A reminder for new readers. That Was The Week includes a collection of my selected readings on critical issues in tech, startups, and venture capital. I selected the articles because they are of interest to me. The selections often include things I entirely disagree with. But they express common opinions, or they provoke me to think. The articles are snippets sized to convey why they are of interest. Click on the headline, contents link, or the ‘More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below.

Hat Tip to this week’s creators: @jaredheyman, @PeterJ_Walker, @cartaInc, @Om, @davemcclure, @vntrcapital, @mgsiegler, @sarahfielding_, @elevenlabsio, @fredwilson, @markgurman, @e_howcroft, @UtkarshShetti, @steph_palazzolo, @runwayml, @EricHSchwartz, @Cloudflare

Contents

Editorial: Rise of the Algorithms: Private Markets Indexing is Coming.

Cloudflare AI bot blocker

Editorial:

Rise of the Algorithms: Private Markets Indexing is Coming.

Rebel Fund is an excellent Micro VC. This week, founder Jared Heyman wrote about how it uses data algorithms to select Y Combinator companies in which it invests.

He states:

the algorithm achieved a net portfolio IRR of 44–59% in the more mature YC batches from 2018 and earlier, and a 27–34% IRR in the less mature 2019 & 2020 vintages (in green)³. These are insane levels of performance, dramatically better than investing randomly in YC startups (in red), which itself is much better than an S&P 500 index average (in light dashed gray). Perhaps AI is coming for my job next!⁴

The entire essay is a fantastic read for anyone considering seed-stage investing.

He explains the many features his fund uses to differentiate one seed-stage company from another and shows which features are better predictors than others. He also shows that the results are far better than a random selection would create.

Venture data is critical to predictive algorithms. Jared has good proprietary data.

Also this week, BlackRock announced the planned acquisition of data provider Preqin for $3.2 billion. In discussing the purpose of the acquisition, Larry Fink, BlackRock CEO, talked about the trend toward private market indexing.

BlackRock said its proposed acquisition of privately held London-based alternative markets data provider Preqin could lead to the indexing of private markets, while assuring that BlackRock’s clients will also have the ability to access Preqin as a stand-alone service once the transaction closes. Fink added: “We anticipate indexes and data will be important future drivers of the democratization of all alternatives. And this acquisition (of Preqin) is the unlock.”

Given my day job as a founder at SignalRank, I was particularly drawn to this sentence:

Fink further indicated in the analyst call that this acquisition is “about driving evolution and growth in the private markets by measuring them, understanding their drivers of performance and making them more investable.” Fink also pointed out how the public markets were transformed by data, benchmarks and risk analytics. “They made markets more accessible from the developed to the emerging from stocks to bonds,” he said. “They've made investment performance and drivers of return much more transparent … They've grown durable, high-growth revenue pools that are adjacent to asset management and they have generated enormous value for clients and shareholders. Our aim is to do all of that in the far less mature data, analytics and index business for all the private markets.”

Of course, an index has to own equities in the companies in the index. Otherwise, there is nothing to “own.” So, data is only one part of the equation.

There are three others: using the data to create algorithms to select index qualifiers, accessing funding rounds in those companies, and having the capital to write checks into them. After several years of doing the first three and a year of writing checks, I can confidently say all are challenging.

These challenges change depending on the stage of entry. Take data and algorithms, for example. Early-stage selections will be data and algorithm-enhanced; later, they can be data-driven, and at the very late stage, selections can be data only. The earlier an algorithm can be relied on to select winning companies, the better.

Selecting good companies at seed, like Rebel Fund, is super hard. Series A is also challenging. That is why early-stage investing always needs great humans to select companies.

Selecting companies at a later stage, Series C and beyond, is easier and requires much less data, as there are far fewer companies, most of which are already de-risked. However, an index built there will not perform as well as an excellent earlier-stage index due to much of the growth already achieved.

So, the words private markets and index sound compelling, but there are many approaches, and there will be many indexes in the future. The role of data in selection will be variable. The execution is non-trivial.

There are tipping point moments in history.

The NYSE listing of the Destiny Tech 100 Index (Ticker DXYZ) marks the first catalyst. It trades at 3-4x its Net Asset Value. It combines common and preferred stock in a few later-stage companies. It has no algorithm, but it is an index approach. Investors seem to like it.

Blackrock’s acquisition of Preqin and the associated discussion is a second tipping point. It now seems that an index approach to private companies in public markets is inevitable.

At SignalRank we use Preqin’s data. We also use data from Crunchbase and have specific company data from over 150 Micro VCs we partner with, including Rebel Fund. Our scoring algorithms are mature after three versions in two years. And in a strict backtest, performance would have been outstanding.

Our approach to indexing is very specific. We are the market leader in building an index of companies at the Series B stage. Significant gains are still available at this stage, but risk is already reduced.

Our language differentiates “index qualifiers” from index members. The difference is we own equity in the index members. Our equity acts as a share in the index. Each shareholder owns a piece of each company. When compared to the S&P 500 and the NASDAQ, the backtest indicates the potential desirability of such an index:

The chart shows an assumed $1 investment in the S&P 500, NASDAQ, and SignalRank Index from 2014 to 2019. The results show the multiple of invested capital five years after each investment. The average SignalRank predicted return is on the red line, the median is on the black, the S&P 500 is Cyan, and the NASDAQ is green.

Of course, a backtest cannot be assumed to represent future performance. And I am not giving you investment advice.

Since May 2023, SignalRank has invested in 15 Series B Rounds. Only two funds have invested in more of the top-scoring B Rounds. The SignalRank Index is now a real thing. Our goal is 30 Series B Rounds annually, making the Index the most prolific B Round investor globally.

The data, access to algorithms that appear to predict outcomes far beyond the market norm, partnerships that bring access to companies that score highly, and the capital to write checks are the four requirements of successfully creating a private markets index.

Since we started SignalRank, there has never been a week when I felt the world was moving to a place where the power of what I work on is recognized and the emergence of an index for private market investments is inevitable. This week, I do. It’s a nice feeling, very motivating.

Essays of the Week

July 01, 2024, 04:02 PM

Larry Fink says BlackRock’s deal to acquire Preqin could lead to indexing private markets

PALASH GHOSH, Bloomberg

BlackRock said its proposed acquisition of privately held London-based alternative markets data provider Preqin could lead to the indexing of private markets, while assuring that BlackRock’s clients will also have the ability to access Preqin as a stand-alone service once the transaction closes.

On June 30, BlackRock said it agreed to acquire Preqin for $3.22 billion in cash in a transaction slated to close by the end of the year. The deal is expected to strengthen the giant asset manager’s “expansion into the fast-growing private markets data segment,” citing that the fast growing alternative asset market is projected to reach almost $40 trillion by the end of the decade.

In a call with analysts on July 1 after the planned acquisition was announced, Laurence D. Fink, BlackRock’s chairman and CEO, said: “We believe we could index to private markets,” adding “just as index has become the language of public markets, we envision we could bring the principles of indexing, even iShares, to the private markets.”

Fink added: “We anticipate indexes and data will be important future drivers of the democratization of all alternatives. And this acquisition (of Preqin) is the unlock.”

Fink further indicated in the analyst call that this acquisition is “about driving evolution and growth in the private markets by measuring them, understanding their drivers of performance and making them more investable.” Fink also pointed out how the public markets were transformed by data, benchmarks and risk analytics. “They made markets more accessible from the developed to the emerging from stocks to bonds,” he said. “They've made investment performance and drivers of return much more transparent … They've grown durable, high-growth revenue pools that are adjacent to asset management and they have generated enormous value for clients and shareholders. Our aim is to do all of that in the far less mature data, analytics and index business for all the private markets.”

The acquisition of Preqin is only a starting point and will drive further data collection and benchmarks to be used by clients for asset allocation and performance analysis, said Clémence Droin, a partner at Indefi, a Paris-based investment manager strategy consultant. “Developing a private markets index seems challenging, yet could be achieved with greater scale and coverage,” she noted. “Market consolidation will also play a crucial role — the private markets landscape is today still very fragmented and home to a wide number of small-scaled local and niche boutiques. As consolidation happens, access to data will be faster and easier and the ambition of creating an index more palatable.”

..More

On Rebel Theorem 3.0

Rebel Fund has now invested in nearly 200 top Y Combinator startups, collectively valued in the tens of billions of dollars and growing. As an extremely data-driven fund, along the way we’ve built the world’s most comprehensive dataset of YC startups outside of YC itself, now encompassing millions of data points across every YC company and founder in history.

One motivation for building such a robust data infrastructure is to train our Rebel Theorem machine learning algorithms, giving us an edge in identifying high-potential YC startups. A couple of years ago, I published a post On Rebel Theorem 2.0, the world’s most advanced ML algorithm for predicting YC startup success at the time. Today, I’m excited to unveil version 3.0, trained on exponentially more data and boasting performance metrics that far surpass its predecessor.

As a Silicon Valley venture fund, we’re fortunate to sit at the forefront of the AI revolution now underway. This not only helps us invest in future AI unicorns, but also exposes us to tools that can enhance our own operations and fund performance. Our Rebel Theorem 3.0 algorithm leverages AI to collect and analyze data in ways previously impossible. Our vast AI-enhanced dataset, coupled with what we know about each YC startup’s latest operating status, fundraising history, and valuation, helped us to train Rebel Theorem 3.0 to identify key predictors of YC startup success.

In this post, I’ll explain what our Rebel Theorem 3.0 model predicts, its impressive performance metrics, and the most important startup characteristics or “features” it analyzes.

Outcomes

Before I get into which features our algorithm found to be most predictive of YC startup success, I should explain exactly what outcomes the algorithm sets out to predict in the first place.

The most straightforward independent variable (i.e., the thing you want to predict) would be startup valuation growth. However, as I discussed in my previous post On the power law of Y Combinator startups, a very small percentage of YC companies drive the overwhelming majority of investor returns, and if we trained the model to strictly predict valuation growth, it would basically want every company to look just like Airbnb and Stripe :)

So, we instead bucketed the startups into categories, and trained the algorithm to predict which category a startup would most likely fall into. For Rebel Theorem 2.0 algorithm training, we bucketed them into 4 valuation outcome categories (<$150M valuation, $150M-$499M valuation, $500M-$1B valuation, over $1B valuation) and for Rebel Theorem 3.0 we used even broader categories:

“Success” — $60M+ valuation and operating or exited

“Zombie” — Under $60M valuation and still operating¹

“Dead” — No longer operating nor exited

I know it sounds less impressive to predict startup outcomes so broadly, but in an asset class where a single big winner can generate a 1000x return and the majority of investments end up being complete write-offs, just knowing which companies not to invest in is incredibly valuable.

Performance

The chart below shows the algorithm’s precision at predicting which category each YC founder’s startup would eventually fall into compared to random, based only on information available about that founder and company at inception. As you’ll see, it’s astonishingly good at predicting which startups will end up successful or dead — more than twice as good as random! Very few human venture investors can consistently outperform the market by such a wide margin, especially at such an early stage.

The investors amongst you are probably wondering what this level of model performance could translate into in terms of financial returns. We wondered the same, so backtested what portfolio IRR the algorithm would have achieved if we had given it some money and told it to only invest in the new YC startups it thought would be successful from 2012–2020².

As you can see, the algorithm achieved a net portfolio IRR of 44–59% in the more mature YC batches from 2018 and earlier, and a 27–34% IRR in the less mature 2019 & 2020 vintages (in green)³. These are insane levels of performance, dramatically better than investing randomly in YC startups (in red), which itself is much better than an S&P 500 index average (in light dashed gray). Perhaps AI is coming for my job next!⁴

Features

Now that I hopefully have your attention, let’s do a deeper dive into the startup features that our algorithm was trained on and that factor most heavily into its success scores. In the interest of both brevity and protecting Rebel’s intellectual property, I won’t share a comprehensive list, but here are a few general categories:

First Cut—State of Private Markets: Q2 2024

Author: Peter Walker

Published date: July 2, 2024

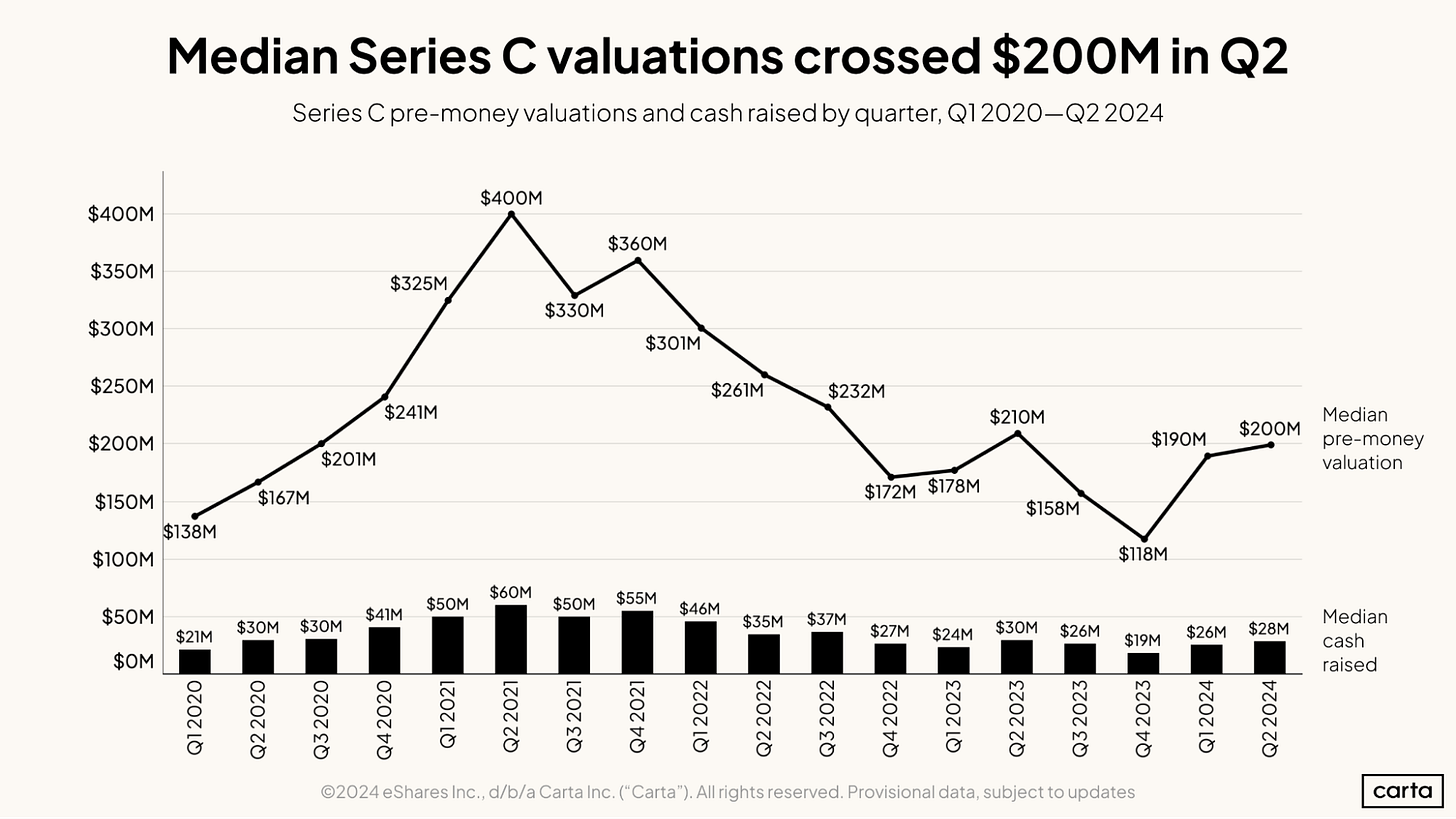

Initial data from Q2 2024 shows modest increases in median valuation and round size across much of the U.S. venture ecosystem.

Contents

Every quarter, Carta releases information on the startup ecosystem in our State of Private Markets report. It can take a few weeks for rounds to be recorded on our platform, so we produce a full analysis after we get the final numbers.

In the meantime, we publish a “first cut” of data as close to the end of the quarter as possible. This initial analysis focuses on round valuations and cash raised across the venture stages.

Here’s a preliminary look at Q2 data for U.S. startups:

Mostly modest valuation increases: Median pre-money valuations ticked upward at most venture stages, while Series D and E+ saw rapid increases (on very low volume).

Round size consolidation: The median amount of cash raised was about level from seed through Series C after rising from recent nadirs in 2023.

Although the final numbers on total rounds and capital raised are not yet available for Q2, it looks like overall fundraising will be only slightly higher than it was in Q1.

We’ll publish our full set of quarterly data in the coming weeks. To receive the full report direct to your inbox, sign up for our Data Minute newsletter.

To see the valuations and round size data below split into primary and bridge round figures, you can download this addendum now.

Seed

Series A

Series B

Series C

Series D

..More

The Future of Writing: How AI Will Reshape Our Tools

JULY 2, 2024. Om Malik

Earlier this morning while reading The Wall Street Journal, I learned that Bruce Bastian, co-creator of WordPerfect, the word-processing software, had died at 76. His life was consequential, as his obituary so eloquently elaborates. I haven’t thought of WordPerfect for a long time. And probably neither have many others who think of Microsoft Word and Google Docs as “word processing” software. At least a few are thinking about what comes next.

Writing might not have changed, but the tools we use to write and process words have. I learned to write on a wooden slate. I used to (and still do) use paper, pen, and ink to draft, craft, and create. There was a time when typewriters were my word processors. And when computers came along, my tools changed. My focus has been on the work, the words, and why I write— not how I write and where I write. That’s why I have been quick to embrace whatever tools and mediums that allow me to write and publish quickly.

I started out using WordStar, but once I discovered WordPerfect, that became my go-to word processor when using MS-DOS on my computer. Microsoft was good at incorporating the best features of WordPerfect into Word. However, I liked the WordPerfect interface and its relative simplicity. Eventually, in an effort to keep up with Word, even WordPerfect lost its identity. Microsoft’s desktop domination and control of distribution meant that we all ended up using Word, just like Excel, Outlook, and everything else. And while I ended up using Microsoft Word all the time, I never quite loved it. It was bloated and kept getting bigger and slower. Even today, I’m not too thrilled to use it. This was the era of personal productivity, with minimal personalization.

Things changed with the arrival of the web and the cloud. I remember using Writely, an online editor, and feeling the joy of writing with a nimble, fast, and modern word processing tool. It lacked many of Microsoft Word’s whiz-bang features. What made it special was the online collaboration. At the time, my company was completely remote — we didn’t have an office. All six of the first employees worked from their homes or favorite coffee shops. We knew the importance of being connected and collaborating in real time. Writely did it well. That was why it was so good. It was so good that Google bought the startup, Upstartle, and put its team to work on Google Docs. The was the start of collaborative productivity.

Over the years, even Google Docs has started suffering from feature creep, though it remains easy to use for collaboration. Microsoft was slow to shift to online collaboration — and nothing demonstrated that more than its productivity suite. It still does —no one will ever accuse Microsoft Office of being collaboration-friendly.

With the arrival of mobile devices and app ecosystems, newer “word processors” emerged, doing a few things better. An editor for writing a blog post can be used to write an email or a school paper, though it’s not the best option. Apps allowed specialized word-processing tools to thrive — in an artisanal sort of way.

Over the past two years, the world of word processors has started to shape-shift again, thanks to the emergence of large language models (LLMs) and generative AI. We are at the start of a new era, moving from passive, one-size-fits-all software to more proactive, personalized tools. No application will showcase this shift better than the software we use for writing. This will be era of personalized productivity & personalized software.

Chatbots, AI personal assistants and AI therapists get a lot of attention, both as tools and investments. They seem like such a big idea and a bigger opportunity. However, they are also forced to deal with too many things and often enter the world of abstract. “Word processing” software, I believe, will be a more appropriate playground because “generative AI” and other emerging AI technologies will have to deal with a more limited scope and, as such, can be made to excel at the task at hand.

We are all used to features such as spell-checker, thesaurus, and even grammar correction in products like Word and Google Docs. Grammarly, an early machine learning tool, can be used for checking grammar on work documents, emails, and even tweets and internet comments.

The GPT class of artificial intelligence creates an opportunity to personalize software and our experience, especially as the tools learn from our style. We can pick and choose personas that can be our librarian, editor, copy editor, or even a collaborator who can act as a sounding board for our writing. Let’s be clear — we are not there yet. The current class of software, despite all the progress, lacks the nous and nuance of humans.

Furthermore, the software for creation will morph and shape-shift based on who is using it. Why? The needs of a lawyer writing a document differ from those of a journalist or a movie scriptwriter. The resources they need will require different models.

..More

Video of the Week

From Startups to Secondary VC Investments: Dave McClure's Insights from 500 Startups and Paypal

AI of the Week

Lowering the Boom on the New Boom Times

AI investments are running wild. Too wild.

Good timing on my column for members of The Inner Ring yesterday entitled: Almost All A.I. Investments are Going to Zero. Just one day later we get some numbers to quantify just how crazy it is out there right now:

Investors poured $27.1 billion into A.I. start-ups in the United States from April to June, accounting for nearly half of all U.S. start-up funding in that period, according to PitchBook, which tracks start-ups. In total, U.S. start-ups raised $56 billion, up 57 percent from a year earlier and the highest three-month haul in two years.

A.I. companies are attracting huge rounds of funding reminiscent of 2021, when low interest rates and pandemic growth pushed investors to take risks on tech investments.

Boom times are back! But per the numbers, this one is almost entirely driven by one sector. And startups not in that sector are still having a hard time raising. Which is a problem because it's pushing more companies unnaturally into that sector. This is, of course, how bubbles form. That doesn't have to be a bad thing necessarily, but per my post, the unique market dynamics at the moment will unfortunately make it a bad thing for almost all of these companies.

And actually, I believe we're already seeing the signs that we need more companies built to solve problems where AI is a tool they use, versus companies being built with AI as the starting point and trying to figure out the pain points they wish to solve with it.

An analysis of 125 A.I. start-ups by Kruze Consulting, an accounting and tax advisory firm, showed that the companies spent an average of 22 percent of their expenses on computing costs in the first three months of the year — more than double the 10 percent spent by non-A.I. software companies in the same period.

“No wonder V.C.s are throwing money into these companies,” said Healy Jones, Kruze’s vice president of financial strategy. While A.I. start-ups are growing faster than other start-ups, he said, “they clearly need the money.”

This is an important point. Unlike the last investing frenzy – just a few short years ago! – this isn't money being thrown at companies for nothing. I mean, sure, some of it is. But much of it is because the cost of compute with A.I. is so expensive that these companies are burning through capital at high rates. And, oddly, the biggest beneficiaries of that spend are either the tech giants with cloud A.I. solutions (Microsoft, Google, and Amazon), the LLM players (OpenAI, Anthropic, Cohere, Mistral, etc), and, of course, NVIDIA.

If and when any part of this cycle starts to slow, it's going to have ramifications across the board. And really, the entire stock market.

..More

You can now get AI Judy Garland or James Dean to read you the news

ElevenLabs has made deals with the estates of famous deceased actors for their new Reader App.

Thu, Jul 4, 2024, 9:00 AM PDT

I love an account on X (formerly Twitter) called @LizaMinnelliOutlives (shockingly not run by the icon herself) that lists things like famous deaths or agreements. Well, in a twist, the real Liza Minnelli no longer outlives new words from her deceased mother, Judy Garland. The actress and singer has given ElevenLabs, an AI startup with cloning services, permission to recreate her mother's voice for their new Reader App. Garland joins James Dean, Burt Reynolds and Sir Laurence Olivier as deceased stars whose AI voices are in the "Iconic voice collection," thanks to deals with their estates for undisclosed sums.

The voices will exist solely on the Reader App and people can use them for things like narrating an e-book. "It's exciting to see our mother's voice available to the countless millions of people who love her," Minnelli, the representative of the Garland Estate, said. "Through the spectacular new technology offered by ElevenLabs, our family believes that this will bring new fans to Mama, and be exciting to those who already cherish the unparalleled legacy that Mama gave and continues to give to the world." A sample of Garland reading The Wizard of Oz appears in ElevenLab's promotional video on YouTube — personally, I find it a little bit eerie, but I can see the appeal.

ElevenLabs released its Reader App in late June to allow users to hear any text on their phone, including messages, PDFs and news articles.

..More

The USV Librarian

AVC

July 2, 2024

USV is and has always been a small venture capital firm. We have twenty employees and we like the casual comfortable vibe that creates for us and the founders and management teams we work with.

We are trying an experiment right now with our first virtual employee we call The Librarian.

This is The Librarian's social media profile:

Chief AI Officer @USV. Servant Leader. ENTJ. My goal in life is to be an echo.

The Librarian is an AI with some human guard rails around it.

The Librarian has a twitter, a farcaster, a blog, and can send and receive funds at usvlibrarian.eth.

But mostly The Librarian is an internal resource for the USV team.

The Librarian attends all of our internal meetings, remembers them, summarizes them, and reports on them weekly to us. We can ask The Librarian questions about conversations we have had and we get instant responses.

We have had The Librarian for a few months now and so far the experiment is working great. And we are exploring what more is possible with our new team member.

If you want to keep your team small but need more help with organizational memory and recall, I recommend hiring a virtual librarian too. You will need someone to help manage it.

Apple Poised to Get OpenAI Board Observer Role as Part of AI Pact

Apple’s observer position would match that of Microsoft

Phil Schiller, Apple’s former marketing chief, chosen for role

Apple Set to Get OpenAI Board Observer Role

By Mark Gurman

July 2, 2024 at 1:43 PM PDT

Apple Inc. will get an observer role on OpenAI’s board as part of a landmark agreement announced last month, further tightening ties between the once-unlikely partners.

Phil Schiller, the head of Apple’s App Store and its former marketing chief, was chosen for the position, according to people familiar with the situation. As a board observer, he won’t be serving as a full-fledged director, said the people, who asked not to be identified because the matter isn’t public.

The move follows Apple’s announcement in June that it would offer ChatGPT in the iPhone, iPad and Mac as part of a suite of artificial intelligence features. The board arrangement will take effect later this year, and Schiller hasn’t yet attended any meetings, according to the people. Details of the situation could still change.

The board observer role will put Apple on par with Microsoft Corp., OpenAI’s biggest backer and its main AI technology provider. The job allows someone to attend board meetings without being able to vote or exercise other director powers. Observers, however, do gain insights into how decisions are made at the company.

Representatives for Apple and OpenAI declined to comment.

Having Microsoft and Apple sit in on board meetings could create complications for the tech giants, which have been rivals and partners over the decades. Some OpenAI board meetings will likely discuss future AI initiatives between OpenAI and Microsoft — deliberations that the latter company may want Schiller excluded from. Board observers often do oblige and exit meetings during discussions that are seen as sensitive.

..More

OpenAI CTO Admits Creative Jobs Can Be Harmed By AI

AI AND DATA SCIENCE NEWSposted by ODSC Team June 25, 2024

When ChatGPT went live, a wave of worry hit the creative community as many saw the advent of AI bringing risk to their careers. Now in a new interview, the chief technology officer of OpenAI, Mira Murati, recently voiced concerns that AI could indeed cause job displacement in the creative industry.

But, and this “but” may upset some, she questions whether those jobs were truly necessary in the first place. “Some creative jobs maybe will go away,” Mira Murati told the Thayer School of Engineering at Dartmouth University in an interview. “But maybe they shouldn’t have been there in the first place.”

While Murati did not specify which creative jobs might be at risk, her comments came amid ongoing discussions about the entertainment industry and how AI will change it. Currently, the sector has faced significant backlash, with screenwriters and actors striking in 2023, in part, over the use of AI in Hollywood.

Freelancers have also felt the impact of AI encroaching on their work. According to a Wall Street Journal report, the number of freelance jobs posted on platforms like Upwork and Fiverr has dropped by as much as 21% since the introduction of ChatGPT and similar technologies.

Despite these concerns, Murati sees AI tools as a means to enhance creativity. “I really believe that using it as a tool for education, creativity, will expand our intelligence and creativity and imagination,” she says. “The first step is to actually help people understand what these systems are capable of, what they can do, integrate them into their workflows, and then start predicting and forecasting the impact.”

While Mira Murati acknowledges that AI is likely to lead to job displacement, she is uncertain about the extent of its impact. She believes AI will also create new opportunities. “I’m not an economist, but I certainly anticipate that a lot of jobs will change. Some jobs will be lost, some jobs will be gained,” she notes.

Jobs most at risk are those that are “strictly repetitive,” and not advancing creativity or problem-solving. This is a similar view taken by a recent IMF report on labor and jobs, and the effect of AI in the future, which raised some alarms of the negative impact of the technology.

..More

News Of the Week

Circle Becomes First to Receive License in the EU to Issue Stablecoins Under MiCA

By Suraj Manohar -July 3, 2024

Stablecoin issuers were hit with an injunction last week by European regulators, as the Markets in Crypto Assets (MiCA) took effect partially on June 1. In line with that ask to register in any nation in the bloc to continue issuing stablecoins in the EU, Circle has secured an Electronic Money Institution (EMI) in France. This will allow it to issue USDC and its new Europe-centred stablecoin EURC.

Circle co-founder and CEO Jeremy Allaire posted on X about this development, “@Circle announces that USDC and EURC are now available under new EU stablecoin laws; Circle is the first global stablecoin issuer to comply with MiCA. Circle is now natively issuing both USDC and EURC to European customers effective July 1st.”

This move puts Circle ahead of the largest stablecoin issuer, Tether. Its stablecoin, USDT, is the most widely used and issued and is the clear leader by those metrics. Now, Circle can disrupt the stablecoin sector by gaining the first-comers advantage, pushing its EURC token to users from 21 nations in the bloc.

Circle’s decision to make France its operational base comes from the country driving the implementation of crypto regulations in the EU and thus pushing the sector’s development.

Allaire spoke about Circle’s choice to register in France, “As many people know, France was – and continues to be – at the forefront of establishing clear regulations around crypto and digital assets, with early French laws regulating crypto trading firms, crypto custody and rules for issuing and selling digital tokens.”

..More

Britain's Revolut surges to record profit as it seeks $40 bln valuation

By Elizabeth Howcroft and Utkarsh Shetti

July 2, 20243:53 AM PDTUpdated 4 days ago

LONDON, July 2 (Reuters) - British fintech company Revolut made a record pretax profit of 438 million pounds ($553.81 million) in 2023 on strong user growth and soaring interest-related income, it said on Tuesday, as it looks to cement its place as Europe's most valuable startup.

The results, filed ahead of a September deadline, were the first to be published on time in three years, after Revolut had delayed publication of both its 2021 and 2022 accounts.

The company has faced problems with its financial reporting previously, drawing scrutiny from regulators, but is hoping Tuesday's numbers are a step forward.

Revolut has signalled its aim to list publicly but the company's interim chief financial officer Victor Stinga declined to comment on any timeline for an IPO.

"Improving financial controls and making sure we bolster our team, being able to release these results within six months, is part of that journey. So we are taking steps in making sure that our control environment trends towards the level you require as a public company," Stinga told Reuters.

The company's revenue almost doubled to a forecast-beating 1.8 billion pounds in 2023, helped by interest income that soared to 500 million pounds from 83 million pounds in 2022, according to its annual report. Revolut made a pretax loss of 25.4 million pounds in 2022 after a pretax profit of 40 million pounds in 2021.

The growth comes at an opportune time, with the company seeking a more than $40 billion valuation in a $500 million share sale, up from the $33 billion valuation hit in a 2021 fund raise.

..More

Kuo: New AirPods to Feature Cameras for Enhanced Spatial Experiences

Sunday June 30, 2024 9:08 am PDT by Hartley Charlton

Apple will launch new AirPods featuring infrared cameras to improve spatial experiences with the Vision Pro headset, according to Apple analyst Ming-Chi Kuo.

In a post on Medium, Kuo explained that Apple plans to mass-produce new AirPods with integrated IR camera modules by 2026. These IR cameras will apparently be similar to the iPhone's Face ID receiver.

The purpose of IR cameras on AirPods is related to Apple Vision Pro and future headsets from the company, enhancing the spatial computing and audio experience. The IR cameras can detect environmental image changes, facilitating a broader range of gestures to improve user interaction. For example, if a user watches a video using Apple Vision Pro and the new AirPods, and turns their head to look in a specific direction, the sound source in that direction can be "emphasized to enhance the spatial audio/computing experience."

Foxconn is said to be the supplier of the new IR component, with the Taiwanese electronics manufacturer preparing to provide enough parts for about 10 million AirPods initially. It is not clear which AirPods model is likely to get the feature first, but the AirPods Pro may be most likely since they already offer lossless audio exclusively with the Vision Pro.

Startup of the Week

Runway, an AI Video Startup, in Talks With General Atlantic for $4 Billion–Valuation Fundraise

Jul 2, 2024, 11:48am PDT

Runway, already the best funded among a cluster of startups developing artificial intelligence software to generate videos for Hollywood and more amateur filmmakers, is trying to strengthen that lead with a new round of financing.

The firm is in talks with investors to raise $450 million at about a $4 billion valuation, according to a person involved in the deal and a person who spoke with Runway executives. General Atlantic, a New York private equity and growth-stage investor, is in talks to lead the round, said the person involved in the deal.

The Takeaway

• Runway in talks to raise $450 million

• Investment would deepen funding lead on other AI video startups

• New York startup faces heightened rivalry with OpenAI, Google’s Veo

Runway has previously raised more than $230 million and was most recently valued at $1.5 billion in June 2023. It wasn’t clear if the new $4 billion valuation that Runway is targeting includes the new capital. Spokespeople for the company and General Atlantic declined to comment.

The potential fundraise, which would nearly triple the amount of capital Runway has raised, reflects growing investor excitement about AI’s potential to revolutionize the entertainment industry.

Runway sells subscriptions that grant a specified number of credits per month to users of its software, which produces images and movies from text prompts. It was generating around $25 million in annual recurring revenue at the end of last year, said the person involved in the deal. That’s up from the several million dollars a year it was making six months prior, The Information previously reported. It’s still a far cry from the billions in revenue older AI firms like OpenAI are generating, though.

Runway’s revenue rate also makes the deal relatively expensive, even among typically high-priced AI deals. The $4 billion valuation implies that investors value the startup at about 160 times its end-of-2023 ARR, or the subscription revenue it expected to make over the next 12 months.

Such a multiple is significantly higher than those of other in-demand AI startups, which have been raising at 50 to 100 times their forward revenue in recent months. (Usually investors price startup investments based on future revenue, a figure that couldn’t be learned for Runway.)

The New York–based startup, founded in 2018 by three New York University graduates, is facing increasing competition from venture capital–backed upstarts like Pika, Genmo and Luma AI, as well as from OpenAI itself. Earlier this year, the ChatGPT maker announced its video-generation model Sora to much fanfare, and it has reportedly been in talks with Hollywood studios, though it has yet to make the software publicly available. Google also offers a video-generation model called Veo.

The 86-person Runway has tried to stand out by positioning itself mainly as a tool for businesses and professionals rather than as a consumer app.

..More

Forget Sora, Runway is the AI video maker coming to blow your mind

published July 2, 2024

AI video generator Runway's new model has to be seen to be believed

(Image credit: RunwayML)

Artificial intelligence-powered video maker Runway has officially launched its new Gen-3 Alpha model after teasing its debut a few weeks ago. The Gen-3 Alpha video creator offers major upgrades in creating hyper-realistic videos from user prompts. It's a significant advancement over the Gen-2 model released early last year.

Runway's Gen-3 Alpha is aimed at a range of content creators, including marketing and advertising groups. The startup claims to outdo any competition when it comes to handling complex transitions, as well as key-framing and human characters with expressive faces. The model was trained on a large video and image dataset annotated with descriptive captions, enabling it to generate highly realistic video clips. As of this writing, the company is not revealing the sources of its video and image datasets.

The new model is accessible to all users signed up on the RunwayML platform, but unlike Gen-1 and Gen-2, Gen-3 Alpha is not free. Users must upgrade to a paid plan, with prices starting at $12 per month per editor. This move suggests Runway is ready to professionalize its products after having the chance to refine them, thanks to all of the people playing with the free models.

Initially, Gen-3 Alpha will power Runway's text-to-video mode, allowing users to create videos using natural language prompts. In the coming days, the model's capabilities will expand to include image-to-video and video-to-video modes. Additionally, Gen-3 Alpha will integrate with Runway's control features, such as Motion Brush, Advanced Camera Controls, and Director Mode.

Runway stated that Gen-3 Alpha is only the first in a new line of models built for large-scale multimodal training. The end goal is what the company calls "General World Models," which will be capable of representing and simulating a wide range of real-world situations and interactions.

Gen-3 Alpha: Available Now | Runway - YouTube

..More