A reminder for new readers. That Was The Week includes a collection of my selected readings on critical issues in tech, startups, and venture capital. I selected the articles because they are of interest to me. The selections often include things I entirely disagree with. But they express common opinions, or they provoke me to think. The articles are sometimes long snippets to convey why they are of interest. Click on the headline, contents link, or the ‘More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below.

Congratulations to this week’s creators: @aatilley, @kimmackrael, @gruber, @mgsiegler, @cookie, @AndrewYNg, @sequoia, @mikebutcher, @marketsentiment, @datadrivenvc, @AndreRetterath, @rzhou186, @blockchained000, @lauramandaro, @rideember, @psawers, @affinitybyserif, @canva

Contents

Andrew Ng at Sequoia Capital AI Day

Affinity Acquired by Canva

Editorial

It’s Friday morning in Palo Alto, rain is drizzling down my windows, and the weekend will be wet.

This week’s newsletter is heavily influenced by my week. The AI section is full of great people writing about data-driven venture investing. Mike Butcher of TechCrunch reports on a data study that finds that unicorn founders are heavily populated by “underdogs,” which seems intuitively right. By underdogs, Mike means immigrants, women, and non-whites. As an immigrant myself, with 2 unicorns (but before the 2013 start point for the survey), this wasn’t surprising.

The study (“Unicorn Founder DNA Report”) by Defiance Capital of 845 unicorns and 2,018 unicorn founders set out to look at the “DNA” of unicorn founders, concentrating on the U.S. and U.K. (no EU/European) from 2013 to 2023, to define the common traits of these kinds of founders.

The study found:

70% of unicorns have “underdog founders” (immigrants, women, people of color).

Unicorns used to have only male founders, but this is changing, with 17% having a female founder in 2023.

53% have degrees from the top 10 global universities.

49% of unicorn CEOs had STEM degrees (64% of female founding CEOs had STEM degrees) and 70% of founder teams have STEM degrees.

Outside of SV Angel (6.4%) and YC (10%), no other VC fund got into more than 2.8% (Sequoia) of unicorns. This suggests the market to invest in a potential unicorn is completely fragmented at seed, meaning outlier VC funds have as much chance as a well-known fund to invest in a unicorn at the earliest stages.

The Market Sentiment Substack examines whether Hedge Funds can beat market indexes like the S&P500. Its author is a super experienced investment analyst and concludes that Hedge Funds are far worse than market averages.:

Result

S&P500 has beaten the hedge funds summarily with it returning a whopping 222% more than the hedge fund over the last 24 years [5]. This difference becomes even more drastic if you consider the last 10 years. During 2011-2020, SPY has returned 265% vs the average hedge fund returns of just 60%.

This awesome visualization by AEI shows the enormous difference in returns over the last 10 years.

If you are wondering about the impact of this on the average investor (who will not be able to invest in a Hedge fund due to the stringent capital requirements), these above returns correlate directly with the returns of Fund of Funds (FOF). FOFs usually invest in a wide variety of Hedge funds and do not have the capital requirements required by a normal Hedge fund so that anyone can invest in it.

All of this points to stock picking being harder than buying the whole market.

Andre Retterath of EarlyBird is the publisher of the excellent Data-driven VC and writes about automating the selection of companies - or stock-picking.

Venture capital has mostly not been available as an Index. There is no Private Markets S&P500.

There are too many funding rounds at each stage, and the deals are hard to access. So, venture capital is a stock-picking game. AI and machine learning can aid stock picking but not replace it. Narrowing selection is the name of the game. It is worth quoting Andre at length:

On a portfolio level, early-stage VC returns are distributed based on a Power-law, whereas later-stage and private equity (PE) returns follow a normal distribution. In line with the most well-known Power-law distribution, the Pareto Principle (or “80-20-rule”), early-stage VC returns are driven by a high alpha coefficient that leads to oftentimes only 10% or less of the portfolio delivering 90%+ of the returns.

Consequently, a well-performing early-stage VC fund with a portfolio of 25-35 startups depends on one or two outlier IPOs or trade sales and is comparably insensitive to write-offs. Said differently, early-stage VCs are upside-oriented, whereas growth VCs and PEs rather try to limit their downside.

In turn, every VC investment needs to have the potential to become one of the few outliers. I shared my thoughts and a rule of thumb on how big your startup needs to become to be a VC investment case here.

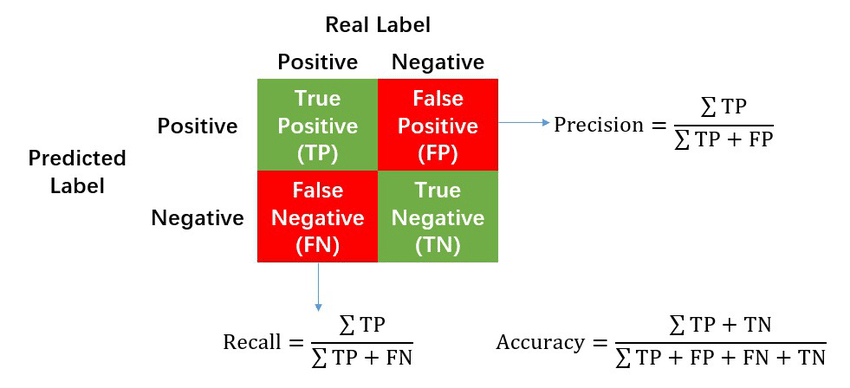

While early-stage VCs can afford to write off a significant portion of their portfolio, they cannot afford to miss an outlier. Translated into data speech: VCs face an asymmetric cost matrix where false positives (FP=decide to invest but need to write it off later) are OK/less costly as they can lose their money only once, but where false negatives (FN=decide to not invest but turns out to be a multi-billion dollar company later) are NOT OK/more costly as they miss an opportunity to multiply their money several times.

He goes on to outline how to reduce false negatives.

Obviously, VCs could decrease FN by investing in every company but in reality, they face natural limitations such as a) how many companies a human VC can look into more detail for screening and b) how many companies a VC can invest in given a fixed fund size, clear split of initial versus follow-on allocation and approximate target with respect to the number of companies in mind. Therefore, a successful VC needs to improve recall (=reduce false negatives) with a fixed number of investments as a limitation.

He proposes “Macro Screening” as a method:

Overall think of the macro level as an equation like success score = a*team score + b*market score + … + n*x-score; whereas a to n are the weights of the respective screening criteria.

And also ‘Micro-Screening:

Micro screening, meaning how VCs evaluate individual screening criteria like “a CS undergrad and subsequent Stanford MBA with 2 years BizDev experience at a scale-up and two complementary technical founders is a great team indicator whereas a uni drop-out who disappeared from the surface and suddenly came back as single founder with a biz idea might be a bad team signal”. The example is bad, I know, but you get the point ;)

Ray Zhou of the Forbes Council writes about methods for screening too:

From job change signals, company growth signals and website traffic signals to communications and activity on X and GitHub, everyone and everything has some kind of digital footprint now. The opportunity lies in collecting every relevant data point from that footprint to develop a superhuman coverage of your investing thesis.

Data-driven firms can effectively analyze all that data to identify earlier when a signal becomes interesting and when to reach out to turn the opportunity into a deal. They use automation to automatically update CRM records, log interactions and keep all that deal data up to date.

Christian Martinez of @The Financial Fox writes and advises how to use ChatGPT to assist with screening and selection.

These pieces were fortuitous because my week consisted of working on the next version of SignalRank’s selection algorithm. Before starting its’s important to note that different goals imply different methods of deploying data as an aid to selection.

A VC like Andre aims to fund Alpha (individual winners) or, as he calls it, “finding a needle in a haystack”. His goal of excluding false negatives is best understood in that context.

SignalRank’s goal is different. We are not looking for individual winners. We are looking to exclude high-risk companies from a high-performing Index in order to produce “smart beta” or a stable of good companies. We remove “hay” to concentrate the “needles” in the remaining group. As such, our data strategies are not comparable in terms of “good” or “bad”. They are different.

To be specific about the SignalRank algorithm, when it removes likely negatives (companies that will fail), it is left with a smaller group (roughly 15%, but we can tune that to any %). The remaining group has a higher percentage of likely winners (positives). The winning group breaks down into true positives (real winners) and false positives (losers). We have done that since v1 of the algorithm in 2022.

The 15% of companies we select at any stage (Pre-Seed, Seed, Series A, B, C and so on) perform far better than the market average. For example, in the market as a whole about 10% of Series B companies become Unicorns; for us, in v2 of the SignalRank algorithm, that is above 25%. All Series Bs produce an average return of 3.5x at the five-year mark in the market. v2 of Signalrank produces selections that exceed 5x, so our true positive ratio is very good.

The job this week was to improve what Andre calls ‘recall”. That is removing false negatives. To achieve that, I worked on v3 of the Signalrank algorithm.

After one week of tuning, our backtest shows 30% unicorns and an average gain of 8.47x across 2012-2024 and 9.4x 2012-2019 (a more realistic time frame as letter Series B companies are still maturing).

The number of companies in the selection stays constant at 2900 (2012-2024). So, clearly, the true positives have grown as a proportion of the total, and the false negatives have declined.

Here is an Excel spreadsheet that you can use to assess the outcomes.

Because of the differing goals, I do not use any of the signals Mike, Andre, Ray, or Christian listed.

Early-stage data about a company is highly likely to produce false positives. All of my signals leverage data about investors, not companies. Unlike a startup, investors have a meaningful track record, and many have repeatable performance. By scoring investors' expertise at specific funding stages, I can analyze and score a term sheet before closing without any company due diligence. That work is left where it belongs - with investors. A similar real-world example would be scoring the success of a coach over her career as a better way of predicting how their team might perform. It is “money ball” for decision-makers.

While Andre is right that reducing false negatives (missing a good one) is important for pursuing individual investments, it is only the second stage for SignalRank. It has to be good at removing likely losers and producing a pool of likely winners.

The job of re-introducing false negatives starts there. SignalRank v3 has a higher recall than the first 2 versions (2022 and 2023).

SignalRank invests money in Series B rounds that qualify by supporting the pro-rata rights of investors in prior rounds of the company. Those investors are our partners and owners of the pro-rata capability. The partners own a share of profits in the outcomes. So, as with Andre, this is a “put your money where your mouth is” game.

It starts with scoring Series B term sheets, which have already been scored in prior rounds for the company. Investment qualifiers are known as “The SignalRank Index”

Then, we look at the number of Series B term sheets we see via our partners and invest in the qualifiers based on the score above a threshold. Thresholds are calculated daily.

Our current portfolio of 11 investments, which has been developing since June 2023, is testimony to the flow from qualification to partners supplying access to actual investment.

The bottom line is that we can successfully use data-driven selection processes to create a flow of scored opportunities that backtest amazingly. We can also access current Series Bs by supporting the rights of Seed and Series A investors. The future performance will reflect the choices and may be better or worse than the backtest of course.

In the process of scoring the companies we removed 85% or more of possible Series B rounds and invested in many of the rest (today, we see about 20% of the term sheets of qualifiers before close).

A share of SignalRank is an ownership token (a share) of all the companies we invest in. In other words, it is an Index. The SignalRank Index is a data-driven private market asset class that outperforms the market and most individual stock pickers due to its S&P500-like characteristics. Our goal is to make a share of SignalRank the equivalent of being able to buy a top-performing Index. We are well on the way.

Essays of the Week

Apple Turns to Longtime Steve Jobs Disciple to Defend Its ‘Walled Garden’

Former Chief Marketing Officer Phil Schiller has frequently made it clear that Apple doesn’t intend to yield to developer criticism

By Aaron Tilley, and Kim Mackrael

Software developers and regulators battling Apple over how it grants access to its more than two billion active devices increasingly find themselves at odds with one man:Phil Schiller.

Apple’s former chief marketing officer and longtime “mini-me” to Steve Jobs has emerged as perhaps the most ardent public defender of the company’s ecosystem, a vision of electronic devices that work seamlessly together and protect user security and privacy.

Once seen as a virtue, Apple’s vision has increasingly come under attack, from regulators in the Justice Department, the European Union and other jurisdictions as well as from rivals including Spotify,Microsoft, Match Group,X and Meta. Critics see Apple’s fees as excessive and have suggested its control of external software is oppressive and impeding innovation.

In legal filings, public announcements and courtrooms, Apple has made it clear that it isn’t going to go down without a fight, and more often than not, Schiller has been the one to deliver the message.

Phil Schiller, left, was a primary company witness in Epic Games’ antitrust lawsuit against Apple in 2021. PHOTO: DAVID PAUL MORRIS/BLOOMBERG NEWS

“I have no qualms in saying that our goal is going to always be to make the App Store the safest, best place for users to get apps,” Schiller recently told Fast Company. “I think users—and the whole developer ecosystem—have benefited from that work that we’ve done together with them. And we’re going to keep doing that.”

An Apple spokesman declined to make Schiller available. The spokesman said Apple complies with the law in countries where it does business and in a way that protects the user experience that its customers value.

Although Schiller retired from his role as chief of marketing in 2020, he continues as an “Apple Fellow,” a transition that led some Apple watchers to wonder whether he was close to retirement. Instead, he has become the public face of Apple’s efforts to defend itself.

He served as a primary company witness in “Fortnite”-maker Epic Games’ antitrust lawsuit against Apple in 2021. On the stand, Schiller made the case that Apple had invested in the store, worked to create a level playing field and avoided charging for certain kinds of apps. Apple largely prevailed in the case.

On social media and in media interviews, Schiller has frequently made it clear that Apple doesn’t intend to yield to developer criticism. In February, he chided the chief executive of Epic Games for criticizing Apple’s plan for complying with a new law called the Digital Markets Act in Europe requiring it to allow software downloads outside of the app store.

“Your colorful criticism of our DMA compliance plan, coupled with Epic’s past practice of intentionally violating contractual provisions with which it disagrees, strongly suggest that Epic” doesn’t intend to follow the rules, he wrote in a Feb. 23 email that Epic published online. In March, Apple said the company had canceled Epic’s developer account, drawing criticism from an EU enforcement official. Apple reversed the decision shortly thereafter.

Schiller has warned that the new EU rules might lead to objectionable content that the App Store has always sought to prevent and said Apple was trying to minimize new security risks.

Defending the ‘walled garden’

Schiller’s strident advocacy is emblematic of Apple’s internal rancor over the fight, which many see as an existential challenge to the “walled garden” of controlled and connected devices and software that dates back to Jobs, the company’s co-founder.

Other Apple executives including Chief Executive Tim Cook have also defended its approach. Cook, who often allows lieutenants to handle their areas of responsibility, defers to Schiller on some App Store matters, people familiar with the company said. Schiller oversees the App Store alongside marketing head Greg Joswiak and services chief Eddy Cue, but Schiller has acted as its most prominent advocate.

The EU’s Share of Apple’s Global Revenue

Tuesday, 26 March 2024

By JOHN GRUBER

A few readers have asked about my speculation that Apple, along with the other DMA-designated gatekeepers (none of which are European companies of course), might reasonably pull out of the relatively small EU market rather than risk facing disproportionately large fines from the European Commission. The DMA allows the EC to fine gatekeepers up to 10 percent of global revenue (which would hit a hardware-based company like Apple particularly hard) for a first offense, and up to 20 percent for subsequent fines. But the EU represents only 7 percent of Apple’s revenue. That figure comes from CFO Luca Maestri on Apple’s Q1 2024 analyst call:

AMIT DARYANANI, EVERCORE: Fair enough, and then as a follow up, you folks have implemented a fair bit of changes around the apps for in Europe post the DMA implementation there. Can you just touch on what are some of the key updates and then Luca, does NetApp at all, do you see it having any significant impact financially to your services or the broader Apple P&L statement.

[Remarks from Tim Cook omitted.]

LUCA MAESTRI: Yes, and Amit, as Tim said, these are changes that we’re going to be implementing in March. A lot will depend on the choices that will be made. Just to keep it in context, the changes apply to the EU market, which represents roughly 7% of our global absolute revenue.

It’s unclear whether Maestri was saying that the EU accounts for 7 percent of Apple’s worldwide App Store revenue, or 7 percent of all revenue, but I suspect it doesn’t matter, and that both are around 7 percent. App Store revenue ought to be a good proxy for overall revenue — there’s no reason to think EU Apple users spend any less or any more in the App Store than users around the world.

There’s some “7 percent sounds way too low” confusion that stems from the fact that Apple, in its quarterly consolidated financial statements, breaks results into five geographic regions: Americas, Europe, Greater China, Japan, and “Rest of Asia Pacific”. “Europe” accounts for somewhere around 25 percent of Apple’s global revenue. That’s the number most people think about. But there are a significant number of high-GDP countries in Europe that aren’t in the EU — the UK (most famously), Russia, Turkey, Switzerland, Norway, and Ukraine. More importantly, Apple’s “Europe” includes the entire Middle East.

So EU member states account for only 25–30 percent of Apple’s revenue from “Europe”, and just 7 percent globally. 7 percent is significant, to be sure, and in addition to users, there are of course many iOS and Mac developers in EU countries. I really don’t know what Apple pulling out of the EU would even look like, but it would be ugly. Could they merely stop selling the iPhone there but continue selling other products? Would that create a massive gray market for iPhones imported from outside the EU? How would Apple deal with the hundreds of millions of existing iPhone owners in the EU? I have no idea. It would be a mess, to be sure, but the DMA has already made doing business in the EU a mess for Apple and the other designated gatekeepers. But one can make the case — as Eric Seufert has — that American companies have to at least consider the fact that doing business in the EU isn’t worth the risk of fines so vastly disproportionate to the revenue they generate in the EU.

And it’s not like the risk is merely a first-offense fine of up to 10 percent of annual global revenue and a single second fine of up to 20 percent — there’s no limit to how many times the EC can fine a gatekeeper for non-compliance with the DMA’s arbitrary and vague rules.

Apple EU Fine is Bonkers

In my post a couple weeks ago making the case for the one way Apple could go back on offense against the EU: by threatening to pull their products out of Europe, I thought that while a powerful move, it probably wasn't feasible:

This would all mean a ding in revenue. The EU isn't as important to Apple as the US or China, but it certainly matters.2 Does it matter more than say, 10% of worldwide revenue? Perhaps not! And the broader calculus would have to be something along the lines of: if we give into these EU demands, the whole world will start demanding the same, and that would significantly degrade the largest growth driver of our revenue: Services.

That footnote #2 notes:

Data suggests there are something well north of 100M iOS users (including iPadOS) in the region. And undoubtedly many millions more Mac users.

But actually, that number that matters here is perhaps more directly known, as John Gruber points out, no less than Apple CFO Luca Maestri addressed this head-on during Apple’s Q1 2024 analyst call:

AMIT DARYANANI, EVERCORE: Fair enough, and then as a follow up, you folks have implemented a fair bit of changes around the apps for in Europe post the DMA implementation there. Can you just touch on what are some of the key updates and then Luca, does NetApp at all, do you see it having any significant impact financially to your services or the broader Apple P&L statement.

[Remarks from Tim Cook omitted.]

LUCA MAESTRI: Yes, and Amit, as Tim said, these are changes that we’re going to be implementing in March. A lot will depend on the choices that will be made. Just to keep it in context, the changes apply to the EU market, which represents roughly 7% of our global absolute revenue.

Gruber goes on to note:

It’s unclear whether Maestri was saying that the EU accounts for 7 percent of Apple’s worldwide App Store revenue, or 7 percent of all revenue, but I suspect it doesn’t matter, and that both are around 7 percent. App Store revenue ought to be a good proxy for overall revenue — there’s no reason to think EU Apple users spend any less or any more in the App Store than users around the world.

There’s some “7 percent sounds way too low” confusion that stems from the fact that Apple, in its quarterly consolidated financial statements, breaks results into five geographic regions: Americas, Europe, Greater China, Japan, and “Rest of Asia Pacific”. “Europe” accounts for somewhere around 25 percent of Apple’s global revenue. That’s the number most people think about. But there are a significant number of high-GDP countries in Europe that aren’t in the EU — the UK (most famously), Russia, Turkey, Switzerland, Norway, and Ukraine. More importantly, Apple’s “Europe” includes the entire Middle East.

So this is actually pretty simple math. If the EU is truly going to slap Apple with a fine to the tune of 10 percent of global revenue, there's no way it makes sense for Apple to stay in the 7 percent of global revenue EU. And that's with just the first offense, which Apple is clearly already well down the path of committing in the eyes of the EU. The second offense doubles that fine. At that point, Maestri and Tim Cook would be fired if they paid that fine versus pulling out of the EU.

Marissa Mayer’s startup just rolled out photo sharing and event planning apps, and the internet isn’t sure what to think

Connie Loizos @cookie / 12:18 AM PDT•March 27, 2024

Image Credits: Nhat V. Meyer/Bay Area News Group / Getty Images

When Marissa Mayer co-founded a startup six years ago in Palo Alto, California, expectations were sky high for the former Yahoo CEO and early Google employee. When that startup, Sunshine, revealed that its first app centered around subscription software for contact management, people wondered if something more ambitious might be around the corner. Today, after Sunshine released two equally mundane features — event organizing and photo sharing — internet commenters were decidedly mystified.

I was also baffled last week when Mayer walked me through Sunshine’s new offerings. Though there are AI components to all that Sunshine offers, it’s hard to understand how Sunshine’s new photo app enhances photo sharing as it exists today, and the same could be said of its new events app, which looks very much like something that was designed 20 years ago.

It’s tempting to dismiss the 15-person outfit as out of touch. But Mayer may be onto something with Sunshine, and that’s nostalgia. Throwback tech is all the rage these days. Further, while most Silicon Valley startups focus on the newest new thing, America is getting older, as the U.S. Census Bureau declared last year. Mayer says Sunshine is tackling problems for people “of all ages,” but targeting a slightly older demographic that gravitates toward the familiar would be a smart move. Older Americans now account for a record share of spending. They have the time to socialize and take pictures. Sunshine’s interface is even steeped in the same purple hue that was long associated with Yahoo, which she famously led for five years beginning in 2012.

Asked if the design choice was intentional, Mayer seemed surprised for a moment, calling it “purely coincidental.” She instead offered that users’ photos are hosted on Sunshine’s servers and “available indefinitely,” and that users can share albums and send invites easily through text, iMessage, email and other sharing platforms. Mayer further stressed that Sunshine will never sell its customers’ data to a third party and that the company is “not building models or deriving any other data for any other purposes from what is shared.”

Mayer sees the need for something simpler, certainly. “There are a lot of companies that focus on that bleeding and leading edge of AI,” she said. “But we think there’s a lot of things that can be done with AI that just help with everyday problems, things that we all experience every day, and are often overlooked.”

She mentioned, for example, that before launching events and photo sharing, Sunshine rolled out a birthday app as “kind of an adjacent area to addresses and contacts.”

She declined to discuss customer numbers, but the product is reminiscent of an app run by entrepreneurs Michael and Xochi Birch called BirthdayAlarm.com. The birthday reminder and e-card site is not exactly design forward, but with more than 50 million registered members at one point, it has made the couple — who earlier sold a social media company to AOL for $850 million in cash — many millions more dollars.

Video of the Week

What's next for AI agentic workflows ft. Andrew Ng of AI Fund

AI of the Week

New study of unicorn founders finds most are ‘underdogs,’ and female founders are rising

Mike Butcher @mikebutcher / 3:24 AM PDT•March 27, 2024

Image Credits: Defiance Capital

A new study that zeros-in on the founders of so-called “unicorns” — companies worth over a billion dollars — has found most have “underdog” founders who are often drawn from the top 10 universities. There’s also a rising female founder make-up, and no obvious monopoly at seed stage of funding for VCs.

The study (“Unicorn Founder DNA Report”) by Defiance Capital of 845 unicorns and 2,018 unicorn founders set out to look at the “DNA” of unicorn founders, concentrating on the U.S. and U.K. (no EU/European) from 2013 to 2023, to define the common traits of these kinds of founders.

The study found:

70% of unicorns have “underdog founders” (immigrants, women, people of color).

Unicorns used to have only male founders, but this is changing, with 17% having a female founder in 2023.

53% have degrees from the top 10 global universities.

49% of unicorn CEOs had STEM degrees (64% of female founding CEOs had STEM degrees) and 70% of founder teams have STEM degrees.

Outside of SV Angel (6.4%) and YC (10%), no other VC fund got into more than 2.8% (Sequoia) of unicorns. This suggests the market to invest in a potential unicorn is completely fragmented at seed, meaning outlier VC funds have as much chance as a well-known fund to invest in a unicorn at the earliest stages.

The study further found that unicorns were dominated by white founders, but that every third unicorn had an Asian founder. Indeed, 38% of unicorns had at least one founder who was not white: 82% had at least one white founder, 62% had first or second generation immigrant founders. Only 3% of unicorns had a black founder.

And only 21% of immigrant and female founders raised from top 10 VCs. Teams with female founders were two years younger than all-male teams when founding their unicorns (32 versus 34).

Serial founders (50%) were more likely to succeed building unicorns, but only one in five unicorns had solo founders.

During the last decade, all top seed funds were generalist funds, and the market for seed funds is highly fragmented. Only 28% had raised capital from a top VC seed fund (with more than 1% market share).

Only 34% of unicorn founders had worked at an elite employer prior to founding a unicorn, suggesting a McKinsey or similar background is not a prerequisite to success.

The study also found three dominant factors in the “DNA” of a unicorn founder.

1. No “plan B”

2. “A chip on the shoulder”

3. Unlimited self-belief

Do Hedge Funds beat the market?

I analyzed the performance of 5000+ Hedge Funds over the past 24 years and benchmarked it against SP500. Here are the results!

MARKET SENTIMENT, AUG 08, 2021

Hedge Funds are a controversial breed of companies. On one hand, you have Michael Burry’s Scion Capital returning 489% shorting the housing market and on the other hand, you have Melvin Capital losing 53% of its investment value in 1 month following them shorting GameStop. Adding to this, most hedge funds have an eye-watering 2 and 20 fee structure -> What this means is that they will take 2% of your investment value and 20% of your profits every year as management fees [1].

Even with these significant risk factors and hefty fees, the total assets managed by Hedge Funds have grown year on year and is now over $3.8 Trillion. Given that you need to be an institutional or accredited investor to invest directly in a hedge fund [2], it begs the question

Do Hedge funds beat the market?

Data

The individual performance data of hedge funds are extremely hard to get [3]. For this analysis, I would be using the Barclay Hedge Fund Index that calculates the average return [4] of 5,878 Hedge Funds. The data is available from 1997.

This dataset was also used by American Enterprise Institute in their analysis, so the data must be accurate. All the data used in this analysis is shared as a Google sheet at the end.

Result

S&P500 has beaten the hedge funds summarily with it returning a whopping 222% more than the hedge fund over the last 24 years [5]. This difference becomes even more drastic if you consider the last 10 years. During 2011-2020, SPY has returned 265% vs the average hedge fund returns of just 60%.

This awesome visualization by AEI shows the enormous difference in returns over the last 10 years.

If you are wondering about the impact of this on the average investor (who will not be able to invest in a Hedge fund due to the stringent capital requirements), these above returns correlate directly with the returns of Fund of Funds (FOF). FOFs usually invest in a wide variety of Hedge funds and do not have the capital requirements required by a normal Hedge fund so that anyone can invest in it.

The catch here is that you will be paying the management fee for both FOFs as well as the Hedge Funds. This implies that your net return would be even lower than directly investing in the Hedge Fund. This becomes apparent as if you consider the last 24 years, on average FOFs (Barclay Fund of Funds index), returned 233.1% (~390% less than avg Hedge Fund) vs SPY returning 846%!

Warren Buffet’s take of Hedge Funds

In 2007, Warren Buffet had entered into a famous bet that an unmanaged, low-cost S&P 500 stock index fund would out-perform an actively managed group of high-cost hedge funds over the ten-year period from 2008 to 2017 when performance was measured net of fees, costs, and expenses. The result was similar to the above with S&P 500 beating all the actively managed funds by a significant margin. This is what he wrote to the investors in his annual letter

A number of smart people are involved in running hedge funds. But to a great extent their efforts are self-neutralizing, and their IQ will not overcome the costs they impose on investors. Investors, on average and over time, will do better with a low-cost index fund than with a group of funds of funds.

Performance comes, performance goes. Fees never falter

While I don’t completely agree with this view that it’s impossible for Hedge Funds to beat the market (The famous Medallion Fund of Renaissance Technologies[6] have returned 39% annualized returns (net of fees) compared to S&P 500‘s ~8% annualized returns over the last 30 years). But, it seems that on average Hedge Funds do return lesser than the stock market benchmark!

An alternative view

It would be now easy to conclude now that Hedge funds are pointless and the people who invest them in at not savvy investors. But,

Given that the investors who invest in Hedge Funds usually are high net worth individuals having their own Financial Advisors or Pension Funds having teams of analysts evaluating their investments, why would they still invest in Hedge Funds that have considerably lesser returns than SPY?

How to Automate Startup Screening?

Finding the Needle in the Haystack

MAR 28, 2024

What Makes a VC Successful?

“Beauty is in the eye of the beholder” also holds true for VC success. Although we have been observing a shift from a pure financial return perspective to a more holistic ESG-centered one, the majority of GPs still operate with return on investment (ROI) top of their minds.

On a portfolio level, early-stage VC returns are distributed based on a Power-law, whereas later-stage and private equity (PE) returns follow a normal distribution. In line with the most well-known Power-law distribution, the Pareto Principle (or “80-20-rule”), early-stage VC returns are driven by a high alpha coefficient that leads to oftentimes only 10% or less of the portfolio delivering 90%+ of the returns.

Consequently, a well-performing early-stage VC fund with a portfolio of 25-35 startups depends on one or two outlier IPOs or trade sales and is comparably insensitive to write-offs. Said differently, early-stage VCs are upside-oriented, whereas growth VCs and PEs rather try to limit their downside.

In turn, every VC investment needs to have the potential to become one of the few outliers. I shared my thoughts and a rule of thumb on how big your startup needs to become to be a VC investment case here.

While early-stage VCs can afford to write off a significant portion of their portfolio, they cannot afford to miss an outlier. Translated into data speech: VCs face an asymmetric cost matrix where false positives (FP=decide to invest but need to write it off later) are OK/less costly as they can lose their money only once, but where false negatives (FN=decide to not invest but turns out to be a multi-billion dollar company later) are NOT OK/more costly as they miss an opportunity to multiply their money several times.

Obviously, VCs could decrease FN by investing in every company but in reality, they face natural limitations such as a) how many companies a human VC can look into more detail for screening and b) how many companies a VC can invest in given a fixed fund size, clear split of initial versus follow-on allocation and approximate target with respect to the number of companies in mind. Therefore, a successful VC needs to improve recall (=reduce false negatives) with a fixed number of investments as a limitation.

Join 21,000+ thought leaders from VCs like a16z, Accel, Index, Sequoia, and more.

Subscribed

Cutting Through the Noise

How can VCs improve recall while being sensitive to capital constraints? Having spoken to hundreds of VC firms about their screening processes (partially throughout my PhD research, partially thereafter; detailed overview in my paper here pg11-14), I identified two important screening dimensions and four major groups of screening approaches. Let’s find the needle in the haystack!

The Two Most Important Screening Dimensions:

Macro screening, meaning how VCs balance different screening criteria (such as team, problem/market (size, growth, timing pull/push, fragmentation), solution/product (USP, IP, etc), business model, go-to-market motion, traction (product, financial), competitive landscape, defensibility, cap table, round structure etc) relatively against each other. For example, team matters more than market size. Overall think of the macro level as an equation like success score = a*team score + b*market score + … + n*x-score; whereas a to n are the weights of the respective screening criteria.

Micro screening, meaning how VCs evaluate individual screening criteria like “a CS undergrad and subsequent Stanford MBA with 2 years BizDev experience at a scale-up and two complementary technical founders is a great team indicator whereas a uni drop-out who disappeared from the surface and suddenly came back as single founder with a biz idea might be a bad team signal”. The example is bad, I know, but you get the point ;)

The Four Major Groups of Screening Approaches:

Manual selection through investment team: Status quo, most VCs are here. They rely on a limited sample size of success cases within their own spectrum of experiences to balance selection criteria (macro) and evaluate them (micro). All manual, no clear playbook. Different deterministic macro balancing (a to n) and micro evaluation for each team member, lead to high variability in outcomes.

Pro: high level of control & trust

Con: manual, inefficient, non-inclusive, subjective and biased for every individual team member, huge variety across the team

Manual selection through scorecards: Some VCs note down their macro criteria balance (“criteria X is more important than criteria Y”) and their micro criteria evaluation playbook (“graduate from uni O is great, but uni P is not so great”) to standardize their screening process and train more junior investment team members. See a public example of such an equation here on P9’s “VC compatibility score”. Deterministic macro balancing (a to n) and micro evaluation, but standardized across the team.

Pro: high level of control & trust, standardized across the team

Con: manual, inefficient, subjective on a team level, potentially the least inclusive approach as we need to overlap all biases of decision-makers in the fund (that are again based on very limited sample size) to end up with a tiny intersection of positive micro criteria (what is good or bad)

Automated selection through scorecards: Very similar to the previous approach, but the balancing on the macro level (a to n) as well as the evaluation on the micro level is automated via algorithms. For example, we can deterministically define that a (team weight) is 0.4, whereas b (market weight) is 0.2, and hereby consider the team as two times more important than the market. On a micro evaluation level, we can define simple dictionaries with keywords to calculate a score. For example, we can define 0 = “drop out” or “no degree”; 1 = “whatever name of a mid-tier uni” or “another name of a mid-tier uni”; 2 = “name of a top-tier uni” or “TU Munich” ;) to then calculate the team score.

Pro: high level of control & trust, standardized across the team, semi-automated, efficient

Con: subjective on a team level, potentially the least inclusive approach as we need to overlap all biases of decision-makers in the fund (that are again based on very limited sample size) to end up with a tiny intersection of positive micro criteria (what is good or bad)

Automated selection through machine learning: The most innovative and fully automated approach. We train ML models based on historical data to identify patterns that predict success in the future. While the underlying sample size is comprehensive and the model learns all available patterns, it mirrors the past into the future and only in retrospect adapts to changing dynamics.

Pro: fully automated, efficient, objective, standardized across the team, potentially the most inclusive option as it relies on a comprehensive sample size

Con: low level of control & trust, mirrors the past into the future (=only reactive)

After all, the automated ML approach seems like the most desirable solution but - for now - comes with two big blockers: the lack of trust and the fact that it mirrors the past into the future (=only reactive). While I will dedicate the next episode to how we can overcome both hurdles, I will describe the automated ML approach itself in a bit more detail below.

Training a Startup Screening Model (Detailed Explanation in My Paper Here pg29-ff)

Input

First off, I assume that we finished the data cleaning, entity matching and feature engineering as described in “How to create a single source of truth for startups” and “‘Sh*t in, sh*t out’ and why feature engineering is the ultimate differentiator for VCs”. So let’s assume input features can now be comprehensively collected and stored in a regular cadence as a time-series dataset.

The Data-Driven Investor Of Today And Tomorrow

Ray Zhou, Forbes Councils Member

As CEO of Affinity, Ray’s goal is to bring relationship intelligence to the world because every opportunity begins with a relationship.

The term "data-driven investor" might sound pedestrian—it’s hard to point to an industry that hasn’t become more data-driven over the past two decades. But in recent years, the private capital industry’s adoption of data-driven insights represents a very real and material shift in how firms are now operating.

As a proxy, one can look at the hedge fund industry for a historic example of this strategic shift. Up until the 1980s, hedge funds were mostly run by Wall Street veterans who used their intuition and connections to make investment decisions. But as more data became available, a new breed of funds emerged that combined quantitative models with human judgment to drive better decisions and reduce cognitive biases. Venture capital and private equity are at a similar inflection point right now.

Data-driven investing is the idea of using data to augment human decision-making and automate away human data entry from every aspect of a firm’s operations—from sourcing and deal management to portfolio collaboration, fundraising and investor relations. It means using everything from a firm’s private data (communications, deal data and performance data) to third-party data (about startups and founders, alternative signals and job movement) to make better decisions, faster.

Taking A Data-Driven Approach To Finding And Investing In Companies

Deal sourcing is the most obvious pillar going through a data-driven transformation because of the sheer volume of information available on companies and founders—even “proto-founders” like great engineers or PhDs who don't yet realize they want to start a company.

From job change signals, company growth signals and website traffic signals to communications and activity on X and GitHub, everyone and everything has some kind of digital footprint now. The opportunity lies in collecting every relevant data point from that footprint to develop a superhuman coverage of your investing thesis.

Data-driven firms can effectively analyze all that data to identify earlier when a signal becomes interesting and when to reach out to turn the opportunity into a deal. They use automation to automatically update CRM records, log interactions and keep all that deal data up to date.

When it’s time to get in touch, they use relationship intelligence to generate critical contextual insights like: "Who has the strongest relationship with someone at this startup we want to talk to?" "Who knows this specific founder, CEO or CFO?" and "Have we already talked to them?"

This helps the data-driven investor source the highest quality opportunities faster and pursue them in a way that maximizes their chance of winning the deal.

The Impact Of AI On The Data-Driven Investor

The advantages of data-driven investing are significant today—and they’re increasing all the time. AI is quickly transforming how productive the data-driven investor can be in at least two important ways.

First are the more basic productivity use cases of AI for streamlining the manual, repetitive tasks that we all do. From writing outreach emails and intro emails to producing market maps, industry reports and thought leadership, many firms are adopting AI-assisted research and writing to increase their productivity.

The second cluster of applications is using AI to generate data and uncover new signals, further putting otherwise manual data entry on autopilot. Today, for example, most investors still summarize notes, update deal statuses and owners, and create follow-ups by hand. Much of this is the work of investment associates and analysts—work that AI is increasingly taking on end to end. At the same time, with the explosion of available data and signals for sourcing, VC and PE investors are deploying AI to sift through the information to uncover great founders and startups before their peers.

The Next Frontier For The Data-Driven Investor

Putting to use the volumes of data, automation and AI capabilities investors now have access to is fundamentally changing how private capital operates today. With how rapidly these technologies have been developing, I believe we’re on course to seeing AI copilots capable of helping investors with investment decision-making itself.

Soon, this will mean taking all of a firm’s historical performance data across every phase of the investing value chain—sourcing, screening, deal flow—and feeding it back into AI models that learn and self-improve. Such a copilot would be capable of answering important questions like "Which deals did we miss?" and "What signals were there that this was a good investment?" It’s not hard to imagine these agents automating, testing and optimizing a firm’s investment hypothesis much more quickly than a human team.

..More

How to Use ChatGPT to Learn Data Driven Investing?

Christian Martinez Founder of The Financial Fox

Data-driven investing is a strategy that relies on statistical analysis, algorithms, and various data sources to make investment decisions.

With the rise of artificial intelligence, particularly language models like ChatGPT, investors now have access to a powerful tool that can assist them in navigating the complexities of data-driven investing.

Let’s start with 15 key concepts you should learn to effectively engage in data-driven investing:

Quantitative Analysis: The use of mathematical and statistical models to evaluate financial markets and securities for investment purposes.

Algorithmic Trading: The use of computer algorithms to execute a large number of orders at very fast speeds based on pre-defined criteria.

Machine Learning: Applying AI techniques to predict market movements by analyzing large datasets, identifying patterns, and making decisions based on historical data.

Big Data Analytics: The process of examining large and varied data sets to uncover hidden patterns, unknown correlations, market trends, and customer preferences.

Risk Management: Techniques and practices used to identify, assess, and prioritize risks followed by coordinated application of resources to minimize or control the probability and impact of unfortunate events.

Portfolio Optimization: The process of choosing the proportions of various assets to be held in a portfolio, to make the portfolio better aligned with the investor’s financial goals and risk tolerance.

Sentiment Analysis: The use of natural language processing to analyze news, reports, and social media to gauge market sentiment and predict potential market movements.

Technical Analysis: A trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume.

Fundamental Analysis: Assessing a company’s value based on financial statements, management, competitive advantages, and its competitors and markets.

Behavioral Finance: Understanding the effects of psychological influences and biases on the financial behaviors of investors and the subsequent effects on markets.

High-Frequency Trading (HFT): A type of algorithmic trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools.

Backtesting: The process of testing a trading strategy on past periods to see how it would have performed.

Predictive Analytics: The use of data, statistical algorithms, and machine learning techniques to identify the likelihood of future outcomes based on historical data.

Blockchain and Cryptocurrency Analysis: Understanding the impact of blockchain technology and cryptocurrencies on financial markets and how to analyze these assets.

Environmental, Social, and Governance (ESG) Investing: Using ESG criteria to screen potential investments, which has become increasingly important for investors looking to invest in companies that align with their ethical values.

ChatGPT Prompts to use to learn Data Driven Investing

And now here are prompts you can use to learn more about the topics:

What is quantitative analysis and how is it utilized in data-driven investing?

Explain the concept of algorithmic trading and its significance in modern financial markets.

How does machine learning contribute to predicting market movements in data-driven investing?

Describe the process of big data analytics and its role in uncovering market trends and patterns.

What are the key principles of risk management in data-driven investing?

How is portfolio optimization carried out to align with investors’ financial goals and risk tolerance?

Discuss the application of sentiment analysis in predicting market movements using natural language processing.

Explain the methodology behind technical analysis and its relevance in investment decision-making.

What factors are considered in fundamental analysis to assess a company’s value?

How does behavioral finance influence investor behavior and market dynamics?

What distinguishes high-frequency trading (HFT) from other forms of algorithmic trading?

Describe the process and importance of backtesting in evaluating trading strategies.

How are predictive analytics utilized to forecast future outcomes in data-driven investing?

What is the significance of blockchain and cryptocurrency analysis in financial markets?

Explain the principles of ESG investing and its growing importance for investors.

Why should you use ChatGPT to Learn Data Driven Investing?

Using ChatGPT to learn data-driven investing offers numerous advantages.

Firstly, it provides a comprehensive understanding of the subject matter.

Through interactive conversations, ChatGPT can explain fundamental concepts and advanced techniques involved in data-driven investing, ensuring that learners grasp the intricacies of the field.

Additionally, learners can ask specific questions or request explanations on particular topics, allowing for a tailored learning experience based on their interests and knowledge level.

Access to knowledge is another benefit of using ChatGPT. With access to a vast array of information on data-driven investing, ChatGPT can provide insights into the latest trends, strategies, and technologies in the field. Learners can stay updated on industry developments, ensuring that their knowledge remains current and relevant.

Furthermore, ChatGPT offers continuous support and guidance, available 24/7 to assist learners as they navigate the complexities of data-driven investing.

Interactive learning is facilitated through dialogue with ChatGPT. Learners can engage in discussions, ask questions, and receive answers in real-time, fostering a dynamic learning process. Complex concepts or terminology can be clarified in simple terms, ensuring that learners have a clear understanding of the subject matter.

ChatGPT adapts to the pace of learning and preferences of the learner, providing additional information or explanations as needed to optimize comprehension and retention.

Moreover, ChatGPT enables learners to practice and apply their knowledge. Learners can discuss hypothetical scenarios, analyze case studies, or even test their investment strategies with ChatGPT, allowing for practical application of the concepts learned.

This hands-on approach enhances understanding and reinforces learning outcomes. Additionally, learning through ChatGPT is time-efficient, as it offers quick and concise explanations, saving learners time compared to traditional methods of learning.

News Of the Week

Sam Bankman-Fried Sentenced to 25 Years in Prison

Mr. Bankman-Fried, who was convicted of stealing $8 billion from customers of his FTX cryptocurrency exchange, faced a maximum sentence of 110 years.

Just 18 months ago, Sam Bankman-Fried was a titan of the corporate world and was one of the youngest billionaires on the planet.Credit...Hiroko Masuike/The New York Times

By David Yaffe-Bellany and J. Edward Moreno

David Yaffe-Bellany and J. Edward Moreno have covered the collapse of FTX extensively.

March 28, 2024

Sam Bankman-Fried, the founder of the FTX cryptocurrency exchange who was convicted of stealing billions of dollars from customers, was sentenced to 25 years in prison on Thursday, capping an extraordinary saga that upended the crypto industry and became a cautionary tale of greed and hubris.

Mr. Bankman-Fried’s sentence was shorter than the 40 to 50 years that federal prosecutors had sought after a jury found him guilty of fraud, conspiracy and money laundering — charges that carried a maximum penalty of 110 years behind bars. But the punishment was far above the six and a half years requested by his defense lawyers.

Mr. Bankman-Fried, 32, did not visibly react as Judge Lewis A. Kaplan handed down the sentence in Federal District Court in Manhattan. His parents, the law professors Joe Bankman and Barbara Fried, sat two rows from the front, staring at the floor.

“He knew it was wrong. He knew it was criminal,” Judge Kaplan said of Mr. Bankman-Fried’s actions.

Before the sentence was delivered, Mr. Bankman-Fried, cleanshaven and wearing a loosefitting brown jail uniform, apologized to FTX’s customers, investors and employees.

Amazon doubles down on Anthropic, completing its planned $4B investment

Devin Coldewey@techcrunch / 3:22 PM PDT•March 27, 2024

Image Credits: metamorworks / Getty Images

Amazon invested a further $2.75 billion in growing AI power Anthropic on Wednesday, following through on the option it left open last September. The $1.25 billion it invested at the time must be producing results, or perhaps they’ve realized that there are no other horses available to back.

The September deal put $1.25 billion into the company in exchange for a minority stake, and certain tit-for-tat agreements like Anthropic continuing to use AWS for its extensive computation needs.

Amazon reportedly had until the end of the first quarter to decide whether to increase its investment to a maximum of $4 billion, and here we are just before the deadline, and the company has decided to throw in the maximum amount.

Anthropic’s AI models are one of very few that compete at the highest levels of capability (however you define it) yet are available at scale for enterprises to deploy internally or in user-facing applications. OpenAI’s GPT series and Google’s Gemini are the others up there, but upstarts like Mistral may soon threaten that fragile triumvirate.

..More

BlackRock CEO ’very bullish’ on Bitcoin as its ETF crosses $17B

BlackRock’s CEO Larry Fink says he’s been “pleasantly surprised” at the level of retail demand for his firm’s spot Bitcoin ETF.

BlackRock CEO Larry Fink has been “pleasantly surprised” by the performance of his firm’s spot Bitcoin (BTC) exchange-traded fund (ETF) and has reiterated he's “very bullish” on the long-term viability of Bitcoin.

“IBIT is the fastest growing ETF in the history of ETFs. Nothing has gained assets as fast as IBIT in the history of ETFs,” Larry Fink said in a March 27 interview with Fox Business.

Fink said the iShares Bitcoin Trust’s (IBIT) performance has even “surprised” him at how well it has performed over the first 11 trading weeks.

IBIT has a strong start to trading, tallying $13.5 billion in flows in the first 11 weeks, with an $849 million daily high on March 12, according to Farside Investors. IBIT averages a little over $260 million in inflows per trading day.

“We’re creating now a market that has more liquidity, more transparency and I'm pleasantly surprised. I would never have predicted it before we filed it that we were going to see this type of retail demand,” Fink said.

Asked whether IBIT would “do good, but not this good,” Fink responded: “Yes, definitely.”

“I’m very bullish on the long-term viability of Bitcoin,” the BlackRock CEO added.

..More

FTX Founder Bankman-Fried Sentenced To 25 Years For Fraud, Conspiracy

March 28, 2024

FTX founder Sam Bankman-Fried was sentenced to 25 years in prison on Thursday on seven criminal charges — two counts of fraud and five counts of conspiracy — related to the collapse of his crypto exchange and related hedge fund.

The sentence was significantly less than the 110-year maximum he faced and the 40 to 50 years prosecutors were seeking. Nevertheless, it is substantially more than the handful of years Bankman-Fried’s attorneys were seeking.

“Samuel Bankman-Fried orchestrated one of the largest financial frauds in history, stealing over $8 billion of his customers’ money,” said Damian Williams, U.S. attorney for the southern district of New York. “His deliberate and ongoing lies demonstrated a brazen disregard for his customers’ expectations and disrespect for the rule of law, all so that he could secretly use his customers’ money to expand his own power and influence,” Williams said.

In November, a jury convicted Bankman-Fried on all seven criminal charges he faced. The jury in Manhattan took just over four hours to decide the disgraced FTX founder stole about $8 billion from customers on his cryptocurrency exchange.

The fall

The sentencing is likely one of the final chapters in FTX’s epic fall from grace, which rattled the markets and took Bankman-Fried from the wunderkind white knight that was crypto’s savior to a poster child for greed and hubris.

The collapse is the greatest startup and investor failure of all time.

For perspective, Theranos had raised about $1.3 billion in funding and had a $10 billion valuation at its peak before the walls came tumbling down on Elizabeth Holmes and Sunny Balwani. Holmes was sentenced to 11.25 years in prison in 2022 and Balwani received nearly 12.75 years.

Bankman-Fried’s FTX crypto exchange and its U.S. counterpart — FTX US — had raised a combined $2.2 billion at a $32 billion valuation and $8 billion valuation, respectively, before everything fell apart.

..More

Secondary Market Seeing Rebound After Slowdown

March 26, 2024

Payments giant Stripe turned a few heads late last month when it announced it had a secondary deal with investors to buy current and former employees shares through a tender offer that valued the company at $65 billion.

The valuation was a 30% uptick from its previous funding round and seemed to show the robustness of a secondary market that had its own stumbles as venture capital fundraising tumbled last year.

“It is picking up,” said Kevin Swan, head of private markets solutions for Morgan Stanley. “There’s an increase in activity after a lull as the spread on valuations have improved.”

Those who watch and invest in secondaries see little reason to expect the market to see the dip it hit in late 2022 and well into 2023 as an improving venture environment, a growing amount of dedicated secondary funds, and a plethora of strong mature companies to invest in should propel the secondary market upward.

Mirroring the primary market

The startup secondary market — where GPs, LPs and employees can sell their stake in a private company without having to wait for an exit such as an IPO or M&A event — can often follow the path of the primary fundraising market for a variety of reasons.

One of those reasons can be market valuation corrections.

“Like the broader venture capital market, the secondary market was overheated a few years ago and there has been a correction playing out,” Swan said.

While accurate data on secondary transactions can be tricky due to the disparate nature of the market, few deny the market slowed after the first half of 2022 and moved into last year.

“We’ve definitely seen a cooldown,” said Luke Kirrane, a senior corporate coverage manager on startup equity management platform Carta’s liquidity team. “There is overlap with the primary (funding) market and we’ve seen a cooling down there.”

In fact, Kirrane said about 40% to 50% of the deals he saw last year were structured as buybacks — as companies took advantage of the slow market and advantageous price point for opportunistic buybacks of previously issued shares.

One of the noticeable things that changed in the market was transaction size, Kirrane said. A couple of years ago, a median secondary transaction was $50 million to about $60 million, but now it’s less than $10 million.

Another reason the market slowed is the simple fact that a lot of primary funding rounds also consist of a secondary tender offer element for those looking to get cash early on their investment or shares.

With primaries at least showing early signs of coming back, that secondaries component also is coming along, said Kirrane, adding a large amount of secondaries are done with connection with primaries.

Why Fewer Than 20% of Startup Unicorns Are Likely to Go Public Soon

Mar 27, 2024, 10:48am PDTComments by hunter walk and Nikhil Thadani

The market for initial public offerings is crawling out of a two-year slumber, invigorated by the debuts of Reddit and Astera Labs. But most startups valued at $1 billion or higher won’t go public soon, predicts Accel partner Rich Wong.

Of the 1,200-plus private startups that now have this valuation, he estimated far fewer than 20% will end up going public in the next few years. Many of the rest may be sold or will just stay private for longer. That’s because they haven’t started to generate enough revenue—say, at least $250 million annually—or shown they’re close to turning a profit, two characteristics public market investors want to see. Plus, the market can only handle so many new tech listings a year.

“The IPO destination is going to be very much for a small minority of that 1,000-plus unicorns,” Wong said on a call with Morgan Stanley Managing Director Diana Doyle, streamed to The Information’s subscribers Tuesday.

The Takeaway

•Reddit, Astera pave way for ‘super busy’ 2025

•New listings should show at least $250 million in revenue

•Many high-valuation startups likely to continue to delay offerings

There’s a silver lining to his forecast. Wong, who led Accel’s investments in the now-public enterprise software companies Atlassian and UiPath, anticipates some of the startups that remain private will use the time to develop their businesses. Then they may debut in a few years as much stronger companies. That would repeat what happened in the 2010s when startups such as Zoom, Datadog and Slack waited to list until they were larger companies—and in Zoom’s case, were already profitable.

That said, some 15 to 20 tech companies will attempt IPOs this year, said Doyle, who is head of technology and equity-linked capital markets in the Americas at Morgan Stanley. She added, “2025 is going to be super busy.”

That volume would still fall short of past years. From 2013 to 2021, there have been an average 45 tech IPOs a year in the U.S., according to Dealogic.

Investors are interested in new tech listings as long as they can show healthy growth, she said.

“Over 50% of the tech companies out there are growing below 10%; only 5% of tech companies are even growing more than 40%,” she said. “The biggest thing that’s missing from the public markets right now is growth.”

Wong and Doyle also spoke about opportunities for acquisitions of startups, including by newly public companies such as CrowdStrike and Atlassian; on whether artificial intelligence fever has started to ebb; and on private equity firms’ appetite for private tech startups.

The interviews have been edited for brevity and clarity.

What is the reaction from the venture capital community for these IPOs?

Startup of the Week

How Ember is building an all-electric intercity bus network in the UK

With fresh $14M in funding, Scottish startup takes 'full-stack' approach to intercity bus travel

Paul Sawers @psawers / 12:00 AM PDT•March 26, 2024

Image Credits: Chris Watt Photography(opens in a new window)

A Scottish company building one of the U.K.’s first all-electric intercity bus networks has raised $14 million (£11 million) in a Series A round as it looks to expand across the entire country.

Building any bus network from scratch — electric or otherwise — isn’t something anyone can conjure up overnight with a laptop and endless amounts of coffee. A bus network needs, well, buses — and lots of them. And that is what Keith Bradbury and Pierce Glennie have been doing since founding Ember out of Edinburgh back in 2019, starting initially with a single vehicle procured from one of the few manufacturers willing to take them seriously.

“In 2019, we didn’t have a [web] domain … we didn’t have anything, actually,” Bradbury told TechCrunch. “We were approaching these companies and telling them that we’d like to buy ‘one’ electric coach, because that’s all we had money for. Obviously, when you say you want to buy one electric coach, no one takes you seriously. Some companies laughed in our faces.”

One company that was willing to do business was China’s Yutong and its U.K. distributor Pelican, which sold Ember its first bus with little in the way of customizations beyond things like what materials they wanted the seats made of. Ember introduced its first bus route in late 2020, connecting Scotland’s capital Edinburgh with the city of Dundee (the birthplace of Grand Theft Auto, FYI), and in the intervening years it has expanded to Glasgow, Stirling, Perth, and other smaller pit stops within and between these cities.

Today, Ember counts 24 buses in operation, though it has just taken receipt of an additional 14 next-gen vehicles from Yutong, which sport an increased 563 kWh battery capable of powering 510 km of travel on a single charge — this compares to around 380 km for the previous generation bus.

“Now we’re up to 38, we have the option of actually talking about serious numbers with Yutong and starting to get vehicles built to our specification,” Bradbury said. “Our new generation vehicle didn’t actually exist 18 months ago. While it’s not being built just for Ember, the product development has had a lot of input from us — we were closely involved with the design, with the battery layout, and with the actual architecture of the vehicle. There were some things that we couldn’t change, and there were some things that we could change, but we’ve been able to really input into that process.”