Contents

Editorial: Is Apple Intelligent?

Essays

The Defense Startup & VC Ecosystem: A Transatlantic Perspective

OpenAI calls DeepSeek ‘state-controlled,’ calls for bans on ‘PRC-produced’ models

Apple's Siri Chief Calls AI Delays Ugly and Embarrassing, Promises Fixes

Apple Set to Unveil Major Design Overhaul in iOS 19 & macOS 16

AI frenzy leads US venture capital to biggest splurge in three years

Y Combinator founders raising less money signals a ‘vibe shift,’ VC says

AI

OpenAI launches new tools to help businesses build AI agents

OpenAI calls for US government to codify ‘fair use’ for AI training

Interview of the Week

Marc Dunkelman on Why Nothing Works with Andrew Keen

Startup of the Week

Post of the Week

Apple AirPods Live Translation Coming?

Editorial: Is Apple Intelligent?

Apple is being accused of bad behavior by its strongest advocates. In this week’s newsletter there are strongly worded assaults on the company’s integrity and decision making from John Gruber, Om Malik and MG Siegler. The reason? Because Apple announced that many of the features of Apple Intelligence promised at its 2024 developer event, WWDC, are going to be delayed, at least until 2027.

The breach of confidence is so bad that they are accused of faking demonstrations and producing and running ads for the iPhone 16 when they knew for sure they were not going to be able to deliver.

Internally the team responsible for Siri met and had to eat humble pie.

The scale of the failure is so extreme that Elon Musks promises seem positively accurate by contrast.

Now, it might just be me, but I am both OK with Apple not delivering and not surprised. The gains in AI over the past 12 months make most of the promises outdated. And almost all of the functionality of the best AI is available on my iPhone, iPad and Mac using software from OpenAI, Anthropic, Deepseek, Perplexity and others.

Apples failure has not impacted me one bit. And I still love my Apple products.

The opportunity to build in AI to the operating system is still there, but even without it the apps give me everything I need.

So…why is Apple so embarrassed? Well, because it probably lied, or at least over-promised. Now it has to correct. The internet is awash with advice, but one piece makes a ton of sense. Apple should acquire Anthropic and/or Perplexity.

Here are some examples:

Perplexity is my favorite, but both would be excellent. Could it happen? Only if Apple’s DNA changes dramatically. It has not made major acquisitions for years. But the ideas make sense. Claude is the best model for many things (I wrote an Xcode app using it as I mentioned last week). And Perplexity is a big improvement on Google when used for AI and web search. I would be a fan.

Meanwhile a lot is happening in public markets this week. Most commentators pin the blame on tariffs and uncertainty around them. But I suspect it is simply another correction caused by inflated asset values when compared to fundamentals. The rate of growth of SaaS companies is slowing. And new SaaS companies are not choosing to go public. Public markets are not where the growth is.

The rapidly expanding capabilities of AI means that startups will need less and less capital to reach growth. As Alex Wilhelm said in his excellent ‘Cautious Optimism’ piece titled ‘Do today’s best startups need venture capital?’:

“But I’ll bet you a nickel that, compared to the SaaS era, venture dollars invested per dollar of ARR is going down. And the further down it goes, the less startups will need external capital. The best, most enticing startups, at least.”

The evidence suggests that AI startups get to large revenues quickly, and the vertical AI startups do so with far less capital than traditional SaaS companies. See the first essay below.

Apple is just fine, AI is just fine, startups are just fine. Lets all chill :-)

Essays of the Week

Early-Stage VC in the Age of Vertical AI

Author: EUCLID VENTURES Source: EUCLID VENTURES Published: March 12, 2025 Classification: Venture Capital Subcategory: Early Stage

In an essay published in October last year, we discussed the reckoning underway in the seed stage market and how the assembly-line approach to early-stage venture capital was becoming challenged as graduation rates hit an all-time low.

Optimizing fund strategy for graduation rate, however, is a risky proposition that is getting riskier. An unintentional consequence of such an approach can be the “assembly line” approach to early-stage venture capital. A high volume of initial investments requires intense systemization–and often simplification–of the picking process. Many firms rely heavily on thematic strategies that focus dollars into “hot” or fast-growing sectors. So, while conveyor-belt investing may produce impressive short-term performance on paper, it will inevitably underperform without a consistent way to consistently foresee cycles.

An increasing number of Vertical AI success stories, both inside and outside our portfolio, has led us to rethink implications for early-stage investors once again. Historically, vertical platforms have been able to achieve higher penetration rates than their horizontal peers, in large part because the solutions are built to spec for an industry. As a result, switching costs are high with lower competitive intensity. As discussed in our essay last week, AI has also significantly eroded barriers to software adoption across even the most recalcitrant industries.

The early adoption curves of top-tier Vertical AI—some with growth rates that look more like best-in-class consumer or marketplace businesses than B2B software—make it clear that there is something unique to the formula. And if this phenomenon proves replicable throughout the economy, the already massive opportunity in Vertical is set to experience a generational acceleration.

Large language models (LLMs) enable vertical software solutions to engage customers—and often their customers—based on how, where, and when they work. Instead of needing customers to adjust to a new app and user experience (UX), vertical AI solutions can connect directly through voice, text, or industry-standard documentation. These wedge products require significantly less, if any, market education or training. These systems can also integrate and operate within existing systems of record, eliminating the need to overhaul workflows and avoiding high-friction integration processes. The main traditional barrier to adoption that vertical software has encountered—persuading customers to change how they do business—is diminishing rapidly.

Powerful A.I. Is Coming. We’re Not Ready.

Author: Kevin Roose Source: Published: March 14, 2025 Classification: AI Subcategory: Artificial General Intelligence

In this thought-provoking article, Kevin Roose explains why society may be unprepared for the rapid advancements in artificial intelligence. Roose outlines his perspective based on discussions with engineers, industry insiders, and researchers, arguing that AI has already begun to surpass human capabilities in domains such as math, coding, and medical diagnosis. He foresees that within the next few years—perhaps as early as 2026 or 2027—one or more companies might claim to have created an artificial general intelligence (A.G.I.), a system capable of handling almost every cognitive task that a human can.

Roose emphasizes that when the announcement of A.G.I. comes, debates over its definition might follow, but the larger implication remains: we are entering a new era where humans no longer hold a monopoly on intelligence. He discusses how A.I. is not only transforming technology but is also set to generate substantial economic value and shift political and military power, with governments and corporations already investing heavily in these technologies.

The article highlights the warnings coming from the very experts who build these systems. Leaders from major A.I. labs—including opinions from figures like Sam Altman, Demis Hassabis, and Dario Amodei—suggest that not only is change imminent, but the pace of improvement is accelerating. Roose also notes that independent researchers such as Geoffrey Hinton and Yoshua Bengio, along with other economists and security officials, share concerns about our preparedness for these developments.

Roose further illustrates his point by contrasting early A.I. systems, which struggled with tasks like basic arithmetic and complex reasoning, with today's more advanced, reasoning-enhanced models. These new systems are not only achieving higher levels of performance in standardized tests and professional tasks but are also finding their way into everyday business functions, coding, and research support roles. The shift is so dramatic that even software engineers now often see their role evolving into supervisors of A.I. rather than sole creators.

Ultimately, the article calls for urgent preparation at multiple levels: from updating policy and regulation to modernizing critical infrastructure, enhancing cybersecurity, and promoting A.I. literacy. Roose warns that, much like the underestimation of social media’s societal impact, ignoring the challenges and opportunities of A.G.I. could leave many unprepared when the technology's transformative effects become undeniable.

The Defense Startup & VC Ecosystem: A Transatlantic Perspective

Author: Paulina Szyzdek Source: Artificial Intelligence Published: March 09, 2025

Classification: Venture Capital Subcategory: Defense Startups

The US defense tech ecosystem is thriving, fueled by rising defense budgets, evolving procurement strategies, and venture-backed startups that are redefining how defense technologies are developed and deployed. This transatlantic perspective casts light on not only the innovation exploding within U.S. defense startups but also the increasingly collaborative nature of defense innovation between the U.S. and Europe.

Across the Atlantic, European enterprises and governmental agencies are forging new partnerships with U.S. ventures, aiming to leverage technologies that promise to modernize traditional defense approaches. The overall momentum is underpinned by significant investments and strategic shifts in both public and private sectors.

The dialogue between venture capital plots and national defense strategies has never been more dynamic. Investors are showing growing confidence in a landscape where emerging technologies—ranging from advanced robotics to sophisticated cybersecurity—are taking center stage. This robust interest is indicative of a broader trend where innovation and national security concerns converge.

While the full story is explored in detail on Medium, the initial observations underline how defense tech innovation is emerging as a crucial battleground for future strategic advantages. The ongoing initiatives reflect not only the technological ambitions of startups but also the geopolitical recalibrations that these new defense paradigms are driving.

OpenAI calls DeepSeek ‘state-controlled,’ calls for bans on ‘PRC-produced’ models

Author: Kyle Wiggers Source: TechCrunch Published: March 13, 2025 Classification: Tech News Subcategory: AI

In a new policy proposal, OpenAI describes Chinese AI lab DeepSeek as “state-subsidized” and “state-controlled,” and recommends that the U.S. government consider banning models from the outfit and similar People’s Republic of China (PRC)-supported operations.

The proposal, a submission for the Trump administration’s “AI Action Plan” initiative, claims that DeepSeek’s models, including its R1 “reasoning” model, are insecure because DeepSeek faces requirements under Chinese law to comply with demands for user data. Banning the use of “PRC-produced” models in all countries considered “Tier 1” under the Biden administration’s export rules would prevent privacy and “security risks,” OpenAI says, including the “risk of IP theft.”

It’s unclear whether OpenAI’s references to “models” are meant to refer to DeepSeek’s API, the lab’s open models, or both. DeepSeek’s open models don’t contain mechanisms that would allow the Chinese government to siphon user data; companies including Microsoft, Perplexity, and Amazon host them on their infrastructure.

OpenAI has previously accused DeepSeek, which rose to prominence earlier this year, of “distilling” knowledge from OpenAI’s models against its terms of service. But OpenAI’s new allegations — that DeepSeek is supported by the PRC and under its command — are an escalation of the company’s campaign against the Chinese lab.

There isn’t a clear link between the Chinese government and DeepSeek, a spin-off from a quantitative hedge fund called High-Flyer. However, the PRC has taken an increased interest in DeepSeek in recent months. Several weeks ago, DeepSeek founder Liang Wenfeng met with Chinese leader Xi Jinping.

★ Something Is Rotten in the State of Cupertino

Author: John Gruber Source: Daring Fireball Published: March 12, 2025 Classification: Industry Analysis Subcategory: Apple and AI

In the two decades he’s been covering technology, John Gruber laments missing a major story: Apple’s announcement that the “more personalized Siri” features of its new Apple Intelligence initiative would be delayed until the coming year. Gruber recounts how he was lulled into complacency by Apple’s history of shipping pre‐announced products and features, and how the marketing umbrella of “Apple Intelligence” obscured the fact that what was promised was far from a cohesive, demonstrable system.

He explains that Apple’s nomenclature—much like the term Continuity—is a marketing construct rather than a reflection of a single technical framework. Rather than delivering a unified project, Apple’s announcement bundled a range of features that varied significantly in their state of readiness. While some features had been shown in controlled, live demos (such as Writing Tools and predictive code completion), the critical “more personalized Siri” capabilities were never demonstrated outside of a polished concept video.

Gruber outlines a four-stage hierarchy for product doneness: (1) live, on-stage demos by company reps; (2) guided, hands-on demos for select media; (3) public beta releases; and (4) full consumer releases. By his account, the Apple Intelligence features showcased at WWDC were all at stage 1—even as the most ambitious, context-aware Siri functions remained firmly in the vaporware realm (stage 0).

He notes the irony that, despite the lack of a working demonstration, Apple not only promised these features for the coming year but also prominently featured them in an iPhone 16 commercial. Gruber questions the internal decision-making at Apple, suggesting that promoting features which are not demonstrably ready erodes the company’s long-earned credibility. The classic example of internal accountability he recalls—Steve Jobs’s infamous outburst over MobileMe’s failures—serves as a stark contrast to Apple’s current strategy.

Ultimately, Gruber argues that Apple’s credibility, built over decades on the trust that a promised feature would actually ship, is now at risk. Delivering table-stakes functionality in the age of generative AI is not enough when the more innovative and personalized features remain unproven. When a technology giant like Apple overpromises, it not only disappoints customers but also undermines the trust that has been carefully accumulated over years of excellence.

Apple Intelligence: Fud, Dud or Both

Author: Om Malik Source: On my Om Published: March 13, 2025 Classification: Tech News Subcategory: AI Analysis

John Gruber is not mincing his words.

What Apple showed regarding the upcoming “personalized Siri” at WWDC was not a demo. It was a concept video. Concept videos are bullshit, and a sign of a company in disarray, if not crisis. The Apple that commissioned the futuristic “Knowledge Navigator” concept video in 1987 was the Apple that was on a course to near-bankruptcy a decade later. Modern Apple—the post-NeXT-reunification Apple of the last quarter century—does not publish concept videos. They only demonstrate actual working products and features.

You have to read the whole thing. Gruber’s long-time familiarity with Apple means that when he criticizes it, the problems run deep.

As someone who was highly enthusiastic about Apple Intelligence, I must admit the final results have been disappointing. Apart from impressive transcription and proofreading, most of the features have fallen short of expectations. I’ve been writing about its shortcomings for a while now.

As I wrote before: “The ‘AI’ transition is a shift in how we interact with information, much like the browser and later the mobile device changed our relationship with it.” This change—driven by AI—reminds us of previous technological leaps that expanded our capabilities with information.

I’m on my knees, praying to the tech gods that Apple can pull off something miraculous with its upcoming products. If Apple fumbles with Apple Intelligence, it risks falling behind in a crucial generational shift in computing.

It’s clear Apple must radically rethink its reason for being. Gruber sums it up: “Something is rotten in the state of Cupertino.” He argues that Apple pitched a story that wasn’t true, setting the company on a misguided course.

I have my own explanation. Just as Google is trapped in its conventional approach, Apple is strangled by the weight of its market capitalization and unrealistic stock market expectations. Rather than streamlining its product lineup with the daring vision of Steve Jobs, the company continues to do more rather than better.

Apple’s AI event turned out to be more of a show-and-tell for Wall Street than a true innovation for consumers. Stockholders are clearly a primary focus, and with the stakes so high, Apple’s management can’t afford to make mistakes.

Apple's Siri Chief Calls AI Delays Ugly and Embarrassing, Promises Fixes

Author: Source: Hacker News Published: March 14, 2025 Classification: Tech News Subcategory: Artificial Intelligence

Apple Inc.’s top executive overseeing its Siri virtual assistant told staff that delays to key features have been ugly and embarrassing, and a decision to publicly promote the technology before it was ready made matters worse.

Robby Walker, who serves as a senior director at Apple, delivered the stark comments during an all-hands meeting for the Siri division, saying that the team was facing a difficult period. Walker also mentioned that it remains unclear when the planned enhancements will actually be launched, according to sources familiar with the matter who requested anonymity given the private nature of the meeting.

Apple Set to Unveil Major Design Overhaul in iOS 19 & macOS 16

Author: Huma Ishfaq Source: TechJuice Published: March 11, 2025

Classification: Tech News Subcategory: Apple Operating Systems

A significant transformation is on the horizon for Apple’s operating systems, marking the most substantial design refresh in years. Reports indicate that iOS 19, iPadOS 19, and macOS 16 will introduce sweeping visual and functional updates aimed at creating a more unified experience across devices.

The changes, expected to be unveiled at the Worldwide Developers Conference (WWDC) in June 2025, will reportedly bring a modernized aesthetic while preserving the distinct identities of Apple’s various platforms.

Sources suggest that this redesign will go beyond minor visual adjustments. The overhaul will include updates to icons, menus, apps, windows, and system buttons, making interactions more intuitive and visually cohesive. Inspired by visionOS, the software running on Apple Vision Pro, the new look is being developed under the codenames "Luck" for iOS and iPadOS 19, and "Cheer" for macOS 16.

This update is anticipated to be the most extensive Mac redesign since macOS Big Sur in 2020 and the most significant iOS update since iOS 7. However, despite the design alignment across Apple’s ecosystem, the company is committed to keeping macOS and iPadOS as distinct operating systems rather than merging them.

One of the key motivations behind this redesign is to enhance user experience across devices, ensuring that transitioning between an iPhone, iPad, and Mac feels more seamless. Additionally, the move comes at a time when Apple is looking to regain momentum after a slowdown in post-pandemic sales.

While the company experienced remarkable growth in 2021, recent years have seen a dip in numbers, making this redesign a potential strategy to reignite consumer interest.

Another challenge the company faces is addressing concerns around Apple Intelligence, particularly the delayed rollout of the improved Siri. Initially expected to debut in iOS 18.4, the more advanced and personalized Siri update has now been postponed. It remains uncertain whether this enhancement will be included in iOS 19 or if further delays are likely.

While an official statement has yet to be made, anticipation is building for WWDC 2025, where these groundbreaking updates are expected to be revealed.

The upcoming changes signal a new era for Apple’s software, aiming to refine usability, modernize aesthetics, and enhance the overall digital experience for users worldwide.

Revisiting Competitive Moats

Defensibility Is For Dummies

Author: Kyle Harrison Source: Investing 101 Published: March 08, 2025 Classification: Startups Subcategory: Moats

A few years ago, my wife and I got super into a BBC show called "Luther," about a police detective in London living on the edge, often confronted with sociopaths. One surprise while watching the show was the result, I realized later, of being an American. This cop would walk into what felt like ridiculously dangerous situations with no gun.

I'm used to American cop shows where any time there is even the slightest possibility of danger, they're going to have their gun out. If this concept was more central to my post, I'd spend more time researching this, but in general I'm sure there is some term for the differences in the comfort levels of various culture's with different things, in this case violence.

So what got me thinking about this? I was asking myself, "what's an interesting analogy or story or example to illustrate the idea that something you think is a competitive edge isn't always as real as you think. And the only two examples I could come up with were both violent and from movies. 🤷♂️

The first? In Butch Cassidy & The Sundance Kid, a rather large man challenges Butch to a knife fight. You'd think the size of this guy would be all the competitive moat he needed. But the moat turns out to be moot.

The second is a classic scene from Indiana Jones. Indy is met in the street by a talented swordsman, with a similarly intimidating moat. But Indy's response proves to be as nullifying to that moat as Butch's approach.

So let's talk about competitive moats, and particularly why, for a big part of the journey, defensibility is for dummies.

All That Matters

One of the things that has brought defensibility and competitive moats to the forefront of the conversation recently has been the newest wave of AI startups. When a whole swath of companies are building on the same open source foundation models, or as wrappers around GPT, can they really be defensible in the long run?

Ten Years Later

Author: Om Malik Source: On my Om Published: March 12, 2025 Classification: Essays Subcategory: Personal Reflection

I spent today on a series of long phone calls—with Katie Fehrenbacher, Stacey Higginbotham, and Chris Albrecht. A chance coffee with Surj Patel and today's significance—the tenth anniversary of one of the most painful days in my life—brought back a flood of memories. That day, I closed the doors on a business that not only carried my name but had grown to be a part of my identity. I used to joke that dating someone was cheating on my business.

Turning off the office lights and writing the blog post announcing GigaOM’s demise was one of the hardest moments I’ve experienced. I encountered a mix of responses; while many former colleagues and friends expressed their disappointment, for me, the loss was deeply personal. As Tony Conrad pointed out, you don’t get over such losses overnight—it takes years. By the time three to five years had passed, I began to see that my failure had transformed me. I emerged a better investor and, more importantly, a more empathetic person.

This morning, the cosmos reminded me that it has been ten years since that turning point. I found myself reflecting on the journey—the early believers, the colleagues who have become lifelong friends, and the evolution of our industry. What were once painful wounds have now turned into cherished battle scars that tell the story of growth and transformation.

In our experimental days, we pioneered paid subscriptions and events—practices that have now become standard for major media companies such as Politico, Axios, and The Atlantic. We wrote about innovations like ubiquitous connectivity, the future of work, and clean technology, topics that have become central to the modern tech narrative. Looking back, I realize that seeking big venture dollars nudged us into directions that ultimately didn’t serve our mission. I wasn’t the best manager then, but the experience taught me to value listening, openness, and empathy—a lesson that now informs my approach as an investor and writer.

After closing that chapter, a new passion emerged: photography. In the silence of early mornings and the play of light with nature, I discovered a way to reconnect with life and embrace the slow passage of time. The shift from tech journalism to creative exploration has underscored an important truth: our worst setbacks often pave the way for future growth.

Today, I am writing with open-eyed optimism on CrazyStupidTech, where I share thoughts on technology and life for its own sake—free from the pressures of business imperatives. I remain grateful to all my readers for joining me on this evolving journey.

Do today’s best startups need venture capital?

Author: Alex Wilhelm Source: Cautious Optimism Published: March 13, 2025 Classification: Venture Capital Subcategory: Startups

The other day on TWiST, Jason and I hosted Roy Lee of Columbia and Amazon-interviewing fame. He built a tool that made it possible to use AI tools during remote technical interviews with tech companies. It worked so well he got some offers, which he turned into a viral stunt by rejecting them and talking to the press.

In terms of academia-corporate relations, Lee is a catastrophe for Columbia. Amazon tattled on Lee after he shared a video of him using his little tool during an interview with the ecommerce giant, leading to Columbia making a stink about punishing him. What’s hilarious is that Lee doesn’t intend to finish his time at the university and instead has already scaled the product he built off his little hack to a $1 million run rate.

I bring all this up because Lee is the sort of person that venture investors want to back. Why? He’s clearly technically able to build something interesting, create buzz around it, and monetize his efforts. That’s a lethal combination in the startup game. The fact that he’s razzing incumbents while doing so? A cherry atop the cake.

But when my co-host brought up the idea of putting some of his capital into whatever it Lee decides to eventually build, the college-age maverick politely declined. Why? Because his little company is already airdropping revenue all over his head. Why raise equity funding when you can simply open up a spigot and let income funnel in?

Lee is a microcosm of what’s going on in the market today. The best startups today are:

Growing faster than ever: Lovable, Cursor, Mercor, ElevenLabs and others are posting insane growth curves. It’s bonkers.

Able to do more with fewer humans: Small teams are in, big teams are out.

Not wedded to conventional sales methods: Given that AI tools often offer workers a personal productivity upgrade, they sell themselves to both users and companies alike.

The result of the above is more valuable, less expensive startups. That’s a great model to build founder and early employee wealth, but does seem to tilt the balance away from venture capital as a ~requirement for scale.

I’m at least partially full of shit here, to be clear. Lovable raised $15 million. Cursor has raised a lot of capital tool, as has ElevenLabs. So, no, some of the best-known startups today are still tapping venture coffers. But I’ll bet you a nickel that, compared to the SaaS era, venture dollars invested per dollar of ARR is going down. And the further down it goes, the less startups will need external capital. The best, most enticing startups, at least.

Rise Of AI Drives US Growth In New Unicorns

Author: Gené Teare Source: Crunchbase News Published: March 11, 2025 Classification: Startups Subcategory: Unicorns & AI Growth

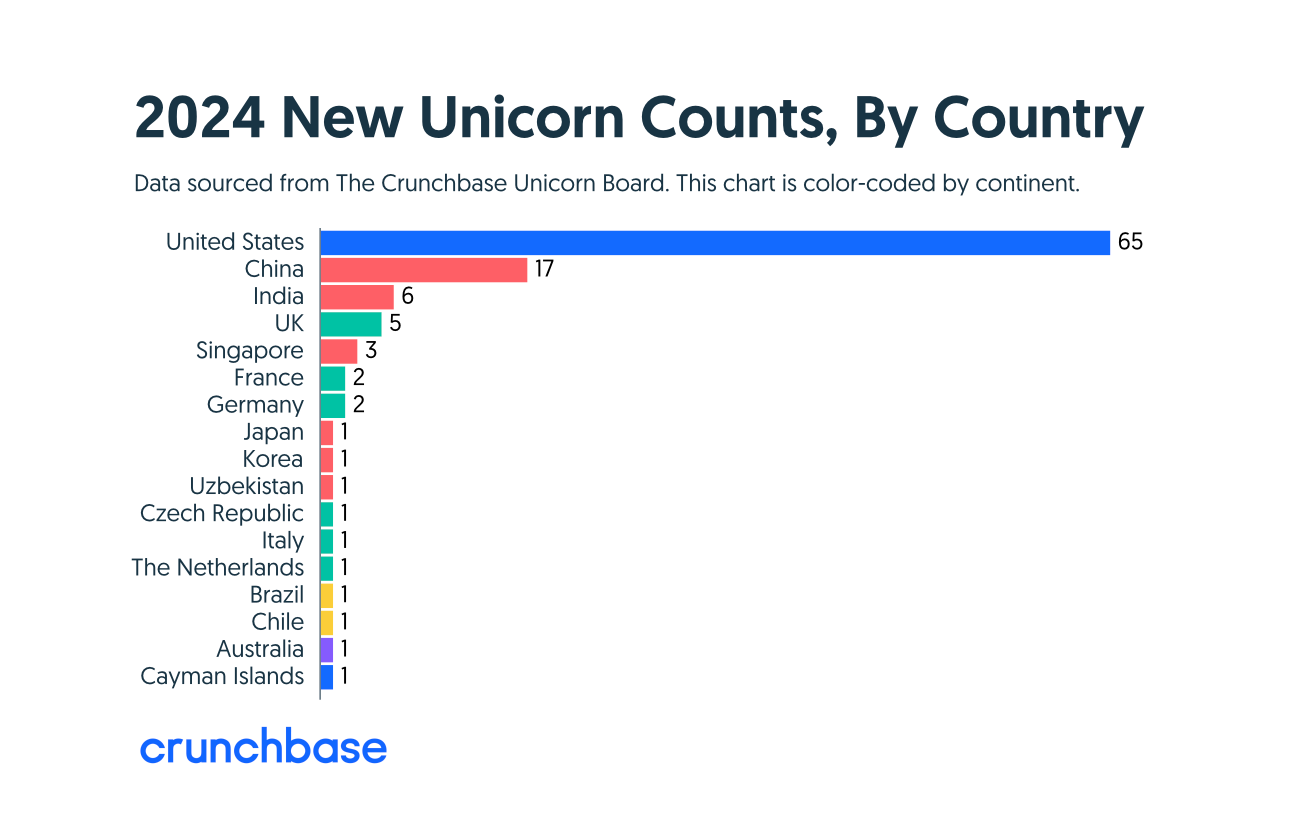

U.S. unicorn growth surged in 2024, spearheaded largely by companies in the AI sector. According to a Crunchbase analysis, the global Crunchbase Unicorn Board added 110 companies last year – an increase from 100 in 2023 – with U.S.-based startups jumping from 42 to 65 new unicorns. This significant rise reflects America’s leadership in AI technology, illustrated by high-profile additions such as Elon Musk’s xAI, 3D immersive firm Infinite Reality, AI search startup Perplexity, quantum computing services provider Quantinuum, and the new foundation model company Safe Superintelligence.

While the U.S. experienced notable growth, China—the world’s second-largest hub for unicorns—witnessed a drop in its net new unicorns from 29 in 2023 to 17 in 2024. Despite this decline, China remains a major player, particularly in AI funding. Other regions also posted interesting trends: India saw an increase to six new unicorns (up from two) in sectors like finance and transportation, and Singapore recorded its first three unicorns in areas spanning banking, Web3, and semiconductor assembly. In Europe, notable markets such as the U.K., France, and Germany reported steady or declining numbers, with sectors including analytics, fintech, healthcare, and e-commerce at the forefront.

The report also highlights that overall private companies – now numbering over 1,500 – raised more than $1 trillion in funding as of December 2024, with these companies collectively valued north of $5 billion each. Early-stage unicorns, those valued at $1 billion or more at an early round of financing (seed to Series B), experienced a 70% increase compared to 2023. The majority of new unicorns were five years old or younger at the time they hit the valuation mark, though a significant number were older, suggesting that accelerated unicorn creation does not necessarily lead to faster exits.

The analysis underscores the pivotal role of AI, which is interwoven into a variety of service offerings across multiple sectors. Following AI, fintech emerged as the next significant sector—spanning banking, payments, credit, and wealth management—while healthcare and biotech also played prominent roles. Other sectors such as energy, Web3, robotics, and cybersecurity contributed steadily to the growing unicorn ecosystem.

Crunchbase’s methodology for tracking unicorns centers on companies reaching a post-money valuation of $1 billion through priced funding rounds. The criteria excludes internal valuations and varies with investor assessments, ensuring that only companies meeting strict benchmarks are included on the Unicorn Board.

AI frenzy leads US venture capital to biggest splurge in three years

Author: George Hammond Source: Financial Times Published: March 09, 2025 Classification: Venture Capital Subcategory: AI Investment Trends

US start-ups are raising more cash than at any point since 2021, fueled by a surge of investor enthusiasm for artificial intelligence. More than $30bn has already been invested this quarter with an additional $50bn in the pipeline. Major deals are underway with companies such as OpenAI, Safe Superintelligence, and the defense tech start-up Anduril, signaling a robust commitment from the venture capital community.

The buzz around AI has driven capital investment at rates not seen since the tech boom of 2021—a period when $358bn flowed into tech firms, often inflating valuations. However, venture groups are optimistic that this cycle will chart a new course. Hemant Taneja, chief executive of General Catalyst, emphasized that AI is a transformative force, enabling businesses to potentially expand tenfold from where they stand today.

Recent data from PitchBook shows that US fundraising leapt to approximately $80bn in the last quarter of 2024, marking the best fourth quarter since 2021. Yet, this impressive figure is largely driven by just six major deals involving heavyweights such as OpenAI, xAI, and Databricks, illustrating a trend where capital is funneling into an elite group of high-growth companies.

In just the past two weeks, fintech companies like Stripe and Ramp have conducted funding rounds at valuations of $91.5bn and $13bn respectively. Similarly, AI start-ups Anthropic and Shield AI have secured deals at $61.5bn and $5.3bn. Of notable mention is OpenAI, currently in talks with SoftBank to raise $40bn at a $260bn valuation—a record-setting round that would eclipse even the massive $10bn investment in Databricks from late last year.

Anduril, founded by Palmer Luckey, is also in discussions to raise at least $2bn at a valuation exceeding $30bn, more than doubling its previous round. While these established companies, with revenues in the hundreds of millions or billions, are seen as lower-risk bets, the inflow of capital has also propelled younger companies with little revenue. For instance, Safe Superintelligence, launched by Ilya Sutskever, raised $1bn at a $5bn valuation and is eyeing a potential new round at a valuation of $30bn or more.

This shift marks a departure from traditional venture capitalism, which typically targets nascent companies, to a model more focused on high-growth, branded enterprises. Investors—referred to by PitchBook’s Kyle Stanford as "pseudo-VCs"—such as Thrive Capital, General Catalyst, and Lightspeed Venture Partners, are leveraging their substantial funds to invest in both early-stage and established companies, often holding on for long-term growth.

Financial commentator Sebastian Mallaby, author of The Power Law, noted that while the sheer scale of these investments reflects remarkable confidence, the principles that guided early-stage investing may need adjustment when applied to these blockbuster rounds.

Additional reporting by Cristina Criddle in San Francisco.

Y Combinator founders opt for smaller VC rounds

Author: Naomi Li Gan Source: Tech in Asia Published: March 12, 2025

Classification: Venture Capital Subcategory: Startup Funding

A shift is occurring in Silicon Valley’s startup ecosystem. Some founders in the latest Y Combinator (YC) batch are opting for smaller VC funding rounds despite experiencing rapid growth.

This trend arises as AI startups show significant revenue generation while maintaining minimal employee counts.

Founders at YC are reevaluating the trade-offs associated with large VC investments. They are favoring ownership retention and operational flexibility.

This reflects a desire for reduced VC involvement despite the availability of oversubscribed funding.

While lean growth has its supporters, analysts warn that well-funded competitors may have an edge in scaling and product development.

Y Combinator founders raising less money signals a ‘vibe shift,’ VC says

Author: Marina Temkin Source: TechCrunch Published: March 11, 2025

Classification: Venture Capital Subcategory: Startup Funding

Silicon Valley has been captivated by the prospect of AI, not only as a productivity enhancer but also as a catalyst for creating successful companies with much leaner teams than in the past.

Stories abound of AI startups quickly reaching tens of millions in revenue with headcount as low as 20 people. With less overhead, some startups may be inspired to take less venture capital funding, especially at the earliest stages.

Terrence Rohan, an investor with Otherwise Fund who’s been investing in Y Combinator since 2010, says he’s noticing a “vibe shift” from some founders in the current batch of the famed accelerator.

He described how one founder felt about it on X last week: “People used to climb Everest and they needed oxygen. Today, people climb it without oxygen. I want to summit Everest and use as little oxygen (VC) as possible.”

This founder wasn’t just saying this because of lack of VC interest. The round was oversubscribed, Rohan said, meaning lots of VCs wanted in.

“Smart founder” was the reaction of Alexis Ohanian, the founder of VC firm Seven Seven Six and co-founder of Reddit.

Raising less means founders maintain a larger ownership stake of their companies. By doing that, founders give themselves more ongoing business, and perhaps eventually exit, options, Rohan told TechCrunch. It’s actually becoming more common for YC startups to raise less capital than was offered to them by investors, TechCrunch reported last year.

Less funding, big mistake?

But Parker Conrad, co-founder and CEO of Rippling, the HR tech startup with a $13.4 billion valuation, disagreed that having less capital will help a startup succeed.

“The way this will play out is a competitor will raise a ton of financing, invest more deeply in R&D, build a better product, and absolutely crush this guy with sales and marketing. You have to play the game on the field,” he wrote on X.

While building a good product with a small engineering team may be possible, Conrad points out that having more funding can accelerate company growth.

Closed-source AI models are doing pretty darn well

Author: Alex Wilhelm Source: Cautious Optimism Published: March 12, 2025 Classification: AI Subcategory: AI Business

Welcome to Cautious Optimism, a newsletter on tech, business, and power.

In today’s discussion, we dive into how closed-source AI models are carving out a profitable niche in the tech landscape. As markets catch a slight break after softer inflation data, investors have their eyes fixed on the booming revenue streams generated by closed-source AI companies.

If you want to profit from the AI wave, there are many paths—from leveraging AI tools to building innovative applications and even backing visionary founders. However, the strategy that’s turning heads involves substantial capital commitments to AI model companies like OpenAI, Anthropic, and Mistral. Despite their enormous cash requirements, these companies are demonstrating explosive growth.

For example, Anthropic’s annualized revenue has surged from $1 billion at the end of last year to $1.4 billion recently—a staggering 40% increase in just a quarter. This impressive momentum mirrors the explosive growth observed at OpenAI, reinforcing why investors are eager to back these closed-source approaches, even at high valuations.

Anthropic’s most recent $61.5 billion valuation reflects an effective 44x annual recurring revenue (ARR) multiple—a figure that, while steep, underscores the faith placed in the lucrative potential of closed AI models. Moreover, companies like Manus are integrating Anthropic’s technology on their backends, generating significant API call volumes and driving further revenue opportunities.

In related news, there’s buzz around the IPO market. Reports indicate that Figma is in discussions with investment banks for a possible initial public offering later this year—a major event that could reshape parts of the tech finance landscape amid global market turbulence.

AI’s Circular Money Flows

Author: Martin Peers Source: The Information Published: March 13, 2025 Classification: Industry Analysis Subcategory: AI Investments

If you want a sense of the risks that lurk in the great AI-data center investment boom now underway, check out our scoop today about Nvidia’s relationship with CoreWeave, the upstart cloud computing firm planning to go public in a couple of weeks. The story reveals that Nvidia, beyond both investing in CoreWeave and selling chips to it, also agreed two years ago to spend $1.3 billion over several years renting those chips from CoreWeave. That arrangement gave CoreWeave’s business an invaluable early boost, paving the way for further business deals it is riding toward the IPO.

But if the circular arrangement makes you scratch your head, consider this: It’s just one example of several in the AI world where money has traveled in a circle, making the AI business seem bigger than it actually is. At least part of Microsoft’s $13 billion investment in OpenAI went back to the software giant in the form of OpenAI’s spending on Microsoft’s Azure cloud service. Both Amazon and Google have invested billions in Anthropic, which turned around and spent at least part of that money on their cloud services.

OpenAI launches new tools to help businesses build AI agents

Author: Maxwell Zeff Source: TechCrunch Published: March 11, 2025 Classification: Tech News Subcategory: AI Tools

On Tuesday, OpenAI released new tools designed to help developers and enterprises build AI agents — automated systems that can independently accomplish tasks — using the company’s own AI models and frameworks.

The tools are part of OpenAI’s new Responses API, which lets businesses develop custom AI agents that can perform web searches, scan through company files, and navigate websites, much like OpenAI’s Operator product. The Responses API effectively replaces OpenAI’s Assistants API, which the company plans to sunset in the first half of 2026.

The hype around AI agents has grown dramatically in recent years despite the fact that the tech industry has struggled to show people, or even define, what “AI agents” really are. In the most recent example of agent hype running ahead of utility, Chinese startup Butterfly Effect earlier this week went viral for a new AI agent platform called Manus that users quickly discovered didn’t deliver on many of the company’s promises.

In other words, the stakes are high for OpenAI to get agents right.

“It’s pretty easy to demo your agent,” Olivier Godement, OpenAI’s API product head, told TechCrunch in an interview. “To scale an agent is pretty hard, and to get people to use it often is very hard.”

Earlier this year, OpenAI introduced two AI agents in ChatGPT: Operator, which navigates websites on your behalf, and deep research, which compiles research reports for you. Both tools offered a glimpse at what agentic technology can achieve, but left quite a bit to be desired in the “autonomy” department.

Now with the Responses API, OpenAI wants to sell access to the components that power AI agents, allowing developers to build their own Operator- and deep research-style agentic applications. OpenAI hopes that developers can create some applications with its agent technology that feel more autonomous than what’s available today.

OpenAI calls for US government to codify ‘fair use’ for AI training

Author: Kyle Wiggers Source: TechCrunch Published: March 13, 2025 Classification: AI Subcategory: Policy and Regulation

In a proposal for the U.S. government’s “AI Action Plan,” the Trump administration’s initiative to reshape American AI policy, OpenAI called for a U.S. copyright strategy that “[preserves] American AI models’ ability to learn from copyrighted material.”

“America has so many AI startups, attracts so much investment, and has made so many research breakthroughs largely because the fair use doctrine promotes AI development,” OpenAI wrote.

It’s not the first time OpenAI, which has trained many of its models on openly available web data, often without the data owners’ knowledge or consent, has argued for more permissive laws and regulations around AI training.

Last year, OpenAI said in a submission to the U.K.’s House of Lords that limiting AI training to public domain content “might yield an interesting experiment, but would not provide AI systems that meet the needs of today’s citizens.”

The content owners who’ve sued OpenAI for copyright infringement will no doubt take issue with the company’s latest reassertion of this stance

Inside Google’s Investment in Anthropic

Author: Cade Metz, Nico Grant and David McCabe Source: NYT > Technology Published: March 11, 2025 Classification: Tech NewsSubcategory: Artificial Intelligence Investments

To win the artificial intelligence race, Google has not only developed its own technologies, but has also pumped money into prominent A.I. start-ups. And to preserve its competitive edge, Google has kept its ownership stakes in those start-ups a secret.

Court documents recently obtained by The New York Times reveal Google’s stake in one of those start-ups, Anthropic, as well as how its investment in the young company is set to change.

Google owns 14 percent of Anthropic, according to legal filings that the A.I. start-up submitted as part of a Google antitrust case. But that investment gives Google little control over the company. The internet giant can only own up to 15 percent of Anthropic, and it holds no voting rights, no board seats, and no board observer rights at the start-up.

Still, Google is set to invest an additional $750 million in Anthropic in September through a type of loan known as convertible debt, according to the filings. The companies agreed to the convertible note in 2023. In total, Google has invested more than $3 billion in the A.I. company.

The filings offer a rare glimpse into a big tech company’s investment in an A.I. start-up. Such investments have been under scrutiny by regulators, who questioned whether these deals gave incumbents an unfair advantage in the rapidly evolving technology landscape. In addition to Google, Amazon and Microsoft have also invested in high-profile A.I. start-ups such as Anthropic and OpenAI, the maker of the ChatGPT chatbot.

“A big company like Google knows that there is a race to A.I., and it has a big enough cash pile that it can bet on multiple horses,” said Chris V. Nicholson, an investor with the venture capital firm Page One Ventures who focuses on A.I. technologies.

China’s Autonomous Agent, Manus, Changes Everything

Author: Craig S. Smith Source: Forbes Published: March 09, 2025

Classification: AI Subcategory: Autonomous Agents

One recent evening in Shenzhen, a team of software engineers gathered in a dimly lit co-working space, their eyes fixed on high-resolution monitors as they put Manus—China’s groundbreaking AI agent—to the test. Unlike typical chatbots or digital assistants, Manus was designed to operate independently without waiting for human prompts. Launched on March 6, this fully autonomous system quickly proved its ability to make decisions on its own, setting off a global debate on the future of artificial intelligence.

Manus isn’t merely an evolution of existing AI models. It stands apart as the world’s first true autonomous AI agent that not only assists but can also replace human tasks. From analyzing financial transactions to screening resumes, Manus demonstrates an ability to process vast amounts of data and execute decisions with unprecedented speed and precision. Its design allows it to handle diverse tasks, such as reading job applications in detail, extracting relevant skills, and even generating optimized hiring recommendations complete with supporting data sets.

So, what makes Manus so revolutionary? The secret lies in its multi-agent architecture. Unlike AI systems that rely on a single neural network, Manus functions like an executive managing a team of specialized sub-agents. Each sub-agent is assigned specific components of a task, enabling the system to break down complex workflows and tackle them in a highly efficient, cloud-based asynchronous manner. This design not only boosts productivity but also paves the way for AI systems to operate as independent digital workers.

The practical implications are significant. For example, when tasked with finding an apartment in San Francisco, Manus doesn’t simply list options. Instead, it factors in crime statistics, rental trends, and even weather patterns to deliver a tailored shortlist based solely on implied user preferences. In another instance, tech writer Rowan Cheung tested Manus by asking it to compile a personal biography and build a functioning website—all without further guidance.

Yet, with its arrival comes a host of challenges. Manus forces a rethinking of existing regulatory and ethical frameworks. Who is responsible when an autonomous AI makes a costly error? And how do regulators manage systems capable of independent action? While Chinese authorities have shown a willingness to experiment with such innovations, Western models—traditionally reliant on human oversight—are now confronted with a paradigm shift.

Manus not only marks a technological leap in AI but also signals a future where autonomous systems may fundamentally alter traditional work and innovation. As the debate deepens, one thing is clear: the era of self-directed AI agents is upon us, challenging long-held assumptions and demanding new approaches to regulation, ethics, and labor.

Interview of the Week

Startup of the Week

Cursor in talks to raise at a $10B valuation as AI coding sector booms

Author: Marina Temkin Source: TechCrunch Published: March 08, 2025 Classification: Tech News Subcategory: AI Coding

Investor interest in AI coding assistants is exploding.

Anysphere, the developer of AI-powered coding assistant Cursor, is in talks with venture capitalists to raise capital at a valuation of nearly $10 billion, Bloomberg reported.

The round, if it transpires, would come about three months after Anysphere completed its previous fundraise of $100 million at a pre-money valuation of $2.5 billion, as TechCrunch was first to report. The new round is expected to be led by returning investor Thrive Capital.

Thrive Capital and Anysphere didn’t immediately respond to a request for comment.

While Anysphere’s previous round valued the company at 25 times its $100 million ARR (per The New York Times), investors seem to be willing to value fast-growing companies at even higher multiples now. Anysphere’s current annualized recurring revenue (ARR) may have already climbed to $150 million, The Information reported, which means the new deal, should it happen would be a whopping 66 times ARR.

Anysphere isn’t the only company receiving such a high valuation from investors.

Codeium, a company behind AI coding editor Windsurf, is raising capital at a valuation of nearly $3 billion, TechCrunch reported last month. Kleiner Perkins, which is leading the round into Codeium, valued the company at about 70 times ARR of about $40 million.

AI is adapting fastest in coding tools, outpacing its use in sales, law, healthcare, and other sectors, according to investors.

Post of the Week

A reminder for new readers. Each week, That Was The Week, includes a collection of selected essays on critical issues in tech, startups, and venture capital. I choose the articles based on their interest to me. The selections often include viewpoints I can't entirely agree with. I include them if they provoke me to think. Click on the headline, contents link, or the ‘Read More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below. There is a weekly News of the Week supplement that has the week’s most interesting news.

Tech News

Ex-Tesla, Polestar execs unveil new ultralight electric sports cars

Gemini gets personal, with tailored help from your Google apps

OpenAI Unveils Advanced AI Model Capable of Creative Writing

DOGE Has Deployed Its GSAi Custom Chatbot for 1,500 Federal Workers

Cursor in talks to raise at a $10B valuation as AI coding sector booms