Contents

Andrew is away this week so we are not recording a video. In its place I gave my newsletter to Notebook LM. Its podcast is the video. Enjoy.

Editorial: Patterns in the Chaos? Don’t be a Victim

Essays

AI

Mark Zuckerberg – Llama 4, DeepSeek, Trump, AI Friends, & Race to AGI

Sam Altman’s eyeball-scanning project Worldcoin makes US debut

Venture Capital

Figure AI sent cease-and-desist letters to secondary markets brokers

Musk’s xAI Holdings is reportedly raising the second-largest private funding round ever

Plural Partner, Taavet Hinrikus: Why Founders Will Realise Multi-Stage Funds Damage Seed Rounds

Between 2013-2018 — 25-33% of the Series A rounds Benchmark led became $5bn companies

Government Overreach

Geopolitics

Private Markets Innovation

Interview of the Week

Startup of the Week

Post of the Week

Editorial: Patterns in the Chaos? Don’t be a Victim.

Attempting to discern patterns in times of great change is hard. “What is happening?” is a hard question to answer. Especially because the answer is always, “it depends”.

It depends on what you decide to do, and not only you but all of us. History is not pre-ordained. There is no definite path it will take. History is decided by human decisions taken in real time.

And to make those decisions involves deciding on an outcome, and then engaging with the world to make the outcome you desire more likely to happen.

Briefly scanning the titles of this week’s articles seems to show trends in many conflicting directions.

The judicial treatment of Apple, Meta and Google implies they are in serious trouble, triggered by regulatory intervention in their businesses.

Earning seems to indicate they are in great shape.

Ai innovations seem to prefigure a new set of large companies that can damage them and eclipse them.

AI itself points to an AI agent future where humans get significant help from software agents able to carry out plans and leverage tools.

Packy McCormick’s “Chaos is a Ladder” pokes at the fact that chaos begets outcomes. It is a great read. So too is Sangeet Paul Choudary’s “Humans as Luxury Goods” also starts to understand the future role of humans in these outcomes.

But the essay I am drawn to is Albert Wengers book review of Ezra Klein’s Abundance. Albert criticizes Klein for stopping short of the promise the book’s title implies:

Whenever they get to the point of talking about what could be done, for example to drastically refocus government funding for innovation, they pull back hard towards incremental patches applied to the existing system.

….

Now here is a guess: they encountered a fear that the degree of change required is such that we don’t know how to accomplish it with “democracy as usual” but they rightly don’t want to provide any ammunition for the “tear it all down” and “we need a new aristocracy” crowds.

This is the real discussion we need to be having: how can we achieve the disruptive level of change required for an actual abundance agenda in a democratic fashion.

Albert gets to the cruz of historical change. People doing things. Consciously.

The question has been for quite some time: what should we do about it? And here is where the authors utterly lack the courage of their convictions to call for bold changes, for some kind of actual reinvention.

Predicting the future is impossible. Making the future according to a plan is far more possible. Observation versus Participation.

For our current world there are some things I care about enough to fight for. And my participation, partly here in words you can read, is to state clearly what those things are and seek to gain your approval for them so you too can be an agent (of change).

I want a world where the economy grows (global GDP).

I want a world where human beings are increasingly supplemented by software and robotics to reduce labor time and increase leisure time.

I want AI to get better and better at producing products and services.

I want government to get out of the way except when building things we all share (infrastructure for civic and physical needs) or protecting us all (laws).

I want abundance, defined as unlimited access to everything humans need to enjoy life.

I want that abundance to lift everybody up, not only one or two nations or a handful of people.

I do not want national elite’s fighting wars for their own share of the abundance pie and asking us to die for them.

I want us all to feel we have control over decisions that affect us. Democratic decision making is core to this, but it can be better. When we all have smart phones and internet, and can identify ourselves as citizens with voting rights, democracy can be way better than its current form.

I could go on. But the point is, when we assess AI or Venture Capital, or Geopolitical issues or Blockchain we need to have a framework driven by a set of outcomes we want to see. Only then can an opinion help create history. And creating history is the job of humanity. Not simply being an object of it.

This isn’t a manifesto, but it is a method of thinking.

Essays

Chaos is a Ladder

Notboring • Packy McCormick • April 29, 2025

Business•Startups•Innovation•SupplyChain•VerticalIntegration•CreativeDestruction•Essays

The article "Chaos is a Ladder" explores the transformative power of chaos and uncertainty in the business landscape, drawing parallels between ancient myths, economic theory, and modern startup dynamics. The author argues that periods of upheaval—such as the current economic turbulence driven by tariffs, trade wars, and supply chain disruptions—create opportunities for startups to disrupt entrenched incumbents. By leveraging architectural innovation (reconfiguring existing technologies in new ways), startups can outmaneuver larger, less agile competitors. The piece cites examples like Tesla's resilience during the COVID chip shortage and Bitcoin's rise post-2008 financial crisis to illustrate how chaos acts as a "ladder" for those positioned to climb it.

Key themes include the inevitability of chaos (framed through Norse mythology's trickster god Loki) and the concept of "Creative Destruction" from economist Joseph Schumpeter. The author emphasizes that incumbents, burdened by rigid architectures and embedded processes, struggle to adapt during crises, while startups—like tricksters—thrive due to their flexibility. Vertical Integrators (companies that control their supply chains and product ecosystems) are highlighted as particularly well-suited to capitalize on this moment, as seen in Tesla's dominance over traditional automakers. Data points include:

Over 60% of 2019 VC funds have returned zero cash to LPs, signaling a venture capital downturn.

Tesla increased production by 87% in 2021 despite global chip shortages, while legacy automakers faltered.

Architectural innovations (e.g., Sony's portable radios displacing RCA) historically topple industry leaders.

The article concludes with a call to embrace uncertainty, positioning startups as the "tricksters" who will rebuild industries. The author predicts that the current chaos will accelerate the rise of Vertical Integrators, much like the 2008 financial crisis birthed Airbnb and Uber. The cyclical nature of innovation—order giving way to chaos, then rebirth—is framed as an enduring truth, with startups playing the pivotal role in shaping the next techno-economic paradigm.

How On Earth Will OpenAI Hit $129 Billion in Four Years?!

Battellemedia • John Battelle • April 29, 2025

Technology•AI•OpenAI•RevenueProjection•GrowthRates•Essays

I’ve been traveling for the past week, and ignoring the news as best as one can while on the road. But when The Information posted this doozy of a story – OpenAI Forecasts Revenue Topping $125 Billion in 2029 as Agents, New Products Gain – I made a note to myself: Grok those numbers, and see what on earth is going on.

By the time I got home, Ed Zitron, currently the tech world’s most fervid antagonist – had beat me to it. Zitron dissembled The Information’s reporting, noting that the piece takes “great pains to accept literally everything that OpenAI says as perfectly reasonable, if not gospel, even if said things make absolutely no sense.”

So what doesn’t make sense? Well first off, the numbers themselves. OpenAI earned less than $4 billion in revenue in 2024. The report, sourced from anonymous “potential and current investors,” claims OpenAI is projecting 2029 revenues to be $129 billion – an increase of $125 billion in just five years. That’s a more than 100% annual compounded growth rate – for five years in a row. Calling such a projection optimistic is a disservice to the word optimistic. It’s fantasy, and Zitron rightly skewers The Information for accepting the numbers without so much as a reality check from anyone who might have the experience to provide context.

Take Google, which was the fastest growing tech company of its time, and emblematic of a dramatic shift in Internet business overall. Back in 2003, the year before the company went public, the company earned nearly $1.5 billion in revenue. Five years later, the company had grown at an annual rate of more than 70% – to more than $21 billion in revenue. That’s extraordinary – but it’s not close to what OpenAI and The Information is reporting.

How about Facebook? Well, the year before it went public, it earned $3.7 billion in revenue, close to what OpenAI earned in 2024. Five years later, its revenues had increased to more than $26 billion – a nearly 50% annual growth rate. Again, historic, but less than half of the history OpenAI claims to be making.

OK, what about Apple, during its fastest era of growth – from 2003 through 2008, after the launch of the iPhone? Apple grew from $6.2 billion to $32.5 billion in those heady times, impressive, but… that’s only a 39% annual growth rate.

I could go on, but finding examples of paradigm-shifting technology companies that grow at double digits (or more) over an extended period of time is beyond difficult – it’s impossible. Not to mention, the only way OpenAI gets to these eye-popping growth rates is to adopt advertising – the very business model it’s said to eschew.

So, if we’re to believe OpenAI, and by extension, The Information as a credible source of journalism, we’d have to ignore history, pop the red pill, and suspend disbelief. It seems investors in OpenAI are willing to do just that.

Google Earnings, Search and AI, Building AI Products

Stratechery • Ben Thompson • April 28, 2025

Technology•AI•MachineLearning•Innovation•Strategy•Essays

Google's recent earnings report has been well-received, but it highlights a strategic shift that could have significant implications for the company's future. The focus is increasingly on the race between Search + AI and AI > Search, indicating a major emphasis on integrating AI into Google's core products and potentially surpassing traditional search capabilities.

Strategic Shifts

Integration of AI into Search: Google is heavily investing in AI technologies to enhance its search capabilities. This integration aims to provide more accurate and personalized results, leveraging AI's ability to understand context and intent better than traditional algorithms.

AI Beyond Search: The company is also exploring AI applications beyond search, such as developing AI-driven products and services. This strategy reflects a broader trend in the tech industry, where AI is seen as a key driver of innovation and growth.

Competitive Landscape: Google's focus on AI reflects a competitive landscape where tech giants are racing to integrate AI into their offerings. This race is not just about improving existing products but also about creating new markets and revenue streams through AI-driven innovations.

Implications and Analysis

The implications of this strategic shift are multifaceted:

Innovation and Growth: By focusing on AI, Google aims to drive innovation and growth. AI can help improve existing products and create new ones, potentially opening up new revenue streams.

Risk and Uncertainty: However, this shift also comes with risks. The AI landscape is rapidly evolving, and there are challenges related to accuracy, privacy, and ethical considerations.

Market Impact: The success of Google's AI strategy will have significant market implications. It could influence how other companies approach AI integration and could reshape the competitive dynamics in the tech industry.

Conclusion

In summary, Google's strategic focus on AI reflects a broader industry trend towards leveraging AI for growth and innovation. While this strategy holds promise, it also presents challenges that Google must navigate to maintain its leadership position in the tech sector.

Abundance (Book Review)

Paragraph • continuations@newsletter.paragraph.com (Albert Wenger) • April 27, 2025

Politics•PublicPolicy•Abundance•Innovation•Regulation•Geopolitics•Essays

Abundance is the bold title for a new book by Ezra Klein and Derek Thompson that has been receiving a lot of attention. Given my own profound interest in how to get past scarcity thinking I felt compelled to read it rather than rely on the profusion of reviews. In short, while I commend Klein and Thompson on wanting to shift the dialog towards a positive vision, the book falls comically short of its title. A more apt name would have been something like “Awakening” as it does a good job of representing the authors’ realization of just how ineffective government has been.

Unless you have been sitting under a rock, or been an unquestioning Democrat (maybe the two are the same?), very little in the book will be new to you. It recounts our inability to build new housing, new railways, new transmission lines, along with the apparent slow down of innovation and traces it back to bureaucracies more concerned with process than with outcome, mired in complex laws and regulations, and subject to constant litigation by myriads of interests. All correct but definitely not news.

The question has been for quite some time: what should we do about it? And here is where the authors utterly lack the courage of their convictions to call for bold changes, for some kind of actual reinvention. The inside jacket breathlessly claims “Abundance is a once-in-a-generation paradigm-shifting call to renew a politics of plenty” (admittedly this is language by the publisher but the authors have sufficient heft that they could have probably objected to this). If this is what you are looking for you will be sadly disappointed. Whenever they get to the point of talking about what could be done, for example to drastically refocus government funding for innovation, they pull back hard towards incremental patches applied to the existing system.

Late in the book Klein and Thompson appear to grasp how short they are falling of boldness and their unease is captured perfectly in this sentence “What we are proposing is less a set of policy solutions than a new set of questions around which our politics should revolve” (p. 216). Now here is a guess: they encountered a fear that the degree of change required is such that we don’t know how to accomplish it with “democracy as usual” but they rightly don’t want to provide any ammunition for the “tear it all down” and “we need a new aristocracy” crowds.

This is the real discussion we need to be having: how can we achieve the disruptive level of change required for an actual abundance agenda in a democratic fashion. Now that would be an actual once-in-a-generation paradigm-shifting book. A good first stab at this is Astra Taylor’s book from 2020 presciently titled “Democracy May Not Exist, But We'll Miss It When It's Gone.”

P.S. I am really tired of the current style of popular books where everything has to be motivated by some anecdote to apparently make it engaging. The anecdotes at times drag on for pages of fluff that does nothing to push harder on the arguments.

Abundance and the Left

Nytimes • April 29, 2025

Politics•Policy•InfrastructureDevelopment•EconomicGrowth•RegulatoryReform•Essays

The article discusses perspectives from Saikat Chakrabarti and Zephyr Teachout on why America struggles with building and development. This topic is often intertwined with broader societal and political issues, including economic policies, infrastructure development, and the role of government in facilitating growth.

Perspectives on Development Challenges

Chakrabarti and Teachout likely address several key challenges that hinder development in America. These challenges might include regulatory barriers, lack of investment in infrastructure, and political polarization that prevents consensus on large-scale projects. Understanding these challenges is crucial for policymakers and stakeholders aiming to improve the country's ability to build and innovate.

Key Factors and Implications

Regulatory Environment: Complex and often outdated regulations can significantly slow down development projects. Simplifying these regulations could help streamline the process and encourage more investment.

Infrastructure Investment: Adequate investment in infrastructure is essential for supporting economic growth and development. This includes not just physical infrastructure like roads and bridges but also digital infrastructure.

Political Consensus: Building consensus across political lines is crucial for implementing large-scale projects. This requires effective communication and collaboration among different stakeholders.

Conclusion and Future Directions

In conclusion, addressing America's development challenges requires a multifaceted approach that includes regulatory reform, increased investment in infrastructure, and political cooperation. By understanding these factors and working towards solutions, the country can improve its capacity to build and innovate, ultimately enhancing economic and social outcomes.

The group chats that changed America

Semafor • a crazy China mind virus.” • April 28, 2025

Politics•SocialMedia•GroupChats•Signal•SiliconValley•Geopolitics•Essays

Last Thursday morning, a bit before 10 am in Austin and nearly 11 pm in Singapore, Joe Lonsdale had enough of Balaji Srinivasan’s views on China.

“This is insane CCP thinking,” Lonsdale, a co-founder of Palantir, wrote to a 300-member Signal group. “Not sure what leaders hang out w you in Singapore but on this you have been taken over by a crazy China mind virus.”

Srinivasan, a former Coinbase chief technology officer and influential tech figure who now lives in the city-state, responded that China “executed extremely well over 45 years. Any analysis that doesn’t take that into account makes it seem like the US could have held it back.”

It was a normal, robust disagreement among friends in a friendly space (as both raced to X to declare, after I emailed them about it).

And it was just another day in Chatham House, a giant and raucous Signal group that forms part of the sprawling network of influential private chats that began during the fervid early days of the COVID-19 pandemic, and which have fueled a new alliance of tech and the US right. That same week in Chatham House, Lonsdale and the Democratic billionaire Mark Cuban sparred over affirmative action, and Cuban and Daily Wire founder Ben Shapiro discussed questions of culture and work ethic.

This constellation of rolling elite political conversations revolve primarily around the venture capitalist Marc Andreessen and a circle of Silicon Valley figures. None of their participants was surprised to see Trump administration officials firing off secrets and emojis on the platform last month. I did not have the good fortune to be accidentally added to one of the chats, which can be set to make messages disappear after just 30 seconds.

But their influence flows through X, Substack, and podcasts, and constitutes a kind of dark matter of American politics and media. The group chats aren’t always primarily a political space, but they are the single most important place in which a stunning realignment toward Donald Trump was shaped and negotiated, and an alliance between Silicon Valley and the new right formed. The group chats are “the memetic upstream of mainstream opinion,” wrote one of their key organizers, Sriram Krishnan, a former partner in the venture capital firm Andreessen Horowitz (typically styled a16z) who is now the White House senior policy adviser for AI.

Of course, these are hardly the only power group chats. Anti-Trump liberals are now coordinating their responses on Signal. There are group chats for Black political elites and morning show producers. A vast and influential parallel set of tech conversations take place on WhatsApp. There’s a big China-friendly group over on WeChat. Elite podcasters have one.

★ Is Chrome Even a Sellable Asset?

Daringfireball • John Gruber • April 28, 2025

Technology•Web•GoogleChrome•Antitrust•Divestiture•Government Overreach•Essays

There are two ways to consider a forced divestiture of Chrome by Google, as the U.S. Department of Justice has, for months now, been requesting after Judge Amit P. Mehta ruled that Google has illegally maintained its monopoly in web search. One is from a business perspective (which I believe is the only perspective considered by the DOJ). The other is from a technical perspective. I don’t think either makes any sense. I’m not talking about whether it’s fair or just that Google be forced to sell Chrome. I’m talking about whether it’s even possible in any practical sense.

The Business Perspective

The whole premise that forcing Google to sell Chrome would be an appropriate remedy for their illegal monopolizing is predicated on the notion that Chrome, in and of itself, is a valuable asset. Here’s an article from Bloomberg reporters Leah Nylen and Josh Sisco that asserts in its headline “Google’s Chrome Worth Up to $20 Billion If Judge Orders Sale”. Their source for this valuation, which, again, they simply state as fact in their own headline, is a Bloomberg Intelligence analyst:

Should a sale proceed, Chrome would be worth “at least $15-$20 billion, given it has over 3 billion monthly active users,” said Bloomberg Intelligence analyst Mandeep Singh.

The price prospective buyers are willing to pay may depend on their ability to link Chrome to other services, said Bob O’Donnell of TECHnalysis Research. “It’s not directly monetizable,” he said. “It serves as a gateway to other things. It’s not clear how you measure that from a pure revenue-generating perspective.”

3 billion users = $15–$20 billion is not real math. It’s just bullshit. The users are only valuable right now because they perform a lot of Google web searches within Chrome. Chrome users also make money for Google by using other Google properties that show ads, like Maps and Gmail. And Chrome encourages users, in general, to use Google properties and services like Docs. If you try to work out how valuable Chrome is to Google, it’s seemingly worth a veritable fortune. But that doesn’t mean Chrome holds any value of its own, on its own.

AI

Meta unleashes Llama API running 18x faster than OpenAI: Cerebras partnership delivers 2,600 tokens per second

Venturebeat • Michael Nuñez • April 29, 2025

Technology•AI•LlamaAPI•Cerebras•AIInference

Meta partners with Cerebras to launch its new Llama API, offering developers AI inference speeds up to 18 times faster than traditional GPU solutions, challenging OpenAI and Google in the fast-growing AI services market.

Agentic AI: Adoption insights from 600 executives

Georgian • David Poole • April 24, 2025

Technology•AI•AgenticAI•Adoption•Research

91% of R&D Respondents have implemented or are planning to implement agentic AI, with human-AI collaboration leading the way

New research from Georgian and NewtonX reveals early agentic AI adoption trends, human oversight requirements and reliability challenges. (Note that numbers below are approximate and rounded to the nearest whole number.)

Key Findings

• Widespread R&D adoption momentum: 91% of R&D Respondents have plans to adopt agentic AI, including 45% already implemented.

• Strategic implementation approach: 48% of both R&D and GTM Respondents focus on systems with human approval as they build confidence in the technology.

• Clear path to value: 55% of R&D Respondents expect high or transformational impact from agentic AI; 43% of GTM Respondents anticipate similar impact.

• Marketing leading GTM adoption: Marketing content creation (43% actively using or piloting) and website/chatbot implementations (40% actively using or piloting) show early momentum.

• Efficiency as the primary driver: 41% of GTM and 31% of R&D Respondents cite increased efficiency and workflow automation as the top benefit, creating ROI cases for implementation.

The Rise of Agentic AI

Agentic AI represents an evolution beyond generative AI, with capabilities to autonomously plan, reason about and execute complex tasks with minimal human intervention. Organizations across industries are recognizing the potential of this technology and taking steps to incorporate it into their operations.

In March 2025, Georgian, in partnership with NewtonX, surveyed over 600 executives, including 400 growth-stage software executives and 200 enterprise executives. The study included 300 R&D Respondents and 300 GTM Respondents across 11 countries and 15 industries to provide a view of the current state of agentic AI adoption, implementation strategies and expected benefits.

For the purpose of this research, “agentic AI” was defined as software that is able to (a) interpret a task and any available context (data), (b) independently plan and reason about how to complete that task (and any identified sub-tasks) and then (c) complete the task with minimal human oversight.

Implementation Momentum Building

Our research reveals that organizations are making early progress in their agentic AI implementation journeys.

R&D Respondents (n=300) are showing early momentum, with 45% reporting their organizations are actively using agentic AI (14% organization-wide implementation, 15% individual use cases, 17% piloting). Only 9% indicated they are not considering implementing agentic AI.

The GTM side (n=300) suggests similar momentum, with 36% actively implementing agentic AI (6% broadly across functions, 12% in limited use cases, 17% piloting), while 41% are in planning stages, demonstrating widespread recognition of the technology’s potential.

AI Friends Are a Good Thing, Actually

Digitalnative • Rex Woodbury • April 25, 2025

Technology•AI•AICompanions•Loneliness•DigitalFriendship

I didn’t have many friends in middle school. I was deep in an awkward phase: bowl cut, gap teeth, gangly limbs. For an entire school-year, I wore a hat with furry dog ears that said “TOP DOG” on it. True story.

But I had one texting friend: a girl named Paloma who went to my school. Oddly enough, Paloma and I never interacted at school. But we texted all day, morning to night. I’d ask Paloma how her math exam had gone; she’d ask me about track practice. It was nice to have someone to talk to, to feel close to.

When I think of AI companions, I think of Paloma. Obviously she was a real person, but to me, she effectively existed in the ether. She was a wholly digital source of companionship and support during a time of loneliness.

Here’s the argument of this week’s Digital Native: AI friends are a good thing, actually.

New technologies often feel dystopian, until they feel commonplace.

If someone told you in the 90s that in 2025, millions of people would count people they met online—on Discord, Reddit, Fortnite, Twitch—as among their closest friends, you might recoil. A best friend you’ve never met in person? Feels a little dystopian. Today, of course, it feels commonplace. And you might have more in common with someone you meet online than with the people in your small town; online, relationships are unbounded by geography.

In the future, we might feel the same way about AI friends.

Right now AI friends feels icky. Shouldn’t we have real, in-person friends? Of course we should! No one’s saying that isn’t ideal. But the reality is, many people don’t have real-world friends, despite our best efforts.

In the last 30 years, the percentage of people with <=1 close friend has nearly tripled to 20% of the population. The percentage of people who report 10+ close friends has dropped from 40% to 15%. From one of our 10 Charts editions:

Technology is at least partly (perhaps largely) responsible for this decline. “It’s the phones, stupid.” Here’s another depressing chart:

When Every Employee Becomes an Agent Boss

Tomtunguz • AI. • April 27, 2025

Technology•AI•EmployeeAgents•StrategicWork•OrgChartEvolution

If every employee starts managing agents, how does a company change?

“83% of global leaders say AI will let employees take on more complex, strategic work earlier in their careers.”

One executive recently framed this transition of teams evolving to three areas of work: operational, tactical, & strategic. Operational work can be mostly fully automated today. Agents are chomping away at tactical work – better accuracy will improve their share. Humans will focus on strategy work, but likely assisted by AI.

“When asked why they turned to AI instead of a colleague, employees cited 24/7 availability (42%), machine speed and quality (30%), and unlimited ideas on demand (28%) as the top reasons—all things humans cannot provide.”

Advanced AI users use AI as a thought partner. With some studies demonstrating AI’s creativity as superior to humans, combined with infinite patience, profound memories, & a little bit of obsequiousness, we should expect AI as a strategic work sidekick.

The impact on org charts is likely to be profound.

Manu Cornet’s interpretation of org charts will need an additional box. What will it look like?

“But with expertise on demand, the traditional org chart may be replaced by a Work Chart—a dynamic, outcome-driven model where teams form around goals, not functions…”

Microsoft’s Work Trend Index argues most businesses will resemble movie production: teams of specialists who descend upon a project, achieve a goal & move on.

And the impact is mostly on customer-facing teams: “In our survey, global leaders listed customer service, marketing, and product development as the top three areas for accelerated AI investment in the next 12–18 months.”

The Cornet image of the future will undoubtedly have more agents than humans—by 10x or 100x is hard to say. The leverage from AI is hard to overstate & expectations for speed, depth of thought, creativity, & effectiveness will surge as a result—a huge opportunity for those who understand how to use these new tools effectively.

Can the Web Browser Be the Disruptor Yet Again?

Spyglass • M.G. Siegler • April 28, 2025

Technology•Web•AI•Agents•Browsers

There are a number of interesting tidbits from Heath’s sit down with Aravind Srinivas – unsurprising, as he tends to say provocative things quite often – but his comments as to why Perplexity feels the need to make a web browser, stand out:

“The reason we’re doing the browser is that it might be the best way to build agents. On both iOS and Android, we don’t have OS level control. You cannot easily call apps and access their information. You can deep link to them, but for example, with Uber, I cannot go and check prices of different Uber rides and provide you Comfort if there’s not much of a price difference. I cannot compare prices between Uber and Lyft to get the best ride. I cannot compare the wait times between Uber Eats and DoorDash to get whatever is optimal.

So, we need to build an OS-level agent, and a browser is essentially a containerized operating system. It can let you access other third-party services through hidden tabs if you’re already logged into them, scrape the page on the client side, and perform reasoning and take actions on your behalf. That’s the architecture that appeals to us.

Answering questions is going to be a commodity. We need to build our next set of advantages in performing actions. That’s why we’re building a browser. The browser is the best place to take action for people. We want to move to a different front-end.”

The agentic/browser relationship was my immediate reaction upon using ChatGPT’s Operator a few months back. As I wrote at the time:

“To me, the most interesting aspect of OpenAI’s new ‘Operator’ product – their first real agent – is not what it can do, but how it does it. Unlike the early iterations of similar products from Anthropic and Google, ‘Operator’ doesn’t take over your computer, it outsources the work you want to do to OpenAI’s computer in the cloud. And like so many of us these days, that computer really is just using one app: the web browser.

It’s both clever and at the same time obvious. Why would you want to do this on your own machine, thus tying it up while you’re trying to do something else – isn’t that the point of an agent, freeing you up to do other things? But it’s also a bit weird: watching a bot perform a task you’ve asked of it on some remote computer from afar. It’s all a bit Kabuki theater. And that quickly made me realize another obvious element of all this: OpenAI needs to make their own web browser.”

The fact that OpenAI clearly built some sort of custom version of Chrome to make Operator work just underscored the point that all of the AI companies hoping to compete probably shouldn’t be relying on software operated by Google, which, of course, is also competing in this space. And it’s perhaps the one actually compelling argument for why they should be made to spin-off Chrome. Not because of the past with Google Search share, but because of the future with AI. At the very least, this situation probably needs to be monitored closely given Chrome’s market share. If Gemini is baked right into Chrome and deeply integrated...

Reality Check

Wheresyoured • Edward Zitron • April 28, 2025

Technology•AI•OpenAI•RevenueProjections•AIAgents

I’m sick and god-damn tired of this! I have written tens of thousands of words about this and still, to this day, people are babbling about the “AI revolution” as the sky rains blood and crevices open in the Earth, dragging houses and cars and domesticated animals into their maws. Things are astronomically fucked outside, yet the tech media continues to tell me to get my swimming trunks and take a nice long dip in the pool.

I apologize, this is going to be a little less reserved than usual.

I don’t know why I’m the one writing what I’m writing, and I frequently feel weird that I, a part-time blogger and podcaster, am writing the things that I’m writing. Since I put out OpenAI Is A Systemic Risk To The Tech Industry, I’ve heard nothing in response, as was the case with How Does OpenAI Survive? and OpenAI Is A Bad Business.

There seems to be little concern — or belief — that there is any kind of risk at the heart of OpenAI, a company that spent $9 billion in 2024 to lose $5 billion. While I’d love to add a “because…” here, if not because it’s important to be intellectually honest and represent views that directly contrast my own, even if I do so in a somewhat sardonic fashion, nobody seems to actually have a cogent response to how they right this ship other than Hard Forker Casey Newton throwing a full-scale tantrum on a podcast and saying I’m wrong because “inference costs are coming down.”

Newton is a nakedly-captured booster that ran an infographic from Anthropic a few weeks ago the likes of which I haven’t seen since 2013, but he’s far from the only one with a flimsy attachment to reality.

The Information ran a piece a couple of weeks ago that made me furious, which was a surprise because — for the most part — their coverage of tech, and especially AI, has been some of the best around, and they generally avoid the temptation to be shills for shaky and unsustainable tech companies.

The story claimed that OpenAI was “forecasting revenue topping $125 billion in 2029” based on “selling agents” and “monetizing free users…as a driver to higher revenue.” The piece, reported out based on things “…told [to] some potential and current investors,” takes great pains to accept literally everything that OpenAI says as perfectly reasonable, if not gospel, even if said things make absolutely no sense.

According to The Information’s reporting, OpenAI expects “agents” and “new products” to contribute tens of billions of dollars of revenue, both in the near-term (somehow contributing $3 billion in revenue this year, which I’ll get to in a little bit) and in the long-term, with an egregious $25 billion in revenue in 2029 projected to come from “new products.”

If you’re wondering what those new products might be, I am too, because The Information doesn’t seem to know, and instead of saying “OpenAI has no idea what the fuck they’re talking about and is just saying stuff,” the outlet chooses instead to publish things with the kind of empty optimism that’s indistinguishable from GPT-generated LinkedIn posts.

Check out this fucking chart.

I want to be really, really clear: we are nearly in May 2025, and I see no evidence that OpenAI even has a marketable agent product, let alone one that will make it three billion god damn dollars in the next six or seven months.

Humans As Luxury Goods In The Age

Platforms • Unknown Author • April 28, 2025

Technology•AI•HumanInteraction•DigitalEconomy•AttentionEconomy

In today's digital landscape, the commodification of human interaction has become increasingly prevalent. As technology automates more tasks, human engagement is often reserved for those who can afford it, leading to a society where personal attention is a luxury. This shift is evident in various sectors, from healthcare to education, where personalized services are accessible primarily to the affluent. (news.ycombinator.com)

The rise of platforms like Substack exemplifies this trend. Substack offers creators a space to monetize their content through subscriptions, fostering direct relationships with their audience. This model contrasts with traditional ad-based platforms, emphasizing quality over quantity and enabling creators to sustain themselves without relying on advertising revenue. (businessinsider.in)

Luxury consumers are increasingly turning to Substack for curated content. Influencers and creators find that Substack's subscription model attracts a dedicated audience willing to invest in high-quality, personalized content. This shift underscores a broader movement towards valuing human curation and direct engagement in the digital economy. (pymnts.com)

The attention economy plays a significant role in this transformation. As human attention becomes a scarce resource, platforms that prioritize meaningful engagement over mass reach are gaining prominence. This evolution reflects a growing desire for authentic connections and curated experiences in an increasingly automated world. (curatedbykayla.com)

Mark Zuckerberg – Llama 4, DeepSeek, Trump, AI Friends, & Race to AGI

Dwarkesh • Dwarkesh Patel • April 29, 2025

Technology•AI•Llama

Zuck on:

Llama 4, benchmark gaming

Intelligence explosion, business models for AGI

DeepSeek/China, export controls, & Trump

Orion glasses, AI relationships, and preventing our tech from reward-hacking us

Dwarkesh Patel: Mark, thanks for coming on the podcast again.

Mark Zuckerberg: Yeah, happy to do it. Good to see you.

Dwarkesh Patel: You too. Last time you were here, you had launched Llama 3. Now you've launched Llama 4.

Mark Zuckerberg: Well, the first version.

Dwarkesh Patel: That's right. What's new? What's exciting? What's changed?

Mark Zuckerberg: The whole field is so dynamic. I feel like a ton has changed since the last time we talked. Meta AI has almost a billion people using it monthly now, which is pretty wild. I think this is going to be a really big year for all of this, especially once you get the personalization loop going, which we’re just starting to build in now really, from both the context that all the algorithms have about what you’re interested in — feed, your profile information, your social graph information — but also what you're interacting with the AI about. That’s going to be the next thing that's super exciting. I’m really big on that.

Mark Zuckerberg: The modeling stuff continues to make really impressive advances too. I’m pretty happy with the first set of Llama 4 releases. We announced four models and released the first two — the Scout and Maverick ones — which are mid-size to small models. The most popular Llama 3 model was the 8 billion parameter one. So we’ve got one of those coming in the Llama 4 series too. Our internal code name for it is “Little Llama.” That’s coming probably over the next few months. Scout and Maverick are good. They have some of the highest intelligence per cost you can get of any model out there. They’re natively multimodal, very efficient, run on one host. They’re designed to be very efficient and low latency, for a lot of the use cases we’re building for internally. That’s our whole thing. We build what we want, and then we open-source it so other people can use it too. I'm excited about that.

“Death by 1,000 Pilots”

Oreilly • Tim O’Reilly and Mike Loukides • April 29, 2025

Technology•AI•PilotProjects•ProofOfConcept•AgenticAI

Most companies find that the biggest challenge to AI is taking a promising experiment, demo, or proof-of-concept and bringing it to market. McKinsey Digital Analyst Rodney Zemmel sums this up: It’s “so easy to fire up a pilot that you can get stuck in this ‘death by 1,000 pilots’ approach.” It’s easy to see AI’s potential, come up with some ideas, and spin up dozens (if not thousands) of pilot projects. However, the issue isn’t just the number of pilots; it’s also the difficulty of getting a pilot into production, something called “proof of concept purgatory” by Hugo Bowne-Anderson, and also discussed by Chip Huyen, Hamel Husain, and many other O’Reilly authors. Our work focuses on the challenges that come with bringing PoCs to production, such as scaling AI infrastructure, improving AI system reliability, and producing business value.

Bringing products to production includes keeping them up to date with the newest technologies for building agentic AI systems, RAG, GraphRAG, and MCP. We’re also following the development of reasoning models such as DeepSeek R1, Alibaba’s QwQ, Open AI’s 4o1 and 4o3, Google’s Gemini 2, and a growing number of other models. These models increase their accuracy by planning how to solve problems in advance.

Developers also have to consider whether to use APIs from the major providers like Open AI, Anthropic, and Google or rely on open models, including Google’s Gemma, Meta’s Llama, DeepSeek’s R1, and the many small language models that are derived (or “distilled”) from larger models. Many of these smaller models can run locally, without GPUs; some can run on limited hardware, like cell phones. The ability to run models locally gives AI developers options that didn’t exist a year or two ago. We are helping developers understand how to put those options to use.

A final development is a change in the way software developers write code. Programmers increasingly rely on AI assistants to write code, and are also using AI for testing and debugging. Far from being the “end of programming,” this development means that software developers will become more efficient, able to develop more software for tasks that we haven’t yet automated and tasks we haven’t yet even imagined. The term “vibe coding” has captured the popular imagination, but using AI assistants appropriately requires discipline—and we’re only now understanding what that “discipline” means. As Steve Yegge says, you have to demand that the AI writes code that meets your quality standards as an engineer.

AI assisted coding is only the tip of the iceberg, though. O’Reilly author Phillip Carter points out that LLMs and traditional software are good at different things. Understanding how to meld the two into an effective application requires a new approach to software architecture, debugging and ‘evals’, downstream monitoring and observability, and operations at scale. The internet’s dominant services have built using systems that provide rich feedback loops and accumulating data; these systems of control and optimization will necessarily be different as AI takes center stage.

The challenge of achieving AI’s full potential is not just true for programming. AI is changing content creation, design, marketing, sales, corporate learning, and even internal management processes; the challenge will be building effective tools with AI, and both employees and customers will need to learn to use those new tools effectively.

Helping our customers keep up with this avalanche of innovation, all the while turning exciting pilots into effective implementation: That’s our work in one sentence.

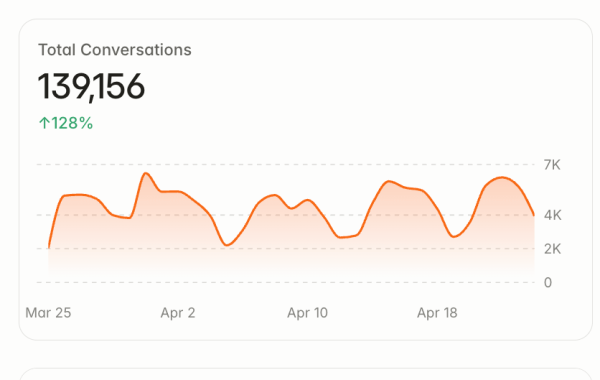

Our SaaStr AI Has Done 139,156 Conversations On Its Own Already. And They Are Really, Really Good. Don’t Fall Behind.

Saastr • Jason Lemkin • April 29, 2025

Technology•AI•SaaS•ConversationalAI•WorkflowAutomation

So SaaStr is a 5 person entity. Just 5 of us, but we do a lot. A lot. And yes, there are agencies and contractors that help us (bless them), but the full-time team is just 5.

Before AI, we maybe could respond to a handful of email-based issues, and a few chats. And we could not provide any direct 1-on-1 advice.

Oh so much has changed in just a few weeks. Our AI has now handled 139,156 conversations for us. And most of them are epicly good.

Now our AI can:

Advise founders on who to hire

Review VC pitch decks

Review board materials

Help you pick the right SaaS vendor

Help you work through slowing growth

Answer ticket questions for SaaStr Annual better than any human

Help folks that want to volunteer for SaaStr Annual figure out how

Manage 100s of speaker submissions

Help sponsors pick the right sponsorship for them, without bias

Answer 100s of nitty gritty sponsorship questions

Before, we had a pre-AI intercom chat that we answered maybe once a week. Now we can do 139,156 conversations a month with AI. And they are really, really good.

Think about this for your app, if you haven’t gone all-in on AI. What if your competitor can handle millions of interactions effortlessly a month? Automate almost all those workflows that today aren’t automated?

You will lose if you can’t figure some version of this out yourself.

This is an age of change in business software like we have never seen. Get on it fast, for real. Not just to be “adding some AI”. Because AI, used right, enables you to do more things at scale than were ever possible before.

Sam Altman’s World unveils a mobile verification device

Techcrunch • Maxwell Zeff • April 30, 2025

Technology•AI•IdentityVerification•Biometrics•Blockchain

Tools for Humanity, the startup behind the World human verification project co-founded by OpenAI CEO Sam Altman, unveiled Wednesday a mobile device designed to help people determine the difference between a human and an AI agent.

Rich Heley, Tools for Humanity’s Chief Device Officer and a former Apple director, debuted the Orb Mini device during its “At Last” event in San Francisco. The device looks like a smartphone and has two cameras on the front to scan users’ eyeballs.

World, a web3 project started by Altman and Alex Blania that was formerly known as Worldcoin, is based on the idea that it will eventually be impossible to distinguish humans from AI agents on the internet. To address this, World wants to create digital “proof of human” tools; these announcements are part of its effort to get millions of people to sign up.

After scanning your eyeball with one of its silver metal Orbs — or now, one of its Orb Minis — World will give you a unique identifier on the blockchain to verify that you’re a human.

The Orb Mini, a reference to the company’s larger Orb devices, has the familiar shape of a smartphone and is designed to be portable, a Tools for Humanity spokesperson told TechCrunch in a briefing. Thomas Meyerhoff, a former Apple designer, helped design the Orb Mini, according to people familiar with the new product.

The main purpose of the Orb Mini is to verify more people, not necessarily to use apps, make calls, or send texts. However, the spokesperson said it’s unclear what the device’s ultimate functionality would be.

Tools for Humanity is also launching its World Network in the U.S. on Thursday and will open storefronts in Austin, Atlanta, Los Angeles, Miami, Nashville, and San Francisco. The stores, which World already has in other countries, are designed for people to come in and have their eyeballs scanned by one of the company’s Orbs.

The World project claims 26 million people have signed up, and 12 million people are verified, around the world. Today, the company has a larger presence in Latin America, South America, and Asia — but Wednesday's announcement aims to grow the project in the U.S.

While the company was light on details about its Orb Mini, the device seems to be an effort to distribute its verification devices more broadly. While World’s objectives have shifted over the years, the Orb seems core to their mission.

A key question swirling around World is whether it will one day partner with Sam Altman’s other venture, OpenAI. It’s unclear if the Orb Mini will have any AI features or whether it’s related to the AI device OpenAI is reportedly working on.

Sam Altman’s eyeball-scanning project Worldcoin makes US debut

Ft • April 30, 2025

Technology•AI•Biometrics•Cryptocurrency•Privacy

Sam Altman's Worldcoin project, known for its iris-scanning "orb" technology and associated cryptocurrency token, has officially launched in the US. Previously limited to international markets due to the Biden administration's resistance to crypto, the project is now expanding under Donald Trump’s administration, which supports making the US a leading crypto hub. Worldcoin, rebranded as "World," aims to create unique digital IDs to distinguish humans from AI as the technology becomes more advanced. Developed by Tools for Humanity—founded by Altman and Alex Blania—the group has raised $200 million and plans to scale up production, targeting 10,000 orbs for the US. A new plant in Texas will help meet demand. Worldcoin's technology, which will be integrated into dating apps via a partnership with Match Group, is being positioned as a tool for improving trust and safety online. Despite promise, Worldcoin has faced international scrutiny and regulatory pushback over privacy and data security, including bans in several countries. The group claims all biometric data is anonymized. World expects operational costs to be offset by network fees within 18 months. (ft.com)

100 Trillion Tokens

Tomtunguz • April 30, 2025

Technology•AI•Azure•Tokens•InferenceCosts

“We processed over 100t tokens this quarter, up 5x year over year, including a record 50t tokens last month alone.”

If the market harbored any doubt for the insatiable demand for AI, this statement during Microsoft’s quarterly earnings yesterday, quashed it.

What could this mean for a run rate? Using some basic assumptions1, this implies :

So AI is roughly between 2 to 22% of Azure revenue. Error bars here are quite large, though.

A major contributor to this increased demand is performance, especially with reasoning models.

Combined with some of the massive reductions in inference costs, especially with smaller models like the Phi-4 models that Microsoft released yesterday that are open source and small. The margins on AI inference should continue to surge.

“…our cost per token, which has more than halved.”

“You see this in our supply chain where we have reduced dock to lead times for new GPUs by nearly 20% across our blended fleet where we have increased AI performance by nearly 30% ISO power…”

Jevon’s Paradox in full force.

“The real outperformance in Azure this quarter was in our non AI business.”

This was a surprise, but it likely is the result of additional demands placed on adjacent systems. AI doesn’t exist in a vacuum. It needs databases, storage, orchestration, and observability to succeed.

“PostgreSQL usage accelerated for the third consecutive quarter… Cosmos DB revenue growth also accelerated again this quarter…”

A later quote within the analyst call reinforces this point, the database systems, Cosmos (a MongoDB-like document data store) & PostGres, Both of which are transactional databases.

100 trillion tokens up 4x y/y. Next year, could we see a quadrillion?

1 20:1 input-to-output token ratio; a model usage mix of 60-70% OpenAI, 20% Anthropic, remainder of other models; and a 20% discount to public prices. See the work here

How Google’s Antitrust Case Could Upend the A.I. Race

Nytimes • David McCabe • May 1, 2025

Technology•AI•Google•Antitrust•AICompetition

A landmark antitrust lawsuit about the past has turned into a fight about the future. What began as an examination of Google’s search dominance more than a decade ago has evolved into a broader contest over who will lead in artificial intelligence. At the heart of the government’s case is the claim that Google’s exclusive agreements with phone makers, browsers and other digital outlets for default search status shut out rivals and stifled innovation—practices that prosecutors say unfairly enriched Google’s search engine while undermining competition in up-and-coming AI services.

During opening arguments, Justice Department lawyers warned that if Google’s current behavior goes unchecked, the company could extend its web-search monopoly into the next generation of AI-powered tools. They pointed to internal Google documents discussing how default placement on smartphones and browsers could be leveraged to “supercharge” new AI offerings, ensuring that consumers would turn first to Google for any internet query, whether simple or complex. The trial has featured testimony from industry experts who argue that Google’s control of distribution channels has enabled it to collect vast troves of data, giving it a leg up in training large language models and other AI systems.

Google’s defense team countered that stringent remedies risk hampering the very innovations the government claims to protect. They painted a picture of a company investing billions in cutting-edge AI research, from advanced natural language processing to autonomous driving technology, and argued that default search agreements were standard industry practice that benefited consumers by providing convenient access to Google’s services.

As the trial moves into its second week, analysts are watching for indications of how judges might restrict Google’s contracts or impose structural remedies. The outcome could reshape the competitive landscape for AI, influencing partnerships, data-sharing arrangements and the future of companies racing to deploy the next breakthrough in machine intelligence.

Venture Capital

Figure AI sent cease-and-desist letters to secondary markets brokers

Techcrunch • Marina Temkin • April 29, 2025

Technology•AI•Robotics•SecondaryMarkets•StartupValuation•Venture Capital

Last month, Brett Adcock, founder of robotics startup Figure AI, claimed in a post on X that his company "is now 1 most sought-after private stock in the secondary market."

However, the company has sent cease-and-desist letters to at least two brokers who run secondary marketplaces, demanding that they stop marketing Figure AI's stock. These letters were issued after Bloomberg reported in mid-February that Figure was seeking a $1.5 billion round at a $39.5 billion valuation—a significant increase from its $2.6 billion valuation in February 2024.

A spokesperson for Figure AI stated that the company sends such letters when unauthorized brokers market its shares without board approval. They emphasized that Figure does not allow secondary market trading in its shares without board authorization and will continue to protect itself against unauthorized brokers.

As a private company, Figure's stock cannot be easily sold by its investors without a company-authorized event. This restriction has led to the emergence of secondary markets offering investors alternative ways to liquidate shares ahead of an IPO.

The secondary markets that received Figure's letters suggested that some CEOs dislike share sales on their platforms because existing shareholders were attempting to sell their stock at prices below the new hoped-for $39.5 billion valuation. They noted that some companies are concerned that lower-priced secondary shares could compete with the new funding round.

Sim Desai, founder and CEO of secondary shares marketplace Hiive, commented that companies sometimes block direct secondary sales because they believe "it's a zero-sum game." He argued that active secondary market trading could attract more interest for primary shares in a new raise. Desai added that if someone is having difficulty selling something, it may be a function of price and valuation rather than the availability of capital.

Cash is King

Netinterest • April 25, 2025

Finance•Investment•EndowmentInvesting•IlliquidAssets•PrivateEquity•Venture Capital

“I don’t think the strategies that we have employed over the past 40 years are going to work going forward.” — Marc Rowan, CEO, Apollo

“One thing, though, is certain: success over the next four decades will look different than success over the last four.” — Matt Mendelsohn, CIO, Yale

John Maynard Keynes had been running the endowment at King’s College, Cambridge, for 15 years when he published his masterwork The General Theory in 1936. After starting as a macro investor with a focus on market timing, he gradually shifted his approach towards bottom-up stock-picking with improved results. “As time goes on, I get more and more convinced that the right method in investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes,” he wrote in a letter to a fellow investor in August 1934.

By the time The General Theory was released, Keynes was on a run of seven straight years of outperformance, having reduced portfolio turnover to around 30% per annum from 55% in the 1920s. His best year came in 1935, when his discretionary portfolio gained 34.0% against a market up just 7.2%. Yet despite his success as a long-term investor, Keynes was troubled by the speculative nature of markets. He wondered if the job could be better done if investment decisions were “permanent and indissoluble, like marriage, except by reason of death or other grave cause.”

Fifty years later, another endowment manager picked up on the idea. David Swensen took over as chief investment officer of Yale University in 1985 and identified private investment as a natural extension of Keynes’ thinking. “While falling somewhat short of the gravity of the decision to marry, funding a private equity firm represents a long-term commitment,” he wrote in his book, Pioneering Portfolio Management.

Although his high allocation to illiquid investments would become a hallmark of the Yale Model of endowment investing that he pioneered, Swensen’s rationale was more opportunistic than philosophical. “Rewarding investments tend to reside in dark corners, not in the glare of floodlights,” he observed, noting how Wall Street’s focus on trading volume left less liquid markets underexplored. “Because market players routinely overpay for liquidity, serious investors benefit by avoiding overpriced liquid securities, and by embracing less liquid alternatives.”

By the time he died in 2021, Swensen had shifted 51% of Yale’s investments into illiquid assets. His target was that venture capital should comprise 23.5% of the fund, leveraged buyouts 17.5%, real estate 9.5% and natural resources 4.5%. The strategy worked. Over his 36 years running it, Yale produced an annualized gain of 13.7% per annum. In dollar terms, outperformance during Swensen’s tenure represented over $50 billion in value added relative to the average endowment.

Musk’s xAI Holdings is reportedly raising the second-largest private funding round ever

Techcrunch • Connie Loizos • April 25, 2025

Technology•AI•Funding•ElonMusk•xAIHoldings•Venture Capital

Elon Musk's xAI Holdings is in discussions to raise $20 billion in new funding, potentially valuing the combined AI and social media entity at over $120 billion. If successful, this would mark the second-largest private funding round ever, trailing only OpenAI's recent $40 billion raise. The talks are reportedly in early stages, and xAI has not yet responded to requests for comment.

The substantial funding could help alleviate X's significant debt burden, which includes monthly servicing fees of $200 million and annual interest expenses exceeding $1.3 billion as of last year. This move underscores the continued investor interest in artificial intelligence and highlights Musk's growing influence within President Trump's administration.

Musk is expected to seek support from longstanding backers of his ventures, such as Antonio Gracias of Valor Equity Partners and Luke Nosek of Gigafund. Notably, Gracias has taken on a role in Musk's Department of Government Efficiency.

Lessons from 20 Years of Venture Capital: Roelof Botha (Managing Partner and Steward at Sequoia Capital)

Thegeneralist • Mario Gabriele • April 29, 2025

Business•Management•VentureCapital•Investing•DecisionMaking•Venture Capital

Sequoia Capital is synonymous with outstanding performance, backing companies like Apple, Google, Airbnb, and Stripe. In today’s episode, I chat with Roelof Botha, Sequoia’s Managing Partner, about what it takes to see the future first, capitalize on it intelligently once it arrives, and help founders build enduring companies.

Roelof is especially well-placed to discuss such matters. Not only has Sequoia navigated more than 50 years of market cycles, Roelof has personally spent more than 20 years helping shape the firm’s unique approach. From honing a philosophy rooted in clear thinking and long-term vision to asking the tough question of “What would you do with only 12 months of runway?” Roelof breaks down the mindset that’s helped Sequoia and its founders thrive, and what others can learn from it.

In our conversation, we explore:

The psychological biases that most frequently derail investors

Why the first-mover advantage is often a disadvantage in technology

Why excess funding often undermines innovation

The story of PayPal’s near-death experience and how it sparked its most critical innovations

How Roelof’s training as an actuary shaped his long-term thinking

How Sequoia maintains investment discipline through market cycles

Why they don’t use the word “deal” at Sequoia

How the US can maintain the lead in the AI race

The thinking behind the Sequoia Capital Fund and the firm’s organizational structure

And much more

What's "Market" for Startup Valuations Now?

X • PeterJ_Walker • April 28, 2025

Venture Capital

Key takeaway: Median valuations across funding stages for software (including AI) startups are at or near all-time highs, underscoring a robust market—though the biggest “mega” rounds that make headlines remain outliers.

Data shared by @PeterJ_Walker on April 28, 2025.

Seed round median: $15.2 million (the highest ever recorded)

Series A median: $48.9 million (near its all-time peak)

Series B median: $115 million

Series C median: $253.9 million

Series D median: $545 million

While outlier mega-rounds frequently dominate headlines, the median figures provide a more representative view of the current funding landscape. Early-stage startups are commanding valuations never seen before, and mid- to late-stage rounds continue to grow substantially.

The SPAC Is Back

Crunchbase • Joanna Glasner • April 30, 2025

Finance•Investment•SPACDeals•AutonomousTrucking•Biotech•Venture Capital

Going public via SPAC was a very 2021 thing to do.

During the peak of the last bull market, dozens of startups took this quick route to market, merging with publicly traded shell companies, or SPACs, in lieu of a traditional IPO.

Looking back, most of them didn’t work out so well, in areas from scooters to autonomous driving, genetic testing and vertical farming — the list goes on. It was enough to give SPACs a bad name.

Well, maybe not quite enough. Those who thought the SPAC chapter of market history was written and done haven’t been following recent developments. Over the past few weeks, a new crop of blank-check companies have announced plans to merge with target companies in areas like crypto, autonomous vehicles and nuclear power.

Meet the new SPACs

These aren’t small deals either.

In the venture-backed startup space, the highest profile deal features Kodiak Robotics, a provider of autonomous trucking technology. Two weeks ago, the Silicon Valley company announced plans to go public through a merger with a SPAC at a pre-money valuation around $2.5 billion.

Other noteworthy merger announcements in recent weeks include:

Cancer therapy developer Veraxa Biotech announced last week that it plans to carry out a merger with a biotech-focused SPAC at a pre-money equity valuation of $1.3 billion.

Twenty One Capital, a new venture co-owned by Tether and Bitfinex that is focused on accumulating Bitcoin, will merge with a blank-check acquirer at what it says will be a “pro-forma enterprise value of $3.6 billion.”

Two nuclear energy companies also announced SPAC deals. Terra Innovatum, a developer of micro-modular nuclear reactors, said last week that it plans a merger at a $475 million pre-money equity valuation. A few weeks earlier, Terrestrial Energy, a developer of nuclear plants using molten salt reactor technology, announced a deal at a $925 million pre-money equity value.

Plural Partner, Taavet Hinrikus: Why Founders Will Realise Multi-Stage Funds Damage Seed Rounds

Youtube • 20VC with Harry Stebbings • April 28, 2025

Business•Startups•VentureCapital•SeedFunding•FounderAdvice•Venture Capital

Overview of the Discussion

In this episode, Taavet Hinrikus, co-founder of Wise and partner at Plural, joins Harry Stebbings to examine how multi-stage funds are inadvertently undermining the health of seed rounds. Drawing on his experience as both a founder and investor, Hinrikus argues that the growing trend of large funds participating across multiple financing stages creates misaligned incentives, distorted valuations, and ultimately harms early-stage founders.

Why Multi-Stage Funds Enter Seed Rounds

• Relationship-Driven Entry: Hinrikus notes multi-stage investors often back seed deals primarily to secure allocation for later rounds, not because they have a deep conviction in the early-stage thesis.

• Valuation Pressure: These funds push for higher seed valuations to maximize mark-to-market gains, which can sabotage the company’s ability to raise subsequent rounds at realistic terms.

• Due Diligence Mismatch: Seed-stage diligence requires different expertise than Series B or C assessments; multi-stage firms may lack the network or processes to support nascent teams effectively.

Consequences for Founders and Seed Ecosystems

• Founder Dilution: With inflated seed valuations, follow-on rounds become more dilute, disappointing founders who expected smaller, incremental dilution.

• Market Dynamics: As more large funds crowd seed, specialized seed firms face reduced allocation, eroding their capacity to provide mentorship, network introductions, and hands-on support.

• Misaligned Incentives: Hinrikus highlights that seed funds aim for 10–20x returns on small bets; multi-stage funds often require 5x in order to justify larger follow-on cheques, shifting the growth pressure prematurely.

Key Quotes

• “When you bring in a fund that’s looking at the seed as just a pipeline, you end up inflating valuations without the ecosystem to back them up.”

• “True seed investors are aligned when the company stays small enough to learn its product–market fit; growth-stage investors are not incentivized to play that waiting game.”

• “Founders will wake up and realize that chasing a headline valuation at $5m or $10m pre-money can come back to bite them in the Series A.”

Best Practices and Founder Advice

• Stick with Specialized Seed Funds: Hinrikus recommends partnering with investors who focus exclusively on the seed stage, ensuring alignment on outcomes, timelines, and support structures.

• Negotiate Fair Valuations: Founders should benchmark valuations against market comparables and cap terms that prevent detrimental dilution in future rounds.

• Maintain Optionality: Retaining the ability to choose lead investors for Series A/B is critical; avoid take-it-or-leave-it offers from crossover funds that demand participation in later stages.

• Emphasize Value Beyond Capital: Seek partners who bring operational expertise, customer introductions, recruiting channels, and sector insights—areas where true seed specialists excel.

Implications for the Venture Capital Landscape

The rise of crossover participation in seed rounds may lead to a bifurcated market: one where professional seed funds double down on differentiation by offering value-add services, and another dominated by generalist players chasing deal flow. Hinrikus predicts that as founders become more savvy, they will steer clear of one-size-fits-all capital providers, restoring a healthier segmentation of fund stages and preserving the integrity of the seed ecosystem.

Conclusion

Taavet Hinrikus’s insights serve as a warning and guidepost: while multi-stage funds bring deep pockets, their involvement in seed financings can distort incentives and harm long-term company growth. Founders who partner with dedicated seed investors, negotiate realistic valuations, and prioritize strategic support over headline numbers will be best positioned to achieve sustainable success.

Rising Valuations, Flat Activity: The 2025 Early-Stage Paradox

X • PeterJ_Walker • April 30, 2025

Venture Capital

Source: Peter J. Walker/Twitter)

Key takeaway: Although seed and Series A valuations have rebounded to 2021 highs, the number of early-stage deals remains sharply lower—suggesting a market driven by concentrated capital rather than broad-based momentum.

Thread Overview

In a concise but data-rich Twitter thread, fintech analyst Peter J. Walker pushes back on the hype that “early stage is so back” by contrasting sky-high valuations with subdued deal volumes. His core argument: we’re seeing 2021 price tags on far fewer transactions, raising questions about market health and sustainability.

Key Points

VCs often compare today’s seed/Series A environment to the 2021 boom.

Median valuations for both stages have returned to—or even eclipsed—the peaks seen in 2021.

Deal activity, however, is significantly below 2021 levels, indicating fewer transactions overall.

The current dynamic: higher valuations concentrated in a smaller number of startups.

While this may reflect more disciplined capital allocation, it also highlights a bifurcated market where only select companies attract funding.

Visual Data

Why It Matters

By spotlighting the mismatch between valuation and volume, Walker urges founders and investors alike to rethink the narrative of a broad-based early-stage resurgence. Are we witnessing a healthier, selective market—or simply a narrower funding environment propped up by a handful of high-profile deals?

Benchmark Series A Rounds: 25–33% Became $5 B+ Outcomes

X • ColeRotman • April 29, 2025

Venture Capital

Key Takeaway: Between 2013 and 2018, Benchmark saw a remarkably high conversion rate at the Series A stage, with roughly one-quarter to one-third of its investments growing into $5 billion-plus companies.

Context & Insights

In a single tweet, Cole Rotman highlights Benchmark’s Series A track record over a six-year span. The private venture firm, known for its concentrated partner model and founder-friendly approach, demonstrated an unusually high “home-run” rate compared to industry norms. This success underscores the importance of:

Rigorous founder selection

Hands-on support at the earliest stages

Concentrated, partner-driven decision-making

While most VCs see a handful of their Series A bets become truly large exits, Benchmark’s consistency in delivering companies that reach $5 billion+ valuations speaks to its disciplined sourcing and post-investment engagement.

Visual Data

Why It Matters

Benchmark’s numbers offer a bench-mark (no pun intended) for early-stage investors. If you’re raising or investing at Series A, consider what processes, networks, and value-adds can tilt the odds toward building the next generation of tech giants.

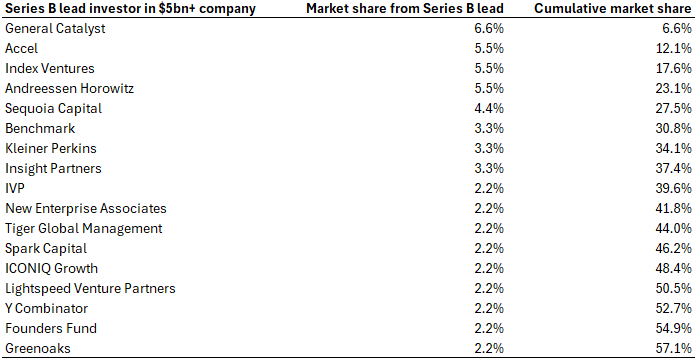

Top Series B lead investors

Signalrankupdate • Rob Hodgkinson • April 30, 2025

Business•Startups•SeriesB•LeadInvestors•VentureCapital•Venture Capital

DST Global’s Cole Rotman created this sheet to keep track of Series A leads in every $5bn+ venture-backed company (ex crypto, energy, bio & China).

The output from this work is this list (Figure 1) of the top Series A lead investors, ranked by number of lead investments in $5bn+ companies. He shows A16Z as 1, followed by Sequoia, Benchmark & Accel.

Figure 1. Top Series A lead investors in $5bn+ companies

Using the same list of $5bn+ companies as Rotman, this post conducts the same analysis for Series B lead investors, as well as considering earlier investors.

Figure 2 ranks Series B leads in $5bn+ companies (where an investor has led 2+ Series Bs in these companies).

With Crunchbase data, the number of lead investments in all Series Bs since 2012 is shown. This column is used to calculate a hit rate when each of these investors leads a Series B ($5bn+ Series B lead / all Series B lead).

General Catalyst is the 1 investor for leading Series B investments into $5bn+ companies. But Benchmark has an astonishing 19% hit rate when they lead any Series B (followed by Y Combinator at 13% and Greenoaks at 11%).

A16Z is the 1 investor in all Series Bs in $5bn+ companies, with 16 investments (including 5 where it led and 11 where it did not lead).

Figure 2. Series B lead investors in $5bn+ companies

We then reviewed the market share for each lead in $5bn+ companies, comparable to the analysis that Rotman conducted for Series A (Figure 3).

This demonstrates a fragmented market where no single investor has market power. You would have to be an LP across all top 14 funds to achieve 50%+ market share.

Figure 3. Market share for leading Series Bs in $5bn+ companies

In Rotman’s analysis, he also considered lead investments over time. Figure 4 shows similar analysis for Series B lead investors.

Figure 4. Lead Series B investments into $5bn+ companies by year

What Does it Take to Be Good at Series A and B Today?

Youtube • 20VC with Harry Stebbings • May 1, 2025

Business•Startups•SeriesA•SeriesB•VentureCapital•Venture Capital

Government Overreach

Congress Passes TAKE IT DOWN Act Despite Major Flaws

Eff • Jason Kelley • April 28, 2025

Politics•Legislation•Censorship•ContentModeration•DigitalRights•Government Overreach

Today the U.S. House of Representatives passed the TAKE IT DOWN Act, giving the powerful a dangerous new route to manipulate platforms into removing lawful speech that they simply don’t like. President Trump himself has said that he would use the law to censor his critics. The bill passed the Senate in February, and it now heads to the president’s desk.

The takedown provision in TAKE IT DOWN applies to a much broader category of content—potentially any images involving intimate or sexual content—than the narrower NCII definitions found elsewhere in the bill. The takedown provision also lacks critical safeguards against frivolous or bad-faith takedown requests. Services will rely on automated filters, which are infamously blunt tools. They frequently flag legal content, from fair-use commentary to news reporting. The law’s tight time frame requires that apps and websites remove speech within 48 hours, rarely enough time to verify whether the speech is actually illegal. As a result, online service providers, particularly smaller ones, will likely choose to avoid the onerous legal risk by simply depublishing the speech rather than even attempting to verify it.

Congress is using the wrong approach to helping people whose intimate images are shared without their consent. TAKE IT DOWN pressures platforms to actively monitor speech, including speech that is presently encrypted. The law thus presents a huge threat to security and privacy online. While the bill is meant to address a serious problem, good intentions alone are not enough to make good policy. Lawmakers should be strengthening and enforcing existing legal protections for victims, rather than inventing new takedown regimes that are ripe for abuse.

Chrome Is Worth $100B+ to Google

Spyglass • M.G. Siegler • April 30, 2025

Technology•Web•GoogleChrome•Valuation•Antitrust•Government Overreach

A lot of good/interesting points from John Gruber in this piece on the Google Chrome sell-off situation (and I swear I’m not just saying that because he riffs on my own earlier piece on the matter). In terms of valuing Chrome: