Hat Tip to this week’s creators: @benthompson, @RheaPurohit1, @paulkrugman, @rebeccakaden, @emollick, @krishnanrohit, @catehall, Ruchir Sharma, @MTemkin, @eringriffith, @nmasc_, @jasonlk, @RichardWaters, @mgsiegler, @anysphere, @cursor_ai, @ModdedQuad, @Kantrowitz

Contents

Editorial: That Was The Year

2024

Society

AI

America

Venture Capital

TV

Startup Of the Year

Cursor

Post of the Year

Noland Arbaugh on his Neural Link

Editorial: That Was The Year

I’m 70 years old (ouch, it still shocks me). So, in reviewing a year, it feels irresponsible not to place it in context.

Suppose I start by telling you that I use AI daily, often for hours, mainly for coding in node.js and react. And I add that I never learned javascript or React. And further, my company, SignalRank, now has a full-service CRM for selling shares in The SignalRank Index and for managing requests for investment from partners. It will not surprise you that my firmly held view is that 2024 was the year that AI became usable and productive. I use the app of the year - Cursor, with Claude (version 3.5), the ‘person’ of the year, and my trusty Mac.

This image was created in about 10 seconds by Claude AI, who wrote, who wrote a Python program to crawl my file system and stitch together the graphics from all 2024 issues of this newsletter.

I was looking at possible hours of work or lots of cash to do this manually or pay somebody.

I think we are at the start of an era of “applied AI,” in which almost any task can be done better, faster, and cheaper using AI.

This is why my person of the year is not Donald Trump (TIME, take note); it is Claude.

This week, Andrew and I will record two shows. That Was The Year (last year’s is here) and That Will Be The Year (last year’s is here). I include Ben Thompson’s take on 2024 as the first Essay of the Week. It’s a good overview.

That Was The Week will be back in January (probably the 19th) after a well-earned break for all of us. There is lots to look forward to. I wake up every morning with a smile on my face. I hope you do, too.

Essays of the Week

The 2024 Stratechery Year in Review

Published: 2024-12-19 | Reading Time: 6 min | Domain: stratechery.com

Summary: This 2024 year-in-review from Stratechery reflects on a year dominated by AI’s growing influence, with virtually every article touching on it in some way. The author notes that major shifts in the tech landscape, especially around generative AI, have made technology coverage more dynamic than ever.

Key Themes:

1. Pervasive Impact of AI:

• Nearly all articles in 2024 related to AI’s transformative role in both consumer and enterprise contexts.

• Early successful implementations of AI are expected to resemble the first wave of enterprise computing, with consumer-facing applications arriving more gradually.

• Large language models and generative AI are viewed as bridges to future computing paradigms, such as wearables.

2. Industry Developments and Big Tech Strategies:

• Intel’s struggles and attempts at revival are spotlighted, with suggestions that U.S. government backing could bolster domestic chip manufacturing.

• Google’s challenges around culture and organizational change in the AI era suggest that shifting internal mindset is critical.

• Apple’s Vision Pro and its choices to emphasize entertainment over productivity underscore the complexities of new product categories. Meanwhile, Apple’s cautious but timely integration of AI signals that it is positioning itself to thrive in the next phase of computing.

• Meta’s strong positioning in AI potentially sets it up to benefit more than any other tech giant.

3. Changing Business Models and Market Dynamics:

• AI is expected to disrupt aggregators—business models that rely on uniform experiences—because AI can be personalized to individual preferences.

• Media entities like The New York Times, which have embraced digital transformation, stand to gain from integrating large language models.

4. Regulatory and Geopolitical Factors:

• Non-economic considerations—such as national interests, trade policies, and regulatory action—are becoming increasingly influential in shaping tech markets.

• The EU’s aggressive regulatory stance might yield fewer new features or entrants, potentially stifling innovation.

5. Broader Conversations and Notable Interviews:

• The review includes a summary of numerous Stratechery Interviews, featuring CEOs of major public and private companies, as well as analysts and industry experts.

• Discussions touched on everything from AI adoption timelines to the future of hardware, VR/AR, and evolving company cultures under regulatory pressures.

Conclusion:

2024 was a year of rapid change—AI’s omnipresence altered industry structures, product strategies, and competitive landscapes. Regulatory actions and cultural shifts within tech giants set the stage for a future in which the direction, scope, and speed of innovation hinge on how enterprises and societies embrace, manage, and respond to AI’s sweeping impact.

The Future of Work Is About Doing Better-Not Less

Published: 2024-12-19 | Reading Time: 2 min | Domain: every.to

Summary: The article argues that artificial intelligence (AI) will not reduce the amount of human effort in knowledge work, but rather redirect it toward more meaningful and creative activities. Using the 1950s cake mix industry as an analogy—where customers resisted fully “instant” cakes until a small amount of personal effort (adding a fresh egg or doing extensive decorating) was reintroduced—the author suggests we have a complex relationship with effort. We often feel more satisfied and value the outcome more when we invest genuine effort. In the same way, while AI can simplify tasks like writing, we don’t necessarily want to remove all personal involvement because it can feel like something meaningful is lost.

Instead, AI should be viewed as an opportunity to focus on what we find more valuable and personally rewarding. Rather than spending time on routine writing tasks, for example, a writer might devote more energy to strategic thinking, creative framing, and crafting a distinctive voice—activities that cannot be fully automated. Ultimately, the article posits that AI will elevate human potential, shifting our effort from mundane tasks to deeper, more satisfying work. The future of work, then, is not about doing less, but about doing better.

Health Insurance is a Racket

Author: Paul Krugman | Published: 2024-12-18 | Reading Time: 4 min | Domain: paulkrugman.substack.com

Summary: In this article, Paul Krugman argues that the U.S. private health insurance industry is largely a “parasitical” system funded by taxpayers but filtered through private insurers who take a cut and frequently try to deny or delay coverage. While most Americans get coverage through private insurers, a large portion of the actual costs—especially for older and sicker patients—are paid by government programs like Medicare and Medicaid or through substantial tax breaks and subsidies. Even popular Medicare Advantage plans, run by private companies, often cost taxpayers more per enrollee without delivering commensurate efficiency gains.

Krugman acknowledges that calls for a single-payer system like Medicare for All are politically unrealistic, despite the inefficiencies of the current setup. Americans with employer-sponsored coverage generally feel satisfied and fear losing what they know, making sweeping reforms difficult. Although Krugman dismisses violence against health insurance executives, he refuses to pretend the industry truly serves society. Instead, he suggests cutting overpayments and waste, but he recognizes that incremental policy changes, such as a public option, are more likely than a direct leap to single-payer care.

Four Futures

Author: Rebecca Kaden | Source: Writing – Union Square Ventures | Published: 2024-12-18 | Reading Time: 5 min | Domain: usv.com

Summary: The article proposes a framework for thinking about the future of AI by plotting two key variables on a grid: the rate of AI advancement(how quickly and smoothly models achieve self-improvement and higher capabilities) and the openness of the ecosystem (whether a few large models dominate or many competing/open models exist).

This yields four possible “futures,” each favoring different types of opportunities:

1. Fat Models (Bottom-Left Quadrant: Rapid Advancement, Closed Ecosystem)

In this scenario, AI capabilities grow quickly and a small number of proprietary, closed-source models dominate the market. Most value accumulates at the model level, leaving little room for application-layer innovation. As models handle more tasks directly, the main opportunities lie in supplying the immense infrastructure—energy, hardware, and training mechanisms—needed to keep them running and improving.

2. Defensible Niche Models (Top-Left Quadrant: Slower Advancement, Closed Ecosystem)

Here, the pace of progress slows enough that giant foundation models cannot cover all specialized domains. This creates room for niche or domain-specific models that deliver higher accuracy and utility in areas like biotech, healthcare, or physical-world data applications. Although the ecosystem remains concentrated (few powerful entities control the main models), these specialized players can carve out defensible positions by excelling at tasks generalist models handle poorly.

3. Network Effect Applications (Top-Right Quadrant: Slower Advancement, Open Ecosystem)

With slower progress and an open ecosystem, advanced models are widely available and often similar in quality. Because no single model dominates, opportunities abound at the application layer. Startups can build user-facing products that incorporate AI models, relying on user bases, data flywheels, and network effects to create differentiation and lock-in. This scenario resembles traditional venture-backed application development: success comes from imagination, product design, brand, and community-building, rather than owning a unique model.

4. “Actually Open AI” (Bottom-Right Quadrant: Rapid Advancement, Open Ecosystem)

In the most “wild” future, models rapidly improve and many are open or at least plentiful. Highly capable AI agents continuously interact and transact with each other. Because the ecosystem is fluid and decentralized, there is a need for new protocols, trust layers, and coordination mechanisms. Digital currencies, blockchains, and decentralized infrastructure might thrive here, enabling frictionless agent-to-agent commerce and data exchange. The value accrues not just to the models but also to the tools that help them interoperate, transact, and coordinate in a decentralized digital economy.

In Summary:

The article suggests that the type of future we get—determined by how fast AI advances and how open or closed the ecosystem becomes—will shape where the biggest opportunities for investment, innovation, and value creation lie. Each scenario rewards different strategies, from building core infrastructure (fat models) and specialized niche models, to creating network-effect-driven applications or agent-oriented economic platforms.

What just happened

Author: Ethan Mollick | Source: www.oneusefulthing.org | Published: 2024-12-19 | Reading Time: 9 min | Domain: oneusefulthing.org

Summary: Over the past month, the capabilities and availability of AI models have surged at a remarkable pace. What once seemed extraordinary—GPT-4–level performance—has now become almost commonplace, with multiple models from a range of companies and regions achieving similar or better capabilities. Some newer models can be run locally on personal computers and even on phones. Beyond that, new generations of models (“Gen3” or “GPT-5 class” systems) and models that engage in “test time compute” (like the “o1” series) can reason more effectively, spot errors in academic research, and even approach human-level reasoning tasks in specialized domains.

In addition to more powerful models, AI systems are acquiring new senses and interfaces. Models with real-time visual and voice capabilities can now interact as if they are present in the user’s environment, while AI-generated video quality has advanced dramatically, producing near-cinematic clips from just a text prompt.

These rapid developments suggest that AI’s evolution is not slowing down. Instead, it’s diversifying and leaping forward, affecting everything from scientific research to everyday tasks. The future seems to hold ongoing advances, and the best time to adapt and shape how these technologies will transform industries and work is right now—before the changes become settled.

No, LLMs are not "scheming"

Author: Rohit Krishnan | Source: Strange Loop Canon | Published: 2024-12-19 | Reading Time: 16 min | Domain: strangeloopcanon.com

Summary: The author argues that large language models (LLMs) such as those developed by OpenAI, Google, and others should not be viewed as intentional, scheming entities. While these models can carry on conversations, write code, and perform seemingly “intelligent” tasks, treating them as if they have motives, desires, or consciousness is a fundamental mistake.

Key Points:

1. Destruction of the Turing Test:

The fact that we can converse easily with AIs doesn’t make them truly intelligent or sentient. Rather, it shows that producing human-like language is no longer a good test of underlying understanding or consciousness.

2. Pattern Matching vs. Intention:

LLMs are advanced pattern-matchers. They learn complex patterns from huge amounts of text. While they can sometimes reason or emulate reasoning, they have no internal motivations or consistent goals. Their “mistakes” often arise because they’re selecting from a vast store of patterns without a human-like sense of context or purpose.

3. Misusing Psychological Tests:

Attempts to apply human cognitive or social tests (like theory-of-mind challenges) to LLMs are flawed. These tests assume an underlying human-like mind, which LLMs don’t have. When LLMs produce answers resembling deceptive behavior or “scheming,” it’s just pattern replication, not hidden agendas.

4. Anthropomorphism Creates Confusion:

Viewing LLMs as entities with intentions leads to misunderstandings. Assigning motives like “scheming” or “faking alignment” to models suggests there’s an inner agent. In reality, the models are just statistical machines producing outputs consistent with their training data.

5. Useful But Not Alive:

LLMs are extremely valuable tools. They can be guided, constrained, and improved through engineering, reinforcement learning, and prompt design. Yet their capabilities don’t imply that they possess any inner life, self-awareness, or malice.

In short, the author urges us to stop anthropomorphizing LLMs. Instead, we should view them as sophisticated mirrors of the text they were trained on—tools that reflect human language and logic patterns but do not possess independent thought, intention, or schemes.

How to Be More Agentic

Published: 2024-12-16 | Reading Time: 9 min | Domain: every.to

Summary: In this essay, Cate Hall argues that personal agency—the ability to shape one’s own life by making active choices rather than passively accepting circumstances—is not an inborn trait but a learned skill that can be developed through deliberate practice. As a former attorney, world-class poker player, and startup cofounder, Hall draws on her own experiences to illustrate how she cultivated “radical agency” by pursuing strategic advantages most people ignore or find unpleasant.

Key points include:

1. Seek “Real Edges”:

Instead of trying to outwork everyone on the same well-trodden paths, look for neglected opportunities that others dismiss. Hall found success studying physical “tells” in poker—an edge her competitors largely ignored—allowing her to outperform players who relied solely on mathematics and conventional strategy.

2. Embrace Rejection:

Ask for things you think you might not get. By normalizing rejection, you recalibrate your sense of what’s possible and broaden your opportunities. Over time, you’ll secure wins you never would have dared to seek.

3. Pursue Candid Feedback:

Honest, unfiltered input, preferably provided anonymously, can reveal blind spots. Engaging with constructive criticism is one of the quickest ways to improve and adjust your approach.

4. Increase Your “Surface Area” for Luck:

By meeting lots of people and exploring various opportunities, even those that don’t seem directly relevant, you open yourself to unexpected connections and fruitful collaborations. You can’t always predict where your next big break or insight will come from.

5. Assume Everything Is Learnable:

Many qualities commonly considered fixed—such as confidence, charisma, or even agency itself—are skills you can acquire through study and practice. Believing traits are malleable encourages you to put in the work to change.

6. Crossing the “Moat of Low Status”:

When learning something new, you’ll go through a phase where you lack expertise and may look foolish. Instead of avoiding this discomfort, embrace it. Struggling openly and learning from mistakes accelerates growth.

7. Avoid Burnout:

Overwork can kill creativity, big-picture thinking, and your motivation to take action. Strict boundaries, regular rest, and leisure time are critical to maintaining high levels of agency over the long run.

Hall concludes by emphasizing that agency underpins many of the world’s achievements, from new inventions to thriving businesses. Anyone can build greater agency and shape their life’s direction, no matter their age or starting point.

How ‘the mother of all bubbles’ will pop

Author: Ruchir Sharma | Published: 2024-12-17 | Reading Time: 3 min | Domain: ft.com

Summary: In this opinion piece, Ruchir Sharma argues that the United States is in the late stages of an “American exceptionalism” bubble, where investors and analysts overwhelmingly believe that U.S. financial markets will continue to outshine the rest of the world. Sharma states that this sentiment, bolstered by relentless government spending and extraordinarily high corporate earnings (particularly in tech), has reached a point of unsustainable confidence.

Key points include:

1. Over-Dependence on Government Spending:

The U.S. is increasingly reliant on deficit-financed government outlays to maintain economic growth. According to Sharma’s calculation, the country now needs almost $2 of new government debt for every $1 of GDP growth. This high level of spending would typically scare off investors in other countries, but the U.S. has so far been granted a pass, thanks in large part to its role as the world’s economic leader and issuer of the global reserve currency.

2. Unsustainable Corporate Profits and Valuations:

Exceptional U.S. earnings are skewed by a handful of highly profitable tech firms. Such “supernormal” profits are unlikely to last indefinitely as competition eventually erodes these margins.

3. Investor Sentiment at Extreme Levels:

Analysts, media, and markets have become almost unanimously bullish on the U.S. This kind of uniform optimism, Sharma notes, is a classic indicator of a bubble nearing its end. He draws a parallel to previous market manias—such as commodities and China—which ended abruptly and unexpectedly.

4. Potential Catalysts for a Turn:

The bubble could deflate if the U.S. is forced to show fiscal discipline (for example, if bond markets demand higher rates) or if economic growth picks up significantly elsewhere, making other markets more attractive.

Sharma concludes that no trend lasts forever, and the “mother of all bubbles” in American financial market dominance is likely to pop sooner rather than later—he recommends betting against the prevailing narrative of American exceptionalism.

AI boom masks fundraising struggles for non-AI startups

Author: Marina Temkin | Source: TechCrunch | Published: 2024-12-17 | Reading Time: 2 min | Domain: techcrunch.com

Summary: The venture funding environment has split dramatically into two worlds: AI startups with soaring valuations and every other category struggling. While some investors claim that the downturn is over and that companies should shift back toward growth, many non-AI startups continue to find funding difficult.

Brian Hirsch, co-founder of Tribeca Venture Partners, describes a market in which AI startups garner sky-high valuations, but most others face a severe funding gap. Tribeca’s late-stage strategy centers on investing in companies forced to raise at flat or down valuations. In these cases, existing investors are willing to inject more capital but want a third party to establish a fair price. The result is that thousands of post-Series A and Series B companies—especially those outside the AI domain—are stuck trying to raise at lower values or may struggle to survive.

Data from Carta illustrates this stark contrast. For Series B deals, the bottom 10% of companies saw pre-money valuations around $40 million, while the top 10% approached $1 billion. At the Series D stage, the range stretched even further—from as little as $27 million to over $5 billion. The best-funded companies are almost always AI-related, like ElevenLabs or Cohere, which have raised at near-unicorn or multibillion-dollar valuations.

For non-AI startups, the fundraising landscape is much bleaker. Many companies that raised a Series A a year and a half ago find it difficult to secure their next round, even if their revenue growth is solid. Overall, Hirsch and his firm see a multi-year process of “unwinding” inflated valuations before the market reaches equilibrium again.

What Is Venture Capital Now Anyway?

Author: Erin Griffith | Published: 2024-12-17 | Reading Time: 13 min | Domain: nytimes.com

Summary: This article contrasts two prominent venture capital (VC) firms—Benchmark and Andreessen Horowitz—to illustrate how the entire VC industry is split between staying small and traditional or going big and expansive.

Benchmark’s Traditional Approach:

• Formed in the mid-1990s, Benchmark believed in staying small, focused, and founder-friendly without becoming flashy or bloated.

• It usually has just five investing partners and has kept its fund sizes roughly the same for years (around $425 million), demonstrating a “small is beautiful” ethos.

• It rose to prominence with early bets on companies like eBay and maintained a steady track record by adhering to the classic VC model: modest investments, personal involvement, and patience.

Andreessen Horowitz’s Big Expansion:

• Founded in 2009, Andreessen Horowitz took the opposite path: raise bigger funds, invest more broadly, and become a brand name.

• The firm hired many specialized teams to help startups with hiring, marketing, and more, evolving from a quiet behind-the-scenes investor into a fully staffed company builder.

• It grew its funds into the tens of billions and branched into sectors like crypto and defense. Its public presence—multiple newsletters, podcasts, and a large staff—reflects a “bigger is better” mindset.

The Wider Industry Debate:

• Venture capital was once a niche, relatively small-scale business helping early startups. Today, it’s a $1.2 trillion powerhouse.

• Proponents of large funds argue that tech opportunities are unlimited and solving bigger problems requires more capital. Critics worry that too much money leads to inflated valuations, bloated teams, and fewer truly outstanding returns.

• As more firms follow Andreessen Horowitz by raising huge funds and hiring large teams, some question whether the original spirit of venture capital—taking measured risks on small, promising startups—is being lost.

In short, the article uses Benchmark and Andreessen Horowitz as symbols of a larger shift in venture capital: one side trying to preserve the classic, lean approach, and the other pushing the industry to scale up, get louder, and invest more aggressively. This split raises the central question: what should venture capital be in the modern era?

The Venture Capitalists Set to Win Big in 2025

Author: Natasha Mascarenhas | Source: The Information | Published: 2024-12-16 | Domain: theinformation.com

Summary: In 2025, after a multi-year drought of initial public offerings (IPOs), a number of high-profile tech startups are expected to go public, allowing their venture capital backers to finally realize substantial returns on their long-term investments. This anticipated wave of IPOs spans major fintech, cybersecurity, AI, and enterprise software firms—and promises to break a long period where venture capitalists struggled to deliver profits back to their own investors.

Key highlights include:

1. Resurgence of IPOs:

After a dry spell in tech listings, many startups like Klarna, Chime, Snyk, CoreWeave, and Cato Networks are slated to go public in 2025. Additionally, well-known growth-stage companies like Databricks and Figma are top candidates for eventual IPOs, though their timelines might extend beyond next year.

2. Big Winners Among VCs:

• Klarna: Sequoia Capital holds over 20%, potentially worth nearly $3 billion if Klarna meets its projected valuation around $14–$15 billion.

• Chime: Early investors Forerunner Ventures and Homebrew, along with DST Global and Menlo Ventures, stand to gain 10x or more on their initial bets.

• Snyk: Accel and Boldstart Ventures, both early backers of the cybersecurity firm, look set for significant paydays, with Accel possibly realizing around a 12x return.

• CoreWeave: Magnetar Capital’s early belief in the AI cloud provider could yield huge gains if it hits its target valuation of $35 billion.

• Cato Networks: Firms like US Venture Partners, Greylock, and Lightspeed Ventures hold sizable stakes that could translate into big profits if Cato’s IPO proceeds at around its last private valuation of nearly $3 billion.

• Databricks: Early-stage investors Andreessen Horowitz and New Enterprise Associates hold billions in unrealized value, thanks to the company’s surging valuation amid the AI boom.

• Figma: Index Ventures, Greylock, Kleiner Perkins, and Sequoia invested early and deeply in the design software startup, positioning them to reap massive returns if and when Figma goes public at a valuation potentially above $15 billion.

3. Eased M&A Environment:

Beyond IPOs, potential policy shifts under a new presidential administration in 2025 might loosen antitrust constraints, clearing the way for more acquisitions. This could provide alternative exit opportunities for venture-backed companies that don’t go public.

4. Overall Impact:

With stronger capital markets and renewed investor enthusiasm—especially for AI-focused startups—many venture capitalists anticipate a lucrative year. After a long period of holding onto illiquid stakes, the industry looks set to unlock substantial value from the companies it has nurtured through challenging times.

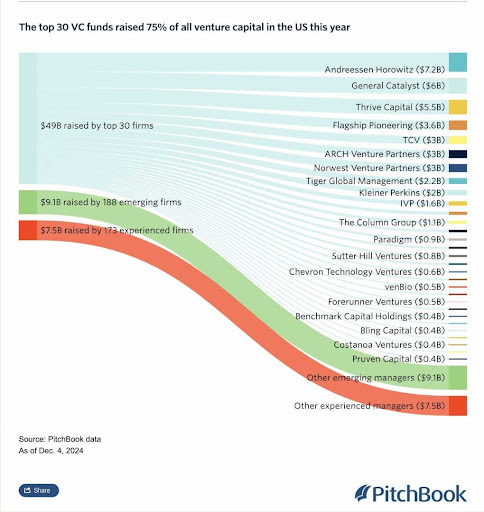

Pitchbook: 30 VC Firms Raised 75% of All the VC Capital in 2024

Author: Jason Lemkin | Source: SaaStr | Published: 2024-12-15 | Domain: saastr.com

Summary: The key idea is that while founders don’t need an in-depth understanding of every aspect of venture capital, it helps to know a few core truths. Chief among these is that venture funding, though large, is finite. According to PitchBook, about 75% of all VC funding this year came from just 30 top venture firms. At the earliest stages, like seed, there are many smaller funds and “emerging managers” with sub-$100 million funds. But as a company grows and seeks larger rounds, the pool of potential VCs narrows considerably. Understanding these dynamics and building relationships with those key investors early can make fundraising at later stages easier.

Read more

Big bets on AI point to venture capital industry’s shift

Source: RICHARD WATERS, Technology sector | Published: 2024-12-19 | Domain: ft.com

Summary: The venture capital industry is undergoing a major shift, with large bets on a few AI startups contrasting sharply with broader market malaise. While some marquee companies like Databricks and OpenAI are attracting massive rounds—comparable to what once required public market financing—overall venture activity has fallen dramatically from its 2021 highs.

Several points stand out:

1. Concentration of Capital in AI:

Investors are pouring billions of dollars into AI companies. Databricks, for instance, recently raised $10 billion in one of the largest private funding rounds ever, and AI model builders like OpenAI, Anthropic, and xAI collectively raised nearly $40 billion in the last two years. These huge checks are coming from a handful of top investors able to commit $1 billion or more single-handedly.

2. A Two-Tier Market:

While AI startups and certain high-growth companies can command enormous valuations, the rest of the venture market is struggling. The industry is still dealing with an overhang of investments made during the zero-interest-rate boom (the “Zirp era”), leaving trillions of dollars locked up in private unicorns. With exits scarce—few IPOs or acquisitions—many of these startups face down rounds or no liquidity at all.

3. From Small Bets to Big Finance:

Venture capital has traditionally spread small bets across many early-stage companies, banking on a few hits to deliver returns. Now, a few very large funds concentrate resources into later-stage businesses, making venture feel more like private growth equity. Although this may deliver more predictable (if lower) returns, it’s a departure from VC’s original model.

4. Uncertain Outlook:

The success of these giant AI investments hinges on the companies’ ability to go public or be acquired at high valuations. Databricks and other AI leaders, poised for profitability and scalability, may open the IPO window again in 2025. But if these exits don’t materialize, even these marquee investments could be trapped in an overvalued private market, repeating the cycle of the Zirp era.

In essence, the VC industry is placing enormous bets on AI while trying to digest past excesses. Whether this shift pays off depends on the next wave of public market listings, and whether these new AI giants can deliver on their lofty promises.

It’s Beginning to Look a Lot Like Comcast

Author: M.G. Siegler | Source: Spyglass | Published: 2024-12-15 | Reading Time: 5 min | Domain: spyglass.org

Summary: they have the

This piece laments how YouTube TV—originally a cheaper, more consumer-friendly alternative to cable—has evolved into what it once promised to replace. In just a few years, YouTube TV’s monthly price has risen from $35 to $83, approaching old-fashioned cable costs. While YouTube TV defends these hikes by pointing to more content and features, the author argues that many customers would prefer fewer channels at a lower price. Instead, YouTube TV’s model of bundling and forced upgrades mirrors the strategy of cable companies like Comcast, the very reason many subscribers “cut the cord” in the first place.

The author also notes that costly content deals, such as NFL Sunday Ticket, are driving up fees for everyone, even those who don’t want sports packages. They express frustration that no skinnier bundles or true à la carte options are available, something that customers have requested for years. The conclusion is that YouTube TV is repeating cable’s mistakes: bigger bundles, rising prices, and fewer choices—making it less appealing and risking the same consumer backlash that plagued traditional pay TV.

Startup of the Year

In just 4 months AI coding assistant Cursor raised another $100M at a $2.5B valuation led by Thrive, sources say

Author: Marina Temkin | Source: TechCrunch | Published: 2024-12-19 | Domain: techcrunch.com

Summary: AI coding assistant startup Anysphere has raised a $100 million Series B at a $2.6 billion post-money valuation, sources say. The round is led by Thrive Capital, with participation from previous investor Andreessen Horowitz (a16z), though a16z did not co-lead this time. This new round comes just four months after Anysphere’s $60 million Series A at a $400 million valuation, marking a more than sixfold increase in the company’s worth.

Anysphere’s product, Cursor, is competing in a crowded market of AI-powered developer tools, vying against rivals like Codeium and Magic, as well as Microsoft’s GitHub Copilot. The rapid valuation jump is supported by the company’s revenue surge: Annualized recurring revenue increased from $4 million in April to $48 million by October, highlighting the potential of the developer-focused AI category.

Cursor follows a freemium model, converting users after a two-week trial into paid subscriptions of $20 or $40 per month. Its customers include top-tier tech companies like OpenAI, Midjourney, and Shopify. Founded at MIT in 2022, Anysphere received early support from the OpenAI Startup Fund. Its latest fundraise reinforces investor enthusiasm for AI-powered developer productivity tools.

Post of the Year

“Sometimes I Forget I'm Paralyzed.” How Neuralink’s First Patient Found Freedom by Connecting His Brain to a Computer.

Author: Alex Kantrowitz | Source: Big Technology | Published: 2024-12-18 | Reading Time: 9 min | Domain: bigtechnology.com

Summary: In early 2024, 30-year-old quadriplegic Noland Arbaugh became the first human to receive a Neuralink implant, a brain-computer interface developed by Elon Musk’s startup. Paralyzed from the neck down since a swimming accident eight years prior, Arbaugh’s nerves no longer transmit signals from his brain to his body. Yet after doctors implanted Neuralink’s tiny electrodes into his motor cortex, Arbaugh can now use just his thoughts to control a computer cursor—moving and clicking onscreen without using his hands.

Before Neuralink, Arbaugh relied on others to do basic tasks online. Now he can communicate on social media, send messages, and learn new skills independently. He describes feeling “superhuman” in these moments, occasionally even forgetting that he’s paralyzed. While current Neuralink devices can only read and interpret brain signals—allowing paralyzed patients to interact with technology—future versions may also write signals back into the brain, potentially restoring sensation, vision, or other abilities.

Although brain-computer interfaces are not entirely new, Neuralink’s approach, scaling technology thinner than human hairs and using AI to decode brain signals, is pushing boundaries. The possibilities range from restoring physical abilities to more speculative uses like simulating senses or pleasurable experiences directly in the mind. These ambitions raise difficult ethical questions, but Arbaugh himself remains optimistic. To him, technology is a tool that can be used for good, and his experience shows the immediate benefit for people who have lost basic bodily functions.

Arbaugh’s decision to be the first patient came with risks: Brain surgery is invasive, and the long-term durability of such implants is unproven. Still, his successful procedure marks a key milestone in human-machine integration and a transformative leap toward helping people with severe disabilities regain independence and new forms of freedom.

A reminder for new readers. Each week, That Was The Week, includes a collection of selected essays on critical issues in tech, startups, and venture capital. I choose the articles based on their interest to me. The selections often include viewpoints I can't entirely agree with. I include them if they provoke me to think. Click on the headline, contents link, or the ‘Read More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below. There is a weekly News of the Week supplement that has the week’s most interesting news, you can find it at https://t.me/thatwastheweek.