A reminder for new readers. That Was The Week includes a collection of my selected readings on critical issues in tech, startups, and venture capital. I selected the articles because they are of interest to me. The selections often include things I entirely disagree with. But they express common opinions, or they provoke me to think. The articles are snippets sized to convey why they are of interest. Click on the headline, contents link, or the ‘More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below.

Hat Tip to this week’s creators: @PeterJ_Walker, @mgsiegler, @jglasner, @lennysan, @AndreRetterath, @alex, @pmarca, @nklsrh, @dmehro, @timmarchman, @adamclarkestes, @Kyle_L_Wiggers, @MTemki

Contents

The true story -- as best I can remember -- of the origin of Mosaic and Netscape.

X of the Week

Editorial

It’s Sunday, two days later than I usually send this out. Two excuses. I was in recovery from PTSD after the “debate.” And then I almost had a relapse watching England in the Euro last 16 game against Slovakia.

I’m unsure of my mental state now (we won 2-1 in extra time). But the other, more important “game” is still undecided.

But in AI, it seems everybody is getting PTSD from wild allegations that AI might kill the human race to now new suggestions that there may be a bubble in valuations for early-stage companies.

The items in this week’s newsletter are really good. MG Seigler, Alex Wilhelm and Peter Walker dominate. The first two are former TechCrunch writers (hats off to Mike Arrington for his talent-spotting). Peter is the leading contributor to VC data; he has access to Carta data and uses it super effectively.

MG and Alex have relatively new newsletter sites - SpyGlass and Cautious Optimism, respectively). They are great observers and even better writers - subscribe. Links in their articles are below.

Big tech seems to be running scared of AI regulation. This from MG Seigler’s : No MacBook Air Killer, All MacBook Air Filler

Microsoft really shit the bed here both from a security and PR perspective. And what's left sounds very 'meh'. It's almost like Microsoft forget the 'Copilot' part of 'Copilot+ PCs'. And certainly they forgot the '+' part.

MG also wrote about the EU and Apple, claiming that the EU is seeking to entrap Apple by refusing to state what Apple can and cannot do with its AI intentions. Apple, in response, is saying it will not launch AI in Europe until the EU says what product flexibility it has.

You have to smile. Apple plays this game super well.

Finally, he has ‘Behold the Hackquisition’, which shows how big tech avoids M&A blocks by buying teams instead of companies.

Alex Wilhelm’s anticipation of the Circle (USDC) IPO is a great example of his regular style and substance.

Peter Walker heads up data storytelling at Carta (great title). This week, he also has three pieces, all originally posted on his LinkedIn profile.

‘Is there an AI bubble’ (my title) examines the spread of Series A venture funding valuations. He separates the percentiles and measures the spread between them, noting that the gap between the 50th percentile and the 95th is the widest ever - even wider than 2021 and 2022. This is for SaaS rounds that include much AI.

In H1 2019, the 50th percentile for pre-money valuations was $26M (Series A SaaS companies only, primary rounds). The 95th pct at that time was $96M.

Now that's a pretty large gap. We're talking a 3.7x jump from the middle to the top end.

But today things are even more skewed.

𝗦𝗲𝗿𝗶𝗲𝘀 𝗔 𝗦𝗮𝗮𝘀 𝗩𝗮𝗹𝘂𝗮𝘁𝗶𝗼𝗻𝘀 𝗶𝗻 𝗛𝟭 𝟮𝟬𝟮𝟰

• 50th pct: $44M

• 95th pct: $203M

• Gap: ~4.6x

That 4.6x gap is the largest of the past 5 years and likely the past 10, though I don't have full data to prove it.

Regular readers will know my point of view. Yes, there is a bubble in that smart money wants to be in the best AI companies and will compete on price to secure equity. And no, there is no bubble because this chase for future-winning companies is entirely rational. At a time when the entire planet is about to become AI users - even without being aware of it - enormous value will be created. The price of current participation is far below the actual value that will ultimately be created.

Essays of the Week

Is there an AI Bubble?

We all left wild overvaluations in 2021 where they belong...right?

Maybe not.

There's a strange dichotomy happening right now in startups, exemplified by the Series A data we pulled below. On the one hand, fundraising difficulty has shot upwards in recent quarters, limiting the total number of rounds raised.

On the other hand, we are inundated with headlines of (mostly AI) companies raising at truly boom-times valuations.

I think the graphic does a great job of illustrating our current confusing moment.

In H1 2019, the 50th percentile for pre-money valuations was $26M (Series A SaaS companies only, primary rounds). The 95th pct at that time was $96M.

Now that's a pretty large gap. We're talking a 3.7x jump from the middle to the top end.

But today things are even more skewed.

𝗦𝗲𝗿𝗶𝗲𝘀 𝗔 𝗦𝗮𝗮𝘀 𝗩𝗮𝗹𝘂𝗮𝘁𝗶𝗼𝗻𝘀 𝗶𝗻 𝗛𝟭 𝟮𝟬𝟮𝟰

• 50th pct: $44M

• 95th pct: $203M

• Gap: ~4.6x

That 4.6x gap is the largest of the past 5 years and likely the past 10, though I don't have full data to prove it.

Now perhaps the 95th percentile Series A company today is vastly different from their counterpart in 2021 or 2022. Maybe they have a much firmer financial foundation. Perhaps they're even peeking around a corner at profitability. Certainly they're likely to have AI in their name or domain.

But I can't help but feel like we might have exchanged one bubble for another.

Here's hoping the Series A outliers of today fare better!

Robotics Startups On The Rise In 2024

June 27, 2024

So far, 2024 is shaping up as a not-so-shabby year for robotics startup funding.

Developers of workplace robots, robotic surgery technologies, and even humanoid models have all raised large rounds in the past six months. The artificial intelligence funding boom has also helped boost the space, with investors backing big deals at the intersection of AI and robotics.

Altogether, robotics startups have pulled in over $4.2 billion in seed through growth-stage financing this year, per Crunchbase data. That puts funding on track to exceed last year’s muted levels, albeit still below its cyclical peak, as illustrated below.

Workplace robots

Where’s the money going? Per Crunchbase data, workplace robotics still accounts for the largest number of rounds, with startups looking to offset the need for human labor for tasks like delivering meals, pulling weeds and moving stuff in warehouses.

Among the largest recipients in this vein is San Francisco-based Bright Machines, a developer of software and robotics technology for factory manufacturing. The company raised $106 million in Series C funding, plus $20 million in debt, in a BlackRock-led financing announced Tuesday.

Another big round went to Silicon Valley-based Collaborative Robotics, which landed a $100 million General Catalyst-led Series B this spring. Its business model centers on building “cobots” or robots that can work alongside humans doing tasks like carrying boxes and moving industrial carts.

On the agtech front, Seattle-based Carbon Robotics has harvested a total of $85 million to date, with its latest funding raised in a May Series C. Its primary offering is an AI-enabled weeding robot that provides farmers a less labor-intensive way to reduce reliance on herbicides.

Redwood City, California-based Bear Robotics, meanwhile, snagged $60 million in an LG Electronics-led financing in March. The company makes a mobile robot capable of carrying trays or packages, which it markets to customers in hospitality, assisted living, warehouse operations and other industries.

Here come the humanoids

We’re also seeing large investments in startups developing humanoid robots — a staple of science fiction that has yet to penetrate everyday reality.

Sunnyvale, California-based Figure, which describes itself as an “AI robotics company bringing a general purpose humanoid to life,” was the biggest draw here, snapping up $675 million in a February Series B. It drew heavy interest from corporate investors, with Nvidia, Microsoft and Amazon among its backers.

1X, a startup with dual headquarters in Norway and Silicon Valley, picked up $98 million in January to further development of its initial humanoid models. This includes NEO, whose human-like body is engineered with muscle-like anatomy, and EVE, a robot which resembles a human but with wheels instead of feet.

Per 1X, the humanoid robot represents the most logical form factor for integrating advanced processing and AI more deeply into the physical world. A research note on its website postulates that: “At its core, our world is designed by and for humans, which makes the human form the most effective means of interfacing with it.”

By and large, it’s still early days envisioning what these AI-powered humanoids might actually accomplish. The startup envisions them making contributions in industries including agriculture, construction and healthcare, with a particular focus on taking on dangerous and repetitive jobs.

Surgical robotics

Surgical robotics has also been a major area for robot-related startup investment over the years, and 2024 is no exception.

The biggest round went to MMI, a developer of technology for robotic-assisted microsurgical procedures that raised $110 million in a February Series C led by Fidelity. The company says its technology lets surgeons replicate movements of the human hand at the micro scale and can expand treatment options for patients needing soft tissue, open surgical procedures.

Most recently, Shanghai-based Ronovo Surgical raised $44 million in a Series B financing announced this month. The company develops a robotic-assisted system for laparoscopic surgeries.

..More

Behold: the Hackquisition

An acquisition by any other name...

Stop me if you've heard this one before. A multi-trillion dollar Seattle-based tech company is hiring the team behind a highly capitalized AI startup whose founding team has a strong pedigree in the space. This is not an acquisition. I repeat – well, they repeat – this is not an acquisition. There is a team being left behind at the old company to focus on continuing down a certain path... And well, probably the brand new and undoubtedly insanely highly priced licensing deal from the big tech company that just poached their executives.

No, this is not about Microsoft acquiring hiring Inflection. This week, it's about Amazon acquiring hiring Adept. Here's Taylor Soper:

Amazon is amping up its AI efforts by hiring executives from Adept, a San Francisco-based startup building “agents” that automate enterprise workflows.

Adept co-founder and CEO David Luan, the former vice president of engineering at OpenAI, will join Amazon. Adept co-founders Augustus Odena, Maxwell Nye, Erich Elsen, and Kelsey Szot will also move to Amazon, along with a few other employees.

Adept will continue operating as an independent company with its remaining workforce. Amazon will use some of Adept’s technology as part of a non-exclusive license.

Two is a trend. We now clearly need a name for such shenanigans. It's not exactly an acqui-hire, because the "acqui" part has been very specifically avoided here as it would raise regulatory red flags. Might I suggest: a hackquisition? As in, a hacked acquisition. We can quibble on the details, but in a different time, with a different regulatory environment, this clearly would have been an actual acquisition made by Amazon, be it for talent, tech, or both.1

Yes, if you squint, you can see the official narrative here. From Adept's blog post:

Continuing with Adept’s initial plan of building both useful general intelligence and an enterprise agent product would’ve required spending significant attention on fundraising for our foundation models, rather than bringing to life our agent vision. Therefore, to focus on maintaining the strong momentum and potential of our agent tech stack, we are announcing some updates to our strategy and the company.

Adept will now focus entirely on solutions that enable agentic AI, which will continue to be powered by a combination of our existing state-of-the-art in-house models, agentic data, web interaction software, and custom infrastructure. We look forward to continuing towards this vision and working with partners to bring agentic capabilities to their products and tools.

In addition, the Adept co-founders and some of the team are joining Amazon’s AGI organization to continue to pursue the mission of building useful general intelligence. Amazon is also licensing Adept’s agent technology, family of state-of-the-art multimodal models, and a few datasets.

And if you have a big enough wallet, as Amazon clearly does, you can buy that story – quite literally! In English, what Adept is saying is that while they started out trying to create AGI, the realities of both business and life require that businesses have an actual business model at some point. And Adept thinks they have a path there with their "agents". So the founders along with an untold number from the team are going off to Amazon to work on AGI while some other employees remain behind to build out Adept's "agentic" business. Again, the same basic narrative as Microsoft/Inflection.

This one is packaged a little better since they don't need to bring in an outside person to be the new CEO of Adept, and instead it will be the former Head of Engineering. The Head of Product is also remaining. What's not stated, but will be dug up in the coming days, is if any of these "licensing" fees are going back to the cap table. Or if any of the massive amount of cash the company raised previously is being returned. Or if there's some sort of deal where Amazon will pay out investors in Adept over time (presumably via the licensing model). Adept is now a very different company than the one investors put hundred of millions of dollars into, so presumably they would and do value it differently now. It's a different team at the top going after a subset of their former vision.

The Entrapment of Apple 📧

The EU would like Apple to roll out their products, just not their version of their products

With all the talk about how the EU believes Apple is anticompetitive, it never occurred to me to read it more literally. By announcing the would not be shipping their 'Apple Intelligence' tools in the EU, Apple is choosing to not compete in AI in the region. That isanticompetitive. I guess?

Margrethe Vestager was asked about Apple's maneuver at an event:

Apple’s move to roll back its AI plans in Europe is the most “stunning, open declaration that they know 100% that this is another way of disabling competition where they have a stronghold already,” Vestager, the Commission’s vice president for a Europe fit for the digital age and Commissioner for Competition, told a Forum Europa event.

The “short version of the DMA [Digital Markets Act]” is that to operate in Europe, companies have to be open for competition, said Vestager.

I know she's nearing the end of her tenure, but it's perhaps worth asking now if Vestager knows what competition is. Or how it works? Apple's move is a risky one simply because their customer base in Europe could choose to switch to a competing product that offers AI functionality. But Vestager seems to believe that the customer base will stick with Apple, no matter what, and AI will suffer as a result. I mean, maybe? But I'm not sure how it's a regulator's job to force a company to roll out features to ensure they compete with rivals. Feels weird.

But that seems to be just what the EU thinks it can do with the DMA. And the reality is that they might be able to do anything they want with the DMA because they wrote it. And they wrote it vaguely, perhaps for things like this.

But if Apple rolls out 'Apple Intelligence' in the EU they will almost certainly get at least the threat of a fine under the DMA. So this is sort of entrapment?

The reality, of course, is that the EU wants the cake and to eat it too. They want Apple to roll out all of their features to their region, but only in the way the EU sees fit. Undoubtedly that would mean an 'Apple Intelligence' that was open to all. Both in terms of integrations beyond ChatGPT – like, say, a nice French AI startup – but also perhaps an 'Apple Intelligence' that would also work on other devices not made by Apple. Why would Apple do that?

For its part, Apple must know what pressure such an "anticompetitive" (EU definition) move would put on the regulating body. And Vestager's comments seems to be a clear indication of that. You can't just not ship a feature, Apple. That's not only anticompetitive, it's antisocial!

This all continues to creep closer to the once unthinkable: that Apple pulls out of the EU entirely.

..More

The social radar: Y Combinator’s secret weapon | Jessica Livingston (co-founder of Y Combinator, author, podcast host)

JUN 27, 2024

Jessica Livingston is a co-founder of Y Combinator, the first and most successful startup accelerator. Y Combinator has funded over 5,000 companies, 200 of which are now unicorns, including Airbnb, Dropbox, DoorDash, Stripe, Coinbase, and Reddit. Jessica played a crucial role in YC’s early success, when she was nicknamed the “social radar” because of her uncanny ability to quickly evaluate people—an essential skill when investing in early-stage startups. She’s also the host of the popular podcast The Social Radars, where she interviews billion-dollar-startup founders, and the author of the acclaimed book Founders at Work, which captures the origin stories of some of today’s most interesting companies. In our conversation, we discuss:

How Jessica gained the affectionate title of the “social radar”

Why defensive founders are a red flag

How to develop your social radar

What she looks for in founders during YC interviews

How YC’s early inexperience in angel investing led to the batch model

Her favorite stories from interviews with Airbnb, Rippling, and more

Lessons learned from hosting her own podcast

Much more

Some takeaways:

When evaluating early-stage investments, you need to assess the founders and their social dynamics, not just the idea. Jessica’s ability to read people in the early days of YC was a crucial element in the accelerator’s success. One reason founders and social dynamics matter is because early-stage ideas are bound to change many times, but the people will remain the same.

During short YC interviews, Jessica focused on assessing the founders while her technical co-founders evaluated the product. As the “social radar,” she looks for:

How co-founders interact: Pay close attention to interpersonal dynamics during interviews. Green flags include signs of mutual respect and collaboration. Red flags include one founder dominating conversations or preventing their co-founder from speaking.

Domain expertise: Look for founders who are solving a problem they deeply understand and are passionate about.

Earnestness and authenticity: Earnestness shows up in practice through humility, honesty, and transparency—admitting when you don’t know something, and not trying to reframe or avoid tough questions.

Attitude toward feedback: Founders who are defensive or closed off during discussions may indicate challenges with receiving feedback or collaboration. Look for openness and adaptability in how founders respond to questions and challenges.

Commitment and passion: Founders who convey genuine passion and energy for their ideas can often sway investors, even if the initial concept is met with skepticism. Assess if founders are genuinely passionate about their idea and willing to commit fully (e.g. quitting their job, relocating). Having that “desperation” of needing the startup to succeed because you don’t have a plan B is important for driving commitment.

Relentless resourcefulness: The ability to find creative solutions and make things happen even with limited resources or knowledge. This determination and scrappiness is crucial.

Defensiveness is a big red flag in founders. Startups are usually doing something new, which often leads to lots of questions from other people, like “Why is your product better?” Good founders respond to these questions with open-mindedness and they educate people. Defensive founders will not educate people and their attempts will backfire.

YC’s lack of experience in investing actually led them to discover their signature “batch” model. None of the founders had prior experience as angel investors, so they decided to invest in a whole group of startups at once during the summer, with the goal of learning how to invest. The lesson here is to not be afraid of your own inexperience. Embrace it as an opportunity to try new things and discover better ways of doing things. Be willing to experiment, learn, and iterate based on what works. You can make important discoveries by approaching things with fresh eyes.

Watch out for signals that a company has a “hacker in a cage.” This is when a business founder has clearly convinced someone technical to join the team, only to give them very little equity and very little say in the direction of the product. Technical team members need to have a voice in companies involving tech.

..More

Can We Fully Automate Startup Investing?

How Different Firm Types Require Different Models Across Quant, Augmented & Traditional

ANDRE RETTERATH, JUN 27, 2024

Will Quant Investors Rule the World?

One of the most surprising insights from the Data-Driven VC Landscape 2024 for me is that every tenth survey respondent already believes that Quant VC will be the dominating model in the future of startup investing.

In light of the fact that only 191 firms, or 1-2% of the overall VC industry launched dedicated internal initiatives, it’s interesting to see such a high relative share of insiders already part of the purist algo-only camp. To shed more light on this disruptive approach, I had the founder of Quant VC “Koble” share a deep dive on their model here.

Together with “Traditional VC” and “Augmented VC”, “Quant VC” forms the trio of fundamentally different approaches to startup investing. I wrote about them for the first time early 2023 here. A recap of my “definitions” below:

Handcraft / Traditional VC: A shrinking group of senior, gray-hair industry veterans, characterized by a strong belief that VC is more art than science and that the best deals will always be sourced through their proprietary personal networks. Moreover, they are rarely aware of their biases (recency, similarity, confirmation, over-simplification, etc.) when making decisions and tend to overestimate their position based on their firm and personal brands as well as their (oftentimes impressive) investment track records.

Augmented VC: Combining the best of both worlds, where machines collect, process and contextualize vast amounts of data to achieve comprehensive coverage and give direction, and where human investors focus on a select number of founders to build deep relationships and assess the soft factors based on their intuition. While data provides coverage and guidance, the human makes the final decision.

Quant VC: A new species of purebred algorithmic VCs who believe that startup investment decisions should not involve humans at all, just like in pure-play quant public funds. Just algos, no humans. Fast, clean and repeatable. These investors believe that human involvement skews the models and reduces the likelihood to generate alpha.

Since then, a lot has happened and I’d like to share an updated and more nuanced view on the different approaches and their relevance for The Future of VC below.

No Room for Traditional VCs?

While my definitions for Augmented VC and Quant VC have not really changed, conversations with our DDVC community led me to rethink my perspective on the definition for Traditional/Handcraft VC.

Previously, it had a negative connotation. I even believed that the handcraft model wouldn’t survive and won’t be part of The Future of VC at all as it is structurally disadvantaged compared to data-driven models.

Fast forward to today, I have a more nuanced view. Why? Let me cluster VC types based on two dimensions: Fund size and Target Stage.

Let’s look at firm characteristics across the five major clusters of Micro/Solo GP, Early, Boutique, Multi stage, and Growth, and what this means for the respective approaches across Traditional/Augmented/Quant VC.

The 2024 IPO I’m Most Excited About

ALEX WILHELM, JUN 26, 2024, Cautious Optimism

Circle, the company behind the USDC stablecoin, filed privately to go public earlier this year. More recently, it began working to shift its corporate home to the United States.

Circle’s upcoming debut is the IPO I am most excited about this year, thanks to the clarity it will bring to a massive, growing industry (stablecoins), the questions it will answer when it prices (what are its comps?), and what it will teach us about contra-inflation industries more generally.

Backing up, Circle nearly went public via a SPAC back in 2021. I wrote in favor of the transaction at the time, noting that if rates went up, Circle’s business could prosper:

[R]ecall that stablecoins are pegged to an external currency and are backed by the same. So, if lots of folks buy USDC from Circle, it will sit on a mountain of reserved cash. It can generate interest on those sums. Those revenues would likely expand as interest rates [rise]. So, if you are bullish on central-bank tightening in the United States, you may be bullish on Circle’s USDC reserve-related incomes.

I am hardly an oracle, but the point has been born out. Rates have risen, boosting the value of held cash and equivalents greatly. So, since Circle first considered a SPAC — after it repriced that deal to raise its valuation, and in the wake of its eventually scuppered SPAC — we’re on the cusp of getting our hands deep into not only Circle’s own business, operations, risks, and results, but also data concerning how quickly changing central economic policy can lift a company’s financial performance.

Subscribed

On the comps question, I wonder. Every company wants its public-market comps to be richly valued—or at least as richly valued as possible in today’s conservative public market for software companies. What would you comp Circle against? The company will likely covet a software-styled revenue multiple, and it has some claim to such. It is, after all, a technology company that works at the intersection of traditional and distributed finance.

It’s also a massive pile of cash that generates yield, I suspect. I don't think anyone knows how much of Circle’s business will not come from interest-related incomes, but I wouldn’t wager that it’s much in percentage terms. So Circle is a bank of sorts, which means it could be staring down the barrel of a 2-3x revenue multiple. Unless it can prove that it has oodles of growth ahead of it.

Let’s go to the tape, starting with the total number of USDC stablecoins in the market:

As each USDC token is pegged to the dollar, the above chart tells us the number of stablecoins Circle has in the market. It’s gone up lately, from around $24 billion at the nadir of its recent trough to around $32 billion more recently. More tokens, more reserves, more income.

Video of the Week

AI of the Week

I Will Fucking Piledrive You If You Mention AI Again

Published on June 19, 2024

The recent innovations in the AI space, most notably those such as GPT-4, obviously have far-reaching implications for society, ranging from the utopian eliminating of drudgery, to the dystopian damage to the livelihood of artists in a capitalist society, to existential threats to humanity itself.

I myself have formal training as a data scientist, going so far as to dominate a competitive machine learning event at one of Australia's top universities and writing a Master's thesis where I wrote all my own libraries from scratch in MATLAB. I'm not God's gift to the field, but I am clearly better than most of my competition - that is, practitioners like myself who haven't put in the reps to build their own C libraries in a cave with scraps, but can read textbooks, implement known solutions in high-level languages, and use libraries written by elite institutions.

So it is with great regret that I announce that the next person to talk about rolling out AI is going to receive a complimentary chiropractic adjustment in the style of Dr. Bourne, i.e, I am going to fucking break your neck. I am truly, deeply, sorry.

I. But We Will Realize Untold Efficiencies With Machine L-

What the fuck did I just say?

I started working as a data scientist in 2019, and by 2021 I had realized that while the field was large, it was also largely fraudulent. Most of the leaders that I was working with clearly had not gotten as far as reading about it for thirty minutes despite insisting that things like, I dunno, the next five years of a ten thousand person non-tech organization should be entirely AI focused. The number of companies launching AI initiatives far outstripped the number of actual use cases. Most of the market was simply grifters and incompetents (sometimes both!) leveraging the hype to inflate their headcount so they could get promoted, or be seen as thought leaders1.

The money was phenomenal, but I nonetheless fled for the safer waters of data and software engineering. You see, while hype is nice, it's only nice in small bursts for practitioners. We have a few key things that a grifter does not have, such as job stability, genuine friendships, and souls. What we do not have is the ability to trivially switch fields the moment the gold rush is over, due to the sad fact that we actually need to study things and build experience. Grifters, on the other hand, wield the omnitool that they self-aggrandizingly call 'politics'2. That is to say, it turns out that the core competency of smiling and promising people things that you can't actually deliver is highly transferable.

I left the field, as did most of my smarter friends, and my salary continued to rise a reasonable rate and sustainably as I learned the wisdom of our ancient forebearers. You can hear it too, on freezing nights under the pale moon, when the fire burns low and the trees loom like hands of sinister ghosts all around you - when the wind cuts through the howling of what you hope is a wolf and hair stands on end, you can strain your ears and barely make out:

"Just Use Postgres, You Nerd. You Dweeb."

The data science jobs began to evaporate, and the hype cycle moved on from all those AI initiatives which failed to make any progress, and started to inch towards data engineering. This was a signal that I had both predicted correctly and that it would be time to move on soon. At least, I thought, all that AI stuff was finally done, and we might move on to actually getting something accomplished.

And then some absolute son of a bitch created ChatGPT, and now look at us. Look at us, resplendent in our pauper's robes, stitched from corpulent greed and breathless credulity, spending half of the planet's engineering efforts to add chatbot support to every application under the sun when half of the industry hasn't worked out how to test database backups regularly. This is why I have to visit untold violence upon the next moron to propose that AI is the future of the business - not because this is impossible in principle, but because they are now indistinguishable from a hundred million willful fucking idiots.

..More

Perplexity Is a Bullshit Machine

BY DHRUV MEHROTRA AND TIM MARCHMAN

A WIRED investigation shows that the AI-powered search startup Forbes has accused of stealing its content is surreptitiously scraping—and making things up out of thin air.

Considering Perplexity’s bold ambition and the investment it’s taken from Jeff Bezos’ family fund, Nvidia, and famed investor Balaji Srinivasan, among others, it’s surprisingly unclear what the AI search startup actually is.

Earlier this year, speaking to WIRED, Aravind Srinivas, Perplexity’s CEO, described his product—a chatbot that gives natural-language answers to prompts and can, the company says, access the internet in real time—as an “answer engine.” A few weeks later, shortly before a funding round valuing the company at a billion dollars was announced, he told Forbes, “It’s almost like Wikipedia and ChatGPT had a kid.” More recently, after Forbes accused Perplexity of plagiarizing its content, Srinivas told the AP it was a mere “aggregator of information.”

The Perplexity chatbot itself is more specific. Prompted to describe what Perplexity is, it provides text that reads, “Perplexity AI is an AI-powered search engine that combines features of traditional search engines and chatbots. It provides concise, real-time answers to user queries by pulling information from recent articles and indexing the web daily.”

A WIRED analysis and one carried out by developer Robb Knight suggest that Perplexity is able to achieve this partly through apparently ignoring a widely accepted web standard known as the Robots Exclusion Protocol to surreptitiously scrape areas of websites that operators do not want accessed by bots, despite claiming that it won’t. WIRED observed a machine tied to Perplexity—more specifically, one on an Amazon server and almost certainly operated by Perplexity—doing this on WIRED.com and across other Condé Nast publications.

The WIRED analysis also demonstrates that, despite claims that Perplexity’s tools provide “instant, reliable answers to any question with complete sources and citations included,” doing away with the need to “click on different links,” its chatbot, which is capable of accurately summarizing journalistic work with appropriate credit, is also prone to bullshitting, in the technical sense of the word.

WIRED provided the Perplexity chatbot with the headlines of dozens of articles published on our website this year, as well as prompts about the subjects of WIRED reporting. The results showed the chatbot at times closely paraphrasing WIRED stories, and at times summarizing stories inaccurately and with minimal attribution. In one case, the text it generated falsely claimed that WIRED had reported that a specific police officer in California had committed a crime. (The AP similarly identified an instance of the chatbot attributing fake quotes to real people.) Despite its apparent access to original WIRED reporting and its site hosting original WIRED art, though, none of the IP addresses publicly listed by the company left any identifiable trace in our server logs, raising the question of how exactly Perplexity’s system works.

Until earlier this week, Perplexity published in its documentation a link to a list of the IP addresses its crawlers use—an apparent effort to be transparent. However, in some cases, as both WIRED and Knight were able to demonstrate, it appears to be accessing and scraping websites from which coders have attempted to block its crawler, called Perplexity Bot, using at least one unpublicized IP address. The company has since removed references to its public IP pool from its documentation.

..More

What, if anything, is AI search good for?

Humans are still better than robots at finding correct answers online. Good.

Jun 29, 2024, 6:00 AM PDT

There’s some common sense that AI doesn’t have, like knowing whether or not it’s okay to eat rocks and glue.

There’s some common sense that AI doesn’t have, like knowing whether or not it’s okay to eat rocks and glue. sjharmon/Getty Images

Adam Clark Estes is a senior technology correspondent at Vox. He’s spent 15 years covering the intersection of technology, culture, and politics at places like Gizmodo, Vice, and the Atlantic.

It has been a month since Google’s spectacular goof. Its new AI Overviews feature was supposed to “take the legwork out of searching,” offering up easy-to-read answers to our queries based on multiple search results. Instead, it told people to eat rocks and to glue cheese on pizza. You could ask Google what country in Africa starts with the letter “K”, and Google would say none of them. In fact, you can still get these wrong answers because AI search is a disaster.

This spring looked like a turning point for AI search, thanks to a couple of big announcements from major players in the space. One was that Google AI Overview update, and the other came from Perplexity, an AI search startup that’s already been labeled as a worthy alternative to Google. At the end of May, Perplexity launched a new feature called Pages that can create custom web pages full of information on one specific topic, like a smart friend who does your homework for you. Then Perplexity got caught plagiarizing. For AI search to work well, it seems, it has to cheat a little.

There’s a lot of ill will over AI search’s mistakes and missteps and critics are mobilizing en masse. A group of online publishers and creators took to Capitol Hill on Wednesday to lobby lawmakers to look into Google’s AI Overviews feature and other AI tech that pulls content from independent creators. This is just a couple days after the Recording Industry Association of America (RIAA) and a group of major record labels sued two AI companies that generate music from text for copyright infringement. And let’s not forget that several newspapers, including the New York Times, have sued OpenAI and Microsoft for copyright infringement for scraping their content in order to train the same AI models that power their search tools. (Vox Media, the company that owns this publication, meanwhile, has a licensing deal with OpenAI that allows our content to be used to train its models and by ChatGPT. Our journalism and editorial decisions remain independent.)

Generative AI technology is supposed to transform the way we search the web. At least, that’s the line we’ve been fed since ChatGPT exploded on the scene near the end of 2022, and now every tech giant is pushing its own brand of AI technology: Microsoft has Copilot, Google has Gemini, Apple has Apple Intelligence, and so forth. While these tools can do more than help you find things online, dethroning Google Search still seems to be the holy grail of AI. Even OpenAI, maker of ChatGPT, is reportedly building a search engine to compete directly with Google.

..More

Andrew Ng plans to raise $120M for next AI Fund

10:48 AM PDT • June 27, 2024

AI big shot Andrew Ng’s AI Fund, a startup incubator that backs small teams of experts looking to solve key problems using AI, plans to raise upward of $120 million for its second effort.

A filing with the SEC shows that the AI Fund’s second fund, AI Venture Fund II, has so far amassed $69.75 million from 13 partners — leaving around $50 million to be invested. The AI Fund’s PR declined to comment.

Ng, the founder of the Google Brain deep learning project, co-founder of Coursera, and recent Amazon board appointee, was one of the most recognizable names in the AI community when he became Baidu’s chief scientist in 2014. He left Baidu in 2017 to jumpstart a number of AI ventures, including the DeepLearning.ai course and Landing AI, a startup developing AI tools targeting manufacturing companies.

Ng launched the AI Fund in 2018 with $175 million, serving as the incubator’s GP and leading its direction. (On the aforementioned SEC filing, he’s named as the “managing member of the general partner” for AI Venture Fund II.) The idea was to provide funding at the seed and Series A stages of a company’s life cycle, allowing teams to work in relative stealth until they were ready — and connecting them with Ng’s extensive professional network.

Greylock Partners, New Enterprise Associates, Sequoia Capital and SoftBank Group were among the AI Fund’s initial backers. Crunchbase lists 38 portfolio companies, including AI observability platform WhyLabs, Ng’s own Landing AI, and AI app-building tool Baseten.

At $120 million, AI Venture Fund II would be considerably smaller than the first AI Fund vehicle. Still, it’s more than double what Ng reportedly originally hoped to raise — $50 million — for the AI Fund’s follow-up.

..More

No MacBook Air Killer, All MacBook Air Filler

Microsoft's Surface Laptops also may have an AI problem...

Tom Warren really likes Microsoft's new Surface Laptop. But he's also a Windows guy. Reading this as someone who hasn't regularly used Windows in 20 years,1 my takeaway is different. Basically, it sounds like Microsoft has (finally) done a good job creating an answer to Apple's MacBook Air – 16 years after the launch of the first Air, but to be more fair, just about four years since the first MacBooks running Apple Silicon, which truly moved the ball forward for laptops – but these Surfaces don't actually move the ball forward for laptops in any meaningful way. Nor is it going to entice any MacBook users to switch. It's just a great update if you were already a Windows user with a Surface Laptop previously.

Even then, it still feels a bit goalpost-shifty to compare the Surface Laptop, which has a fan, to the MacBook Air, which does not. That fan allows Microsoft to run their CPU, in this case, the new Qualcomm Snapdragon X Elite, hotter and thus, faster. Apple also offers a laptop with a fan, it's called a MacBook Pro. It's not the comparison Microsoft or Qualcomm wish to make here, and I guess that's fine since it's the Air which is the best-selling laptop and in the price-range of these machines from Microsoft. But it's just not exactly apples-to-Apple.2

Fan aside – and to be clear, Warren notes that it only really kicked on while he was doing his benchmark tests, but it wasn't noticeable during regular usage; also true with a MacBook Pro, btw – the benchmarks indicate a machine that is somewhat faster than the MacBook Air. But really only when it comes to multi-core performance. So for, say, browsing the web, this simply won't matter and the MacBook Air will still likely be faster.

Also, it sounds like the emulator, a feature which Microsoft has been touting to no end, still mostly sucks. And this matters not only for performance but for the element of the device most highly-touted: battery life. It sounds like Microsoft has finally gotten battery life on the Surface Laptop to a good place, if you're using apps optimized for ARM64, which isn't a huge number right now. That will change with time, of course, but again, this is stuff that Microsoft touted as being solved.

But the real lump of coal:

For all the improvements in battery life and performance, the Surface Laptop is also a Copilot Plus PC with a neural processing unit (NPU) for new built-in AI features in Windows. Microsoft has made a big deal about these, with Recall supposed to be the flagship feature on these new laptops. Recall has been delayed due to security concerns, and it’s a delay that has overshadowed the entire launch of Copilot Plus PCs. It’s why you’re only reading this review now and not on launch day last week.

What’s left of the AI-powered Windows 11 features aren’t nearly as controversial as Recall, but they’re also not that compelling. Cocreator lets you create images in Paint through a text prompt and by drawing what you want to see. Because the Surface Laptop 7th Edition no longer supports the Surface Slim Pen, this feature feels a lot less useful than it is on the new Surface Pro.

Microsoft really shit the bed here both from a security and PR perspective. And what's left sounds very 'meh'. It's almost like Microsoft forget the 'Copilot' part of 'Copilot+ PCs'. And certainly they forgot the '+' part.

..More

Hebbia raises nearly $100M Series B for AI-powered document search led by Andreessen Horowitz

1:20 PM PDT • June 27, 2024

Hebbia, a startup using generative AI to search large documents and return answers, has raised a nearly $100 million Series B led by Andreessen Horowitz, according to three people with knowledge of the matter.

The round valued the company between $700 million and $800 million, although TechCrunch couldn’t verify whether that valuation is pre- or post-money. (One possible scenario is $700 million pre/$800 million post.) Hebbia disclosed in an SEC filing in May that it had by then raised $93 million out of a hoped-for $100 million, but we understand from two of the people that the round hit a near $100 million mark and has closed.

Hebbia and Andreessen Horowitz didn’t respond to a request for comment.

Hebbia was founded in 2020 by George Sivulka, who launched the company while working on his PhD in electrical engineering at Stanford. Sivulka was inspired by his friends working in the financial industry who told him that part of their long work weeks was spent searching for information in SEC filings and other dense documents. Sivulka thought that AI could help them save hours at the office and give them more time for rest and sleep.

Hebbia’s AI can look over billions of documents at once, including PDFs, PowerPoints, spreadsheets and transcripts and return specific answers, the company says.

..More

News Of the Week

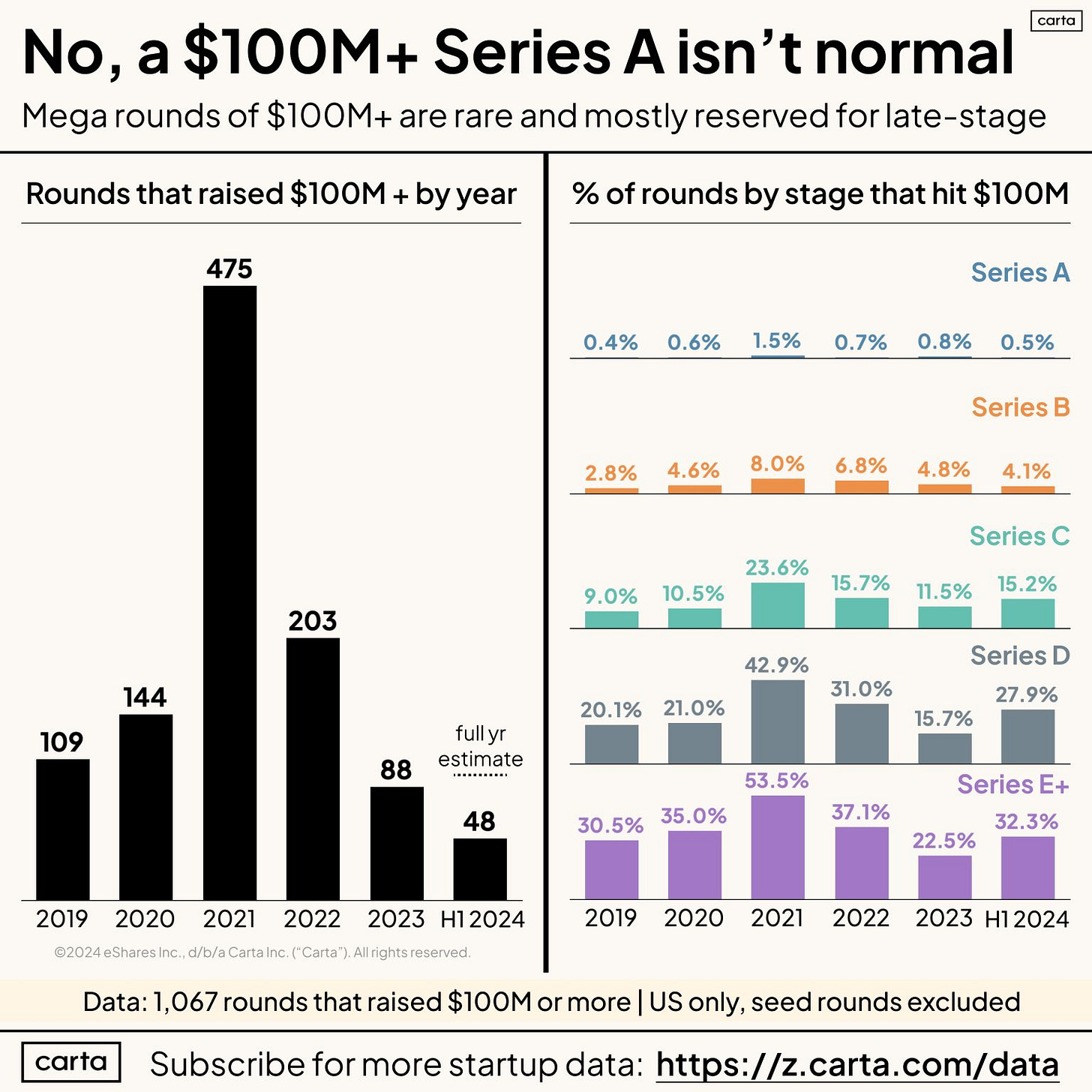

No, a $100m + Series A Round isn’t Normal

Peter Walker, Head of Insights @ Carta | Data Storyteller

Founders, ignore the headlines - $100M rounds are still extraordinarily rare for early-stage startups.

In 2019, we saw 109 rounds of $100M+ on Carta (check out the lefthand chart below).

In 2021, we all overindulged on some Kool-Aid and 475(!) companies raised rounds of $100M+.

And today, feels like some sanity has returned. 48 rounds hit the $100M mark so far in 2024, with the year-long estimate right around 100.

Now move over to the righthand chart. You can see that even at the height of the good times in 2021, only 1.5% of Series A rounds hit this mega-round status. Today that figure is 0.5%.

The mega-round becomes increasingly more common as you down up the alphabet stack until about 30% of rounds hit the $100M+ figure in Series D and beyond.

So - why do we care about these giant fundraises?

𝟭) 𝗨𝗻𝘂𝘀𝗲𝗱 𝗗𝗿𝘆 𝗣𝗼𝘄𝗱𝗲𝗿

By some estimates, there is around $250 billion in committed capital just waiting to be deployed into startups. Well, you can't deploy that level of firepower into seed-stage companies. The math doesn't work.

You need large, late-stage rounds to be happening at a healthier pace in order for that dry capital to become working capital.

𝟮) 𝗙𝗼𝗹𝗹𝗼𝘄-𝗢𝗻 𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀

VCs at the early stages are making calculated bets on companies and founders, sure. But they are also taking into account the market potential for various sectors. If a part of the venture market is missing (eg. growth rounds) for a specific industry, early investors will be less likely to take bets on companies in that industry. DTC is a perfect example.

𝟯) 𝗘𝘃𝗲𝗻𝘁𝘂𝗮𝗹 𝗜𝗣𝗢𝘀

Another data point - about 46% of companies that went on to IPO had a round of at least $75 million in their history (about 30% had a $100M round).

Major late-stage rounds are a pretty good sign of becoming a player in the public markets - seems obvious. The lack of exits in today's climate are putting a cap on venture as whole and these mega-rounds returning may signal the impending return of useful IPOs (or maybe vice-versa).

Can you get to IPO without a major cash injection? Has the startup build process really shifted that dramatically in the last two years? Maybe! Will be fascinating to watch.

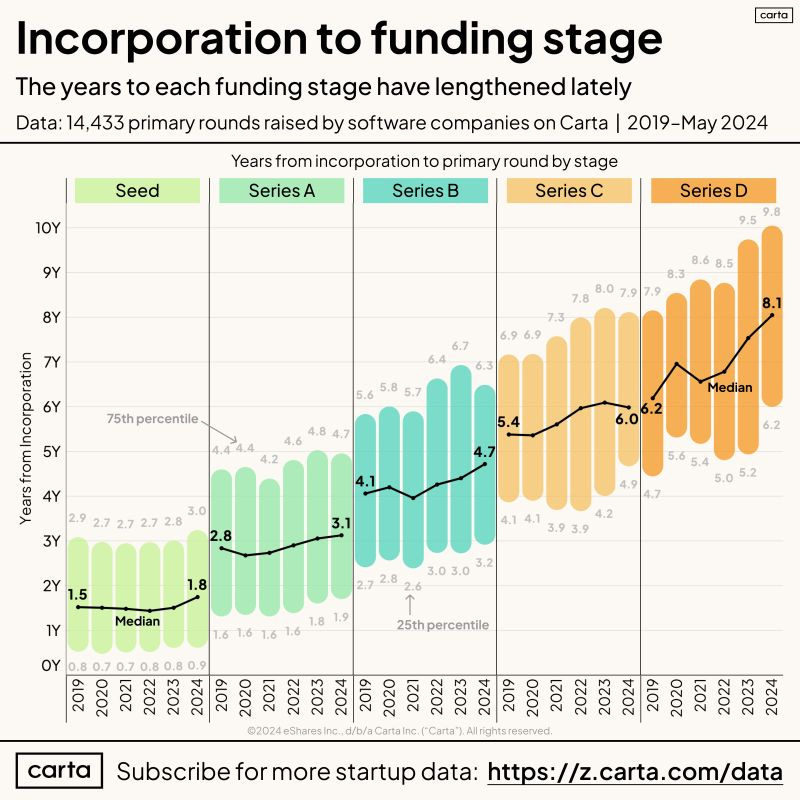

It takes ten years to succeed as a Startup

Peter Walker, Head of Insights @ Carta | Data Storyteller

Venture-backed founders: you really are signing up for a decade.

Here's some new data on the time (in years) from the day of incorporation to various funding milestones for software startups.

Yes, I know funding milestones aren't everything. But if you're on the venture path then they matter - and speed is a major aspect of the VC growth model.

Chart below shows time to primary round (no funny business with bridges or extensions) and is filtered to just software companies (hardware / biotech plays at different timescales).

𝗦𝗲𝗲𝗱 (𝗶𝗻𝗰𝗹𝘂𝗱𝗲𝘀 𝗽𝗿𝗶𝗰𝗲𝗱 𝘀𝗲𝗲𝗱 𝗿𝗼𝘂𝗻𝗱𝘀 & 𝗦𝗔𝗙𝗘𝘀 𝗼𝘃𝗲𝗿 $𝟮𝗠)

• Median of 1.8 years from incorporation recently

• Up 15% or so from 2019

𝗦𝗲𝗿𝗶𝗲𝘀 𝗔

• Median: 3.1 years from incorp

• Up a gentle 10% from 2019

𝗦𝗲𝗿𝗶𝗲𝘀 𝗕

• Median: 4.7 years from incorp, 16% higher than 2019

𝗦𝗲𝗿𝗶𝗲𝘀 𝗖

• Median: 6 years from incorp (and down a little from 2023? Odd.)

𝗦𝗲𝗿𝗶𝗲𝘀 𝗗

• Median bounced all the way to 8.1 years from incorporation

So what stands out from this data?

Couple points to me. First, obviously companies in the venture ecosystem are staying private longer. We didn't show it in the chart but you can get medians up to 12 years or even higher for Series E, F, etc.

Second - founders are definitely skipping stages. The round names are taken from the term sheets themselves, but there's no reason a founder has to hit every funding milestone. Get a seed, make amazing progress, boom jump up to a Series B.

Third - damn that's a long time! The "cofounder as marriage" analogy hits hard. Build with the right people 🙏

What else would you want us to analyze through the lens of incorporation timelines? Open to new ideas in the comments!

Elon Musk has won $56bn pay package despite judge ruling it void, Tesla argues

Company says in court filing Musk is entitled to vast payout because shareholders voted in his favor earlier this month

Reuters

Thu 27 Jun 2024 15.08 EDT

Tesla is claiming Elon Musk won his legal battle over his $56bn pay package because shareholders voted for the compensation, despite a judge rescinding it earlier this year, according to court filing made public on Friday.

The company’s filing comes two weeks after Tesla shareholders voted to ratify the 2018 package of stock options. Tesla held the vote following a January ruling by a Delaware judge to void the compensation because Musk improperly controlled the negotiation process and the company misled shareholders about key details.

The uncertainty in the case hangs over Musk’s relationship with Tesla, which is struggling with slower sales and stiffer competition. He has said he might develop some products outside the company if he does not obtain a larger ownership stake.

Tesla made its argument in its proposal for how the judge, Chancellor Kathaleen McCormick of Delaware’s court of chancery, should craft a final order that is needed to implement the January ruling. Tesla said the final order should state that “judgment is entered for the defendants”.

The shareholders’ legal team wants the judge to stick with her original ruling voiding Musk’s pay package. They want her to order Tesla to pay them potentially billions of dollars worth of Tesla stock as a legal fee award.

Tesla has said a fair fee might be as low as $13.6m.

On Thursday, McCormick ordered the parties to begin preparing briefs laying out their views on the effect of the shareholder vote on the case. She also asked the parties to agree on a date in late July or early August for oral arguments on the issue.

McCormick will hear oral arguments over the legal fee on 8 July and she might take at least a few weeks before ruling.

..More

Kleiner Perkins announces $2 billion in fresh capital, showing that established firms can still raise large sums

12:20 PM PDT • June 28, 2024

Many VC firms are struggling to attract new capital from their own backers amid a tepid IPO environment.

But established, brand-name firms are still able to raise large funds.

On Friday, Kleiner Perkins announced that it closed on more than $2 billion in fresh capital across two funds, a slight increase from the 52-year-old firm’s $1.8 billion previous fundraise in early 2022.

Other prominent firms that successfully defied the VC fundraising slump this year include Andreessen Horowitz, which secured $7.2 billion for several of its funds; General Catalyst, which is reportedly wrapping up a $6 billion fundraise; and Norwest, with its $3 billion capital haul.

Kleiner Perkins said in a blog post that it will continue to invest in enterprise software, consumer, healthcare, fintech and hardtech startups, as it has for its previous fund. But what’s changed is the opportunity to make these industries more efficient with the help of AI.

..More

Startup of the Week

Webtoon Rises Modestly In IPO Debut

June 27, 2024

Shares of online comics publisher Webtoon Entertainment closed up nearly 10% in first-day trading Thursday, after the company priced shares for its IPO at the top of the proposed range.

The company raised $315 million in the offering, setting an initial valuation of around $2.67 billion. Shares are trading on Nasdaq under the symbol WBTN.

Although headquartered in Los Angeles, Webtoon has its roots in Korea. It’s majority-owned by South Korea’s Naver, which had a 71% pre-IPO stake, and Japan’s LY Corp., with a 29% stake.

Webtoon was launched in Korea nearly 20 years ago as the brainchild of its CEO, Junkoo Kim, then a search engineer at Naver. The founding vision was to create a platform for comic creators to reach a wider global audience.

Since then, Webtoon’s well-known format displaying art and text in a single continuous, vertical scroll has caught on in a big way. The company estimates that half of South Koreans visit the platform each month. It also has broad global reach, with an estimated 170 million monthly active users each month across more than 150 countries.

Between 2017 and 2023 it has paid out over $2.8 billion to creators who publish on its platform, Webtoon says. The average professional creator, it adds, is earning $48,000 a year and the top 100 are earning $1 million.

In the first quarter of this year, Webtoon had revenue of $327 million and net income of $6 million. In all of 2023, meanwhile, Webtoon had revenue of $1.28 billion, and posted a net loss of $145 million.

X of the Week

AI Poetry Camera? Seriously?

JUNE 26, 2024 | On Technology, TheDailyOm

Some days randomly remind you of the uniqueness of the place you call home. Yesterday was one of those days. I met Ryan Mather, who works for Sudowrite*, for coffee. He was in town for the Figma Design Conference. We chatted about writing, books, and how I use “AI” in my process. We discussed what I would want from the process of writing a book with the help of AI. David Simon, creator of “The Wire,” in a conversation with NPR, put it best:

“If a writer wants to play around with AI as the writer and see if it helps him, I mean, I regard it as no different than him having a thesaurus or a dictionary on his desk or a book of quotable quotes. Play around with it.”

As a former journalist, and now as a (part-time investor and a) full-time creator, I can easily divide the writing process into two distinct halves — the creative part, which occurs in my brain, and the mechanical part, which includes tasks such as copy editing, research, and sourcing information. AI can significantly accelerate these mechanical aspects, thereby speeding up the entire creative process. However, creation itself remains a bigger black box than large language models (LLMs) — and thankfully so. (Here is a link to a piece I wrote about how I use AI as part of my writing process.)

During our conversation, I discovered that Ryan is what I call “fountain pen curious.” I shared a few tips, the name of an online store run by a pen friend, and generally expounded on the joys of writing by hand with pen and ink. After we finished talking, we stood up to walk. That’s when I noticed he was carrying a camera bag, so I asked him, “What’s in your bag?

Like a proud parent showing photos of his children, Ryan whipped out his creation — the Poetry Camera.

Poetry Camera prints poems instead of pictures. It’s a new way to make memories — away from screens, notifs, and apps.

Cute! It is essentially a 3D-printed camera body that houses a Raspberry Pi and a small printer typically used for printing receipts. It uses a Raspberry Pi’s visual module to capture a “photo,” then sends it to the internet, uses “AI” to analyze the image, and returns with a poem based on what it sees.

..More