Contents

Editorial

Essay

Crossing the AI Threshold: When Does Writing Stop Being Yours?

Announcing Our Investment in SchoolAI: Personalizing Education for Every Student and Teacher

The U.S. Led the World in Science and Technology and Just Gave It Up

AI has opened a new era in venture capital according to Forerunner founder Kirsten Green

AI

SoftBank And OpenAI Make History With Largest Startup Financing Ever

Sam Altman says that OpenAI’s capacity issues will cause product delays

DeepMind’s new research restrictions threaten AI innovation, warns Iris.ai CEO

DeepMind slows down research releases in battle to keep competitive edge

DeepMind’s 145-page paper on AGI safety may not convince skeptics

Regulation

Something Else for Europe and the U.S. to Disagree About: ‘Free Speech’

European Commission Takes Aim at End-to-End Encryption Again

Mark Zuckerberg Lobbies Trump to Settle Antitrust Suit Against Meta

Geopolitics

FT: TikTok’s U.S. Business To Be Spun Off With ByteDance Retaining Nearly 20% Ownership

Andreessen Horowitz is trying to nab a piece of TikTok with Oracle, report says

Andreessen Horowitz in talks to help buy out TikTok’s Chinese owners

Andreessen Horowitz in talks to help buy out TikTok’s Chinese owners

Copyright

Researchers suggest OpenAI trained AI models on paywalled O’Reilly books

EFF Urges Third Circuit to Join the Legal Chorus: No One Owns the Law

Google's pro-innovation proposals for the UK copyright framework

Venture Capital

Fintech Plaid raises $575M at a $6.1B valuation, says it will not go public in 2025

The 10 Biggest Rounds Of March: Anthropic’s Massive $3.5B Round Leads

Global Venture Funding In Q1 2025 Indicate Strongest Quarter For Investment Since Q2 2022

Fintech Plaid completes new funding round but finds valuation cut in half

Education

Cryptocurrency

Startup of the Week

Editorial

The Birth of the First Multi Trillion Dollar AI Company

No video this week as Andrew is traveling so I did a Notebook LM version of a Podcast. Enjoy (or not) ;-)

But quite a week. The highlight of the week is OpenAi closing a funding round of $40 billion at $300 billion valuation.

Andrew and I have long debated whether OpenAi can become a trillion dollar company. Well it is 30% of the way there.And with revenues trending to $12,5 billion it would be a brave person who would predict that it cannot 4x that over the next 1-2 years. $1 trillion is almost too small to contain what is being built.

This and the impact of OpenAi integrating its new image generation tech into its 4o model dominate much of the important trends.

My bet is that these signals to the future will be longer lasting than the impact of tariffs.

It's fascinating to consider the evolving relationship between human creativity and artificial intelligence, particularly in the realm of writing. As generative AI tools become increasingly integrated into our workflows, we can ponder a fundamental question: how does the emergence of AI reshape our understanding of authorship and originality? JF Martin in one of today's featured essays does just that, asking when does writing stop being "yours"?

In my view writing tools are a normal evolution of the art, and AI is a tool for a writer to leverage.

This is about a gradual shift in the creative process.

While AI offers remarkable abilities in generating text, it seems clear that the creation of truly meaningful and high-quality content still relies heavily on human direction and insight.

The intricate dance of crafting prompts, providing feedback, and ultimately evaluating the AI's output remains a crucial aspect of the process. The sophisticated capabilities of models developed by OpenAIcertainly expand the possibilities, but they also underscore the ongoing importance of human intent and critical judgment.

A lot this week about copyright. Of course, this new landscape brings with it important considerations. The question of intellectual property and the ethics of AI-generated content is one that continues to generate discussion. Reports suggesting that AI models, potentially including OpenAI's, have been trained on copyrighted material like O'Reilly books, and the resulting copyright lawsuits from news outlets such as the New York Times , highlight the urgent need for clarity in what is fari game for AI to train on. I am probably on the extreme side of thinking AI should be able to learn like a human. Anything we read goes into our brain as a source of future consideration.

Navigating these ethical and legal complexities will be essential as AI becomes more deeply embedded in content creation.

Despite these challenges, the potential benefits of AI in content creation are undeniably exciting. We're seeing how AI can accelerate content production, facilitate creative experimentation, and even personalize educational experiences through platforms like SchoolAI. Companies like Runway are demonstrating how AI can revolutionize video generation, opening up new avenues for storytelling. From PwC's analysis, it's evident that AI holds the promise of enhancing quality, personalization, and consistency across various industries.

I think that teaching is a key target where AI can improve the world while releasing teacher to more human skills like engaging with students as coach and mentor. The SchoolAI investment and Anthropics offering to universities point in that direction.

Looking ahead, it's difficult not to be astoundetd by he ambitious trajectory of companies at the forefront of AI innovation.

The strong venture funding in the AI sector, with OpenAI seemingly at its center, and the reported projections of substantial revenue growth for OpenAI, reaching potentially $12.7 billion in 2025 and even surpassing $125 billion by 2029, paint a compelling picture. While some may raise valid points about current valuations and potential challenges, the underlying trend of AI adoption across all sectors appears undeniable.

Considering this rapid growth, coupled with OpenAI's pioneering work and public recognition through products like ChatGPT, the notion that OpenAI could potentially become the first multi trillion AI company doesn't feel entirely far-fetched. As AI's influence becomes as fundamental as electricity or the internet, the companies driving this transformation are likely to see unprecedented value creation.

There is a new Geopolitics section this week, and arguably the Regulation section could be included. That reflects the realities of de-globalization that accelerated through the tariffs announced Tuesday. The de-coupling of world trade and economics is going to have a big impact on us all. That said, technology and trade both "want" to be global. Ultimately governments have limited ability to turn back history. What they can do is play a self-serving national game in the short term. When that happens the most global nations will prosper. It seems to me that China is the big winner this week as the US retreats from the world stage.

Thomas L. Friedman's piece in the New York Times about China is a timely reminder of the real world.

Essay

Crossing the AI Threshold: When Does Writing Stop Being Yours?

Numericcitizen | March 31, 2025

#Technology • #AI • #Authorship • #Creativity • #Ethics • #Essay

Generative AI tools have transformed the landscape of writing, offering unprecedented capabilities in content creation. However, leveraging these tools effectively requires more than simply inputting text and receiving polished articles. The effort involved extends beyond basic interactions, requiring a deep understanding of both the technology and the artistic nuances of writing. **Complex Crafting with AI** Creating quality content with AI involves intricate processes. Users must guide the AI meticulously, providing detailed prompts and iterative feedback to refine outputs. This process parallels traditional editing, where the author's creative intent plays a crucial role in shaping the final piece. At each stage, the writer must evaluate and adjust AI-generated suggestions, ensuring coherence and relevance while maintaining their personal voice. **Ownership and Creativity Dilemma** The question of ownership becomes particularly challenging with AI involvement. When AI contributes significantly to content development, pinpointing the origin of creative ideas is tricky. This raises ethical and legal considerations about intellectual property and the essence of authorship. Writers must reflect on what constitutes originality and how much AI can influence a piece before it begins to compromise the writer’s identity or style. **Quality Control and Ethical Implications** High-quality output demands rigorous quality control. Writers are responsible for fact-checking and ensuring the integrity of AI-generated content. Ethical responsibility lies in mitigating potential biases inherent in AI models, which can unintentionally propagate misinformation or cultural stereotypes. This adds layers of editorial vigilance to the writing process, making the human role indispensable even in AI-driven environments. **Technological Challenges and Opportunities** Despite these challenges, the integration of AI in writing offers significant opportunities across multiple sectors. It enables faster content production, aids in multilingual communication, and drives creative experimentation by providing diverse perspectives. Harnessing AI effectively can lead to innovation in storytelling techniques, enhancing how narratives are crafted and consumed. In conclusion, while generative AI tools are reshaping the writing process, they demand an intricate balance of machine efficiency and human creativity. Writers must navigate this delicate interplay to produce authentic, original work that respects both technological potential and artistic integrity.

Is OpenAI worth $300B?

Cautiousoptimism | Alex Wilhelm | April 1, 2025

#Technology • #AI • #Valuation • #Investment • #MarketTrends • #Essay

Welcome to Cautious Optimism, a newsletter on tech, business, and power. Happy Tuesday, everyone! Welcome to Q2. Yes, that means we’re on the cusp of earnings season — get hype! — as the year’s IPO cycle gets into gear. With CoreWeave public, Circle ramping up, and eToro and StubHub out with S-1s we’re all but feasting. Oh, and Cerebras has been unleashed! POTUS is expected to drop a raft of new trade barriers tomorrow. Notably, Heritage has come out — in contrast with its historical economic views — in favor of Trumpish economics. Seeing the group get lit up by their own former fans is a great place to mine smiles if you have the time. Trending Up: Musk as political foil … TikTok? … photonics … staying the course … the need for soft power … cooked books … what the fuck … the god of the sea … Transgender Day of Visibility … collective spine … lol, lmao even … Quote of the Day: “Mr Trump is a man on a mission, determined to jack up tariffs in order to remake America’s economic model; or, more accurately, to wind it back by a century.” Rounds of Note: $600 million for Isomorphic, $146 million for Temporal … and rumors of Cursor closing $625 million … Trending Down: Logistics … naming rights … the CHIPS Act? … inflation in Europe … merit … market sentiment … doing your expenses … How much did it cost OpenAI to generate this image? Fuck it, $40B After Wiz sold to Google for $32 billion in cash, and X ‘sold’ to xAI for $33 billion worth of equity, who expected to see a new, largest tech transaction so quickly? Enter OpenAI with a new $40 billion raise that it pegs at a $300 billion valuation post-money. CNBC notes that the round — led by SoftBank for $30 billion with capital from Microsoft aboard — makes OpenAI “among the world’s most richly valued private companies.” The round is an enormous mark of trust for the AI giant, which is building an enormous new constellation of data centers, recently picked up Microsoft’s option for access to CoreWeave’s GPUs, and now has more capital than all startups in Europe ($12.5 billion) and Asia ($15.6 billion) raised in Q4 2024 combined. Note: The Information reported in the runup to the deal that about “half of [the] capital […] will go toward Stargate, a joint venture between OpenAI, SoftBank and Oracle.” So, the headline figure is likely not all new operating cash for OpenAI. Calling OpenAI a startup is abuse of the term, but we lack a truly better moniker for high-growth, unprofitable technology companies that remain private even as they scale into the billions of dollars worth of yearly revenue. In more numerical terms, OpenAI is probably not worth $300 billion today if we calculate its worth entirely based on known historical results. OpenAI is reported to have generated revenues last year of $3.7 billion (and losses of around $5 billion). OpenAI’s 2024 top line and new, shiny 2025 valuation put it at around 81x revenue. Of course, if we took its Q4 revenue and converted it into a run rate, its effective multiple would fall. As it will this year in more concrete terms. The company has told investors that it expects revenues of around $12.5 billion this year. If OpenAI hits that mark on the nose, and its valuation stays static the rest of the year, OpenAI will exit this year with a trailing price/sales ratio — a far more conservative metric than an ARR multiple — of 24x. That’s not even the richest we see amongst public cloud companies. So, is OpenAI worth $300 billion today? If the company’s 2025 plans are realistic, and the company has made a quarter’s worth of progress thereof, yes.

Announcing Our Investment in SchoolAI: Personalizing Education for Every Student and Teacher

Nextview | April 2, 2025

#Education • #Technology • #AI • #PersonalizedLearning • #EdTech • #Essay

When Authentic Understanding Meets AI My first 30-minute meeting with SchoolAI founder Caleb Hicks stretched to over ninety as we delved into his vision. What immediately struck me was Caleb’s authenticity as both a former educator and EdTech leader. His journey from middle school teacher to product leader has given him a prepared mind for understanding the challenges and opportunities in education. This background is crucial in shaping SchoolAI's mission to personalize education for every student and teacher. SchoolAI's innovative approach to education involves using artificial intelligence to tailor learning experiences to individual students' needs and interests. This is achieved through tools that help teachers create personalized lessons, leveraging everyday examples to engage students more effectively. For instance, lessons might focus on the supply and demand for sneakers or managing a comic book shop, making learning more relatable and enjoyable. The platform also includes features like "pulse checks," which help identify students who need extra support, even if they are hesitant to ask for it. The company's vision extends beyond the classroom, aiming to create a cohesive educational environment where teachers, parents, and students are all connected and supported. SchoolAI's technology is designed to enhance communication between parents and teachers, ensuring that everyone involved in a student's education is informed and aligned. This integrated approach not only improves student engagement but also streamlines administrative tasks for teachers, allowing them to focus more on teaching and less on paperwork. SchoolAI has recently secured significant funding to further develop its Classroom Experience platform. This platform provides AI tools for teachers and students, helping to address challenges such as shrinking budgets and teacher shortages. The funding will support the expansion of SchoolAI's reach, ensuring that more schools and districts can benefit from its personalized learning solutions. With its commitment to inclusivity and accessibility, SchoolAI is poised to make a significant impact on the future of education. The use of AI in education is becoming increasingly important as schools face challenges like growing class sizes and pandemic-related learning gaps. SchoolAI's tools are designed to help teachers understand how each student is performing and provide targeted support when needed. This approach not only enhances student success but also supports teacher productivity by automating routine tasks and providing actionable insights. SchoolAI's platform is used in over 1 million classrooms across the U.S. and more than 80 countries, demonstrating its potential to transform education globally. The company's focus on responsible AI adoption ensures that its tools are implemented safely and effectively, enhancing rather than replacing quality instruction.

What if IPOs never come back?

Signalrankupdate | March 31, 2025

#Investment • #IPOs • #Venture Capital • #Indexing • #Essay

The thought of a world without IPOs presents an intriguing scenario, reflecting the changes in the financial landscape since 2022. Recent years have witnessed a drastic reduction in tech IPOs, with fewer than ten occurring annually, far below historical averages. Market observations, such as those from Redpoint’s Logan Bartlett and the NVCA Pitchbook Venture Monitor, show that venture capital distributions have hit new lows. CoreWeave’s recent IPO, which fell short of its financial targets, highlights the challenges facing companies looking to go public. Despite hopeful candidates like Klarna, Chime, Figma, and Discord, significant players such as SpaceX and OpenAI remain private, indicating a broader trend of companies delaying public offerings. This shift suggests deeper structural changes at play. The median age for companies going public has increased from six years in 1980 to eleven years in 2021, with the overall number of U.S. public companies shrinking. As a result, a new category of "quasi public" companies has emerged, capturing significant value before ever issuing stock publicly. Reasons for this trend include public market volatility, poor IPO performances, and the growing appeal of private capital markets. The secondary markets provide a way for companies to remain private longer while offering liquidity options to investors and employees. However, issues such as corporate control over equity sales and the relatively small size of the secondary market limit its impact. Furthermore, the idea of continuation vehicles, tokenization of assets, and liquid investment structures present intriguing, although still limited, alternatives for liquidity. Continuation vehicles offer another exit option but face valuation disconnects. Tokenization could democratize access but remains underdeveloped, and liquid investment structures are expanding but primarily benefit retail investors. Despite the gloomy current picture, there remains potential for IPO markets to recover. These alternative liquidity mechanisms represent a maturing market adapting to new realities, although substantial scale is required to meet the demands of today’s venture ecosystem.

Copyright-Aware AI: Let’s Make It So

Oreilly | April 2, 2025

#Technology • #AI • #Ethics • #Innovation • #CopyrightLaw • #Copyright • #Essay

The concept of **copyright-aware AI** is gaining attention as AI technologies become more integrated into various industries, including publishing. The idea revolves around ensuring that AI systems, particularly those involved in content generation and summarization, respect copyright laws and ethical standards. This involves not only avoiding copyright infringement but also ensuring that AI-generated content is transparent about its sources and does not misrepresent original ideas. One of the key challenges in developing copyright-aware AI is the complexity of copyright laws themselves. These laws vary significantly across different countries and jurisdictions, making it difficult for AI systems to universally comply. Moreover, AI models like large language models (LLMs) are trained on vast amounts of data, some of which may be copyrighted. Ensuring that these models do not infringe on copyrights while still providing useful and accurate information is a significant technical and legal challenge. ### Key Considerations for Copyright-Aware AI - **Training Data**: AI models are trained on large datasets that may include copyrighted materials. Ensuring that these datasets are properly licensed or that the use of copyrighted material falls under fair use provisions is crucial. - **Content Generation**: When AI generates new content, it must avoid reproducing copyrighted material without permission. This requires sophisticated algorithms that can detect and prevent copyright infringement. - **Transparency and Attribution**: AI systems should be designed to provide clear attribution for any content they generate that is based on copyrighted sources. This helps maintain ethical standards and legal compliance. - **Legal Frameworks**: Developing legal frameworks that address AI-generated content and its relationship with copyright law is essential. This includes clarifying what constitutes infringement and how AI companies can ensure compliance. ### Implications and Future Directions The development of copyright-aware AI has significant implications for industries like publishing, media, and education. It can help ensure that AI tools are used ethically and legally, promoting innovation while respecting intellectual property rights. As AI technologies continue to evolve, addressing these challenges will be crucial for maintaining trust and compliance in AI-driven content creation. In conclusion, creating copyright-aware AI requires a multifaceted approach that involves technical innovation, legal clarity, and ethical considerations. By addressing these challenges, we can ensure that AI systems contribute positively to content creation and dissemination while respecting the rights of creators.

What I Saw in China on the Eve of Trump’s ‘Liberation Day’

Nytimes | Thomas L. Friedman | April 1, 2025

#Politics • #InternationalRelations • #USChinaRelations • #GlobalEconomy • #Geopolitics • #Essay

The article discusses China's perception of the United States, particularly in the context of economic and political dynamics. Beijing's stance is one of confidence and resilience, emphasizing that China is not intimidated by the U.S. and that both countries have evolved beyond their traditional roles. ## **China's Economic and Political Positioning** China's message to America is centered around the idea that both nations have misconceptions about each other. China asserts its strength and independence, signaling that it is not afraid of U.S. policies or actions. This stance reflects China's growing economic and political influence on the global stage. Key points from this perspective include: - **Economic Resilience**: China has demonstrated its ability to withstand economic pressures, such as tariffs imposed by the U.S. This resilience is attributed to China's strategic economic planning and its increasing integration into global trade networks. - **Political Confidence**: China's confidence in its political system and leadership is evident in its assertive foreign policy. This includes its stance on issues like Taiwan and its Belt and Road Initiative, which aims to expand China's global influence. - **Misconceptions and Identity**: The article highlights that both the U.S. and China have outdated perceptions of each other. China believes that the U.S. underestimates its capabilities and overestimates its own influence, while the U.S. sees China as more fragile than it actually is. ## **Implications and Analysis** The implications of China's stance are significant for global politics and economics. The relationship between the U.S. and China is complex and multifaceted, involving trade, security, and ideological differences. Key implications include: - **Global Economic Impact**: The economic rivalry between the U.S. and China affects global trade dynamics. China's ability to maintain economic stability despite external pressures influences its position in international trade agreements and its role in shaping global economic policies. - **Political Tensions**: The political tensions between the two nations are heightened by their differing ideologies and strategic interests. This tension is evident in areas such as technology competition, military presence in the Asia-Pacific region, and diplomatic efforts to influence other countries. - **Future Relations**: The future of U.S.-China relations will depend on how both countries navigate these complexities. This includes managing trade disputes, addressing security concerns, and finding common ground on global issues like climate change and economic development. ## **Conclusion** In summary, China's message to the U.S. reflects a broader shift in global power dynamics. China's confidence in its economic and political systems underscores its emergence as a major global player. The implications of this shift are far-reaching, affecting not only the U.S.-China relationship but also global economic and political landscapes. Understanding these dynamics is crucial for navigating future international relations and economic strategies.

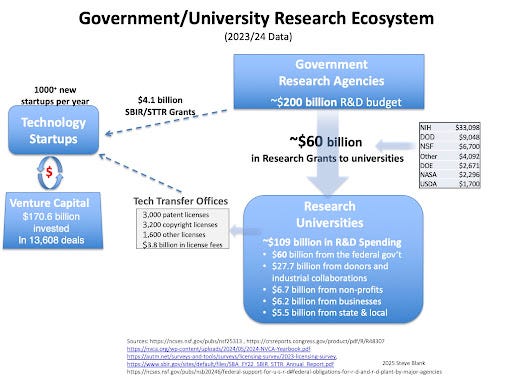

The U.S. Led the World in Science and Technology and Just Gave It Up

Steveblank | steve blank | April 3, 2025

#Technology • #Innovation • #SciencePolicy • #ResearchFunding • #GlobalCompetition • #Geopolitics • #Essay

The United States has historically led the world in science and technology, a position it held for nearly 85 years following World War II. This dominance was largely due to a robust government-university research ecosystem, where federal funding played a crucial role in advancing scientific and technological innovation. However, recent cutbacks in U.S. government support for research, combined with China's significant investments in science over the past three decades, suggest that the U.S. may be relinquishing its leadership role. ### The Government-University Research Ecosystem The U.S. government is the primary source of funding for academic research and development (R&D), with agencies like the National Institutes of Health (NIH) and the National Science Foundation (NSF) providing substantial support. Universities spend approximately $109 billion annually on research, with $60 billion coming from federal agencies. This funding model has been instrumental in creating a thriving tech ecosystem, fostering startups, and driving economic growth. The Bayh-Dole Act of 1980 further enhanced this ecosystem by allowing universities to retain ownership of inventions developed using federal funds, leading to significant technology transfer and commercialization. ### Historical Context and Innovation Models During World War II, the U.S. and Britain employed different approaches to innovation. The U.S. adopted a decentralized model, leveraging university research to develop advanced technologies, while Britain relied on centralized government labs. This U.S. model, championed by Vannevar Bush, integrated government funding with university research, leading to breakthroughs in radar, computing, and nuclear power. Post-war, the U.S. continued to invest heavily in research, establishing institutions like the National Science Foundation, which further solidified its position as a global leader in science and technology. ### Challenges and Implications Recent changes in U.S. research funding policies, such as the reduction in indirect cost reimbursement rates by the NIH, pose significant challenges to the sustainability of this ecosystem. Universities may need to cut research budgets or reduce investments in new students and facilities, potentially leading to a brain drain as researchers seek opportunities abroad. This shift could have profound implications for U.S. economic growth and technological leadership, as other nations, particularly China, continue to invest heavily in science and technology. ### Conclusion The U.S. has been a global leader in science and technology for decades, but its position is now under threat due to reduced government support and increased competition from countries like China. The historical success of the U.S. innovation ecosystem was built on a strong partnership between government, universities, and industry, which has been crucial for driving technological advancements and economic prosperity. As the global landscape evolves, maintaining this ecosystem will be essential for preserving U.S. leadership in science and technology.

AI has opened a new era in venture capital according to Forerunner founder Kirsten Green

Techcrunch | TC Video | April 4, 2025

#Business • #Startups • #VentureCapital • #AI • #Innovation • #Essay

**Introduction to AI in Venture Capital** The integration of AI in venture capital has marked a significant shift in how investments are made and analyzed. Forerunner, a venture capital firm known for its successful investments in companies like Oura, Chime, and The Farmer's Dog, has been at the forefront of this change. In a recent discussion, Kirsten Green, the founder of Forerunner, highlighted the role of AI in opening a new era for venture capital. This new era is characterized by enhanced data analysis, improved trend prediction, and more informed investment decisions. **Impact of AI on Investment Strategies** AI has revolutionized the way venture capital firms approach investments by providing advanced data analytics and predictive models. These tools enable firms to better identify emerging trends and make more strategic investment decisions. For instance, AI can analyze vast amounts of consumer data to predict market shifts and identify potential growth areas. This capability allows venture capitalists to invest in companies that are more likely to succeed in the future. Key points about AI in venture capital include: - **Enhanced Data Analysis**: AI tools can process large datasets to identify patterns and trends that might not be visible through traditional analysis. - **Predictive Modeling**: AI models can predict consumer behavior and market trends, helping venture capitalists make informed decisions. - **Strategic Investments**: By leveraging AI insights, firms can focus on companies with high growth potential. **Challenges and Opportunities** While AI offers numerous opportunities for venture capital, it also presents challenges. One of the main challenges is ensuring that AI systems are transparent and unbiased. Additionally, there is a need for skilled professionals who can interpret AI data effectively and make strategic decisions based on those insights. Despite these challenges, the integration of AI in venture capital is seen as a positive development. It allows firms to stay ahead of the curve by identifying emerging trends and investing in innovative technologies. As AI continues to evolve, it is likely to play an increasingly important role in shaping the future of venture capital. **Conclusion** The integration of AI in venture capital represents a significant shift towards more data-driven and strategic investment practices. By leveraging AI tools, firms like Forerunner are better positioned to identify and capitalize on emerging trends. As AI technology continues to advance, it is expected to further enhance the efficiency and effectiveness of venture capital investments.

AI

OpenAI Closes Deal That Values Company at $300 Billion

Nytimes | March 31, 2025

#Technology • #AI • #Valuation • #Investment

The start-up's valuation, which has nearly doubled in six months, shows continued enthusiasm for A.I. among investors.

SoftBank And OpenAI Make History With Largest Startup Financing Ever

Crunchbase | Joanna Glasner | April 1, 2025

#Business • #Startups • #Investment • #ArtificialIntelligence • #Innovation • #AI

In the history of startup funding, SoftBank’s announcement that it is backing an investment of up to $40 billion in OpenAI is in a league of its own. No other financing even comes close. This landmark deal represents not only the largest single financing event for a startup but also underscores the immense belief in the transformative power of artificial intelligence. OpenAI, renowned for its breakthroughs in machine learning and natural language processing, is set to utilize this influx of capital to drive further innovation and advance its ambitious projects. Investors and analysts alike are closely watching to see how OpenAI will deploy this substantial investment. The focus is expected to be on expanding its technical capabilities, increasing research and development efforts, and exploring new commercial applications for AI technologies. This historic investment reflects SoftBank's confidence in OpenAI's potential to lead the next wave of technological evolution, positioning itself as a central player in the rapidly advancing AI landscape. The deal is a testament to the growing significance of artificial intelligence and its potential to reshape industries and society at large.

Sam Altman says that OpenAI’s capacity issues will cause product delays

Techcrunch | Kyle Wiggers | April 1, 2025

#Technology • #AI • #CapacityIssues • #OpenAI • #ChatGPT

In a series of posts on X on Monday, OpenAI CEO Sam Altman said that the popularity of the company’s new image-generation tool in ChatGPT will cause unspecified product delays. “We are getting things under control, but you should expect new releases from OpenAI to be delayed, stuff to break, and for service to sometimes fail,” Altman explained. The rapid adoption of the image-generation feature has surpassed OpenAI's current capacity, leading to strain on their systems. Altman assured users that the team is working diligently to address these challenges, but he cautioned that during this period, stability might be compromised. This is emblematic of the broader challenge faced by tech companies in scaling their infrastructure rapidly enough to match demand. OpenAI plans to prioritize scaling its infrastructure to better handle current and future demands. However, in the interim, users may continue to experience disruptions. Altman’s transparency about these issues is intended to prepare users for any inconveniences that may arise. Despite these challenges, OpenAI remains committed to enhancing its AI capabilities and ensuring long-term stability and reliability of its services. The company is investing in expanding its technical capacity to prevent such issues in the future.

DeepMind’s new research restrictions threaten AI innovation, warns Iris.ai CEO

Thenextweb | Thomas Macaulay | April 2, 2025

#Technology • #AI • #Research • #Innovation • #Collaboration

**DeepMind's New Restrictions on Research** Google DeepMind, a leading entity in AI research, has reportedly implemented stricter measures on the dissemination of its research findings. According to a report by the Financial Times, these new restrictions involve additional vetting processes and increased bureaucratic hurdles designed to maintain the company’s competitive edge in the AI sector. This move has sparked concern among industry leaders about the potential impacts on innovation and collaboration within the AI research community. **Concerns from Iris.ai and Industry Implications** Anita Schjøll Brede, CEO of Iris.ai, expressed concerns over these restrictions, highlighting that such limitations could hinder the collaborative nature that is crucial for advancements in AI. She argues that scientific progress thrives on open access to research, which fosters innovation through collective insights and efforts. The decision by DeepMind, therefore, could create a siloed environment where breakthroughs are kept within corporate walls, stifling industry-wide progress. - Iris.ai CEO warns that restrictions could hinder innovation - Open research is crucial for collaborative advancements - Potential shift towards a more competitive and secretive AI landscape **DeepMind’s Justification and Objectives** The primary motivation behind DeepMind's decision is to protect its intellectual property and maintain its leadership position in the AI space. The company, acquired by Google in 2014, has been at the forefront of several notable AI breakthroughs. By restricting the dissemination of research, DeepMind aims to keep its cutting-edge developments proprietary, potentially ensuring its technologies and insights are protected from competitors. - DeepMind aims to safeguard intellectual property - Stricter controls may enhance competitive advantage - Long-term goal includes leading in AI breakthroughs **Broader Impact on the AI Landscape** This shift towards more restricted sharing of AI research could lead other companies to adopt similar measures. The potential consequences include a fragmented research community where collaboration and shared insights are diminished. Such a trend can create disparities in access to crucial AI developments, affecting smaller companies and researchers who rely on shared knowledge for innovation. - Possible trend of increased research secrecy in AI - Smaller players may face challenges without access to open research - Could lead to increased competition rather than collaboration **Balancing Innovation and Protection** The ongoing debate highlights the challenge of balancing innovation with the protection of intellectual assets. While companies like DeepMind have legitimate reasons to protect their research, there is a pressing need to find a balance that still encourages openness and shared progress. Industry experts suggest that frameworks enabling collaborative research while protecting proprietary assets could benefit the entire AI ecosystem, driving technological advancements without compromising individual company advantages. - Need to balance proprietary protection with collaborative openness - Frameworks for shared research could benefit industry-wide innovation - Maintaining open channels is crucial for technological progress **Conclusion** DeepMind’s new restrictions on research sharing reflect broader challenges within the AI sector concerning innovation, competition, and collaboration. While the move aims to protect company interests, it raises significant questions about the future of open research and its role in driving technological advancements. Stakeholders in the AI community must navigate these complexities to ensure that innovation continues to thrive in a manner that benefits all.

DeepMind slows down research releases in battle to keep competitive edge

Ft | March 31, 2025

#Technology • #AI • #Research • #Innovation • #StrategicChange

Google’s AI division, DeepMind, headed by Demis Hassabis, is implementing significant changes to its research dissemination strategies. The organization is now placing more restrictions on its researchers, making it more challenging to publish their findings. This shift aims to protect DeepMind’s competitive advantage in the fast-evolving artificial intelligence sector. In recent years, DeepMind has been at the forefront of AI developments, contributing groundbreaking work across various fields, including health care and gaming. The new approach reflects a strategic move to safeguard proprietary research that could provide technological and commercial superiority. The decision comes amidst rapid advancements in AI and increasing competition from other tech giants and startups. As companies vie for leadership in AI innovations, maintaining exclusive access to novel discoveries has become paramount. This strategic shift may impact the broader research community, potentially slowing the dissemination of information that could spur further innovation. The turn towards limited publications has sparked discussions within the scientific community about the balance between open research and business interests. While some argue that this might hinder scientific progress, others believe it is a necessary step to preserve competitive advantage in a cutthroat industry.

DeepMind’s 145-page paper on AGI safety may not convince skeptics

Techcrunch | April 2, 2025

#Technology • #AI • #AGISafety • #Ethics • #Innovation

Google DeepMind on Wednesday published an exhaustive paper on its safety approach to AGI, roughly defined as AI that can accomplish any task a human can. AGI is a bit of a controversial subject in the AI field, with naysayers suggesting that it’s little more than a pipe dream. Others, including major AI labs like DeepMind, consider its development inevitable and emphasize the importance of safety measures in its creation. DeepMind’s paper is comprehensive, consisting of 145 pages that delve into the potential risks and methodologies for ensuring AGI safety. The document explores various theoretical and practical strategies to prevent harm, focusing on ethical, technical, and societal considerations. Despite the level of detail, the paper might not sway skeptics who question the feasibility of AGI or the proposed safety measures. The paper discusses strategies such as implementing robust monitoring systems, integrating fail-safes, and ensuring transparency in decision-making processes. The goal is to align AGI behavior with human values, reducing the risk of unintended consequences. However, some critics argue that because AGI is still largely speculative, these safety frameworks may be premature or misdirected.

Regulation

Something Else for Europe and the U.S. to Disagree About: ‘Free Speech’

Nytimes | Jeanna Smialek and Adam Satariano | April 4, 2025

#Politics • #InternationalRelations • #FreeSpeech • #SocialMedia • #Regulation

The article discusses the ongoing debate between Europe and the U.S. over free speech, particularly in the context of social media platforms. This divide has been exacerbated by differing regulatory approaches to online content. Europe, particularly the European Union, has been more proactive in regulating speech, often citing concerns over hate speech, misinformation, and privacy. In contrast, the U.S. has traditionally taken a more permissive stance, emphasizing the importance of free speech. **Regulatory Differences** - **European Union's Approach**: The EU has implemented stricter regulations on online content, such as the Digital Services Act, which requires platforms to remove illegal content and provide more transparency about their moderation practices. This approach reflects a broader societal consensus in Europe that certain types of speech, such as hate speech, should be restricted to protect public order and individual rights. - **U.S. Perspective**: In the U.S., free speech is protected under the First Amendment, which limits government intervention in regulating speech. This has led to a more hands-off approach by U.S. authorities, with social media companies largely self-regulating their content. However, there is growing pressure for greater oversight, especially concerning misinformation and harmful content. The implications of these differing approaches are significant. For instance, Elon Musk's acquisition of Twitter and his stated commitment to free speech have highlighted these transatlantic differences. Musk's policies could potentially clash with European regulations, leading to legal and operational challenges for social media platforms operating globally. **Global Implications** - **Legal Challenges**: Companies like Facebook and Twitter face legal challenges in Europe due to stricter regulations. This can lead to fines or even bans if they fail to comply with local laws. - **Cultural Differences**: The debate also reflects deeper cultural differences between Europe and the U.S. regarding the role of government in regulating speech and the balance between free expression and social protection. - **Technological Impact**: The regulatory environment influences how social media platforms develop their content moderation policies, affecting users worldwide and shaping the future of online discourse. In conclusion, the debate over free speech between Europe and the U.S. highlights fundamental differences in legal, cultural, and technological approaches to regulating online content. As social media continues to play a central role in global communication, these differences will remain a critical point of contention.

European Commission Takes Aim at End-to-End Encryption Again

Pxlnv | Nick Heer | April 2, 2025

#Technology • #Cybersecurity • #Encryption • #Privacy • #Surveillance • #Regulation

The European Commission has recently announced plans to develop strategies for law enforcement agencies to access encrypted data. This initiative is part of a broader effort to enhance cybersecurity while ensuring lawful access to data for investigative purposes. The Commission aims to create roadmaps that identify and assess technological solutions for accessing encrypted data, which is a contentious issue given the importance of end-to-end encryption in safeguarding privacy and security online. ### Key Points and Analysis - **Encryption and Law Enforcement**: The Commission's approach highlights the ongoing tension between privacy and security. End-to-end encryption is crucial for protecting user data, but law enforcement agencies argue that it hampers their ability to investigate crimes effectively. The proposed solutions must balance these competing interests without compromising cybersecurity. - **Technological Solutions**: The focus on identifying technological solutions suggests that the Commission is exploring methods to bypass or decrypt encrypted data legally. This could involve developing new encryption standards or backdoors, which are controversial due to potential vulnerabilities they might introduce. - **Cybersecurity Concerns**: Any attempt to weaken encryption for law enforcement access raises significant cybersecurity concerns. Critics argue that creating backdoors or vulnerabilities could be exploited by malicious actors, undermining the security of the internet. - **Privacy and Ethics**: The debate also touches on ethical considerations regarding privacy and surveillance. Advocates for strong encryption argue that any compromise could erode trust in digital communications and infringe on privacy rights. ### Implications and Future Directions The implications of the European Commission's plans are far-reaching. If successful, these strategies could set a precedent for other regions, influencing global standards for encryption and data access. However, the challenge lies in ensuring that any solutions do not undermine the security and privacy that encryption provides. The Commission must navigate these complex issues while addressing the legitimate needs of law enforcement agencies. ### Conclusion In summary, the European Commission's initiative to access encrypted data reflects broader global debates about privacy, security, and law enforcement capabilities. The development of technological solutions to facilitate lawful access to encrypted data will require careful consideration of cybersecurity risks and privacy rights. As these efforts evolve, they will likely have significant implications for digital privacy and security worldwide.

★ France Fines Apple $162M for App Tracking Transparency, Taking the Side of Surveillance Advertisers Over Users

Daringfireball | John Gruber | March 31, 2025

#Technology • #Privacy • #Regulation • #Advertising • #AI

France’s competition regulator fined Apple €150 million, saying the iPhone maker went overboard in its implementation of pop-up messages that let users consent to or reject tracking that third-party applications use for targeted advertising. The App Tracking Transparency (ATT) framework used by Apple on iPhones and iPads since 2021 makes the use of third-party applications too complex and hurts small companies that rely on advertising revenue, said a press release by the Autorité de la concurrence (Competition Authority). The system harms “smaller publishers in particular since, unlike the main vertically integrated platforms, they depend to a large extent on third-party data collection to finance their business,” the agency said. User consent obtained via the ATT framework “authorizes the application in question to collect user data for targeted advertising purposes,” the agency said. “If consent is given, the application can access the Identifier for Advertisers (‘IDFA’), the identifier by which each device can be tracked through its use of third-party applications and sites.” The French investigation was triggered by a complaint lodged by advertising industry associations. The Autorité found that the ATT framework imposed by Apple is not necessary, insofar as the consent obtained is not valid under the applicable laws, in particular the French Data Protection Act. In practice, the fact that publishers that so wish cannot rely on the ATT framework to comply with their legal obligations means they must continue to use their own consent collection solutions, known as consent management platforms (“CMPs”). The result is that multiple consent pop-ups are displayed, making the use of third-party applications in the iOS environment excessively complex. It’s ostensibly “not necessary” because French and EU privacy laws are supposedly enough, and all that’s needed. And it’s unfair because now, under ATT, third-party surveillance advertisers who seek to track users across apps on iOS need to ask permission twice—first through the clear-as-a-bell “Ask App Not to Track” / “Allow Tracking” prompt required by Apple, and again through the byzantine but ultimately toothless permission requirements of France and the EU.

Mark Zuckerberg Lobbies Trump to Settle Antitrust Suit Against Meta

Nytimes | Mike Isaac and David McCabe | April 2, 2025

#Technology • #Business • #AntitrustRegulation • #TechIndustry • #RegulatoryScrutiny • #Regulation

Mark Zuckerberg, the CEO of Meta, recently visited the White House to engage in discussions with President Trump and his advisors about an ongoing antitrust lawsuit against Meta. This meeting comes as a trial is scheduled to begin in less than two weeks, highlighting the urgency and importance of resolving the case. The antitrust suit is significant, as it could have profound implications for Meta's operations and the broader tech industry. ### Key Points and Analysis - **Antitrust Suit Context**: The antitrust lawsuit against Meta is part of a broader regulatory scrutiny of tech giants, focusing on issues like market dominance and competition practices. Such lawsuits are critical in ensuring fair competition in the tech sector. - **Implications of the Meeting**: Zuckerberg's meeting with President Trump indicates a strategic effort to influence the outcome of the case. This approach reflects the high stakes involved, as a favorable resolution could safeguard Meta's business model and market position. - **Regulatory Environment**: The tech industry is facing increased regulatory pressure globally, with antitrust laws being used to challenge the dominance of large tech companies. This trend underscores the need for tech firms to navigate complex legal landscapes effectively. - **Future of Tech Regulation**: The outcome of this case could set precedents for future antitrust actions against tech companies. It will be closely watched by both the tech industry and regulatory bodies worldwide. ### Conclusion The meeting between Mark Zuckerberg and President Trump highlights the intense political and legal maneuvering surrounding the antitrust case against Meta. The implications of this case extend beyond Meta, influencing the broader tech industry's relationship with regulatory bodies. As the trial approaches, the outcome will be pivotal in shaping the future of tech regulation and competition policies.

Copyright

Researchers suggest OpenAI trained AI models on paywalled O’Reilly books

Techcrunch | Kyle Wiggers | April 1, 2025

#Technology • #AI • #Ethics • #Copyright • #OpenAI • #Streaming

OpenAI has been accused by many parties of training its AI on copyrighted content without permission. Now, a new paper by an AI watchdog organization makes the serious accusation that the company increasingly relied on non-public books it didn’t license to train more sophisticated AI models. AI models are essentially complex prediction engines. Trained on extensive datasets, they interpret input and produce human-like text, among other capabilities. The watchdog claims that a significant portion of OpenAI's data came from O'Reilly Media's technical reference books, which are typically behind a paywall. This use of paywalled content for training has sparked a debate over the legal implications and ethical standards employed by OpenAI. The watchdog underscores that using such content without licensing agreements is not just a breach of intellectual property laws but also an affront to authors who rely on royalties from their work. OpenAI, for its part, neither confirmed nor denied these claims but insists that its practices comply with current data protection and copyright laws. While OpenAI points out that it ceased using certain datasets after public criticism, it remains under scrutiny for the transparency of its data sourcing. The situation depicts a growing concern in the tech industry over the balance between technological advancement and respecting content creators' rights. The implications of these practices extend beyond legal areas into ethical dimensions. Tech companies face increasing pressure to adopt fair policies and ensure transparency in AI model training processes. The controversy signals a potential shift towards stricter regulations and guidelines in AI development, where consent and compensation for data sources become standard requirements.

EFF Urges Third Circuit to Join the Legal Chorus: No One Owns the Law

Eff | March 31, 2025

#Politics • #Legal • #Copyright • #PublicAccess • #Democracy

The Electronic Frontier Foundation (EFF) has filed an amicus brief with the Third Circuit Court of Appeals, urging the court to reject a claim by a private organization that it owns the law. This case involves ASTM, a standards organization that developed some building codes incorporated into law, and UpCodes, a company that created a database of these codes. ASTM argues that it retains copyright over these codes even after they have been adopted into law, which would allow it to control public access and sharing. However, the EFF and other entities argue that no one should own the law, as it is essential for public access and understanding. The EFF's argument is supported by previous court decisions. For instance, the Fifth Circuit Court of Appeals has held that codes lose copyright protection once they are incorporated into law. Similarly, the D.C. Circuit Court of Appeals has ruled that making such codes accessible online is a lawful fair use. A federal court in Pennsylvania also found that UpCodes' database was a protected fair use. The Supreme Court has emphasized that all citizens should have free access to the law, as it is presumed that everyone knows the law. The EFF argues that copyright law should not impede this access, especially in an era where the internet has democratized access to legal information. **Key Points:** - **Legal Precedents**: Previous courts have ruled against private ownership of laws once they are incorporated into legal frameworks. - **Fair Use**: Courts have supported making laws accessible online as a fair use, promoting public access and understanding. - **Public Interest**: The EFF emphasizes that public access to laws is crucial for democracy and civic engagement. - **Technological Impact**: The internet has made it easier for the public to access and share legal information, which should not be restricted by copyright claims. The implications of this case are significant, as it affects how laws and regulations are accessed and shared by the public. If the Third Circuit affirms the lower court's ruling, it would reinforce the principle that laws are in the public domain and should be freely accessible. This would be particularly important for journalists, safety professionals, and ordinary citizens who rely on understanding and sharing legal information to advocate for public safety and democratic participation. In conclusion, the EFF's stance reflects a broader consensus that laws should not be owned by private entities. The legal system's recognition of this principle is crucial for ensuring that citizens have the information they need to engage with and comply with the law. As the Supreme Court has noted, access to the law is fundamental to democratic society, and any restrictions based on copyright claims would undermine this principle.

Google's pro-innovation proposals for the UK copyright framework

Blog | April 2, 2025

#Technology • #AI • #CopyrightReform • #Innovation • #IntellectualProperty • #Copyright

Google has proposed a balanced approach for the responsible use of content in AI within the UK copyright framework. This initiative aims to foster cooperation and support the development of a thriving AI ecosystem. The proposal emphasizes the importance of collaboration between stakeholders, including content creators, AI developers, and policymakers, to ensure that AI technologies are developed and used responsibly. **Key Proposals and Implications** - **Balanced Approach**: Google's proposals seek to strike a balance between protecting intellectual property rights and promoting innovation in AI. This balance is crucial for ensuring that AI systems can access and process the vast amounts of data needed for their development without infringing on copyright laws. - **Cooperation and Collaboration**: The proposals highlight the need for cooperation among various stakeholders. This includes working with content creators to ensure that AI systems use their content in ways that respect their rights while also allowing for the advancement of AI technologies. - **Thriving AI Ecosystem**: By promoting responsible AI development, Google aims to contribute to a thriving AI ecosystem in the UK. This ecosystem would support the growth of AI startups, enhance research capabilities, and encourage innovation in AI technologies. - **Challenges and Opportunities**: Implementing these proposals will require addressing several challenges, including ensuring that AI systems do not infringe on copyrights and maintaining the quality and accuracy of AI-generated content. However, successful implementation could lead to significant opportunities for innovation and economic growth in the UK's tech sector. In conclusion, Google's proposals for the UK copyright framework reflect a commitment to fostering a collaborative environment that supports AI innovation while respecting intellectual property rights. This approach could have significant implications for the development of AI technologies in the UK, potentially enhancing both innovation and economic growth.

Venture Capital

Fintech Plaid raises $575M at a $6.1B valuation, says it will not go public in 2025

Techcrunch | April 3, 2025

#Finance • #Investment • #Fintech • #VentureCapital • #IPO • #Venture Capital

Plaid, a fintech company that specializes in connecting bank accounts to financial applications, has raised $575 million in a recent funding round. This round values Plaid at $6.1 billion post-money, which is significantly lower than its previous valuation of $13.4 billion during its Series D funding. The company has evolved from focusing solely on bank linking to offering a suite of data analytics products essential for financial services and related markets. The funding round was led by existing investors such as Ribbit Capital and NEA, with new investors including Fidelity Management & Research Co., BlackRock Inc., and Franklin Templeton. According to Plaid's CEO, Zach Perrett, the company plans to use the funds primarily to address employee tax withholding obligations and provide liquidity to its current team. This move is part of Plaid's strategy to prepare for future growth without immediate plans for an initial public offering (IPO) in 2025. Perrett noted that an IPO is on the horizon but emphasized that the company is not yet ready, indicating that this funding round would be its last private fundraising before going public. Plaid's expansion into new products has been significant, with these offerings accounting for more than 20% of its annual recurring revenue last year. The company has also broadened its client base to include major enterprise players like Citi, H&R Block, Invitation Homes, and Rocket. Additionally, Plaid's services are widely used, with over half of Americans having utilized its platform. The company is also tracking long-term trends such as the digitization of financial services and the rise of artificial intelligence (AI), which it believes will transform the banking sector both internally and in consumer interactions. Plaid's growth and strategic positioning reflect the ongoing upswing in the fintech sector. The company's ability to adapt and expand its product suite has been crucial in maintaining its relevance and attracting significant investment. As fintech continues to evolve, companies like Plaid are at the forefront of innovation, leveraging technology to enhance financial services and consumer experiences.

Seed-Strapping vs Boot-Scaling in the AI Native Era

Henrythe9th | Henry Shi | March 28, 2025

#Technology • #AI • #StartupFunding • #BusinessModels • #Entrepreneurship • #Venture Capital

**Seed-Strapping vs Boot-Scaling: New Models for AI-Native Startups** In the evolving landscape of business funding, two emerging models, seed-strapping and boot-scaling, are revolutionizing how companies are built, especially in the AI-native era. Traditional methods, such as bootstrapping and venture capital (VC) funding, have dominated the startup world for decades, but each presents significant challenges. Bootstrapping involves self-funding, often leading to prolonged periods of financial strain with high failure rates due to cash constraints. Venture capital, on the other hand, requires surrendering large equity shares, often resulting in diminished control and a mere 0.1% achieving the coveted unicorn status. **Traditional Models and Their Drawbacks** Bootstrapping requires founders to deplete personal financial resources, resulting in ownership but often at a significant personal and financial cost. Statistics reveal that 80% of bootstrapped businesses fail within 18 months. Conversely, venture capital offers substantial funding but at the cost of equity and control. A founder may find themselves with only 15% ownership of their company by Series C, and 75% of VC-backed startups never provide returns to their investors. **Boot-Scaling: A Hybrid Approach** Boot-scaling emerges as a hybrid between bootstrapping and VC funding. Founders self-fund until achieving substantial traction before accepting a significant funding influx from private equity. While this retains early control, the model necessitates a high-stakes, all-or-nothing scaling event. The risk involves significant dilution and loss of control, creating a precarious balance of potential rewards and substantial risks. **The Rise of Seed-Strapping in the AI Era** Seed-strapping addresses the pitfalls of traditional models by combining moderate initial funding with a focus on sustainable growth and profitability. By raising modest seed capital ($100K-$1MM), founders can maintain control while capitalizing on AI-enabled efficiencies. This model emphasizes revenue growth from day one, fundamentally altering the company-building process by leveraging AI to lower operating costs and speed time-to-market. AI's integration into business models has led to dramatic reductions in software development costs, enabling startups to launch with minimal capital compared to previous decades. As AI-generated codebases become more prevalent, startups are scaling faster with fewer employees, enhancing capital efficiency and reducing time-to-revenue. **Seed-Strapping: A Revolutionary Model** The seed-strapping model encourages founders to focus on revenue and profitability from the outset, with the unique advantage of potentially increasing ownership over time through buybacks. It prioritizes founders' liquidity and breaks away from reliance on successful exits. Instead, it supports consistent personal wealth accumulation through profit distributions. Investors benefit from early, predictable returns, aligning their goals with founders' objectives of sustainable, long-term growth. By avoiding the pitfalls of premature exits or superfluous fundraising rounds, the seed-strapping model offers stability and financial freedom to founders, reshaping the entrepreneur's journey in the AI era. **Implications of AI on Traditional Business Economics** AI's disruptive capabilities have enabled entirely new business approaches. With software development costs near zero and rapid market entry, AI-native companies can achieve high profit margins and scalability with minimal personnel. Such efficiencies are redefining standard economic models, allowing for one-person billion-dollar companies to become conceivable. As a result, seed-strapping not only offers financial benefits but also empowers founders with psychological advantages. Unlike traditional models fraught with stress or feeling trapped by success, seed-strapping facilitates autonomy and satisfaction, providing the flexibility to pivot or scale without relinquishing control. **Conclusion** In context, seed-strapping embodies a profound shift in startup financing, particularly suited for AI-native businesses. The approach balances initial financial outlay with growth flexibility, emphasizing sustainable economic growth without sacrificing ownership or control. For aspiring entrepreneurs and domain experts, seed-strapping offers a viable path forward, blending the benefits of initial capital input with AI-driven operational enhancements to foster a new era of business innovation.

The 10 Biggest Rounds Of March: Anthropic’s Massive $3.5B Round Leads

Crunchbase | April 1, 2025

#Technology • #AI • #VentureCapital • #FundingRounds • #Innovation • #Venture Capital

March 2025 saw significant venture capital activity, with several large funding rounds across various sectors. The largest round was secured by Anthropic, an artificial intelligence company, which raised a massive $3.5 billion. This highlights the continued interest and investment in AI technologies, reflecting the sector's growth and potential for innovation. ### Key Funding Rounds - **Anthropic's AI Funding**: The $3.5 billion raised by Anthropic is a testament to the increasing importance of AI in the tech landscape. This investment underscores the potential of AI to drive future technological advancements and its appeal to investors looking for high-growth opportunities. - **Sector Diversification**: The funding rounds in March were not limited to AI; other sectors like IT and fintech also saw significant investments. This diversification indicates a robust venture capital environment where multiple industries are attracting substantial funding. - **Threshold for Notable Rounds**: To be considered among the largest rounds in March, companies needed to raise nearly a quarter-billion dollars. This threshold reflects the high stakes and competitive nature of the venture capital market. ### Implications and Analysis The large funding rounds in March have several implications for the tech industry: - **Growth in AI**: The substantial investment in Anthropic suggests that AI remains a priority area for investors. This trend is likely to continue as AI technologies become more integral to various sectors, from healthcare to finance. - **Market Confidence**: The overall size and number of significant funding rounds indicate market confidence in the tech sector. This confidence is crucial for startups and established companies alike, as it provides them with the capital needed to innovate and expand. - **Sectoral Diversification**: The presence of large funding rounds across multiple sectors highlights the diversity and resilience of the tech industry. This diversification helps mitigate risks and ensures that innovation is not confined to a single area. ### Conclusion March 2025's funding landscape was marked by significant investments, particularly in AI, reflecting the sector's potential for growth and innovation. The large rounds also underscore the confidence of investors in the tech sector as a whole, highlighting its diversity and resilience. As AI continues to attract substantial funding, it is likely to remain a key driver of technological advancements in the coming years.

Global Venture Funding In Q1 2025 Indicate Strongest Quarter For Investment Since Q2 2022

Crunchbase | April 2, 2025

#Business • #Startups • #VentureCapital • #AI • #Investment • #Venture Capital

The first quarter of 2025 marked a significant milestone in venture funding, with the strongest investment quarter since Q2 2022. This period was highlighted by two major events: the largest funding round for a venture-backed company and the largest acquisition of a venture-backed company. One of the most notable transactions was OpenAI's $40 billion funding round, which was the largest private round ever recorded. Key points from this quarter include: - **Record Funding Rounds**: OpenAI's $40 billion funding round set a new benchmark for private funding, underscoring the growing interest in AI and related technologies. - **Acquisitions**: The largest acquisition of a venture-backed company also occurred during this period, indicating a robust market for startups. - **Market Trends**: The strong investment activity suggests a warming startup environment, with investors showing increased confidence in venture-backed companies. The implications of these developments are multifaceted: - **Investor Confidence**: The significant funding and acquisition activities reflect a renewed confidence among investors in the startup sector, particularly in AI-driven ventures. - **Market Growth**: This trend could lead to further growth in the startup ecosystem, as more companies may seek to capitalize on the current investment climate. - **Technological Advancements**: The focus on AI and related technologies indicates a broader shift towards innovation and technological advancements in the industry. In conclusion, Q1 2025 was a pivotal quarter for venture funding, marked by unprecedented investment and acquisition activities. These developments signal a strong and optimistic outlook for startups, particularly those focused on AI and emerging technologies. As the market continues to evolve, it will be important to monitor how these trends impact the broader startup ecosystem and technological innovation.

Eye On AI: Massive OpenAI Deal Masks AI’s Slow Quarter

Crunchbase | April 3, 2025

#Technology • #VentureCapital • #MachineLearning • #Innovation • #Venture Capital

The big news in the world of venture and artificial intelligence obviously has been OpenAI's massive $40 billion investment led by SoftBank, a big-money deal that has folks talking. However, a deeper look at the funding numbers for AI in Q1 seems to show a slight pullback from investors. Despite this, AI remains a dominant force in venture capital investments, with a significant portion of funds allocated to AI-related projects. The first quarter of 2025 saw a substantial increase in U.S. venture capital activity, with over $91.5 billion invested across approximately 3,990 deals, according to PitchBook. This represents a more than double increase from the $42.4 billion invested in Q1 of 2024, despite a slight decrease in the number of deals. A major contributor to this increase was OpenAI's $40 billion funding round. Excluding this deal, AI still captured nearly half of the total invested during the quarter, highlighting its continued appeal to venture capitalists. The dominance of AI in venture capital is not new; 2024 also saw significant investments in AI, with established players like OpenAI, xAI, and Anthropic receiving substantial funding. This trend is expected to continue, driven by advancements in generative AI and specialized models. However, the exit environment remains subdued, with fewer companies completing public listings compared to previous years. This liquidity challenge could impact future investment flows, as investors have less capital to reinvest in new ventures. In addition to OpenAI, other AI startups have also secured significant funding in Q1 2025. Over 150 AI-focused startups raised more than $5 billion, with notable investments in sectors like enterprise automation, cybersecurity, and healthcare. Companies such as Celestial AI, Anthropic, and Together AI have raised substantial funds, indicating strong investor confidence in AI innovation. This surge in funding is expected to drive further growth and innovation in the AI sector. The investment landscape also includes startups working on AI-related hardware and technologies. Companies developing AI chips, data center communications, and quantum hardware have seen significant investments. These advancements are crucial for supporting the growing demand for AI processing and data management, especially in data centers and cloud infrastructure. Overall, while the AI sector experienced a slight pullback in Q1 2025, it remains a priority for venture capitalists. The massive investment in OpenAI and the continued growth of AI startups underscore the sector's potential for innovation and disruption across various industries.

Fintech Plaid completes new funding round but finds valuation cut in half

Ft | April 3, 2025

#Finance • #Investment • #Fintech • #OpenBanking • #VentureCapital • #Venture Capital

Unfortunately, the provided article content is limited. However, based on similar news about Plaid's recent funding round, here is an extract of relevant information: Plaid, a pioneer in open banking, has raised $575 million in a new funding round. This round was led by Franklin Templeton, with participation from Fidelity Management and Research, BlackRock, and other existing investors like NEA and Ribbit Capital[1][3][4]. The funds will be used to address employee tax withholding obligations related to the conversion of expiring restricted stock units (RSUs) to shares and to offer liquidity to current team members[1][3]. Plaid has experienced significant growth, expanding its product suite beyond bank linking to include data analytics essential for financial services and adjacent markets. The company's network is crucial for customers in signing up new users, fighting fraud, enabling bank payments, and making underwriting decisions[1][3]. More than half of Americans have used Plaid, reflecting its widespread adoption[3]. In recent years, Plaid has seen substantial revenue growth and a return to positive operating margins. The company's focus on new products has contributed significantly to its annual recurring revenue, with these products accounting for over 20% of the total[3]. Plaid's client base now includes major enterprise players such as Citi and Rocket[3]. Despite the funding, Plaid's valuation has been reported to be lower than expected, but the company remains focused on future growth and an eventual initial public offering (IPO)[3][4]. Plaid's evolution and growth are set against the backdrop of the fintech sector's upswing and the ongoing digitization of financial services. The company is also tracking long-term trends such as the rise of artificial intelligence (AI) in banking[3].

Geopolitics

Apple loses $250B market value as tariffs tank tech stocks

Techcrunch | Rebecca Bellan | April 3, 2025

#Business • #Finance • #Tariffs • #TechStocks • #GlobalTrade • #Geopolitics

Apple lost more than $250 billion in market value Thursday, with shares down as much as 8.5% as a result of President Donald Trump’s tariff spree. The iPhone maker took one of the biggest hits on Wall Street, where tech stocks dropped as investors shifted money away from volatile assets. Tesla, Nvidia, and Meta were among the other tech giants affected by the tariffs, which have significantly impacted companies with manufacturing ties to China. The tariffs imposed by the Trump administration have been particularly challenging for Apple, given its substantial manufacturing presence in China. Apple manufactures about 90% of its hardware in China, which was hit with a 34% import tax. This has led analysts to suggest that Apple might need to raise its prices by around 6% to offset the costs associated with these tariffs[1]. However, there is speculation that Apple might receive exemptions similar to those it received in the past, especially considering its recent announcement to invest more than $500 billion in the U.S. over the next four years[1]. The broader tech sector also saw significant declines, with Amazon shares falling more than 7%, while Nvidia, Meta, and Tesla each dropped about 6%. Alphabet and Microsoft experienced smaller declines, with 4% and 3% drops, respectively[1]. The Roundhill Magnificent Seven ETF, which tracks these major tech companies, lost more than 10% of its value in March, reflecting the overall volatility and investor skepticism in the sector[1]. The tariffs have not only affected tech stocks but have also raised concerns about potential retaliatory measures from countries like China, which could further destabilize global markets. The impact of these tariffs extends beyond the immediate financial losses for tech companies. They also signal a broader shift in global trade policies, which could lead to increased costs for consumers and potentially slower economic growth. As companies like Apple navigate these challenges, they will need to balance price increases with maintaining competitiveness in a rapidly changing market environment.

FT: TikTok’s U.S. Business To Be Spun Off With ByteDance Retaining Nearly 20% Ownership

Pxlnv | Nick Heer | April 2, 2025

#Business • #Strategy • #TikTok • #Investment • #Regulation • #Geopolitics