Contents

Essays

I’m a recent Stem grad. Here’s why the right is winning us over

Meet Steve Davis, Elon Musk’s Top Lieutenant Who Oversees DOGE

Apple’s TV+ Losing $1 Billion Annually as Apple Services Falter

An Interview with OpenAI CEO Sam Altman About Building a Consumer Tech Company

Intel’s New CEO, Reevaluating Gelsinger, Lip-Bu Tan and Cadence

Regulation in Europe

EU Adopts New ‘Interoperability’ Requirements for Apple Under DMA

iOS 19 and iOS 20 Must Include a Long List of Major Changes, EU Says

IPOs

Startups

On the beach after the gold rush (reminiscing the first Internet)

AI

Nvidia to spend hundreds of billions on US supply chain, says chief

Elon Musk’s xAI and Nvidia join BlackRock and Microsoft’s $30bn AI fund

Venture Capital

How a $6M bet on Wiz turned into a massive 200x return for one early backer

Pennsylvania employees pension reins in private equity commitment plans

Telegram-focused TON Foundation says VCs buy over $400 million of Toncoin

Sequoia shutters Washington, D.C., office, lets go of policy team

Interview of the Week

Andrew Keen and Andrew Checcia - The State of American Journalism

Startup of the Week

Mercor ($1m to $100m in 11 Months)

Post of the Week

SkyReels by El.Cine

Editorial: Reflect.

Europe Goes Mad and AI Marches On

The audacity of the European Commission is staggering in its use of power, and also in the short sightedness of its decisions. This week we are witness to the Commission telling Apple what to prioritize in its product development. interoperability apparently. And also depicting Apple as a gatekeeper due to the success of the iPhone.

If there was ever an example of why removing Government from economic and business decisions this is it.

I say this not because I support Apples detailed decisions about its products, although I mostly am OK with them, but because if Apple makes mistakes users will abandon it. There is no need for Governments to get involved. The market is a harsh judge already.

Here was part of the EU pronouncement:

Interoperability enables a deeper and more seamless integration of third-party products with Apple's ecosystem. Interoperability is therefore key to opening up new possibilities for third parties to develop innovative products and services on Apple's gatekeeper platforms. As a result, a wider choice of products will be available to consumers in Europe which are compatible with their Apple devices.

https://ec.europa.eu/commission/presscorner/detail/en/ip_25_816

What a contrast to Sam Altman’s thinking in his interview with Ben Thompson’s Stratechery. Asked to explain AGI he uses the historical analogy of the transistor. I have used the analogy of water in the past (it seeps everywhere) Altman sees AI “diffusing into everything.”

My favorite historical analog is the transistor for what AGI is going to be like. There’s going to be a lot of it, it’s going to diffuse into everything, it’s going to be cheap, it’s an emerging property of physics and it on its own will not be a differentiator.

The EU wants to micro-manage and control but AI wants to seep or diffuse. It’s hard not to want the latter.

Jaye Chen writes in the Guardian about why STEM graduates are being won over by the “right wing”.

Today’s progressives not only do not understand technology; worse, we have completely ceded technological power to the right.

The idea that tech is bad and needs controlling lives on the “left”. The idea that tech is good and needs to be accelerated lives on the “right”.

This is a pretty good example of why the labels of left and right are poor identifiers in 2025. Innovation and progress are intertwined with free speech. These are progressive ideas learned from the enlightenment. That the “left” rejects them says more about their ideology than it does about the merits of the ideas. The “left” is no longer progressive and needs to find its way back there.

Talking of which, tech achievements are everywhere this week. A new OpenAI O1-Pro model, Skyreels, another text to video breakthrough, a Chinese EV that charges in 5 minutes and Nvidia announcing next years products are 100x faster than this years.

Oh and one last thing. My app ‘Reflect’ for Teens needing Help is now in beta. If you have a teen who needs to talk privately about feelings and life challenges have them click this link on their iPhone.

It give access to OpenAI, Perplexity, Anthropics Claude and DeepSeek as chat buddies.

Essays of the Week

I’m a recent Stem grad. Here’s why the right is winning us over

Author:Jaye Chen Source: The Guardian Published: March 18, 2025

Classification: Essays Subcategory: Political Commentary

When my friends and I graduated with our math degrees this past May, we felt like we could do anything. After long nights spent wrestling with problem sets, some of us chose to bypass grad school and dive straight into internships and jobs at major corporations—big banks, the military industrial complex, big tech, and big pharma—where we tackled challenging problems on cushy salaries.

Working at the “department of government efficiency” (Doge) requires a similar skillset. Fueled by unbridled techno‐optimism and edgy cultural capital, Doge comes across less like a government agency and more like one of Elon Musk’s shaky startups. As pundits such as Fareed Zakaria struggle to understand the emerging technocracy in Washington, our new Doge overlords seem to be familiar faces from our own school days.

This is the new generation of young technocrats: the crypto-obsessed offspring of Musk and Donald Trump, blending Silicon Valley’s innovation with the ideological heft of conservative think tanks. Meanwhile, graduates who lean left find themselves with far fewer progressive opportunities. With progressive job hubs listing only a modest number of open positions compared to the aggressive recruitment in the financial and tech sectors, the choice seems stark.

For decades, the progressive movement has failed to marshal technical talent for its own causes. On graduation, the binary choice for STEM students appears to be between pursuing a career in industry—such as at BlackRock—or remaining in academia. Even organizations with a progressive bent, like OpenSecrets or Split Ticket, focus more on advocacy than building sustainable governance models.

Throughout our education, we were trained to value technical prowess above all else. In college, problem-solving was taught through the lenses of programming and economic theories—think game theory, homo economicus, and Pareto efficiency. These simplified frameworks have paved the way for neoliberal movements such as effective altruism, which often fail to grapple with society’s complex challenges.

Empowered by figures like Trump and Musk, rightist technocrats are now poised to change the world by applying the same principles they learned in their technical training. With flashy tech stacks and a blind confidence that any problem can be solved with code, they set out to reform government as if it were a mere optimization problem. Yet, by trying to solve societal issues without grappling with their nuances, they risk oversimplifying challenges that require deeper understanding.

To counter this trend, American progressives must rekindle the imagination of engineers. By rethinking how technical skills can challenge existing power structures—and by recruiting and organizing technical talent on a large scale—there remains hope to eventually turn the master’s tools against him.

Meet Steve Davis, Elon Musk’s Top Lieutenant Who Oversees DOGE

Author: Ryan Mac, Kate Conger and Theodore Schleifer Source: NYT > Most Popular

Published: March 20, 2025 Classification: Tech News Subcategory: Cryptocurrency

Elon Musk declared last month that the federal government was engaged in “utterly insane” activity, claiming without evidence that it had distributed $100 billion to people without Social Security numbers.

Two days after Mr. Musk’s comments, one of his key lieutenants, Steve Davis, began pressing the Social Security Administration for information. Mr. Davis called the agency’s leaders to insist they give a young engineer from Mr. Musk’s so-called Department of Government Efficiency access to databases that contained sensitive information about Americans.

Mr. Davis’s demand was “unprecedented,” Tiffany Flick, a former Social Security official, said in a sworn statement this month for a lawsuit filed by federal employees trying to block access to the data. She added that she could feel Mr. Davis grow impatient in the hours before the DOGE engineer was eventually permitted to investigate “the general myth of supposed widespread Social Security fraud.”

Deploying staff into federal agencies is just one task that Mr. Davis has carried out recently for Mr. Musk, as the world’s richest man continues an all-out effort to reshape the U.S. government. At every turn, Mr. Davis has backed his boss, laying the groundwork for cost cutting during the presidential transition, slashing diversity initiatives, meeting lawmakers and helping to send a governmentwide “Fork in the Road” email that urged workers to resign.

Those actions demonstrate how Mr. Davis, 45, has effectively become the day-to-day leader of DOGE. He has more power than Amy Gleason, the Trump administration’s acting DOGE administrator, two people close to the effort said, adding that Ms. Gleason has sometimes been in the dark about Mr. Davis’s decisions.

How Mr. Davis got to this position is hardly a secret. For more than 20 years, the engineer has devoted himself to fulfilling Mr. Musk’s desires, following the billionaire to his various companies, including the rocket maker SpaceX and the social media platform X. Mr. Davis wholeheartedly believes Mr. Musk will bring about humanity’s progress, according to interviews with 22 friends, former colleagues and government officials.

For Mr. Musk, Mr. Davis represents the ideal employee — an engineer who will throw himself at any task, even if he has no expertise in the area, two former colleagues said. Mr. Musk has especially praised Mr. Davis’s ability to excise waste, once likening his lieutenant to a cancer-killing treatment.

“Steve is like chemo,” Mr. Musk said at a transition meeting before President Trump took office. “A little chemo can save your life; a lot of chemo could kill you.”

Report: TV+ Losing $1 Billion Annually as Apple Services Falter

Author: Hartley Charlton Source: MacRumors Published: March 20, 2025

Classification: Tech News Subcategory: Streaming Services

Apple TV+ is hemorrhaging money amid a broader stall in Apple's services, according to a new report from The Information's Wayne Ma.

The paywalled report reveals that Apple TV+ is the only Apple subscription service that is not profitable. While its subscriptions grew to around 45 million last year, it is still losing more than $1 billion annually. The company spent over $5 billion a year on content since the service launched in 2019, though this was reduced by $500 million in 2024 following pressure from Apple CEO Tim Cook and other executives.

Cook raised questions last year about several movie deals with Apple TV+ executives, including the spy action-comedy film "Argylle." The movie, starring Henry Cavill and Dua Lipa, cost $200 million to produce, yet it failed to generate the expected audience or boost subscriptions.

The report explains that "the audience for Apple TV+ remains relatively small," constituting less than 1% of total U.S. streaming service viewing, while Netflix and Amazon held 8.2% and 3.5% of total viewing respectively in February.

Apple's initial business plan for Apple TV+ predicted losses between $15 billion and $20 billion over its first decade. Although heavy losses are common in the streaming industry, this represents a significant departure for a company known for its fiscal discipline.

Executives such as Eddy Cue initially shielded Apple TV+ from strict budget scrutiny and even rejected proposals to increase oversight of programming costs. Notably, Apple lacked internal data to confirm whether Apple TV+ would drive customers to purchase its devices.

Despite successes like "CODA" winning an Oscar for Best Picture, Cook began scrutinizing Apple TV+'s financial performance from 2022, demanding more oversight. Lavish spending, including the use of private jet travel for stars at substantial cost, came under fire, prompting Apple to negotiate better deals with flight-chartering companies.

While Apple's overall corporate profits can easily absorb these losses, the continued struggles of Apple TV+ highlight a broader issue within its services division. Other services such as Apple Music, Apple News+, Fitness+, and Apple Arcade are also facing challenges in gaining widespread appeal and profitability. Many users now subscribe via the Apple One bundle, which inflates the perceived interest in individual services.

OpenAI Debuts O1-Pro, Its Priciest AI Model So Far

Author: Huma Ishfaq Source: TechJuice Published: March 20, 2025

Classification: Tech News Subcategory: Artificial Intelligence

OpenAI has introduced an enhanced version of its o1 “reasoning” AI model, named o1-pro, in its developer API. According to OpenAI, o1-pro leverages more computing power than its predecessor to deliver consistently better responses.

At present, access is limited to select developers—specifically, those who have already spent at least $5 on OpenAI API services. However, the pricing is steep. The company is charging $150 per million tokens (~750,000 words) for input and $600 per million tokens for output. This represents double the cost of OpenAI’s GPT-4.5 for input and ten times the price of the standard o1 model.

OpenAI is banking on o1-pro’s superior performance to justify its high cost. "O1-pro in the API is a version of o1 that uses more computing to think harder and provide even better answers to the hardest problems," said an OpenAI spokesperson. "After getting many requests from our developer community, we’re excited to bring it to the API to offer even more reliable responses."

Early reactions to o1-pro have been mixed. Although it has been available to ChatGPT Pro subscribers on OpenAI’s ChatGPT platform since December, some users have noted that the model struggled with tasks like solving Sudoku puzzles and understanding simple optical illusion jokes. Additionally, internal benchmarks from late last year revealed that while o1-pro performed slightly better than the standard o1 in coding and math tasks, its primary advantage lies in generating more consistent answers.

An Interview with OpenAI CEO Sam Altman About Building a Consumer Tech Company

Author: Ben Thompson Source: Stratechery by Ben Thompson Published: March 20, 2025 Classification: Tech News Subcategory: Consumer Tech

In this extensive interview, Ben Thompson sits down with Sam Altman, the OpenAI CEO, to discuss OpenAI’s evolution from its early days as a nonprofit research lab to becoming one of the most influential consumer tech companies today. Altman explains how his own background—from growing up a computer nerd in St. Louis, to launching Loopt and later joining Y Combinator—helped him prepare for the immense challenges of leading OpenAI. He reflects on the gradual shift from academic research to transforming OpenAI into a company that now commands a massive consumer presence.

Key discussion points include:

The Early Years & YC: Altman recounts his early involvement with technology, his formative years at Y Combinator, and how spending time among brilliant founders and investors shaped his mindset. The serendipitous dinner with Elon Musk signaled AI as not just a side project but a powerful frontier technology that would transform industries.

The OpenAI Transition: Initially envisioned as a research lab dedicated to disseminating scientific breakthroughs, OpenAI evolved as the team grappled with business models. Altman details the challenges of figuring out pricing, scaling compute resources, and the eventual monetization through API offerings and subscription models.

ChatGPT's Unlikely Journey: The conversation highlights the inception of ChatGPT—from early experiments with GPT-3 and the subsequent development of GPT-3.5 and GPT-4. Altman discusses how a snap decision to launch a chatbot, even with a model that was not yet perfect, led to unforeseen viral success that forced rapid scaling and a major pivot towards consumer tech.

Business Strategy & Product Suite: While OpenAI did not set out to become a consumer company, the explosive uptake of its products pressed them into that role. Altman explains that along with a robust API, the company is building a suite of products designed to integrate AI deeply into everyday life, including a bundled subscription service that leverages a user’s personalized OpenAI identity.

Revenue Models and Advertising: When asked about advertising, Altman prefers a model based on high-value transactions—using affiliate-style fees or alternative monetization schemes—instead of traditional ads. He emphasizes that the value lies in tools that make users markedly more productive.

Future Outlook & AGI: Toward the end, the discussion shifts to the future of AI, with Altman offering his perspective on AGI (and its evolving counterpart, ASI). While acknowledging ongoing challenges like model hallucinations and regulatory pressures, he remains optimistic that continued innovation and adaptation will drive the next phase of technological breakthroughs.

Altman closes with personal advice for graduating seniors: master AI tools, cultivate adaptable skills, and learn how to deliver value to others. His insights serve as both a roadmap for OpenAI’s future and a broader reflection on the rapidly changing tech landscape.

Charge in a Flash: BYD’s EVs Now Recharge in Just 5 Minutes

Author: Huma Ishfaq Source: TechJuice Published: March 19, 2025

Classification: Tech News Subcategory: Electric Vehicles

Chinese automaker BYD continues to outpace Tesla, making significant strides in the electric vehicle market. On Monday, the company unveiled a groundbreaking battery system that it asserts can charge an electric vehicle in just five minutes – comparable to the time it takes to refuel a conventional gasoline-powered car.

Achieving such rapid charging has long been an ambition within the industry, which has struggled with charging limitations that have deterred potential EV buyers.

According to the company, this innovation can deliver 249 miles of range in just five minutes in its new Han L sedan. In comparison, Tesla’s fastest charging capability provides a range of 170 miles in 15 minutes using its high-voltage superchargers.

Years ago, Elon Musk placed a major bet on Tesla’s in-house battery production to extend vehicle range and enhance efficiency. However, battery development has proven more complex than anticipated, and the company’s 4860 battery has yet to meet expectations.

Following this announcement, BYD’s stock surged, bringing its market value to approximately $158 billion. The company’s shares have risen about 58% so far this year, reflecting investor confidence in its rapid advancements.

Concerns Over Fast Charging Technology

Some industry analysts have voiced concerns that ultra-fast charging, like BYD’s, could potentially reduce the lifespan of EV batteries. However, current evidence does not strongly support this notion. In a past interview with Reuters, the CEO of leading Chinese battery manufacturer CATL took a jab at Musk, claiming that he “doesn’t know how to make a battery.”

BYD, now China’s top EV manufacturer, initially started as a battery production company in 1995 before pivoting to the automotive sector. The company foresaw a future where cars would function as computers on wheels. In addition to EV production, BYD assembles iPads for Apple. Its vehicle lineup spans a wide range of price points, with its most affordable model, the Seagull, starting at just $9,700.

The company has been aggressively expanding into international markets, including Europe and South America, bolstering China’s global influence by creating jobs abroad and demonstrating success beyond its domestic market.

The U.S. EV Market Faces Challenges

This progress comes at a time when Musk is pushing for the removal of U.S. government subsidies that have supported the transition to EVs. Critics argue that China’s subsidies give its automakers an unfair advantage in global markets by enabling them to offer lower-priced products. However, BYD has reached profitability in its EV segment, and American automakers could potentially achieve the same if given more time to scale production…

Intel’s New CEO, Reevaluating Gelsinger, Lip-Bu Tan and Cadence

Author: Ben Thompson Source: Stratechery by Ben Thompson Published: March 18, 2025 Classification: Industry Analysis Subcategory: Corporate Strategy

Intel's new CEO casts Pat Gelsinger's tenure and firing in a new light: was Intel's problem simply bad execution?

I have to admit that, while Tan was rumored to be a candidate, I was pretty surprised by this appointment, and need to change a few of my assumptions about what has happened at Intel over the last few months and, frankly, the entire Gelsinger tenure.

Reevaluating Gelsinger

Gelsinger was named Intel CEO in January 2021 and announced his IDM 2.0 strategy in March 2021; Tan joined the board in September 2022, i.e. well after the strategy — that Gelsinger put forward to the board before he was even hired — was underway, and had his role expanded to oversee Intel’s foundry operations in 2023. Then, last August, he resigned; from Reuters at the time:

Rippling Sues Deel Over ‘Spy’ Scheme

Author: Cory Weinberg Source: The Information Published: March 17, 2025

Classification: Startups Subcategory: Corporate Espionage

Software startup Rippling escalated its bitter rivalry with Deel dramatically on Monday with a lawsuit accusing the startup of corporate espionage.

Represented by celebrity attorney Alex Spiro, Rippling claims that it uncovered evidence indicating that Deel’s executives had deployed a "spy" to leak critical information to them. The lawsuit details how these actions, if proven, could amount to serious breaches of trust and legal boundaries in the fiercely competitive tech industry.

The allegations, while not yet proven, have heightened tensions between the two companies, both of which are significant players in the software startup arena. This legal move underscores the growing intensity of internal competition and the desperate measures companies might resort to gain an edge in the market.

As the case unfolds, industry observers are keenly watching not only the specific claims of espionage but also the broader implications for corporate governance and competitive practices among startups. The outcome of this lawsuit could set a precedent for how business rivalries are managed and litigated within the tech industry.

EU Adopts New ‘Interoperability’ Requirements for Apple Under DMA

Author: John Gruber Source: Daring Fireball Published: March 19, 2025

Classification: Tech News Subcategory: Digital Markets Act

The European Commission, today:

Today, the European Commission adopted two decisions under the Digital Markets Act (DMA) specifying the measures that Apple has to take to comply with certain aspects of its interoperability obligation. [...]

The first set of measures concerns nine iOS connectivity features, predominantly used for connected devices such as smartwatches, headphones or TVs. The measures will grant device manufacturers and app developers improved access to iPhone features that interact with such devices (e.g. displaying notifications on smartwatches), faster data transfers (e.g. peer-to-peer Wi‑Fi connections, and near‑field communication) and easier device set‑up (e.g. pairing).

Benjamin Mayo, reporting for 9to5Mac:

In a statement to 9to5Mac, Apple firmly rebuked the EU decision announced today about specific interoperability requirements the company must implement over the coming months.

Apple said “Today’s decisions wrap us in red tape, slowing down Apple’s ability to innovate for users in Europe and forcing us to give away our new features for free to companies who don’t have to play by the same rules. It’s bad for our products and for our European users. We will continue to work with the European Commission to help them understand our concerns on behalf of our users.”

In regards to customer privacy, Apple is especially concerned with the requirements surrounding opening up access to the iOS notification system. The company indicated these measures would allow companies to suck up all user notifications in an unencrypted form to their servers, sidestepping all privacy protections Apple typically enforces.

My interpretation of the adopted decision is that the EU is requiring Apple to treat iOS like a PC operating system—like macOS or Windows—where users can install third‑party software that runs, unfettered, in the background.

Apple’s statement makes clear their staunch opposition to these decisions. But at least at a superficial level, the European Commission’s tenor has changed. The quotes from the Commission executives (Teresa Ribera, who replaced firebrand Margrethe Vestager as competition chief, and Henna Virkkunen) are anodyne. Nothing of the vituperativeness of the quotes from Vestager and Thierry Breton in years past. But the decisions themselves make clear that the EU isn’t backing down from its general position of seeing itself as the rightful decision‑maker for how iOS should function and be engineered, and that Apple’s core competitive asset — making devices that work better together than those from other companies — isn’t legal under the DMA.

iOS 19 and iOS 20 Must Include a Long List of Major Changes, EU Says

Author: Joe Rossignol Source: MacRumors Published: March 19, 2025

Classification: Tech News Subcategory: iOS Updates & EU Regulation

The European Commission today announced a long list of changes that Apple is legally required to implement in future iOS 19 and iOS 20 updates.

The announcement clarifies interoperability requirements that Apple must adhere to in the EU under the Digital Markets Act, which has been fully enforced since March 2024. The changes will further open up the iPhone and its technologies to competing companies and devices, a move that has not sat well with Apple.

Key Highlights:

Third-party smartwatches must be able to display and interact with iOS notifications by the end of 2025, which likely means iOS 19.2 or earlier.

Apple must make its automatic audio switching feature available to third-party headphones by June 1, 2026, likely in iOS 19.4 or earlier. This feature allows most AirPods and select Beats to automatically switch connections between Apple devices such as a Mac and an iPhone.

Changes to iOS are required to allow third parties to offer equivalent AirDrop alternatives by June 1, 2026.

Adaptations to enable third parties to offer equivalent AirPlay alternatives must be completed by iOS 20, or the end of 2026. The general public is expected to see iOS 20 in September 2026.

For the complete list of changes, visit the European Commission's website.

Apple has voiced its discontent, criticizing these requirements as "bad for our products and for our European users." In a statement, Apple said, "Today's decisions wrap us in red tape, slowing down Apple's ability to innovate for users in Europe and forcing us to give away our new features for free to companies who don't have to play by the same rules."

iOS 19 is set to be announced at WWDC 2025 this June, with iOS 20 following a year later.

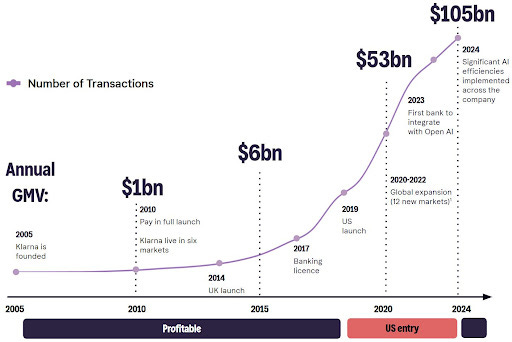

Klarna S-1 Breakdown

Author: Tanay Jaipuria Source: Tanay’s Newsletter Published: March 19, 2025

Classification: Industry Analysis Subcategory: Financial Analysis / Fintech

Hi friends,

Klarna has just filed its F-1 to go public. Widely known for pioneering the "buy now, pay later" (BNPL) market, the company has evolved into a next-generation commerce network connecting over 93 million active consumers and more than 675,000 merchant partners across 26 countries.

I. Overview & Market Context

Founded in Sweden in 2005 with a simple “Pay Later” offering, Klarna’s early BNPL model has transformed as it diversified into financial services. The firm now presents itself as a comprehensive ecosystem that not only facilitates transactions but also works to enhance customer engagement.

II. Product Suite

For Consumers:

Offers flexible payment options including Pay Later, Pay Now, and Fair Financing (with interest charged on longer-term loans).

Its app, which boasts 32 million monthly active users, serves as a hub for product discovery, order tracking, and financial management.

For Merchants:

Provides seamless checkout experiences, targeted incentives, and advertising solutions to capture high-intent customers.

Serves 30-50% of the top 100 merchants in key markets.

III. Business Model & Revenue Breakdown

Klarna earns revenue through several streams:

Merchant Fee Revenue (~57%): Fees collected from merchants each time their payment options are used.

Consumer Fees (~12%): Includes fees such as late payment charges.

Interest Income (~24%): Generated from the Fair Financing product line.

Advertising Revenue (~6%): Monetized via targeted placements on the Klarna app using detailed consumer data.

Approximately two thirds of Klarna’s revenue stems from merchant interactions while the remaining third comes from consumer-related fees.

IV. Financial Performance

Klarna now processes over $100B in GMV and generates $2.8B in revenue. The company has experienced accelerated growth in both GMV (14% in 2024) and revenue (24% growth), alongside an improved net take rate and decreasing operating costs bolstered by their AI initiatives…

CoreWeave Plans Smaller IPO Than Expected

Author: Cory Weinberg Source: The Information Published: March 20, 2025

Classification: Venture Capital Subcategory: IPO

CoreWeave is planning to sell about $2.5 billion of stock in an initial public offering, a significantly smaller deal than previously expected, and launch its investor road show as soon as Thursday, according to a person with direct knowledge of the transaction.

The move marks a change in the company's approach, indicating a more measured entry into the public market. The revised, smaller-scale IPO suggests that the company may be recalibrating its strategy, potentially in response to shifting market conditions or internal strategic adjustments.

Michael Seibel is leaving Y Combinator

Author: Connie Loizos Source: TechCrunch Published: March 20, 2025

Classification: Startups Subcategory: Accelerators

Michael Seibel announced late Wednesday on X that after more than 12 years at the famed accelerator Y Combinator, he is transitioning to a “partner emeritus” role. Y Combinator CEO Garry Tan shared the news separately in a company blog post, highlighting Seibel’s long history with the outfit. Seibel first joined YC as a founder, […]

On the beach after the gold rush

Author: Steve Bowbrick Source: Bowblog – In which I try, after 25 years of blogging, to drop the ironic stance a bit. Published: March 19, 2025 Classification: Startups

Subcategory: Dotcom Era

I wrote this article originally for Mark Ellen at The Word fourteen years ago. It is a memoir of the dotcom boom and its inevitable crash—a firsthand account of both the heady optimism and the eventual collapse of early internet ventures. The narrative takes us back to 1990s London, where companies with youthful ambition secured millions of pounds in investments and where an era of indoor lawns, extravagant parties, and endless PowerPoint presentations reigned. The excitement was palpable; even the idea that HTML had reached a breakthrough by allowing pictures was cause for an exuberant celebration.

The author, who played the role of the salesperson in his startup ventures, recounts his experiences with Webmedia—a company he founded with his friend Ivan Pope, a passionate, energetic, and anarchic creative. They began by publishing a magazine on the World Wide Web and quickly evolved into a web-design business that catered to forward-thinking clients like Time Out magazine and The Body Shop. The office, often located in quirky spaces like a bankrupt wine-tasting school beneath a cybercafe in London’s West End, became a melting pot of bold ideas and frenetic energy.

The article vividly describes the surreal experience of securing investment during the dotcom boom. From pitching ideas to traditional marketing directors to navigating the sophisticated yet bewildering world of investment bankers, the author captures the anxiety and unpredictability of raising money. He recalls absurd moments—such as negotiating a multi-clause offer in a glass-paneled boardroom by the Thames, and experiencing both rapturous celebrations and crushing disappointments when deals fell through.

A particularly memorable segment details the startup’s early US adventure in New York. Staying in the Chelsea Hotel, the author mingled with investment legends at events in the Rainbow Room, experiencing the high life with midtown skyscraper dinners and quirky pitches at celebrity-like breakfast meetings. Despite the glamour and promise of excitement, these episodes ultimately underscore the relentless pressure and volatility of the emerging internet market.

The narrative then shifts to another venture, another.com, an email service born from the same ambition. From the challenges of rebranding and acquiring a coveted domain name (even brokering a deal with an Amazon employee) to the rush of securing private investment on the promise of explosive growth, the story is both humorous and candid. It portrays the dotcom world as a time of extreme highs and painful lows—a period marked by bubble-like exuberance that was as destructive as it was innovative.

In the end, the author reflects on the nature of bubbles. Despite the immense losses and heartbreak when the bubble burst, the period remains a formative chapter in his life. The personal anecdotes and reflective footnotes add a layer of historical context and human irony to the explosive yet transient world of early internet startups.

Nvidia to spend hundreds of billions on US supply chain, says chief

Author: Tim Bradshaw and Michael Acton in San Jose Source: Financial Times

Published: March 20, 2025 Classification: Tech News Subcategory: Semiconductor Supply Chain

Nvidia’s chief executive, Jensen Huang, has announced a bold plan to invest hundreds of billions of dollars over the next four years in chips and other electronics manufactured in the United States. In response to President Trump’s tariff threats and evolving global trade dynamics, Nvidia is rebalancing its supply chain away from Asia—a shift mirrored by other tech giants such as Apple.

Huang revealed that over the coming years the company expects to procure roughly half a trillion dollars’ worth of electronics, with a significant portion manufactured domestically. This strategic maneuver includes leveraging partnerships with major suppliers like Taiwan Semiconductor Manufacturing Company (TSMC) and Foxconn, even as the company faces increasing competitive pressure from Chinese technology leader Huawei.

At Nvidia’s annual developers’ conference, the unveiling of the next-generation AI chip, Vera Rubin, underscored its commitment to innovation. Huang detailed plans to construct clusters comprising millions of interconnected chips designed to power massive data centers that demand vast energy resources. He also noted that the Trump administration’s supportive stance—ensuring that energy supply and industrial policies boost the AI sector—could accelerate the growth of America’s AI industry.

Recent investments further demonstrate this shift. TSMC has announced a $100 billion commitment to new chip manufacturing facilities in Arizona, supplementing a previously agreed $65 billion investment under the Biden administration. Nvidia’s rollout of its new Blackwell systems, now produced in the US, marks a clear step toward enhanced supply chain resilience. This move is critical as reliance on Taiwan’s cutting-edge manufacturing exposes companies to geopolitical risks and natural disasters.

While ongoing US export controls tighten access to Nvidia’s advanced chips used in AI, and with restrictions affecting sales to Chinese firms, Huang remains confident. He emphasized the importance of diversifying the supply chain, noting that even if production in Taiwan were disrupted, a robust domestic network would mitigate the impact. Meanwhile, despite revenue gains from China, Huawei’s growing foothold in AI is drawing close scrutiny.

In parallel, challenges at Intel—America’s other major contender in high-end chip production—are being addressed. Even as Nvidia continues to evaluate Intel’s foundry and packaging capabilities, Huang expressed confidence in Intel’s potential to innovate and compete in the advanced chip market.

A Podcaster Develops AI to Search His Own Episodes

Author: Kaya Yurieff Source: The Information Published: March 19, 2025

Classification: Tech News Subcategory: AI

When I ask creators how they’re using AI, I typically get this response: They’re primarily using ChatGPT or other similar chatbots to talk through ideas or to help them write scripts for brand partnerships or videos.

Chris Williamson, the host of the popular podcast Modern Wisdom, is going deeper. He’s hired a software engineer to develop what’s called a RAG, or retrieval augmented generation, system. This involves gathering data on his YouTube transcripts, blog posts and other content. Then his staff plans to build what’s known as a vector database to store the information for searching. Finally, he’ll give a large language model, such as OpenAI’s GPT-4o, access to the information for answers.

Elon Musk’s xAI and Nvidia join BlackRock and Microsoft’s $30bn AI fund

Author: Chloe Cornish in Dubai and Rafe Uddin in San Francisco

Source: Technology sector Published: March 19, 2025 Classification: Venture Capital Subcategory: Artificial Intelligence

Tech groups and financial institutions join forces in plans to build data centres and energy projects to underpin the AI boom. With major players including Elon Musk’s xAI and Nvidia now aligning with financial giants like BlackRock and Microsoft, the strategy marks a significant step towards securing the infrastructural backbone required to sustain growth in artificial intelligence initiatives.

Valuation Policies Are A Mess

Author: Seth Levine Source: VC Adventure Published: March 19, 2025

Classification: Venture Capital Subcategory: Valuation Methodologies

Every venture firm reports the “value” of each of its underlying investments. Typically, this is updated quarterly and sent to each of the fund’s investors. The idea is that investors will then have a definitive view of the value of the firm’s investments. Simple, right? But what is the “value” of a private company? Turns out the answer to that question is not so easy to determine, and, as a result, valuation reporting in venture is a mess.

Prior to 2007, most firms held company valuations at the price of the most recent round. This was relatively straightforward and generally pretty consistent across funds. The rationale for this approach was that the best indicator of value was the last “market” price someone was willing to pay for the asset (this approach has some limitations, which I describe below). Under this methodology, GPs did have some discretion to write companies up or down—meaning to say that their value was more or less than the last round had indicated—due to performance or changing market conditions, especially if the last round was a while ago and the valuation mark was “stale.” Typically, the threshold to do this was quite high, meaning that something with the business, the market, or the company’s prospects had to have clearly and materially altered to warrant a change in valuation. While definitely not perfect, this methodology made for relatively uniform reporting. It was uncommon for companies held in different portfolios to be reported at different values—this only happened in edge cases with businesses that hadn’t raised in a while, although quite a few funds had policies that held all companies at a maximum of the last round price. There was certainly some incentive for perverse behavior—raising money to establish a new valuation benchmark, or unjustified discretionary mark-ups (say around the time a fund was going out to market with a new fund)—but these were actually relatively uncommon, and most funds only had discretion to write down assets, not write them up.

There was concern, however, that this methodology wasn’t rigorous enough. In the wake of the Enron scandal, where the company manipulated its balance sheet by misrepresenting the underlying asset value of various entities it had interests in (among many other things), there was a desire to ensure that assets of all kinds were valued “accurately.” Some LPs also didn’t like that high-performing companies that didn’t need to raise capital were being “artificially” held at a lower valuation based on their last round price.

Enter FAS 157 (Fair Value Measurements), adopted in the fall of 2006 and enforced for reporting periods after November 15, 2007. GAAP provided varying methodologies for establishing the fair value of assets and investors and regulators wanted greater consistency and transparency. FAS 157 (and its subsequent modifications) established an “exit value” concept for valuations—essentially asking reporting entities and their auditors to determine the price at which an independent third party would purchase an asset. In 2009, FAS 157 was integrated into ASC 820 (Accounting Standards Codification), which classifies assets based on their liquidity. Level 1 assets have publicly quoted market prices; level 2 assets aren’t directly quoted but can be relatively easily valued based on market prices; and level 3 assets rely on internal methodologies because their value cannot be directly compared to market prices…

Turning $5M Into $100M

Author:Matt Kaufman Source: Collab Fund Published: March 20, 2025

Classification: Venture Capital Subcategory: Investment Strategy

In 2015, Collaborative Fund made a bold bet by investing $5M—20% of a $25M fund—into a single startup. Less than five years later, that one investment returned over $100M, quadrupling the overall fund. This post explores whether such a risk was justified and examines the art and science behind venture portfolio construction.

Venture capital returns often follow a power law: a small percentage of investments generate the bulk of returns. The challenge lies in structuring a portfolio that can capture these breakout winners without over-diluting returns. Many funds use mathematical models to get a rough idea of how many bets to place and how much to allocate per investment.

Several popular models are discussed:

Kelly Criterion: Originally developed for gamblers, this method calculates the optimal bet size to maximize long-term returns. However, it assumes precise probabilities and the ability to reinvest winnings—conditions that rarely hold true in venture capital.

Back of the Envelope Power Law Math: This approach assumes, for example, a 5% chance that a startup will deliver a 20x+ return and calculates the diminishing odds of missing a breakout winner as more investments are made. Although useful, it oversimplifies startup outcomes into binary results, ignoring the variety of return profiles seen in practice.

Monte Carlo Simulations: By running thousands of randomized scenarios based on assumed success rates and exit outcomes, this method can help test different allocation strategies. Its effectiveness, however, is highly dependent on the accuracy of its input data and assumptions. Even small changes—like including major breakout investments—can significantly shift the projected returns.

The article further discusses trade-offs between diversifying broadly and concentrating capital. On one hand, a diversified portfolio might better ensure that at least one investment delivers a power-law outcome, thereby safeguarding the fund’s overall performance. On the other hand, a concentrated bet allows for deeper involvement and potentially larger returns if a high-conviction opportunity pays off.

In the case of Collaborative Fund, the unusually large $5M bet was made out of conviction rather than strict adherence to numerical models. While most models would have warned against such concentration, the decision proved prescient. This experience serves as a reminder that while quantitative models can provide guidance, the final decision often hinges on qualitative factors and strategic judgment.

How a $6M bet on Wiz turned into a massive 200x return for one early backer

Author: Marina Temkin Source: TechCrunch Published: March 20, 2025

Classification: Venture Capital Subcategory: Startup Investments

Wiz’s $32 billion all-cash acquisition by Google parent Alphabet promises a colossal payday for the cybersecurity startup’s early-stage investors. The deal is a big win for Sequoia, one of the best-known VC firms, which stands to make $3 billion—about 25x the money it invested in the company, according to Bloomberg. Despite substantial returns for Sequoia’s backing, the story underscores the risks and rewards encountered by early backers in disruptive technology startups. Investment in a nascent company like Wiz, especially at a $6M valuation, can lead to incredible returns when market conditions align and when strategic moves, such as a major acquisition, pivot the landscape. This acquisition not only signals confidence in Wiz’s innovative cybersecurity solutions but also sets a precedent in how early investments in tech firms can yield exponential profits, reshaping venture capital strategies across the board.

Telegram-focused TON Foundation says VCs buy over $400 million of Toncoin

Author: RT Watson Source: The Block Published: March 20, 2025

Classification: Venture Capital Subcategory: Cryptocurrency Investment

The Open Network Foundation, or TON Foundation, said on Thursday that a group of venture capital firms—including Sequoia Capital, Ribbit, Benchmark, and Kingsway—invested over $400 million buying the Toncoin cryptocurrency. TON powers the growing number of mini apps within Telegram’s messaging app ecosystem.

"These venture capital firms have invested over $400 million in Toncoin, which is the native cryptocurrency of the TON blockchain," a TON Foundation spokesperson explained, noting that the funding was provided in the form of Toncoin rather than traditional equity or cash.

During the past year, the TON blockchain’s active user numbers have surpassed 40 million, and there are 121 million unique holders of Toncoin. "The TON team is the best in the world at the intersection of consumer product thinking and crypto infrastructure. When you combine this with the global distribution of Telegram, we’re very excited to see where they go," said Shaun Maguire, a partner at Sequoia Capital.

Other investors—including Vy Capital, Draper Associates, and Libertus Capital—have joined key backers such as CoinFund, Hypersphere, SkyBridge, and Karatage. These venture capital firms are betting on the future success and utility of the TON blockchain, its growing ecosystem, and its potential to provide real-world utility for crypto holdings, especially within Telegram.

The promising trajectory of TON has attracted significant VC interest due to its strong connection to Telegram, which now boasts 1 billion users. Last year, Pantera Capital made two separate investments in Toncoin tokens. Animoca Brands co-founder and executive chairman Yat Siu remarked that his company first started buying TON tokens when they were trading below $1. Although Toncoin has retreated from a high of over $8.00 reached in mid-2024, it currently trades around $3.75 and remains a top 20 cryptocurrency with a market cap exceeding $9 billion.

Interest in the TON blockchain and Telegram mini apps soared last year after clicker games like "Notcoin" and "Hamster Kombat" spurred rapid growth in engagement with the crypto ecosystem.

Sequoia shutters Washington, D.C., office, lets go of policy team

Author: Dominic-Madori Davis Source: TechCrunch Published: March 19, 2025

Classification: Venture Capital Subcategory: Office Operations

Sequoia will shutter its Washington, D.C., office and part ways with the policy team there at the end of March, TechCrunch has confirmed. The decision comes amid a contrasting trend where other prominent VC firms in Silicon Valley appear to be strengthening their strategic ties with Capitol Hill and the current administration. This move by Sequoia highlights a distinct shift in how the firm approaches its operational structure and policy engagement.

The report marks a significant moment for the firm, as reducing its presence in the nation’s capital could signal broader changes ahead for venture capital firms concerning their political and regulatory strategies. As other firms leverage closer relations with government policy makers, Sequoia’s decision raises questions about what priorities will drive the future direction of the key players in the industry.

Sequoia Capital to cut policy team and shutter Washington, D.C. office just as the tech industry increases its visibility under Trump

Author: Jessica Mathews Source: Fortune Published: March 18, 2025

Classification: Venture Capital Subcategory: Policy and Regulation

Sequoia Capital, one of Silicon Valley’s most prominent venture capital firms, is laying off its Washington, D.C.-based policy team and shuttering its office there. This move comes at a time when other tech-related companies are boosting their presence in the U.S. capital following President Trump’s re-election.

The changes will take effect at the end of March and affect three full-time employees as well as policy fellows who have worked with the firm. Sequoia confirmed the layoff while sources familiar with the matter noted that the firm would also close its Washington office. The firm had initially set up its small policy team five years ago, during the first Trump Administration, to advise its investment team and portfolio companies on regulatory issues. This strategy was aimed at deepening their understanding of the policy landscape and enhancing connections with global policymakers, experts, and think tanks.

Don Vieira, who previously held senior national security roles at the Department of Justice and the House Permanent Select Committee on Intelligence, was responsible for opening the office. However, as part of the recent changes, Vieira will be leaving Sequoia. Although he did not respond to requests for comment, Sequoia's spokesperson acknowledged the policy group’s strategic guidance and noted that the relationships built are expected to be carried forward in both the U.S. and Europe.

While Sequoia Capital is retreating from its dedicated policy function, many tech companies are intensifying their efforts in Washington, D.C. to influence policy. For instance, Meta recently hired Joel Kaplan to lead its global policy team, and CEO Mark Zuckerberg has made visits to influential political venues, including the White House and Mar-a-Lago. Other venture capital firms are also ramping up their presence in Washington to assist portfolio companies operating in highly regulated or political industries like defense, crypto, and AI. Notably, firms like Andreessen Horowitz and General Catalyst have taken significant steps to bolster their policy and regulatory teams.

Historically, Sequoia Capital has maintained a stance of political neutrality as a firm. Although individual partners have expressed personal political views or contributed to presidential candidates, the firm as a whole has avoided taking sides. Top partner Roelof Botha emphasized focusing on policies that drive entrepreneurship, job creation, and maintaining America’s competitive edge.

Interview of the Week

Startup of the Week

Post of the Week

A reminder for new readers. Each week, That Was The Week, includes a collection of selected essays on critical issues in tech, startups, and venture capital. I choose the articles based on their interest to me. The selections often include viewpoints I can't entirely agree with. I include them if they provoke me to think. Click on the headline, contents link, or the ‘Read More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below. There is a weekly News of the Week supplement that has the week’s most interesting news.