I am considering sponsorships for That Was The Week. Here is the draft rate card. Take a look and reach out if you’d like to be a sponsor. Discounts for readers.

A reminder for new readers. Each week, That Was The Week includes a collection of selected readings on critical issues in tech, startups, and venture capital. I chose the articles based on their interest to me. The selections often include viewpoints I can't entirely agree with. I include them if they provoke me to think. The articles are snippets or varying sizes depending on the length of the original. Click on the headline, contents link, or the ‘More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below.

Hat Tip to this week’s creators: @albertwenger, @chaykak, @washingtonpost, @pxlnv, @gideonrachman, @paulg, @KateClarkTweets, @scottehartley, @geneteare, @jesslivingston, @ycombinator, @garrytan, @rhodgkinson, @signalrank, @jordannovet, @erinkwoo, @markgurman, @Kyle_L_Wiggers, @CovariantAI, @_thatstartupguy

Contents

Editorial: Really?

The Arrest of Telegram’s Founder Illuminates Global Anxieties About Social Platforms

Opinion: In this free speech fight, Musk’s X has marked the right position

Elon Musk Is an Influential Idiot Who Should Not Be Arrested for Being Dumb

Venture Firms Take A Break In August With Lowest Monthly Funding In 2024

Jessica Livingstone and the YC team on YC DNA

How Long it takes to get Funding

Editorial: Really?

I am generally not surprised at how far self-labeled “left” intellectuals will go in silencing those they disagree with. Robert Reich is not my normal idea of an authoritarian. But this week, he penned a Guardian Opinion piece that included a request for “global regulators” to “threaten Musk with arrest” to stop him from “disseminating lies and hate on X.” It is a good measure of how far the labels “left” and “right” no longer have meaning. Authoritarian and Civilized might be better labels for these ideas. Reich says, “Elon Musk is out of Control.” The title gives away his motive. He wants to control Musk. To “rein him in”.

Wow. There are not many First Amendment rights there. He also calls for advertisers to boycott X, consumers to boycott Tesla, and the FTC to “take down lies” that “likely to endanger individuals.”

This is from his website:

He is Chancellor's Professor of Public Policy at the University of California at Berkeley and Senior Fellow at the Blum Center. He served as Secretary of Labor in the Clinton administration, for which Time Magazine named him one of the 10 most effective cabinet secretaries of the twentieth century.

How Berkeley has changed. If I were an authoritarian, I might suggest they fire him for opposing everything the University’s history has stood for. But I’m not, so instead I am calling him out here.

To be clear, I will be voting for Kamala Harris in November. So, this is not a hit piece.

But Reich is clearly out of order in suggesting Musk be treated like a criminal, especially in the wake of Telegram founder Pavel Durov's arrest. Musk is right about many things and an idiot about others, but not a criminal.

The new trend for “liberals” to seek revenge and state recourse on those they disapprove of by calls to treat them as criminals is not new. But it is now unchallenged as a legitimate exercise. The Guardian is happy to give those views a prominent platform.

As an opponent of racism, women’s oppression, homophobia, anti-semitism, and anti-Muslim sentiment, I have no wish to demonize my opponents ’s legal beliefs and opinions. I want to be able to disagree with them and persuade you to agree with me.

This week we have articles from the Editorial Board of the Washington Post defending Musk:

Brazilians shouldn’t have to put up with a government suppressing political viewpoints, however abhorrent a court might think those opinions are. Mr. Musk himself has a right to speak his mind, and to legal due process, notwithstanding Brazilian President Luiz Inácio Lula da Silva’s demagogic take to the contrary: “The world is not obliged to put up with [Mr. Musk’s] far-right free for all just because he is rich,” he has said. This response reflects badly on the democratic vocation of Mr. da Silva, who was indeed legitimately elected in 2022. And the entire episode is turning into a cautionary tale for democracies that believe the answer to troublesome online expression is to suppress it.

Robert Reich and others who want to use the state to defeat opponents' arguments should be ashamed. That is not the hallmark of civilized behavior but a throwback to medieval times before the Enlightenment.

More this week on AI regulation also. A new global convention on AI was announced:

Britain’s justice minister, Shabana Mahmood, emphasized the importance of this agreement, stating, “This Convention is a major step to ensuring that these new technologies can be harnessed without eroding our oldest values, like human rights and the rule of law.”

The Convention is separate from the EU’s AI Act, which recently came into force and provides comprehensive regulations on developing, deploying, and using AI systems within the EU internal market. While the EU AI Act focuses on internal governance, the AI Convention represents a broader international commitment to ethical AI use.

The call to preserve Western values like free speech and the rule of law is great but misplaced. The desire to control is at the heart of the regulatory instinct regarding AI. The EU’s AI Act crosses the line into control.

The convention has a weaker set of goals. But both agree that we cannot trust scientists to do the right thing. The driving belief is that we should fear innovation and human ingenuity.

We already have many laws that would punish criminality by innovators using AI for criminal purposes. And I would strongly favor using them when due process suggests we should.

These moves, like the California SB 1047 initiative, are not focused on criminality. They are designed to remove freedom of scientific innovation and put Government roadblocks in the way. We humans will not benefit from allowing Reich or regulators to determine what we can and cannot do.

Essays of the Week

Moderation in Social Networks

Albert Wenger

First Pavel Durov, the co-founder and CEO of Telegram, was arrested in France, in part due to a failure to comply with moderation requests by the French government. Now we have Brazil banning X/Twitter from the country entirely, also claiming a failure to moderate.

How much moderation should there be on social networks? What are the mechanisms for moderation? Who should be liable for what?

The dialog on answering these questions about moderation is broken because the most powerful actors are motivated primarily by their own interests.

Politicians and governments want to gain back control of the narrative. As Martin Gurri analyzed so well in Revolt of the Public, they resent their loss of the ability to shape public opinion. Like many elites they feel that they know what’s right and treat the people as a stupid “basket of deplorables.”

Platform owners want to control the user experience to maximize profits. They want to be protected from liability and fail to acknowledge the extraordinary impact of features such as trending topics, recommended accounts, and timeline/feed selection on people’s lives and on societies.

The dialog is also made hard by a lack of imagination that keeps us trapped in incremental changes. Too many people seem to believe that what we have today is more or less the best we will get. That has us bogged down in a trench war of incremental proposals. Big and bold proposals are quickly dismissed as unrealistic.

Finally the dialog is complicated by deep confusions around freedom of speech. These arise from ignoring, possibly willfully, the reasons for and implications of freedom of speech for individuals and societies.

In keeping with my preference for a first principles approach I am going to start with the philosophical underpinnings of freedom of speech and then propose and evaluate concrete regulatory ideas based on those.

We can approach freedom of speech as a fundamental human right. I am human, I have a voice, therefore I have a right to speak.

We can also approach freedom of speech as an instrument for progress. Incumbents in power, whether companies, governments, or religions, don’t like change. Censoring speech keeps new ideas down. The result of suppressed speech is stasis, which ultimately results in decline because there are always problems that need to be solved (such as being in a low energy trap).

But both approaches also imply some limits to free speech.

You cannot use your right to speech to take away the human rights of someone else, for example by calling for their murder.

Society must avoid chaos, such as runaway criminality, massive riots, or in the extreme civil war. Chaos also impedes progress because it destroys the physical, social, and intellectual means of progress (from eroding trust to damaging physical infrastructure).

With these underpinnings we are looking for policies on moderation in social networks that honor a fundamental right but recognize its limitations and help keep society on a path of progress between stasis and chaos. My own proposals for how to accomplish this are bold because I don’t believe that incremental changes will be sufficient. The following applies to open social networks such as X/Twitter. A semi-closed social network such as Telegram where most of the activity takes place in invite-only groups poses additional challenges (I plan to write about this in a follow-up post).

First, banning human network participants entirely should be hard for a network operator and even for government. This follows from the fundamental human rights perspective. It is the modern version of ostracism, but unlike banishing someone from a single city it potentially excludes them from a global discourse. Banning a human user should either require a court order or be the result of a “Community Notes” type system (obviously to make this possible we need some kind of “proof of humanity” system which we will need in any case for lots of other things, such as online government services, and a “proof of citizenship” could be a good start on this – if properly implemented this will support pseudonymous accounts).

Second, networks must provide extensive tools for facilitating moderation by participants. This includes providing full API access to allow third party clients, support for account identity and post authorship assertions through digital signatures to minimize impersonation, and implement at least one “Community Notes” like system for attaching information to content. All of this is to enable as much decentralized avoidance of chaos, starting with maintaining a high level of trust in the source and quality of content.

Third, clients must not display content if that content has been found to violate a law either through a “Community Notes” process or by a court. This should also allow for injunctive relief if that has been ordered by a court. Clients must, however, display a placeholder where that content would have been, with a link to the reason (ideally the decision) on the basis of which it was removed. This will show the extent to which court-ordered content removal is taking place.

What about liability? Social networks and third-party clients that meet the above criteria should not be liable for the content of posts. Neither government nor participants should be able to sue a compliant operator over content.

Social networks should, however, be liable for their owned and operated recommender algorithms, such as trending topics, recommended accounts, algorithmic feeds, etc. Until recently social networks were successfully claiming in court that their algorithms are covered by Section 230, which I believe was an overly broad reading of the law. It is interesting to see that a court just decided that TikTok is liable for suggestions surfaced by its algorithm to a young girl that resulted in her death. I have an idea around viewpoint diversity that should provide a safe harbor and will write about that in a separate post (related to my ideas around an “opposing view” reader and also some of the ways in which Community Notes works).

..More

The Arrest of Telegram’s Founder Illuminates Global Anxieties About Social Platforms

Pavel Durov may have been detained for the company’s alleged illegal conduct, but his predicament is also a signal of government concern about digital networks’ outsized power.

By Kyle Chayka

September 4, 2024

On August 24th, Pavel Durov, the billionaire Russian founder of Telegram, a messaging app and social network, was detained after his private plane landed outside of Paris, from Baku, Azerbaijan. At first, the action was greeted with shock: the C.E.O. of a major tech company, with nearly a billion users, appeared to have been punished for the misdeeds of his platform, not unlike if Mark Zuckerberg were arrested for the misinformation published on Facebook. Elon Musk quickly posted in support of Durov on X, framing the arrest as a violation of the principles of free speech. (In 2022, after his acquisition of Twitter, Musk fired much of the company’s content-moderation staff.) But when the charges against Durov were made public, last Wednesday, the six items on the list appeared deeply consequential, including accusations of complicity in drug trafficking and the dissemination of child pornography, in addition to unlawfully “providing cryptology services.” (Durov’s lawyer has called the allegations against his client “absurd.”)

Telegram, founded in 2013, combines the features of a messaging app and a social network, with broadcasting functions that allow users to reach hundreds of thousands of people at once. The app has developed a reputation for robust privacy and security, reflecting values that Durov has often promoted on X, where he has more than two and a half million followers. On its Web site, Telegram notes that, because its servers are scattered around the world, “we can ensure that no single government or block [sic] of like-minded countries can intrude on people’s privacy and freedom of expression.” Its lax content-moderation policies have helped to make it a haven for users who might not otherwise be able to post freely, including dissidents, brokers of stolen personal data, child pornographers, American right-wing extremists, and members of the Islamic State. (After Durov’s arrest, Telegram said that its content moderation meets industry standards and that it abides by E.U. laws.)

Despite the platform’s public image, however, cybersecurity experts have long known that Telegram’s encryption system is far shallower than those of its competitors. Many messaging apps, such as the U.S.-based Signal, or Meta’s WhatsApp, use a security protocol known as end-to-end encryption, which insures that only the direct parties of any communication can read its content. Communication on Telegram is not end-to-end encrypted by default; in theory, this means that any illegal activity on the platform should be easy enough to monitor and report to law enforcement. It’s possible to turn on full encryption while using Telegram, but the settings are hard to find and both chat participants have to opt in.

David Thiel, the chief technologist at the Stanford Internet Observatory, who has studied the online ecosystem surrounding child-sexual-abuse material (otherwise known as CSAM), told me, “To the extent that they are marketing user privacy and free speech, it’s not about their tech; it’s about their behavior.” Instead of making it technically impossible to spy on users, as many apps do, Telegram only promises not to monitor too closely. Evidence would suggest that, in many cases, the company is true to its word. Thiel’s team has monitored the platform for hashes—the abstract strings of characters that indicate what’s in a file—of known CSAM material and found it in, for example, QAnon-related groups. “Our systems flagged things in those groups, then nothing seems to happen to them,” Thiel said. He continued, “The fact that we were able to detect that content means that they would be able to detect it perfectly fine as well.”

Beyond content-moderation concerns, Durov’s arrest is a sign that governments around the world are growing more alarmed by what they see as digital platforms’ outsized power. The U.S. is years into its effort to pass a ban on TikTok, fearing data leaks to Chinese authorities and the app’s ability to influence American youth. The European Union is rolling out a series of laws that protect users’ rights to their own data and regulate digital marketplaces, curtailing Apple’s app store, for example. In 2023, following deadly attacks on schools, Brazil temporarily banned Telegram after it refused to divulge data from neo-Nazi groups. On Saturday, the country also suspended X, because the company refused to name a local legal representative, following the government’s issues with the persistence of disinformation on the platform.

In a time of global conflict, the digital services that the world uses to communicate take on more importance than ever. Durov’s arrest comes as Telegram is being used by all sides of the war in Ukraine, including both the Russian military, which uses it for battlefield communications, and Russian civilians, who turn to it as one of their main sources of relatively uncensored news. The Russian military’s dependence on Telegram as a crucial part of its communications infrastructure would seem to have changed the government’s attitude toward its founder: Durov left Russia in 2014, after the Federal Security Service reportedly pressured him to sell his stake in his first social-network company. Now the Russian government is loudly decrying his arrest.

Tech companies are “looking at a very volatile geopolitical environment,” Meredith Whittaker, the president of Signal, told Wired in an interview last week. As a result, they may find themselves newly confronted with more stringent regulation, which would fundamentally change their businesses—and, potentially, their users’ capabilities. The experts I spoke with affirmed that Telegram markets itself inaccurately and fails to guarantee users’ privacy, but they were also concerned that the French government may end up overreaching in its prosecution of the platform. Matthew Green, a professor at Johns Hopkins University who studies cryptography, told me that issues like CSAM can provide a justification for more scrutiny—but, he continued, “I also feel, underneath that, there is a motivation that is more ‘We need to control these platforms.’ ” In particular, there is a worry that governments may soon begin to actively prevent more companies from offering privacy-protecting technologies. (The Spanish government is already considering banning end-to-end encryption entirely.) “I’m hoping they’re just coming up with a bunch of charges and assuming some would drop,” Thiel, the Stanford researcher, said of France’s charges against Durov. But, he added, if French officials succeed in prosecuting encryption, “I would be pretty concerned.”

Opinion: In this free speech fight, Musk’s X has marked the right position

A Brazilian court’s ill-considered attempt to snuff out controversial speech online.

By the Editorial Board

September 4, 2024 at 3:56 p.m. EDT

When it comes to free expression, Elon Musk tends to talk the talk more ably than he walks the walk. In his latest public tussle on the subject, however, he’s managing to do both. The billionaire CEO of Tesla and SpaceX is correct when he says a Brazilian jurist’s move to unilaterally prohibit X, which he owns, from operating in the country is an assault on internet speech around the world.

Brazilian Supreme Court Justice Alexandre de Moraes has been on a quest to clean up online disinformation for years, having ordered platforms to remove reams of posts that he has declared threatening to democracy. The effort garnered praise from left of center commentators during the latter stages of right-wing populist Brazilian President Jair Bolsonaro’s term, as the then-incumbent and his supporters threatened not to accept the results if they lost the 2022 election. And, indeed, yanking down lies with the potential to distort the vote or inspire violence may be the responsible thing for platforms such as X to do in certain limited circumstances. But it is beyond irresponsible for the government to make such calls. The story in Brazil has shown why.

Mr. Moraes’s takedown campaign might have been effective in combating right-wing conspiracy theories, but at a substantial cost to free expression — with mandates for removals and even arrest warrants often issued under seal and with scant reasoning to support them. The recent move against X is both more of the same and just plain more: After X ignored the court’s orders to block more than 140 accounts, the justice warned he would arrest its legal representative in Brazil. That prompted Mr. Musk to remove X’s team from the country. That lack of a physical presence, in turn, led Mr. Moraes to instruct that X be blocked for all 220 million Brazilians — who, he said, could face fines of almost $9,000 a day if they tried to circumvent the restriction.

If this sounds authoritarian, it is. Whatever the threat to democracy that the accounts Mr. Moraes wanted gone might have posed, the threat from one government official limiting the speech of 220 million people is greater. Taken together with Mr. Moraes’s choice to freeze the assets of internet-provider Starlink, a separate company of Mr. Musk’s, this move aligns Brazil not with the free world but with the likes of China and Russia.

None of this is to say that Mr. Musk has pursued his goals through the most practical means, or even the most principled ones. His own posts are regularly gratuitous and inflammatory, including his recent reposting of a declaration that the U.S. government ought to be made up exclusively of “high[-testosterone] alpha males.” He doesn’t consistently go after online lies but rather sporadically spreads them. Just this week, he promoted Tucker Carlson’s interview with a historian who traffics in apologetics for Hitler. Meanwhile, Mr. Musk bizarrely cracked down on the term “cisgender.”

Elon Musk Is an Influential Idiot Who Should Not Be Arrested for Being Dumb

Robert Reich, former U.S. Secretary of Labor for the Clinton administration and Sam Reich’s dad, wrote about Elon Musk’s political influence in an editorial for the Guardian. It begins as a decent piece, comparing the power of owning a social media platform with Musk’s childlike gullibility — my words, not Reich’s. But, in a section of ideas about what to do, one suggestion seems particularly harmful:

3. Regulators around the world should threaten Musk with arrest if he doesn’t stop disseminating lies and hate on X.

Global regulators may be on the way to doing this, as evidenced by the 24 August arrest in France of Pavel Durov, who founded the online communications tool Telegram, which French authorities have found complicit in hate crimes and disinformation. Like Musk, Durov has styled himself as a free speech absolutist.

There are places where U.S.-style interpretation of free expression is contradicted by local laws and, so, X’s operations must comply. Maybe Musk could be legally responsible in some jurisdiction for things he has said, or for things hosted on a platform he owns. But we should almost never encourage the idea of arresting people for things they say. Yes, there are limits: threats of violence and fraud are both types of generally illegal speech. Yet charging Musk for being a loud public idiot is a very bad idea.

Also, while details about Pavel Durov’s arrest are still solidifying, it does not yet appear he is being held responsible for “hate crimes and disinformation”. According to French prosecutors (PDF), which I translated with DeepL, his charges are mostly about failing to comply with subpoenas and other legitimate legal demands. If X follows legal avenues for either complying with or disputing government demands, then I do not see how Durov’s arrest is even relevant. And, for what it is worth, neither Durov nor Telegram have been “found complicit” in anything. The United States is not the only country which has legal procedures.

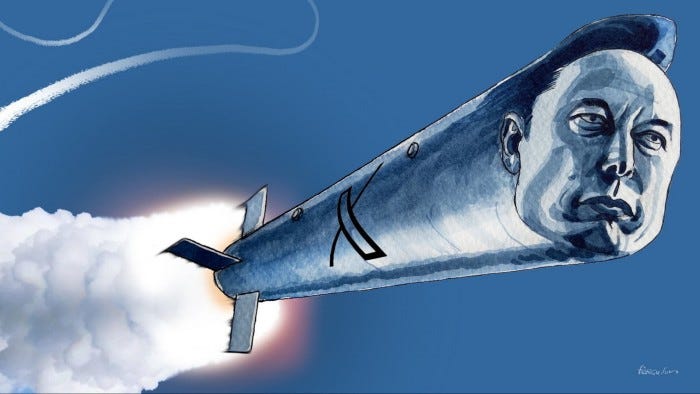

Elon Musk is an unguided geopolitical missile

While his influence is showing up from Ukraine to China, he still lacks the ability to make the law

Gideon Rachman

Big businesses and billionaires usually steer clear of political controversy. If they exercise power, they prefer to do it in the shadows.

Elon Musk is different. In recent weeks, he has endorsed Donald Trump and conducted a softball interview with him on X, the social media platform that he owns. Musk is also engaged in a bitter public feud with the Supreme Court of Brazil, which banned X last week. He has recently claimed that civil war is inevitable in Britain and responded to the arrest in France of Pavel Durov, the founder of Telegram, by posting: “POV: It’s 2030 in Europe and you’re being executed for liking a meme.”

The ownership of X has handed Musk a massive megaphone to broadcast his views. But focusing on his social media platform obscures the real extent and source of his geopolitical power.

It is the control of SpaceX, Starlink and Tesla that have given Musk a central role in the war in Ukraine and in the growing rivalry between the US and China; as well as a walk-on part in the war in Gaza.

In these conflicts, Musk’s role is more ambiguous than in the west’s culture wars. His unpredictable interventions — combined with immense technological and financial power — make him an unguided geopolitical missile, whose whims can reshape world affairs.

When Russia launched its full-scale invasion of Ukraine in 2022, one of its first goals was to knock out the internet access. By providing Ukraine with access to Starlink, his satellite internet service, Musk kept the country’s armed forces in the fight at a critical moment.

Later in the conflict, however, Musk chose to restrict Ukrainian access to Starlink — so as to hamper any effort to attack Russian forces in Crimea. Musk cited the risk of a third world war as justification. That action — allied to his promotion of a peace plan that incorporated some Russian demands — made Musk much less popular in Kyiv. But his view of the risks of a third world war were not that different from those of the Biden administration.

Where Musk and the US government have really parted company is over China. The opening of a massive Tesla factory in Shanghai in 2019 is seen in Washington as a major setback for the American goal of staying ahead of China in the key technologies of the future. China is now the world’s leading producer of electric vehicles and US officials believe that Chinese manufacturers have learnt from — and sometimes stolen from — Tesla.

The Biden administration is trying to persuade America’s leading tech companies to diversify away from China and was encouraged when Musk scheduled a visit to India earlier this year, with a view to opening a Tesla plant there. But, at the last minute, Musk cancelled and turned up in Beijing instead. In China, he announced an intensification of Tesla’s relationship with the country. The Shanghai factory now produces more than half the Teslas manufactured globally.

American officials note that Musk’s championship of free speech — and willingness to insult world leaders — does not extend to China. X has long been banned in China but Musk is scrupulously respectful towards Xi Jinping, China’s dictatorial leader.

Another foreign leader who seems to have got Musk’s measure is Israel’s Benjamin Netanyahu. Musk has been accused of promoting antisemitic conspiracy theories on X. But it was his proposal to provide Starlink to aid organisations in Gaza that really alarmed the Israeli government — which claimed this would help Hamas. After a visit to Israel last year, Musk agreed that he would only operate Starlink in Gaza with Israeli approval.

The Biden administration is uneasy about many of Musk’s activities. But his companies have technological capabilities that even the US government lacks. To keep Ukraine connected, when Musk wavered, the Pentagon had to contract with Starlink. When Nasa wants to ferry astronauts to and from the International Space Station, it is SpaceX that makes it happen.

If Musk often talks and acts as if he is more powerful than any government it may be because, in certain respects, that is true.

..More

Founder Mode

Paul Graham

September 2024

At a YC event last week Brian Chesky gave a talk that everyone who was there will remember. Most founders I talked to afterward said it was the best they'd ever heard. Ron Conway, for the first time in his life, forgot to take notes. I'm not going to try to reproduce it here. Instead I want to talk about a question it raised.

The theme of Brian's talk was that the conventional wisdom about how to run larger companies is mistaken. As Airbnb grew, well-meaning people advised him that he had to run the company in a certain way for it to scale. Their advice could be optimistically summarized as "hire good people and give them room to do their jobs." He followed this advice and the results were disastrous. So he had to figure out a better way on his own, which he did partly by studying how Steve Jobs ran Apple. So far it seems to be working. Airbnb's free cash flow margin is now among the best in Silicon Valley.

The audience at this event included a lot of the most successful founders we've funded, and one after another said that the same thing had happened to them. They'd been given the same advice about how to run their companies as they grew, but instead of helping their companies, it had damaged them.

Why was everyone telling these founders the wrong thing? That was the big mystery to me. And after mulling it over for a bit I figured out the answer: what they were being told was how to run a company you hadn't founded — how to run a company if you're merely a professional manager. But this m.o. is so much less effective that to founders it feels broken. There are things founders can do that managers can't, and not doing them feels wrong to founders, because it is.

In effect there are two different ways to run a company: founder mode and manager mode. Till now most people even in Silicon Valley have implicitly assumed that scaling a startup meant switching to manager mode. But we can infer the existence of another mode from the dismay of founders who've tried it, and the success of their attempts to escape from it.

There are as far as I know no books specifically about founder mode. Business schools don't know it exists. All we have so far are the experiments of individual founders who've been figuring it out for themselves. But now that we know what we're looking for, we can search for it. I hope in a few years founder mode will be as well understood as manager mode. We can already guess at some of the ways it will differ.

The way managers are taught to run companies seems to be like modular design in the sense that you treat subtrees of the org chart as black boxes. You tell your direct reports what to do, and it's up to them to figure out how. But you don't get involved in the details of what they do. That would be micromanaging them, which is bad.

Hire good people and give them room to do their jobs. Sounds great when it's described that way, doesn't it? Except in practice, judging from the report of founder after founder, what this often turns out to mean is: hire professional fakers and let them drive the company into the ground.

One theme I noticed both in Brian's talk and when talking to founders afterward was the idea of being gaslit. Founders feel like they're being gaslit from both sides — by the people telling them they have to run their companies like managers, and by the people working for them when they do. Usually when everyone around you disagrees with you, your default assumption should be that you're mistaken. But this is one of the rare exceptions. VCs who haven't been founders themselves don't know how founders should run companies, and C-level execs, as a class, include some of the most skillful liars in the world. [1]

Whatever founder mode consists of, it's pretty clear that it's going to break the principle that the CEO should engage with the company only via his or her direct reports. "Skip-level" meetings will become the norm instead of a practice so unusual that there's a name for it. And once you abandon that constraint there are a huge number of permutations to choose from.

..More

The Cult of Founder Mode

By Kate Clark

Sep 5, 2024, 3:00pm PDT

Maybe it was a blessing in disguise that I spent most of Labor Day weekend in bed recovering from a bout of Covid, because I was blissfully unaware of the newest venture capital debate brewing online.

Rather than enjoy barbecues with their families, it seems like many venture capitalists and startup founders spent the weekend engaging in an argument about the efficacy of “founder mode” versus “manager mode,” a conversation inspired by the latest blog post from Y Combinator co-founder Paul Graham.

In case you missed it, founder mode advocates for founders to trust their instincts and continue to run the company the way they did in the early startup days. This mode requires founders to remain deeply involved in all aspects of the business, rather than absorbing managerial books that encourage executives to "hire good people and give them room to do their jobs,” Graham writes. Manager mode, on the other hand, involves delegating tasks and focusing on the big picture.

He points to Airbnb co-founder Brian Chesky and Steve Jobs, the late Apple founder, as examples of founders who were able to lead their companies to success as they grew bigger because they clung to their original mindset. (Fidji Simo, CEO of Instacart, argued in a guest post on The Information that nonfounder CEOs “should also operate in founder mode, and their boards should reward these behaviors.”)

Graham’s argument was straightforward and not particularly surprising. Simply, he believes the founders of companies that grow into successful, large businesses should be cautious of any advice that’s tailored to professional CEOs, whom he describes as “some of the most skillful liars in the world,” individuals who will “drive the company into the ground.”

He also writes that “there are things founders can do that managers can’t, and not doing them feels wrong to founders, because it is,” Graham wrote.

This delineation is where myself and others begin to disagree with Graham’s argument. It reinforces Silicon Valley’s tendency to worship founders, which can encourage investors to turn a blind eye to excessive and even fraudulent actions.

..More

Venture Capital as Psychology

Motivation is at the core of successful entrepreneurship

Scott Hartley, Sep 06, 2024

Last week I had the pleasure of speaking in an online forum with a few thousand entrepreneurs, family office principals, and venture capitalists from around the world. On my panel an interesting opinion surfaced around the use of social media. Is there a strong rationale for backing, or avoiding, a founder with a high disposition for sharing, or as it’s now more popular to say, “building in public.” While some laud this behavior as core to building your business, or creating teachable moments, others see it as self-centered, or further fueling the cult of founder in an era of team.

I think, with many things, the lesson is two layers deep. It’s less about if and how a founder, or any individual for that matter, is vocal on social media, and more “why.” I learned a framework a while back known as R.I.C.E. For the injury prone athletes among us, I’m not referring to “Rest, Ice, Compression, Elevation,” but rather:

R: REWARD

I: IDEOLOGY

C: COERCION

E: EGO

Reward as a motivation speaks to what that individual is seeking. This outcome could be money, status, fame, or any external or internal reward for their actions. We can debate the value of working for such “reward” outputs, or if there are more “pure” motivations, but think of this as Jerry McGuire shouting, “Show me the money.”

Ideology is more about a world view, or a fundamental belief system. It could be perhaps framed as values. What does this founder see in the world that they want to will into being? At some point this is where job becomes career becomes mission. It’s perhaps less common that you hear about someone with a life-long passion and core ideology about building a CRM, but in some sectors like, say, climate, it’s prevalent. I would argue someone like Elon Musk is an ideological founder. He really doesn’t need more rewards. He’s building because of core convictions about humanity, risks technology can impose, and benefits it can engender if stewarded correctly.

Coercion is about trying to affect change, but perhaps more aggressively, without authentic openness to alternative viewpoints. The line between an ideological founder and a coercive founder is perhaps thin, but inheres in a founders genuine openness to logic or objectivity, and a humility about the validity of alternative viewpoints.

Ego is about how others perceive this person, how they want to be known. Ego invokes a narcissism, a self obsession, and a mirror back on oneself for why or how they might be acting. In truth, we all probably exhibit elements of all four letters from time to time. We work for reward, ideology, to coerce others, and because of ego. And of course we certainly self-identify in ways far more flattering than reality.

As a venture capitalist, namely as someone tasked with deploying money on behalf of limited partners into founders and CEOs whom we believe can impact the world, I would argue that I try to isolate and invest in those working in earnest toward Reward and Ideology. My belief is that founders with these two motivations are aligned with the outcomes that drive venture scale financial returns for my limited partners. As we live in a capitalistic society, I do fundamentally believe it’s ok for a founder to want to become a billionaire. That’s not mutually exclusive with creating an insanely positive company for the world and many in it. Therefore I seek out founders with a “chip on their shoulder,” and a drive to win, to chase “reward.” I also fundamentally believe this is an honest, if not purely “good” motivation. As stewards of capital, we as investors also maintain a huge responsibility to steer capital into ideas that are fundamentally “world positive,” or on a trajectory we believe to be net good. As such, there are many categories of business that we will never invest in, even if they’re moneymakers. The founder’s hunger or drive, insofar as they’re going the right direction, is just fuel.

Ideology is a motivation that can cut both ways. It can mean principled, but it can also mean stubborn, intransigent, fundamentalist and uncompromising. These are not good characteristics, and not ones that we seek in our portfolio CEOs. Great founders are coachable, adaptable, malleable, and flexible. They might have a strong world view, but they are not ideologues incapable of change. They are those who can listen, hear both sides of an argument, and make the best informed decision for the company, regardless of how it makes them look. The truly competent founder can therefore put Reward or outcome far above Ideology, Coercion, or Ego.

Ideology can also be a slightly less honest motivation, in my view. Most people say they want to make supply chain efficient, or reduce climate change, but in their own hierarchy of needs they probably first want to safeguard their own health, their family, their security. As such I’m wary of the overly idealogical founder who can’t also admit the type of outcome they’re seeking, because I don’t trust them completely. People often want to appear ecumenical, so might wear the mask of Ideology, but then this is just a betrayal of their own Ego, and the importance of how they’re being viewed. As such, I’d much rather a founder be dead honest and tell me what they want.

The Coercive founder is the one who’s quick to tug on the FOMO strings. “I got an extension to close for a few more days because I want to take in your check.” “I’ll let you in on the old SAFE valuation but I’m closing by Friday.” Or my absolutely favorite, “We’re already oversubscribed,” (as the email comes in the middle of the weekend). Coercion is a yellow flag, a manipulative tactic that, sure, might close you some sales leads, but is not a core characteristic or motivation that I seek in founders I back. I think authenticity, solving a huge problem, and building authentic brand have more impact on long-term sales success than any form of glib “hustling.”

And finally Ego is the red flag that makes me run for the hills. I think this may come across as contrarian to some, but I’d argue that the nuance here is the difference between Reward or Ideology, and pure Ego. Pure Ego is concerned with vanity, with narcissism, with the appearance of success rather than the attainment of it. Nothing screams Ego like the TechCrunch article that comes out about the acquisition that lost everyone money. Yes, saving face can be nice, but ultimately this is Ego. The company failed, and the “optical win” is dishonest pat on the back (and this can be motivated either by the founder wanting to project success, or the investors also wanting to mollify their limited partners, and project success. Ego is all around). While we’ve all seen these, and probably even helped write press releases, Ego is the characteristic that probably led to that failed outcome in the first place. Oh, the irony.

The problem with Ego is that it’s actually irrational when juxtaposed with Reward as a motivation. For example, we’ve all had the experience where the terms of a great deal change at the last minute. The egocentric founder walks away because they were slighted, bruised. Or they chalk it up to “principles” or “values,” hiding their own Ego behind the mask of being Ideological (but we know that’s a ruse). “That person shouldn’t have done that.” But if one fundamentally believes it’s still a good deal, even after the terms have changed, even after your pride is bruised, swallow your Ego, and make the deal happen. Make the rational decision as pertains to your job, which is to prioritize the success of your company, not to babysit your ego and pretend that you’re teaching someone a lesson. Don’t take two steps back to punish an enemy when you could take one step forward by being the better person, and swallowing your pride. The founder who can maintain an even keel and make the best business decision every time will win against the one who has to babysit their Ego behind an Ideology.

..More

Venture Firms Take A Break In August With Lowest Monthly Funding In 2024

September 5, 2024

Global venture funding slowed last month, reaching $18 billion — the lowest monthly funding so far in 2024, Crunchbase data shows.

Funding was down month over month by 36% and year over year by 23% from $23.7 billion in August 2023.

Through July this year, monthly funding totals were each above $20 billion. However, in 2023 global funding dipped below that amount in February, July and December.

In this market, funding dips have been cyclical and not an indication of a slower market slowing further. In fact, Q2 was up year over year driven by mega rounds of $100 million and more, with some active investors increasing their pace.

North America’s share hike

North American companies — which includes the U.S. and Canada — raised 66% of total global funding this past month, amongst the largest monthly proportion this year so far. Companies based in Asia raised around 25% of funding — in line with averages so far this year but down from an average of 29% of global funding last year. European startups raised 7% — the lowest monthly proportion this year — down from an average of 17% this year and 18% in 2023.

AI leads

The leading sector for funding amounts in August 2024 went to AI-related companies, which raised $4.3 billion, around 24% of funding. The second-largest sector, healthcare and biotech companies raised $3.5 billion.

AI is a growing proportion of dollar volume, with around 1 in 4 dollars invested in the industry so far this year. In 2023 1 in 5 dollars went to AI-related companies. And in 2022 1 in 10 dollars went to this sector.

The largest fundings this past month went to Los Angeles-based defense tech company Anduril, which raised a $1.5 billion Series F funding at a value of $14 billion, led by Founders Fund and Sands Capital Ventures. So far this year, five companies have raised rounds of $1.5 billion or more. And one other company raised above a $10 billion value, with Massachusetts-based Devoted Health, healthcare for medicare patients, raising a further $112 million in a Series E extension, at a value of $13 billion.

Large rounds were raised by Mountain View, California-based AI chipmaker Groq ($640 million), San Mateo-based secure sharing company Kiteworks ($456 million), India-based e-grocery Zepto ($340 million), San Francisco-based Magic, an AI coding startup, ($320 million), and Beijing-based foundation model company Moonshot AI ($300 million).

Exits still sluggish

The IPO markets are expected to continue on a low note in 2024, despite companies readying themselves. And M&A hasn’t quite picked up as much as was expected. If Character.ai had been acquired for the $2.5 billion Google paid its investors, it would have been the largest M&A deal in August ahead of the $1 billion Outbrain spent to acquire New York-based ad tech platform Teads.

Video of the Week

AI of the Week

How to index venture capital

"Don’t look for the needle in the haystack. Just buy the haystack" - John Bogle

Signal Rank Corporation, Rob Hodgkinson

Sep 03, 2024

This is not investment advice and is for informational purposes only. Investors should conduct their own research.

It is often said that the private markets are an access class, not an asset class. The power law dynamics ensure that venture is the most “clubby” of all the private markets. You’re either an early stage investor in Databricks / Uber / Rippling or you’re not. The top decile of VCs deliver IRRs of 35%+ (see Figure 1). But most do not. And you can’t eat IRR. 50% of VCs deliver DPI of <1.0x.

So as more investors (including retail investors) adopt the Yale model of allocating 25%+ to alternatives, is it possible to not just “democratize venture” but democratize access to power law returns?

Figure 1. IRR dispersion across all major private asset classes (2004-16)

At SignalRank, we believe that an indexing strategy can deliver the holy grail of making venture capital a scaled asset class that delivers both consistent growth & liquidity. We previously wrote about why indexing of venture is gathering pace. This is clearly the direction of travel. BlackRock’s Larry Fink agrees, commenting after their recent acquisition of Preqin, that BlackRock “anticipates indexes and data will be important future drivers of the democratization of all alternatives.”

OK, but how do you actually index venture capital?

What is an index fund?

First of all, let’s start with shared understanding of what an index is.

We are going to use the working definition from John Bogle, founder of Vanguard:

“The index fund is a practical, cost-effective way to achieve the market’s rate of return with little work and price. Individual stocks, market sectors, and management selection are all removed from index funds, leaving simply stock market risk.”

In practice, index funds have the following broad characteristics:

Broad basket of assets to represent the asset class – indices aim to reflect the underlying asset class by representing the asset price of a diverse number of assets. So, for example, the S&P 500 is made up of the top 500 US listed companies by market capitalization.

Transparent rules-based methodology with predefined weighting - indices aim to minimize manager bias by enshrining transparency with regards to asset selection and portfolio construction. Many indices are equally weighted across all assets.

Passively managed (with some rebalancing) – index managers allow the rules-based methodology to define portfolio construction as the underlying thesis is that the market will underperform individual manager selection. Many indices rebalance (i.e. buy/sell assets) at predetermined times to ensure that the index remains representative.

Updated with real-time data – most indices are live entities where real-time data will lead to the portfolio being updated on a regular basis. This ensures that the index remains up to date with current data.

You could seek to diversify by investing in a fund of funds model, but indices tend to be a superior product for the following reasons:

Indices are lower cost as they are passively managed. Indices also tend to invest direct into companies, eliminating a layer of fees/carry by not investing into funds.

Indices are transparent with rules-based methodologies (thereby reducing manager risk).

Many indices are publicly-traded thereby allowing for liquidity (even if the underlying assets are private).

Index funds have been very successful. The first passive index fund was launched by Wells Fargo in July 1971 with $6m from the Samsonite pension fund. By 2020, indices represent over 37% of the US stock market capitalization.

In 2024, total assets in US passive strategies in public markets surpassed those in active ones for the first time (Figure 2). We anticipate passive investing will accelerate in private markets to echo its growth in public markets.

Dell and Palantir to join S&P 500; shares of both jump

Published Fri, Sep 6 20245:27 PM EDTUpdated 1 Min Ago

Key Points

Dell and Palantir shares rose in extended trading on Friday after the announcement that they’re being added to the S&P 500.

Their inclusion comes after tech companies Super Micro and CrowdStrike joined the index earlier this year.

Dell was previously a member of the S&P 500 until the company was taken private in 2013 in a deal led by founder Michael Dell.

In this article

Alex Karp, CEO of Palantir Technologies, speaks at the World Economic Forum in Davos, Switzerland, Jan. 18, 2023.

Arnd Wiegmann | Reuters

Dell and Palantir both jumped about 7% in extended trading on Friday after S&P Global announced that the companies would join the S&P 500 index.

Palantir will take the place of American Airlines, and Dell is replacing Etsy, according to a statement. Shares of companies added to the benchmark often rally after the announcement because fund managers who track the index regularly update their portfolios to mirror the additions.

For Dell, the announcement marks a return to the benchmark index. The computer and server maker was a constituent from 1996 to 2013, when founder Michael Dell and private equity firm Silver Lake took the company private. Dell went public again in 2018.

Super Micro Computer, which competes with Dell in selling servers for artificial intelligence workloads, joined the S&P 500 earlier this year following a historic rally in the stock that has pushed the company’s market cap past $50 billion. Its value has since been sliced in half.

After operating as a venture-backed startup for over 15 years, Palantir went public on the New York Stock Exchange in 2020, and in the fourth quarter of 2022, the company started posting profits. In the second quarter, Palantir’s net income totaled $135.6 million, up from $27.9 million in the same period a year earlier. Annual revenue growth has accelerated for four quarter in a row.

Palantir co-founder and CEO Alex Karp has gained a reputation for promoting patriotism in tech, helping the government and military agencies manage their data. He recently told The New York Times that Palantir is engaged in “the finding of hidden things.”

To join the S&P 500, companies must have reported a profit in their latest quarter and have cumulative profit over the four most recent quarters.

“My interest in profitability is for obvious reasons, but it’s also, I think, we’ll just be in a much stronger position as it becomes clear that we qualify for participation in S&P,” Karp told analysts on a conference call in May 2023.

Dell has been profitable almost every quarter since 2019. The stock jumped 90% in 2023, and was up 33% this year before the rebalancing announcement. Growth has been driven by sales of servers containing Nvidia graphics processing units that can handle AI workloads. Dell told investors last week that it saw $3.2 billion in AI server demand in the quarter ended Aug. 2, up 23% from the prior quarter.

Cybersecurity vendor CrowdStrike was added to the index during the previous rebalancing, in June.

The additions are a better reflection of U.S. stocks with high market capitalizations, S&P Global said. The median market cap of companies in the index is about $33.5 billion. Palantir has a market cap of over $67 billion, while Dell is valued at over $72 billion.

US, Britain, and EU Set to Sign AI Treaty

The first legally binding international AI treaty, known as the AI Convention, is set to be open for signing on Thursday. The treaty is the result of extensive negotiations among 57 countries, including the United States, Britain, and European Union members.

This marks a significant step toward regulating AI on a global scale.

Addressing AI’s Impact on Human Rights

Adopted in May, the AI Convention is primarily focused on safeguarding the human rights of individuals affected by AI systems. The treaty establishes a framework for member states to ensure that AI technologies do not undermine fundamental values such as human rights and the rule of law.

Britain’s justice minister, Shabana Mahmood, emphasized the importance of this agreement, stating, “This Convention is a major step to ensuring that these new technologies can be harnessed without eroding our oldest values, like human rights and the rule of law.”

The Convention is separate from the EU’s AI Act, which recently came into force and provides comprehensive regulations on developing, deploying, and using AI systems within the EU internal market. While the EU AI Act focuses on internal governance, the AI Convention represents a broader international commitment to ethical AI use.

Foundations and Challenges of the AI Convention

The Council of Europe, established in 1949 laid the groundwork for this treaty by creating a dedicated Committee on Artificial Intelligence in 2022. This committee, alongside an ad hoc group formed in 2019, examined the feasibility of an international AI framework.

The AI Convention allows signatory countries the flexibility to adopt or maintain legislative, administrative, or other measures to implement its provisions. However, some experts have raised concerns about the treaty’s effectiveness.

..More

OpenAI Investor Hoffman Says Musk’s New AI Chip Cluster Is ‘Table Stakes’

Spending on AI is not excessive, given the opportunity, Hoffman said

By Erin Woo

Sep 5, 2024, 4:02pm PDT

Elon Musk’s recent claim that his xAI startup had assembled a cluster of 100,000 Nvidia chips in four months represents “table stakes” for the kinds of artificial intelligence Musk is pursuing, venture capitalist Reid Hoffman said Thursday at The Information’s AI Summit.

“I don't think it's necessarily [that] he's in the lead,” said Hoffman, a partner at venture firm Greylock Partners and a director at Microsoft. He said such a cluster allows xAI to catch up to others that have been investing heavily in AI for years.

The Takeaway

Clusters of 100,000 specialized chips are “table stakes” for companies serious about artificial intelligence, investor Reid Hoffman said.

Musk and his team are “smart and are fast learners,” Hoffman said. But, he added, there are a “whole bunch of learnings about the scale of that cluster. Nobody just puts them all in a rack together, puts all the cabling together and presses play and gets instant AI.”

..More

News Of the Week

Everything to Expect From Apple’s iPhone 16 Launch on Sept. 9

Company also planning major updates for AirPods and watches.

By Mark Gurman

September 6, 2024 at 4:00 AM PDT

Apple Inc.’s most important event of the year takes place Monday, when the company will roll out its latest iPhones and set the stage for a new artificial intelligence platform.

The event kicks off from Apple’s headquarters in Cupertino, California, on Sept. 9 at 10 a.m. local time. Apple doesn’t typically hold this event on a Monday, but the earlier timing lets the company get out ahead of an eventful Tuesday: There’s a US presidential debate that day, and the European Commission is slated to announce a decision on whether Apple has to pay $14 billion in taxes stemming from a longstanding agreement with Ireland.

The most significant product announcement will be the iPhone 16 line, but the company is also preparing major updates to both the Apple Watch and AirPods. Apple Intelligence — a new suite of AI tools that includes an updated Siri digital assistant — also will feature prominently. The theme of the event, “It’s Glowtime,” is a reference to Siri’s new interface.

The 10 Biggest Rounds Of August: Anduril And Groq Lead Hot Month

September 4, 2024

This is a monthly feature that runs down the month’s top 10 funding rounds in the U.S. Check out the biggest rounds of last month here.

It was another big month for megadeals. You had to raise more than $150 million to make the top 10 list this month — as investors put money into everything from defense tech to semiconductors to biotech.

1. Anduril Industries, $1.5B, defense: Anduril Industries matched its own record for the largest defense tech round ever. The Costa Mesa, California-based startup locked up a $1.5 billion Series F that values the company at $14 billion — a 69% jump from the $8.5 billion valuation it received after its massive $1.5 billion Series E in late 2022. The round was co-led by Founders Fund and Sands Capital. The company will use some of the new proceeds for the development of Arsenal-1 — a more than 5 million-square-foot production space designed to produce tens of thousands of autonomous military systems annually. After a slow start to the year, funding to defense tech startups has picked up dramatically in the past few months. Just last month, Helsing, which develops artificial intelligence software for defense, raised approximately $489 million in funding led by General Catalyst that values the company at $5.4 billion. After Anduril’s huge round, defense tech startups now have raised $2.5 billion in 2024, per Crunchbase data. Last year, such startups collected only $2 billion total.

2. Groq, $640M, semiconductor: AI semiconductor and software startup Groq locked up a $640 million Series D round at a valuation of $2.8 billion. The round was led by funds and accounts managed by BlackRock. The Mountain View, California-based firm is helping develop ways to optimize AI and lessen the vast amount of computing power that is currently needed to do that. The new round almost triples the company’s valuation from its Series C in 2021. Founded in 2016, the company has raised $1 billion, per Crunchbase.

3. Kiteworks, $456M, cybersecurity: Investors seem to be digging cybersecurity yet again. Secure content company Kiteworks raised a $456 million round from Insight Partners and Sixth Street. The San Mateo, California-based company described the new round as “growth equity,” but also said it was a “partial liquidity event,” meaning some investors were able to cash out. While the company did not specify a valuation, it did state it was a minority investment, meaning its valuation is greater than $1 billion. Kiteworks’ platform allows customers to share sensitive data with other trusted parties via communication channels such as email and file sharing. In 2020 the company raised $120 million in a funding round led by Bregal Sagemount. Founded in 1999, Kiteworks has raised $592 million. The company was formerly known as Accellion and suffered a major data breach in 2021.

4. GondolaBio, $300M, biotech: BridgeBio Pharma spun off GondolaBio this month, a biotech focused on early-stage genetic disease treatments. The company was also formed with a nice tranche of cash — $300 million from a handful of well-known firms, including Viking Global Investors and Sequoia Capital. The new company will focus on research and development, manufacturing, and commercialization activities for early-stage clinical or preclinical programs across a handful of different areas.

5. Grafana Labs, $270M, analytics: It does seem like companies are raising extensions of rounds from longer and longer ago. This month, New York-based Grafana Labs raised $270 million in a mix of growth equity and a secondary offering — so some money went to the company and some to shareholders. The company described it as an extension of its $240 million Series D in 2022. The new round was led by Lightspeed Venture Partners and values the company at $6 billion. Grafana’s open-source software platform helps monitor and visualize data. Founded in 2014, the company has now raised more than $805 million, according to Crunchbase data.

6. Abnormal Security, $250M, cybersecurity: Abnormal Security closed a $250 million Series D that values the San Francisco-based cybersecurity startup at $5.1 billion. The new round was led by Wellington Management. The latest valuation is a more than 28% uptick from the $4 billion valuation Abnormal got when it raised a $210 million Series C led by Insight Partners back in May 2022. Founded in 2018, Abnormal looks to stop attacks and find compromised accounts across email and connected applications through leveraging machine learning and AI to understand human behavior. The startup has raised nearly $546 million total, per the company. Abnormal also says it recently surpassed $200 million in annual recurring revenue. After a down 2023, cybersecurity startups are once again seeing the cash. In the second quarter of 2024, cyber startups saw a robust $4.4 billion invested, according to Crunchbase data. The dollar figure represents a 63% increase from Q1, which saw $2.7 billion roll to startups in 173 deals. It was the best quarter for funding in the sector since Q1 2022 and a 144% increase from Q2 2023.

7. Flyr, $225M, travel: Travel startup Flyr raised $225 million in equity and $70 million in debt in a new funding round. The equity portion was led by WestCap and reportedly values the startup at $900 million. The San Francisco-based startup develops software for the travel industry, such as airlines. Founded in 2013, the company has raised $482 million, per Crunchbase.

8. Cribl, $200M, data: San Francisco-based Cribl raised a $319 million Series E led by new investor GV and valuing the data infrastructure company at $3.5 billion. The new round is actually a mix of $200 million in capital and a $119 million secondary offering, per Bloomberg. The raise represents a significant up-round for the company, which last raised a $150 million Series D led by Tiger Global Management at a valuation of nearly $2.6 billion in 2022. Cribl’s platform gives users observability into their data, allowing them to understand the health of the data and organize it for IT and security teams. Just last year, Cribl announced it had passed the $100 million mark in annual recurring revenue. The company has more than 700 employees worldwide. While the explosion of data has given companies the potential for deep understanding of their business, the process of actually collecting, verifying and organizing that data has proven to be difficult and time-consuming. It’s that problem that platforms such as Cribl’s tries to rectify. Founded in 2018, Cribl says it has raised more than $600 million.

9. (tied) Bilt Rewards, $150M, loyalty rewards: Wasn’t it just seven or so months ago Bilt was here? It was. Bilt Rewards raised a $200 million round led by General Catalyst at a $3.1 billion valuation just in January — more than doubling its value after its fundraising in 2022. Well, the loyalty startup is back, this time with an additional $150 million round led by Teachers’ Venture Growth. The New York-based startup allows consumers to earn rewards on the rent they pay. Bilt plans to use some of the proceeds to expand its network to include local dining, grocery stores, ridesharing and other retail purchases. Founded in 2021, the company has raised a total of $711 million, per Crunchbase.

9. (tied) Codeium, $150M, artificial intelligence: AI-powered coding assistant Codeium closed a $150 million Series C round led by General Catalyst that values the Mountain View, California-based startup at $1.25 billion. Codeium’s platform uses generative AI models trained on public code to give developers suggestions for building apps, and can support dozens of programming languages. Founded in 2021, the company has raised $243 million, per Crunchbase.

Big global deals

All the biggest raises came from the U.S., but there was a large round that went to a grocery delivery startup in Asia.

India-based e-grocery firm Zepto raised a $340 million Series G.

Wealthy Harris donors are reportedly pressing for ouster of FTC Chair Lina Khan

1:52 PM PDT • September 6, 2024

Some of Vice President Kamala Harris’ wealthier donors are informally asking for FTC Chair Lina Khan to be replaced, reports Bloomberg. It’s not really surprising: Her expansive definition of antitrust enforcement has countless industries frantic, and the largest corporations opposed her appointment from the start.

Khan’s FTC, which has opposed mergers that would have been waved through by previous FTC chairs, has seen mixed success. But her nomination by President Biden in 2021 was clearly a challenge to longstanding doctrines that allowed mega-corporations, including “Big Tech,” to consolidate power. She went so far as to call them “mob bosses” in a recent interview with TechCrunch.

The donor pressure may be misplaced, considering that Khan’s term ends later this month. While she will remain in place until the next agency chief is appointed, chances are this will extend her term by months, not years.

Meanwhile, the donors reportedly also expressed a dislike of SEC Chairman Gary Gensler, whose term ends in June 2026.

Andreessen Horowitz shutters its Miami office after two years

3:48 PM PDT • September 4, 2024

Andreessen Horowitz (a16z) has closed a satellite office in Miami Beach just two years into a five-year lease it signed for an 8,300-square-foot space. The reason? Disuse, reports Bloomberg.

Miami — once a hotspot for crypto, an area of interest for a16z — has struggled to retain venture cash and entrepreneurial talent in recent years, Bloomberg notes, with venture investments dwindling to $400 million in Q2 2024 from $5.5 billion in all of 2022, per Pitchbook.

For a16z, the closure deals a blow to plans it outlined in 2022 to ditch a central HQ for “global outposts” in cities including NYC and Santa Monica. Pitched as an antidote to the remote working arrangements that became commonplace during the pandemic (which a16z co-founders Ben Horowitz and Marc Andreessen once derided as “not a good life“), the outposts were meant to “build relationships” amid founders and help “develop [a16z’s]” culture.

Evidently, things didn’t go quite as planned in Miami.

Startup of the Week

Covariant Founders Will Join Amazon in Latest Acqui-Hire

By Kate Clark

Source:The Information

Amazon has hired the founders of the industrial robotics company Covariant, the e-commerce giant announced in a blog post on Friday. The deal follows a trio of other acqui-hires, including Microsoft’s acquisition of artificial intelligence company Inflection’s founders and most of its staff in March.

It’s unclear what Amazon is paying for the startup, which was valued at $625 million in an April 2023 fundraising. Its investors include Index Ventures, Singaporean sovereign wealth fund Temasek and Bill Gates’ Cascade Asset Management.

In the blog post, Amazon said it was hiring Covariant founders Pieter Abbeel, Peter Chen and Rocky Duan, and that it was licensing the startup’s “robotic foundation models to advance the state-of-the-art in intelligent and safe robots.” Amazon also plans to bring on about a quarter of the company’s employees, who will join its fulfillment technologies and robotics team. Bloomberg reported in July that Amazon was interested in acquiring the startup.