A reminder for new readers. Each week, That Was The Week includes a collection of selected readings on critical issues in tech, startups, and venture capital. I chose the articles based on their interest to me. The selections often include viewpoints I can't entirely agree with. I include them if they provoke me to think. The articles are snippets or varying sizes depending on the length of the original. Click on the headline, contents link, or the ‘More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below.

Hat Tip to this week’s creators: @sarafischer, @mgsiegler, @TamasOrbanEC, @KrishnanRohit, @geneteare, @ZeffMax, @Om, @Kyle_L_Wiggers, @jasonlk, @rocketalignment, @sizpatel, @mvpeers, @mikebutcher, @bindureddy, @Rapahelz

Contents

LLMs, Forecasting, Prediction and Data

Editorial

Bindu Reddy is an accomplished Silicon Valley technical founder. She is also a prolific poster to X.

This week (see X of the Week below) she posted this:

Raph H replied with a Leon Blum quote from 1932:

I spent the past two weeks in Paris and London so this piqued my interest.

The news that the AI regulations passed by the European Commission come into force this week and the accompanying US news that Google has been found guilty of being a monopolist in mobile search and is abusing that monopoly both serve to force a discussion about regulation and decline—or, in the inverse, regulation, and innovation.

MG Seigler’s essay about what eventually undermined Microsoft (not regulation) is also pertinent in this context. Market forces shrunk the impact of Microsoft, especially the rise of the Internet and Mobile.

“Europe is slowly dying because it's not innovating and the governments are stifling” (Bindu Reddy)

The lack of innovation in Europe is real. But it does not have to do with stifling regulations alone. The primary cause is the lack of funding for innovation, and therefore lack of innovation. Most of that is coming from the USA and some from China.

In some ways, governments do try to counter the lack of funds. The European Investment Bank is a large investor in funds and startups, as is the British Government via the British Business Bank. But those amounts are trifling compared to the USA and China. What is missing is genuine risk-seeking capital at all stages.

Unlike in the US, European pools of capital (self-directed pension funds, for example) are not permitted to invest in the venture capital ecosystem. This means that billions of Euros are left on the sidelines and invested in asset classes with less impact on innovation.

Most venture capital in Europe, and increasingly so, is sourced from US origins. However, the trend is for US investors to reduce their allocation to Europe as it becomes clear that Europe is not doing its part to support venture-backed companies.

Regulations compound this structural reality. When the EU tells Apple to put a USBc port on an iPhone, insists on permitting third-party app stores, or places bureaucratic requirements on AI developers, it signals that the free market does not exist or at least does not function. Worse, governments play the role of product managers in the tech ecosystem. Merger and acquisition rules also run amok, preventing venture exits and capital recycling.

The recent UK moves to control content on X adds a further dimension. The claim is that X is not as cooperative as other networks in prohibiting and removing content that, while not illegal, is considered (struggling for a word here) - hateful, harmful or misleading, or “misinformation.”

Apple’s decision not to ship its AI features in Europe points to a likely consequence. Companies will not risk product innovations for fear of being fined billions of euros afterward. They will seek clarity. And that clarity will not be forthcoming. So innovation will further freeze, alongside the freezing of capital flows.

The US is showing significant signs of joining Europe in “biting the hand that feeds it.” Google is a large, powerful company that dominates search. However, the federal prosecutors could not make a case for search being monopolized because more searches happen off Google than on Google (Amazon, Facebook, etc.). instead, they defined a sub-market - mobile search. They claimed Google has a monopoly there. That is contestable. Every app has a search, and most do not use Google. Android and iOS do use Google but only in the browser. The browser is less and less of the total attention on mobile. However, the court ruled that Mobile search is a market and that Google has a monopoly in it. A highly dubious finding in my opinion.

We should remember that Google makes no money from searches. Search is a feature and a cost, involving capital and operational expenditures. Google’s payment to Apple for Safari’s embedding of Google Search is a case in point—a cost, not a revenue earner. Search is an onramp to advertising, as is Amazon, Facebook, and TikTok.

If we abstract to the total number of mobile searches leading to the delivery of an ad, then Google would be a minority player. Google dominates only by limiting the scope to a shrinking browser-based search behavior.

Google does have a big business, but it is advertising. In that business, Amazon, Facebook, and TikTok are giant percentage owners of the revenue on both mobile and desktop, not to mention the tens of thousands of apps with search and advertising built in.

Google’s only actual crime is that it is booming and big. Governments seem to want to restrict success. The claimed consumer protection is nakedly false. Where are the better search engine users prevented from using?

In Europe and America, those in power fear the freedom of speech and the economic power of their successful companies. In America, new startups are funded. In Europe, too, but on a far lesser scale. Time, money, and effort are dedicated to slowing, reversing, or stopping growth and innovation. This is at a time when AI promises to transform the human experience, reducing working time through automation.

What is striking is the political class's lack of a compelling vision for enhancing human existence through technical innovation or an optimistic and executable plan for the future. What I see are calls for less speech and more constraints on innovation. We need leaders with vision and passion for innovation's fantastic impact on our lives and an understanding of the role of human ingenuity in producing technologies that enhance life.

Leon Blum may have been right in his day, but today, we would have to rewrite his thesis to focus on the adverse effects of regulation on innovation.

"The essence of American and European capitalism is driven by fear of the market and innovation. Regulation is a stranglehold on progress."

Essays of the Week

Independent journalist era takes off

Substack is on track to more than double its politics and news subscribers in 2024, executives told Axios. The number of Substack journalists in news and politics making more than $1 million has doubled over the past year — and is now in "double digits," the company says.

Why it matters: Journalists with big brands or unique expertise are betting there's more upside in building their own products and audience relationships right now than freelancing or joining another potentially volatile newsroom.

News industry cuts totaled 2,569 between January and July, up 10% from the same time last year, per Challenger, Gray & Christmas.

How we got here: A boom in digital publishing tech combined with a slew of media cutbacks prompted a big wave of journalists to go independent during the pandemic.

But the trend slowed following a huge turnaround for media businesses in 2021, pegged to an unprecedented comeback in the ad market.

Today, industry instability, combined with product improvements at independent publishing platforms like Substack, has made independent ventures viable for a wider array of journalists.

By the numbers: More than 22 politics, news, business and tech Substack newsletters have "tens of thousands" of paid subscribers.

While several of those Substacks are publications, including The Free Press, Bulwark and Zeteo, most are individual journalists — formerly of prominent newsrooms. Politics and opinion drive outsized interest.

"The 2024 election, in particular, is driving millions of new readers to Substack for original reporting, opinion and analysis," Substack co-founder Hamish McKenzie told Axios.

The Free Press, founded by Bari Weiss, is now the top moneymaker on Substack, a Substack spokesperson confirmed. Its success proves Substack can become an incubator for full newsrooms.

The outlet has more than 750,000 subscribers (free and paid) on Substack, per the New York Times. Weiss said more than 100,000 pay $8 a month for full access to the company's journalism.

Mehdi Hasan left MSNBC and launched Zeteo News, a video-first media company, on Substack in February. Today, the firm has more than 20,000 paid subscribers and over 217,000 free email readers.

"I always thought of [Substack] as just a newsletter company. And actually, I realized it's a really good shop for video," he told Axios.

"A lot of other newsletter sites can't handle the video we're putting up," he said, while adding that he recently uploaded an hourlong clip to the platform ahead of making it available to subscribers on YouTube.

Hasan plans to debut his first documentary, a 40-minute video, on Substack for subscribers soon.

The Bulwark, a center-right, anti-Trump news and opinion outlet has more than 39,000 paid subscribers and 283,000 free email readers total across six newsletters, a spokesperson said.

Paid subscribers to Bulwark+ on Substack get access to special newsletters and podcasts. The outlet, which launched in 2018, has been entirely on Substack since 2020

The Ankler, a Hollywood news startup, joined Substack in 2022. Co-founder Janice Min said she assumed the company would leave Substack eventually, but there are no plans to do so now. "They just keep growing what they do with us. They keep growing the product," she said.

Min noted that the firm is doing more to service enterprise businesses. "I think it probably refocuses the ambitions of even the individual writers who are coming because there are concrete examples of little empires that have grown out of Substack."

..More

Let's Not Pass 'Go' Just Yet...

A few thoughts on the Google monopoly ruling...

This is, of course, a big deal. But at least for now, it's a bigger deal in what it symbolizes rather than what it's going to change. This feels like the culmination of years of building "techlash" – first by non-"Big Tech" companies and increasingly by the government (and governments around the world). Sure, there are pockets of end users, in particular those who feel tech platforms marginalize them or muffle their voices, but for the most part, people seem to still love these companies and products. So it's a sort of weird dichotomy.

In terms of timing, while most parallels to Microsoft's antitrust case 25 years ago don't make a ton of sense here – that's a longer post (update: here!) – the structure of this all feels like it could play out similarly. The ruling against Microsoft came down in April 2000 (after a "finding of fact" in November 1999). The proposed remedy actually came pretty quickly: in June 2000, with the judge saying that Microsoft should be split into two companies, one for operating systems and one for other software.

That, of course, never happened. The appeals were immediate, as they will be here. In July 2001, a Circuit Court overturned the ruling, but on a technicality (the judge talking to the media). It upheld the findings of fact about the monopoly but the demand the company be broken up as the remedy was effectively over. A few months later, Microsoft settled. But even that settlement wasn't finalized until 2004, after various challenges by individual states.

So that's just over four years from the ruling to the actual case being over after the appeals and settlement. Obviously this case won't play out the exact same way – presumably the judge was on media lockdown this time! – but still, the timeline is likely to be years. Unless Google finds a way to settle earlier, in a way they determine won't destroy their business. The likelihood of that won't be clear until we get the proposed remedies.

The ones being thrown out there today range from break-ups/split-ups of various Google properties (selling Chrome, splitting off Android, etc), to far more nuanced tweaks to the business. This opinion today in Bloomberg Law by antitrust economist Tessie LiJu Su feels the most correct right now, at least directionally:

Enjoining Google from the alleged bundling and revenue sharing practices is probably the best remedy. Android phone makers will no longer be required to use Google Search as default on their devices in order to license its intellectual property. Nor will they or Apple be induced by financial gains when Google’s revenue sharing stops. This approach will open up distribution to rival search engines.

This would effectively be telling Google to put their mouth where their money currently is – i.e. backing up the notion that their search product is the best without paying to place it everywhere.

The Apple element of this is arguably just as interesting as the Google element, because as everyone is well aware by now, a massive percentage of Apple's now-all-important Services business – not to mention overall profit – is their search deal with Google. To the tune of $20B+ a year.

While Su suggest the revenue sharing would stop, I imagine it would just change. No more paying for default placement in lump sums and instead perhaps paying out a share for actual usage. The argument here might be that this would still give Google too much power because they could afford to pay more than anyone else, but an equalized market rate would incentivize product over payment.

Regardless, the Occam's razor read of such a remedy suggests a situation that would perhaps not change all that much. Because it wouldn't dictate that Android phone makers or Apple make another search engine the default, it would likely instead lead to more pop-ups asking people to explicitly make a choice. And Google would still have a huge market advantage there, simply thanks to brand awareness, if nothing else. And if companies were allowed to bid on placement in such a screen, the effect would likely be even more muted.

The next paragraph by Su though seems like more of a stretch:

The device manufacturers would be free to design their own products. They would balance the competition in the mobile device market with the potential stream of search and revenue they are now in a position to generate. If consumers desire choice screens they would provide them. However, they are more likely to offer their own search engines as default.

Sure, they would be free to do so, but would they? This would seem to really undersell just how hard it is to build a search engine. Maybe AI helps change that equation a bit, but it's not something that's going to change overnight or even in the time horizon we're talking about with these remedies, I suspect. Maybe it entices Apple to finally buy Bing? But would they even be allowed to?! That would seemingly put them in a bad bundling bucket eventually!

And so if we instead assume some sort of "choice screen", it may hurt Apple more than Google because of the end of the default payment. Again, I sill envision some sort of revenue share for search, but it would perhaps be less massive and certainly more lumpy. And yes, Mozilla might be in more trouble than they already are as well in such a world because the revenue would be less constant and predictable, and possibly just less.

..More

Reminder: What Actually Disrupted Microsoft

It was not the Justice Department, despite the rhetoric this week...

With the news of the Google monopoly verdict rippling through tech, and really, the world, right now, Microsoft is being brought along for the ride. Nearly everyone you talk to and everything you read will bring up the fact that this is the biggest antitrust decision since the one against the software giant 25 years ago. The fact that both companies dominate their respective fields – PC operating systems in the case of Microsoft and internet search in the case of Google – in a similar manner, with upwards of 90%+ market share, just adds to it all. Plus the fact that the two are rivals, two multi-trillion dollar companies, and for years there's been this fear that Google was becoming the thing they swore they'd never become: Microsoft.

Anyway, some of the parallels are fun, but do they actually matter? My contention would be 'no, not really'. Because what ultimately ended Microsoft's monopoly wasn't the verdict against them, or any of the remedies. It was time and technological progress. In fact, you could argue that Microsoft still has that monopoly in PC operating systems. It's just that it doesn't matter anymore.

I would argue that ultimately, the same will be true for Google. What will eventually end the reign of Google Search isn't the rise of Bing or some other would-be competitor in internet search, it's going to be something tangential that makes internet search just matter less. Maybe it has something to do with AI (though I'd be skeptical that something like SearchGPT is the, um, answer). Or perhaps it's something no one is really thinking about right now. I don't know. I'm just pretty certain that this case will have little to do with that end.

I was thinking about this in reading Steve Lohr's piece for The New York Times this week drawing on those parallels between the Google and Microsoft cases. And he should know, since he was there all those years ago covering the Microsoft antitrust case for NYT. Here's a piece he wrote in 1998 entitled "If Microsoft Loses Case, Remedies Are Thorny".1

Microsoft did lose the case and the remedies were thorny. Namely, the aim to break Microsoft into two (an operating system company, and a company for all of the other software) ultimately failed. Lohr's piece highlights how the government was struggling to come up with changes Microsoft should have to make, going into the weeds about API access and the like. Ultimately, after years of appeals, Microsoft settled the case and agreed to some changes which still have some impact on the company to this day. But again, I'd argue that they're not what ultimately ended the rule of Windows.

For years and years we've heard that even if the government didn't directly end Microsoft's dominance, they indirectly helped because they distracted the entire company – and in particular, founder Bill Gates – at a time when it needed to be focused. Maybe there was some of that at play, but my guess would be that it had minimal impact. What ultimately mattered was simple: the internet.

That's interesting in the case of Microsoft – and in the case against Microsoft – because it was Netscape, the web browser company, which was the focal foil. Microsoft crushed Netscape's Navigator browser by bundling their own browser, Internet Explorer, with Windows. That was bad. But again, decoupling that software is not what did Windows in. In fact, Internet Explorer became the dominant web browser regardless – it peaked around 94% market share in 2004, incidentally the year Microsoft settled their case, but years after the ruling. What did Windows in was the fact that the web browser – any web browser, even Microsoft's – made Windows no longer matter as it once did.

The government didn't ensure Microsoft wouldn't control the internet just as they had operating systems. Again, in fact, Microsoft went on to dominate the web browser market.2 But that wasn't the market that ultimately mattered. Web search mattered. By the time Microsoft realized that, it was too late. Bing, despite billions of dollars and endless years spent on the service, simply doesn't matter.3

And so again, whatever remedies are put in place for Google – after years of appeals, no doubt – may matter for certain aspects of their business. But they won't be what ends the search dominance. In fact, nothing may end the search dominance. But something will make it no longer matter as it once did.

So the far more interesting parallel is if that something is already here, just as it was in the case of Netscape Navigator in the Microsoft case. But again, Navigator itself wasn't the key, it was what it ushered in: the world wide web. It's certainly possible that AI is the thing that makes web search matter less, but my bet would be that it's not because it's a better version of that style of search (again, SearchGPT or what Google itself is doing with 'AI Overviews'). It's some new UI or product that it unlocks (voice, vision, etc – some new device for those?).

..More

EU’s Artificial Intelligence Regulation Goes Into Effect

Critics say the Act will hinder innovation and give Europe’s competitors an edge.

Photo by Growtika on Unsplash

The European Union’s flagship artificial intelligence regulation package, commonly known as the “AI Act,” entered into force on Thursday, August 1st. Eurocrats have celebrated it as the globe’s first comprehensive legal framework around AI and hope it will serve as a regulatory model for the rest of the world, although others have heavily criticised it.

The primary aim of the Act is to classify how artificial intelligence is used into four categories based on its “risk level” to the economy, industry, and society. AI technology used in industries is then regulated according to these categories. The highest-risk ones—including China-inspired social scoring, biometric surveillance, targeted scanning, and other privacy-violating practices—are completely banned in the EU.

First proposed by the European Commission in April 2021 and adopted last December, the legislative process for the AI Act has been plagued by one problem after another, with criticism that EU elites are attempting to regulate the unregulatable and risk driving away AI startups entirely.

While Brussels has praised it as a “launch pad” for European businesses, several leaders including French President Emmanuel Macron have warned that overregulating AI risks giving the U.S. and particularly China an unfair advantage in the global industrial race.

Echoing the remarks made by Macron, Visiting Research Fellow at MCC Brussels Dr. Norman Lewis stated to The European Conservative that the package was “not anything to celebrate” as he explained that Eurocrats were attempting to regulate themselves out of a commercial hole they had created.

Referring to the Act as almost entirely “self-defeating” for Europe, Dr. Lewis explained how the EU was allowing lawyers to set the pace of change for AI and declared the entire bloc is now on the “slow lane” for innovation relative to other parts of the World.

“Referees don’t win matches,” Dr. Lewis declared as he summarized Europe’s increasing role in AI development, saying that the bloc was unlikely to impose the AI Act on the world in a similar fashion as was done with GDPR due to the declining power of its common market to dictate terms.

Depending on their size, companies operating in the EU and producing or using artificial intelligence products have three to six months to comply with the new regulations. Most of them will remain unaffected, however, as 85% of all AI companies fall under the ‘minimal risk’ category and are subject to barely any new regulation.

Why AI hasn’t shown up in the GDP statistics yet

Aug 07, 2024

AI is meant to bring us closer to utopia, according to its builders. For its detractors, AI is meant to usher us into dystopia.

Apart from a few who dismiss the potential for AI In stimulating the economy much, like Acemoglu, most others expect dramatic changes as AI seeps into the economy.

Thanks for reading Strange Loop Canon! Subscribe for free to receive new posts and support my work.

Adoption is clearly on the rise. It’s already part of people’s workflow, at least at an individual level.

And it’s also true that for types of tasks that LLMs, or LLM agents, can do, they are substantially cheaper than humans. It shows the agents performing at c.3% of the human’s cost.

So if LLMs are being adopted rather fast, and LLMs can solve problems at a fraction of the cost of a human, why haven’t we started to see its impact on the GDP yet?

If the answer is that an AI can do anything a human can do, something Ege and Tamay from Epoch wrote a paper about, then the growth might well be much bigger.

We examine whether substantial AI automation could accelerate global economic growth by about an order of magnitude, akin to the economic growth effects of the Industrial Revolution. We identify three primary drivers for such growth: 1) the scalability of an AI "labor force" restoring a regime of increasing returns to scale, 2) the rapid expansion of an AI labor force, and 3) a massive increase in output from rapid automation occurring over a brief period of time.

So … if that’s true … why hasn’t AI started showing its effects on the world GDP yet?Well, the answer is simple, it can’t do much of the tasks a human does.

But why is that? That answer is a bit more complicated, and I go into it a bit in this article.

What can LLMs never do?

Apr 23

Lest I do a Paul Krugman (though he’s unfairly maligned and was right) I’m not suggesting that the effects will always be mild. Only that the if in the paragraph above is crucial.

But here I thought I’d show you one simple recent example which reminded me again of why we can’t just drop-in replace people with LLMs yet.

So one of the things I had to do for work was to take a chunk of unstructured text, something captured from a website so not too many tokens, like a page, and to extract about 10-12 different specific details from it. The text had information about a person, name, address details, time, a dollar amount for something they bought, and a bunch of other details, and I wanted those. It’s hard because the text was unstructured, and there isn’t an easy pattern.

This is something LLMs are great at. You can copy paste it into GPT-4 or Claude or Gemini and ask and they all can write valid JSON to give you the answer.

The problem is that there were around 10,000 plus such pieces, and you can’t copy paste that one by one.

..More

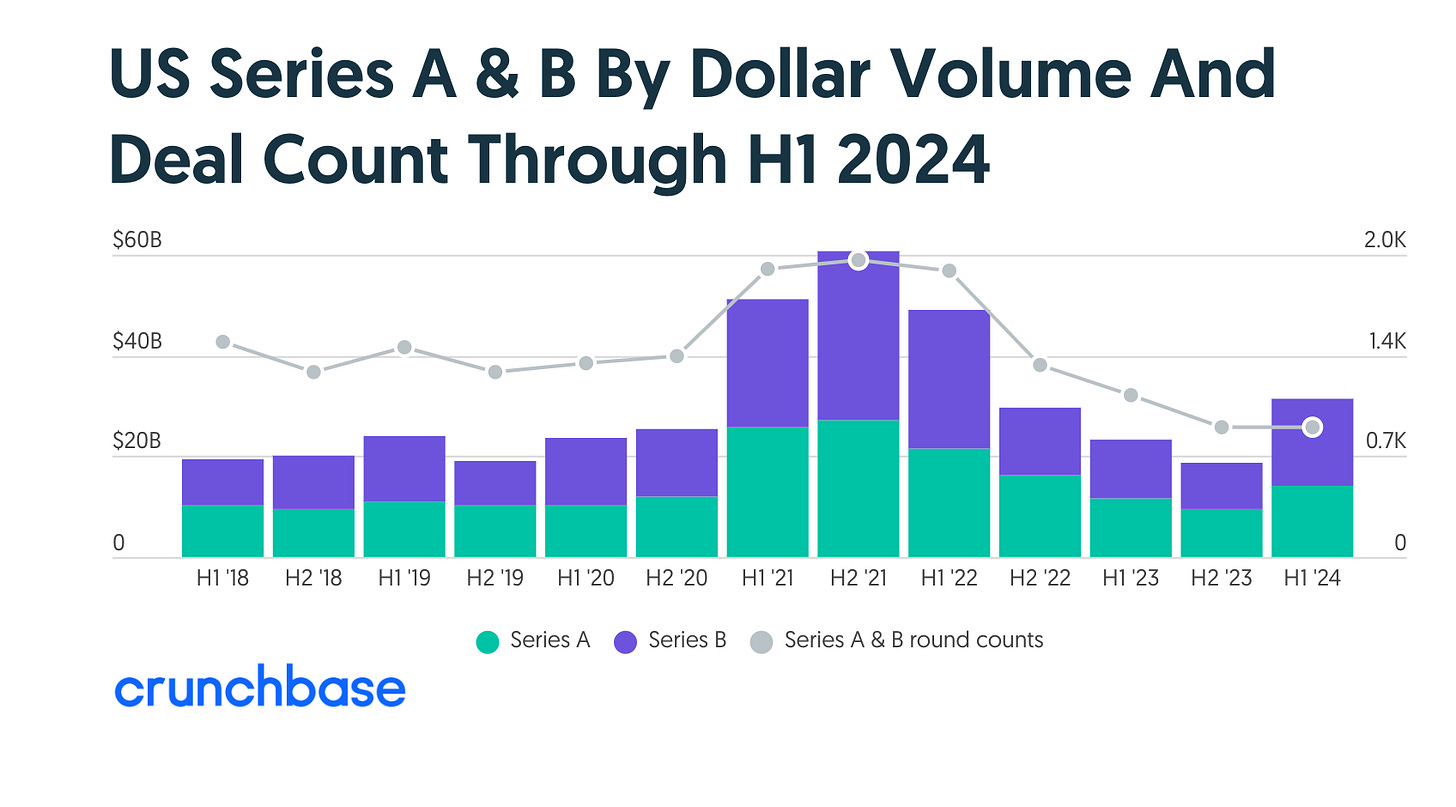

US Series A And B Funding Picked Up in H1. What Does That Mean For Funding In 2024?

August 9, 2024

Editors note: Next up we will look at the investors that have increased their pace at this stage in the first half of 2024.

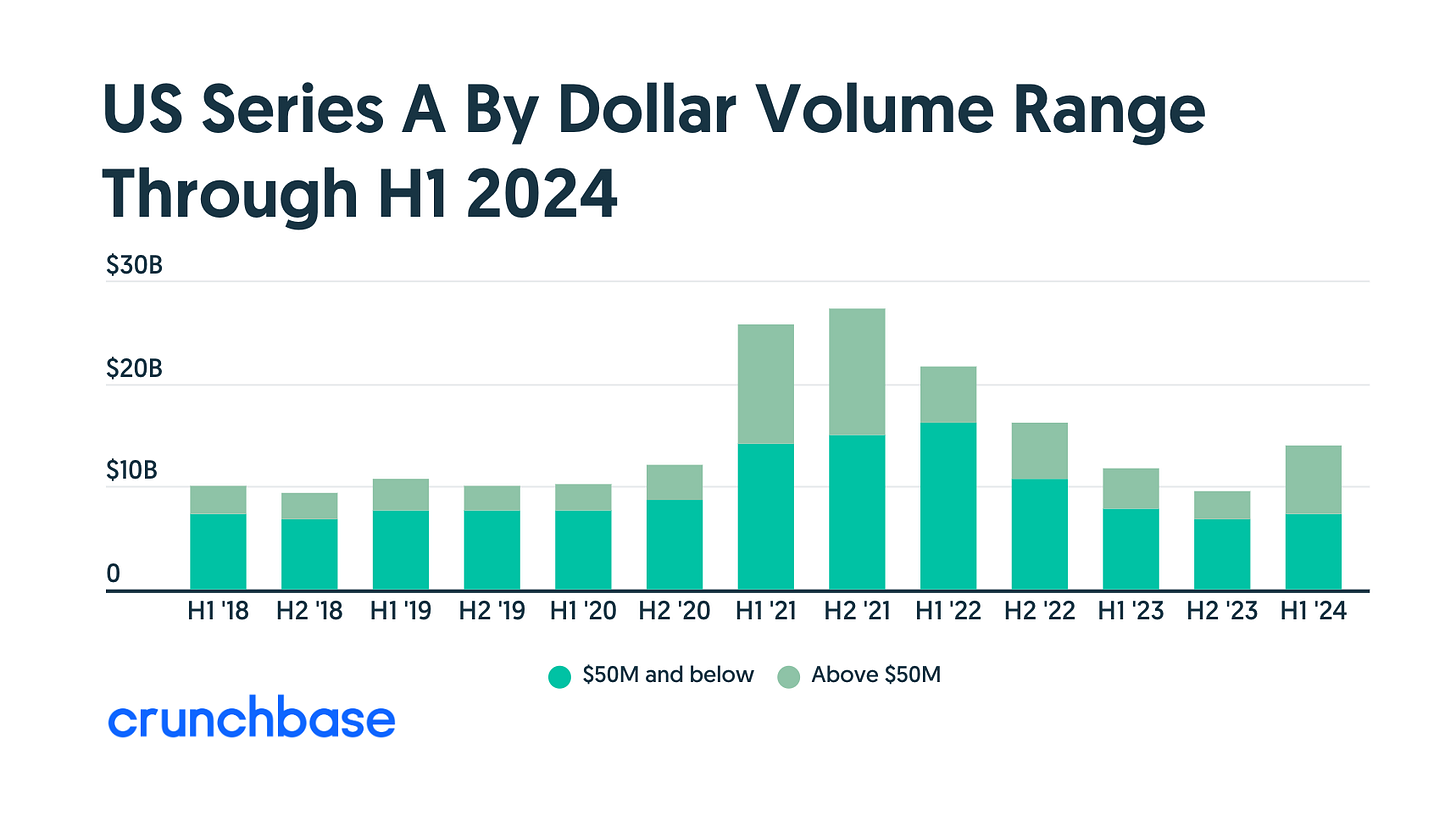

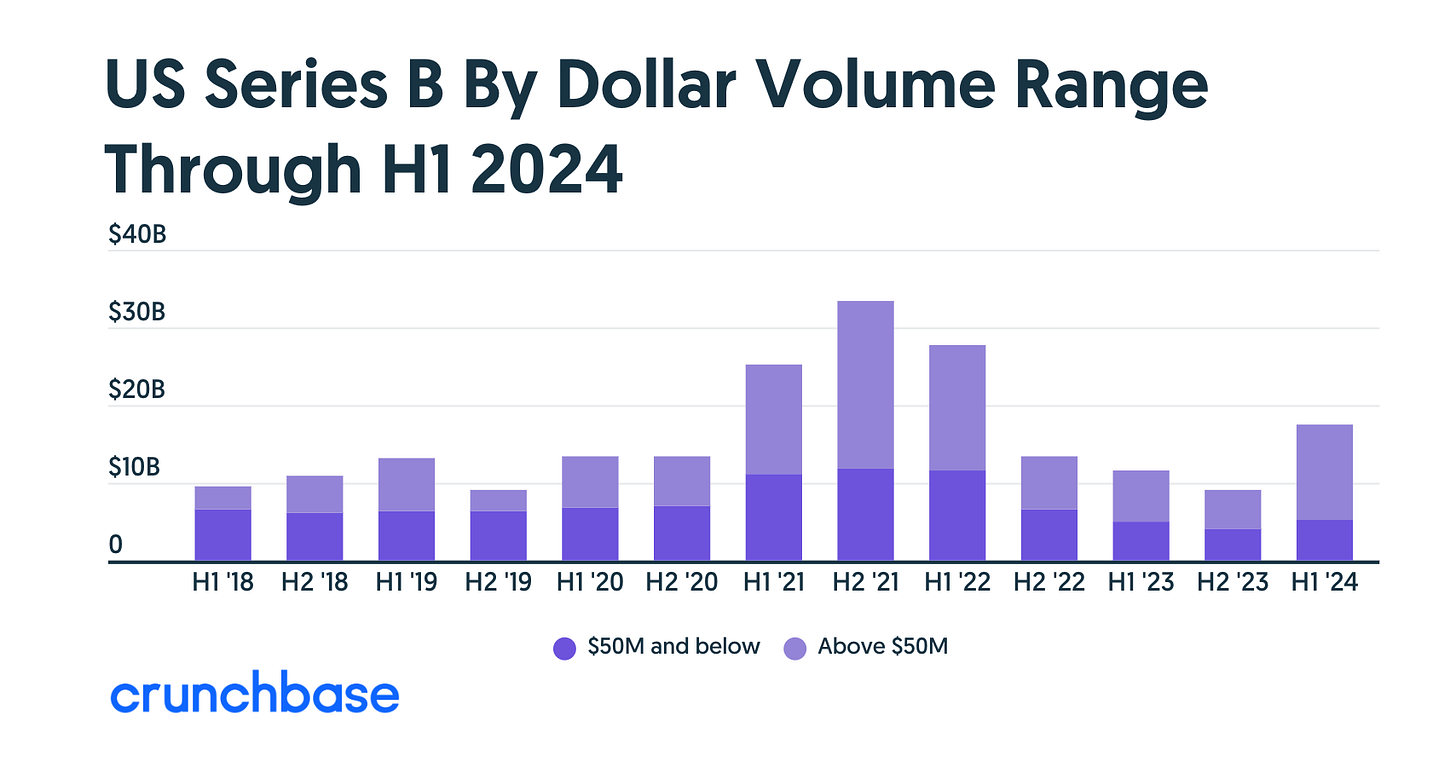

Although Series A and B funding for U.S.-based companies picked up in H1 2024 — up 34% year over year — the uptick may be deceiving.

While total funding reached $31.5 billion — the highest amount invested at this stage in two years — that increase was concentrated in larger fundings and in two leading sectors — healthcare/biotech and AI.

That includes a $6 billion Series B to xAI, which accounts for much of the increase. Still, if we remove that funding, H1 2024 is still above the half-year funding amounts in 2023.

Bottleneck at Series A

Since the second half of 2022, we found a Series A bottleneck based on an analysis of Crunchbase data. As the market tightened, seed-stage companies faced a more challenging environment in which to raise a Series A round. While all companies face this crunch, seed represents the largest absolute number of companies funded, as well as the stage with the least funding and lower revenues to manage through a tightened funding environment.

The recent uptick in Series A and Series B funding does not address that bottleneck.

Large rounds boost early stage

The increase at Series A and Series B fundings in the first half of 2024 was concentrated in larger funding at these stages. We looked at fundings by half-year both below and above the $50 million mark since 2018.

Large Series A rounds picked up in 2021 — the peak market. Those large rounds slowed every half year since, but increased in 2024.

Close to two-thirds of these large Series A companies in H1 2024 are in healthcare/biotech. The runner-up industry for large Series A rounds is artificial intelligence. Other sectors with large fundings in the low- to mid-single digits include Web3, energy and hardware.

Series B rounds show a similar trajectory. Around the market peak, larger rounds of $50 million and above increased and slowed since the second half of 2022. Recently, they’ve begun to pick up.

Alongside the xAI megaround, the pick-up this year is led by healthcare/biotech as the leading industry followed by AI. Hardware, including semiconductor and robotics, is the third-largest sector for large Series B rounds.

Concentrated bets

The increase in Series A and B fundings in H1 were concentrated in larger fundings and in two leading sectors; healthcare/biotech and AI.

Other sectors got short shrift.

There is a big gap between these two leading sectors and others. Financial services, e-commerce and shopping, and transportation sector amounts, for instance, were significantly down.

..More

Video of the Week

AI of the Week

Apple Unveils Apple Intelligence: AI Suite

Aug 8, 2024

Apple has announced the release of the first version of Apple Intelligence. It is a comprehensive suite of AI features designed to enhance Siri, automate email and image generation, and streamline notifications.

The new software, unveiled on Monday, is included in the developer beta of iOS 18.1. It is available for similar beta releases on iPad and Mac. Currently, access to Apple Intelligence is limited to registered Apple developers, who pay an annual fee of $99.

How to Access

To access the new AI features, users must update their devices. Of course, they will have to register for a waitlist within the Apple settings app. This registration process involves connecting to Apple servers to handle more complex requests.

Apple plans to make Apple Intelligence available to the general public later this year. The 18.1 version number indicates that the AI suite will not be released in conjunction with new iPhone hardware, which is anticipated to debut with iOS 18 in the fall.

The system is designed to work exclusively on the iPhone 15 Pro, iPhone 15 Pro Max, and newer models. Bank of America analyst Wamsi Mohan expressed optimism about the long-term impact, stating, “We expect this iPhone cycle to remain strong for longer as AI feature sets (software and possibly hardware) improve in the 2025 iPhone.”.

Key Features Demonstrated at Apple’s Annual Developers Conference

The current preview of Apple Intelligence includes several key features demonstrated at Apple’s annual developers' conference in June:

Revamped Siri Interface: The new Siri interface features a glowing edge on the phone, enhancing visual appeal.

Enhanced Siri Capabilities: Siri can now better understand commands, even if the speaker stumbles over their words, and can answer troubleshooting questions about Apple products.

Improved Photo Search and Movie Creation: Users can enjoy more efficient photo searches and enhanced movie creation tools.

AI-Generated Summaries: Mail, Messages, and voicemail transcriptions now benefit from AI-generated summaries.

Writing Tools: Apple’s text-generation service offers new writing tools to assist users.

Expected Features

With that said, there are several anticipated features are not yet included in the AI preview. As expected, there are some that the company is still keeping in the sleeve until it’s ready. So Apple has promised to roll out these additional capabilities over the next year:

Image and Emoji Generation: Automated generation of images and emojis.

Automated Photo Cleanup: Tools to help users organize and clean up their photo libraries.

Advanced Siri Improvements: Further enhancements, including the ability to use personal information for more personalized responses and perform actions within apps.

OpenAI ChatGPT Integration

..More

Meet Black Forest Labs, the startup powering Elon Musk’s unhinged AI image generator

3:45 PM PDT • August 14, 2024

Elon Musk’s Grok released a new AI image-generation feature on Tuesday night that, just like the AI chatbot, has very few safeguards. That means you can generate fake images of Donald Trump smoking marijuana on the Joe Rogan show, for example, and upload it straight to the X platform. But it’s not really Elon Musk’s AI company powering the madness; rather, a new startup — Black Forest Labs — is the outfit behind the controversial feature.

The collaboration between the two was revealed when xAI announced it is working with Black Forest Labs to power Grok’s image generator using its FLUX.1 model. An AI image and video startup that launched on August 1, Black Forest Labs appears to sympathize with Musk’s vision for Grok as an “anti-woke chatbot,” without the strict guardrails found in OpenAI’s Dall-E or Google’s Imagen. The social media site is already flooded with outrageous images from the new feature.

Black Forest Labs is based in Germany and recently came out of stealth with $31 million in seed funding, led by Andreessen Horowitz, according to a press release. Other notable investors include Y Combinator CEO Garry Tan and former Oculus CEO Brendan Iribe. The startup’s co-founders, Robin Rombach, Patrick Esser, and Andreas Blattmann, were formerly researchers who helped create Stability AI’s Stable Diffusion models.

..More

AI Unicorns Are Running Amok

Agrowing number of skeptics— including many on Wall Street — are getting increasingly nervous about the “AI” bubble. But that hasn’t stopped money from flowing into AI startups, according to a new State of the Markets report by Silicon Valley Bank. The report points out that “More AI companies are becoming unicorns,” and it is happening at earlier stages than non-AI companies, despite the downturn in venture capital investing.

Twenty-eight (38%) of 73 new unicorns in past 18 months are AI companies.

Top 25% of AI unicorns reach $1 billion valuation in under 2 1/2 years

Late-stage AI deals account for half of late-stage investment, and the median AI company is valued 68% higher than non-AI companies.

Thirty percent of AI unicorns are classified as early stage, compared with 11% of their non-AI counterparts.

As of June 30, 2024, there were 736 unicorns.

Now, thanks to AI investments, the top 10 U.S. venture capital deals capture 20% of total fundraising, up from 9%, with much of the VC money being spent on GPUs.

The “GPU” spending is reminiscent of the massive investments in Sun Microsystems servers and Cisco routers and switches during the initial buildout of the internet and the dot-com boom (bubble). While not all dot-coms survived, a handful, such as eBay and Amazon, evolved into generational companies. Encore, anyone?

The aspect outlined in the SVB report, that unicorns aren’t dying, shouldn’t be overlooked.

Only 12% of U.S. tech unicorns are well-positioned for IPO.

The median U.S. tech unicorn has more than 20 months of runway.

About half of unicorn companies are more than 10 years old.

Graduation rates remain below historical norms — there were just five U.S. venture capital-backed tech IPOs during the first half of 2024.

What does that mean:

The market pullback and the end of the zero-interest-rate policy are affecting growth trajectories.

These companies face some serious survival challenges, so don’t be surprised by big failures.

Graduation levels will remain below historical norms until the backlog of companies is reduced.

..More

OpenAI co-founder Schulman leaves for Anthropic, Brockman takes extended leave

7:23 PM PDT • August 5, 2024

John Schulman, one of the co-founders of OpenAI, has left the company for rival AI startup Anthropic.

In addition, OpenAI president and co-founder Greg Brockman is taking an extended leave — through the end of the year — after nine years at the company to “relax and recharge,” the company confirmed.

Peter Deng, a product manager who joined OpenAI last year after leading products at Meta, Uber, and Airtable, also exited some time ago, the company confirmed. The news of Brockman’s and Deng’s departures was earlier reported by The Information.

A spokesperson shared this statement about Schulman: “We’re grateful for John’s contributions as a founding team member at OpenAI and his dedicated efforts in advancing alignment research. His passion and hard work have established a strong foundation that will inspire and support future innovations at OpenAI and the broader field.”

Schulman posted about the decision on X today, saying that it stemmed from a desire to deepen his focus on AI alignment — the science of ensuring AI behaves as intended — and engage in more hands-on technical work.

“I’ve decided to pursue this goal at Anthropic, where I believe I can gain new perspectives and do research alongside people deeply engaged with the topics I’m most interested in,” Schulman said. “I am confident that OpenAI and the teams I was part of will continue to thrive without me.”

..More

News Of the Week

State of Private Markets: Q2 2024

Author: Hamza Shad

Published date: August 8, 2024

In Q2 2024, the venture ecosystem showed modest signs of improvement.

Contents

Executive summary

In Q2 2024, the venture ecosystem showed modest signs of improvement, but not a drastic break, from Q1.

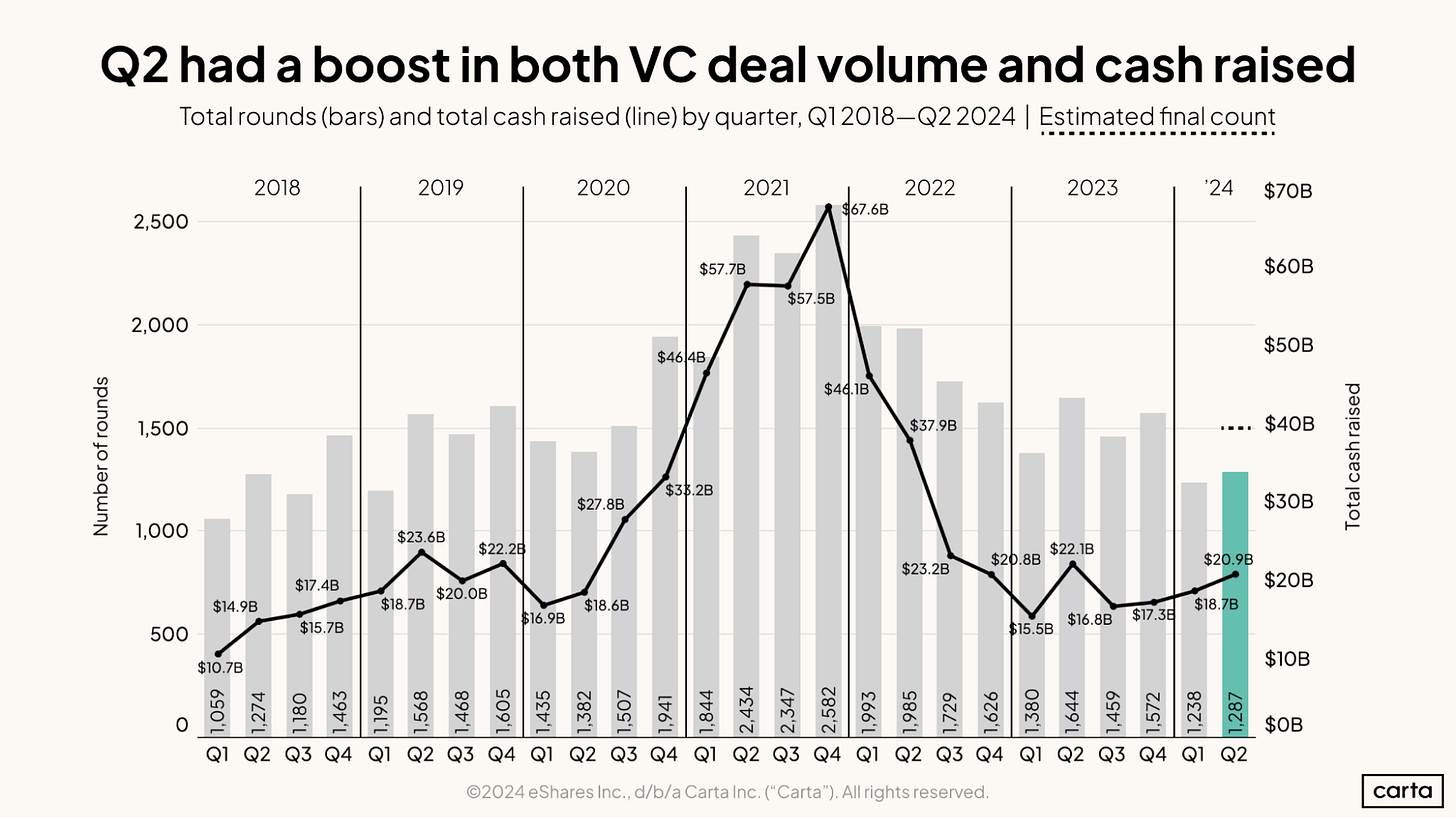

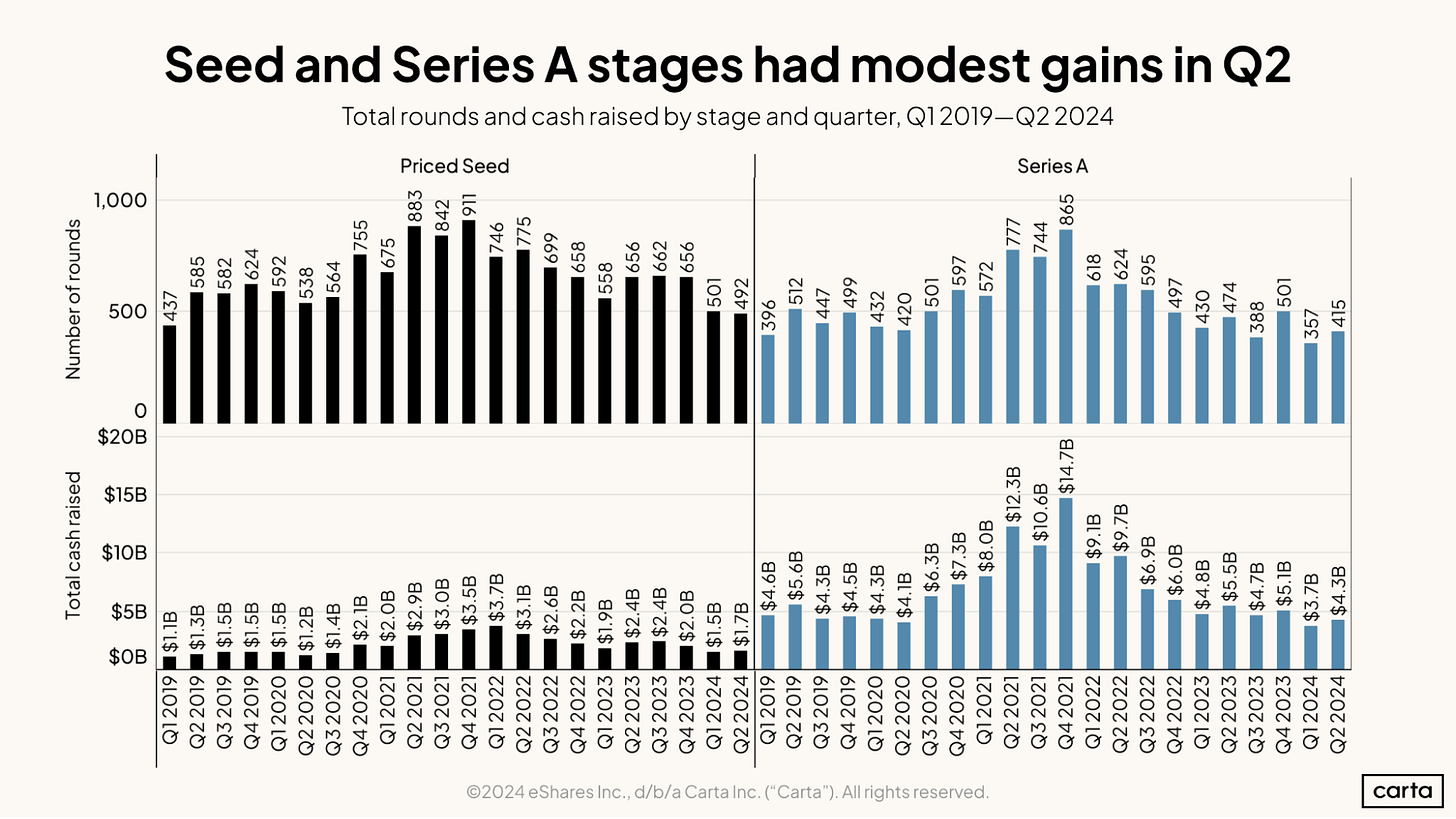

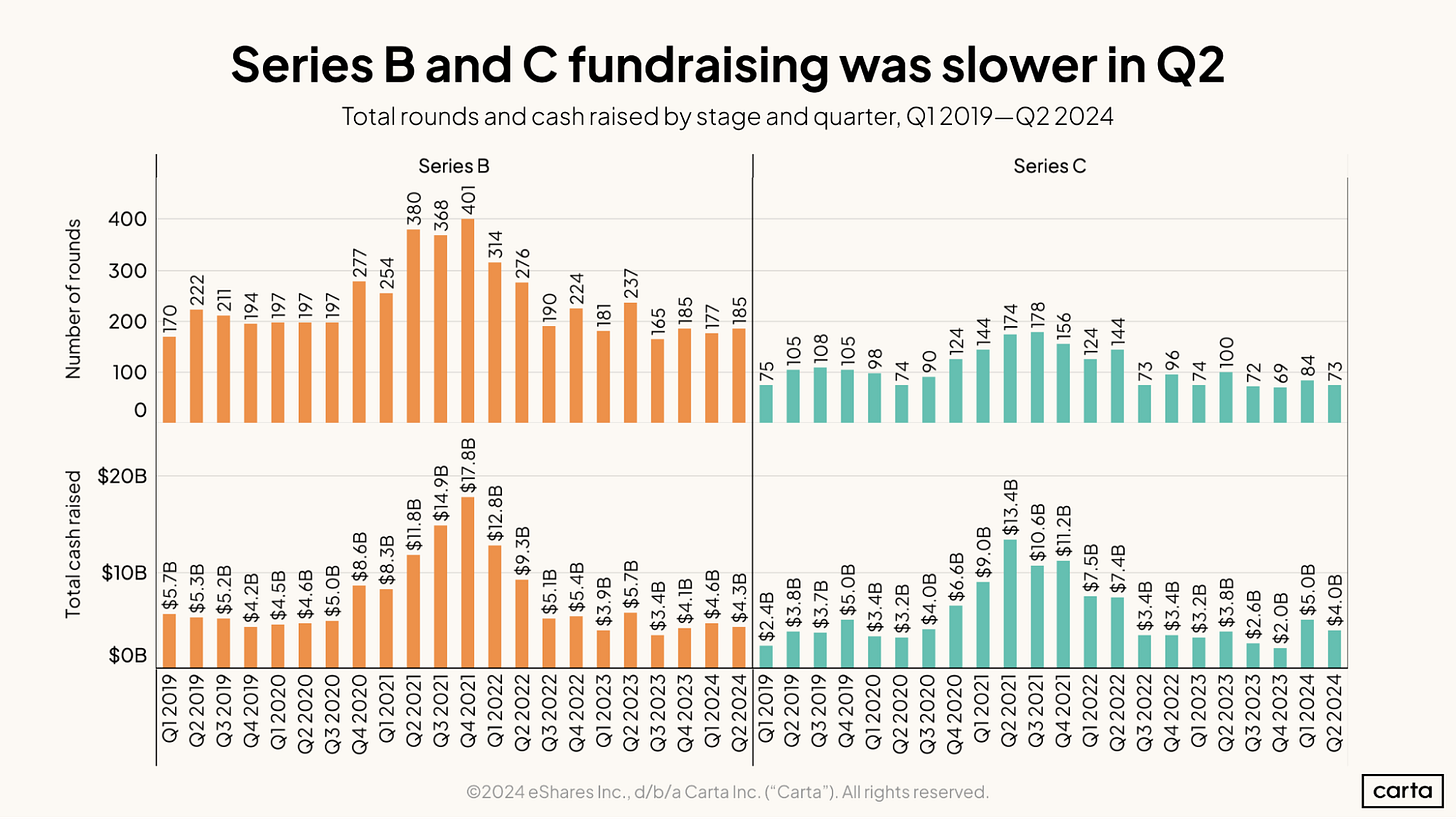

Based on current data, companies on Carta completed 1,287 new funding rounds in the second quarter of 2024, up 4% from Q1 2024. VCs invested a total of $20.9 billion in Q2, up 12% from Q1. Both of these figures will increase as more Q2 data is reported.

While Q1 experienced a record-high frequency of bridge rounds, there were fewer bridge rounds in Q2 at the Series A, B, and C stages. At the seed stage, the rate of bridge financings remained flat from Q1 at 41%.

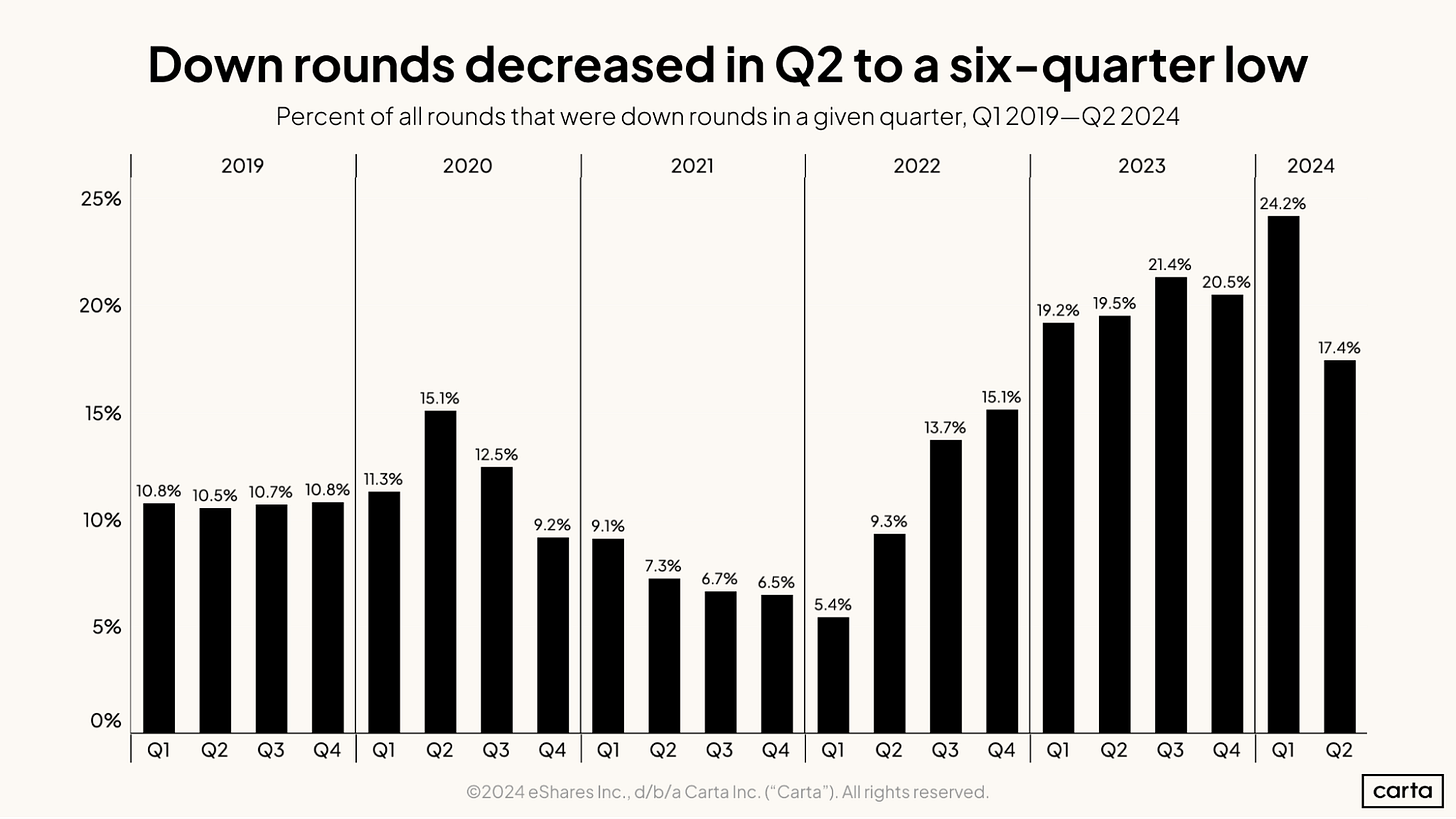

Median pre-money valuations rose at all stages in Q2 except for Series A, where they held steady. The rate of down rounds across stages fell from 24.2% to 17.4%. These findings indicate that founders were in better positions to negotiate higher valuations for their companies this quarter.

The year got off to a slow start in Q1, but Q2’s positive movement along multiple metrics could mean that better days are coming for U.S.-based startups.

Download additional industry-specific data

Q2 highlights

Positive signs in venture activity: The number of rounds and total cash raised by startups both increased this quarter. Primary round valuations rose at all stages except for Series A, where they held steady.

More founder-friendly environment: The rate of down rounds fell to a six-quarter low, and it is less common for deals to include structured terms that favor investors. Bridge rounds also fell for Series A through C.

Northeastern recovery: Startups based in the Northeast increased their share of VC cash to 25%, at the expense of the West and Midwest census regions. The New York Metro Area brought in $3.6 billion this quarter, a notable increase from Q1.

Note: If you’re looking for more industry-specific data, download the addendum to this report for an extended dataset.

Key trends

The current data from Q2 2024 shows a boost in both deal count and total cash raised compared to Q1 2024. Q2’s deal count of 1,287 rounds totaling $20.9 billion is already a marked improvement over Q1. Both figures will increase further as some companies have a lag in reporting their data.

Q2 had the highest amount of VC cash invested in any quarter over the past year—and perhaps even longer, as data from Q2 financings continues to finalize in the coming weeks. The increase in deal volume relative to last quarter may indicate that Q1 was the trough and that market activity will stabilize or go up from here.

Q1 2024 represented a five-year high in the prevalence of down rounds, but Q2 reversed that trend. This quarter, the rate of down rounds fell from 24.2% to 17.4%. The falling trend is likely to continue. The downturn in VC fundraising is now more than two years old, which means that going forward, companies that are fundraising are more likely to have raised their most recent round in 2022 or after—in other words, after the period of inflated valuations that occurred in 2020-2021.

Seed deal count in Q2 is about even with Q1’s total, but Q2 will likely post a slight gain over Q1 after accounting for data lags. At the Series A stage, the data already shows that Q2 fared better than the previous quarter. The rebound in Q2 may represent a turning point from Q1, which had represented the lowest quarterly deal counts for both seed and Series A since early 2019.

Total cash raised for both stages increased modestly in Q2. At the Series A stage, Q1’s total cash raised was the lowest value recorded in the past five years. This quarter’s 16% increase still ranks Q2 among the lowest-earning quarters for Series A, but may signal the beginning of an upward trend.

Companies in the middle stages of fundraising experienced a slower quarter. Although the number of Series B deals picked up slightly in Q2, total cash raised declined. For Series C companies, both deal count and cash raised declined this quarter, after previously gaining momentum in Q1.

A Robust Seed Market Creates Its Own Dilemmas In A Slower Funding Market

July 31, 2024

In the first half of 2024, U.S. seed funding reached $6.4 billion, which is flat compared to H2 2023 and down from $7 billion in H1 2023.

However, through the downturn following the 2021 market peak, seed was the most robust of all the funding stages. In 2022, early- and late-stage funding fell, while seed funding grew year over year.

The seed train has slowed since 2022, down from the peak years, but still well above 2020 amounts.

That momentum has created concerns about where this all leads as the bar to raising Series A funding has gotten harder.

According to Crunchbase data, we find a larger pool of companies still at seed since 2021, with slimmer chances of raising that Series A.

In any market, a significant proportion of seed companies never make it to Series A. For companies that raised a milestone of at least $1 million in 2020, around half have graduated to raise post-seed funding since. For the 2021 cohort, that proportion drops to a third, based on current data.

Since 2021, graduating beyond seed has gotten harder.

Seed also got larger

Based on an analysis of Crunchbase data, we find that larger seed rounds picked up in the boom year of 2021, which is what one might expect. However, in the down market of 2022, as Series A fundings became elusive, larger seed rounds continued to grow.

In 2021, seed rounds greater than $5 million increased as round sizes across all stages increased. That trend continued into 2022, with more than 50% of seed funding and over 10% of seed rounds going above the $5 million mark. (For this analysis we exclude seed rounds of $100 million or more.)

While this is a small fraction of deals and a growing percentage of dollar volume at seed, it is not what you might expect given a market pullback.

Over the past decade, seed has become a more elastic phase broken into its own stages — pre-seed, seed, pre-Series A — as companies mark milestones in approaching a Series A.

And in a downturn, investors at all stages focused on seed, which is seen as less risky since expected returns are eight to 10 years out.

In this market, seed round sizes have not come down as companies prepare to take longer to get to Series A. As Bay Area investor Jenny Lefcourt, a partner at seed investor Freestyle, told Crunchbase News earlier this year on investing in the downturn, “our valuations have actually been higher in this market, which is not what we would have predicted.”

Breaking through to Series A takes longer and is harder, in a tougher sales environment. And once you raise a Series A, the Series B track is next.

In an uncertain funding environment, staying at seed might feel like the best option.

..More

UK neobank Revolut valued at $45B after secondary market sale

Revolut has confirmed a new valuation of $45 billion via a secondary market share sale, shortly after the U.K.-based neobank secured its own banking license in the U.K. and Mexico.

The news positions Revolut as one of Europe’s most valuable private tech companies.

Founded in London in 2015, Revolut is one of numerous fintechs to emerge from Europe over the past decade to challenge the big bank incumbents. Revolut offers a range of services spanning multi-currency accounts, payment and transfer services, crypto products, insurance and more. The company has also expanded beyond the U.K. into international markets including Europe and the U.S.

Revolut has raised around $1.7 billion since its inception, its most recent tranche coming via a Series E of $800 million in 2021, which gave it a $33 billion valuation post-money. In the intervening years and against a backdrop of a global economic downturn, Revolut’s valuation reportedly dipped at various junctures. The speculation last year was that it may have fallen to around $20 billion.

With Revolut a private company, nothing was ever confirmed. But off the back of record profits this year and strong user growth, with customers hitting the 45 million mark, rumors emerged that the company was seeking a valuation of around $40 billion; now that’s been confirmed.

Revolut’s secondary share sale today is designed to spur “employee liquidity,” which the company says helps them to “realise their contribution to Revolut’s growth.”

“It’s their hard work, innovation, and dedication that has driven us to become the most valuable private technology company in Europe,” Revolut CEO Nik Storonsky (pictured above) said in a statement.

..More

BVP: The Top Unicorns Are Still Raising at 23x ARR

by Jason Lemkin | Blog Posts, Growth, Scale

So there’s a curious thing anyone close to venture capital fundraising and rounds is seeing today:

Valuations for Hot VC Deals remain far higher than pre-March 2020 … even though growth for the overall public SaaS and Cloud companies has slowed to … all time lows.

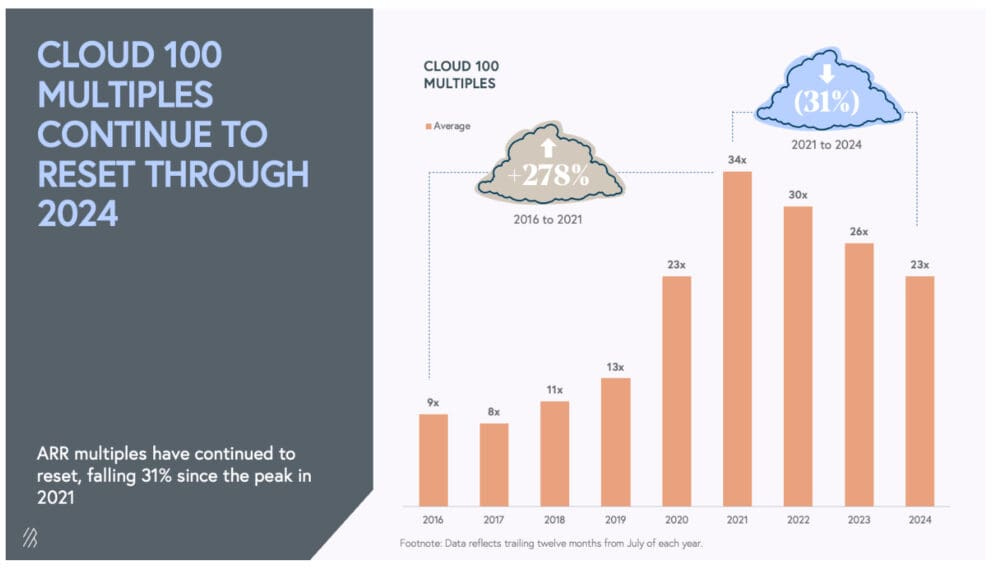

The latest Bessemer data proves this out in a very helpful chart and summary:

For the best of the best in SaaS and Cloud, yes ARR multiples in VC rounds are down 31% from their 2021 peak. But … they are still double where they were in 2018-2019. And just as high as 2020.

Now the BVP Cloud 100 of course represents some of the best of the best in SaaS, from Wiz to Stripe to Figma and more. Most likely no matter how well you are doing — that’s likely not quite you.

So you can discount some of this as outliers, even the outliers of the outliers. But the Cloud 100 was always outliers. And as you can see above, valuations started to grow into 2019 … exploded in 2020 and 2021 and into 2022 , which sort of made sense, as overall growth rates exploded … but then valuations for the best of the best have stayed persistently high.

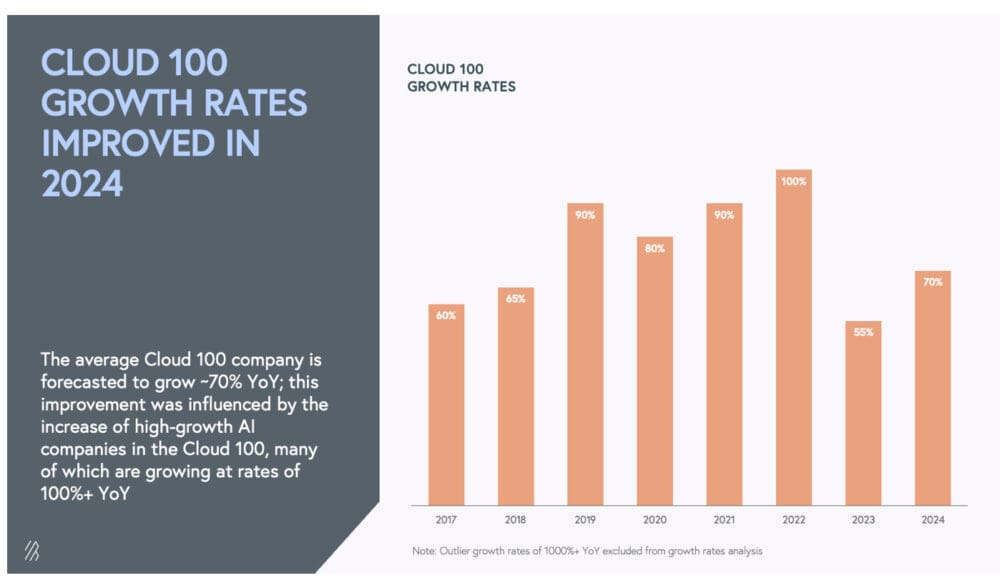

Now to be clear, this is for the best of the best of the best. The average Cloud 100 company has nine figures+ of ARR and is growing a stunning 70% (!):

So at those growth rates, sky high valuations at the growth stage are arguably merited, at least in theory. So many of the Best of the Best are growing at crazy rates at scale, from Canva to Databricks and Wiz and more.

And yet … and I think almost everyone in venture also knows this … it doesn’t quite make sense.

Public SaaS and Cloud multiples have fallen to almost 5x ARR, an all-time low for past 8+ years at least. And growth rates have fallen to all-time lows.

And yet optimism, or perhaps even just the pressure to deploy capital, has seen private valuations stay not as far off their 2021 peaks as one would expect.

IMHO, it’s justified for a Wiz or two, for sure. But when even the Best of the Best like the latest SaaS IPO, OneStream, growing 34%+ at $500m ARR … trade for 10x ARR …

Then VC valuations still seem awfully disconnected from reality. Especially in good deals, but not Wiz-grade deals.

We’ll see.

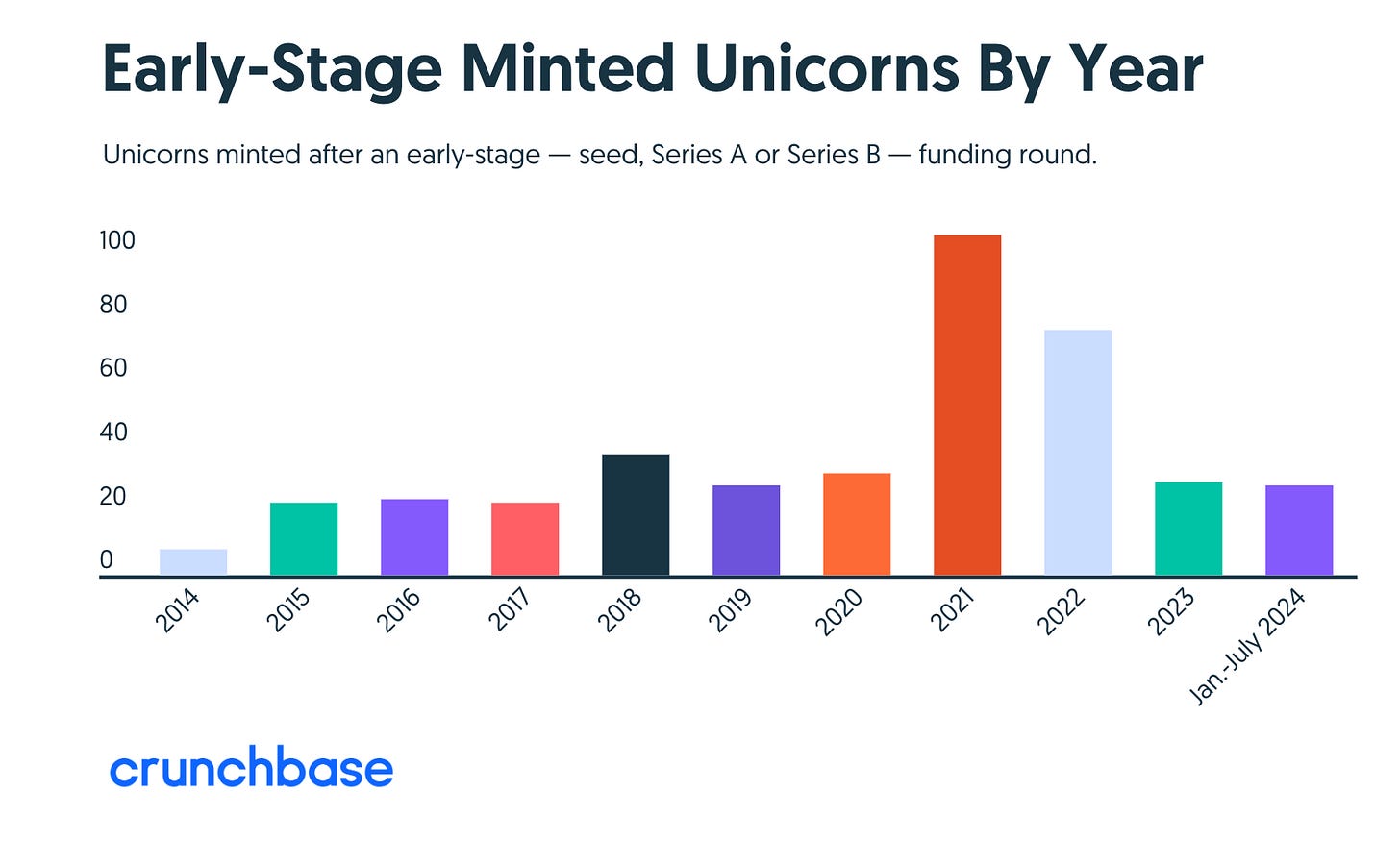

More Early-Stage Startups Are Getting Minted As Unicorns

August 15, 2024

Just as it looks like the pace of creating new unicorns is once again picking up, so is minting them in earlier stages of funding.

Through July, 70 new unicorns — private companies valued at $1 billion or more — had been minted. Perhaps somewhat surprisingly, 28 of those companies were granted their unicorn horn after an early-stage funding round — defined as seed, Series A or Series B — an analysis of Crunchbase data shows.

That is only one shy of the 29 young unicorns created through all of last year — although still significantly off the pace in 2021 and 2022 when 107 and 77 early-stage unicorns were minted, respectively.

Back to old ways?

While this certainly isn’t 2021 again in the venture world, it is noteworthy that investors once again seem willing to invest at high valuations, even if the company is still relatively young in the maturation process.

Not too shocking, it is mainly AI leading the way. Nearly a dozen early-stage unicorns are generative AI or heavily AI-related startups. That list includes:

Elon Musk’s generative AI startup xAI, raised a $6 billion Series B in May that included investment from the likes of Valor Equity Partners, Vy Capital, Andreessen Horowitz and Sequoia Capital, and valued the company at $24 billion.

In February, China’s artificial intelligence startup Moonshot AI raised more than $1 billion in a Series B led by the Alibaba Group Holding and HongShan, formerly Sequoia Capital China.

In April, San Francisco-based Cognition reportedly locked up a $175 million Series A led by Founders Fund at a $2 billion valuation. The 6-month-old startup has developed an artificial intelligence-powered coding assistant called Devin.

However, not everything was AI-related when it came to minting early-stage unicorns. Perhaps the most eye-catching was that the much-maligned sector of Web3 saw three startups hit unicorn status after early-stage funding: Blockchain platform Berachain raised a $100 million Series B at $1.5 billion valuation; New York-based layer 1 blockchain Monad raised a $225 million Series A led by crypto investor Paradigm at a $1 billion valuation; and infrastructure platform Polyhedra Network has raised $20 million at a valuation of $1 billion.

In fact, a lot of sectors saw at least one startup hit the $1 billion-or-more valuation after an early funding, including retail (Uzum), space (Yuanxin Satellite) and defense (Saronic).

What it means

It’s hard to draw any big conclusions from the fact more early-funded startups are getting minted as unicorns than last year. However, it is telling that for the last several quarters investors have talked about valuations coming down and self-correcting — while on the other hand very young companies in the earliest stages of growth and funding are getting valued at $1 billion or more.

..More

EU Commissioner Breton Rebuked for Musk Letter

By Rocket Drew

EU Commissioner Thierry Breton’s open letter to Elon Musk was “neither coordinated nor agreed” with European Commission President Ursula von der Leyen, a spokesperson for the governing body told reporters in a taped news conference Tuesday.

The public criticism of Breton, one of Europe’s most outspoken officials on tech issues, followed a letter sent by Breton warning X owner Elon Musk to respect the Digital Services Act during Monday’s live-streamed interview of former U.S. president Donald Trump.

Breton warned Musk to mitigate the “amplification of harmful content” that might “generate detrimental effects of civic discourse and public security.” Breton said the European rules extended to U.S.-headquartered X because the EU region’s residents could watch the broadcast. Musk responded to Breton with an expletive and X CEO Linda Yaccarino posted that “This is an unprecedented attempt to stretch a law intended to apply in Europe to political activities in the U.S.”

Warner Bros. Discovery Writes Down $9.1 Billion, Suffers Steep Losses

By Sahil Patel

Warner Bros. Discovery wrote down the goodwill value of its TV networks by $9.1 billion, citing uncertainties over its NBA rights and the softness it is seeing in the U.S. TV ad market. The writedown plunged the company into a loss of $10 billion for the quarter, compared with a loss of $1.2 billion a year earlier.

Two weeks ago, the NBA awarded future broadcast TV rights to Disney, Amazon and Comcast, a major blow to WBD whose cable channels have aired NBA games for decades. Without the live programming of the games, WBD’s channels are sure to lose significant advertising and the leverage to negotiate higher fees from cable and satellite TV operators which carry its channels. (WBD is currently in a legal battle with the NBA over those rights.)

Overall, it was a rough quarter for WBD. Revenue for its TV networks fell 8% to $5.3 billion, a result of both lower advertising revenue and distribution fees. Revenue for its direct-to-consumer segment, which includes its Max and Discovery streaming services, fell 5% to $2.6 billion. The company also reported a loss $107 million in the segment, a reversal from last year when the segment was essentially break even.

Paramount Global Takes $6 Billion Writedown

By Martin Peers

Paramount Global wrote down the value of its business by $6 billion in the second quarter, the entertainment company reported on Thursday, following the lead of Warner Bros. Discovery which took a $9 billion writedown on its TV network businesses earlier this week. The writedown follows Paramount’s agreement to merge with David Ellison’s Skydance early last month.

The writedown pushed the company to an operating loss of $5.3 billion, although the underlying business showed signs of improvement. Excluding the writedown and other restructuring charges, Paramount Global reported a pre tax profit of $537 million compared with $234 million a year earlier.

Paramount also reported a small profit in its direct to consumer streaming segment, on 13% higher revenue, although subscribers to its flagship Paramount+ service shrank slightly due to the company’s withdrawal from a distribution deal in South Korea.

Meanwhile the company’s TV operations suffered a 17% drop in revenue, as both advertising and subscription revenues shrank. Paramount’s film studio also reported an 18% drop in revenue and a small loss.

Startup of the Week

Euro VCs welcome Balderton’s fresh $1.3B but grumble about Europe’s AI misses

11:05 AM PDT • August 12, 2024

Balderton Capital — one of the older, larger European VCs noted for investing in Revolut and Wayve — has raised a fresh $1.3 billion in total, spread across two funds. Its Early Stage Fund IX will get $615 million, and its Growth Fund II will get $685 million. The news was greeted with cautious optimism by the VCs TechCrunch spoke with.

It’s also a further indication that European VC is picking up after a lackluster couple of years following the ZIRP and post-COVID-driven bull-run of 2021 and 2022.

Indeed, the London-based Balderton pointed to research that said European VC funds have outperformed VCs in the U.S. over 10- and 15-year periods, based on data from both Invest Europe and Cambridge Associates.

In an interview with TechCrunch, partner Suranga Chandratillake said the raise had gone relatively smoothly: “We raised [these funds] faster than we’ve ever raised them before. It was about 80% reupping of existing LPs.”

He said the fund has also raised from a large, but unnamed, U.S.-based institution: “What we’ve heard a lot is that European venture feels like a proper, solid, here-to-stay part of the industry VC globally, which obviously seems like old news to me or to you, but it’s amazing how long that takes, in a global sense, to really permeate into everybody’s way of thinking about the world.”

In fact, European AI startups Mistral, Wayve and Poolside AI now account for 18% of all European VC funding, according to Dealroom. Balderton’s fundraise follows raises by other VCs in Europe, including Accel’s European arm, Index Ventures and Creandum.

In the last 12 months, Balderton has announced 12 new investments: Checkly, SAVA, Tinybird, Qargo, Huspy, trawa, Payflows, Scalable Capital, Lassie, Writer, Anytype and Deepset.

However, the firm’s Europe-only focus means it has largely missed out on investing in the “foundational” wave of AI startups out of Silicon Valley, such as OpenAI and Anthropic. These have ben backed by giant U.S. firms such as Andreessen Horowitz, Sequoia Capital and Lightspeed Venture Partners, all of which now have London offices.

Balderton has singled out London and Paris as key innovation centers. But despite having Bernard Liautaud, a Frenchman, as managing partner of the fund, Balderton didn’t opt to back the Paris-based Mistral.

“We think Mistral is a great company and there’s nothing negative about the team or their mission,” Chandratillake told me. “We think it’s a hard investment for a more early-stage focused VC like ourselves because it’s the kind of company that will have to raise huge amounts of money to stay up with the leaders. If you are early in those sorts of companies, you get really squashed. You won’t have the firepower to keep going, to write checks of hundreds of millions of dollars. And so you get squashed in the cap table, you lose your relevance, you lose your board seat, etc., etc. So it was not necessarily a good fit for our kind of fund. That doesn’t mean it isn’t a great company. It just isn’t a very good fit for us.”

Is the strategy instead to watch the whole AI field play out and pick off the emerging companies? “We believe in foundational models, and we believe that there should be a healthy market of those. But we think that the amount of capital required to build a great foundational model is colossal, [and better suits] private equity firms, hyperscaler public companies that are printing cash in their core businesses,” Chandratillake said.

“We do think there are a lot of interesting companies that are going to get built that use this technology in different ways to solve very specific problems and that’s where you’ll see a lot of our dollars going. Wayve is in our portfolio, and they have raised the largest single round of any AI company in Europe. So I think we feel pretty good about AI.”

TechCrunch also spoke to other VCs to gauge industry opinion about the raise.

..More