A reminder for new readers. That Was The Week includes a collection of my selected readings on critical issues in tech, startups, and venture capital. I selected the articles because they are of interest to me. The selections often include things I entirely disagree with. But they express common opinions, or they provoke me to think. The articles are snippets sized to convey why they are of interest. Click on the headline, contents link, or the ‘More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below.

Hat Tip to this week’s creators: @reidhoffman, @dougleone, Credistick, @credistick, @rex_woodbury, @NathanLands, @ItsUrBoyEvan, @berber_jin1, @cityofthetown, @keachhagey, @pmarca, @bhorowitz, SignalRank Update, @signalrank, @steph_palazzolo, @julipuli, @MTemkin, @geneteare, @lorakolodny, @jasminewsun, @JBFlint, @asharma, @thesimonetti, @lessin

Contents

The American Dream - Marc Andreessen and Ben Horowitz

Doug Leone - I am supporting Trump.

Reid Hoffman - I am supporting Biden

Editorial

I woke on Tuesday to Doug Leone of Sequoia Capital on X saying:

I have become increasingly concerned about the general direction of our country, the state of our broken immigration system, the ballooning deficit, and the foreign policy missteps, among other issues. Therefore, I am supporting former President Trump in this coming election.

Doug has the right to support Trump. It is also clear that the immigration system is broken, the deficit is ballooning, many things are wrong with foreign policy, and there are “other issues.” Trump as the solution is less obvious. But there it is—hot on the tails of Chamath Palihipitaya and David Sacks announcing a fund-raiser for Trump on the All-In podcast (they said they would do the same for Biden).

Reid Hoffman followed up a day later with:

On one level, this is a straightforward choice, but any literate attempt to analyze Leone’s issues might arrive at the following conclusions:

Like many Western nations, the USA is aging rapidly and has a shrinking working-age population across all skill sets. Immigrants are needed, and pro-immigration leadership is needed, creating a path to entry for large numbers of skilled and unskilled workers to fill empty jobs as we get close to full employment.

The deficit is large, and there are many palliatives available. Selling more to China would help, but both party leaders are protectionist. Taxes to reduce the divide between the 1% and the rest would help a bit. However, what would help the most is economic growth, which requires investment in technology and productivity. Neither leader seems too focused on innovation and investment.

Foreign Policy - well, sheesh, it’s a big issue. However, saber-rattling about Taiwan and provoking China seems to be a hobby shared by both parties and does not seem smart. Ukraine and the future of Europe are better in Biden’s hands, but not by a lot. Europe looks very shaky. The US is increasingly isolationist. The appetite for world leadership is on the decline. Again, the solution would focus on economic growth, which seems absent.

Voting for Trump is a big no-no for me. But voting for Biden is, at best, a lesser evil instinct, not a belief system. The election will not be where the future is built, but it is important. Politicians are collectively disappointing.

This week’s video of the week from Marc Andreessen and Ben Horowitz is called “The American Dream” and champions their view about American Dynamism. And I must confess that this comes closer to a vision of the future than either political outfit. Their vision requires political support, massive government financial commitment, and private capital investment. I see no evidence of those happening.

The real winning effort seems to be happening on the ground. This week, Nvidia hit $3 trillion, eclipsing Apple as the world's second-most valuable company. This is even though Apple has 7 times the revenue of Nvidia.

This week’s first essays also focus on prospects for boom time. Rex Woodbury’s ‘The Consumer Renaissance’ examines the impact of consumer spending on our lives. In ‘The Creator Economy on AI Steroids, ’ Nathan Lands focuses on how emerging tools will transform creativity. But in ‘AI Is Transforming the Nature of the Firm, ’ Evan Armstrong gets closest to a future vision.”

AI is the first universally flexible technology. It can interact with our digital environments in similar ways to humans, so it can have all the flexibility that we do. In that way, it may be the last technology we ever need.

This seems to be the crux of hope in a world where dreams and nightmares are strangely devoid of detail. What the world needs (not only America) is hope. And hope is born from optimism. Optimism is born from success. The most likely success of the next decades will result from specific uses of AI that improve human life.

I know and like Doug Leone. I know and like Reid Hoffman.

Doug's bar for success needs to be higher. Voting for Trump is not right, and even if it were, it would not be sufficient.

Reid also needs a higher bar. Voting for Biden will not be sufficient even if it is right.

Let’s focus on where success can be found, grow optimism, and breed hope. There is a need for a broad technical revolution and the social rebirth it enables. Silicon Valley and its friends globally need to invent the next version of human existence to the benefit of all. The social rebirth requires a conscious effort; technology will not magically bring it about. More in this week’s video.

Essays of the Week

Crossing The Series A Chasm

Dan Gray, a frequent guest author for Crunchbase News, is the head of insights at Equidam, a startup valuation platform, and a venture partner at Social Impact Capital.

June 5, 2024

As we get deeper into 2024, there is increasing concern about the state of Series A fundraising. The bar for investment appears much higher, and fewer startups are reaching it.

This is a problem for founders, and investors like Jenny Fielding, managing partner of Everywhere Ventures, who said, “Every Seed investor’s dilemma: All my Series A buddies want to meet my companies early! All my companies are too early for my Series A buddies.”

To attach some data to this, we can see that the median step-up in valuation from seed to Series A has gone from $19.5 million in Q1 2022 to $28.7 million in Q1 2024. Series A firms seem to be looking for much stronger revenue performance, with targets of $2 million to $3 million in ARR, compared to $1 million to $2 million just a few years ago.

The outcome is that while 31.8% of Q1 2020 seed startups closed their Series A within two years, that fell to just 12% for Q1 2022 — which should worry everyone.

Why are Series A investors so much more demanding?

Today’s Series A investors are looking at startups that raised their seed between 2021 and 2023, which identifies the root of the problem: it spans the Q2 2022 high-tide mark for venture capital.

For example, there were 1,695 seed rounds of more than $5 million in 2021, rising to 2,248 in 2022, then falling to 1,521 in 2023. As a comparison, there have been just 137 so far in 2024.

The result is two categories of startups that are looking to raise their Series A today:

Pre-crunch startups that raised generous seed rounds and stretched the capital out as far as they could, to grow into inflated valuations.

Post-crunch startups that raised modest seed rounds on more reasonable terms, with shorter runways and less demonstrable growth.

Strictly speaking, neither is more appealing than the other; the first group has less risk, the second offers more upside, and both are adapted to current market realities. It shouldn’t cause a problem for investors, provided they can distinguish between the two.

The cost of market inefficiency

Venture investors have a market-based lens on investment decisions, which means looking fairly broadly at trends in revenue performance and round pricing to determine terms, e.g. a typical Series A is within certain bounds of revenue performance and valuation. While that approach may be serviceable and efficient under ideal conditions, the past few years have been far from ideal.

Without distinguishing between the two cohorts, investors are now looking at the performance of Series A candidates that spent more than $5 million on a war chest for two to three years of growth alongside the valuations of candidates that raised around $2 million to prove scalability. It just doesn’t work as an average, and thus the unreasonable expectations.

..More

The Consumer Renaissance

From Predicting Consumer AI Applications to Analyzing Consumer Spend

REX WOODBURY, JUN 05, 2024

“Consumer” has become something of a bad word in venture capital circles.

We see this reflected in the early-stage markets: recent data from Carta showed that just 7.1% of Seed capital raised last year went to consumer startups. That’s less than half the share from 2019 (14.3%).

But I think consumer is actually a great place to be building and investing. Whenever something is out of favor, that’s a sign it’s probably a good place to spend time: this is an industry built on being contrarian, not built on following the herd. We’re entering a compelling few years for consumer entrepreneurship.

First, I’d argue that consumer is too narrowly defined. When people think consumer, they often think consumer social (a tough category) or consumer brands (a tough fit for venture compared to internet and software businesses, with typically lower return profiles). But consumer is broader. Consumer encompasses businesses that sell to consumers and those that rely on consumer spending. This means the obvious names—apps on our phones like Uber, Instacart, Spotify—and the enablers: Shopify, for instance, powers online retail; Faire powers offline retail; Unity powers game development. Each of the latter three is B2B2C, in its own way, but I would categorize each is also a consumer technology business.

The wins in consumer can be massive. The biggest technology businesses in history began as consumer businesses—Google, Facebook, Apple, Amazon. The original companies comprising FAANG—with Microsoft conspicuously absent—were allconsumer.

And some of the best returns of the last five years have stemmed from consumer tech IPOs. At Daybreak, we invest ~$1M at Pre-Seed and Seed. Here’s how much a $1M investment in the Seed round of five recent consumer IPOs would yield:

Big consumer wins compare favorably to big enterprise wins—relative to Snowflake’s market cap, Uber is ~3x in size, Airbnb is ~2x in size, and DoorDash is roughly equal. (Snowflake is the biggest enterprise IPO of the last decade.) The last few years produced a windfall of consumer outcomes, yet investors today almost write off the category.

At Daybreak, we don’t focus exclusively on consumer; my view is that you need to balance more binary consumer outcomes with B2B SaaS and B2B marketplaces. But we do approach investing through the lens of the consumer—how people make decisions. The buyers of products like Figma and Ramp, after all, are people, and software companies are increasingly selling bottom-up into organizations. The line between consumer and enterprise has been blurring for years.

This week’s Digital Native makes the argument that consumer tech is a compelling place to build and invest. We’ll look at the data to back up this argument, then delve into three categories of consumer that I’m particularly interested in right now:

Checking in on Consumer Spend

Consumer Tech: The Data Doesn’t Lie

What to Watch: AI Applications

What to Watch: Shopping

What to Watch: Consumer Health

Rule of Thumb: Follow the Spend

This week we’ll cover #1-3, and next week in Part II we’ll tackle #4-6.

Let’s dive in 👇

Checking in on Consumer Spend

Joe Biden’s reelection hopes hinge on how voters view the economy. And right now, voters aren’t too thrilled.

An April poll from Echelon Insights found that 57% of voters somewhat or strongly disapprove of how Biden is handling the economy. Yet most economic indicators are strong—GDP, unemployment rate, job growth, inflation. Each is trending in the right direction. What gives?

While inflation is down overall, the prices of lower-priced goods are up. These are our more frequent purchases. Car prices may drag down inflation broadly, but if you see higher prices during your weekly grocery run, you’ll be upset. A good piece in The Atlantic last December characterized this as “The English-Muffin Problem.” When people were surveyed about what factors they consider when deciding how the national economy is doing, the most-cited factor was “The price of groceries for your home.” When asked what they had in mind when reporting that their personal finances were getting worse, 81% of people chose groceries. No one wants to shell out $5.99 for a pack of English Muffins.

This is a key reason that Biden is struggling with working class voters. We see the same concept at work in fast-food prices:

Yet despite voter sentiment, consumer spending remains strong.

Even amidst high inflation rates in 2022, even with the S&P 500 dropping -19.64%, people kept spending. A Bank of America study found that credit and debit card spending rose +5.9% in 2022. Last year was up on 2022, and Q1 2024 was up on Q4 2023.

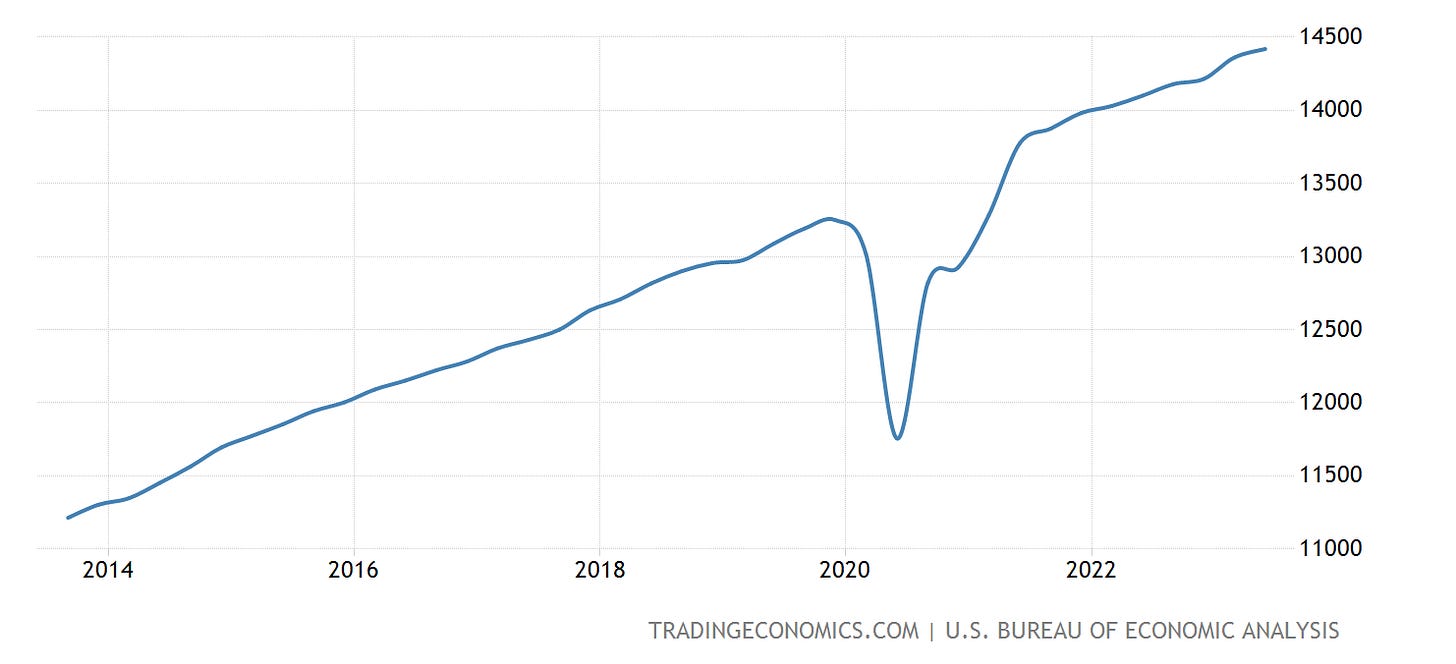

The chart below commits egregious Y-axis crime—starting at 11,000? come on!—but it’s helpful nonetheless. After a COVID dip in 2020, spending rebounded and has been rising steadily the past few years. The Y-axis is in billions here and data is quarterly, meaning that the chart ends at around ~$14.5 trillion in quarterly U.S. consumer spend.

A lot of headlines in the media tell the same story—that of the broke Millennial. But as Jean Twenge pointed out in The Atlantic recently, this narrative is wrong; Millennials are actually thriving.

The Creator Economy on AI Steroids

Nathan Lands

June 5, 2024

Create Your Own Netflix, Roberto Nickson Interview, First Pig-to-Human Liver Transplant, And Eminem Uses AI

Ever since ChatGPT launched, I’ve been telling friends who asked me for advice on what to do in the Age of AI two things:

Buy NVIDIA stock(not financial advice!)

Get involved in the creator economy. AI is going to put it on steroids.

That’s why I got active on X last year, growing my account from 5k followers to 64k, and now doing The Next Wave podcast with Matt Wolfe and HubSpot.

As AI makes execution easy, three big things remain: great ideas, great taste, and great personalities.

Peter Thiel recently said something similar, stating that individuals who excel in articulating ideas will surpass those skilled in mathematics, and our cultural values will shift to prioritize these communicators. I couldn't agree more.

The Age of AI will be dominated by Creative Generalists.

Possessing a broad set of creative skills and a strong online personality is crucial to thrive in this new era.

One aspect of this most people aren’t thinking about is that as AI content is everywhere, people will want to see real humans more and more. At the same time, those in the creator economy will have an easier time creating software and other products because of AI. This means lots of money for creators.

And actually, it’s already happening.

Tyler1, a famously jacked 6’5(possibly 5’4? Who knows) shit-talking League of Legends streamer with over 7 million followers, launched his startup, Backseatgg, this week.

It puts his personality into the game while you play. He talks directly to you and gives you advice, including telling you when you suck.

I believe this is the start of a megatrend, with creators not just getting sponsors but building their own tech products.

As more creators get their hands on AI tools and it becomes easier to generate software with AI agents, we will see an explosion of wild ideas and new experiences that were never possible before.

Imagine an AI voice bot with Alex Hormozi's entrepreneurial expertise guiding your business decisions, a Sam Sulek bot reminding you to do your cardio, or a Paul Graham bot punching holes in your startup pitch.

My key takeaway from all of this is that, as annoying as he can be, Gary Vaynerchuk was right.

The most important thing you can do for your career or business is to get involved in the creator economy or to align yourself with creators and support them.

My current tier-list for the creator economy is: YouTube > X > Everything Else.

X is the easiest place to start, so I suggest just going there and writing what you think as often as you can.

And with AI mass-producing tons of mid-content, it’s smart to put your true personality and thoughts out there. As uncensored as possible.

Put the human soul into your content.

Creative Generalists

In the Age of AI, creative generalists rule.

Execution becomes easy with agents.

Finding truly unique ideas becomes hard.

Those with creativity and the ability to do many different things and blend them in unique ways will thrive.

Create Your Own Netflix With AI

This week, The Simulation, a Silicon Valley-based startup created by people who worked at Pixar and Oculus, announced Showrunner. And it’s one of the coolest things I’ve ever seen in AI.

Showrunner allows users to create virtual worlds populated with AI characters. You can set up the initial prompts, define the characters, and then let the AI take over, creating unique storylines and interactions. You can choose to interfere as much or as little as you want and then sit back and watch how things unfold.

https://twitter.com/NathanLands/status/1797823823217410282

Today, I talked with the founder, Edward Saatchi, and now I’m even more excited.

They’re aiming to turn Showrunner into the Netflix of AI, where users can create shows, watch shows created by others, or eventually create shows entirely by AI.

The first sandbox world they’ve created is sunny Sim Francisco, with a more dystopian vibe, Neotokyo coming next.

They have a private Alpha right now, with over 1,000 people creating their own stories. Edward is going to give me access soon so I can try it out myself.

Edward said the surprising thing to him is that people love putting themselves and their friends into the show. That makes a ton of sense to me. I would love to put my friends and family in a sim, put us all in hilarious situations, and share clips with them.

This will be huge if he unlocks a viral loop in which celebrities and influencers create episodes and share clips online.

Jason Evanish, a reader of Lore, had a great idea, too. Imagine if Showrunner could eventually license top IP, and you could create new episodes of your favorite shows. Even if they were in South Park style, I wouldn’t care. However, I assume they’ll have many styles to pick from, including anime, etc.

Imagine creating new episodes of Seinfeld, Star Trek, X-Files, or Firefly. It would be so addicting.

I’d love to change the last season of Game of Thrones…

This all makes me wonder: if, in the long term, I can make my own show that feels more interactive, like a game, do I need Netflix?

The Next Wave with Roberto Nickson

In this week’s episode of The Next Wave, Matt Wolfe and I spoke with Roberto Nickson, one of the top voices in AI & Tech on Instagram.

We discussed:

His mega-viral Kanye West AI video from last year started much of the conversation around AI Music.

Why he thinks humans will continue to be an important part of creative work and art.

His time interviewing Mark Zuckerberg and why he’s very bullish on Meta’s chances to compete with OpenAI and Google.

..More

AI Is Transforming the Nature of the Firm

By reducing transaction costs, AI will reshape how companies operate and interact

JUNE 4, 2024

To truly understand business strategy, you have to accept that it is, by nature, bullshit. Of course, the practice of guiding a business, making choices with trade-offs, and responding to unexpected crises is real. But the academic study of business strategy is something closer to divination.

You may have heard of such famous frameworks as disruptive innovation, blue ocean, or Porter’s five forces. They look smart, sound smart, and are frequently cited by writers like myself. They try to add structure to something innately chaotic and mysterious.

So, why are they bullshit? Simple. The value of a forecasting method is in its ability to be right, not sound right. Despite decades of study and the relentless efforts of the good people over at the Harvard Business School, we have yet to discover any strategy that is universally predictive.

This does not mean that the study of business strategy has no value. Counterintuitively, because no single theory is wholly predictive, you can bundle multiple theories together to generate differentiated insights. Strategy is not business physics—it's analytic art.

When the world gets confusing—say, for example, AI is remaking the entire technology landscape—these frameworks can inform the choices you need to make. The better you know these theories, the more instinctual their lessons become, the more prepared your intellect is, the faster you’ll be able to react to new opportunities in front of you. And when change is happening fast (like it is right now), speed is one of the biggest advantages.

Can you answer the big questions about what AI means for computers and the internet in general? With the proper study of business strategy, you should be able to make a pretty good guess.

Today I’d like to explain what I consider one of the very first pieces of business strategy writing, from 1936. Despite being 88 years old, it can help us answer some of those questions about the nature of companies, what they chose to outsource, and how they interact with each other.

The foundation of business strategy

Our current AI conundrum would not have been a surprise to British economist Ronald Coase. At age 26, he published his legendary essay, "The Nature of the Firm."Coase grapples with a fundamental problem: If the market is efficient, shouldn’t it be cheaper for a firm to outsource the majority of its internal activities to specialized contractors? Markets typically reward specialized labor that can focus on performing one task better than anyone else. At its most elemental, Coase is trying to understand the relative merits of integration (i.e., a company makes all the stuff that goes into its products, like Tesla making many of the components of its cars) versus modularization (a company that uses off-the-shelf components like IBM).

Coase's major insight on this topic was to focus on transaction costs, which are the costs associated with using the market for production and exchange.

In a market, transactions occur through contracts between independent agents, each of which incurs costs. Within a firm, however, transactions are managed internally by a founder or manager, reducing the need for individual contracts for each transaction. Coase argues that firms exist because they can reduce these transaction costs relative to what they would outside the firm.

The size and scope of a firm are determined by the balance between the costs of organizing an extra transaction within the firm and the costs of conducting the same transaction on the open market. A firm will expand until the cost of organizing an additional transaction within the firm equals the cost of carrying out the same transaction through the market.

This theory has several implications: Firms may integrate vertically to reduce transaction costs, or they may outsource functions if the market can perform them more efficiently. The size of a firm is influenced not just by economies of scale but also by the efficiency in managing transaction costs internally instead of through the market.

However, the most important implication is that technology dramatically reduces costs. Widely distributed technology has a way of standardizing the way that firms interact with each other. Let me show you what I mean.

The Opaque Investment Empire Making OpenAI’s Sam Altman Rich

Many companies backed by CEO do business with the ChatGPT maker and benefit from the AI boom driven by the blockbuster startup, raising questions of conflicts

By Berber Jin, Tom Dotan and Keach Hagey

June 3, 2024 at 12:01 am ET

Sam Altman has a day job and a side gig. Only one of them is making him rich.

As the chief executive and co-founder of OpenAI, the 39-year-old oversees an artificial-intelligence startup valued at $86 billion that is spearheading a technological revolution. He owns no stake in the ChatGPT developer, saying he doesn’t want the seductions of wealth to corrupt the safe development of artificial intelligence, and makes a yearly salary of just $65,000.

Less publicly, Altman is one of Silicon Valley’s most prolific and aggressive individual investors, managing a sprawling investment empire that is becoming a direct beneficiary of OpenAI’s success. The holdings he controls were worth at least $2.8 billion as of early this year, according to company filings and Wall Street Journal reporting. Much of the portfolio isn’t widely known.

Altman and his venture funds have invested in more than 400 companies, by Altman’s own estimate, including big names such as Stripe, Airbnb and Reddit. The holdings are managed by his family office and rival the value and size of some full-blown venture firms.

Altman has added to his startup stakes by drawing on a debt line from JPMorgan Chase, his longtime personal bank, allowing him to pour hundreds of millions of dollars more into private companies. Altman’s strategy, not previously reported, is rare among venture capitalists given the volatile nature of startup investing, where high percentages of young companies go bust. Taking on such personal levels of debt is a risky gamble.

A growing number of Altman’s startups do business with OpenAI itself, either as customers or major business partners. The arrangement puts Altman on both sides of deals, creating a mounting list of potential conflicts in which he could personally benefit from OpenAI’s work.

OpenAI is in talks for a deal with Helion, a nuclear-energy startup that is chaired by Altman, in which it would buy vast quantities of electricity to provide power for data centers.

The 11-year-old company is planning to build nuclear-fusion power plants, a technology that doesn’t yet exist in a usable format. Altman invested $375 million in Helion in 2021, his largest startup check ever written. The startup signed on Microsoft, its first customer and OpenAI’s largest investor, last year.

Altman has recused himself from the deal talks between OpenAI and Helion, which haven’t been previously reported.

Last month, OpenAI announced a partnership with Reddit in which it would pay to bring the messaging site’s content to ChatGPT and other AI products. Altman and entities he controls own 7.6% of Reddit, making him the third-largest outside shareholder, and he briefly served as its CEO in 2014.

Reddit’s stock shot up 10% after the announcement, boosting Altman’s stake by $69 million to $754 million. Altman didn’t lead the partnership talks, OpenAI said in a blog post.

Altman’s more recent investments have focused on companies that aim to capitalize on the artificial intelligence boom being driven by OpenAI. Apex Security, in which Altman invested an undisclosed amount last summer, aims to sell cybersecurity software to companies using AI products such as ChatGPT. He also invested an undisclosed amount in Exowatt, a startup tackling the clean-energy needs of big data centers used by AI companies.

Through a spokesperson, Altman declined to comment on any potential conflicts of interest between OpenAI and his personal investments.

Video of the Week

The Future of the American Dream

Marc Andreessen and Ben Horowitz

AI of the Week

SignalRank Version 3 Improves Performance Again

Announcing the next version of SignalRank's Predictive Algorithms

JUN 05, 2024

SignalRank's scoring algorithms aim to align our investments with our partner's greatest chance of seeing returns on their investments. We seek to provide capital for the best prospects within their portfolio.

Because our partners share profits on our investments, they have a common interest in the quality of the companies we place capital into. Our scores are intended to weigh all Series B rounds against each other. We target the top 5-10% of high-scoring rounds. In that sense, our accuracy is of significant interest to our partners.

Last October, we announced version 2 of SignalRank's algorithms.. At that time, we highlighted a significant improvement in the algorithm’s ability to detect companies likely to achieve a 5x MOIC (multiple of invested capital) or more within 5 years of their Series B funding round, while maintaining strong unicorn prediction capabilities.

While version 2 showed relative performance metrics slightly below version 1 (24% unicorns vs. 26% and 4x MOIC vs. 4.6x MOIC), it demonstrated substantial absolute gains (641 unicorns vs. 203), making it far superior in overall performance. Here is what we said at the time. These were 2012-2023 numbers so included many immature qualifiers.

v1 has an average MOIC of 4.6x 2012-2023. v2 has 4.0x. 2012-2023.

v1 has 203 unicorns from the 858 selections (26%) v2 has 641 from 2,612 selections (24%)

This means we have significantly grown the candidate base while maintaining excellent performance.

With version 3, these performance metrics have improved even further, as evidenced in the following charts. We focus on four dimensions of improvement:

1. Number of Qualifiers: Ensuring sufficient candidates to produce at least 100 investable Series B rounds per year.

2. Average and Median MOIC: Evaluated through backtesting.

3. Unicorn Percentage: The proportion of unicorns produced by the backtest.

4. Absolute Number of Unicorns: The total count of unicorns identified.

No single model excels in all four dimensions, but MOIC production and the number of qualifiers are the most critical as they directly impact the number of accessible Series B rounds and the likely performance of those investments.

Version 3 outperforms both version 1 and version 2, producing more qualifiers, a significantly higher average and median MOIC, and a much higher unicorn percentage.

To correlate performance to the age of the investments in the qualified companies, we will use 2012-2020 as the range of years tested and compared.

This permits us to include 2021-24 performance in investments made up to 2020, and so shows a realistic set of outcomes.

For 2012-2020 here is the comparison:

It is clear that v3 has performed by optimizing qualifiers to provide at least 100 annual qualifiers (v2 produced too many), increasing MOIC against v2, and unicorn percent against both previous models. v1 produces better MOIC but at the heavy cost of too few qualifiers and as a result a low absolute number of unicorns.

..More

How Long Can OpenAI’s First-Mover Advantage Last?

By Stephanie Palazzolo Jun 4, 2024, 7:00am PDT

As companies like OpenAI, Anthropic, Google and Meta Platforms race to leapfrog each other with marginally faster, cheaper or more accurate large language models, a number of developers have told me that these LLMs are beginning to reach parity when it comes to performance.

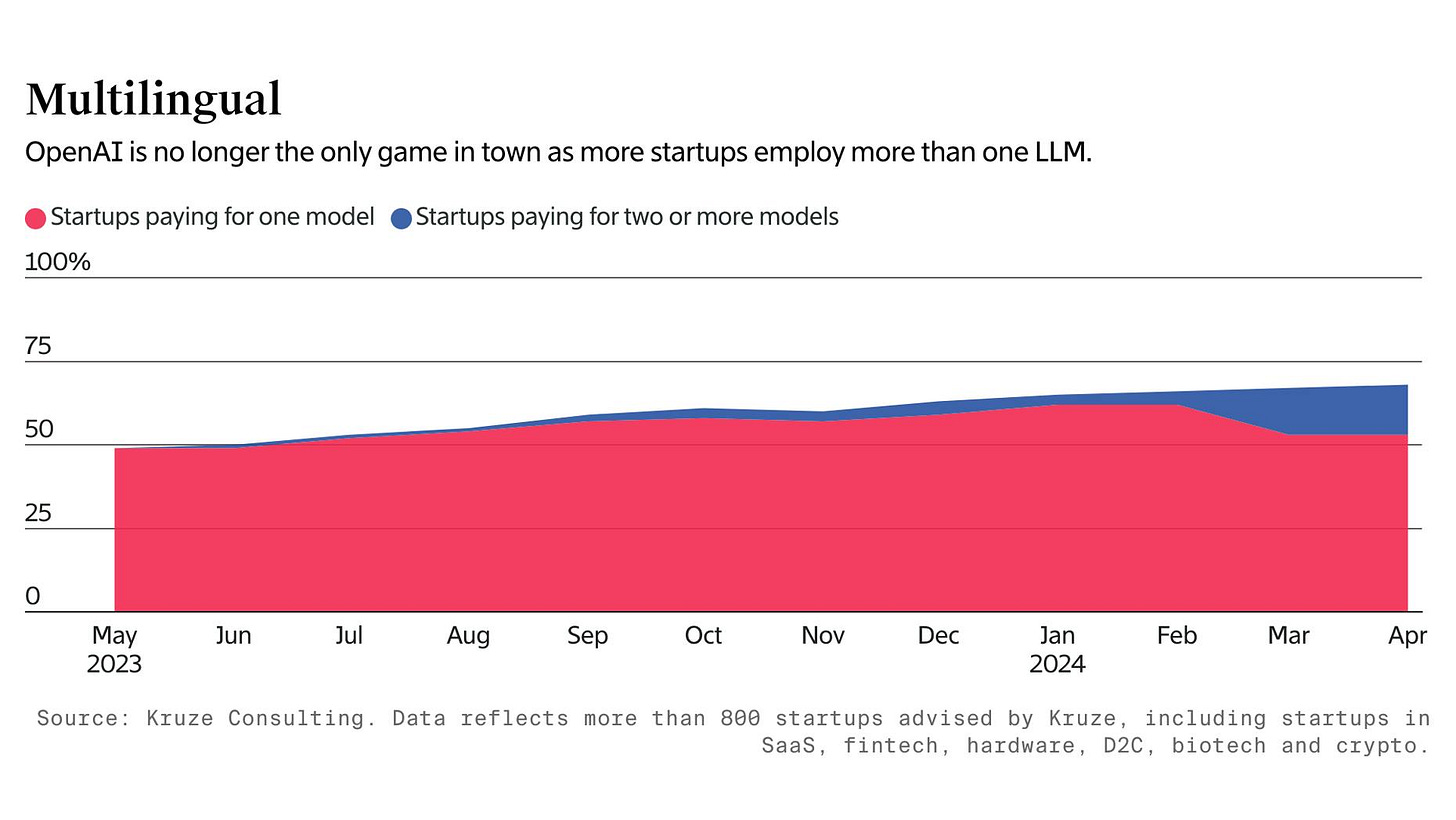

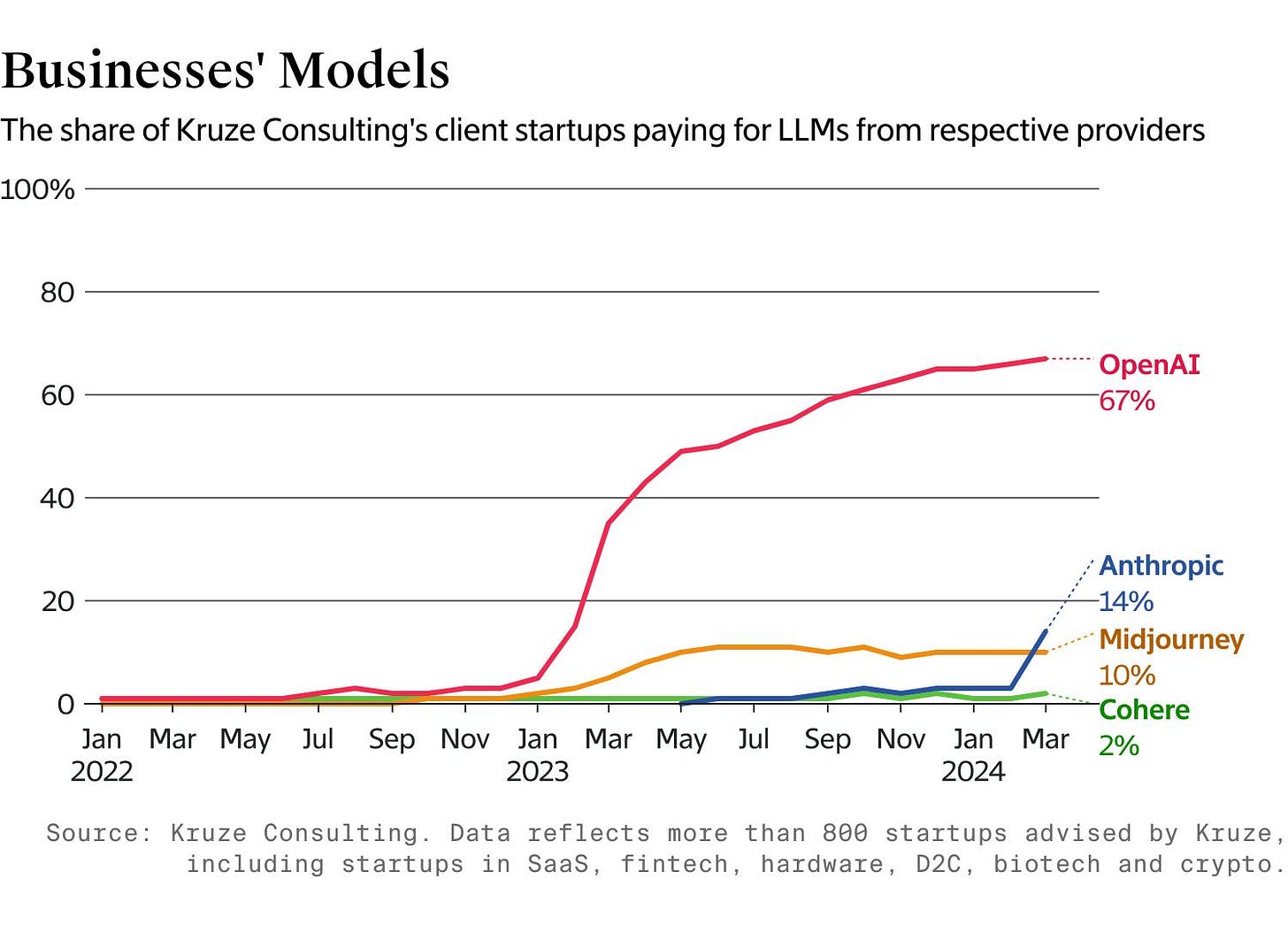

And now, new exclusive data from Kruze Consulting, a finance and HR consulting firm, backs up those anecdotes. Over the last year, the proportion of the firm’s 800-plus venture-backed startup customers using multiple AI models has grown significantly, expanding from 1% last summer to 15% in April.

OpenAI remains by far and away the market leader when it comes to LLM usage, and I’ll be the first to admit that 15% is still a relatively modest number. But, this trend could signal that developers aren’t as married these days to any specific model provider as they once were, a belief that industry practitioners have shared with me as well.

“The most recent open-source models today are on par with GPT-4, and until the release of GPT-4o, OpenAI, Anthropic and Google’s models were very close in terms of performance,” said Ion Stoica, a professor of computer science at the University of California, Berkeley and the co-founder of AI startups Anyscale and Databricks. “It does raise the question of whether these models will get commoditized.”

In another example, data from Kruze shows that the growth in the consulting firm’s customers using OpenAI’s LLMs has slowed in recent months. Meanwhile, Anthropic’s release of Claude 3 in March saw a dramatic increase in usage compared to its Claude 2launch last July, suggesting that many developers saw the latest model as a serious contender compared to other frontier LLMs.

OpenAI could still have a few cards left up its sleeve. The company could take a page out of its biggest shareholder’s book by bundling together more AI products and creating an all-in-one package for customers—a strategy Microsoft used to make its Teamsmessaging app an attractive option despite Slack’s popularity. That strategy has likely worked for the ChatGPT maker in the past: Its choice to begin bundling together its image-generation software, DALL-E, with its ChatGPT Plus and Enterprisesubscriptions last October coincided with a decrease in Kruze’s customers using rival software from Midjourney, the firm said.

OpenAI Employees Warn of Advanced AI Dangers

Tuesday June 4, 2024 12:55 pm PDT by Juli Clover

Several current and former employees of OpenAI and Google DeepMind today shared an open letter warning of the dangers of advanced AI and the current lack of oversight of companies working on AI technology.

The employees suggest there are a number of risks that we are facing from AI development, including further entrenchment of existing inequalities, manipulation and misinformation, and loss of control of autonomous AI systems, which the letter says could lead to human extinction.

AI companies have "strong financial incentives" to forge ahead with development and to avoid sharing information about their protective measures and risk levels. "We do not think they can all be relied upon to share it voluntarily," reads the letter, which says that it is up to current and former employees to speak out.

So long as there is no effective government oversight of these corporations, current and former employees are among the few people who can hold them accountable to the public. Yet broad confidentiality agreements block us from voicing our concerns, except to the very companies that may be failing to address these issues. Ordinary whistleblower protections are insufficient because they focus on illegal activity, whereas many of the risks we are concerned about are not yet regulated.

Employees are ultimately calling on AI companies to offer solid whistleblower protections for speaking out about the risks of AI.

Avoid creating or enforcing agreements that prevent criticism for risk-related concerns.

Offer a verifiably anonymous process for employees to raise risk-related concerns to the board, regulators, and independent organizations with relevant expertise.

Support a culture of open criticism to allow employees to raise risk-related concerns about technologies to the public, the board, regulators, and more, as long as trade secrets are protected.

Avoid retaliating against employees who publicly share risk-related confidential information after other processes have failed.

A total of 13 employees signed the letter, including seven former OpenAI employees, four current OpenAI employees, one former Google DeepMind employee, and one current Google DeepMind employee. OpenAI has threatened employees with loss of vested equity for speaking up, and it makes them sign draconian NDA agreements that muzzle criticism.

The letter comes as Apple prepares to announce multiple AI-powered features for iOS 18 and other software updates on Monday. Apple is working on its own AI functionality that will be baked into apps across the operating system, plus it has signed a deal with OpenAI to integrate ChatGPT features into iOS 18.

A Right to Warn about Advanced Artificial Intelligence

We are current and former employees at frontier AI companies, and we believe in the potential of AI technology to deliver unprecedented benefits to humanity.

We also understand the serious risks posed by these technologies. These risks range from the further entrenchment of existing inequalities, to manipulation and misinformation, to the loss of control of autonomous AI systems potentially resulting in human extinction. AI companies themselves have acknowledged these risks [1, 2, 3], as have governments across the world [4, 5, 6] and other AI experts [7, 8, 9].

We are hopeful that these risks can be adequately mitigated with sufficient guidance from the scientific community, policymakers, and the public. However, AI companies have strong financial incentives to avoid effective oversight, and we do not believe bespoke structures of corporate governance are sufficient to change this.

AI companies possess substantial non-public information about the capabilities and limitations of their systems, the adequacy of their protective measures, and the risk levels of different kinds of harm. However, they currently have only weak obligations to share some of this information with governments, and none with civil society. We do not think they can all be relied upon to share it voluntarily.

So long as there is no effective government oversight of these corporations, current and former employees are among the few people who can hold them accountable to the public. Yet broad confidentiality agreements block us from voicing our concerns, except to the very companies that may be failing to address these issues. Ordinary whistleblower protections are insufficient because they focus on illegal activity, whereas many of the risks we are concerned about are not yet regulated. Some of us reasonably fear various forms of retaliation, given the history of such cases across the industry. We are not the first to encounter or speak about these issues.

We therefore call upon advanced AI companies to commit to these principles:

That the company will not enter into or enforce any agreement that prohibits “disparagement” or criticism of the company for risk-related concerns, nor retaliate for risk-related criticism by hindering any vested economic benefit;

That the company will facilitate a verifiably anonymous process for current and former employees to raise risk-related concerns to the company’s board, to regulators, and to an appropriate independent organization with relevant expertise;

That the company will support a culture of open criticism and allow its current and former employees to raise risk-related concerns about its technologies to the public, to the company’s board, to regulators, or to an appropriate independent organization with relevant expertise, so long as trade secrets and other intellectual property interests are appropriately protected;

That the company will not retaliate against current and former employees who publicly share risk-related confidential information after other processes have failed. We accept that any effort to report risk-related concerns should avoid releasing confidential information unnecessarily. Therefore, once an adequate process for anonymously raising concerns to the company’s board, to regulators, and to an appropriate independent organization with relevant expertise exists, we accept that concerns should be raised through such a process initially. However, as long as such a process does not exist, current and former employees should retain their freedom to report their concerns to the public.

Nvidia hits $3tn and surpasses Apple as world’s second most valuable company

AI chipmaker’s stock has surged 147% so far in 2024, underscoring shift in tech world as demand for its processors far outstrip supply

Reuters, Wed 5 Jun 2024 21.46 BST

Shares of Nvidia rallied to record highs on Wednesday, with the artificial-intelligence chipmaker’s stock market valuation hitting the $3tn mark and overtaking Apple to become the world’s second most valuable company.

The chipmaker’s stock was up 5.16% at $1,224.40, giving Nvidia a market value of $3.01tn at market close. Apple’s market capitalization was at $3.00tn at market close as its stock climbed 0.78%.

The latest rally for Nvidia comes as it prepares to split its stock 10-for-one, effective on 7 June, a move that could increase its appeal to individual investors.

The surge in Nvidia’s stock market value above Apple’s underscores a shift in Silicon Valley, where the company co-founded by Steve Jobs has dominated since it launched the iPhone in 2007.

Microsoft, based in Redmond, Washington, remains the world’s most valuable company with a market value of $3.14tn as its shares climbed slightly the same day, the only other company to reach such a stratospheric valuation.

Demand for Nvidia’s top-of-the-line processors is far outstripping supply as Microsoft, Meta Platforms and Google parent Alphabet race to build out their AI computing capabilities and dominate the emerging technology.

Nvidia has rallied nearly 30% just since 22 May, when it issued its latest stellar revenue forecast.

Optimism about AI lifted chip stocks broadly on Wednesday, with the PHLX chip index surging about 4%. Super Micro Computer, which sells AI-optimized servers built with Nvidia chips, climbed nearly 5%.

..More

VCs are selling shares of hot AI companies like Anthropic and xAI to small investors in a wild SPV market

10:00 AM PDT • June 1, 2024

VCs are clamoring to invest in hot AI companies, and willing to pay exorbitant share prices for coveted spots on their cap tables. Even so, most aren’t able to get into such deals at all. Yet small, unknown investors, including family offices and high-net-worth individuals, have found their own way to get shares of the hottest private startups like Anthropic, Groq, OpenAI, Perplexity, and Elon Musk’s X.ai (the maker of Grok).

They are using special purpose vehicles, or SPVs, where multiple parties pool their money to share an allocation of a single company. SPVs are generally formed by investors who have direct access to the shares of these startups and then turn around and sell a part of their allocation to external backers, often charging significant fees while retaining some profit share, known as carry.

While SPVs aren’t new – smaller investors have relied on them for years – there’s a growing trend of SPVs successfully getting shares from the biggest names in AI.

These investors are finding that the most popular AI companies, except OpenAI, are not all that hard for them to buy at their smaller levels of investing. That’s because early backers in sought-after AI startups are eager to exercise their pro-rata rights, which allow them to buy more shares each time a company raises, maintaining their percentage ownership. That’s the perfect scenario for an SPV. Rather than giving up the shares because the early investor can’t afford them, they’ll create the SPV, fund it by raising money from others, and, in most cases, charge additional fees.

In many cases, the VCs will offer access to the SPV to their existing limited partner investors, but they also may use brokers to offer access to a much larger universe of potential investors. In fact, the same AI startup may have multiple SPVs on their cap table, representing lots of small investors. But the terms each small investor will pay depend on the SPV. It’s a bit of a wild west, buyer-beware situation.

Ken Sawyer, co-founder of Saints Capital, a secondaries market VC firm, said he regularly sees SPVs for the same company marketed with different terms. “Fees and carry are all over the map,” he said, adding that SPV sponsors can charge as high as 2% of the total money invested and keep 20% of the profits.

What’s more, some SPVs are formed on top of another SPV. For instance, when Menlo Ventures was raising a $750 million SPV to invest in Anthropicearlier this year, some funds that invested in it resold a slice of their SPV allocation to other investors, charging additional fees on their second-layer SPV, Sawyer said.

News Of the Week

Crunchbase Monthly Recap May 2024: AI Leads Alongside An Uptick In Billion-Dollar Rounds

June 5, 2024

Venture funding rebounded in May to reach $31 billion, the highest monthly tally so far this year. Investment was up over 40% month over month and 29% year over year, with AI leading as the sector that raised the most funding.

A spate of billion-dollar fundings contributed to the total, with $11 billion — over a third of capital raised last month — invested in six companies in rounds at $1 billion or more. This was the highest count of billion-dollar fundings in a single month since the venture market slowdown began in 2022.

Elon Musk’s xAI raised the largest funding, $6 billion at a $24 billion value. Billion-dollar rounds also went to CoreWeave, Wayve, Abound, Scale AI and Wiz. Investors who led or co-led these fundings include Lightspeed Venture Partners, Andreessen Horowitz, Accel and GSR Ventures on the venture side. Growth investors Thrive Capital, Coatue and SoftBank also led rounds.

AI leads

In total, companies in the AI sector raised 40% of venture funding in May with $12.5 billion invested across more than 250 companies, based on an analysis of Crunchbase data. xAI raised close to half of that amount.

Other leading sectors include healthcare and biotech companies, which raised $5.1 billion, and financial services companies, which raised $3.9 billion last month.

As of the end of May, AI, healthcare and biotech are the leading sectors so far this year, with each raising around $27 billion in funding.

Are the M&A markets making a comeback?

A record five venture-backed companies were acquired for more than $1 billion this past month. Three were biotech companies EyeBiotech, HI-Bio and Mariana Oncology. In the enterprise software sector, Venafi, a machine identity security company, and AuditBoard, a cloud compliance management software provider, were acquired.

..More

Elon Musk ordered Nvidia to ship thousands of AI chips reserved for Tesla to X and xAI

PUBLISHED TUE, JUN 4 20249:00 AM EDT

KEY POINTS

Emails circulated inside Nvidia and obtained by CNBC show that Elon Musk told the chipmaker to prioritize shipments of processors to X and xAI ahead of Tesla.

Musk has said he can grow Tesla into a major player in artificial intelligence and that the company is spending heavily on Nvidia’s AI processors.

By ordering Nvidia to let X jump the line ahead of Tesla, Musk delayed the automaker’s receipt of over $500 million in processors by months.

Elon Musk, chief executive officer of SpaceX and Tesla and owner of X, speaks at the Milken Conference 2024 in Beverly Hills, California, May 6, 2024.

David Swanson | Reuters

Elon Musk says he can grow Tesla into “a leader in AI & robotics,” an ambition that he’s said will require a lot of pricey processors from Nvidia to build up its infrastructure.

On Tesla’s first-quarter earnings call in April, Musk said the electric vehicle company will increase the number of active H100s — Nvidia’s flagship artificial intelligence chip — from 35,000 to 85,000 by the end of this year. He also wrote in a post on X a few days later that Tesla would spend $10 billion this year “in combined training and inference AI.”

But emails written by Nvidia senior staff and widely shared inside the company suggest that Musk presented an exaggerated picture of Tesla’s procurement to shareholders. Correspondence from Nvidia staffers also indicates that Musk diverted a sizable shipment of AI processors that had been reserved for Tesla to his social media company X, formerly known as Twitter.

Tesla shares slipped as much as 1% on the news Tuesday morning.

By ordering Nvidia to let privately held X jump the line ahead of Tesla, Musk pushed back the automaker’s receipt of more than $500 million in graphics processing units, or GPUs, by months, likely adding to delays in setting up the supercomputers Tesla says it needs to develop autonomous vehicles and humanoid robots.

“Elon prioritizing X H100 GPU cluster deployment at X versus Tesla by redirecting 12k of shipped H100 GPUs originally slated for Tesla to X instead,” an Nvidia memo from December said. “In exchange, original X orders of 12k H100 slated for Jan and June to be redirected to Tesla.”

A more recent Nvidia email, from late April, said Musk’s comment on the first-quarter Tesla call “conflicts with bookings” and that his April post on X about $10 billion in AI spending also “conflicts with bookings and FY 2025 forecasts.” The email referenced news about Tesla’s ongoing, drastic layoffsand warned that head-count reductions could cause further delays with an “H100 project” at Tesla’s Texas Gigafactory.

..More

Introducing video to Substack Chat

Speak directly to subscribers in a space you own

JASMINE SUN, JUN 05, 2024

Today we’re bringing video to Substack Chat. Now, for the first time, you can easily record a video on your phone and send it directly to your subscribers. Posting a video to Chat instantly notifies your audience, and the video can be paywalled to paid subscribers or your founding tier.

When we introduced video to Notes in April, we saw an explosion of creativity across the platform. Many Substackers jumped on the opportunity to introduce themselves to the broader Substack network, bringing potential new subscribers behind the scenes of their work. We saw Wu Fei 吴非 sing to a local hummingbird, Dr Sharon Blackie announce her new book, and Viv Chen share an outfit of the day. Others asked for the option to use video in a more private space that they own and control, where they can be candid with their community. We built video in Chat for publishers who wish to speak directly to subscribers in this way.

Think of video in Chat like sending a voice memo to a group chat, or recording a video for your Instagram story—minus the opaque algorithm deciding whether your post gets seen. Rather than getting lost in a sea of content, video in Chat is an easy way for creators to speak directly to their subscribers.

How to share videos in Substack Chat

Open your publication’s chat in the Substack app by tapping on the Chat tab (the messages icon). Then tap on the orange “New chat” button. If you’ve enabled chat, your publication will be listed at the top.

Tap the plus icon in the bottom left corner, next to the composer. Choose “Video” to upload from your gallery, or “Camera” to record a video directly from your phone’s camera.

You can then choose to add a caption, paywall the video thread, or send an email to notify subscribers.

You’re done! Subscribers will get an instant push notification to their mobile device, prompting them to react and reply.

Videos in Chat can be up to five minutes long. For the smoothest experience, we recommend uploading at 1080p or lower. If you allow subscribers to start their own chat threads, they are able to share their own videos with the community (video replies are coming soon!).

..More

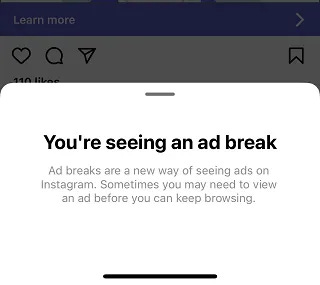

Instagram’s Testing Video Ads That Stop You From Scrolling Further

Published June 2, 2024

By Andrew Hutchinson, Content and Social Media Manager

Unskippable video ads in your main Instagram feed? How would that work?

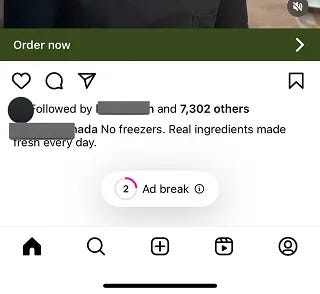

According to various reports, Instagram is currently testing out a new video ad format that does indeed stop users from scrolling in the main feed of the app until they’ve viewed a video ad.

As you can see in this example, shared by photographer Dan Levy, Instagram’s new in-feed ad units appear with a timer at the bottom, and you can’t scroll past the ad till the timer runs down.

Here’s an explainer of how the new ad units work:

As Instagram explains, you’ll actually need to view the ad before you can keep scrolling, so these are essentially unskippable video ads in IG form.

Which, as you can imagine, is not going down great with Instagram users.

YouTube’s unskippable video ads have long been cited as a key reason why people download ad blockers, because there are few things more annoying on the web than being forced to view disruptive, all-encompassing promotions for things that you’re not interested in.

Ideally, digital ad targeting would have gotten so advanced by this stage that the targeting element is less of an issue, but really, there’s no way to always display the right ad to the right user every time. So you are going to get random promos, particularly from big brands, blasted at you from time-to-time at least, and this new format would provide another way to force such messaging down your throat as you scroll through Instagram.

Which, from a brand perspective, I can understand the benefits of, in terms of exposure, timed placement, etc. But for users, not so much.

So why would Instagram do it?

Well, now that your main Instagram feed is half filled by AI-recommended content from profiles that you don’t follow, predominantly short-form Reels video clips, that presents a great opportunity for Meta to add in more promotions, because if 50% of the content in your feed is from profiles that you don’t follow anyway, you’re not going to be as affronted by ads within that stream.

But the scroll-stopping part, I’m not so sure about.

Startup of the Week

NBA Nears $76 Billion TV Deal, a Defining Moment for Media and Sports

Advanced talks with NBC, Amazon and ESPN spotlight the staggering value of sports rights and could portend industry changes

By Joe Flint, Amol Sharma and Isabella Simonetti

Updated June 5, 2024 at 8:37 am ET

The National Basketball Association entered its first TV negotiations in a decade with a problem: Its main business partners seemed to be on shaky footing.

TNT parent Warner Bros. Discovery WBD 0.73%increase; green up pointing triangle was saddled with more than $40 billion in debt, while ESPN parent Disney DIS -1.77%decrease; red down pointing triangle was battling a Wall Street activist over its slumping stock. Each company was reluctant to pony up the full premium the league wanted. But the NBA had quietly laid the groundwork with two other potential partners, Amazon AMZN 1.08%increase; green up pointing triangle and NBC, which pounced as soon as they got the chance.

Now, with negotiations progressing as the Boston Celtics and Dallas Mavericks prepare to face off in the NBA Finals, the league is on track to score big: It is closing in on deals with NBC, ESPN and Amazon that would bring in about $76 billion in media revenue over 11 years, people familiar with the discussions said.

The NBA sweepstakes has turned into a defining moment for the TV industry, highlighting the anxieties of traditional media companies about the collapse of cable and their uncertain financial futures in the streaming world. It has put front and center the paradox that sports content is outrageously expensive but also critical to own in an industry in which it is one of the few reliable ways to draw in audiences.

“Entertainment is a swamp, and sports is the only firm ground,” said former Fox Sports chief David Hill.

NBC is near an accord with the league to pay an average of $2.5 billion a year, people familiar with the deal talks said. It would show around 100 games per season, with about half airing exclusively on the Peacock streaming service, reflecting a major bet on the future of streaming. Games would air on NBC on Tuesdays and Sundays when there isn’t a conflict with NBC’s “Sunday Night Football.”

Amazon’s $1.8 billion-a-year package would include regular-season and playoff games, the new NBA in-season tournament, and the “play-in” games in which teams compete for the final playoff spots. It also would have a share of the conference finals, which the media partners would split in a rotation, the people familiar with the terms said.

Disney would retain an NBA package and would continue to air the NBA Finals, with payments averaging about $2.6 billion a year, people familiar with the terms say, up from $1.5 billion under the current deal. Disney would get fewer games than under its current deal. ESPN’s deal will allow the company to air games on its direct-to-consumer streaming service, which is set to launch in 2025.

Warner, led by Chief Executive David Zaslav, still has a right to match a rival package, and the league could always carve out a new package for the company in the final stretch, but its options are limited.

The deals would go into effect after the 2024-2025 season and would include rights to WNBA telecasts, as that league grows in popularity with the rise of rookie sensation Caitlin Clark. Owners must approve the deals, and any announcement could still be a few weeks away.

The deals are clarifying the media industry’s pecking order and could set the table for big mergers down the road. For the league, the deals would translate into a windfall that would help fund blockbuster contracts for stars such as Jayson Tatum and Luka Doncic in the coming years.

The NBA is on track to increase its annual fees by more than 2.5 times under the new deal, to an average of nearly $7 billion. The NFL roughly doubled its fees under its last deal to around $10 billion a year. The NBA has much lower average ratings than the NFL, but it has more games and a young audience that is important to advertisers. It is very popular abroad, which is a big motivator for Amazon’s Prime Video.

“Yes, there’s risk at these fee levels given recent ratings, but they are also looking at the downside of the games being on competing services. Which is worse?” said Brent Magid, CEO of media consulting firm Magid.