Contents

Essays

Geopolitics

AI

Venture Capital

Government Overreach

Meta v. FTC, The Three Facebook Eras, Video Slop and Market Forces

The U.S. Wants to Break Up Google and Meta. That Could Be Hard.

What If Mark Zuckerberg Had Not Bought Instagram and WhatsApp?

Google Is a Monopolist in Online Advertising Tech, Judge Says

Google ‘wilfully’ monopolised online advertising market, US judge rules

IP

Startup of the Week

Interview of the Week

Post of the Week

Editorial: Are Google and Meta Screwed?

When Meta paid $1bn for Instagram in 2012 I wrote a piece for TechCrunch called It’s Not About Instagram, It’s About Mobile. And when it acquired WhatAapp for $19 bn in 2014 I wrote Mobile Is From Mars, Facebook Is From Venus, And WhatsApp Is Ephemeral

Think about it. Would you give up 20 percent of your worth and 35 percent of your cash if you got to live on in the face of an otherwise certain demise. Of course you would! By this criteria Facebook is brave, bold and right. And it definitely didn’t overpay[for WhatsApp]. Bravo, Facebook (really!).

Not to reminisce too much, but I also wrote about the threat mobile represented to Google and Facebook. In Mobile – Facebook And Google Can’t Live With It And They Can’t Live Without It, written in 2012, I said:

Facebook (and Google) will most likely, by building or buying, evolve their monetization strategies to better suit the mobile future. It may take time, it may be painful, they may even fail. But try they will and try they must. Facebook 2.0 will try to kill Facebook 1.0 and Google 2.0 will try to kill Google 1.0.

Twenty Three years later, and after Facebook and Google both survived the rise of mobile, and the relative decline of the desktop based web, the Government has caught up with them, calling illegal the tactics they used to survive and prosper.

Nobody can accuse the Government of being fast.

This week courts began to try Meta for its Instagram and WhatsApp acquisitions. And Google was found guilty of being a monopoly in the advertising tools market (responsible for 11% of Google’s revenue).

This all happens in a context, where once again a platform shift is underway, and the market is challenging Meta and Google to stay relevant as OpenAI, Anthropic, Perplexity, and Grok capture users for AI based search and discovery.

The Government wants $30 billion in damages from Meta and some say it will have to spin off Instagram and WhatsApp. In the case of Google it is unclear what the punishment will be.

The ‘Government Overreach’ section this week chronicles the latest developments.

Following last week’s editorial about ‘the end of the West’ the essays this week contain several relevant pieces. Frank Furedi’s Spiked piece - ‘The End of Globalism is Nigh’ stands out as a balanced capture of the underlying inevitability of economic globalization alongside the undeniable growth of social and political nationalism, arguing that the former is good and the latter is a response to top down globalizing projects that are social and political (and undemocratic) in nature.

Tom Friedman’s piece on China is a reminder of the real world as is Noah Smith’s piece where he states:

Trump’s current trade strategy will diminish American power and American technological capability, divide the U.S. from allies and partners, and give China an opening to become the world’s preeminent nation.

The US cannot and will not re-industrialize. It cannot grow its GDP domestically without trading. It cannot reverse history. It can shrink the world’s GDP and its own. It will not stop China’s domestic market growing (5% last quarter). it also cannot stop globalization - but it can participate less and less in it.

None of this means the tariff policy is necessarily wrong if the goal is to slow down a decades long process and perhaps repatriate some manufacturing. That is not impossible, but neither is it forward thinking.

Elon Musk has built Giga factories in Germany, Shanghai and the US. It produces cars locally, for local markets, at great scale. This is economic globalization. It is rational and inevitable, that any successful business will want to do the same. As nations fragment, businesses will globalize if they want to remain competitive.

Humans are predictable. We want the best stuff, as cheap as possible, and we will support anybody who delivers it. But we also want to be ‘ourselves’. That is how it is possible to reconcile social conservatism (small c) with globalism in economics.

AI is a major globalizer, and this week more was announced than any week so far. OpenAI jumped further ahead by launching o3 and o4 models in its API. And it now has a billion unique users per week.

Enjoy this week’s best writing and thinking below.

Essays

Nvidia H20 Restricted in China, The Huawei CloudMatrix 384, Whither Chip Controls

Stratechery • Ben Thompson • April 16, 2025

Technology•Hardware•ArtificialIntelligence•Chips•ExportControls•Geopolitics•Essays

It appears that Nvidia will never be allowed to sell AI accelerators to China again, even crappy ones, while Huawei makes its own supercomputer with outside help.

Nvidia on Tuesday said it would take $5.5 billion in charges after the U.S. government limited exports of its H20 artificial intelligence chip to China, a key market for one of its most popular chips. Nvidia's AI chips have been a key focus of U.S. export controls as U.S. officials have moved to keep the most advanced chips from being sold to China as the U.S. tries to keep ahead in the AI race. After those controls were implemented, Nvidia began designing chips that would come as close as possible to U.S. limits. Nvidia shares were down about 6% in after-hours trading.

On April 9, 2025, the U.S. government, or USG, informed NVIDIA Corporation, or the Company, that the USG requires a license for export to China (including Hong Kong and Macau) and D:5 countries, or to companies headquartered or with an ultimate parent therein, of the Company’s H20 integrated circuits and any other circuits achieving the H20’s memory bandwidth, interconnect bandwidth, or combination thereof. The USG indicated that the license requirement addresses the risk that the covered products may be used in, or diverted to, a supercomputer in China. On April 14, 2025, the USG informed the Company that the license requirement will be in effect for the indefinite future.

Just for clarity's sake, that $5.5 billion in charges is not money that Nvidia now needs to pay, but rather money that it has already paid or committed to pay to its various suppliers; normally Nvidia would recognize those costs when it sold the H20 cards, but now those sales are not going to happen, so it will need to write off those costs, putting them directly onto its first quarter results.

What is interesting to consider is why those sales are not going to happen, and the reason is straightforward: the H20 is a pretty crappy AI accelerator. Compared to an H100, it has fewer cores, much lower memory bandwidth, no NVLink support, and is limited to the PCIe form factor. No one outside of China is going to want these accelerators, which is why they're being written off.

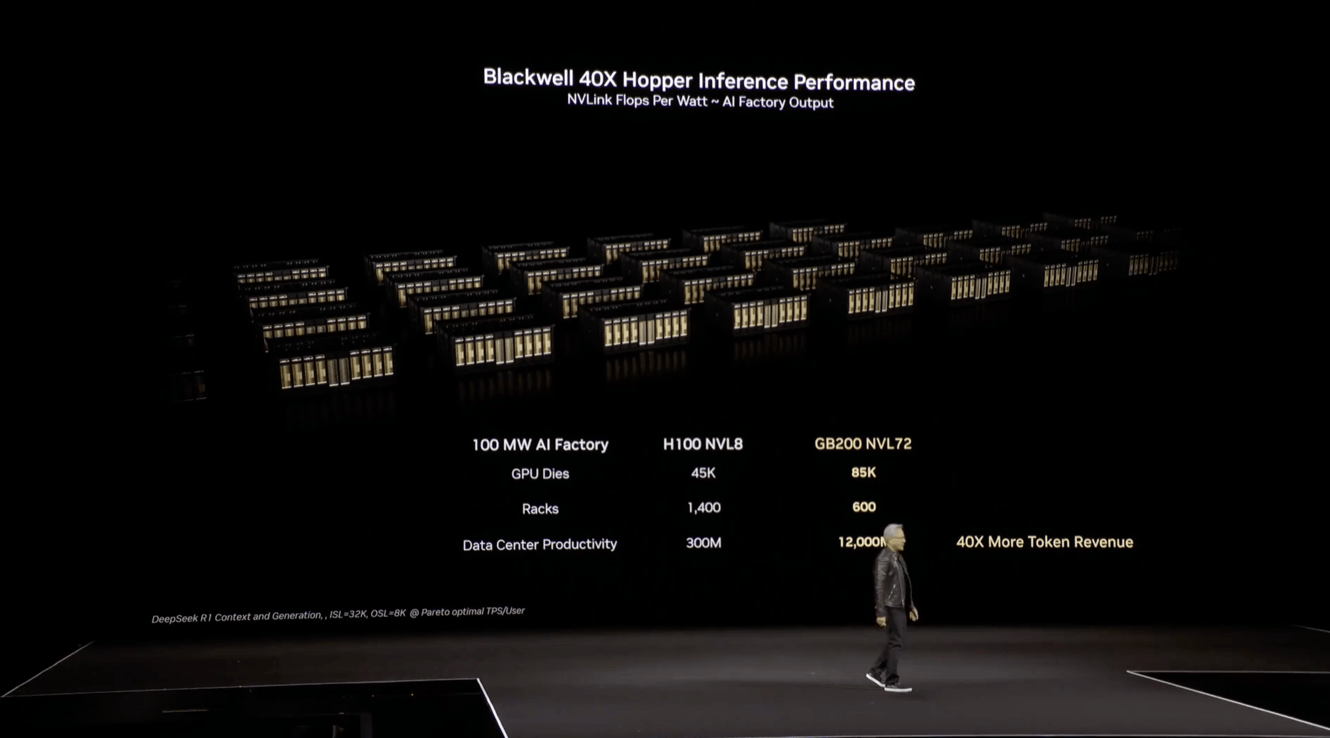

China’s Huawei Technologies has launched a new artificial intelligence infrastructure architecture that is reportedly set to rival US chip giant Nvidia’s offerings in addressing computing power bottlenecks. Introduced last week, the CloudMatrix 384 Supernode was described as a “nuclear-level product” that matched Nvidia’s NVL72 system in alleviating computing bottlenecks for AI data centres.

Huawei's CloudMatrix 384 consists of 384 Ascend 910C chips connected through an all-to-all topology. A full CloudMatrix system can deliver 300 PFLOPs of dense BF16 compute, almost double that of the GB200 NVL72. With more than 3.6x aggregate memory capacity and 2.1x more memory bandwidth, Huawei and China now have AI system capabilities that can beat Nvidia’s.

Despite the performance improvements, the CloudMatrix 384 requires significantly more power and space. However, China’s distinct power production capabilities provide a workaround for these challenges, highlighting the difference in operational constraints between the U.S. and China in the AI hardware race.

The Meta Points of Meta's Trial

Spyglass • M.G. Siegler • April 16, 2025

Technology•Web•Antitrust•Meta•FTC•Government Overreach•Essays

The first rule of corporate communications is: you do not put it in email.

The second rule of corporate communications is: you do not put it in email.

Luckily for us, Meta clearly doesn't follow the rules. Nor, seemingly, does anyone else. Which makes the discovery element of every trial so much fun – as long as you're not part of it. One day, these companies will likely learn to keep such communication to phone calls or, even better, in person. Today is not that day.

We're only two days into Meta's antitrust trial, and the amount of headlines is already dizzying. While it may be a bit front-loaded with Mark Zuckerberg being the first witness called, we're still likely to get days and days of stories around what Meta thinks about almost everything as it relates to social networking and tangential topics, like Settlers of Catan.

But the most interesting element of the whole trial may be the yes, meta aspect. First and foremost, in a just world, the FTC has no shot to win this case. The case is so nebulous and weak that it makes the (also mostly ridiculous) antitrust case against Apple look like a steel trap.

The FTC wants to litigate the past here and force changes that only make sense in hindsight. And the desired result – the cleaving off of Instagram and WhatsApp – wouldn't do much of anything other than destroy a sizable chunk of Meta's business. That, in turn, would put Meta's future very much in peril. Without Instagram's ad dollars flowing in, you can say goodbye to either the metaverse spend or their AI build-out. Maybe both, depending on how Wall Street reacts.

And that's seemingly what the FTC wants. Certainly, it's what former FTC chair Lina Khan wanted – and she was clearly thrilled to stay in this spotlight when The Wall Street Journal asked her to comment on the case today. But aside from nearly killing this case in the cradle by initially putting forward a somehow even weaker case which the judge immediately threw back at them, Khan neither started nor will finish this. The regimes change, but the animosity against Meta stays the same, it seems. Even when you have a Biden presidency squeezed between two Trump terms. It's the only topic that can unite both sides these days.

That's despite Zuckerberg's considerable time spent – and money literally spent – to try to change Donald Trump's mind about him and his company. But really just him, because, let's be honest, that's what Trump really cares about. He believes Zuckerberg helped to derail his initial presidency with his "Zuckerbucks". And so Zuckerberg has had to go over the top – far more than the other sycophantic CEOs – to try to prove to Trump that he's changed.

Why did Zuckerberg and Meta want out of this trial so badly? Especially, again, if the FTC seemingly has such a weak case? Well, first and foremost, anything can happen – especially when it's one person deciding. Just ask Google. But second, go back to those emails. Often, in such trials, the true damage comes not from the verdict but from the embarrassment of disclosures.

After riding high last year, Zuckerberg is now back in the public opinion doghouse. And as he goes, so goes Meta. All of this naturally ebbs and flows, but having all of your dirty laundry aired in public is probably not going to help the perception of Zuckerberg and Meta. So they very well could win the case but lose the PR war.

The end of globalism is nigh

Spiked Online • Frank Furedi • April 15, 2025

Politics • Globalization • Economic Nationalism • TradeWars • Mercantilism • Geopolitics • Essays

Suddenly, in the aftermath of President Trump’s tariff wars, even the most enthusiastic supporters of globalisation are on the defensive. They have been forced to acknowledge that a new era of economic nationalism, indeed of mercantilist protectionism, is now in the ascendancy.

Britain’s prime minister Keir Starmer put matters bluntly last week when he declared that ‘the world as we knew it is gone’. UK treasury minister Darren Jones quickly echoed his boss’s diagnosis, declaring that ‘globalisation as we’ve known it for the past couple of decades has come to an end’.

In truth, the obituaries for globalisation have been a long time in the writing. Throughout most of the 21st century, the durability of globalisation has been called into question. This happened most notably after the economic crisis of 2008, as world trade relative to global GDP fell by five per cent over the course of the 2010s and many national governments increasingly adopted protectionist measures.

The Covid pandemic in 2020 and then Russia’s invasion of Ukraine in 2022 further undermined economic globalisation. Indeed, in the aftermath of the war in Ukraine, we’ve seen the emergence of rival economic blocs, and a growing global competition for access to vital raw materials and energy sources.

Little wonder that economic commentators and geopolitical experts have been lamenting the end of globalisation for the best part of the past decade. Yet much of the commentary over the demise of globalisation fails to make a distinction between globalisation as an economic phenomenon, promoting the internationalisation of capital, and globalisation as the self-serving ideology of the cosmopolitan elites.

Globalisation as an economic process, promoting interaction among different people and nations in the world, may have hit the buffers, but it is clearly not about to end any time soon. Despite the rise of protectionism, capitalism continues to transcend national borders, and national economies remain interdependent on one another. There is little realistic prospect of any nation achieving genuine economic autarky. Even the Trumpian White House has been forced to retreat on its tariff plans in the face of pressure from the international financial markets.

It is true, however, that over the past two decades globalisation has lost its expansive dynamic. The rules and expectations that governed global economic relations no longer possess the force that they once did. We now live in a world where trade and economic rivalries have become far more politicised than in the recent past, and governments are more willing than ever to pursue protectionist measures.

More importantly, the relationship between economic blocs is being renegotiated with unpredictable consequences. The place of China in the new world order and the capacity of America to retain its privileged position in international affairs are the key economic and geopolitical questions facing the world today.

Yet while globalisation as an economic process may have partially stalled, it’s a different story for globalisation as an ideology, otherwise known as ‘globalism’. It’s fair to say that globalism has effectively been killed off by the Trump presidency’s adoption of hardcore mercantilism.

Globalism promotes the dogma that free trade, open borders and transnational investment benefit all and guarantee a stable and peaceful world order. It is an ideology that elevates the status of international institutions and devalues the role of national governments. In effect, it promotes the idea that national governments lack the power to determine their own countries’ futures in the face of global market forces and institutions.

Wayne Ma at The Information: ‘How Apple Fumbled Siri’s AI Makeover’

Theinformation • John Gruber • April 10, 2025

Technology•AI•MachineLearning•Siri•Apple•Essays

Apple's efforts to revamp Siri with advanced AI features have been marred by internal conflicts and poor leadership, leading to significant delays in the rollout of new capabilities. The company's AI and machine-learning group, led by John Giannandrea, has faced criticism for its relaxed culture and lack of ambition, earning it the nickname "AIMLess" among employees. This nickname reflects the group's struggles with execution and innovation, which have been exacerbated by conflicting personalities within the organization.

The development of Siri has been further complicated by the company's stance on user privacy, which, while important, has contributed to the challenges in advancing AI capabilities. Apple initially considered building both small and large language models, dubbed "Mini Mouse" and "Mighty Mouse," but later shifted towards a single large model. However, this decision was followed by multiple technical pivots, frustrating engineers and leading some to leave the company.

A notable example of the internal turmoil was the demo of Siri's new features at WWDC, which included capabilities like accessing emails for flight data and plotting routes in maps. However, this demo was reportedly not based on working prototypes, surprising members of the Siri team. The lack of urgency from senior leaders, including Giannandrea's skepticism about the value of chatbots like ChatGPT, has also been cited as a factor in Siri's slow progress.

Additionally, there have been resentments between the AI and software engineering groups due to differences in pay and work schedules. Some engineers in the AI group received higher pay and faster promotions, while also enjoying more flexible work arrangements, which created tension. This distrust led to requests for extensive documentation of joint projects to prevent blame-shifting.

In response to these challenges, Apple has made significant changes, including a leadership shake-up. Mike Rockwell has taken over Siri's development from Giannandrea, and Craig Federighi has established a new AI division called "Intelligent Systems." This team is seen as more effective and has been given the green light to use open-source third-party models, marking a shift from Apple's previous reliance on internal models.

Tom Friedman Thinks We’re Getting China Dangerously Wrong

Nytimes • April 15, 2025

Politics•InternationalRelations•USChinaRelations•TradeWar•Policy•Geopolitics•Essays

The Times Opinion columnist explores the misconceptions held by former President Trump and American policymakers regarding China amidst the intensifying trade war. The article delves into the complexities of U.S.-China relations and suggests that prevailing narratives often overlook the nuances necessary for effective policy formulation.

Thomas Friedman emphasizes the need for a deeper understanding of China’s strategies and objectives, asserting that a simplistic view could lead to misguided policies. He argues for a balanced approach that considers both cooperation and competition, urging policymakers to ground their strategies in a comprehensive analysis of China's long-term goals.

The columnist also highlights China's significant progress in areas like technology and infrastructure, suggesting that these advancements are reshaping global dynamics. The discourse invites reflection on how America can respond strategically to China's growing influence on the world stage, advocating for policies that enhance mutual understanding and sustainable coexistence.

What would a real anti-China trade strategy look like?

Noahpinion • April 14, 2025

Business•Strategy•TradePolicy•China•Economy•Geopolitics•Essays

Trump’s current trade strategy is seen as diminishing American power, dividing the U.S. from its allies, and giving China a chance to become the world’s leading nation. While some suggest the strategy is intentional, it's more likely a result of disorganization. Within the Trump administration, there are individuals who wish to contain China’s power, recognizing that China’s mercantilist model impacts global trade dynamics.

Key figures like Treasury Secretary Scott Bessent advocate for trade agreements with countries like Japan, South Korea, Vietnam, and India to economically pressure China. The idea is to form a coalition of nations, described as a “grand encirclement” strategy, to balance China’s influence. This approach envisions the U.S. radically pivoting its trade policies to form alliances that could economically counterbalance and even isolate China.

The rationale behind economically pressuring China ties back to geopolitical concerns. China’s growing manufacturing capabilities and ambitions to dominate regions like Taiwan, and its disposition toward the U.S. and allies as rivals, require a strategic response. The goals of trade policy should include preventing China from gaining military superiority, reducing its economic influence, and minimizing supply chain vulnerabilities of nations threatened by China.

Forming a free trade zone among non-Chinese countries could allow these nations to achieve economies of scale similar to those of China. Previous agreements like TPP and TTIP aimed to establish such common markets but were halted. A shift to zero trade barriers between nations like Europe, Japan, and Southeast Asia would help replicate China’s vast market advantages.

To protect against supply chain weaknesses, targeted protectionism and fast-acting trade barriers against Chinese exports are necessary. Furthermore, tariffs should be applied based on the origin of value-added goods, ensuring intermediates from China are also taxed. This requires robust data collection on supply origins, which would necessitate increased bureaucratic resources.

Industrial policy must also focus on filling existing manufacturing gaps, like chip production, and encouraging companies to diversify production locations. The CHIPS Act and similar policies initiated under the Biden administration mark the beginning of such efforts. Alongside, the U.S. should reduce procedural barriers to factory construction, fostering manufacturing competitiveness domestically.

In sum, a comprehensive strategy balancing China’s rise involves eliminating trade barriers within allied nations, protecting against economic vulnerabilities, and bolstering manufacturing capacities both at home and abroad.

Tokenization

Tomtunguz • April 13, 2025

Finance•Cryptocurrency•Tokenization•Investment•Innovation•Essays

Coinbase is now tokenizing its stock on Base, while BlackRock has tokenized its on-chain treasury product BUIDL, totaling $2 billion. This represents a form of regulatory arbitrage related to the history of regulations concerning public offerings.

Brad Gerstner highlighted the transformative impact of such developments, suggesting that traditional IPOs might be becoming obsolete.

Larry Fink noted the success of BlackRock’s IBIT, which ranks third in asset gathering after major S&P 500 index funds. He emphasized that over half of its demand is driven by retail investors, including many first-time purchasers of iShares products.

Fink further asserted that tokenizing every asset—be it stocks, bonds, or funds—could revolutionize investing by eliminating closures of markets and drastically reducing transaction times from days to seconds. This efficiency could potentially unlock billions of dollars currently stalled due to settlement delays, fostering immediate reinvestment and economic growth.

How the U.S. Became A Science Superpower

Steveblank • April 15, 2025

Science•Innovation•U•Geopolitics•Essays

Prior to WWII, the U.S. lagged behind in science and engineering. However, by the war's end, it had surpassed Britain, leading global advancements in these fields for 85 years. This transformation was guided by two influential science advisors to national leaders, each with unique approaches and visions.

The U.S. achieved this scientific supremacy through strategic investments in research and development, coupled with fostering a culture that valued innovation and technological progress. Government policies played a crucial role in this transformation, providing necessary support to scientific institutions and facilitating collaboration between academia and industry.

These efforts were further bolstered by the establishment of new research organizations and initiatives, which laid the groundwork for future breakthroughs in various interdisciplinary fields. Allied with a focus on education and professional training, these measures equipped the U.S. to sustain its leadership in science and engineering.

How Marc Lore Architects Unicorns

Thegeneralist • Mario Gabriele • April 17, 2025

Business•Startups•Entrepreneurship•Innovation•Strategy•Essays

Successful serial entrepreneurs are a unique group. They test themselves in diverse environments, repeatedly learning what works. The skill lies in distinguishing between a smartly structured team and one successful due to market trends. Marc Lore is one such entrepreneur, having sold Quidsi to Amazon and Jet.com to Walmart. His new venture, Wonder, aims to revolutionize food hall experiences with substantial financial backing.

Marc's method, VCP (Vision, Capital, People), is central to his strategy. He emphasizes turning visions into actionable strategies and measurable success metrics, underlining the importance of detailed organization. His quantitative approach is evident in how Wonder operates, with frameworks focusing on impact, efficiency, and performance.

For founders, Marc's insights are valuable, especially in scaling effectively while prioritizing what matters. His company's structure maximizes Speed, Ownership, Accountability, and Results.

Wonder operates both brick-and-mortar locations and a digital service, offering a variety of dining experiences. It involves managing real estate, inventory, and logistics, aiming to challenge the low-margin industry norm.

Lore's approach to entrepreneurship is akin to a business athlete, blending diverse skills and dedicated practice. This mindset has guided his successful ventures and promises to influence Wonder's trajectory.

Geopolitics

Trump’s Tariffs Are Part of a ‘Tectonic Plate Shift’ in the Global Economy

Nytimes • April 11, 2025

Business•Strategy•Trade•Tariffs•Economy•Geopolitics

Peter R. Orszag, the C.E.O. of Lazard, discusses how markets are reacting to the uncertainty caused by Trump's tariffs. According to Orszag, these tariffs are part of a broader movement in the global economy which he describes as a "tectonic plate shift." This shift is transforming international trade and impacting economic relationships between countries.

The tariffs introduced by the Trump administration have created a complex environment for global markets. Businesses are increasingly worried about the potential for escalating trade wars, which could disrupt established supply chains and affect international commerce. This uncertainty has led to fluctuations in markets as investors try to anticipate the potential outcomes of these policies.

Orszag notes that this could lead to significant shifts in how countries approach trade and economic partnerships. The long-term impacts might redefine economic policy strategies and necessitate new approaches to global commerce.

The situation presents both challenges and opportunities. While some industries may struggle under increased tariffs and disrupted trade, others might find new pathways for growth as they adapt to changing conditions. This adaptability and strategic realignment could mark a notable transformation in economic dynamics.

Donald Trump’s Tariffs Will Only Strengthen China’s Hand

Nytimes • April 15, 2025

Business•ECommerce•TrumpTariffs•China•Technology•Geopolitics

China’s e-commerce ecosystem illustrates how Trump’s tariffs only strengthen that country’s hand. The thriving digital marketplace in China has been bolstered by these tariffs, as retaliatory measures and internal reforms help domestic companies expand their influence. The tariffs have inadvertently pushed China to accelerate its technological advancements, making their products more competitive on the global stage.

Chinese companies have shifted focus towards innovation and self-reliance, amplifying their technological capabilities. This strategic pivot has also been supported by government policies that prioritize technological development and encourage local entrepreneurs. As a result, China’s tech giants are not only thriving domestically but are also expanding their reach internationally, challenging American tech dominance.

Moreover, these tariffs have caused American businesses to reconsider their positions due to increased costs, thereby allowing Chinese firms to capitalize on newfound opportunities. The resilience and adaptability of the Chinese market, coupled with strategic governmental support, are reshaping global e-commerce dynamics. This shift is indicative of a broader trend where technological and economic landscapes are increasingly influenced by political maneuvers.

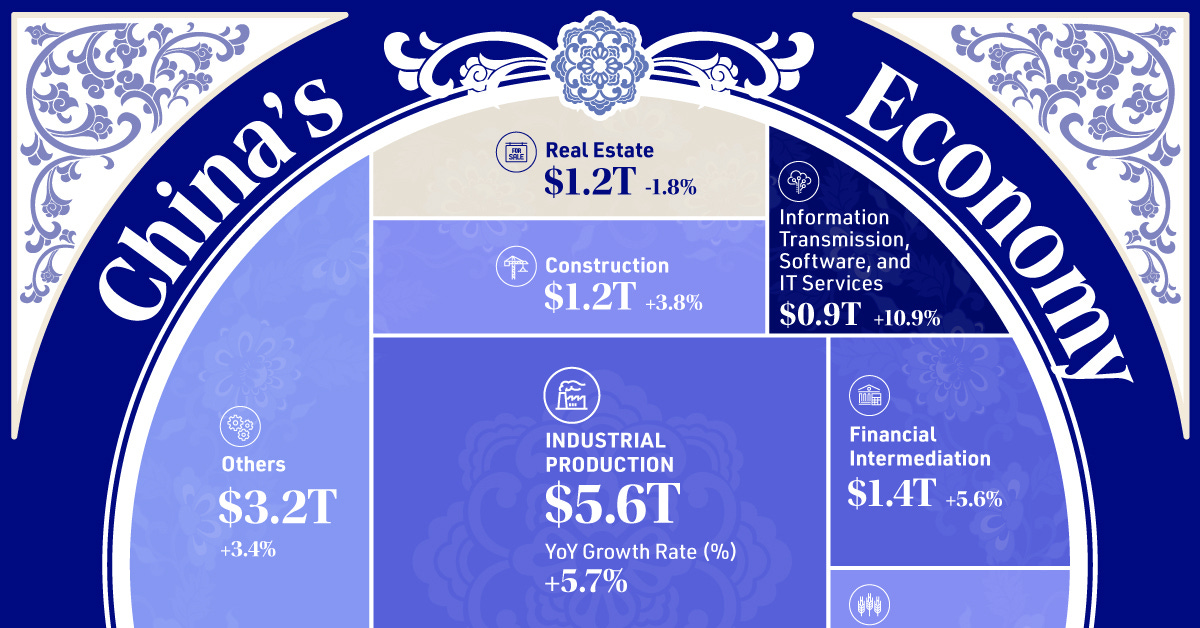

Visualizing China’s $18.6 Trillion Economy by Sector in 2024

Visualcapitalist • April 15, 2025

Business•Economy•China•GDP•Growth•Geopolitics

China's total GDP grew to $18.6 trillion in 2024, hitting the government's official target of "around 5%". A significant portion of this growth is attributed to the industrial sector, which remains a cornerstone of China's economic structure. This sector alone contributes substantially to the GDP, reflecting the nation’s continued emphasis on manufacturing and production as key drivers of growth.

In addition to industry, the services sector is playing an increasingly vital role in sustaining economic expansion. This sector's growth is propelled by both domestic consumption and international trade, underscoring China's strategic pivot towards a more diversified economy.

Agriculture, while contributing a smaller fraction to the total GDP, still holds critical importance for rural employment and food security. The sector continues to undergo modernization to improve efficiency and output, aligning with the country's long-term development goals.

As China progresses towards its economic targets, the government has also been prioritizing technology and innovation. Significant investments in green technologies and digital infrastructure are part of efforts to transition to a more sustainable and technologically advanced economy.

Temu and Shein slash US ad spending as trade war hits

Ft • April 16, 2025

Business•ECommerce•TradeWar•DigitalAdvertising•Tariffs•Geopolitics

Chinese retailers like Temu and Shein are significantly reducing their advertising spend in the U.S. due to escalating trade tensions with China. This shift is particularly impactful for major digital platforms such as Google and Meta, which have seen a substantial drop in ad revenue from these companies. Temu, owned by PDD Holdings, has been a major advertiser in the U.S., but it has recently halted its digital ad campaigns across platforms like Google Shopping and Meta's Facebook and Instagram. This decision follows the imposition of new tariffs on Chinese goods, which have risen to as high as 125%, and the closure of the "de minimis" import loophole that allowed low-cost shipments to enter the U.S. duty-free[1][3][4].

The closure of this loophole and the increased tariffs pose significant challenges to Temu's business model, which relies on shipping low-cost items directly from Chinese suppliers. The company's advertising presence on platforms like Google Shopping has plummeted, with its impression share dropping from around 21% to near zero in a matter of days. Similarly, its ad spend on Meta platforms, which was nearly $2 billion in 2023, has collapsed to negligible levels by April 2025[3][4]. This drastic reduction in advertising is not only affecting Temu's visibility but also impacting its app store rankings, which have significantly declined[3][4].

The implications of these changes extend beyond Temu and Shein, as they could potentially force these companies to reconsider their presence in the U.S. market. Consumers are already showing signs of reduced spending on these platforms, with nearly 30% indicating they would stop shopping if prices rise due to tariffs[2]. The broader impact on the digital advertising landscape is also significant, as the departure of a major spender like Temu could lead to reduced auction pressure and lower ad costs for other brands, though the market volatility might prevent immediate absorption of the ad space left behind[4].

The situation highlights the fragility of e-commerce models built on low-cost imports and aggressive marketing strategies. As trade policies continue to evolve, companies like Temu and Shein must adapt their pricing and supply chains to remain competitive in the U.S. market. The current environment suggests that these companies might need to exit the U.S. market temporarily or permanently unless they can find ways to mitigate the effects of the tariffs and the closure of the de minimis loophole[5].

AI

xAI adds a ‘memory’ feature to Grok

Techcrunch • Kyle Wiggers • April 16, 2025

Technology•AI•Chatbots•Memory•Innovation

Elon Musk's AI company, xAI, is steadily advancing its Grok chatbot to be on par with leading competitors like ChatGPT and Google's Gemini. Recently, xAI unveiled a "memory" feature for Grok, which allows the chatbot to recall details from previous interactions. This enhancement means that when you request recommendations from Grok, the responses will be more personalized, based on past conversations.

The inclusion of memory aims to improve user experience by making interactions with Grok feel more tailored and less transactional. By remembering user preferences and previous queries, the chatbot can potentially provide a more engaging and efficient dialogue.

This development is part of xAI's ongoing strategy to enhance the capabilities of Grok and integrate sophisticated AI technology into its offerings. With these updates, xAI continues to position itself as a significant player in the AI industry, challenging established entities with innovative features.

🚨 ChatGPT hits another milestone: a billion weekly users

Exponentialview • April 12, 2025

Technology•AI•MachineLearning•Innovation•UserAdoption

The article highlights a significant milestone achieved by ChatGPT, a leading AI chatbot developed by OpenAI, which has reached a billion weekly users. This achievement underscores the rapid growth and adoption of AI technologies in everyday life and their increasing role in information dissemination and interaction.

Key Points and Analysis

User Growth: The milestone of a billion weekly users indicates a massive scale of engagement with AI tools. This growth reflects the increasing reliance on AI for information, entertainment, and assistance.

Implications for AI Development: As AI models like ChatGPT continue to evolve, they are likely to become more sophisticated, capable of handling complex queries, and providing personalized experiences. This could further accelerate their adoption across various sectors.

Potential Applications and Challenges: The widespread use of AI chatbots raises questions about their applications in education, customer service, and content creation. However, challenges such as ensuring accuracy, handling bias, and maintaining user privacy remain critical.

Future of AI Adoption

The future of AI tools like ChatGPT seems promising, with potential applications in automating tasks, enhancing decision-making processes, and improving productivity. However, addressing ethical concerns and ensuring these tools are used responsibly will be essential for sustained growth.

Conclusion

In conclusion, the rapid adoption of AI tools like ChatGPT highlights the transformative power of technology in modern society. As AI continues to advance, it is crucial to balance innovation with ethical considerations to ensure that these technologies benefit humanity as a whole.

Claude just gained superpowers: Anthropic’s AI can now search your entire Google Workspace without you

Venturebeat • Michael Nuñez • April 15, 2025

Technology•AI•WorkspaceIntegration•AutonomousSearch•EnterpriseSecurity

Anthropic has introduced a new capability for its AI, Claude, enabling it to autonomously search across Google Workspace. This feature is positioned as a direct challenge to OpenAI, offering faster results and enhanced security catered to enterprises and knowledge workers.

Claude's latest upgrade emphasizes its ability to perform complex searches and execute tasks without constant user intervention. This development allows Claude to efficiently manage and process information scattered across various applications within Google Workspace, such as Gmail, Google Docs, and Google Drive.

The integration of Claude within Google Workspace aims to boost productivity by leveraging AI to relieve users from the repetitive and time-consuming process of manually searching through vast amounts of data. This advancement not only highlights the competitive landscape of AI technologies but also underscores the increasing demand for AI-driven tools in workplace environments.

Anthropic's focus on enterprise-grade security ensures that data privacy and protection are paramount, addressing common concerns associated with AI tools in professional settings. By prioritizing security, Anthropic aims to build trust with businesses looking to integrate AI solutions into their daily operations.

ChatGPT Memory, Boundaries and AI Companions, Auren

Stratechery • Ben Thompson • April 14, 2025

Technology•AI•MachineLearning•UserExperience•Privacy

ChatGPT's memory feature is pretty basic, but it's the sort of product feature that can build a moat, particularly if it's extended to other use cases.

Memory in AI is a significant development because it allows an AI model to retain important information across sessions. This feature has the potential to transform how users interact with AI companions by fostering more personalized and meaningful engagements. It operates by remembering details users have shared in past conversations, which could be leveraged to enhance user experience in various contexts.

The implementation of memory in chatbots like ChatGPT could lead to breakthroughs in creating AI companions that are more personal and trusted by their users. This kind of memory could enable AI to become more contextually aware, providing more relevant and accurate responses based on user history and preferences.

However, this capability brings about questions regarding data privacy and security. Users might be concerned about what information is stored and how it is utilized. Ensuring transparency and allowing users control over their data are essential components in building user trust.

Expanding this feature could revolutionize interactions in customer service, therapy, education, and more. Personalization through memory can make AI a more integral part of daily digital interactions, reducing the gap between human-like understanding and machine responses.

OpenAI slashes prices for GPT-4.1, igniting AI price war among tech giants

Venturebeat • Bryson Masse • April 14, 2025

Technology•AI•PriceWar•OpenAI•Innovation

OpenAI has dramatically reduced the prices of its GPT-4.1 API by up to 75%, sparking what is being termed a price war among tech giants like Anthropic, Google, and Elon Musk's company, xAI. This move is expected to reshape the AI landscape, making high-performance language models more accessible to a broader market of developers and businesses. The substantial price cut comes alongside enhancements in the AI's coding capabilities and the expansion of its context window to accommodate a million tokens, providing even greater utility for developing complex applications.

This competitive shift is part of a broader strategy to gain a stronger foothold in the rapidly evolving AI sector. The aggressive pricing is likely a response to similar attempts from other companies to carve out their respective market shares in a field that has seen explosive growth and innovation over recent years. By offering better performance metrics at reduced costs, OpenAI aims to attract more developers to its platform, potentially boosting its user base significantly and further entrenching its position as a leader in the artificial intelligence domain.

The reduction in API costs not only makes advanced AI technology more accessible but could also lead to a surge in AI-driven solutions as developers leverage these tools for diverse applications. This includes everything from improving customer service with chatbots to enhancing data analysis with sophisticated language models capable of interpreting complex datasets.

The competitive dynamics in the AI market are likely to intensify as companies like Anthropic and Google are compelled to reconsider their pricing strategies and product offerings. This environment fosters accelerated innovation and the creation of more sophisticated AI models, benefiting developers and end-users alike by providing more choices and capabilities.

OpenAI Unveils New ‘Reasoning’ Models o3 and o4-mini

Nytimes • April 16, 2025

Technology•AI•MachineLearning•VisualReasoning•Innovation

OpenAI has recently introduced two new AI reasoning models, o3 and o4-mini, which represent significant advancements in the company's o-series. These models are designed to pause and work through questions before responding, enhancing their ability to handle complex tasks. The o3 model is OpenAI's most advanced reasoning model to date, capable of handling a wide range of tasks, including coding, math, science, and visual perception. It excels in visual tasks such as analyzing images, charts, and graphics, making it ideal for complex queries that require multi-faceted analysis[1][2][4].

The o4-mini model is smaller and optimized for fast, cost-efficient reasoning. Despite its size, it achieves remarkable performance, particularly in math, coding, and visual tasks. It is noted for its efficiency and supports higher usage limits than the o3 model, making it suitable for high-volume tasks[1][2][4]. Both models can think with images, integrating visual information into their reasoning process, which is a significant breakthrough in visual perception. This capability allows users to upload images, even if they are blurry or low-quality, and the models can still extract insights from them[3][5].

A key feature of both o3 and o4-mini is their ability to independently use all ChatGPT tools, including web browsing, Python, image understanding, and image generation. This allows them to solve complex, multi-step problems more effectively and take steps toward acting independently. The models are available to ChatGPT Plus, Pro, and Team users, with o3-pro set to be released in a few weeks[5]. Additionally, OpenAI has introduced Codex CLI, a lightweight, open-source coding agent that works with these models, providing users with a simple way to connect AI models to their local code and tasks[5].

The launch of these models marks a significant step forward in AI reasoning capabilities, offering enhanced performance across academic benchmarks and real-world tasks. External evaluators have noted improved instruction following and more useful responses compared to previous models, thanks to their advanced intelligence and inclusion of web sources[1][4]. The models have been stress-tested under OpenAI's safety program and evaluated using the company's updated Preparedness Framework[5].

In terms of practical applications, these models can assist in tasks such as analyzing regional travel data and economic statistics to recommend ideal locations for business expansion. They can also gather scientific studies and industry data to summarize key advancements in fields like battery technology[1]. Overall, o3 and o4-mini represent a significant advancement in AI's ability to reason and interact with visual information, setting a new standard for intelligence and usefulness in AI models.

Windsurf. Do the deal. But at $5B, not $3B. Sam can afford it.

Cautiousoptimism • Alex Wilhelm • April 17, 2025

Technology•AI•StartupAcquisition•OpenAI•BusinessStrategy

Welcome to Cautious Optimism, a newsletter focusing on tech, business, and power. Happy Thursday, though with a brief note today due to being under the weather. More insights follow tomorrow.

Trending Up: An exploration into corporate giveaways, truth finding, and reasonableness continues to capture attention.

Trending Down: Rumors around Plaid growth, debates on economic dominance without immigrants, and concerns about Federal Reserve independence are creating ripples.

OpenAI is potentially set to acquire the rebranded Windsurf, a startup known for AI developer tools, including an AI-integrated IDE. Previously known as Codeium, the company caught OpenAI's interest as it uses rival AI models from Anthropic. This transaction could be strategic, depriving Anthropic of a growing customer while reinforcing OpenAI's ecosystem.

Despite Windsurf's valuation of around $1.25 billion, with potential to return several times that amount, the suggested deal price is $3 billion. Considering OpenAI’s massive valuation, this acquisition would represent a fraction of its market cap, making it financially feasible and desirable.

The acquisition may allow OpenAI to capture value at the application layer, thus reducing risk while undercutting a competitor. However, it's suggested that $5 billion might be a more accurate price for Windsurf.

Meanwhile, in broader business news, Chris Krebs, a former Federal cybersecurity official, finds himself at the center of controversy. After being ousted by Trump for truth-telling and having his security clearance revoked, Krebs experience represents challenges faced by those opposing the administration.

Krebs plans to resign from SentinelOne to challenge the influence of political power over business operations, spotlighting Trump's tendencies to retaliate against critics. Despite the lack of a significant market reaction, this issue highlights the tension between political actions and corporate integrity.

The narrative underlines a recurring theme of standing up versus cowering in the face of governmental pressure. As Krebs takes a stand, it remains to be seen how others in the industry respond amid the political landscape.

Google’s Veo 2 video generating model comes to Gemini

Techcrunch • April 15, 2025

Technology•AI•VideoGeneration•Google•Innovation

Google is bringing its Veo 2 video-generating AI model to users who pay for Gemini Advanced, the company’s premium AI plan. The expansion comes as Google looks to deliver an answer to OpenAI’s Sora video generation platform, and as competition in the space grows fiercer.

Two weeks ago, one of the more formidable synthetic media advancements was unveiled by another tech giant, indicating the rapid pace of development and adoption in this sector. With Veo 2's integration, Gemini Advanced subscribers will gain advanced video generating capabilities, highlighting Google's commitment to expanding its AI-driven tools in creative fields.

The integration of Veo 2 into the Gemini platform sets the stage for new opportunities in media creation, allowing users more flexibility and creativity. It aims to offer an enhanced experience with a focus on high-quality content generation, adding value to Google's suite of AI offerings.

Social AI

Tomtunguz • watching others • April 16, 2025

Technology•AI•SocialNetworking•Innovation•UserEngagement

I want to see how you use AI.

The biggest challenge to AI adoption is reimagining workflows; AI is best discovered socially.

Midjourney’s launch on Discord was brilliant. As a new user, I knew enough to ask for an image of a rabbit on a firetruck. But by watching others, I discovered I could create vector images, recast photos into Ghibli-style art, change aspect ratios, or convert photos to pencil-shaded drawings.

Here’s an example on X. A poster creates a challenge and asks Grok to pick a user from the comments (using AI to act).

A reader asks Grok to verify the claim.

I don’t know if the contest is valid, but I do know this is a novel way of engaging with AI and social.

I wrote a post earlier this week sharing how my AI usage patterns have changed and received many emails explaining different workflows. With AI canvases, sharing buttons work fine, but discovery would be better if it were social.

Modern AI systems have canvases: places to draft code or create 3D renderings. Here’s an interactive point cloud of a torus (doughnut).

Using Twitter to broadcast the idea and Github to distribute the code? There’s an opportunity to unify the two.

Like GitHub, social code repositories help with discovery, forking, and inspiration.

Plus, social behavior is sticky. Social networks keep users engaged and could counter the high churn and low switching costs of AI platforms, especially with consumers—if the network can nail the dynamics.

OpenAI is rumored to be launching a social network and if true, it reinforces this idea: social AI is a powerful product combination.

OpenAI’s mind-boggling growth masks challenges

Ft • April 17, 2025

Technology•AI•MachineLearning•Ethics•Innovation

OpenAI, a leading AI company, is experiencing rapid growth as it approaches 1 billion users. However, this growth is accompanied by challenges, particularly in clarifying the purpose and functionality of its flagship product, ChatGPT. ChatGPT is an AI chatbot that uses large language models to generate human-like responses to user queries, making it a versatile tool for various applications. Despite its popularity, OpenAI faces the task of defining what ChatGPT is for, as its broad capabilities can lead to confusion about its intended use cases.

One of the key challenges OpenAI faces is ensuring that users understand the potential and limitations of ChatGPT. This includes addressing ethical concerns and ensuring that the technology is used responsibly. As AI technology continues to evolve, companies like OpenAI must balance innovation with transparency and accountability. For instance, AI summarization tools, which can be built using similar large language models, highlight the need for clear communication about AI capabilities and limitations. These tools use extractive and abstractive summarization techniques to condense complex information into digestible formats, but they also require careful management to avoid biases and inaccuracies.

The growth of OpenAI and the popularity of ChatGPT underscore the broader trends in AI adoption. As AI becomes more integrated into daily life, companies must prioritize user education and ethical considerations. This involves not only developing advanced AI models but also ensuring that users understand how to use these tools effectively and responsibly. The implications of AI growth extend beyond technology itself, influencing how businesses and individuals interact with information and make decisions.

In conclusion, OpenAI's rapid expansion highlights both the opportunities and challenges in the AI sector. As the company continues to innovate, it must address the need for clarity about its products and ensure that users are well-informed about their capabilities and limitations. This approach will be crucial for maintaining trust and driving responsible AI development.

Venture Capital

260179

Investmentnews • Unknown Author • April 17, 2025

Finance•Investment•PrivateMarkets•ModelPortfolios•WealthManagement•Venture Capital

BlackRock has launched a pioneering customizable public-private model portfolio within a Unified Managed Account (UMA), marking a significant innovation in wealth management. This new offering integrates access to both private and public market assets in a single, professionally managed portfolio, facilitated by GeoWealth’s UMA technology and iCapital’s infrastructure. The collaboration aims to simplify and enhance advisors’ ability to allocate across asset classes, providing a streamlined administration and custodial integration experience.

The initiative responds to growing advisor demand for more tailored investment solutions that include private market exposure, traditionally accessible only to ultra-high-net-worth clients or family offices. By lowering the barriers to private markets, BlackRock seeks to democratize access and help advisors deliver differentiated services and outcomes for their clients across their entire portfolio.

At launch, the model portfolios include BlackRock’s $1.1 billion Private Credit Fund and its $300 million Private Investments Fund, with private assets initially comprising about 15% of the portfolios. There is potential to expand the alternatives exposure to include infrastructure and additional private credit investments over time. This approach reflects BlackRock’s broader strategic shift towards alternative investments, supported by a series of acquisitions totaling over $28 billion in the past year, including firms specializing in private credit, infrastructure, and alternative data.

BlackRock manages approximately $300 billion in model portfolios globally and anticipates the managed model portfolio market to double to $10 trillion over the next four years. The firm’s custom models segment has attracted $50 billion in new assets over the past five years, underscoring the growing importance of scalable, customizable model solutions among registered investment advisors (RIAs).

The new public-private model portfolios offer advisors intuitive workflows, efficient reporting tools, and comprehensive investment management capabilities throughout the investment lifecycle. iCapital’s Multi-Investment Workflow Tool enhances the alternative assets investing experience by streamlining processes. GeoWealth’s UMA technology addresses the longstanding challenge of integrating private market investments systematically and at scale within wealth management practices.

BlackRock’s U.S. Wealth Advisory business, which generated about a quarter of the firm’s revenue in 2024, is a key growth driver. The firm’s focus on private markets as a diversification tool beyond traditional stock and bond portfolios aligns with increasing advisor demand for alternative investments to boost returns and manage risk in volatile markets.

This innovative model portfolio offering represents a significant step forward in making private market investments more accessible and manageable for advisors and their clients, combining technology, customization, and a broad asset class reach within a unified account structure.

Figma ignores the fear, files paperwork for an IPO

Techcrunch • April 15, 2025

Technology•Software•IPO•Figma•DesignTools•Venture Capital

Design software startup Figma announced Tuesday it has filed its confidential paperwork for an IPO. We won’t know more until that paperwork becomes public, which, best-case scenario, would be in about a month. However, with the stock market in groundhog mode—seeing its shadow with every new gyration of trade policies—companies have shown hesitance toward public offerings.

Despite market volatility and economic uncertainty, Figma seems undeterred. The company has successfully raised significant capital in past funding rounds, demonstrating strong investor confidence. Known for its web-based collaborative design tools, Figma has carved out a substantial niche in the market, challenging industry heavyweights like Adobe.

The move towards an IPO is seen as a strategic step to capitalize on its growth and scale its operations further. As remote work continues to be a significant trend, Figma's collaborative design tools are well-positioned to meet the needs of distributed teams, potentially bolstering its appeal to investors.

Startup funding hit records in Q1. But the outlook for 2025 is still awful.

Techcrunch • Marina Temkin • April 16, 2025

Business•Startups•VentureCapital•Investment•Venture Capital

Startups attracted $91.5 billion in venture capital funding in Q1, according to the latest report from data provider PitchBook. This figure not only exceeds the previous quarter’s allocation by 18.5% but also represents the second-highest quarterly investment in the last decade. Despite this seemingly positive news, Kyle Stanford, lead U.S. venture capital analyst at PitchBook, indicated that the horizon for 2025 is not as bright.

Investors are increasingly wary due to economic uncertainties and potential regulatory challenges, which could affect the flow of capital in the coming years. The excitement over emerging technologies is currently driving investment, but long-term sustainability is questioned by many industry experts.

Stanford pointed out that while the current surge in funding appears robust, startups face significant hurdles in maintaining growth. He emphasized the importance of not just relying on initial funding rounds but also focusing on efficient capital management and clear paths to profitability.

This sentiment is echoed by numerous venture capitalists who argue that the market is overheating. The fear is that excess capital without diligent strategic planning will lead to unsound financial practices, ultimately resulting in a downturn.

AI companies secure at least $52bn in global VC funding during Q1 2025

Techmonitor • Swagath Bandhakavi • April 17, 2025

Technology•AI•VentureCapital•Investment•GlobalEconomy•Venture Capital

AI companies raised at least $52bn out of the $126.3bn in global venture capital (VC) deployed during Q1 2025, according to KPMG Private Enterprise’s Venture Pulse Q1 2025 report. The surge was led by OpenAI’s record-breaking $40bn transaction, the largest VC funding deal ever recorded. AI-focused companies dominated eight of the 10 largest global venture deals during the quarter, with Anthropic securing $3.5bn across two closings, Infinite Reality raising $3bn, and Groq adding $1.5bn. Combined, these four US-based firms accounted for over $48bn.

“AI is driving a large bulk of global VC investment right now, buoying investment levels that might otherwise be soft,” said KPMG International partner Francois Chadwick. “It is an exciting space too, with an incredible reach both in terms of geographies that are attracting investments — if not often at the size of deals in the US — and in terms of the solutions gaining attention. Industry-focused solutions are going to be particularly hot over the next quarter as startups continue to target the intersection of AI and industry in order to drive unique business value.”

Additional US AI-related investments included $537m by KoBold Metals, $480m by Lambda, and $403m by Apptronik, which is developing humanoid robotics. These later-stage deals contributed to a broader upward trend in deal size, with Series D+ median rounds in the Americas reaching $96.2m during the quarter.

Europe also saw significant AI deal activity. UK-based Isomorphic Labs raised $600m to expand AI-powered drug discovery. Sweden’s Neko Health secured $260m, and Synthesia in the UK raised $180m to scale AI-generated video solutions. A $500m raise by Ori, also in the UK, and $150m by Cera, a healthtech company leveraging AI for preventative care, added to the region’s AI investment momentum.

In Asia-Pacific, AI investments featured in a number of mid-sized rounds despite regional venture activity falling to a ten-year low. China-based Neolix Technologies and Univista each raised $137m. Australia’s Harrison.ai brought in $111m, while Hong Kong- and Boston-based InSilico Medicine secured $100m, and India-based Spotdraft raised $54m.

Foundational model development remained active in China, with the launch of three new AI models in Q1, including DeepSeek’s R1 and additional offerings from Tencent and Alibaba. According to KPMG, these models were positioned as more energy-efficient than earlier versions, reinforcing China’s competitiveness in large language model innovation.

The report also highlighted the role of corporate investment. Global corporate venture capital (CVC) investment increased to $80.8bn from $69.4bn in Q4 2024. In the US alone, $65.5bn of CVC was recorded, with AI megadeals accounting for a large share.

In terms of public market activity, the quarter featured a single AI IPO. US-based infrastructure company CoreWeave went public but delivered a muted post-listing performance, signalling investor caution amid geopolitical volatility and trade tensions.

Policy support for AI also intensified. The US government announced the Stargate Project, which is a $500bn initiative aimed at building national AI infrastructure, backed by OpenAI, Oracle, SoftBank, and MGX. Meanwhile, the European Union and China unveiled large-scale public investment plans targeting AI ecosystems and semiconductor development.

Looking ahead, KPMG expects AI to remain the primary driver of global VC activity into Q2 2025. Areas likely to attract continued funding include robotics, agentic AI, LIDAR systems, and sector-specific AI applications. Merger and acquisitions (M&A) activity is also projected to accelerate as established companies move to acquire AI capabilities in a subdued IPO environment.

Most-Active Startup Investors Spent More In Q1

Crunchbase • April 14, 2025

Business•Startups•Investment•VentureCapital•Growth•Venture Capital

The busiest venture backers upped their game in the recently ended first quarter. Among the 14 most-active post-seed investors, a majority backed more deals in Q1 2025 than they did a year ago.

This surge in activity highlights a growing confidence among investors in the startup ecosystem. Notably, established players like SoftBank and Y Combinator maintained their relentless pace, contributing to a marked increase in funding rounds. Such enthusiasm is fueled by the promising potential of emerging technologies and innovative business models that continue to attract significant capital inflow.

The increased spending suggests that venture capitalists are eager to capitalize on budding opportunities. This trend is further supported by an evolving market landscape where innovation and adaptability have become crucial. As a result, investors are increasingly seeking out startups that demonstrate scalability and resilience.

Can you secondary your way to top-decile DPI?

Cautiousoptimism • April 15, 2025

Business•VentureCapital•SecondaryMarkets•Economy•SPAC•Venture Capital

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

Happy Tuesday! Today I had planned a rundown of venture capital data from around the world, but that’s on hold until tomorrow as we have to take a moment to discuss the current state of the nation. That said, there’s business goodies aplenty below for your enjoyment! — Alex

📈 Trending Up: Getting over your skis … ads in your AI search … Series A founder secondary? … Kaitlyn Chen … Japanese deterrence … UK-US economic ties …

On the subject of secondary transactions, the Setter VC Q1 report of the most sought-after private companies is worth your time. Shockingly, it’s not all AI shops!

📉 Trending Down: Chamath’s stock on X … Chinese exports in Q2? … Chinese mercenaries in Ukraine … domestic oil profits? …

Chart of the day: The Empire State Manufacturing Survey is pretty grim. Tracking business activity and sentiment in New York state, the forward looking information points in a single direction:

If, like CO, you want lots of economic growth, the above is a dog’s breakfast.

Yesterday, POTUS blamed Ukraine for Russia’s invasion, saying that “Listen, when you start a war, you gotta know that you can win the war, right? You don’t start a war with someone who’s 20 times your size and then hope people give you some missiles? You don't start a war against somebody that's 20 times your size.” I raise that quote because it underscores the quality of the current American premier; or his lack, if you will. The guy in charge thinks that the democratic nation under assault is the bad guy. We’re not merely whining about the President’s lack of international savvy. No, this is the leader that a lot of folks think is great, and worthy of praise. Lots of folks in tech and business to boot.

I think it’s time to start worrying. Not merely because POTUS appears incapable of treating Russia as an adversary, but because the Bad Things are starting to accumulate: Academic freedom is under direct threat, with the White House forcing universities to choose between financial pain and heavy-handed oversight. Given that we’ve seen from other MAGA higher-education efforts, there’s little evidence that the brains behind Trump University are ready to run, say, Harvard.

Business freedom is under direct threat, with the Executive Branch taking punitive actions against companies and sectors that it has historical — material or dreamed — complaint with. Business thrives on rules and consistency; a lawless business climate run on the patronage system is not how you retain superpower status.

Free speech is under direct threat, with access to the nation being circumscribed by thought. Support of Palestinian causes is now sufficient to get bounced from the country. And with POTUS openly pitching greater incarceration of citizens in foreign prisons, the trend lines here are incredibly negative.

The separation of powers is under direct threat, as SCOTUS told the government to work to return someone from El Salvadoran prison it was told by the courts not to deport. Now, the Trump administration is trying to get around the Supreme Court with a mix of intransigence, and aw-shucks denialism. We’re accustomed to political parties ceding some of their Constitutional authority to the President in terms of agenda-setting when their own group is in power. But seeing the Executive Branch to abrogate the Judicial Branch is terrifying; without court oversight and with a neutered Congress, that’s how you backslide from democracy.

Corruption is rampant, with the President’s family and even his own person doing what seems to be as much as possible to cash in on declining crypto regulation and enforcement, to pick an example. There are others. And the risk of corruption thanks to the possibility of tariff relief by Executive fiat over our heads.

The trade stuff? That’s just bad policy. You have to eat bad policy at times in a democracy because quite often your team will lose. So goes the election.

The above-listed concerns are different. They undercut critical protections of citizens from the state (speech, etc), and concentrate too much power in one branch — one person, let’s be honest — than our founding documents allow.

Panic? No. Worry? Yes. It’s time to start thinking what we’re going to do, so that when our kids ask later on we don’t have to answer I shoveled shit in Louisiana.

If you don’t speak venture, our little sub-headline asks can venture capitalists earn very strong cash returns on their investments without depending on traditional exit pathways like acquisitions or IPOs? The answer is we’re going to find out.

Much hay was made over the short-term pulse of IPOs that we saw in the first quarter, and the present dearth of similar transactions. Disregarding our present pickle, exits were pretty good in dollar terms in the first quarter, with PitchBook pinning the North American figure at $57.9 billion and the European number at $12.3 billion; both figures are above their year-ago comps.

And yet, EquityZen writes in its own Q1 market report pegs “the current U.S. VC secondary market size between” $40 billion and $60 billion. About the size as a strong quarterly exit total for American startups.

Is a quarter or thereabouts a lot? Yes. Enough to replace IPOs? No, or at least not for larger venture capital funds. But as Precursor’s Charles Hudson writes, secondaries as material, consistent exit pathways for smaller, earlier-stage venture players is becoming the norm.

The situation isn’t great for incentive alignment, but can Seed-stage funds wait for more than a decade to return cash to their backers? Probably not. So, something had to give. If you are anti-secondary, you need to reduce IPO expectations and get some tourist late-stage money out of the market.

And if you are irked that secondaries are becoming all too primary an exit path, check this: That’s bullish. Just not for traditional liquidity.

A SPAC? In this economy? Yes, we’re not kidding. Self-driving truck company Kodiak is going public via a SPAC in a deal that values it at around $2.5 billion (equity, pre-money).

Who is the Taylor Swift of venture capital?

Signalrankupdate • Rob Hodgkinson • April 17, 2025

Business•Startups•VentureCapital•SocialMedia•Branding•Venture Capital

VCs act as intermediaries between capital and founders. Fred Wilson of USV aptly summarized their role as service providers to entrepreneurs, identifying venture capital as fundamentally a people business. Despite differences between musicians and VCs, parallels exist, especially the importance of brand in both industries. Venture capital, like music, experiences a strong power law dynamic, where brand helps attract top founders and drive success to a few key players.

The role of social media in shaping brand dynamics reflects a shift towards focus on individual personalities. This is evident in both music and venture industries, with Taylor Swift exemplifying the benefits of such trends in music with her distinct style and massive influence. In venture capital, the future seems to align with solo General Partners (GPs). Brand development in the social media era is more effective when centered on individual authenticity rather than traditional corporate messaging.

The evolution of the music industry through technology points to broader economic implications. Transition from physical to digital distribution combined with social media has favored solo artists. Taylor Swift's dominance illustrates this shift, evidenced by her unprecedented reach and record-breaking tour sales. This mirrors changes within venture capital, where individual brand importance is rising amidst the decline of traditional partnerships.

The venture capital landscape is experiencing change as solo GPs gain traction. In the era of social media, individual authenticity carries more weight. Comparison to the music industry shows a concentration of power and success among few individuals. However, achieving Taylor Swift-like status in venture capital necessitates enduring success, prominent mindshare, and a unique investment style.

Government Overreach

Meta v. FTC, The Three Facebook Eras, Video Slop and Market Forces

Stratechery • Ben Thompson • April 15, 2025

Technology•SocialMedia•Antitrust•Meta•Competition•Government Overreach

The FTC’s case against Facebook conflates three different Facebook eras, and today's environment is defined by competition. The trial could impact future antitrust enforcement and possibly lead to Meta having to divest Instagram and WhatsApp. The FTC argues that Meta is monopolistic, while Meta contends that the competitive landscape has evolved with new players like TikTok.

Meta CEO Mark Zuckerberg's testimony highlighted the evolution of Facebook from a platform centered on connecting with friends to a broader discovery and entertainment space. The company's growth has been marked by distinct periods: its inception and transition to mobile, the dominance phase up to 2019, and the current era defined by competition with platforms like YouTube and TikTok.

During Zuckerberg's testimony, the discussion centered on how Facebook originally transitioned to mobile and dominated consumer attention and mobile advertising. The acquisition of Instagram was a strategic move during a period of market skepticism. This acquisition, along with WhatsApp, has become central points in the antitrust case.

The era of Facebook's monopoly from 2014-2019 is described as a time when the company successfully expanded its global market through smartphones, solidifying its position in digital advertising. The focus has shifted towards video and messaging due to competition from new platforms. Despite this evolution, the FTC's arguments seem rooted in an outdated view of the social media market, not accounting for current competitive dynamics.

Zuckerberg once aimed to prioritize meaningful interactions over passive consumption, but the market's preference for video content has pushed Meta to adapt. Instagram's shift reflects consumer preferences and competition, illustrating a dynamic market structure that contradicts the FTC's stagnant monopoly narrative.

Without Instagram, Meta is Screwed

Spyglass • M.G. Siegler • April 14, 2025

Technology•Business•SocialMedia•Meta•Instagram•Antitrust•Government Overreach

We're just at the beginning of Meta's antitrust trial, and things are expected to get more interesting as the week progresses. Reflecting on the situation now, it may seem obvious that Meta should not have been allowed to purchase Instagram and WhatsApp. However, when these deals occurred in 2012 and 2014, respectively, many thought Meta was making an absurd decision. At the time, Mark Zuckerberg's decision to buy Instagram for $1 billion was met with skepticism and ridicule, with critics like Jon Stewart mocking the purchase as unnecessary for an app centered around photo filters.

While the mainstream media and many tech analysts dismissed the deal, some, including emerging venture capitalists, saw it differently. They viewed Facebook's acquisition as astute, recognizing the potential in Instagram's early success. The skepticism largely overlooked Instagram's longer-term potential and strategic value to Facebook.

Now, revisiting this decision in the context of the ongoing trial seems bizarre, particularly since the government seeks to declare the deal illegal well after it was completed. The Trump administration appears intent on challenging Meta, which is justifiably concerned. Instagram has evolved into a crucial part of Meta's strategy, especially as Facebook faces declining engagement.

In recent earnings calls, Zuckerberg mentioned the idea of returning to "OG Facebook," highlighting its continued importance as a revenue driver amidst growing challenges from new technologies like augmented reality and artificial intelligence. Without Instagram, Meta's ability to monetize effectively and fund initiatives like the metaverse could be severely hampered. This prospect underscores the importance of Instagram to Meta's overall business model and future prospects.

The U.S. Wants to Break Up Google and Meta. That Could Be Hard.

Nytimes • Steve Lohr • April 15, 2025

Technology•Web•Antitrust•Google•Meta•Government Overreach

For the first time since the late 1990s Microsoft case, federal trials are weighing antitrust breakups, a tactic that harks back to Standard Oil.

The Justice Department and a group of states are challenging Google in a pair of antitrust cases focused on search and advertising technology. Similarly, the Federal Trade Commission has targeted Meta Platforms, pursuing a breakup based on allegations of stifling competition.

The tech giants have become central to modern communication, commerce, and information flow. They control digital markets, handling vast troves of data and access. Critics argue this dominance can lead to harmful effects on the economy and hinder innovation.

However, breaking up such complex companies is a challenging legal battlefield. Legal precedent for breakups is scarce and complex, making antitrust cases difficult to execute successfully. These cases will require judges to assess intricate technical details alongside traditional legal arguments.

The outcomes of these trials could set legal benchmarks for managing tech giants, impacting future regulatory approaches and the structure of the digital economy.

What If Mark Zuckerberg Had Not Bought Instagram and WhatsApp?

Nytimes • April 14, 2025

Technology•Business•Mergers•Antitrust•SiliconValley•Government Overreach

Meta’s antitrust trial focuses on accusations that the company stifled competition by acquiring rising competitors such as Instagram and WhatsApp. The trial explores hypothetical scenarios in Silicon Valley, considering how different the landscape might have been if Meta hadn’t made these pivotal purchases.

The government's case suggests that by purchasing Instagram and WhatsApp, Meta prevented them from developing into significant independent competitors. Speculation about what could have happened highlights the potential for these platforms to have evolved uniquely, thereby driving innovation and providing alternatives to Meta's offerings.

Critics argue that these acquisitions cemented Meta's dominance, reducing consumer choices and stifling technological advancements that independent Instagram and WhatsApp might have achieved. The trial seeks to address broader concerns about the balance between fostering innovation and preventing monopolistic practices in the tech industry.

Meta had ‘monopoly power’ after buying rival apps, FTC says

Ft • April 14, 2025

Technology•Antitrust•Regulation•MonopolyPower•TechGiants•Government Overreach

A significant antitrust trial has commenced in Washington, potentially impacting the future of a major tech company. The Federal Trade Commission (FTC) has alleged that Meta, the parent company of Facebook, Instagram, and WhatsApp, holds "monopoly power" due to its acquisitions of rival apps. This case could lead to a breakup of the $1.5 trillion tech giant, marking a pivotal moment in the ongoing scrutiny of tech monopolies.

Key Points and Analysis

Monopoly Allegations: The FTC's case against Meta centers on its acquisition of Instagram and WhatsApp, arguing that these purchases were part of a strategy to eliminate competition. This is a critical aspect of antitrust law, as it aims to prevent companies from using their market power to stifle innovation and choice.