A reminder for new readers. That Was The Week includes a collection of my selected readings on critical issues in tech, startups, and venture capital. I selected the articles because they are of interest to me. The selections often include things I entirely disagree with. But they express common opinions, or they provoke me to think. The articles are snippets sized to convey why they are of interest. Click on the headline, contents link, or the ‘More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below.

Hat Tip to this week’s creators: @tedgioia, @benthompson, @stratechery, @peterwalker99, @omri_drory, @sama, @mariogabriele, @gruber, @giannandrea, @craigfederighi, @gregjoz, @alex, @MParekh, @waxeditorial, @romaindillet, @cookie, @ttunguz, @Kantrowitz

Contents

Editorial: Checkmate!

John Gruber, John Giannandrea, Craig Federighi, and Greg Joswiak on Apple Intelligence

3, 3 Trillion Dollar Companies

Editorial: Checkmate!

Checkmate! That seems like the appropriate word if you analyze what happened with OpenAI this week.

After being built into every conceivable Microsft interface, Apple announced that it would integrate OpenAI into all of its operating systems across devices via Siri.

By locking up Microsoft and Apple, it has effectively locked out Google, at least for now. That will leave Google itself as the only large implementation of its Gemini AI family.

This gives Apple a global advantage in the iPhone versus Android battle. Few will prefer Gemini to OpenAI.

Beyond that, Apple successfully showed how its own ‘Apple Intelligence’ will face inwards to the device, interoperating with all apps and supporting ‘actions’ while leaving all user data on the device. And when you need more power than the device can deliver, the new Apple Intelligence Cloud steps up in a fully encrypted secure environment. Even Apple cannot decrypt your data as it has no keys.

Ben Thompson from Stratechery sums up Apple’s play as follows:

This is good news for Apple in two respects. First, with regards to the title of this Article, the fact it is possible to be too early with AI features, as Microsoft seemed to be in this case, implies that not having AI features does not mean you are too late. Yes, AI features could differentiate an existing platform, but they could also diminish it. Second, Apple’s orientation towards prioritizing users over developers aligns nicely with its brand promise of privacy and security: Apple would prefer to deliver new features in an integrated fashion as a matter of course; making AI not just compelling but societally acceptable may require exactly that, which means that Apple is arriving on the AI scene just in time.

The concept of “just in time” seems appropriate. Although, as a developer possessing all of the beta products, I can say that very few of the features announced are yet available.

The contrast with Microsoft couldn’t be more extreme. Its Recall product, which took a screen recording every five seconds and stored its findings in clear text on the device, got a backlash from journalists and privacy campaigners. Microsoft has all but canceled the product, and its PR tail is between its legs. Apple’s ‘Crush’ ad has almost been forgotten.

Microsoft could make a mistake here. It is already working on products competing with OpenAI and might be tempted to go alone. What Bing is to Google, Microsoft AI will be to OpenAI. If it does so, it will once again shoot itself in the foot. OpenAI is far ahead in features and capabilities. Google cannot integrate it. Microsoft has gained an advantage from having done so. Apple too. Don’t bite the hand that feeds you seems an apt reminder.

This week’s essays focus a lot on the social impact of innovation and venture capital.

Ted Gioia’s essay about “Universe 25” focuses on the Durkheim concept of ‘anomie.’ It is the idea that our isolation leads to meaninglessness in life.

“More than 100 years ago, sociologist Emile Durkheim studied the problem of anomie. That’s not a word you hear very often nowadays. But we need to bring it back.

Anomie is a sense that life has no purpose or meaning. The people who suffer from it are listless, disconnected, and prone to mental illnesses of various sorts. Durkheim believed, for example, that suicide was frequently caused by anomie.

But the most shocking part of Durkheim’s analysis was his view that anomie increased when social norms were lessened. You might think that people rejoice when rules and regulations get eliminated. But Durkheim believed the exact opposite.”

Gioia examines the aimlessness of a world where people live in social media.

The Venture Capital essays are excellent. Sam Altman’s ‘Startup Playbook’ contains intelligent advice for startup founding teams. And Mario Gabriele’s piece about ‘How to Find a Unicorn’ has good advice for emerging fund managers. Omri Drory’s piece: How VCs Become Assholes - is both funny and true. A great read.

Essays of the Week

Is Silicon Valley Building Universe 25?

How a creepy experiment from 1968 is eerily relevant today

TED GIOIA, JUN 10, 2024

Back in groovy 1968, visionaries dreamed of a utopia of peace and love. But only one person actually created it.

I’m referring to John B. Calhoun, a scientist who built a perfect society in a small town in Maryland. He created an actual Garden of Eden in modern America.

But only for mice.

Even today, Dr. Calhoun’s bold experiment—known as Universe 25—demands our attention. In fact, we need to study Universe 25 far more carefully today, because zealous tech accelerationists—that’s now a word, by the way—aim to create something comparable for human beings.

What would you do if AI took care of all your needs?

Would you be happier? Would you be kinder and gentler? Would you love your neighbor more? Would you spend more time with family? Would you have a richer, more fulfilled life?

Calhoun tried to answer that question by creating a utopia for mice, and watching how their society evolved when all their needs and desires were met.

It didn’t turn out like he planned.

Calhoun started with eight mice—and he gave them a perfect environment. His specially designed mouse utopia offered unlimited food and drink, cozy apartments for nesting, ample supplies of nesting material, and constant temperature control to maximize comfort.

There were no predators. There was no disease. There was no competition. There were no threats.

Mice were free to be the best they could be. The only thing missing was 24/7 Netflix.

There was just one rule: Nobody could leave.

The galvanized metal walls of Universe 25 had no exit doors. But why would a mouse want to move out of the Garden of Eden?

Calhoun expected that his mice would flourish and propagate. He had room for 3,000 mice in his pen. He anticipated that the population would soon reach that limit.

It never happened.

At first, the population doubled every 55 days. But things started to deteriorate after the mouse population reached 620—although that was only around 20% of Universe 25’s capacity.

The problem started in the northeast corner of the pen, where the birth rate dropped enormously. But the decline soon spread elsewhere.

Dominant males adopted a narcissistic lifestyle—cleaning and preening themselves, and gorging on food. But they lost interest in routine mating behavior, although rape of both males and females was now on the rise.

Many other males became listless. Calhoun shared some details:

They became very inactive and aggregated in large pools near the centre of the floor of the universe. From this point on they no longer initiated interaction with their established associates, nor did their behaviour elicit attack by territorial males. Even so, they became characterized by many wounds and much scar tissue as a result of attacks by other withdrawn males.

Females now became very aggressive—attacking each other, and even their own children. Males no longer acted as protectors, losing interest in defending the nests. Yet they would increasingly attack other mice for no purpose. Although ample food was available, mouse-on-mouse cannibalism was now commonplace.

The mouse population stopped growing on day 560. A few baby mice survived weaning for several more weeks—but after day 600 not a single newborn mouse lived to adulthood.

Autopsies of female mice now showed how rarely they mated:

At autopsy at a median age of 334 days only 18% had ever conceived… and only 2% were pregnant….By this age most females in a normal population would have had five or more litters, most of them successfully reared.

The last living mice in Universe 25 were totally anti-social. They had been raised without maternal affection and nurturing, and grew up in a society of extreme narcissism, random violence, and disengagement.

Eventually the entire mouse population in Universe 25 died out. They couldn’t survive utopia.

When you read that mice case study, did it remind you of our current human condition? Are we deliberately creating a “leisure” world of narcissism, violence, and asexuality?

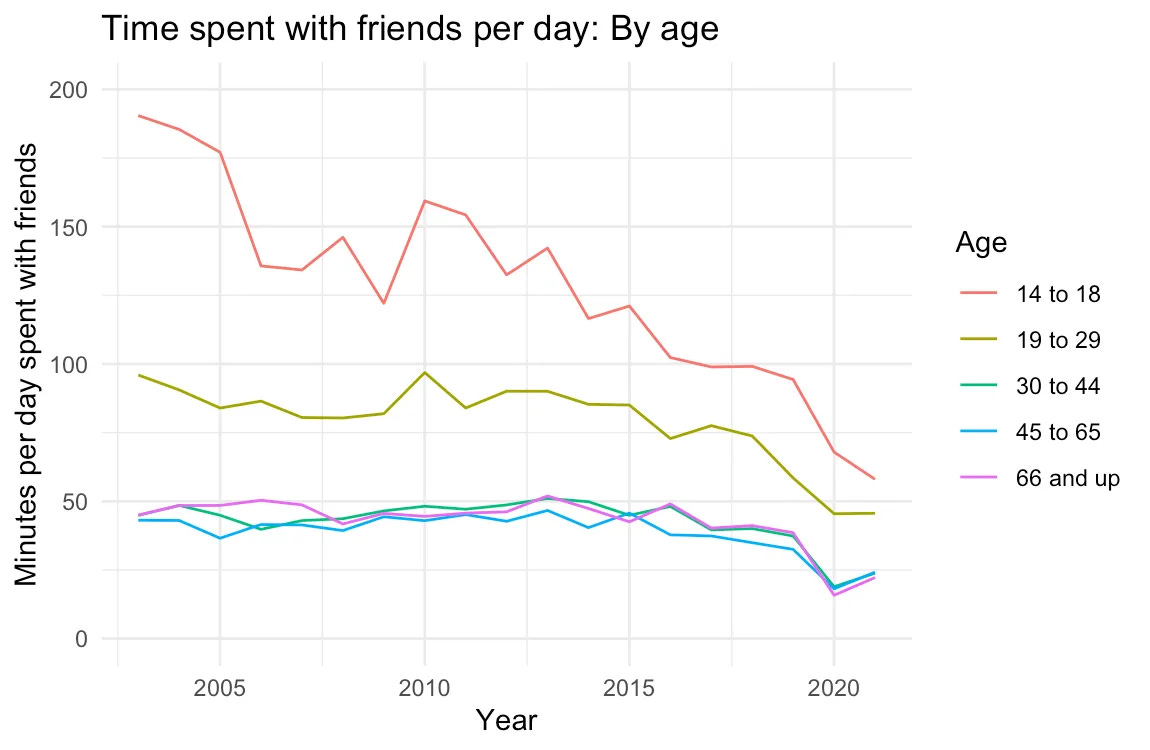

Maybe you have wondered why people have become solitary, like the rodent residents of Universe 25. They have fewer friends, even as leisure time has increased.

Intimate relationships are faring even worse nowadays. Like the mice in utopia, people are abandoning their standard mating behavior.

They have less sex, get married less often, and have fewer babies. Who would ever have guessed that the hottest trend in relationships would be virginity?

But here’s the reality: People’s deepest relationship is now with their phone.

It is an addictive relationship. That’s not my opinion—it’s what people using the phones say themselves. And the level of addiction increases with each generation.

Like our mouse utopia, the phone provides for all their needs. Whatever you want —a pizza, a driver, a lover, a game—there’s an app for it. Who needs friends or family, just so long as you’ve got the latest iPhone?

And it gets better! With the rise of AI and algorithms, you don’t even need to choose. The technocracy tells you what you need, and delivers it immediately.

Welcome to Universe 25 for humans!

Apple Intelligence is Right On Time

Ben Thompson, Stratechery, Monday, June 10, 2024

Apple’s annual Worldwide Developer Conference keynote kicks off in a few hours, and Mark Gurman has extensive details of what will be announced in Bloomberg, including the name: “Apple Intelligence”. As John Gruber noted on Daring Fireball:

His report reads as though he’s gotten the notes from someone who’s already watched Monday’s keynote. I sort of think that’s what happened, given how much of this no one had reported before today. Bloomberg’s headline even boldly asserts “Here’s Everything Apple Plans to Show at Its AI-Focused WWDC Event”. I’m only aware of one feature for one platform that isn’t in his report, but it’s not a jaw-dropper, so I wouldn’t be surprised if it was simply beneath his threshold for newsworthiness. Look, I’m in the Apple media racket, so I know my inside-baseball obsessions are unusual, but despite all the intriguing nuggets Gurman drops in this piece, the thing I’m most insatiably curious about is how he got all this. Who spilled? By what means? It’s extraordinary. And don’t think for a second it’s a deliberate leak. Folks inside Apple are, I assure you, furious about this, and incredulous that one of their own colleagues would leak it to Gurman.

The irony of the leak being so huge is that nothing is particularly surprising: Apple is announcing and incorporating generative AI features throughout its operating systems and making them available to developers. Finally, the commentariat exclaims! Apple is in danger of falling dangerously behind! The fact they are partnering with OpenAI is evidence of how desperate they are! In fact, I would argue the opposite: Apple is not too late, they are taking the correct approach up and down the stack, and are well-positioned to be one of AI’s big winners.

Apple’s Business Model

Start with the most basic analysis of Apple’s business: despite all of the (legitimate) talk about Services revenue, Apple remains a hardware company at its core. From its inception the company has sold personal computers: the primary evolution has been that the devices have become ever more personal, from desktops to laptops to phones, even as the market as a whole has shifted from being enterprise-centric to consumer-centric, which plays to Apple’s strengths in design and the user experience benefits that come from integration.

Here’s the thing about an AI-mediated future: we will need devices! Take the classic example of the Spike Jonze movie “Her”:

Jonze’s depiction of hardware is completely unrealistic: there is not a single battery charger in the entire movie (the protagonist removes the device to sleep, and simply places it on his bedside table), or any consideration given to connectivity and the constraints that might put on the size and capability of the device in the protagonist’s ear; and yet, even then, there is a device in the protagonist’s ear, and, when the protagonist wants the AI to be able to see the outside world, he puts an iPhone-esque camera device in his pocket:

Now a Hollywood movie from 2013 is hardly dispositive about the future, but the laws of physics are; in this case the suspension of disbelief necessary to imagine a future of smarter-than-human AIs must grant that we need some sort of device for a long time to come, and as long as that is the case there is an obvious opportunity for the preeminent device maker of all time. Moreover, to the extent there is progress to be made in miniaturization, power management, and connectivity, it seems reasonable to assume that Apple will be on the forefront of bringing those advancements to market, and will be courageous enough to do so.

In other words, any analysis of Apple’s prospects in an AI world should start with the assumption that AI is a complement to Apple’s business, not disruptive. That doesn’t mean that Apple is guaranteed to succeed, of course: AI is the only foreseeable technological advancement that could provide sufficient differentiation to actually drive switching, but even there, the number of potential competitors is limited — there may only be one (more on this in a moment).

In the meantime, AI makes high-performance hardware more relevant, not less; Gurman notes that “Apple Intelligence” will only be available on Apple’s latest devices:

The new capabilities will be opt-in, meaning Apple won’t make users adopt them if they don’t want to. The company will also position them as a beta version. The processing requirements of AI will mean that users need an iPhone 15 Pro or one of the models coming out this year. If they’re using iPads or Macs, they’ll need models with an M1 chip at least.

I’m actually surprised at the M1 baseline (I thought it would be M2), but the iPhone 15 Pro limitation is probably the more meaningful one from a financial perspective, and speaks to the importance of RAM (the iPhone 15 Pro was the first iPhone to ship with 8GB of RAM, which is also the baseline for the M1). In short, this isn’t a case of Apple driving arbitrary differentiation; you really do need better hardware to run AI, which means there is the possibility of a meaningful upgrade cycle for the iPhone in particular (and higher ARPUs as well — might Apple actually start advertising RAM differences in iPhone models, since more RAM will always be better?).

2018 cohort graduation rates?

Peter Walker analyzed 3,067 startups founded in 2018 (using Carta) to see how many progress to the next round

Out of the 3,067 pre-seed startups

→ 1,917 raised a seed round

→ Likely within 18 months

I used the 1,917 who raised a Seed round as 100% to line up closer with my $100M Success Rate post from a few weeks ago of the % of startups that raised more than $3M make it to $100M ARR

➡️ 62% go on to raise a Series A

→ Of the 1,917 who raised a Seed round

→ 1,196 went on to raise a Series A

→ Likely around 2020/21

Peter Walker also has data that shows the graduation from Seed to Series A in under 2 years peaked in Q3 2020 at 37%

Which means that +25% go on to raise a Series A after 2 years

This also lines up with 30% of seed rounds in 2020 being bridge rounds

And since most Series A companies are or will make it past $3M in ARR, this also lines with the $100M Success Rate post showing that 60% of all the startups that raised $3M+ made it past $3M ARR

➡️ 23% raised a Series B

→ Of the 1,917 who raised a Seed round

→ 1,196 went on to raise a Series A

→ And only 441 raised a Series B

→ Likely around 2021/22

This is about half of what the next step of the $100M Success Rate (40% of companies that raise $3M+ make it past $10M ARR)

Typically companies raise their Series B between $6M and $12M ARR

So my guess is that the 17% delta is from the Seed/Series A that never raised again but kept growing and eventually hit $10M ARR

→ 431 Seed stage never raised again

→ 570 Series A never raised again

Which makes 1K companies still active after raising a Seed/Series A

→ if 40% make it to $10M ARR

→ and 23% comes from Series B

Then 325 of the 1K will get to $10M ARR without raising B round

➡️ 6% raised a Series C

→ Of the 1,917 who raised a Seed round

→ 1,196 went on to raise a Series A

→ And only 441 raised a Series B

→ Just 87 raised a Series C

→ Likely around 2023/24

Which is about a third of the next step of the $100M Success Rate (20% of companies that raise $3M+ make it past $30M ARR)

Typically companies raise their Series C between $15M and $25M ARR

So my guess again is that the 14% delta is from Seed/A/B that never raised again but kept growing to eventually hit $30M ARR

→ 325 of the Seed/A made it past $10M ARR

→ and 274 Series B never raised again

Which makes 599 companies that are still active and past $10M ARR that haven’t raised a Series C

→ if 20% make it to $30M ARR

→ and 6% comes from Series C

Then 268 of the 599 will get to $30M ARR without raising a C round

➡️ Series D and Series E are still in progress

Because the average time between rounds right now for Series B to C is 27 months, I wouldn’t expect to know the Series D and E graduation rates until 2026 and 2028

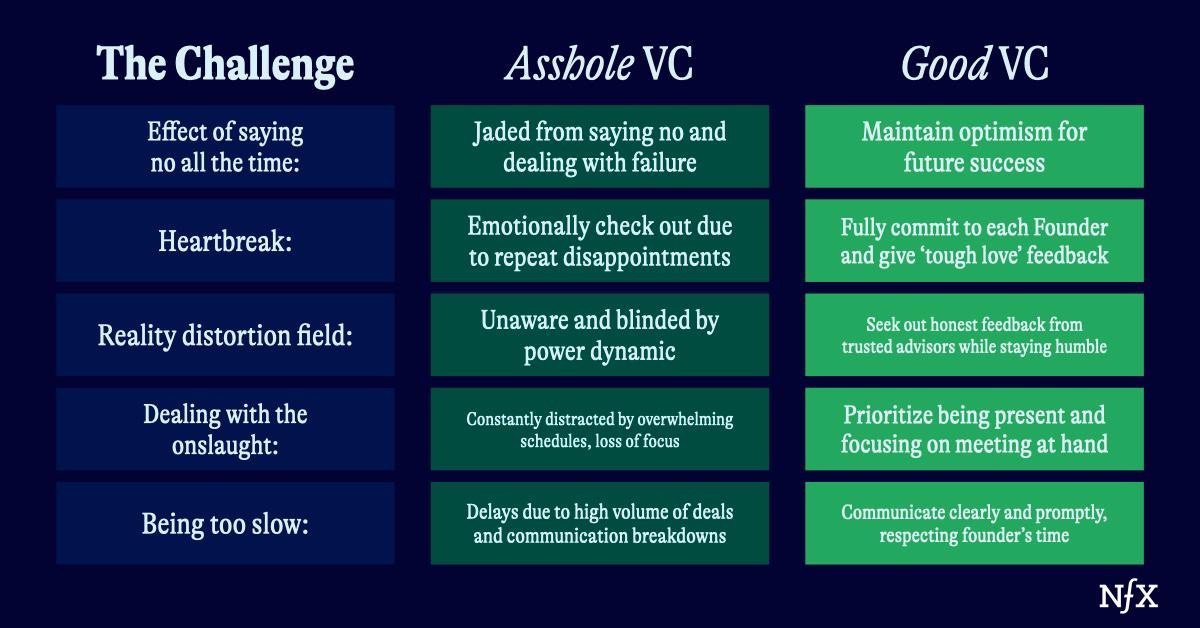

How VCs Become Assholes

Omri Drory, Ph.D.·@omri_drory·Jun 2024

Table of Contents

The partners at NFX are all founders. One of the main reasons NFX exists is to be the kind of investors we wished we had when we ran our own companies.

Each of us had experiences with amazing investors…and some real asshole investors. Our biggest fear is waking up one day and realizing that somehow, we became the thing we hated the most. You know the type: late for meetings, always looking at their phone instead of listening, ghosting founders, stressing founders out for no reason, giving unthoughtful, obvious advice.

That’s an investor that adds negative value (other than their investment). Sometimes, it’s so bad that they add negative value even considering their investment.

I truly believe that investors are generally good and mean well. Most, if not all, go to investing because they want to create value for all involved and change the world. (At least, everyone is a hero in their own mind.) But even with the best of intentions, it’s easy to become an asshole if you’re not careful. Many investors don’t realize all the invisible forces that will push them down this path. And if you don’t know your own psychology, you can start slipping.

These are the primary ways that investors can become assholes, along with the causal factors. I want founders to understand the inner workings. When you see this happening, you should call your investors out on it. If you ever see this from me, do me a favor and call me out on it – it will be the best thing you can do.

Overwhelmed By Negativity

Sometimes I see investors who have become jaded or overly negative and they often take this out on their founders.

This makes no sense, because you became an investor because you believe in stuff. Being positive is truly the only way to succeed as an investor, because you have to believe that you will find that one big company that returns the fund and makes a huge impact. That core belief is what keeps us going.

But, in pursuit of those few outliers, investors spend a lot of time saying no. At NFX we only invest in less than 1% of the companies we see. When a good investor says no, they should always try to give detailed feedback. A one-word “no” is useless to a Founder. Though it’s true that a quick no is definitely better than a prolonged maybe.

Still, we have to say no to the vast majority of the pitches we see. Many of them aren’t even bad ideas. It’s just that they’re not big enough. I’ve written about this before: but to be venture-backable, your company has to have the potential to return the entire fund… plus some.

Even for the companies we do invest in, only a few will create a massive impact and return the fund over time. That’s part of the game, and we all understand that we’re going to miss more than we hit. But over time, I think this still takes a toll on investors that they don’t always acknowledge.

Lots of investors don’t handle this pressure as well as they think. They feel like they must find the next big thing to justify their fund’s existence. This pressure can contribute to apathy or a “spray and pray” approach followed by cynicism when most of those investments fail. This creates a downward spiral.

First: Our social brains are extremely good at pattern recognition, and when you realize you’re losing most of the time, it is easy to assume that pattern will continue. It’s the “hot” or “cold” fallacy – you believe that your past behavior or results will predict your future results. But it’s not true. The fact that you saw a handful of companies and said no to them today, has no bearing on whether you will get a great pitch tomorrow.

People forget this. They assume the pattern will continue. Because most investors are positive people, a pattern of “mostly no” leads to an uncomfortable dissonance. When will I stop saying no? Will I ever get to say yes? What’s the point? Are all my ideas wrong?

Second: investors who are caught in that downward spiral may subconsciously look for information to back up their negative beliefs. It’s a form of confirmation bias that many don’t recognize.

..More

Startup Playbook

Written by Sam Altman · Illustrated by Gregory Koberger · Spanish translation

We spend a lot of time advising startups. Though one-on-one advice will always be crucial, we thought it might help us scale Y Combinator if we could distill the most generalizable parts of this advice into a sort of playbook we could give YC and YC Fellowship companies.

Then we thought we should just give it to everyone.

This is meant for people new to the world of startups. Most of this will not be new to people who have read a lot of what YC partners have written—the goal is to get it into one place.

There may be a part II on how to scale a startup later—this mostly covers how to start one.

Your goal as a startup is to make something users love. If you do that, then you have to figure out how to get a lot more users. But this first part is critical—think about the really successful companies of today. They all started with a product that their early users loved so much they told other people about it. If you fail to do this, you will fail. If you deceive yourself and think your users love your product when they don’t, you will still fail.

The startup graveyard is littered with people who thought they could skip this step.

It’s much better to first make a product a small number of users love than a product that a large number of users like. Even though the total amount of positive feeling is the same, it’s much easier to get more users than to go from like to love.

A word of warning about choosing to start a startup: It sucks! One of the most consistent pieces of feedback we get from YC founders is it’s harder than they could have ever imagined, because they didn’t have a framework for the sort of work and intensity a startup entails. Joining an early-stage startup that’s on a rocketship trajectory is usually a much better financial deal.

On the other hand, starting a startup is not in fact very risky to your career—if you’re really good at technology, there will be job opportunities if you fail. Most people are very bad at evaluating risk. I personally think the riskier option is having an idea or project you’re really passionate about and working at a safe, easy, unfulfilling job instead.

To have a successful startup, you need: a great idea (including a great market), a great team, a great product, and great execution.

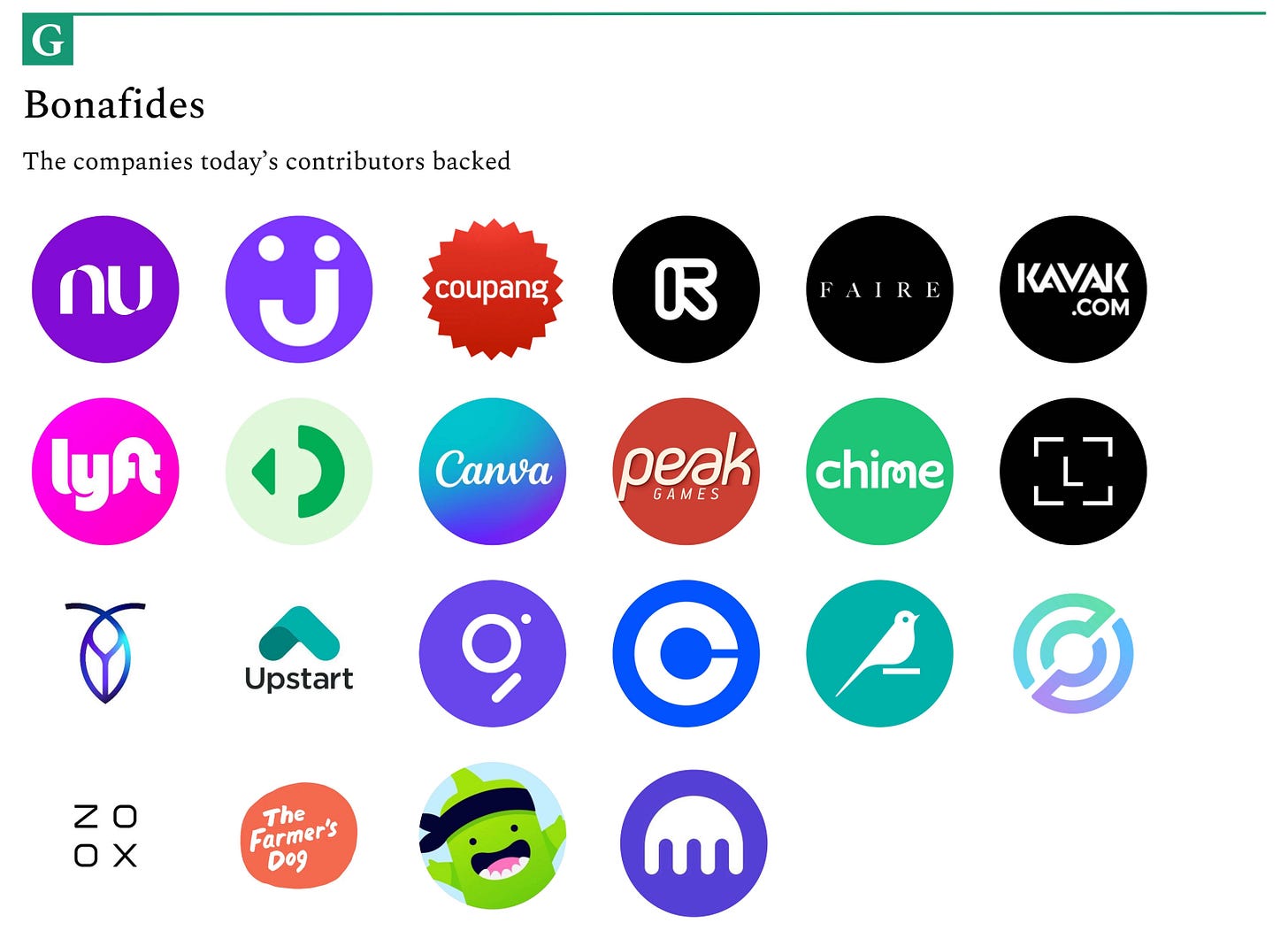

How to Find a Unicorn

A tactical guide to sourcing legendary investments.

MARIO GABRIELE, JUN 11, 2024

Friends,

Welcome to the latest edition of The Investors Guide – a new Generalist series exploring the essential challenges of raising, running, and succeeding as a venture capitalist. We do that by conducting detailed interviews with some of the world’s best established and insurgent investors, and compiling their advice, tactics, and strategies into an actionable guide.

It was fantastic to learn how many of you enjoyed the first edition and hear the stories behind your funds. I hope you’ll find today’s guide just as valuable, if not more so. I loved how investor and Generalist subscriber Sajith Pai summarized the value of The Investors Guide series: “Up until now, info / content like this could only be unlocked via 1:1 convos (and only for privileged insiders).”

Using Sajith’s framing, I can comfortably say that today’s edition, “How to Find a Unicorn,” is the equivalent of at least 20 coffee meetings – compressed into an 11,500-word guide. This guide is the result of dozens of hours of interviewing, research, and writing.

Below, you’ll find a detailed discussion of the inbound and outbound strategies global investors use to find legendary startups. Throughout their careers, this group (or the firms they run) have backed many of the most consequential companies across the asset class including Nubank, Jet, Coupang, Runway, Faire, Kavak, Lyft, Stone, Canva, Peak Games, Chime, Ledger, Cockroach DB, Upstart, The Graph, Coinbase, Dataiku, Circle, Zoox, The Farmer’s Dog, ClassDojo, and Kraken.

Cumulatively, they have assessed tens of thousands of companies, spoken to countless entrepreneurs, and identified some of the best to back. Though all run elite, well-regarded firms today, none started with the benefit of a historic brand name. Rather than relying on their firm’s reputation, these investors have won through savvy, intelligence, intense hustle, and a little bit of luck.

Here’s what we’ll be covering:

How to find your first unicorn (Today!)

How to win a competitive deal

How to spot a super trend

How to be a top 1% angel

How to get your first institutional investor

How to size your investments

How to actually add value

How to build a unique voice in the ecosystem

How to win at secondaries

**Secret bonus edition 🤫**

How to Find a Unicorn

Firms live and die on the deals they find. It is perfectly possible to raise a fund from LPs, spend four years sourcing opportunities, meeting with founders, diligencing diligently, and writing checks without ever encountering a true unicorn. Without meeting the kind of reality-bending founder capable of building a generational business.

A shrewd manager may be able to salvage such a vintage. You could land some base hits, secure some savvy secondary sales, and minimize losses. All of these can stanch the bleeding, but they are not the basis for eyebrow-raising DPI. Nor are they the basis for the establishment of a new franchise.

All of which is to say that if you don’t see great companies, you cannot build a great fund. It really is that simple and that difficult.

Valor

Sourcing and origination – I think that’s probably the biggest driver of alpha. Alpha is really doing things that other people aren’t doing. That could be focusing on a particular geography, sector, or disruptive technology.

Great performance comes from a relatively small number of companies, and you want to be in those companies early.

– Scott Sobel

While the crowd jostles for space along the shoreline, casting their lines in the same direction, you may find opportunity standing alone among the reeds, using a fly you have fashioned yourself.

Whatever your strategy, however you choose to play the game, the imperative is the same: you must find your unicorn.

What do we mean by a “unicorn?”

It deserves some clarification. The term typically denotes a startup valued at or above $1 billion. However, too many companies have achieved billion-dollar status over the past few years based on little more than market exuberance. We’re using the word a little differently here, in a manner truer to its initial spirit. A unicorn is simply that company. The startup on the far right tail, a skewer of returns – a fund returner and reputation-maker.

The advice below reflects how to find these rarest of startups. Here’s what we’ll cover:

Know your game

Recognize your fund’s position

Understand your magnetism

Assess your circles of competence and incompetence

Know what you’re looking for

Build a founder profile

Constrain your focus

Calibrate by stage

Develop an inbound strategy

Increase your surface area for serendipity

Share your thinking

Make “upstream” friends

Invest in your network

Pay attention to referrals from founders

Build your outbound strategy

Chase your curiosity

Look for “adjacent greatness”

Trace the idea pipeline

Map, then infiltrate

Lean on scouts

Hone the craft

Get the reps in

Build a process (but don’t over-engineer)

Improve your picking

Forge a reputation

Thank you to Ann Miura-Ko (Floodgate), Scott Sobel (Valor), Kanyi Maqubela (Kindred), Kirsten Green (Forerunner), Ben Sun (Primary), Nikhil Basu Trivedi (Footwork), Matt Turck(FirstMark), Niki Scevak (Blackbird), Firat Ileri (Hummingbird), Hernan Kazah (Kaszek), Michael Dempsey (Compound), and Nathan Benaich (Air Street) for sharing their insights for this issue of the Investors Guide series.

Step 1: Know your game

An effective sourcing strategy begins by knowing the game you’re playing. That starts with two fundamental tasks:

Understanding your fund’s position

Knowing your strengths and limitations

Video of the Week

AI of the Week

OpenAI's growth is one of the most astounding business results of all time

ALEX WILHELM, JUN 13, 2024

OpenAI’s revenue growth is flat-out bonkers

The Information reported, and Bloomberg confirmed that OpenAI’s revenue has scaled massively thus far in 2024, rising from a $1.6 billion annualized run rate towards the end of 2023 to around $3.4 billion today. Of that total, around $200 million comes from its partnership with Microsoft’s Azure cloud service, which offers OpenAI models. The rest the company generates on its own.

Subscribed

A run rate of $3.4 billion works out to monthly revenue of just over $283 million. The $1.8 billion in new annual run rate that OpenAI added since late last year is worth $150 million of that monthly total.

OpenAI’s revenue growth is one of the most astounding business results ever.

It’s not rare to see private-market tech companies post triple-digit top-line growth when they are small. It’s easier, after all, to double a $10 million run rate than it is a $50 million run rate. And it’s easier to double a $50 million run rate than a $250 million run rate.

To more than double from an annualized revenue base of $1.6 billion in less than a year is hard to fully grok, but the company’s performance does help us understand a few things that we’ve seen in the market:

OpenAI’s revenue growth explains why so many VCs and other wealthy entities are busy stuffing capital into its rivals. Mistral’s recent round might feel strange, given that it is forced to compete with the largest tech companies and their vassals. But if OpenAI can grow as much as it has recently demonstrated it can, the market it hopes to dominate is so large that it should be able to support multiple healthy competitors.

People are willing to pay for AI tools. We do not know today is what share of OpenAI’s revenue comes from folks like myself who pay $20 each month for access to its newest models and what portion comes from larger corporate customers. But no matter how you estimate its revenue mix, there’s clearly ample demand for what OpenAI has cooking from a wide customer base. That’s good for both consumer-facing AI companies and their B2B kin alike.

A good question to ask is what OpenAI’s gross margins are. Its value is radically different if its revenue margins work out to 5%, 50%, or 95%. Given its partnership with Azure, I would not be shocked if the math there is not simple. But how much gross profit OpenAI can yank from each dollar of revenue it brings in will determine what sort of multiple companies of its ilk can and will eventually command on the public markets.

Why? Because greater gross margins at OpenAI would imply the ability for AI products to charge well in excess of their revenue costs. Or, more simply, that AI companies like OpenAI have comfortable pricing power.

Microsoft’s bet on OpenAI looks prescient, even if its arms-length-subsidiary-like partner is also helping Apple. So long as OpenAI keeps performing as it has this year, I don’t expect private capital to stop its hunt for the next OpenAI. After all, Ramp launched after Brex.

..More

AI: New Focus on 'Accelerated' Local AI Devices. RTZ #387

...Apple's new AI roadmap makes it 'Real'

JUN 14, 2024

With Apple’s just announced ‘Apple Intelligence’ ‘AI’ strategy, the company made clear that many of its AI features would only run on Apple’s latest, top of the line iPhone 15 Pro smartphones, and Macs/laptops/iPads with Apple Silicon M chips or better. And that to get these wide array of AI features, users will have to upgrade their devicesgoing forward.

That’s resulting in a market anticipation of a faster smartphone upgrade cycles, and dismay in some quarters that older phones and computers won’t be able to do cool AI things.

There’s been both disappointment and excitement for observers that more AI features for smartphone and PC/laptop users mean that devices will need to be upgraded more regularly. Possibly annually even, to get the best AI performance in applications and services. This is something I’ve outlined as a key next step for Apple and others.

I’ve been talking about a ‘Small AI’ and Local/’On-Prem’ phase in this AI Tech Wave for some time now. We started to see this early this year as hardware and software vendors started to talk about ‘AI PCs’, culminating in Microsoft’s ‘Copilot + PC’ strategy just a few weeks ago.

It’s clear that companies like Microsoft, Google, and now Apple, with meaningful Operating System platforms, both in computers, and/or smartphones, are rapidly leveraging LLM and Generative AI capabilties deep in their devices and operating systems, often with DOZENS of local and small language models (SLMs), both closed and open source.

And they’re reworking the hardware semiconductor chipsets with AI GPUs, ‘Neural Processing’ chips, higher amounts of high speed memory, and other upgrades, to run AI training and inference cycles locally on the devices themselves whenever possible.

The advantages here of course are deeper access to the user’s most personal content and data, with the highest amounts of Privacy, along with the lowest ‘latency’, meaning that there are fewer long round trips to data and compute in the cloud for AI computations. Not to mention higher power efficiencies locally via batteries and plugged in power.

..More

News Of the Week

visionOS 2: Spatial Personas Can Touch Fingers, High Five, Fist Bump Each Other With Visual and Audio Feedback

Thursday June 13, 2024 5:29 am PDT by Tim Hardwick

First introduced in April, spatial Personas in Apple Vision Pro are designed to feel as if they are in the same physical space, and to enhance the experience, the lifelike avatars will soon be able to interact directly with each other using some new gestures in visionOS 2.

Previewed at WWDC last year, spatial Personas allow Vision Pro users to "break out of the familiar FaceTime tile and feel more present, like they are gathered in the same physical space," according to Apple. They feature a transparent background and are able to show body language and additional movement such as hand gestures for a more lifelike experience.

As shared by indie developer xChester on social media, spatial Personas in the same Environment can now high five, fist bump and touch fingers, and the visionOS 2 beta provides visual and audio feedback to highlight the virtual interaction.

Elsewhere in visionOS 2, spatial Personas can be invoked in the Photos app via SharePlay, allowing Vision Pro users to enjoy their panoramas, spatial videos, and more — all while feeling like everyone is in the same physical space.

visionOS 2 is also giving developers more control over spatial Personas that will allow them to fine-tune the placement of Personas in their app, enabling new shared experiences in games, for example.

..More

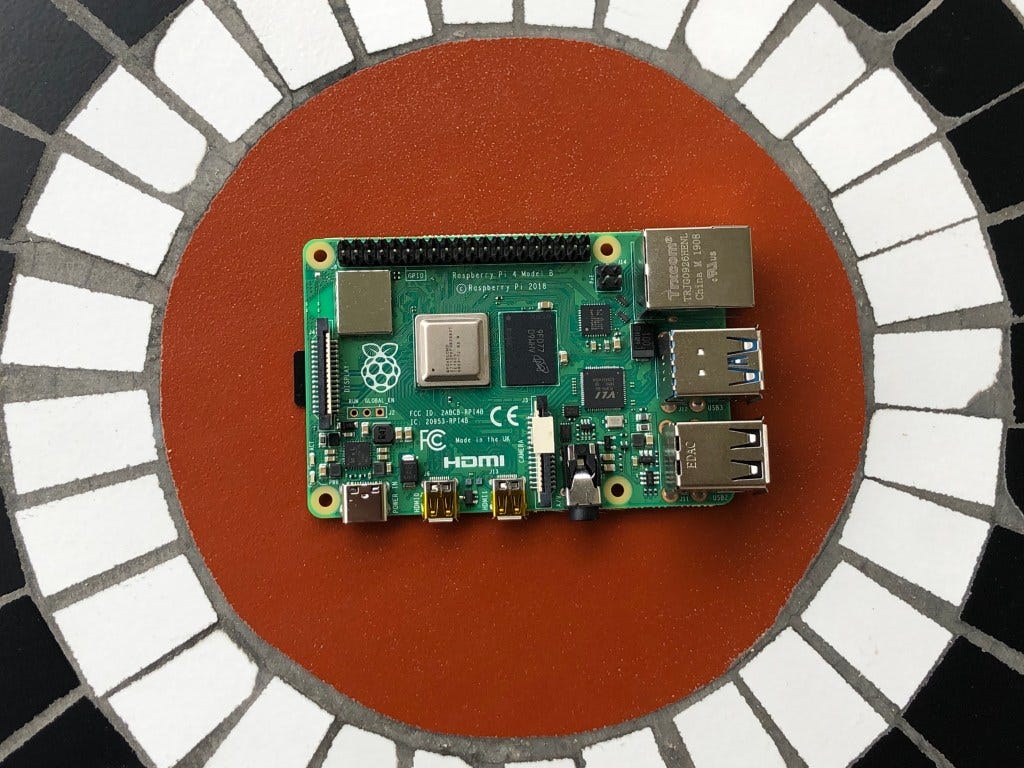

Raspberry Pi is now a public company

The company’s shares popped 32% after its IPO pricing

Romain Dillet, 4:08 AM PDT • June 11, 2024

Who would have thought that Raspberry Pi, the maker of the tiny, cheap, single-board computers, would become a public company? Yet, this is exactly what’s happening: Raspberry Pi priced its IPO on the London Stock Exchange on Tuesday morning at £2.80 per share, valuing it at £542 million, or $690 million at today’s exchange rate.

Shortly after that, the company’s shares jumped a nice 32% to £3.70. It means that Raspberry Pi could end up raising more than $200 million during its IPO process.

Retail investors can’t buy Raspberry Pi shares just yet, as only certain institutional shareholders can trade the company’s shares right now. Retail investors will be able to buy and sell shares starting on Friday.

This listing is also a win for the London stock market. Deliveroo and Wise both trade in London, but many U.K. tech companies choose to go public in the U.S., as the stock markets there are more liquid.

Raspberry Pi is mostly known for its tiny computers that can be programmed to perform all sorts of tasks without spending too much money and requiring too much power. These ARM-based computers became particularly popular among tech hobbyists who wanted to create media servers, retro game consoles, interactive dashboards, robotics projects and more.

More recently, many industrial companies have started integrating the Raspberry Pi in their devices and facilities. The company reports that the industrial and embedded segment represents 72% of its sales.

Raspberry Pi has sold 60 million units since its inception. In 2023 alone, Raspberry Pi generated $266 million in revenue and $66 million in gross profit.

Raspberry Pi Ltd, the public company, is the commercial subsidiary of the Raspberry Pi Foundation. The Foundation says it wants to make it easier for people to learn coding through a low-cost, programmable computer. It also remains the main shareholder of Raspberry Pi Ltd.

Other strategic shareholders in the company include ARM and Sony Semiconductor Solutions Corporation, a subsidiary of Sony that makes image sensors for smartphones and other components. ARM previously said it intended to increase its stake in Raspberry Pi via the public listing.

..More

Carta’s valuation to be cut by $6.5 billion in upcoming secondary sale

5:24 PM PDT • June 6, 2024

Carta, a once-high-flying Silicon Valley startup that loudly backed away from one of its businesses earlier this year, is working on a secondary sale that would value the company at $2 billion, TechCrunch has learned.

Carta is working with the investment bank Jeffries on the sale and initially hoped to find demand for the offering at a valuation of $4 billion, but according to our sources, even $2 billion may prove ambitious.

That’s a massive, if not entirely unexpected, drop in valuation for Carta, which originally focused on cap table management software but began over time to evolve into a “private stock market for companies.” Its goal was to take advantage of the network of companies and investors that use its platform and into which it has insights. The big idea was to become the transfer agent, brokerage and clearinghouse for all private stock transactions in the world.

..More

LinkedIn Adds New Elements to Its Newsletter Creation Platform

LinkedIn says newsletters have seen significant growth over the past year.

Published June 13, 2024

By Andrew Hutchinson Content and Social Media Manager

LinkedIn has announced some new updates for its newsletter creation platform, including an updated reader UI and new tools

First off, LinkedIn’s newsletter display has been updated, with the comments now shifted to the right of the main display.

As you can see in this example, now, your newsletter will get main screen real estate at the left, with the comments appearing in a separate panel alongside, which LinkedIn believes will help to encourage more comment engagement by having the discussion and context on one screen.

Readers can choose to sort the comments by “Most Relevant” or “Most Recent” in the comment filters.

LinkedIn’s also adding some new newsletter creation elements, including the ability to embed LinkedIn profiles in your text.

As per LinkedIn:

“You now have the ability to embed member profiles and pages directly into your newsletter, making it easier for your readers to click directly through to those you’re referencing. These interactive embeds will allow you to spotlight members and pages with an eye-catching approach.”

It’s also adding new “staging links” for newsletters, which will enable you to view an article’s URL before it’s been published. That’ll help you get a better idea of what you’re sending before you actually publish, which could help to catch errors and glitches in actual presentation.

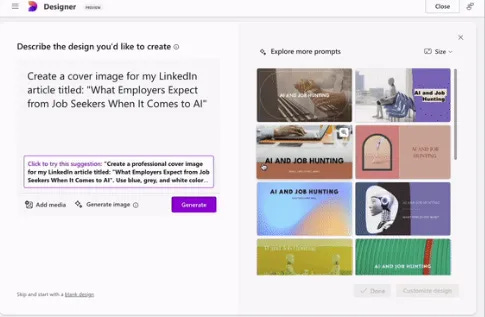

LinkedIn’s also rolling out a new Microsoft Designer integration, which will enable you to use Microsoft’s AI image generation tools to come up with cover images for your newsletter updates.

As with all generative AI tools, some of these are going to look a little questionable, but if you need an image that fits your topic, it’s an easy way to add in a visual element.

Finally, LinkedIn’s also updating its newsletter notifications to help creators drive more sign-ups:

“Each time you publish a newsletter, subscribers get email and in-app notification of it and anyone following you will be prompted to subscribe if they aren’t already. It’s truly a surefire way to get your knowledge in front of more people.”

LinkedIn says that newsletters have seen big growth over the past year, with a 59% increase in the amount of people publishing newsletter articles on the platform, and a 47% increase in engagement on newsletters. There are also now more than 184,000 newsletters being published in the app, underlining the potential opportunity of utilizing LinkedIn’s scale to maximize your audience reach.

Startup of the Week

Databricks' Accelerating Growth

Databricks revealed some sensational growth this week, as they did last year. Exiting this quarter to $2.4 billion annual run rate, the company’s revenue growth is accelerated year-over-year by 10 percentage points.

Net dollar retention is a major driver of growth at 140%, which is top decile. The table above shows the other data points that we’ve collected through their press releases in the last two years.

The fastest growing product category mentioned is the data warehouse revenue : 300% growth, now at $400m annually, nearing 20% of revenue.

With these modest data points, we can build a basic linear regression model for what the company is worth. This model is rough with an R^2 of approximately 0.45.

Assuming Databricks continues to grow at roughly 50%, that implies the company in the public markets would be worth approximately $54b. However, the company will likely trade at a premium to this. It is one of the few companies that provides significant exposure to AI software in the public markets.

Compared to Snowflake, Databricks is growing nearly twice as quickly. Without additional data, it’s difficult to comment on the relative sales efficiency or profitability.

Databricks’ growth rate is yet another example of the rapid demand for AI infrastructure & the systems needed to power it.