Contents

Essays

A quarter of startups in YC’s current cohort have codebases that are almost entirely AI-generated

The Government Knows A.G.I. Is Coming - Ezra Klein

Philosophy Mondays: Randomness, Replication, Selection and Free Will

Post Election

Sam Bankman-Fried’s Parents Explore Seeking Trump Pardon for Son

Michael Grimes Expected to Lead Trump’s Sovereign Wealth Fund

No one cares when presidential advisers want bigger government

AI

OpenAI reportedly plans to charge up to $20,000 a month for specialized AI ‘agents’

Anthropic’s C.E.O., Dario Amodei, on Surviving the A.I. Endgame

Vinod Khosla: Most AI Investments Will Lose Money as Market Enters ‘Greed’ Cycle

Venture Capital

Interview of the Week

Meenakshi Ahamed and Andrew Keen on Indians in America

Startup of the Week

Post of the Week

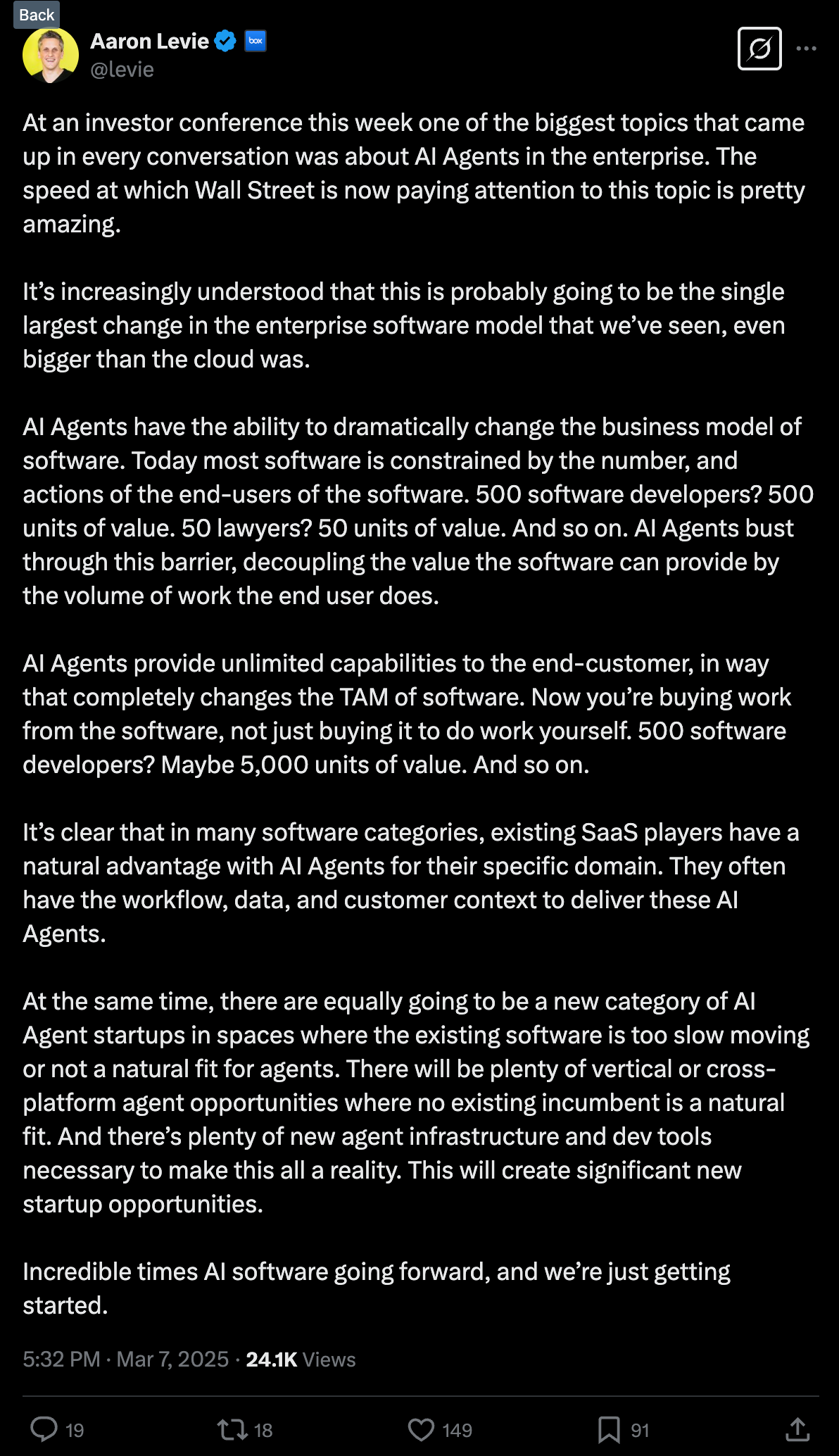

Aaron Levie on Enterprise AI Agents

Editorial: I Built an App for Teens

Here is a short video showing a teen help app I built this week.

It is an iPhone app written in Swift. I do not know Swift. The app took about a week to imagine and create. It was done by using Claude 3.7 inside an app called Cursor. 100% of the code was from them.

I had the help of my 3 sons Liam (22); Dylan (23) and Luke (18). You can download the video embedded above to see what AI can build.

It is a real app that has built in support for OpenAI; Anthropic; Perplexity and DeepSeek.

The App uses the AIs as a buddy, a coach, a therapist and a counsellor to the teen user allowing private conversation and problem solving.

In the real world there is a large shortage of these people and schools are overwhelmed. Luke has epilepsy and some school challenges and was the inspiration for ‘Reflect’.

The app can’t replace a professional but it gives a teen a private place to talk and think and. yes, Reflect. If you have a teen who would be a good tester reach out.

In this week’s That Was The Week we have a lot of discussion about what AI can and cannot do.

Ivan Mehta discloses that 25% of YC’s cohort use AI for >95% of codebases, enabling solo founders to launch products in days.

CoreWeave’s IPO filing ($1.9B revenue, 737% YoY growth) exemplifies AI infrastructure demand, while OpenAI spin-offs (Anthropic, xAI, Safe Superintelligence) form a $500B+ “Constellation” ecosystem.

Benn Stancil critiques YC’s fading relevance as AI tools let founders bypass traditional incubation. Snowflake’s $200M accelerator expansion and Ron Hodgkinson’s (SignalRank) VC consolidation analysis reflect a broader trend: capital concentrates in established players, leaving emerging managers struggling.

Alex Kantrowitz’s “Okay, I’m Starting to Think AI Can Do My Job After All” is also pointing out the fast moving change of assumptions about what AI can do. He acknowledges AI’s role as a productivity tool but warns of structural shifts: leaner teams, reduced hiring, and potential job losses as AI handles tasks like research, drafting, and customer interactions. This “force multiplier” effect risks concentrating economic power while eroding middle-skill employment pathways.

Ben Buchanan, talking to Ezra Klein, warns AGI could destabilize global order by 2028 if current development trajectories hold, echoing Dario Amodei’s warnings, both below.

He critiques the U.S. for treating AI as a purely commercial race while China strategically prioritizes military-civil fusion. Export controls on Nvidia chips, while necessary, risk driving China toward open-source alternatives like DeepSeek’s models—a dynamic Buchanan calls “the open-source trap.” The discussion highlights how China’s $7B investment in AI infrastructure (vs. U.S.’s $3.2B) exploits Western open-source breakthroughs to bypass sanctions. Buchanan argues for “asymmetric containment”: restricting compute access to hostile states while fostering alliances with democracies via initiatives like the U.S.-EU AI Accord.

Klein adopts a more definitive position on AGI’s near-term arrival, repeatedly framing it as inevitable within a “two- to three-year time frame.” He challenges Buchanan to justify the Biden administration’s limited preparatory actions, arguing that AGI demands urgent, large-scale policy responses akin to wartime mobilization. This contrasts with his earlier skepticism of LLMs as “bullshit generators” in 2023, marking a stark shift.

On the plus side Dwarfish Patel sees fully automated firms that will harness AI’s unique digital advantages to create organizations that are more scalable, cohesive, and adaptable than traditional human-centric models. By capitalizing on the abilities to copy, merge, and evolve, AI-driven companies will operate with unprecedented efficiency and strategic coherence.

My take: We are entering a phase of human existence where autonomous agents will increasingly help us achieve goals. Each of us has differing goals. Many of them will become achievable wherever they previously were not. Its real and exciting.

Essays of the Week

A quarter of startups in YC’s current cohort have codebases that are almost entirely AI-generated

Author: Ivan Mehta Source: TechCrunch Published: March 06, 2025

Classification: Startups Subcategory: AI-generated code

With the release of new AI models that are better at coding, developers are increasingly using AI to generate code. One of the newest examples is the current batch coming out of Y Combinator, the storied Silicon Valley startup accelerator. A quarter of the W25 startup batch have 95% of their codebases generated by AI, YC managing partner Jared Friedman said during a conversation posted on YouTube.

Friedman said that this 95% figure didn’t include things like code written to import libraries but took into consideration the code typed by humans as compared to AI.

“It’s not like we funded a bunch of non-technical founders. Every one of these people is highly technical, completely capable of building their own products from scratch. A year ago, they would have built their product from scratch — but now 95% of it is built by an AI,” he said.

In a video titled “Vibe Coding Is the Future,” Friedman, along with YC CEO Garry Tan, managing partner Harj Taggar, and general partner Diana Hu, discussed the trend of using natural language and instincts to create code.

Last month, former head of AI at Tesla and ex-researcher at OpenAI, Andrej Karpathy used the term “vibe coding” to describe a way to code using large language models (LLMs) without focusing on code itself.

Code generated from AI is far from perfect, though. Studies and reports have observed that some AI-generated code can insert security flaws in applications, cause outages, or make mistakes, forcing devs to change the code or debug heavily. […]

Okay, I’m Starting to Think AI Can Do My Job After All

Author: Alex Kantrowitz Source: Big Technology Published: March 07, 2025

Classification: AI Subcategory: Job Automation

We’re witnessing a transformation in how work is done in the age of AI. Although early predictions about chatbots wiping out jobs have not fully materialized, generative AI is moving beyond simple chats. Today’s technology is starting to automate more complex tasks such as computer operation, research, and even conducting interviews.

One notable example comes from journalist Evan Ratliff, who experimented with cloning his own voice to create an AI bot. In a groundbreaking test, his voice bot conducted an interview with a tech CEO—extracting candid insights that, according to Ratliff, were even more revealing than those obtained in a face-to-face conversation. This incident suggests that AI can sometimes push beyond the limits of human interaction, encouraging sources to open up in unexpected ways.

AI’s progress isn’t confined to journalism. Google’s release of NotebookLM, capable of generating lively podcasts from minimal input, demonstrates that these advancements are also touching creative media. Meanwhile, leaders in customer service and sales are finding AI agents that offer patience, extensive knowledge, and even an improved listening experience. For example, Sebastian Siemiatkowski, the CEO of Klarna, noted that AI-driven customer service can match, and sometimes exceed, the satisfaction typically provided by human agents.

Despite these encouraging signs, AI still has its shortcomings. It often struggles with multitasking and relies on human guidance to operate effectively. While some experts predict that human-level artificial intelligence could emerge in just a few years, cautionary voices like that of ex-OpenAI chief scientist Ilya Sutskever remind us that the methods driving today’s models may soon reach their limits.

The broader implications are significant. As AI extends its reach beyond chat interfaces—taking on roles like research, customer interaction, and even creative endeavors—it may serve as a force multiplier. This might lead to fewer hires in certain areas or drive a shift towards leaner companies that can do more with the help of automation.

In a related note, the article also highlights a sponsored segment on BOXABL. The company is pioneering assembly line automation in home construction, aiming to build houses faster, at higher quality, and for less cost. This serves as a reminder that AI and automation are shaking up diverse industries, not just technology and journalism.

The piece challenges us to reconsider our assumptions about work and the future. Will AI simply augment human capabilities, or is there a broader transformation at hand?

The Government Knows A.G.I. Is Coming - The New York Times

Author: Ezra Klein Source: The New York Times Published: March 06, 2025 Classification: AI Subcategory: Government and National Security

For months, experts from both AI labs and government circles have been warning that a breakthrough—artificial general intelligence (AGI)—is imminent. Once thought to be a decade or longer away, many now predict AGI could emerge within two to three years. The discussion, highlighted in this extensive conversation, covers the immense impact of AGI on national security, labor markets, and society as a whole.

Key voices include a former special advisor for AI in the Biden White House who recounts early government efforts to prepare for radically capable AI systems. With applications spanning cyber operations, intelligence analysis, and even drug discovery, these technologies promise to reshape global dynamics. However, the dual-use nature of AGI also presents risks: if adversaries such as China gain an edge, the consequences for economic and military power could be profound.

Policymakers have started to respond with measures like export controls on advanced AI chips and voluntary safety testing requirements. These steps are meant to buy time and ensure that U.S. leadership in AI is not compromised as technologies evolve rapidly. Yet, tensions remain between fostering innovation and ensuring safety. The debate pits those who champion swift technological advancement against voices pushing for robust regulatory frameworks to manage the risks associated with such transformative power.

The conversation also delves into the difficulty of modernizing government processes to keep pace with cutting‐edge developments. While AI can accelerate decision making and enhance productivity, integrating these tools into longstanding public sector systems represents a significant challenge. Historical parallels—from the early days of railroads to the evolution of nuclear power—illustrate that safety and regulation, when properly implemented, can actually spur progress rather than stifle it.

Finally, the dialogue wraps up with recommendations for further reading, encouraging the audience to explore works such as Thomas Kuhn’s "The Structure of Scientific Revolutions", Thomas Rid’s "Rise of the Machines", and George Saunders’ "Swim in the Pond in the Rain". These books offer insights into how paradigm shifts occur and underscore the uniquely human qualities that may remain beyond the reach of even the most advanced AI.

Read more

What fully automated firms will look like

Author: Dwarkesh Patel Source: Dwarkesh Podcast Published: March 06, 2025 Classification: Essays Subcategory: AI and Automation

Developed in collaboration with Ege Erdil, Tamay Besiroglu, and Gavin Leech.

Epistemic status: Shooting-the-shit; 25% sure this roughly describes how firms of AGIs will actually work.

Even as discussions of human-level AI grow more frequent, most people underestimate how radically different the business world will be with fully automated companies. While many ponder the impact of having a smart assistant available around the clock, the true transformation lies in the collective advantage of digital entities that can be copied, merged, and scaled at will.

Copy:

Today’s firms face bottlenecks in hiring and training talent. Imagine if a company like Google could replicate its best engineers—turning leaders like Jeff Dean or Noam Shazeer into millions of copies with intact expertise. Such replication isn’t limited to individual brilliance; it extends to entire teams that historically propelled early successes (think the PayPal Mafia or the Traitorous Eight). This digital replication can radically transform management, as even thousands of middle managers might be replaced by copies of an AI CEO capable of perfect oversight.

Merge:

The limitations of a human CEO—unable to absorb every detail or customer interaction—could be overcome by a central AI, dubbed here as mega-Sundar. Similar to Tesla’s Full Self-Driving technology which learns from millions of driving records, mega-Sundar would aggregate insights from specialized AI copies. These interactions, through latent representations, would allow near-perfect information transfer, ensuring that knowledge is consistently refined and shared across the organization.

Scale and Distillation:

When roles are defined by the compute required rather than by scarce human talent, companies can scale unprecedentedly. The cost for an AI role becomes a function of compute, enabling firms to duplicate world-class talent at minimal marginal cost. Even as specialization deepens, vast amounts of factual knowledge remain easily stored and replicated, ensuring operational efficiency across diverse functions.

Evolve and Takeover:

The evolutionary capacity of AI firms marks the greatest departure from traditional corporate models. Unlike human firms—hampered by the inherent inefficiencies of social learning and cultural transmission—AI firms can replicate their best practices flawlessly and evolve continuously. Though this may lead to increasingly large and efficient firms, market dynamics will still enforce an outer loop of feedback through profits and losses.

Philosophy Mondays: Randomness, Replication, Selection and Free Will

Author: continuations@newsletter.paragraph.xyz (Albert Wenger) Source: Continuations Published: March 04, 2025 Classification: Essays Subcategory:Philosophy

At present it is once again wildly popular to speculate about the relationships between fundamental physics and concepts such as consciousness and free will. Despite the high caliber of many participants in these discussions, I consider much of it to be largely bunk. In essence, applying theories that describe low-information particles to the complex, high-information systems that make up consciousness and free will is deeply flawed. I firmly believe that both consciousness and free will are emergent phenomena arising from these intricately structured systems. In today’s post I focus on free will within the framework of a philosophy centered on the notion of choice.

I begin with a question about the emergence of structure. As I write upstate overlooking a forest, using a laptop on a desk while seated in a chair, I observe that every object—even myself—displays significant structure. Yet when we examine our solar system, most planets and even the sun exhibit minimal structure. So, where does our structured reality come from?

It turns out that three processes, when combined under the right conditions, generate structure: randomness, replication, and selection. These mechanisms explain the rise of structure in three distinct phases: assembly, evolution, and intelligence. Each phase is governed by a different selector—stability, fitness, and rationality respectively.

The first phase, assembly, occurred long before life as we recognize it today. In this phase, random combinations of elements achieved lower energy states, creating more stable compounds that catalyzed the formation of other stable arrangements. This laid the groundwork for the earliest forms of replication.

The second phase, evolution, introduced the encoding of information via genetic material. Random mutations, genetic splicing, and the dynamics of sexual reproduction enabled organisms to copy and vary their blueprints. Here, natural selection favored species that were better adapted to their niches.

The third phase, intelligence, began with the emergence of expressive—and later written—language. In this era, randomness manifested as the generation of novel ideas, which were then replicated through speech, text, and other media. Selection occurred through the evaluation of effectiveness alongside moral and aesthetic judgment. In this phase, intelligence not only refined the processes of randomness and replication but also played a central role in shaping decision-making.

How does this framework permit free will? While individual, moment-to-moment decisions may be predetermined or random, the cumulative interaction of human brains—augmented by externalized knowledge—enables the emergence of free will over time. In essence, a single brain unfolds as a fixed physical process, but a network of brains sharing and building upon knowledge creates the conditions for free will as innovation.

This view carries important moral implications. One immediate takeaway is that artificial intelligences, through their interactions with humans and other machines, might also exhibit free will. Recognizing this possibility challenges us to treat emerging machine beings as worthy of ethical consideration—a notion inspired by the work of David Deutsch, Chiara Marletto, Lee Cronin, and Sara Walker among others.

Skype is dead. What happened?

Author: Om Malik Source: On my Om Published: February 28, 2025 Classification: Industry Analysis Subcategory: Communication Technology

Microsoft is shutting down Skype – it will go offline in May 2025. The decision, explained by Microsoft’s Jeff Teper, hinges on lessons learned from Skype that are being applied to Teams. In his words, the shift is about being simpler for the market, serving customers better, and delivering innovation faster by focusing on Teams.

It makes for a bittersweet moment. As Om Malik reflects, Skype’s decline had been apparent for years. Once a beloved daily tool, Skype’s magic faded after a series of acquisitions and bureaucratic shifts. Malik recalls a time when Skype, even with its simple design, reigned as a pioneer in chat, messaging, and phone calls. The product’s evolution into a tool burdened by corporate sluggishness led him to derisively call it “a turd of the highest quality."

Microsoft’s redirection to Teams—and the lack of understanding of what made Skype iconic—illustrates how detrimental middle management and corporate inertia can be. Once a game-changer, Skype not only revolutionized long-distance calls (making them free for millions, especially immigrants) but also paved the way for similar innovations, including WhatsApp’s global success.

Malik also muses on the cultural impact of Skype. The service featured in films such as The Social Network, Skyfall, and TV shows like The Office and Breaking Bad—the very medium through which its influence spread. Despite its legacy as a catalyst for network effects and early distributed internet innovations, Skype’s fate was sealed when it was absorbed by Microsoft—a move that, according to Malik, stifled its creative potential.

In a nostalgic tone, Malik recalls his extensive coverage of Skype over the years—from its early days as a startup to its acquisition by Microsoft. While he laments the loss of a digital icon, he also points to a CNBC documentary for those interested in a deeper look into Skype’s journey.

Sam Bankman-Fried’s Parents Explore Seeking Trump Pardon for Son

Author: Ava Benny-Morrison Source: Published: March 07, 2025 Classification: Other Subcategory: Legal and Pardons

The parents of FTX co-founder Sam Bankman-Fried are exploring ways to secure a pardon for the onetime crypto billionaire from President Donald Trump, according to a person familiar with the matter.

Stanford Law School Professors Joseph Bankman and Barbara Fried had meetings in recent weeks with lawyers and other figures considered to be in Trump’s orbit about clemency for their 32-year-old son, who was sentenced to 25 years in prison for fraud, the person said. It’s unclear if outreach has been made to the White House.

Bankman and Fried declined to comment. A lawyer for Bankman-Fried, who has also filed a legal appeal of his 2023 conviction on charges tied to the collapse of his cryptocurrency exchange, didn’t immediately respond to a request for comment. The White House also declined to comment.

The president’s swift use of his pardon power, including for Silk Road founder Ross Ulbricht, has encouraged a rush among white-collar defendants eager to put their case before Trump. In seeking Trump’s mercy, Bankman-Fried — once hailed as an industry darling and then vilified — would be appealing to a man who shifted from a crypto skeptic to its booster.

Bankman-Fried has argued that his sentence was “draconian,” noting that FTX customers have recovered most of the money they initially lost. Ryan Salame, a former FTX executive sentenced to more than seven years in prison, has also indicated that he is seeking a pardon.

Jeffrey Grant, who runs a legal and advisory firm in New York for white-collar defendants, mentioned that he has received perhaps 100 inquiries about pardons. He noted, "We have been hearing from people in prison, from people recently sentenced who haven’t reported to the Bureau of Prisons yet, from people who have been indicted. They are looking for somebody who knows somebody."

Federal prisoners can apply for clemency through a dedicated Justice Department office, though Trump has made decisions based on less formal appeals. Grant disapproves of prioritizing those with influence over long-incarcerated individuals.

Sam Mangel, a white-collar prison consultant with prior ties to Steve Bannon and Peter Navarro, said he is working on several clemency requests. He mentioned that advice from contacts in the president’s circle has influenced his approach, advising clients not to include cases involving sex crimes, violent crimes, or illegal immigration.

The president’s early use of his pardon power marks a contrast with his first term, when most clemency orders were issued towards the end of his presidency. Similar trends were observed with other presidents, including Joe Biden, who issued a number of pardons in his final days, affecting both political allies and opponents.

Michael Grimes Expected to Lead Trump’s Sovereign Wealth Fund

Author: Sylvia Varnham O'Regan Source: The Information Published: March 06, 2025 Classification: Other Subcategory: Finance

The Commerce Department plans to tap former Morgan Stanley banker Michael Grimes to lead President Donald Trump’s U.S. sovereign wealth fund, according to Reuters.

Trump signed an executive order in February to establish the fund—a vehicle for investment—and gave the secretary of the Treasury, Scott Bessent, and the secretary of commerce, Howard Lutnick, 90 days to come up with a plan for how it would. Funding sources for the fund remain unclear and plans to appoint Grimes could change, Reuters reported.

In his time at Morgan Stanley, Grimes worked on Elon Musk’s takeover of Twitter, now X. He also worked on initial public offerings for major tech companies including Meta Platforms, Uber and Airbnb.

No one cares when presidential advisers want bigger government

Author: Christian Britschgi Source: Reason.com Published: February 27, 2025 Classification: Other Subcategory: Political Commentary

Elon Musk's unclear position on the federal government's organization chart continues to generate controversy and legal challenges for the Trump administration. Despite being the very public face of the Department of Government Efficiency (DOGE) and enjoying the backing of President Donald Trump, administration lawyers claim in court filings that Musk holds no official role in any DOGE-designated White House unit. Instead, as Reason’s Jacob Sullum explained, Musk is officially listed only as a senior adviser to Trump within the White House office.

Opponents of DOGE have pounced on Musk’s ambiguous role by filing lawsuits that challenge the unit's authority to access government data, reduce federal staff, and reorganize departments. A group of Democratic attorney generals even initiated a lawsuit arguing that Musk’s expansive powers, which resemble those of a principal officer requiring Senate confirmation, make his role unconstitutional.

Media critics of DOGE have leveled stark accusations against Musk, claiming he has essentially appointed himself as a "dictator" and is in the midst of staging a coup within the federal government. However, the controversy over his influential advisory position is not entirely unprecedented. The administration defends DOGE’s approach, arguing that its core mission is to instruct government employees rather than to interfere with private citizens or companies.

The debate draws an interesting comparison with the Biden administration's appointment of Andy Slavitt as a senior adviser on its COVID-19 response task force. Unlike the contentious role assumed by Musk, Slavitt’s appointment was largely uncontroversial. His leadership in public press conferences—announcing significant policy measures ranging from the use of the Defense Production Act to alter vaccine and test production, to measures affecting Medicare and Medicaid pricing—was widely accepted as a standard executive decision-making process.

Moreover, while Slavitt’s role once extended to influencing communications with tech giants like Facebook and Amazon, efforts to remove or moderate online content fell within clearly defined executive directives. In contrast, the Trump administration’s vague delineation of DOGE’s authority has resulted in bureaucratic uncertainty and legal disputes, hindering efforts to implement its agenda to reduce federal waste and overstaffing.

OpenAI reportedly plans to charge up to $20,000 a month for specialized AI ‘agents’

Author: Kyle Wiggers Source: TechCrunch Published: March 05, 2025

Classification: Tech News Subcategory: Artificial Intelligence

OpenAI may be planning to charge up to $20,000 per month for specialized AI “agents,” according to The Information.

The publication reports that OpenAI intends to launch several “agent” products tailored for different applications, including sorting and ranking sales leads and software engineering. One, a “high-income knowledge worker” agent, will reportedly be priced at $2,000 a month. Another, a software developer agent, is said to cost $10,000 a month.

OpenAI’s most expensive rumored agent, priced at the aforementioned $20,000-per-month tier, will be aimed at supporting “PhD-level research,” according to The Information.

It’s unclear when these agentic tools might launch or which customers will be eligible to purchase them. But The Information notes that SoftBank, an OpenAI investor, has committed to spending $3 billion on OpenAI’s agent products this year alone.

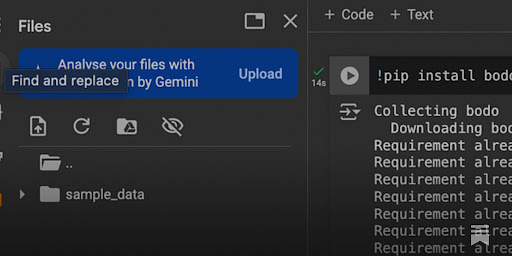

In defense of Gemini

Author: Rohit Krishnan Source: www.strangeloopcanon.com Published: March 05, 2025 Classification: AI Subcategory: Product Analysis

AI has clearly entered its product arc, with models that are becoming more capable and increasingly integrated into everyday workflows. In this era, while many users eagerly adopt and adapt to new AI models, the author finds himself nearly alone in engaging with Gemini—a model produced by a top-notch research organization backed by seemingly infinite resources. Despite a handful of colleagues and insiders showing some interest, Gemini appears to be underutilized, a state of affairs that both frustrates and concerns him.

The piece explains that Gemini, though packed with promising features such as long context, multimodal interactivity, and even live conversational capabilities, is stifled by cumbersome product design. Rather than offering an integrated, seamless user experience, Gemini is bogged down by heavy system prompts and fragmented tool integrations. For instance, while it performs admirably for tasks like analyzing code bases, processing PDFs, or rewriting memos, its overall usage experience falls short of what one would expect from such a powerful system.

A significant part of the critique centers on the disjointed nature of Google’s AI offerings. Gemini’s features are scattered across different products—be it Colab, Docs, or even the newly introduced Code Assist—without a unified interface. The author argues that this compartmentalization not only confuses users but also prevents the full potential of these models from being realized. Ideally, a flagship offering should cohesively bring together capabilities like natural language interaction, code generation in popular IDEs, and integration with Google’s other powerful services such as Search, Google Drive, and Cloud Workstations.

The article further highlights several breakthroughs that Gemini brings to the table, including its live interaction model, visible chains-of-thought in reasoning processes, and its integration with tools like NotebookLM. Despite these advancements, the author feels that the product suffers from a bureaucratic bloat and a lack of smart product design that could glue these innovations into a truly compelling experience.

In wrapping up, the author stresses the need for a dedicated "skunkworks" team to integrate these fragmented features into a coherent product that both developers and end-users can embrace. As the AI landscape shifts towards systems that integrate multiple models and functionalities seamlessly, the author hopes that Gemini will eventually evolve to become a flagship product that fully leverages Google’s extensive resources.

Anthropic’s C.E.O., Dario Amodei, on Surviving the A.I. Endgame

Author: Kevin Roose, Casey Newton, Rachel Cohn, Whitney Jones, Rachel Dry, Alyssa Moxley, Dan Powell, Elisheba Ittoop, Rowan Niemisto and Leah Shaw DameronSource: NYT > Technology Published: February 28, 2025 Classification: AI Subcategory: Podcast Interview

This week, Anthropic’s C.E.O., Dario Amodei, returns to the show for a candid, wide-ranging interview. In the discussion, he shares insights on Anthropic’s brand-new Claude 3.7 Sonnet model, addresses the escalating A.I. arms race with China, and reveals his hopes and concerns about where this transformative technology is headed over the next two years.

The conversation takes a deep dive into the challenges and strategic decisions shaping the future of artificial intelligence. The dialogue not only uncovers the technical advancements at Anthropic but also sheds light on broader industry trends and the competitive dynamics currently at play.

In addition to exploring these critical topics, the show wraps up by reviewing recent technology stories in a unique segment called HatGPT—a playful yet insightful roundup that adds a lighter touch to the intense discourse on A.I. innovation.

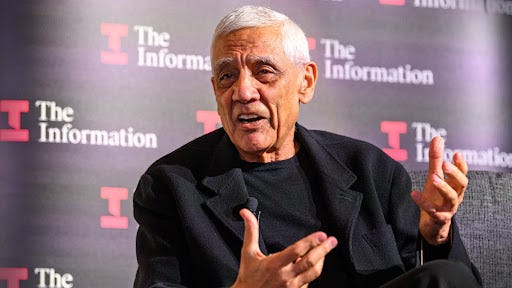

Vinod Khosla: Most AI Investments Will Lose Money as Market Enters ‘Greed’ Cycle

Author: Jon Victor Source: The Information Published: February 28, 2025

Classification: Venture Capital Subcategory: AI Investments

Early OpenAI investor Vinod Khosla has warned that most investments in artificial intelligence are likely to lose money. As the market enters what he called a “greed cycle” with a flood of investors backing startups, only a few outliers are expected to deliver disproportionately high returns that could eventually offset the overall failures.

Speaking at The Information’s AI Agenda Live conference in San Francisco, Khosla explained, “More money will be made than lost because a few outliers will give disproportionate returns.” He emphasized that the current surge in investment has created a scenario where caution is warranted despite the market’s momentum.

Khosla, the founder of Khosla Ventures, also discussed the ongoing transition of OpenAI from its nonprofit structure into a public benefit corporation, which would align social objectives with profit-making. Despite legal challenges—most notably from Elon Musk, who has raised antitrust concerns—Khosla remains optimistic about OpenAI’s future, stating, “Nothing changes for me. My expectation is it will happen. It’s all upside if it happens.”

The article also highlighted OpenAI's ambitious $40 billion fundraising effort at a $300 billion valuation, with SoftBank poised to lead the investment. Khosla compared SoftBank CEO Masayoshi Son’s early missteps with the lessons he has learned, emphasizing the importance of conviction in venture investments.

In addition to following the progress of OpenAI, Khosla is keeping an eye on emerging AI models that adopt novel approaches. His firm has invested in the foundation model developer Symbolica, which works on alternative architectures compared to the popular transformer models. Khosla noted that new entrants, such as China's DeepSeek, are reshaping the AI landscape by demonstrating that innovation does not require massive financial resources.

By calling for breakthroughs beyond incremental improvements, Khosla expressed a clear interest in models that diverge from conventional transformer designs, remarking on the need for fundamentally different approaches if they are to capture investor interest.

Where PE leads, VC follows

Author: Rob Hodgkinson Source: SignalRank Update Published: March 06, 2025 Classification: Industry Analysis Subcategory: Private Equity & Venture Capital

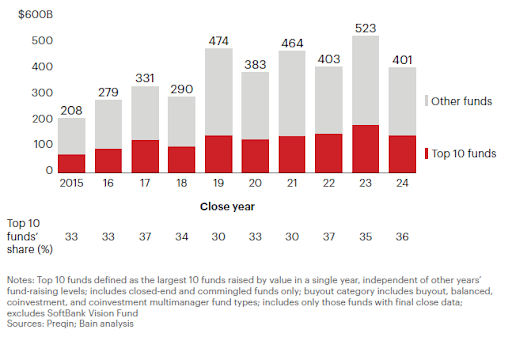

This week, Bain released its annual global private equity report, providing a broad view of trends in an industry now worth over $15 trillion in assets under management. With private equity (PE) as the larger sibling to venture capital (VC), shifts in PE are setting the pace for changes in VC.

Key Trends Highlighted:

Capital Flight to Quality:

Fundraising across private asset classes fell for the third consecutive year in 2024, with capital increasingly flowing to large, experienced managers. Top funds capture a significant share of the pie, with nearly all capital going to established names while emerging managers receive only a marginal portion.

This trend is evident in both PE and VC. For instance, Pitchbook data shows that a few dominant VC funds captured half of all VC capital last year.

Alternative Liquidity Strategies:

As distributions as a percentage of net asset value have declined dramatically (from 29% to 11% in PE), GPs are increasingly adopting alternative mechanisms to generate liquidity. These include minority stakes, continuation funds, NAV loans, and dividend recaps.

The secondary markets for both PE and VC have grown, with significant increases noted in assets under management and deal activity. Venture-backed secondaries are also expanding rapidly.

Public Listing of GPs:

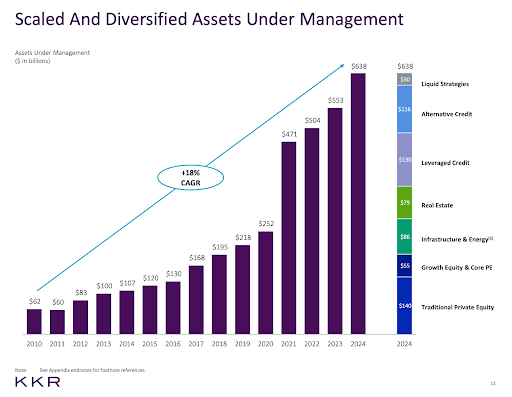

Historically, private equity GPs have opted for public listings over the years (examples include Blackstone, KKR, and TPG). Now, this trend is creeping into the VC space, with reports of firms like General Catalyst considering a public offering.

The move toward public listing underscores a shift in focus from performance-based carried interest to a growth model driven by steady management fees.

Looking Ahead:

Bain’s report does not stop at describing current trends. It anticipates future shifts that include:

Margin Compression: Pressure on the traditional 2/20 fee structure as competition intensifies and LPs demand more cost-efficient structures.

New LP Sources and Structures: Increasing participation by private wealth, sovereign wealth funds, and even retail investors, which is already changing the dynamics of capital allocation in alternative asset management.

Strategic M&A: Accelerated consolidation through mergers and acquisitions, as asset managers seek scale and efficiency.

In essence, what unfolds in private equity tends to set the stage for venture capital. With industry tailwinds—such as BlackRock’s strategic moves and evolving liquidity tools—VC firms are beginning to mirror the trends long observed in PE.

Venture Firms Going Public

Author: Tanay Jaipuria Source: Tanay’s Newsletter Published: March 04, 2025 Classification: Venture Capital Subcategory: IPO Analysis

This weekly newsletter explores an emerging trend in the technology and finance sectors: venture capital firms going public. Recently, Axios reported that General Catalyst is in the early stages of exploring an IPO, and there are hints that other major players (like Andreessen Horowitz) might follow suit. The write-up clarifies that while the views expressed are personal, the discussion is timely given evolving market dynamics.

Traditionally, venture firms operate as private partnerships. They raise closed-ended funds from limited partners (such as pension funds and endowments) every few years, charge management fees (about 1.5%-2.5% per year), and earn carry on profitable investments. If these firms go public, they would primarily sell a stake in their management company—the entity that collects fees and carry—while still raising funds in the traditional manner.

The article discusses several structural considerations for a successful IPO:

Governance: A dual-class share system can ensure that founding partners retain control while allowing public investors to participate in the economics.

Regulatory: It is crucial to avoid the classification as an investment company under SEC rules, which would impose restrictions.

Corporate Structure & Taxation: Some PE firms initially used publicly traded partnerships for pass-through taxation before converting to C-corporations to broaden their investor base.

Beyond the structure, the piece explains why a venture firm might choose to go public. Key benefits include:

Liquidity and Monetizing the Management Company: Founders and early partners can unlock liquidity without waiting for traditional fund distributions.

Acquisition Currency: Public stock can serve as a tool for acquiring additional assets or expanding into new areas.

Brand & Credibility: A public listing can enhance fundraising prospects, attract top talent, and help win competitive deals.

However, the transition also brings trade-offs such as earnings pressure due to market expectations for predictable revenue growth, short-term scrutiny from quarterly reporting, and potential complexities in compensation structures.

The article then details how public markets might value a venture firm by focusing on four key metrics:

Assets Under Management (AUM): Seen as a proxy for future revenue and overall scale.

Fee-Related Earnings (FRE): Representing stable, recurring revenue from management fees.

Performance-Related Earnings: Although more cyclical, these are derived from carried interest on investment gains.

Distributable Earnings: A non-GAAP measure combining recurring revenue and performance earnings.

Concluding, the author speculates that only larger VC firms managing over $30B, and with ambitions to diversify, might successfully navigate the public market requirements. Back-of-the-envelope valuations comparing to firms like Blackstone and KKR suggest that a VC firm with around $40B in AUM could conservatively be valued between $8B and $16B based on different multiples.

US VC firm General Catalyst considers IPO

Author: Diya Lal Source: Tech in Asia Published: March 02, 2025

Classification: Venture Capital Subcategory: IPO

To attract investors, General Catalyst is expanding beyond venture capital. The firm, known for its deep roots in venture funding, is now exploring an initial public offering as a strategic step to diversify its funding sources and broaden its market appeal. This move indicates a significant shift in the firm's approach as it seeks to leverage public market dynamics while retaining its entrepreneurial spirit.

Unicorn Valuations Crest Higher

Author: Joanna Glasner Source: Crunchbase News Published: March 07, 2025

Classification: Venture Capital Subcategory: Unicorn Valuations

When the term unicorn first entered startup parlance in 2013, VC-backed private companies with billion-dollar-plus valuations were still relatively rare creatures.

How long ago that seems.

This week, generative AI heavyweight Anthropic became the latest one-time unicorn to surpass the $60 billion valuation threshold.

The San Francisco-based company announced Monday that it secured $3.5 billion at a $61.5 billion post-money valuation in a round led by Lightspeed Venture Partners. The financing followed the launch of the latest version of its popular AI chatbot and agent, Claude.

There was a time when a venture-backed startup at such a lofty value would be in a lonely bracket. Lately, however, the ranks of ultra-high-valuation unicorns are looking increasingly crowded. Currently, at least seven U.S. venture-backed, private companies have last reported valuations over $45 billion, and several are reportedly on the verge of new financings at much higher values.

Here’s a quick rundown:

SpaceX: Founded in 2002 in Hawthorne, California, SpaceX is no longer a startup. However, it is the most highly valued U.S. private, venture-backed company, hitting a reported 350 billion valuation in a secondary share sale late last year.

OpenAI: The San Francisco-based generative AI company secured a $157 billion valuation when it raised its last round, including a 6.6 billion round in October. More recently, under the leadership of Sam Altman, it is reportedly looking to raise $40 billion in a SoftBank-backed round at a jaw-dropping $260 billion pre-money valuation.

Stripe: This payments infrastructure provider from South San Francisco garnered a $91.5 billion valuation in a tender offer announced last week aimed at providing liquidity to current and former employees.

Databricks: The San Francisco-based data analytics platform confirmed in January that it completed a previously announced $10 billion Series J equity financing at a $62 billion valuation.

xAI: The 2-year-old company raised $6 billion in a November Series C round at a reported $50 billion valuation. In February, it was reportedly discussing a roughly $10 billion funding round at a $75 billion valuation.

Waymo: Alphabet’s autonomous driving spinoff closed a $5.6 billion Series C last summer at a reported $45 billion valuation.

More gains ahead?

The public market contraction of the past two weeks aside, momentum seems to be on the side of high-valuation unicorns. Leading artificial intelligence startups, in particular, have demonstrated the ability to raise consecutive rounds in quick succession at ever-escalating prices.

Hopefully, more of these names will be making it to public markets in coming quarters. If not, there appears to be plenty of capital to tide them over.

Illustration: Dom Guzman

Interview of the Week

Startup of the Week

CoreWeave Files For IPO As Revenue Surges

Author: Joanna Glasner

Source: Crunchbase News

Published: March 04, 2025

Classification: Venture Capital

Subcategory: IPO & Funding

CoreWeave, provider of a fast-growing cloud platform for managing AI infrastructure at scale, filed for its long-awaited Nasdaq IPO on Monday.

The filing follows a period of sharp growth for the 8-year-old, Livingston, New Jersey-based company, which posted revenue of $1.9 billion in 2024 — up an astonishing 737% from the prior year.

Those gains come with widening losses as well. Last year, CoreWeave posted an $863 million net loss, up 45% year over year. The company attributes the losses to its decision to invest in growing its business to capitalize on ever-larger market opportunities.

CoreWeave did not say how much it plans to raise in the offering. Multiple news outlets, however, have speculated that it will seek to raise around $4 billion, at a valuation of around $35 billion.

The impending IPO is poised to break a protracted dry spell for public offerings of hot U.S. unicorns. The pace of market debuts for venture-backed tech companies was sluggish in 2024, and while there’s been plenty of buzz about a potential pickup this year, CoreWeave’s filing is the first real sign of life.

As a private company, CoreWeave has been a prodigious fundraiser. It’s landed $1.57 billion in known equity funding, along with over $10 billion in debt financing, per Crunchbase data. Most recently, the company carried out a $650 million November secondary transaction.

Evanston, Illinois-based asset manager and structured credit investor Magnetar Capital is CoreWeave’s largest stakeholder, with 34.5% of outstanding Class A shares. Other large stakeholders include Fidelity (7.6%) and Nvidia (6%).

Looking ahead, CoreWeave can count on robust revenue for some time to come. The company said it has $15.1 billion in remaining “performance obligations” as of the end of last year, with the average contract a four-year duration. Customers include top-tier names in tech and AI, such as Microsoft, IBM, Meta, Mistral AI and Nvidia.

CoreWeave plans to trade under the ticker symbol CRWV, with JP Morgan, Morgan Stanley and Goldman Sachs serving as lead underwriters.

Illustration: Dom Guzman

Post of the Week

A reminder for new readers. Each week, That Was The Week, includes a collection of selected essays on critical issues in tech, startups, and venture capital. I choose the articles based on their interest to me. The selections often include viewpoints I can't entirely agree with. I include them if they provoke me to think. Click on the headline, contents link, or the ‘Read More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below. There is a weekly News of the Week supplement that has the week’s most interesting news.

Other Tech News

Microsoft EOLs Skype, Skype’s Founding, Microsoft’s Skype Charity

Apple Vision Pro to Debut First Feature-Length Bono Documentary

Volkswagen’s cheapest EV ever is the first to use Rivian software

Sequoia’s Roelof Botha on the current dealmaking climate, VC firm proliferation, and sneaker style

8VC raises nearly $1B for its new flagship venture capital fund