A reminder for new readers. That Was The Week includes a collection of my selected readings on critical issues in tech, startups, and venture capital. I selected the articles because they are of interest to me. The selections often include things I entirely disagree with. But they express common opinions, or they provoke me to think. The articles are sometimes long snippets to convey why they are of interest. Click on the headline to go to the original or the ‘More’ link at the bottom of each piece. I express my point of view in the editorial and the weekly video below.

Congratulations to this week’s selected creators: @mvpeers,@jgkelley, @CollingsPaige, @hbarra, @krishnanrohit, @geneteare, @chudson, @aliyalakhani, @jeffbeckervc, @nvidia, @LanceUlanoff, @JoannaStern, @RachelEnsignWSJ, @gvipers, @viaCristiano, @jacobbogage, @marianaa_alfaro, @stevesi, @mgseigler, @oliverbethell, @abbyohlheiser, @alex, @ChristineMHall, @Jessicalessin, @Cyantist

Contents

Editorial: Ban Foreigners Owning Key Assets?

NVIDIA CEO Jensen Huang

The Information

Cyan Bannister on Space X and Elon Musk

Editorial: Ban Foreigners Owning Key Assets?

As I digested the news that the House had voted to force Chinese-based investor ByteDance to divest ownership in TikTok, I pondered whether the US or US companies owned key strategic assets in other nations. I was pretty sure the answer was yes.

I asked ChatGPT:

What key assets of overseas countries are owned by the United States or US Companies?

The answer was long. There are a lot, covering Real Estate, Energy and Natural Resources, Financial Services, Technology and Telecoms, Infrastructure, Media, Entertainment, Agriculture, and Pharmaceuticals and healthcare.

I asked it to dive deeper into Energy and Natural Resources:

Can you expand on energy and natural resources and list the top 5 assets that are US-owned by strategic to the country in question?

ChatGPT

Expanding on the energy and natural resources sector, U.S. companies' overseas investments often focus on areas with significant strategic value, either due to their size, the nature of the resources, or their critical role in the host country's economy. Identifying the "top 5" assets can be challenging due to the dynamic nature of the industry and the sensitivity around such strategic assets. However, I can provide examples that highlight the kind of assets that would be considered strategically significant:

Oil Fields in the Middle East: U.S. companies have long had interests in the Middle East's oil fields, which are among the world's largest and most productive. An example would be Chevron's stake in the Partitioned Zone between Saudi Arabia and Kuwait. These assets are crucial due to their vast reserves and the global oil market's dependence on Middle Eastern oil.

Natural Gas Projects in Australia: The U.S. energy giant Chevron operates two of Australia's largest natural gas projects, Gorgon and Wheatstone. Australia is a key player in the global LNG market, and these projects represent significant U.S. interests in the region, providing energy to Asia-Pacific markets.

Mining Operations in Africa: U.S. companies have significant mining operations in Africa. For instance, Freeport-McMoRan's involvement in the Democratic Republic of the Congo's cobalt and copper mining industry is crucial, given cobalt's importance in battery production for electric vehicles.

Shale Gas in Argentina: U.S. companies like Chevron and ExxonMobil are involved in Argentina's Vaca Muerta shale formation, one of the largest reserves of shale gas and oil outside North America. This is strategic for Argentina, contributing to its energy security and potential as an energy exporter.

Renewable Energy Investments in Europe: U.S. companies are increasingly investing in renewable energy assets abroad, such as Iberdrola, a Spanish company in which the U.S. investment bank JPMorgan Chase holds a significant stake. This investment is strategic as Europe transitions towards sustainable energy, and Iberdrola is a major player in wind and solar energy.

These examples illustrate the diverse nature of U.S. energy and natural resource investments abroad, emphasizing assets that are strategically important due to their size, the resources they provide, or their role in the host country's energy sector.

What is the point of this exercise? The goal is to illustrate that global interconnectedness is the norm, not the exception. International relations have had reciprocity—allowing foreign companies to operate in the U.S. fosters a reciprocal environment where American companies can also expand and thrive overseas. The moment the domicile of ownership appears as an issue, the biggest loser will be the largest owner of foreign assets—hint: not China.

TikTok does not represent a threat to the US. And Bytedance’s ownership is not more concerning than Shell’s ownership of oil platforms overseas should be. Indeed, Bytedance, and therefore TikTok, is not even “Chinese” anymore: This is from the FT:

The company is often described by western politicians as a “Chinese” entity. However, as I have noted before, some 60 per cent of the group is actually owned by “international” investors, overwhelmingly American. An estimated $8bn has been invested by private capital companies, including Sequoia Capital, Susquehanna, General Atlantic and Coatue Management. Mainstream investment funds such as Fidelity, T Rowe Price and BlackRock are exposed, too.

Returning to the economic nationalism of the inter-war years and fear-driven politics will not serve humanity at all. Demonizing Chinese ownership will equally have negative results, especially if China reciprocates with US ownership, such as Tesla or Apple in China.

Who benefits from this demonization? - jingoistic politicians seeking cheap votes. I cannot think of any example of jingoism serving good human outcomes.

So, it seems the “predecessor” agrees, but I do not favor a TikTok ban or forced divestiture. I am with the EFF (see this week’s essays) in seeing this ban as wholly negative.

Essays of the Week

Busting Myths on Foreign Media Ownership as TikTok Ban Looms

By Martin Peers

Mar 13, 2024, 5:00pm PDT

It’s taken four years, but the push to ban TikTok is moving at lightning speed—which will continue until it comes to a dead halt sometime in the near future. Today’s lopsided vote in the House of Representatives on the ban-or-sell TikTok bill moves the battle to the Senate, where its prospects are uncertain. Let’s assume it passes in that chamber and then gets signed by President Joe Biden. The next stop is likely to be a court case initiated by TikTok, which will almost certainly put this issue on hold for some time to come. So don’t hold your breath for a resolution anytime soon.

In the meantime, the debate over a TikTok ban is generating some fact-challenged commentary among venture capitalists over U.S. rules on foreign ownership of media. Upfront Ventures’ Mark Suster, for instance, tweeted today, “We have never allowed foreign entities to control our media,” apparently unaware that a German company, Axel Springer, owns Business Insider and Politico. Suster was responding to Keith Rabois, who tweeted that Rupert Murdoch became a U.S. citizen “because the US didn’t even allow Australians…to own a NYC newspaper.” Actually, Murdoch owned several newspapers in the U.S. for more than a decade before he became an American citizen, which he did when he was buying the Fox TV station group. Rabois seemed to be thinking of foreign ownership laws affecting television stations, which is what prompted Murdoch’s citizenship change in 1985.

In fact, there are no laws restricting foreigners from buying U.S. newspapers or media generally, other than long-standing rules related to broadcast TV and radio. And the Federal Communications Commission has relaxed even those rules in the past decade, an understandable move given the diminished state of broadcast media. To be sure, the lack of foreign regulation hasn’t been much of an issue for the rest of U.S. media until recently, given the relative paucity of rich foreigners buying up media businesses. Aside from Murdoch in the days before he became American, one of the few foreigners to own a newspaper was Canada’s Conrad Black, who for a time owned the Chicago Sun-Times. In cable TV, a European firm controls the Altice cable TV operator, which serves part of the New York metropolitan area and the Southeastern U.S.

Until the internet came along, technological limitations kept most media companies focused on their home territories. The borderless nature of the internet has changed things, creating opportunities for everyone from Netflix to The New York Times to expand in much of the world (while Axel Springer expanded in the U.S.). In that sense, the TikTok bill sets a bad precedent that U.S. companies might come to regret. Its saving grace, however, is that it targets apps controlled by a “foreign adversary,” most obviously China, which already blocks access to U.S. internet companies. So the bill simply puts business opportunities between China and the U.S. on a more equal playing field. When you think of it like that, it’s hard to argue against the TikTok bill.

..More

Congress Should Give Up on Unconstitutional TikTok Bans

BY JASON KELLEY AND PAIGE COLLINGS

MARCH 12, 2024

Congress’ unfounded plan to ban TikTok under the guise of protecting our data is back, this time in the form of a new bill—the “Protecting Americans from Foreign Adversary Controlled Applications Act,” H.R. 7521 — which has gained a dangerous amount of momentum in Congress. This bipartisan legislation was introduced in the House just a week ago and is expected to be sent to the Senate after a vote later this week.

A year ago, supporters of digital rights across the country successfully stopped the federal RESTRICT Act, commonly known as the “TikTok Ban” bill (it was that and a whole lot more). And now we must do the same with this bill.

As a first step, H.R. 7521 would force TikTok to find a new owner that is not based in a foreign adversarial country within the next 180 days or be banned until it does so. It would also give the President the power to designate other applications under the control of a country considered adversarial to the U.S. to be a national security threat. If deemed a national security threat, the application would be banned from app stores and web hosting services unless it cuts all ties with the foreign adversarial country within 180 days. The bill would criminalize the distribution of the application through app stores or other web services, as well as the maintenance of such an app by the company. Ultimately, the result of the bill would either be a nationwide ban on the TikTok, or a forced sale of the application to a different company.

The only solution to this pervasive ecosystem is prohibiting the collection of our data in the first place.

Make no mistake—though this law starts with TikTok specifically, it could have an impact elsewhere. Tencent’s WeChat app is one of the world’s largest standalone messenger platforms, with over a billion users, and is a key vehicle for the Chinese diaspora generally. It would likely also be a target.

The bill’s sponsors have argued that the amount of private data available to and collected by the companies behind these applications — and in theory, shared with a foreign government — makes them a national security threat. But like the RESTRICT Act, this bill won’t stop this data sharing, and will instead reduce our rights online. User data will still be collected by numerous platforms—possibly even TikTok after a forced sale—and it will still be sold to data brokers who can then sell it elsewhere, just as they do now.

The only solution to this pervasive ecosystem is prohibiting the collection of our data in the first place. Ultimately, foreign adversaries will still be able to obtain our data from social media companies unless those companies are forbidden from collecting, retaining, and selling it, full stop. And to be clear, under our current data privacy laws, there are many domestic adversaries engaged in manipulative and invasive data collection as well. That’s why EFF supports such consumer data privacy legislation.

Congress has also argued that this bill is necessary to tackle the anti-American propaganda that young people are seeing due to TikTok’s algorithm. Both this justification and the national security justification raise serious First Amendment concerns, and last week EFF, the ACLU, CDT, and Fight for the Future wrote to the House Energy and Commerce Committee urging them to oppose this bill due to its First Amendment violations—specifically for those across the country who rely on TikTok for information, advocacy, entertainment, and communication. The US has rightfully condemned other countries when they have banned, or sought a ban, on specific social media platforms.

Montana’s ban was as unprecedented as it was unconstitutional

And it’s not just civil society saying this. Late last year, the courts blocked Montana’s TikTok ban, SB 419, from going into effect on January 1, 2024, ruling that the law violated users’ First Amendment rights to speak and to access information online, and the company’s First Amendment rights to select and curate users’ content. EFF and the ACLU had filed a friend-of-the-court brief in support of a challenge to the law brought by TikTok and a group of the app’s users who live in Montana.

Our brief argued that Montana’s ban was as unprecedented as it was unconstitutional, and we are pleased that the district court upheld our free speech rights and blocked the law from going into effect. As with that state ban, the US government cannot show that a federal ban is narrowly tailored, and thus cannot use the threat of unlawful censorship as a cudgel to coerce a business to sell its property.

Instead of passing this overreaching and misguided bill, Congress should prevent any company—regardless of where it is based—from collecting massive amounts of our detailed personal data, which is then made available to data brokers, U.S. government agencies, and even foreign adversaries, China included. We shouldn’t waste time arguing over a law that will get thrown out for silencing the speech of millions of Americans. Instead, Congress should solve the real problem of out-of-control privacy invasions by enacting comprehensive consumer data privacy legislation.

What TikTok tells us about the paradox of markets right now

From geopolitical risk to capricious US decision-making, investors face uncertain times

Gillian Tett

There are not many issues that attract bipartisan support in Washington these days. TikTok, however, is one. On Wednesday, the House of Representatives passed a bill to ban the social media app unless it is sold by its Chinese-based parent ByteDance — by a resounding 352-65 votes.

This might yet be blocked by the Senate or the courts; when Montana lawmakers tried to ban TikTok last year, there were legal appeals. Alternatively, ByteDance might agree on a sale — although this could be hard if antitrust issues hang over natural buyers, such as Microsoft. What’s more, Beijing says it opposes a sale, probably because it does not want to lose control of TikTok’s content algorithm (which is arguably a bigger national security flashpoint than data storage).

Either way, Wednesday’s vote has tossed TikTok into limbo in a way that most observers (including myself) did not expect a few months ago, given that this could anger many youthful voters — something Congress rarely wants to do.

There is a big lesson for investors here. Most notably, it reveals a paradox now haunting markets. On the one hand, the price of many assets, including both equities and bonds, have surged in a manner that suggests investors are not only optimistic about the short-term economic outlook — but also confident that they can forecast the medium-term trajectory as well.

On the other, as Ángel Ubide, head of macro analysis at Citadel, points out, the world currently faces more medium-to-long-term dangers than most investors have ever seen in their lifetimes, be that domestic politics, geopolitical tensions, climate change or innovation. A sense of cognitive dissonance abounds, creating the potential for shocks — good and bad.

Consider TikTok. The company is often described by western politicians as a “Chinese” entity. However, as I have noted before, some 60 per cent of the group is actually owned by “international” investors, overwhelmingly American. An estimated $8bn has been invested by private capital companies, including Sequoia Capital, Susquehanna, General Atlantic and Coatue Management. Mainstream investment funds such as Fidelity, T Rowe Price and BlackRock are exposed, too.

A year ago, the buzz in tech circles was that these investors were on track to reap massive profits — at least on paper. Fundraising rounds suggested ByteDance had a putative valuation of as much as $300bn, and groups such as Fidelity have reportedly been valuing it between $260bn and $320bn.

..More

Vision Pro is an over-engineered “devkit”

Hardware bleeds genius & audacity but software story is disheartening // What we got wrong at Oculus that Apple got right // Why Meta could finally have its Android moment

by Hugo Barra (former Head of Oculus at Meta)

Friends and colleagues have been asking me to share my perspective on the Apple Vision Pro as a product. Inspired by my dear friend Matt Mullenweg’s 40th post, I decided to put pen to paper.

This started as blog post and became an essay before too long, so I’ve structured my writing in multiple sections each with a clear lead to make it a bit easier to digest — peppered with my own ‘takes’. I’ve tried to stick to original thoughts for the most part and link to what others have said where applicable.

Some of the topics I touch on:

Why I believe Vision Pro may be an over-engineered “devkit”

The genius & audacity behind some of Apple’s hardware decisions

Gaze & pinch is an incredible UI superpower and major industry ah-ha moment

Why the Vision Pro software/content story is so dull and unimaginative

Why most people won’t use Vision Pro for watching TV/movies

Apple’s bet in immersive video is a total game-changer for Live Sports

Why I returned my Vision Pro… and my Top 10 wishlist to reconsider

Apple’s VR debut is the best thing that ever happened to Oculus/Meta

My unsolicited product advice to Meta for Quest Pro 2 and beyond

The Apple Vision Pro is the Northstar the VR industry needed, whether we admit it or not

I’ve been a VR enthusiast for most of my adult life, from working as an intern at Disney Quest VR in the 1990s, to being an early backer of the Oculus Rift DK1 on Kickstarter in 2013, to leading the Oculus VR/AR team at Meta from 2017 to 2020 (and getting to work alongside VR legends like John Carmack, Brendan Iribe and Jason Rubin), and always testing every VR product or experience I can get my hands on.

Back in my Oculus days, I used to semi-seriously joke with our team (and usually got a lot of heat for it!) that the best thing that could ever happen to us was having Apple enter the VR industry and become a direct competitor to Oculus. I’ve always believed that strong competition pushes a team to do their best work in any industry. This became clear to me especially after living for nearly 10 years at the center of the iOS/Android battle of ecosystems where each side made the other infinitely better by constantly raising the bar on UX, features, performance, developer APIs etc, and seeing each side respond by not only fast following but usually also improving on what the other had released. (And this definitely went both ways: iOS copied Android as much as Android copied iOS).

But in the case of VR at Oculus, we also never really felt like the world had a Northstar that could truly capture human hearts and minds, and without that it would be impossible to transition VR from being a niche gamer tech to the incredible spatial computing paradigm that we always thought it potentially represented (which I still very much believe in). Apple could really help us if they cared about VR.

The Vision Pro launch has more or less done exactly what I had always hoped for, which is to build a huge wave of awareness and curiosity that elevates the spatial computing ecosystem and could ultimately lead to mass-market consumer demand and a lot more developer interest that VR has ever had. Now it’s up to the industry to create enough user value and demonstrate whether this is in fact the future of computing.

The Vision Pro’s instant magic comes down to just: (1) an unprecedented new level of presence in VR, and (2) a new UI superpower using gaze & pinch

Using Vision Pro is an instantly magical and intuitive experience — whether or not you’ve used other VR headsets — purely because of Apple’s unrelenting focus on delivering two specific capabilities that speak to our humanity:

1) Feeling present and connected to your physical world: thanks to a high-fidelity passthrough (“mixed reality”) experience with very low latency, excellent distortion correction (much better than Quest 3), and sufficiently high resolution that allows you to even see your phone/computer screen through the passthrough cameras (i.e. without taking your headset off).

Even though there are major gaps left to be filled in future versions of the Vision Pro hardware (which I’ll get into later), this level of connection with the real world — or “presence” as VR folks like to call it — is something that no other VR headset has ever come even close to delivering and so far was only remotely possible with AR headsets (ex: HoloLens and Magic Leap) which feature physically transparent displays but have their own significant limitations in many other areas. Apple’s implementation of Optic ID as an overlay on top of live passthrough is a beautiful design decision that only enhances this sense of presence.

MY TAKE: The Vision Pro high-fidelity passthrough experience parallels Apple’s introduction of the iPhone’s original retina display, which set a new experience bar and gold standard in mobile display fidelity. While much remains to be improved in the Vision Pro passthrough experience, Apple is unquestionably setting a new standard for all future headsets (by any vendor) that VR passthrough must be good enough to closely resemble reality.

2) Having a new UI superpower with gaze & pinch, thanks to a very precise eye tracking system (with 2 dedicated cameras per eye) embedded into the lenses, coupled with a wide-field-of-view hand tracking system that can “see” a finger pinch even with your hands are down or resting on your lap. Because it works so effortlessly for the user, it really feels like having a new “laser vision” superpower.

LLMs have special intelligence, not general, and that's plenty.

“Life can only be understood backwards, but it must be lived forwards.”

MAR 13, 2024

We finally have a Large Language Model that beats the average human IQ. Claude-3, released last week by Anthropic, has been received extremely well, and it good enough that it beats all others including GPT-4.

Now, this is impressive. Anthropic themselves released the below graphic.

Thanks for reading Strange Loop Canon! Subscribe for free to receive new posts and support my work.

Pledge your support

But what does it mean?

These are the benchmarks below by the way. I’ve gone over much of them in detail in this post about ‘Evaluations are all we need’ so I won’t do it again. But the key aspect is that there’s a vast gulf not between what they purport to measure and what we think we see when they measure.

It has surpassed the limits set by the already lofty predecessors, if only by a bit, and it shows. The amount of praise it has received is not small. In sharp contrast to the reception that Google’s Gemini received, Claude’s seem pretty much nothing but praise. And well deserved praise at that.

It can do economic modeling, ML experimentation, understands science, writes extremely well, solves PhD level problems, create new quantum algorithms, and can write really good code.

However, it also fails at much more mundane tasks. Opus is much better at this than GPT-4. It’s really good! And yet …

Like at crosswords, or creating word grids, or sudoku, or even playing wordle. Things which ordinary humans of far less ability solve rather easily!

Nor can it solve mazes.

So … is it actually intelligent? Or something else?

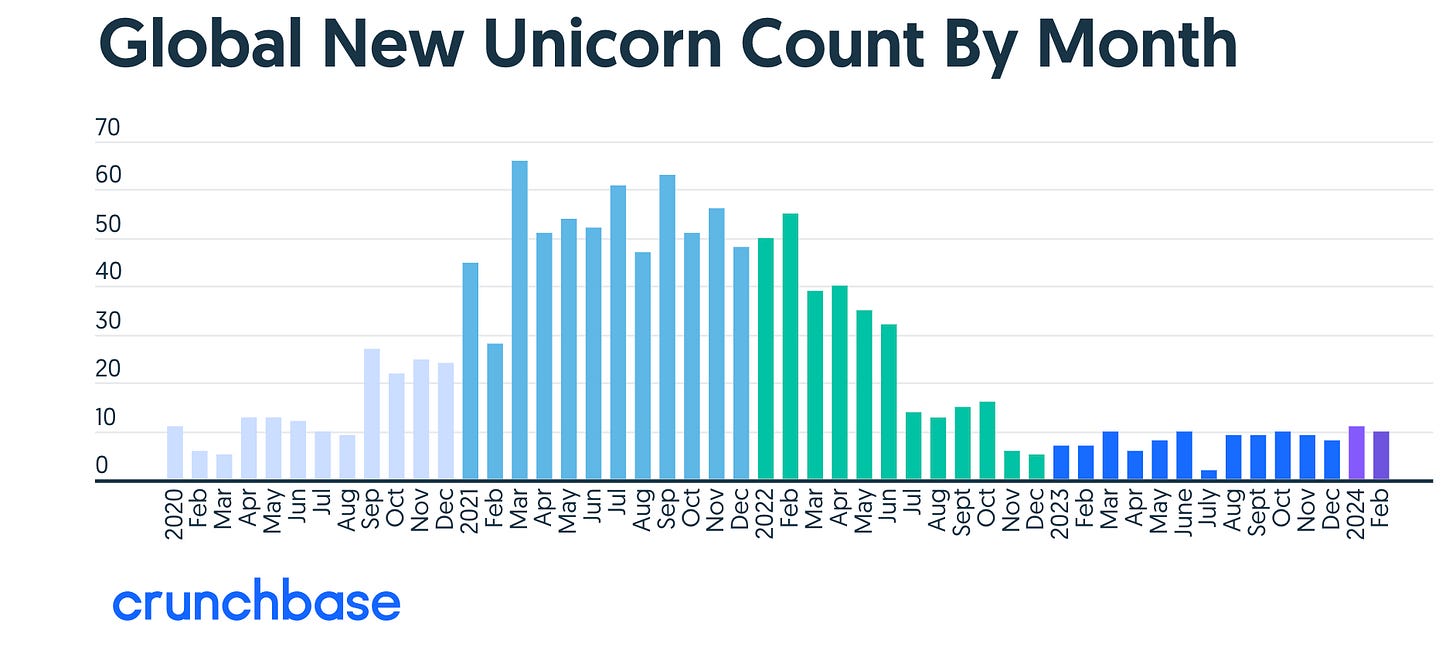

Fintech Unicorns Trot Onto Leaderboard In February

March 12, 2024

Ten new unicorns globally added more than $18 billion in value to The Crunchbase Unicorn Board in February, but in a sign that the long-term status of many companies on the board are in flux, one startup fell off completely after its valuation was slashed to less than a third of a unicorn valuation.

Two companies from China joined the board after raising around a billion dollars in funding each: a year-old foundation model company and a 6-year-old satellite network company.

The next-largest funding for a new February unicorn was raised by a 2-year-old U.S.-based robotics company.

The artificial intelligence theme was evident again on the board last month: Two of the new companies on the board are in the AI sector, and many of the other newcomers have the technology woven into their products.

Four of the new unicorns hail from the U.S., three from China and one each from France, The Netherlands and Italy.

Now let’s take a closer look at the new unicorns of February 2024 and the sectors from which they hail.

AI

One-year-old foundation model LLM company Moonshot AI raised a Series B of $1 billion led by e-commerce giant Alibaba Group and Sequoia Capital China. The Beijing-based company was valued at $2.5 billion in the deal.

San Francisco-based Lambda, a cloud-based GPU company, raised its $320 million Series C. Pittsburgh-based US Innovative Technology Fund led the funding to the 12-year-old company, at a value of $1.5 billion.

Security

Texas-based endpoint management company NinjaOne has grown in recent years with the shift to hybrid work and the need for oversight of remote devices by IT teams. According to the company, it has around 17,000 customers. The 10-year-old company raised a $232 million Series C led by ICONIQ Growth. It was valued at $1.9 billion.

The Changing Nature of Pre-Seed Syndication

The syndication dynamics for pre-seed rounds are changing, and things are getting harder for founders looking to raise pre-seed rounds.

CHARLES HUDSON AND ALIYA LAKHANI

MAR 11, 2024

When I started making investments out of our first pre-seed fund in 2015, we had a very robust and deep set of co-investors who had the same interest in backing companies searching for product-market fit. Lately, I noticed we were not seeing the same set of firms we used to see on pre-seed cap tables. My colleague Aliya and I recently looked at the changing nature of our most common co-investors across our last few funds and noticed an interesting result. Many of the firms that were our most frequent co-investors in our first two funds are no longer among the folks with whom we often collaborate on new pre-seed investments.

When we talk about pre-seed investing, we are talking about rounds of $1 million or less for companies still searching for product-market fit. That’s the lens through which we analyzed the data. I recognize that many others have different definitions for what constitutes pre-seed, but that is and always has been how we define it

To get a handle on what happened, Aliya looked at our most frequent co-investors from Fund I and Fund II and pulled a bunch of data about what those firms have invested in since ?2018?. We looked at those firms’ investing activities using a combination of public and private data along the following dimensions:

Investment pace and the number of investments made per year

Size of the rounds in which they participated

Check size for new investments

When we looked at the data, a few conclusions jumped out at us and largely accounted for why we see those firms less frequently than we used to. In many cases, the change in firm investing behavior is a combination of several factors noted below.

Some categories are now skipping pre-seed (as defined above)

There are some investment categories where small pre-seed rounds are not where most of the action occurs. This is particularly true in areas like defense tech, AI, deep tech, and other categories where the capital requirements to start are high or where founders can access more capital to do the kind of zero-to-one product innovation that characterizes pre-seed investing. We have not invested heavily in any of those categories, and many of the firms with whom we invested previously have ramped up their activities in those domains.

Pre-seed investing is the domain of new, emerging funds, and many of those folks are on pause or significantly less active than they used to be

Pre-seed investing is largely the domain of small and emerging funds. The period from 2018-2021 saw an explosion of new venture capital firms created, many of which were small firms that focused on pre-seed and seed investing. While many of those firms are healthy, a meaningful chunk of those newly-created firms are less active (when measured by the number of net new investments) today than they were in previous years. Some of those firms have pulled back due to a deliberate strategy to slow investment pacing. In contrast, others have simply invested all of the capital that they have for new investments and are not actively making new commitments. Compared to prior years, this decline in activity from these firms has a big impact on the pre-seed ecosystem.

Some of the firms we used to co-invest with are no longer in business

This one was surprising to me. There is a cohort of firms that we used to co-invest with that simply no longer exist. Many of the investors from those funds are still in the business, but those entities are no longer around and actively investing.

Many of our pre-seed investing partners are investing in larger rounds with companies that have more traction - those look more like seed rounds than pre-seed rounds under our definition

My sense is that this is the single biggest reason we no longer see our favorite pre-seed co-investors as often as we used to.

..More

Screening for Maniacs

Work in progress

MAR 11, 2024

TLDR: Below is a copy of a document I use to brainstorm questions and evolve my approach to screening founders at day zero

Three or four standard deviations higher on resilience.

That’s what Sam Altman says is the non-obvious founder trait that predicts success.

“Non-obvious” in the sense that it’s hard to determine and underwrite, not that it’s hard to believe as a prerequisite for success.

I do 30-40 founder screening calls a week during peak scouting periods, and well over 500 per year. That’s a lot of shots on goal and repetitions to figure out how to screen for resilience, but the real mistake would not be having a system to consistently improve.

Below is an evolving document I use, swapping out questions and traits, iterating on my process and seeing what questions I can use to learn the most I can about a founder. As this evolves and strengthens, so does my edge. Entire sections will be added and deleted over time.

Screening for Maniacs

Below are some traits that show up in our most productive and successful founders. Each section has a brief explanation, example, and set of questions, along with the intention behind what we’re trying to observe from the answers. Keep in mind, our diligence on execution comes during the residency, so interviews are primarily for underwriting character.

We should obsess over this topic endlessly, and develop pattern recognition by doing it over and over again. In doing so, we will calibrate founder interviews more effectively, and optimize our learning toward a person’s character, values, and potential to accomplish something undeniably hard. Important: actual answers do not matter as much as observations of character.

Narcissism

Explanation: Crazy confidence in themselves, believe they’re destined for more, and have big egos. To do something that changes the world, you first have to believe you’re capable of it and destined for it

Example: «Antler Founder» gets a $6m term sheet with a standard vesting schedule, and he says to me “if they want my shares to vest over four years, they don’t understand that I will die before this is less than a $10B company” — obviously absurd to debate vesting, but it’s the sentiment

Questions:

Do you believe you’re a natural leader, or is that something you learn?

Do you find that if you wanted to, you could win any argument?

If you’re honest with yourself, do you feel like you’re better than others?

What to observe: the answer doesn’t matter, what we’re looking for is if the founder is assertive, opinionated, demonstrating unnatural enthusiasm and optimism, and if they are more interested in getting you to believe what they’re saying, versus interested in saying the socially acceptable thing for an interview

No Balance

Explanation: Founder should be front-loading their time, giving it everything they have, working nights and weekends, insanely passionate (re; Kobe’s 4am, Reid Hoffman’s “no balance”)

Example: «Antler Founder» will text me every single morning at 6am to remind me he is working hard than me, and I’ll even get 2-5am texts of playlists that keep the team motivated at crazy hours to keep grinding

Questions:

What’s more important; the business and making it succeed, or keeping a sense of balance? Why?

Walk me through a typical weekday versus weekend day, from wake-up to bed

What are your work hours and output expectations from yourself and your team?

Observe: Outlier expectations of themselves and of others, with examples as well as clear speed in execution. It’s not enough to be working hard and fast. Fast can be directionless, founders need to be fast *and* demonstrate trajectory

Optimism & Creativity

Explanation: Founder needs to believe problems are just obstacles not impossible roadblocks. Succeeding is about solving problem after problem for a decade or more; that requires optimism and reframing of problems into opportunities

Example: «Antler Founder» is an ex-pro athlete. He couldn’t get BaaS licenses to build the banking solution he envisioned so he pivoted to card-linked offers because it was another path to the same outcome. He couldn’t raise money, so he collected 50 SAFE’s. Now he’s doing 700K in monthly revenue and is building the banking solution he originally drew up. He sees every challenge as an opportunity to solve something that someone else couldn’t/didn’t/won’t

Questions:

If a law changed, a privacy regulation for example, and it all the sudden made your product illegal, what would you do?

Tell me about a time something seemed impossible, maybe you even doubted yourself, but you overcame it. What was the situation, what did you do about it, and what was the outcome?

Imagine your co-founder quits, a competitor gets $50m in funding, social unrest is rampant, and things at home are rocky. Life is as bad as it’s ever been. Can you name 3 opportunities that would come from that?

Observe: They should bring creativity to solutions, and come up with ways around obstacles. They should see opportunity in chaos—very good at seeing the silver lining of anything. Often reframe things well or can create a value proposition out of anything. Again, answer doesn’t matter, most ideas are bad anyway, the observation is about their enthusiasm, creativity, and optimism

Problem Solver

Video of the Week

Michael Jackson

Venture Capitalist

"People with very high expectations have very low resilience, and resilience matters in success. I don't know how to teach it to you except I hope suffering happens to you...I use the phrase 'pain and suffering' inside our company with great glee...

...for all of you Stanford students I wish upon you ample doses of pain and suffering." - Jensen Huang

Dostoevsky immediately came to mind: "Pain and suffering are always inevitable for a large intelligence and a deep heart. The really great men must, I think, have great sadness on earth."

NVIDIA CEO Jensen Huang at 2024 SIEPR Economic Summit

AI of the Week

Forget Sora, this is the AI video that will blow your mind – and maybe scare you

The combo of Figure 01 robotics and OpenAI proves to be a potent one

(Image credit: Figure AI)

Humanoid robotic development has for the better part of two decades moved at a snail's pace but rapid acceleration is underway thanks to a collaboration between Figure AI and OpenAI with the result being the most stunning bit of real humanoid robot video I've ever seen.

On Wednesday, startup robotics firm Figure AI released a video update (see below) of its Figure 01 robot running a new Visual Language Model (VLM) that has somehow transformed the bot from a rather uninteresting automaton into a full-fledged sci-fi bot that approaches C-3PO-level capabilities.

In the video, Figure 01 stands behind a table set with a plate, an apple, and a cup. To the left is a drainer. A human stands in front of the robot and asks the robot, "Figure 01, what do you see right now?"

After a few seconds, Figure 01 responds in a remarkably human-sounding voice (there is no face, just an animated light that moves in sync with the voice), detailing everything on the table and the details of the man standing before it.

OpenAI Made AI Videos for Us. These Clips Are Good Enough to Freak Us Out.

In an exclusive interview with our columnist, CTO Mira Murati explains the company’s new Sora AI video tool and how it plans to roll it out

By Joanna Stern

March 13, 2024 5:30 am ET

You wake up one morning with an inescapable urge to see a bull wandering around a china shop. Your options:

A) Contact a local livestock trainer and a nearby Crate & Barrel.

B) Hire a Hollywood animator.

C) Type six words into this magical AI tool:

Welcome to the next “holy cow” moment in AI, where your words transform into smooth, highly realistic, detailed video. So long, reality! Thanks for all the good times.

OpenAI won’t publicly release Sora, its new text-to-video tool, until later this year. Still, it’s already showing us how easy it could be to replace many people involved in video productions with some well-written prompts and a lot of processing power. I sent the company a few prompts of my own, because who doesn’t want to see a mermaid reviewing a smartphone with her crab assistant? Or a bull strolling daintily through a china shop?

Then I sat down for a video interview with Mira Murati, the company’s chief technology officer, to dissect them and discuss my concerns around this technology.

When OpenAI began previewing videos made with the generative-AI tool last month, the internet understandably lost its mind. Other AI video technology has produced choppy, low-resolution clips. These looked like something out of a nature documentary or big-budget film.

Sora brings new intensity to the now-familiar AI Feelings Loop—amazement about the capability followed by fear for society. Murati assured me OpenAI is taking a measured approach to releasing this powerful tool. That doesn’t mean everything’s gonna be all right.

Wait! AI made that?

I’d already been wowed by Sora-generated videos: drone shots of the Amalfi Coast, a corgi with a selfie stick and an animated otter on a surfboard. I asked OpenAI for something more familiar to my life: “Two professional women, both with brown hair and in their 30s, sitting down for a news interview in a well-lit studio.”

The mouth and hair movements, the details on the leather jacket—it all looks so real. Murati said the 20-second 720p-resolution clip took a few minutes to generate. There’s also no sound. Murati said they plan to add that eventually.

How does it all work? It’d be easier to explain the evolution of mermaids than the inner workings of “diffusion models,” but here’s the gist: The AI model analyzed lots of videos and learned to identify objects and actions. Then, when you give it a text prompt, it sketches out the whole scene then fills in each frame.

Industry observers and competitors—including Runway’s chief executive—attribute some of these superior results to OpenAI’s vast computing power and training data. OpenAI has recently faced copyright infringement lawsuits alleging the AI company has scraped content without permission to train ChatGPT.

News Of the Week

House passes TikTok bill that could ban app in the U.S., spawning Senate support

The swift rebuke shifts attention to the Senate, where the bill faces political barriers and constitutional concerns

By Cristiano Lima-Strong, Jacob Bogage and Mariana Alfaro

Published March 13, 2024 at 10:38 a.m.

The House overwhelmingly passed a measure Wednesday to force TikTok to split from its parent company or face a national ban, a lightning offensive that materialized abruptly after years of unsuccessful negotiations over the platform’s fate.

The legislation, approved 352 to 65, is a sweeping bipartisan rebuke of the popular video-sharing app — and an attempt to grapple with allegations that TikTok’s China-based parent, ByteDance, presents national security risks.

For years, lawmakers have been introducing proposals seeking to restrict the company’s activities in the U.S., and finding limited momentum. But these lengthy behind-the-scenes deliberations were hastened, lawmakers said, by the Biden administration’s growing support of the effort, coupled with concerns about TikTok’s potential to influence U.S. politics, which intensified after the Oct. 7 Hamas attack on Israel.

HR 7521

Steven Sinofsky

@stevesi

The full title of HR 7521 is:

To protect the national security of the United States from the threat posed by foreign adversary controlled applications, such as TikTok and any successor application or service and any other application or service developed or provided by ByteDance Ltd. or an entity under the control of ByteDance Ltd.

Even if you agree with the outcome, the above rationale should not have been used. It would have been much better to use international trade reciprocity since China already bans US companies or adds essentially trade barrier market requirements preventing access to the market.

Instead we now make it easy for many countries to ban US products because they can simply state it is a product controlled by a foreign adversary.

It is unfortunate that we're using this moment to make trade relations less level rather than responding to disproportionate measures already used against US companies.

Interestingly section 2(b) is one of the key problems with US companies doing business in China as the Chinese govt mandates this approach. They go further and include monitoring as well.

2(b). Data And Information Portability To Alternative Applications.—Before the date on which a prohibition under subsection (a) applies to a foreign adversary controlled application, the entity that owns or controls such application shall provide, upon request by a user of such application within the land or maritime borders of United States, to such user all the available data related to the account of such user with respect to such application. Such data shall be provided in a machine readable format and shall include any data maintained by such application with respect to the account of such user, including content (including posts, photos, and videos) and all other account information.

Here again, the internet works because there aren't computers everywhere there are customers. By driving this requirement we encourage other countries to throw up "national security" and mandate data centers and data locality (NB, EU did this for "privacy"). I had this discussion with China official many times over HotMail and OneDrive.

In section 2(a)1A you can see how the bill takes advantage of app stores! Without these stores to enforce this ban it would be almost impossible and a constant cost of enforcement effort.

The use of app stores as a government enforcement mechanism is a dangerous precedent in a free-market democracy.

Text:

A) Providing services to distribute, maintain, or update such foreign adversary controlled application (including any source code of such application) by means of a marketplace (including an online mobile application store) through which users within the land or maritime borders of the United States may access, maintain, or update such application.

Steven Mnuchin Says He Is Putting Together a Group to Buy TikTok

Former Treasury secretary’s comments come after House voted to ban the app in the U.S. or force a sale

By Rachel Louise Ensign and Gareth Vipers

Former Treasury Secretary Steven Mnuchin said he’s putting together a consortium to try to buy TikTok, as a bid to divorce the popular social-media platform from its Chinese owners gathers momentum in Congress.

Mnuchin, who has long crusaded against Chinese ownership of the app, didn’t specify how he might buy the business, which could be valued at more than $100 billion. But his comments show that should there be a forced sale, interest would likely be high in a platform that boasts more than 170 million U.S. users.

“I think the legislation should pass and I think it should be sold,” Mnuchin said on CNBC Thursday morning. “It’s a great business and I’m going to put together a group to buy TikTok.”

The House this week voted to approve a bill that would ban TikTok from web-hosting services and app stores in the U.S. if its Chinese owner, ByteDance, doesn’t divest itself of the business.

TikTok has said it sees that as an effective ban and that separating the U.S. portion wouldn’t be practical and would undercut the appeal of the app as a global product. China has said it would oppose any forced sale of TikTok.

Steven Mnuchin served as Treasury secretary from 2017 until January 2021. PHOTO: TONI L. SANDYS/ASSOCIATED PRESS

The bill still needs to be blessed by the Senate, where lawmakers signaled a more cautious approach, and any deal is far from guaranteed. A forced sale on such a scale would have little precedent and would have to overcome any number of hurdles including a reluctance of regulators to bless big tech combinations and the challenges a bidder like Mnuchin could face raising sufficient funds.

The app has faced scrutiny over its China-based ownership, which U.S. officials say potentially gives Beijing a way to collect data on Americans and influence public opinion. Officials are concerned about the way its algorithm works to select content for users on sensitive issues such as teen depression and the Israel-Hamas war.

TikTok and ByteDance didn’t respond to requests for comment Thursday.

Strangulation or Regulation?

Oh boy:

The European Union's parliament on Wednesday endorsed the world's first major set of regulatory ground rules to govern the mediatized artificial intelligence at the forefront of tech investment.

The EU brokered provisional political consensus in early December, and it was then endorsed in the Parliament's Wednesday session, with 523 votes in favour, 46 against and 49 votes not cast.

"Europe is NOW a global standard-setter in AI," Thierry Breton, the European Commissioner for internal market, wrote on X.

Two things can be true at the same time: Apple's App Store rules are comically out of date – I've been saying this for years – and the EU's attempted regulation of such things is even more out of touch with reality.1 And so you'll forgive my skepticism that the body is going to properly regulate AI. A series of technologies which are not only nascent, but are moving so quickly that it's basically impossible to figure out how to invest in the space, let alone set rules to try to control it.

President of the European Parliament, Roberta Metsola, described the act as trail-blazing, saying it would enable innovation, while safeguarding fundamental rights.

"Artificial intelligence is already very much part of our daily lives. Now, it will be part of our legislation too," she wrote in a social media post.

Lol, that quote. Sounds great! What can possibly go wrong?

I suspect we're going to find out! But actually, the way we'll primarily find out may be the sudden halt of any interesting AI work and startups coming out of European Union countries. Something which at least a few of them seemed worried about:

Some EU countries have previously advocated self-regulation over government-led curbs, amid concerns that stifling regulation could set hurdles in Europe's progress to compete with Chinese and American companies in the tech sector. Detractors have included Germany and France, which house some of Europe's promising AI startups.

This is all setting up to be like GDPR meets the DMA with the potential to be exponentially worse for the ecosystem because again, it's all so nascent. Are there things we need to be mindful about and worried about? Of course. But the likelihood that the government – let alone several governments bonded together by their love of headlines and general tech strangulation – is going to effectively do this is comical. I hope I'm wrong. But I'm not.

An update on our preparations for the DMA

Jan 17, 2024

Oliver Bethell, Director, Legal, Google

Last year the European Union enacted a new regulation called the Digital Markets Act (DMA), which applies to companies who have been designated as “Gatekeepers.” These new rules come into force in March, so we have begun testing and rolling out a number of changes to our products to get ready. People and businesses in Europe will begin to see those changes in the coming weeks and so we wanted to explain what we’re doing.

As we test and roll out these changes, some of the Google products you use may look and work differently. For example:

Additional consents for linked services: We currently share data across some Google products and services for certain purposes, including to help personalize your content and ads, depending on your settings. Over the next few weeks, we will be presenting European users with an additional consent banner to ask them whether some services can continue to share data for those purposes. If services aren’t linked, some features may be limited or unavailable. Users can change their choices anytime in their Google Account settings.

Changes to Search results: When you are searching for something like a hotel, or something to buy, we often show information to help you find what you need, like pictures and prices, as part of our results. Sometimes this can be as part of a result for a single business like a hotel or restaurant, or sometimes it can be a featured group of relevant results. Over the coming weeks in Europe, we will be expanding our testing of a number of changes to the search results page. We will introduce dedicated units that include a group of links to comparison sites from across the web, and query shortcuts at the top of the search page to help people refine their search, including by focusing results just on comparison sites. For categories like hotels, we will also start testing a dedicated space for comparison sites and direct suppliers to show more detailed individual results including images, star ratings and more. These changes will result in the removal of some features from the search page, such as the Google Flights unit.

Choice screens: When you use an Android phone, you can easily switch your default search engine or browser. Under the DMA, we and other designated companies will need to show additional choice screens. You may start to see these on Android phones as you set up a device, and on your Chrome app on desktop and iOS devices.

Data portability: For over a decade we have offered users the ability to download or transfer a copy of their data from more than 80 Google products. We continue to make investments in Google Takeout, the Data Transfer Initiative and data portability more broadly. To meet new requirements around moving your data to a third-party app or service, we will soon be testing a Data Portability API for developers.

Over the last few months we have been seeking feedback on our changes from the European Commission and from stakeholders like developers, advertisers and companies who will be affected by them. While we support many of the DMA's ambitions around consumer choice and interoperability, the new rules involve difficult trade-offs, and we're concerned that some of these rules will reduce the choices available to people and businesses in Europe.

Today is an update on an ongoing process. We’ll share more details on the final changes we are making to comply with the new rules ahead of the March deadline.

Banning TikTok would be both ineffective and harmful

The US House passed a bill that could ban the social video app, but sending TikTok into the ether won’t make social media any safer

By A.W. Ohlheiser Mar 14, 2024, 6:30am EDT

A.W. Ohlheiser is a senior technology reporter at Vox, writing about the impact of technology on humans and society. They have also covered online culture and misinformation at the Washington Post, Slate, and the Columbia Journalism Review, among other places. They have an MA in religious studies and journalism from NYU.

TikTok, like any place on the internet where a ton of people are watching and sharing and competing for attention, is best understood in terms of both/and.

TikTok is both a vital platform for community building and plagued by dangerous misinformation. TikTok is both uniquely good at providing a means for non-influencers to reach a huge audience and a platform that has failed, again and again, to fairly and adequately moderate the content posted there. TikTok is both riddled with huge concerns about the privacy of the data it collects on its users and, just like any other major social media platform, intent on collecting that data as part of its business model.

On Wednesday morning, the House of Representatives overwhelmingly voted to pass a bill that could eventually lead to a US ban of the app. Before we get there, some big ifs are in play: if the Senate also passes the legislation, if President Joe Biden follows through on his intention to sign it should the bill arrive on his desk, and if TikTok’s parent company, ByteDance, doesn’t successfully sell TikTok to a non-Chinese owner before the legislation’s specified deadline.

Still, the threat of a ban was real enough to prompt TikTok to take action. In a push notification sent to users last week, TikTok urged its users to “speak up now — before your government strips 170 million Americans of their constitutional right to free expression.”

As a result, some House offices were inundated with calls, and some lawmakers who supported the bill accused TikTok of using the app to start a “propaganda campaign.” That language resonates with Republican calls late last year to ban TikTok, citing a viral but unfounded accusation that TikTok’s Chinese owners were “brainwashing” America’s youth with anti-Israel content by forcing it to get views thanks to the platform’s powerful recommendation algorithms.

The gray area of TikTok

One of the challenges of writing about social media is that both/and isn’t nearly as catchy as framing, say, TikTok as wholly good or wholly evil. TikTok’s counter-campaign to lawmakers’ push to frame the app as a data-guzzling Chinese propaganda tool is to point to the creators who make a living on the platform sharing educational, humorous, and otherwise wholesome content. Many of those creators are themselves speaking out about how the platform changed their life or helped them find a voice or earned them money.

Here are a couple both/ands about the bill to ban TikTok: It is both a bill that would potentially upend the livelihoods of people who use the platform as an income source and a bill that would not adequately protect user data across social media. It is both a bill that could have serious consequences for online expression and a bill that seems to be created by people with little understanding of what TikTok actually does.

“I have yet to hear policymakers talk about TikTok in a way that makes me think they know anything about it,” said Casey Fiesler, an associate professor of information science at the University of Colorado Boulder.

Coinbase Raises $1 Billion Through Convertible Notes Offering

Key Takeaways

Coinbase intends to offer $1 billion of Convertible Senior Notes due 2030 in a private offering to qualified institutional buyers, subject to market conditions and other factors.

These notes will be senior, unsecured obligations, with interest payable semi-annually in outstanding payments and maturing on April 1, 2030. They will be convertible into cash, shares of Coinbase’s Class A common stock, or a combination thereof at Coinbase’s discretion.

The company intends to utilize the net proceeds from the offering for various purposes, including repaying existing debts, general corporate purposes, paying the cost of capped call transactions, and potentially making investments or acquisitions.

American cryptocurrency exchange Coinbase announced plans to raise $1 billion through a convertible note offering, allowing investors to provide capital to Coinbase with the potential to convert their notes into company stock.

Funds Targeted For Debt Repayment And General Corporate Needs

Coinbase intends to use the proceeds from this offering to manage its existing debt. The company aims to repay or repurchase its outstanding convertible senior notes due in 2026, 2028, and 2031.

The raised capital will also be allocated for general corporate purposes, including working capital, expenditures, and capped call transactions associated with the offering.

Convertible Notes Offer Flexibility For Both Coinbase And Investors

The convertible notes function as loans. They accrue interest semi-annually and have a maturity date of April 1, 2030. However, before that date arrives, holders of the notes can convert them into cash, shares of Coinbase’s Class A common stock, or a combination of both at Coinbase’s discretion. This will also allow investors to benefit from potential stock price appreciation while offering Coinbase a financing option that doesn’t immediately dilute its current stock value.

Coinbase Imitates MicroStrategy

Coinbase’s convertible note offering follows a similar plan to that of other cryptocurrency companies, such as MicroStrategy. Issuing convertible notes is a common tactic for businesses seeking capital, and it is not uncommon for companies in similar industries to use the same approach.

Stripe’s growth continues to impress as total payment volume tops $1 trillion

The payments infrastructure company says it's ‘robustly cash flow positive’

Alex Wilhelm, Christine Hall/ 11:28 AM PDT•March 13, 2024

Comment

Image Credits: SOPA Images / Contributor / Getty Images

Stripe’s annual letter provides the outline of a business that is healthy and growing. Stripe is sufficiently large that when we consider its growth, we have to weigh it against the overall growth in the payment space more generally. By that measure, the company is outperforming its market.

Major growth points

Stripe notes that it crossed the $1 trillion total payment volume metric in 2023, a figure that is large and round, if imprecise. Certainly the threshold is notable, but when paired with recent growth figures, it becomes all the more impressive. In 2023, its payment volume rose 25%, according to the letter. If the company did in fact process precisely $1 trillion last year, it would imply $800 billion in 2022 processing, and gains of $200 billion worth of TPV in a single year. At Stripe’s size, it’s quite a result.

Stripe’s fee structure starts at 2.9% with an added 30-cent charge for domestic card-based transactions. This implies that even when accounting for volume discounts, its added payment volume last year equaled massive new revenues for the private company.

Those revenues are translating into cash flow, an all-important metric for investors. The company says in the letter that it was “robustly cash flow positive in 2023 and expects to be again in 2024,” which means it likely doesn’t need to raise more capital before it goes public. That may be part of the reason why it is not pursuing a near-term IPO: Public offerings are fundraising mechanisms, and Stripe is currently kicking off cash.

Two other data points stood out.

There are now 100 companies that use its service that are processing $1 billion or more per year with Stripe. Those companies make up about 10% of its total payment volume, implying some customer concentration — a concern for some investors, although it doesn’t trip our risk radar — but more importantly it means that Stripe is managing to hold on to large accounts over time. Any company processing that much total payment volume through Stripe could decide to build an in-house stack or pursue a more DIY option. The fact that so many big accounts are sticking with Stripe, though, shows that customers will not necessarily “graduate” from its offered payment services. This bodes well for future growth and revenue stability.

Startup of the Week

The Information Honored with Five ‘Best in Business’ Journalism Awards

Mar 14, 2024, 1:23pm PDT

I just shared this note with our staff at The Information. Congratulations to all the journalists doing such incredible work. And thank you to our subscribers for supporting us.—Jessica

***

Team,

The Society for Advancing Business Editing and Writing (SABEW) has awarded their 2023 awards, and we cleaned up! For those who count such things, we were in second place with total wins (5) behind the New York Times. And what is so amazing to me is, once again, we won across so many categories. Make no mistake: The Information leads across business coverage broadly.

A huge congratulations to The Information's winners (Full list here.)

Michael Roddan in Banking/Finance for banking fakes and scams

Erin Woo, Anissa Gardizy, Aaron Holmes, Amir Efrati, Jon Victor, Stephanie Palazzolo, Kate Clark and Cory Weinberg for OpenAI breaking coverage in Breaking News:

Cory Weinberg, Maria Heeter and Becky Peterson in Investing/Markets for IPO Drama

Kate Clark for Dealmaker (AI Fever) in Newsletters

Maria Heeter, Ann Gehan, Nick Wingfield and Theo Wayt in Travel/Transportation for Convoy coverage

Honorable mention in the Feature category

Theo Wayt for Amazon's After Dark Delivery Dangers

Becky Peterson for Google's Darkest Days

In reading the comments on each recognition, I am struck by how many times we were cited for our strong sourcing and clear and concise writing as well as being, and I quote "ahead of competitors in spotting, breaking and explaining an important business story." I've pasted the judges' notes below as they really speak to what makes our journalism excellent.

And a very big thank you to Martin and all the editors for the submissions which take weeks of work. We do this all without award consultants or huge teams. Your journalism speaks for itself.

Thank you and onward!

Jessica