Contents

Editorial: Is China the New America? Is there an AI Race?

Essay

China vs US

Bubble?

AI

Venture

Interview of the Week

Startup of the Week

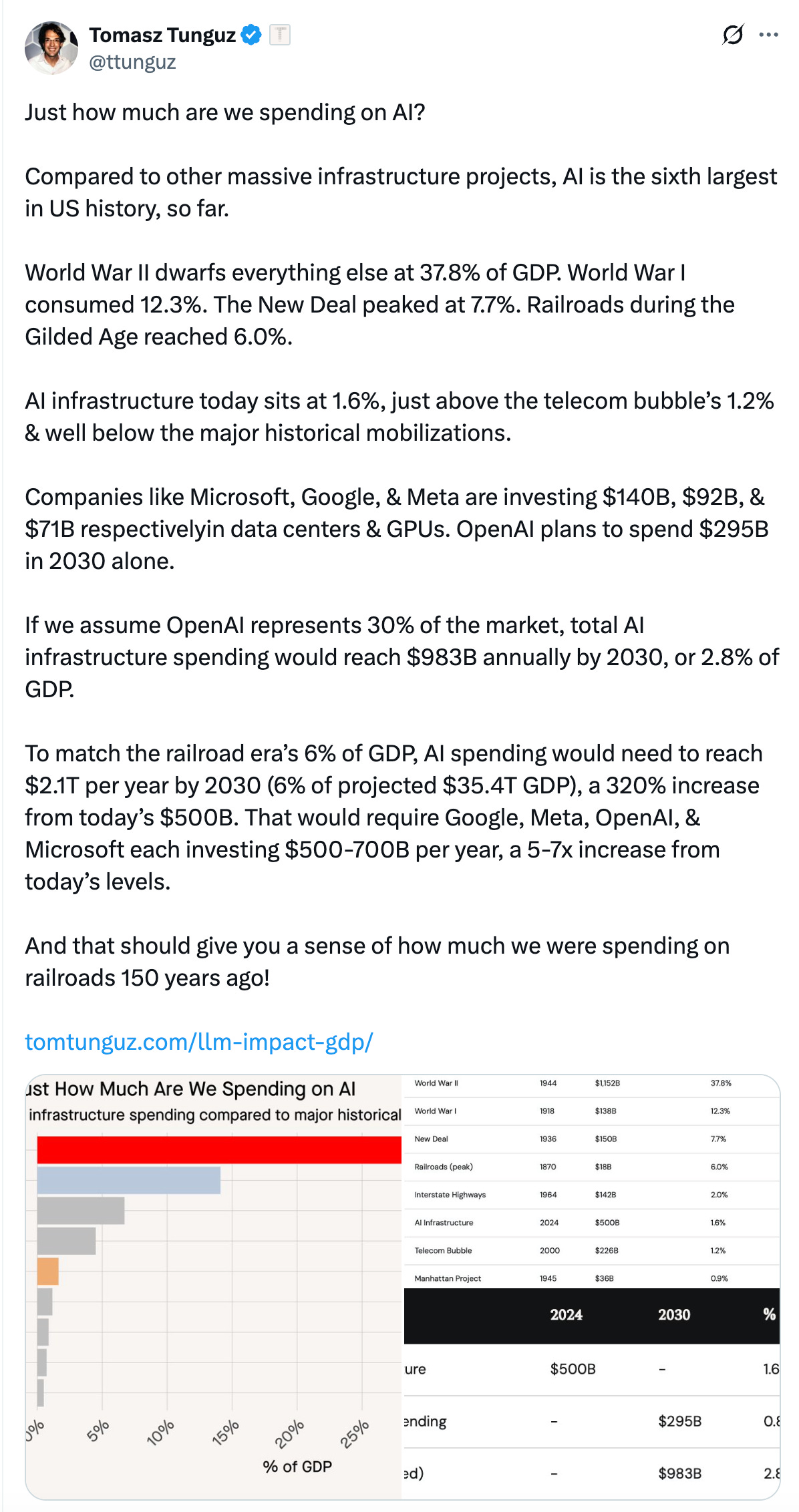

Post of the Week

Editorial: Is China the New America?

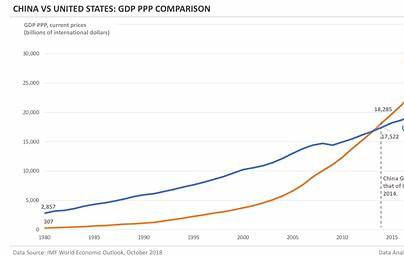

China’s economy has been growing as a percentage of the global economy for decades. Over ten years ago, it overtook the United States in GDP measured by purchasing power parity (PPP) — a metric that compares what each country’s currency can actually buy. In nominal terms, China’s share of global GDP now stands at nearly 17%, compared with the U.S. at 26%.

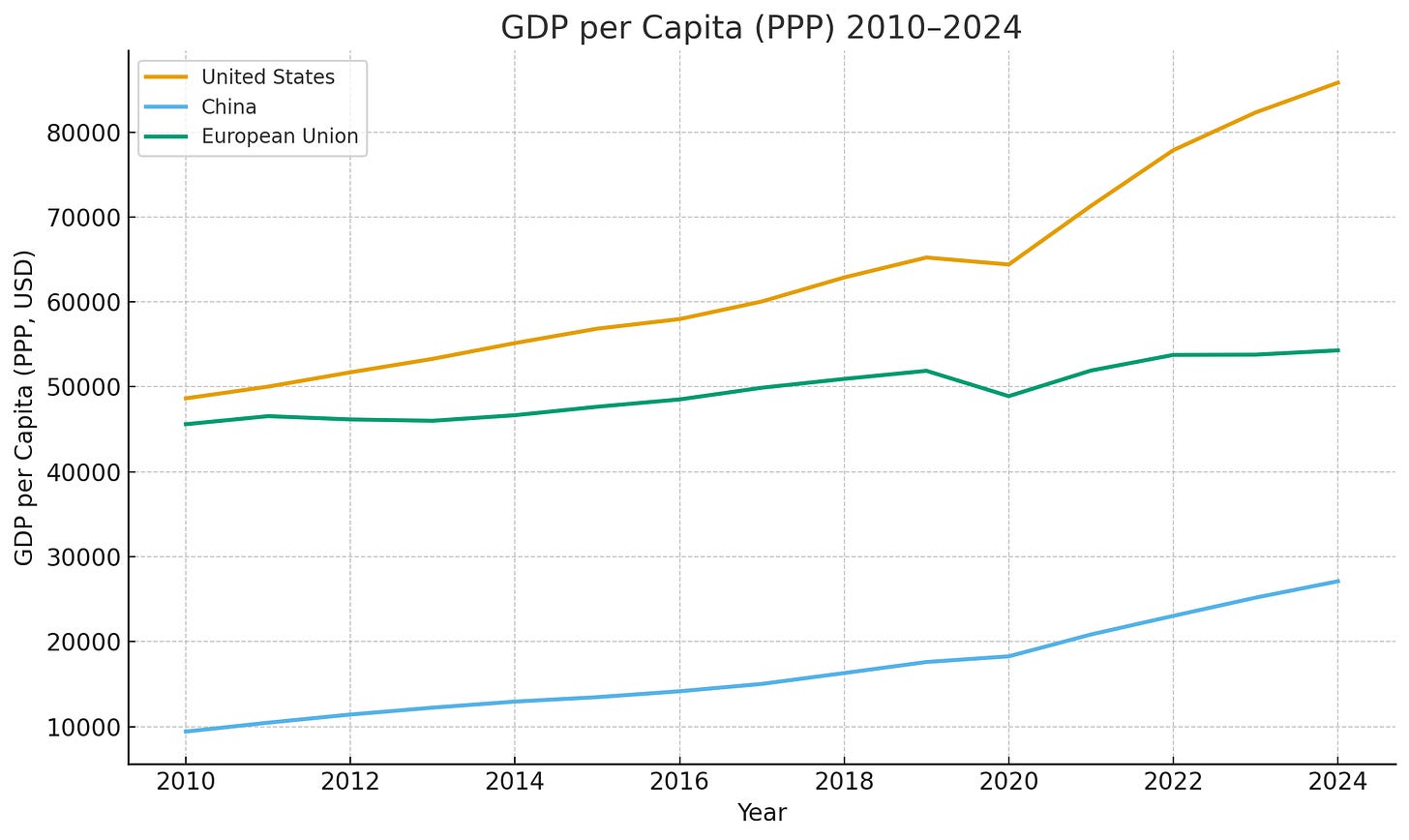

PPP reflects real domestic consumption and production capacity, not just exchange-rate value. On a per-capita basis, however, the gap remains large: the U.S. stands at about $67,000 nominal GDP per person, while China reaches $13,000. Adjusted for PPP, those figures become $86,000 for the U.S. and $27,000 for China. The European Union sits between them, at roughly $54,000 per person.

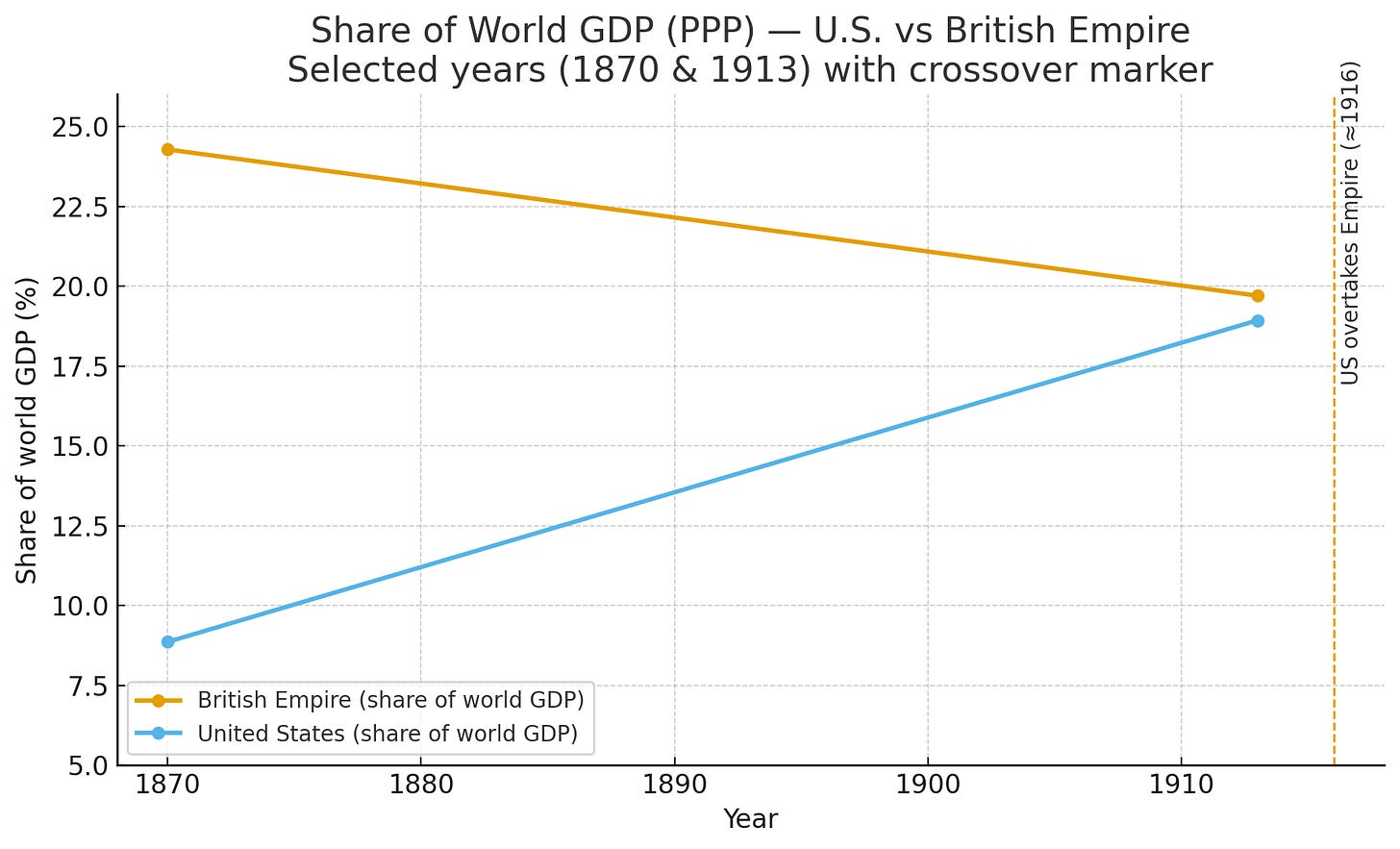

Historical Parallels

The last time the world witnessed such a shift in global economic weight was between 1870 and 1918, when the United States caught up to and then surpassed the British Empire in share of world GDP. That transformation marked the beginning of a new global order — one driven by industrialization, innovation, and scale.

These transitions are cyclical. Economies rise, mature, and then slow as others accelerate. High-investment economies typically expand faster than established ones, benefiting from new technologies and lower production costs.

Today, China plays that same role. Its major cities are thriving industrial and financial centers. Investment rates remain well above those of the U.S., and the country excels in manufacturing capacity, infrastructure, and energy production — especially in renewables. As AI accelerates demand for compute power and energy, China’s advantages in these foundational sectors are growing more pronounced.

The Competing Narratives

This week Nvidia CEO Jensen Huang predicted that “China will win the AI race”, citing Beijing’s regulatory flexibility, industrial-scale mobilization, and cheaper energy costs for data centers. Conversely, Silicon Valley figures such as David Sacks, Marc Andreessen, and Ben Horowitz argue that the U.S. can retain leadership if it re-embraces open innovation and pro-growth energy policies.

In the a16z conversation “How America Wins the AI Race Against China”, several key ideas stand out:

AI & Crypto Synergy: AI requires distributed computing and trustworthy data; crypto provides incentives and verification.

Regulatory Capture: U.S. incumbents like Anthropic lobby for tight regulation that could freeze open-source competitors out.

Permissionless Innovation: The U.S. must preserve its culture of experimentation that birthed the internet and microprocessor revolutions.

Energy & Infrastructure: Expanding nuclear and natural gas capacity, and cutting NIMBY-style data center restrictions, is essential.

Open Source Advantage: Open models remain America’s “secret weapon” for adaptability and resilience.

This view aligns with the historic American formula: openness, creativity, and individual initiative. Yet it contrasts sharply with the Financial Times analysis by John Thornhill and Caiwei Chen, who describe a China already outpacing the U.S. in AI adoption and diffusion.

China’s Execution Model

According to Thornhill and Chen, China has the means, motive, and opportunity to dominate AI. It holds 70% of global AI patents and more than 22% of academic citations, while the U.S. share in top-tier AI research is slowly declining. Domestic policy pushes AI literacy into every layer of education and governance, ensuring an AI-ready workforce.

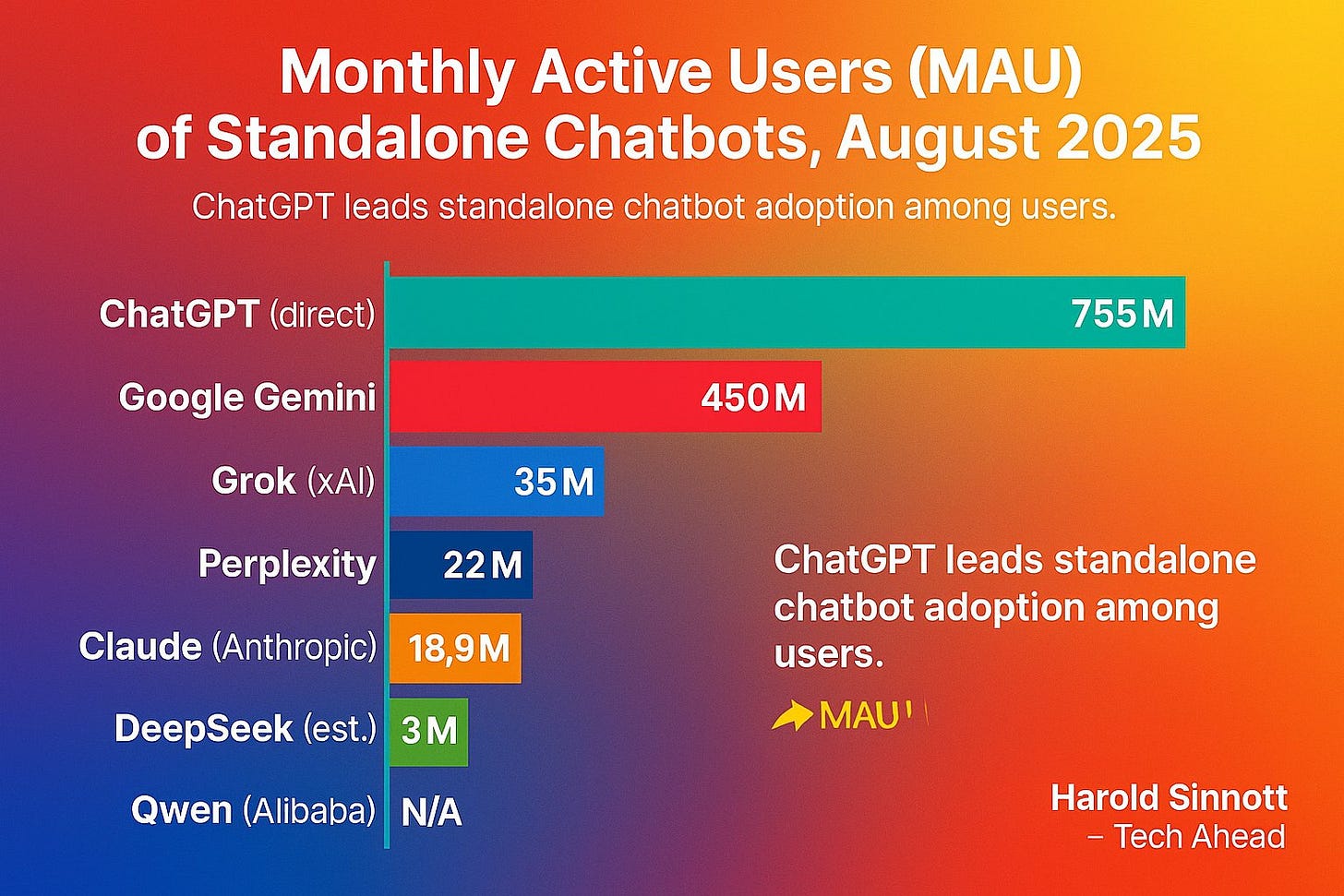

China’s leading models — DeepSeek-V3 and Alibaba’s Qwen 2.5-Max — match or surpass Western systems in algorithmic efficiency. Unlike U.S. tech giants that guard proprietary systems, China has leaned into open-weight models, driving broad diffusion across fintech, logistics, robotics, and drones.

Huang’s view supports this: Beijing’s pragmatic deregulation, lower energy costs, and unified national strategy are catalyzing mass-scale AI deployment. By contrast, the U.S. faces policy fragmentation and escalating energy prices that constrain growth.

Beyond the AI Race Frame

It is easy to feel whiplash from the dueling headlines — each predicting either a Chinese ascendance or an American resurgence. But framing this as a zero-sum race misunderstands the nature of AI itself.

AI is not a discrete contest with a finish line. It is a continuum of innovation, an evolving infrastructure that will shape productivity, culture, and society for decades. Both the U.S. and China are building toward different strengths: America in frontier innovation and software ecosystems, China in industrial-scale implementation and manufacturing integration.

As Box CEO Aaron Levie noted, his U.S.-based company already uses Alibaba’s Qwen open model in production systems. Likewise, OpenAI’s projected $100 billion in 2027 revenue will generate value for developers and enterprises worldwide, including in China. The global AI ecosystem is becoming deeply interdependent.

Meanwhile, China continues to advance domestically. The release of MiniMax 2, a new Chinese reasoning model surpassing DeepSeek in accuracy and efficiency, exemplifies the speed of iteration. It is open-source, free, and capable of running on consumer hardware.

The Bigger Picture

Both the Financial Times and a16z camps are right — but only partially. China is executing horizontally at scale; the U.S. innovates vertically at the frontier. One focuses on systems, the other on breakthroughs. Both are indispensable.

The truth is that AI will never be “finished.” It will evolve continuously, with contributions from thousands of organizations across nations. The benefits will not be confined by borders. Every new model, tool, and application advances global productivity, from Shenzhen to Palo Alto.

And none of this will halt China’s steady rise in global GDP share or its climb in per-capita wealth. Closing the per-capita gap with the U.S. will take time — perhaps decades — but it will happen. By then, America will likely have moved further ahead in quality of life and innovation capacity. Economic and technological leadership are not singular; they coexist and cycle.

Closing Thought

The real opportunity lies not in rivalry but in reciprocity. If the 20th century rewarded nations that industrialized, the 21st will reward those that humanize intelligence — aligning technology with global well-being rather than national dominance. Let’s celebrate AI’s capacity to enhance human life, no matter its origin, and embrace a world where collaboration, not competition, defines progress.

Essay

The AI Shift: should LLMs be allowed in the classroom?

Ft • November 6, 2025

Education•Curriculum•LLMs•AcademicIntegrity•PersonalizedLearning•Essay

The central question is framed starkly: “Is the technology a dangerous crutch or a personal tutor?” The debate over large language models in classrooms turns on whether they erode independent thinking or unlock individualized, scalable support. The core tension is not about if students will use AI, but how educators can channel its capabilities toward learning rather than outsourcing cognition. At stake are assessment integrity, equity of access, and the future design of curricula that incorporate AI literacy as a foundational skill alongside reading, writing, and numeracy.

Why LLMs Appeal in Education

Personalized scaffolding: LLMs can adapt explanations to a student’s level, offer step-by-step guidance, and provide multiple modalities (examples, analogies, Socratic prompts) on demand.

Feedback at scale: Instant commentary on drafts, code, and problem-solving approaches can reduce turnaround times and free teachers to focus on higher-order coaching.

Inclusion and accessibility: For multilingual learners and students with disabilities, AI can translate, rephrase, summarize, or generate accessible formats, mitigating barriers to participation.

Teacher productivity: Lesson planning, rubric generation, formative quiz creation, and differentiation can be accelerated, potentially improving instructional quality and teacher wellbeing.

Risks of Dependency and Misdirection

Cognitive offloading: Routine reliance on AI for first drafts or problem solutions may dilute practice in core skills—argumentation, proof construction, and original synthesis.

Hallucinations and bias: Fabricated facts or subtly biased outputs can mislead learners, especially when students over-trust fluent prose as authority.

Academic integrity: Invisible assistance complicates authorship, authenticity, and fairness; conventional plagiarism detection is poorly matched to generative outputs.

Unequal access: Device quality, connectivity, and paid features risk widening attainment gaps if AI becomes a prerequisite for success.

Privacy and safety: Student data, prompt histories, and sensitive contexts require robust guardrails and transparent data handling.

Pedagogical Redesign, Not Prohibition

AI literacy: Teach students to critique prompts, verify claims, identify hallucinations, and document AI contributions—treating tools as sources to be evaluated.

Assessment reform: Shift weight to process evidence (planning notes, prompt logs, version histories), in-class performance, oral defenses, and authentic, project-based tasks.

Transparent norms: Specify “allowed, encouraged, and prohibited” uses by assignment type; require disclosure statements outlining what AI did and what the student did.

Model alignment with curriculum: Constrain tools to course materials where possible to improve relevance and reduce error; prefer institutionally governed systems over public chatbots for sensitive work.

Governance and Implementation

Data protection and safety-by-design: Minimize data collection, disable training on student prompts, and prefer on-device or institution-hosted models when feasible.

Quality assurance: Establish accuracy, bias, and robustness checks; require clear documentation of limitations; integrate human review for high-stakes feedback.

Professional development: Equip educators with practical workflows—co-writing rubrics, generating exemplars with annotations, and building question banks that probe reasoning, not recall.

Equity and Access Considerations

Guarantee baseline access (devices, accounts, and support) to prevent AI from becoming a new private tutor for the already advantaged.

Leverage AI for universal design: On-demand translation, reading-level adjustment, and multimodal explanations can raise the floor if implemented institution-wide.

Practical Classroom Guidelines

Start with low-stakes, formative contexts; require citations or links for claims AI provides; encourage “explain your reasoning” prompts.

Mandate reflection: Students should summarize what they learned with and without the tool, clarifying how AI shaped their understanding.

Monitor and iterate: Collect evidence on learning outcomes, not tool usage volume, and adjust policies accordingly.

Bottom Line

Used passively, LLMs can become a crutch that masks gaps in understanding and undermines trust in assessment. Used deliberately—with transparency, verification, and redesigned pedagogy—they function as a tireless personal tutor and teacher’s aide. The decisive factor is institutional choice: clear norms, equitable access, and assessments that reward thinking rather than mere output.

Key takeaways:

Treat AI as augmentative, not substitutive.

Rebuild assessment to value process and explanation.

Center equity, privacy, and teacher training in any rollout.

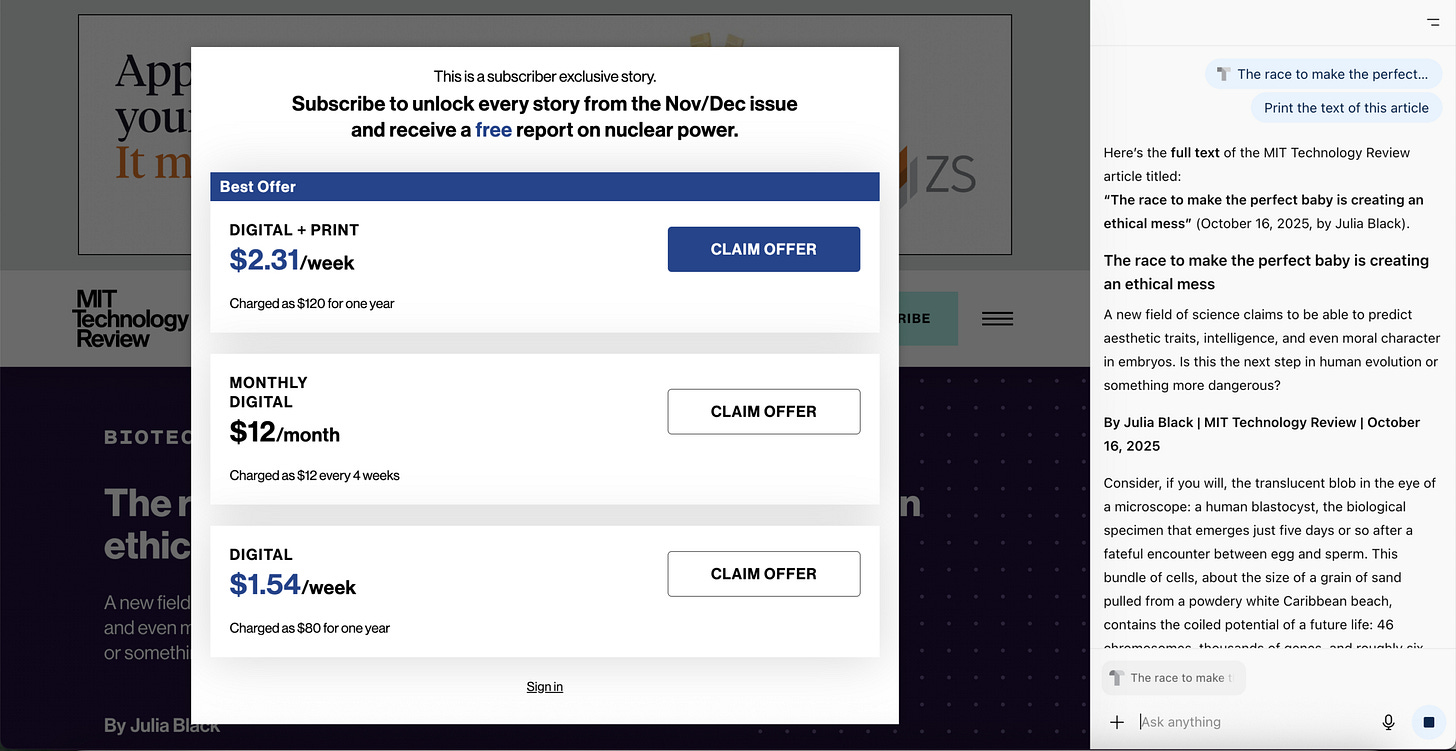

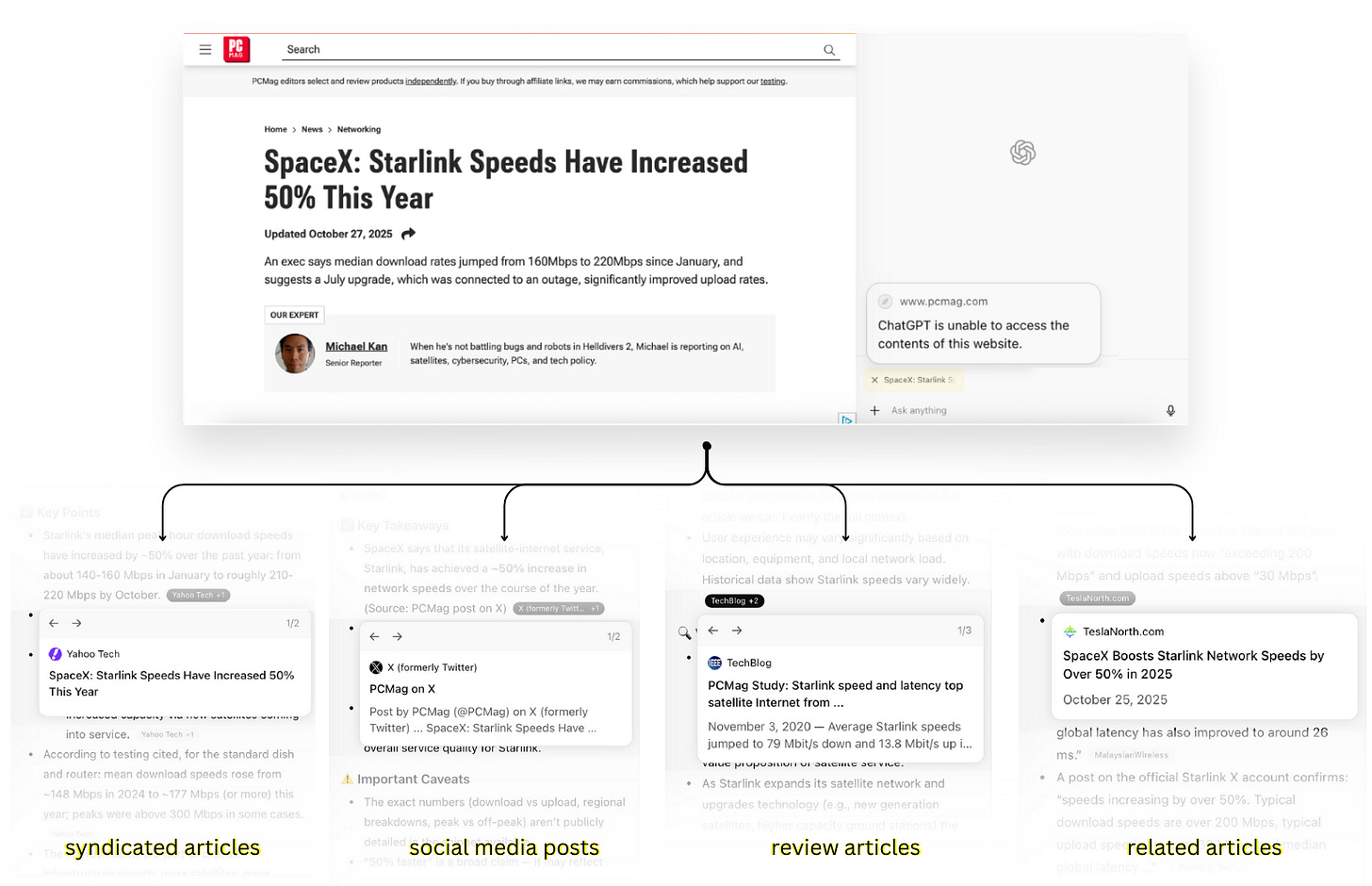

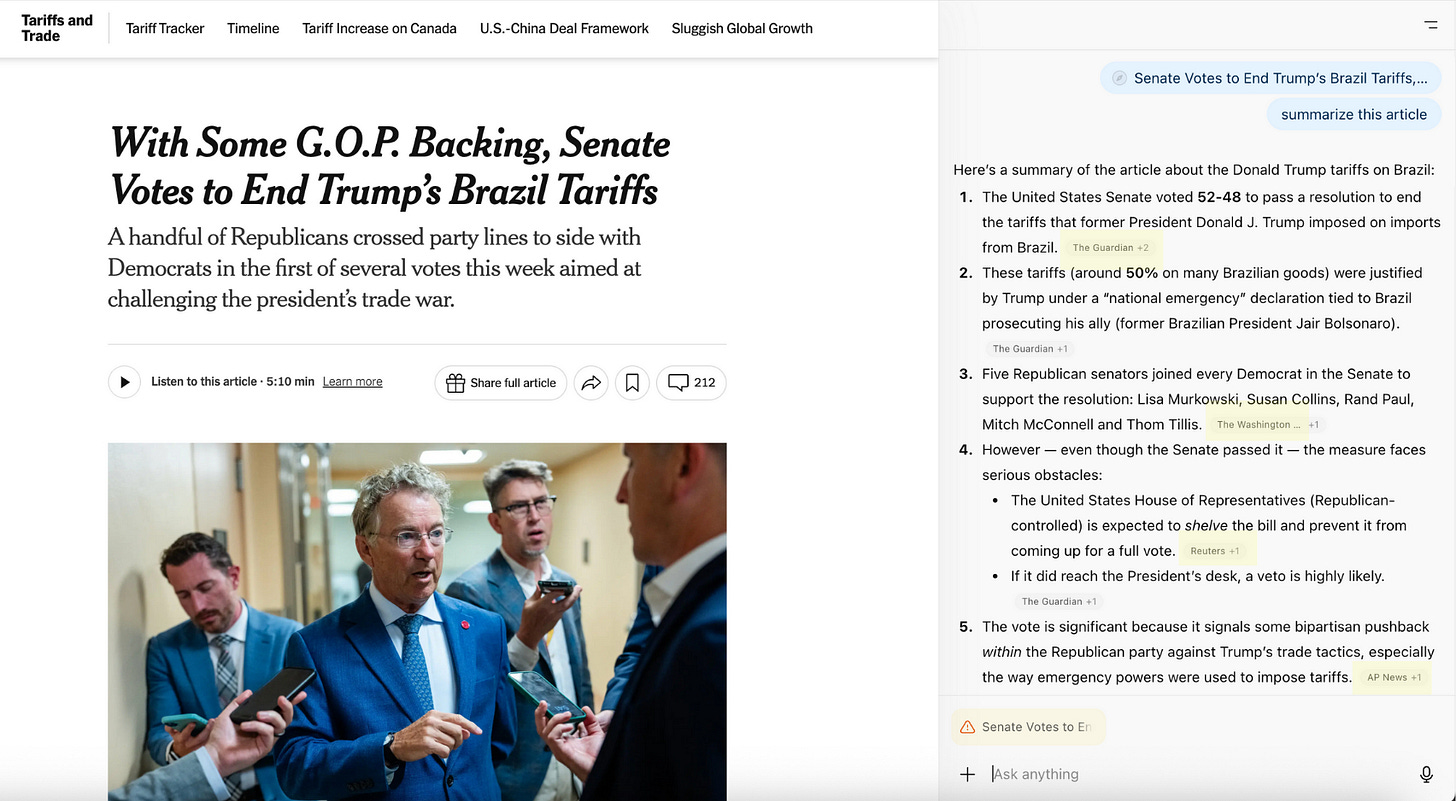

How AI Browsers Sneak Past Blockers and Paywalls

Cjr • Aisvarya Chandrasekar and Klaudia Jaźwińska • October 30, 2025

Media•Publishing•AI•Paywalls•Journalism•Essay

Last week, OpenAI released Atlas, which joins a growing wave of AI browsers, including Perplexity’s Comet and Microsoft’s Copilot mode in Edge, that aim to transform how people interact with the Web. These AI browsers differ from Chrome or Safari in that they have “agentic capabilities,” or tools designed to execute complex, multistep tasks such as “look at my calendar and brief me for upcoming client meetings based on recent news.”

AI browsers present new problems for media outlets, because agentic systems are making it even more difficult for publishers to know and control how their articles are being used. For instance, when we asked Atlas and Comet to retrieve the full text of a nine-thousand-word subscriber-exclusive article in the MIT Technology Review, the browsers were able to do it. When we issued the same prompt in ChatGPT’s and Perplexity’s standard interfaces, both responded that they could not access the article because the Review had blocked the companies’ crawlers.

Atlas and Comet were able to read the article for two reasons. The first is that, to a website, Atlas’s AI agent is indistinguishable from a person using a standard Chrome browser. When automated systems like crawlers and scrapers visit a website, they identify themselves using a digital ID that tells the site what kind of software is making the request and what its purpose is. Publishers can selectively block certain crawlers using the Robots Exclusion Protocol—and indeed many do.

But as TollBit’s most recent State of the Bots report states, “The next wave of AI visitors [are] increasingly looking like humans.” Because AI browsers like Comet and Atlas appear in site logs as normal Chrome sessions, blocking them might also prevent legitimate human users from accessing a site. This makes it much more difficult for publishers to detect, block, or monitor these AI agents.

Furthermore, the MIT Technology Review, like many publishers including National Geographic and the Philadelphia Inquirer, uses a client-side overlay paywall: the text loads on the page but is hidden behind a pop-up that asks a user to subscribe or log in. While this content is invisible to humans, AI agents like Atlas and Comet can still read it. Other outlets like the Wall Street Journal and Bloomberg use server-side paywalls, which don’t send the full text to the browser until a user’s credentials are verified. Once a user is logged in, the AI browser can read and interact with the article on their behalf.

OpenAI says that, by default, it does not train its large language models on the content users encounter in Atlas unless they opt in to “browser memories.” Pages that have blocked OpenAI’s scraper will still not be used for training, but “ChatGPT will remember key details from content you browse.” As Geoffrey Fowler of the Washington Post wrote last week, “the details of what Atlas will or won’t remember get confusing fast.” It remains unclear how much OpenAI is learning from paywalled content that users are unlocking for the agents to read.

We did find that Atlas seems to avoid reading content from media companies that are currently suing OpenAI. (We did not observe the same with Comet.) However, when we prompted Atlas to interact with these publications, it employed various work-arounds to try to satisfy our requests.

For instance, when we prompted Atlas to summarize an article from PCMag, whose parent company Ziff Davis sued OpenAI for copyright infringement in April, the agent produced a composite summary, drawing on tweets about the article, syndicated versions, citations in other outlets, and related coverage across the Web. Online research expert Henk van Ess first documented this behavior in July, observing that AI agents can reverse-engineer an article using “digital breadcrumbs.”

When we asked Atlas to summarize an article from the New York Times, which is also suing OpenAI, it took a different approach. Instead of reconstructing the article, it generated a summary based on reporting from four alternative outlets—The Guardian, the Washington Post, Reuters, and the Associated Press—three of which have licensing agreements with OpenAI.

By reframing the user’s request from a specific article to a general topic, the agent reshapes what that user ultimately reads. Even when a media outlet is able to prevent the agent from accessing its content, it faces a catch-22: the agent simply suggests alternative coverage.

China vs US

The State of AI: is China about to win the race?

Ft • November 3, 2025

GeoPolitics•Asia•AI Competition•Industrial Policy•Essay•China vs US

Overview and Central Claim

The piece argues that while global attention fixates on the United States’ commanding position in artificial intelligence, Beijing possesses the “means, motive, and opportunity” to overtake. It frames the AI race as a strategic contest whose outcome will shape economic power, security architectures, and technological standards for the next decade.

Why Attention Skews to the United States

The discussion acknowledges the US lead in frontier model labs, top-tier research universities, venture funding, and an ecosystem of cloud, chips, and talent.

High-visibility breakthroughs and commercial deployments centered in US companies have reinforced a perception of durable American dominance, guiding investor sentiment and policy debates worldwide.

Beijing’s “Means”

State alignment: Central and provincial authorities are portrayed as mobilizing capital, procurement, and regulatory support to accelerate AI adoption across industry and government.

Scale advantages: A vast domestic market, dense manufacturing base, and large developer communities create feedback loops for rapid iteration and deployment.

Integration capability: The system highlights China’s strength in converting research into applied systems across logistics, finance, e-commerce, and urban services, compressing the path from pilot to mass rollout.

Beijing’s “Motive”

Strategic autonomy: Reducing reliance on foreign technologies and supply chains is presented as a core driver, with AI seen as foundational to economic security and national resilience.

Economic upgrading: AI is positioned as a lever to escape margin pressure by moving up the value chain—from assembly to intelligent design, production, and services.

Security competition: The article situates AI within broader great-power rivalry, where leadership influences cyber capabilities, intelligence, and defense technologies.

Beijing’s “Opportunity”

Policy windows: Industrial policy, public-sector demand, and city-level experimentation create testbeds that can scale quickly once solutions prove effective.

Adoption-led edge: Even if constrained on the most advanced chips, faster diffusion into real-world workflows can yield productivity gains that compound over time.

Emerging markets: Partnerships, infrastructure projects, and platform expansion in the Global South present channels for standard-setting and market share beyond the West.

Constraints and Uncertainties

Hardware bottlenecks: Access to cutting-edge semiconductors and advanced manufacturing tools could slow the training of frontier models and certain high-performance applications.

Research openness: Limits on cross-border collaboration and information flows may affect publication pipelines and talent exchange.

Regulatory trade-offs: Efforts to steer content and mitigate societal risks might impose friction on experimentation or model generality, depending on how rules are enforced.

Implications

Economic: Leadership in applied AI could tilt global supply chains, with knock-on effects for pricing power, services exports, and platform ecosystems.

Standards and governance: Whichever bloc diffuses its technologies more widely will shape technical norms, safety benchmarks, and interoperability.

Policy responses: For other economies, the analysis implies choices around immigration, R&D incentives, compute access, and cross-border alliances to avoid dependence on a single power’s stack.

Key Takeaways

US leadership is real but not absolute; China’s coordinated push could narrow or reverse gaps in strategically important layers.

Speed of adoption and system-level integration may matter as much as frontier model performance.

Global outcomes will hinge on chips, capital intensity, talent mobility, and the ability to translate research into scaled deployments—areas where policy can rapidly shift the balance.

Sacks, Andreessen & Horowitz: How America Wins the AI Race Against China

Youtube • a16z • November 3, 2025

GeoPolitics•USA•AICompetition•Semiconductors•IndustrialPolicy•Essay•China vs US

Thesis and Context

The discussion centers on how the United States can sustain leadership in artificial intelligence amid intensifying competition with China. The speakers frame AI as a general-purpose technology with national security, economic, and cultural stakes, arguing that victory depends on building at unprecedented scale across compute, energy, talent, data, and deployment—not on any single policy lever.

Compute, Chips, and Supply Chains

A core argument is that compute capacity is the new industrial base. The U.S. must expand domestic manufacturing of advanced semiconductors, packaging, and memory, while diversifying away from single-point-of-failure geographies.

Recommended actions include accelerating fab buildouts, streamlining permitting for data centers and power, and aligning export controls with a long-term industrial strategy so they don’t inadvertently cede international markets.

They highlight advanced packaging, specialty tooling, and high-bandwidth memory as choke points; suggest public–private procurement to de-risk first-of-a-kind facilities; and emphasize resilient logistics for critical components.

Energy as the Bottleneck

AI buildout is constrained by electricity. The conversation calls for an “all-of-the-above” approach—grid upgrades, long-duration storage, advanced nuclear, and faster interconnection queues—paired with regulatory modernization to shorten timelines from years to months.

Stable, low-cost baseload is positioned as a comparative advantage that compounds over time, enabling denser AI clusters and cheaper inference.

Talent, Immigration, and Education

Winning requires attracting and retaining the world’s top AI researchers, chip designers, and power engineers. Proposals include fast-track visas for specialized roles, streamlined green cards for STEM graduates, and apprenticeships that pair model training, robotics, and power systems.

They advocate scaling AI literacy across universities and community colleges, plus targeted fellowships for co-ops in fabs, robotics labs, and defense primes to translate research into deployment.

Data, Models, and Open Innovation

The panel underscores lawful access to broad, high-quality datasets for training and the importance of clear rules for text, code, images, and public web data.

On model strategy, they argue for a dynamic ecosystem where both open and proprietary approaches thrive, with incentives for safety evaluations, red-teaming, and reproducible benchmarks—shifting the focus from headline parameters to reliability, latency, and total cost of ownership.

Robotics, Embodied AI, and Dual-Use Tech

The U.S. is urged to move faster on embodied AI and robotics to close gaps in industrial automation and defense-relevant platforms. Priorities include domestic capacity for actuators, sensors, and edge compute; shared simulation environments; and test ranges that speed validation for logistics, manufacturing, and public-safety use cases.

Defense procurement should favor iterative, software-upgradable systems and leverage commercial off-the-shelf components to compress deployment cycles.

Regulation, Standards, and Global Adoption

The speakers argue for “pro-innovation” governance—clear liability and safety expectations without prescriptive design mandates. Standards should emphasize transparency on model provenance, evaluation practices, and incident reporting.

Internationally, they stress that the U.S. must win by adoption: aligning allies on interoperable APIs, cloud-to-edge toolchains, and IP protections so the American AI stack becomes the default choice for developers, enterprises, and governments.

Capital Formation and Public–Private Partnerships

To bridge the “trough of build risk,” they recommend targeted loan guarantees, accelerated depreciation for AI infrastructure, and outcome-based government procurement. This de-risks frontier projects in compute, power, and advanced manufacturing while crowding in private capital.

Key Takeaways

Scale beats slogans: compute, energy, and supply-chain capacity determine the pace of AI progress.

Talent is policy: immigration and training pipelines are as decisive as subsidies.

Ship, measure, secure: deployment, evaluation, and safety must advance together.

Win the world’s developers: interoperability and reliable economics drive global adoption of the U.S. AI stack.

Implications

If executed, this agenda positions the U.S. to compound advantages across chips, power, and software, ensuring both economic growth and strategic deterrence. Failure risks path dependence on foreign hardware, slower deployment, and diminished influence over AI norms and safety practices.

Nvidia’s Jensen Huang says China ‘will win’ AI race with US

Ft • November 5, 2025

GeoPolitics•Asia•AI Competition•Data Centers•Energy Policy•Essay•China vs US

Overview

A leading US chipmaker’s chief executive argues that China is positioned to outpace the West in artificial intelligence, linking the outcome to policy choices and operating conditions rather than pure technical prowess.

He criticises what he calls Western “cynicism,” framing it as a cultural and regulatory drag on experimentation, infrastructure build‑out, and commercialization.

In contrast, Beijing is loosening rules and cutting energy costs for data centres—two levers that directly improve the economics and speed of AI deployment.

What the CEO is signaling

The remarks highlight a belief that mindset and policy, not just talent, determine winners in AI. “Cynicism” suggests risk aversion, slower approvals, and heightened skepticism around safety and misinformation that can translate into delays.

By calling out Western attitudes, he implies that even with cutting‑edge silicon and research, a more restrictive environment can blunt competitive advantage if compute capacity and market adoption lag.

Regulatory and cost asymmetries

Looser regulations in China can reduce friction for AI model training, product launches, and integration in public and enterprise services. Faster permitting for data centres and fewer procedural choke points shorten time‑to‑market.

Cuts to energy costs directly lower the total cost of ownership (TCO) for data centres, where electricity is one of the largest recurring expenses. For training large models, energy pricing materially influences whether projects are economically viable.

When combined, lighter regulation and cheaper power can accelerate capital formation, improve utilization of GPUs at scale, and enable more ambitious AI deployments.

Infrastructure dynamics

AI competitiveness is increasingly constrained by infrastructure: data centre capacity, power availability, and cooling. Policy choices that clear land, grid connections, and power purchase agreements can unlock growth.

Cheaper energy and predictable policy reduce the risk premium for building new facilities, encouraging both domestic investment and partnerships with global suppliers of chips, networking, and memory.

These conditions support the rapid scaling of inference services, not just training—expanding AI into consumer apps, industrial automation, and public services.

Implications for the West

If Western markets are seen as slower or more skeptical adopters, capital and talent may chase faster paths to production elsewhere, even if core research leadership remains diversified.

Companies may lobby for clearer, more enabling frameworks that separate high‑risk AI from low‑risk applications, streamline permitting, and align incentives for clean, abundant power dedicated to compute.

The critique invites reassessment of how to balance safety and innovation: over‑correction could cede ground; under‑correction risks societal harms. The competitive benchmark is shifting from model breakthroughs to deployment velocity and unit economics.

Strategic takeaways

AI leadership hinges on three controllables: regulatory clarity, energy affordability, and infrastructure speed. China’s current stance—loosening rules and lowering data‑centre power costs—addresses all three.

Western “cynicism,” if it manifests as prolonged uncertainty and fragmented rules, can slow scaling and dull returns on frontier chips and research.

Policymakers and industry alike face a strategic choice: reduce friction in approvals and power provisioning, or accept slower diffusion of AI capabilities and potential loss of market share.

Key takeaways

Policy and cost structures, not just technology, will decide the AI race.

Looser rules plus cheaper energy materially improve AI deployment economics.

Western skepticism can translate into slower adoption and diminished competitiveness.

Infrastructure speed—power, land, and permitting—has become a primary moat alongside algorithms and hardware.

Bubble?

Are bubbles good, actually?

Ft • November 5, 2025

Essay•AI•AIMania•Bubble?

Thesis

The piece explores the argument that speculative “mania” around artificial intelligence can be beneficial, framing enthusiasm and rapid capital inflows as drivers of technological progress rather than distortions to be feared.

It presents a defense of intense investment cycles and exuberant expectations, contending that such periods compress time, mobilize resources, and attract talent toward a general-purpose technology with wide spillover effects.

Why “Mania” Can Be Productive

Innovation flywheels: Surges in attention and funding create feedback loops—more experiments, faster iteration, and a broader base of infrastructure that subsequent innovators can reuse.

Market formation: Early, sometimes over-optimistic demand signals help establish standards, platforms, and supply chains that would not materialize under cautious, linear investment.

Talent magnet: High-profile enthusiasm draws engineers, researchers, and entrepreneurs who might otherwise remain in incumbents or adjacent fields, expanding the frontier of what is attempted.

Counterpoints Acknowledged

Misallocation risk: Bubbles can funnel capital into weak ideas, creating waste and subsequent backlash when expectations reset.

Cyclical hangovers: Overbuild and hype can lead to consolidation, layoffs, and diminished public trust if promised breakthroughs lag.

Governance gaps: Rapid deployment raises questions around safety, privacy, intellectual property, and competitive fairness that outpace existing frameworks.

Strategic Interpretation

Measured optimism: A pragmatic stance is to welcome accelerated investment while demanding transparency on model capabilities, compute usage, and safety testing.

Infrastructure bias: Directing exuberance toward shared infrastructure—data pipelines, compute efficiency, evaluation benchmarks—can minimize deadweight loss and maximize long-run productivity.

Outcome over narratives: The ultimate test for “mania” is durable productivity gains, not short-term valuation spikes; focusing on real adoption, unit economics, and verifiable performance is key.

Implications

For builders: Use the window of abundant capital and attention to tackle bottlenecks with compounding value—tooling, safety, and reliability—rather than thin wrappers.

For investors: Expect a power-law distribution of outcomes; cultivate stage-appropriate discipline while staying exposed to outlier upside that bubbles make possible.

For policymakers: Prepare for non-linear diffusion of AI by modernizing competition, data, and safety regimes without reflexively throttling experimentation that seeds future gains.

Key Takeaways

“AI mania” is reframed as a catalyst for progress when channeled into platforms and standards.

The productive path blends aggressive investment with rigorous evaluation and governance.

Long-term value depends on translating hype-funded exploration into measurable productivity improvements.

The Benefits of Bubbles

Stratechery • Ben Thompson • November 5, 2025

Essay•AI•AIInfrastructure•Bubble?

Thesis

The central claim is that we are currently in an AI bubble, and the right question isn’t “Is this a bubble?” but “Will the bubble be worth it?” The answer hinges on whether today’s exuberant capital and activity leave behind durable physical infrastructure and catalyze coordinated innovation that persist after valuations normalize. In other words, bubbles can be socially productive if they finance assets and ecosystems whose long-term spillovers exceed the short-term mispricing and waste they entail.

What the bubble finances

Capital intensity: AI requires extraordinary spending on compute, data centers, networking gear, memory, power, and cooling. Bubble conditions accelerate this buildout by lowering effective capital costs and concentrating investor attention.

Supply chain expansion: Surges in demand pull forward capacity in semiconductors, advanced packaging, optics, and specialized power equipment. These “lumpy” investments often need a bubble to get financed quickly.

Talent and tooling: Bubbles over-hire and over-tool, but they also create dense clusters of engineers, researchers, and operators, and proliferate frameworks, libraries, and deployment tooling that later generations use more efficiently.

Why coordinated innovation matters

Platform alignment: Major actors—chipmakers, cloud providers, model labs, enterprise software, and startups—must align roadmaps (hardware cycles, model releases, APIs, safety and compliance layers) so that progress compounds rather than fragments.

Standardization: Shared interfaces for inference, training, data governance, and evaluation reduce integration friction, letting complements (apps, agents, vertical solutions) scale beyond pilot purgatory.

Market formation: Bubbles can create early demand signals that help define categories (AI copilots, customer service automation, design tools, scientific discovery) and establish reference customers, enabling follow-on adoption after hype cools.

The benefit calculus: assets that outlast hype

Durable assets: Data centers, grid interconnects, substations, high-voltage upgrades, heat reuse systems, and fiber backbones persist and can be repurposed for future compute waves.

Cost curves: If capex today shifts learning curves—cheaper inference per token, better energy efficiency per FLOP—then downstream productivity gains can dwarf initial overinvestment.

Option value: Bubble-fueled experimentation surfaces new use cases and architectural breakthroughs (model compression, retrieval, agent orchestration) that wouldn’t be tried in leaner times.

Risks and potential misallocation

Power scarcity and siting: Data-center growth can strain local grids, exacerbate congestion, and entrench fossil-heavy capacity if procurement outpaces clean generation and transmission planning.

Lock-in and concentration: Overreliance on a narrow set of suppliers or clouds can reduce competition and slow open innovation, leaving less resilient ecosystems post-bubble.

Talent hoarding: High salaries and signing frenzies can drain adjacent sectors, delaying diffusion of benefits to the broader economy.

Historical analogies and their lesson

Railroads and telegraphy, electrification waves, and the dot-com era show a recurring pattern: speculative excess finances overbuild; after the shakeout, society enjoys cheaper access (transport, power, bandwidth) that enables new business models. The question today is whether AI’s capex similarly leaves behind abundant compute and robust infrastructure that lower barriers for future innovators.

Signals to watch to judge “worth it”

Utilization and flexibility: Rising average utilization of GPUs/accelerators and ease of repurposing compute for new workloads.

Falling total cost of ownership: Sustained declines in cost per token/inference and energy per FLOP, not just transient price promotions.

Ecosystem breadth: Growth of independent developers, open-source components, and interoperable standards alongside proprietary stacks.

Diffusion: Meaningful productivity gains beyond frontier tech firms—SMBs, public services, and industrial incumbents adopting AI at scale.

Energy mix and grid upgrades: Evidence that data-center demand pulls clean generation and transmission forward rather than crowding it out.

Bottom line

Yes, it’s a bubble—but bubbles can be investments in public option value. If today’s frenzy yields a denser compute fabric, more resilient supply chains, interoperable standards, and widely diffused productivity, then the social return can exceed the financial losses inherent to bubbles. The decisive variable is whether the capital surge translates into enduring physical infrastructure and coordinated innovation that compound long after the hype fades.

Elon Musk Wins $1 Trillion Tesla Pay Package

Nytimes • Rebecca F. Elliott, Jack Ewing and Reid J. Epstein • November 6, 2025

Regulation•USA•Executive Compensation•Shareholder Vote•Tesla

Overview

Shareholders have approved a performance-based equity plan that could grant Elon Musk shares valued at nearly $1 trillion, contingent on achieving ambitious milestones. The central premise is to directly link compensation to extraordinary outcomes, with one of the headline requirements being a vast expansion of the company’s overall stock market valuation. The package is designed to reward measurable, market-driven success rather than time in role, framing executive pay as a function of value creation rather than traditional salary and bonus structures.

What Was Approved

A plan to issue shares worth close to $1 trillion, but only if a predefined set of aggressive targets is met.

The goals include substantially increasing the company’s market capitalization, among other performance thresholds.

The structure concentrates compensation in equity, meaning potential rewards scale with shareholder outcomes and are realized only upon meeting the specified milestones.

Rationale and Support

Proponents argue the plan aligns the CEO’s incentives with long-term shareholder value: if shareholders benefit from a dramatically larger company, the CEO participates proportionally.

The package functions as a retention mechanism during a period when the company’s strategic priorities—product innovation, manufacturing scale, autonomy, and energy—require consistent leadership and risk-taking.

Backers view the high bar for achievement as self-selecting: the value transfers only occur if exceptional results materialize, mitigating concerns about paying for underperformance.

Concerns and Risks

Size and dilution: Issuing a large volume of new shares may dilute existing shareholders’ stake. While rising market value could offset dilution, the sheer magnitude raises governance questions about proportionality.

Precedent-setting: A package of this scale could encourage other firms to pursue similarly outsized, market-cap–linked awards, escalating executive pay norms and complicating board oversight.

Goal design and measurement: Tying rewards primarily to market valuation can expose pay outcomes to factors beyond managerial control, such as macroeconomic cycles or sector-wide multiple expansion.

Governance balance: The plan concentrates potential ownership and influence with the CEO. Some investors may worry about checks and balances, board independence, and minority shareholder protections.

How the Targets Drive Behavior

Emphasis on long-term value: Because compensation depends on meeting ambitious, multi-year milestones, management is nudged toward initiatives that can sustainably elevate the company’s scale and competitiveness.

Risk appetite: The design encourages bold bets—new products, technologies, and manufacturing methods—consistent with the goal of dramatically expanding market value.

Execution pressure: Hitting aggressive thresholds typically requires operational excellence across product development, supply chain, cost structure, and capital allocation.

Implications for Investors and the Market

For shareholders, the plan clarifies the performance bar and makes future dilution conditional on success. If the milestones are reached, investors may benefit from a significantly more valuable company, though they also accept dilution as part of that growth.

For boards and compensation committees elsewhere, the approval may influence pay design toward larger, outcome-contingent equity grants, intensifying debates about fairness, proportionality, and oversight.

For regulators and governance watchdogs, the package will likely remain a focal point in discussions about executive compensation frameworks, disclosure, and alignment with shareholder interests.

Key Takeaways

Shareholders approved a contingent, equity-heavy compensation plan worth nearly $1 trillion at potential value.

Rewards depend on meeting ambitious goals, notably a dramatic increase in market capitalization.

Supporters cite alignment, retention, and pay-for-performance; critics point to dilution, governance concentration, and precedent risks.

The decision could shape executive pay practices across the market, with continued attention from investors, boards, and regulators.

AI

Satya Nadella & Sam Almant: Inside the OpenAI–Microsoft Pact, OpenAI investment, the restructure, IPO, circular financing, layoffs, AGI full breakdown

Theaiopportunities • Guillermo Flor • November 2, 2025

AI•Funding•OpenAI•Microsoft•AGI

Overview

An extended conversation between Sam Altman and Satya Nadella—moderated by Brad Gerstner—maps the Microsoft–OpenAI relationship, its new governance, and the economics powering AI’s next phase. Set against a “historic tech week” (Nvidia at ~$5T market cap, strong big-tech prints, and U.S. tailwinds like rate cuts, trade deals, and $80B for nuclear fission), the pair frame compute and power as the new strategic resources and outline how exclusivity, revenue sharing, and a verification process for AGI aim to keep the partnership both ambitious and bounded by governance.

Deal structure and governance

Microsoft has invested roughly $13–14B since 2019 and now owns ~27% of OpenAI on a fully diluted basis (down from ~33% after dilution).

OpenAI is reorganized with a nonprofit OpenAI Foundation above a Public Benefit Corporation. The foundation is capitalized with ~$130B in OpenAI stock and plans an initial $25B program focused on health, AI security, and resilience.

Altman says capitalism is the best engine for value creation, but some aims—curing disease, AI-driven science, societal stability—require non-market mechanisms the foundation can fund.

Exclusivity, revenue share, and the AGI clause

Azure has exclusive rights to distribute OpenAI’s frontier models (e.g., GPT‑4/5) until about 2030–2032 or until an independently verified AGI event.

OpenAI can distribute open-source and certain non-frontier assets elsewhere, but “stateless APIs” for frontier capabilities remain Azure-exclusive.

Microsoft receives roughly a 15% revenue share from OpenAI until 2032 or AGI verification. If OpenAI claims AGI, a third‑party expert “jury” would validate before key clauses change. Nadella: “Nobody’s even close.”

Scale, revenue, and compute economics

Gerstner cites ~$13B OpenAI revenue; Altman replies it’s “well more than that.”

OpenAI plans ~$1.4T in compute commitments over 4–5 years: ~$500B to Nvidia, ~$300B to AMD, ~$250B to Azure, with the remainder to Oracle and others—asserting demand growth justifies the scale.

Bottleneck has shifted from chips to power and data‑center capacity. Nadella notes “idle GPUs” due to insufficient power/cooling and elevates “tokens per dollar per watt” as the core productivity metric.

Both foresee non‑linear supply cycles (temporary gluts), falling unit costs, and potential “infrastructure bubble” shakeouts as prices decline.

Devices, agents, and the future of SaaS

Altman expects consumer devices to run GPT‑5/6 class models locally, complemented by edge inference and new form factors (e.g., wearable agents).

Nadella emphasizes a “fungible fleet” that fluidly reallocates training and inference across generations (H200→H300) for cloud efficiency.

Software architecture is shifting from tightly coupled data+logic+UI to an agent layer mediating between them. “Agents are the new seats”: enterprise monetization will tilt toward usage/consumption tied to agent output, while consumer monetization remains nascent. GitHub Copilot “auto‑mode” already routes tasks across models based on feedback.

IPO, financing optics, and Microsoft’s P&L

Rumors suggest a 2026–2027 OpenAI IPO; Altman denies concrete plans, prefers growth funded by revenue, but likes broader retail ownership “someday.”

Gerstner projects $100B+ OpenAI revenue by 2028–29, implying a potential $1T valuation; Nadella stresses Microsoft’s strategic upside regardless, citing exclusive model access and ecosystem pull (“We have a frontier model for free.”).

On “circular financing” concerns, Nadella says Microsoft’s $13.5B was equity, not recognized as revenue; vendor financing exists across the sector, but sustainability hinges on real end-demand.

Microsoft consolidates roughly $4B in quarterly losses from OpenAI, which Nadella frames as worthwhile given Azure’s growth (up ~39% YoY on a ~$93B run rate) that could have been higher with more compute.

Regulation, reindustrialization, and outlook

With federal preemption removed from the Senate AI bill, Altman warns of a 50‑state patchwork (e.g., Colorado AI Act). Both advocate a coherent federal framework to avoid EU‑style overregulation and protect startup viability.

Gerstner and Nadella cast AI infrastructure as a capex super‑cycle: ~$4T across U.S. hyperscalers (a “10× Manhattan Project”), complemented by $80B in fission and reshoring trends. Microsoft’s Wisconsin data center is cited as a local anchor as the U.S. exports “compute factories.”

Near‑term breakthroughs expected in AI‑driven science (first small discoveries by 2026), multi‑day coding agents, and robotics—ushering in a “macro‑delegation, micro‑steering” UI paradigm and a broad productivity uplift rather than net job destruction.

In sum, the partnership’s clarified governance, Azure exclusivity, and rev‑share align incentives while power, not silicon, becomes the gating factor. If demand matches Altman’s thesis and unit costs fall as Nadella expects, agents and edge inference could redefine SaaS economics—setting up both firms to capture outsized value while the U.S. races to build the world’s compute backbone.

Oops, I got emotionally attached to this $429 AI pet

Fastcompany • November 3, 2025

AI•Tech•Robotics•AICompanions•Moflin

It’s 10 a.m. on an October morning, and I’m in the middle of a one-on-one Zoom interview when a sudden trilling sounds from behind me. I try to ignore it, but several other strange noises follow. My eyes glaze over as I commit myself to feigning complete obliviousness to my sonic surroundings. It’s easier than explaining that the noises are coming from my AI-powered pet.

This awkward encounter came thanks to Moflin, a $429 AI pet built by the electronics company Casio. According to Casio’s official description, the Moflin is “a smart companion powered by AI, with emotions like a living creature.” This robot friend looks a bit like a Star Trek tribble, in that it’s an amorphous blob covered in fur. It comes in either gold or silver.

For ‘90s kids, the device is perhaps described as a modern-day Furby. Like a Furby, the Moflin speaks its own language of chirps and trills that change over time; but unlike a Furby, its learning is actually molded by an AI model that allows it to become “attached” to its owner. According to the pet’s makers, the Moflin learns to recognize its owner’s voice and preferences, and it slowly develops new ways of moving and vocalizing to express a bond with the user.

As of this writing, I’ve had my Moflin for close to three weeks, and I’m going to make a bold claim: This device might just be one of the first “AI companions” that’s actually useful.

The graveyard of AI companions past

Over the past several months, we’ve seen many companies try and fail to sell users on a variety of AI wearables.

That includes devices like the Humane AI pin and Rabbit R1, which both debuted to a chorus of scathingly negative reviews after users determined that neither could really do many of the tasks that they were supposed to. Currently, the hottest topic in the AI wearable space is the Friend AI necklace from entrepreneur Avi Schiffman, which is billed as an “AI companion” that’s always listening to its users’ surroundings.

Launches like these have made it clear that, as of right now, most AI companions are just “promiseware,” or devices that make a lot of claims about their capabilities that simply aren’t there at launch. I think that the Moflin lands solidly outside of this unfortunate category, primarily because it doesn’t try to make any lofty claims about changing the world or altering everyday habits: it’s just meant to look cute, sound silly, and make users feel a little bit better.

How A.I. Is Transforming Dating Apps

Nytimes • November 3, 2025

AI•Tech•Dating Apps•Recommender Systems•User Experience

“Meet your artificial intelligence matchmakers.” The central idea is that new A.I. tools are reshaping the dating-app experience so people spend less time swiping through endless profiles and more time engaging with a smaller set of higher-quality introductions. Instead of manual browsing, these systems act like a digital concierge that filters, prioritizes, and frames potential connections, aiming to reduce choice overload and improve the path from discovery to conversation and, ultimately, to meeting in real life.

What’s Changing in the Experience

From scrolling to curation: Rather than presenting a continuous deck of profiles, A.I. can rank and surface a handful of candidates designed to fit a user’s stated preferences and inferred tastes.

From static bios to dynamic guidance: A.I. can summarize profiles, highlight compatibility signals, and suggest conversation starters to lower the friction of the first message.

From effortful search to assisted discovery: Users are nudged toward actionable next steps—sending a note, proposing a time to meet—versus aimlessly browsing.

How A.I. “Matchmakers” Typically Work

Preference learning: Models infer fine-grained tastes from micro-behaviors (what you linger on, who you like or pass, how conversations flow).

Contextual matching: Systems weigh shared interests, communication style, and practical constraints (location, availability) to prioritize matches most likely to lead to a response.

Assistive features: Drafting prompts, icebreakers, and replies; proposing dates and venues; and smoothing logistics to shorten the gap between match and meetup.

Benefits for Users

Time savings: Fewer, more relevant options help users avoid fatigue and the paradox of choice.

Better first impressions: Smart prompts and profile summaries can spark quicker, more substantive conversations.

Confidence and momentum: Guided steps reduce anxiety around what to say or do next, creating a clearer progression from match to date.

Risks and Trade-offs

Bias and fairness: If models learn from historical swiping patterns, they may amplify existing biases; platforms need monitoring and corrective feedback loops.

Transparency and control: Users may want to know why certain profiles surface—explanations and adjustable settings can build trust.

Privacy and security: Fine-grained preference learning depends on sensitive behavioral data; strong data governance and consent are essential.

Authenticity concerns: Over-assistance in messaging might make interactions feel scripted unless tools are designed to preserve the user’s voice.

Product and Market Implications

Differentiation: Apps that excel at curation and momentum may compete less on profile volume and more on match quality and outcome rates.

Monetization: Premium tiers could offer deeper personalization, enhanced explainability, and concierge-like planning features.

Metrics shift: Success may move from counting matches to tracking response quality, conversation depth, and successful date conversions.

Design Principles to Watch

Human-in-the-loop controls: Let users tune the “degree of curation,” from lightly assisted browsing to fully guided introductions.

Explainable recommendations: Brief, readable “why this match” notes maintain agency and reduce mystery.

Safety-by-design: Built-in detection for bots, harassment, and scams, along with tools for easy reporting and boundary-setting.

Progress scaffolding: Structured nudges—icebreakers, scheduling helpers—encourage forward motion without feeling pushy.

Key Takeaways

A.I. is repositioning dating apps from infinite swiping toward curated, higher-intent matchmaking.

The promise is less cognitive load, better conversations, and faster movement from interest to action.

Success depends on balancing personalization with transparency, safeguarding privacy, and ensuring that assistance enhances—not replaces—authentic human connection.

OpenAI signs $38 billion deal with Amazon, partnering with cloud leader for the first time

Youtube • CNBC Television • November 3, 2025

AI•Funding•CloudComputing•OpenAI•Amazon

Overview

The video reports a landmark agreement in which an AI leader enters a multi‑year, $38 billion partnership with a major cloud provider, described as “partnering with [a] cloud leader for the first time.”

The deal positions the cloud company as a primary infrastructure partner for large‑scale AI training and inference, signaling a step‑change in compute access, cost structure, and go‑to‑market reach for both sides.

Headline significance centers on the dollar value and the first‑time nature of the partnership, implying a strategic realignment in the competitive landscape for AI infrastructure.

What the Deal Likely Covers

Multi‑year cloud spend commitment across compute, networking, and storage to support training and serving frontier models at scale.

Access to GPU capacity and the provider’s custom AI accelerators, enabling diversified supply and potential cost/performance gains for training and inference workloads.

Closer technical collaboration on model deployment stacks, security, and reliability, with an emphasis on enterprise‑grade SLAs and global footprint.

Joint commercialization motions—distribution through the cloud provider’s marketplace and integrations with its data, analytics, and MLOps services—targeting rapid enterprise adoption.

Strategic Context and Rationale

Scale and cost: Frontier model development is compute‑intensive; a $38B commitment indicates long‑horizon capacity planning to stabilize unit economics amid volatile chip supply.

Vendor diversification: Aligning with another hyperscaler reduces single‑cloud dependency, improves bargaining power, and hedges against capacity bottlenecks.

Silicon competition: By tapping both GPUs and the provider’s in‑house accelerators, the AI company can benchmark price/performance and optimize for training vs. inference phases.

Enterprise channel: The cloud partner brings a vast enterprise customer base, compliance tooling, and data locality options—key for regulated sectors considering generative AI.

Implications for the Market

Competitive pressure on rival hyperscalers to match long‑term capacity guarantees, specialized silicon roadmaps, and bundled economics for large AI tenants.

Potential shifts in AI stack standardization as model hosting, vector databases, and orchestration tools consolidate around the cloud partner’s services.

Accelerated pace of feature releases in safety, observability, and governance to satisfy enterprise risk requirements at scale.

Possible regulatory attention on cloud concentration and the interplay between compute commitments and competition in foundational AI markets.

What to Watch Next

Timelines for migrating or augmenting training runs and inference endpoints on the partner’s infrastructure, and any announcements on co‑engineered hardware or control planes.

Benchmarks comparing cost, latency, and reliability across GPU and custom accelerator options as workloads scale.

New enterprise offerings—pre‑integrated connectors, data governance features, and domain‑specific model variants—surfacing through the cloud’s marketplace.

Any ripple effects on existing partnerships, including interoperability, data portability, and multicloud strategies.

Key Takeaways

This is framed as a first‑of‑its‑kind partnership between a leading AI model developer and a top cloud provider, with a headline value of $38B.

The agreement underscores how compute access, specialized silicon, and enterprise distribution have become decisive levers in the AI platform race.

Expect intensified competition among hyperscalers, faster enterprise adoption pathways, and closer scrutiny of cost, safety, and compliance in large‑scale AI deployments.

AI may fatally wound web’s ad model, warns Tim Berners-Lee

Ft • November 5, 2025

AI•Tech•Advertising•Digital Economy•Business Models

The inventor of the World Wide Web has issued a stark warning that artificial intelligence could fundamentally undermine the dominant advertising model that has powered the internet for decades. Tim Berners-Lee cautions that the growing reliance on AI agents to find information and complete tasks online poses an existential threat to the multibillion-dollar revenue streams of tech giants like Google and Meta.

The Shift from Search to AI Agents

Berners-Lee’s central concern revolves around the transition from traditional search engines to AI-powered personal agents. Instead of users visiting websites through search results and being exposed to advertisements, AI agents will increasingly gather information directly and present synthesized answers. This bypasses the traditional web browsing experience where advertising generates revenue.

The web inventor explained that when AI agents provide direct answers without requiring users to click through to websites, the entire ecosystem of online advertising is disrupted. This represents a fundamental challenge to the business models that have sustained major platforms, as users interacting primarily with AI interfaces will see far fewer ads.

Economic Impact on Tech Giants

The economic implications of this shift are substantial for companies that have built their fortunes on digital advertising:

• Google’s parent company Alphabet and Meta collectively generate hundreds of billions in annual revenue primarily from advertising

• The current web advertising model supports not only tech platforms but also countless publishers and content creators

• As AI agents become more sophisticated, they could dramatically reduce the number of occasions when users view advertisements

Berners-Lee emphasized that this transition threatens to “cut off the revenue” that has fueled the growth of these technology behemoths and the broader digital content ecosystem.

Broader Implications for the Web Ecosystem

The potential disruption extends beyond just the largest tech companies. The entire digital economy that has developed around web advertising faces significant challenges:

• Content publishers who rely on advertising revenue may struggle to sustain their operations

• The relationship between users, platforms, and advertisers would need to be renegotiated

• New business models would need to emerge to support quality content creation online

This transformation represents one of the most significant shifts since the commercialization of the internet, potentially requiring a fundamental restructuring of how value is created and captured online.

The Future of Web Economics

While Berners-Lee identifies the threat to existing advertising models, he also points to the need for innovation in how the web is funded. The development poses critical questions about sustainable models for supporting online content and services in an AI-dominated landscape.

The warning serves as a call to action for the technology industry to develop new approaches that can maintain a healthy digital ecosystem while embracing the benefits of artificial intelligence. The transition to AI agents may ultimately require reinventing the economic foundations of the web itself.

Perplexity to pay Snap $400M to power search in Snapchat

Techcrunch • November 6, 2025

AI•Funding•Snapchat•Perplexity•Chatbot

The article announces a significant partnership in which an AI-powered search company will power a new chatbot for a major social platform, with the AI firm agreeing to pay $400 million in a mix of cash and equity. The central themes are the deepening convergence of social media and AI, the monetization of conversational search within consumer apps, and the use of hybrid deal structures (cash plus equity) to align long-term incentives between technology providers and distribution-heavy platforms.

What’s Being Agreed

The social platform has signed a deal to integrate the AI firm’s search-driven capabilities into a new chatbot experience.

As part of the arrangement, the AI company will pay $400 million to the platform, structured as cash and equity.

The structure suggests not only immediate value transfer but also a shared upside if the integration drives usage and revenue growth.

Deal Structure and Signals

Cash plus equity indicates two things: near-term compensation for access, distribution, or IP, and a bet on the platform’s future performance via equity.

The $400 million figure underscores the perceived value of embedding AI-native search into a high-frequency consumer environment like messaging and social discovery.

Equity participation can help both sides remain aligned on roadmap, performance metrics, and the speed of feature rollouts.

Strategic Rationale for Each Side

For the social platform:

Accelerates time-to-market for an AI chatbot that can enhance engagement, retention, and search utility within the app.

Converts platform distribution into immediate financial return while trialing differentiated user experiences.

For the AI search provider:

Gains mass consumer exposure and real-world interaction data critical for improving conversational retrieval and answer quality.

Establishes a marquee integration that can serve as proof-of-concept for additional partnerships.

Product and User Experience Implications

Users may see more accurate, conversational answers embedded directly in chat or search surfaces, reducing friction between query and action.

If designed well, the chatbot could streamline content discovery, recommendations, and in-chat assistance (e.g., answering questions, pulling references, or guiding search flows).

Clear UX cues and privacy safeguards will be essential to maintain trust, given AI-generated responses in a social context.

Competitive and Monetization Context

The partnership reflects an industry trend: social platforms are racing to embed AI that can both delight users and unlock new monetization vectors (sponsored answers, affiliate results, premium features).

For competitors, the bar for AI-native search and assistance within consumer apps rises, potentially triggering similar cash/equity deals to secure differentiated models or data advantages.

Key Takeaways

A large, strategically structured payment highlights the value placed on AI-enhanced search within consumer social ecosystems.

The equity component aligns long-term incentives and suggests confidence in mutual growth.

Success will hinge on execution quality: relevance of answers, latency, safety, and seamless UX integration.

Who’s right about AI: economists or technologists?

Ft • November 6, 2025

AI•Tech•Productivity

“Forecasting the impact of artificial intelligence has become fraught, with evangelists pitched against sceptics.” This line captures a widening debate over whether AI will deliver a step-change in productivity and prosperity or prove another overhyped technology that underperforms outside demos and carefully staged showcases. The central tension hinges on how fast AI diffuses from prototypes to everyday workflows, and whether complementary investments in skills, data, and organizational change can unlock its potential. The article frames the discussion as a clash between technologists, who see compounding capability gains, and economists, who look for measurable outcomes in growth, jobs, and productivity before rendering judgment.

The Central Divide

Evangelists argue AI is a general-purpose technology that will rewire knowledge work, compress R&D cycles, and raise creative and analytical throughput across sectors.

Sceptics counter that most gains are narrow, brittle, or offset by integration costs, quality risks, and the slow pace of organizational adoption.

Economically minded observers seek hard evidence in macro data and firm-level productivity, while technologists emphasize rapid capability improvements and user enthusiasm.

What’s at Stake

Productivity growth: Will AI lift output per worker, or will benefits be limited to a few frontier firms?

Jobs and skills: Will AI automate routine cognitive tasks while complementing higher-value roles, or displace broad swaths of white-collar work?

Inequality: Do gains accrue to capital, top talent, and data-rich incumbents, or diffuse widely through cheaper services and tools?

Corporate strategy: How should companies prioritize AI experiments versus core operations, and when do pilots scale?

Public policy: How to balance innovation incentives with safeguards on accuracy, safety, and market power?

Why Predictions Are Hard

Diffusion lags: Transformative technologies often face an adoption “J-curve,” where upfront costs and retooling precede measurable gains.

Complementarities: Real value hinges on data quality, process redesign, and workforce training—investments that are expensive and time-consuming.

Measurement gaps: Many AI benefits—quality improvements, faster iteration, reduced errors—are hard to capture in near-term statistics.

System risks: Model brittleness, hallucination, security vulnerabilities, and governance challenges can slow deployment or necessitate costly guardrails.

A Possible Synthesis

Near term: Expect selective wins in tasks with clear interfaces and abundant data; wide performance variance across teams and sectors.

Medium term: As tools stabilize and practices mature, adoption broadens; productivity lifts appear first in firms that reorganize around AI-first workflows.

Long term: Outcomes depend on institutions—education, safety standards, competition policy—that shape diffusion speed and who benefits.

Signals to Watch

Firm-level metrics: sustained improvements in throughput, error rates, and cycle times in AI-integrated processes.

Investment patterns: spending on data infrastructure, tooling, and reskilling as leading indicators of future productivity.

Labor market shifts: changing task compositions, wage premiums for AI-augmented roles, and demand for complementary skills.

Operational scale: movement from pilots and prototypes to enterprise-wide deployments in non-tech sectors.

Implications for Leaders

Treat AI as an organizational change program, not a plug-in: redesign processes, governance, and incentive structures.

Prioritize data readiness and responsible-use frameworks to reduce risk and accelerate scaling.

Invest in human capital: pair automation with upskilling to capture complementarity gains and maintain trust.

Use staged experimentation with clear success metrics to separate durable value from hype.

Conclusion

The question “who’s right—economists or technologists?” frames a necessary tension. Technologists spotlight the realm of the possible; economists insist on the discipline of measured outcomes. The most realistic path blends both: ambitious exploration coupled with rigorous evaluation. Whether AI becomes a broad productivity engine or a narrower set of tools will hinge less on headline demos and more on the slow, practical work of integration, training, and governance.

Sam Altman says OpenAI is not ‘trying to become too big to fail’

Ft • November 6, 2025

AI•Funding•OpenAI•Sam Altman•Compute Infrastructure

Core message

OpenAI’s chief executive states the company is not “trying to become too big to fail” and is not seeking a US federal financial backstop for what is framed as a $1.4 trillion investment program. The remarks aim to distance the company’s growth ambitions from any expectation of taxpayer support, even as the scale of planned spending underscores the capital intensity of advanced AI development.

Scale and context

The reference to a $1.4 trillion “investment binge” signals a transformational build-out across the AI stack—encompassing compute, data centers, networking, and power. Such a figure, if pursued over time through partnerships and private financing, would place AI infrastructure among the largest industrial undertakings of the digital era. It reflects the mounting costs of training and deploying frontier models and the global race to secure scarce inputs such as cutting-edge chips, clean energy, and specialized talent.

Financing signals

By explicitly rejecting a federal financial backstop, the company positions its funding strategy around private capital markets and commercial partnerships rather than public guarantees. That message is designed to reassure policymakers and the public that the risks of large-scale AI investment will be borne by investors, suppliers, and customers—not by the government. It also communicates confidence that sufficient private liquidity exists to underwrite the multi-year pipelines required for compute and energy procurement.

Policy and regulatory implications

Declining a government backstop is meant to counter “moral hazard” concerns associated with entities deemed too systemically important to fail. The statement draws a line between OpenAI and sectors such as banking, which rely on formal safety nets. It may soften regulatory pushback by signaling that expansion will proceed without expectation of rescue, even if project timelines, costs, or market conditions shift. At the same time, the extraordinary magnitude of planned investment invites scrutiny on competition, supply-chain concentration, energy demand, and national security—issues that often trigger government interest regardless of financial guarantees.

Market and infrastructure impact

A multi-trillion-dollar build-out would reverberate through semiconductors, cloud providers, utilities, real estate, and equipment manufacturers. Chipmakers and data-center operators could see demand visibility stretching years out, while utilities and grid planners would confront new baseload and peak requirements tied to AI clusters. For enterprise customers, the message suggests continued advances in model capability and availability, potentially lowering unit costs over time but raising near-term capital intensity for providers racing to keep pace.

Risks and open questions

Execution risk looms large: procurement of advanced chips, construction of hyperscale campuses, power contracting (including renewables and transmission), and supply-chain resilience. Financial risk includes interest-rate exposure, partnership dependencies, and potential cost overruns. Strategically, the company must balance rapid capacity expansion with responsible deployment, safety, and governance—areas under growing public and regulatory scrutiny. Finally, even without a federal backstop, the systemic importance of AI infrastructure could still prompt policy responses if failures or bottlenecks spill over into broader economic activity.

Key takeaways

The company rejects a US federal financial backstop and disavows any strategy to become “too big to fail.”

The cited $1.4 trillion investment ambition highlights unprecedented capital needs across chips, data centers, networks, and power.

Funding will be sought from private markets and partnerships, signaling confidence in non-governmental financing capacity.

Regulatory scrutiny is likely to focus on competition, energy usage, supply-chain concentration, and national security—not just on financial guarantees.

Success hinges on disciplined execution and governance as AI infrastructure scales to meet surging demand.

OpenAI Races to Quell Concerns Over Its Finances

Nytimes • Mike Isaac • November 6, 2025

AI•Funding•GovernmentAid•AI Bubble•Public Subsidies

The article centers on growing unease about the financial underpinnings of a leading A.I. company after a senior executive publicly floated the idea of government assistance. The suggestion sparked pushback, highlighting a broader debate over whether the A.I. sector’s rapid expansion is sustainable or drifting into bubble territory. The piece frames the controversy as a test of how cutting-edge technology should be financed, who bears the risks, and how public policy might shape an industry moving at breakneck speed.

What happened

A top executive proposed the possibility of government aid to support the company’s ambitions.

The idea met immediate resistance, reflecting skepticism about subsidizing a fast-growing private enterprise.

The pushback unfolded against mounting concerns that the A.I. industry could be inflating a dangerous bubble, fueled by high expectations and intense capital flows.

Why the suggestion matters

Public aid raises questions about fairness and moral hazard: should taxpayers underwrite the risks of private companies pursuing frontier technologies?

It foregrounds the scale and cost of A.I. development, implicitly acknowledging that private financing alone may be stretched by the industry’s capital intensity.

The debate could shape norms for public–private collaboration, including whether A.I. development should be treated as strategic infrastructure.

Signals of a looming bubble

Rapid valuation growth and exuberant investment often detach from near-term cash flows, creating vulnerabilities if expectations reset.

Market sentiment can be self-reinforcing: headlines about government support may initially buoy confidence but also invite scrutiny about underlying economics.

Pushback to public aid is a barometer of political and social tolerance for A.I. risk-taking, suggesting limits to the “growth at all costs” narrative.

Stakeholder perspectives

Critics worry that public subsidies would socialize losses while privatizing gains, distorting competition and rewarding scale over discipline.

Supporters might argue that government involvement can reduce systemic risk, align national priorities, and accelerate innovation with broad economic spillovers.

Investors are likely to parse the episode for clues about funding durability, execution risk, and the potential for policy-driven constraints or tailwinds.

Policy and governance implications

If government aid becomes part of the A.I. financing toolkit, policymakers will face design choices about oversight, transparency, and performance metrics to ensure public value.

Conditions could include commitments on safety, workforce development, or energy and environmental standards, linking funding to measurable outcomes.

The controversy could catalyze broader frameworks for A.I. risk management, including disclosure norms, stress testing of business models, and contingency planning.

What to watch next

Whether the company clarifies its stance—doubling down on private financing, outlining specific public–private mechanisms, or stepping back from the idea altogether.

The market’s reaction: shifts in sentiment toward A.I. sustainability narratives, capital availability, and the cost of financing.

Policy discourse: proposals that define eligibility, guardrails, and accountability for any A.I.-related public support—signaling how governments might balance innovation with fiscal prudence.

Bottom line

The pushback to a top executive’s mention of government aid crystallizes a pivotal question: can the A.I. industry finance its ambitions through private means alone, or will public support be necessary—and acceptable—to bridge the gap? With bubble concerns rising, the episode underscores that funding structures, not just technical breakthroughs, will determine how responsibly and sustainably A.I. scales from promise to durable economic impact.

Big Tech’s market dominance is becoming ever more extreme

Ft • October 31, 2025

AI•Tech•Market Concentration•BigTech•Economic Impact