Contents

Editorial

Unicorns Are Back

Essays of the Week

Tech

Venture Capital

AI

A.I. Is Prompting an Evolution, Not an Extinction, for Coders

AI and Copyright: Expanding Copyright Hurts Everyone—Here’s What to Do Instead

AI: Microsoft achieves a milestone in 'Quantum Computing'. RTZ #638

Microsoft Says It Has Created a New State of Matter to Power Quantum Computers

NVIDIA and Arc Institute Unveil Evo 2, a Groundbreaking Foundation Model for Biomolecular Sciences

Elon Musk’s xAI Unveils Grok 3 AI Model, Claims Edge Over OpenAI and DeepSeek

“You have to assume every company will have access to the same LLMs and voices.

Interview of the Week

Tim Wu and Andrew Keen

Startup of The Week

Saronic raise $600m

Post of the Week

Brad Gerstner and Robert Reich - Billionaires are Cheats, or Not?

Editorial

I spent this week working hard on various SignalRank projects. The week ended with the good news that Saronic, a SignalRank Index portfolio company, raised $600m to continue its work providing naval and maritime forces with the most intelligent Autonomous Surface Vessels available. More below.

My work this week was to build the first multi-agent chatbot that understands SignalRank’s predictive data on venture backed companies, so that investors and others could ask questions and get answers.

The agents have access to SignalRank’s data warehouse. You can try asking it anything related to company scores, investor scores or round scores. You can use company names, or ask for all companies at a stage, or with common investors. It’s prett flexible in reporting scores for anything, and ranking against them.

You can see the alpha version here - https://agents.signalrank.ai. FYI, this site will be up and down from time to time.

Here is what is happening under the hood:

There are several AI agents that have access to Anthropic, OpenAI, Snowflake and Perplexity. They receive questions via the Orchestrator. Depending on the question it issues jobs to the reasoning agent for analysis and the sql agents for data queries and a visualization agent to build charts. Then a document creation agent that can enable the analysis, data tables and charts to be downloaded. Everything is collected and returned to the user as a single response.

To do this I used Cursor, Anthropic, Open AI, Perplexity, Snowflake, Plotly and did not write a single line of code myself or have help from colleagues. We are in a new world of engineering as Erin Griffith writes this week in the New York Times (See below).

Here is an example of a question and the result, and the document I downloaded at the end:

The total time to build this agent system was about two weeks. And I was the only builder.

I tell you this to put this week’s newsletter into context.

Unicorns are being minted at an accelerated pace because real breakthroughs in what is achievable are happening. And hundreds of millions of people are already using them. I could not have built this system a few months ago.

Crunchbase launched its new platform this week and announced that the future of data is predictive.

CEO Jager McConnell declared historical data dead.

“The historical data industry as we know it is dead. AI has disrupted the status quo. Companies still relying on static data are already obsolete. Crunchbase is not just adapting—we’re leading this transformation. Our AI doesn’t just capture what happened yesterday; it predicts what’s coming tomorrow so customers can stay ahead of the market.”

He is right. Congratulations. Crunchbase is shining a light on the next phase of venture data predicting IPOs, Mergers and Funding round likelihood.

SignalRank is an Index builder seeking to decide which companies to invest in. The SignalRank predictive algorithms are designed to predict value growth over time and it invests in the high scoring companies.

SignalRank examines live Series B Rounds and based on a prediction either qualifies them for investment or rejects them. It is really good at saying no.

The algorithm says no 93% of the time. When it says no the company actually fails to meet the definition of success in 87% of cases. Success is defined as a 5x gain in 5 years, or better.

In 7% of cases the algorithm says yes. In those cases, 31% of the time it is right, the company will perform at 5x gain or better in 5 years. All this is done by scoring the funding rounds using a heuristic and an ML approach. A venture fund being right more 30% of the time is very rare. The backtest of the algorithms achieves it for the 2012-2020 timeframe and is consistent.

When the algorithm rejects 93% of company Series B funding rounds it is not surprising that the remaining 7% do very well, averaging over 6x in 5 years. To achieve this predicting failure is as important as predicting success.

SignalRank invests capital behind its predictions. When you combine investing actual cash with predictive algorithms you can de-risk capital deployment and create wealth for investors.

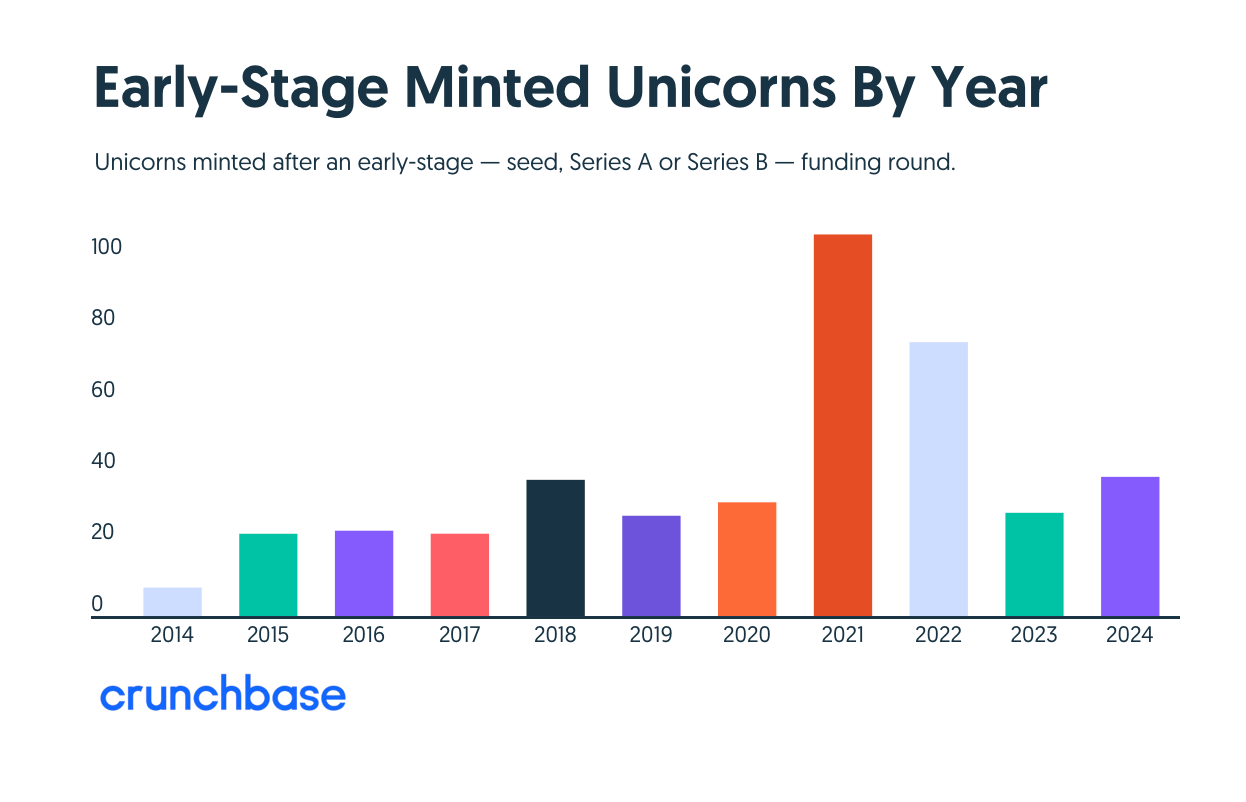

The early stage unicorn renaissance written about by Crunchbase is real. Having capital in those companies at an early stage produces meaningful outcomes.

Saronic, part of the SignalRank Index, and predicted to be in the top 7% by SignalRank’s algorithms, raised $600m at its Series C.

As Chris Metinko states below, many of the companies raising funds are doing so at Series A and B at weighty valuations.

It is a good time to be an innovator.

Essays of the Week

Historical Data is Dead. The Future is Predictive Intelligence.

The data industry is changing. Historical company data is no longer useful when it comes to making decisions about private markets.

I know that’s a surprising thing for me to say as CEO of a data company. But that’s the point: We’re not just a data company anymore.

Today, we’re relaunching Crunchbase as an AI-powered, predictive company intelligence solution. We’re moving beyond historical data, showing people not just what happened to a company yesterday or today, but what will happen to that company tomorrow.

Say Goodbye to Historical Data

Historical data is dead. If you still rely on static data from the past to make your business decisions, you’re at risk of becoming obsolete. AI has upended the status quo, compelling businesses to act quickly and think ahead in ways that standard data analysis cannot support.

We’re leading the shift away from traditional data by offering real-time predictions that help you maintain a competitive edge. The new Crunchbase – which analyzes billions of live signals to anticipate future company movements – provides a dynamic, forward-looking view of the market.

Is a company growing? We’ll tell you. Will it get acquired? We’ll tell you that, too. Will it raise funding soon? We have the answer.

The Future is Predictive — and You Need to Keep Up

Here’s the reality of traditional data analysis: by the time you consume even live information, it’s already a thing of the past. That data, whether it’s a funding round or acquisition, remains unchanged and accessible to everyone, and any robust analysis of these facts will consistently lead to the same insights and next steps.

AI has set a new paradigm for how we look at data, giving us the power to process data en masse, detect patterns, and foresee company activity before it happens. Rather than look at past funding or growth, we leverage our proprietary data and AI to look forward at projections of future funding, growth and more. Think about ChatGPT: it makes sense of the entire internet and predicts the next word to answer your questions. When applied to Crunchbase, AI can interpret our data in the same way, gathering, analyzing and extrapolating to make predictions about market behavior.

While historical data prompts reactive measures based on past events, predictive data offers foresight, enabling proactive decision-making. After all, it’s predictive data that drives action. When you look at funding data, you don’t actually want funding data. What you really want is to know whether a company is the right one to approach, and if it’s the right time to approach them. Having foresight, and not just hindsight, is priceless when it comes to navigating uncertainty, outpacing competitors, and uncovering opportunities.

The Unmatched Predictive Power of Crunchbase

If you think this is unbelievable, you aren’t alone. We’ve tapped into a technology so powerful that it feels more like magic. Our predictions are transformative when it comes to winning in private markets — internal backtesting showed our funding predictions to have up to 95% accuracy and 99% recall. These insights empower Crunchbase users to make faster, smarter, and more confident decisions.

Recently, for instance, Coda was acquired by Grammarly, less than 60 days after Crunchbase gave it a 93% chance of acquisition. Imagine you’d had this information beforehand — before the news broke and your competitors got in on it. Crunchbase would’ve given it to you, and will give you predictions that are equally prescient every single day from now on.

They’ve Been Waiting Years to Go Public. They’re Still Waiting.

Author:Erin Griffith • Source:NYT > Technology • Published:2025-02-18 • Reading Time:1 min • Domain:nytimes.com

Turo, a car rental start-up in San Francisco, has been trying to go public since 2021. But a volatile stock market in early 2022 delayed its listing. Since then, the company has waited for the right moment.

Last week, Turo pulled its listing entirely. “Now is not the right time,” Andre Haddad, the company’s chief executive, said in a statement.

For months, investors have eagerly anticipated a wave of initial public offerings, spurred by President Trump’s new administration. Since his election victory in November, which ended a tumultuous campaign season, Corporate America and Wall Street have heralded the start of a pro-business, anti-regulation period. The stock market soared ahead of an expected bonanza of deal making.

But the administration’s tariff announcements and rapid-fire regulatory changes have created uncertainty and volatility. Worsening inflation has set off market jitters. And the emergence of the Chinese artificial intelligence app DeepSeek last monthcaused investors to question their optimistic bets on U.S. tech, leading to a drastic sell-off among A.I.-related stocks.

All that has affected initial public offerings. “The calendar just went from fully booked to being wide open in a span of like three weeks,” said Phil Haslett, a founder of EquityZen, a site that helps private companies and their employees sell their stock.

So far this year, the pace of public offerings is ahead of last year’s, with companies raising $6.6 billion from listings, up 14 percent compared with this time last year, according to Renaissance Capital, which manages I.P.O.-focused exchange traded funds.

Yet there are no signs of the I.P.O. wave that many had anticipated, especially from big-name companies that had spent the past two years waiting to go public. Apart from Turo’s canceled listing, Cerebras, an A.I. chip company that filed its investment prospectus this past fall, has also delayed plans to go public.

It is too early to know if macroeconomic concerns about inflation, interest rates and geopolitical risks will cause other companies to change their plans, I.P.O. advisers and analysts said. More listings are expected in the second half of the year.

“We do need to allow a little more time to see where the administration starts to land on some of these key topics that are driving some of the uncertainty,” said Rachel Gerring, the I.P.O. leader for Americas at EY, an accounting and professional services firm. “I.P.O. planning is still very much occurring.”

Klarna, a lending start-up, and eToro, an investment and trading provider, have confidentially filed to list their shares in recent months. But many of the most valuable private tech companies, including Stripe and Databricks, have indicated that they plan to stay private for now by raising capital from the private market instead.

David Solomon, the chief executive of Goldman Sachs, said last month that one reason I.P.O. activity had been slow was that start-ups could get the capital they needed from private investors. Goldman helped Stripe, the payments start-up valued at $70 billion, raise billions of dollars last year, he said.

“That’s a company that never would have been a private company today, given their capital needs, but today you can,” he said at a conference organized by Cisco…

Silicon Valley fights EU tech rules with backing from Trump

Source:Technology sector • Published:2025-02-19 • Reading Time:1 min • Domain:ft.com

Big tech companies are growing confident in their efforts to challenge EU regulations, believing new backing from the Trump administration will allow them to fight what they see as hostile rules on artificial intelligence and market dominance.

Facebook’s owner Meta has this year led the charge against the EU’s AI Act, according to people familiar with its strategy, with tech lobbyists in the bloc believing they can successfully water down implementation of a law considered the world’s strictest regime over the cutting edge technology.

Silicon Valley is also pushing Brussels to limit enforcement of the Digital Markets Act, which curbs market abuse by major online platforms and can impose large financial fines on the companies, according to people familiar with the matter.

Their cause has been boosted by the new administration. Vice-president JD Vance used his recent trip to Europe to lash out at the EU’s legislation on tech by denouncing the bloc’s “onerous international” rules. He also called for AI regulation that does “not strangle” the rapidly evolving sector.

Lobbyists from other Big Tech companies pointed to the row of tech executives who were front and centre at Donald Trump’s inauguration — including Google chief Sundar Pichai, Amazon founder Jeff Bezos and Apple chief Tim Cook — as an illustration of the new political reality in Washington.

The EU’s tech chief Henna Virkkunen told the Financial Times that Europe was “fully committed to enforce our rules”, despite US pressure. But earlier this month, the European Commission withdrew its planned AI Liability Directive, which was designed to make tech companies pay for any harm caused by AI tools or systems, as part of a broader push for deregulation from Brussels.

Virkkunen said the decision was made in order to spur investments in AI because of pressure from US tech companies. Some European industry officials and lawmakers interpreted the move as a sign that limiting actions against big tech companies could become a bargaining chip in transatlantic negotiations on trade or even Washington’s commitment to European security.

The most immediate battle will focus on the AI code of practice, expected in April, which will outline how companies can implement the rules of its landmark AI Act, such as how they should handle “systemic” risks in artificial intelligence.

Live and Let Buy

Author:M.G. Siegler • Source:Spyglass • Published:2025-02-20 • Reading Time:8 min • Domain:spyglass.org

It has been a few hours since I heard the news and I honestly still can't believe it. Amazon is taking over full control – full creative control – of the James Bond franchise. To the casual observer, this may seem like no big deal. They did, after all, buy the studio associated with the franchise and thus, technically the rights to the franchise, for $8.5B a few years back. But this is a massive deal. As part of that pact was keeping intact the Michael G. Wilson/Barbara Broccoli near-absolute control over the franchise, as had been the case for decades. Just as Diamonds Are Forever, so too was the Wilson/Broccoli control of the Bond franchise.

Never Say Never Again, AGAIN, I guess.1 Here's Justin Kroll for Deadline with the appropriately titled, "James Bond Shocker!"

Everyone is well aware of the tension that seemed to be boiling over between the producers – and in particular, Broccoli – and Amazon. I wrote up some thoughts in December after an in-depth piece of reporting from The Wall Street Journal on the matter which cited no fewer than twenty – 20! – sources. The franchise was falling perilously behind schedule with tensions continuing to mount and so the entire situation was obviously untenable. As I wrote:

Investors Are Once Again Rapidly Minting Early-Stage Startups As Unicorns

Author:Chris Metinko • Source:Crunchbase News • Published:2025-02-18 • Reading Time:3 min • Domain:news.crunchbase.com

Through the past couple years, investors have talked about how the calming of the venture market was good, allowing more time for due diligence and companies to mature before they sought sky-high valuations.

Well, while investors haven’t totally reverted back to their 2021 attitudes, they are back to rapidly minting more early-stage startups as unicorns, or private companies valued at $1 billion or more.

Just as the overall pace of creating unicorns picked up slightly last year, so did minting them in earlier stages of funding — defined as seed, Series A or Series B — an analysis of Crunchbase data shows. Last year, 39 early-stage companies attained unicorn status — a 70% increase from 2023, when only 23 such young startups got their horns.

Together AI’s Valuation Jumps To $3.3B After New Round

Author:Chris Metinko • Source:Crunchbase News • Published:2025-02-20 • Reading Time:1 min • Domain:news.crunchbase.com

Together AI, a developer of a cloud platform to allow developers to build on open and custom artificial intelligence models, raised a $305 million funding round led by General Catalyst and Saudi Arabia’s Prosperity7 Ventures at a $3.3 billion valuation.

The new valuation is a more than 160% jump from The $1.25 billion it was valued at after Salesforce Ventures 1 led a $106 million round for Menlo Park, California-based startup last March.

More than a dozen other investors joined the round, including Salesforce Ventures, Nvidia, Kleiner Perkins, Coatue and others.

Initialized Backs Valar Atomics to Build Nuclear Gigasites

Author:Kim-Mai Cutler • Source:View from Initialized • Published:2025-02-19 • Reading Time:1 min • Domain:blog.initialized.com

In the century since nuclear fission was discovered, humanity has built fewer than 1,000 commercial reactors. The constraint hasn’t been technology – it’s been the deployment model. That’s why we’re excited to announce our investment in Valar Atomics‘ $18M seed round alongside Riot Ventures, AlleyCorp, Day One Ventures, and Steel Atlas.

When I first met Isaiah Taylor, he presented an ambitious vision historically rooted in his family’s ties to the early Atomic era and the Manhattan project. While existing development scatters individual reactors across dispersed locations, Valar’s gigasite model enables continuous operation of thousands of reactors on a single site, fundamentally changing the economics of nuclear power.

The timing is perfect. Tech giants face a projected 100-gigawatt energy shortfall for AI data centers by 2030, while fourteen of the world’s largest banks have announced support for nuclear expansion. Valar has already completed their non-nuclear prototype ahead of schedule and secured the world’s first Coordinated Research Project contract with the Philippines Nuclear Research Institute.

Auctions in AI : Cost of Capital as a Strategic Advantage

Source:Tomasz Tunguz • Published:2025-02-21 • Reading Time:1 min • Domain:tomtunguz.com

A decade ago, most startup pitches ended with a calculation justifying the amount they sought to raise.

In other words, the raise was an output of the financial model.

But for the most sought after companies, the raise amount is disjointed from the capital needs of the business - instead it’s driven by the fundraising auction.

Great fundraisers are the teams that build the most auction pressure.

This auction dynamic, combined with venture capital’s explosive growth over the last decade, has transformed fundraising strategy. The goal is no longer to raise what you need, but to optimize for the lowest cost of capital.

Cost of capital is the expense of a business to find dollars it needs to pursue its plan. Legal expense, dilution in the case of equity, interest in the case of debt. The reality is even though cost of capital is taught in economics classes, I’ve never heard it uttered in a board meeting.

Companies with a lower cost of capital have a strategic advantage. Assume all companies in a space have the same cost-of-customer acquisition. The company with the lowest cost of capital should be able to acquire more of them.1

A.I. Is Changing How Silicon Valley Builds Start-Ups

Author:Erin Griffith • Source:NYT > Technology • Published:2025-02-20 • Reading Time:1 min • Domain:nytimes.com

Almost every day, Grant Lee, a Silicon Valley entrepreneur, hears from investors who try to persuade him to take their money. Some have even sent him and his co-founders personalized gift baskets.

Mr. Lee, 41, would normally be flattered. In the past, a fast-growing start-up like Gamma, the artificial intelligence start-up he helped establish in 2020, would have constantly looked out for more funding.

But like many young start-ups in Silicon Valley today, Gamma is pursuing a different strategy. It is using artificial intelligence tools to increase its employees’ productivity in everything from customer service and marketing to coding and customer research.

That means Gamma, which makes software that lets people create presentations and websites, has no need for more cash, Mr. Lee said. His company has hired only 28 people to get “tens of millions” in annual recurring revenue and nearly 50 million users. Gamma is also profitable.

“If we were from the generation before, we would easily be at 200 employees,” Mr. Lee said. “We get a chance to rethink that, basically rewrite the playbook.”

The old Silicon Valley model dictated that start-ups should raise a huge sum of money from venture capital investors and spend it hiring an army of employees to scale up fast. Profits would come much later. Until then, head count and fund-raising were badges of honor among founders, who philosophized that bigger was better.

But Gamma is among a growing cohort of start-ups, most of them working on A.I. products, that are also using A.I. to maximize efficiency. They make money and are growing fast without the funding or employees they would have needed before. The biggest bragging rights for these start-ups are for making the most revenue with the fewest workers.

Stories of “tiny team” success have now become a meme, with techies excitedly sharing lists that show how Anysphere, a start-up that makes the coding software Cursor, hit $100 million in annual recurring revenue in less than two years with just 20 employees, and how ElevenLabs, an A.I. voice start-up, did the same with around 50 workers.

A.I. Is Prompting an Evolution, Not an Extinction, for Coders

Author:Steve Lohr • Source:NYT > Technology • Published:2025-02-21 • Reading Time:1 min • Domain:nytimes.com

John Giorgi uses artificial intelligence to make artificial intelligence.

The 29-year-old computer scientist creates software for a health care start-up that records and summarizes patient visits for doctors, freeing them from hours spent typing up clinical notes.

To do so, Mr. Giorgi has his own timesaving helper: an A.I. coding assistant. He taps a few keys and the software tool suggests the rest of the line of code. It can also recommend changes, fetch data, identify bugs and run basic tests. Even though the A.I. makes some mistakes, it saves him up to an hour many days.

“I can’t imagine working without it now,” Mr. Giorgi said.

That sentiment is increasingly common among software developers, who are at the forefront of adopting A.I. agents, assistant programs tailored to help employees do their jobs in fields including customer service and manufacturing. The rapid improvement of the technology has been accompanied by dire warnings that A.I. could soon automate away millions of jobs — and software developers have been singled out as prime targets.

But the outlook for software developers is more likely evolution than extinction, according to experienced software engineers, industry analysts and academics. For decades, better tools have automated some coding tasks, but the demand for software and the people who make it has only increased.

A.I., they say, will accelerate that trend and level up the art and craft of software design.

“The skills software developers need will change significantly, but A.I. will not eliminate the need for them,” said Arnal Dayaratna, an analyst at IDC, a technology research firm. “Not anytime soon anyway.”

The outlook for software engineers offers a window into the impact that generative A.I. — the kind behind chatbots like OpenAI’s ChatGPT — is likely to have on knowledge workers across the economy, from doctors and lawyers to marketing managers and financial analysts. Predictions about the technology’s consequences vary widely, from wiping out whole swaths of the work force to hyper-charging productivity as an elixir for economic growth.

The disparate views of generative A.I., which can already converse with humanlike fluency and create realistic images and videos, reflect a basic uncertainty: How fast will the technology improve, and how far it can go?

Mark Zuckerberg, Meta’s chief executive, stirred alarm among developers last month when he predicted that A.I. technology sometime this year would effectively match the performance of a midlevel software engineer, though he later suggested that it could free up human developers to be more creative.

AI and Copyright: Expanding Copyright Hurts Everyone—Here’s What to Do Instead

Author:Tori Noble • Source:Deeplinks • Published:2025-02-19 • Reading Time:9 min • Domain:eff.org

You shouldn't need a permission slip to read a webpage–whether you do it with your own eyes, or use software to help. AI is a category of general-purpose tools with myriad beneficial uses. Requiring developers to license the materials needed to create this technology threatens the development of more innovative and inclusive AI models, as well as important uses of AI as a tool for expression and scientific research.

Requiring researchers to license fair uses of AI training data could make socially valuable research based on machine learning (ML) and even text and data mining (TDM) prohibitively complicated and expensive, if not impossible. Researchers have relied on fair use to conduct TDM research for a decade, leading to important advancements in myriad fields. However, licensing the vast quantity of works that high-quality TDM research requires is frequently cost-prohibitive and practically infeasible.

Fair use protects ML and TDM research for good reason. Without fair use, copyright would hinder important scientific advancements that benefit all of us. Empirical studies back this up: research using TDM methodologies are more common in countries that protect TDM research from copyright control; in countries that don’t, copyright restrictions stymie beneficial research. It’s easy to see why: it would be impossible to identify and negotiate with millions of different copyright owners to analyze, say, text from the internet.

Copyright and AI: the Cases and the Consequences

Author:Tori Noble • Source:Deeplinks • Published:2025-02-19 • Reading Time:5 min • Domain:eff.org

The launch of ChatGPT and other deep learning quickly led to a flurry of lawsuits against model developers. Legal theories vary, but most are rooted in copyright: plaintiffs argue that use of their works to train the models was infringement; developers counter that their training is fair use. Meanwhile developers are making as many licensing deals as possible to stave off future litigation, and it’s a sound bet that the existing litigation is an elaborate scramble for leverage in settlement negotiations.

These cases can end one of three ways: rightsholders win, everybody settles, or developers win. As we’ve noted before, we think the developers have the better argument. But that’s not the only reason they should win these cases: while creators have a legitimate gripe, expanding copyright won’t protect jobs from automation. A win for rightsholders or even a settlement could also lead to significant harm, especially if it undermines fair use protections for research uses or artistic protections for creators. In this post and a follow-up, we’ll explain why.

First, we need some context, so here’s the state of play:

A Humanist Vision for AI

Author:continuations@newsletter.paragraph.xyz (Albert Wenger) • Source:Continuations • Published:2025-02-15 • Reading Time:3 min • Domain:paragraph.xyz

The other day I wrote that people praising the speech given by Vice President J.D. Vance at the Paris AI summit are “mistaking jingoism and wishful thinking for true global leadership with a real vision for AI and humanity.” It is of course only fair to ask what true leadership on AI would look like. Here is what I wish he would have said instead:

Dear leaders of nations, we gather here in Paris at a moment of unprecedented possibility and peril in human history.

We stand at the threshold of opportunities so vast they would have seemed like science fiction to our grandparents. The possibility of becoming a multi-planetary species, of eliminating diseases that have plagued humanity for millennia, of creating abundant clean energy to power the dreams and aspirations of all peoples – all of these are within our grasp.

AI: Microsoft achieves a milestone in 'Quantum Computing'. RTZ #638

Author:Michael Parekh • Source:AI: Reset to Zero • Published:2025-02-21 • Reading Time:6 min • Domain:michaelparekh.substack.com

I remain relatively tempered in these pages on tech topics beyond AI innovation in this AI Tech Wave. As a result, you won’t see too much here on quantum computing and other exciting long term tech pursuits. I remain deeply interested in those and other technologies like cold fusion, but believe in being focused and prioritized in terms of one’s daily efforts.

But today, a development on the quantum computing side, involving long theorized ‘Majorana fermions’, and barely observable in experimental setups (see above), does bear a mention. Particularly due to a quantum computing innovation around them by Microsoft, who’s been working on this stuff for two decades. So now, CEO Satya Nadella’s x/twitter statement that the impact on computing ‘from this new state of matter’ in our daily world could come ‘not in decades by in years’, got my interest. Enough to discuss it here today.

Microsoft announced the development in “Microsoft’s Majorana 1 chip carves new path for quantum computing”, an effort underway ‘to create a new state of matter’ there for over two decades:

Microsoft Says It Has Created a New State of Matter to Power Quantum Computers

Author:Cade Metz • Source:NYT > Technology • Published:2025-02-19 • Reading Time:1 min • Domain:nytimes.com

Anyone who has sat through a third-grade science class knows there are three primary states of matter: solid, liquid and gas.

Microsoft now says it has created a new state of matter in its quest to make a powerful machine, called a quantum computer, that could accelerate the development of everything from batteries to medicines to artificial intelligence.

On Wednesday, Microsoft’s scientists said they had built what is known as a “topological qubit” based on this new phase of physical existence, which could be harnessed to solve mathematical, scientific and technological problems.

With the development, Microsoft is raising the stakes in what is set to be the next big technological contest, beyond today’s race over artificial intelligence. Scientists have chased the dream of a quantum computer — a machine that could exploit the strange and exceedingly powerful behavior of subatomic particles or very cold objects — since the 1980s.

The push heated up in December when Google unveiled an experimental quantum computer that needed just five minutes to complete a calculation that most supercomputers could not finish in 10 septillion years — longer than the age of the known universe.

Microsoft’s quantum technology could leapfrog the methods under development at Google. As part of its research, the company built multiple topological qubits inside a new kind of computer chip that combines the strengths of the semiconductors that power classical computers with the superconductors that are typically used to build a quantum computer.

When such a chip is cooled to extremely low temperatures, it behaves in unusual and powerful ways that Microsoft believes will allow it to solve technological, mathematical and scientific problems that classical machines never could. The technology is not as volatile as other quantum technologies, the company said, making it easier to exploit its power.

Some question whether Microsoft has achieved this milestone, and many leading academics said quantum computers would not be fully realized for decades. But Microsoft’s scientists said their methods would help them reach the finish line sooner.

“We view this as something that is years away, not decades away,” said Chetan Nayak, a Microsoft technical fellow who led the team that built the technology.

NVIDIA and Arc Institute Unveil Evo 2, a Groundbreaking Foundation Model for Biomolecular Sciences

Author:ODSC - Open Data Science • Source:Stories by ODSC - Open Data Science on Medium • Published:2025-02-20 • Reading Time:2 min • Domain:odsc.medium.com

Scientists worldwide now have access to Evo 2, a cutting-edge foundation model designed to advance biomolecular research. Built using NVIDIA DGX Cloud on Amazon Web Services, Evo 2 is the largest publicly available AI model trained on genomic data. It was developed through a collaboration led by the nonprofit Arc Institute and Stanford University.

The Evo 2 model is available via the NVIDIA BioNeMo platform, including as an NVIDIA NIM microservice, enabling streamlined and secure AI deployment for developers.

Evo 2 was trained on an extensive dataset comprising nearly 9 trillion nucleotides — the fundamental units of DNA and RNA. This allows the model to analyze genetic information across species, offering applications in healthcare, agriculture, and industrial biotechnology.

Elon Musk’s xAI Unveils Grok 3 AI Model, Claims Edge Over OpenAI and DeepSeek

Author:ODSC - Open Data Science • Source:Stories by ODSC - Open Data Science on Medium • Published:2025-02-20 • Reading Time:2 min • Domain:odsc.medium.com

Elon Musk’s artificial intelligence company, xAI, has introduced its latest model, Grok 3, which the company asserts outperforms rival systems from OpenAI and China’s DeepSeek in early evaluations. The unveiling took place Tuesday during a demonstration streamed on Musk’s social media platform, X.

“We’re very excited to present Grok 3, which is, we think, an order of magnitude more capable than Grok 2 in a very short period of time,” Musk said during the event.

Grok 3 is designed to handle complex reasoning tasks across disciplines such as mathematics, science, and programming. According to xAI, the model surpassed competitors in internal testing and received high ratings on Chatbot Arena, a platform that conducts blind evaluations of AI systems.

You have to assume every company will have access to the same LLMs and voices.

Author:Hunter Walk • Source:Stories by Hunter Walk on Medium • Published:2025-02-21 • Reading Time:8 min • Domain:hunterwalk.com

Homebrew makes investments by consensus — it works because there’s just two of us. We’ve done it this way for two reasons — first, it works internally given our style of decision-making and respectful but loud debate. Second, it matters to us externally that founders know it’s always Homebrew making the investment — never a situation where one of us was excited and the other one didn’t block it. To that end, backing Regal, now a leader in AI Powered Calls for your businesses’ sales, support and operations, was quick to mutual agreement. Satya and I were excited by the vision and the cofounders’ previous work experience together. Since the world of AI is moving quite rapidly, I wanted to check in with Regal CEO Alex Levin to ask Five Questions.

Hunter Walk: In a recent Five Questions the person I was interviewing said to think about your career as a story you’re telling about yourself. What story does your career tell?

Alex Levin: I remember studying the philosophy and psychology around consciousness in college and thinking I might pursue academia. One day I realized that I could study my topic for my whole career and never get to the end of what was already known. And at that moment, it was crystal clear to me that I had to find a career where I could get to the forefront of what was known more quickly so I could help contribute instead of feeling like I was always behind.

Interview of the Week

Startup of the Week

Saronic Raises $600M Series C to Take on Autonomous Shipbuilding

Published:2025-02-18 • Reading Time:4 min • Domain:prnewswire.com

Saronic to inaugurate Port Alpha, a next-generation shipyard designed to build autonomous ships for the hybrid fleet

AUSTIN, Texas, Feb. 18, 2025 /PRNewswire/ -- Saronic Technologies today announced it has closed $600 million of funding for its Series C round to advance its mission of redefining maritime superiority for the United States and its allies. The round was led by Elad Gil and values the company at $4 billion. This most recent round quadrupled Saronic's valuation just seven months after the company hit unicorn status in July 2024. Saronic welcomes General Catalyst as a new investor and recognizes commitments from existing investors, including a16z, Caffeinated Capital, and 8VC.

The raise marks a new phase in advancing autonomy for naval and maritime missions. With this funding, Saronic plans to build Port Alpha, a next-generation shipyard capable of delivering new classes of unmanned ships at the speed and scale needed to protect and defend the maritime domain. Port Alpha will enable the expansion of Saronic's Autonomous Surface Vessel (ASV) fleet into medium and large-class autonomous ships for defense applications. With this move, Saronic is addressing gaps in U.S. shipbuilding capacity and investing in the critical infrastructure to deliver the range and volume of autonomous ships needed to create and sustain the U.S. military's hybrid fleet.

Post of the Week

A reminder for new readers. Each week, That Was The Week, includes a collection of selected essays on critical issues in tech, startups, and venture capital. I choose the articles based on their interest to me. The selections often include viewpoints I can't entirely agree with. I include them if they provoke me to think. Click on the headline, contents link, or the ‘Read More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below. There is a weekly News of the Week supplement that has the week’s most interesting news.