Contents

Editorial: Whither Europe - When the New Stack Is Power?

Essay

AI

Apple’s new Creator Studio isn’t just about getting you to subscribe to apps

OpenAI CFO Sarah Friar: ChatGPT has become the noun and the verb

Regulatory Arbitrage as Strategy: How Big Tech’s ‘License + Talent’ Deals Avoid Antitrust Review

Tech groups shift $120bn of AI data centre debt off balance sheets

Rewiring Carta Fund Admin: AI Agents Working 24/7 for Audit Readiness

Logical Intelligence brings LeCun on board as it touts AI breakthrough

Apple Picks Gemini to Run AI-Powered Siri | Bloomberg Tech 1/12/2026

Adobe Acrobat now lets you edit files using prompts, generate podcast summaries

Corporate AI adoption could take ‘even longer’ than 10 to 15 years, says Thoma Bravo founder

Ads are coming to ChatGPT. News publishers with OpenAI deals won’t see a dime.

China

Venture

Robotics Startup Skild AI Lands $1.4B, Tripling Valuation To $14B In Just 7 Months

Definitive benchmarks for US startup fundraising in 2025. Angel rounds through Series A.

The venture firm that ate Silicon Valley just raised another $15 billion

Large American VCs Topped 2025 Active Investor Ranks, Including A16Z, Accel And Sequoia

European Venture Funding Nudged Higher In 2025, While AI Led For The First Time

Interview of the Week

Editorial

Whither Europe? After Davos

If we follow the money and the plumbing this week, Europe’s problem stops looking like “too little AI” and starts looking like “too little power.” Not compute power—political and financial power.

The conversation with Andrew Keen and Gené Teare begs a hard question that Carl Benedikt Frey only half answers: is it game over for Europe? Frey’s “not yet—but close” sounds academic until we set it against this week’s deals.

Look at who owns the AI foundations.

Apple, the archetype of vertical integration, quietly concedes that “Apple Foundation Models didn’t actually have a foundation” and signs up to run Siri and future “Apple Intelligence” on Google’s Gemini. Creator Studio spreads AI features across Final Cut, Logic and Pixelmator—but the cognition is rented.

The same week, Skild AI raises $1.4B at a $14B valuation to build an “omni‑bodied” robotics brain, while Nvidia executes the Groq non‑acquisition: license the LPU IP, hire “substantially all” the staff, leave GroqCloud as a legal fig leaf so antitrust can pretend there’s still competition.

In my framing in the discussion I make the point that this isn’t just product news; it’s a new stack of power: models, chips, and robotics brains at the core; everyone else—including Apple—on the application edge. Europe has almost no one in that inner ring.

Gené’s data makes it worse. U.S. venture is concentrating around the same four “venture majors”—a16z, Sequoia, GC, Lightspeed—while a16z alone pulls in another $15B, openly claiming that “the fate of new technology in the United States rests partly on our shoulders.” SignalRank’s Series B analysis shows these majors sitting in 60–70% of “qualifying” deals. Carta rewires fund admin with 24/7 AI agents, and $120B of AI data‑center debt quietly migrates into special‑purpose entities held by banks and pensions.

We’re not just centralizing technology; we’re centralizing the plumbing of capital and risk around a tiny set of U.S. actors.

Now contrast that with China’s model, which Gené and I call out: MiniMax, a DeepSeek rival, pops 87% on Shanghai debut; Hygon doubles post‑IPO. Beijing routes its AI and chip bets through domestic exchanges with explicit state blessing. It’s chaotic, but it is unmistakably a power project.

Europe? Frey’s warning is brutal: without a true single market for services, it really could be the end of the European dream of continent‑wide progress. The DLD panel made the subtext explicit: Europe regulates platforms it doesn’t own, splinters its market, and wonders why founders and capital head for Delaware or Shanghai.

This week’s stories suggest the question isn’t “Can Europe catch up in AI models?” It’s: can Europe stomach the power moves everyone else is already running?Off‑balance‑sheet data‑center vehicles. “License + talent” deals that would make Brussels blanch. Evergreen “firm, not fund” capital that commits for decades, not election cycles.

Looking ahead, three tensions will tell us whether “not yet—but close” becomes “too late”:

Foundations: Does any European actor build or anchor a true foundation layer—model, chip, or robotics brain—or does the continent resign itself to being an OEM for U.S. and Chinese cognition?

Capital: Can Europe create its own “venture majors” and permanent‑capital vehicles instead of outsourcing growth equity to a16z and Sequoia?

Market: Will the single market for services ever be completed, so a Skild‑equivalent can scale from Lisbon to Tallinn without 27 frictions?

Frey is right: the endgame is political, not technical. The new stack is power. The only real open question is whether Europe chooses to wield it—or just regulate whoever does.

Essay

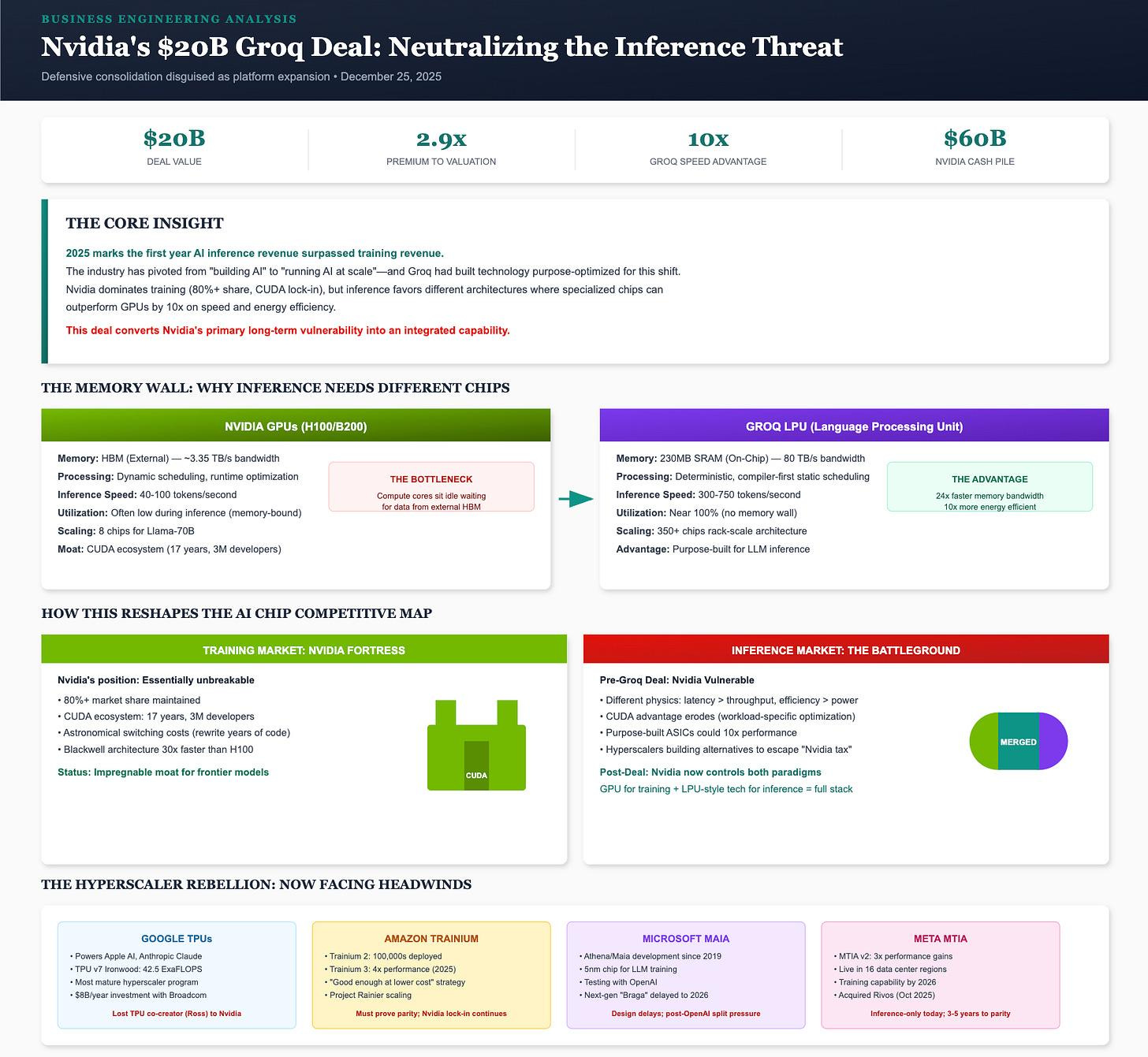

Nvidia and Groq, A Stinkily Brilliant Deal, Why This Deal Makes Sense

Stratechery • Ben Thompson • January 6, 2026

Essay•AI•Semiconductors•Mergers•Competition

Nvidia is licensing Groq’s technology and hiring most of its employees; it’s the most potent application of tech’s don’t-call-it-an-acquisition deal model yet. This is a brilliant deal for Nvidia, and a stinkily brilliant one for Groq’s investors.

The deal, announced yesterday, sees Nvidia acquiring a license to Groq’s LPU (Language Processing Unit) inference technology and offering jobs to “substantially all” of Groq’s employees. In exchange, Groq’s investors will receive an undisclosed amount of Nvidia stock. This structure is a clever workaround for the regulatory scrutiny that would accompany a traditional acquisition, particularly given Nvidia’s dominant position in the AI chip market.

For Nvidia, the benefits are immense. The company gets access to Groq’s specialized inference technology and, most importantly, its engineering talent, without the antitrust headaches of a formal merger. Groq’s LPU is designed for high-performance, low-latency inference, an area of increasing importance as AI models move from training to deployment. This bolsters Nvidia’s portfolio against competitors like AMD and Intel, as well as cloud providers designing their own chips.

For Groq’s venture backers, the deal provides a lucrative exit via Nvidia stock, a currency that has been incredibly valuable. They avoid the risks and uncertainties of taking the company public or finding an independent path in a brutally competitive and capital-intensive market dominated by Nvidia itself.

The transaction highlights a recurring pattern in tech: the “acqui-hire” or asset/license deal that achieves the strategic ends of an acquisition while avoiding regulatory classification as one. In this case, the model is applied with unprecedented scale and strategic significance, neutralizing a potential competitor and absorbing its key innovations directly into the industry titan’s ecosystem.

Elon Musk’s 2026 Vision: AGI Timelines, China’s Rise, Job Markets, and Clean Energy | MOONSHOTS

Youtube • Peter H. Diamandis • January 8, 2026

Essay•AI•AGI•FutureOfWork•Geopolitics

In a recent discussion, Elon Musk shared his perspectives on the trajectory of artificial intelligence and its profound implications for the future. He predicts that Artificial General Intelligence (AGI), defined as AI smarter than any human, could arrive as soon as the end of 2025 or within the next three years. This development is expected to trigger an intelligence explosion, fundamentally altering civilization.

Musk emphasizes that the rise of AI will render many jobs obsolete, but he views this not as a crisis but as a transition. He suggests that in a future of material abundance driven by AI and robotics, the concept of a universal high income could replace traditional employment, allowing people to pursue work for personal meaning rather than economic necessity.

The conversation also touches on geopolitical dynamics, particularly China’s rapid advancement. Musk acknowledges China’s significant progress and predicts it will become the world’s largest economy, potentially twice the size of the United States’. He stresses the importance of maintaining a strong and positive relationship between the US and China, framing it as a collaborative rather than adversarial dynamic for global stability.

On the topic of sustainable energy, Musk reiterates his vision for a fully sustainable energy economy. He outlines a future powered by solar and wind, supported by battery storage, and highlights the transformative potential of autonomous electric vehicles and the continued expansion of companies like Tesla and SpaceX in driving this transition.

Firm > Fund

A16z • January 12, 2026

Essay•Venture

The Idea of the Week, from David Haber.

The venture capital industry is in the midst of a fundamental shift. For decades, the dominant model has been the “fund” model, where a firm raises a pool of capital with a fixed lifespan (typically 10 years) to invest in a portfolio of companies. This model has been incredibly successful, but it is increasingly at odds with the needs of the most ambitious founders building the most important companies.

Founders today are building for the long term, often with missions that span decades. They need partners who can match that time horizon. The traditional fund model, with its pressure to return capital to investors within a set period, can create misalignment. It can force premature exits or discourage the patient, enduring support that category-defining companies require to reach their full potential.

This is why we are seeing the rise of the “firm” model. In this model, the venture capital entity is structured as a permanent, evergreen entity, often a holding company or an operating company. This structure aligns the firm’s incentives with the long-term success of its portfolio companies. Capital can be recycled, and the firm can hold positions for as long as it makes strategic sense, without the artificial clock of a fund’s expiration date.

The distinction is more than financial; it’s cultural. A firm built for the long haul invests in building deep operational expertise, institutional knowledge, and a platform that adds value across generations of companies. It’s not just about providing capital at a point in time; it’s about being a foundational partner throughout a company’s entire journey. This shift from “fund” to “firm” represents the next evolution in venture capital, moving from transactional investing to transformational partnership.

AI

Apple’s new Creator Studio isn’t just about getting you to subscribe to apps

Fastcompany • January 14, 2026

AI•Tech•Apple•CreativeSoftware•SubscriptionServices

On the surface, Apple’s announcement on Tuesday of a subscription service called Apple Creator Studio does not demand a whole lot of explanation or analysis. The Mac/iPad/iPhone offering, which bundles the Final Cut Pro video editor, Logic Pro audio editor, Pixelmator Pro image editor, and other apps for making and manipulating media for $13 a month or $129 a year, is exactly the sort of thing you’d expect the company to get around to introducing.

After all, its strategy of expanding the portion of its revenue that comes from services has already resulted in offerings such as Apple TV, Apple Music, Apple Arcade, and Apple News+. It would have been weird if Apple hadn’t pushed its creativity apps in a service-y direction—a process that began a couple of years ago when the first iPad versions of Final Cut Pro and Logic Pro carried subscription pricing.

But Creator Studio, which arrives in the App Store on January 28, also ties together several other ongoing plot lines relating to Apple’s business. Its very existence helps answer questions about how the company sees AI as a creative tool. The company has the opportunity to address others as it builds out the product in the coming years.

Apple’s history in creativity software is long: For example, Final Cut Pro and Logic Pro both date to the previous century. Yet at times, it hasn’t been entirely clear whether the company saw the customer base for such tools as consisting literally of professionals, prosumers who’d outgrown products such as iMovie and GarageBand, or some combination thereof. Even now, Creator Studio does not add up to a full-blooded rival to Adobe’s Creative Cloud, which offers many more apps in various editions at much higher prices.

Still, Apple’s VP of Worldwide Product Marketing Bob Borchers offered a reasonably crisp definition of Creator Studio’s intended audience: creators who, increasingly, do a little bit of everything. “A musician isn’t just songwriting,” he said. “They’re producing the tracks, they’re creating album artwork, they’re editing music videos, they’re designing merch. They’re doing all of those things, and they’re inherently working across some of those traditional boundaries.”

With that in mind, Apple is spreading useful functionality between Creator Studio’s apps in ways that share the wealth and reduce the learning curve. For example, Pixelmator Pro’s AI-infused features that can intelligently auto-crop images and scale them up are now available in Keynote, Pages, and Numbers. Similarly, Logic Pro’s Beat Detection feature, which uses AI to visualize an audio track’s tempo, will be available in Final Cut Pro as well.

It’s no shock that the new features Creator Studio is launching with are largely about AI-based assistance. Some run on-device and use Apple’s own technology, including visual and audio search options. Others draw on OpenAI cloud-based models, like image-generation options that go beyond Apple Intelligence’s Image Playgrounds, as well as Keynote’s newfound ability to turn text outlines into presentations.

Apple is taking pains to emphasize that it’s not trying to turn content creation over to algorithms. “The key thing is, we’re doing this with the philosophy that AI should amplify one’s ideas and not replace any piece of human artistry or creativity,” says senior director of Worldwide Product Marketing Brent Chiu-Watson. “We’re just trying to make someone more efficient as they explore their process.”

OpenAI CFO Sarah Friar: ChatGPT has become the noun and the verb

Youtube • CNBC Television • January 21, 2026

AI•Tech•ChatGPT•BusinessStrategy•Branding

OpenAI CFO Sarah Friar discusses the company’s trajectory and the cultural impact of its flagship product, ChatGPT. She highlights how the brand name has transcended its original function to become a part of everyday language, used both as a noun and a verb, similar to how “Google” is used for search.

Friar emphasizes the company’s focus on moving beyond being a mere research lab to building a sustainable, profitable business. This involves a significant investment in infrastructure to support the growing demand for AI compute power from both consumers and enterprise clients.

The conversation touches on the competitive landscape, with Friar expressing confidence in OpenAI’s position. She points to the company’s leading models, strategic partnerships, and the rapid adoption by developers and businesses as key advantages. The discussion also covers the importance of responsible AI development and navigating the evolving regulatory environment.

Regulatory Arbitrage as Strategy: How Big Tech’s ‘License + Talent’ Deals Avoid Antitrust Review

Fourweekmba • Gennaro Cuofano • December 24, 2025

Regulation•USA•Antitrust•BigTech•Mergers•AI

The article analyzes a sophisticated corporate strategy where major technology companies use “license + talent” deals to achieve the functional benefits of an acquisition while avoiding the legal definition that would trigger mandatory antitrust review. This practice, termed “regulatory arbitrage,” allows firms like Nvidia, Microsoft, Google, and Amazon to consolidate market power and capture key innovations without formal mergers. The central thesis is that this strategic innovation exploits a lag in regulatory frameworks, allowing big tech to maintain “the fiction of competition” while functionally eliminating rivals.

The Nvidia-Groq Deal as a Case Study

The analysis centers on Nvidia’s arrangement with AI chip startup Groq. Instead of a traditional acquisition, the deal was structured as a non-exclusive technology license for Groq’s LPU architecture and intellectual property, coupled with the hiring of key executives—including CEO Jonathan Ross and President Sunny Madra—and the transfer of all assets except GroqCloud. An earnout structure ties investor payouts to performance milestones. As Bernstein analyst Stacy Rasgon noted, “Antitrust would seem to be the primary risk here, though structuring the deal as a non-exclusive license may keep the fiction of competition alive.” By leaving the cloud service (GroqCloud) as a nominally independent entity, the deal creates a legal distinction without a substantive competitive difference.

A Normalized Big Tech Playbook

This structure is not an isolated incident but a normalized pattern of consolidation. The article highlights several precedents that established this playbook:

Microsoft’s complex deals with OpenAI and Inflection AI.

Google’s $3 billion arrangement with Character.ai, which triggered a Department of Justice review but resulted in no action.

Amazon’s strategic partnerships with Anthropic.

The common thread is paying billions to acquire core technology and vital human talent without technically acquiring the corporate entity, thereby sidestepping the scrutiny, delays, and potential blockages of traditional merger review processes.

Strategic and Market Implications

The proliferation of this strategy has profound implications for the market and regulation. For dominant technology companies, expertly navigating regulatory frameworks has become a core competitive capability and a “defensible moat.” It allows them to consolidate power and capture innovation at a pace that outstrips competitors who might trigger formal reviews.

For startups, the economics of being acquired now favor deal structures that preserve a shell of independence, potentially altering negotiation dynamics and long-term strategic outcomes. For regulators, the article argues that traditional merger review frameworks are failing to capture the reality of market consolidation because they are based on legal formalities that no longer match economic substance. The distinction between an “acquisition” and a “non-exclusive licensing with comprehensive asset transfer and key personnel hiring” has eroded.

Conclusion and Key Takeaway

The article concludes that Nvidia’s deal for Groq represents regulatory arbitrage elevated to a core corporate strategy. This “license + talent” model offers the substance of an acquisition—technology control, talent capture, and competitive neutralization—without the form that triggers regulatory review. As long as a fragment of the target company remains operationally separate, the legal fiction holds. The expectation is that this playbook will continue to proliferate, enabling further concentration in critical sectors like artificial intelligence while outdated regulatory tools struggle to address the underlying economic realities of market power.

Tech groups shift $120bn of AI data centre debt off balance sheets

Ft • December 23, 2025

AI•Funding•Regulation•SEC•Compliance•CorporateFinance

Major technology companies are using complex financial engineering to fund the massive capital expenditure required for artificial intelligence data centers, moving approximately $120 billion in associated debt off their balance sheets. This strategy allows them to insulate their core businesses from the risks of this high-stakes investment while simultaneously binding Wall Street investors to the future success or failure of the AI boom.

The Scale and Structure of Off-Balance-Sheet Financing

The push to build AI data centers represents one of the largest capital investment cycles in corporate history. To fund this without bloating their balance sheets and alarming shareholders, tech giants like Microsoft, Google, and Amazon have established special purpose entities (SPEs). These legally separate companies own the data center assets and carry the debt used to build them. The parent tech company then enters into long-term contracts to lease capacity from these SPEs. This structure keeps the substantial debt—estimated at $120 billion—off the tech companies’ main financial statements, presenting a cleaner financial profile to the market.

Motivations and Benefits for Big Tech

This approach offers several key advantages for the technology firms:

Balance Sheet Management: It protects their credit ratings by avoiding a direct surge in reported debt, which could increase borrowing costs.

Risk Isolation: The potentially volatile economics of building and operating data centers are compartmentalized. If the AI demand surge falters, the financial and operational risks are partly contained within the separate entity.

Capital Efficiency: It frees up capital on the parent company’s balance sheet for other strategic investments, such as AI research, model development, or acquisitions.

Implications for Wall Street and Investors

The financing shift has profound implications for capital markets. Major banks and institutional investors like pension funds and insurance companies are providing the debt financing for these SPEs, attracted by the long-term contracts with credit-worthy tech giants. This effectively transfers the direct financial risk of the AI infrastructure build-out from tech shareholders to debt markets.

The article suggests this creates a “do-or-die” dynamic for the AI sector. If the anticipated AI-driven productivity and profit boom materializes, the tech companies will reap enormous rewards with a relatively light debt burden on their books. Their leasing costs will be easily covered by new revenues. However, if the boom disappoints, the tech firms may face difficult renegotiations or even walk away from some leases, potentially triggering significant losses for the banks and bondholders who financed the SPEs. This could lead to instability in the corners of the debt market most exposed to this financing.

Broader Economic and Sectoral Impact

This trend underscores the immense cost and scale of the current AI arms race, which is being funded in a novel way. It also raises questions about transparency, as the full extent of corporate commitments and leverage can be obscured by off-balance-sheet accounting. The strategy binds the fate of Wall Street closely to the success of generative AI, making the financial system a direct stakeholder in the technology’s commercial adoption and profitability.

Meta Lays Off 1,500 People in Metaverse Division

Wsj • Meghan Bobrowsky • January 14, 2026

AI•Jobs•Metaverse•Layoffs•Wearables

Meta Platforms Inc. has laid off about 1,500 people in its metaverse division, affecting roughly 10% of the unit’s staff, as the company shifts spending toward its artificial intelligence glasses and other wearable products.

The layoffs, which occurred last week, were part of a broader restructuring of the company’s Reality Labs division, which houses its metaverse and augmented-reality projects. The cuts were focused on teams working on the company’s Horizon metaverse platform and other virtual-reality software.

The move reflects Meta’s continued pivot away from the metaverse, a concept it championed for years, and toward AI and wearable devices. The company has been investing heavily in its Ray-Ban Meta smart glasses, which feature an AI assistant, and other hardware products.

Meta has been cutting costs and streamlining its operations for the past few years, after a period of rapid hiring during the pandemic. The company has laid off more than 20,000 people since late 2022, including previous cuts in Reality Labs.

Rewiring Carta Fund Admin: AI Agents Working 24/7 for Audit Readiness

Youtube • Carta • December 30, 2025

AI•Work•VentureCapital•Automation•Compliance

The video discusses Carta’s transformation of its fund administration services through the implementation of AI agents. The core idea is to move beyond traditional, manual processes to achieve a state of continuous, automated audit readiness.

These AI agents are designed to work around the clock, monitoring and validating financial data in real-time. This system proactively identifies discrepancies, ensures compliance with accounting standards, and prepares necessary documentation automatically.

By rewiring their operations with AI, Carta aims to provide fund managers with unprecedented accuracy and transparency. The technology reduces the administrative burden and potential for human error, allowing teams to focus on higher-value strategic work rather than manual reconciliation and report preparation.

The shift represents a significant evolution in financial operations, leveraging automation to create a more resilient and trustworthy infrastructure for venture capital and private equity funds.

Apple Teams Up With Google for A.I. in Its Products

Nytimes • January 12, 2026

AI•Tech•Partnership•Apple•Google

Apple was facing increasing questions about its plans for artificial intelligence as other big tech companies invested tens of billions in the technology. The company has been in discussions with Google to license its Gemini AI engine for future iPhones, according to a report from Bloomberg. This potential partnership would bring Google’s generative AI models to Apple’s devices, marking a significant shift in Apple’s AI strategy.

The talks are still ongoing and no final decisions have been made, but the discussions center on licensing Google’s Gemini for powering new AI features in iOS 18, the next major iPhone software update expected later this year. Apple has also reportedly held discussions with OpenAI about using its models. This move suggests Apple is looking to partner with established AI leaders rather than build all its capabilities from scratch, at least in the short term.

An Apple-Google deal would build upon their existing search partnership, where Google pays Apple billions annually to be the default search engine on Safari. Integrating Gemini AI would deepen this relationship significantly. For Apple, this partnership would help it quickly catch up in the AI race where it has been perceived as lagging behind competitors like Microsoft and Google.

Logical Intelligence brings LeCun on board as it touts AI breakthrough

Ft • January 21, 2026

AI•Funding•Startup•Reasoning•YannLeCun

Six-month-old US start-up Logical Intelligence has launched a new “energy based” reasoning model for artificial intelligence and has brought on board Meta’s chief AI scientist Yann LeCun as an adviser, as it targets a valuation of more than $1bn.

The company, which was founded last year by former executives from Google and Meta, has developed a new approach to AI reasoning that it claims is more efficient and powerful than existing models. The start-up’s technology is designed to enable AI systems to perform complex logical reasoning tasks with greater accuracy and speed.

Logical Intelligence’s new model uses an “energy-based” framework, a concept championed by LeCun, which differs from the probabilistic approaches that underpin most current generative AI systems. The company argues that this allows for more robust and reliable reasoning, particularly in areas requiring multi-step logic and planning.

The involvement of LeCun, a Turing Award winner and one of the most prominent figures in AI research, provides a significant endorsement for the fledgling company. His theories on energy-based models have influenced the start-up’s technical direction. The company is now engaging with investors to raise a large funding round that would value it at over $1 billion, reflecting the intense investor appetite for breakthroughs in AI reasoning.

The launch positions Logical Intelligence in the competitive race to develop AI with advanced reasoning capabilities, seen as the next frontier beyond today’s large language models. Success in this area could have wide applications, from scientific research and software development to more reliable autonomous systems.

Apple, Rather Quietly and With No Details, Announces Partnership With Google to Use Gemini Technology for Apple Foundation Models, and Presumably, the Year-Overdue More Personalized Siri

Cnbc • John Gruber • January 12, 2026

AI•Tech•Apple•Google•Partnership

The multi-year partnership will lean on Google’s Gemini and cloud technology for future Apple foundational models, according to a joint statement obtained by CNBC’s Jim Cramer.

“After careful evaluation, we determined that Google’s technology provides the most capable foundation for Apple Foundation Models and we’re excited about the innovative new experiences it will unlock for our users,” Apple said in a statement on Monday.

The models will continue to run on Apple devices and the company’s private cloud compute, they added. Apple declined to comment on the terms of the deal. Google referred CNBC to the joint statement.

That’s the whole announcement, at least for now. A statement that, as far as I can see, went only to CNBC (and Jim Cramer specifically, of all people).

There’s slightly more detail in a brief announcement from Google on Twitter/X: “Joint Statement: Apple and Google have entered into a multi-year collaboration under which the next generation of Apple Foundation Models will be based on Google’s Gemini models and cloud technology. These models will help power future Apple Intelligence features, including a more personalized Siri coming this year.”

I suspect more details will be forthcoming from Apple sooner rather than later. But for now, that’s it.

This phrasing, in both Apple’s statement to Cramer and the joint Apple/Google statement released by Google, is, I think subtly telling about how significant this news is: “Google’s AI technology provides the most capable foundation for Apple Foundation Models”. There’s a slight redundancy with foundation appearing twice in the span of four words. So this brief bit of phrasing reveals the obvious, awkward truth that Apple Foundation Models didn’t actually have a foundation.

Apple Picks Gemini to Run AI-Powered Siri | Bloomberg Tech 1/12/2026

Bloomberg • January 12, 2026

AI•Tech•Siri•Gemini•Pharmaceuticals

Apple has selected Alphabet’s Gemini to power its Siri voice assistant in a multiyear deal, marking a significant partnership in the AI race. This collaboration aims to integrate advanced generative AI capabilities into Apple’s ecosystem, enhancing Siri’s functionality and positioning it against competitors like OpenAI’s ChatGPT.

In another major AI development, Nvidia plans to invest $1 billion over five years to establish a new lab with pharmaceutical giant Eli Lilly & Co. The joint venture is focused on accelerating the use of artificial intelligence within the drug discovery and pharmaceutical industry, leveraging Nvidia’s computing power for complex research.

Separately, Paramount Global has escalated its takeover defense by suing Warner Bros. Discovery. The media company is also planning to nominate directors to its board, intensifying hostilities in the ongoing corporate battle for control.

Adobe Acrobat now lets you edit files using prompts, generate podcast summaries

Techcrunch • Ivan Mehta • January 21, 2026

AI•Work•Adobe•Productivity•PDF

Adobe is adding AI tools to Acrobat, including the ability to generate podcast summaries of files, create presentations, and a way for users to edit files using prompts.

The company is adding a new feature called “Edit with prompts” that will let users change the content of a PDF through a text prompt. For example, a user can ask the AI to “make this more concise” or “change the tone to be more professional.” The company said that the AI will also be able to change the formatting of the document based on the prompt.

Adobe is also adding a feature to generate a podcast-style summary of a document. The company said that the AI will read the document and create an audio summary that users can listen to. This feature is designed for people who want to consume content on the go.

Additionally, the company is adding a feature to generate presentations from documents. Users can upload a document and ask the AI to create a presentation based on the content. The AI will generate slides with key points from the document.

These features are part of Adobe’s broader push into AI. The company has been adding AI tools across its product suite, including Photoshop and Premiere Pro. Adobe is betting that AI will become a core part of how people create and edit content.

The new features will be available to Acrobat users in the coming months. The company didn’t specify pricing for the new AI tools, but they are likely to be part of a premium subscription.

Corporate AI adoption could take ‘even longer’ than 10 to 15 years, says Thoma Bravo founder

Youtube • CNBC Television • January 21, 2026

AI•Work•CorporateStrategy•AdoptionTimeline•PrivateEquity

Orlando Bravo, founder of private equity firm Thoma Bravo, discusses the timeline for widespread corporate adoption of artificial intelligence. He suggests that the process may take longer than many current optimistic projections, potentially extending beyond a 10 to 15-year horizon.

Bravo emphasizes that while AI technology is advancing rapidly, integrating it deeply into the core operations and decision-making processes of large corporations is a complex and gradual undertaking. The challenge lies not just in the technology itself, but in changing business processes, workforce skills, and organizational culture.

He points to the enterprise software adoption cycle as a historical precedent, noting that major shifts like the move to cloud computing took decades to fully permeate the business world. AI, with its profound implications for data analysis, automation, and strategy, may follow a similar or even more protracted path as companies navigate implementation costs, data integration, and proving return on investment.

The discussion highlights a note of caution amidst the current AI investment frenzy, suggesting that the transformation of the corporate landscape through AI will be a marathon, not a sprint. This long-term view is critical for investors and business leaders setting expectations and making strategic plans.

Ads are coming to ChatGPT. News publishers with OpenAI deals won’t see a dime.

Niemanlab • Andrew Deck • January 21, 2026

AI•BusinessModels•Advertising•Media•OpenAI

Ads are officially coming to ChatGPT. A new article from The Information confirms that OpenAI has already pitched placements in ChatGPT to dozens of advertisers. The report comes on the heels of an announcement last week from the company, which said ChatGPT ads would start rolling out for some users in the U.S. imminently.

For now, ads will only appear on free ChatGPT accounts and for users who have signed up for ChatGPT GO, the product’s latest and cheapest subscription tier, which is $8 per month in the U.S.

Among other details in its pitch, The Information reports that advertisers are expected to pay per view, not per click, as is standard for traditional search engines like Google. Alongside other restrictions, ads will not appear in response to political or health-related queries.

OpenAI is not the first conversational AI player to experiment with ads. Perplexity rolled out early ad offerings back in the fall of 2024. Similar to Perplexity, ChatGPT ads will not appear directly in users’ conversations, but instead beneath the response to a prompt. Unlike Perplexity, OpenAI has not announced any plans to share the revenue it earns from ChatGPT ads with the dozens of publications with which it has ongoing licensing deals. These publications help fuel OpenAI’s model training and real-time web browsing capabilities.

As of late last year, ChatGPT has over 800 million weekly active users. The company’s first foray into advertising will start to monetize the large swaths of those users who do not pay for a monthly subscription.

China

DeepSeek rival’s shares jump 87% in China AI listings boom

Ft • January 8, 2026

China•Technology•AI•IPO•StockMarket

Shares in Chinese artificial intelligence company MiniMax surged 87 per cent on their Shanghai debut on Thursday, as investors piled into a wave of listings by the country’s technology groups.

The stock’s strong performance came as Beijing pushes to develop its domestic capital markets and attract more high-growth companies to list at home. MiniMax, which is backed by Chinese tech giant Tencent, is one of the country’s leading AI start-ups and a rival to DeepSeek.

The company raised Rmb2.5bn ($345mn) in its initial public offering, which was priced at the top of its marketed range. The listing is the latest in a series by Chinese AI and semiconductor companies seeking to tap into strong investor appetite for the country’s tech sector.

MiniMax’s debut follows the blockbuster listing of chipmaker Hygon Information Technology in Shanghai last month, which raised $880mn. Hygon’s shares have more than doubled since they began trading.

The strong performance of these listings underscores investor confidence in China’s efforts to achieve self-sufficiency in critical technologies such as semiconductors and artificial intelligence. The government has prioritised the development of these sectors amid escalating tensions with the US.

Venture

Robotics Startup Skild AI Lands $1.4B, Tripling Valuation To $14B In Just 7 Months

Crunchbase • Judy Rider • January 14, 2026

Venture

Skild AI, a robotics company building an “omni-bodied” brain to operate any robot for any task, announced Wednesday that it has raised $1.4 billion, tripling its valuation to over $14 billion.

The fundraise comes just over seven months after Skild raised a $135 million Series B at a $4.5 billion valuation.

SoftBank Group led the startup’s latest financing, which included participation from NVentures, Nvidia’s venture capital arm, entities administered by Macquarie Capital, Bezos Expeditions, Disruptive and 1789 Capital. Several strategic investors also wrote checks into the round, including Samsung, LG Technology Ventures, Schneider Electric, CommonSpirit Health, and Salesforce Ventures.

The raise brings Pittsburgh-based Skild AI’s total raised to over $1.83 billion, according to Crunchbase.

The company says it grew from zero to about $30 million revenue “in just a few months” in 2025, and “is growing exponentially.” It is deploying its technology in a variety of environments, including security and facility inspection, last-mile and point-to-point delivery, warehouses, manufacturing, data centers, and construction tasks, among others.

Looking ahead, Skild AI plans to deploy robotics in consumers homes, with enterprise tasks as the first application.

Last year was a good year for robotic startup funding. Overall, robotics startups raised $13.8 billion in funding in 2025, up from $7.8 billion in 2024 and even topping the $13.1 billion raised in the peak venture funding year of 2021.

Skild AI claims to be building the industry’s “first unified robotics foundation model” called the Skild Brain. The company says its model differs from traditional ones that are tailored to specific robot designs in that it is omni-bodied and “can control any robot without prior knowledge of their exact body form,” including quadrupeds, humanoids, tabletop arms and mobile manipulators.

As such, Skild AI says its technology gives robots the ability to perform simpler tasks such as household chores like cleaning, loading a dishwasher and making an egg, as well as more physically demanding activities such as navigating slippery terrain.

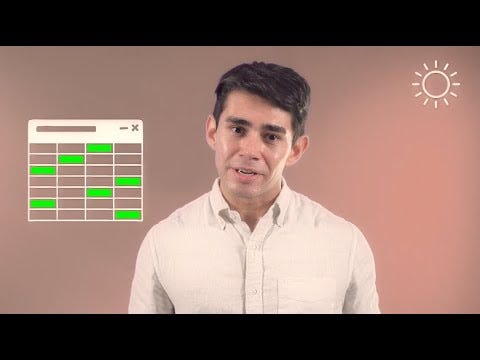

Definitive benchmarks for US startup fundraising in 2025. Angel rounds through Series A.

LinkedIn • Keith Teare • December 22, 2025

Venture

Source: LinkedIn | Author

Angel rounds through Series A.

Data: over 4,000 rounds raised in 2025. Only includes software companies, deep tech version coming… | Peter Walker | 13 comments

Definitive benchmarks for US startup fundraising in 2025.

Angel rounds through Series A.

Data: over 4,000 rounds raised in 2025. Only includes software companies, deep tech version coming soon.

Rounds on SAFEs in the blue/green color tiers are split by total amount raised, since everyone has a slightly different definition of “pre-seed” and “seed on SAFEs”.

Rounds on priced equity in the orange color tiers split by round names. Just primary rounds, no bridges or extensions or “Series A Jr” stuff going on.

𝗧𝗵𝗶𝗻𝗴𝘀 𝘁𝗼 𝗸𝗲𝗲𝗽 𝗶𝗻 𝗺𝗶𝗻𝗱

These are heavily influenced by SF and NY deals because…that’s where the most deals are happening! National figures take on the character of the most mature markets.

Said differently - if you are not in SF, you should adjust these medians down.

More rounds moved from priced equity to SAFEs in these stages this year. Roughly half of all seed rounds now happen on SAFEs.

AI is ALL OVER this data. If you’re building a software company and not using AI, expect to be asked why a lot by VCs and to get a lower valuation.

Founders should care about not getting overly diluted. But they should never kill the company by refusing cash they need because the dilution isn’t right at median. Stay alive first.

These are just benchmarks. Each deal is different. Typically dilution does NOT scale with size, meaning a large seed round still usually sells about 20% equity.

These are pretty expensive numbers, candidly. $20M post-money at Seed is pricey!

But the underlying dynamic is not all rosy for founders. VCs are competing hard for certain deals but the total number of rounds is falling. The venture tale of “haves and have nots” has never been more true.

Share with a fundraising founder 🙏 | 13 comments on LinkedIn

The venture firm that ate Silicon Valley just raised another $15 billion

Techcrunch • Connie Loizos • January 9, 2026

Venture

In a blog post published Friday morning, Ben Horowitz writes that “as the American leader in Venture Capital, the fate of new technology in the United States rests partly on our shoulders.” It’s the kind of statement certain to cause agita at rival firms.

The post accompanied the announcement that Andreessen Horowitz has raised $15 billion across three new funds. This massive haul underscores the firm’s dominant position and its ability to attract capital even in a challenging market environment.

The new funds include $10.5 billion for its flagship “Growth” fund, $3.5 billion for a new “Infrastructure” fund focused on areas like AI compute and data centers, and $1 billion for its “American Dynamism” fund, which invests in companies tied to national interests. This capital raise brings the firm’s total assets under management to over $45 billion.

Horowitz’s blog post framed the firm’s mission in starkly patriotic terms, arguing that technological leadership is essential for American economic and military security. He positioned Andreessen Horowitz as a critical player in this contest, suggesting that its investment decisions will help determine which technologies are developed in the U.S. versus abroad.

This rhetoric and the sheer scale of the fundraise highlight how the venture capital industry has evolved from a niche financier of startups into a powerful economic and geopolitical force. Andreessen Horowitz’s continued fundraising success allows it to place bigger bets across more sectors than ever before, consolidating its influence over the direction of innovation.

Large American VCs Topped 2025 Active Investor Ranks, Including A16Z, Accel And Sequoia

Crunchbase • Joanna Glasner • January 9, 2026

Venture

If you’re looking for new up-and-comers in venture capital, don’t read our rankings of the most active investors in 2025.

That’s because this past year, the list almost exclusively featured longstanding, familiar names. These are firms that routinely topped prior rankings, and for the most part they only got busier in 2025.

This is certainly true for our most active post-seed investors last year – Y Combinator, Andreessen Horowitz, Accel, General Catalyst and Sequoia Capital. Each of them participated in more than 100 reported rounds last year and backed more deals than in 2024.

Overall, there were at least 15 investors who participated in 50 or more post-seed rounds of over $3 million, per Crunchbase data, plus another three in the high 40s.

We also analyzed active investor rankings for the fourth quarter of 2025, which produced results that aren’t dramatically different by some measures. The most similar was the ranking of post-seed investors, which featured the same five names in the top slots as the full-year list.

The same familiar names showed up in our Q4 ranking of most active lead or co-lead investors, albeit in reshuffled spots. The standout exception was Y Combinator, which typically takes a non-lead role in follow-on rounds for companies that partook in its accelerator program.

The top names start to look quite a bit different when we focus more on round size. For the ranking below, we look at investors who led or co-led rounds totalling $1 billion or more in Q4. This isn’t an exact proxy for who spent the most, since rounds with multiple investors don’t break out each backer’s share. However, it does give a general sense of who put serious sums of capital to work.

Fidelity, Insight Partners, and J.P. Morgan Asset Management came out on top, as they were co-lead investors in Databricks’ $4 billion December financing.

How capital concentration impacts Series Bs

Signalrankupdate • January 19, 2026

Venture

Overview: Capital Concentration and Series B Dynamics

The article argues that venture capital at the Series B stage has become increasingly concentrated around four “venture majors”: a16z, Sequoia, General Catalyst (GC), and Lightspeed Venture Partners (LSVP). Their growing asset bases, exemplified by a16z’s recently announced $15 billion fund, have turned them into broad asset managers that effectively sit above traditional venture, while also exerting outsized influence on which companies get funded and at what scale. SignalRank, which invests at Series B using a quantitative qualification engine, sits directly in the slipstream of this concentration and provides a way for allocators to gain diversified exposure to these majors’ Series B portfolios while also supporting early-stage seed managers via pro rata financing.

Rising Share of Series B Rounds and Capital

The share of global Series B rounds that include at least one of the four venture majors has doubled in recent years to about 8% of all Series Bs.

In dollar terms, these rounds now represent roughly 20% of all capital raised at the Series B stage worldwide.

This demonstrates that while the majors are present in a minority of rounds by count, they participate disproportionately in the largest, most capital-intensive financings.

These figures highlight a structural shift: a relatively small number of large managers are controlling a growing portion of late-early-stage capital, which amplifies their influence over valuation norms, round sizes, and the trajectory of promising companies as they scale.

Concentration Within “Qualifying” High-Quality Series Bs

SignalRank defines “qualifying” Series Bs as those raised by companies that score highly based on the quality of their investor syndicates at seed, Series A, and Series B.

Among these qualifying rounds, the presence of a venture major is markedly higher: over 60% of qualifying Series Bs now feature at least one of the four firms, a threefold increase over the last decade.

By capital deployed, the concentration is even more pronounced: 71% of dollars in qualifying Series Bs are invested in rounds that include one or more venture majors.

This suggests that when you filter for higher-quality syndicates and stronger signals of future success, the majors dominate the landscape, effectively anchoring much of the “top-tier” Series B deal flow.

Link to Unicorn Creation and Power-Law Outcomes

The article uses unicorn generation as a rough, imperfect proxy for power-law outcomes.

Almost 50% of all Series B financings that later produced unicorns involved one or more of the venture majors at the Series B stage, up from only about 10% ten years ago.

While not every unicorn is a true power-law winner, and not all power-law companies become unicorns at Series B, this trend indicates that venture majors are increasingly central to backing the companies that ultimately define fund returns.

This correlation supports the argument that co-investing alongside these majors—while not sufficient on its own—is directionally aligned with capturing a meaningful share of future outlier winners.

SignalRank’s Positioning and Portfolio Interpretation

One interpretation of the data is that SignalRank’s qualification engine may over-index on rounds featuring majors, relative to their statistical contribution to unicorn production.

Another perspective is that SignalRank effectively offers a diversified “slice” of the majors’ Series B portfolios, given that the four firms are its most common co-investors but with no dependence on any single one.

Importantly, SignalRank stresses it does not blindly follow the majors: a Series B must be high quality at seed, Series A, and Series B to qualify, and not every major-backed Series B passes this bar.

The article frames SignalRank’s product as a form of “smart beta” for high-quality Series Bs: systematic, rules-based exposure to a concentrated but diversified set of top-tier Series B deals, with SignalRank occupying a central position in the Series B co-investment network.

Implications for Allocators and the Venture Ecosystem

For allocators, the growing dominance of a16z, Sequoia, GC, and LSVP at Series B means that accessing top outcomes increasingly requires some exposure to these managers or to vehicles that systematically co-invest with them.

SignalRank positions itself as such a vehicle, while also channeling capital back to seed managers by financing their pro rata rights, partially counterbalancing the concentration at later stages.

For founders and seed investors, the data underscores how much the Series B landscape has narrowed and how strongly success paths now run through a small set of powerful firms.

In conclusion, the article contends that high-quality Series Bs—and a large share of potential future unicorns—are increasingly clustered around four venture majors. SignalRank’s methodology and portfolio construction turn this concentration into an investable, diversified product, offering allocators exposure to the majors’ Series B opportunities while preserving a systematic, quality-driven approach rather than pure name-following.

European Venture Funding Nudged Higher In 2025, While AI Led For The First Time

Crunchbase • January 21, 2026

Venture

Venture funding to Europe-based startups last year gained only slightly, around 9% year over year, reaching $58 billion, with AI emerging as the region’s leading sector for startup investment for the first time, an analysis of Crunchbase data shows.

The $58 billion invested in 2025 represents a modest increase from the $53.3 billion invested in 2024. While the total is up, it remains significantly below the peak years of 2021 and 2022, which saw $115 billion and $94 billion invested, respectively.

For the first time, AI was the top-funded sector in Europe, attracting $13.6 billion. This surpassed the energy sector, which had led in 2024. The healthcare and biotech sector followed AI, securing $10.5 billion in funding.

The data indicates a continued slowdown in late-stage and technology growth funding, which fell to $21.6 billion in 2025 from $23.8 billion the previous year. In contrast, early-stage funding saw a notable increase, rising 24% to $24.5 billion.

Seed funding also experienced growth, climbing 16% to $11.9 billion. This shift suggests investors are focusing more on younger companies despite a more cautious overall market.

Interview of the Week

Is It Game Over For Europe?

Keenon • Andrew Keen • January 20, 2026

Essay•GeoPolitics•Europe•Technology•Competition•Interview of the Week

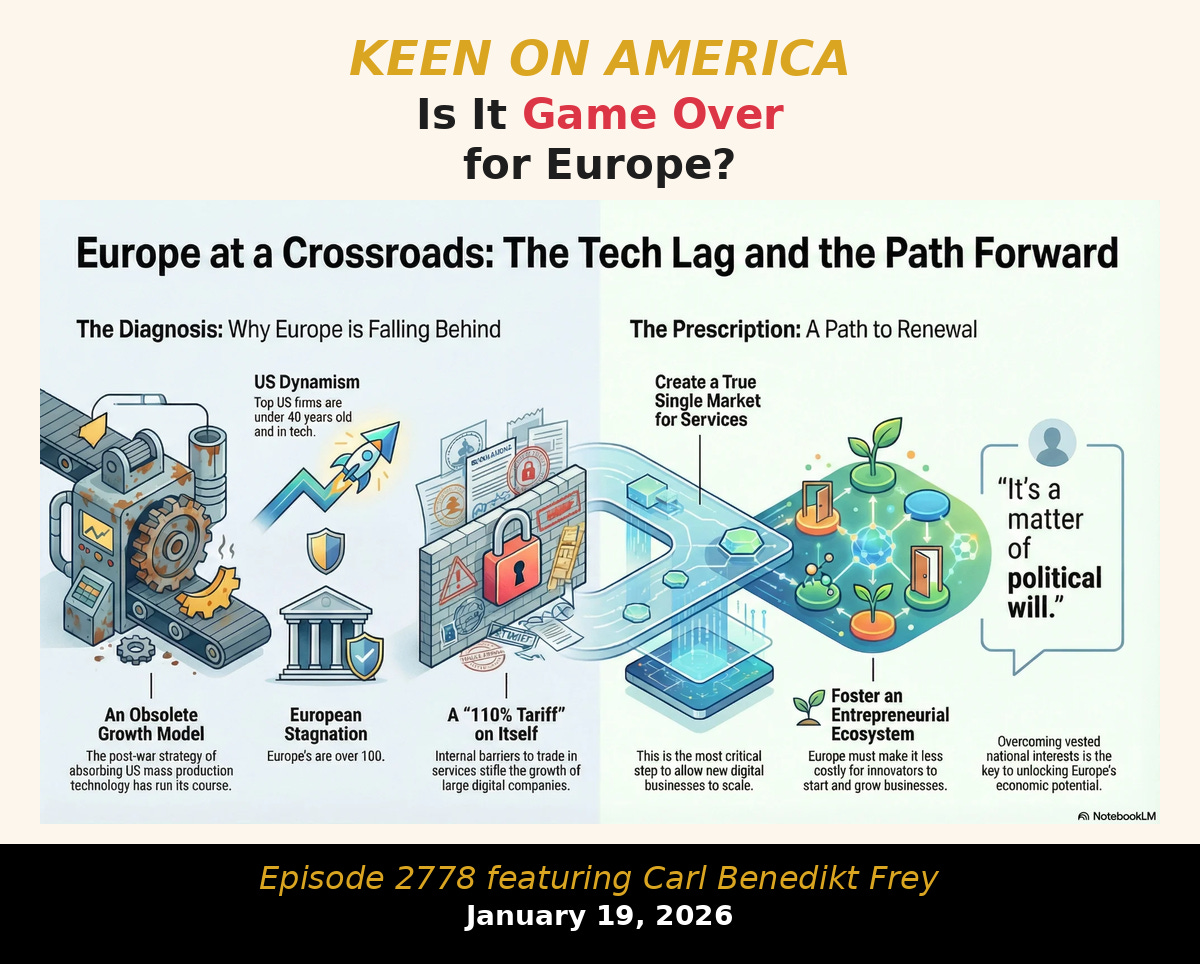

Yesterday’s show from the DLD conference was about the need for Europe to relearn the language of power. Today, things get even more dire for our European friends. I asked another DLD speaker, Carl Benedikt Frey, a Swedish economic historian who teaches at Oxford, whether it’s “game over” for Europe in terms of its ability to compete with American and Chinese big tech. His answer: not yet—but close.

Frey’s last book, shortlisted for the 2025 Financial Times business book of the year, is entitled How Progress Ends: Technology, Innovation and the Fate of Nations. But it’s specifically Europe’s economic progress and the fate of European nations that most concerns Frey. Unless Europeans create a true single market for services, he warns, it really could be the end of the European dream of continent-wide progress. So no more crossroadsfor a continent perennially at a crossroads. And that single market, Frey explains, is ultimately a matter of political rather than economic will.

A reminder for new readers. Each week, That Was The Week, includes a collection of selected essays on critical issues in tech, startups, and venture capital.

I choose the articles based on their interest to me. The selections often include viewpoints I can't entirely agree with. I include them if they make me think or add to my knowledge. Click on the headline, the contents section link, or the ‘Read More’ link at the bottom of each piece to go to the original.

I express my point of view in the editorial and the weekly video.