A reminder for new readers. That Was The Week includes a collection of my selected readings on critical issues in tech, startups, and venture capital. I selected the articles because they are of interest to me. The selections often include things I entirely disagree with. But they express common opinions, or they provoke me to think. The articles are snippets sized to convey why they are of interest. Click on the headline, contents link, or the ‘More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below.

Hat Tip to this week’s creators: @krishnanrohit, @EconSteveM, @abracarioca, @jasonlk, @HarryStebbings, @DavidStreitfeld, @PranavDixit, @amir, @waynema, @ingridlunden, @odsc, @seancaptain, @JacobERobbins, @Kantrowitz, @Ryan_S_Gladwin, @EricNewcomer, @maddierenbarger, @gruber, @paulg

Contents

Harry Stebbings and Jason Lemkin on Seed Investing

If A.I. Can Do Your Job, Maybe It Can Also Replace Your C.E.O.

OpenAI signs 100K PwC workers to ChatGPT’s enterprise tier as PwC becomes its first resale partner

Generative AI seed funding drops 76% as investors take wait-and-see approach

VC Says "Chaos" Coming for Startups, Ads, and Online Business as Generative AI Eats Web

Editorial: Stand Back, Think Big, Dig Deep

We need big and deep thinkers with bold ideas

I used Suno to create a theme song for this newsletter. You can download the MP3 to see how limited my creative skills are, even when using advanced AI.

The lyrics are mine and include the following:

[Verse]

That Was The Week

No time to be Meek

The goal is to Seek

The Next Big Thing [

[Chorus]

That Was The Week

That Was The Week

Stand Back Think

Big Dig Deep

That Was The Week

I’m starting with this in honor of the essay of the week written by Rohit Krishnan - “Whither Utopia”. Rohit charts the rise of utopian ideas (before that was a pejorative term), and the fall of utopian thinking. Toward the end of the essay he states:

Instead of grand narratives the focus became on micro narratives, skepticism of rational progress, and, perhaps consequently, a reliance on technology to be the answer.

Micro narratives pervade technology today, while macro narratives are frowned upon or described as dangerous. OpenAI has become a magnet for hostility to big ideas and transformative technologies.

Rohit points out that technology may have obviated the need for large social thinking about organizing the world. I think that may be a temporal anomaly. As AI improves productivity and frees humans to have more leisure time (in the negative lexicon, “eats jobs”), the macro narrative around wealth distribution is likely to raise its head loudly.

So the theme this week is “Stand Back, Think Big, Dig Deep.”

It seems very likely that AI, or at least the LLM version we are experiencing now, will remove hours and hours of monotonous work from many humans each week. It seems very likely that the world will become cleverer as Apple introduces AI to the iPhone in Junes WWDC, and Android follows suit. Billions of us will have a ready-made, multi-skilled assistant. Increasingly, it will be able to carry out tasks and report results. It also seems likely that physical beings running computers with this AI embedded, will be capable of real-world tasks. And it seems likely that we will be able to raise science to a new level, as the Chinese diabetes technology reported below demonstrates. Oh, and the entire world will have access to these new skills and tools. The trend will be towards them being free.

We are on the verge of an era of enormous advancement in what we can collectively do.

So, this is not a time for fear, complaints, or accusations. it is a time to get stuff done.

PWC adopting ChatGPT and Apple reportedly doing so are early signals of a new technical revolution.

China’s $47 billion semiconductor fund (see below) will undoubtedly be able to leverage AI to make advanced semiconductors faster than we made the first ones.

The new world will challenge all of today's institutions and require new social arrangements, both globally and locally, as the earth flattens from an economic and demographic point of view and human demands regarding work are reduced.

You can’t have rapid technical shits without equally dramatic social shits. Rohit’s historical survey of utopian thinkers demonstrates that all greatly impacted how societies evolved. This generation needs to ask some big questions, dig deep for answers, and do so from an overview of where we are and where we want to go.

Essays of the Week

Whither Utopia?

The mystery of why we don't dream of building perfect societies anymore

ROHIT KRISHNAN, MAY 30, 2024

Let’s start with a story.

Robert Owen was a Welsh industrialist. Born in Newtown, Owen moved to Manchester when he was quite young, and quickly rose to prominence as a manager in the cotton industry.

He was self-educated, reading everything that he could get his hands on. He was particularly impressed by the enlightenment thinkers, from Locke’s theories on human development and the importance of education to Rousseau’s ideas on natural human goodness and the corrupting influence of society. They resonated with Owen’s belief in the perfectibility of human beings through environmental improvements.

His success at New Lanark Mills in Scotland, where he implemented progressive labor practices such as fair wages, reasonable working hours, and comprehensive education for workers' children, demonstrated his commitment to improving social conditions through rational management.

After he had his economic success he wanted to put his grand theories into play and create a true utopian society.

So he created New Harmony, in Indiana, aimed at demonstrating the feasibility of social reform through cooperative living and education. He brought about the smartest people he could find, artists and scientists and intellectuals, to make New Harmony incredible.

It worked for a while too, even though its story ends in decline. New Harmony faced economic difficulties, internal disagreements, and lack of enough practical skills among its members.

Thanks for reading Strange Loop Canon! Subscribe for free to receive new posts and support my work.

There are at least a couple interesting things here. One is the fact that New Harmony seemed to have a strong undercurrent around things we consider highly modern, around equality and collective living and education.

The second, which is arguably more interesting, is that they clearly believed in the perfectibility of man. Some combination of the christian belief with the American belief with the Enlightenment belief combined to say “we can be so much better”. They truly believed that with individual effort we could create a better society. And what's more, they felt they could demonstrate it, and did just that by gathering up followers and heading to the middle of America to show the world.

Robert Owens was by no means the only one.

Etienne Cabet wrote a novel called Voyage en Icarie. The novel was about his vision of utopian communism. Later, he led a group of followers from France to establish this utopian community. Since it was about communism, naturally they ended up in Texas.

They later ended up moving because of ‘harsh conditions’ to Nauvoo Illinois, and then later again to Iowa. After this Biblical voyage there was a bit of a leadership kerfuffle, where Cabet was kicked out of his own community. And then, despite all odds, it went on to survive for another fifty years.

If this all sounds rather eccentric, it was. It was considered even so in his days.

John Humphrey Noyes created the Oneida Community in New York. In much more normal cult-like fashion, they practiced “complex marriage”, where every man was considered married to every woman. There was only collective unity. There even was “stirpiculture”, a form of selective breeding to lead to better children.

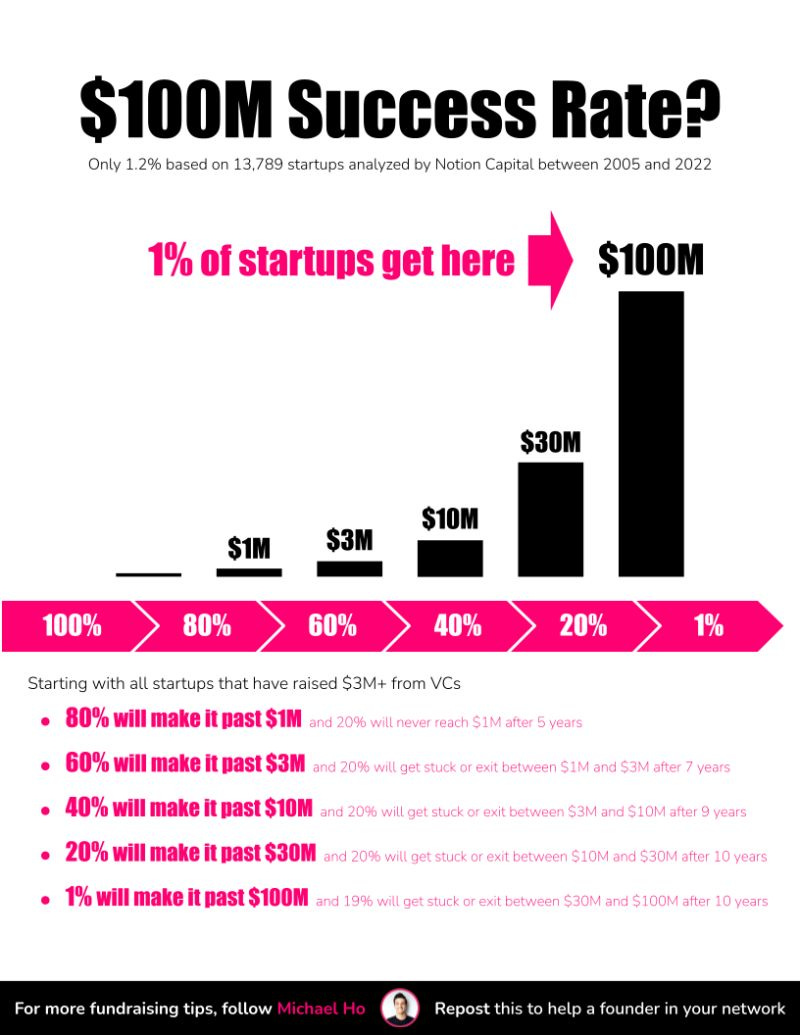

1% of VC backed startups will make it past $100M ARR

Michael Ho

1% of VC backed startups will make it past $100M ARR

But does that make the other 99% a failure?

Let’s dig in to the numbers…

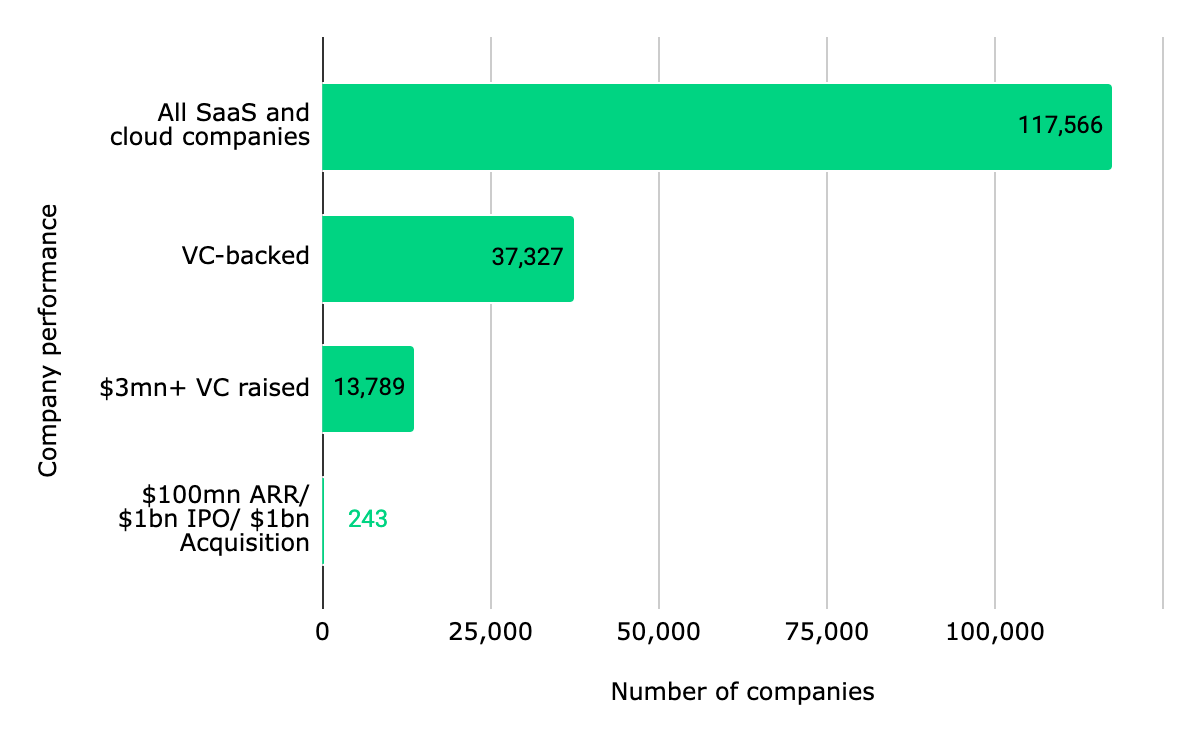

I was fortunate to have Chris Tottman introduce me to Stephen Millard who analyzed 117K startups founded between 2005 and 2022

→ Of those 117K startups founded

→ 31% (37K) were VC backed

→ 12% (13K) raised $3M+

Of those 13K startups, 1.8% (243) either made it past $100M ARR and/or achieved a $1B+ exit

→ 0.5% (71) had a $1B+ exit without reaching $100M ARR

→ 1.2% (168) made it past $100M ARR

→ 109 of the 168 did it <10 years

I was excited to talk to Stephen because he shares my deep belief…

💡 Every company is a snowflake, but we should be able to identify the key operating markers of (capital efficient) venture scale growth to give startups a better roadmap and increase the probability of success

Okay...

Let’s talk about the two elephants in the room

🐘 Why do VCs care about $100M if only 1% make it there?

🐘 Does that make the other 99% a failure?

--------

🐘 Why do VCs care about $1M to $100M in 7 to 10 years?

Because venture capital is a power law game

They understand that a VERY small % of companies will make it to $100M and they’re job is to figure out which ones have a better chance of getting there

So that’s the lens they look through

Now…

Because there’s a lot of future risk with every startup, betting on anything less than a *potential* to reach $100M would put a glass ceiling on their fund that goes against their power law objectives

Series A is the inflection point of the venture scale curve and where VCs are trying to build conviction on a startups *potential* to reach $100M

--------

🐘 But does that make the other 99% a failure?

Absolutely not ❌

I like how Stephen phrased it: many companies have great outcomes at smaller revenues, especially if they have not raised too much capital and / or strike a balance between growth and profitability

And this has become my life’s work over the past 5 years…

→ I don’t believe venture is a $100M or bust binary game

But we need clearer milestones to truly understand where we are in the journey that we can check ourselves against every month/quarter/year so we can continually make better informed decision on a go-forward basis

The chances of becoming a pro athlete is <1% in any given field

But that doesn’t mean we tell kids not to dream of the big leagues?

Of course not...

But it does mean we need to help them re-evaluate their chances of making it every month/quarter/year

--------

Okay, so where can you start?

Focus on unlocking milestones and keep your cap table as light as possible until you're ready for step 3️⃣

1️⃣ Problem Solution Fit

2️⃣ Go to Market Fit - unlocks Series A

3️⃣ Scale PMF #1 - Series A use of funds

4️⃣ Scale PMF #2

From $1 to $100m revenue: Scaling VC backed SaaS with Notion Capital

Words by: Stephen Millard, March 21, 2023

The first in a series of articles exploring “$1 to $100m revenue with Notion Capital"

Highlights:

The probability of a VC backed SaaS company hitting $100m in revenue is approximately 1 in 100

The majority of companies that achieve $100m revenue do so in less than ten years: thereafter the probability seems to decrease

The journey is discontinuous and what makes company successful at one stage will most likely undermine it at the next

You can view the full webinar below, and click the button to receive the associated resources in your inbox.

Setting the scene

People often think of the entrepreneurial startup journey - building a market-leading SaaS company - as linear and continuous. But this is not the case. Things change dramatically as companies move from one phase to the next and the behaviours and people that make a company successful at one stage may well hinder them at the next. The fact that the startup journey is tough, fraught with risk and often chaotic is well understood. The fact that it is discontinuous, less so.

Achieving $100m in revenue and doing so within ten years, is a critical milestone for VC-backed SaaS founders and companies; ten years because that is the typical term of the majority of VC funds and $100m in revenue because that has a strong correlation with enduring value.

Thousands of companies raise Series A rounds every year, but a far smaller number achieve that $100m milestone. This inspired us to ask ourselves a few questions:

What is the probability of that outcome - from raising VC money to $100m ARR?

What happens to the companies that do not achieve that $100m goal?

While recognising that each company is different, is it possible for us to isolate the core operating principles that underpin the very best companies and how they progress from one stage to the next?

And, perhaps even more importantly, can we identify the mistakes that undermine the rest and help our companies avoid them?

And could we use this understanding to better support our portfolio and the wider SaaS ecosystem?

The possibility of an improbable outcome

Venture capital is built on the foundation of the power law; a small number of VC investments generate the majority of the returns, so every company we invest in must have the possibility of a credible pathway to $100m in revenue and be acquired or listed for a billion dollar plus outcome within the ten years of a fund. We know of course that outcome is highly improbable. But just how improbable?

We have started with a cohort of SaaS and Cloud companies founded between 2005 and 2022:

117,566 SaaS and Cloud Tech companies were founded globally;

37,327 of those companies founded are (or were) VC-backed; and

13,789 of those raised more than $3m.

Source: Sources: Dealroom, Companies House, OpenCorporates, company website information, 2023. Data used was from 2005 to 2023, where data availability allowed. For revenue data, 2016-2023 was used. The analysis looks at the number of companies, the proportion of companies (as a proportion of the total number of companies), total investment levels, valuation, and the headquarter locations of companies selected. The most recent valuation was selected to reflect the current value of these companies and state of the market in 2023. For instances where a valuation range was provided, the midpoint was calculated and used.

Bessemer called out the importance of “The Centaur,” in 2002, companies that achieve in excess of $100m of revenue, pointing to the overriding importance of the $100m milestone for enterprise value creation. We extended our analysis to also include companies from this cohort that were also acquired or IPO’d for $1BN or more.

From 13,789 SaaS and Cloud companies that all raised more than $3m, we identified 243 companies that had either achieved $100m ARR and / or been acquired and / or listed, equivalent to 1.8%, or approximately one in 50.

There are a number of tracks for companies to achieve a high value outcome - the main ones we focus on here are $100mn annual recurring revenue, a $1bn acquisition or a public listing. For the majority of companies, the way they become one of the 1.8% is by becoming a centaur - though this isn’t mutually exclusive from achieving a $1bn exit - 87 companies, or 36% of high achievers managed both $100mn ARR and a $1bn exit. 29% of companies successfully floated, or were bought for $1bn or more, without having achieved $100mn ARR. We have tried to summarise using this Treemap slide.

China’s $47B semiconductor fund puts chip sovereignty front and center

Anna Heim, 2:15 PM PDT • May 28, 2024

China has closed a third state-backed investment fund to bolster its semiconductor industry and reduce reliance on other nations, both for using and manufacturing wafers — prioritizing what is called chip sovereignty.

China’s National Integrated Circuit Industry Investment Fund, also known simply as “the Big Fund,” had two previous vintages: Big Fund I (2014 to 2019) and Big Fund II (2019 to 2024). The latter was significantly larger than the former, but Big Fund III is larger than both at 344 billion yuan, or about $47.5 billion, public filings revealed.

Exceeding expectations, and following Huawei’s recent increased reliance on Chinese suppliers, the size of Big Fund III confirms the country’s aim to achieve self-sufficiency in semiconductor production. It is also a reminder that the chip war between China and the West goes both ways.

The U.S. and Europe aren’t alone in wishing to reduce their dependence on their perennial tech rival. China, too, has reasons to worry about its supply, and it’s not just exports from the U.S. and its partners that are at risk.

When it comes to chip manufacturing, Taiwan is the chief concern. China seizing control of its production capabilities would put the U.S. and its allies at a massive disadvantage; Taiwan Semiconductor Manufacturing Company (TSMC) currently makes around 90% of the world’s most advanced chips.

On the other hand, Bloomberg heard from sources that Netherlands-based ASML and TSMC have ways to disable chipmaking machines in the event that China invades Taiwan.

As for China, it is producing some 60% of legacy chips — the type that are found in cars and appliances, U.S. Commerce Secretary Gina Raimondo recently declared.

The chip war extends to both legacy and advanced chips, with uneven results.

The Chinese official narrative is that U.S. policy is backfiring, with exports from leading U.S. chip players dropping, and others share that view.

Either way, this leaves a company like Nvidia walking a fine line “between maintaining the Chinese market and navigating U.S. tensions,” Hebe Chen, a market analyst at IG, recently told Reuters. The company tailored three chips for China after U.S. sanctions prevented it from exporting its most advanced semiconductors, but competition forced it to adopt a lower price than it might have wanted.

Chinese scientists develop cure for diabetes, insulin patient becomes medicine-free in just 3 months

ET Online Last Updated: May 27, 2024, 04:58:00 PM IST

Synopsis

Chinese scientists achieve diabetes cure through innovative cell therapy, detailed in Cell Discovery. Patient, treated in July 2021, no longer requires insulin after eleven weeks, and is now medication-free for 33 months. The breakthrough, praised by Timothy Kieffer, signifies a major advancement in diabetes treatment. This novel approach utilizes the body's regenerative abilities and could alleviate China's healthcare burden. Further studies are needed for validation.

In a significant medical milestone, Chinese scientists have successfully cured a patient's diabetes using a groundbreaking cell therapy. This pioneering treatment was developed by a team from Shanghai Changzheng Hospital, the Centre for Excellence in Molecular Cell Science under the Chinese Academy of Sciences, and Renji Hospital, and was detailed in the journal Cell Discovery on April 30.

Patient's Journey to Recovery

According to a South China Morning Post report, the patient underwent the cell transplant in July 2021. Remarkably, within eleven weeks, he no longer required external insulin. Over the next year, he gradually reduced and ultimately stopped taking oral medication for blood sugar control. "Follow-up examinations showed that the patient’s pancreatic islet function was effectively restored," said Yin, one of the lead researchers. The patient has now been insulin-free for 33 months.

This breakthrough marks a significant advancement in cell therapy for diabetes. Timothy Kieffer, a professor at the University of British Columbia, praised the study, saying, "I think this study represents an important advance in the field of cell therapy for diabetes."

Diabetes is a chronic condition that affects the body's ability to convert food into energy, leading to severe complications if not managed properly. Traditional treatments involve insulin injections and constant monitoring, which can be burdensome for patients.

Innovative Approach to Cell Therapy

The new therapy involves programming the patient's peripheral blood mononuclear cells, transforming them into "seed cells" to recreate pancreatic islet tissue in an artificial environment. This approach leverages the body's regenerative capabilities, an emerging field known as regenerative medicine.

..More

Video of the Week

AI of the Week

If A.I. Can Do Your Job, Maybe It Can Also Replace Your C.E.O.

Chief executives are vulnerable to the same forces buffeting their employees. Leadership is important, but so is efficiency — and cost-cutting.

Reporting from San Francisco

May 28, 2024

As artificial intelligence programs shake up the office, potentially making millions of jobs obsolete, one group of perpetually stressed workers seems especially vulnerable.

These employees analyze new markets and discern trends, both tasks a computer could do more efficiently. They spend much of their time communicating with colleagues, a laborious activity that is being automated with voice and image generators. Sometimes they must make difficult decisions — and who is better at being dispassionate than a machine?

Finally, these jobs are very well paid, which means the cost savings of eliminating them is considerable.

The chief executive is increasingly imperiled by A.I., just like the writer of news releases and the customer service representative. Dark factories, which are entirely automated, may soon have a counterpart at the top of the corporation: dark suites.

This is not just a prediction. A few successful companies have begun to publicly experiment with the notion of an A.I. leader, even if at the moment it might largely be a branding exercise.

A.I. has been hyped as the solution to all corporate problems for about 18 months now, ever since OpenAI rolled out ChatGPT in November 2022. Silicon Valley put $29 billion last year into generative A.I. and is selling it hard. Even in its current rudimentary form, A.I. that mimics human reasoning is finding a foothold among distressed companies with little to lose and lacking strong leadership.

“In struggling companies, you’ll be replacing operational management first but probably keep a few humans to think beyond the machines,” said Saul J. Berman, a former senior consulting partner with IBM. Overall, he said, “the change delivered by A.I. in corporations will be as great or greater at the higher strategic levels of management as the lower ranks.”

Chief executives themselves seem enthusiastic about the prospect — or maybe just fatalistic.

EdX, the online learning platform created by administrators at Harvard and M.I.T. that is now a part of publicly traded 2U Inc., surveyed hundreds of chief executives and other executives last summer about the issue. Respondents were invited to take part and given what edX called “a small monetary incentive” to do so.

The response was striking. Nearly half — 47 percent — of the executives surveyed said they believed “most” or “all” of the chief executive role should be completely automated or replaced by A.I. Even executives believe executives are superfluous in the late digital age.

When Anant Agarwal, the founder of edX and a former director of M.I.T.’s Computer Science and A.I. Lab, first saw the 47 percent, his initial response was that the executives should be saying something else entirely.

“My first instinct is they would say, ‘Replace all the employees but not me,’” he said. “But I thought more deeply and would say 80 percent of the work that a C.E.O. does can be replaced by A.I.”

That includes writing, synthesizing, exhorting the employees. More subtly, A.I. — if it reaches any of the levels its salespeople are promising — will democratize the job of top management even while scaling it back.

OpenAI says it stopped multiple covert influence operations that abused its AI models

The ChatGPT maker claims Russian, Chinese, Iranian, and Israeli networks attempted to manipulate public opinion using AI-generated content.

Pranav Dixit, Senior Editor

Thu, May 30, 2024, 3:51 PM PDT·2 min read

OpenAI said that it stopped five covert influence operations that used its AI models for deceptive activities across the internet. These operations, which OpenAI shutdown between 2023 and 2024, originated from Russia, China, Iran and Israel and attempted to manipulate public opinion and influence political outcomes without revealing their true identities or intentions, the company said on Thursday. “As of May 2024, these campaigns do not appear to have meaningfully increased their audience engagement or reach as a result of our services,” OpenAI said in a report about the operation, and added that it worked with people across the tech industry, civil society and governments to cut off these bad actors.

OpenAI’s report comes amidst concerns about the impact of generative AI on multiple elections around the world slated for this year including in the US. In its findings, OpenAI revealed how networks of people engaged in influence operations have used generative AI to generate text and images at much higher volumes than before, and fake engagement by using AI to generate fake comments on social media posts.

“Over the last year and a half there have been a lot of questions around what might happen if influence operations use generative AI,” Ben Nimmo, principal investigator on OpenAI’s Intelligence and Investigations team, told members of the media in a press briefing, according to Bloomberg. “With this report, we really want to start filling in some of the blanks.”

..More

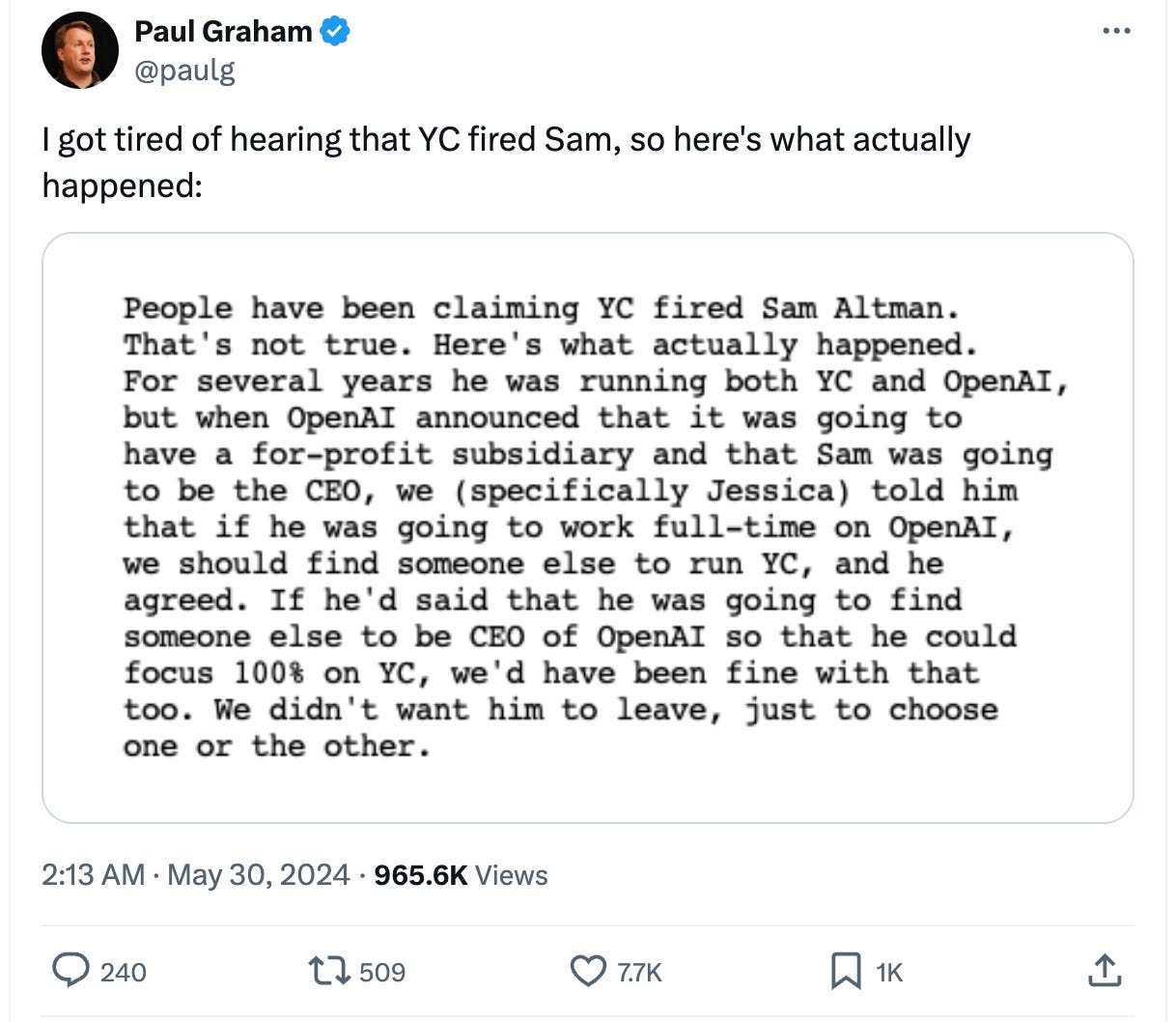

OpenAI CEO Cements Control as He Secures Apple Deal

Seven months after a short-lived ouster of Sam Altman as OpenAI CEO, Altman is more powerful than ever, having eliminated his primary foes within the company and succeeding in striking a key deal with Apple to boost the impact of OpenAI’s technology.

By Amir Efrati and Wayne Ma

Art by Clark Miller. Altman via Getty Images.

When OpenAI’s board of directors ousted Sam Altman as CEO last year, it looked like a shocking derailment of a fast-rising career. Even after Altman returned to the role just days later, it seemed like he would be kept on a shorter leash. Instead, he has become more powerful than ever.

His primary foes within OpenAI resigned or were pushed out. He is propelling the company’s board to overhaul OpenAI’s nonprofit structure so that it won’t conflict with the multibillion-dollar revenue business it is building. One possibility is he could turn OpenAI into a for-profit corporation, an idea he has discussed, according to a person who has spoken to him. Some investors in the company have said they want Altman to get an equity package to align his interests with the businesses. Now, he has fulfilled a longtime goal by striking a deal with Apple to use OpenAI’s conversational artificial intelligence in its products, which could be worth billions of dollars to the startup if it goes well, this person said.

The Takeaway

• Altman has discussed turning OpenAI into a regular corporation

• As part of shakeup, investors want Altman to get an equity package

• Restructuring of OpenAI and Apple deal highlights Altman’s growing power

Aside from the financial windfall such a deal might bring, a partnership with Apple has the potential to boost OpenAI’s position within the tech industry over the long term. Altman and his colleagues hope the Apple partnership might one day supplant a longstanding alliance Apple has with Google, OpenAI’s main rival, which today handles searches on Apple’s Safari browser and is critical to preserving Google’s search monopoly.

To top it off, Altman is working on two new projects outside OpenAI: the first is a daring effort to make AI server-chip factories and the other is developing an AI-powered personal device, such as earbuds with forward-facing cameras that could emulate the AI companion in the film “Her,” with the aid of former Apple designer Jony Ive. Both efforts could complement his work at OpenAI—which would own stakes in the ventures—and give him even more clout.

Meanwhile, Altman and his colleagues also believe that the newest large language model OpenAI is training will far surpass the best LLM it sells today, putting to rest the growing questions in the industry about whether the technology has hit a plateau.

Altman still faces challenges, such as rifts between himself and OpenAI employees who have focused on safeguarding its technology. Those conflicts have steadily spilled into public view and could attract regulatory scrutiny. In addition, the Apple deal could complicate Altman’s relationship with OpenAI’s most important business partner, Microsoft. Altman recently met with Microsoft CEO Satya Nadella to discuss Microsoft’s concerns about how the Apple deal might affect the cloud software giant’s own product ambitions, said one person who spoke to Altman and one person who spoke to Nadella. The two executives also discussed the servers Microsoft would need to handle Apple’s use of OpenAI services, one of these people said.

Altman’s growing power could insulate him from a spate of recent missteps that called his trustworthiness into question. Scarlett Johansson last week complained publicly that, after she turned down Altman’s offer last year to be the voice behind the company’s new voice assistant, OpenAI used a similar-sounding voice anyway when it launched the assistant. Altman said the voice wasn’t supposed to resemble Johansson’s, despite his earlier pronouncement that the OpenAI voice assistant was akin to “her”—a reference to the film, in which Johannson played the voice-based AI companion.

He also disappointed staff when he said he wasn’t aware that departing OpenAI employees had been made to sign a clause agreeing to never speak negatively about the company. Altman said last week he was “embarrassed” by the episode and would undo that part of the company’s standard exit agreements.

Spokespeople for OpenAI and Apple didn't have a comment.

OpenAI signs 100K PwC workers to ChatGPT’s enterprise tier as PwC becomes its first resale partner

1:59 AM PDT • May 29, 2024

ChatGPT has changed how most people regard and interact with AI, and the tool has been used widely to do everything from create travel itineraries to assisting developers with coding. Now its creator, OpenAI, on Wednesday announced that it has signed a major enterprise customer that it hopes will indicate how a similar effect could play out in the world of work.

PwC, the management consulting giant, will become OpenAI’s biggest customer to date, covering 100,000 users. Alongside that, the consulting firm will become OpenAI’s first partner for selling the AI company’s enterprise offerings to other businesses.

OpenAI launched ChatGPT’s enterprise tier in August 2023 as part of a big swing to monetize its generative AI products on the back of the billions it has raised to date. The enterprise tier offers faster, unlimited interactions and is much more flexible for building customized models for different use cases. It also comes with more analytics and other tools.

But as with any enterprise software, OpenAI will still have to convince companies to make the shift from small and occasional use, or pilots, of its generative AI products and think of it as a major IT, business process and workforce investment.

“PwC is the first partner that we are leaning into in this way,” said Richard Hasslacher, OpenAI’s global head of alliances and partnerships, in an interview. “PwC becomes our largest customer, but they’re also our first partner who’s going to be reselling ChatGPT enterprise… It is penetration into industry verticals, but also providing an expansive set of services that customers desperately need to take advantage of in a brand-new solution category.”

Last month, OpenAI disclosed that ChatGPT’s enterprise tier had around 600,000 users, which, according to Hasslacher, includes 93% of all Fortune 500 companies. He declined to disclose what that works out to in terms of engagement time across that user base.

PwC’s 100,000 employees in the U.S., U.K. and the Middle East would boost that number substantially. When, and if, the firm expands its usage of ChatGPT to the rest of its global operations, that could include 328,000 employees.

For PwC, the deal underscores how it believes its own business will be evolving as well as the next big growth opportunity for winning new deals for its consulting business.

Why London is a Powerhouse in Artificial Intelligence

Everyone talks about San Francisco & Silicon Valley as being the go-to places for artificial intelligence, and sure, there’s plenty there, but there are other cities that offer their own unique perspectives and boons to AI. London’s AI scene isn’t talked about enough, even though it’s home to many world-renowned AI organizations, including Google’s DeepMind. Here are a few reasons why you should consider learning more about the London AI scene, including AI companies, research institutions, and startups.

Research Labs

We guarantee you’ve heard of these AI research labs in London! Here are just a few standout ones.

The DeepMind Lab: DeepMind, acquired by Google in 2014, has been responsible for groundbreaking advancements in AI, such as the AlphaGo program that defeated the world’s best Go players.

The Alan Turing Institute: Housed within the British Library, this lab works to solve challenges in data science and artificial intelligence. Named in honor of the pioneering theoretical mathematician Alan Turing, the center started with five founding universities, including two on this list already: Cambridge, Edinburgh, Oxford, UCL, and Warwick.

UCL Centre for Artificial Intelligence: The center brings together researchers who work on core AI challenges including machine vision, machine learning, and natural language processing. They also collaborate with other AI communities in London. Their research is intended to provide a foundation for methodological advancements in AI across UCL.

The Institute for Ethical AI & Machine Learning: The Institute for Ethical AI & Machine Learning is a Europe-based research center that develops frameworks that support the responsible development, deployment, and operation of machine learning systems.

Artificial Intelligence Research Centre (CitAI) — City, University of London: The Artificial Intelligence Research Centre (CitAI) is a research group at City, University of London. CitAI’s research interests include the development of novel AI techniques, Explainable AI (XAI), and Artificial General Intelligence (AGI), with a focus on the legal, ethical, and social impact of AI.

King’s Institute for Artificial Intelligence: The King’s Institute for Artificial Intelligence is a research center at King’s College London that supports a wide range of AI research, with a focus on real-world applications. Areas of research strength include machine learning, robotics, natural language processing, and AI for healthcare.

AI Companies in London

There are plenty of amazing AI companies in London that are developing the latest technology, tools, frameworks, and other life-changing developments! Here are just a few of them:

Synthesia uses machine learning to generate videos with AI avatars and audio.

Quantexa is a data intelligence company serving the banking, insurance, and telecommunications industries.

Wayve uses AI to analyze driving and traffic data to develop self-driving vehicles. They just received a $1B investment.

Microsoft recently announced a new AI Hub coming to London soon as well.

Startups and Funding

London and surrounding areas are home to plenty of AI startups that have received funding in recent memory. Here are some AI startups in London to pay attention to.

Hyperexponential, a London-based provider of pricing decision intelligence (PDI) software for the commercial insurance sector based in London, raised a $73,000,000 Series B round.

Jigsaw: London-based Jigsaw, a builder of diagrams, that allows users to both visualize and manipulate the complex underlying data, raised over £12M in Series-A funding.

PolyAI: London-based PolyAI, which developed a machine learning platform for conversational artificial intelligence, raised $116M in Series C

Leading Names in AI

Representing the companies above and plenty more, here are some previous ODSC Europe speakers who represent what the UK has to offer in the field of AI.

Heiko Hotz | Senior Solutions Architect for AI & Machine Learning | AWS

AI May Dominate Billionaire Family Investments

Latest UBS survey of ultra high net worth family offices shows high enthusiasm for artificial intelligence and other tech investing.

May 27, 2024

A Google data center. Courtesy Google

The AI industry is hot right now. That’s not news. But there’s a constant flow of news reinforcing how breathtakingly hot it is. On June 22, AI chip behemoth Nvidia announced a record-setting Q1 revenue of $26 billion. That’s 18% more than it made in the previous quarter and a staggering 262% more than in Q1 2023.

That same day, brought insights on how keen the ultra-wealthy are to pour money into AI when UBS released its annual Global Family Office survey. Though small operations with usually 10 staffers or less, these organizations move huge amounts of money for the wealthiest families in the world. Among the 320 family offices surveyed, the average net worth was $2.6 billion—representing a total $600 billion in investment potential.

AI Becoming Most Popular Investment

And AI is a growing part of these portfolios, with 78% percent of family offices worldwide (and 83% in the U.S.) saying they are likely to invest in the next two to three years. That makes it the most-popular sector, with the other top six also in technologies such as automation, medical devices, and “green tech.” (The survey does not reveal the actual dollar amounts that are or may be invested in sectors, just the level of interest in them.

“It’s eight in 10. That’s pretty much everybody,” said Jennifer Gabrielli, head of the Ultra High Net Worth Solutions Group at UBS Wealth Management Americas. “There’s a heavy concentration of U.S. investment opportunity in that space.”

She believes that as the number of family offices grows, “they’re going to increasingly be a leading indicator of what other investors are thinking, both ultra-high net worth investors, and probably high net worth investors.”

Industry Shakeout May Be Coming

However, some cooling off may be coming, says Ravi Mhatre, co-founder and managing director at Lightspeed Venture Partners, one of the leading Silicon Valley VC firms. At the Milken Global Conference, he explained to Worth the challenges of making AI with development costs being so high.

Generative AI seed funding drops 76% as investors take wait-and-see approach

May 30, 2024

Even with AI, what goes up must eventually come down.

For two consecutive quarters, generative AI dealmaking at the earliest stages has declined, dropping 76% from its peak in Q3 2023 as wary investors sit back and reassess following the initial flurry of capital into the space.

VC deal value for pre-seed and seed-stage deals fell in Q1 2024 to $122.9 million, a far cry from Q3’s peak of $517.7 million. Deal count has also declined with only 34 deals recorded in Q1. In all, the latest quarter marks the lowest deal value and count since ChatGPT’s launch kicked off the generative AI frenzy in November 2022.

After flooding the space with VC dollars and with how quickly the tech is advancing, investors say it’s time to hit the brakes and watch how things play out.

“There was this huge rush, and a lot of people got funded who probably shouldn’t have,” said Matt Cohen, founder and managing partner at Ripple Ventures, which invests in pre-seed enterprise software startups.

One reason for wariness is the release of OpenAI’s GPT store, which offers free services like code completion, copywriting and document analysis. Effectively, Cohen said, this store has made a bevy of startups obsolete and forced investors to exercise greater caution when fielding potential investments.

With the recent release of OpenAI’s image and speech-heavy new model GPT-4o, some are concerned that this pattern will repeat itself. Stability AI, the maker of the popular text-to-image generator Stable Diffusion, has faced layoffs and its CEO’s resignation in recent months as it grapples with increasing competition.

“I ask them (startups) now, ‘don’t bullshit me,’ just tell me what’s the differentiator and if you’re using third-party tools,” Cohen said. “Right now, there’s just a ton of market saturation.”

Investors are chiefly concerned about how questions around profitability will shake out. “The ability to make money as an investor at this point is really hard. The bets have been made,” said Richard Dulude, co-founder and general partner at pre-seed and seed investor Underscore VC.

..More

VC Says "Chaos" Coming for Startups, Ads, and Online Business as Generative AI Eats Web

If the web is an infrastructure built on paying and optimizing for referred traffic, what happens when that's diminished?

ALEX KANTROWITZ, MAY 31, 2024

As generative AI products ingest more of the web — via deals like OpenAI’s with Vox and The Atlantic this week — the impact could be felt well beyond news publishers.

“Chaos” is en route for the broader online economy, VC Joe Marchese of Human Ventures texted me this week, with the technology poised to reshape a decades-old system of online referrals and business building.

Marchese sold his ad tech firm, TrueX, to 21st Century Fox, and ran advanced advertising at Fox Networks for years, so he knows the system better than most. After his “chaos” text, I called him up to ask him what he meant. Here’s our (brief) conversation:

Alex Kantrowitz: Why is “chaos” coming for the business model of every business on the internet, as you texted?

Joe Marchese: The web is an infrastructure built on paying for, or optimizing for, referred traffic, and the ability to monetize people once they get to a webpage. If that changes in any way, it's not just publishers who are going to feel massive shifts in their business models, but online travel, ecommerce, and every sector that's built on the pipes of the internet.

How would that play out in online advertising, for example?

The vast majority of online advertising is built on top of search. Click on a link, get a fee, create a value chain. Or it's impression based: Someone goes to a web page, is served an impression, an advertiser is charged. Even if generative AI is not going to collapse that tomorrow, if it causes a 10% or 20% decrease in that, imagine what it means for something that’s basically the size of the internet.

Upgrade to paid

But the conventional wisdom is that, instead of ad dollars, Generative AI companies will get an agent fee for introducing you to new services or new information. Would that work as a replacement?

It’s very difficult to pull off. In theory, the agent fee could replace the click through and tracking to purchase. But there are so many companies involved at each step today. You might be able to replace that, but you would need a new model and it doesn't exist yet.

What about traditional online businesses like Kayak-style travel brokers? How will they end up in chaos?

One of the most valuable searches is people looking for things to do. In this case, the layer between the large language model and the consumer is very, very important. I don't want to ask ChatGPT what to do in Rome. But I would ask Conde Nast Traveler. That is a massive opportunity, but you've just removed an entire industry that’s fighting over search engine results so they can give you flight answers and get a piece of the revenue. If you look at the value chain potentially contracting, there will be new business models for it. But they're not built yet.

Startups also use this online referral system to build userbases. What happens to them?

The best use of performance marketing is always early because your customer acquisition cost is lowest at the beginning. Google, Facebook, and Amazon are great at finding you the most likely earliest users. But as companies try to scale, there’s a need to build a brand. If consumers don’t got to websites and see ads, it’ll be very hard to build that brand. Mediums that are less disrupted, like billboards — which I'm a huge fan of — will become more valuable.

..More

News Of the Week

Ethereum ETFs: BlackRock Gets $10M Seed Investment and Grayscale Adds Coinbase Custody

Two of the largest fund managers updated their spot Ethereum ETF filings, bringing in $10 million in seed investment and named a custodian.

May 30, 2024

We do the research, you get the alpha!

Get exclusive reports and access to key insights on airdrops, NFTs, and more! Subscribe now to Alpha Reports and up your game!

Both BlackRock and Grayscale have updated their U.S. spot Ethereum exchange traded fund (ETF) filings to add a seed investor and establish a custodian.

The video player is currently playing an ad.

BlackRock, the world’s largest fund manager, has received $10 million in capital from the seed investor who bought shares in its upcoming iShares Ethereum Trust, filings show. The S-1 form, filed late Wednesday with the SEC, states that the seed investor bought 400,000 shares at $25 and will act as a “statutory underwriter.”

A seed capital investor initially funds an ETF to get it off the ground and trading on a stock exchange.

This comes after the SEC approved spot Ethereum ETFs last week, in a stunning change in attitude towards the investment products. Just a week prior, experts had seemingly written off the possibility of an ETH ETF in the U.S. But after fund issuers dropped language around staking, the SEC had a swift change of heart.

..More

Sequoia's Elon Play

Plus, VCs from a16z, Lux Capital, and Work-Bench dive into enterprise AI.

ERIC NEWCOMER AND MADELINE RENBARGER

MAY 31, 2024

Sequoia Bets Big on Musk-World

Sequoia Capital wrote another check to Elon Musk this week, taking a small part of a $6 billion funding round that valued his artificial intelligence startup, xAI, at $24 billion.

It wasn’t the first time Sequoia has doubled down on the Musk universe.

Let’s step back for a second.

The resume of Sequoia’s former top boss, Doug Leone, is chock full of wonky enterprise software companies like Medallia, which makes customer experience management products, and RingCentral, a cloud-based phone system. He led the firm through an era where marketplaces like Airbnb and video conferencing companies like Zoom were key winners for Sequoia.

Those deals helped solidify Leone-era Sequoia as the top venture firm in Silicon Valley.

But stuff like old-school enterprise software and marketplace businesses are out of favor these days.

ServiceNow, another one of Leone’s wins, was hammered on the stock market this week, with shares down 17.5% over the last five days. It’s far from the only traditional software stock that’s hurting.

Sequoia’s current senior steward, Roelof Botha, is leading the firm through a different epoch, one where the venture capital industry is excited mostly about defense tech and large language models. Predictable software-as-a-service businesses are out; big, bold bets on the future are in. Hardware companies like Nvidia, an early Sequoia investment, are making a resurgence. In some ways, Sequoia is going back to its hardware investing roots.

What founder is better at creating crazy, futuristic, hard technology, and bet-the-farm opportunities than Botha’s old PayPal mafia buddy Elon Musk?

As you may or may not remember, Sequoia has a long history with Musk that goes back to the PayPal days. Sequoia legend Michael Moritz was one of the earliest investors in Musk’s X.com, which merged with Peter Thiel’s company Confinity to become PayPal. Botha was PayPal’s chief financial officer.

Meanwhile, Sequoia partner Shaun Maguire has built a close relationship with Musk, with reporter Margaux MacColl at The Information recently calling him the “Musk Whisperer.” Maguire is Sequoia’s guy trying to see into the future.

Over the past few years, Sequoia has made a string of big investments in Musk’s expanding universe of companies.

Salesforce: We Need 50% More Pipeline Than Before To Hit the Plan

by Jason Lemkin | Blog Posts, Scale

So Salesforce had a rough quarter. While overall growth met Wall Street’s projections, their guidance for next year was down. For the first time ever, Salesforce projected only single digit growth for next year. I.e., less than 10%.

Marc Benioff and team were clear on the challenges:

Sales cycles remain longer

Deal sizes are under pressure, and some new customers cut back projected spend in deals

Need much more sales enablement in deals

While the end of the year saw a bit of an upturn in demand, this quarter is back to the same tough dynamics as the past 24 months. HubSpot saw the same thing.

So for classic “B2B2B”, it’s clearly still tougher times.

Net net, what does that mean? Marc in an unguarded moment answered this:

Salesforce now needs 3x pipeline coverage, vs the 2x it needed before the “downturn”:

Now pipeline coverage is a metric that can really vary based on what stage you are at. A typical startup might aim for 5x coverage, i.e. that 20% of your pipeline converts to paying customers. And that you have 5x more in your pipeline than you need to hit the plan. Salesforce is more enterprise, more proven, and more likely looking at a stage down the funnel. So more pipeline might be expect to convert. Whatever stage you use, however you measure pipeline-to-close … measure it consistently.

And Salesforce is now seeing it needs 3x the dollars of deals in play to cover each $1 of bookings now. 24 months ago, it only needed 2x.

Startup of the Week

New from Lux, makers of Halide:

Today we’re excited to launch Kino, a powerful filmmaking app for beginners and experts alike. As say they say in screenwriting, “Show, Don’t tell,” so let’s walk through a few of the tent-pole features in our huge 1.0 release. [...]

Last fall, everything changed when Apple introduced “Log” video support on the iPhone 15 Pro. When recording in this format, your iPhone saves a version of your video with most of the original information, and before any creative decisions have been applied. Using that cake analogy, it’s like the iPhone now saves all the ingredients that make up a cake, but leaves you to do the baking.

That’s great if you’re a skilled baker… er… colorist… but it’s challenging for most of us. Out of the box, Apple Log footage looks really flat. It’s not meant to look good. It’s meant to be edited later.

But what if you didn’t have to edit? What if you could use all that powerful extra color data and get a cinematic look with one tap?

What a delightful prosumer balance Kino strikes. Preset color grades include some from Evan Schneider, Tyler Stalman, Stu Maschwitz, Sandwich Video, and Kevin Ong.

And I just adore some of the UI touches in the app, like drawing a big red border around the entire display when recording footage. It’s like those big red lights in TV studios.

Kino is going to cost $20 as a one-time purchase, but is available at launch for just $10. What a great deal.

SEE ALSO: Lux cofounders Sebastiaan de With and Ben Sandofsky were my guests on The Talk Show back in October, and dropped some hints about what is now Kino.