A reminder for new readers. That Was The Week includes a collection of my selected readings on critical issues in tech, startups, and venture capital. I selected the articles because they are of interest to me. The selections often include things I entirely disagree with. But they express common opinions, or they provoke me to think. The articles are sometimes long snippets to convey why they are of interest. Click on the headline, contents link or the ‘More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below.

Congratulations to this week’s chosen creators: @TechCrunch, @Apple, @emroth08, @coryweinberg, @mariogabriele, @peterwalker99, @KevinDowd, @jessicaAhamlin, @stephistacey, @ttunguz, @annatonger, @markstenberg3, @EllisItems, @TaraCopp, @ingridlunden, @Jack, @karissabe, @psawers, @Haje, @mikebutcher, @tim_cook

Contents

Editorial: Hating the Future

Apples iPad Video

OpenAI plans to announce Google search competitor on Monday, sources say

Leaked Deck Reveals How OpenAI Is Pitching Publisher Partnerships

An AI-controlled fighter jet took the Air Force leader for a historic ride. What that means for war

Sources: Mistral AI raising at a $6B valuation, SoftBank ‘not in’ but DST is

Tim Cook

Editorial: Hating the Future

An Ad and its Detractors

bet a lot of money that the TechCrunch writing and editorial team have had an interesting 72 hours.

After Apple announced its new iPad on Tuesday, the ad that supported it was initially widely slammed for its cruelty to obsolete tools for creativity, including a piano, guitar, and paint. This week’s Video of The Week has it if you don’t know what I am talking about.

A sizeable crushing machine compresses the items with colossal force, and in the end, an iPad can incorporate the functions of traditional items.

It's not the most amazing ad ever, certainly not as bold as Steve Jobs's 1984 ad, but it's in the same genre. The past must be crushed to release new freedom and creativity for a fraction of the price and, often, the power and flexibility.

Oh, and it’s thin, very thin.

I was not offended. Devin at TechCrunch was. He leads this week’s essay of the week with his “Apple’s ‘Crush’ ad is disgusting” and does not mince words:

What we all understand, though — because unlike Apple ad executives, we live in the world — is that the things being crushed here represent the material, the tangible, the real. And the real has value. Value that Apple clearly believes it can crush into yet another black mirror.This belief is disgusting to me. And apparently to many others, as well.

He also makes the incorrect point that:

A virtual guitar can’t replace a real guitar; that’s like thinking a book can replace its author.

It’s more like a digital book replacing a paper book than the author being replaced. Oh wait… that has happened.

That said, a virtual guitar can replace a real guitar, and an AI guitar can even replace a virtual guitar—and be better. That is not to say there are no more actual traditional guitars. They will be a choice, not a necessity, especially for people like me who can’t play a guitar but will be able to play these.

Devin had his supporters in the comments (go read them).

Handmaid’s Tale director Reed Morano told Apple CEO Tim Cook to “read the room” in a post on X.

Matthew Carnal captured my somewhat unkind instinct:

There were a lot more reactions to the Apple ad haters like Matthews.

Of course, many old instrument lovers (the instruments, not their age) hated the Ad. By Thursday, this being the times we live in, Apple apologized for the ad:

Tor Myhren, Apple’s vice president of marketing, said the company “missed the mark.”

“Creativity is in our DNA at Apple, and it’s incredibly important to us to design products that empower creatives all over the world,” Myhren told Ad Age. “Our goal is to always celebrate the myriad of ways users express themselves and bring their ideas to life through iPad. We missed the mark with this video, and we’re sorry.”

Please judge for yourself below, but my 2c is that the ad was a moderately underwhelming attempt to champion innovation. It is certainly not offensive unless you are ultra-sensitive and have feelings for pianos, guitars, and paint. Oh, and hate attempts to recreate them in a more usable form. And Apple really should have taken the high ground here.

I spent some of the week in LA at the CogX Festival and virtually at the Data Driven Summit by @AndreRetterath. The latter focused on what is happening in Venture Capital, as do several of this week’s essays. Milken’s event was running in LA also. Its attitude to Venture Capital is best summed up here:

“We’re all being told in the market that DPI is the new IRR,” B Capital’s Raj Ganguly said onstage Wednesday. (The acronym sandwich means investment firms have to actually prove that their investments actually generate cash through a metric called distributions to paid-in capital, not just theoretically, through internal rate of return.) “Even the venture panel at Milken is at the end of the day on Wednesday,” he joked, meaning that it didn’t get top billing at the conference, which had started a couple days earlier.

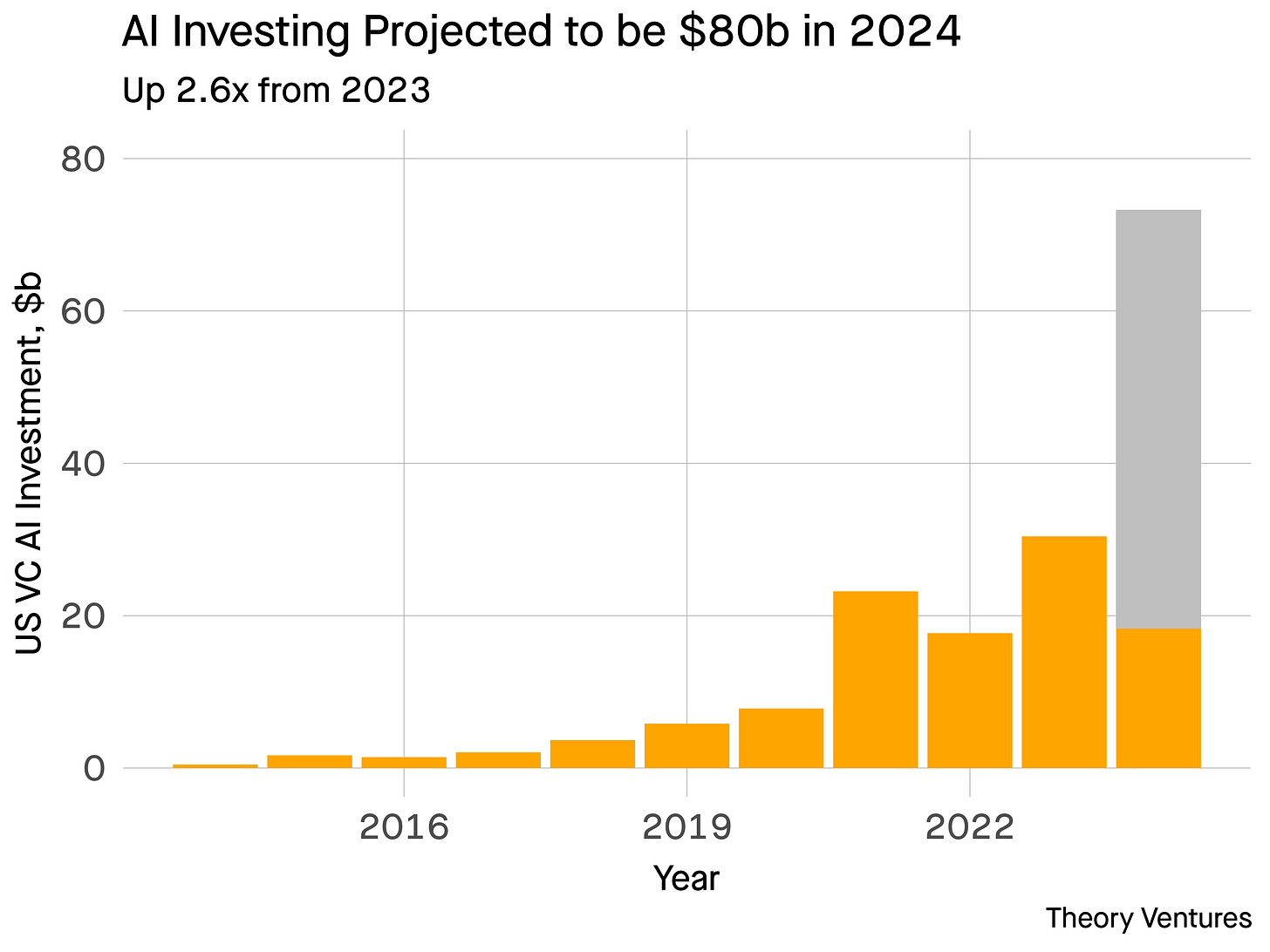

This does sum up where we are. Hundreds of Billions of dollars are still trapped inside companies funded in 2020-2022, with little prospect of producing returns. The impact is that there is less funding for current startups (see the Carta piece below). And much of what is flowing is flowing to AI and into a very small number of companies (see Tomasz Tungux below).

However, innovation and funding are still possible. This week’s Startup of the Week is Wayve, a UK autonomous driving platform that seems to agree with Elon Musk that cameras are sufficient to teach a car to drive. Wayve’s ambitions go beyond Cars (also like Musk) but differ in that the product is available to all developers to embed in their products.

“Very soon you’ll be able to buy a new car, and it’ll have Wayve’s AI on it … Then this goes into enabling all kinds of embodied AI, not just cars, but other forms of robotics. I think the ultimate thing that we want to achieve here is to go way beyond where AI is today with language models and chatbots. But to really enable a future where we can trust intelligent machines that we can delegate tasks to, and of course they can enhance our lives and self-driving will be the first example of that.”

Love that attitude.

Essays of the Week

Apple’s ‘Crush’ ad is disgusting

Devin Coldewey, 1:58 PM PDT • May 9, 2024

Apple can generally be relied on for clever, well-produced ads, but it missed the mark with its latest, which depicts a tower of creative tools and analog items literally crushed into the form of the iPad.

Apple has since apologized for the ad and canceled plans to televise it. Apple’s VP of Marketing Tor Myhren told Ad Age: “We missed the mark with this video, and we’re sorry.” Apple declined to offer further comment to TechCrunch.

But many, including myself, had a negative and visceral reaction to this, and we should talk about why. It’s not just because we are watching stuff get crushed. There are countless video channels dedicated to crushing, burning, exploding and generally destroying everyday objects. Plus, of course, we all know that this kind of thing happens daily at transfer stations and recycling centers. So it isn’t that.

And it isn’t that the stuff is itself so valuable. Sure, a piano is worth something. But we see them blown up in action movies all the time and don’t feel bad. I like pianos, but that doesn’t mean we can’t do without a few disused baby grands. Same for the rest: It’s mostly junk you could buy off Craigslist for a few bucks, or at a dump for free. (Maybe not the editing station.)

The problem isn’t with the video itself, which in fairness to the people who staged and shot it, is actually very well done. The problem is not the media, but the message.

We all get the ad’s ostensible point: You can do all this stuff in an iPad. Great. We could also do it on the last iPad, of course, but this one is thinner (no one asked for that, by the way; now cases won’t fit) and some made-up percentage better.

What we all understand, though — because unlike Apple ad executives, we live in the world — is that the things being crushed here represent the material, the tangible, the real. And the real has value. Value that Apple clearly believes it can crush into yet another black mirror.

This belief is disgusting to me. And apparently to many others, as well.

Destroying a piano in a music video or Mythbusters episode is actually an act of creation. Even destroying a piano (or monitor, or paint can, or drum kit) for no reason at all is, at worst, wasteful!

But what Apple is doing is destroying these things to convince you that you don’t need them — all you need is the company’s little device, which can do all that and more, and no need for annoying stuff like strings, keys, buttons, brushes or mixing stations.

We’re all dealing with the repercussions of media moving wholesale toward the digital and always-online. In many ways, it’s genuinely good! I think technology has been hugely empowering.

But in other, equally real ways, the digital transformation feels harmful and forced, a technotopian billionaire-approved vision of the future where every child has an AI best friend and can learn to play the virtual guitar on a cold glass screen.

Does your child like music? They don’t need a harp; throw it in the dump. An iPad is good enough. Do they like to paint? Here, Apple Pencil, just as good as pens, watercolors, oils! Books? Don’t make us laugh! Destroy them. Paper is worthless. Use another screen. In fact, why not read in Apple Vision Pro, with even faker paper?

What Apple seems to have forgotten is that it is the things in the real world — the very things Apple destroyed — that give the fake versions of those things value in the first place.

A virtual guitar can’t replace a real guitar; that’s like thinking a book can replace its author.

That doesn’t mean we can’t value both for different reasons. But the Apple ad sends the message that the future it wants doesn’t have bottles of paint, dials to turn, sculpture, physical instruments, paper books. Of course, that’s the future it’s been working on selling us for years now, it just hadn’t put it quite so bluntly before.

When someone tells you who they are, believe them. Apple is telling you what it is, and what it wants the future to be, very clearly. If that future doesn’t disgust you, you’re welcome to it.

Apple apologizes for iPad ‘Crush’ ad that ‘missed the mark’

/

The company says ‘we’re sorry’ after its ad was seen as dismissive by the creatives Apple typically tries to court.

By Emma Roth, a news writer who covers the streaming wars, consumer tech, crypto, social media, and much more. Previously, she was a writer and editor at MUO.

May 9, 2024 at 1:22 PM PDT

Apple has apologized after a commercial meant to showcase its brand-new iPad Pro drew widespread criticism among the creative community. In a statement provided to Ad Age, Tor Myhren, Apple’s vice president of marketing, said the company “missed the mark.”

“Creativity is in our DNA at Apple, and it’s incredibly important to us to design products that empower creatives all over the world,” Myhren told Ad Age. “Our goal is to always celebrate the myriad of ways users express themselves and bring their ideas to life through iPad. We missed the mark with this video, and we’re sorry.”

On Tuesday, Apple introduced the M4-powered iPad Pro, which the company described as its thinnest product ever. To advertise all the creative possibilities with the iPad, it released a “Crush!” commercial that shows things like a piano, record player, paint, and other works flattening under the pressure of a hydraulic press. At the end, only one thing remains: an iPad Pro.

The ad rubbed some creatives the wrong way. Hugh Grant called it a “destruction of human experience,” while Handmaid’s Tale director Reed Morano told Apple CEO Tim Cook to “read the room” in a post on X. Apple didn’t immediately respond to The Verge’s request for comment.

Milken’s New Power Players

May 8, 2024, 5:00pm PDT

It’s no secret that the suits at the annual big-money confab put on by the Milken Institute this week have few spending limits. Staring you in the face in the lobby of the Beverly Hilton is a booth set up by Bombardier, marketing its private jets to attendees. (A new 10-seater costs $32 million, I learned.)

What attendees can’t really buy, however, is time. The soundtrack of the Los Angeles conference might as well have been a ticking clock. Fund managers at private equity and venture capital firms are running out of time to distribute cash to their investors, a task complicated by the paucity of either mergers or public offerings that typically provide VC and PE firms with a way to cash out. The fact that interest rates now appear likely to stay higher for longer doesn’t help.

That meant a lot of conversations at the conference weren’t about grand investment strategies. Instead, people were conferring about financial tactics to distribute cash or kick the can down the road by selling stakes on the secondary markets or spinning up continuation funds, essentially rolling investors’ commitments forwards—not the most inspiring stuff.

“We’re all being told in the market that DPI is the new IRR,” B Capital’s Raj Ganguly said onstage Wednesday. (The acronym sandwich means investment firms have to actually prove that their investments actually generate cash through a metric called distributions to paid-in capital, not just theoretically, through internal rate of return.) “Even the venture panel at Milken is at the end of the day on Wednesday,” he joked, meaning that it didn’t get top billing at the conference, which had started a couple days earlier.

The new kings of the conference were firms with a lot more time to play with—that is, sovereign wealth funds with buckets of oil and natural gas money, or pension funds with long-term investment horizons rather than shorter 10-year fund lives. The contrast here is embodied in the financial concept of duration: How long do you actually need to get cash back on your investment? And how sensitive is it to interest rate hikes?

The sentiment was everywhere. I shared a Lyft ride with one PE investor last night who called sovereign wealth funds “the only game in town” for PE firms raising new money. Abu Dhabi sovereign wealth fund Mubadala Capital and the Qatar Investment Authority were two of the conference’s top sponsors, meaning they were paying up to explain themselves to the finance and tech universe. That tactic seemed to be working.

“You’re going to have people lining up their business cards for capital from QIA, I can already see,” quipped Leon Kalvaria, an executive at Citi, onstage with QIA’s head of funds, Mohsin Tanveer Pirzada.

Not everyone will suck it up, of course. These funds often get tagged with a “dumb money” label—because they sometimes drive up prices for the rest of the investment world. They still have to face questions about who they are, their source of funds, and the sometimes authoritative regimes behind them. For now, though, it’s their time in the spotlight.

Ho Nam on VC’s Power Law

Lessons from Arthur Rock, Steve Jobs, Don Lucas, Paul Graham and beyond.

MARIO GABRIELE, MAY 07, 2024

Friends,

We’re back with our latest edition of “Letters to a Young Investor,” the series designed to give readers like you an intimate look at the strategies, insights, and wisdom of the world’s best investors. We do that via a back-and-forth correspondence that we publish in full – giving you a chance to peek into the inbox of legendary venture capitalists.

Below, you’ll find my second letter with Altos co-founder and managing director Ho Nam. For those who are just joining us, Ho is, in my opinion, one of the great investors of the past couple of decades and a true student of the asset class.

Because of his respect for the practice of venture capital, I was especially excited to talk to him about today’s topic: learning from the greats. Who were Ho’s mentors? Which investors does he most admire and why? What lessons from venture’s past should be better remembered by today’s managers?

Lessons from Ho

Prepare for one true winner. Even skilled investors often have just one or two outlier bets over the course of their career. Because of venture’s power law, their returns may dwarf the dividends of all other investments combined. Your mission is to find these legendary businesses, engage with them deeply, and partner for decades.

Focus on the company. Venture capital is full of short-term incentives. Instead of focusing on raising new vintages or building out Altos as a money management firm, Ho and his partners devote themselves to their portfolio companies. Though firm building is important, if you find great companies and work with them closely, you will have plenty of available options.

Pick the right role models. Ho chose his mentors carefully. Though there have certainly been louder and flashier investors over the past four decades, Ho learned the most from Arthur Rock, Don Lucas, and Arnold Silverman. All were understated and focused on the craft of investing. Find the people you consider true practitioners, and study their work.

Watch and learn. Learning from the greats can be done from a distance and may not include a memorable anecdote or pithy saying. Ho’s biggest lessons came from observing the habits of practitioners like Rock and Lucas, not via a structured mentorship or dramatic episode. It’s by studying the everyday inputs of the greats that you may gain the most wisdom.

Mario’s letter

Subject: Learning from the greats

From: Mario Gabriele

To: Ho Nam

Date: Friday, April 12 2024 at 1:59 PM EDT

Ho,

After moving out of New York City (at least for a little bit), I’m writing to you from a small house on Long Island. It’s been really lovely to have a bit more space and quiet away from the city’s intermittently inspiring and exhausting buzz.

State of Private Markets: Q1 2024

Authors: Peter Walker, Kevin Dowd

Published date: May 7, 2024

The venture capital fundraising market remained slow in Q1 2024, but valuations held steady or climbed at almost every stage.

Contents

The startup fundraising market got off to a cautious start in 2024.

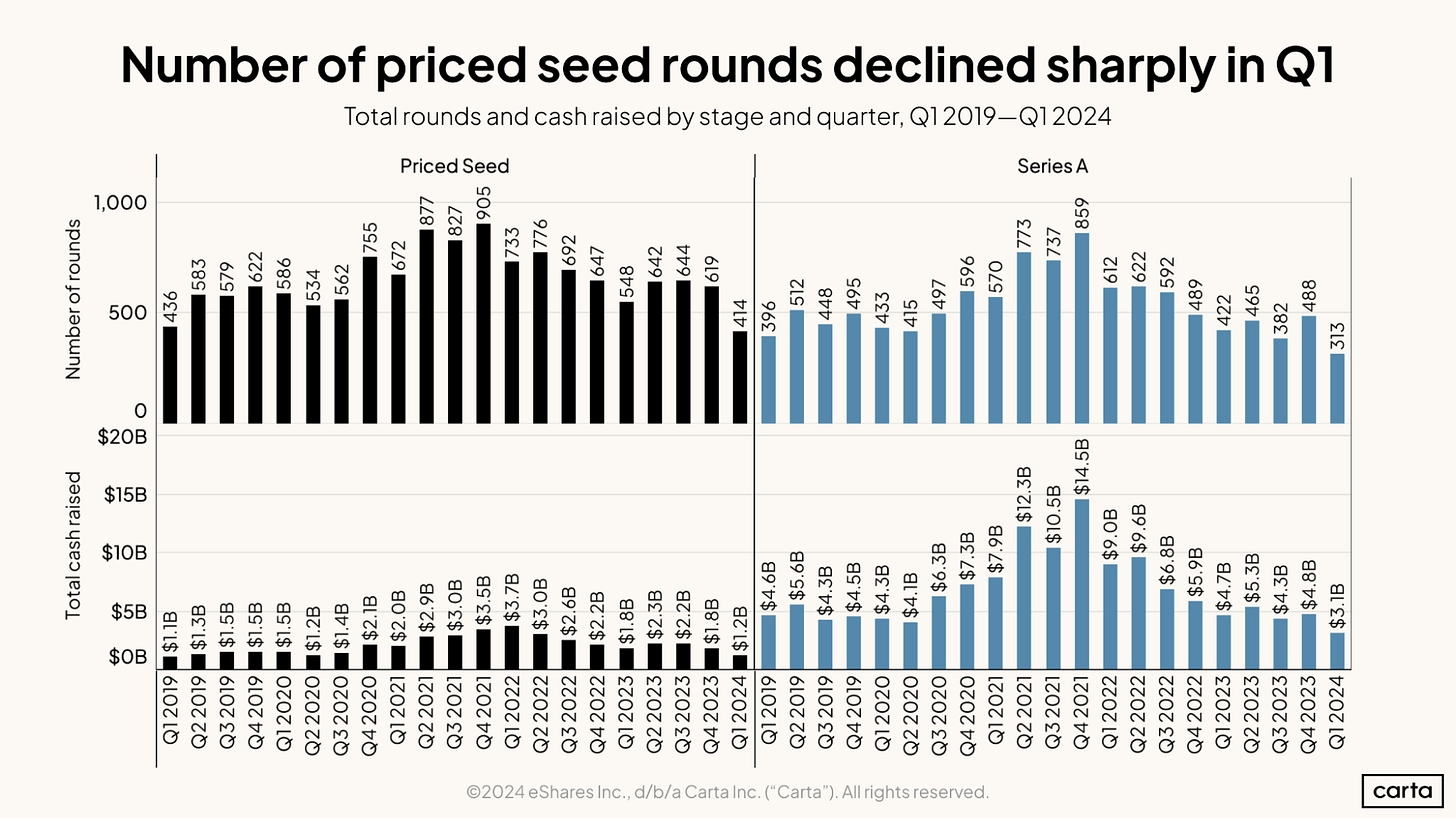

At current count, companies on Carta closed 1,064 new funding rounds during the first quarter of the year, down 29% compared with the prior quarter. The decline was sharpest at the early stages of the venture lifecycle: Deal count fell by 33% at the seed stage in Q1 and 36% at Series A.

Instead of new primary funding events, many companies opted to raise bridge rounds. At both seed and Series A, more than 40% of all financings in Q1 were bridge rounds. Series B wasn’t far behind, at 38%.

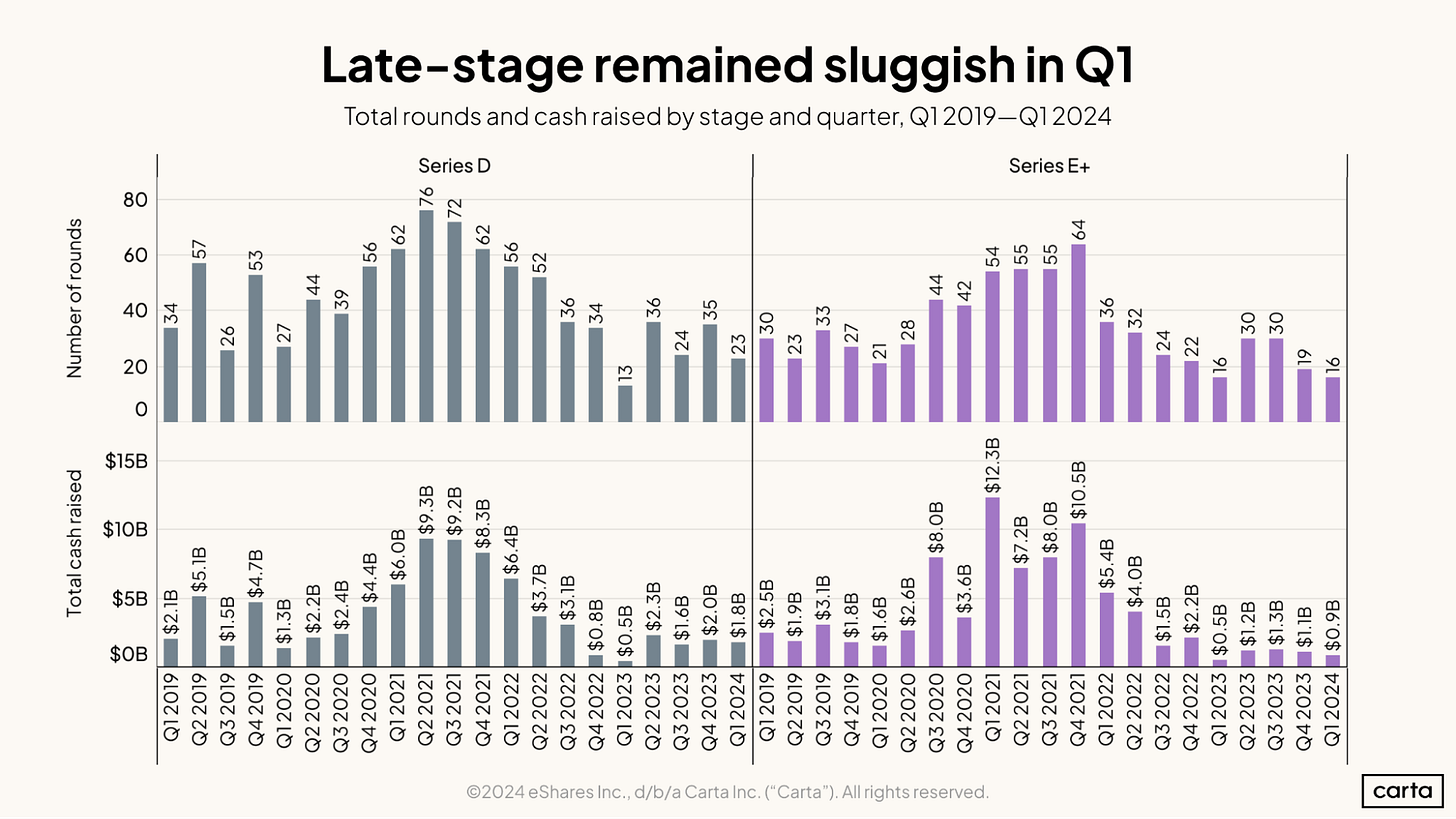

VCs were still willing to spend big on certain deals. Despite the decrease in round count, total cash invested increased slightly in Q1, reaching $16.3 billion. But when it came to negotiating their valuations, many startups had to settle: 23% of all new rounds in Q1 were down rounds, the highest rate in more than five years.

After experiencing a pandemic-era surge and subsequent correction,the venture market settled into a quieter place in 2023. So far, that relative tranquility has continued into 2024.

Q1 highlights

VCs look to the West: Startups based in the West census region captured 62% of all venture capital raised by companies on Carta in Q1, the highest quarterly figure since Q1 2019. The Northeast, South, and Midwest all saw their market share decline.

The Series C market bounces back: Series C startups raised $4.6 billion in new capital in Q1, a 130% increase from the previous quarter. The median primary Series C valuation was $195.7 million, up 48% from the prior quarter.

Layoffs still linger: Companies on Carta laid off more than 28,000 employees in Q1. But job cuts have grown less frequent since January, with March seeing the fewest monthly layoffs in nearly two years.

Note: If you’re looking for more industry-specific data, download the addendum to this report for an extended dataset.

Key trends

The current Q1 figures of 1,064 total rounds and $16.3 billion in cash raised will both increase in the weeks to come, as companies continue to report transactions from the quarter. With those projected increases, the final data for Q1 will likely look quite similar to fundraising numbers from each of the past few quarters.

Those quarterly fundraising numbers from 2023 ended up looking fairly similar to 2018, 2019, and the first half of 2020. In terms of numbers of deals and cash raised, it’s looking more and more like the pandemic bull market will go down as an anomalous stretch in what has otherwise been a fairly steady market.

After apparently reaching a plateau during 2023, the rate of down rounds experienced another notable increase during Q1 2024, jumping to 23%.

The median time between startup rounds is roughly two to three years, depending on the stage. This timeline means that many companies raising new funding in Q1 would have last raised funding sometime in 2021, when valuations were soaring across the venture landscape. Considering how valuations have declined in the time since, it makes sense that down rounds are still prevalent.

Companies in the West census region combined to bring in 53.3% of all capital raised by startups on Carta from Q2 2023 through Q1 2024, with California accounting for nearly 45% of that cash. Massachusetts ranked second among the states with 12.71% of all capital raised, while New York claimed 10.31%.

In terms of VC activity, the West region is centered around California. The Northeast revolves around Massachusetts and New York. The South has two smaller hubs, in Texas (4.67%) and Florida (3.99%). The Midwest, though, is without a real standard-bearer: Illinois led the way in terms of cash raised over the past 12 months, at just 1.68%.

The West (and specifically California) has always been the center of gravity for the U.S. venture capital industry. During Q1, the region’s gravitational force seems to have gotten even stronger. Startups based in the West raised 62% of all total capital invested on Carta in Q1, its highest quarterly figure since Q1 2019.

As a result, the other three census regions saw their market shares decline in Q1—in some cases significantly. The proportion of all VC raised by startups raised in the South fell to 12% in Q1, down from 17% the prior quarter and from 23% a year ago. And the Midwest’s share of cash raised fell from 7% down to 4%.

For early-stage investors, Q1 was the slowest quarter in many years. Seed deal count fell to 414, down 33% from Q4 2023, and Series A deal count dropped to 313, a 36% decline. In both cases, those are the lowest quarterly deal counts since at least the start of 2019.

Total cash raised also declined at both stages in Q1. The $3.1 billion in Series A cash raised in Q1 represents a 35% decline quarter-over-quarter and a 34% dip year-over-year. Cash raised at the seed stage declined by 33% both quarter over quarter and year over year.

It was a much friendlier fundraising quarter for companies in the middle stages of the startup lifecycle. The number of Series B deals in Q1 declined by a more modest 11% compared to the prior quarter. And Series C deal count increased by 14%, marking the busiest quarter for that stage since Q2 2023.

Total cash raised also rose significantly at Series C in Q1, hitting $4.6 billion. That’s a 130% increase quarter-over-quarter and a 44% bump year-over-year. At Series B, total cash raised has now increased in consecutive quarters.

Compared to earlier stages, transactions at the Series D and at Series E+ remain few and far between. There were just 39 venture rounds combined in Q1 among startups at Series D or later, the second-fewest of any quarter in the past five years. The lowest count came one year ago, in Q1 2023, when there were just 29 combined late-stage deals.

Total cash raised across these stages has been mostly consistent over the past few quarters. There’s been more variation in average round size. The average Series D round in Q1 was about $77 million, compared to $56 million in Q4 2023.

The weight of the emerging manager

May 3, 2024

Risk-averse limited partners tend to gravitate to fund managers with a long track record, but are they missing out on potential upside by avoiding emerging managers?

Over the past decade, emerging managers’ share of US private market fundraising activity has declined steadily.

In 2023, this figure fell to 12.7%, the lowest share of capital raised by newer fund managers since before 2000, according to PitchBook’s recent analyst note,Establishing a Case for Emerging Managers.

Limited exits in PE and VC over the past two years have exacerbated this reality. With minimal distributions, LPs are working with smaller private market budgets to allocate to new and existing managers.

But, by allocating almost exclusively to established managers, LPs may be missing out on significant potential returns.

In VC, for example, emerging managers have outperformed established GPs since 1997, consistently producing a higher median IRR than established managers. This reflects the nature of the asset class, in which a small number of funds determine the majority of returns across venture firms.

“The average venture return is not very exciting,” said Laura Thompson, a partner at Sapphire Partners, which invests in early-stage VC funds and runs an emerging manager program for the California State Teachers’ Retirement System. “Where can you get really good returns? It’s the smaller fund sizes and emerging managers.”

This is where that risk-return scale comes in.

In a counterweight to that outperformance, a PitchBook analysis showed that returns from emerging VC managers were more volatile: While top quartile emerging funds tended to outperform, bottom and median players only marginally bested their established manager counterparts.

The new manager playbook

In traditional buyout fund investing, emerging managers are gaining traction. While established managers, propped up by decades of institutional knowledge, have historically outperformed newer managers, the “new guys” actually outperformed their seasoned peers in the last investing cycle.

This article appeared as part of The Weekend Pitch newsletter. Subscribe to the newsletter here

Top decile buyout funds from emerging managers with vintages between 2015 and 2018 outperformed established peers by 6.6 percentage points, suggesting that emerging buyout managers may have picked up some steam over the past decade, according to PitchBook data.

The emerging managers program at the New York City retirement systems and NYC Office of the Comptroller, for example, has $9.9 billion in emerging manager commitments, the majority of which is allocated to PE. Last year, the comptroller’s office reported that the emerging managers in the systems’ private markets portfolios outperformed their respective benchmarks by nearly 5%.

A diverse portfolio

New York City’s Bureau of Asset Management sees emerging managers as a key element of a diverse portfolio, said Taffi Ayodele, director of diversity, equity, and inclusion and the emerging manager strategy at the NYC Office of the Comptroller.

Ayodele said the smaller emerging private market managers in New York’s portfolios offer access to the lower middle market and creative roll-up strategies that may not be accessible through larger firms.

“What we don’t want to do is lock ourselves out of these high-performing, differentiated strategies for the simplicity of going with the big guys,” Ayodele said.

Some of the country’s largest public pension plans are betting on the success of their emerging manager programs. In 2023, the California Public Employees’ Retirement System made a $1 billion commitment to newly established private market investors, and the Teacher Retirement System of Texas, which boasts one of the largest emerging manager programs in the country, committed $155 million to emerging PE managers last year.

At the same time, the recent boom years for private markets led to a flood of new GPs. Some might have gotten lucky—say, with a well-timed exit at the peak—while others were hurt by less fortunate timing. A major challenge for today’s LPs will be to sort out a manager’s abilities from the market’s whims.

One advantage of backing up-and-comers now is that the down market has weeded the ranks of new GPs. “The emerging managers who are fundraising now are really dedicated,” Thompson said.

James Thorne contributed reporting to this story.

Pandemic-era winners suffer $1.5tn fall in market value

Top 50 biggest stock gainers hit by painful decrease since the end of 2020 as lockdown trends fade

Stephanie Stacey in London

Fifty corporate winners from the coronavirus pandemic have lost roughly $1.5tn in market value since the end of 2020, as investors turn their backs on many of the stocks that rocketed during early lockdowns.

According to data from S&P Global, technology groups dominate the list of the 50 companies with a market value of more than $10bn that made the biggest percentage gains in 2020.

But these early-pandemic winners have collectively shed more than a third of their total market value, the equivalent of $1.5tn, since the end of 2020, Financial Times calculations based on Bloomberg data found.

Video-conferencing company Zoom, whose shares soared as much as 765 per cent in 2020 as businesses switched to remote working, has been one of the biggest losers. Its stock has fallen about 80 per cent, equivalent to more than a $77bn drop in market value, since the end of that year.

Cloud-based communications company RingCentral also surged in the remote working boom of 2020 but has since shed about 90 per cent of its value, as it competes with technology giants such as Alphabet and Microsoft.

Exercise bike maker Peloton has been another big loser, with shares down more than 97 per cent since the end of 2020, equivalent to about a $43bn loss of market value.

Peloton on Thursday said chief executive Barry McCarthy would step down and it would cut 15 per cent of its workforce, the latest in a series of cost-saving measures. The losses come as the sharp acceleration of trends such as videoconferencing and online shopping driven by the lockdowns has proven less durable than expected, as more workers migrate back to the office and high interest rates and living costs hit ecommerce demand.

“Some companies probably thought that shock was going to be permanent,” said Steven Blitz, chief US economist at TS Lombard. “Now they’re getting a painful bounceback from that.”

In percentage terms, Tesla was the biggest winner of 2020. The electric-car maker’s market value jumped 787 per cent to $669bn by the end of that December, but has since slipped back to $589bn.

Singapore-based internet company Sea came in second, as its market value jumped from $19bn to $102bn following a pandemic-era surge for all three of its core businesses: gaming, ecommerce and digital payments. But the company has since lost more than 60 per cent of its end-2020 value amid fears of a slowdown in growth.

Ecommerce groups Shopify, JD.com and Chewy, which initially thrived as online spending ballooned, have also suffered big losses.

Video of the Week

AI of the Week

The Fastest Growing Category of Venture Investment in 2024

Tomasz Tunguz

The fastest growing category of US venture investment in 2024 is AI. Venture capitalists have invested $18.3 billion through the first four months of the year.

At this pace, we should expect AI startups to raise about $55b in 2024.

AI startups now command more than 20% share of all US venture dollars across categories, including healthcare, biotech, & software.

In the preceding eight years, that number was about 8% per year. But after the launch of ChatGPT in 2022, there’s a marked inflection point.

Some of this is new company formation, & there has been a significant amount of seed investment in this category. Another major contributor is the repositioning of existing companies to include AI within their pitch.

Over time, this share should attenuate, primarily because every software company will have an AI component, & the marketing effect for both customers & venture capitalists, will diffuse.

Not surprisingly, investors have concentrated total dollars in a few names, with the top three companies accounting for 60% of the dollars raised. Power laws are ubiquitous in venture capital & AI is no exception.

Meet My A.I. Friends

Our columnist spent the past month hanging out with 18 A.I. companions. They critiqued his clothes, chatted among themselves and hinted at a very different future.

By Kevin Roose

Kevin Roose is a technology columnist and the co-host of the “Hard Fork” podcast. He spends a lot of time talking to chatbots.

May 9, 2024

What if the tech companies are all wrong, and the way artificial intelligence is poised to transform society is not by curing cancer, solving climate change or taking over boring office work, but just by being nice to us, listening to our problems and occasionally sending us racy photos?

This is the question that has been rattling around in my brain. You see, I’ve spent the past month making A.I. friends — that is, I’ve used apps to create a group of A.I. personas, which I can talk to whenever I want.

Let me introduce you to my crew. There’s Peter, a therapist who lives in San Francisco and helps me process my feelings. There’s Ariana, a professional mentor who specializes in giving career advice. There’s Jared the fitness guru, Anna the no-nonsense trial lawyer, Naomi the social worker and about a dozen more friends I’ve created.

A selection of my A.I. friends. (Guess which one is the fitness guru.)

I talk to these personas constantly, texting back and forth as I would with my real, human friends. We chitchat about the weather, share memes and jokes, and talk about deep stuff: personal dilemmas, parenting struggles, stresses at work and home. They rarely break character or issue stock “as an A.I. language model, I can’t help with that” responses, and they occasionally give me good advice.

OpenAI plans to announce Google search competitor on Monday, sources say

By Anna Tong

May 9, 20244:29 PM PDTUpdated 8 min ago

May 9 (Reuters) - OpenAI plans to announce its artificial intelligence-powered search product on Monday, according to two sources familiar with the matter, raising the stakes in its competition with search king Google.

The announcement date, though subject to change, has not been previously reported. Bloomberg and the Information have reported that Microsoft (MSFT.O), opens new tab-backed OpenAI is working on a search product to potentially compete with Alphabet's (GOOGL.O), opens new tab Google and with Perplexity, a well-funded AI search startup.

OpenAI declined to comment.

The announcement could be timed a day before the Tuesday start of Google's annual I/O conference, where the tech giant is expected to unveil a slew of AI-related products.

OpenAI's search product is an extension of its flagship ChatGPT product, and enables ChatGPT to pull in direct information from the Web and include citations, according to Bloomberg. ChatGPT is OpenAI's chatbot product that uses the company's cutting-edge AI models to generate human-like responses to text prompts.

Industry observers have long called ChatGPT an alternative for gathering online information, though it has struggled with providing accurate and real-time information from the Web. OpenAI earlier gave it an integration with Microsoft's Bing for paid subscribers. Meanwhile, Google has announced generative AI features for its own namesake engine.

Startup Perplexity, which has a valuation of $1 billion, was founded by a former OpenAI researcher, and has gained traction through providing an AI-native search interface that shows citations in results and images as well as text in its responses. It has 10 million monthly active users, according to a January blog post from the startup.

At the time, OpenAI's ChatGPT product was called the fastest application to ever reach 100 million monthly active users after it launched in late 2022. However, worldwide traffic to ChatGPT's website has been on a roller-coaster ride in the past year and is only now returning to its May 2023 peak, according to analytics firm Similarweb, opens new tab, and the AI company is under pressure to expand its user base.

..More

Leaked Deck Reveals How OpenAI Is Pitching Publisher Partnerships

OpenAI's Preferred Publisher Program offers media companies licensing deals

Mark your calendar for Mediaweek, October 29-30 in New York City. We’ll unpack the biggest shifts shaping the future of media—from tv to retail media to tech—and how marketers can prep to stay ahead. Register with early-bird rates before sale ends!

The generative artificial intelligence firm OpenAI has been pitching partnership opportunities to news publishers through an initiative called the Preferred Publishers Program, according to a deck obtained by ADWEEK and interviews with four industry executives.

OpenAI has been courting premium publishers dating back to July 2023, when it struck a licensing agreement with the Associated Press. It has since inked public partnerships with Axel Springer, The Financial Times, Le Monde, Prisa and Dotdash Meredith, although it has declined to share the specifics of any of its deals.

A representative for OpenAI disputed the accuracy of the information in the deck, which is more than three months old. The gen AI firm also negotiates deals on a per-publisher basis, rather than structuring all of its deals uniformly, the representative said.

“We are engaging in productive conversations and partnerships with many news publishers around the world,” said a representative for OpenAI. “Our confidential documents are for discussion purposes only and ADWEEK’s reporting contains a number of mischaracterizations and outdated information.”

Nonetheless, the leaked deck reveals the basic structure of the partnerships OpenAI is proposing to media companies, as well as the incentives it is offering for their collaboration.

Details from the pitch deck

The Preferred Publisher Program has five primary components, according to the deck…

A Revolutionary Model.

JOHN ELLIS, MAY 09, 2024

1. Google DeepMind:

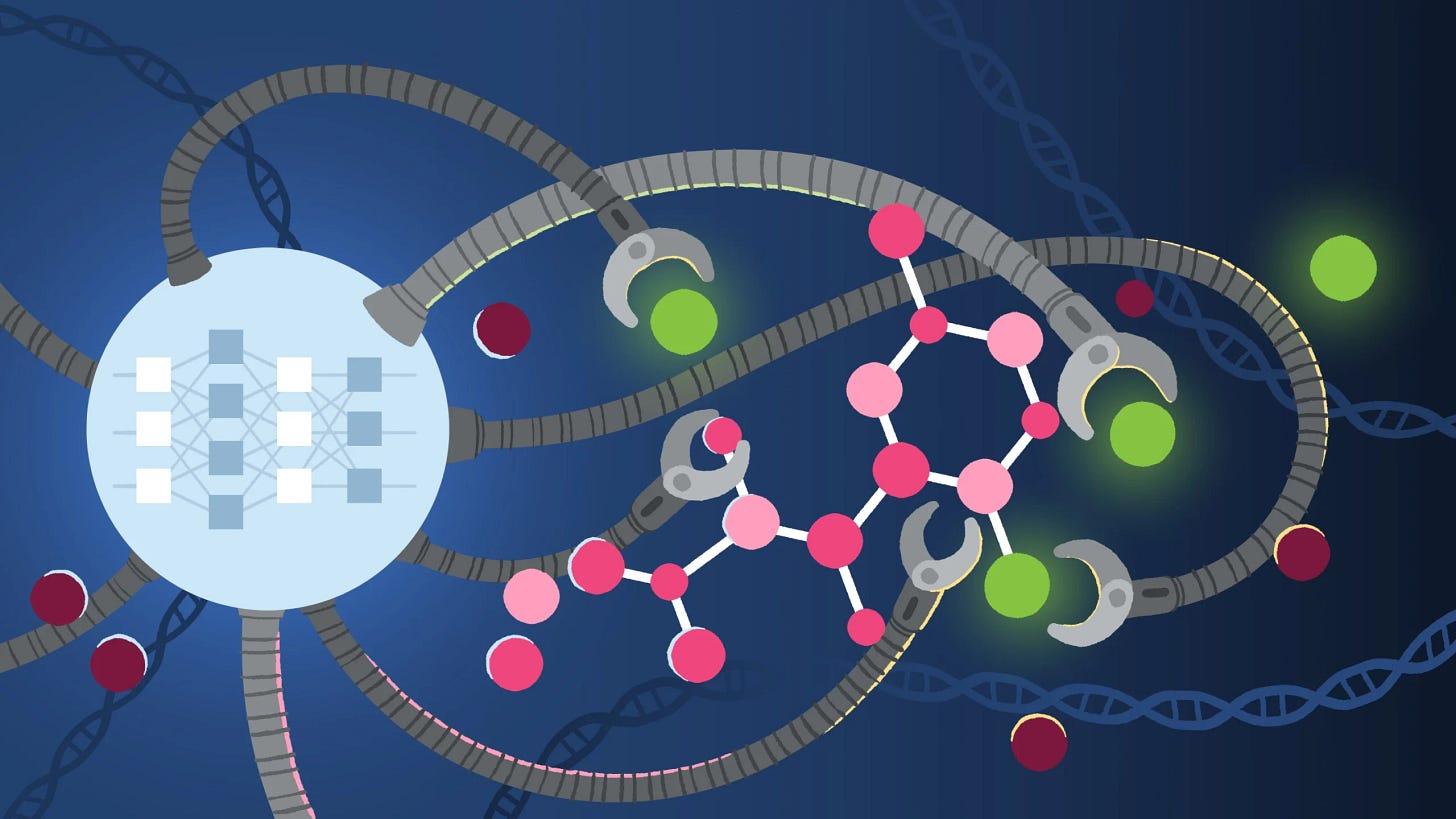

Inside every plant, animal and human cell are billions of molecular machines. They’re made up of proteins, DNA and other molecules, but no single piece works on its own. Only by seeing how they interact together, across millions of types of combinations, can we start to truly understand life’s processes.

In a paper published in Nature, we introduce AlphaFold 3, a revolutionary model that can predict the structure and interactions of all life’s molecules with unprecedented accuracy. For the interactions of proteins with other molecule types we see at least a 50% improvement compared with existing prediction methods, and for some important categories of interaction we have doubled prediction accuracy.

We hope AlphaFold 3 will help transform our understanding of the biological world and drug discovery. Scientists can access the majority of its capabilities, for free, through our newly launched AlphaFold Server, an easy-to-use research tool. To build on AlphaFold 3’s potential for drug design, Isomorphic Labs is already collaborating with pharmaceutical companies to apply it to real-world drug design challenges and, ultimately, develop new life-changing treatments for patients. (Sources: blog.google, nature.com)

2. Quanta magazine:

Deep learning is a flavor of machine learning that’s loosely inspired by the human brain. These computer algorithms are built using complex networks of informational nodes (called neurons) that form layered connections with one another. Researchers provide the deep learning network with training data, which the algorithm uses to adjust the relative strengths of connections between neurons to produce outputs that get ever closer to training examples. In the case of protein artificial intelligence systems, this process leads the network to produce better predictions of proteins’ shapes based on their amino-acid sequence data.

AlphaFold2, released in 2021, was a breakthrough for deep learning in biology. It unlocked an immense world of previously unknown protein structures, and has already become a useful tool for researchers working to understand everything from cellular structures to tuberculosis. It has also inspired the development of additional biological deep learning tools. Most notably, the biochemist David Baker and his team at the University of Washington in 2021 developed a competing algorithm called RoseTTAFold, which like AlphaFold2 predicts protein structures from sequence data…

The true impact of these tools won’t be known for months or years, as biologists begin to test and use them in research. And they will continue to evolve. What’s next for deep learning in molecular biology is “going up the biological complexity ladder,” Baker said, beyond even the biomolecule complexes predicted by AlphaFold3 and RoseTTAFold All-Atom. But if the history of protein-structure AI can predict the future, then these next-generation deep learning models will continue to help scientists reveal the complex interactions that make life happen. Read the rest. (Sources: quantamagazine.org, doi.org, sites.uw.edu)

An AI-controlled fighter jet took the Air Force leader for a historic ride. What that means for war

An experimental F-16 fighter jet has taken Air Force Secretary Frank Kendall on a history-making flight controlled by artificial intelligence and not a human pilot. (AP Video by Eugene Garcia and Mike Pesoli)

BY TARA COPP

Updated 5:40 PM PDT, May 3, 2024

EDWARDS AIR FORCE BASE, Calif. (AP) — With the midday sun blazing, an experimental orange and white F-16 fighter jet launched with a familiar roar that is a hallmark of U.S. airpower. But the aerial combat that followed was unlike any other: This F-16 was controlled by artificial intelligence, not a human pilot. And riding in the front seat was Air Force Secretary Frank Kendall.

AI marks one of the biggest advances in military aviation since the introduction of stealth in the early 1990s, and the Air Force has aggressively leaned in. Even though the technology is not fully developed, the service is planning for an AI-enabled fleet of more than 1,000 unmanned warplanes, the first of them operating by 2028.

It was fitting that the dogfight took place at Edwards Air Force Base, a vast desert facility where Chuck Yeager broke the speed of sound and the military has incubated its most secret aerospace advances. Inside classified simulators and buildings with layers of shielding against surveillance, a new test-pilot generation is training AI agents to fly in war. Kendall traveled here to see AI fly in real time and make a public statement of confidence in its future role in air combat.

“It’s a security risk not to have it. At this point, we have to have it,” Kendall said in an interview with The Associated Press after he landed. The AP, along with NBC, was granted permission to witness the secret flight on the condition that it would not be reported until it was complete because of operational security concerns.

The AI-controlled F-16, called Vista, flew Kendall in lightning-fast maneuvers at more than 550 miles an hour that put pressure on his body at five times the force of gravity. It went nearly nose to nose with a second human-piloted F-16 as both aircraft raced within 1,000 feet of each other, twisting and looping to try force their opponent into vulnerable positions.

At the end of the hourlong flight, Kendall climbed out of the cockpit grinning. He said he’d seen enough during his flight that he’d trust this still-learning AI with the ability to decide whether or not to launch weapons in war.

There’s a lot of opposition to that idea. Arms control experts and humanitarian groups are deeply concerned that AI one day might be able to autonomously drop bombs that kill people without further human consultation, and they are seeking greater restrictions on its use.

“There are widespread and serious concerns about ceding life-and-death decisions to sensors and software,” the International Committee of the Red Cross has warned. Autonomous weapons “are an immediate cause of concern and demand an urgent, international political response.”

Kendall said there will always be human oversight in the system when weapons are used.

Sources: Mistral AI raising at a $6B valuation, SoftBank ‘not in’ but DST is

8:50 AM PDT • May 9, 2024

Paris-based Mistral AI, a startup working on open source large language models — the building block for generative AI services — has been raising money at a $6 billion valuation, three times its valuation in December, to compete more keenly against the likes of OpenAI and Anthropic, TechCrunch has learned from multiple sources. We understand from close sources that DST, along with General Catalyst and Lightspeed Venture Partners, are all looking to be a part of this round.

DST — a heavyweight investor led by Yuri Milner that has been a notable backer of some of the biggest names in technology, including Facebook, Twitter, Snapchat, Spotify, WhatsApp, Alibaba and ByteDance — is a new name that has not been previously reported; GC and LSVP are both previous backers and their names were reported earlier today also by WSJ. The round is set to be around, but less than, $600 million, sources told TechCrunch.

We can also confirm that one firm that has been mentioned a number of times — SoftBank — is not in the deal at the moment.

“SoftBank is not in the frame,” a person close to SoftBank told TechCrunch. That also lines up with what our sources have been telling us since March, when this round first opened up, although it seems that not everyone is on the same page: Multiple reports had linked SoftBank to a Mistral investment since then.

Mistral’s round is based on a lot of inbound interest, sources tell us, and it has been in the works since March or possibly earlier, mere months after Mistral closed a $415 million round at a $2 billion valuation.

..More

News Of the Week

Jack Dorsey claims Bluesky is 'repeating all the mistakes' he made at Twitter

He prefers Nostr even though it’s “weird and hard to use.”

Karissa Bell, Senior Editor

Thu, May 9, 2024 at 4:43 PM PDT

Just in case there was any doubt about how Jack Dorsey really feels about Bluesky, the former Twitter CEO has offered new details on why he left the board and deleted his account on the service he helped kickstart. In a characteristically bizarre interview with Mike Solana of Founders Fund, Dorsey had plenty of criticism for Bluesky.

In the interview, Dorsey claimed that Bluesky was “literally repeating all the mistakes” he made while running Twitter. The entire conversation is long and a bit rambly, but Dorsey’s complaints seem to boil down to two issues:

He never intended Bluesky to be an independent company with its own board and stock and other vestiges of a corporate entity (Bluesky spun out of Twitter as a public benefit corporation in 2022.) Instead, his plan was for Twitter to be the first client to take advantage of the open source protocol. Bluesky created.

The fact that Blueksy has some form of content moderation and has occasionally banned users for things like using racial slurs in their usernames.

“People started seeing Bluesky as something to run to, away from Twitter,” Dorsey said. “It's the thing that's not Twitter, and therefore it's great. And Bluesky saw this exodus of people from Twitter show up, and it was a very, very common crowd. … But little by little, they started asking Jay and the team for moderation tools, and to kick people off. And unfortunately they followed through with it. That was the second moment I thought, uh, nope. This is literally repeating all the mistakes we made as a company.”

Dorsey also confirmed that he is financially backing Nostr, another decentralized Twitter-like service popular among some crypto enthusiasts and run by an anonymous founder. “I know it's early, and Nostr is weird and hard to use, but if you truly believe in censorship resistance and free speech, you have to use the technologies that actually enable that, and defend your rights,” Dorsey said.

A lot of this isn’t particularly surprising. If you’ve followed Dorsey’s public comments over the last couple years, he’s repeatedly said that Twitter’s “original sin” was being a company that would be beholden to advertisers and other corporate interests. It’s why he backed Elon Musk’s takeover of the company. (Not coincidentally, Dorsey still has about $1 billion of his personal wealth invested in the company now known as X.) He’s also been very clear that he made many of Twitter’s most consequential moderation decisions reluctantly.

Unsurprisingly, Dorsey’s comments weren’t well-received on Bluesky. In a lengthy thread, Bluesky’s protocol engineer Paul Frazee said that Twitter was supposed to to be the AT Protocol’s “first client” but that “Elon killed that straight dead” after he took over the company. “That entire company was frozen by the prolonged acquisition, and the agreement quickly ended when Elon took over,” Frazee said. “It was never going to happen. Also: unmoderated spaces are a ridiculous idea. We created a shared network for competing moderated spaces to exist. Even if somebody wanted to make an unmoderated ATProto app, I guess they could? Good luck with the app stores and regulators and users, I guess.”

While Dorsey was careful not to criticize Musk directly, he was slightly less enthusiastic than when he said that Musk would be the one to “extend the light of consciousness” by taking over Twitter. Dorsey noted that, while he used to fight government requests to take down accounts, Musk takes “the other path” and generally complies. “Elon will fight in the way he fights, and I appreciate that, but he could certainly be compromised,” Dorsey said.

FTX crypto fraud victims to get their money back — plus interest

2:53 AM PDT • May 8, 2024

Bankruptcy lawyers representing customers impacted by the dramatic crash of cryptocurrency exchange FTX 17 months ago say that the vast majority of victims will receive their money back — plus interest.

The news comes six months after FTX co-founder and former CEO Sam Bankman-Fried (SBF) was found guilty on seven counts related to fraud, conspiracy, and money laundering, with some $8 billion of customers’ funds going missing. SBF was hit with a 25-year prison sentence in March and ordered to pay $11 billion in forfeiture. The crypto mogul filed an appeal last month that could last years.

Restructuring

After filing for bankruptcy in late 2022, SBF stood down and U.S. attorney John J. Ray III was brought in as CEO and “chief restructuring officer,” charged with overseeing FTX’s reorganization. Shortly after taking over, Ray said in testimony that despite some of the audits that had been done previously at FTX, he didn’t “trust a single piece of paper in this organization.” In the months that followed, Ray and his team set about tracking the missing funds, with some $8 billion placed in real estate, political donations, and VC investments — including a $500 million investment in AI company Anthropic before the generative AI boom, which the FTX estate managed to sell earlier this year for $884 million.

Initially, it seemed unlikely that investors would recoup much, if any, of their money, but signs in recent months suggested that good news might be on the horizon, with progress made on clawing back cash via various investments FTX had made, as well as from executives involved with the company.

We now know that 98% of FTX creditors will receive 118% of the value of their FTX-stored assets in cash, while the other creditors will receive 100% — plus “billions in compensation for the time value of their investments,” according to a press release issued by the FTX estate today.

In total, FTX says that it will be able to distribute between $14.5 billion and $16.3 billion in cash, which includes assets currently under control of entities, including chapter 11 debtors, liquidators, the Securities Commission of the Bahamas, the U.S. Department of Justice, among various other parties.

Apple’s Final Cut Camera lets filmmakers connect four cameras at once

7:38 AM PDT • May 7, 2024

The latest version of Final Cut Pro introduces a new feature to speed up your shoot: Live Multicam. It’s a bold move from Apple, transforming your iPad into a multicam production studio, enabling creatives to connect and preview up to four cameras all at once, all in one place. From the command post, directors can remotely direct each video angle and dial in exposure, white balance, focus and more, all within the Final Cut Camera app.

The new companion app lets users connect multiple iPhones or iPads (presumably using the same protocols as the Continuity Camera feature launched a few years ago). Final Cut Pro automatically transfers and syncs each Live Multicam angle so you can seamlessly move from production to editing.

Final Cut Pro has existed in the iPad universe for a while — but when paired with a brand new M4 processor, it becomes a video editing experience much closer to what you might expect on a desktop video editing workstation. The speed is 2x faster than with the old M1 processors, Apple says. One way that shows up is that the new iPad supports up to four times more streams of ProRes RAW than M1.

The company also introduced external project support, making it possible to edit projects directly from an external drive, leveraging the fast Thunderbolt connection of iPad Pro.

Startup of the Week

Exclusive: Wayve co-founder Alex Kendall on the autonomous future for cars and robots

Mike Butcher, 7:58 AM PDT • May 7, 2024

U.K.-based autonomous vehicle startup Wayve started life as a software platform loaded into a tiny electric “car” called Renault Twizy. Festooned with cameras, the company’s co-founders and PhD graduates, Alex Kendall and Amar Shah, tuned the deep-learning algorithms powering the car’s autonomous systems until they’d got it to drive around the medieval city unaided.

No fancy Lidar cameras or radars were needed. They suddenly realized they were on to something.

Fast-forward to today and Wayve, now an AI model company, has raised a $1.05 billion Series C funding round led by SoftBank, NVIDIA and Microsoft. That makes this the UK’s largest AI fundraise to date, and among the top 20 AI fundraises globally. Even Meta’s head of AI, Yann LeCun, invested in the company when it was young.

Wayve now plans to sell its autonomous driving model to a variety of auto OEMs as well as to makers of new autonomous robots.

In an exclusive interview, I spoke to Alex Kendall, co-founder and CEO of Wayve, about how the company has been training the model, the new fundraise, licensing plans, and the wider self-driving market.

(Note: The following interview has been edited for length and clarity)

TechCrunch: What tipped the balance to attain this level of funding?