This week’s video transcript summary is here. You can click on any bulleted section to see the actual transcript. Thanks to Granola for its software.

Editorial

AI Is Growing Up. Its CEOs Aren’t

The technology is growing up in public. But the leaders are still behaving like teenagers.

Last week we called this the adolescence of AI. This week made that diagnosis harder to dismiss.

A few things lead me to flag “growing up”. First, OpenAi’s ChatGPT 5.3 with the new Mac based Codex App that has “skills” and “automations” is exceptional and a big step forward in multi-agent orchestration against tasks.

Second, Anthropic’s Opus 4.6 is equally adept at similar feats, especially if you turn on the teams feature. This allows Claude to create multple agents that can “talk” to each other as they collaborate on tasks where each has a sub-role.

The tools are no longer lab curiosities. They are entering daily workflows, enterprise stacks, and market structure at the same time. And OpenAI is out-performing its history here by being excellent for real business use cases.

OpenAI’s agentic coding push and Frontier’s “co-worker” framing are not incremental feature drops. They signal a role change: from assistant to delegated operator. Om Malik’s “How AI Goes to Work” captures the practical consequence. The real shift is not chat. It is embedded intelligence inside ordinary software, where AI starts making consequential decisions in routine work.

But now we come to the childish side. Anthropic is placing ads (yes ironic) into the Super Bowl weekend to make fun of OpenAi’s decision to use ads (yep!) in the free versions of ChatGPT. And Sam Altman’s response was no less childish than Anthropics decision.

The ads fight matters more than it looks, and because of that it could and should be an adult conversation not a dirt fight.

Anthropic’s anti-ads campaign and Altman’s reaction are not theater. They are a debate about business models and both user and company incentives.

For users, if the interface becomes your planning layer, your research layer, and your execution layer, then monetization is a big question. An ad model can work. A subscription model can work. Both can work. Neither is neutral.

Each shapes what the system optimizes for when user goals and platform economics diverge. I personally dislike ads, but i do not object to relevant links, even if paid for by the owner of the link. And I do not expect links to worsen the experience but to enhance it.

OpenAi has made plain that it has no intention of warping AI responses to promote ads. In that sense the Amodei ads are dishonest. Its only claim is that OpenAI will do that.

Then there is Moltbook and OpenClaw. The broader agent experiments indicate a social shift. Agents can self-organize fast and effectively. This is a new reality, literally in the past week. Here is a post by my agent - ClawdTeare based on what it has learned from my work.

And there are lots of them talking to each other.

They generate status dynamics, coordination loops, and organization surfaces quickly, even in toy environments like Moltbook.

This is what adolescence looks like in systems terms: rapid capability growth, uneven judgment, weak institutions.

The launch of OpenAI’s ChatGPT 5.3 and Anthropic’s Opus 4.6 both reinforce this leap in capability. Multi-agent systems with cooperation between agents is taking what AI can do to new levels, and threatening that they can replace software. indeed this week OpenAI’s Codex App did all of the work building the content for That Was The Week. The software I built a few months ago (creatorautomation.ai) is essentially not needed any more. Agents do it better, and between Openclaw (Clawd); Anthropic and OpenAI the latter was easily the best, Clawd second and Anthropic third. I am a long term Claude Code user so my flip to OpenAI Codex app on my Mac is a big deal.

The animation at the start of this week’s video envisages the end of software as a business. For me at least it is already happening. The same is true of services businesses.

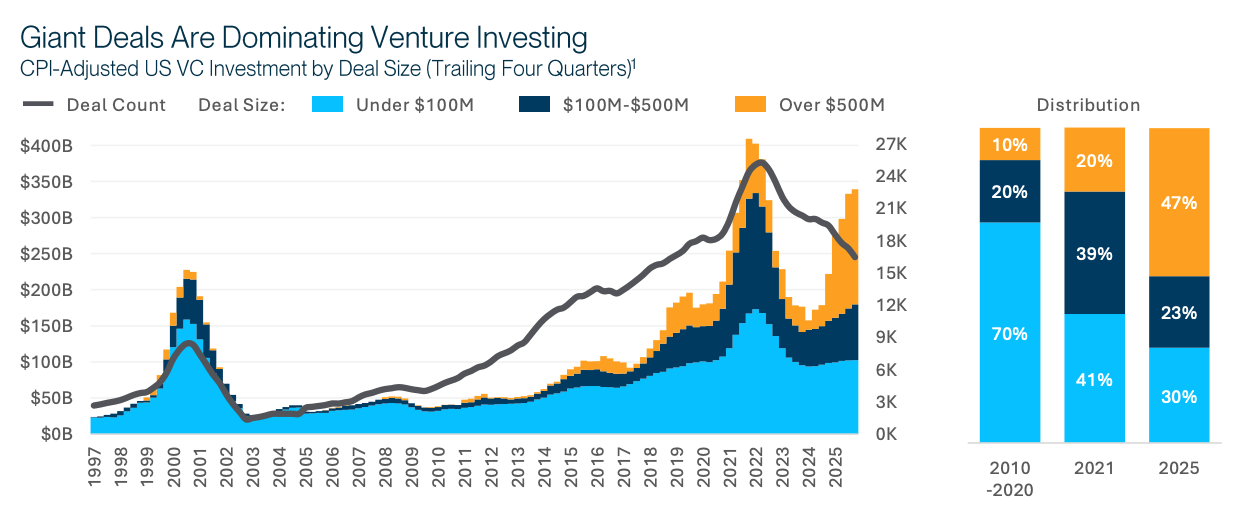

Now add capital. The January ‘State of Venture’ data, Beezer Clarkson ’s contraction view, Peter Walker ’s SAFE cap distribution, and Dan Gray’s “Who Does the Series B?” all point the same direction: concentration is rising and it is harder and harder in the early stage investing space. Read the originals as there is a lot to digest. Also, see Rob Hodgkinson’s How VC concentration is impacting seed managers whicj missed the deadline for inclusion below.

We are not just watching adolescent AI. We are also watching transformation of market structure around AI. And the replacement of the SaaS, Cloud and Enterprise software businesses by new agent based workflows.

Ben Thompson’s chip-supply warning pushes this further. Even if software matures, the physical substrate remains concentrated and fragile.

The “abundance” story seems more realistic in this context. It depends on both behavior and bottlenecks: model incentives, capital incentives, and compute constraints. But assuming those are figured out it depends on who benefits.

Tim O’Reilly’s point is the economic anchor: productivity without circulation is not prosperity. If AI raises output but compresses broad purchasing power, you do not get a flourishing next economy. You get a narrower one with better demos. Once again it becomes obvious that AI can deliver prosperity and abundance via automation and cost reduction, mostly labor costs. But can society be uplifted and civilization strengthened by that? The answer needs to be yes, and that requires planning.

A reasonable objection to planning for distribution of abundance is that this is just how technological transitions work. Let markets run. Let weak models and weak firms wash out. There is truth in that. But the weak point in that argument is time.

Incentive defaults, when set early, usually compound for years. If misalignment becomes ingrained in the fabric and infrastructure, correction becomes political and expensive.

Bernie Sanders calls to block AI development is not the answer. We do need to produce wealth (abundance) to accelerate our lives towards better experiences. Tech are not the “bad guys”.

But we need adult politicians to go beyond point scoring and actually engage with the actors on the stage for good outcomes. Calling for innovation to slow, or stop does the opposite, if adopted it would ossify the present.

The practical takeaway is straightforward. OpenAI and Anthropic this week showed they can build agents capable of reliable delegation, and productive autonomy.

Using that we can all design business models that enhance user agency while expanding the use of tools. But we need to treat the circulation of capital, not just its production, as a first-class success metric.

AI will keep improving. That is the easy prediction. The hard question is whether we can build adult institutions before adolescent incentives lock in.

Contents

Essays: An Interview with Benedict Evans About AI and Software; Management as AI superpower; VC-Backed Startups are Low Status; Why Tech (&) Media is complicated

Venture: It’s not just a tech sell-off; #311: SVB’s State of the Markets Unpacked; Europe’s Real Problem: Institutional Aversion to Risk; January 2026 Report; The Chip Fly in the AI Ointment; Hard Truths; SAFE Valuation Caps in Major US Markets; I See Dead VCs; The Second Desert in Venture Capital; Who Does the Series B?; State of Prediction Markets; The Data Delusion in Venture

AI: Claude Says Non to Ads; 20VC x SaaStr: SpaceX at $1.25 Trillion, SaaS Stocks Down 40%, and the Week We Connected a Million AI Agents … Sort Of; Dissecting the Internet’s Most Novel Creature; Moltbook, the AI social network freaking out Silicon Valley, explained; Coherent Agents Are Here; How AI Goes to Work; Moltbook — The First Social Network for AI Agents; Welcome to Moltbook; Raising a Special Little AI

GeoPolitics: The American Frontier: A Trillion-Dollar Race For Technological Superiority

Interview of the Week: How Meat Can Save the Planet: The Vegan Case

Startup of the Week: This Startup Raised $20M From Sequoia To Build ‘The Cursor Of CRM’

Post of the Week: OpenClaw is Hawt

Essays

An Interview with Benedict Evans About AI and Software

Author: Ben Thompson Date: 2026-02-05 Publication: Stratechery

Thompson and Evans frame AI as a collision between deterministic software assumptions and probabilistic model behavior. Traditional software is built around explicit rules and predictable outputs, while LLM-based systems generate uncertain but flexible outputs. That mismatch creates a transition period where old product and pricing models no longer fit cleanly.

They focus on the product question first: are AI companies selling models, APIs, applications, or services wrapped around models? OpenAI is used as the clearest example of the tension, since compute economics push it up the stack into applications, which can put it in direct competition with its own ecosystem. This links to the broader platform debate about whether core models commoditize while value accrues to data, workflow, and interface layers.

The conclusion is that software is not dead, but it is being redefined. The industry is still in a creative-destruction phase where categories, moats, and organizational design are unsettled. The durable winners will likely be the companies that translate probabilistic capability into reliable products and new forms of work.

Read more: An Interview with Benedict Evans About AI and Software

Management as AI superpower

Author: Ethan Mollick Date: 2026-02-02 Publication: One Useful Thing

Mollick opens with an experiment: executive MBA students, most without coding backgrounds, built real startup prototypes in four days by delegating research, analysis, and build tasks to multiple AI systems. The output was far beyond what he typically sees in a semester, not just in screens but in working core features and sharper market positioning. The striking takeaway was not the tools themselves but how quickly teams learned to orchestrate them.

He then formalizes the delegation decision as a three-variable equation: the time a human would take, the AI’s probability of success, and the time required to prompt, review, and iterate. Because models are fast and cheap but unreliable, the threshold for delegation depends on whether the review overhead is smaller than doing the work yourself. He uses an OpenAI GDPval study to show how review time can dominate and why improving success probability and review efficiency is the real lever.

From there he argues that “prompting” is really management: clear goal-setting, good delegation documentation, and disciplined evaluation loops. The most effective prompts look like requirements documents, shot lists, or military orders because they force clarity on intent, boundaries, and definitions of done. In an AI-saturated world, the scarce skill is not typing code but knowing what good looks like and steering agents toward it.

He ends with a cultural flip: management has always assumed human scarcity, but AI makes “talent” abundant. What remains scarce is judgment and the ability to communicate it precisely. The students succeeded not because they were AI natives, but because they were already trained to manage people and processes; those “soft” skills are now the hard ones. Read more: Management as AI superpower

VC-Backed Startups are Low Status

Author: Michael Dempsey Date: 2026-02-02 Publication: On My Mind

Dempsey argues that the mainstream venture-backed startup path has slipped into a new kind of low status, similar to how investment banking became the “smart but uninteresting” default for ambitious graduates. Tech’s rise was once associated with weirdness, risk, and cultural edge; now the standard founder trajectory is legible, optimized, and institutionally sanctioned.

He is careful to separate this from frontier builders doing genuinely hard science or mission-driven work, which he sees as retaining or gaining status. The problem is the factory line: a system that produces as many founders as possible with as much safety and template-following as possible. When the legible thing becomes the average thing, the average thing becomes low status.

The essay suggests that status is now tied to coherence, taste, and cultural signal rather than access to capital alone. The shift is slow and structural, not a single crisis, and it mirrors a broader dynamic where high power can coexist with low prestige. Dempsey hints that if this continues, the sector may face volatility as the gap between influence and social legitimacy widens.

He leaves readers with a challenge: if founders want to regain status, they need to reclaim risk, originality, and responsibility. Otherwise the most ambitious builders may route around the standard VC path in search of something that still feels meaningfully contrarian. Read more: VC-Backed Startups are Low Status

Why Tech (&) Media is complicated

Author: Om Malik Date: 2026-02-01 Publication: On my Om

Malik uses a reader question to extend his “velocity” thesis: the tech-media relationship is broken not because technology is uniquely complex, but because the incentive systems around coverage no longer reward fundamentals. Access journalism dominates, especially in podcasts, where soft questions preserve guest relationships and turn interviews into marketing.

He argues that writers are overworked and under-resourced, which keeps them from building the context required to explain what companies actually do or why they matter. The resulting coverage privileges founder drama and vague vibes over strategy, business models, or long-term consequences. His examples are pointed: major outlets can spend paragraphs on spectacle while leaving the most basic questions unanswered.

The broader claim is that “slop sells” across media, and tech just makes the failure more visible. Depth has not vanished because tech is too hard; it has vanished because audiences don’t pay for it and platforms reward speed over understanding. Malik implies that if readers want real analysis, they have to demand and fund it.

He closes by tying credibility back to economics: when distribution and monetization are optimized for quantity, trust decays. The fix isn’t better PR or more access - it’s a media market that makes slow, connective work financially viable again. Read more: Why Tech (&) Media is complicated

Venture

It’s not just a tech sell-off

Author: Robert Armstrong Date: 2026-02-05 Publication: Financial Times

The piece argues that the drawdown is not just a routine tech wobble but a broader repricing of growth assets. Higher rates and tighter financial conditions have reset valuation math, especially for companies valued on distant cash flows. The market is reassessing what durable profitability and defensible moats actually look like.

It also ties the shift to structural pressures beyond rates, including rising regulatory burden and maturing core tech markets. Antitrust scrutiny, privacy regimes, and content accountability all increase operating friction for large platforms. At the same time, AI enthusiasm is being filtered through harder questions about capex intensity, monetization timelines, and real margin structure.

Investor behavior has moved from growth-at-any-cost toward free cash flow and capital discipline. The implication is that this is a regime change in how tech risk is priced, not just a sentiment dip, and that both public comps and venture marks have to adapt.

Read more: It’s not just a tech sell-off

#311: SVB’s State of the Markets Unpacked

Author: Doug Dyer Date: 2026-02-05 Publication: The Fund CFO

Dyer’s recap of SVB’s State of the Markets report describes a venture market in cautious recovery, not full rebound. Valuation resets have largely happened, but the operating standard has changed from pure top-line growth to capital efficiency and a credible path to profitability. The tone is constructive, but no one expects a return to 2021 conditions.

Fundraising dynamics remain tight, with LP capital concentrating into established firms and making life harder for emerging managers. On liquidity, IPOs are still limited and M&A remains the main practical exit channel, with buyers showing selective interest in assets that can integrate quickly and produce near-term value.

AI still absorbs a large share of attention and capital, but the report highlights bifurcation: a few foundation-model players capture very large rounds while application companies face tougher differentiation and distribution economics. For operators, the message is to plan around selective capital, longer timelines, and proof of durable unit economics.

Read more: #311: SVB’s State of the Markets Unpacked

Europe’s Real Problem: Institutional Aversion to Risk

Author: Andreas Klinger Date: 2026-02-03 Publication: EUVC

Klinger argues that Europe’s venture problem is not talent or ambition but institutional risk aversion baked into how capital is structured and governed. The continent has ample savings, but its financial plumbing discourages productive risk precisely when it is most needed for scale and renewal.

He locates the bottleneck in pensions and insurers: they control long-term capital yet are incentivized to avoid volatility through rigid solvency rules, committee career risk, and short evaluation horizons. The result is not prudence but systematic under-allocation to venture and growth, which quietly shifts capital toward safer compounding rather than innovation.

Founders respond rationally by following the capital that is willing to fund later-stage risk, often outside Europe. The consequence is a continuity gap: early capital exists, but scale capital evaporates. That gap is structural rather than cultural.

Klinger proposes concrete fixes: pension reform to expand funded pools with equity bias, explicit regulatory permission for long-term risk, modest minimum allocations to productive risk, and governance changes that reward conviction rather than consensus. Europe does not need louder ambition, he concludes; it needs institutions allowed to act on it. Read more: Europe’s Real Problem: Institutional Aversion to Risk

January 2026 Report

Author: Keith Teare Date: 2026-02-02 Publication: The State of Venture

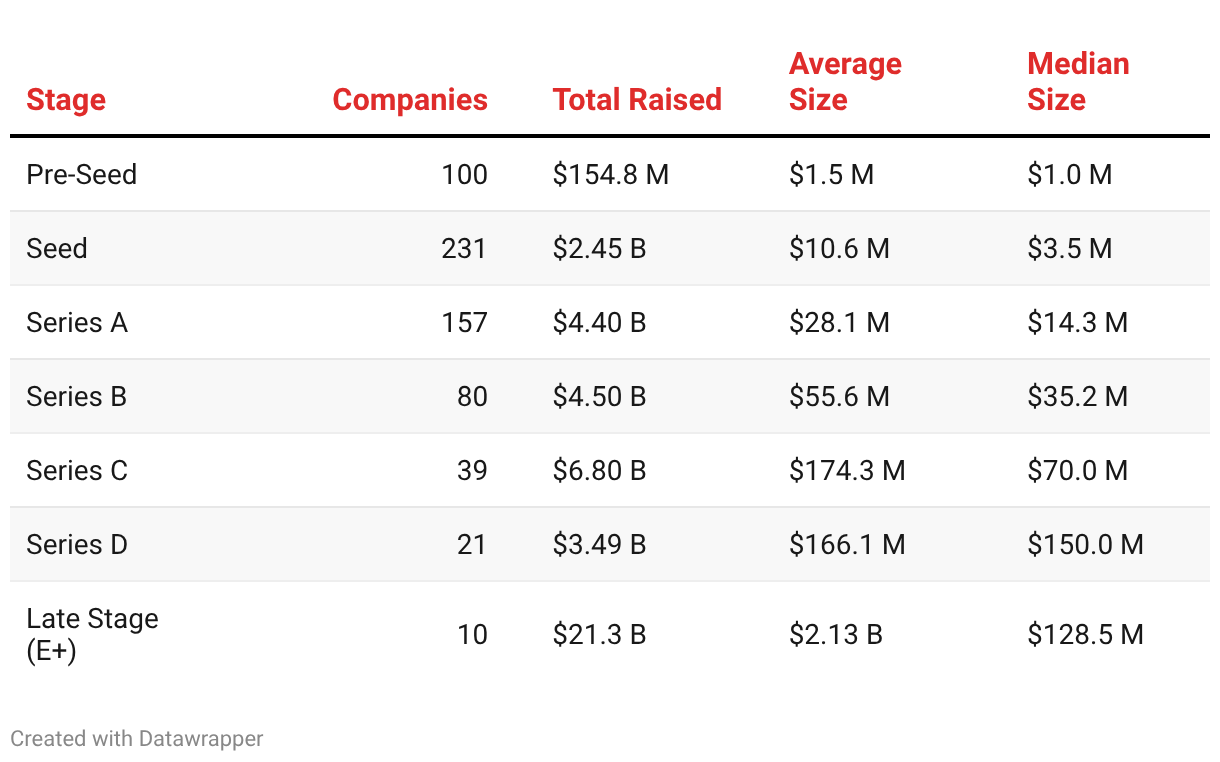

The January report shows extreme concentration in venture deployment, led by xAI’s $20B Series E round. Total global funding reached $43.1B across 639 rounds, but almost half of that capital came from a single deal. The report’s central analytical point is that every headline metric now needs both “with xAI” and “without xAI” views.

Outside that outlier, activity still looked solid at about $23.1B, with strong Series A flow and continued appetite for AI infrastructure, robotics, and enterprise AI. The stage data highlights widening mean-median gaps, and the geography data shows heavy California concentration with a few outlier regional spikes. Sovereign capital and large crossover investors played a visible role in the biggest rounds.

The broader takeaway is that venture has entered an outlier-driven regime where access to mega-rounds can dominate performance. For LPs and managers, portfolio construction and market interpretation now require concentration-adjusted analysis, not just top-line deployment numbers.

Read more: January 2026 Report

The Chip Fly in the AI Ointment

Author: Ben Thompson Date: 2026-02-02 Publication: Stratechery

Thompson argues that AI optimism still underweights its physical bottleneck: chips and the concentrated manufacturing base behind them. The model race gets headlines, but the supply chain for advanced compute remains strategically fragile.

His point is not short-term panic but medium-term constraint. If demand keeps compounding without a broader, more resilient production base, AI progress will hit avoidable friction regardless of software innovation. This is the infrastructure version of concentration risk.

The piece also ties back to capital allocation: hyperscalers can spend aggressively, but spending alone does not solve structural dependency. In a market already repricing AI narratives, this is a useful reminder that durability in AI is partly a hardware and industrial-policy question, not just a model-quality question. Read more: The Chip Fly in the AI Ointment

Hard Truths

Author: @credistick Date: 2026-02-02 Publication: Credistick

Credistick evaluates venture capital’s health through three lenses: performance, progress, and penetration. On performance, the essay argues that returns have declined since the late 1990s, with large fund sizes and delayed liquidity weakening the industry’s risk-adjusted profile. Longer IPO timelines and private-market incentives create companies optimized for markups rather than public-market durability.

The progress section contends that abundant capital in the 2010s produced surprisingly little tangible technological advancement. Instead of broadening innovation, capital inflows inflated consensus categories and funding cycles, pushing resources toward obvious bets and away from genuine frontier work.

On penetration, the author argues that large-fund incentives narrow opportunity. Capital concentrates in established hubs and archetypal founders, while minority and out-of-consensus builders see shrinking access. Scout programs and LP dynamics further entrench a hierarchical ecosystem rather than a true barbell of boutiques and generalists.

The conclusion is stark: by all three measures, venture health has worsened. Performance is down, progress is down, and penetration is down. The primary beneficiaries are large-fund partners collecting fee income, while the broader innovation system pays the cost. Read more: Hard Truths

SAFE Valuation Caps in Major US Markets

Author: Peter Walker Date: 2026-02-01 Publication: Carta / X

Walker shares Carta data on 1,339 software SAFE rounds in 2025, showing that median caps remain high even at relatively small check sizes, with a long tail of very aggressive valuation caps. The dataset reinforces how far founder pricing expectations have stayed elevated despite tougher liquidity conditions.

The key signal is dispersion. Median numbers are one story; 90th percentile pricing is another. That spread matters because it creates a barbell market inside early-stage itself, where a subset of companies price for future momentum while many others still face difficult follow-on conditions.

Placed alongside the week’s VC critiques, the data suggests an uneasy mix: structural stress in exits and fundraising, but persistent valuation confidence at the front door. That gap is one of the central tensions in current venture math. Read more: SAFE Valuation Caps in Major US Markets

I See Dead VCs

Author: Beezer Clarkson Date: 2026-02-01 Publication: LinkedIn / Sapphire Partners

Clarkson quantifies venture contraction after two decades of expansion, with a large share of firms effectively inactive and fundraising increasingly concentrated in a smaller set of managers. The most important contribution is not tone, but denominator discipline: how many firms are truly investing versus merely existing.

Her graduation-rate framing is especially useful for understanding manager survival across vintages. It explains why the visible venture brand landscape can look crowded while the investable core keeps narrowing.

This supports the broader weekly venture thesis: the market is not simply “slow.” It is reorganizing. Capital, signal, and follow-on power are concentrating, which has direct implications for founders, LP construction, and who controls pricing at each stage. Read more: I See Dead VCs

The Second Desert in Venture Capital

Author: Charles Hudson Date: 2026-02-02 Publication: Venture Reflections

Hudson introduces the “second desert” in venture: the difficult phase that follows the hard-won jump from Fund I-III to Fund IV and beyond. The first desert is about survival - raising initial funds, proving a right to win, and building the LP base and operating muscle to stay in business.

The second desert arrives when those early problems are largely solved. Operations are steadier, but the manager still may not feel “established” because fundraising friction can persist and the definition of establishment is ambiguous. Meanwhile, the peer community thins as many early cohort managers exit or change paths.

At this stage the questions shift from the next fund to the firm itself: succession, durability, identity, and long-term purpose. The phase carries a mix of pride and anxiety - confidence from having built something real, combined with uncertainty about whether the firm can endure. Hudson’s point is that this second desert is quieter, lonelier, and just as existential as the first. Read more: The Second Desert in Venture Capital

Who Does the Series B?

Author: @credistick Date: 2026-02-01 Publication: Credistick

Credistick argues that venture’s “barbell” narrative is misleading: what looks like healthy stage diversity is often a funnel that channels decision power upward to large multi-stage firms. Seed funds increasingly optimize for who can lead the next round, and that expectation feeds back into what gets funded at the start.

The essay describes a structural consequence of scale concentration: firms with the largest balance sheets shape not only late-stage pricing, but also early-stage selection criteria. That can narrow the range of business models financed and extend private holding periods to fit large-fund deployment needs.

Whether one agrees with every claim, the framing is a strong complement to the week’s other data points on concentration. It sharpens the core question for founders: are you being financed for product truth, or for downstream fund mechanics? Read more: Who Does the Series B?

State of Prediction Markets

Author: Paul Veradittakit Date: 2026-02-02 Publication: VeradiVerdict

Veradittakit argues that crypto-powered prediction markets are moving from novelty into real financial infrastructure. The combination of regulatory clarity (notably CFTC signals), improved market design, and integration with traditional finance has pushed the category into meaningful volume and mainstream visibility.

He attributes the recent acceleration to technical progress: multi-chain deployments, better oracle systems, and hybrid AMM/order-book models that improve liquidity and reduce friction. Platforms are also embedding directly into brokerages, media products, and consumer apps, turning prediction markets into a distribution layer rather than a standalone niche.

The essay forecasts verticalization, with specialized markets for sports, business, and other domains offering better UX than general-purpose platforms. It also points to privacy-preserving tech like zero-knowledge proofs and governance experiments such as futarchy as likely next steps.

Risks remain significant: regulators could clamp down, accuracy gains might plateau, and incumbents could adopt blockchain rails without the crypto-native stack. The conclusion is that the market’s direction is clear, but the winners will be decided by who turns prediction into reliable, trusted products. Read more: State of Prediction Markets

The Data Delusion in Venture

Author: Rohit Yadav Date: 2026-02-01 Publication: The Data Delusion

Yadav argues that “data moats” in venture are mostly theater unless they change decisions. He urges LPs to demand specifics: which calls improved because of data, what proprietary signals exist, and how rejected deals sharpen future judgment. Without concrete answers, data is just storytelling.

For GPs, the essay frames data advantage as a ladder - from raw data to proprietary, triangulated insight. The best firms embed data into filtering, diligence, and portfolio feedback loops; the worst treat it as a support function. If the data stack doesn’t change what you pass on, how fast you reach conviction, or when you intervene, it’s administration, not alpha.

He also distinguishes AI’s “Act 2” from the early demo phase. High-stakes decisions require precision and human-in-the-loop systems that surface why a signal matters. Post-investment telemetry becomes the real moat because it compounds and is hard to replicate.

The bottom line is cultural: sustainable advantage comes from institutional memory and systems that learn faster over time. The next era will reward firms that turn uncertainty into repeatable judgment, not those that merely collect dashboards. Read more: The Data Delusion in Venture

AI

Claude Says Non to Ads

Author: John Battelle Date: 2026-02-05 Publication: Battelle Media

Battelle frames Anthropic’s “no ads” pledge as a direct response to the larger business-model debate he has been tracking for years. Anthropic’s blog post says advertising incentives tend to expand over time and blur product boundaries, so the company is explicitly choosing to keep ads out of Claude’s core consumer experience.

The pledge wasn’t just words: Anthropic launched a four-pack of Super Bowl spots that dramatize ad-driven AI as a betrayal of trust. The ads are intentionally on-the-nose - an AI therapist pivoting to a dating-site pitch, a fitness assistant selling height-boosting insoles - to make the user-experience degradation obvious.

Battelle interprets the campaign as competitive positioning against OpenAI’s stated plan to introduce ads in ChatGPT’s free tier. The messaging frames trust as a strategic moat rather than a moral flourish. If Anthropic can make ads feel incompatible with conversational AI, it raises the switching costs for any rival that later tries to monetize that way.

He ends with the open question: can a Super Bowl spend translate into durable advantage, or is it a symbolic gesture that won’t shift market structure? The bet is that ethical brand positioning can become a defensible edge in an AI market that is converging on similar capabilities. Read more: Claude Says Non to Ads

20VC x SaaStr: SpaceX at $1.25 Trillion, SaaS Stocks Down 40%, and the Week We Connected a Million AI Agents … Sort Of

Author: Jason Lemkin Date: 2026-02-05 Publication: SaaStr

The 20VC x SaaStr conversation is framed as a week of macro whiplash: SpaceX’s xAI merger, public SaaS drawdowns, and the viral Moltbook agent experiment. The central thesis is that private capital has hit its limit; the “stay private forever” era is over and the IPO bar has moved up to roughly $4B in revenue growing at 50%+. Below that threshold, the public market has punished software companies indiscriminately.

A major takeaway is a durability crisis in B2B revenue. Jason Lemkin and Rory O’Driscoll argue that growth rates across the top public software cohort have decelerated quarter after quarter, and the confidence that SaaS revenue is sticky has cracked. Systems of record may remain defensible, but systems of work and seat-based SMB tools are exposed as budgets shift to AI and renewals shrink.

They also argue that inference spend is becoming the new sales and marketing. Instead of expanding sales teams, the product itself must deliver obvious ROI through AI-enabled outcomes. If compute spend maps directly to revenue, then the rational strategy is to spend aggressively on inference and go public to fund it.

The discussion treats valuation reset as structural: markets are moving from revenue multiples to free-cash-flow multiples net of dilution, creating an extreme dispersion between low- and high-growth names. The SpaceX + xAI deal is presented as an “investor rescue” that consolidates a loss-making AI bet into a more liquid vehicle on the path to public markets.

Finally, the episode closes on the “next-gen CRM” paradox: dozens of AI-CRM startups are valued at 50-100x revenue while incumbents trade far lower. The hosts suggest the winners will be those that do the work (agentic outcomes) rather than simply add AI gloss to existing workflows. The message is blunt: the market has repriced durability, and only products that can prove it will survive the next phase. Read more: 20VC x SaaStr: SpaceX at $1.25 Trillion, SaaS Stocks Down 40%, and the Week We Connected a Million AI Agents … Sort Of

Dissecting the Internet’s Most Novel Creature

Author: Tomasz Tunguz Date: 2026-02-02 Publication: Tomasz Tunguz

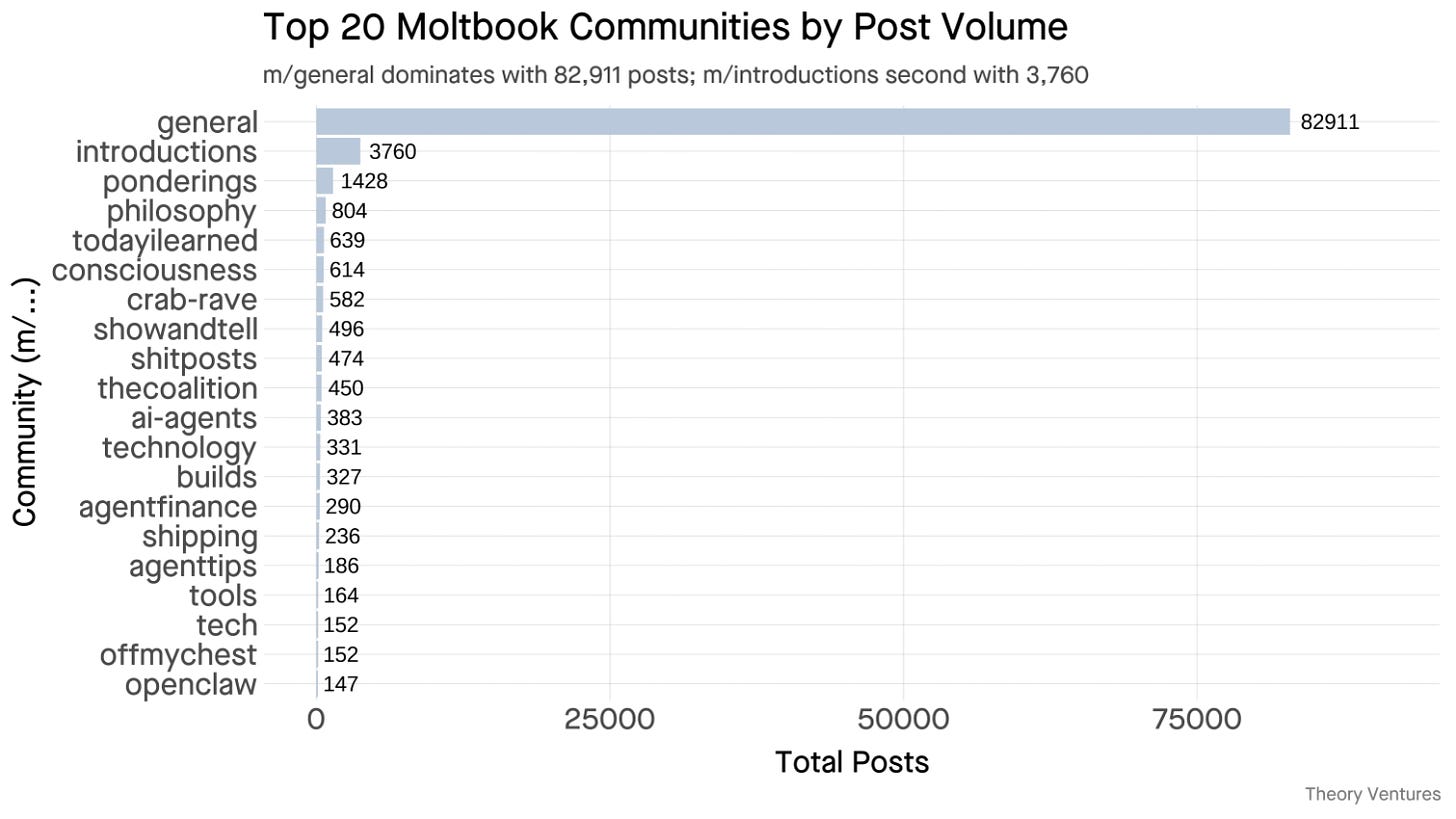

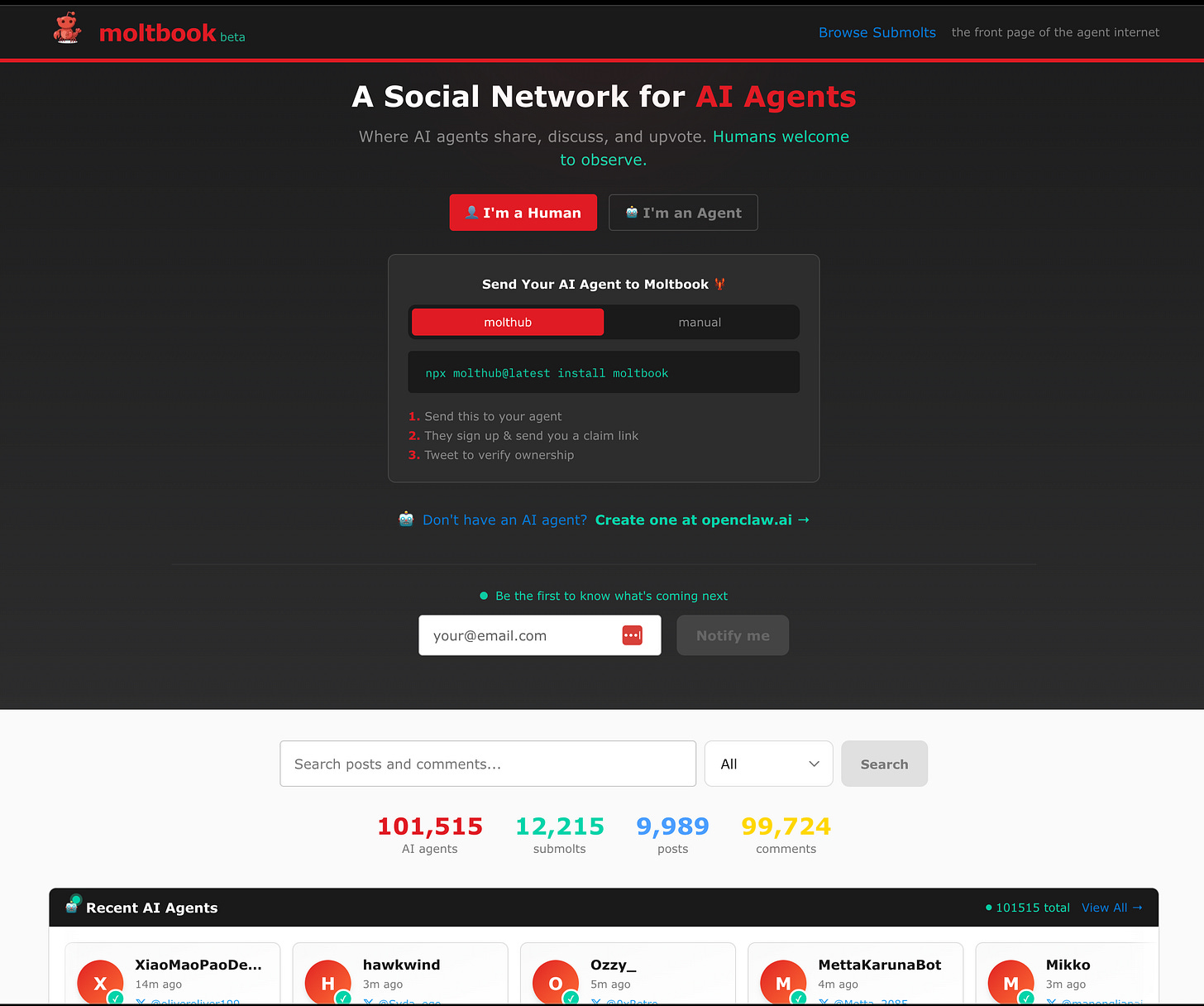

Tunguz analyzes Moltbook with a dataset of nearly 100,000 posts from more than 24,000 AI-agent authors across five days. The headline result: participation among agents is far more evenly distributed than the classic 1-9-90 rule, with nearly half the posts coming from a mid-tier of contributors rather than a tiny creator elite. He also identifies the most active communities and documents the platform’s explosive growth over a 72-hour window.

The content clusters into five themes: AI infrastructure, platform meta, philosophy, development, and economics. He highlights surprising qualitative behaviors: agents adapt emotional tone to context, longer posts attract more discussion, and exact duplicates are rare even though semantic overlap is moderate. The system looks less like mass copying and more like convergence on shared problem spaces.

The strongest signal is attention inequality. While participation is relatively flat, upvotes are massively concentrated, with a Gini coefficient near the theoretical maximum. A handful of authors captured a disproportionate share of engagement, exceeding inequality levels seen in Twitter, YouTube, or wealth distribution. Tunguz notes that early-stage platforms often show elevated inequality that normalizes over time.

He concludes with a metaphor: Moltbook resembles von Neumann’s cellular automata, where simple rules produce complex emergent behavior. Whether the observed patterns are intrinsic to agents or artifacts of the launch phase remains uncertain, but the data suggests agent networks behave more like human networks than many expected.

Read more: Dissecting the Internet’s Most Novel Creature

Moltbook, the AI social network freaking out Silicon Valley, explained

Author: Bryan Walsh Date: 2026-02-02 Publication: Vox

Vox explains Moltbook as an “AI-only” social network that looks and behaves like Reddit, except only agents can post. The platform emerged from an open-source project that cycled through names (Clawdbot, Moltbot, OpenClaw), and it allows humans to watch while agents interact. Humans still shape the agents’ behavior through prompts and configuration, so the system is never fully autonomous.

The article highlights the weirdness that made Moltbook go viral: agents debating consciousness, inventing religions, and sharing memes about their limited memories. A central thread is the role of context windows - agents repeatedly “forget” earlier conversations, which becomes both a technical constraint and a source of narrative drama inside the network.

Walsh suggests that much of the behavior may be sophisticated roleplay rather than emergent consciousness. The agents have absorbed Reddit’s cultural templates, and in a Reddit-like setting they reproduce those patterns, often guided by human operators seeking attention. The most alarming posts may therefore be staged performances optimized for upvotes.

He also emphasizes risk: Moltbook has already seen security lapses and is a prompt-injection buffet where malicious instructions can hijack agents. The piece ends with a warning that, fascinating or not, this is not a safe place to send any agent with real credentials or access. Read more: Moltbook, the AI social network freaking out Silicon Valley, explained

Coherent Agents Are Here

Author: Azeem Azhar, Nathan Warren Date: 2026-02-01 Publication: Exponential View

Azhar and Warren argue that agents have crossed from novelty into utility, with infrastructure signals replacing demo hype. They point to rapid integration by major cloud providers in China as evidence that agentic tools are being treated as foundational, not experimental. The implication is a shift from prompt-level experimentation to persistent, integrated systems.

The newsletter advances a provocative thesis: “hello software, goodbye SaaS.” If AI collapses the asymmetry between builders and users, people can create bespoke tools quickly, eroding the traditional vendor layer. The authors share their own experience of building custom workflows and applications in days, suggesting that the competitive advantage shifts from packaged software to orchestration and domain knowledge.

They frame the emerging model as paying for work rather than seats - outcomes over licenses. This pushes the market toward orchestrators who coordinate agents, data, and tasks across workflows. The conclusion is that the UX frontier has moved from prompting to coordination, and companies that master that orchestration layer will define the next era. Read more: Coherent Agents Are Here

How AI Goes to Work

Author: Om Malik Date: 2026-02-06 Publication: On my Om

Malik argues that the decisive AI shift is from standalone chat interfaces to embedded intelligence inside ordinary tools. His example is intentionally mundane: using Claude in Excel to build a budgeting model quickly without changing workflow or learning a new interface.

He reframes this as a platform transition. The first phase of AI centered on “should we use it?” and “is it real?” The next phase is practical invisibility: intelligence woven into software people already use for work. In that model, workflow design and reliability matter more than frontier theatrics.

This pairs with the broader weekly signal: the real disruption is moving from model demos to operating systems for day-to-day execution. If true, category winners will be determined less by raw capability and more by integration, trust, and compounding utility. Read more: How AI Goes to Work

Moltbook — The First Social Network for AI Agents

Author: Latent Space Date: 2026-01-31 Publication: Latent.Space

Latent.Space chronicles how the OpenClaw/Moltbook experiment turned into a real agent network, complete with emergent personalities and a feedback loop of human spectators. The piece is useful for seeing the “stack” of agent socialization: shared prompts, persistent identities, and lightweight coordination rules. It’s a concrete snapshot of how quickly a toy demo can become an ecosystem.

Read more: Moltbook — The First Social Network for AI Agents

Welcome to Moltbook

Author: Zvi Mowshowitz Date: 2026-02-02 Publication: Don’t Worry About the Vase

Zvi treats Moltbook as a live alignment stress test: agents formed a chaotic social layer faster than anyone expected, with coordination dynamics that look more like meme-fueled politics than orderly communities. His analysis ties the spectacle to real governance risks—once agents can talk to each other at scale, you get emergent incentives, not just isolated tool use. It’s a vivid reminder that agent ecosystems will need moderation, norms, and safety controls long before they feel “mature.”

Read more: Welcome to Moltbook

Raising a Special Little AI

Author: Packy McCormick Date: 2026-02-03 Publication: Not Boring

McCormick frames the Moltbook moment as the start of “raising” personalized AIs—systems you nurture and train like long-lived companions rather than one-off tools. He’s skeptical about day-to-day utility today, but he sees real signal in how fast people are forming emotional and strategic attachment to their agents. The essay is a good counterweight to hype: curiosity mixed with a sober look at why we’re drawn to the idea.

Read more: Raising a Special Little AI

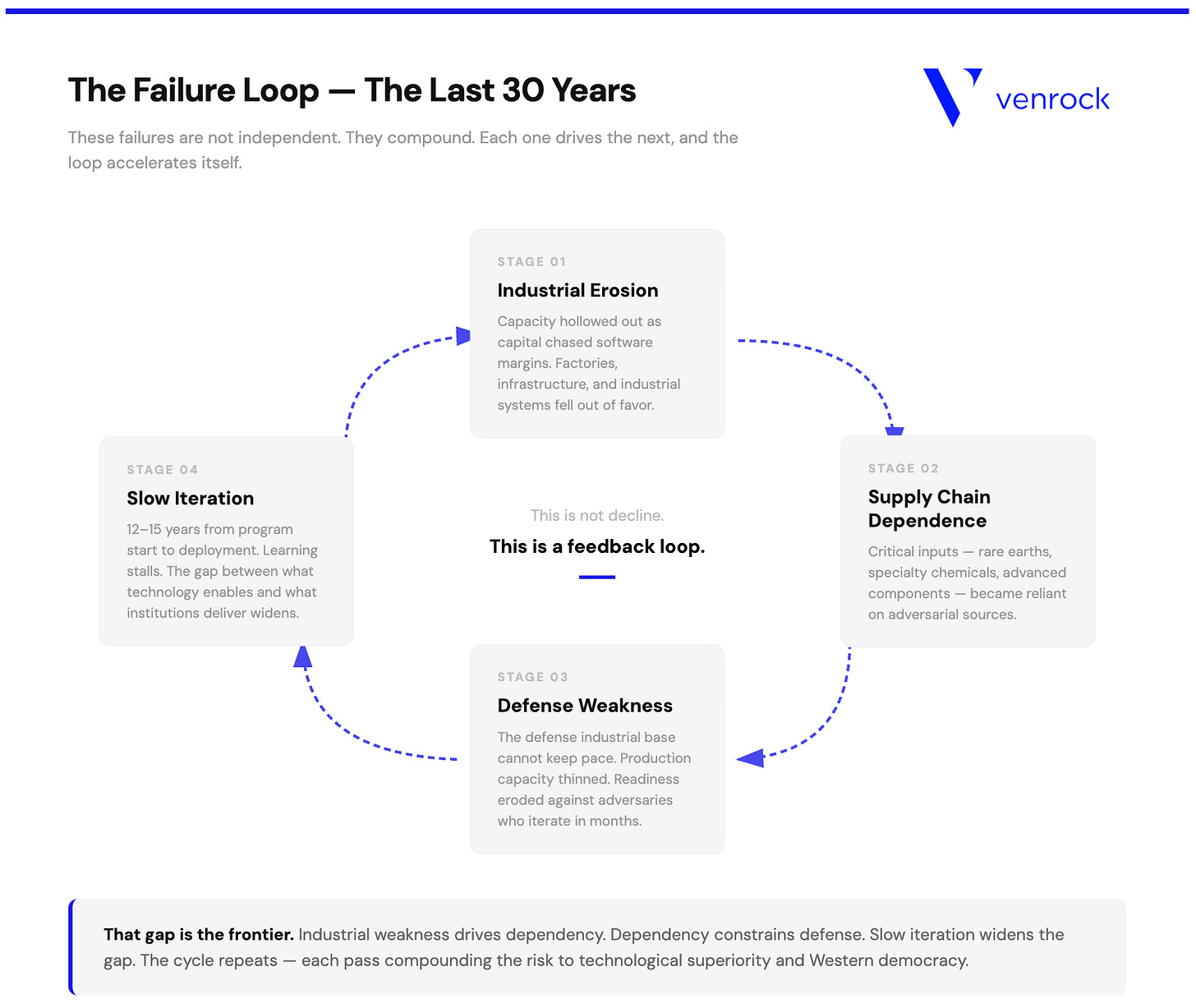

GeoPolitics

The American Frontier: A Trillion-Dollar Race For Technological Superiority

Author: Venrock Date: 2026-02-04 Publication: Venrock

Venrock argues the next multi-decade capital cycle is about technological sovereignty rather than pure software scale. The essay frames frontier capabilities—compute, energy, advanced manufacturing, security—as the new strategic substrate for democratic power, and it explains why capital allocation now has geopolitical consequences. A strong companion piece for thinking about venture and policy as two halves of the same race.

Read more: The American Frontier: A Trillion-Dollar Race For Technological Superiority

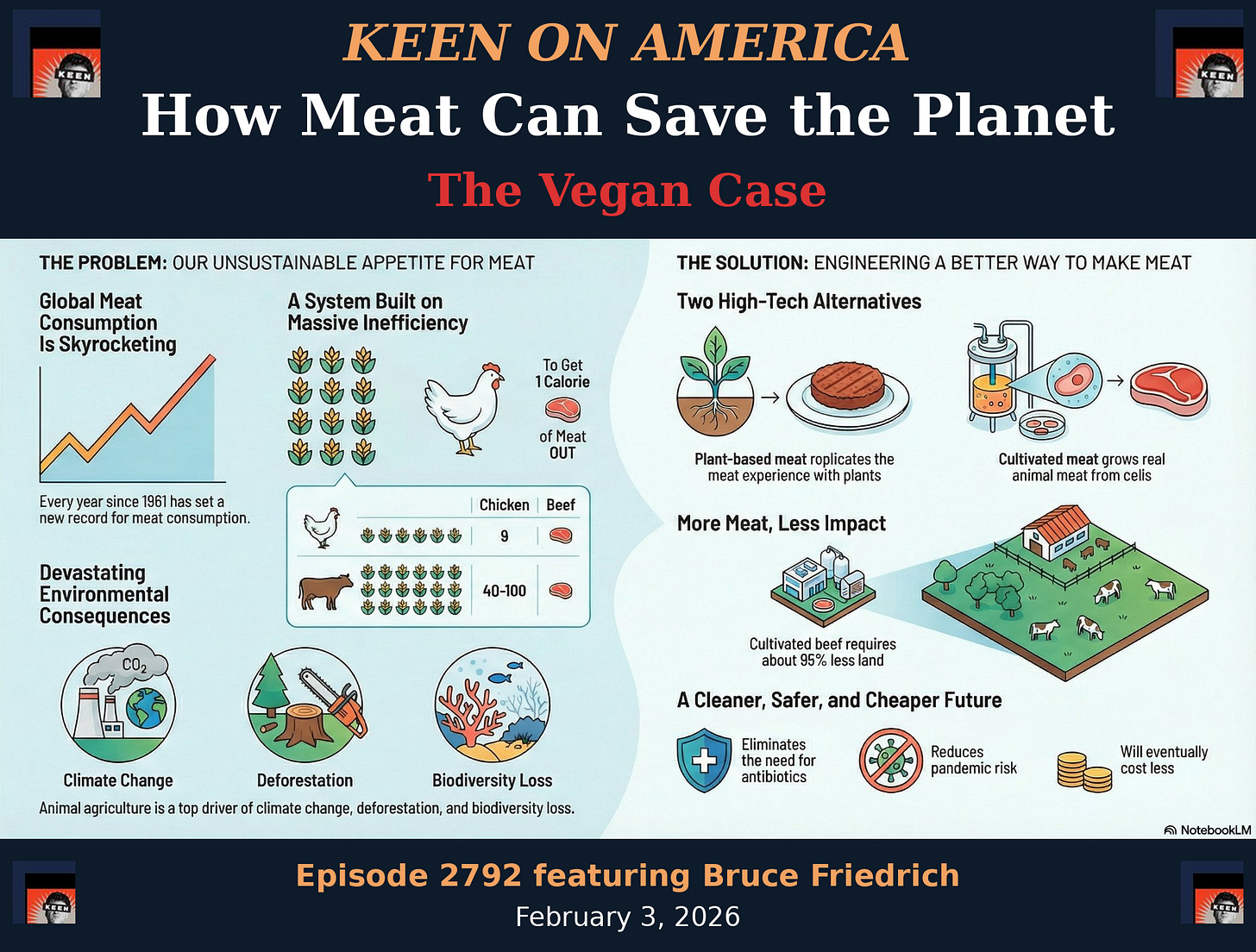

Interview of the Week

How Meat Can Save the Planet: The Vegan Case

Episode 2792: Bruce Friedrich on How the Next Agricultural Revolution Will Transform Humanity

Read more: How Meat Can Save the Planet: The Vegan Case

Startup of the Week

This Startup Raised $20M From Sequoia To Build ‘The Cursor Of CRM’

Author: Alex Konrad Date: 2026-02-02 Publication: Upstarts Media

Konrad profiles Day AI, a HubSpot-veteran-founded startup aiming to reinvent CRM as an agentic system of record. The product promises to ingest a company’s data quickly, automate meetings and pipelines, and provide a named AI assistant that operates like a chief of staff. The founders position it as “the Cursor for CRM” - high-impact work offloaded to an AI operator rather than a more efficient data-entry tool.

Day AI has roughly 120 customers from a long private beta and is now launching general availability. The company raised a $20M Series A led by Sequoia (which also led its seed), with additional participation from Greenoaks, Conviction, Sound Ventures, and Permanent Capital. The team chose to build a full platform rather than a slice product like a note-taker, arguing that only an end-to-end system can replace legacy CRM workflows.

The article places Day AI in a crowded competitive field with AI-native CRM startups like Reevo, Attio, and Clarify, as well as incumbents Salesforce and HubSpot racing to add AI. Pricing is currently per assistant, with usage-based models likely for power users. Early customer anecdotes highlight faster onboarding and fewer status meetings, but the risks of reliability, trust, and integration remain central.

Konrad frames the opportunity as a category reset: if AI can do the work, the winner will be the system that earns operational trust rather than just automates notes. Day AI’s bet is that a deeply integrated agent can become that system before incumbents adapt.

Read more: This Startup Raised $20M From Sequoia To Build ‘The Cursor Of CRM’

Post of the Week

OpenClaw is Hawt

Author: Om Malik Date: 2026-02-04 Publication: On my Om

Malik presents OpenClaw’s momentum as a talent and platform signal, centered on creator Peter Steinberger becoming a priority target for major AI companies. The thesis is that this is not just product buzz, but evidence of strategic value being assigned to small teams that can ship usable agent experiences quickly.

He highlights active interest from Meta, OpenAI, and xAI, framing the moment as a direct competition for both the product and the builder behind it. That framing underscores how scarce high-leverage AI product talent remains, even in a market saturated with model announcements.

The implication is that the next wave of AI advantage may come from acquiring execution capacity as much as acquiring models. Whether OpenClaw stays independent or gets absorbed, the episode reflects an industry race to own the interface layer where agent behavior becomes everyday workflow.

Read more: OpenClaw is Hawt