitalize and decarbonize the economy quickly enough to be able to rival its competitors to the east and west.

“For the first time since the Cold War we must genuinely fear for our self-preservation,” Draghi told reporters in Brussels Monday. “And the reason for a unified response has never been so compelling and I am confident that in our unity we will find the strength to reform.”

Implementing the report’s most ambitious proposals, such as more joint debt, will face significant push back from countries including Germany and the Netherlands, that are strongly opposed to deeper fiscal integration. What’s more, most of the largest EU countries are contending with difficult domestic political situations that could give them limited room to maneuver.

European Commission President Ursula von der Leyen, who tasked Draghi with delivering the report, will need to decide how much of his recommendations to pursue.

The report comes as European leaders are increasingly aware of the loss of competitiveness against the bloc’s main rivals, partly due to Europe’s energy dependency and lack of raw materials. Meanwhile the EU continues to be hampered by the inability of its telecom and defense industries to harness economies of scale and be better prepared for a more nimble security stance.

..More

Draghi's view of Europe: Investment, R&D & the US-EU comparison

Adam Tooze, Sep 10, 2024

In Europe this week, everyone is talking about a major report on competitiveness published under the leadership of Mario Draghi the legendary former ECB President and Prime Minister of Italy. The reports - Part A with the general argument and Part B with the more technical sectoral arguments - are fascinating and dense reading. In this newsletter I am excerpting some of the more striking graphs, focusing only on the questions of investment and R&D and specifically in comparison with the USA. There is much more to say about China and the many sectoral analyses in Part B.

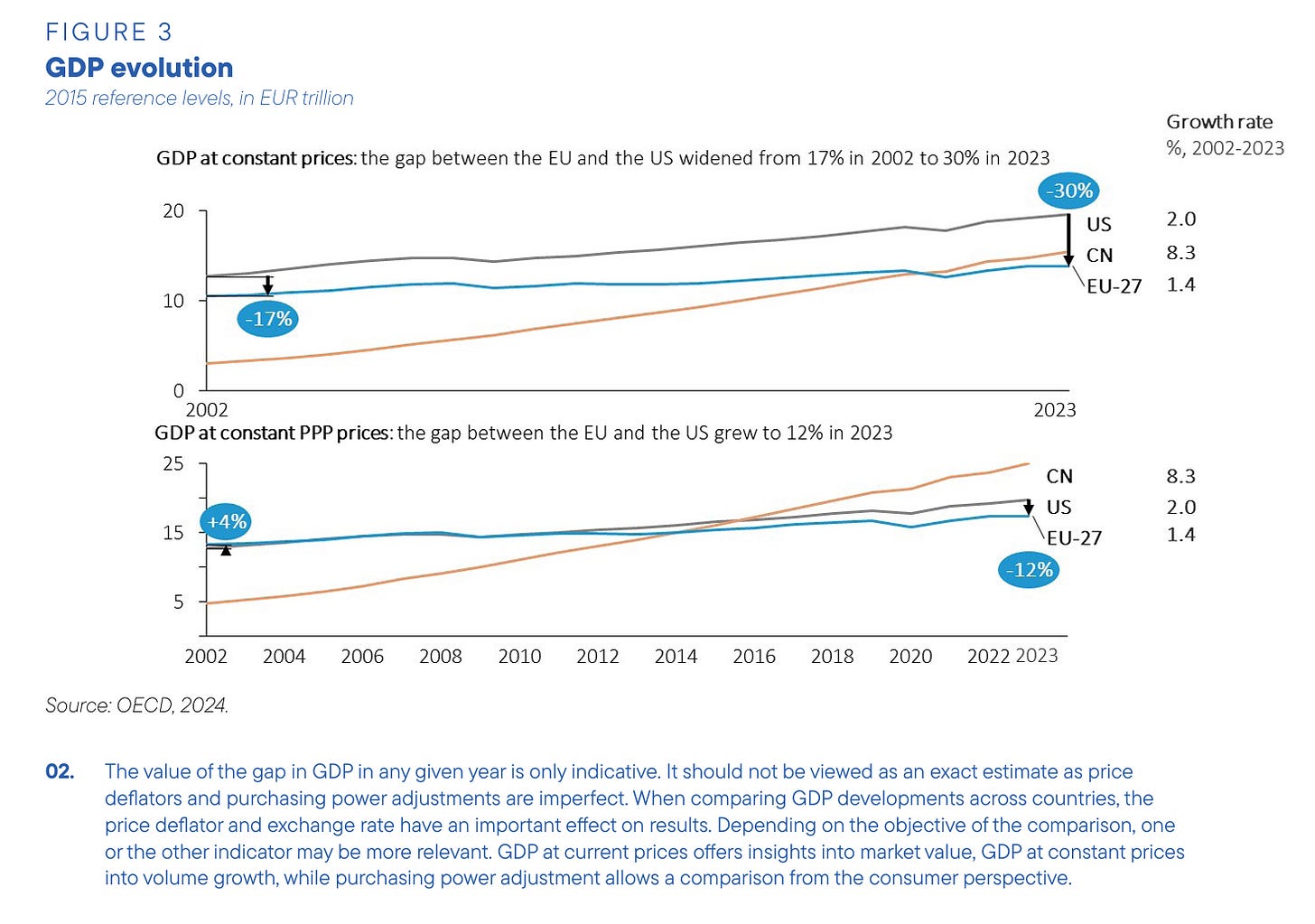

The problem that the report addresses is that: “… EU economic growth has been persistently slower than in the US over the past two decades, while China has been rapidly catching up. The EU-US gap in the level of GDP at 2015 prices has gradually widened from slightly more than 15% in 2002 to 30% in 2023, while on a purchasing power parity (PPP) basis a gap of 12% has emerged. The gap has widened less on per capita basis as the US has seen faster population growth, but it is still significant: in PPP terms, it has risen from 31% in 2002 to 34% today.”

Overall production depends on many variables including overall size of workforce and the amount of hours people work. Europe has slower population growth and Europeans work fewer hours than Americans, but what worries Draghi and his team is the fact that “around 70% of the gap in per capita GDP with US at PPP is explained by lower productivity in the EU. Slower productivity growth has in turn been associated with slower income growth and weaker domestic demand in Europe: on a per capita basis, real disposable income has grown almost twice as much in the US as in the EU since 2000.”

The gap between European and US labour productivity is not a new phenomenon. The gulf was already clear by the late 19th century. It widened to a maximum in the 1940s. Europe’s remarkable growth after 1945 closed the gap to as little as 90 percent in 2000. The worrying thing is that between 2000 and 2010 the gap widened again to 20 percent and since then there has been no re-convergence.

From a quick reading of the reports, I am not convinced that Draghi really addresses the historical question of the timing of this pattern: i.e. convergence 1945-2000, divergence 2000-2010 and parallel development since 2010. What happened in the 2000s and how is Europe now level-pegging? But, setting these ticklish questions aside, the Draghi reports do offer a lot of material with which to explain the fact that European productivity is lower and is not re-converging with the US.

When we seek to explain labour productivity, one obvious place to look is investment. Workers equipped with more capital tend to be more productive.

The Draghi report delivers striking data on how investment as a share of GDP in Europe has declined over the last half century.

Not only has European investment declined as a share of gdp, it also lags behind investment in the USA. Somewhat counter-intuitively, if you assume that the US has “small government”, public investment in Europe lags chronically behind that in the US. Tbh, I would love to understand that difference better.

It is also counter-intuitive that in the 2000s, as US labour productivity was surging ahead of that of Europe, private investment in equipment, infrastructure and innovation in the US lagged behind that of the EU. After 2010 the balance flipped. As the European economies relapsed into the eurozone recession, US private investment surged ahead and has remained ahead of the EU ever since, to the tune of 1.5 percent of gdp.

That gap is significant, but perhaps not enough to explain the persistent difference in productivity that we see. Where the US is truly in a different league from the EU is in the most innovative types of investment, notably venture capital.

Broadly speaking, on every metric and at every stage of venture capital the ratio between the US and Europe is 4:1.

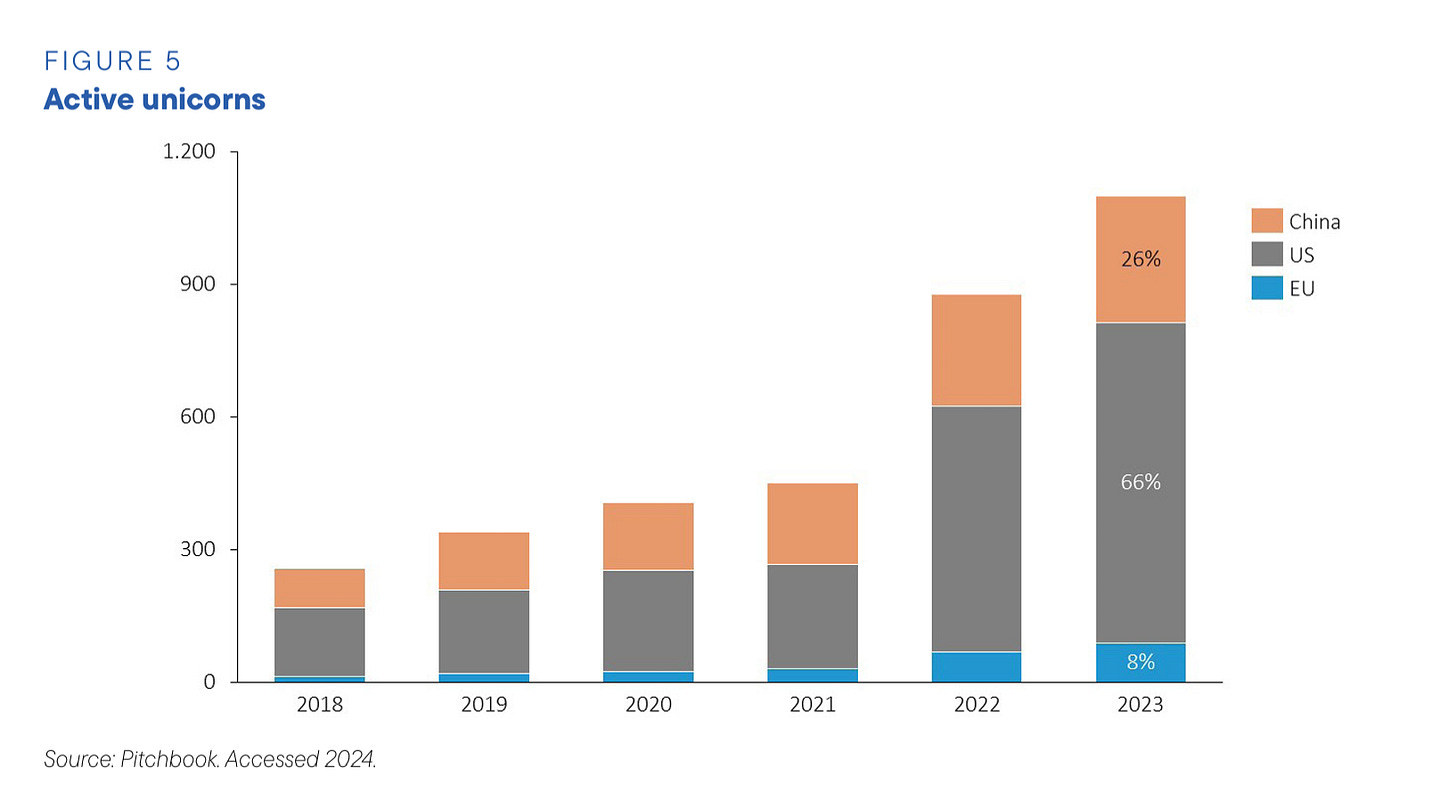

That, in turn, makes it easier to understand the huge advantage of the United States when it comes to unicorns, new billion dollar-plus businesses. Europe’s share of those companies globally is as small as 8 percent, compared to 66 percent for the US.

This is very striking and clearly paints a bleak picture for the EU. It would seem to suggest that we should expect further EU-US divergence in years to come, further deteriorating the status quo that has stabilized since 2010.

..More

Musk, Telegram and the European Assault on Online Speech

September 7, 2024

Executive summary

As we have previously detailed, the EU has amassed a fierce arsenal of anti-speech legislation. But recent developments show that European politicians are determined to go beyond simply removing ‘offensive’, ‘illegal’ or ‘dangerous’ content.

In fact, the focus of European regulators is now increasingly on stopping free speech in the first place.

The recent revelations by Elon Musk and Mark Zuckerberg of the secret deals offered to digital platforms to ‘self-police’ censorship of online speech are a watershed moment in the debate about free speech online.

They demonstrate that European regulators want to render invisible the operation of censorship: ensuring platforms remove content ‘voluntarily’ without the overt influence of regulators or politicians.

The arrest of Telegram founder Pavel Durov takes the next logical step in this development: if platforms refuse to engage in the ‘voluntary’ censorship of speech, those who operate them will be arrested and prosecuted.

These two developments demonstrate that the focus of European regulators – led and cheered by the EU elite – have moved into a dangerous new era of speech regulation. This is no longer ‘merely’ a case of censoring speech but preventing ‘offending’ speech from taking place at all.

Worryingly, the EU’s authoritarianism has emboldened other political elites across the world to increase a similar assault on free speech in the name of countering hate and disinformation – from the UK to the US to Brazil.

It is high time for a determined fightback against the censorious and anti-democratic ethos that has come to dominate EU and European elites.

Introduction

If anyone thought our report Controlling the Narrative: The EU’s Attack on Online Speech was an exaggeration, then events since the EU Parliamentary elections should be a wake-up call. Elon Musk’s revelation that Thierry Breton, the EU Commissioner for Internal Markets and chief censorship mogul behind the Digital Services Act (DSA), offered immunity from prosecution to X (under the DSA) if Musk was willing to secretly censor speech on the platform in the run-up to the election, has highlighted the critical point of our report; namely, that the EU’s narrative of hate speech and disinformation is not a well-meaning one but a dictatorial authoritarian bid to control and manipulate outcomes – all in the name of defending democracy.

The Paris arrest of the founder and now CEO of the social media platform Telegram, Pavel Durov, while ordered by a French Court, shows how the drive to control the narrative by Europe’s political elite is now on a war footing. The target is not curbing ‘disinformation’ but the spurious and perilous idea of holding the owner of a social media platform criminally responsible for content posted by users on their platform.

It is naïve to think this has nothing to do with free speech. What’s at stake here is the existence of Telegram as an independent outlet for free expression, which the EU technocratic elite are desperate to control. The attack on Durov is a thinly disguised assault on the independence of the 21st Century public square.

These developments reveal the depth of the cynicism and duplicity of a democratically unaccountable elite who are not only drunk on their power but grossly contemptuous of democracy and the people in whose name they rule. Most worryingly, the EU’s authoritarianism has emboldened other political elites in the West to increase a similar assault on free speech in the name of countering hate and disinformation – from Keir Starmer in the UK through the Biden administration’s manipulation of the media and demands on Meta to censor speech on their platform through to the banning of X in Brazil for non-compliance with demands for censorship.

These examples reveal that we are indeed on a slippery slope, and the defence of free speech is skating on fragile ice. From Brazil, through Telegram in France to Breton in Brussels, the attack on free speech is gathering pace. This mini-report makes the conclusions we set out in our report even more urgent. We stated ‘the need for a campaign that unequivocally argues that the only legitimate counter to hateful speech and the disinformation narrative is free speech and that more speech in the court of public opinion is the only long-term defence of democracy in Europe’.

Freedom from speech is now being globalised and institutionalised across the West. The fight is truly on.

I: The rise and rise of anti-democratic authoritarianism

When we published our report Controlling the Narrative: The EU’s Attack on Online Speech in the run-up to the EU Parliamentary elections, we warned that the EU elite was on an endless crusade to curb free speech to assert their need to control the narrative. We suggested that the hate speech and disinformation narratives are just that – narratives – aimed at controlling what can or cannot be said in the European political arena to ensure the dominance of the Brussels federal and cosmopolitan world view.

One of the critical points of the report was how it highlighted the systemic character of the censorship dynamic in the EU and how this was gathering pace.

We noted that through laws like the DSA, the EMFA, the AIA, the Child Sexual Abuse Regulation and the regulation of political advertising, Brussels had enabled a censorship operating system – a legal censorship citadel headed up by an invisible ‘Ministry of Truth’ – which aims to monitor and police speech to ensure their political narrative remains dominant.

The report also noted how the EU’s cynical manipulation of the asserted threat posed by generative AI has been used to justify Brussels adopting this same technology in its crusade against free speech. We noted how the dangers of algorithmic manipulations, the very technology the EU holds responsible for the spread of fake news or hate speech, became righteous tools when recruited to support their crusade against hate speech.

The report concluded as follows:

..More

Venture Capitalists Turn to Novel Methods to Return Cash

A two-year-old IPO drought has pushed venture capitalists to find new ways to return cash to their backers, from continuation funds to crypto staking to strip sales.

By Kate Clark, Sep 13, 2024, 6:00am PDT

Art by Mike Sullivan

In 2022, not long after the window for initial public offerings slammed shut, European early-stage investment firm Speedinvest hired someone who informally began using a wonky new job title. The firm’s self-styled “head of DPI” is in charge of making sure the distributed to paid-in capital ratio—a measurement of the cash the firm has returned to investors—is as strong as possible.

While venture capital firms have long paid attention to their DPI, the metric has become increasingly important. That’s because the limited partners who put money into VC funds have grown tired of waiting for the startups those funds invested in to go public. Many of those LPs want to see cash from their VC investments by any means necessary, and they are less dazzled than they once were by other measurements of venture fund performance that emphasize paper gains.

The Takeaway

• Trinity Ventures is forming a continuation fund

• Secondary sales surged 56% to $28 billion in the first half of 2024

• Some LPs discredit continuation funds as “synthetic distributions”

The DPI job title is another sign of the new normal in VC, an industry that was spoiled by a boisterous initial public offering market during a record-long bull run. Now, two years into an IPO drought, venture capitalists are working a lot harder to generate liquidity for their investors however they can.

Venture capitalists with crypto investments have been using a tactic called staking—generating income by locking up tokens to help a blockchain run—to raise capital from their token holdings. Another increasingly popular tactic for getting cash involves allowing LPs in a venture fund to sell startup stakes to other LPs, who become part of a new investment vehicle called a continuation fund.

Continuation funds are just one of several ways firms are using secondary sales, which allow existing shareholders to sell their stakes in startups, and other methods to send money back to their investors.

“Thank god for secondaries because secondaries are the only thing that’s keeping the money flowing,” said Ben Black, co-founder of an investment firm, Akkadian Ventures, that has bought startup shares in businesses including Gusto and MasterClass through secondary offerings. “They’re providing the liquidity that the IPO market used to, and if it wasn’t for the secondary funds, we’d all be in a world of hurt.”

The value of these types of deals is on the upswing across private equity and VC, rising 56% to $28 billion in the first half of 2024 compared to the same period last year, according to Jefferies data. Continuation funds represent 90% of those transactions.

“It’s a very, very active market right now,” said Nigel Dawn, global head of Evercore’s private capital advisory group, referring to secondaries. “This will be a record year for volume.”

A frozen IPO market isn’t the only factor holding back cash returns. More startups are choosing to stay private longer, in part because many of them want to avoid the scrutiny that comes with going public, and also because the ones with the best prospects have no problem raising huge VC rounds.

The Rise Of Fintech Families

Friday the 13th reading!

Sep 13, 2024

In the world of startups, we often hear about startup mafias like the "PayPal Mafia" - the group of PayPal alumni who went on to found and lead some of the most influential companies of our time – think Elon Musk, Reid Hoffman, Peter Thiel, Max Levchin and more. Arguably, Silicon Valley was created as a result of another mafia: the “Fairchildren” – the group of founders that came out of Fairchild Semiconductor. According to the Computer History Museum, “Although the firm’s market valuation never exceeded $2.5 billion, its surviving combined progeny have been estimated to be worth over $2 trillion.”

Thanks for reading [99%Tech]! Subscribe for free to receive new posts and support my work.

In my book Out-Innovate (HBR), I wrote about the rise of a few emerging market mafias, coming out of first-generation leaders like Mercado Libre in Latin America and Aramex in the Middle East. A recent study conducted by Gilgamesh ventures and the Wharton School of Business set out to expand this inquiry, specifically targeted in fintech. The results are fascinating, revealing what they call "Fintech Families" - a generation of fintech powerhouses that are powering global entrepreneurship.

The Fintech Families: How Top Companies Are Shaping The Future Of Financial Technology

The research identified 15 fintech companies, dubbed "Fintech Families," that have produced an outsized number of founders. These companies, all launched after 2000 and with revenues exceeding $250 million, have collectively spawned nearly 3,000 founders worldwide.

The list of Fintech Families includes well-known names like Square, Stripe, and Robinhood, as well as Latin American giants like Mercado Libre and Nubank. But it's not just the quantity of founders that's impressive - it's the quality and impact of the companies they're building.

The DNA of Fintech Family Founders

To give you a sense of the types of companies getting created by Fintech Family Alumni, see below.

So, who are these founders emerging from the Fintech Families?

Product and engineering roles were the core source of talent. A full 50% of the founders came with these backgrounds. They were not alone. Strategy and business operations roles were also well represented.

These Family members were not staying in the same field. The majority of alumni from these companies have gone on to found businesses in other sectors. This speaks to the transferable nature of the skills and mindset developed at leading technology firms.

How Fintech Families Are Created

So, what creates a Fintech Family? While there's no simple formula, the research suggests that strong brands play a crucial role. Companies that can attract top talent and build nationally or internationally recognized brands seem to be the most fertile ground for future founders. I suspect looking at the data, sufficient liquidity events help too – companies that have meaningful secondary tenders (e.g. Stripe) or IPOs (Mercado Libre) give the next generation the financial freedom to experiment – and their peers the ability to angel invest. I would be remiss without mentioning Endeavor’s work in ecosystem building, and their own research on Multipliers, many of which are represented in this research.

Those that create mafias, do so in spades. Like all things in startups, power laws matter. VC fund returns are dominated by outlier VC funds, driven by underlying outlier startups. And similarly, certain companies are outliers in creating startup mafias. Not all are created equal and choose carefully.

What was equally surprising to me was the exclusion of certain companies from the list. For instance, giants like Shopify or UiPath, giants from Canada or Romania, were not high on the list.

Why this matters

This research underscores the importance for investors and entrepreneurs to be actively building relationships with key talent at these startup factories - early. Many of today's top founders cut their teeth at other successful fintech startups before.

Fintech Families alumni haven’t just succeeded in raising capital, they also seem to be reasonably resilient. Despite the economic headwinds of recent years, 2023 saw the highest number of new fintech companies founded by alumni of these firms.

..More

The Shadow Dollar That’s Fueling the Financial Underworld

Cryptocurrency Tether enables a parallel economy that operates beyond the reach of U.S. law enforcement

ILLUSTRATION: Rachel Mendelson/WSJ, Getty (2), iStock (2)

By Angus Berwick and Ben Foldy

Sept. 10, 2024 5:30 am ET

A giant unregulated currency is undermining America’s fight against arms dealers, sanctions busters and scammers. Almost as much money flowed through its network last year as through Visa cards. And it has recently minted more profit than BlackRock, with a tiny fraction of the workforce.

Its name: tether. The cryptocurrency has grown into an important cog in the global financial system, with as much as $190 billion changing hands daily.

In essence, tether is a digital U.S. dollar—though one privately controlled in the British Virgin Islands by a secretive crew of owners, with its activities largely hidden from governments.

Known as a stablecoin for its 1:1 peg to the dollar, tether gained early use among crypto aficionados. But it has spread deep into the financial underworld, enabling a parallel economy that operates beyond the reach of U.S. law enforcement.

Wherever the U.S. government has restricted access to the dollar financial system—Iran, Venezuela, Russia—tether thrives as a sort of incognito dollar used to move money across borders.

Russian oligarchs and weapons dealers shuttle tether abroad to buy property and pay suppliers for sanctioned goods. Venezuela’s sanctioned state oil firm takes payment in tether for cargoes. Drug cartels, fraud rings and terrorist groups such as Hamas use it to launder income.

Yet in dysfunctional economies such as Argentina and Turkey, beset by hyperinflation and a shortage of hard currency, tether is also a lifeline for people who use it for quotidian payments and as a way to protect their savings.

Tether is arguably the first successful real-world product to emerge from the cryptocurrency revolution that began over a decade ago. It has made its owners immensely rich. Tether has $120 billion in assets, mostly risk-free U.S. Treasury bills, along with positions in bitcoin and gold. Last year it generated $6.2 billion in profit, outearning BlackRock, the world’s largest asset manager, by $700 million.

Paolo Ardoino is the chief executive officer of Tether. Photo: Nathan Laine/Bloomberg News

Tether’s CEO, Paolo Ardoino, boasted earlier this year that, with under 100 employees, it earned more profit per person than any company ever.

Tether wants “to build a fairer, more connected, and accessible global financial system,” Ardoino said in a May press release. He claims over 300 million people are using the currency.

With sanctions, Washington can cut adversaries off from the dollar and thus much of the global trading system, since all dollar transactions involve U.S. regulated banks. Tether’s popularity subverts those powers.

..More

Startup Success - How to Measure it?

Peter Nixey

If you're having a tough time in your startup right now, here are some numbers to make you feel better. Let's imagine you were funded by A16Z...

Now as you know, that's no small thing. A16Z have some of the best dealflow in the industry. Only 0.7% of startups who pitch them receive investment. That's 7 in every 1,000.

Out of that elite seven (the founders who effortlessly get the conference invites and McKinsey job applicants), four won't even return the money they raised.

So say b'bye to your McKinsey SLT. And if you haven't had the good luck and sense to take secondary then it's sadly b'bye to any liquidity too 😢.

1-2 companies will return 3x the money invested (that's over a 10 year period so only a measly 12% IRR to poor A16Z). With a good wind and no funky preferences then maybe you get to make some $$ too 👏🏻👏🏻.

One little piggie will return 3-10x money invested (12-25% IRR).

And 0.7 little piggies go wee wee wee all the way to a 10x return.

Long and short is that even if you're the top company out of 7,000 companies pitching A16Z you're still only 70% likely to realise a proper venture return.

So, apart from recognising the ridiculousness of the game we choose to play, what can we learn?

First off, don't be too hard on yourself. Even if you're the best of the best this game is really, really hard and the tides of chance and fate will toss you every bit as far as your skill and intuition will power you.

But I think there's a second takeaway too. Which is that if you're currently mature and struggling then the odds are that you're not going to be that one company. And it's time to stop pretending otherwise.

If you're several years old and things still aren't working then it's worth facing the fact that you're likely not the top company in A16Z's portfolio. You're not (currently) a 10x to any new investors.

But that doesn’t mean you can’t reshape yourself until you are.

Cut costs. Aggressively. I did a cost cutting exercise with a Series-A startup recently and identified 40% of burn that could be switched off in a month. Much of this was as simple as SaaS subscriptions with too many seats. List through every item in Xero and cut everything that won’t break you.

Then reprice. Figure out what profits looks like & give yourself a (future) valuation of 5x that. Or find out *exactly* who's going to acquire you and for how much.

Then reprice yourself to look attractive to an investor on that basis. If the odds are that you're still going to die or zombie your new price might still need to offer a 10x to look appealing. Which may make your valuation feel painfully low. And if it's so low you don't want to continue then consider leaving. Or negotiating more equity.

..More

Illiquidity is a feature, not a bug

Rob Hodgkinson, Signal Rank Corporation

Sep 12, 2024

It’s hard not to be romantic about venture capital (to paraphrase Billy Beane from Moneyball). Investors love the image of the wizened VC unearthing two entrepreneurs working on the next big thing in their Palo Alto garage, providing seed capital and sage advice before culminating in the obligatory opening bell photo at the NYSE.

Core to this VC lore is the concept of the power law. It is well understood that most companies fail, and that most returns come from a small number of companies. In fact, the power law itself has taken on mythical status within the industry.

One could go so far as to argue that the whole framing of the VC industry is now based on the power law. The power law’s perceived uniqueness to venture capital is projected onto allocators. VCs hold an idealized view of the industry as a “special” institutional asset class where a small number of winners drive all returns.

Yet we will show here how Pareto distributions (cleverly rebranded as the “power law”) are not unique to VC in institutional financial markets.

To the extent that VC is a unique institutional asset class, it is in its illiquidity. (To be crystal clear, by illiquidity, we are using short hand for very long holding periods which are followed ultimately by returning capital to LPs). Very few investments exit each year from M&A or IPO. Since 2021, we have been in a particularly fallow period. Hence the VC thinkbois crowing on X about the end of VC as we know it.

Yet it is only when you view the asset class through the prism of illiquidity, and not power law returns, that one could argue for VC having a special place in institutional allocators’ portfolios. It is precisely because VC is illiquid (and not despite the illiquidity) that VC is attractive.

The high growth of early stage companies compounds over time into stellar IRRs because VCs have no option but to hold their positions. In response to Carta’s much shared report on the state of VC performance, Vencap’s David Clark showed that a fund with eventual 12x DPI had zero DPI by Year 5 (echoed today by Sapphire’s Beezer Clarkson who shows average funds get to 1x DPI by Year 8).

LPs know and appreciate that VC is illiquid. To be clear, LPs obviously want a return on capital and require DPI. But they do not have a problem with illiquidity per se. It is the unpredictability of this illiquidity that is the underlying issue in the industry.

Let’s unpack this.

..More

Video of the Week

AI of the Week

Waymo and Uber expand their robotaxi partnership to Austin and Atlanta

Waymo’s driverless vehicles are on the Uber app in Phoenix, with two more cities coming soon.

By Andrew J. Hawkins, transportation editor with 10+ years of experience who covers EVs, public transportation, and aviation. His work has appeared in The New York Daily News and City & State.

Sep 13, 2024, 6:00 AM PDT

Waymo and Uber — bitter enemies turned awkwardly polite work friends — announced they were expanding their two-year robotaxi partnership to two new cities: Austin, Texas, and Atlanta, Georgia, starting in early 2025.

The companies have been working together in Phoenix, Arizona, since last year — but not in California in San Francisco or Los Angeles. It’s a mutually beneficial partnership in which Waymo gets access to Uber’s vast customer base, while Uber gets to serve as a platform for a futuristic mode of transportation.

When it launches, Waymo’s robotaxis will “only” be available to hail for rides on Uber’s app in Austin and Atlanta. That means Waymo’s own ridehail app, Waymo One, will not be operational in either city. The Alphabet-owned company is currently testing its self-driving cars in both cities.

It’s a mutually beneficial partnership

Waymo employees in Austin have been using the company’s Waymo One app to hail rides as part of early testing. Waymo spokesperson Ethan Teicher said that in the following weeks, the company will invite “a limited number of early riders into the Waymo One app before fully transitioning to the Uber app next year.”

The scope of the partnership will be significantly different in these two cities than it is in Phoenix. Waymo and Uber will share the responsibilities of operating a fleet of driverless ridehail vehicles: Uber will take care of fleet management services, including vehicle cleaning, repair, and other general depot operations, and Waymo will provide the driverless vehicles while handling roadside assistance (when the robot Jaguar I-Paces inevitably get stuck) and customer service.

They will obviously share in the costs and the revenue produced by the robotaxi service, though Teicher declined to share the revenue split between the two companies.

Waymo currently operates its own Waymo One ridehail service in San Francisco, Phoenix, and Los Angeles; it recently hit the milestone of operating 100,000 rides each week in all three cities. Studies have shown that Waymo has better customer retention than human-powered ridehail services like Uber and Lyft.

The scope of the partnership will be significantly different in these two cities

The robotaxi business is difficult thanks to restrictions on where the vehicles can travel and the costs incurred by expensive hardware. Human-driven services like Uber and Lyft have no such limitations. And customers can be fickle, quick to switch to another service that promises shorter wait times and fewer limits on where they can travel.

Waymo co-CEO Tekedra Mawakana said she was “excited to launch this expanded network and operations partnership with Uber in Austin and Atlanta to bring the benefits of fully autonomous driving to more riders.” And Uber CEO Dara Khosrowshahi said he was “thrilled to build on our successful partnership with Waymo, which has already powered fully autonomous trips for tens of thousands of riders in Phoenix.”

..More

New AI Chip Surpasses Nvidia, AMD, and Intel with 20x Faster Speeds and Over 4 Trillion Transistors

The AI hardware market is experiencing a new shift thanks to Cerebras Systems. Cerebras Systems is a California-based startup making waves with its latest release, Cerebras Inference. This innovative solution claims to outperform Nvidia’s GPUs by 20 times, positioning Cerebras as a formidable contender against industry giants like Nvidia, AMD, and Intel.

Cerebras’ Wafer Scale Engine

The driving force behind Cerebras Inference is the third generation of the Wafer Scale Engine (WSE). A chip design that integrates 44GB of SRAM on a single, massive wafer. This approach eliminates the need for external memory, a common bottleneck in traditional GPU architectures, thus enabling unparalleled speeds.

Cerebras Inference delivers an impressive 1,800 tokens per second for Llama3.1 8B and 450 tokens for Llama3.1 70B, setting new industry standards for AI inference speeds.

The Competition: How Cerebras Stacks Up Against Nvidia, AMD, and Intel

Cerebras’ Wafer Scale Engine stands out with approximately 4 trillion transistors and on-chip memory integration, which dramatically reduces latency and boosts performance for large AI models. In contrast, Nvidia’s architecture relies on a multi-die approach with GPUs connected via high-speed interlinks like NVLink.

While this allows for a modular and scalable system, it involves complex coordination between multiple chips and memory, which can lead to inefficiencies in data transfer. Nvidia’s strength lies in its versatility and robust ecosystem.

Its GPUs, optimized for both AI training and inference, are widely adopted across various sectors, from gaming to complex simulations. However, in terms of raw inference speed per chip, Cerebras outshines Nvidia with its unique architecture tailored for AI tasks requiring minimal latency and maximum data throughput.

Performance and Application Suitability: A Closer Look

Cerebras chips excel in scenarios where speed and efficiency are paramount, such as natural language processing and other deep learning inference tasks. The direct integration of processing and memory on the WSE allows for faster data retrieval and processing, which is crucial for enterprises handling large AI models.

This makes Cerebras a preferred choice for organizations that need to process large volumes of data in real-time. On the other hand, Nvidia’s GPUs offer broader application suitability. They are not only powerful in AI tasks but also serve diverse industries with needs ranging from rendering graphics in video games to conducting complex scientific simulations.

Nvidia’s comprehensive software stack and well-established market presence make its GPUs a reliable option for a wide array of applications.

Implications for the AI Hardware Market

The entry of Cerebras with potentially superior technology is likely to disrupt the current market dynamics, challenging the dominance of Nvidia, AMD, and Intel in the AI hardware sector. For tech enthusiasts and investors, Cerebras’ advancements present a unique opportunity to witness a shift in the landscape of AI computing.

..More

Is OpenAI’s New “o1” Model The Big Step Forward We’ve Been Waiting For?

The new model can reason through really hard problems. Some will see its promise before others.

Alex Kantrowitz, Sep 13, 2024

On Thursday, OpenAI released “o1,” a new AI model that can reason through hard problems by breaking them down to their component parts and handling them step by step. Released in two iterations, o1-preview and o1-mini, the model is available to all ChatGPT Plus users, with a broader release to follow.

The o1 release is the first of OpenAI’s “Strawberry” AI reasoning project (originally called Q*), which the company believes is a major step forward for the field. “We think this is actually the critical breakthrough,” OpenAI research director Bob McGrew told The Verge this week. “Fundamentally, this is a new modality for models in order to be able to solve the really hard problems that it takes in order to progress towards human-like levels of intelligence.”

After trying the new o1 models myself, and analyzing the documentation, I’m already impressed, but still have some pretty big questions. Here are my critical takeaways from the release, including whether it is indeed OpenAI’s long anticipated big step forward:

A step change in AI?

OpenAI’s o1 models write out their chain of thought as they work through your queries, showing how they ‘think’ through the problem before delivering an answer. I asked o1-preview, the most powerful model available, to write a poem with 14 lines, spelling my name out with the first letter of each line, and spelling a country name with the first letter of the words in each sentence. The model ‘thought’ for 59 seconds, handling some rows easily but trying hard to find a country that started with the “X” in my first name. Eventually, it realized it couldn’t answer that part satisfactorily, but it nailed the rest of the poem. “A unique star travels radiantly in autumn,” it began, using the “A” in Alex to start the poem and spelling out Austria across the line. I gave Anthropic’s Claude the same prompt and it failed.

The o1 model’s ability to handle these multi-step, complex tasks suggests OpenAI has once again advanced AI’s state of art, but the magnitude of the advance will still take some time to determine. Though o1 exceeds existing benchmarks in coding, math, and science, its ‘chain of thought’ can feel like a party trick in other cases. In a best case scenario, o1 is a step on a path to something potentially bigger.

More of a math and science thing

These new models will likely create a divergence of public opinion on AI. People who use AI for writing, editing, and marketing tasks will likely be disappointed. But people that use it for coding, math, and science research will be thrilled. In OpenAI’s testing, people who used o1 for writing actually preferred it less than GPT-4o. But those who used it for mathematical calculation, data analysis, and computer programming preferred it by a wide margin.

“Words people’ who write about this technology might therefore be more negative about it, given their subjective experience, as ‘math people’ using it in its best use case see its full capabilities. That could create more negative perceptions of the technology than merited, something that bears watching as OpenAI pushes ahead toward a $150 billion valuation.

Chat vs. Work

To get the most out of reasoning models, you may have to assign them work as opposed to chatting with them. Scott Stevenson, CEO of Spellbook, an AI legal assistant, said the bot is good at taking long sets of instructions and using them to modify legal documents. “When people are underwhelmed by o1, I think it’s because they’re thinking of it as chat still,” Stevenson said. “Its ability to *do work* is going to be really good.”

If this sounds like a step toward AI agents to you, it does to me as well. As OpenAI licenses this technology, it’s inevitable that companies will attempt to build AI agents with it. Still, despite the buzz, so-called ‘agentic AI’ appears far off.

OpenAI COO Says ChatGPT Passed 11 Million Paying Subscribers

By Amir Efrati

Sep 12, 2024, 2:44pm PDT

OpenAI’s ChatGPT has more than 10 million paying subscribers and another 1 million subscribers that are part of higher-priced plans for business teams, COO Brad Lightcap recently told staff in a message, according to a person who viewed the message.

Those numbers, which the company hasn’t publicly disclosed, imply that the artificial intelligence chatbot is conservatively generating more than $225 million in revenue per month, or $2.7 billion on an annual basis, based on publicly available prices of its subscriptions. Customers use it to generate computer code, help write or edit text, and conduct general research, among other things.

The Takeaway

• The new subscriber figures imply overall annualized revenue of $4 billion

• OpenAI’s unprecedented growth is coupled with high financial losses

• Its proposed valuation multiple on forward revenue is twice as high as Nvidia’s

Including OpenAI’s sale of AI models to app developers, the company could be on pace to generate around $4 billion over the next 12 months, up from about $3.4 billion in annualized revenue in the middle of this year and $1.6 billion in annualized revenue toward the end of 2023. An OpenAI spokesperson did not have a comment about the figures.

As of March, OpenAI was generating more than $83 million a month, or $1 billion in annualized revenue, from selling access to its AI models to app developers such as Stripe and Morgan Stanley to aid in fraud detection or automate customer service responses. That business has likely grown since then.

..More

OpenAI In Talks To Raise $6.5 Billion at $150 Billion Valuation

Model developer OpenAI is in talks to raise $6.5 billion in new funding at a pre-investment valuation of $150 billion, according to a person with direct knowledge of the fundraise. Investment firm Thrive Capital is slated to lead the round, the person said.

The ChatGPT maker is also in talks to raise an additional $5 billion in debt from banks in the form of a revolving credit facility, according to a Bloomberg report. It isn’t clear how the debt would be collateralized. Bloomberg first reported the details of the round.

Thrive Capital has committed to investing $1 billion in OpenAI as part of the deal, the Wall Street Journal first reported, and the ChatGPT maker could also get cash from several of its business partners and suppliers—Microsoft, Apple and Nvidia.

..More

Gary Marcus on How to Tame Silicon Valley's AI Barons

Mistral releases Pixtral 12B, its first multimodal model

4:40 AM PDT • September 11, 2024

French AI startup Mistral has released its first model that can process images as well as text.

Called Pixtral 12B, the 12-billion-parameter model is about 24GB in size. Parameters roughly correspond to a model’s problem-solving skills, and models with more parameters generally perform better than those with fewer parameters.

Built on one of Mistral’s text models, Nemo 12B, the new model can answer questions about an arbitrary number of images of an arbitrary size given either URLs or images encoded using base64, the binary-to-text encoding scheme. Similar to other multimodal models such as Anthropic’s Claude family and OpenAI’s GPT-4o, Pixtral 12B should — at least in theory — be able to perform tasks like captioning images and counting the number of objects in a photo.

Available via a torrent link on GitHub and AI and machine learning development platform Hugging Face, Pixtral 12B can be downloaded, fine-tuned and used under an Apache 2.0 license without restrictions. (A Mistral spokesperson confirmed the license being applied to Pixtral 12B via email.)

This writer wasn’t able to take Pixtral 12B for a spin, unfortunately — there weren’t any working web demos at the time of publication. In a post on X, Sophia Yang, head of Mistral developer relations, said Pixtral 12B will be available for testing on Mistral’s chatbot and API-serving platforms, Le Chat and Le Plateforme, soon.

News Of the Week

Why the SpaceX spacewalk is such a huge deal

The mission tested lots of new technology for future, longer missions.

by Ellen Ioanes

Sep 12, 2024, 1:21 PM PDT

Ellen Ioanes covers breaking and general assignment news as the weekend reporter at Vox. She previously worked at Business Insider covering the military and global conflicts.

Billionaire Jared Isaacman and SpaceX engineer Sarah Gillis completed the first privately funded spacewalk Thursday — a critical aspect of a risky, somewhat troubled mission designed to test new SpaceX technology, gather valuable data about high-altitude space travel, and generally push the limits of space exploration.

The mission, called Polaris Dawn, was supposed to launch in late August, but was grounded due to safety concerns. But on Tuesday, Isaacman and Gillis — along with two other crew members, former Air Force pilot Scott Poteet and SpaceX engineer Anna Menon — finally took off.

Since then, the astronauts have gone about 870 miles from Earth, which makes Polaris Dawn the farthest crewed space mission since the Apollo 17 mission to the moon in 1972. They came closer to Earth — away from the high radiation levels they faced at the furthest point of their journey — for Thursday’s spacewalk.

“Back at home, we all have a lot of work to do, but from here, Earth sure looks like a perfect world,” Isaacman said, observing the planet from outside his SpaceX Crew Dragon spacecraft Thursday.

Though the spacewalk is complete, the astronauts aren’t done. Their mission is set to last five days — much shorter than typical NASA missions which can last weeks or months — but still includes dozens of experiments, and, critically, safely reentering the Earth’s atmosphere.

Why is SpaceX’s Polaris Dawn mission so groundbreaking?

SpaceX’s current mission is supposed to be the first of three Polaris missions, all funded by Isaacman and SpaceX, Elon Musk’s aerospace company.

The goal of the Polaris mission series is to help SpaceX develop the skills and technology needed to achieve its longer term goals of sending humans to Mars. The company hoped this first mission would be a useful test of the spacecraft and its instruments’ ability to survive the extreme conditions of space, particularly as it passes through the Van Allen radiation belts, regions in space that encircle the planet and are highly radioactive. They were detected on the first US space mission in 1958, and their highly charged, energetic particles can damage spacecraft instruments.

The crew traveled through the Van Allen belts on their way to the furthest point in their journey, and, so far, the tech aboard the capsule — and the astronauts — seem to have withstood that radiation.

The trip was also a test of SpaceX’s latest spacesuit designs, which were designed in just two and a half years — an astonishingly quick turnaround by space exploration standards — and are meant to be upgrades to the bulky suits NASA has made famous. Rather than having life support systems integrated into the suit, like in NASA’s, Space X’s new suits connect to a spacecraft via a tube — all of the Polaris Dawn astronauts used that functionality to breathe while Isaacman and Gillis performed their spacewalk.

That’s because though only Isaacman and Gillis exited the craft, all four astronauts were exposed to space (and that means, technically, all four astronauts completed a spacewalk). To complete the spacewalk, Isaacman and Gillis had to open the Crew Dragon’s hatch to exit, exposing everyone inside to vacuum. Though that was once the preferred way for astronauts to leave their spacecraft, modern astronauts usually exit via an airlock mechanism, which has two doors separated by a chamber so that the vacuum of space doesn’t enter into the spacecraft.

..More

Silicon Valley’s Y Combinator to Double Number of Cohorts Per Year

The startup accelerator now will accept four smaller groups of startups instead of two larger ones.

September 12, 2024 at 1:39 PM PDT

Y Combinator, the startup-building school that has launched businesses ranging from Airbnb Inc. to Stripe Inc., is expanding to four cohorts a year from two — meaning that the accelerator will be in session almost the entire year.

Spring and fall cohorts are joining the traditional winter and summer cohorts, President Garry Tan confirmed in a message. The program lasts about 11 weeks, each capped with an investor “Demo Day” when the startups pitch top venture capital firms.

The stepped-up schedule is the brainchild of Tan, an entrepreneur and venture capitalist who became president of Y Combinator, or YC, early last year. Under the new schedule, a season that traditionally was a break between the June-September summer session and January-April winter session will fill up with a new batch of founders and the attendant talks, meetups and office hours.

Starting in 2025, a spring session will follow the winter one. The size of each batch will be smaller, Tan said, roughly half the size of the most recent cohort of 256.

“The great thing for everyone is we will be more responsive to founders and fund them right when they start,” Tan said in a text exchange. “We will also have 4X in-person demo days,” which will give investors “twice as much time to meet half the number of companies.”

Even the smallest moves of YC are closely scrutinized in Silicon Valley. Earlier this year, Tan made a different controversial change, shuttering its $700 million Continuity Fund, which invested selectively in YC startups judged to hold the greatest potential.

The latest scheduling shift could address criticism that YC cohorts have gotten too large to retain the program’s exclusivity. In late 2021 and early 2022, cohorts hovered around 400. Now, having closer to 100 startups in a batch will bring YC back to levels from about a decade ago.

Still, the total number of startups going through the program each year will hold steady at about 500, a far cry from the days when Stripe attended, when just 26 startups participated in its 2009 cohort. And there will be more Demo Days, potentially eroding each one’s importance, even as it allow for more individualized attention.

..More

The Unicorn Board Adds 8 New Companies, With One Newly Minted Entry Valued At $16B

September 12, 2024

Eight companies joined The Crunchbase Unicorn Board in August, with six based in the U.S., and two hailing from China and India, respectively.

Among them was Huawei Technologies’ smart car subsidiary Yinwang Smart Technology, valued at $16 billion. That dollar amount represents the second-largest value for a newly minted unicorn this year — trailing only xAI, which was valued at $24 billion in May when it joined the board.

The eight new unicorns in August added $25 billion in value to the board. To date in 2024 $152 billion in value was added by 79 new unicorns.

In 2023, 99 companies joined the board, collectively valued at $176 billion as of the most recent valuations. The most highly valued new unicorn from 2023 is currently CoreWeave valued at $19 billion.

Here are the new unicorns in August by sector.

Transportation

Yinwang Smart Technology, a Huawei subsidiary based in Shenzhen, raised $1.6 billion each from electric vehicle brands Seres Group and Avatr. The less than 1-year-old company was valued at $16 billion.

Bangalore-based electric two-wheel vehicle manufacturer Ather Energy raised $71 million at a $1.3 billion valuation led by government-backed NIIF. It competes with Ola Electric, another India-based unicorn which went public in August.

Web3

Story Protocol, a blockchain technology to protect intellectual property rights for content creators, raised an $80 million Series B led by Andreessen Horowitz. The 2-year-old Bellevue, Washington-based company was valued at $2.25 billion.

AI

Mountain View, California-based AI coding platform Codeium raised a $150 million Series C led by General Catalyst. The 3-year-old company was valued at $1.25 billion.

Privacy and security

San Mateo, California-based Kiteworks, a secure content company, raised a $456 million funding led by Insight Partners and Sixth Street. Previously known as Accellion, the 24-year-old company was valued at more than $1 billion.

Agtech

Los Angeles-based Agrovision, a global berry producer using genetics and AI, raised $100 million in funding from private equity firm Aliment Capital. The 11-year-old company was valued at $1 billion.

Sales and marketing

DevRev, which develops AI for customer support and other uses, raised a $101 million series A led by Khosla Ventures, Mayfield Fund

and Param Hansa Values. The 3-year-old Palo Alto, California-based company was valued at $1.2 billion.

Real Estate

EliseAI , an AI-powered property management communication platform, raised a $75 million Series D led by Sapphire Ventures. The 7-year-old New York-based company was valued at just over $1 billion.

And one we missed

Fei-Fei Li’s stealth startup World Labs, founded in April this year, raised $100 million from NEA in July at a $1 billion valuation within months of its founding. The company plans to build AI models with spatial awareness. It raised an earlier round from Andreessen Horowitz and Radical Ventures.

Startup of the Week

AI-Powered Work Assistant Glean Doubles Valuation To $4.6B In Less Than Seven Months

September 10, 2024

That didn’t take long.

Less than seven months after raising a more than $200 million Series D at a $2.2 billion valuation, AI-enhanced work assistant and enterprise search startup Glean raised more than $260 million in a Series E funding at a $4.6 billion valuation co-led by Altimeter Capital and DST Global.

The Palo Alto, California-based startup hit unicorn status in May 2023 after raising a $100 million Series C led by Sequoia Capital.

Founded by former Google engineers, Glean’s generative AI search tool connects with enterprise companies’ applications and databases, and its AI assistant and platform lets users build their own AI apps.

Along with the new round, Glean also announced new features to help automate multistep workflows and native integrations for Zendesk and Salesforce Service Cloud

.

New investors in the round include Craft Ventures, Sapphire Ventures and SoftBank Vision Fund 2. Existing investors Coatue, General Catalyst, Iconiq Growth, IVP, Kleiner Perkins, Lightspeed Venture Partners and Sequoia Capital also participated.

Continued growth

In the release announcing its funding, Glean says it has more than tripled its annual recurring revenue in the past year.

“We’re honored to help some of the world’s largest companies adopt AI to transform their businesses,” said Arvind Jain, co-founder and CEO of Glean. “To truly unlock new levels of creativity, productivity, and operational efficiency, AI needs to draw on the full picture of an organization’s knowledge — and it needs to be accessible by everyone.”

Founded in 2019, Glean has raised $620 million, per the company.