A reminder for new readers. That Was The Week includes a collection of my selected readings on critical issues in tech, startups, and venture capital. I selected the articles because they are of interest to me. The selections often include things I entirely disagree with. But they express common opinions, or they provoke me to think. The articles are sometimes long snippets to convey why they are of interest. Click on the headline, contents link, or the ‘More’ link at the bottom of each piece to go to the original. I express my point of view in the editorial and the weekly video below.

Congratulations to this week’s chosen creators: @daringfireball, @stevensi, @riptari, @caseynewton, @mattbirchler, @rex_woodbury, @jasonlk, @MParekh, @carnage4life@mas.to, @markgurman, @sanguit, @julie188, @Techcrunch, @refsrc, @_odsc, @Om, @cartainc, @PeterJ_Walker, @gabydvj, @mtemkin, @JonPorty,

Contents

Editorial: Lawmakers Ignoring the Law

Apple Is in Talks to Let Google Gemini Power iPhone AI Features

After raising $1.3B, Inflection is eaten alive by its biggest investor, Microsoft

Here’s how Microsoft is providing a ‘good outcome’ for Inflection AI VCs, as Reid Hoffman promised

Stability AI CEO resigns because you’re ‘not going to beat centralized AI with more centralized AI’

Editorial

In her influential 2017 Yale Law Journal article, "Amazon's Antitrust Paradox," Lina Khan argues that the current antitrust framework, which primarily focuses on consumer welfare and price effects, fails to capture the full range of anticompetitive practices employed by digital platforms like Amazon. She suggests that the Sherman Act and other antitrust laws may need to be reinterpreted or updated to address the specific challenges these companies pose.

Khan writes,

"The current framework in antitrust—specifically its pegging competition to 'consumer welfare,' defined as short-term price effects—is unequipped to capture the architecture of market power in the modern economy."

She argues that focusing primarily on price effects overlooks other ways digital platforms can harm competition, such as by leveraging their dominance across multiple markets or using their control over data to create barriers to entry.

While Khan does not explicitly state that the Sherman Act is inadequate, her arguments suggest that the current interpretation and application of antitrust laws, including the Sherman Act, may not be sufficient to address the challenges posed by Big Tech. Her work has contributed to a broader discussion about updating antitrust enforcement for the digital age.

The DOJ complaint that Apple is a monopoly (not a crime) and abusing its monopoly power fails if the Sherman Act is relied upon to judge criminality. Although the FTC is not bringing the case—it is run by Lina Khan—the DOJ is clearly on the same page as she is in bringing it. In July 2023, I argued, “Khan and Gensler Should be Fired.” The case for that is now even more convincing.

As Jason Snell from Six Colors argues:

Defining a “monopoly.” Before we get to some of the details of Apple’s specific anti-competitive behavior, it’s worth noting that this suit is charging Apple with violations of the Sherman antitrust act, which is meant to specifically regulate monopolies. Things that are legal for regular companies to do become illegal when monopolies do them.

Part of this document, then, has to establish that Apple holds monopoly power over a specific market. Given that Apple’s share of the U.S. smartphone market is about 60 percent, how can it be called a monopoly? The DoJ attempts to square this circle in a few different ways:

It uses revenue instead of unit sales, pointing out that Apple and Samsung combined hold 90 percent of the U.S. smartphone market by revenue.

It creates a new sub-market, the “Performance Smartphone,” which pushes Apple up to about 70 percent of the market in terms of unit sales.

It accuses Apple of attempting to create a monopoly through its various business tactics, which is also illegal.

Questions I would ask about this approach: Can you add in Samsung, find a number starting in ninety, and declare something a monopoly? Is revenue share how monopolies are defined? Can you draw borders on a product category in a beneficial way in order to declare it a new market?

Apple’s position in the U.S. market is certainly strong, but regardless of how you view its behavior, it will be interesting to see if the DoJ can make a convincing case that Apple is actually a monopoly, given the presence of Samsung and Google in the market.

Jason Snell, six colors

Because the law does not provide a solid case against Apple, the DOJ is attempting to redefine the meaning of words to allow its case. This alone should be sufficient evidence that the complaint is a political, not a criminal, decision. The case will fail before a judge and jury, and Apple’s response indicates it plans to fight.

Renowned former journalist Walt Mossberg had this to say on Threads:

And Steven Sinofsky - his article is below - gives a damning appraisal of the DOJs chances.

His first day X post is a great overview from somebody who - at Microsoft - has been down this path with the DOJ. Click the graphic for the full thread.

Apple’s multibillion-dollar investment in building a global software distribution platform benefits its shareholders. But it also benefits users, even Android users. Who in their right mind would have thought Eric Schmidt would have focused on mobile as much had Apple not started the mobile revolution in 2007?

The intense competition for users (Android’s many varieties have about 80% global market share) drives innovation on all sides.

In my opinion, the essence of the DOJ case is that Apple should be forced to be as bad as Android, or there will be no equality. The essay By Kurt Vonnegut that Daring Fireball ‘typeset’—‘HARRISON BERGERON’—is therefore entirely appropriate—and hilarious, too. It’s the first Essay of the Week. See below.

This DOJ complaint is not for “the people.” It is for the DOJ and the FTC, who are increasingly attempting to hold back innovation, especially when the innovator is better than the competition. This makes it increasingly irrelevant as accelerated competition challenges all incumbents.

OpenAI and its peers (now several) are a great example, seemingly driving two of the slower movers - Apple and Google - to partner on AI in the next version of iOS.

Well, there you have it. Shame on the DOJ for filing this amateur complaint. And if we buy the DOJ case or fail to oppose it, Shame on us.

Essays of the Week

‘HARRISON BERGERON’ ★

The overriding gist of the DOJ’s lawsuit against Apple brought to mind, for DF reader E.G., Kurt Vonnegut’s dystopian short story Harrison Bergeron. Despite being an enormous Vonnegut fan, I couldn’t recall reading it before. It’s so apt. As E.G. quipped in his email to me, “Only in making all products, services, and experiences equally bad, will we have equality and fairness.”

There are a couple of plain text versions of the story on the web, but none that do justice to the story typographically. So, channeling my inner Dean Allen, I typeset one. Curl up with it on your iPad — or, dare I suggest, go old-school and print it out.

United States v. Apple (Complaint)

March 21, 2024 the United States filed an antitrust complaint against Apple. The filing is a new approach to antitrust and hinges on mostly how Apple chose to design the iPhone from the very start.

MAR 23, 2024

“If you’re weak on the facts and strong on the law, pound the law. If you’re weak on the law and strong on the facts, pound the facts. If you’re weak on both, pound the table.”

— Oliver Wendell Holmes1

There’s a lot of table pounding going on.

In United States v. Apple, the Department of Justice and 16 states with the District of Columbia filed a lawsuit alleging Apple to have abused its market position illegally under the Sherman Antitrust Act. The release can be found here and filing here.

This is the very first step in what will last at least 5 years and perhaps 10, though a settlement or withdrawal is possible at any time. The antitrust legal process is a lot like those early Apollo program drills in The Right Stuff. There is silence and nothing for long stretches of time and then suddenly there are red lights, sirens, and steam flying out of pipes everywhere—moments of sheer terror. This goes on for years. Patience is required. You can’t even predict who is ahead at any given time.

Right now the vast majority of analysis will claim this is a landmark case. The government is presenting a very strong case. This is a new era in the digital economy. In other words breathless coverage. They have to say this. Why? First, they are the only two parties talking now after reading the filing. There’s the antitrust world of academics and activists. The people who talk now are those that always want more antitrust. They spend their careers studying the topic and see antitrust with every big company at scale. There is literally nothing more exciting in the entire field than going after the biggest and most successful company of an era. Second, there are the regulatory critics that have long disliked technology and especially big technology companies. “Going after big tech” is a natural endpoint. These are the experts quoted in stories right now. The people who are not saying anything? Apple of course. And antitrust defense counsel who are always low key. And when someone from tech raises objections their opinion is instantly dismissed as both obviously biased and an ill-informed layperson.

What follows are some of those ill-informed opinions of a layperson and tech person that spent almost two decades deeply invested as a participant in antitrust. But correct, I am not a lawyer.

As observers and for my friends at Apple, an important aspect of the case to keep in mind is that most steps in the process are legal steps—plodding, boring, and deeply technical from a legal perspective. A few of them are constructed for legal as well as public relations optics. This initial filing is mostly an optics step. Short of a dramatic case dismissal (which Apple will certainly file) or dismantling (which a judge could do in response), the filing is meant to stir emotions and create a broad base of public support and awareness while providing just enough to continue the legal journey. The effort is as much politics as it is legal. That’s why there are no footnotes or citations. We know because they quote Steve Jobs, but since he has passed and cannot be cross-examined in the context of this case it really isn’t there for evidence as much as the headlines. I personally found that deeply offensive. This is a story with hints of the facts that will form the basis of the argument. You cannot judge the strength of the case on what is filed today, though you can see where it is going.

I wrote a long twitter thread starting here. This post has that thread below and I’ve also summarized here.

Apple slams DOJ case as misguided attempt to turn iPhone into Android

Natasha Lomas @riptari / 11:46 AM PDT•March 21, 2024

Image Credits: Apple

Apple is coming out swinging against the Department of Justice’s (DOJ) antitrust case, just announced Thursday, which accuses the iPhone maker of being a monopolist with its thumb on a mobile chokepoint of its own making.

Apple is dubbing the litigation misguided and warning the DOJ risks trashing all the things its customers value about its integrated mobile ecosystem.

The lawsuit threatens to undo the features that make its smartphones different from the rest of the market, as Apple tells it — with the risk, should the suit prevail, of the iPhone ending up looking and feeling just like an Android phone. So it’s even managed to get a trolling swipe at Google into its defense.

In a statement provided to TechCrunch, Apple said:

This lawsuit threatens who we are and the principles that set Apple products apart in fiercely competitive markets. If successful, it would hinder our ability to create the kind of technology people expect from Apple—where hardware, software, and services intersect. It would also set a dangerous precedent, empowering government to take a heavy hand in designing people’s technology. We believe this lawsuit is wrong on the facts and the law, and we will vigorously defend against it.

The suit, which is being filed by the DOJ and 16 state attorneys general, accuses the iPhone maker of anti-competitive exclusion across two markets the litigation will seek to establish — so-called “performance smartphones” and “US smartphones” — which are narrower market definitions than the smartphone market as a whole. The suit claims Apple holds a more than 70% share of “performance smartphones” and over 65% of the US smartphone market, respectively.

In a briefing with journalists following the DOJ’s announcement this morning, Apple dismissed these market definitions as gerrymandering on the part of government lawyers trying to make a monopoly case stick where it argues there is none.

It says the circa 20% global smartphone market share the iPhone holds is the only market definition that makes sense.

In wider remarks Apple hit out at the DOJ’s case as legally dubious and/or misguided — suggesting it’s an attempt to replicate the antitrust case the government successfully brought against Microsoft’s Windows OS back in the 1990s by desperately trying squeeze Apple into the same mould.

Apple representatives reject any comparison here, pointing out that Microsoft had a 95% market share, for example. They also argue it ignores how Apple has created an entirely new marketplace for developers and consumers.

On the call, Apple representatives sought to back up this claim by dropping in a few growth metrics — saying for example that, over the past ten years, the number of paid developers on the App Store has increased by 374% (from 1.1 million to 5.2 million).

Citing stats from 2020 to 2022, they also sought to highlight growth in commerce generated by developers in its App Store. Globally, they said this increased by 64%, from 685 billion to 1.1 trillion. Although it’s worth noting the time period Apple selected to highlight here spans the pandemic, when digital commerce skyrocketed for all sorts of services as a consequence of lockdowns. And often came back down to Earth with a bump after pandemic restrictions lifted.

The Department of Justice comes for Apple

One way or another, real competition may be coming to the iPhone

Casey Newton

Mar 21, 2024 — 11 min read

Today let’s talk about one of the most significant antitrust lawsuits ever filed in the tech industry: this 88-page complaint against Apple, filed by the Department of Justice and joined by 16 states, accusing the iPhone maker of illegally maintaining its monopoly over high-end smartphones and artificially inflating prices for consumers.

Here are Dave Michaels and Aaron Tilley in the Wall Street Journal:

The government’s antitrust complaint, filed in a New Jersey federal court, alleges Apple used its control of the iPhone to prevent competitors from offering innovative services such as digital wallets and limited the functionality of hardware products that compete with Apple’s own devices. The suit also claims that Apple makes it difficult for users to switch to devices that don’t use Apple’s operating system, such as Android smartphones.

Apple “has maintained its power, not because of its superiority, but because of its unlawful exclusionary behavior,” Attorney General Merrick Garland said at a press event.

Apple responded by saying that the lawsuit represents a case of government overreach:

This lawsuit threatens who we are and the principles that set Apple products apart in fiercely competitive markets. If successful, it would hinder our ability to create the kind of technology people expect from Apple — where hardware, software, and services intersect. It would also set a dangerous precedent, empowering government to take a heavy hand in designing people's technology. We believe this lawsuit is wrong on the facts and the law, and we will vigorously defend against it.

I. The market, defined

The first question to ask with any antitrust case is how regulators are defining the relevant market. In order to prove that a company is illegally maintaining a monopoly, the government first has to prove that the tech giant in question actually has one. In the most famous tech antitrust case, United States vs. Microsoft, the defendant had more than 90 percent market share of operating systems for personal computers

The global smartphone market is more fragmented. Apple has a plurality of market share at 23 percent. Most smartphones in the world run on Android. And so the Department of Justice argues that Apple’s monopoly is in the category of “performance smartphones,” which are more expensive, use premium materials, and have extra components and features, such as NFC chips used for contactless payments.

Of these performance smartphones, the suit says, Apple has 70 percent market share by revenue. And from that market definition, it seeks to make the case that Apple illegally restricts competition and inflates prices.

It’s not clear whether a judge will accept this definition. A federal judge threw out an antitrust case against Meta in 2021 for failing to establish that the company had an illegal monopoly in personal social networking services. (The government refiled it two months later, and the case is ongoing.) It may seem obvious that Meta is the most powerful player in social networks in the United States, but the government had a difficult time defining the relevant markets such that it could credibly accuse the company of having a monopoly.

Similarly, it seems obvious that Apple is the dominant smartphone manufacturer in the United States. But the case is less clear cut than US vs. Microsoft, as Matt Rosoff argued in TechCrunch, and until a judge accepts the relevant market definitions there’s no telling if this lawsuit can actually bring about change.

II. What’s changed already

On two of the five charges against the company, Apple has already moved to address competition concerns.

The first relates to apps that can stream video games over the cloud, such as Xbox Cloud Gaming and GeForce Now. Apps like these let users subscribe to play a variety of games for a single monthly fee; in that sense, they can offer developers a way to make an end run against Apple rules that prevent third-party app stores. They also let users play high-end games on low-end hardware, meaning they don’t have to upgrade their devices as often. Apple said it would allow game streaming apps in the App Store in 2020, but only if developers submitted each individual game within the service for review.

Then this January, in response to pressure from European regulators, Apple said it would allow game streaming apps without those onerous extra requirements. So there’s one Department of Justice complaint resolved. But the point that the DOJ was making here — that Apple blocks apps that would let consumers hang on to their iPhones for longer — still stands.

The second charge Apple has moved to address involves iMessage. Many commentators noted today that the DOJ’s lawsuit marked the first known case of the federal government weighing in on green bubbles — and, more broadly, the way Apple intentionally makes the messaging experience worse for non-Apple customers as a way of discouraging customers from switching to Android. As one Apple executive put it in 2016, according to the lawsuit: “moving iMessage to Android will hurt us more than help us.”

In November, Apple said it would support Rich Communication Services, or RCS, at some point this year. It’s not the same as building an iMessage app for Android. But it is a modern messaging standard that will add typing indicators, read receipts, location sharing, and other features that Android users haven’t been able to enjoy when messaging their friends on iOS. If the RCS standard expands to support end-to-end encryption, a move Apple says it will support, security protections for all smartphone users will improve accordingly.

In the meantime, Apple’s moves to protect iMessage highlight the ways it is willing to worsen the experience for consumers, including around privacy and security, in the name of creating lock-in on its devices.

III. The changes still to come

The lawsuit also accuses Apple of improperly restricting access to the NFC chip in the iPhone, which enables Apple Pay. By limiting use of the chip to its own digital wallet, and collecting a fee for every Apple Pay transaction, the company has been able to extend its dominance, the suit argues.

On this point in Europe, Apple has already thrown in the towel. In January, the company said it would open up its tap-to-pay technology to other companies. And while it will surely fight the broader claims in the DOJ’s lawsuit, when it comes to digital wallets, it’s clear that Apple is ready to make concessions.

That leaves two outstanding claims for Apple to address.

The first concerns smartwatches. For developers seeking to integrate their hardware with iOS, the DOJ argues that Apple has improperly restricted them from letting users respond to messages and notifications from their non-Apple watches. Apple also prevents them from ensuring a persistent connection with iPhones, the case argues. The overall effect, the lawsuit states, is to deny users the chance to use smartwatches with “preferred styling, better user interfaces and services, or better batteries, and it has harmed smartwatch developers by decreasing their ability to innovate and sell products.”

It may seem like a minor point. But the watch example illustrates how Apple is taking its dominance in smartphones and using it to ensure that it makes the best smartwatches as well — not only by building better features, but by preventing competitors from matching them.

Finally, the DOJ accuses Apple of improperly restricting so-called “super apps.” The most famous super app is China’s WeChat, which encompasses a huge range of functions, from social networking to commerce. In China, WeChat’s dominance allows people to switch easily from iPhone to Android and back depending on their preference, because most of their digital life is contained within their WeChat account.

I find this the least compelling aspect of the DOJ’s case, since WeChat is a uniquely Chinese phenomenon. WeChat took off in large part because of heavy regulation from China’s authoritarian government, which blocked competition from western apps. Moreover, WeChat is so dominant in China that if it were similarly successful in the United States, the DOJ would probably be trying to force its divestiture or ban it. (Or, if it were American-owned, break it up for its own anticompetitive behavior.)

If the underlying argument is that Apple should permit third-party app stores, the DOJ should say that. If its argument is that Apple should permit apps that contain within them an unlimited number of other apps, that seems more fraught. The more different experiences an app enables, the harder it is for Apple to evaluate it for security, privacy, and other concerns. Ultimately, I’m not convinced that consumers are harmed by having to download different apps for different purposes. Almost all of the most important apps are available on Android and iOS, and it’s not clear to me that people would be more willing to switch to Android if an American WeChat existed.

..More

A few thoughts on the DOJ’s antitrust case against Apple

Matt Birchler

22 Mar 2024

I’m no lawyer, and I’m not going to pretend I’m one, so don’t expect me to make any confident legal claims here. That said, I did read the 88-page suit (PDF) against Apple and I have some thoughts.

Oh, I also haven’t really looked at any other posts about what other people think of this case, so I have no idea if this is in line or not with the general consensus.

My wife’s reaction to the suit

My wife is technically adept, but it’s not a hobby for her, so I always find it interesting to hear her impressions on things that people in our corner of the internet feel very strongly about. Her overall impression is that it’s absurd Apple has absolute control over what people get to run on their iPhones. From that perspective, the cloud gaming ban seemed clearly malicious to her and the NFC restrictions seemed egregious. I did mention to her that some people think the iPhone is more like a Switch or PS5 than a computer so this absolute control is fine, and her exact response was, “people actually think that?”

She was also persuaded by the idea that Apple has taken their dominant position in smartphones and used that to unfairly take over the smartwatch market. “If you have an iPhone, you can’t even get anything besides an Apple Watch, can you?”

She didn’t know if the messaging thing was technically illegal, but she did say something interesting. She said green bubbles suck so much that it makes her never want to get an Android phone lest she be the green bubble person everyone else in the group thread is slightly angry at all the time. “It’s social suicide.”

Finally, she pulled up this Mean Girls GIF to explain how she thinks Apple will defend itself:

The weirdest part of the suit that stumbles into a cogent point

Back to me now, early in the suit there is a section about the U.S. vs. Microsoft suit in the late 90s and how Apple benefitted from that result.

A path-clearing antitrust enforcement case, brought by the United States and state attorneys general, against Microsoft opened the market and constrained Microsoft’s ability to prohibit companies like Apple from offering iTunes on Windows PCs.

What? Even at the height of Microsoft’s dominance in the 90s, there was no situation where they were in a position to block a competitor from releasing software on Windows. The case authors basically say just as much a little later:

In 1998, Apple co-founder Steve Jobs criticized Microsoft’s monopoly and “dirty tactics” in operating systems to target Apple, which prompted the company “to go to the Department of Justice” in hopes of getting Microsoft “to play fair.” But even at that time, Apple did not face the same types of restrictions it imposes on third parties today; Apple users could use their iPod with a Windows computer, and Microsoft did not charge Apple a 30 percent fee for each song downloaded from Apple’s iTunes store.

Exactly! Even at their most anti-competitive, Microsoft would allow iTunes on Windows and they would not have any mechanism to take 30% from all music sales because there simply wasn’t a concept of either of those at the time.

That said,this idea that general purpose computers have one gatekeeper with absolute control over what businesses are and aren’t allowed to exist, and that those allowed businesses owe 10-30% of their revenue to the gatekeeper is quite new, and honestly even in 2024 only applies to iOS and iPadOS. I’m not saying this is illegal, I’m just saying whatever headwinds Apple of the 90s would have made against Microsoft are nothing in comparison.

the iPod did not achieve widespread adoption until Apple developed a cross-platform version of the iPod and iTunes for Microsoft’s Windows operating system, at the time the dominant operating system for personal computers.

I do think it’s notable that (a) the iPod is what really pushed Apple off the brink and into the mainstream, setting them on the path that got them to be the biggest tech company in the world and (b) the iPod really took off once Windows users could buy it, and Apple would not have been able to do this if Microsoft had the same rules in place that Apple has over the iPhone and iPad.

Two Roads Diverged: The Splitting of Venture Capital

Labor vs. Capital, Artisans vs. Asset Managers

MAR 21, 2024

Venture capital has a bad rap. We have…a bit of a PR problem.

In my mind, this is undeserved. I realize this view is self-serving, given that I work in venture and recently started a venture firm, but bear with me.

A 2021 Stanford paper found that venture-backed companies account for 41% of US market capitalization and 62% of US public company R&D spending. Among public companies founded within the last 50 years, the numbers are even higher: VC-backed companies account for half in number, three-quarters in value, and 92% in R&D spending. If entrepreneurship is the engine of innovation, venture capital is the fuel.

Take the 10 largest US public companies—six were venture-backed. Apple and Tesla are the bookends here, with Apple taking its first venture funding in 1977 and Tesla first taking venture dollars in 2004.

This graphic is built on 2020 data and already outdated. If it were refreshed with 2024 data, updates would include the addition of Nvidia, another venture-funded company (first venture dollars: 1993) that now boasts a market cap over $2 trillion.

Venture capital is often (unfairly) lumped in with its cousin, private equity; the latter is a media scapegoat for job loss, and VC is often collateral damage. But research shows that venture funding drives employment growth. A 2022 paper found that employment at VC-backed companies grew 960% from 1990 to 2020, compared to a 40% increase in total private sector employment during the same time period. That growth is also recession-resistant: during the Great Recession, total private sector employment shrank 4.3%, while VC-backed company jobs grew 4.0% annually.

This piece isn’t meant to be venture propaganda; the industry has its shortcomings, and more on those later. But this piece is meant to use hard data to show that when done right, venture should fuel innovation, which in turn fuels economic growth and makes our lives better.

The goal in this week’s Digital Native is to step back, take stock of the industry today, and explore where it’s going. I’ve broken this piece into four sections:

Snapshot of the VC Market

Labor and Capital

The Bifurcation of Venture: Artisans vs. Scaled Asset Managers

Daybreak’s Thesis

Let’s dive in.

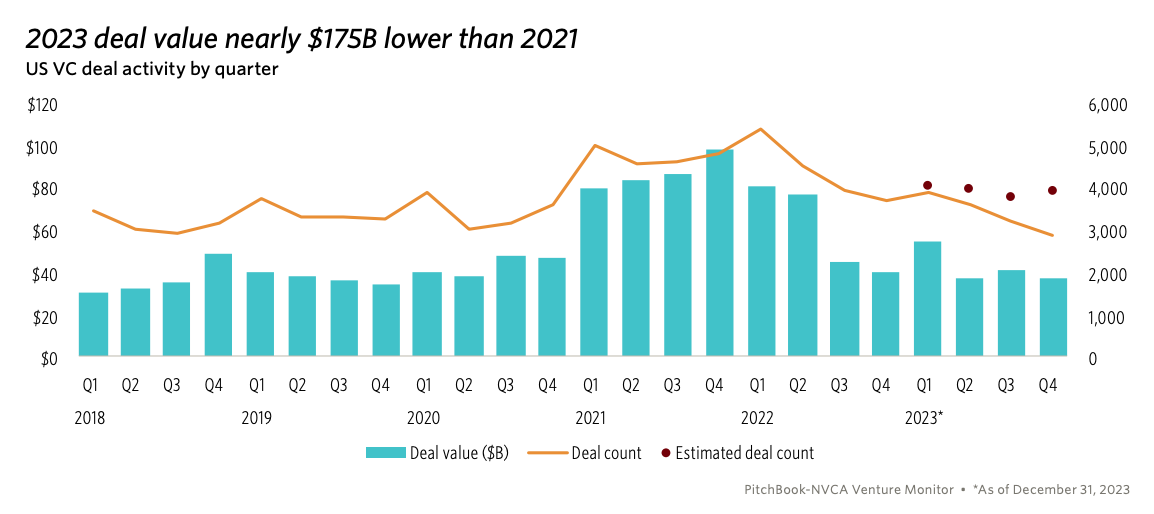

Snapshot of the VC Market

Part of the reason that VC’s reputation has soured is because the industry has drifted away from its roots. The industry started acting a lot more like asset management than a niche, cottage industry built on power law outcomes.

This was especially true in the post-COVID ZIRP (zero-interest rate policy) days, when the markets overheated. We can play the blame game, pointing fingers at entrepreneurs for taking money at inflated prices, at VCs for offering those sky-high prices, or at LPs for pouring capital into the asset class in pursuit of yield. But everyone acted as expected, in their own best interest; a confluence of market dynamics simply led to a frothy market that needed an overdue correction.

Over the last 18 months, we got that correction. 2023 deal value was down sharply from 2021:

The six quarters from Q1 2021 to Q2 2022 are the outliers here, with the ZIRP phenomenon in full effect post-COVID. That period will be remembered for Bored Apes and mega-rounds led by Tiger. Nearly everyone played a role in the frothiness—again, incentives.

We now see markets cooling across every stage. Late-stage deals have been hardest hit, with the growth markets only starting to show signs of life in the last quarter or two. But Pre-Seed and Seed have also slowed to a 13-quarter low:

Video of the Week

The Odds of Raising a Series A, The Latest in Venture Valuations, The AI Premium and More!

AI of the Week

Nvidia's Accelerating AI Strategy. RTZ

...Computing with a lot more than just 'GPUs'

MAR 24, 2024

The Bigger Picture, Sunday March 24, 2024

Earlier this week, I discussed at length, Nvidia’s rocking Developer Conference at their GPU GTC 2024 Conference this week, complete with founder/CEO rock star of the moment Jensen Huang with 11,000 plus in approving attendance. There were so many notable items on Nvidia’s product roadmap in the two plus hour keynote, and combined with the truly long game being played by Jensen in AI for over a decade, I thought it’d be helpful to take a look at The Bigger Picture of Nvidia in the context of the AI Tech Wave. And explain the deeper technical bits in a more mainstream context. Let me unpack.

If OpenAI’s AI software innovations with GPT and ChatGPT kicked off the current iteration of the AI revolution, it was Nvidia’s AI GPU (Graphical Processor Unit) hardware and software, that made them really REAL at scale. As I’ve long said, ‘AI’ without the GPUs to do the math compute would just be two non-adjacent letters in the library. And Google’s seminal ‘Attention is all you need’ AI paper that gave the world the ‘T’ for Transformers in OpenAI’s GPT, would just be an interesting mathematical computing exercise. This is a world where a ‘billion quadrillion’ math computations in micro-fractions of a second, are currently just the starting point in 2024. Training, Inference, and all.

Jensen Huang has been focused on AI eating Software as Software Eats the World for over a decade now. As he highlighted on stage at the keynote, Nvidia’s key AI ‘Eureka’ moment was when Alexnet, a key AI project that Nvidia backed in 2013, managed to convert millions of images and figure out what makes a cat a ‘Cat’. And spit out the text.

And as Jensen pithily summarized in the keynote, the last decade has been about Nvidia building out the AI GPU hardware and software to enable so many companies building on the Nvidia platform to now convert text on Cats into amazing images and videos on Cats and everything imagined by humans. And beyond.

The overall theme Jensen Huang has been using for a while now is that Nvidia has been about enabling new markets with ‘Accelerated Computing’, for its three plus decades of ‘overnight success’. This is useful to keep in mind, especially as AI computing, driven by Nvidia hardware and software in particular, is poised to deliver 10x and beyond AI compute performance for the next few years. Far beyond the 2x in two plus years long promised and delivered in the tech industry by ‘Moore’s Law’ for decades now.

That is the bigger picture context on what drives Nvidia and its founder/CEO today. The rest are details on the immediate next steps of how the AI Tech Wave gets build from its current very early years.

Let’s go through some of that near-term product roadmap. In relatively non-technical language.

Apple Is in Talks to Let Google Gemini Power iPhone AI Features

Companies considering AI deal that would build on search pact

Apple also recently held discussions with OpenAI about deal

By Mark Gurman

March 17, 2024 at 10:23 PM PDT Updated on March 18, 2024 at 1:10 PM PDT

Apple Inc. is in talks to build Google’s Gemini artificial intelligence engine into the iPhone, according to people familiar with the situation, setting the stage for a blockbuster agreement that would shake up the AI industry.

The two companies are in active negotiations to let Apple license Gemini, Google’s set of generative AI models, to power some new features coming to the iPhone software this year, said the people, who asked not to be identified because the deliberations are private. Apple also recently held discussions with OpenAI and has considered using its model, according to the people.

If a deal between Apple and Google comes to fruition, it would build upon the two companies’ search partnership. For years, Alphabet Inc.’s Google has paid Apple billions of dollars annually to make its search engine the default option in the Safari web browser on the iPhone and other devices. The two parties haven’t decided the terms or branding of an AI agreement or finalized how it would be implemented, the people said.

..More

How to win at Vertical AI

How AI Agents and Open APIs create new rebundling opportunities

MAR 21, 2024

Much of the AI hype of 2023-24 has been centered around horizontal capabilities of foundational models.

The real opportunity of AI lies not in creating mediocre marketing copy, but in the ability to reconfigure value creation across vertical value chains.

While most AI hype is centred around horizontal B2C use cases, the real opportunity lies in vertical B2B AI.

This post unpacks the the opportunity of vertical AI and how companies can win this game.

Short-term and long-term games in vertical AI

Most vertical AI players today focus on developing vertical advantage with a proprietary fine-tuned model and a targeted UX.

This advantage creates a flywheel as I explain in How to win at Generative AI:

Smaller models, trained on domain-specific data deliver better performance on latency, accuracy, and cost than larger foundational models. This verticalization has its own reinforcing feedback effect. The more you develop vertical advantage, the more competitive you get on all parameters.

To deliver the most compelling vertical solution over time, the more the model is fine-tuned, the more deeply coupled future UX changes should be with the model in order to deliver the benefits of that model into the user workflow.

The advantage that vertical AI players have is that they operate full-stack - which is to say they provide a fully-integrated solution across the interface, proprietary models, and proprietary data. This creates the above flywheel of increasing defensibility as continued right to own the interface grants the tight to keep gathering proprietary data that helps further fine-tune the model.

This is how you win the short-term game in vertical AI.

But that doesn’t guarantee a long-term win.

Despite this flywheel, all vertical plays eventually end up participating in someone else’s ecosystem. This is a natural outcome of the abundance of vertical solutions that eventually proliferate. The end user looks to get their work done across one or two interfaces, instead of hopping across individual interfaces for every new use case.

Eventually, the only way to win in the long term with a vertical solution is to go horizontal.

Vertical strategies and AI-driven rebundling

To understand the opportunity in vertical AI, it’s helpful to look at the rise of vertical Saas over the past decade.

Vertical software repeatedly followed a playbook of

(1) gaining adoption with a focused use case, and

(2) rapidly rebundling adjacent capabilities around that initial use case.

Players like Square (with payments as a starting point), Toast (with POS software as a starting point) or ServiceTitan (with estimates as a starting points) have followed this playbook to scale out.

Eventually, all vertical plays seek to go horizontal.

The reason for that is as follows:

Most 'disruption' of the status quo happens through unbundling. But most venture returns are realized through rebundling.

Vertical plays unbundle. But in order to capture value at scale, you need to go horizontal and rebundle.

As I explain in How to win at Generative AI:

There is no sustainable value capture in unbundling. Unbundling unseats incumbents but doesn't create scalable and defensible value pools.

That is achieved through rebundling. Rebundling involves bundling multiple unbundled capabilities into a cohesive customer-centric offering.Most important, the successful ‘rebundlers’ establish a hub position and gain primacy of user relationship.

Venture capital chases unbundling because unbundlers hold the promise of rebundling and capturing value. Yet, most venture money is lost because a tiny handful rebundle.

This is the end game with Vertical AI as well.

You go vertical in order to go horizontal.

AI creates a new locus of rebundling

The opportunity for creating long-term competitive advantage in vertical AI is not so much in solving an initial pain point deeply and effectively. A lot of players will succeed in creating proprietary, fine-tuned models to solve for that. It’s a necessary requirement, but it’s not sufficient.

Long-term competitive moats in vertical AI are created by rebundling around the initial use case, using the unique rebundling benefits that AI provides.

AI creates a new locus for rebundling and the players that effectively leverage it around initial success in solving an early use case will be the ones that effectively dominate vertical AI.

Rebundling workflows in the age of AI

Business workflows are scattered across silo-ed software.

To actually get work done, these workflows have to be rebundled towards a business goal. You take the output of workflow X, Y, and Z, and make decisions or take actions towards a goal. This bundling of workflows towards a goal is performed by human managers.

Managers in organisations achieve this bundling by solving two problems:

The plumbing problem i.e. coordinating across silo-ed workflows

The goal-seeking problem i.e. using diverse workflows to achieve an organisational goal

After raising $1.3B, Inflection is eaten alive by its biggest investor, Microsoft

Devin Coldewey @techcrunch / 11:01 AM PDT•March 19, 2024

Image Credits: Hieronymus Bosch

In June 2023, Inflection announced it had raised $1.3 billion to build what it called “more personal AI.” The lead investor was Microsoft.

Today, less than a year later, Microsoft announced that it was feasting on Inflection’s body and sucking the marrow from the bones (though I think they phrased it differently).

Co-founders Mustafa Suleyman and Karén Simonyan will go to Microsoft, where the former will head up the newly formed Microsoft AI division, along with “several members” of their team as Microsoft put it — or “most of the staff,” as Bloomberg reports it. Reid Hoffman will stay behind with new CEO Sean White to try to salvage what’s left of the company, which, I feel I have to repeat, raised $1.3 billion dollars nine months ago and $225 million in mid-2022.

..More

Here’s how Microsoft is providing a ‘good outcome’ for Inflection AI VCs, as Reid Hoffman promised

Julie Bort@julie188 / 3:50 PM PDT•March 21, 2024

Image Credits: Kelly Sullivan/Getty Images for LinkedIn

Exactly how much Microsoft is paying all the investors of Inflection AIas part its oddly structured deal to abscond with the co-founders, much of the staff and the rights to use the tech hasn’t been publicly revealed. And Microsoft declined comment when asked.

But unnamed sources tell The Information that it’s plunking out approximately $650 million: $620 million for non-exclusive licensing fees for the technology (meaning Inflection is free to license it elsewhere) and $30 million for Inflection to agree not to sue over Microsoft’s poaching, which includes co-founders Mustafa Suleyman and Karén Simonyan.

Microsoft board member Reid Hoffman, also a co-founder of Inflection and an investor in it, along with his VC firm Greylock, did promise “that all of Inflection’s investors will have a good outcome today, and I anticipate good future upside,” in a LinkedIn post earlier this week.

Investors in the early $225 million round will be getting 1.5 times their investment; those in the later $1.3 billion round will get 1.1 times their investment, according to The Information. While that math doesn’t add up to $650 million, these investors will also retain their equity in the skeleton of the startup that remains. The new company, however, will be pivoting away from building a personalized AI chatbot named Pi on a massive computer structure of 22,000 of Nvidia’s expensive, hard-to-find AI chips. It will now become an AI studio helping other companies work with large language model AI.

Inflection did not respond to a request for comment.

In its short life as an aspiring OpenAI competitor — it was founded in 2022 — Inflection raised its more than a billion at a $4 billion valuation— from a who’s who: Microsoft co-founder Bill Gates, Microsoft itself, as well as former Google CEO Eric Schmidt, Dragoneer Investment Group, Nvidia and others.

Just to state the obvious: Microsoft provided a soft landing for Gates (who is technically no longer with the company but still a godlike figure there) and its board member’s VC firm, for their expensive, and possibly fruitless AI venture. The big cloud vendors have all already lined up with other chatbot partners: Microsoft with OpenAI, Google and Amazon with Anthropic, Cohere picking up assorted others like Oracle and Salesforce.

Stability AI CEO resigns because you’re ‘not going to beat centralized AI with more centralized AI’

Manish Singh @refsrc / 10:58 PM PDT•March 22, 2024

Image Credits: David Paul Morris / Bloomberg

Stability AI founder and chief executive Emad Mostaque has stepped down from the top role and the unicorn startup‘s board, the buzzy firm said Friday night, making it the second hot AI startup to go through major changes this week.

Stability AI, which has been backed by investors including Lightspeed Venture Partners and Coatue Management, doesn’t have an immediate permanent replacement for the CEO role but has appointed its COO Shan Shan Wong and CTO Christian Laforte as interim co-CEOs, it said in a blog post.

Stability AI, which has lost more than half a dozen key talent in recent quarters, said Mostaque is stepping down to pursue decentralized AI. In a series of posts on X, Mostaque opined that one can’t beat “centralized AI” with more “centralized AI,” referring to the ownership structure of top AI startups such as OpenAI and Anthropic.

He additionally asserted that it was his decision to step down from the top role as he held the most number of controlling shares. “We should have more transparent & distributed governance in AI as it becomes more and more important. Its [sic] a hard problem, but I think we can fix it..,” he added. “The concentration of power in AI is bad for us all. I decided to step down to fix this at Stability & elsewhere.”

..More

Saudi Arabia Announces New $40B AI Fund

Hoping to position itself at the forefront of AI, the Kingdom of Saudi Arabia has announced its intentions to establish a monumental $40 billion AI fund. As reported by the New York Times, the fund would focus on investments in the emerging tech field.

This is an ambitious plan, that underscores the nation’s commitment to reducing its reliance on fossil fuel revenue by becoming a leading hub for artificial intelligence and technology innovation. Saudi Arabia’s Public Investment Fund (PIF) is at the helm of this initiative.

AI is changing writing

MARCH 19, 2024 | On Technology

I recently redesigned my homepage to provide a clearer context about “me” as a writer and as a person. Not just to simplify things, but also to put more “I” in the new age of “AI” where it will increasingly become challenging to distinguish human from machine.

The best part of the Internet is that it is always evolving.

It is nothing if not a reflection of we the people, who use, evolve, and shape the network. Just as the network shapes us. This truth about constant change has helped me embrace and evolve with it. And a lot of that is reflected in what I write.

The latest change that is going to shape the network, and how we work on it is the emergence of “AI” — artificial intelligence to some, but “augmented intelligence to me.”

Despite all the existential anxiety over AI, this is a natural progression of how we have worked with technology in general, and software in specific. Increased automation and simplification of tools are just part of making technology (and software) work for way more people. And that means it has to be simpler and faster. And like everything that tries to do that, it has its side effects and downsides.

Just look at blogs — when we started, blogging was not easy. You needed specialized software. Since those days, the “blogs” as we knew them have been atomized. The platforms have taken over, and blogging is everywhere: social media, newsletters, and communities – they do what we all used to do. But ultimately, the ideology of blogging is still the same. Whether you post on Twitter or LinkedIn, you are doing what I have been doing on specialized software.

The rise of various platforms means a lot more is being published. A lot of new ideas are flowing freely, but so is the drivel. You don’t have to look too far to see how much of the internet is essentially thinly veiled marketing “content.” It is a pet peeve of mine (I have my reasons.)

“Content is inherently transactional; its goal is to drive towards some kind of conversion, some kind of exchange of value,” said Khoi Vinh, designer and blogger.

The emergence of generative AI tools means that we will see more content being generated and put on the web. It would be a unique challenge for all the major technology platforms — Facebook, Instagram, YouTube, and most importantly Google Search — to tame the beast that has been unleashed. Recently, we have seen generative AI has been beneficial for the SEO business, but not for long. Technology giveth, and taketh.

My approach to AI has been to embrace and extend my capabilities. I use quite a few tools with AI inside. Many of them have boosted my productivity. I am on the lookout for more to add to my arsenal, so I can become more effective when it comes to my creative output. I don’t need it to write for me. I need AI to make sure I don’t make spelling mistakes, point out some overused phrases, repetitive usage of phrases, and what my editors used to call “Om” things.

News Of the Week

VC Funds Drawing Down More Capital

What early signals can we uncover about the trend in startup fundraising?

Well, before any founder can celebrate closing their round, the cash has to be “called” by the GPs of the fund.

(Quick aside for founders reading this - the vast majority of the capital for any given VC fund actually sits with their LPs most of the time. Periodically, GPs will do a “capital call” and actually take possession of the committed dollars in order to invest in startups).

And whaddya know - the total capital called by funds on Carta has started to climb.

The rolling 3-month average of called capital crossed $1 billion in November 2023 for the first time 16 months. Not a massive leap forward, but progress.

Of course January was also the month with the most startup shutdowns we’ve ever seen on the platform. It was the best of times, it was the… you get it.

Truth Social is going public

/

Shareholders of the Digital World Acquisition Corporation approved a merger with Trump’s social media company.

By Gaby Del Valle, a policy reporter. Her past work has focused on immigration politics, border surveillance technologies, and the rise of the New Right.

Mar 22, 2024 at 10:06 AM PDT

Shareholders of the Digital World Acquisition Corporation approved a long-awaited merger with Truth Social, former President Donald Trump’s beleaguered social media app, on Friday — potentially boosting Trump’s net worth by $3 billion.

As a result of the merger, shareholders of publicly traded DWAC will become shareholders of the Trump Media & Technology Group (TMTG), the parent company behind Truth Social. Trump’s media company will begin trading on the Nasdaq under the symbol DJT as early as next week, The Associated Press reports.

Reddit prices IPO at $34 per share, the top of the range

Marina Temkin @mtemkin / 4:35 PM PDT•March 20, 2024

Image Credits: TechCrunch

Reddit priced its stock on Wednesday at $34 a share, the top of the anticipated range, a signal that investors are excited about the company’s IPO on Thursday. The social media giant raised nearly $500 million in the offering.

Excluding employee stock options, the 19-year old company’s valuation will start at $5.4 billion, a far cry from its last private market value of $10 billion, set in August 2021, the top of the last tech markets boom.

The stock, which is the most anticipated offering of the year so far, will debut on New York Stock Exchange on Thursday with the ticker symbol “RDDT.”

If Reddit’s stock jumps on its first day of trading, other VC-backed companies waiting in the wings will surely launch their IPO processes shortly after.

Astera Labs, which offers connectivity hardware for data computing data centers, popped 72% on its first day of trading on Wednesday, a strong sign that public markets are ready for new publicly traded companies.

Despite being profitable on EBITDA basis, Instacart and Klaviyo, two main IPOs of 2023, had lukewarm receptions on Wall Street last year.

But Reddit is still generating net losses of more than $90 million, which may bode poorly for the company’s stock amid push for profitability for newly traded companies.

..More

Startup of the Week

Neuralink video shows patient using brain implant to play chess on laptop

/

The company’s first human patient said the technology has changed his life but that ‘there’s still a lot of work to be done.’

By Jon Porter, a reporter with five years of experience covering consumer tech releases, EU tech policy, online platforms, and mechanical keyboards.

Mar 21, 2024 at 3:14 AM PDT

Image: Neuralink

Elon Musk’s brain-computer interface company has released a video purporting to show the first human patient using Neuralink’s brain implant to control a mouse cursor and play a game of chess.

The patient, identified as 29-year-old Noland Arbaugh, said he was injured in a diving accident eight years ago that paralyzed him below the shoulders. Arbaugh describes using the Neuralink implant as like using the Force from the Star Wars franchise, allowing him to “just stare somewhere on the screen” and move the cursor where he wants.

Elon Musk, who founded Neuralink in 2016, retweeted the video of Arbaugh and said it demonstrated “telepathy.”

X of the Week

“Always good to know you can be fired from Deepmind for being an asshole, abandon your $$ startup, and still get hired as a Microsoft VP!”

Share this post