Contents

Editorial: The Great Realignment

Essays of the Week

Post Election

AI

Regulation

Venture Capital

Startup Funding Regained Its Footing In 2024 As AI Became The Star Of The Show

Despite VCs investing $75B in Q4 , it’s still hard for startups to raise money, data proves

Top New York VC Ben Lerer says more mid-sized VC firms are heading for failure

Number of US venture capital firms falls as cash flows to tech’s top investors

Crunchbase: 50% of VC Capital Went to SF Bay Last Year, Q4 Roared Back for Venture Capital

Interview of the Week

Albert Wenger

Startup of the Week

Silicon Valley defense start-up Shield AI hits $5bn valuation

Palantir in Talks to Invest in Drone Startup at $5 Billion Valuation

Post of the Week

“Unchecked Corporate Power” from DLD

Editorial: The Great Realignment

How AI, Politics, and Capital are Reshaping Our Future

This is the second That Was The Week of 2025, following the 2025 predictions on January 1st.

The first weeks of 2025 have revealed a profound transformation in the global landscape. The convergence of artificial intelligence, political shifts, and capital flows creates new power structures shaping our future. Many of my friends are gasping for air. The key changes are:

The AI Arms Race Intensifies

The scale of AI infrastructure investment has reached staggering levels. As reported by The Information, Microsoft's announcement of an $80 billion investment in data centers this year signals that the AI arms race is entering a new phase. This isn't just about building computing power—it's about controlling the fundamental infrastructure of the AI-driven future. Who owns the largest data centers seems assured to take a larger share of the value pie being created.

While the UK's attempts to position itself as an AI hub are admirable, they highlight the growing disparity between American and European AI ambitions. As the Financial Times notes, the UK "has half of what it needs to be an AI hub," reflecting a broader pattern of American tech dominance becoming even more entrenched. Silicon Valley's resurgence is particularly telling, with the region "devouring over half of all global VC funding in 2024," according to Crunchbase.

Political Realignment and Tech Policy

A fascinating shift is occurring in tech companies' relationship with politics. Meta's transformation under Mark Zuckerberg is particularly emblematic of this change. The New York Times reports that Zuckerberg has moved from "apologies to no more apologies," while simultaneously restructuring Meta's approach to content moderation and diversity programs. The appointment of Republican Joel Kaplan to lead Meta's global policy team, replacing Nick Clegg, signals a broader realignment of tech companies with the anticipated political landscape.

Musk in DC and Andreessen in Florida are symptomatic of these shifts in alignment. Marc has been featuring on various podcasts explaining his journey from Democrat to Trumpist. Elon has been super transparent longer. Both are, along with Zuckerberg, blowing in the wind. They represent a short term desire to benefit both themselves and their businesses. Nothing wrong with that. Biden’s accusation that they represent a Tech industrial complex is also true but is it a problem?

The Venture Capital Revolution

The venture capital ecosystem is transforming. As TechCrunch reported, Ben Lerer's prediction about the fate of mid-sized VC firms suggests a bifurcation in the industry: "More mid-sized VC firms are heading for failure," while mega-funds and specialized boutiques thrive. This consolidation of capital mirrors the broader concentration of power we're seeing in tech.

The emergence of AI-powered venture capital, exemplified by the ai16z fund's reaching a $2 billion market cap, hints at how AI might reshape investment decision-making. This meta-application of AI to the funding of AI companies creates an interesting feedback loop that could accelerate technological development unexpectedly.

Concentration of VC funds into larger and fewer will threaten the value chain that starts with emerging managers finding and funding very early-stage companies. That can’t happen so we should expect some correction with capital re-emerging at the early stage.

The China Question

Noah Smith analyzes the ongoing debate about measuring China's economic position relative to America's, which takes on new significance in AI development. The TikTok controversy, with the app facing potential shutdown rather than forced sale, demonstrates how technology has become inextricably linked with national security concerns. As Smith notes, "TikTok is just the beginning." We're likely to see more technological decoupling between China and the West. I think this is inevitable but troubling. The idea of nation-states exercising control over private companies’ global ambitions has no positive merit.

The Moderation Overcorrection and the Return to Free Speech

Perhaps the most significant shift in early 2025 is Meta's dramatic reversal on content moderation, which signals a broader reckoning with past approaches to online speech. As reported by Spiked Online, Zuckerberg's "bonfire of the orthodoxies" represents more than just a policy change – it's an acknowledgment that the tech industry's previous approach to content moderation may have done more harm than good.

Meta's elimination of fact-checkers and reduction in content censorship point to a growing recognition that terms like "misinformation" and "disinformation" have become problematic tools. Brendan O'Neill notes in his analysis that these terms have often been "weaponized to punish dissenting views" rather than protect truth. Meta's admission that government entities pressured them to censor certain content, including humor and satire, raises serious questions about the appropriate boundaries between platform governance and state control.

This shift comes at a crucial moment when the concept of "misinformation" is reevaluated. What was labeled as misinformation one day often became accepted fact the next, particularly during recent global events. The arbitrary nature of these designations has increasingly revealed them to be, in many cases, mechanisms for controlling narrative rather than protecting truth.

The move away from heavy-handed moderation also acknowledges a fundamental principle of democratic discourse: that the cure for problematic speech is more speech, not enforced silence. As Meta's new approach suggests, the tech industry's previous attempts to arbitrate truth may have inadvertently undermined the democratic processes they claimed to protect.

This return to free speech principles isn't just about correcting past overreach – it's about recognizing that robust public discourse, even when messy, is essential for a democratic society. One Meta executive noted in internal communications, "We need to trust our users more and our content moderators less."

My take is that I welcome the changes. I do not believe that “disinformation” or “misinformation” are concerns and are closer to weaponized political words meaning “I disagree with you”. Labeling and canceling these ideas is a lazy way of combatting them. That said as the title this week suggests. Zuck is definitely “Blowing in the Wind” and making astute business decisions. I doubt he has any real moral line in play.

Looking Forward

Several trends suggest where this is all heading. The concentration of AI infrastructure investment in the hands of a few American companies, combined with Silicon Valley's dominance of venture funding, points to an unprecedented consolidation of technological power.

Joe Biden’s farewell warning about the “Tech Industrial Complex” and Oligarchy (Billionaires in power) echo what many feel.

Scott Alexander points out in his analysis of AI's impact on wealth inequality, we're moving toward a world where "there will be no social mobility and everyone's wealth will grow at the same rate." This raises questions about the social implications of AI-driven automation and wealth concentration.

My take is that scientific breakthroughs in AI and other disciplines driven by AI will unlock enormous value, creating the conditions for abundance. The concentration of wealth this produces is inevitable. When billions of humans are owners of hand held super computers this value will produce billionaires. There will be more very wealthy people. And they will have both economic and political power. But that is no more the end of history than was the case after the collapse of the Soviet Union.

A tech industrial complex. looked at this way, is beneficial to society despite the concentration of wealth.

Abundance creates the possibility of human freedom from work. It only leaves one question to be answered. Who will benefit from that wealth? Without abundance, the question does not arise. But once it exists it can be used to human benefit.

How that happens is a good discussion. Biden seems to want to stop it from happening. That is symptomatic of the fact that Democrats seem to not have any real definition of '“progress” or the part technology plays in it. Or of the relationship between progress and wealth.

The billionaires have no project beyond driving tech innovation. They certainly are not consciously anti democratic. Basically they have no broader agenda.

Conclusion

The technology industry is not just being reshaped – it's being fundamentally reconstituted on a rapid growth platform. Massive AI investments, political realignment, and capital concentration create a new power structure that will likely dominate the next decades. How to seize that and use it for good should be the focus.

The key question isn't whether this transformation will happen but whether we can manage its implications for society, democracy, and economic opportunity. As we watch these changes unfold, it's crucial to remember that technology's impact on society isn't predetermined – it's shaped by the choices we make today about how to develop and deploy these powerful tools.

The trends we're seeing in early 2025 suggest that a smaller, more powerful group is increasingly making these short term choices.

Whether this concentration of power will lead to more rapid technological progress or create new social and economic challenges remains to be seen. We do have the option of creating a genuine view of the future we want and then fighting to make it happen. That’s where I come out.

What's clear is that we're witnessing a pivotal moment in the evolution of the technology industry, which will have far-reaching implications for years to come.

Essays of the Week

Is America an Oligarchy Yet?

Source: NYT > Opinion | Published: 2025-01-16 | Reading Time: 2 min | Domain: nytimes.com

Confirmation hearings rarely cut to the heart of an existential question about the nature of our society. But Thursday’s hearing for Scott Bessent, President-elect Donald Trump’s pick for Treasury secretary, did just that when Senator Bernie Sanders of Vermont tried to get him to admit that the United States is becoming an oligarchy, a question that ought to be the subject of far more public debate.

Quoting from President Biden’s farewell address to the nation, which warned against the unchecked power of tech moguls, Sanders asked if Bessent agrees that the concentration of so much wealth and political and media power in the hands of three men — Elon Musk, Mark Zuckerberg and Jeff Bezos — is a danger to democracy.

Bessent, himself a billionaire hedge fund manager who has never served in government before, gave all the answers one would expect: Musk and the others made their money fair and square. Biden has been friendly with some billionaires, too.

“Forget how they made their money,” Sanders pressed. “When so few people have so much wealth and power, do you think that is an oligarchic form of society?”

TikTok is just the beginning

Source: Noahpinion | Published: 2025-01-15 | Reading Time: 5 min | Domain: noahpinion.blog

Back in April, Congress passed a bill that would force TikTok and other social media apps that are “controlled by a foreign adversary” to sell themselves to buyers in the U.S. or friendly nations. If the apps don’t sell, they can no longer be legally downloaded from app stores. This so-called “TikTok ban” — which isn’t really a ban, just a rule about corporate ownership — was set to go into effect one day before the next presidential inauguration.

TikTok’s Chinese parent company, ByteDance, had many months to sell TikTok, and would have doubtless find a willing buyer. Instead it refused. In fact, now TikTok is apparently planning to shut itself down completely, going far beyond the penalty that the U.S. law itself stipulates:

TikTok plans to shut off its app for U.S. users on Sunday, when a federal ban on the social media app could come into effect, The Information reported on Tuesday, unless the Supreme Court moves to block it…If TikTok shuts off for all U.S. users, the outcome would be different from that mandated by the law. The law would mandate a ban only on new TikTok downloads on Apple…or Google…app stores while existing users could still continue using the app for some time.

TikTok plans to shut off its app for U.S. users on Sunday, when a federal ban on the social media app could come into effect, The Information reported on Tuesday, unless the Supreme Court moves to block it…If TikTok shuts off for all U.S. users, the outcome would be different from that mandated by the law. The law would mandate a ban only on new TikTok downloads on Apple…or Google…app stores while existing users could still continue using the app for some time.

The reason, according to Bloomberg, is that Chinese officials really don’t want the TikTok app leaving their control:

Beijing officials strongly prefer that TikTok remains under the ownership of parent ByteDance Ltd., the people say, and the company is contesting the impending ban with an appeal to the US Supreme Court. But the justices signaled during arguments on Jan. 10 that they are likely to uphold the law.

Beijing officials strongly prefer that TikTok remains under the ownership of parent ByteDance Ltd., the people say, and the company is contesting the impending ban with an appeal to the US Supreme Court. But the justices signaled during arguments on Jan. 10 that they are likely to uphold the law.

Trump comments on TikTok ban: ‘Stay tuned!’

Source: TechCrunch | Published: 2025-01-17 | Reading Time: 1 min | Domain: techcrunch.com

Just ahead of today’s Supreme Court ruling — which saw the nation’s highest court uphold the law banning TikTok in the U.S. as of January 19 — Donald Trump posted on Truth Social that he had a “very good” phone call with China’s President Xi Jinping, which included discussion of TikTok. In addition, the president-elect […]

© 2024 TechCrunch. All rights reserved. For personal use only.

EFF Statement on U.S. Supreme Court's Decision to Uphold TikTok Ban

Source: Deeplinks | Published: 2025-01-17 | Reading Time: 1 min | Domain: eff.org

We are deeply disappointed that the Court failed to require the strict First Amendment scrutiny required in a case like this, which would’ve led to the inescapable conclusion that the government's desire to prevent potential future harm had to be rejected as infringing millions of Americans’ constitutionally protected free speech. We are disappointed to see the Court sweep past the undisputed content-based justification for the law – to control what speech Americans see and share with each other – and rule only based on the shaky data privacy concerns.

The United States’ foreign foes easily can steal, scrape, or buy Americans’ data by countless other means. The ban or forced sale of one social media app will do virtually nothing to protect Americans' data privacy – only comprehensive consumer privacy legislation can achieve that goal. Shutting down communications platforms or forcing their reorganization based on concerns of foreign propaganda and anti-national manipulation is an eminently anti-democratic tactic, one that the US has previously condemned globally.

Mark Zuckerberg’s Political Evolution, From Apologies to No More Apologies

Source: NYT > Technology | Published: 2025-01-08 | Reading Time: 1 min | Domain: nytimes.com

Meta’s chief executive has stepped away from his mea culpa approach to issues on his platforms and has told people that he wants to return to his original thinking on free speech.

By Sheera Frenkel and Mike Isaac

Reporting from San Francisco, Jan. 7, 2025

In November 2016, as Facebook was being blamed for a torrent of fake news and conspiracy theories swirling around the first election of Donald J. Trump, Mark Zuckerberg, the chief executive of the social network, wrote an apologetic post.

In his message, Mr. Zuckerberg announced a series of steps he planned to take to grapple with false and misleading information on Facebook, such as working with fact-checkers.

“The bottom line is: we take misinformation seriously,” he wrote in a personal Facebook post. “There are many respected fact checking organizations,” he added, “and, while we have reached out to some, we plan to learn from many more.”

Eight years later, Mr. Zuckerberg is no longer apologizing. On Tuesday, he announced that Meta, the parent company of Facebook, Instagram, WhatsApp and Threads, was ending its fact-checking program and getting back to its roots around free expression. The fact-checking system had led to “too much censorship,” he said.

Zuckerberg Acts Like Musk but Isn’t

Source: The Information | Published: 2025-01-15 | Reading Time: 1 min | Domain: theinformation.com

You might wonder, watching Mark Zuckerberg’s announcements of the past week, whether we’re witnessing a version of the Hollywood movie “Face/Off,” where the Meta Platforms CEO will shortly rip off a mask and reveal himself to be Elon Musk.

Aside from Zuckerberg’s moves last week to abandon both diversity, equity and inclusion initiatives and fact-checking in favor of a version of X’s “community notes,” and his talking up the value of “masculine energy” on a podcast, Zuckerberg today told staff he planned to speed up the firing of “low performers” to make way for new hires. Despite the superficial similarities, the parallels between Zuckerberg and Musk don’t go very far, at least in terms of management style.

On the job cuts front, for instance, Meta is not Twitter, where Musk slashed staff by 80%. Indeed, even after two rounds of layoffs in 2022 and early 2023, Meta’s workforce grew 9% between the third quarters of 2023 and 2024. After the forthcoming cuts of about 3,600, Meta will have about 68,800 employees, which is still more than it had at the end of 2023.

And given that Zuckerberg implied in his post to staff on Tuesday that the latest cuts would open up new positions for hiring, Meta’s workforce is likely to bounce back very quickly. The reason is that Zuckerberg is still spending a fortune on bets for the future, including its Reality Labs virtual reality and augmented reality laboratory. Meta said last fall it expected operating losses at Reality Labs to “increase meaningfully” in 2024 year over year.

Mark Zuckerberg’s bonfire of the orthodoxies

Source: spiked | Published: 2025-01-08 | Reading Time: 5 min | Domain: spiked-online.com

Move over Elon Musk, another billionaire has hit the headlines. And he didn’t even have to demand the jailing of a prime minister to do so. It’s Mark Zuckerberg, boss of Meta. Yesterday he released the most extraordinary video. Sporting unruly curls, a black tee and dog-tag chain – the uniform of the millennial oligarch – he announced that Meta’s platforms would give their ‘fact-checkers’ the heave-ho and ‘dramatically reduce the amount of censorship’ they carry out. I doubt a more impactful mea culpa will be issued this year.

We’re coached to be cynical these days, but I’ll be honest with you: Zuckerberg’s statement put a big, dumb smile on my face. Here we had one of the captains of Silicon Valley confessing that the boss class to which he belongs has indeed been enforcing a regime of political censure, while also promising to do something about it. Those of us who think you should be free to wander into the town square of social media and say ‘People with dicks are not women!’ or ‘Covid might have come from a lab!’ have cause to be optimistic this morning.

No longer will users of Facebook, Instagram and Threads have ‘fact-checkers’ peering over their shoulder as they post. Starting in the US, Meta will ‘get rid of fact-checkers’, Zuckerberg said, and ‘replace them with community notes similar to X’. That’s Musk’s user-generated system of correction, where swarms of tweeters can add caveats and additional info to posts that are misleading or untrue. Our fact-checkers have ‘just been too politically biased’ said Zuckerberg, and they’ve ‘destroyed more trust than they’ve created’. Welcome, young man, to we merry few who’ve been arguing for years that ‘fact-checking’ is doublespeak for the sidelining of dissent and enforcement of orthodoxy.

Zuckerberg confessed that the ancien régime of post-policing by ideologues dolled up as fact-checkers led to the punishment of perfectly normal beliefs. On topics like ‘immigration and gender’ there was a ‘bunch of restrictions’, he said. And they were ‘out of touch with mainstream discourse’. Many of us knew this. Many of us knew that Facebook’s memory-holing of ‘anti-immigrant views’ and its sexist disciplining of feminists who think men are not women was an ideological crusade masquerading as a clampdown on ‘hate speech’. But it’s still good to hear the man at the top of that old McCarthyism say it out loud.

Zuckerberg is clearly feeling the heat of the masses’ irritation with wokeness. He said the election of Donald Trump felt like ‘a cultural tipping point towards, once again, prioritising speech’. Zuckerberg appears to be submitting to the 77million people who voted for Trump and in the process noisily registered their displeasure with the beliefs and behaviour of Zuckerberg’s own class. A techno-feudalist bowing to the throng? I’m here for it.

We will one day look back in bewilderment, if not outright horror, at this era of tech censorship. It is insane that feminists were booted off pre-Musk Twitter for saying ‘him’ about a bloke in a dress who tried to pressure immigrant women to wax his bollocks. And that you could be sent to ‘Facebook jail’ for stating biological facts, or wondering out loud if mass immigration is a problem, or opposing the mask mandates of the Covid era. Millions of people were reprimanded for challenging ideas so crazy only billionaires and students could believe them.

Brendan O’Neill is spiked’s chief political writer and host of the spiked podcast, The Brendan O’Neill Show. Subscribe to the podcast here. His new book – After the Pogrom: 7 October, Israel and the Crisis of Civilisation – is available to order on Amazon UK and Amazon US now. And find Brendan on Instagram: @burntoakboy

Meta Ends Diversity Programs

Source: The Information | Published: 2025-01-11 | Reading Time: 1 min | Domain: theinformation.com

Meta Platforms on Friday ended many of its diversity, equity and inclusion efforts, according to an internal post viewed by The Information. The company said it would stop requiring consideration of a diverse pool of candidates for job openings; focus on sourcing from small and medium businesses instead of the gender, race or ethnicity of the owners; end its equity and inclusion programs; and cut its diversity, equity and inclusion team.

“The legal and policy landscape surrounding diversity, equity and inclusion efforts in the United States is changing,” Janelle Gale, vice president of human resources, wrote in the post. “The Supreme Court of the United States has recently made decisions signaling a shift in how courts will approach DEI … The term ‘DEI’ has also become charged, in part because it is understood by some as a practice that suggests preferential treatment of some groups over others.”

It's Still Easier To Imagine The End Of The World Than The End Of Capitalism

Source: Astral Codex Ten | Published: 2025-01-12 | Reading Time: 16 min | Domain: astralcodexten.com

No Set Gauge has a great essay on Capital, AGI, and Human Ambition, where he argues that if humankind survives the Singularity, the likely result is a future of eternal stagnant wealth inequality.

The argument: post-Singularity, AI will take over all labor, including entrepreneurial labor; founding or working at a business will no longer provide social mobility. Everyone will have access to ~equally good AI investment advisors, so everyone will make the same rate of return. Therefore, everyone’s existing pre-singularity capital will grow at the same rate. Although the absolute growth rate of the economy may be spectacular, the overall wealth distribution will stay approximately fixed.

Moreover, the period just before the Singularity may be one of ballooning inequality, as some people navigate the AI transition better than others; for example, shares in AI companies may go up by orders of magnitude relative to everything else, creating a new class of billionaires or trillionaires. These people will then stay super-rich forever (possibly literally if immortality is solved, otherwise through their descendants), while those who started the Singularity without capital remain poor forever.

Finally, modern democracies pursue redistribution (and are otherwise responsive to non-elite concerns) partly out of geopolitical self interest. Under capitalism (as opposed to eg feudalism), national power depends on a strong economy, and a strong economy benefits from educated, globally-mobile, and substantially autonomous bourgeoisie and workforce. Once these people have enough power, they demand democracy, and once they have democracy, they demand a share of the pie; it’s hard to be a rich First World country without also being a liberal democracy (China is trying hard, but hasn’t quite succeeded, and even their limited success depends on things like America not opening its borders to Chinese skilled labor). Cheap AI labor (including entrepreneurial labor) removes a major force pushing countries to operate for the good of their citizens (though even without this force, we might expect legacy democracies to continue at least for a while). So we might expect the future to have less redistribution than the present.

This may not result in catastrophic poverty. Maybe the post-Singularity world will be rich enough that even a tiny amount of redistribution (eg UBI) plus private charity will let even the poor live like kings (though see here for a strong objection). Even so, the idea of a small number of immortal trillionaires controlling most of the cosmic endowment for eternity may feel weird and bad. From No Set Gauge:

In the best case, this is a world like a more unequal, unprecedentedly static, and much richer Norway: a massive pot of non-human-labour resources (oil :: AI) has benefits that flow through to everyone, and yes some are richer than others but everyone has a great standard of living (and ideally also lives forever). The only realistic forms of human ambition are playing local social and political games within your social network and class. If you don't have a lot of capital (and maybe not even then), you don't have a chance of affecting the broader world anymore. Remember: the AIs are better poets, artists, philosophers—everything; why would anyone care what some human does, unless that human is someone they personally know? Much like in feudal societies the answer to "why is this person powerful?" would usually involve some long family history, perhaps ending in a distant ancestor who had fought in an important battle ("my great-great-grandfather fought at Bosworth Field!"), anyone of importance in the future will be important because of something they or someone they were close with did in the pre-AGI era ("oh, my uncle was technical staff at OpenAI"). The children of the future will live their lives in the shadow of their parents, with social mobility extinct. I think you should definitely feel a non-zero amount of existential horror at this, even while acknowledging that it could've gone a lot worse.

Microsoft to Spend $80 Billion on Datacenters This Year

Source: The Information | Published: 2025-01-03 | Reading Time: 1 min | Domain: theinformation.com

Microsoft is on track to spend $80 billion on datacenters that are tailor-made for running AI software in the twelve months ending in June, president Brad Smith said in a blog post on Friday. More than half of that spending will take place in the U.S., Smith said. The investment is a sharp ...

We cannot regulate our way to growth

Source: Phil Mullan | Published: 2025-01-11 | Reading Time: 6 min | Domain: philmullan.com

Published by spiked – 10 January 2025

Keir Starmer’s managerialist doctrine is a recipe for continued economic decline.

The UK economy is in trouble. The latest GDP figures showed zero growth in the last quarter of 2024. This week, the pound slumped to a two-year low and borrowing costs reached their highest levels in 16 years. As such, the Labour government’s repeated promises of ‘growth, growth, growth’ seem further out of reach than ever.

Even before this week’s market turmoil, the government tacitly acknowledged that not all was going to plan. Over the Christmas period, in an apparent act of desperation, UK prime minister Keir Starmer, chancellor Rachel Reeves and business secretary Jonathan Reynolds wrote a letter to the UK’s biggest regulators to ask for help. Regulatory bodies such as energy watchdog Ofgem, water regulator Ofwat, the Environment Agency and the Financial Conduct Authority were urged by the government to submit proposals on how best to boost the economy. Ostensibly, Labour’s ‘growth’ mantra remains, with the letter asking for suggestions to make the regulatory environment ‘more pro-growth and pro-investment’. But for the government to turn to the regulators, of all people, is not an encouraging sign.

Of course, government ministers should always be engaging with their functionaries for advice. But to openly admit they have had to grovel to them for help to meet their central policy commitment was an extraordinary testament to Labour’s lack of ideas. It is even more depressing that the government felt it had to seek guidance from organisations with such records of failure as Ofgem and Ofwat.

This plea to the regulators demonstrates that managerialism is a core feature of this Labour government. It would prefer to manage what already exists, aided by ‘expert’ technocrats, than attempt to change things, which would need political vision. In earlier times, a government in trouble would usually persevere with its political programme, reassuring the electorate that the benefits would come later. Or it might come up with better policies to achieve its goals. In contrast, a manager in trouble will often turn to other managers for advice. Starmer’s letter should extinguish any lingering illusions that the debacle of Labour’s first six months were just teething problems. It confirms that there is no transformative plan waiting to be unveiled and that Starmer is a managerialist to his core.

EU reassesses tech probes into Apple, Google and Meta

Published: 2025-01-14 | Reading Time: 3 min | Domain: ft.com

Brussels is reassessing its investigations of tech groups including Apple, Meta and Google, just as the US companies urge president-elect Donald Trump to intervene against what they characterise as overzealous EU enforcement.

The review, which could lead to the European Commission scaling back or changing the remit of the probes, will cover all cases launched since March last year under the EU’s digital markets regulations, according to two officials briefed on the move.

It comes as the Brussels body begins a new five-year term amid mounting pressure over its handling of the landmark cases and as Trump prepares to return to the White House next week.

“It’s going to be a whole new ballgame with these tech oligarchs so close to Trump and using that to pressurise us,” said a senior EU diplomat briefed on the review. “So much is up in the air right now.”

All decisions and potential fines will be paused while the review is completed, but technical work on the cases will continue, the officials said.

While some of the investigations under review are at an early stage, others are more advanced. Charges in a probe into Google’s alleged favouring of its app store had been expected last year.

Two other EU officials said Brussels regulators were now waiting for political direction to take final decisions on the Google, Apple and Meta cases.

The review comes as EU lawmakers call for the commission to hold its nerve against US pressure, while Silicon Valley chiefs hail Trump’s return as the start of an era of lighter tech regulation.

Mark Zuckerberg, Meta’s chief executive, on Friday called on the president-elect to stop Brussels fining US tech companies, complaining that EU regulators had forced them to pay “more than $30bn” in penalties over the past 20 years.

Startup Funding Regained Its Footing In 2024 As AI Became The Star Of The Show

Source: Crunchbase News | Published: 2025-01-17 | Reading Time: 5 min | Domain: news.crunchbase.com

Global venture funding in 2024 edged above 2023’s totals, with AI showing the biggest leap in amounts year to year. Overall startup funding in 2024 reached close to $314 billion — compared to $304 billion in 2023 — up around 3%, based on an analysis of Crunchbase data.

Global venture investment in 2024 was above the pre-pandemic year of 2019, but below 2018 and 2020 amounts at $346 billion and $350 billion, respectively.

Breakout year for AI

One thing was clear: 2024 was the breakout year for funding to AI companies.

Close to a third of all global venture funding went to companies in AI-related fields, making artificial intelligence the leading sector for funding. Funding to AI-related companies reached over $100 billion — up more than 80% year over year from $55.6 billion in 2023 — Crunchbase data shows. Funding to the AI sector in 2024 surpassed every year in the past decade, including the peak global funding year of 2021.

Of those AI dollars, almost a third of all AI funding went to foundation model companies.

The other two-thirds of funding went to sectors impacted by these new models. Infrastructure and data provisioning to manage and operate AI grew. Other leading sectors included autonomous driving, healthcare, robotics, professional services, security and military, Crunchbase data shows.

Q4 push

The higher total in 2024 was due to a big push in Q4 — which saw the highest funding total since the downturn in Q3 2022. The fourth quarter reached $93 billion, up 36% year over year from $69 billion in Q4 2023 , based on an analysis of Crunchbase data.

In recent years, Q4 was typically slower. The 2024 fourth quarter, however, closed with the largest rounds raised this year — $22 billion by three companies.

Large values, billion-dollar rounds

In 2024, a greater share of funding went to billion-dollar rounds, in large part driven by funding to the AI sector. In 2024, $58.3 billion — or 19% of all funding — went to billion-dollar rounds. Compare that with 2023, when $45.8 billion — or 15% of funding — went to rounds of a billion dollars or more.

The fourth quarter picked up steam with the largest valuations achieved last year. OpenAI was awarded a $157 billion valuation. Databricks was valued at $62 billion in the year’s largest venture deal, a $10 billion round. And xAI doubled its valuation in a six-month period, to $50 billion.

Not surprisingly, the largest funding rounds this past year went to companies in the AI sector — not only Databricks, OpenAI and xAI, but also Waymo and Anthropic raised funding of at least $4 billion — or much more.

Other large valuations to companies in AI went to CoreWeave ($19 billion), Anthropic ($18.4 billion), Anduril Industries ($14 billion), Scale AI ($13.8 billion) and Perplexity ($9 billion).

US gained, Silicon Valley fired up

Venture funding to U.S. companies totaled $178 billion — around 57% of total global funding. The U.S. funding market raised a greater proportion of global funding, up from 48% in 2023.

Of all U.S. funding, $90 billion was invested in the corridors of the San Francisco Bay Area, which experienced a boom from AI investing. Compare that with 2023, when Bay Area companies raised $59 billion in total funding.

Late-stage Q4 boom

Late-stage funding in the fourth quarter reached $61 billion, up more than 70% quarter over quarter and an increase year over year from the $36 billion invested in Q4 2023, Crunchbase data shows. The biggest change in Q4 from a year earlier was the increase in billion-dollar rounds. Large fundings were raised in multiple sectors such as AI, applied AI, energy, semiconductor, banking, security and aerospace, among others.

Early stage flat

Early-stage funding was flat in Q4. Large early-stage rounds went to data centers, renewable energy, AI, robotics and biotech.

Seed settled

Seed funding trailed in Q4, for now. Reaching $7 billion in Q4, seed funding was down 16% from the $8.4 billion invested a year ago. (However seed fundings are often added to the Crunchbase dataset after the close of a quarter, and should increase over time.)

Liquidity hold-up

It was a slow year for exits in 2024.

M&A activity was slightly up compared to 2023 — but slower than expected and somewhat concentrated in biotechnology and cybersecurity companies.

Of the magnificent seven,Microsoft, Alphabet and Amazon hired AI teams from Inflection AI, Character.ai and Adept AI, respectively, as the regulatory environment impeded strategic dealmaking. Nvidia was the most active acquirer in 2024 among this cohort.

The IPO market — also slow in 2024 — ended on a positive note with the unexpected bump from the ServiceTitan IPO, which as of the new year is above its IPO price by more than 40%.

An opening up of the IPO markets in 2025 will drive LP allocation to venture, said Beezer Clarkson, a partner at Sapphire Partners, in an interview. “History just shows very clearly that when there’s positive liquidity, more money goes into venture funds,” she said.

Despite VCs investing $75B in Q4 , it’s still hard for startups to raise money, data proves

Source: TechCrunch | Published: 2025-01-16 | Reading Time: 1 min | Domain: techcrunch.com

After two years of relatively muted investment activity, it seems that VCs are starting to pour capital into startups at pandemic-era levels once again. But a closer look shows that they aren’t really.

In the fourth quarter of last year, investors funneled $74.6 billion into U.S. startups, a substantial increase from the average of $42 billion invested in each of the previous nine quarters, according to PitchBook data released on Tuesday.

While these funding levels were previously seen only during the peak of the ZIRP era (end of 2020 through 2021), the reality is that this recent increase in venture capital funding is disproportionately benefiting a select few companies. In fact, $32 billion, or 43.2% of Q4 investment activity, was invested in precisely a handful of colossal-sized deals….

Without these megadeals, Q4 investment activity would have mirrored the previous two years’ average of $42 billion. This stark concentration of venture capital investment highlights the widening gap between a few well-funded companies and the broader startup ecosystem.

We Have Met the Enemy… and He Is (Still) Us

Source: SignalRank Update | Published: 2024-12-31 | Reading Time: 11 min | Domain: signalrankupdate.substack.com

When we reflect on the state of venture capital today, we are reminded of the Kauffman Foundation’s 2012 report titled “We Have Met The Enemy… and He Is Us.”[1] It is a seminal critique of venture capital from an LP’s perspective, highlighting underperformance relative to public markets, low capital returns from realized exits, the short-term nature of the sector and the fundamental misalignment of interests between GPs and LPs. Sound familiar?

The Kauffman report could hold the cultural relevance within venture capital that Fred Schwed’s “Where Are Our Customers’ Yachts?” has held in the public markets since the 1940s. LPs might very well be asking “Where Is Our DPI?”

As such, we want to revisit the core themes in the Kauffman report to consider how the market has developed (or not) since the report first landed in 2012:

Underperformance: The report reveals that most VC funds, particularly larger ones with over $400m in committed capital, have failed to outperform public market equivalents. The most successful VC funds, according to the report, were those established before 1996, with an average size of $96m. However, subsequent larger funds have generally resulted in poorer performance and benefited the managers more than the investors due to fee-based income.

Structural Issues: It criticizes the 2/20 fee structure for incentivizing fund managers to raise larger funds rather than focusing on fund performance. The study advocates for a fee structure that aligns better with performance, suggesting that fund managers should only be rewarded after achieving a certain threshold of returns for their investors.

J-Curve Misconception: The concept of a J-curve, which posits that VC funds typically perform poorly in their early years before generating significant returns, is challenged. IRRs peak just as fund managers are raising their next funds. The report argues that this expectation may lead to inappropriate investment decisions and fund structures, suggesting instead a focus on long-term gains rather than short-term appearances.

Transparency and Alignment: A recurring theme is the need for greater transparency and better alignment of interests between GPs and LPs. The report emphasizes that LPs should demand more detailed disclosures and adopt robust benchmarks like public market equivalents to evaluate fund performance realistically and objectively.

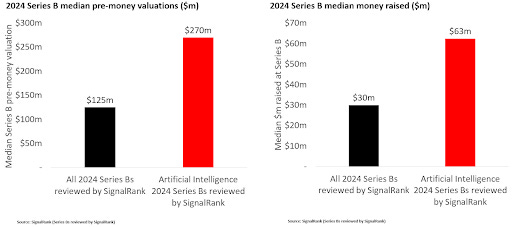

State of the Series B ecosystem

Source: SignalRank Update | Published: 2025-01-09 | Reading Time: 5 min | Domain: signalrankupdate.substack.com

We are excited to share here our second annual report on the state of the Series B ecosystem.

The SignalRank Index reflects the top 5% of Series Bs in terms of MOIC potential, with our Series B investments completed in support of our seed partners (who are existing investors in these companies and wish to exercise their pro rata rights). As such, understanding the Series B ecosystem is critical to our business model.

In this post, we will consider how broader trends impacted the Series B ecosystem, as well as tease out some preliminary conclusions from the report.

We hope you enjoy the report.

The broader context

In 2024, the Series B market was impacted by a number of core broader themes in the technology sector, including:

AI domination The foundational models have continued to improve, while the hyperscalers invest ever more capital into AI infrastructure, research and product. According to CB Insights, 2024 has seen 72 companies become unicorns, and 32 of these (44%) are AI startups. These AI players are reaching unicorn status far faster (median of 2 years) than non-AI companies (median of 9 years).

Liquidity remained elusive While the stock market boomed and interest rates fell, this is yet to translate into IPOs. The rise of private tender offers and continuity funds reflect the persistence of the IPO drought. There were just nine venture-backed IPOs above $1bn valuations in 2024. The success of ServiceTitan’s listing reveals substantial public investor demand for high growth software. Encouraging for 2025.

Concentrated VC fundraising In 2024, 30 firms raised 75% of all capital raised by VC funds in the US, demonstrating how the tech pullback is concentrating influence among a small number of venture brands.

Silicon Valley’s government takeover People used to complain about the revolving doors between government and Wall Street. The importance of Elon Musk’s role in Trump’s election has led to similar noises being made about the influence of Silicon Valley (especially the ex PayPal crew, including Elon Musk, Peter Thiel, and David Sacks). While yet to take office, the impact of Silicon Valley’s central role in government is already starting to be felt (most visibly in crypto markets).

Why fund structure matters

Source: SignalRank Update | Published: 2025-01-16 | Reading Time: 9 min | Domain: signalrankupdate.substack.com

This is not investment advice and is for informational purposes only. Investors should conduct their own research.

Elon Musk was the defining entrepreneur of 2024. Last year, his companies (in no particular order): caught a rocket out of thin air (SpaceX), unveiled the Cybercab (Tesla), raised $6bn for xAI, commenced human trials for Neuralink, built a supercomputer with 100k Nvidia H100 GPUs (xAI), expanded the Boring Company’s tunnels in Las Vegas, and launched Grok on X. Oh, and he became the ‘First Buddy’ after a $277m investment catapulted Donald Trump to electoral victory. To paraphrase Musk’s question to ex Twitter CEO, Parag Agrawal, “what did you get done last year”?

As a result of the above achievements, Musk’s wealth increased by $200bn last year. It is therefore not surprising that several investment groups are seeking to build a type of ‘Musk ETF’ to enable the public to benefit by owning a small part of these enterprises.

However, as we will see, the structure of these investment groups has significant implications for how Musk’s value creation is captured for investors.

Destiny XYZ (ticker: DXYZ) and Cathie Wood’s Ark Ventures (ticker: ARKVX) could be perceived as proxies for Musk’s ventures. Both groups are seeking to build portfolios of private companies in a public wrapper. 37% of Destiny’s portfolio is in SpaceX, while 15% of Ark’s portfolio is spread across numerous Musk’s ventures: SpaceX (12%), xAI, X, and Tesla.

Yet the divergence in their performance since the US election highlights the importance of structure. Since the election (and to the end of 2024), DXYZ’s closed-end fund structure increased in value by 450%, while Ark Ventures increased in value by 12%. (Musk’s wealth increased by 77% since the election to the end of the year; S&P was up 3% to the end of the year by way of comparison)

No wonder DXYZ’s CEO, Sohail Prasad, is trolling Cathie Wood on X….

Crunchbase Unicorn Board Tops $1T In Funding Raised

Source: Crunchbase News | Published: 2025-01-16 | Reading Time: 5 min | Domain: news.crunchbase.com

Last month, the companies on The Crunchbase Unicorn Board topped $1 trillion in collective funding for the first time, marking a new milestone for the board, which lists private, venture-backed companies around the globe that have hit billion-dollar valuations. The board counted a total of 1,562 unicorns at year-end, not including companies that have exited or shuttered after joining.

In 2024, a total of 109 companies joined our unicorn board, adding close to $250 billion in value and $53 billion in funding. Contrast that with 2023, when 100 companies joined and added close to $145 billion in value.

The most highly valued new unicorn of 2024 was xAI, which first joined in May at a $24 billion valuation. Its valuation doubled to $50 billion in a new round of funding six months later.

Meanwhile, the largest round raised by a unicorn company in 2024 was Databricks’ $10 billion deal at a valuation of $62 billion. Databricks joined the board in February 2019 when it was valued at $2.75 billion.

Leading countries

The U.S. led — by far — with 64 new unicorns minted in 2024. China was host to 16 new unicorns, India minted six and the U.K. five. Singapore birthed three new unicorns last year, while Brazil, France, Germany and Hong Kong each added two new unicorns.

December’s minted unicorns

Not surprisingly, AI led for new unicorns in December 2024. Here are the nine newly minted December unicorns, by sector.

AI

AI cloud storage provider Vultr raised a $333 million funding led by AMD Ventures, the venture arm of AMD, and LuminArx Capital Management. The 10-year-old Florida-based company was valued at $3.5 billion.

Anysphere, the maker of AI coding assistant Cursor, raised a $100 million Series B led by Thrive Capital. Andreessen Horowitz and Thrive led its $60 million Series A funding four months earlier, when Anysphere said it had 40,000 customers. The 2-year-old San Francisco-based company was valued at $2.6 billion in its Series B round.

Liquid AI, a developer of smaller foundation models, raised a $250 million Series A led by AMD Ventures. The 1-year-old Cambridge, Massachusetts-based company was valued at $2.3 billion.

Ayar Labs, an optical AI for faster data transmission, raised a $155 million Series D led by Advent International and Light Street Capital. The 9-year-old San Jose, California-based company was valued at $1 billion.

Language learning AI company Speak, which facilitates real-time communication, raised a $78 million Series C led by Accel. The 8-year-old San Francisco-based company was valued at $1 billion.

Foundation model company StepStar raised a Series B led by Shanghai State-owned Capital Investment. The 1-year-old Shanghai-based company was valued at $1 billion.

Fintech

Fintech mobile app One, majority owned by Walmart, raised a $300 million corporate round led by Walmart and Ribbit Capital. The 2-year-old, New York-based company was valued at $2.8 billion.

Digital bank Tyme Group raised a $250 million Series D led by Brazil-based digital bank Nubank. The 12-year-old Singapore-based company was valued at $1.5 billion. Tyme says it has 15 million customers in South Africa and the Philippines, and is planning to expand to Vietnam and Indonesia.

Robotics

Cleaning robotic company Narwal Robotics raised a Series D that valued the 8-year-old company at $1.4 billion led by state-owned enterprises. HongShan, formerly called Sequoia Capital China, led the Series C funding.

December’s exits

Four companies exited the unicorn board in December: three by going public and one via an acquisition….

Top New York VC Ben Lerer says more mid-sized VC firms are heading for failure

Source: TechCrunch | Published: 2025-01-13 | Reading Time: 1 min | Domain: techcrunch.com

Ben Lerer, managing partner of one of New York’s most prestigious seed-stage venture firms, Lerer Hippeau, shared some predictions with Fortune’s Leo Schwartz. He believes venture firms will continue to see a bifurcation as money pours mostly into top funds like Thrive and a16z, as well as into smaller more bespoke funds. “Where you go […]

© 2024 TechCrunch. All rights reserved. For personal use only.

Number of US venture capital firms falls as cash flows to tech’s top investors

Source: Venture capital investment | Published: 2025-01-01 | Reading Time: 1 min | Domain: ft.com

Risk-averse financial institutions concentrate money on biggest Silicon Valley VCs in trend that threatens smaller groups

George Hammond in San Francisco JANUARY 1 2025

The number of active venture capital investors has dropped more than a quarter from a peak in 2021, as risk-averse financial institutions focus their money on the biggest firms in Silicon Valley.

The tally of VCs investing in US-headquartered companies dropped to 6,175 in 2024 — meaning more than 2,000 have fallen dormant since a peak of 8,315 in 2021, according to data provider PitchBook.

The trend has concentrated power among a small group of mega-firms and has left smaller VCs in a fight for survival. It has also skewed the dynamics of the US venture market, enabling start-ups such as SpaceX, OpenAI, Databricks and Stripe to stay private for far longer, while thinning out funding options for smaller companies.

Crunchbase: 50% of VC Capital Went to SF Bay Last Year, Q4 Roared Back for Venture Capital

Source: SaaStr | Published: 2025-01-09 | Reading Time: 1 min | Domain: saastr.com

So Carta and Crunchbase are two of our favorite data sources at SaaStr, and Crunchbase’s latest VC funding report is out here.

Two data points jumped out at me:

51% of all U.S. VC funding ($178 Billion total) went to SF Bay Area companies

Venture roared back in Q4’24. Not to ’21 levels, but up +70% over Q4’23:

Now it’s not quite that simple. Big AI deals in the SF Bay Area and growth rounds were a big part of it. Overall early stage VC wasn’t up much last year — or in Q4. So VC is back, but it’s back for AI (we know this) and fueled by big growth rounds:

We mostly knew this, but it’s good to see more of the actual data. The SF Bay area is back as king. But for the most part, it’s due to big AI and growth rounds.

A new king. But the same old crown.

And here’s what I can tell you more subjectively across the SaaStr Fund portfolio and all the VCs I work with personally: everyone’s looking to deploy capital and fund the best start-ups. Liquidity isn’t back, but the rush to find the next decacorn … is.

The post Crunchbase: 50% of VC Capital Went to SF Bay Last Year, Q4 Roared Back for Venture Capital appeared first on SaaStr.

Like Bananas, Most Unicorn Startups Peak When Underripe

Source: Crunchbase News | Published: 2025-01-17 | Reading Time: 3 min | Domain: news.crunchbase.com

Like most people who regularly add bananas to the grocery cart, I’ve become something of an expert on their lifecycle.

Not until today, however, did I consider the parallels between this ubiquitous fruit and the typical startup.

The core similarity is this: The banana — much like a startup — peaks when slightly underripe.

In the case of bananas, power eaters recognize the indicators. Ideally, it should be sweet but not overly so, bright yellow with a vestige of green on the peel, and a texture that maintains a hint of firmness.

Leave a banana out even a day past this consummate ripeness, and it will still be edible. But it will be mushier, more shriveled, and likely riddled with brown spots. Leave it out a few more days and it will continue to be edible — just not all that appetizing.

For a startup, ripeness indicators are also easy to recognize, at least in hindsight. Like a banana, an upstart company’s desirability tends to peak when its potential is both most obvious and mostly unrealized.

One measure of this is when someone completely unconnected from the startup scene has heard of said company. It’s the point when that person might think: “I only just learned about this, but I bet it’s going to be big.”

Best laid plans

Commonly, entire sectors hit peak ripeness at that moment when everyone thinks it’s a great idea and no one has to actually make money on it yet.

We saw this during the pandemic, when upstarts like remote meeting platform Hopin and audio social network Clubhouse hit star unicorn status amid expectations that we’d all want to connect this way. Turns out we didn’t.

The IPO and SPAC boom of 2021 also brought to market a bumper crop of startups that seemed like the wave of the future until they quickly lost their allure with investors. This included several tied to autonomous vehicles that saw their valuations drive off a cliff, erasing billions in market cap.

Around the same time, we also saw a renewed e-commerce boom, with upstart direct-to-consumer brands and online retail rollup plays attracting billions. That also didn’t last. Or don’t forget scooter-mania — a well-documented bust preceded by a brief period when venture capitalists were convinced they’d found a coveted solution to the last-mile transportation conundrum.

Spotty success

Even startups that did manage to succeed as large-cap companies saw some pretty peaky valuations in their early days, especially considering the risks along the way….

Interview of the Week

Startup of the Week

Silicon Valley defence start-up Shield AI hits $5bn valuation

Source: Technology sector | Published: 2025-01-17 | Reading Time: 1 min | Domain: ft.com

Palantir in Talks to Invest in Drone Startup at $5 Billion Valuation

Source: The Information | Published: 2025-01-17 | Reading Time: 1 min | Domain: theinformation.com

Shield AI, a maker of drones and software whose customers include the Ukrainian and U.S. governments, is in talks to raise hundreds of millions of dollars from investors including Palantir and Lockheed Martin, three people familiar with the matter said.

The round would likely value the San Diego-based startup at about $5 billion, before the investment, roughly double its valuation from its last funding round in 2023, the people said.

Post of the Week

A reminder for new readers. Each week, That Was The Week, includes a collection of selected essays on critical issues in tech, startups, and venture capital. I chose the articles based on their interest to me. The selections often include viewpoints I can't entirely agree with. I include them if they provoke me to think. Click on the headline, contents link, or the ‘Read More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below. There is a weekly News of the Week supplement that has the week’s most interesting news,